Abstract

This paper addresses the issue of assessing eco-efficiency when good and undesirable outputs are jointly produced. We propose that eco-efficiency can be decomposed into two parts: resource efficiency and ecological efficiency. We provide a conceptual framework based on data envelopment analysis (DEA) approach to measure and benchmark eco-efficiency. The study is conducted between 2011 and 2012 using real data from 17 French firms belonging to the services to consumers industry, by developing DEA-based models. The results indicate that only three firms in the sample of the study are relatively eco-efficient. We find that eco-efficiency is closely related to environmental efficiency. The results also show that company size, expressed in terms of turnover and number of employees, is inversely related to eco-efficiency scores.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Sustainable development remains the most discussed concept in the international policy debates. Its main objective is that economic growth must not deplete irreplaceable natural resources, must preserve the ecological systems and should help to reduce social inequalities worldwide (De Simone and Popoff 2000).

Total sustainability can be achieved only if all negative social and environmental externalities are eliminated (Boron and Murray 2004). The challenge of balancing human economic system and the absorption capacity of production externalities, by our planet earth, require new tools and new approaches (Hoffren and Apajalahti 2009). The concept of economic and ecological efficiency which is commonly called eco-efficiency has emerged in the 1990s as a pragmatic approach for a better representation of sustainable development principles (Schaltegger and Synnestvedt 2002). Eco-efficiency concept was popularized and promoted by the World Business Council for Sustainable Development (WBCSD) which presents eco-efficiency as a management philosophy that encourages companies to balance between environmental and economic performance by promoting innovation, growth and competitiveness (WBCSD Report 2000, p. 4). Helminen (1998) emphasizes that any creation of economic wealth must be accompanied by a decrease in the use of natural resources and by an equitable distribution of wealth.

Eco-efficiency concept requires new methodologies to analyze and measure economic activities impacts. A variety of instruments for measuring eco-efficiency has been introduced in the literature (see Tyteca 1996). However, most of these measures represent only a simple one-dimensional assessment that addresses the concept of eco-efficiency from a narrow perspective, considering only a limited number of factors in the organizational production process (Oggioni et al. 2011). For example, eco-efficiency can be measured by ratios linking the economic value of products and services to environmental pressures or environmental impacts of production processes (Picazo-Tadeo et al. 2012). At the macro-economic level, eco-efficiency was measured by indicators such as the ratio between GDP and CO2 emissions. On the micro-economic level, eco-efficiency evaluation has been widely discussed by absolute or relative singular measures about environmental performance indicators (Dyckhoff and Allen 2001; Perotto et al. 2008). Despite their necessity and importance, these indicators are inadequate to capture the holistic nature of eco-efficiency in the sense that economic output can be produced with different combinations of pressures and environmental impacts. In recent years, more sophisticated approaches for assessing eco-efficiency have been developed. Data envelopment analysis (DEA) is one technique that provides an assessment of eco-efficiency with the ability to consider a set of performance indicators of different types within an organizational production process.

This study aims to analyze the eco-efficiency of French companies in the services to consumers industry by employing DEA technique [see Managi et al. (2004) for intuitive explanation of DEA]. DEA evaluates the efficiency of a decision making unit (DMU) that can be any type of homogeneous production process (hospital, university, company, municipality, prison, etc.). This approach has the advantage to consider simultaneously a set of inputs (with different units of measurement) and at the same time, a set of desirable outputs (products or value added services), and a set of undesirable outputs (waste and pollutants) that characterize a production process.

Following this introduction, Sect. 2 reviews the theoretical foundation and the measurement framework of eco-efficiency analysis. Based on previous research, we propose in the third section a DEA model for assessing eco-efficiency in 17 French firms operating in the services to consumers industry. Section 4 provides discussions on the results of our research. Finally, Sect. 5 concludes and suggests several avenues for further research.

2 Eco-efficiency

The theoretical background of eco-efficiency finds its roots in ecological economics. The purpose of eco-efficiency is the combination between economic and material efficiency of production with respect to the objectives of sustainable development (Koskela and Vehmas 2012; Hoffren and Apajalahti 2009). Eco-efficiency means that the intensity at which we both use raw materials and consume energy should be reduced. It also means that we should improve the possibilities of recycling and reusing, optimizing the use of regenerating resources, increasing the product life cycle and its chances to be decomposed into reusable components, reducing toxic emissions in the environment, etc.

However, eco-efficiency is also motivated by the perspective of important financial economy that can potentially results from lower bills for energy and water consumption, less expenses with raw materials, materials, fuel, etc. (Vîrjan 2011). To reach concurrent ecological and economic progress, eco-efficiency concept specifies that companies should adopt innovative and active pollution reduction programs to achieve these goals (Burnett et al. 2007). Porter (1991) and Porter and Van der Linde (1995a, b) basically agree with the eco-efficiency paradigm and argue that when proactive technological innovation is strategically adopted to improve efficiency, product quality will rise while environmental costs, environmental risk, and stakeholder pressure will decrease. Porter hypothesis was tested and validated by Managi et al. (2005) who found that technological progress can play an important role in raising the standard of living while enhancing the environmental quality.

