Abstract

This study empirically investigates the relationship among the levels of formal education and regional economic growth in Greece, over the period 1995–2012. It uses a panel data set, which includes 13 regions. The proxy of human capital is the proportion of the employees that has received primary, secondary and higher education. Also, the study estimates the effect of the level of education on economic growth in low and high-income Greek regions, separately. The empirical analysis reveals that in the long-run considering all regions, secondary and higher education have had a positive effect on regional GDP, while primary education has had a negative effect. Regarding the two subgroups of regions, the results show that in low-income regions, secondary education has more significant effect than higher education, while in high-income regions higher education contributes more to GDP, than secondary education. The results also suggest that there is evidence of bidirectional long-run Granger causality between all levels of education and GDP. The findings indicate that education, especially at secondary and higher levels, has increased regional prosperity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Throughout the years, the process of economic growth and its determinants has been a crucial issue. Since ’60s economic theory argue that human capital is one of the key determinants of economic growth (Tsamadias and Pegkas 2016). In economic literature, the link between human capital and economic growth is well established. It recognizes education as the principal institutional mechanism of the production, accumulation and diffusion of human capital, stresses that it produces, and disseminates market and non-market benefits, externalities and spillovers (Schultz 1961; Becker 1964; Lucas 1988; Romer 1986, 1990; et al.). Since the late 1980’s, the role of human capital on economic growth has been highlighted by different economists. In particular, Mankiw et al. (1992) develop augmented neoclassical Solow’s (1956) model with human capital as an additional production factor, while endogenous growth models (Lucas 1988; Romer 1990; et al.) directly relate human capital and technology adoption. Education, especially higher education, is one of the building blocks of productivity. An educated workforce is more likely to be flexible and innovative. The adoption and application of new technologies require the accumulation of a substantial amount of human capital in the host economy (Borensztein et al. 1998).

In addition, education increases regional prosperity and plays a critical role in regional economic growth. Knowledge is an invisible resource that affects significantly on the regional economy in many ways (Vanhoudt et al. 2000; Coulombe and Tremblay 2001). Depending on the level of economic development in a particular country or region, certain key ingredients are absolutely essential and are best provided by the education establishments. In countries or regions with a low level of economic development and significant needs, the most critical ingredient is a system of education that addresses the basic needs of literacy, fundamental scientific knowledge and an understanding of how economic systems function. In contrast, in more highly developed countries or regions, the need for an education system will include a more sophisticated level of scientific knowledge and skills. The role of human capital is not only confined to one particular region due to the fact that human capital in one region can also influence neighboring ones (Ramos et al. 2010).

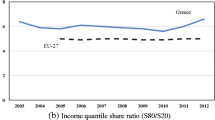

Greece, from 1981 is a member state of European Union and since 2001 is a member state of Eurozone. Over this period, from a country of the Balkan Peninsula, became part of the core of the EU. During this transition period, structural and functional reforms and adjustments were implemented concerning the economy, the labour market and education with little or more success. Also, during the global economic crisis, Greece presented fiscal imbalances and for that reason entered (2010) into the support mechanism (European Commission, European Central Bank, International Monetary Fund).

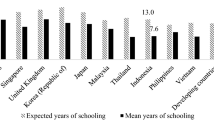

Over the period 1995–2012, there was a high social demand for higher education and the education system, especially the higher education system, expanded rapidly (Pegkas and Tsamadias 2014). At the same time horizon as the demand for education increased, the labor market changed in the labor mix depending on education. Specifically, the proportion of employees with higher education and secondary education increased at about 116 and 57% respectively, while employees with primary education decreased by 42%. The quantity of education increased while the quality remained relatively low (OECD 2014, 2016). Pegkas and Tsamadias (2014) show that the average number of years of education of the population in Greece approximates the mean of OECD countries and European Union countries. These findings show that there were mismatches between education and the labour market, with a gap between the strong demand for higher education and the limited demand of the domestic economy for highly educated personnel.

Since the mid-90s, the responsibilities of regional authorities (13 regions) have continuously been expanding. However, their responsibilities in economy and education, although there were intertemporal widening, are still relatively limited (Rodriguez-Pose and Vilalta-Bufi 2005).

The purpose of this study is to empirically investigate the causal relationship between levels of formal education (primary, secondary and higher education), physical capital and regional economic growth in Greece over the period 1995–2012. Also, it contributes to the existed literature by estimating the effect of each level of education on regional economic growth. Furthermore, it examines the impact of physical and human capital on regional economic growth using a dummy variable for the period of economic crisis in Greece (2008–2012). In the case of Greece there exists a lot of divergences among all the regions both in education, GDP and investment in physical capital (Karatheodoros 2017; Benos and Karagiannis 2016). Therefore, the full sample of regions is divided into two sub-groups, the high-income and the low-income regions. The comparison of the results between the Greek regions sets the basis for policy recommendations.

