Abstract

This paper develops a growth model in which product cycles arise endogenously from investment in incremental and breakthrough innovations. Incumbent firms invest in incremental technology improvements with the aim of reducing production costs. Market entrants develop breakthrough product designs in order to capture the market from vintage product lines. The competing objectives of the two types of innovation generate product cycles within an environment of creative destruction, as new products displace old and are then manufactured using production technologies that are continuously refined. Investigating the relationship between innovation incentives and the average length of product cycles, we characterized three stable patterns of product evolution: incremental innovation alone, breakthrough innovation alone, and product cycles with both types of innovation. Numerical examples suggest that when the market exhibits stable product cycles, subsidies to either type of innovation raise the rate of economic growth and improve welfare.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In a modern industrial society, research and development (R&D) is critical both for the survival of firms in a competitive market place and for the growth of the economy. In the battle for survival, incumbent firms focus on reducing production costs through investment in incremental innovations that refine their production technologies. In contrast, firms entering the market invest in breakthrough innovations that allow them to displace vintage product lines with new products of higher quality, leading to a process of creative destruction from which product cycles may emerge. In this paper, we investigate how competition between investment in breakthrough and incremental innovations determines the existence and length of product cycles.

Product cycles are characteristic of many manufacturing industries.Footnote 1 For instance, Grimm (1998) studies the quality-adjusted price patterns of dynamic random access memory (DRAM) chips for four densities, 4, 16, 64, and 256 kb, over the period from 1974 to 1994, and finds that price trends exhibit a cyclical pattern similar to the stylized pattern reproduced in Fig. 1 following Flamm (1993). The three curves describe quality-adjusted price trends, measured in price per bit, for three memory chip densities, introduced at times I, II, and III. After the introduction of a higher density (quality) chip, price initially falls quickly before flattening out. One potential explanation for these product cycles revolves around a comparison of the incentives for investment in breakthrough and incremental innovation. In this explanation, times I, II, and III reflect the introduction of new product designs that are the result of breakthrough product developments, and the intermittent declining price trends describe the outcome of incremental process innovations that reduce production costs. When combined, these two types of innovation generate product cycles at the industry level, and become key drivers of economic growth.

In this paper, investment in breakthrough and incremental innovations potentially generates product cycles with price trends similar to those of Fig. 1. Our framework combines two strands of the endogenous growth literature. First, following Grossman and Helpman (1991), firms within a given industry compete according to Bertrand competition, resulting in a single industry leader supplying a state-of-the-art product with the highest product quality and the lowest cost production technology. Specifically, the industry leader enters the market with a breakthrough innovation that raises the quality of the state-of-the-art product, while adopting the lowest cost production technology, and sets a limit price that is just low enough to force all rival firms out of the market. Second, following Smulders and Klundert (1995) and Peretto (1996), incumbent industry leaders invest in incremental process innovation with the aim of lowering production costs. Although these process innovations increase firm value by raising future profits, technology spillovers to rival firms induce industry leaders to lower limit prices to prevent rival firms from entering the market.

Using this framework, we find that long-run patterns of product evolution may be characterized by corner solutions with either quality or productivity growth alone, or by an interior solution with product cycles that feature both quality and productivity growth. In an interior equilibrium, product cycles are characterized by the stochastic interaction between breakthrough quality and incremental process innovation, generating heterogeneous processes of product evolution across industries: some industries experience short product cycles while others exhibit long product cycles. As a result, while average product cycle length is constant and average product price falls at a constant rate in an interior equilibrium, limit price adjustments induced by technology spillovers diminish along the product cycle, creating within industry pricing patterns similar to those illustrated in Fig. 1.

Studying investment dynamics around the interior equilibrium, we find that product cycle stability depends on how changes in product cycle length affect the relative returns to breakthrough and incremental innovation. Product cycle length determines the technology gap between industry leaders and rival firms. Thus, a decrease in product cycle length lowers the return to breakthrough innovation, as current profits fall, but raises the return to incremental innovation, as the potential for improving future profits rises. After a fall in product cycle length, adjustments in innovation levels are required to restore equality between the rates of return. In the first case, labor productivity is higher for breakthrough than incremental innovation, and industry leaders raise firm value by reducing investment in process innovation, as the positive effect of reduced labor costs on current profits is greater than the potential benefit of higher future profits. Breakthrough innovation increases and incremental innovation decreases, leading to a further fall in average product cycle length and an unstable interior equilibrium. In the second case, labor productivity is higher for incremental innovation, and the positive effect of higher future profits outweighs the negative effect of lower current profits, inducing industry leaders to increase process innovation and extending product cycle length. Product cycles are therefore stable.