Typically, eco-efficiency is commonly understood as a combination of economic and environmental performance of a specific system (Koskela and Vehmas 2012). Many authors argue that there is a mess of strategies for achieving eco-efficiency. They include lean manufacturing, waste minimization or beneficial reuse, adopting innovative technologies that raise material and energy yields, and shifting energy resource demands from petroleum based to renewable (e.g., wind or solar energy). Table 1 presents key elements and principles for improving eco-efficiency of any economic activity.

Eco-efficiency concept is frequently used to measure the environmental performance of a company in a relative sense. It can be defined as the ratio of the value a company adds (e.g., by producing products) to the waste the company generates by creating that value (Derwall et al. 2005). Like so, it has become accustomed to present eco-efficiency as a combination of economic and environmental values, expressed by the ratio of economic value/environmental impact (Caetano et al. 2012; Sinkin et al. 2008). Zhang et al. (2008) argue that there are still no standard indicators and measurement for economic and environmental values, as well as eco-efficiency.

For the economic part of the eco-efficiency ratio, WBSCD maintain that the general applicable indicators for product/service value are quantity produced and net sales (WBCSD 2000). United Nations Conference on Trade and Development (UNCTAD) suggests using value added indicators such as sales revenue (UNCTAD 2003). For the environmental part of the eco-efficiency ratio, WBSCD suggests that environmental influences can be total energy consumption, materials (raw and ancillary materials) and water consumption, greenhouse gas emissions and ozone depleting substance emissions (WBCSD 2000). Seppälä et al. (2005) point out that those environmental performance indicators should be relevant, measurable, achievable, valuable and understandable to develop sustainability. Wang et al. (2012) note that although it is a big challenge to present a reasonable indicator for the total environmental efficiency, different methods were used as approximations. Weighting factor methods of the various environmental impacts were usually used (Zhang et al. 2008). The judgments from policymakers and experts were used to give weighting values to quantify eco-efficiency ratio. However, this has led to subjective results and has made them unreliable (Kuosmanen and Kortelainen 2005; Seppälä et al. 2005).

A further class of aggregate indicators is derived from the productive efficiency framework. Data envelopment analysis (DEA) is considered to be a solution for aggregating different environmental pressures to build an encompassing of eco-efficiency indicators. DEA methodology proposes that each corporate unit can assume a set of weights, which provide the most favorable combination of weights for the input and output compared to other units (Farrel 1957; Charnes et al. 1978). As a result, DEA can be an alternative solution in the deviation of weight coefficients, normative judgments and subjective valuations of weights. DEA is presented as an aggregation method where production inputs and outputs, pollutants and financial elements, are aggregated using self-defined weighting coefficients to produce an aggregate score. These scores take the value of 1 for units that are efficient and the value of less than 1 for non-efficient units. For each producing unit, DEA (based on linear programming techniques) seeks a weight combination that will yield the maximum value of the efficiency. If the producing unit is efficient, that value will be 1. If no weight combination exists such that efficiency takes the value 1, the producing unit is considered non-efficient (Yu and Wen 2010; Dyckhoff and Allen 2001; Olsthoorn et al. 2001).

On the basis of the above analysis, we seek to develop and select appropriate indicators and DEA models to conceptualize and assess eco-efficiency of French firms operating in the services to consumers industry.

3 Methodology

3.1 Conceptual framework

Through ecological literature, eco-efficiency is perceived as the ratio between economic value added and environmental pressures (Koskela and Vehmas 2012; Picazo-Tadeo et al. 2011; Wang et al. 2012; Korhonen and Luptacik 2004). As noted by Zhang et al. (2008, p. 307), “eco-efficiency is measured as the ratio between the (added) value of what has been produced (income, high-quality goods and services, jobs, GDP, etc.) and the (added) environmental impacts of the product or service”. Thus, eco-efficiency can be expressed as follows:

To apply DEA, performance indicators should be divided into inputs and outputs. The outputs are defined as products and/or services generated by a decision making unit (DMU). The inputs are the resources used to produce outputs. For example, a company uses inputs such as capital, labor and fixed assets to transform them into outputs, usually in the form of products, profit and customer satisfaction.

Zhang et al. (2008) distinguish two classes of inputs that characterize the relationship between the nature and the economy: “the supply of goods/resources (such as raw materials) and nature’s function as the sink for the discharge of residuals and pollutants” (p. 308). Therefore, as suggested by Korhonen and Luptacik (2004), two types of efficiency can be defined. First, “resource efficiency” or “technical efficiency” which considers the environmental impacts resulting from the use of resources. Second, “ecological efficiency” or “environmental efficiency” reflects the environmental impacts following the emission of pollutants. Moreover, Dyckhoff and Allen (2001) note that eco-efficiency assessment must integrate into a single process both resource and environmental efficiency.

As part of our study, two natural resources are considered as inputs: water and energy consumption. The outputs are of two types. First, the desirable outputs which depict the economic value added following the use of resources. We suggest the use of two performance indicators: return on equity (ROE) and waste recycling rate. These desirable outputs are indicators that should be maximized. Second, undesirable outputs show the negative externalities of the production process (e.g., pollutants). These are performance indicators with negative impacts to be minimized in running the DEA model. Two indicators are considered in this study: the quantity of waste produced and the quantity of toxic gas emitted into the atmosphere.