The rest of the paper is structured as follows: Sect. 2 provides a brief literature review; Sect. 3 presents the empirical analysis and Sect. 4 concludes summarizing the main findings and policy recommendations.

2 Literature review

The majority of studies for a country or set of countries conclude that education has a positive effect on economic growth (Krueger and Lindahl 1999; Temple 1999, 2000; Topel 1999; De la Fuente and Domenech 2002; Badinger and Tondl 2005; Ciccone 2004; Tsamadias and Prontzas 2012; Pegkas and Tsamadias 2014). However, there are studies that find a weak or a negative effect of education on economic growth (Islam 1995; Bils and Klenow 2000; Pritchett 2001) and others that found no relation between education and economic growth (Benhabib and Spiegel 1994). These studies have used different proxies for human capital (Tsamadias and Pegkas 2012). The main conclusion is that countries and regions with higher levels of human capital are supposed to expect higher growth rates than countries with lower ones, but only ceteris paribus. Major differences in wages, levels of development etc. can distort this picture. Also, other studies have suggested that different levels of education can have different effects on growth.

These studies have concluded that primary education affects more in less developed countries, while growth in more developed countries depends mainly on higher and secondary education (Petrakis and Stamatakis 2002; Vandenbussche et al. 2006; Di Liberto 2008; Pereira and St. Aubyn 2009; Pegkas and Tsamadias 2015).

2.1 Overview of empirical studies

Empirical studies concerning the role of education on regional economic growth are categorized as follows:

Pelkonen and Ylönen (1998), examined the contribution of human capital to regional economic growth in the Finnish economy from 1970 to 1995, using the model of Mankiw et al. (1992). They found that human capital seems to explain very poorly the regional growth in Finnish regions, although they found a positive correlation between human capital and short-run fluctuations. De la Croix and Vandenberghe (2004), based on the studies of De la Fuente (2003) and Ciccone (2004), tested the effect of education on regional economic growth in Belgium. He concluded that human capital proxied by educational attainment has a positive effect on regional economic growth, while economic returns arising from investment in education are significantly higher than those that result from investment in physical capital (even in poorer regions). Therefore, it is shown that human capital is an alternative investment in social terms. Li and Huang (2009) investigated the effect of education, using the extended neoclassical model of Mankiw et al. (1992) on China’s economic growth and its regions during the period 1978–2005. The results show that education contributed significantly to the growth of the Chinese regions. More specifically, the variable on the percentage of the population having received at least secondary education has the greatest impact, while the elasticity of growth varies from 0.52 to 1.02 for all regions. Bronzini and Piselli (2009) examined the relationship between education and economic growth for Italian regions between over the period 1980–2001. They found a positive long-run relationship between education and growth. Brunow and Hirte (2009) examined the impact of education on average regional productivity in Germany, by applying econometric analysis based on Lucas’s augmented production function. They used as a proxy for human capital the percentage of people with higher education in the total workforce as well as the percentage of people in highly skilled jobs or people who have worked in high skilled jobs before entering into short-term unemployment. Depending on the approach with respect to human capital, their estimated elasticities range from 0.08 to 0.11. Ramos et al. (2010) analyzed the impact of human capital on Spanish regional economic productivity and growth, depending on its composition from 1980 to 2005, using specialized econometric techniques in order to take into account the possible diffusion of human capital. As a proxy of human capital, they used the average years of schooling for the workforce and they found that the number increased from 6.53 in 1980 to 10.56 in 2005. Furthermore, they detected that secondary education has a positive impact on economic growth, but while higher education has a positive effect on productivity, primary education has no effect on these variables. Alaali et al. (2015), investigated the impact of education on the growth of per capita income using panel analysis for 130 countries from 1981 to 2009. They used proxies for human capital such as the percentage of enrollments in secondary and higher education as well as the percentage of population with secondary and higher education. The empirical analysis has shown that education as a whole (secondary and higher) positively affects developed countries.

In the case of Greece, Benos and Karagiannis (2010, 2016) estimated the impact of human capital on regional economic growth from 1981 to 2003 and from 1971 to 2011 respectively, applying the Mankiw et al. (1992) model. In the first study (2010), they used enrolment rates in lower and upper secondary education and student to teacher ratios as education indicators and they detected that secondary education had a positive impact on growth, while a higher student to teacher ratio suspended growth. In addition, in the second study (2016), they used the fraction of the employed population that have completed primary, secondary and higher education and they concluded that secondary and higher education affects positively labor productivity, while primary education has a negative relationship. Moreover, other studies have investigated the relationship between education and economic growth in the case of Greece, and found that education, and especially secondary education contributes to economic growth (Tsamadias and Prontzas 2012; Pegkas and Tsamadias 2014; Pegkas 2014). Pegkas and Tsamadias (2015) study the link between levels of formal education and economic growth in Greece and they conclude that there exists a long-run relationship between all levels of education and economic growth. The results reveal that secondary and higher education have had a positive impact, while primary education has not directly contributed to economic growth.