Focusing on a stable interior equilibrium, we investigate the effects of R&D subsidies on average product cycle length, economic growth, and welfare. Simple numerical examples show that a subsidy to incremental innovation increases the rate of productivity growth relative to the rate of quality growth, resulting in greater average product cycle length and a higher rate of growth. Longer product cycles imply a larger technology gap between industry leaders and rival firms that allows for a greater price-cost markup and hurts welfare. Overall the growth effect dominates generating a positive welfare effect for subsidies to incremental innovation. Alternatively, a subsidy to breakthrough innovation raises the rate of quality growth relative to productivity growth, causing shorter product cycles, accelerating the growth rate, and improving welfare. Our numerical examples suggest that R&D subsidies are welfare improving.

Our paper is closely related to Acemoglu and Cao (2015) who study how the distribution of firm size arises from the incremental innovation of incumbent firms and the radical (or breakthrough) innovation of new market entrants that displace incumbents through creative destruction. The innovation activities of both entrants and incumbents produce drastic quality improvements that lead to constant monopoly prices. Thus, our framework breaks from Acemoglu and Cao (2015) by considering limit prices that decline gradually over the product cycle, as illustrated in Fig. 1.

Klepper (1996) and Cohen and Klepper (1996) develop dynamic models of product life cycles in which the number of firms in an industry expands, peaks, and then declines before stabilizing.Footnote 2 Incumbent firms invest in quality innovations that increase the unit price consumers are willing to pay and in process innovations that reduce production costs. The share of investment in process innovation increases over the life of the industry, as the returns to process innovation rise and the returns to quality innovation fall, and production scales and market shares expand for the remaining incumbent firms. A key feature of these frameworks is that firms benefit from innovation during the investment period. In contrast, rather than studying the dynamics of market structure over a single product cycle, we focus on how the risk of future market entry affects investment in incremental innovation, within an environment of creative destruction, potentially generating consecutive product cycles.

As any R&D-based explanation of product cycles requires at least two types of innovation, our paper also contributes to an expanding endogenous growth literature that considers two types of R&D within a unified framework (Young 1998; Thompson 2001; Peretto and Smulders 2002; Lambertini 2003; Klette and Kortum 2004; Gil 2013; Steinmetz 2015). In particular, Segerstrom (1991), Davidson and Segerstrom (1998) Cheng and Tao (1999), and Palokangas (2008) investigate how the interaction between incentives for investment in quality innovation and quality imitation causes industries to cycle between a monopoly and a duopoly, both of which set constant prices. These frameworks do not generate product cycles with gradually declining prices. Cheng and Dinopoulos (1996) examine the relationship between product cycle length and long-run growth in a model of R&D races with breakthrough quality innovation and intermittent quality improvements that diminish over the product cycle. Their framework cycles through breakthrough and incremental innovations rather than settling at a steady state. Our paper contributes to the literature with a framework in which breakthrough quality and incremental process innovations potentially generate steady-state product cycles with gradually decreasing prices.

The paper proceeds as follows. In Sect. 2 we introduce our model of endogenous growth, and then in Sect. 3 we characterize three equilibrium patterns of product evolution. Section 4 considers the effects of R&D subsidies on product cycle length, economic growth and welfare. The paper concludes in Sect. 5.

2 The model

Consider an economy with three economic activities: production (X), incremental innovation (M), and breakthrough innovation (Q). The production sector consists of a unitary mass of industries, indexed by i, within each of which firms produce goods for consumption and compete according to Bertrand competition. Incremental innovation refers to the invention of new technologies that improve the productivity of incumbent firms thereby reducing production costs. Breakthrough innovation, on the other hand, refers to the market entry of new firms with product designs that improve on the quality of existing product lines. The sole factor of production is labor supplied inelastically by households.

