Abstract

We study the effects of downstream entry in a vertical mixed oligopoly where a privatized upstream firm supplies a common input to asymmetric downstream firms via (i) uniform pricing and (ii) discriminatory pricing. We show that under price discrimination, downstream entry benefits consumers and most likely improves social welfare but hurts incumbent firms as commonly believed, regardless of the efficiency of entrants. However, under uniform pricing, if the upstream firm is highly nationalized, inefficient entry may reduce industry output (consumer surplus) and social welfare when entrants are very inefficient. Further, the entry of inefficient firms may raise both the industry output and the profits of all incumbent firms when the upstream firm is highly privatized. Importantly, we also find that banning price discrimination reduces social welfare when the upstream firm is highly nationalized. The mechanism behind the above results is related to the pricing behavior of the upstream firm, which is affected by the degree of privatization. This mechanism has not been discovered in the literature. Hence, the competition authorities should pay attention to particular features of industries to design proper policies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In imperfectly competitive markets, entry of new firms will affect the best responses of incumbent firms and then change the outcomes of market competition. It is generally believed that entry of new firms benefits consumers and the society at the expense of incumbent firms. However, this view has been questioned in the literature under different frameworks, which provide different reasons for profit-raising and (or) consumers-hurting entry in both horizontal (Wang and Mukherjee 2012; Mukherjee and Zhao 2017; Brito and Lopes 2022; etc) and vertical markets (Tyagi 1999; Mukherjee et al., 2019; etc). But none of the theoretical research has been devoted to vertical industries with public or privatized firms in the upstream market, and thus the profit and welfare effects of entry in such industries are not well understood.

This paper takes the first step to study the profit and welfare effects of entry in a vertical market with a privatized upstream firm and asymmetric downstream firms. The upstream firm provides an intermediate product for downstream firms to produce the final goods. One may also consider the upstream firm as a patent holder who owns a patent to manufacture the final goods and licenses it to downstream firms. It is quite common to observe such market structures worldwide, especially in planned and transitional economies such as China, Vietnam, and Russia, etc.Footnote 1 As in the literature, we focus on entry in the final goods market. The asymmetry in the downstream market allows us to look at two different scenarios with either efficient or inefficient entrant firms. Further, we allow the upstream monopolist to adopt either uniform pricing or price discrimination. Then we can see how the pricing scheme in the input market affects the outcomes of market competition. Our main findings are summarized as follows.

Under uniform pricing, we show that entry of efficient firms increases both consumer surplus and social welfare, but hurts incumbents as commonly believed. However, entry of inefficient firms may generate different results. To understand it, we need to understand the effects of entry on market competition. First, entry intensifies downstream competition, and creates a business-stealing effect, which benefits consumers but hurts the incumbents. Second, entry generates a production-distribution effect, which increases (reduces) production efficiency when entrants are efficient (inefficient). Third, entry affects the input price charged by the upstream firm, creating an input price effect which in turn changes the product decisions of downstream firms. When the upstream firm is highly privatized, entry of inefficient firms may induce the upstream firm to reduce the input price, called the input price-reducing effect. The reduced input price mitigates the double marginalization problem and motivates downstream firms to increase production, leading to higher profits for all incumbents when entrants are sufficiently inefficient (i.e., the profit-raising entry). When the upstream firm is highly nationalized, the input price will be significantly increased in equilibrium to correct the inefficient production distribution, which reduces industry output (called the consumers-hurting entry) and social welfare under certain conditions. Thus, the competition authorities should pay attention to downstream entry in such market structures.

Under price discrimination, an increase in the number of downstream firms, regardless of their marginal costs, always benefits consumers and hurts incumbents. That is, we do not have the results of consumers-hurting entry and profit-raising entry. The major difference between the two pricing schemes is that the upstream firm charges a higher (lower) price to inefficient (efficient) firms under price discrimination when it is highly nationalized, which reduces the production inefficiency. As a result, entry of inefficient firms will not result in a significant input price increase as that under uniform pricing. Hence, the industry output and consumer surplus increase as market competition intensifies. Further, downstream entry on one hand increases market competition, and on the other hand, leads to higher input prices. Both are undesirable to downstream firms.

We also conduct a comparison between uniform pricing and price discrimination. We find that price discrimination improves social welfare when the upstream firm concerns more on social welfare than its own profit, i.e., highly nationalized. In this case, the upstream firm charges a higher (lower) price to inefficient (efficient) producers, which improves production efficiency and benefits social welfare. Thus, it is not a desirable policy to ban price discrimination in industries where upstream firms are more nationalized. However, when upstream firms are more privatized, the standard welfare ranking continues to hold. Thus, the degree of privatization is important to the welfare ranking. This view is new in the literature and worth our greatest attention.

Our paper contains several contributions to the literature. First, we introduce a privatized firm in the upstream market to see how upstream privatization affects market outcomes of entry. With asymmetric firms in the downstream market, we show that the upstream supplier’s input pricing critically depends on the degree of privatization and the efficiency of entrant firms, which therefore leads to different market outcomes. Based on our setting, we provide another explanation for the results of consumers-hurting entry and profit-raising entry. Second, we conduct our analysis under two input pricing schemes: uniform pricing and price discrimination. Under price discrimination, we demonstrate that the upstream supplier always increases input price in equilibrium. So the input price-reducing effect disappears under price discrimination. Our finding indicates that the pricing scheme is also very critical for the results of either consumers-hurting or profit-raising entry in our framework. Third, we show that under price discrimination, the upstream supplier charges a higher (lower) price to inefficient (efficient) producers when it is highly nationalized, which improves production efficiency and benefits social welfare. We then provide another explanation for why (i) the larger firms may receive a price discount, and (ii) banning price discrimination may hurt social welfare.

Our results generate important policy implications. First, it is commonly observed that governments in many countries take actions to foster or deter entry into particular industries. Our analysis indicates that encouraging firm entry is often a good policy which benefits consumers and the society, especially when the upstream firms are allowed to implement price discrimination. However, if the upstream firms are highly nationalized and price discrimination is banned, entry of very inefficient firms may reduce industry output and consumer surplus.Footnote 2 This result should be known to the competition authorities. Second, our findings suggest that banning price discrimination reduces social welfare when the upstream firms are highly nationalized. Hence, corresponding policies should be made according to particular features of industries. Last, we highlight that entry of inefficient firms may raise both the industry output and the profits of all incumbent firms when the upstream firm is highly privatized.Footnote 3 Accordingly, technology spillovers and transfers should be encouraged and supported in this case.

After the literature review, the rest of the paper is organized as follows: Section 3 describes the basic model with uniform input pricing and presents the analysis. Section 4 expands the analysis to price discrimination and conducts the comparisons between the two schemes. Section 5 concludes the paper.

2 Literature review

The profit and welfare effects of entry have received great attention for decades. It is usually believed that higher competition, implying more active firms, benefits consumers and social welfare, but hurts incumbent firms. However, this view has been questioned by researchers under different frameworks.