Regarding the choice of the proposed performance indicators, the validity of related measures find its roots in the scope of the GRI’s guideline and ISO’s environmental performance indicators as well. Moreover, these measures reliably reflect not only the widely used definition of eco-efficiency but also the key elements and principles for eco-efficiency improvement (see Table 1). Our conceptual framework can be presented as follows:

3.2 Modeling eco-efficiency with DEA

3.2.1 Theoretical considerations and DEA basic model

This section introduces the DEA-based linear programming model for both technical and ecological efficiency analysis. Let’s begin with some notation. Suppose we have n independent homogenous decision making units (DMUs), each consuming m inputs and producing p outputs. The outputs corresponding to indices 1, 2, …, k are desirable and the outputs corresponding to indices k + 1, k + 2, …, p are undesirable outputs. We would like to produce desirable outputs as much as possible and not to produce undesirable outputs.

Let X \(\in {\Re }_{ + }^{mxn}\) and Y \(\in {\Re }_{ + }^{pxn}\) be the matrices, consisting of non-negative elements containing the observed input and output measures for the DMUs. We decompose matrix Y into two parts: Y = \(\left( {\begin{array}{*{20}c} {{\mathbf{Y}}^{{\mathbf{g}}} } \\ {{\mathbf{Y}}^{{\mathbf{b}}} } \\ \end{array} } \right),\) where a k × n matrix \({\mathbf{Y}}^{{\mathbf{g}}}\) is standing for desirable (“good”) outputs and a (p − k) × n matrix \({\mathbf{Y}}^{{\mathbf{b}}}\) is standing for undesirable (“bad”) outputs. We further assume that there are no duplicated units in the data set. We denote by x j (the jth column of X) the vector of inputs consumed by DMUj, and by x ij the quantity of input i consumed by DMUj. A similar notation is used for outputs. The vector y j can be decomposed into two parts as

y j = \(\left( {\begin{array}{*{20}c} {\varvec{y}_{j}^{g} } \\ {\varvec{y}_{j}^{b} } \\ \end{array} } \right)\), where sub-vectors \(\varvec{y}_{j}^{g}\) and \(\varvec{y}_{j}^{b}\) refer to the desirable and undesirable output-values of DMUj (Hua et al. 2007). Korhonen and Luptacik (2004) argue that when it is not necessary to emphasize the different roles of inputs and (desirable/undesirable) outputs, we denote u = \(\left( {\begin{array}{*{20}c} {\varvec{y}^{\varvec{g}} } \\ { - \varvec{y}^{\varvec{b}} } \\ { - x} \\ \end{array} } \right)\) and U = \(\left( {\begin{array}{*{20}c} {{\mathbf{Y}}^{\varvec{g}} } \\ { - {\mathbf{Y}}^{\varvec{b}} } \\ { - {\mathbf{X}}} \\ \end{array} } \right)\).

Furthermore, we denote, 1 = [1,…, 1]T and refer by e i to the ith unit vector in \({\Re }^{n}\). We consider set T = {u/u = Uλ, \(\in \varLambda\)}, where \(\varLambda\) = {\(\lambda /\lambda \in {\Re }_{ + }^{n}\) and A \(\lambda \le b\}\), e i \(\in \varLambda\), i = 1,…,n. Further consider matrix A \(\in {\Re }_{ + }^{kxn}\) and vector b \(\in {\Re }^{k}\) which are used to specify the feasible values of \(\lambda\) values (Korhonen and Luptacik 2004).

DEA models are of two types: input-oriented and output-oriented models. In input-oriented models, the optimization problem seeks to minimize the inputs used by keeping unchanged the amount of outputs produced. On the contrary, in models with output orientation, we seek to maximize outputs while keeping constant the amount of inputs entering the production process. It should be noted that performance scores are the same regardless of the DEA model orientation. The difference between the two directions is the way in which adjustments are used for the inefficient DMU to become efficient. If adjustments are introduced on the space of inputs, then the model is input oriented. If adjustments are made on the space of outputs, the model is then output oriented (Belu 2009; Oggioni et al. 2011). As part of the problem of the present study, we believe it is wiser to use input-oriented DEA models. Indeed, the objective of an eco-efficiency analysis is to reduce both the amount of resources used and the quantity of pollutants released into the nature. Because of our performance indicators include two traditional inputs (water and energy consumption) and two undesirable outputs (waste and toxic gas emission) that will be converted into inputs to be minimized, we believe that inpu- oriented DEA approach is the best solution to our optimization problem.

The original model of DEA was developed by Charnes et al. (1978). It is called CCR model and assumes a constant returns to scale production technology, calculates overall technical efficiency for each DMU, and identifies both the sources and amounts of inefficiency (Charnes et al. 1994). CCR model reduced the ratio [(multiple outputs)/(multiple inputs)] into one new ratio (one virtual output/one virtual input). The weights (\({\mathcal{U}}\), \({\mathcal{V}}\)) are assigned to each output and input in order to maximize the relative score of each unit so that no score exceeds unity.