2.1 Households

The demand side of the economy consists of a population of dynastic households (L) that choose optimal expenditure paths with the objective of maximizing lifetime utility. The intertemporal preferences of a single household are described by

where \(\rho \in (0,1)\) is the subjective discount rate. Instantaneous utility u(t) takes the form of a quality-augmented Dixit–Stiglitz consumption index with a unitary elasticity of substitution between industries (Grossman and Helpman 1991):

where \(c_x(i, j, t)\) denotes household consumption of product j(i) in industry i at time t. Product quality \(\lambda ^{j(i)}\) depends on the number of quality innovations j(i) that have been invented in industry i at the time the product is introduced, with each separate innovation improving product quality by an increment of \(\lambda > 1\). Instantaneous utility is increasing in product quality, and thus consumers prefer higher quality products.

Intertemporal optimization requires that a household select an expenditure path that maximizes lifetime utility (1) subject to the following flow budget constraint: \(\dot{V}(t) = r(t) V(t) + w(t) - E(t)\), where V(t) is asset wealth, r(t) is the interest rate, w(t) is the wage rate, E(t) is household expenditure, and a dot over a variable indicates time differentiation. It is well known that the solution to this problem is the optimal expenditure-saving path described by the following Euler equation:

Henceforth, we set household expenditure as the model numeraire \(E=1\), and thus the interest rate is constant: \(r=\rho \). Time arguments are suppressed hereafter in order to simplify notation.

A unitary elasticity of substitution across industries leads to an even allocation of household expenditures across product lines. Within each product line, households purchase the product with the lowest quality-adjusted price \(p_x(i,j)/\lambda ^{j(i)}\), where \(p_x (i, j)\) denotes price. Denoting the state-of-the-art product with the lowest quality-adjusted price by \(j(i) = J(i)\), after aggregating across households, we obtain the total demand for product j(i) from industry i as follows:

Households only consume the good with the lowest quality-adjusted price from each product line, and thus demand is zero for all products that are not state-of-the-art.

2.2 Production

Firms in the production sector employ labor with an industry-specific technology. In particular, the production function is

where m(i) is current productivity and \(L_X(i)\) is firm-level employment in production.

Firms operating in the same industry compete according to Bertrand competition and, as a result, the profit maximizing price of the industry leader, producing the state-of-the-art, is a limit price that is set just low enough to force the closest rival firm out of the market. Denoting the productivity of the closest rival firm as \(\overline{m}(i)\), we find that the industry leader sets a quality-adjusted price that is just equal to the marginal cost of the closest rival firm, \(p_x(i) = w \lambda / \overline{m} (i)\), where w is the economy-wide wage rate. Thus, the industry leader earns operating profit on sales of

where we have used the demand function (4), the limit pricing rule, \(p_x(i) = w \lambda / \overline{m} (i)\), and the marginal cost of the industry leader, w / m(i).Footnote 3

2.3 Incremental innovation

Following Peretto and Connolly (2007), productivity growth may arise within a given industry as the result of incremental production technologies that are invented by independent R&D firms in a process innovation sector and then sold to industry leaders in the production sector. At each moment in time, the market leader in a given industry determines its optimal purchases of productivity improvements with the objective of maximizing firm value. The total cost of these purchases is \(p_m(i) \dot{m} (i)\), where \(p_m(i)\) is the unit price and \(\dot{m}(i)\) is the mass of productivity improvements purchased. Accordingly, in view of operating profit on sales (6), in an industry with positive productivity growth, the market leader earns instantaneous profits equal to

The incentive to invest in incremental innovation is clear. An improvement in the productivity m(i) of the industry leader decreases marginal cost relative to the limit price, \(\overline{m}(i)/\lambda m(i)\), raising operating profit on sales (6), and increasing firm value.

Competitive firms develop incremental productivity improvements for sale to firms in industry i using the following R&D technology:

where \(\alpha >0\) is a productivity parameter, m(i) is the current stock of industry-specific technical knowledge, and \(L_M(i)\) is total labor employed in the development of new production processes for industry i. This R&D technology adapts a key feature of a growing endogenous growth literature which assumes that innovation costs are an increasing function of market size \(p_x(i) x(i)\), as measured by the value of output (Etro 2004; Peretto and Connolly 2007; Dinopoulos and Unel 2011; Peretto and Valente 2015). Free entry into the development of incremental innovations and a continuous mass of production industries leads to a unit price for productivity improvements that matches the cost of development: \(p_m(i) = w p_x(i) x(i)/(\alpha m(i))\).