In a horizontal market with the presence of a public firm, Wang and Mukherjee (2012) demonstrate that entry of private firms, which act as Stackelberg followers, increases the public firm’s profit and social welfare at the expense of consumers. Further, considering foreign ownership in private firms, Wang and Lee (2013) show that the results of Wang and Mukherjee (2012) continue to hold when the foreign shareholding ratio is low. When firms are asymmetric in costs, Mukherjee and Zhao (2017) show that entry of the most inefficient entrant may benefit (hurt) the cost-efficient incumbents (inefficient ones) and raise industry output. In a mixed oligopoly with endogenous privatization, Haraguchi and Matsumura (2021) show that entry of private firms may affect the privatization policy, and thus, the effect on the private firms’ profits is ambiguous. But with exogenous privatization, entry hurts the private firms. In a Cournot-Bertrand game, Brito and Lopes (2022) show that, when there is a single price setter and multiple quantity setters, entry of a price setter benefits the Bertand-type incumbent, but hurts the Cournot-type incumbents if product differentiation is sufficiently small. Several other papers consider endogenous taxation to show the adverse effect of competition on consumers. Dinda and Mukherhee (2014) find that entry of inefficient (efficient) firms hurts (benefits) consumers in the case of strategic unit taxation. However, in the case of ad valorem taxation, Wang et al. (2019a) find that entry of efficient firms unexpectedly hurts consumers when the cost advantage of efficient firms is large. Further, Wang et al. (2019b) propose an asymmetric Stackelberg model to study undesirable competition under both unit and ad valorem taxation.

Another strand of literature studies profit-raising and (or) consumers-hurting entry in vertical markets. With an upstream private monopoly, Tyagi (1999) shows that the effects of downstream entry depend on the demand elasticity which affects the variation of input price. Entry reduces the industry output and raises each incumbent’s profit if the demand function is sufficiently convex. But the two effects, profit-raising and consumers-hurting, disappear in the case of linear demand because the optimal input price is invariant to entry. In a successive Cournot oligopoly, Mukherjee et al. (2009) find that entry of an inefficient entrant may increase the profits of efficient incumbents when the cost difference is large. Further, they show that this kind of entry may hurt social welfare when the input market is not very concentrated. With free entry in the input market, Mukherjee (2019) finds that entry in the final goods market increases incumbents’ profits if the final goods are sufficiently differentiated. Nariu et al. (2021) assume that manufacturers assemble components provided by their own independent suppliers and show that if initially the number of manufacturers is sufficiently small and the number of components is sufficiently large, entry can increase every firm’s profit and benefit consumers.

We contribute to the above literature by introducing a privatized firm in the upstream market and cost asymmetry in the downstream market. Further, we consider both uniform input pricing and price discrimination. With exogenous privatization, we show that downstream entry may raise the incumbents’ profits, but hurt both consumers and the society under certain conditions. The privatization of the upstream firm plays a critical role in our results. Thus, the mechanisms behind the profit-raising and (or) consumers-hurting entry are different in our paper, which have never been discovered in the literature.

Our paper is also related to the literature which discusses how price discrimination influences market behavior and social welfare to assess whether banning price discrimination in input markets constitutes a desirable course of policy. The prevailing view on price discrimination is that the input supplier charges a higher (lower) price to efficient (inefficient) producers (Katz 1987; DeGraba 1990; and Yoshida 2000), which partially offsets the cost advantage and thus shifts production inefficiently. With linear demand and cost in final goods markets and linear wholesale contracts in input markets, price discrimination reduces social welfare in comparison to uniform pricing. The following literature refutes these arguments in different frameworks with the consideration of two-part tariff contracts (Inderst and Shaffer 2009), demand-side substitution (Inderst and Valletti 2009), different timing of investments (Li 2013), sequential contracting (Kim and Sim 2015), a broader class of demand functions (Li 2014), quality differentiation (Chen 2017), and increasing marginal costs (Chen 2022), etc. In all the above literature, the upstream monopolist is a private firm which strategically determines input prices to maximize its profit. The main deviation from the literature is that we consider a mixed oligopoly in which the upstream firm is a partially privatized firm, while all other settings are standard. Thus, in this paper, we focus on a new factor that has attracted relatively less attention, i.e., the degree of upstream privatization, and provide an alternative explanation for (i) why efficient firms (i.e., larger firms) may receive a discount in input markets as commonly observed, and (ii) why banning price discrimination may not always be desirable to social welfare.

3 The model and the analysis

3.1 The model setting

We consider a vertically related market where an upstream supplier provides homogeneous input goods to \(n \ge 1\) symmetric efficient firms and \(m \ge 1\) identical inefficient firms. The upstream supplier is a privatized firm with \(\theta \in [0,1]\) representing the degree of privatization. The presence of privatized firms in upstream markets is commonly observed in practice.Footnote 4 We assume that the upstream firm incurs a constant marginal production cost, which is normalized to zero, to produce input goods.

Each downstream firm purchases input goods from the supplier at a wholesale price w, and transforms one unit of input to one unit of output. The constant marginal cost of efficient and inefficient firms are respectively zero and c, where \(0< c< 1\). All downstream firms compete in the Cournot mode with homogeneous products. The inverse market demand function is \(p=1-Q\), where p is the price, and \(Q=\begin{matrix}\sum _{i=1}^m q_i\end{matrix}+\begin{matrix}\sum _{j=1}^n q_j\end{matrix}\) is industry output. We use subscript i and j to denote inefficient and efficient firms, respectively. Downstream firms’ profits are given by

We propose a two-stage game. In stage 1, the upstream supplier determines the price of input goods to maximize its objective, which is a convex combination of its own profit, \(\pi _0\), and social welfare, SW, following Matsumura (1998), i.e.,

where \(\pi _0=wQ\) and \(SW=\begin{matrix}\sum _{i=1}^m \pi _i\end{matrix}+\begin{matrix}\sum _{j=1}^n \pi _j\end{matrix} +\pi _0+CS\), where \(CS=Q^2/2\) denotes consumer surplus. In stage 2, the downstream firms compete in a Cournot mode to maximize individual profits. As usual, the game is solved by backward induction.

3.2 The analysis and results

In the second stage, given the input price w, the downstream firms determine their quantities to maximize profits in (1). The \(n+m\) first-order conditions are

where \(i=1, 2, \ldots , m\), and \(j=1, 2, \ldots , n.\) The second-order conditions are satisfied. Solving the first-order conditions leads to

We assume that all firms are active in equilibrium. The industry output and the price are

Lemma 1

In the second stage, the equilibrium quantities have the following properties:

-

(i)

\(\partial q_i/\partial w=\partial q_j/\partial w<0\), and \(\partial Q/\partial w<0\);

-

(ii)

\(\partial q_i/\partial m=\partial q_j/\partial m<0\), \(\partial mq_i/\partial m>0\), \(\partial n q_j/\partial m<0\), and \(\partial Q/\partial m>0\);

-

(iii)

\(\partial q_i/\partial n=\partial q_j/\partial n<0\), \(\partial m q_i/\partial n<0\), \(\partial n q_j/\partial n>0\), and \(\partial Q/\partial n>0\).

The results in Lemma 1 are very straightforward. The production of each downstream firm depends negatively on the input price, which leads to a reduction in industry output as the input price increases. Further, entry of new firms steals business from incumbents (called the business-stealing effect of entry), but the industry output increases as competition increases (called the output-expansion effect of entry). Note that the entry of efficient (inefficient) firms also generates a production-distribution effect by increasing the total production of efficient (inefficient) firms and reducing that of inefficient (efficient) firms. Hence, indicated by Lemma 1(ii)-(iii), entry of new firms, regardless of their marginal cost, makes the consumers better off and each incumbent firm worse off when the input price is exogenously given. This result is well-known in the literature.

Further, it follows that

which indicates that the market share of inefficient firms decreases with w while that of efficient firms increases with w. The market production efficiency increases as a result of the desirable change in market share.