Suppose we have a set of n DMUs, j = 1,…, n. For each unit, there are s outputs, r = 1,…, s and m inputs, i = 1,…, m. Let yrj (xij) be the rth (ith) known output (input) of unit j.

Define h j = \(\frac{{\mathop \sum \nolimits_{{{\mathfrak{r}} = 1}}^{{\mathfrak{s}}} {\mathcal{U}\mathfrak{r}\mathcal{Y}\mathfrak{r}\mathfrak{j}}}}{{\mathop \sum \nolimits_{{{\mathfrak{i}} = 1}}^{{\mathfrak{m}}} {\mathcal{V}\mathfrak{r}\mathcal{X}\mathfrak{r}\mathfrak{j}}}}\), where \({\mathcal{U}\mathfrak{r}}\) ≥ 0, \({\mathcal{V}\mathfrak{r}}\) ≥ 0 are unknown variables. The DEA relative efficiency measure hj 0 for a target DMU j 0 can be determined by solving the following CCR model (Charnes et al. 1978):

Using flabby variable and the concept of Archimedes, to transform the above fractional model (Model-1) into a linear programming mode, we will get:

Where \(\theta\) is the pending parameter variable. s− \(\in {\Re }^{m}\) and s+ \(\in {\Re }^{s}\) are, respectively, called input and output slack vectors that correspond to input excesses and output shortfalls. \(\varepsilon\) is a positive non-Archimedean infinitesimal smaller than any positive real number and is used to prevent the weights from being zero (Zhang et al. 2008).

The application of DEA to eco-efficiency concept raises the issue of treatment of undesirable outputs or pollutants (waste and toxic emission). Several modes of undesirable outputs treatment are available in the DEA literature (see, e.g., Charles et al. 2012; Dyckhoff and Allen 2001; Fukuyama et al. 2011; Korhonen and Luptacik 2004; Managi et al. 2005; Nakano and Managi 2012; Riccardi et al. 2012; Scheel 2001; Yu and Wen 2010; Wang et al. 2012; Zhang et al. 2008). As part of an optimization problem, the outputs are usually values to be maximized. In the presence of undesirable outputs, these can be treated as inputs to be minimized. It is this approach that we will retain for the treatment of pollutants. In this study, the input-oriented CCR model will be applied.

3.2.2 DEA models for eco-efficiency

Following Korhonen and Luptacik (2004) and Zhang et al. (2008), we use input-oriented CCR model for the calculation of resource efficiency, ecological efficiency and eco-efficiency. The resource efficiency scores are the result of using resources: water consumption (WC) and energy consumption (EC) as inputs, return on equity (ROE) ratio and waste recycling rate (WRR) as outputs. CCR DEA model for calculating the resource efficiency of unit 0 is as follows:

Thus, in DEA, the resource efficiency of firm A, denoted as REA is maximized subject to the following conditions:

Scores of ecological efficiency are obtained by considering the undesirable outputs: quantity of waste produced (QW) and gas emission (GE) as conventional inputs and the waste recycling rate and ROE ratio as outputs. CCR DEA model for measuring the ecological efficiency of unit 0 takes the form:

Thus, in DEA, the ecological efficiency of firm A, denoted as EEA is maximized subject to the following conditions:

With regard to the eco-efficiency scores, we used as inputs both the resources and the undesirable outputs. The outputs are related to the waste recycling rate and ROE ratio. This idea leads to the following CCR DEA model:

Thus, in DEA, the eco-efficiency of firm A, denoted as EcoEA is maximized subject to the following conditions:

Using a standard technique (Charnes et al. 1978) to transform the above fractional model (Model-4) into a linear mode, we will get the following primal–dual linear programming model pair. So, the (input − undesirable output) oriented CCR model can be presented in the following mode:

This model corresponds to a standard input-oriented primal CCR model provided that undesirable outputs behave in the model like inputs. In this model, the DMU reduces simultaneously the inputs and the undesirable outputs in order to increase eco-efficiency (Korhonen and Luptacik 2004). The vectors s− and sb correspond, respectively, to excesses in inputs and bad outputs. The vector sg expresses shortage in good outputs. Let’s an optimal solution of the above program be (\(\theta^{*}\), \({\text{s}}^{ - *} , s^{g*} , s^{b*} ).\) Then, we can demonstrate that the DMU (x 0, \(y_{0}^{g} , y_{0}^{b} )\) is efficient in the presence of undesirable output if and only if \(\theta^{*} = 1,\) i.e., \({\text{s}}^{ - *} = 0, s^{g*} = 0, s^{b*} = 0.\) If the DMU is inefficient, i.e., \(\theta^{*} < 1,\) it can be improved and become efficient by deleting the excesses in inputs and bad outputs and augmenting the shortfalls in good outputs by the following projections:

3.2.3 Sample and variables measures

The study sample consists of 17 listed French firms belonging to the services to consumers industry. From the environmental management point of view, it is very interesting to explore this sector of activity. Major companies operating in the services to consumers industry have managed to decrease many of their direct environmental externalities by adopting national and international guidelines and standards (e.g., GRI, ISO 14031, global compact, etc.). The choice of this industry is motivated, firstly, by the high environmental visibility of companies that compose it (e.g., Areva, EDF, GDFSuez, Veolia, etc.) and secondly, by the magnitude of the environmental impact of these companies (e.g., Air France KLM, Carrefour, GDFSuez, Veolia, etc.). In addition to the above reasons, selecting one industry for analysis has been suggested by several authors (e.g., Koskela and Vehmas 2012; Branco and Rodriguez 2008). However, the results from the empirical analysis are case specific and the possibilities to generalize the conclusions remain limited.

