Abstract

While the EU is working toward the implementation of the world’s first Carbon Border Adjustment (CBA) Mechanism, a gap remains between the ways in which carbon leakage and CBAs are discussed in policy spheres and economic evidence on these topics. The aim of this paper is to bridge this gap by presenting the EU’s policy context, systematically reviewing the economic literature on carbon leakage and CBAs, and discussing potential future research avenues. Three channels of leakage are identified in our literature review: the competition, energy and innovation channels. The main finding of this paper is that while the competition channel is well understood and taken into account by policymakers, the energy and innovation channels are generally not considered. Policy recommendations are provided to better account for these two channels.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

As the EU has progressively established its Emissions Trading System (ETS), it has had to grapple with the ways in which this system impacts its economic ties with non-EU countries. Under the EU ETS, producers must buy or be allocated emissions allowances, which they can then trade with other participants. At the end of each year, they must turn in enough allowances to cover the greenhouse gas (GHG) emissions from their annual production. This system acts as a price on carbon, which increases participants’ production costs.

If the additional cost is high enough to put them at a competitive disadvantage compared to foreign producers, EU producers could lose parts of their market shares. They might also choose to relocate their activity outside the EU to avoid paying this additional cost. Both of these effects would decrease production within the EU, and increase production outside the EU. Not only would this undermine the EU’s emission reduction efforts—since any internal reduction in emissions would be compensated by an external increase in emissions—it would also harm the bloc's economy and labor market.

This problem is known as carbon leakage, defined in the economic literature as a displacement of carbon emissions from a region with stringent climate policies toward a region with less stringent climate policies (Naegele and Zaklan 2019). Carbon leakage is most commonly understood as we have described it above—a mechanism through which regulated domestic firms lose their competitive edge to unregulated foreign firms. However, this is only one of three channels through which carbon leakage can occur, known as the competition channel.

The second channel is the energy channel. It is an indirect leakage channel working through global energy markets. As a regulated region reduces its demand for fossil fuels, the price of these goods will drop on international markets. This price drop can create an incentive for firms in the unregulated region to increase their fossil fuel consumption, and consequently their GHG emissions too.

Finally, the third channel is the innovation channel, which has an opposite effect to the other two channels. More stringent environmental regulation encourages firms in the regulated region to invest in R&D, innovate, and adopt carbon-abating technologies and processes. Innovations resulting from this may then be diffused to other regions, including those without any environmental regulation. This channel is not discussed much in policy circles, despite its potential for generating negative carbon leakage, i.e., to reduce carbon emissions both in the regulated and the unregulated region.

A fourth channel known as the income channel is sometimes mentioned in the literature. This channel could work through a change in the terms-of-trade between countries as a result of carbon pricing, which could indirectly modify global consumption patterns. However, this channel is very uncertain and likely only has a negligible impact compared to the other channels if it does exist (Cosbey et al. 2019). We therefore do not discuss it further in this paper.

Up until now, the EU has dealt with the threat of leakage by lowering the stringency of its ETS. This was accomplished by freely allocating emissions allowances to firms covered by the ETS and by allowing the use of international carbon offsets to comply with regulation requirements. However, a new policy option is now being considered to replace free allocations: on 14 July 2021, the European Commission (EC) formally adopted a proposal for a Carbon Border Adjustment Mechanism (CBAM), as part of its Fit for 55 program (European Commission 2021b). The CBAM imposes a carbon price on foreign goods imported to the EU which should level the playing field between foreign and domestic producers and reduce the risk of leakage. The current proposal foresees a gradual implementation of the CBAM starting in 2023.

The aim of this paper is threefold. First, we present the context and policy debate surrounding carbon leakage and Carbon Border Adjustments (CBAs) in the EU. Second, we discuss the state of the economic literature on carbon leakage and CBAs. Finally, we include discussions on further research that is necessary in this field to answer policy concerns and unresolved research questions.

Several other literature reviews on carbon leakage and/or border adjustments exist, focusing on specific aspects or methods in the literature. Cosbey et al. (2019) briefly review the economic and legal literature on these topics, before giving an in-depth discussion on policy recommendations for a CBA—although these are not EU-specific. Dechezleprêtre and Sato (2017) review the empirical evidence on the effects of asymmetrical environmental regulation on key aspects of firms’ competitiveness, but do not directly discuss leakage effects. Verde (2020) looks into the empirical evidence on competitiveness and leakage effects caused by the EU ETS. For reviews of the literature using computable general equilibrium (CGE) models, Carbone and Rivers (2017) and Branger and Quirion (2014) are key references. Finally, Popp (2019) looks at recent empirical research delving into the link between environmental policies and green innovation.

The aim of the present literature review is to be broader than the ones cited above, and to provide readers with a global understanding of issues related to the different channels of carbon leakage and to carbon border adjustments. To achieve this, we describe the mechanisms underpinning each of the three channels of carbon leakage, and give a full review of existing evidence from empirical, theoretical, and structural strands of the literature. This allows for a better understanding of the advantages and limitations of these different approaches, and gives some context to the discussions and literature on CBAs which are also presented. Additionally, our description of the EU’s policy context and history dealing with carbon leakage is an addition to existing literature and puts the findings from economic research into perspective.

In this paper, we highlight the discrepancy between the economic literature and policy debates about CBAs. Policymakers tend to focus on the competition channel when designing leakage-prevention measures, without taking into account the potential impacts of the energy and innovation channels. To address this discrepancy, we recommend that policymakers also aim to minimize the impact of the energy channel by developing cooperation with unregulated countries and taking foreign carbon pricing and regulation initiatives into account in the CBA. Additionally, they should work to maximize the impact of the innovation channel by promoting green technology diffusion to unregulated countries and reinvesting CBA funds into an international technology fund.

The paper is structured as follows. Section 2 anchors the problem of carbon leakage in the EU’s political and institutional context, discussing the bloc’s history of carbon leakage mitigation measures, as well as the debate surrounding the proposal for a CBA. Sections 3, 4 and 5 review the literature on the competition, energy, and innovation channels of carbon leakage, respectively. This review includes discussions on further research that may be needed for each channel. Finally, Sect. 6 presents existing literature on CBAs, and looks at the impact of such a policy on each of the three leakage channels. Section 7 concludes.

2 Political and institutional contexts

This section discusses the political and institutional contexts in which carbon leakage has been apprehended in the EU throughout the different phases of the EU ETS. We present the policy choices that have been considered over the years and give some insight into why free allocations and international offsets were preferred to CBAs until now. Our aim is to give a solid understanding of the political considerations linked to leakage mitigation policies so they can be put into perspective with the economic literature presented in Sects. 3, 4, and 5.

2.1 A brief history of leakage mitigation in the EU

Carbon leakage has been discussed in the EU policy sphere since the inception of its ETS. However, it was not a central issue during the first two phases of the EU ETS. This is mostly due to three factors: first, most emissions allowances were freely given out to firms; second, firms were allowed to use international carbon credit offsets to comply with their obligations; and third, carbon prices remained low. As a result, complying with the EU ETS during its first two phases did not represent a large financial constraint on firms, which nullified the risk of leakage (Joltreau and Sommerfeld 2019).