3 Empirical analysis

This section presents the methodology, model, variables, data set, sources and the econometric analysis. It also presents the results and a discussion on the findings.

3.1 Methodology

The empirical analysis of this paper uses the methodology of the aforementioned studies that used as the basis for their econometric analysis the Mankiw et al. (1992) model (Li and Huang 2009; Tsamadias and Prontzas 2012; Benos and Karagiannis 2010, 2016). The Mankiw et al. (1992) model has employed a Cobb-Douglas production function approach (Eq. 1) which has been given in the following form:

where Yit denotes aggregate output per region i (i = 1,2, …,13) during period t (t = 1995, …,2012), Kit is physical capital, Hit is human capital, Ait is a technical efficiency index representing the technological progress and Lit is the labour input. Technological progress (Ait) can be considered as a result of either innovation activity or technological catching-up (Badinger and Tondl 2005). In addition, some exogenous technical progress may exist but we will ignore it for the time being. We assume that Ait and Lit grow at constant and exogenous rates n and g respectively. In addition, considering decreasing returns to scale, that is α +β <1, transform Eq. 1 and end up with an equation on income per worker of the following form:

where sk: the ratio of investment to product, sh: human capital investment, n, g and δ: the growth rates of labour, technology and depreciation rate of capital respectively and t: time. The study uses investment as a percentage of GDP as a proxy of physical capital. The proportion of the employees that has received primary, secondary or higher education as the highest level of education issued as a proxy of human capital. The estimation of this variable is achieved by using the following function:

where \(LE_{i}^{t}\): the proportion of the employees which has received primary, secondary or higher education in region i and in year t.\(L_{p,i}^{t}\): Employees with primary, secondary or higher education in region i and in year t.\(L_{i}^{t}\): total employees in region i and in year t .

Specifically, the variable of primary education reflects the share of the local population whose highest level of educational attainment is only primary education. The variable of secondary education reflects the share of the local population whose highest level of educational attainment is secondary education and lastly, the variable of higher education reflects the share of the local population whose highest level of educational attainment is higher education. It should be noted that all the shares add up to 100% for all regions and for the three levels of education (primary, secondary and higher).

In the model, all three variables of education are entered separately (they are independent but linked), as if they introduced simultaneously the multicollinearity phenomenon could occur in the least squares method (OLS), resulting in decreased reliability of results. In particular, the impact of different forms of educational levels on GDP may vary (Loening 2005). Also, including primary, secondary and higher education into the same equation is a procedure which may provide invalid results due to strong multicollinearity between the variables (Loening et al. 2010).

3.2 Data set

In order to investigate the relationship between education and GDP, we employ a panel of 13 regions (NUTSII level) over the period 1995–2012 with annual census data obtained from the Hellenic Statistical Authority database. The multivariate regional production function framework includes GDP per worker (qit), gross fixed capital formation (Kit) and human capital proxied by the proportion of the employees that has received primary, secondary or higher education (Eit). It should be mentioned that according to Mankiw et al. (1992) the growth rates of technology and the depreciation rates of capital remain constant for all territories (g +δ =0.05) assuming that technology is a public commodity, available to all territories.

Table 1, presents the average growth rate of GDP per worker, gross fixed capital formation and human capital at three different crucial periods. GDP and gross fixed capital formation are in euros and in current prices, which were divided by GDP deflators (2010 = 1) and expressed in 2010 constant prices. Tables 2, 3 and 4 display descriptive statistics of the variables of the model and as it can be ascertained, Greek regions are characterized by numerous disparities. Taking 2008 as the milestone (the year in which the Greek economy went into recession due to the global economic crisis), the evolution of the variables is examined in two sub periods 1995–2008 and 2008–2012. More specifically, as can be inferred from Table 1, an increase of average annual growth rate of GDP per worker from 1995–2012 of 0.28% is observed, while it is noteworthy that the annual increase is of the order of 2.01% from 1995–2008 after which an annual decrease of 4.68% is observed. Investment on physical capital as a percentage of GDP presents an annual decrease of about 2.22% during the examined period. Regarding the proportion of the employees that has primary, secondary and higher education, we observe a decrease of the annual growth rate of 3.14 for primary education while for secondary and higher education an increase of 2.69 and 4.65% respectively. According to Table 2, there are numerous disparities concerning GDP per worker, investments and the proportion of employees with a specific level of education. These differ fundamentally across regions as well as through time. The data indicates the gap that exists in GDP per worker and investments between the major regions in terms of population (i. e. Attica and Central Macedonia) and the other regions. In most regions, GDP per worker increases during the period concerned, but at the same time in certain regions of Greece, the increased GDP causes an investment decrease.