The study was conducted between 2011 and 2012. Table 2 reports the descriptive statistics of input and output variables. Data were collected from companies’ annual reports. For the calculation of DEA scores, we choose to transform the initial inputs and undesirable outputs values, and then take their natural logarithm to avoid the disparities between the statistical observations.

4 Results

4.1 Computed results

Solving Model-2 and Model-3, we obtained, respectively, the measures of resource efficiency and ecological efficiency. Model-4 is used to evaluate the overall score of eco-efficiency. The results are given in Table 3.

Resource efficiency is the result of Model-2 using both water and energy consumption as inputs and return on equity and waste recycling rate as outputs. Only two companies perform efficiently for the 2 years, namely Toupargel and Electricité de Strasbourg which are the smallest companies in the sample with the lowest inputs level. Ecological efficiency is the result of Model-3 with return on equity and waste recycling rate as desirable outputs and as undesirable outputs waste and gas emission. In this simple CCR model, three companies perform efficiently, namely, Toupargel, Electricité de Strasbourg and Club Med, for the 2 years of the study. Following this approach, there are only two companies that are eco-efficient in both resource and environmental efficiency, namely, Toupargel and Electricité de Starsbourg. The company Club Med is only weakly eco-efficient because it is resource inefficient.

Eco-efficiency can also be evaluated by Model-4. In this CCR model, the input variables are both resource consumption and undesirable outputs. The tendency of the same result can be observed when comparing the eco-efficiency results of Model-4 with those obtained as a composition of resource and ecological efficiency. For instance, eco-efficient companies are Toupargel, Electricité de Strasbourg and Club Med.

Model-2, 3 and 4 enable us to understand the importance of resource and ecological efficiency in determining the eco-efficiency scores of each company in the sample. Eco-efficiency scores are almost equal to the ones of environmental efficiency for the 2 years of the study. This result reflects the importance of taking into account the negative environmental externalities when studying the concept of eco-efficiency. Indeed, by consulting Table 4, it is obvious that firms which are less eco-efficient are the ones whose production process consume large quantities of natural resources and produce large quantities of waste and pollutants (e.g., Areva, Veolia, GDFSuez, Air France-KLM).

Furthermore, it appears from Table 3 that the resource efficiency average score for all companies in 2011 is amounted to 50.48 and 52.97 % in 2012. This result means that, on average, under the assumption of constant returns to scale, French companies in the services to consumers industry could have reduced their resource consumption by 49.52 % in 2011 and 47.03 % in 2012, while maintaining a constant level of outputs. Similarly, ecological efficiency scores which assess the potential decrease in environmental externalities while maintaining economic value added indicate that pollutants could have been reduced on average by 27.5 % in 2011 and 26.68 % in 2012 (the average scores of ecological efficiency are 72.5 and 73.32 %, respectively, in 2011 and 2012). Results regarding eco-efficiency scores indicate that by managing their companies in an eco-efficient way, managers could reduce the influences exerted on the environment (resource consumption and pollutants) by nearly 27.16 % in 2011 and 26.48 % in 2012 (the average scores of eco-efficiency are 72.84 and 73.52 %, respectively, in 2011 and 2012).

4.2 Eco-efficiency benchmarking and projection

Model-5 provides a deeper understanding of the eco-inefficiency sources and shows how improvement to particular inputs and outputs can be envisaged. Suppose an eco-inefficient firm that has an activity (x 0 , y 0 ). Let the improved activity obtained by the input-oriented model be (\(\hat{x}_{0}\), \(\hat{y}_{0}\)). Eco-inefficient firm can be optimized according to the following equation:

The results of the model are shown in Tables 5 and 6. The managerial contribution of DEA lies in its ability to provide relevant information indicating the adjustments that must be done by eco-inefficient firms to move toward the efficient frontier. This entails that DEA allows an inefficient firm to adjust the amount of its inputs and outputs to achieve a higher level of eco-efficiency.

In terms of benchmarking, DEA recommends for inefficient firms, one or mOn the measurement of the environmentalore firms as a reference regarding eco-efficiency score. According to Tables 5 and 6, the column entitled “Benchmarks” identifies, for each eco-inefficient firm, one or more efficient firm to serve as corresponding peers to use in seeking improvements. For example, Toupargel and Club Med represent the benchmarking partners of Areva in 2011 and 2012. EDF should be guided by environmental strategies of Toupargel, Electricité de Strasbourg and Club Med to improve the efficiency of its operating processes in relation to the natural environment.