The EU ETS’ first phase (2005–2007) was designed as a pilot phase, so producers could adapt to the new regulation and give feedback on its implementation. 95% of allowances were given out freely, based on a grandfathering approach.Footnote 1 To determine the total number of allowances needed on the market, countries were asked to develop National Allocation Plans, in which they estimated how many allowances their firms would need based on historical emission data. The goal was to develop an equitable, bottom-up approach to allowance distribution. In practice however, most countries overestimated their producers’ needs to protect their national interests. This created an oversupply of allowances throughout the entire trading phase.Footnote 2 As soon as the oversupply was revealed, allowance prices dropped. They remained low and volatile until the end of the first trading period (Le Cacheux and Laurent 2009).

In the second phase (2008–2012), a larger proportion of allowances was auctioned off to producers, but the majority (90%) remained freely allocated using the same grandfathering approach as in the first phase. Allowance oversupply was avoided in this phase through a stricter oversight of National Allocation Plans by the EC (Kossoy and Ambrosi 2010).

Despite this, allowance prices remained low during this phase for two main reasons. The first was a policy choice. The EU ETS was designed with a link to the United Nations Framework Convention on Climate Change’s (UNFCCC) Clean Development Mechanism. This link allowed EU firms to cover their carbon emissions not only by turning in ETS-issued allowances, but also by turning in international credits from the Clean Development Mechanism.Footnote 3 The possibility of complying with EU ETS obligations in this alternative manner, which could be cheaper than buying allowances, reduced demand for EU ETS allowances,Footnote 4 thus lowering prices on the EU carbon market (Trotignon 2011). There is also evidence that CDM credits were granted quite liberally, and that many projects that were awarded these credits would have been built without them (Calel et al. 2021). This implies there was a strong incentive for firms to invest in CDM projects—that were lucrative anyways—rather than invest in the decarbonization of their domestic production.

The second reason why prices remained low was circumstantial: the 2008–2009 financial crisis led to a collapse in production which caused a drop in demand for allowances, mechanically driving carbon prices down as well (de Perthuis and Trotignon 2014).

While leakage itself was not an issue during this second phase of the EU ETS, the subject began taking up more space in policy debates as planning for the EU ETS’ more ambitious third phase started. In 2008/2009, during the review period before the launch of the EU ETS’ third phase (2013–2020), carbon leakage was more explicitly discussed, mostly in terms of the threat it posed to the competitiveness of EU industry. In this third phase, free allocations were to be gradually replaced by an auctioning mechanism, potentially increasing EU firms’ compliance costs and making them more vulnerable to competition from unregulated foreign firms. This shift was motivated by the fact that auctioning reduces distortions caused by free allocation, increases market efficiency, and addresses distributional impacts of the EU ETS. Additionally, it is more compatible with EU State aid legislation and can more easily be combined with a price cushioning mechanism or a CBA (Hepburn et al. 2006).

This review period before the EU ETS’ third phase is when the idea of a CBA gained some traction for the first time—though it was not implemented at this stage. By imposing a carbon price on imports, equal to the EU’s internal carbon price, a CBA was seen as an option to mitigate the risk of carbon leakage and of loss of competitiveness.

A first proposal for a CBA on imports and exports of goods “subject to significant risk of carbon leakage or to international competition” was included in a draft proposal amending the EU ETS.Footnote 5 Additionally, the French government published a white paper promoting a “Carbon Inclusion Mechanism” in 2009 and pushed for this policy in Brussels (Simon 2010). However, the idea was not taken up and the final amendment proposal did not include any mention of a CBA. Instead, it included the use of targeted free allocations for sectors at risk of carbon leakage. A list of these sectors was drawn up in 2010 and amended in 2014 on the basis of their carbon intensity and exposure to international trade. They received a higher share of free allocations than other sectors. On top of this, international carbon offsets remained available to firms who wished to use them for compliance.

The debate over a CBA replacing free allocations was taken up again during the review period for the EU ETS’ fourth phase (2021–2030). In 2016, a second French government white paper proposed a CBAM that would only be applied to the cement sector as a test. However, this was rejected in the European Parliament in favor of keeping targeted free allocations.

Breaking with its previous policy line, the EC announced in its 2020 Green Deal that it would be putting forward a proposal for a CBA to gradually replace free allocations in the fourth phase of the EU ETS. Published on 14 July 2021, this proposal provides for a CBAM that would cover imports from 5 sectors: cement, electricity, fertilizers, iron and steel, and aluminum. Importers would have to buy CBAM allowances from a pool of emissions allowances that mirrors but is separate from the EU ETS. They would then have to surrender enough of these allowances to cover the total embedded emissions of their yearly imports. These allowances would be priced at the level of the weekly average of EU ETS certificate closing prices. The regulation is expected to enter into force in 2023, with a transition period running until 2026 (European Commission 2021b).

The idea of introducing a CBA instead of free allocations is not new, but until now, it had not been taken up by policymakers for implementation. Why did the EU not take up this option before? And why might a CBA now be considered to be viable? The following subsection aims to answer these questions.

2.2 Has a CBA become a viable policy option?

Up until now, the EU had rejected the idea of a CBA, in part because of the complexity of its implementation. It is unclear whether a CBA could be designed to comply with WTO law as well as with the UNFCCC’s principle of Common but Differentiated Responsibilities. Additionally, such a policy could expose the EU to retaliations from trade partners who view it as a protectionist measure. We discuss each of these issues here.

Compliance with WTO law is uncertain for several main reasons. The first is that certain principles of WTO rules might not be compatible with a CBA, depending on how it is designed. The principles of Most Favored NationFootnote 6 and of National TreatmentFootnote 7 could be challenging in this regard. The second reason is that certain technical aspects of WTO rules might not allow for a CBA to be implemented at all—namely the fact that a CBA would tax CO2, an intangible and not easily measurable output in the production of a good. Both of these issues could be overcome if the EU can successfully argue the necessity and proportionality of a CBA for the protection of the environment. However, this is also a challenge given that preliminary studies on CBAs do not clearly indicate that the policy would have strong environmental benefits (see Sect. 3). For a full discussion on WTO-compliance issues, see Mehling et al. (2019). The main takeaway from the legal debate on CBAs is that the design of the policy should focus on ensuring environmental benefits can be obtained from it. This would make it more likely to be WTO-compliant.

Another issue which makes designing a CBA so complex is the necessity of complying with the UNFCCC’s principle of Common but Differentiated Responsibility. The principle states that while all countries are commonly responsible for addressing climate change and environmental destruction, each country’s contribution to this cause should be proportional to its capacity to act and to its share of responsibility in historical global emissions. This means that developed countries are expected to contribute more than developing countries, the latter being responsible for a small share of historical global emissions and having more limited means of action. Böhringer et al. (2018) show that a CBA in OECD countries shifts the burden of decarbonization from developed countries onto developing countries, due to an adverse terms-of-trade effect caused by higher export prices. Additionally, Magacho et al. (2022) highlight that some developing countries are particularly exposed to the costs of an EU CBAM given their heavy reliance on exports of products that will be covered by the regulation. This is especially salient when looking at the weight of these exports in some countries’ total exports and GDP. As such, this policy could unduly shift burden onto developing countries, making it non-compliant with the UNFCCC’s principle of Common but Differentiated Responsibility.

Given that the EU is a net carbon importer (see Fig. 1), a CBA would also create adverse terms of trade for its main trading partners. To avoid shifting this burden onto developing countries, they could be excluded from the CBA’s scope, or compensated with the revenue from the CBA. However, this would potentially make WTO compliance more difficult.