In addition, we divide the regions into two groups, according to whether their average GDP per capita lies below or above the mean GDP per capita of Greece for the examined period 1995–2012. Tables 3 and 4 show the descriptive statistics based on the separation of the regions into low-income (Eastern Macedonia & Thrace, Central Macedonia, Epirus, Thessaly, Western Greece, Peloponnese and North Aegean) and high-income (Western Macedonia, Ionian Islands, Central Greece, Attica, South Aegean and Crete) regions. Low-income regions present a higher level of employees reaching primary and secondary education, while low rates of primary education characterize high-income regions. On the other hand, high-income regions exhibit a greater proportion of employees with higher education compared to low-income ones. Additionally, investments are greater in high-income regions than in low-income ones.

In fact, higher educational attainment results in a more capable workforce, which exploits efficiently modern technologies that fuel economic growth. According to Lolos and Papapetrou (2012), the added value in Greece is mainly produced by the sector of services, with the 70% percentage of the GDP originates from the tertiary sector, the 20% comes from the secondary sector and the rest (about 10%) from the primary sector. The presence of the tertiary sector is high (about 80%) in the Greek islands and Attica, while the contribution of the industrial sector (about 30%) appeared at only two regions (Central Greece and Western Macedonia). Relatively important is the share of the primary sector (10–18%) in roughly half of the regions.

3.2.1 Econometric analysis

The econometric analysis starts by testing for panel unit roots and cointegration followed by the estimation of a panel vector error correction model in order to perform Granger causality tests. All variables are turned into logarithms so that elasticities can be determined and the panel set is strongly balanced due to no lack of observations.

3.3 Stationarity tests

Initially, we examine the existence of unit root in levels and in first differences. There are two types of panel unit root tests in panel data, the common unit root test which tests the occurrence of common unit root for all the cross sections and the individual unit root test which tests the occurrences of an individual unit root for each cross-section of the panel. The stationarity of the data is examined using Philips-Perron (PP), Im, Pesaran and Shin (IPS) and Augmented Dickey Fuller (ADF).

Due to the fact that macroeconomic time series are trended and therefore in most cases are non-stationary, we difference the series successively until they become stationary and then use them for regression analysis. The variables of GDP per worker, investments, the proportion of employees that has achieved primary, secondary and higher education, and labour growth are tested both in level and next in the first difference for each variable and are reported with constant and constant and trend. The null hypothesis is the existence of unit root, the optimal lag length is selected using the Akaike information criterion and the results are shown in Table 5.

As can be inferred from the results shown in Table 5, all the variables, except the labour growth which appears to be an I(0) process—have unit root in their levels, while they are stationary or integrated of order one I(1) in their first difference at the 1 or 5% level of significance. A standard regression analysis on the basis of their levels would produce spurious results, unless the variables were cointegrated. These results allow us to test for cointegration among the variables in consideration.

3.4 Panel cointegration tests

Since we have concluded that all variables are integrated of the same order, we pass to the next step, which is to check whether there is a long-run relationship between the variables of the model. The cointegration of the variables is examined through the heterogeneous panel cointegration tests by Pedroni (1999, 2004). Pedroni suggested two types of residual-based cointegration tests for the test of the null of no cointegration in heterogeneous panels. Especially, for the first type, there are four tests that are based on pooling the residuals along the within-dimension of the panel, while for the second type there are three tests that are based on pooling the residuals along the between-dimension of the panel. We also test the existence of cointegration with the Kao-test (1999), which follows the same method as the Pedroni tests, but in the first stage regressors and cross section specific intercepts it takes into consideration homogeneous coefficients. Finally, we test with an alternative test of Maddala and Wu (1999) that used Fisher’s result to propose a method for combining test from individual cross-sections to obtain a test statistic for the full panel. All these cointegration techniques allow us to take into account the presence of heterogeneity in the estimated parameters and dynamics across regions. To determine the optimal lag length the Akaike information criterion (AIC) is used and cointegration tests are run with heterogeneous trends.

We first perform panel cointegration tests that contain primary education, afterwards secondary education and finally higher education as a proxy for human capital. The results of Pedroni, Kao and Fisher panel cointegration tests on primary, secondary and higher, are presented in detail in Table 6 respectively. The results from Table 6 of Pedroni test, strongly suggest the hypothesis that there exists cointegration among the examined variables, combined with the fact that the panel and group rho-statistics have lower power than the other statistics. Most of the statistics support the existence of cointegration relationship at 1 , 5 or 10% level of significance. The null of no cointegration is rejected by four out of seven tests at 10% probability level. In addition, Kao cointegration test rejects the null hypothesis of no cointegration at 1% level of significance in both secondary and higher education. Finally, the Fisher cointegration test supports the existence of cointegration relationship at 5% level of significance in secondary education and at 1% level in higher education. The results from the tests that were described above and performed support the hypothesis of a long run relationship between our variables in all regions and sub-regions in Greece for the examined period.