Next, we solve the first stage of the game, where the upstream supplier determines the input price w to maximize its objective function in (2). The first-order condition is given by

The second-order condition is satisfied.Footnote 5 Solving the first-order condition leads to the equilibrium input price as

Incorporating (6) into (4) and (5) leads to

We further assume that

under which all firms are active in equilibrium. This assumption is adopted to guarantee that inefficient firms will not be driven out of the market because of low efficiency. We then have the following results regarding the equilibrium input price.

Lemma 2

In equilibrium,

-

(i)

\(\partial w^*/\partial \theta >0\); further, \(w^*>0\) when \(\theta >{1}/{(2+m+n)}\); otherwise, \(w^*<0\);

-

(ii)

\(\partial w^*/\partial m<0\) when \(\theta >1/2\) and \(c_w<c<\bar{c}\); otherwise, \(\partial w^*/\partial m>0\) when \(\theta <1/2\) or \(\theta >1/2\) and \(0<c<c_w\);

-

(iii)

\(\partial w^*/\partial n>0\); where

$$\begin{aligned} c_w=\frac{(m+n)^2 (1-\theta )}{n (2+m+n)^2 \theta ^2+\left( (m+n) \left( m (n-1)+n+n^2\right) -2 n\right) \theta + m^2-n^2}. \end{aligned}$$

Lemma 2(i) implies that a higher degree of privatization raises the input price. The intuitions are straightforward. As the degree of privatization increases, the upstream supplier puts more weights on its own profit, thereby increasing the input price. Further, this input price is negative when the degree of privatization is low and positive otherwise. That is, the upstream supplier may provide production subsidies for downstream firms when the degree of privatization is sufficiently low, i.e., \(\theta <{1}/{(2+m+n)}\).

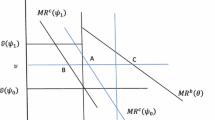

In general, the upstream supplier tends to raise the input price as the number of downstream firms increases because higher competition increases the total input demand. However, our result in Lemma 2(ii) shows that entry of inefficient firms may surprisingly reduce the equilibrium input price (see Region II and III in Fig. 1).Footnote 6 The reason for this result is as follows: Increasing w improves the market share of efficient firms, thereby creating production efficiency which is desirable for social welfare. But meanwhile, it harms market competition by enhancing the competitive advantage of efficient firms, and therefore, could probably hurt the profitability of the input supplier especially with inefficient entrants. The loss in profit to the input supplier becomes more serious when the inefficient entrants are sufficiently inefficient. As a result, if the input supplier is more concerned with its own profit, it tends to reduce the input price to benefit the increasing number of inefficient firms and encourage downstream competition when the inefficient firms are very inefficient, i.e., \(c_w<c<\bar{c}\).Footnote 7 Further, it can be shown that \(\partial c_w/\partial \theta <0\) with \(c_w|_{\theta =1/2}={2}/{(2+3 n)}\), and \(c_w|_{\theta =1}=0\), which indicates that an increase in \(\theta\) increases the likelihood of input price-reducing entry.

The consumer surplus in equilibrium is \(CS^*=(Q^*)^2/2\). Then, \(\partial CS^*/\partial m=Q^* \partial Q^*/\partial m\), and \(\partial CS^*/\partial n=Q^* \partial Q^*/\partial n\). We summarize the effects of downstream entry on consumer surplus in the following proposition.

Proposition 1

In a vertical mixed oligopoly with entry in the downstream market,

-

(i)

an increase in the number of inefficient firms, \(m\), reduces consumer surplus when \(\theta <1/2\) and \(c_q<c<\bar{c}\), where \(c_q={2 \theta }/{(n+2 \theta +n \theta )}\); otherwise, it raises consumer surplus;

-

(ii)

an increase in the number of efficient firms, \(n\), raises consumer surplus.

Common wisdom suggests that higher competition benefits consumers because of the expansion in industry output. However, Proposition 1(i) indicates that entry of inefficient firms unexpectedly hurts consumers when these firms are sufficiently inefficient and the degree of privatization is below 1/2 (see Region I in Fig. 1). The reason for this interesting result is as follows: Suppose the upstream firm is fully nationalized, i.e., \(\theta =0\). An increase in m reduces the total output of efficient firms and increases that of inefficient firms. This production distribution is undesirable to social welfare, which induces the upstream firm to raise the input price aiming to increase the market share of efficient firms. By doing so, the resulting inefficiency due to an increase in m could be partially rectified. To this end, the input price could be significantly raised, which turns out to reduce the industry output, thus making the consumers worse off.Footnote 8 Increasing \(\theta\) (from 0 to 1/2) reduces the weight on social welfare, which lowers the incentive to increase the input price, and then reduces the likelihood of consumers-hurting entry. But as long as the upstream firm weights more on social welfare, the input price could be significantly raised if entrants are very inefficient, i.e., \(c_q<c<\bar{c}\), leading to the result of consumers-hurting entry, where \(\partial c_q/\partial \theta >0\), with \(c_q|_{\theta =0}=0\) and \(c_q|_{\theta =1/2}={2}/{(2+3 n)}\).

This result is very important to the competition authorities to develop relevant policies in industries where the upstream firm is partially privatized. If the upstream firm weighs more on social welfare (i.e., highly nationalized), and the inefficient firms are very inefficient, a good policy is to deter inefficient entry in reasonable ways, gradually phase out outdated technologies or encourage technology transfer.

Furthermore, firms’ profits in equilibrium are

The following proposition summarizes the effects of downstream entry on firms’ profits.

Proposition 2

In a vertical mixed oligopoly with entry in the downstream market,

-

(i)

an increase in the number of inefficient firms, m, raises profits of all incumbents when \(\theta >1/2\) and \(c_\pi<c< \bar{c}\), otherwise, it reduces all incumbents’ profits; where

$$\begin{aligned} {c_\pi =\frac{(m + n)^2 (1 + \theta )}{m^2 (1 + \theta ) (1 + n + n \theta ) + 2 m n (1 + \theta ) x_1 + n (x_1 -1)x_1}}, \text{ where } x_1=n + (2 + n) \theta ; \end{aligned}$$ -

(ii)

an increase in the number of efficient firms, n, reduces incumbents’ profits.

Common wisdom is that higher competition reduces firms’ profits in equilibrium. Indicated by Lemma 1, entry of new firms on the one hand, steals business from incumbent firms, and on the other hand, increases the industry output, which results in a lower retail price. Thus, all incumbent firms suffer the loss in profits. In a vertical market with an upstream supplier, the increased input demand induces the supplier to raise the input price. Therefore, the result of profit-reducing entry most likely continues to hold in vertical markets.

However, we show in Proposition 2(i) that entry of inefficient firms unexpectedly raises profits of all downstream firms when the supplier weights more on its own profit and the entrants are sufficiently inefficient (see Region II in Fig. 1). The main reason for the profit-raising entry is the input price-reducing effect of entry discovered in Lemma 2(ii). The reduced input price mitigates the double marginalization problem and motivates downstream firms to increase production. It can be verified that \(c_\pi >c_w\) when \(\theta >1/2\). That said, when entrants are sufficiently inefficient, the input price would be significantly reduced, yielding higher profits to all incumbent firms. The result profit-raising entry is very important since it helps to explain why, in certain situations, the efficient firms may freely disclose critical knowledge to potential entrants which become direct competitors.