Source: Authors’ visualization based on The Global Carbon Project (For territorial emissions: Friedlingstein et al. (2020) For consumption emissions: updated from Peters et al. (2011). Growth in emission transfers via international trade from 1990 to 2008. Proceedings of the National Academy of Sciences 108, 8903–8908. http://www.pnas.org/content/108/21/8903.abstract)

The EU’s carbon loophole (million tons of CO2 emissions per year). EU changing composition.

Image description: Line graph with one line showing the EU’s territorial emissions and another showing the EU’s consumption emissions. The consumption emissions line is higher than the territorial emissions line, by roughly 150 million tons of CO2 emissions for the entire period (1990–2018). This difference between the two lines represents the EU’s imported emissions.

Finally, the last major argument used against implementing a CBA is the fear of retaliation from trade partners. The EU’s carbon imports mostly come from China, the US, India, and Russia (Peters et al. 2011). These would be the countries most capable and inclined to retaliate with their own trade measures. This risk is especially present given the frayed state of the current international trade environment, and the fact that a CBA’s environmental benefits are not yet certain.

Each of the three points presented above has stopped the EU from implementing a CBA until now. The bloc’s recent shift in policy preference could be explained by several factors. One of them is that the current global geopolitical environment is very different from what it was when a CBA was first proposed. Some of the world’s largest international players—the US first and foremost—have turned to more protectionist and unilateral trade policies. In such an environment, if the EU were to impose its own unilateral trade policy, not only would the opportunity cost be lower, but there would also be less risk of a coordinated retaliation from its trade partners. Another factor which might sway the EU toward a CBA is the internal pressure EU countries are facing from their population as the bloc’s environmental ambition increases. To be socially acceptable, the EU cannot let its producers bear the full brunt of compliance with environmental regulation while competing with unregulated foreign producers, nor can it let its consumers pay for fully passed-through compliance costs.

Beyond these geopolitical considerations, a CBA may now be the preferred leakage mitigation measure because free allocations have proven to have significant flaws. Indeed, with some time having passed since the EU ETS’ inception, researchers have been able to assess the effectiveness of free allocations, focusing on two main questions. First, have they effectively protected EU firms from unregulated foreign competitors? Second, have they also inadvertently muted the ETS’ price signal and reduced its environmental effectiveness?

To answer the first of these two questions, evidence seems to indicate that EU firms did not suffer any competitiveness losses as a result of participating in the EU ETS (Joltreau and Sommerfeld 2019). Due to data availability, most studies with this result only look at the first, second and beginning of the third phase of the EU ETS, when free allocations were the general rule. Thus it seems that during these initial phases, free allocations were effective at protecting EU firms from competition with unregulated foreign firms. However, as discussed above, the absence of competitiveness losses could also be the joint consequence of low carbon prices in this period, and of the possibility of using international carbon offsets.

To answer the second question and understand the impact of free allocations on environmental outcomes, researchers have studied how this mode of allocation impacts firms’ incentives to abate their emissions (see Verde et al. (2019) for a full review on this topic). In theory, there should be no difference in firms’ abatement decisions whether allowances are freely allocated or auctioned, because the opportunity cost of an allowance is the same in both cases. If allowances are freely allocated, a firm deciding not to abate its emissions will lose out on potential income it could have received from selling its allowance. This lost income is the same amount as what it has to pay to buy an allowance if they are auctioned.

In practice however, the hypothesis of neutrality of the mode of allocation does not seem to hold. Evidence from De Vivo and Marin (2018) points to a difference in behavior between firms freely receiving allocations and those subject to auctioning. There could be two main reasons for this. The first is that firms may not be making fully rational decisions; they may choose to change their abatement decisions based on a false sense that auctioning is more burdensome than free allocations. The second is that while the method of allocation may be neutral on a firm’s opportunity cost, auctioning has an impact on its total compliance burden, while free allocations do not. The opportunity cost determines a firm’s abatement decisions (i.e., whether or not to reduce its production to meet emission goals) while the total compliance burden determines its investment strategy (i.e., long-term investments to improve the efficiency of production). As a result, switching to auctioning could have an effect on firms’ investment decisions. This possibility would have to be confirmed with further empirical research as the data currently available does not allow a validation of either of these hypotheses.

This is a particularly important research question, since the EU’s carbon price is set to gradually increase in the coming years, and with it, the long-term incentive for firms to invest in the decarbonization of their production. If free allocations mute this incentive, then the environmental efficacy of the EU ETS is at risk. It is crucial to ensure that firms receive strong and long-term price signals so they can make investment decisions that take environmental factors into account. Firms will only invest in long-term technology and process transformations to decarbonize their production if they feel that the alternative—buying enough allowances to cover their emissions—is more expensive. As such, free allocations risk causing a high-carbon technology lock-in.

This section has described the most prominent concerns related to carbon pricing and leakage in the EU, from legal and policy perspectives. The crux of the problem is that unevenly ambitious global environmental regulations may cause carbon leakage—a risk which policymakers readily associate with the EU ETS. It is therefore crucial to understand how much carbon leakage the EU ETS actually generates.

To answer this question, we turn to the evidence of carbon leakage in the academic literature, through each of the three channels we have presented in Sect. 1. Our aim is to bridge the gap between the policy debates we have just described, and the risks and opportunities identified in the academic literature.

3 The competition channel

As stated in Sect. 1, most EU policy debates surrounding carbon leakage center on the competition channel.Footnote 8 This section aims to give an in-depth understanding of the workings of this channel, highlighting major findings from different strands of the academic literature. We first present the basic functioning of the competition channel through its roots in game theory, before turning to empirical evidence from the ex-post literature and finishing with partial and general equilibrium models. The choice of organizing this literature by methodology is driven by the fact that both quantitative and qualitative results greatly depend on the methodology used in each study.

3.1 How does the competition channel work?

Carbon leakage through the competition channel occurs when a region implements environmental policies on its territory that are more constraining than in other regions. Its domestic producers face additional costs to comply with the regulation, which puts them at a competitive disadvantage compared to foreign producers who supply the same markets but are not subject to the additional compliance costs (see Fig. 2).

In a perfect competition setting, there are two possible consequences to this loss of competitiveness. First, in the short run, domestic producers may lose market shares to unregulated foreign competitors. Second, in the long run, domestic producers may choose to relocate part or all of their activity to countries with less stringent climate policies. This second consequence is also sometimes called investment leakage.

While classical economic theory and most CGE models use a perfect competition setting, carbon leakage has also been modeled in the context of more realistic settings with strategic interactions and imperfect competition. The competition channel was in fact first formalized using game theory, which models international trade as a game between trade partners that may exhibit strategically motivated behaviors. Within game theory, two foundational strands exist: one at the country level and one at the firm level.

Hoel’s (1991) seminal paper is at the core of the first, country-level strand. He sets up a two-country model, in which each country aims to maximize its benefit function and can decide on the quantity of emissions it abates domestically as well as its level of production. Its cost function increases with the amount of emissions it decides to abate domestically, while its benefit function increases with the sum of emissions both countries decide to abate. In this setup, and in the absence of an international agreement on emissions reductions, both countries will always choose not to abate their emissions. If one country were to abate its emissions unilaterally, the other country would mechanically increase its emissions to reduce its cost function, without any loss to its benefit function. This is an expression of carbon leakage at the country level as an uncooperative and non-Pareto efficient Nash equilibrium. Emissions are simply shifted from one country to the other, without any global reductions.