The number in brackets in the column entitled “Benchmarks” corresponds to the intensity with which the inefficient firm must be guided by the management models of its benchmarking partners. Moreover, we note that efficient firms (with an eco-efficiency score of 100 %) shall be given a number corresponding to their citation as benchmarking partner. For example, in the first position, Toupargel represents the reference in terms of eco-efficiency practices (mentioned 14 times in 2011 and 2012). In the second and third position, we find, respectively, Electricité de Strasbourg with 6 citations in both years and Club Med with 6 citations in 2011 and 5 in 2012.

DEA method provides a projection function to improve the performance of inefficient DMUs. In our case, for an input CCR model, projections identify the point either as a positive combination of other DMUs with x 0 \(\ge\) \({\hat{\text{x}}}_{0}\) and \({\hat{\text{y}}}_{0}\) \(\ge\) y 0 unless \(\theta^{*}\) = 1 and all slacks are zero in which case x 0 \(=\) \({\hat{\text{x}}}_{0}\) and \({\hat{\text{y}}}_{0}\) = y 0 for all \(\lambda^{*}\). In an input orientation, one improves efficiency through proportional reduction of inputs. In Tables 5 and 6, columns beginning with {S} present the input slacks that correspond to input excesses both in the consumption of water and energy, and in the production of pollutants.

In terms of input projections, we analyze successively the firms Casino for the year 2011 and Veolia for the year 2012. In 2011, Casino has an eco-efficiency score of 89.24 %. By comparison to its benchmarking partner (Toupargel), Casino should provide further efforts to reduce its energy bills and to control its waste production. It means that the company must, as a first step, reduce its water and energy consumption, respectively by over \(e^{3.87} =\) 47.94 thousand m3 and \(e^{2.74} =\) 15.49 GWh to be closer to the efficient frontier. In a second step, Casino must cut off the quantity of waste produced by over \(e^{1.37} = 3.94\) tones to reach eco-efficiency. In our sample, Veolia is one of the most polluting firms in terms of resource consumption and toxic release into the atmosphere. Its eco-efficiency score stood at 29.56 % in 2011 and 23.85 % in 2012. A review of its environmental management programs, especially those related to energy efficiency initiatives is necessary if its leaders want to bring environmental excellence. Indeed, in 2012, Veolia must reduce its water and energy consumption, respectively, by over \(e^{2.44} = 11.47\) thousand m3 and \(e^{2.11} = 8.25\) GWh.

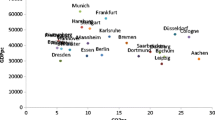

In sum, the results of our study show that only three companies in the services to consumers industry (Toupargel, Electricité de Strasbourg and Club Med) may be qualified as eco-efficient. These results show the extent of the negative environmental impacts of the production processes of companies in this industry. We found that eco-efficiency scores of large companies are very low. This reflects the extent of their contribution to the disappearance of the ecological balance and the acceleration of the adverse effects of climate change (Fig. 1).

5 Discussion

In addition to the industry effect, DEA efficiency results show the existence of a negative association between eco-efficiency scores and firm size, expressed in terms of turnover and number of employees (see Figs. 2, 3). The results suggest that largest companies have the most detrimental activity to the natural environment. Well that most of them have well-founded formal structures for environmental communication and reporting, their eco-efficiency scores are relatively poor. This implies two important results. First, studies that have used the quality and the quantity of environmental disclosure, through analysis grids (see, e.g., Cormier and Magnan 2003; Cormier et al. 2009), as a measure of environmental performance, can not reflect a right assessment of this performance. Environmental performance should be evaluated through the study and the analysis of various tangible performance indicators (Perotto et al. 2008). Consequently, the organizational discourse on environmental issues cannot be a measure of the environmental impact of a company’s activities.

Relationship between eco-efficiency (Model-4) and company size in 2011 (Logarithm of sales)

Relationship between eco-efficiency (Model-4) and company size in 2012 (Logarithm of number of employees)

The second important result that we can discuss is related to the phenomenon of political visibility which is reflected by corporate size. Indeed, large firms are more visible in society and are likely to receive stronger institutional pressures specially related to the environmental protection. Thus, bigger firms attract more scrutiny from different stakeholder groups such as the media, the regulatory bodies, the consumers and non-governmental organizations (NGO). These firms should respond to stakeholders’ demands in order to maintain their reputation and social legitimacy. Highly visible firms are expected to have the best level of environmental responsiveness. Indeed, the assumption that large companies (with both high environmental and political visibility) are expected to have the best level of commitment vis-à-vis the environment is not respected in our study. French big companies (e.g., Carrefour, EDF, GDFSuez, Veolia, etc.) that heavily invest in the establishment of organizational structures for the production, collection, analysis, disclosure and implementation of internal and/or external environmental audits, through the diffusion of various informational media (e.g., sustainability report, corporate social responsibility report, ethical report, code of conduct, etc.), use these practices in order to divert stakeholders attention from their real environmental impacts for which they are the only accountable. Further research on the aforementioned relationship between company size and eco-efficiency scores may include testing for their statistical inference by employing parametric approaches such as regression analysis. However, this kind of work does not match with the scope of our research.