The firm-value of the industry leader is the present value of expected profit flows:

where we have used \(r=\rho \), and \(\iota (i)\) is the industry-specific risk associated with the potential loss of the market to a rival firm entering with a newly developed breakthrough product design. Taking the time derivative of firm-value (9), we describe the instantaneous demand for incremental productivity improvements in industry i using the following asset-pricing condition:

When the industry leader exhibits positive productivity growth, the return on investment in incremental productivity improvements must equal the risk-free interest rate (\(\rho \)) plus an adjustment for the risk associated with market entry \(\iota (i)\). Otherwise, \(L_M(i)\) is set equal to zero, and the industry exhibits no productivity growth.Footnote 4

While technology advances are known to all firms in the industry, rival firms have no incentive to develop new process innovations for vintage product lines, as they would still have to set a higher quality-adjusted price than the state-of-the-art product to earn positive profit, and would not be able to capture a positive share of the market. There is a feedback effect, however, from the industry leader to the closest rival firm, as a share of the incremental improvements developed for the state-of-the-art production line are immediately adaptable to the production technology of the closest rival firm, at no cost. Specifically, we assume that technology spillovers generate productivity growth for the closest rival firm in industry i as follows:

where \(\gamma \in (0,1)\) captures the feasibility of adapting new incremental technologies to vintage production lines. Thus, a fixed share of incremental technology improvements spillover to the nearest rival firm at each moment in time. Note that industry leaders consider technology spillovers to rival firms as an externality when setting their optimal purchase levels for productivity improvements.

2.4 Breakthrough innovation

We next turn to the quality innovation sector where competitive firms invest in R&D with the aim of entering the market with new breakthrough product designs that improve upon the qualities of current state-of-the-art products. Each new product design includes a quality improvement and a production process that adopts all of the quality improvements and incremental process innovations that have been introduced to date in the respective industry. A new breakthrough product design therefore has a quality that is one increment greater than the current state-of-the-art and reproduces the productivity level m(i) of the current industry leader.

Following Grossman and Helpman (1991), a breakthrough innovation is successfully developed in industry i with probability \(\iota (i) d t\), if research is undertaken for a time interval dt at an intensity of \(\iota (i) = \beta L_Q (i)/p_x(i) x(i)\), where \(L_Q (i)\) is labor employment, \(\beta >0\) is a productivity parameter, and we assume that innovation costs are increasing with market size, \(p_x(i) x(i)\). Breakthrough innovation therefore follows a continuous Poisson probability process with a constant arrival rate. With free entry and exit, there is active breakthrough innovation when the expected cost of successfully developing a new quality innovation is equal to the present value of the profit stream that is earned with successful market entry (9): \(v (i) = {w p_x(i) x(i)}/{\beta }\).

Taking the time derivative of this free entry condition yields an asset-pricing condition for investment in breakthrough innovation:

where we have used \(r=\rho \), and \(\iota (i)\) is once again the risk that a subsequently developed quality improvement allows a later entrant to capture the market. The rate of return on breakthrough innovation must equal the sum of the risk-free interest rate (\(\rho \)) and the risk premium \(\iota (i)\) if the industry displays a positive rate of quality growth.

3 Product evolution

We now close the model and characterize the patterns of product evolution associated with various long-run equilibria. In particular, we are interested in three possible patterns of production evolution: incremental innovation alone, breakthrough innovation alone, and product cycles with both incremental and breakthrough innovation. This section investigates and compares the conditions required for each pattern to arise.

3.1 Competing incremental and breakthrough innovation

In order to facilitate a simple interpretation of product evolution, we begin by introducing a variable to describe the length of product cycles within each industry. We then combine the labor demands from each industry in order to derive a labor market condition that determines the equilibrium wage rate. Finally, we investigate the local dynamics associated with each of the three patterns of product evolution.