The second, firm-level strand of game theory literature on carbon leakage was developed by Markusen et al. (1993). In their model, if one region decides to implement constraining environmental regulation, firms in this region decide to relocate their activity to an unregulated region and export part of their production back into the regulated region. Many firms may relocate at once if the constraint from the new environmental policy exceeds the fixed cost of relocating production. As such, there is also only a redistribution of emissions between countries, rather than a global decrease in emissions.

The analytical conclusions derived from these early works are the foundation for empirical tests and structural models that have been developed since then to evaluate the risk of carbon leakage. In the case of the EU ETS, the question is therefore to understand whether the financial constraint of compliance has been large enough to induce a leakage effect. According to theoretical models, this should be the case. The following subsection discusses empirical testing of this hypothesis.

3.2 Has the EU ETS caused carbon leakage through the competition channel?

Different strategies have been adopted to empirically test for carbon leakage caused by the EU ETS. Most studies find no evidence of carbon leakage so far. Verde (2020) surveys the econometric literature on this topic and concludes that very little, if any, carbon leakage can be causally linked to the EU ETS. The author identifies four major strands of research.

The first comprises microeconomic studies of firm-level or sector-level competitiveness indicators such as value added, employment or total factor productivity. The EU ETS’ short-run impact on these indicators depends on the specific measure that is used. However, most of the effects are either null or weakly negative—and in some cases even positive, meaning the ETS has actually improved EU firms’ competitiveness. This could be because some carbon cost passthrough may be occurring or because firms are investing in carbon-abating innovations which are also productivity-enhancing.

The second strand Verde identifies is composed of studies looking at long-term investment leakage. The EU ETS’ long-run impacts have been studied less than its short-run impacts and results are consequently not as clear cut. Two studies looking at investment leakage find that the EU ETS may have increased multinational firms’ FDI toward non-EU countries. However, they look only at Italian and German firms, respectively (Borghesi et al. 2020; Koch and Mama 2019). These studies find a relatively small effect.

The third strand of this literature comprises very few studies, and tries to find direct evidence of carbon leakage. Rather than looking at indicators of competitiveness, studies from this third strand look into the displacement of carbon emissions between regions. Naegele and Zaklan (2019) study the carbon content of trade to and from the EU using a gravity model, while Dechezleprêtre et al. (2022) study carbon leakage within multinational firms. The latter study has been updated and extended in Dechezleprêtre et al. (2020), which covers the first two years of the EU ETS’ third phase. Each of these studies finds no evidence of carbon leakage resulting from the EU ETS. A recent study by Eskander and Fankhauser (2021) looks more broadly into the impact of climate regulation on carbon imports and exports. Interestingly, they find that legislation from 3 years ago and older has in fact led to a small, but significant, negative leakage effect. However, this is not an ETS-specific result.

Finally, Verde discusses a last, more distinct, strand of the literature which studies the effect of EU ETS allowance prices on participating companies’ stock returns. The papers in this strand aim to measure the impact of carbon pricing on investors’ beliefs about a firm’s future profitability, rather than its present profitability. Their results do not measure how much leakage has occurred, but rather how much investors believe ETS prices affect the firm’s profitability, which may in turn lead to leakage—although this is not tested for. Two main results emerge from this literature. First, the relationship between carbon prices and stock prices is generally found to be positive in the EU ETS’ first phase and negative in the second and third phases. This suggests the mode of allocation has an effect on investors’ perception of firm profitability. Second, more carbon-intensive firms’ stock prices tend to be negatively correlated with EU ETS prices, while less carbon-intensive firms’ stock prices tend to be positively correlated with them.

The common conclusion from all four strands of this literature is that carbon leakage does not seem to have materialized as a result of the EU ETS. However, an important caveat should be highlighted: due to data availability, most of the surveyed literature looks only at the first two phases of the EU ETS—and the first years of the third phase for a few of them. During this period, free allocation was the general rule and carbon prices remained low. Researchers exploited breaks in this general rule to study leakage, but this may not accurately reflect the current situation in which prices have tripled, and free allocations have gradually been replaced by auctioning.Footnote 9 As a result, the ETS’ financial impact on firms is likely greater than it was during the period that is studied in the literature, which could imply more carbon leakage is occurring than previously measured.

Going back to the distinction between short- and long-run effects from the theoretical models of leakage through the competition channel, empirical studies have therefore only looked at the short run (2–7 years). Long-run effects will have to be studied separately as more time passes and further data is made available.

Additionally, there may be a stronger risk of within-firm leakage than of between-firms leakage inside the EU. Since the EU ETS regulates only installations whose emissions are above a certain threshold, firms with multiple installations may be switching some of their production from regulated installations to unregulated installations—thus artificially reducing emission levels in the regulated installations. While this phenomenon has not yet been studied in depth in the EU ETS’ context, it has been observed in the context of environmental regulations in the US (Soliman 2020; Gibson 2019). The only study looking at this in the EU ETS context finds no evidence of within-firm leakage. However, this is once again using data which does not go further than the second phase (Wagner et al. 2014).

While observed leakage remains quite low for now, the EU is planning on tightening its ETS to become gradually more stringent. Free allocations will be fully phased out for sectors that do not have a high risk of leakage by 2030 and the ETS’ cap will be tightened by reducing the overall number of allowances on the market by 2.2% each year from 2021 onwards. This should increase the price of carbon over time as well as the financial constraint on participants that do not receive free allocations. This might in turn increase the risk of leakage.

The impacts of this policy tightening cannot yet be tested empirically. As such, ex ante models can provide valuable insights into the potential impacts of a more constraining ETS. We now turn to the description of these models and their main conclusions about carbon leakage through the competition channel.

3.3 What drives carbon leakage according to ex ante general equilibrium models?

CGE models have been the workhorse models used to quantitatively assess the risk of carbon leakage linked to different policy scenarios in the long run. These models identify the conditions under which significant carbon leakage can occur, the policy choices that can mitigate this risk, and the behavioral and contextual parameters which can exacerbate or mitigate the problem. Most of them use data from the Global Trade Analysis Project (GTAP) to calibrate behavioral parameters and elasticities, which are then used in ex ante policy simulations, generally imposing a carbon price on a given region. To avoid any distortionary effects, most of these studies include revenue recycling for this carbon price, in the form of a lump-sum transfer back to consumers (Carbone and Rivers 2017).

Though these models provide quantitative results on the amount of carbon leakage which can be expected given certain assumptions—which we briefly discuss below, these results are quite sensitive to the calibration choices made in each model. Additionally, CGE models are too broad in scope to model specific existing policies like the EU ETS. Instead, they generally model uniform price increases across an entire region. As such, the qualitative insights from this literature are more important to understand leakage. The exact time frame studied in these models is also not too significant but they are meant to capture long-run effects.

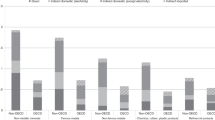

Branger and Quirion (2014) perform a meta-analysis of CGE studies on the topic of carbon leakage and find that estimates of the leakage ratioFootnote 10 range from 5 to 25%. This means that up to one-quarter of the emission reductions a climate policy induces in the region where it is implemented are compensated by an increase in emissions outside of this region.

Carbone and Rivers (2017) review the CGE literature specifically studying the impact of environmental policies on competitiveness indicators. They find that the literature identifies an average 5% reduction in the output of energy-intensive and trade-exposed (EITE) sectors resulting from a 20% unilateral emission abatement objective. This seems to indicate that in a scenario where carbon pricing becomes more stringent, there could be a higher risk of carbon leakage, especially for EITE sectors. However, the magnitude of this phenomenon is not clear and highly depends on the parametrization of each CGE model.