In our opinion, the DEA model could be a useful tool to reflect the level of eco-efficiency in a defined sample of companies and help the policymakers to find the most optimized solutions in improving their eco-efficiencies. Furthermore, French eco-inefficient firms that operate under French and European environmental regulation should be compared to firms from countries without strong or mandatory environmental regulation (like USA, Turkey, Brazil and Canada), in order to assess the effective polluting role of French Firms.

We think that DEA benchmarking and projection results (see Tables 5, 6) are of outstanding academic and practical value. In fact, such results could provide valuable information for researchers and managers to understand and adapt their strategies regarding the interaction between firms and the natural environment.

6 Conclusion

The clarity of the eco-efficiency concept that seeks to enhance simultaneously the economic and ecological impacts has made this concept a pragmatic subject that has attracted the interest of researchers, business leaders, policymakers and the society as a whole. Since the late 1990s, a plethora of studies has sought to provide a measure of eco-efficiency at both the micro and macro-economic level. Our study is part of this line of research by presenting a model for assessing eco-efficiency.

Using real data from 17 French companies belonging to the services to consumers industry, an empirical study was conducted to illustrate the eco-efficiency from developing a DEA-based model. DEA allowed us to study the eco-efficiency from two essential components: resource (or technical) efficiency and ecological (or environmental) efficiency. This approach allows the consideration of organizational negative externalities (undesirable outputs) in the calculation of eco-efficiency scores. Thus, when environmental burdens are generated, societal welfare indexes using only marketable outputs (desirable outputs) and inputs do not reflect the social, economic and environmental reality (Nakano and Managi 2012).

In this research, we adopted data envelopment analysis as a method to assess the relative eco-efficiency when desirable and undesirable outputs are taken into consideration without defining any prior weights for input and output variables. However, some limitations of employing DEA can be considered. First, the DEA measurement needs extensive data. So, data must be relatively accurate and reliable, and the sample size must be sufficiently large (Zhang et al. 2008). Second, DEA identifies weights that maximize the efficiency scores of a specific DMU within a group of similar DMU. However, some DMU may appear as efficient even though they perform well on a single, relatively unimportant criterion. Third, we took the usual definition of eco-efficiency as the ratio between economic value added and environmental influences. However, the social aspects, which are a mainstay of sustainable development, are not yet embedded in the concept of eco-efficiency in its practical level (Zhang et al., 2008), including our research. This is one of the downsides of using eco-efficiency concept.

Finally, due to these limitations, we would like to suggest some lines for further research in the field of assessing eco-efficiency. First, to make eco-efficiency a useful measurement tool for sustainable development, researchers might be interested in developing the use of other models from data envelopment analysis technique when studying the domain of firms greening. Second, to study sustainable development, the DEA-based models should integrate not only economic and ecological performance indicators but also other elements of performance such as social and cultural ones. Third, for a meaningful analysis, researchers should explore the influence of other financial and economic variables (e.g., Economic Value Added (EVA), Return On Assets (ROA), Price Earning Ration (PER), etc.) when making up eco-efficiency scores. We believe that these scores could considerably change when DEA model will integrate in various analyses steps different financial and economic variables. Fourth, investigating and comparing the eco-efficiency assessment models from various industries, regions and countries, might also be a fruitful avenue for future research.

In summary, despite the study’s limitations, the results demonstrate an important connection between eco-efficiency and environmental efficiency. These findings are likely to be of value to firms wishing to reduce the negative externalities of their production process by seeking improvements through their benchmarking partners.

References

Belu C (2009) Ranking corporations based on sustainable and socially responsible practices. a data envelopment analysis (DEA) approach. Sustain Dev 17:257–268

Boron S, Murray K (2004) Bridging the unsustainability gap: a framework for sustainable development. Sustain Dev 12:65–73

Branco MC, Rodriguez LL (2008) Factors influencing social responsibility disclosure by Portuguese Companies. J Bus Ethics 84:497–527

Burnett RD, Hansen DR, Quintana O (2007) Eco-efficiency: achieving productivity improvements through environmental cost management. Account Public Interest 7:66–92

Caetano M, Bezerra de Araujo J, Capaldo Amaral D (2012) A Framework for the application of eco-efficiency to the technology development process. J Technol Manag Innov 7(2):28–37

Charles V, Kumar M, Kavitha SI (2012) Measuring the efficiency of assembled printed circuit boards with undesirable outputs using data envelopment analysis. Int J Prod Econ 136:194–206

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2(6):429–444

Charnes A, Cooper WW, Lewin AY, Seiford LM (1994) Data envelopment analysis: theory, methodology, and applications. Springer, Massachusetts

Cormier D, Magnan M (2003) La communication d’information environnementale un enjeu stratégique pour les entreprises. Revue des Sciences de Gestion (Economie et Sociétés) 33(1)

Cormier D, Ledoux MJ, Magnan M (2009) The use of web sites as a disclosure platform for corporate performance. Int J Account Inf Syst 10(1):1–24

De Simone LD, Popoff F (2000) Eco-efficiency: the business link to sustainable development. First MIT Press paperback Edition, Massachusetts

Derwall J, Guenster N, Bauer R, Koedijk K (2005) The eco-efficiency premium puzzle. Financ Anal J 61(2):51–63