Figure 2 illustrates the evolution of production technology for an industry with active incremental and breakthrough innovation. The horizontal and vertical axes respectively measure the productivity of the industry leader and the productivity of the closest rival firm. When a new firm captures the market with a breakthrough quality innovation, its initial production technology is the same as that of the previous industry leader. Thus, each market entrant begins with a productivity level on the \(m(i) = \overline{m}(i)\) line. As the new industry leader, the firm then invests in incremental process innovations that raise both its own productivity and that of the nearest rival firm, although at a slower rate from (11). This deterministic improvement in production technology is described by a rightward movement along a dashed curve. The total rise in productivity associated with the industry leader depends on the length of time before the next market entry, the timing of which is determined stochastically. During this time interval there may be no productivity growth if subsequent entry is immediate, and infinite productivity growth if subsequent entry never occurs. When market entry does occur, the industry jumps vertically back to the \(m(i) =\overline{m}(i)\) line.

To capture the dynamics of incremental process innovation and breakthrough quality innovation described above, we introduce a new variable

which must, by definition, take values between zero and one. We refer to (13) as inverse product cycle length as, at a given moment in time, the ratio of rival-firm productivity to market-leader productivity provides an indication of the length of the current product cycle. In Fig. 2, as industry i moves away from the \(m(i) = \overline{m}(i)\) line, the incremental innovation that occurs between breakthrough innovations causes \(\chi (i)\) to decrease. As such, the greater the movement away from the \(m(i) = \overline{m}(i)\) line, the longer the product cycle and the lower the value of \(\chi (i)\).

The dynamics of \(\chi \) provide a means of investigating product evolution. At each moment in time, industry-leader productivity changes according to (8). Similarly, the expected change in rival-firm productivity is \(\dot{\overline{m}} (i) = \left( m(i) - \overline{m}(i) \right) \iota (i) + \gamma \overline{m}(i) \mu (i)\), where \(\mu (i) = \dot{m}(i)/m(i)\) is the rate of productivity growth. The first term of this differential equation shows that a new firm enters with a breakthrough innovation and forces the current industry leader to become the closest rival firm with probability \(\iota (i)\). At the moment of market entry, the new industry leader and the new closest rival firm have the same level of productivity, as shown by a vertical jump back to the \(m(i) =\overline{m}(i)\) line in Fig. 2. The second term captures technology spillovers from the market leader to the closest rival firm, and is illustrated by a movement along a dashed curve in Fig. 2.Footnote 5 Substituting \(\dot{m}(i)\) and \(\dot{\overline{m}} (i)\) into the time derivative of \(\chi (i) \equiv \overline{m}(i) / m(i)\), we find that the evolution of inverse product cycle length is governed by

in industry i. Therefore, inverse product cycle length depends on both deterministic incremental process innovation and the stochastic arrival of breakthrough innovations guided by independent Poisson processes (Grossman and Helpman 1991).

3.2 Labor market

Next we derive parameter conditions for patterns of product evolution that are consistent with full employment in the labor market. With active incremental and breakthrough innovation, the labor market clears for

where \(L_X \equiv \int _0^1 L_X (i)d i, L_M \equiv \int _0^1 L_M (i)d i\), and \(L_Q \equiv \int _0^1 L_Q (i)d i\) are the average labor demands from production, incremental innovation, and breakthrough innovation.

Substituting the limit price \(p_x(i) =w \lambda / \overline{m}(i)\) into demand (4) and setting the result equal to supply (5), the average demand for labor from production is

where \(\chi \equiv \int _0^1 \chi (i)d i= \int _0^1 \overline{m}(i)/m(i) d i= \overline{m}/m\) is the average inverse length of product cycles across the economy. Note that m and \(\overline{m}\) are not average values, but rather are the industry leader and closest rival firm productivity levels associated with the average employment levels \(L_X, L_M\), and \(L_Q\); that is, \(m\ne \int _0^1 m (i)d i\) and \(\overline{m}\ne \int _0^1 \overline{m} (i)d i\). Average demand for labor in production is decreasing in both the wage rate and the quality increment, since increases in average product price lead to lower average product demand for a given expenditure level.