3.5 Panel cointegration estimates

Given the presence of cointegration, we use the Fully-Modified OLS (FMOLS) technique, which firstly proposed by Phillips and Hansen (1990). The FMOLS estimator not only generates consistent estimates in small samples, but also it takes into account the presence of the constant term and the possible correlation between the error term and the differences of the regressors, in order to minimize the problems that are caused. The specific estimator is asymptotically unbiased and has fully efficient mixture normal asymptotics. The FMOLS technique fully developed by Pedroni (1996, 2000) for heterogeneous cointegrated panels, which controls for serial correlation of the errors and endogeneity of explanatory variables, in order to determine whether a long-run equilibrium relationship exists or not.

Overall, three different panels are assessed for each level of education. First, the relationship between GDP and education in all levels in all Greek regions is estimated. All the coefficients related to human capital are positive and statistically significant at the 1% level, where the coefficients can be interpreted as elasticity estimates, except for the variable that concerns the employees that has received primary education. The variable regarding labour growth (n +g +δ) was taken as exogenous in the model, since the model of Mankiw et al. (1992) assumes exogenous rates of n, g and δ.

According to our findings (Table 6) the coefficient of elasticity of GDP per worker with regard to the proportion of employees that has had primary education is −0.13 and statistical significant at 1%. On the contrary, the coefficient of elasticity of GDP per worker with regard to secondary and higher education is 0.28 and 0.13 respectively at 1% level of significance, which means that a 1% increase in secondary and higher education will foster GDP by 0.28 and 0.13% respectively. The coefficient of elasticity concerning the investments in all panels is positive and statistically significant and varies from 0.09 to 0.15.

Our findings are in line with those of Benos and Karagiannis (2016), who find a negative impact of primary education and a positive effect of secondary and higher education on labor productivity. Furthermore, we obtain similar findings concerning secondary and higher education with Bronzini and Piselli (2009), Ramos et al. (2010) and Cuaresma et al. (2012). As can be ascertained from the results of the previous tests, the role of secondary and higher education seems to be very important and significantly explains GDP. The findings of the existence of a positive long-run relationship between education and GDP are in line with most of the previous studies mentioned above.

As it is observed, during the period 2008–2012 (economic crisis period) the GDP per worker follows a continuously decreasing trend and thus it is considered appropriate to take a dummy variable (post2008) into account. The dummy variable equals to 1 in years 2008 to 2012 and 0 otherwise. If we take post2008 into account (Table 6), the coefficient of elasticity of GDP with regard to the proportion of employees that has had primary, secondary and higher education is −0.35, 0.33 and 0.33 respectively at 1% level of significance, while the elasticity of GDP concerning investments has no statistical significance in all panels. The parameter for the post2008 variable has the expected negative influence on GDP in all panels. More specifically the coefficient of elasticity of GDP in panel A (primary education) is about −0.15, in panel B (secondary education) is about −0.18 and in panel C (higher education) is about −0.29 and statistically significant at 1%. Thus, the addition of the post2008 variable in the model strengthens the results regarding the variables of education, while it affects the investments substantially.

In order to interact the post2008 variable with our education variables and to make the model more robust, we consider a new dummy which is the result of the multiplication between the variables of education in each panel separately and post2008 variable. This allow us to distinguish whether the elasticity of GDP with respect education differs in the pre-crisis versus the crisis years. If we take the new dummy variable into account the results of the variables concerning the education and the post2008 remain in the same direction about the coefficients and the significance. The parameter for the new dummy variable has not the expected negative influence on GDP in all panels. More specifically the coefficient of elasticity of GDP in panels A and C has positive influence (0.04 and 0.08) and in panel B has the expected negative influence (−0.68) at 1% level of significance.

Next, the regions are separated into two sub-groups as described in Sect. 2.1. Using the mentioned methodology, we repeat our calculations as before for the two groups. For the group of low-income regions (Table 7) primary education has had a negative effect on GDP. The coefficient of elasticity is −0.08 at 1% level of significance. On the contrary, secondary and higher education have a positive impact on GDP of 0.21 and 0.17, with statistical significance at 1%, very similar to the one estimated before for all the regions. Regarding investments have a statistically significant impact on GDP in all panels that examines all levels of education, while the coefficient of elasticity concerning the investments in all panels is positive and statistically significant and ranges at the same levels at 0.18.

Finally, for the group of high-income regions (Table 8) the contribution of primary education to GDP still remains negative and moves along the same levels as before for all regions at about −0.12 at 1% level of significance. Furthermore, the coefficient of elasticity of GDP per worker with regard to secondary and higher education is 0.10 and 0.26 respectively at 1% level of statistical significance, which means that a 1% increase in secondary and higher education will foster GDP by 0.10 and 0.26% respectively. We also find that investments have an insignificant effect on GDP.