Dyckhoff H, Allen K (2001) Measuring ecological efficiency with data envelopment analysis (DEA). Eur J Oper Res 132:312–325

Farrel MJ (1957) The measurement of productive efficiency. J R Stat Soc Ser A 120:253–281

Fukuyama H, Yoshida Y, Managi S (2011) Modal choice between air and rail: a social efficiency benchmarking analysis that considers CO2 emissions. Environ Econ Pol Stud 13:89–102

Helminen R (1998) Eco-efficiency in the Finnish and Swedish pulp and paper industry. Acta Polytechnica Scandinavica Mathematics, Computing and Management in Engineering Series 90, Espoo

Hoffren J, Apajalahti EL (2009) Emergent eco-efficiency paradigm in corporate environment management. Sustain Dev 17:233–243

Hua Z, Bian Y, Liang L (2007) Eco-efficiency analysis of paper mills along the Huai River: an extended DEA approach. Omega 37:578–587

Korhonen P, Luptacik M (2004) Eco-efficiency analysis of power plants: an extension of data envelopment analysis. Eur J Oper Res 154:437–446

Koskela M, Vehmas J (2012) Defining eco-efficiency: a case study on the Finnish forest industry. Bus Strateg Environ 21(8):546–566

Kuosmanen T, Kortelainen M (2005) Measuring eco-efficiency of production with data envelopment analysis. J Ind Ecol 9(4):59–72

Managi S, Opaluch JJ, Jin D, Grigalunas TA (2004) Technological change and depletion in offshore oil and gas industry. Land Econ 81(2):303–319

Managi S, Opaluch JJ, Jin D, Grigalunas TA (2005) Environmental regulations and technological change and depletion in offshore oil and gas. J Environ Econ Manag 47(2):388–409

Nakano M, Managi S (2012) Waste generations and efficiency measures in Japan. Environ Econ Pol Stud 14:327–339

Oggioni G, Riccardi R, Toninelli R (2011) Eco-efficiency of the world cement industry: a data envelopment analysis. Energy Policy 39:2842–2854

Olsthoorn X, Tyteca D, Wehrmeyer W, Wagner M (2001) Environmental indicators for business: a review of the literature and standardization method. J Clean Prod 9:453–463

Perotto E, Canziani R, Marchesi R, Butelli P (2008) Environmental performance, indicators and measurement uncertainty in EMS context: a case study. J Clean Prod 16:517–530

Picazo-Tadeo AJ, Reig-Martínez E, Gómez-Limón JA (2011) Assessing farming eco-efficiency: a data envelopment analysis approach. J Environ Manage 92(4):1154–1164

Picazo-Tadeo AJ, Beltrán-Esteve M, Gómez-Limón JA (2012) Assessing eco-efficiency with directional distance functions. Eur J Oper Res 220:798–809

Porter ME (1991) America’s green strategy. Sci Am 246(4):168 (April)

Porter ME, Van Der Linde C (1995a) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(Fall):97–118

Porter ME, Van Der Linde C (1995b) Green and competitive: ending the stalemate. Harv Business Rev:120–134 (September–October)

Riccardi R, Oggioni G, Toninelli R (2012) Efficiency analysis of world cement industry in presence of undesirable output: application of data envelopment analysis and directional distance function. Energy Policy 44:140–152

Schaltegger S, Synnestvedt T (2002) The link between ‘green’ and economic success: environmental management as the crucial trigger between environmental and economic performance. J Environ Manage 65:339–346

Scheel H (2001) Undesirable outputs in efficiency valuations. Eur J Oper Res 132:400–410

Seppälä J, Melanen M, Mäenpää I, Koskela S, Tenhunen J, Hiltunen MR (2005) How can the eco-efficiency of a region be measured and monitored. J Ind Ecol 9:117–130

Sinkin C, Wright CJ, Burnett RD (2008) Eco-efficiency and firm value. J Account Public Policy 27:167–176

Tyteca D (1996) On the measurement of the environmental performance of firms—a literature review and a productive efficiency perspective. J Environ Manage 46:281–308

Vîrjan D (2011) The rethinking of the economic activity based on principles of eco-efficiency. Theoretical and applied economics XVIII(7):143–154

Wang K, MingWei Y, Zhang X (2012) A comparative analysis of China’s regional energy and emission performance: which is the better way to deal with undesirable outputs? Energy Policy 46:574–584

World Business Council for Sustainable Development (WBCSD) (2000) Measuring Ecoefficiency. A Guide to Reporting Company Performance, WBCSD, Geneva

Yu Y, Wen Z (2010) Evaluating China’s urban environmental sustainability with Data Envelopment Analysis. Ecol Econ 69:1748–1755

Zhang B, Bi J, Fan Z, Yuan Z, Ge J (2008) Eco-efficiency analysis of industrial system in China: a data envelopment analysis approach. Ecol Econ 68:306–316

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Lahouel, B.B. Eco-efficiency analysis of French firms: a data envelopment analysis approach. Environ Econ Policy Stud 18, 395–416 (2016). https://doi.org/10.1007/s10018-015-0115-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-015-0115-4