The input price-reducing effect of entry, which leads to the result of profit raising,Footnote 9 has been discovered in the literature, but the mechanisms are different from ours. Mukherjee et al. (2009) consider an economy with successive Cournot oligopoly. The authors show that inefficient entry increases price elasticity of demand and reduces the equilibrium input price. If the entrant is sufficiently inefficient, the input price effect dominates the competition effect, which benefits efficient incumbent firms. Mukherjee (2019) proposes a successive oligopoly model with free entry in the upstream market and product differentiation in the downstream market. They show that downstream entry encourages more input suppliers to enter the market and then reduces the equilibrium input price. If the final goods are sufficiently differentiated, the competition effect is not significant which may be dominated by the input price effect. The incumbent firms enjoy profit improvement as a result. Nariu et al. (2021) develop a model in which each manufacturer forms an exclusive input supply contract with its own independent suppliers, and show that competition between competing channels mitigates this vertical pricing distortion, which may lead to profit-raising entry when the number of separate input suppliers is great enough. None of these papers considers public firms in the upstream market and demonstrates the role of upstream privatization on equilibrium input price.

We illustrate our findings in Fig. 1 by plotting the critical values: \(c_w, c_q,\) and \(c_\pi\). The upper line is \(\bar{c}\).

-

In Region I, consumers are worse off as more inefficient firms enter the market, i.e., consumers-hurting entry.

-

In Region II, all downstream firms are better off as more inefficient firms enter the market, i.e., profit-raising entry.

-

In Region II and III, entry of inefficient firms reduces the input price, i.e., input price-reducing entry.

Lastly, we examine the effects of downstream entry on social welfare, which is the sum of the industry profit and consumer surplus, i.e.,

The welfare effects of downstream entry are summarized in the following proposition, where \(t=m+n\).

Proposition 3

In a vertical mixed oligopoly with entry in the downstream market, an increase in the number of efficient firms, n, always raises social welfare; an increase in the number of inefficient firms, m,

-

(i)

reduces social welfare if the upstream supplier is fully nationalized;

-

(ii)

raises social welfare if the upstream supplier is fully privatized;

-

(iii)

reduces social welfare when \(\theta \le \hat{\theta }\) and \(c_{sw1}<c<min\{c_{sw2}, \bar{c}\}\) under partial privatization, where \(\hat{\theta }\) solves \(t^2+4t(t+2) \theta -4 (t^2-4) \theta ^2-8 (t+2)^2 \theta ^3=0\), and

$$\begin{aligned}{} & {} c_{sw1}=\frac{t^2 \left( nt+3 n (2+t) \theta +2 (2+n) (2+t) \theta ^2\right) -\sqrt{\Delta }}{2 \left( t x_2+3 (2+t) x_2 \theta +(2+t) x_3 \theta ^2+n^2 (2+t)^3 \theta ^3\right) },\\{} & {} c_{sw2}=\frac{t^2 \left( nt+3 n (2+t) \theta +2 (2+n) (2+t) \theta ^2\right) +\sqrt{\Delta }}{2 \left( t x_2+3 (2+t) x_2 \theta +(2+t) x_3 \theta ^2+n^2 (2+t)^3 \theta ^3\right) }, \end{aligned}$$where \(x_2=n(m+n)\left( m+m n+n^2\right)\), \(x_3=3 n^3 (2+n)+m^2 (2+n (2+3 n))+2\,m n (2+n (4+3 n))\),and \(\Delta = n^2 t^2(t^4+6 t^3 (t+2) \theta +t^2 (t+2) (5t+26) \theta ^2-12 t(t-2) (t+2)^2 \theta ^3-4\)

\((t+2)^3 (5t-2) \theta ^4-8 (t+2)^4 \theta ^5)\); otherwise, it raises social welfare.

An increase in n increases industry output and consumer surplus, and shifts production from inefficient firms to efficient firms, which are desirable to social welfare. However, an increase in m may hurt social welfare because of the undesirable product distribution shown in Lemma 1 under strategic input pricing by the upstream supplier. Thus, the degree of privatization which determines the objective of the upstream supplier and then affects input pricing, and the cost of inefficient firms which reflects the inefficiency of production distribution, are very important to the welfare effect of inefficient entry.

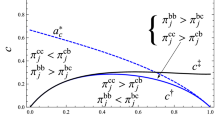

Figure 2 illustrates the region (Region IV) in which social welfare decreases with m. Intuitively, inefficient entry generates two counteracting welfare effects. On the one hand, higher competition leads to higher industry output, which is positive to social welfare. On the other hand, inefficient entry raises the total output of inefficient firms and reduces the total output of efficient firms, which is negative to social welfare. The strengths of the two effects are affected by the effective marginal cost of firms (i.e., marginal cost plus unit input price). If the upstream supplier is fully nationalized (Proposition 3(i)), the input price is significantly raised to rectify the situation of undesirable product distribution, which meanwhile, reduces the output expansion effect. As a result, the negative effect dominates the positive effect and leads to the loss of social welfare. On the contrary, if the upstream supplier is fully privatized (Proposition 3(ii)), it favors the output expansion and therefore obtains no incentives to significantly raise the input price as the public firm. As a result, the positive output expansion effect remains dominant and leads to the improvement of social welfare.Footnote 10 If the upstream firm is partially privatized, social welfare decreases with m in the region where consumer surplus decreases. This result is straightforward from our above discussions. However, in the region where consumer surplus increases with m, inefficient entry may reduce social welfare if the cost of inefficient firms is high and the degree of privatization is low or median. This is due to the undesirable production distribution which increases production costs to the society.

To end this section, it is important to point out that our main results continue to hold when an inefficient semi-public firm competes against k efficient private firms in the upstream market. Efficient entry in the downstream market benefits consumers and social welfare at the expense of incumbent firms, while inefficient entry may lead to opposite results under certain conditions.

4 Price discrimination

In this section, we study the case in which input price discrimination is allowed. The input price for inefficient firms is denoted by \(w_i\), and that for efficient firms is denoted by \(w_j\).

In the first stage, the upstream firm determines input prices \(w_i\) and \(w_j\) to maximize its objective \(\Omega =\theta \pi _0+(1-\theta ) SW\), where \(\pi _0=w_i\begin{matrix}\sum _{i=1}^m q_i\end{matrix}+w_j \begin{matrix}\sum _{j=1}^n q_j\end{matrix}\). In the second stage, the downstream firms determine their quantities to maximize

We solve this two-stage game using the standard backward induction. In the second stage, the \(n+m\) first-order conditions are

The second-order conditions are satisfied. Solving the first-order conditions leads to the equilibrium outputs as

The industry output and price of the final product are, respectively,

In the first stage, the upstream firm determines the input prices. Solving the two first-order condition leads to the equilibrium input prices as

where \(\theta >0\). It can be verified that the second-order conditions are satisfied. Incorporating the equilibrium input prices into the quantities generates the equilibrium outputs as

We assume that \(0< c <\hat{c}\equiv {2 \theta }/{(n + 2 \theta + n \theta )}\) such that all firms are active in equilibrium. As in the case of uniform pricing, the input prices can be either positive or negative. Further, it follows that

Lemma 3

Under price discrimination, the equilibrium input prices satisfy that

-

(i)

\(\partial (w^{**}_i-w^{**}_j)/\partial \theta <0\), with \(w^{**}_i>w^{**}_j\), if \(0<\theta <{1}/{2}\) and \(w^{**}_i<w^{**}_j\) if \({1}/{2}<\theta <1\);

-

(ii)

\(\partial (w^{**}_i-w^{**}_j)/\partial m=\partial (w^{**}_i-w^{**}_j)/\partial n=0\), with \(\partial w^{**}_i/\partial m=\partial w^{**}_j/\partial m>0\), and \(\partial w^{**}_i/\partial n=\partial w^{**}_j/\partial n>0\).