Although labor employment in production is determined independently of the dynamics of product evolution, employment in innovation is closely related to the pattern of product development. In an equilibrium with product cycles, the asset-pricing conditions (10) and (12) must both bind. Accordingly, two conditions for the relationship between average industry employment levels in incremental and breakthrough innovation are respectively

where we have used \(p_m = w L/(\alpha m), v=w L/\beta , \iota = \beta L_Q/L\), and \(\mu = \alpha L_M/L\) with (7), (11), and (13) in (10) and (12). The lefthand sides of these asset pricing conditions are the risk-adjusted market rates of return, while the righthand sides are the rates of return to incremental innovation (\(R_M\)) and breakthrough innovation (\(R_Q\)). On the one hand, a rise in average inverse product cycle length indicates a reduction in the productivity gap between the industry leader and the closest rival firm that increases the marginal profit associated with productivity improvements, resulting in a positive relationship between \(\chi \) and \(R_M\). On the other hand, the increase in \(\chi \) lowers the price-cost markup of the industry leader, reducing profits, lowering incentives for market entry, and thus generating a negative relationship between \(\chi \) and \(R_Q\).

3.3 A pattern of incremental innovation

We begin by considering the stability of long-run equilibria with incremental process innovation alone. In this case, there is no investment in new product designs, and the asset-pricing condition for investment in breakthrough innovation (18) does not bind, indicating that \(\iota =0\). Since we are interested in long-run equilibria that feature a constant allocation of labor across sectors, we consider steady states characterized by \(\dot{L_X} = \dot{L_M}=0\) and \(\dot{\chi }/\chi = \dot{w}/w\), from (16).

Substituting (15) and (16) into (17), and using \(\iota =\beta L_Q/L=0\) and \(\mu =\alpha L_M/L\) with (15) in (14) yields the following differential equations to describe the evolution of the wage rate and the motion of average inverse product cycle length:

The stability of steady-state equilibrium is discerned through an investigation of the local dynamics of the rate of incremental innovation around \(\dot{\mu }=0\):

where we have used the time derivative of (16) with \(\mu =\alpha (L-L_X)/L\). Given that \(\mu \) is a control variable, as \(d \dot{\mu }/d \mu = (3 - \gamma )(\alpha - \mu )>0\) around \(\dot{\mu }=0\), we find that the economy jumps immediately to a dynamic path satisfying \(\dot{\chi }/\chi = \dot{w}/w\), when firms are not investing in breakthrough innovation. Then, the wage rate and average inverse product cycle length converge towards zero together.

Setting (20) equal to zero produces the steady-state rate of incremental productivity growth as follows:

The basic features of this innovation rate are standard with an increase in labor productivity in process innovation raising the innovation rate, and an increase in the interest rate lowering the innovation rate. A rise in the feasibility of adapting new production technologies to vintage product lines results in faster productivity growth.

3.4 A pattern of breakthrough innovation

In this section we next investigate the stability of long-run equilibria for which only breakthrough quality innovation occurs. In this case, as firms are not investing in productivity improvements, the asset-pricing condition for investment in incremental innovation (17) does not bind, and \(\mu = \alpha L_M/L = 0\).

Starting with the dynamics of the wage rate, we find that when there is active quality innovation, regardless of whether process innovation occurs or not, substituting (15) and (16) into (18) yields the following wage dynamics:

As a result, with active breakthrough innovation, the wage rate is determined independently of \(\chi \). Since the wage rage is a control variable, and \(\partial \dot{w}/ \partial w = \beta + \rho > 0\), it jumps immediately to its steady-state value \(w = \beta / (\beta + \rho )\). Then, setting \(\mu = 0\) in (14) and reorganizing the result, the dynamics of average inverse product cycle length are described by the following differential equation:

where we have used (15) and (16). Evaluating the derivative of this differential equation around \(\chi =1\) yields \({d \dot{\chi }}/{d \chi } = - \beta (\lambda w -1)/(\lambda w)< 0\). Given that \(\chi \) is a state variable, we therefore conclude that an equilibrium with breakthrough quality innovation alone is also stable.

Setting \(\mu \) and \(\dot{w}\) equal to zero in (18) and using \(w = \beta / (\beta + \rho )\), we find that the equilibrium rate of breakthrough quality innovation is

In this case, the rate of innovation is increasing with labor productivity and the size of the quality increment, but decreasing in the interest rate, as found in Grossman and Helpman (1991).