As already mentioned above, in order to estimate the effect of the Greek economic crisis across all the regions, post2008 variable is included in the estimated models, which equals to 1 in years 2008 to 2012 and 0 otherwise. If we take post2008 variable into account for both groups, low-income and high-income regions (Tables 7 and 8), the parameter for the post2008 variable has the expected negative result on GDP in all panels, while the results of the education variables remain in the same direction about the coefficients.

Thus, as regards high-income regions, a reversal in the results pertaining to the levels of education that affect GDP is observed. In particular, it is apparent that higher education contributes more to GDP compared to the other levels of formal education, while over the period under question the economies of Greek regions went into knowledge driven economies. These findings are in line with previous studies (Petrakis and Stamatakis 2002; Vandenbussche et al. 2006; Pegkas and Tsamadias 2015). According to these studies, higher education is more important in economic growth, compared to primary and secondary education in developed economies.

3.6 Vector error correction model and granger causality test

Given that the variables under study are cointegrated, a panel Vector Error Correction ModelFootnote 1 (VECM) is estimated to perform Granger (1988) causality tests. The VECM model can give the correction term that reflects the influences of the deviation of the relationship between variables from long-term equilibrium after short-term changes. The lagged residuals from the cointegrating regression with the appropriate number of lags are included in the Granger causality test structure. The proof of the existence of a long run equilibrium relationship among the variables under consideration results when λ is statistically significant and has a negative sign. The vector error-correction model passes all the standard diagnostic tests for residual serial correlation, normality and heteroscedasticity. Defining the lagged residuals from the cointegrating equations as the error correction terms, the following dynamic error correction models are estimated from the following Eq. 4 to 6:

The next step is to examine the short-run and long-run Granger causality between GDP per worker, investments and education in all panel models. Although a long-run relationship among all the variables exists, which suggests that there must be Granger causality in at least one direction, it does not indicate the direction of temporal causality between these variables. Consequently, in this case, the F‑statistic and the lagged ECT can only define the direction of the causality. The long-run causal effect is represented by the t‑statistic on the coefficient of the lagged ECT, while the short-run causal relationship is represented by the F‑statistic on the explanatory variables (Narayan and Smyth 2006).

More specifically, the Wald-test applied to the joint significance of the sum of the lags of each explanatory variable and the t‑test of the lagged error-correction term will imply statistically the Granger exogeneity or endogeneity of the dependent variable. The non-significance of ECT is referred to as long-run non-causality, which is equivalent to saying that the variable is weakly exogenous with respect to long-run parameters. The absence of short-run causality is established from the non-significance of the sums of the lags of each explanatory variable. Finally, the non-significance of all the explanatory variables, including the ECT term in the VECM, indicates the econometric strong-exogeneity of the dependent variable that is the absence of Granger-causality.

Table 9 reports the results of the short-run and long-run Granger-causality tests for all the panels. Estimates of the parameters show that the ECT has the right negative sign and is statistically significant for the three equations and for all the panels. For that reason, in the long-run exists a bidirectional Granger causality relationship between GDP per worker, investments and education in all panels. In the short-run, in panel A the Wald test indicate that there is a unidirectional Granger causality running from primary education to GDP per worker and investments, while in panel B there is bidirectional causality between GDP per worker and secondary education and a unidirectional causality running from secondary education to investments. Finally, in panel C there exists a bidirectional causality between GDP per worker and higher education and unidirectional causality running from investments to higher education. Therefore, given that education is measured based on the employees, findings of bi-direction causality make sense, as a more educated workforce could lead to higher GDP and that may increase the demand for more educated workers to move in to take advantage of employment opportunities.

Furthermore, the ECTs and the Wald test of joint significance of the sum of the lags of each explanatory variable associated with the significant levels provide more information on the impact of investments and education on regional GDP and vice versa. The results indicate that we can reject the hypothesis of strong exogeneity and accept the Granger-endogeneity for all variables, except that of primary education in panel A. Finally, the overall results support the proposition that there is a strong relationship between investments and education on regional GDP in Greece for the period under consideration.

4 Concluding remarks and policy recommendations

The purpose of this study is twofold: first, to empirically investigate the short-run and long-run causal relationship among each level of formal education regional economic growth and investments in Greece over the transition period 1995–2012 and second to estimate the effect of each level of formal education on economic growth for all regions and separately for low and high-income regions by using the methodology/model of Mankiw et al. (1992).