Under price discrimination, it is well-known that the input supplier charges a higher (lower) price to efficient (inefficient) producers (DeGraba 1990; and Yoshida 2000), which partially offsets the cost advantage. Such price discrimination benefits inefficient firms by shifting production from efficient firms to inefficient ones, thus creating production inefficiency. However, this result is obtained when the upstream supplier is a private firm. If the upstream supplier is more concerned with social welfare than its own profit (i.e., highly nationalized), the well-known result in the literature will be reversed as indicated by Lemma 3(i): The input supplier charges a higher (lower) price to inefficient (efficient) producers to benefit efficient firms by creating production efficiency. That is, the efficient and thus the ultimately larger firms receive a discount on input price, which is consistent with the casual observation that larger firms often obtain discounts on input prices. This result contrasts sharply with that found in the extant literature with a few exceptions, and is very important for the welfare effects of input price discrimination. Therefore, Lemma 3(i) highlights the role of upstream privatization on input prices under price discrimination.

In contrast to the case of uniform pricing, an increase in either m or n leads to an equal rise in input prices as indicated by Lemma 3(ii). Then, the difference in input prices (effective marginal costs) is independent of both m and n. That is, price discrimination eliminates the possibility of input price-reducing entry.

As we see in the above discussions, the major difference between uniform pricing and price discrimination is that the input supplier actually charges a higher (lower) price to inefficient (efficient) firms under price discrimination when \(\theta <1/2\), which efficiently reduces the production inefficiency. As a result, entry of inefficient firms will not result in such a significant input price increase as that under uniform pricing. Hence, the industry output and consumer surplus increase as market competition intensifies. Further, the downstream firms’ profits in equilibrium are

Downstream entry on the one hand increases market competition, and on the other hand, leads to higher input prices. Both are undesirable to downstream firms. We then have the results summarized in the following proposition.

Proposition 4

Under price discrimination, an increase in the number of downstream firms, regardless of their marginal costs, always

-

(i)

raises industry output and consumer surplus;

-

(ii)

reduces incumbents’ profits.

So far, we show that price discrimination generates different results from uniform pricing. Thus, the pricing scheme is very critical for the result of either consumers-hurting or profit-raising entry. We next look at the social welfare in equilibrium, which is

after simple calculations, where \(x_4=\theta (m+n+2 (2+m+n) \theta )\).

Proposition 5

Under price discrimination,

-

(i)

an increase in the number of inefficient firms, m, reduces social welfare when \({c}_{sw3}<c<\hat{c}\), otherwise, it raises social welfare; where

$$\begin{aligned} {c}_{sw3}=\frac{2 (2 + m + n) \theta ^2}{(n + (2 + n) \theta )^2 + m (2 \theta ^2 + n (1 + \theta )^2)}; \end{aligned}$$ -

(ii)

an increase in the number of efficient firms, n, raises social welfare.

Proposition 5 shows that entry of inefficient firms reduces social welfare when the marginal cost of inefficient firms is sufficiently high. Similar arguments for this welfare-reducing entry apply here. Entry of inefficient firms shifts production from efficient firms to inefficient firms, which creates production inefficiency and thus is undesirable to social welfare. When inefficient firms are very inefficient, such production inefficiency due to entry of inefficient firms is detrimental to social welfare.

To end this section, we conduct a welfare comparison between uniform pricing and price discrimination in the input market.

Proposition 6

In a vertical mixed oligopoly with a privatized firm in the upstream market, banning price discrimination

-

(i)

does not affect industry output and consumer surplus;

-

(ii)

reduces (improves) social welfare when \(0<\theta <{1}/{2}\) (\({1}/{2}<\theta \le 1\)).

The invariance of industry output under uniform input pricing and price discrimination is not new. However, we show that price discrimination improves social welfare when the upstream firms are highly nationalized (\(0<\theta <{1}/{2}\)), which is in contrast to the well-known result in the literature. As we know, price discrimination provides the upstream monopolist with one more decision instrument to achieve its objective compared to uniform pricing. Hence, when the upstream monopolist is more concerned with social welfare (\(0<\theta <{1}/{2}\)), price discrimination leads to higher social welfare than uniform pricing by charging a higher price to inefficient producers and a lower price to efficient producers. Although several papers show that social welfare can be higher under price discrimination, the mechanism behind this result, i.e., the strategic pricing of the upstream privatized firm, has not been discovered before. Indicated by our findings, it is not a desirable policy to ban price discrimination in industries where upstream firms are more nationalized. This view is new in the literature and worth our greatest attention.

5 Concluding remarks

The profit and welfare effects of entry have received great attention for decades. Entry of firms intensifies market competition, which usually benefits consumers and social welfare at the expense of incumbent firms. However, this view has been questioned in the literature under different frameworks. But no one considers the industries with public firms in the upstream markets. To fill this gap, this study attempts to investigate the impact of entry with the presence of a privatized firm in the upstream market. Our model generates some interesting results which might be important for competition policies.

We show that entry of efficient firms leads to the well-known results in the literature. However, inefficient entry may generate opposite results in our model. When the upstream supplier weighs more on its own profit, entry of inefficient firms may induce the upstream supplier to lower input price in equilibrium, which may benefit incumbent firms when the cost gap is sufficiently large. When the upstream supplier weighs less on its own profit, entry of inefficient firms may hurt consumers when they are sufficiently inefficient. The possibility of consumers-hurting entry and profit-raising entry should be known to the competition authorities for some wider goals such as the protection of consumers or incumbents.

In the case of input price discrimination, we show that the common wisdom—that entry benefits consumers and most likely improves social welfare, but hurts incumbents—continues to hold. The input price-reducing effect found under uniform input pricing disappears. As such, the pricing scheme is also very critical for the result of either consumers-hurting or profit-raising entry in our framework. Further, we show that price discrimination improves social welfare when the upstream firm concerns more on social welfare than its own profit. This result has never been found in the literature, and deserves the attention of competition authorities.

In our model, the degree of privatization is exogenously given. If it is endogenously determined in the first stage by the government,Footnote 11 the optimal degree of privatization in the basic model would be zero (see calculations in Appendix).Footnote 12 However, if privatization improves the production efficiency of the semi-public firm, the optimal degree of privatization might be positive, and our results apply accordingly. Incorporating these factors into our analysis remains for future research. Further, we consider homogeneous final products, constant marginal costs, domestic competition in our model, it is very interesting to relax these assumptions to examine whether and how these factors change our results on the effects of entry. Last, it may be interesting to consider the endogenous determination of the timing of quantity competition as in Kawasaki et al. (2022). The two types of firms, efficient and inefficient, simultaneously determine whether to act as leaders or followers before production. These extensions remain directions for future research.