Some of the parameters that are used in CGE models have a particularly large influence on the size of the estimated carbon leakage ratio. The most determining parameters are the Armington elasticity,Footnote 11 the size of the abating coalition, and market structure assumptions. This is somewhat problematic given that there is uncertainty surrounding the value of these parameters, as described below.

Estimates of the Armington elasticity, which measures the degree of substitutability between foreign and domestic products, can vary substantially; differences in estimates are largely driven by the level of data aggregation, as well as data size, frequency, and dimension (Bajzik et al. 2020). Despite the uncertainty surrounding the real value of this elasticity, Branger and Quirion (2014) note in their meta-analysis that the choice of a high Armington elasticity has a positive and statistically significant impact on a model’s estimate of the carbon leakage ratio. To get around this, some studies carry out sensitivity analyses using relatively higher and lower values of the Armington elasticity to produce a range of leakage estimates. However, this does not remove all of the uncertainty related to this parameter.

Finally, market structure assumptions can also influence the amount of leakage that models find. Most CGE models assume perfectly competitive Armington structures of international trade. However, Babiker (2005) and Balistreri and Rutherford (2012) show that departing from this structure can lead to much higher leakage estimates. Babiker adopts an oligopolistic structure and assumes energy-intensive goods are Heckscher–Ohlin in structure—meaning that goods produced in different countries are perfectly substitutable. In this scenario, the leakage ratio exceeds 100%. Babiker (2005) explains this surprising result by the fact that unexploited economies of scale in energy-intensive industries could be unlocked when production is relocated to developing countries. Balistreri and Rutherford (2012) apply Melitz’s (2003) “New” New Trade theory, a monopolistic competition structure, to an otherwise standard CGE model. They find that adding firm heterogeneity to their model exacerbates the problem of carbon leakage through the competition channel because resources are reallocated to the most productive firms in the unregulated region, which do not have any incentive to reduce their emission intensity.

Mathiesen and Maestad (2004) make the argument that the broad scope of general equilibrium models does not allow them to capture important sectoral specificities which may bias estimates of the carbon leakage ratio. Their paper focuses on the steel sector. They use a partial equilibrium framework and show that adding substitution possibilities between different types of steel production and between inputs to steel production halves the leakage ratio compared to what general equilibrium models—which do not include these specificities—generally find. Another potential source of effect overestimation is that most CGE models apply an economy-wide carbon tax, without any sectoral exemptions. This does not reflect the EU ETS’s functioning, as the regulation only applies to certain industries and thus has a more restricted perimeter which should create a smaller risk of leakage.

The main takeaway from the CGE literature is that while the magnitude of leakage caused by an ETS is uncertain, there is a general consensus around the fact that the more constraining carbon pricing is, and the smaller the abating coalition is, the more of a problem carbon leakage may become.

3.4 What are the remaining gaps in the literature for the competition channel?

As we have seen, the economic literature is inconclusive about how much of a problem leakage through the competition channel actually is. While the empirical literature shows that leakage has not been a problem in the first phases of the EU ETS, it does not yet give results about the more constraining recent phases of the system. On the other hand, ex ante literature points to a higher risk of leakage, the magnitude of which is uncertain.

This literature could therefore be completed with empirical assessments of more recent phases of the EU ETS, once data becomes available. Concerning ex ante modeling, more work could be done on the impact of the EU ETS on value-chains inside and outside the EU, and how network effects could exacerbate leakage.

Additionally, non-price competition is not taken into account in existing models, despite the fact that it may have a significant impact on international trade patterns (Bas et al. 2015). Vertical competition through quality or branding could significantly affect the leakage ratio if consumers have a strong preference for higher quality products. For example, if EU steel producers manage to successfully decarbonize their production, they will likely be able to pass on higher production costs to construction companies which face increasing pressure and mounting regulatory standards to include environmental criteria in their production decisions.

4 The energy channel

The energy channel is less discussed than the competition channel in policy circles, but it has been identified in the economic literature as a potentially significant, long-term threat to the effectiveness of a region’s environmental strategy. In this section, we first discuss the mechanism underlying this channel, before reviewing the literature studying the magnitude of leakage that could occur through it. This is generally studied using CGE models. We also discuss the empirical evidence that can be linked to this channel, before highlighting research areas that should be explored in future.

4.1 How does the energy channel work?

Carbon leakage through the energy channel is a macroeconomic phenomenon resulting from a price change on international energy markets (see Fig. 3). As a region increases the stringency of its environmental policies and transitions its energy system away from fossil fuels, its domestic demand for fossil fuels should decrease and tend to zero in the long run. The region’s lower demand for fossil fuels puts a negative pressure on the price of these products on global markets. As a result, producers in unregulated regions have an incentive to increase their fossil fuel consumption as these fuels get cheaper. They do this either by substituting them into their production process, or by increasing their output. The regulated region’s lower demand for fossil fuels, and consequent decrease in emissions, are therefore compensated by an increased demand in unregulated regions (Arroyo-Currás et al. 2015).

From a policy perspective, it is important to understand the relative weight of the energy channel compared to the competition channel. Policy instruments like free allocations and CBAs are only effective to tackle leakage through the competition channel but have no impact on energy markets and prices. As such, they are not adequate policies to tackle leakage through the energy channel. If the energy channel is larger in magnitude than the competition channel, other policy instruments should be developed to deal with this second leakage channel.

4.2 What is the magnitude of leakage through the energy channel?

To get an initial idea of the potential risk the EU faces from leakage through the energy channel, we first need to understand how much sectors covered by the EU ETS weigh in the bloc’s overall final demand for fossil fuels. Using Eurostat’s commodity balances,Footnote 12 we estimate that in 2020, sectors covered by the EU ETS accounted for roughly 50% of the EU’s demand for gas, 20% of its oil demand and 95% of its demand for solid fossil fuels. This estimate accounts for both energy and non-energy use. The actual impact of a significant and rapid reduction of this usage depends on how much the EU weighs in global energy demand. The studies that try to model this impact are described hereafter.

The energy channel has almost exclusively been studied through ex ante structural models. Empirical methods have not been used due to the absence of observable country-specific demand shocks on fossil fuel markets resulting from stringent environmental policies. The ex ante literature does not decisively converge on the relative importance of the energy channel compared to the competition channel, mostly because of the sensitivity of estimates to certain parameters. For instance, the EC’s own estimates of carbon leakage under different policy scenarios include effects from the energy channel, but their study does not discuss the decomposition between the energy and the competition channel—or how the former channel affects leakage rates under a CBAM scenario (European Commission 2021a).

By far the most determining parameter in energy channel leakage estimates is the elasticity of fossil fuel supply in the energy sector (Burniaux and Oliveira 2012). This channel hinges on the effect of a downward price pressure on global fossil fuel markets. If fossil fuel suppliers cannot adapt their production levels to a negative demand shock (low supply elasticity), lower prices should incentivize producers in unregulated regions to increase their consumption of fossil fuels. This will generate high levels of leakage. However, if suppliers can adapt their production levels when faced with a negative demand shock (high supply elasticity), they can drive prices back up by cutting supply, which would significantly limit leakage.