The overview of relevant empirical literature reveals that education is closely linked to individual and social prosperity as reflected by economic growth, employment and income. The results of our empirical analysis allow us to draw the following conclusions for regions. Firstly, there is evidence of bidirectional long-run causality running from all levels of education to GDP. In addition, in terms of short-run relationship there is a unidirectional causality running from primary education to GDP per worker, bidirectional causality among secondary education and higher education and GDP per worker. Secondly, the elasticity of regional GDP per worker with respect to primary, secondary and higher education, is −0.13, 0.28 and 0.13 respectively. Therefore, secondary and afterwards higher education have a positive impact to the growth process on the economies of the Greek regions during the relevant transitional period. A possible explanation could be that during the examined period, GDP has been steadily rising (apart from 2008–2012), while the share of workers with primary education has been decreasing. On the contrary, the shares of workers with secondary and higher education increased steadily at the same period, with an average annual growth of 2.70 and 4.65% respectively. Furthermore, the contribution of physical capital is also positive and its elasticity ranges from 0.09 to 0.15.

Finally, there are major differences between the two sub-groups of regions. In particular, for low-income regions, secondary education has had a stronger positive impact on regional GDP than higher education, while for high-income regions, higher education was more important for GDP than secondary education. Regarding investments, it seems that its contribution is about 0.18 in low-income regions, while it is insignificant in high-income regions. These results are in line with the findings of previous studies suggesting that mostly highly skilled workers matter for economic growth in technologically advanced/developed economies. Therefore, overall empirical evidence of the study supports the idea that education contributes to regional GDP in Greece.

Policy makers and education planners in Greece have to take into account that education (proxied by quantity variables) has increased during the last four decades and the average years of education of the population is within the average levels of the E.U and O.E.C.D countries, in order to foster economic prosperity. Additionally, reports indicate that the quality of education is still at low levels, focusing public interest on the improvement of the quality of education.

Given that there has not been any research on the effect of quality of education on economic growth, it is estimated that further related research should be directed into investigating the contribution of the quality of education on regional economic growth.

Notes

The results of VECMs are available from the authors upon request.

References

Alaali F, Roberts J, Taylor K (2015) The effect of energy consumption and human capital on economic growth: an exploration of oil exporting and developed countries. The University of Sheffield, Department of Economics, Sheffield

Badinger H, Tondl G (2005) The factors behind European regional growth: trade, human capital and innovation. Jahrb Regionalwiss 25:67–89

Becker GS (1964) Human capital: a theoretical and empirical analysis, with special reference to education. Columbia University Press, New York

Benhabib J, Spiegel M (1994) The role of human capital in economic development: evidence from aggregate cross-country data. J Monet Econ 34(2):143–174

Benos N, Karagiannis S (2010) The role of human capital in economic growth: evidence from Greek regions. Institutional and social dynamics of growth and distribution. In: N. Salvadori, pp 137–168

Benos N, Karagiannis S (2016) Do education quality and spillovers matter? Evidence on human capital and productivity in Greece. Econ Model 54:563–573

Bils M, Klenow P (2000) Does schooling cause growth? Am Econ Rev 90(5):1160–1183

Borensztein E, De Gregorio J, Lee J‑W (1998) How does foreign direct investment affect economic growth? J Int Econ 45:115–135

Bronzini R, Piselli P (2009) Determinants of long-run regional productivity with geographical spillovers: the role of R&D, human capital and public infrastructure. Reg Sci Urban Econ 39:187–199

Brunow S, Hirte G (2009) Regional age pattern of human capital and regional productivity: a spatial econometric study on German regions. Pap Reg Sci 88:799–823

Ciccone A (2004) Human capital as a factor of growth and employment at the regional level. The case of Italy. Report for the European Commission, DG for Employment and Social Affairs

Coulombe S, Tremblay JF (2001) Human capital and regional convergence in Canada. J Econ Stud 28(3):154–180

De la Croix D, Vandenberghe V (2004) Human capital as a factor of growth and employment at the regional level. The case of Belgium. Preliminary report, European Commission, DG Employment and Social Affairs

Cuaresma C et al (2012) Drivers of convergence in eleven eastern European countries. World bank policy research working paper no 6185

De la Fuente A (2003) Human capital in a global and knowledge-based economy, part II: assessment at the EU country level. Report for the European Commission, DG for Employment and Social Affairs

De la Fuente A, Domenech R (2002) Human capital in growth regressions: How much difference does data quality make? J Eur Econ Assoc. https://doi.org/10.1162/jeea.2006.4.1.1

Granger CWJ (1988) Some recent development in a concept of causality. J Econom 39(1–2):199–211

Islam N (1995) Growth empirics: a panel data approach. Q J Econ 110(4):1127–1170

Kao C (1999) Spurious regression and residual-based test for cointegration in panel data. J Econom 90:1–44

Karatheodoros A (2017) The contribution of secondary education on regional economic growth in Greece, over the period 1995–2012s. Int J Educ Econ Dev 8(1):46–64

Krueger A, Lindahl M (1999) Education for growth in Sweden and the world. Swed Econ Policy Rev 6(2):289–339

Li, Huang (2009) Health, education and economic growth in China: empirical findings and implications. China Econ Rev 20:374–387