Notes

For examples, Yantai Tayho Advanced Materials Co., Ltd, familiar to us as a partial privatized firm and the first one that realizes the industrialization of para-aramid in China, owns a new patent on para-aramid to chemicals lithium battery diaphragm. This patented technology is used in the downstream cell phone manufacturing industry. Another example is Yangtze memory technologies co., ltd (YMTC), which is a public firm in China and produces China’s first 128-layer and 192-layer 3D NAND flash memories. Its self-dependent NAND flash memories are widely used in downstream industries that manufacture cell phones and computers, etc. In Europe, Renault S.A. is a highly privatized firm since the privatization starting from 1996. It owns a patent to recharge the battery of a hybrid electric vehicle, which is widely applied in the downstream market.

That is, driving the most inefficient firms out of market benefits consumers. In the last decades, the Chinese government launched a competition policy to eliminate outdated industrial capacity. Over ten years, the government legally shut down a large number of very inefficient firms in sectors such as power, coal, steel, cement, etc. Firms in the upstream markets are usually highly nationalized. Our theoretical results support this policy.

In developing countries, the governments actively encourage enterprises to enter the markets and continue to provide support to micro and small enterprises (MSEs) in certain industries. For example, the Chinese government actively encourages small private factories to enter the retail and manufacturing industries. The upstream firms in these industries are usually highly privatized. The government also establishes and improves mechanisms for technology transfer, which induces potential entrants to enter the market.

Since the world-wide wave of economic liberalization in the 1980s, many public firms have been fully or partially privatized. In planned and transitional economies such as China, Vietnam, and Russia, the presence of partially privatized firms is further significant, which usually exist in the upstream markets, controlling industries such as transportation, telecommunications, power generation, finance, mining, steel, manufacturing and energy industries. We consider an exogenously given privatization in our model, and briefly discuss the situation of an endogenously determined privatization in the Concluding Remarks.

We have \({\partial ^2 \Omega }/{\partial w^2}=-{(m + n) (m + n + 2 \theta + m \theta + n \theta )}/{(1 + m + n)^2}<0.\)

The literature provides several reasons for the input price reduction caused by downstream entry, which may raise the profits of incumbent firms. Detailed discussions can be found after Proposition 3.

Another explanation for the price decrease is as follows. Consider an extreme case where the input supplier is fully privatized with \(\theta =1\). As well-known in the literature, increasing w benefits efficient firms but hurts inefficient firms. Then, the input supplier gains more (less) from efficient (inefficient) firms by raising w. However, as the number of inefficient firms increases, the above-mentioned loss from inefficient firms dominates the gain from efficient firms. Hence, increasing w hurts the input supplier. As a result, an increase in m leads to a reduction in w in equilibrium. This result continues to hold as long as the input supplier is highly privatized and the marginal cost of inefficient firms is sufficiently large.

The mechanism behind this result is similar as that in Dinda and Mukherhee (2014) which consider tax/subsidy policies by the government. However, there are several important differences between our paper and Dinda and Mukherhee (2014). We present a different framework to analyze how privatization in the upstream market affects input pricing, which changes market outcomes, while Dinda and Mukherhee (2014) consider a horizontal market. In addition to the finding of consumers-hurting entry in both papers, we also highlight the possibility of profit-raising entry in our framework. Further, we characterize the equilibrium results under different input pricing schemes, and show that privatization in the upstream market is critical for the welfare effects of price discrimination. Our results indicate that corresponding competition policies should be made according to particular features of vertical industries.

In horizontal markets, the existing literature has identified several other factors which result in profit-raising entry, such as Stackelberg leader-follower; Mukherjee and Zhao, 2017), quality differentiation and heterogeneous consumers (Ishibashi and Matsushima, 2009), and innovation by asymmetric firms (Ishida et al. 2011).

As we know in the literature, in a horizontal market with inefficient entry, the output expansion effect dominates the output distribution effect, and therefore, social welfare increases in equilibrium.

Alternatively, Lee et al. (2018) propose an entry-then-privatization model to study the problem of optimal privatization. Unlike us, the authors consider free entry of private firms in their model.

The results in Sect. 3.2 follow accordingly by applying \(\theta =0\). That is, (i) entry of inefficient firms hurts consumers, all incumbents and the society, and (ii) entry of efficient firms benefits consumers and the society, but hurts all incumbents. Hence, it is desirable to launch a competition policy to phase out outdated techniques or backward enterprises.

References

Brito D, Lopes M (2022) Profit raising entry under mixed behavior. J Econ 138:51–72

Chen CS (2017) Price discrimination in input markets and quality differentiation. Rev Ind Organ 50:367–388

Chen CS (2022) Input price discrimination and allocation efficiency. Rev Ind Organ 60:93–107

DeGraba P (1990) Input market price discrimination and the choice of technology. Am Econ Rev 80:1246–1253

Dinda S, Mukherhee A (2014) A note on the adverse effect of competition on consumers. J Public Econ Theory 16(1):157–163

Haraguchi J, Matsumura T (2021) Profit-enhancing entries in mixed oligopolies. South Econ J 88(1):33–55

Inderst R, Shaffer G (2009) Market power, price discrimination, and allocative efficiency in intermediate-good markets. Rand J Econ 40:658–672

Inderst R, Valletti T (2009) Price discrimination in input markets. Rand J Econ 40(1):1–19

Ishida J, Matsumura T, Matsushima N (2011) Market competition, R &D and firm profits in asymmetric Oligopoly. J Ind Econ LIX:484–505

Katz ML (1987) The welfare effects of third-degree price discrimination in intermediate good markets. Am Econ Rev 77:154–167

Kawasaki A, Ohkawa T, Okamura M (2022) Optimal partial privatization in an endogenous timing game: a mixed oligopoly approach. J Econ 136(3):227–250

Kim H, Sim S-G (2015) Price discrimination and sequential contracting in monopolistic input markets. Econ Lett 128:39–42

Lee SH, Matsumura T, Sato S (2018) An analysis of entry-then-privatization model: welfare and policy implications. J Econ 123(1):71–88

Li Y (2013) Timing of investments and third degree price discrimination in intermediate good markets. Econ Lett 121:316–320

Li Y (2014) A note on third degree price discrimination in intermediate good markets. J Ind Econ 62(3):554–554

Matsumura T (1998) Partial privatization in mixed duopoly. J Public Econ 70(3):473–483

Mukherjee A (2019) Profit raising entry in a vertical structure. Econ Lett 183:108543

Mukherjee A, Zhao A (2017) Profit raising entry. J Ind Econ LXV:214–219

Mukherjee A, Broll U, Mukherjee S (2009) The welfare effects of entry: the role of the input market. J Econ 98(3):189–201

Nariu T, Flath D, Okamura M (2021) A vertical oligopoly in which entry increases every firm’s profit. J Econ Manag Strateg 30(3):684–694

Pal D, Sarkar J (2001) A Stackelberg oligopoly with nonidentical firms. Bull Econ Res 53:127–134

Tyagi RK (1999) On the effects of downstream entry. Manage Sci 45:59–71

Wang LFS, Zeng CH, Zhang QD (2019) Indirect taxation and undesirable competition. Econ Lett 181:104–106

Wang LFS, Zeng CH, Zhang QD (2019) Indirect taxation and consumer welfare in an asymmetric Stackelberg oligopoly. North Am J Econ Fin 50:101034

Wang LFS, Lee J (2013) Foreign penetration and undesirable competition. Econ Model 30:729–732

Wang LFS, Mukherjee A (2012) Undesirable competition. Econ Lett 114(2):175–177

Yoshida Y (2000) Third-degree price discrimination in input market. Am Econ Rev 90:240–246