In their study, Burniaux and Oliveira (2012) run sensitivity analyses on a simplified static CGE model to determine which parameters have a significant influence on the value of leakage estimates. They highlight the importance of the elasticity of fossil fuel supply and note that the Armington elasticity has a smaller influence on the overall leakage ratio. Since this Armington elasticity largely determines leakage through the competition channel but does not impact leakage through the energy channel (Balistreri et al. 2010), this could indicate that the energy channel makes up a larger share of the overall leakage ratio than the competition channel does.

Boeters and Bollen (2012) further explore the question of the relative importance of each channel of leakage. To disentangle leakage through the energy channel from leakage through the competition channel, the authors compare dynamic CGE models in which they fix the price of fossil fuels at their business-as-usual levels (thus removing leakage through the energy channel) with dynamic CGE models in which they do not. They fix fossil fuel prices by adding a compensatory output tax in the system of equations modeling supply and demand responses to a demand shock. The tax adjusts to stabilize the buyer’s price and allows for the stock of natural resources to remain untouched in the case of a negative demand shock. The authors include two different model specifications for the redistribution of revenue from their tax: one in which the revenue is redistributed to exporters from the unregulated region, and one in which it is redistributed to importers from the regulated region. These alternative specifications do not impact the results related to leakage, but allow the authors to demonstrate that welfare in the regulated region is larger when revenue is redistributed to importers. Their results show that the energy channel causes a larger share of leakage than the competition channel does, especially if Europe unilaterally abates its emissions without partnering with other UNFCCC Annex I countries.

Huppmann and Egging (2014) find a similar result using a dynamic bottom-up energy system model rather than a top-down elasticity of substitution model, as is common in CGE models. They conclude that tightening the EU ETS could lead to a leakage ratio of 60–70% via the energy channel.

Contrary to these findings, Arroyo-Currás et al. (2015) argue that leakage through the energy channel might be more restricted than is commonly thought because demand for fossil fuels in unconstrained regions will eventually saturate. They argue that substitution possibilities between fossil fuels are also not infinite. Their dynamic model thus imposes an upper bound on the amount of leakage that is possible through global energy markets. It includes transport costs for international fossil fuel trade, as well as low carbon prices even in unconstrained regions, which further lowers their leakage estimates. The overall leakage ratio their model finds does not exceed 15%.

The CGE models discussed in this section mostly study the period between 2010 and 2050. They compare data from a baseline year (generally 2010) to projected values for a final year (generally 2050), thus measuring change over the course of a relatively long time period. Much like for the competition channel, these studies can therefore be considered to measure the impact of climate policies over the long run. A notable exception is the paper by Boeters and Bollen (2012), which compares a baseline year in 2004 to projected values in 2020.

A separate but related strand of the literature focuses on inter-temporal carbon leakage, a mechanism which also operates through global energy market prices and is founded on the Hotelling rule.Footnote 13 In this literature, stringent climate policies only change the temporal profile of the extraction and consumption of fossil fuels, but not the total, long-term amount that is ultimately extracted and consumed. When prices are low (high), producers extract and sell more (less). As a result, implementing gradually increasing carbon prices may actually incentivize forward-looking fossil fuel producers to increase their present extractions and sales in anticipation of lower future scarcity rents. This is a mechanism known as the green paradox, developed by Sinn et al. (2012). For a full literature review on this topic, see Jensen et al. (2020).

As we have seen, CGE models tend to indicate that the energy channel causes more leakage than the competition channel, with some notable exceptions such as the study by Arroyo-Currás et al. (2015). However, there are some significant caveats attached to this conclusion due to the modeling characteristics we have discussed.

4.3 Can the energy channel be examined through empirical testing?

To our knowledge, no empirical studies exist testing for the presence of cross-country carbon leakage through the energy channel, whether caused by the EU ETS or any other environmental regulation. This is because there has not yet been a large unilateral shock to fossil fuel demand in any region as a result of environmental policy. However, there are a few empirical studies of inter-temporal leakage through this channel, related to Sinn’s (2012) concept of the green paradox.

While most studies looking into the green paradox have been theoretical and analytical, some authors have been able to exploit data related to policy shocks in the US and China to provide empirical analyses of this phenomenon. Jensen et al. (2020) discuss some of this literature in the US context. Zhang et al. (2017) both review the empirical literature and contribute to this strand of research in the Chinese context. Overall, there is limited evidence of any effect in the US, and some evidence that there is a small green paradox effect in China. It should be noted that authors studying both cases highlight that their results are very context-dependent and cannot be generalized to other countries and/or policies.

One other study is of note in relation to the energy channel—more specifically in relation to cross-country rather than inter-temporal leakage through this channel. Though derived from a different context, the conclusions from Knittel et al. (2018) are relevant and potentially insightful. The authors study the impact of the Shale Revolution on international coal trade. The Shale Revolution came from the rapid improvement and expansion of hydraulic fracturing and horizontal drilling technologies, around 2006/2007 (Wang et al. 2014). These new technologies very rapidly made natural gas cheaper than coal in the US. This acted as a fairly sharp negative demand shock on the coal industry in this country, which the authors take as an object of study. They find that the total amount of coal traded on international markets before and after the Shale Revolution are more or less the same, but US coal producers started supplying foreign demand. Indeed, they were able to fully replace the domestic demand that disappeared as a result of the Shale Revolution with foreign demand. This seems to indicate that there could be 100% leakage through the energy channel for coal.

4.4 What are the remaining gaps in the literature for the energy channel?

The largest gap in the literature is of course empirical validation of the energy channel. While this channel is difficult for policymakers to apprehend because it does not yet present a tangible risk, it could invalidate the policy choice of implementing a CBA. Empirical testing will only be possible if a large enough and fast enough country-specific demand shock occurs on fossil fuel markets. The EU’s Green Deal will have to be closely monitored for this type of an effect.

The inter-temporal aspect of this channel could also be further explored. Existing studies look at the effect of inter-temporal leakage on overall leakage, but do not consider the impact the energy channel could have on inter-temporal leakage.

5 The innovation channel

Finally, the last of the three channels through which carbon leakage can occur is the innovation channel. It works in an opposite manner compared to the first two we have discussed, in the sense that it generates negative carbon leakage. When a region imposes a stringent environmental regulation, emissions are reduced in the unregulated region as well. We first describe how this channel works, before turning to the way it is represented in CGE models. We then review the empirical evidence related to it and conclude by identifying remaining gaps in the literature focused on this channel.

5.1 What is the innovation channel?

Carbon leakage through the innovation channel can be described as a three-step process (see Fig. 4). In the first step, climate policies make existing low-carbon processes and technologies more economically viable, which induces firms to start using them. Additionally, firms have more of an incentive to invest in low-carbon research and innovation, which also improves their environmental performance in the long run. As a result, emission levels in the regulated country are brought down. This first step is known as the weak form of the Porter hypothesis (Porter 1991; Porter and van der Linde 1995).Footnote 14

In the second step, these low-carbon innovations are diffused to countries that do not have climate policies in place. In practice, this diffusion may be hindered by the lack of a market for low-carbon products in unregulated countries, as well as lax intellectual property laws and barriers to trade. On the other hand, this channel can be strengthened through international innovation funds and technology transfer initiatives.

Finally, the third step occurs when these innovations are used by firms in the unregulated region, allowing them to reduce the carbon intensity of their production, thus bringing down overall emission levels.

This is the only leakage channel that has a clearly negative leakage effect. Through this channel, stringent climate policies in one region can decrease emissions in other unregulated regions, instead of increasing them like the competition and energy channels. As such, policies that target the development of this channel could have significantly positive impacts on the global climate. The innovation channel increases the efficiency of unilateral climate policies. It is therefore important to understand the magnitude and drivers underlying this channel to design policies aimed at strengthening it.