Di Liberto A (2008) Education and Italian regional development. Econ Educ Rev 27(1):94–107

Loening JL (2005) Effects of primary, secondary, and tertiary education on economic growth: evidence from Guatemala. Policy research working paper series 3610. The World Bank, Washington

Loening J, Bhaskara R, Singh R (2010) Effects of education on economic growth: evidence from Guatemala. MPRA paper 23665. University Library of Munich, Munich

Lolos S, Papapetrou E (2012) Unemployment disparities and persistence in Greek regions, 1981–2008. Reg Sect Econ Stud 12(1):55–78

Lucas E (1988) On the mechanics of economic development. J Monet Econ 22(1):3–42

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61:631–652

Mankiw G, Romer D, Weil D (1992) A contribution to the empirics of economic growth. Q J Econ 107(2):407–437

Narayan PK, Smyth R (2006) Higher education, real income and real investment in China: evidence from granger causality tests. Educ Econ 14(1):107–125

OECD (2014) What students know and can do—students performance in mathematics, reading and science. PISA 2012 results, vol I. PISA OECD Publishing, Paris

OECD (2016) Excellence and equity in education. PISA 2015 results, vol I. OECD Publishing, Paris https://doi.org/10.1787/9789264266490-en

Pedroni P (1996) Fully modified OLS for heterogeneous cointegrated panels and the case of purchasing power parity. Working papers in economics, vol 96-020. Indiana University, Bloomington

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61:653–670

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econ Theory 3:597–626

Pedroni P (2000) Fully modified OLS for heterogeneous cointegrated panels. In: Baltagi et al (ed) Nonstationary panels, panel cointegration and dynamic panels. Advances in econometrics 15. Elsevier, Amsterdam

Pegkas P (2014) The link between educational levels and economic growth: a neoclassical approach for the case of Greece. Int J Appl Econ 11(2):38–54

Pegkas P, Tsamadias C (2014) Does higher education affect economic growth? The case of Greece. Int Econ J. https://doi.org/10.1080/10168737.2014.894551

Pegkas P, Tsamadias C (2015) Does formal education at all levels cause economic growth? Evidence from Greece. Rev Econ Bus Stud 8(1):11–34

Pelkonen L, Ylonen S (1998) Human capital and regional growth in Finland. 38th Congress of The European Regional Science Association, Vienna

Pereira J, Aubyn M (2009) What level of education matters most for growth? Evidence from Portugal. Econ Educ Rev 28(1):67–73

Petrakis PE, Stamatakis D (2002) Growth and educational levels: a comparative analysis. Econ Educ Rev 21(5):513–521

Phillips PCB, Hansen BE (1990) Statistical inference in instrumental variables regressions with I(1) processes. Rev Econ Stud 57:99–125

Pritchett L (2001) Where has all the education gone? World Bank Econ Rev 15(3):367–391

Ramos R, Suriñach J, Artís M (2010) Human capital spillovers and regional economic growth in Spain. Pap Reg Sci 89(2):435–447

Rodríguez-Pose A, Vilalta-Bufi M (2005) Education, migration, and job satisfaction: the regional returns of human capital in the EU. J Econ Geogr 5(5):545–566

Romer P (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Romer P (1990) Endogenous technological change. J Polit Econ 98(5, part 2):71–102

Schultz TW (1961) Investment in human capital. Am Econ Rev 51(1):1–17

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94

Temple J (1999) The new growth evidence. J Econ Lit 37:112–156

Temple J (2000) Growth effects of education and social capital in the OECD countries. OECD, countries economic department working paper no.263

Topel R (1999) Labor markets and economic growth. Handbook of labor economics. Elsevier Science, North-Holland, Amsterdam, pp 2943–2984

Tsamadias C, Pegkas P (2012) The effect of education on economic growth in Greece over the 1981–2009 period. Does the proxy of human capital affect the estimation? Int J Educ Econ Dev 3(3):237–251

Tsamadias C, Pegkas P (2016) Education and economic growth: a review of empirical macro—studies for Greece. 3rd National Greek Conference “New Educator”.

Tsamadias C, Prontzas P (2012) The effect of education on economic growth in Greece over the 1960–2000 period. Educ Econ 20(5):522–537

Vandenbussche J, Aghion P, Meghir C (2006) Growth, distance to frontier and composition of human capital. J Econ Growth (Boston) 11:97–127

Vanhoudt P, Matha T, Schmid B (2000) How productive are capital investments in Europe? Eur Invest Bank Pap 5(2):81–106

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Anastasios, K., Constantinos, T. & Panagiotis, P. The effects of formal educations’ levels on regional economic growth in Greece over the period 1995–2012. Rev Reg Res 39, 91–111 (2019). https://doi.org/10.1007/s10037-018-0128-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10037-018-0128-0