Acknowledgments

We thank the editor, Giacomo Corneo, and two anonymous reviewers for their constructive comments and suggestions that have helped to greatly improve the paper. Financial support from the National Natural Science Foundation of China (Grant No. 72273153) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

6 Appendix: Proofs

6 Appendix: Proofs

1.1 Proof of Lemma 1

Straightforward calculations lead to the following results:

-

(i)

$$\begin{aligned} \frac{\partial q_i}{\partial w}=\frac{\partial q_j}{\partial w}=-\frac{1}{1 + m + n}<0, \quad \frac{\partial Q}{\partial w}=-\frac{m+n}{1 + m + n}<0; \end{aligned}$$

-

(ii)

$$\begin{aligned}{} & {} \frac{\partial q_i}{\partial m}=\frac{\partial q_j}{\partial m}=-\frac{1-c - c n - w}{(1 + m + n)^2}<0, \quad \frac{\partial Q}{\partial m}=\frac{1 - c - c n - w }{(1 + m + n)^2}>0,\\{} & {} \frac{\partial m q_i}{\partial m}= -(1+n) \frac{\partial q_i}{\partial m} >0, \quad \text{ and } \quad \frac{\partial n q_j}{\partial m}= n \frac{\partial q_i}{\partial m} <0; \end{aligned}$$

-

(iii)

$$\begin{aligned}{} & {} \frac{\partial q_i}{\partial n}=\frac{\partial q_j}{\partial n}=-\frac{1-w + c m }{(1 + m + n)^2}<0, \quad \frac{\partial Q}{\partial n}=\frac{1 + c m - w}{(1 + m + n)^2}>0;\\{} & {} \frac{\partial m q_i}{\partial n}= m \frac{\partial q_i}{\partial n} <0, \quad \text{ and } \quad \frac{\partial n q_j}{\partial n}= - (1+m) \frac{\partial q_i}{\partial n} >0. \end{aligned}$$

1.2 Proof of Lemma 2

-

(i)

$$\begin{aligned} \text{ We } \text{ have } \quad \frac{\partial w^*}{\partial \theta }=\frac{((1 - c) m + n) (1 + t) (2 + t)}{t (t + (2 +t) \theta )^2}>0. \end{aligned}$$

-

(ii)

$$\begin{aligned} \text{ We } \text{ further } \text{ have } \quad \frac{\partial w^*}{\partial m}=\frac{c f_1 +t^2 (1 - \theta ) }{t^2 (t +(2 +t) \theta )^2}; \end{aligned}$$

where \(f_1=n^2 -m^2 - (t (m ( n-1 ) + n + n^2)-2 n ) \theta - n (2 +t)^2 \theta ^2,\) and \(t=m+n\). Since the denominator is positive, the sign of \({\partial w^*}/{\partial m}\) only depends on the numerator, which is a linear function of c with coefficient \(f_1\). Notice that \({\partial w^*}/{\partial m}|_{c=0}>0\). We then look at the sign of \({\partial w^*}/{\partial m}|_{c=\bar{c}}.\)

If \(\theta <1/2\), we obtain \({\partial w^*}/{\partial m}|_{c=\bar{c}}>0\), which indicates that \(w^*\) always increases with m for \(c<\bar{c}\).

If \(\theta >1/2\), we obtain \({\partial w^*}/{\partial m}|_{c=\bar{c}}<0\), which indicates there exists \(c=c_w\) such that \({\partial w^*}/{\partial m}=0\). In this case, when \(0<c<c_w\), \({\partial w^*}/{\partial m}>0\); and when \(c_w<c<\bar{c}\), \({\partial w^*}/{\partial m}<0\). Straightforward calculations lead to

$$\begin{aligned} c_w=\frac{t^2 (1 - \theta )}{m^2 - n^2 + (-2 n + t (m (n-1) + n + n^2)) \theta + n (2 +t)^2 \theta ^2}. \end{aligned}$$Hence, \(w^*\) decreases with m when \(\theta >1/2\) and \(c_w<c<\bar{c}\), and increases with m when \(\theta >1/2\) and \(0<c<c_w\) or \(\theta <1/2\).

-

(iii)

Straightforward calculations lead to

$$\begin{aligned} \frac{\partial w^*}{\partial n}=\frac{( m (m^2 -2 + 2 m (1 + n) + n (2 + n)) \theta + m (2 + t)^2 \theta ^2-2 m t) c+t^2 (1 - \theta ) }{t^2 (t + (2 +t) \theta )^2}. \end{aligned}$$Since the denominator is positive, the sign of \({\partial w^*}/{\partial n}\) only depends on the numerator, which is a linear function of c. Because \({\partial w^*}/{\partial n}|_{c=0}>0\) and \({\partial w^*}/{\partial n}|_{c=\bar{c}}>0\), we conclude that \(w^*\) increases with n.

1.3 Proof of Proposition 1

-

(i)

We have

$$\begin{aligned} \frac{\partial Q^*}{\partial m}=\frac{2 \theta - c (n+(2+n)\theta )}{(t+ (2 +t) \theta )^2}; \end{aligned}$$which is negative when \(c>{2 \theta }/{(n+2\theta +n\theta )} \equiv c_q>0,\) and positive otherwise. Notice that if \(\theta <1/2\), we have \(c_q<\bar{c}\). Then, when \(\theta <1/2\) and \(c_q<c<\bar{c}\), the equilibrium industry output \(Q^*\) decreases with m. If \(\theta >1/2\), we have \(c_q>\bar{c}\). Then, \(Q^*\) increases with m.

-

(ii)

Simple calculations lead to

$$\begin{aligned} \frac{\partial Q^*}{\partial n}=\frac{2 \theta + c m (1 + \theta )}{(t + (2 +t) \theta )^2}>0. \end{aligned}$$

1.4 Proof of Proposition 2

Following (1) and (3), we have \(\pi _i^*=(1-Q^*-c-w^*)^2\), and \(\pi _j^*=(1-Q^*-w^*)^2.\) In the proof below, we use \(A=-(Q^*+w^*)\).

-

(i)

Simple calculations lead to

$$\begin{aligned}{} & {} \frac{\partial \pi _i^*}{\partial m}=2 (1-c+A) \frac{\partial A}{\partial m}, \quad \text{ and } \quad \frac{\partial \pi _j^*}{\partial m}=2 (1+A) \frac{\partial A}{\partial m},\\{} & {} \text{ where } \quad \frac{\partial A}{\partial m}=\frac{f_2 c- t^2 (1 + \theta )}{t^2 (t + (2 +t) \theta )^2}, \end{aligned}$$and \(f_2=m^2 (1 + \theta ) (1 + n + n \theta ) + 2\,m n (1 + \theta ) x_1 + n (x_1 -1) x_1>0.\) Since \((1-c+A)>0\), the signs of \({\partial \pi _i^*}/{\partial m}\) and \({\partial \pi _j^*}/{\partial m}\) depend on \({\partial A}/{\partial m}\). Note that the denominator of \({\partial A}/{\partial m}\) is positive. The sign of \({\partial A}/{\partial m}\) only depends on its numerator, which increases with c.

If \(\theta <1/2\), \({\partial A}/{\partial m}|_{c=\bar{c}}<0\), which indicates firms’ profits decrease with m.