5.2 How is the innovation channel modeled in general equilibrium models?

To better understand the functioning of the innovation channel, we first turn to CGE models, which can give some insight into the potential magnitude of the channel. Most of these models include technical change as a fixed exogenous parameter and consequently do not account for the innovation channel. However, some studies argue that this omission can lead to a significant overestimation of the overall leakage ratio.

Di Maria and Van Der Werf (2008) build a theoretical framework exploring this argument. They compare a baseline two-sector, two-country model in which technological change is endogenous and undirected with a model which has exactly the same characteristics except that technological change is directed in the sense given by Acemoglu et al. (2012). In the latter model, stringent climate policies direct technological innovation toward climate-friendly innovations in the regulated country. Allowing for directed technological change leads to a significant reduction in the overall leakage ratio. As a result, the authors argue that most CGE models may be overstating the risk of leakage because they fail to account for the green innovation that stringent climate policies should induce. It is worth noting that in this model, innovations are diffused from one country to another immediately and at no cost, which could lead to overstated numerical results compared to a more realistic diffusion scenario. Qualitatively however, the argument stands.

Gerlagh and Kuik (2014) test Di Maria and van der Werf’s theoretical framework in a CGE model which includes endogenous and directed technological progress. In their setup, the elasticity of substitution between a carbon energy input and a non-carbon energy input is constituted of a technology parameter and a non-technology parameter. Both parameters sum to the total elasticity of substitution between the two inputs. A price increase for either of the inputs induces investments in input-saving technological innovation which modifies the technology parameter of the elasticity of substitution. If the carbon energy input becomes relatively more expensive than the non-carbon input for instance, technology will improve so that less of the carbon energy input is required for the same level of output. Interestingly, the authors find that the leakage ratio can be negative, even at moderate levels of technological diffusion between countries. This is because the innovation channel has the potential to induce large amounts of negative leakage, which can trigger large emission reductions both in the regulated and the unregulated region. To verify the validity of the CGE results we have discussed, we now turn to existing empirical evidence studying the innovation channel.

5.3 Is there any empirical evidence pointing to the existence of the innovation channel?

As we have described in Sect. 5.1, the innovation channel operates as a three-step mechanism: climate policies create incentives for firms in the regulated country to improve their environmental performance through process improvements and low-carbon innovation (step 1). The technology they develop is then diffused to unregulated countries (step 2), thereby reducing their overall carbon emissions as well (step 3). In this section, we sequentially review empirical evidence for each of these three steps.

There is a general consensus in the literature concerning the first step of the innovation channel, which is closely related to the weak form of the Porter hypothesis. Indeed, most studies find a positive and statistically significant relationship between environmental policies and green innovation.Footnote 15

There is also evidence that the EU ETS, specifically, has led to low-carbon innovative activity (Teixidó et al. 2019). Of particular note in this strand of literature is the paper by Calel and Dechezleprêtre (2014), due to the robustness of its methodology and findings. The authors use a matched difference-in-differences specification to compare the innovative behavior of firms regulated under the EU ETS with the innovative behavior of firms not regulated under the EU ETS. They find that regulated firms started patenting more low-carbon innovations than their unregulated counterparts in 2005, when the EU ETS was first implemented. In a more recent study, Calel (2020) found further evidence that the EU ETS has increased low-carbon patenting and R&D in regulated UK firms by 20–30% compared to unregulated UK firms. Though insightful, the approach developed by Calel and Dechezleprêtre is somewhat limited for three reasons. First, it only considers technological progress as innovative activity and not the adoption of new technologies, which can lead to an underestimation of the EU ETS’ effect through the innovation channel. Second, if carbon-abating innovation is occurring in sectors that are not directly covered by the EU ETS, but instead in sectors upstream of covered sectors, there can also be an underestimation of the innovation channel’s effect. Third, the more recent work by Calel (2020) highlights that in spite of having a higher innovation rate as measured by patenting, the carbon intensity of firms covered by the EU ETS did not significantly fall, suggesting that patented inventions did not actually turn into technical change.

Borghesi et al. (2015) take a different approach to explore this question, exploiting data from the 2006–2008 Italian Community Innovation Survey to test whether manufacturing firms covered by the EU ETS adopt more environmental innovations than those not covered by the EU ETS. This avoids one of the problems mentioned above since the authors are not measuring innovative activity as a proxy for technological progress, but measure technological adoption instead. Their results show that participating in the EU ETS makes firms more likely to adopt environmental innovations. Given that their study uses data from the first and second phases of the EU ETS, when free allocations were the general rule and prices were low and volatile, this could mean that firms were anticipating higher future prices and acting accordingly. If this is true, firms’ anticipation of future regulatory pathways could be as important in determining their innovative behavior as current regulation is.

Fewer studies look into the impact of this low-carbon innovative activity on firms’ environmental performance, measured both as carbon intensity and overall carbon emissions. Baudry and Faure (2021) adopt a technological frontier framework which allows for a classification of firm-level technology based on its carbon intensity. They show that while the EU ETS has led to technological progress which reduces firms’ carbon intensity, there has also been a rise in overall carbon emissions as a result of higher production levels. Their findings highlight the fact that even when firms covered by the EU ETS reduce the carbon intensity of their production, they can still have higher overall baseline (or Business As Usual) emissions.

Two further elements should be noted. First, there could be a time component affecting this channel. Most empirical studies do not discuss the expected time frame for the innovation channel to operate, but assume it implicitly through the choices made in data collection. Works adopting a difference-in-differences approach to assess the impact of the EU-ETS (Calel and Dechezleprêtre 2014; Lofgren et al. 2014; Calel 2020) consider a time window ranging from four to seven years after its implementation in 2005. It is worth noting that the response time for companies may have been longer since the ETS project was announced several years in advance by the EC. In their study using the Community Innovation Survey, Borghesi et al. (2015) assume a similar delay. However, these authors are careful to specify that “the time span between the introduction of the EU ETS and the observed innovation effects—though rather limited in the present context—allows to have a clear time lag between the ‘policy dose’ and the ‘innovation response’, and it is commonly used in the literature that evaluates firms’ reaction to the implementation of policies”. It should however be stressed that the aforementioned works also meet a requirement to assess the impact of the EU ETS relatively early after its inception to fuel the debate on possible reforms, and therefore they could not de facto consider a more substantial time lag. Among the few papers that explicitly question the dynamics of innovation effects, we can mention the literature review by Dechezleprêtre and Kruse (2018), which highlights the fact that environmental regulation could initially have a negative effect on innovative activity, which turns positive in the long run. Another interesting paper with this respect is the one by Schmidt et al. (2012) which shows that it is mainly the perceived long-term emissions reduction targets of the EU ETS that affect low-carbon R&D.

The second element to be noted is that the type of green innovation that is developed could matter. For instance, innovations improving firms’ resource efficiency seem to provide positive returns to profitability, while innovations improving other parts of the production process do not (Rexhäuser and Rammer 2014; van Leeuwen and Mohnen 2017). A related strand of literature looks at the strong version of the Porter hypothesis, which posits that environmental regulation improves firm productivity. Proving its validity can be an important factor to improve the social acceptability of environmental regulation. Cohen and Tubb (2018) conduct a broad meta-analysis of studies on this topic and find considerable heterogeneity in the sign and significance levels of results. They find that the most likely conclusion is that environmental regulation is neither significantly beneficial nor significantly detrimental to productivity.