If \(\theta >1/2\), we have \({\partial A}/{\partial m}|_{c=0}<0\), and \({\partial A}/{\partial m}|_{c=\bar{c}}>0\). Hence, there exists a solution \(c_\pi \in (0,\bar{c})\) such that \({\partial A}/{\partial m}=0\). Solving \({\partial A}/{\partial m}=0\) leads to

$$\begin{aligned} c_\pi =\frac{t^2 (1 + \theta )}{m^2 (1 + \theta ) (1 + n + n \theta ) + 2 m n (1 + \theta ) x_1 + n ( x_1-1) x_1}. \end{aligned}$$Hence, firms’ profits increase with m if \(c_\pi<c<\bar{c}\), and decrease with m if \(0<c<c_\pi .\)

-

(ii)

Similarly, we have

$$\frac{\partial \pi _i^*}{\partial n}=2 (1-Q^*-c-w^*) \frac{\partial A}{\partial n}, \quad \text{ and } \quad \frac{\partial \pi _j^*}{\partial n}=2 (1-Q^*-w^*) \frac{\partial A}{\partial n},$$where

$$\begin{aligned} \frac{\partial A}{\partial n}=\frac{f_3 c- t^2 (1 + \theta )}{t^2 (t+ (2 +t) \theta )^2}, \end{aligned}$$and \(f_3=-m (t^2-2 t +2 t (1 +t) \theta + (2 +t)^2 \theta ^2 -2 \theta )<0.\) As in the above proof, the sign of \({\partial A}/{\partial n}\) only depends on its numerator, which decreases with c because of the negative coefficient \(f_3\). Further calculations show that \({\partial A}/{\partial n}|_{c=0}<0\). Hence, A decreases with n. Therefore, the profits of incumbents decrease with n.

1.5 Proof of Proposition 3

We first calculate the equilibrium social welfare and obtain

(i) After standard calculations, we have

where \(f_4={t x_2} +3 (2 + t)x_2 \theta + (2 + t) x_3 \theta ^2 +n^2 (2 +t)^3 \theta ^3,\) \(f_5=-t^2 (n t + 3 n (2 +t) \theta +2 (2 + n) (2 + t) \theta ^2),\) and \(\Delta =f_5^2 - (8 t^2 (2 + t) \theta ^2) f_4\). Since the denominator is positive, the sign of \({\partial SW^*}/{\partial m}\) only depends on the numerator, which is a quadratic function of c with a positive quadratic coefficient \(f_4\). We then look at \(\Delta\).

There exists \(\hat{\theta }\in (1/2,1)\) such that \(\Delta \le 0\) if \(\theta \ge \hat{\theta }\), which indicates that \({\partial SW^*}/{\partial m}\ge 0\). Hence, when the upstream supplier is fully privatized (\(\theta =1\)), we have \({\partial SW^*}/{\partial m}>0\), which proves proposition 3(ii).

If \(0\le \theta < \hat{\theta }\), we have \(\Delta > 0\). Then there exist two roots for \({\partial SW^*}/{\partial m}=0\), represented by \(c_{sw1}\) and \(c_{sw2}\), where

It follows that \(c_{sw1}<c_{sw2}\).

If \(\theta =0\), we have \(0=c_{sw1}<\bar{c}<c_{sw2}\). Thus, when the upstream supplier is fully nationalized, \(SW^*\) decreases with m, which proves proposition 3(i);

If \(0<\theta <\hat{\theta }\), we divide the range into two intervals as follows: (i) if \(0<\theta \le 1/2\), we have \(0<c_{sw1}<\bar{c}<c_{sw2}\). Then \({\partial SW^*}/{\partial m}<0\) when \(c\in (c_{sw1},\bar{c})\); (ii) if \(1/2<\theta <\hat{\theta }\), we have \(0<c_{sw1}<c_{sw2}<\bar{c}\). Then \({\partial SW^*}/{\partial m }<0\) when \(c\in (c_{sw1},c_{sw2})\). That is, if \(0<\theta <\hat{\theta }\), \({\partial SW^*}/{\partial m }<0\) when \(c\in (c_{sw1}, min\{c_{sw2}, \bar{c}\})\), which proves proposition 3(iii).

(ii) Similarly, we obtain

where \(f_6= m^2 ((t-1) t^2 +3 t (t-1)(2 + t) \theta + (2 + t) ( 3 t^2 + 4t -2) \theta ^2 + (2 + t)^3 \theta ^3),\) and \(f_7=m t^2 (t +3 (2 + t) \theta + 2 (2 + t) \theta ^2).\)

Since the denominator is positive, the sign of \({\partial SW^*}/{\partial n}\) only depends on the numerator, which is a quadratic function of c with a positive quadratic coefficient \(f_6\). Further, we have

which indicates that \({\partial SW^*}/{\partial n}>0\).

1.6 Proof of Lemma 3

The results in part (i) and the first half of part (ii) are very obvious. Recall that we assume \(0< c <\hat{c}\equiv {2 \theta }/{(n + 2 \theta + n \theta )}\) such that all firms are active in equilibrium. Then, straightforward calculations lead to

1.7 Proof of Proposition 4

Simple calculations lead to

Further, we obtain

1.8 Proof of Proposition 5

(i) Differentiating \(SW^{**}\) with respect to m leads to

where \(f_9=n t (n + (2 + n) \theta ) + 2 n (2 + t) (n + (2 + n) \theta )\theta + (2 + n) (2 +t) (n + (2 + n) \theta )\theta ^2,\) and \(f_{10}=-2 n t \theta - 4 n (2 +t) \theta ^2 - 2 (2 + n) (2 + t) \theta ^3 - 2(2 + m + n) (n + (2 + n) \theta ) \theta ^2.\) The denominator is positive. Then, the sign of \({\partial SW^{**}}/{\partial m}\) depends on the numerator, which is a quadratic function of c with a positive quadratic coefficient. Further calculations lead to

which indicates that there are two reals solutions for \({\partial SW^{**}}/{\partial m}=0\): \(c=\hat{c}\), and \(c=c_{sw3}\),

Then, if \(c_{sw3}<c<\hat{c}\), \(SW^{**}\) decreases with m. Otherwise, \(SW^{**}\) increases with m.

(ii) After similar calculations, we have

1.9 Proof of Proposition 6

-

(i)

According to equation (9) and (18), the pricing schemes do not change the total output.

-

(ii)

Straightforward calculations yield

$$\begin{aligned} SW^{*}-SW^{**}=\frac{c^2 m n (2\theta -1)}{2 (m+n) \theta }, \end{aligned}$$which is positive when \({1}/{2}<\theta <1\), and negative when \(0\le \theta <{1}/{2}\). Hence, banning price discrimination reduces (improves) social welfare when \(0< \theta <{1}/{2}\) (\({1}/{2}<\theta \le 1\)).

1.10 Equilibrium of endogenously determined privatization

When the degree of privatization is endogenously determined, the two-stage game in the model becomes a three-stage game. We then add a stage at the beginning in which the government determines the degree of privatization \(\theta\) to maximize social welfare. In the following, we show that the optimal degree of privatization is always zero.

Under uniform input pricing, social welfare is obtained in the proof of Proposition 3. The first-order condition is

which leads to the equilibrium degree of privatization as \(\theta ^*=0\).

Under price discrimination, social welfare is given by (21). It follows that

which is negative for any \(\theta >0\). Hence, the optimal degree of privatization is \(\theta ^{**}=0\).

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Han, J., Zeng, C. The effects of downstream entry in a vertical mixed oligopoly: the role of input pricing. J Econ 140, 37–61 (2023). https://doi.org/10.1007/s00712-023-00831-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-023-00831-0