Empirical studies of the innovation channel’s second step study technological diffusion from regulated to unregulated countries. One strand of these studies provide descriptive analyses of the geography of green innovative activity. These works point to a concentration of patented green innovations in very few countries, namely the US, Japan, Germany, and, more recently but to a lesser extent, China. Innovations patented in high-income countries are mostly transferredFootnote 16 to other high-income countries. The small amount that is transferred to middle-income countries (roughly one third of total transfers) mostly goes to China (around 72% of transfers from high- to middle-income countries). Virtually no transfers are made to low-income countries (Dechezleprêtre et al. 2011; Probst et al. 2021). This is a first indication that there may not be perfect diffusion of technology between all countries as modeled by Di Maria and Van Der Werf (2008).

Another strand of this literature looks at the role of technology transfers in specific low-carbon sectors, such as wind and solar power generation. Many papers study the case of China, a country where expertise in both of these fields was developed in large part thanks to strong flows of foreign direct investments and technology transfers. In the case of wind turbines for instance, large parts of Chinese demand were developed through the sale of Clean Development Mechanism credits on the ETS (Baudry and Dumont 2021). In the case of photovoltaic cells, technology transfers from Western countries, especially Germany, were key to develop China’s manufacturing expertise (Huang et al. 2016). This underlines the potential strength of the innovation channel if diffusion is made more widespread.

Finally, empirical evidence concerning the third step of the innovation channel is quite sparse. To our knowledge, there are no studies looking specifically at the ways in which low-carbon technology transfers to unregulated countries improve these countries’ environmental performance and/or productivity. The most closely related paper is a recent study by Eskander and Fankhauser (2021) which measures carbon leakage as the impact of climate policies on the import and export of carbon emissions. The authors take a macro perspective and find that climate legislation passed more than 3 years ago has generated small negative leakage rates. Without getting into any analysis on technology development and diffusion, they note that this result is consistent with the hypothesis of the innovation channel. Some literature also looks at the impact of technology transfers on the receiving country’s knowledge base, but results are mixed and do not allow for a general conclusion on the success or failure of technology transfers as a method of knowledge sharing (Kirchherr and Urban 2018).

It is also worth highlighting evidence from two further papers, which are more indirectly related to this issue. First, Barrows and Ollivier (2021) look at the impact of foreign demand shocks on the carbon emissions of a third country—India. They find that while positive foreign demand shocks drive reductions in emission intensity, they also generate a strong, positive scale effect—meaning firms produce more—leading to overall greater carbon emissions in India. Jaraite et al. (2021) also note a similar effect when studying the impacts of the Clean Development Mechanism (CDM) on Indian manufacturing firms. This is an important result in our context, since it underlines the fact that even if environmental regulation does lead to more diffusion of carbon-abating technologies in third countries, it might not lead to overall emission reductions if there is also a scale effect.

To summarize, papers studying the innovation channel seem to indicate that it does not yet have a large magnitude but could in the future. Green innovation remains highly concentrated in a few, mainly OECD countries and diffusion is quite limited beyond OECD borders. While policy-induced innovations do seem to improve the environmental performance of firms in the regulated region, their impact on firms in unregulated countries has not yet been studied.

5.4 What are the remaining gaps in the literature?

This topic has garnered a lot of attention in the economic literature, in part due to its close relation to the Porter hypothesis. However, many questions remain unanswered. Further studies of the ETS’ impact on innovative activity within the EU should be conducted, especially with a focus on the environmental impact of these innovations. Research on policies which could act to avoid a rebound effect should also be prioritized as the EU ETS becomes increasingly stringent.

Another area of interest could be to look at the EU ETS’ impact on the innovative behavior of sectors that are not directly covered by it, but that are upstream or downstream of sectors that are. For instance, in the sector of wind power generation, most innovation occurs in sectors upstream of those covered by the EU ETS, so it would be interesting to study how the policy is affecting these sectors. This could complement works such as those by Calel (2020) which give insights into the innovative activity of firms directly covered by the EU ETS.

To better understand the innovation channel’s third step, studies could also focus on the ways in which green innovation is absorbed by unregulated countries’ production processes once it is transferred there. Testing whether innovations are well-absorbed and whether they effectively reduce emissions in unregulated countries would be particularly important to quantify the innovation channel’s environmental impact.

6 Designing a carbon border adjustment

Policies aiming to minimize overall carbon leakage can target any or all three of the channels we have described. They should try to minimize positive leakage (i.e., emissions increasing in the unregulated region) through the competition and energy channels, while maximizing negative leakage (i.e., emissions decreasing in the unregulated region) through the innovation channel. Our interest in this section is to explore whether a CBA can achieve these objectives. We present the economic literature on this topic and aim to answer the two following questions:

-

1.

Is a CBA an appropriate instrument to minimize leakage?

-

2.

How can it be designed to best reduce overall leakage through all three channels?

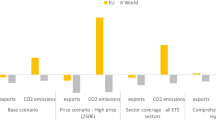

Most of the literature on designing a CBA is focused on minimizing positive leakage through the competition channel. Our contribution is to add considerations about the other two channels based on the evidence presented above on their functioning. Given that a CBA has not been implemented on a large scale anywhere in the world, our discussion is mostly based on theoretical and CGE models.

6.1 How can a CBA reduce leakage through the competition channel?

The idea that a country with domestic carbon pricing could impose an import tariff to avoid carbon leakage was first put forward by Markusen (1975) in a two-good, two-country game-theory model. It was then generalized by Hoel (1996) in a game-theory model with N number of goods. The results from these seminal works indicate that the optimal tariff to avoid leakage is always non-zero and below the domestic (Pigouvian) carbon tax rate. The reason it is lower than the domestic rate is that a carbon tariff decreases the relative price of the polluting good in the unregulated region, mechanically increasing demand for it. This is sub-optimal both from an environmental and a competition perspective, implying the tariff should be lower than the domestic carbon price. One important element to note is that this holds only when the country or coalition of countries that imposes the carbon price is large enough to have some market power at the international level. If it does not, its tariff will have no effect on the foreign price of the polluting good or on production decisions in the unregulated region.

More recently, Balistreri et al. (2019) modified Markusen’s framework to align it with the current WTO context. In Markusen’s model, the optimal tariff rate is a function of the domestic carbon price, a strategic element, and an environmental element. Balistreri et al. (2019) neutralize the strategic element, in line with WTO law which states that countries cannot impose import tariffs for strategic reasons. Even in this setup, the optimal tariff is not zero, and remains below the Pigouvian tax. Testing their model in a numerical simulation, the authors find that if a coalition made up of UNFCCC Annex I countries were to implement a domestic carbon price, the optimal tariff for imports to this coalition would be roughly 40% of the domestic price. Theoretical works clearly indicate that a tariff could be an effective way to reduce carbon leakage through the competition channel.

CGE models tend to confirm these theoretical results. Branger and Quirion (2014) provide a meta-analysis of 25 studies looking at CBAs, and find that all else being equal, CBAs reduce the leakage ratio by an average 6 percentage points. This is a 6-percentage-point reduction in already relatively small leakage rates (5–25% in most CGE models). While CBAs do seem to decrease leakage risk, the CGE-predicted magnitude of this reduction appears quite small compared to the burden of such a complex legislation.