3.5 A pattern of product cycles

Now that we have confirmed the stability of long-run equilibria that feature either productivity growth or quality growth alone, we consider the conditions required for a long-run pattern of product evolution with product cycles. Substituting (15) and (16) into (18), we first confirm that wage dynamics once again follow (22), with the wage rate jumping immediately to \(w = \beta / (\beta + \rho )\), allowing us to focus on the dynamics of average inverse product cycle length. In addition, in Sects. 3.4 and 3.5 we found that positive rates of productivity and quality growth respectively require \(\alpha >\rho \) and \((\lambda -1)\beta >\rho \). Focusing on long-run equilibria with positive growth, we assume that these constraints are satisfied for the remainder of the paper.

Product cycles require simultaneous investment in both types of innovation, implying that the asset-pricing conditions (17) and (18) both bind, and that the rates of return to incremental innovation and breakthrough innovation equalize. Setting \(R_M=R_Q\) and rearranging the result, yields the average rate of productivity growth:

where the threshold value \(\chi _M \equiv \beta \lambda /(\alpha + \beta )>0\) is a boundary on the range of average inverse product cycle length over which there is active investment in incremental innovation. This condition shows the combinations of \(\mu \) and \(\chi \) for which the rates of return to incremental and breakthrough innovation equalize.

A similar investment condition can be obtained for the average rate of quality growth by substituting (25) into (18):

where the threshold value \(\chi _Q \equiv (\alpha + \rho )\beta \lambda /(2 \alpha (\beta + \rho ))>0\) is a boundary on the range of average inverse product cycle length over which there is active investment in breakthrough innovation. This investment condition shows the combinations of \(\iota \) and \(\chi \) that ensure equal rates of return to incremental and breakthrough innovation.

The ranking of the thresholds for average inverse product cycle length, and thus the feasibility of active investment in both types of innovation, with equal rates of return, depends on the productivities of labor in incremental and breakthrough innovation:

Lemma 1

Active investment in both incremental and breakthrough innovation is possible in an interior equilibrium when (i) \(\chi \in (\chi _Q,\chi _M)\) for \(\alpha < \beta \), and (ii) when \(\chi \in (\chi _M,\chi _Q)\) for \(\alpha > \beta \). The interior equilibrium is not defined for \(\alpha = \beta \).

Proof

Sign \(\mu ^{*}\) and \(\iota ^{*}\) using \(\chi _Q - \chi _M=(\alpha -\beta )(\alpha -\rho ) \chi _M/(2 \alpha (\beta + \rho ))\), with \(\alpha > \rho \) as required for a positive rate of productivity growth. \(\square \)

Combining (25) and (26), we calculate the equilibrium ratio of the quality and productivity growth rates as follows:

When this investment condition is satisfied, rates of return equalize, and there are positive levels of investment for both types of innovation.

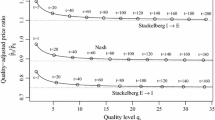

The investment condition is illustrated by the \(R_M=R_Q\) curve in Figs. 3 and 4, with a positive slope for \(\alpha /\beta <1\) and a negative slope for \(\alpha /\beta >1\), matching with cases (i) and (ii) in Lemma 1. The shaded areas in each figure indicate that one type of innovation is not feasible: in Fig. 3 there is no productivity growth if \(\chi > \chi _M\) and no quality growth if \(\chi <\chi _Q\); and in Fig. 4 there is no productivity growth if \(\chi <\chi _M\) and no quality growth if \(\chi >\chi _Q\). Above the \(R_M=R_Q\) curve, the rate of return to incremental innovation is greater than the rate of return to breakthrough innovation, and the ratio of innovation rates falls. In contrast, below the \(R_M=R_Q\) curve, the rate of return to breakthrough innovation is greater and \(\iota /\mu \) rises. These investment dynamics ensure that the economy always lies on the \(R_M=R_Q\) curve when there are positive rates of productivity and quality growth.

Next, we consider the stability of interior equilibria with product cycles through an investigation of the dynamics of average inverse product cycle length. Referring back to (14), the evolution of average inverse product cycle length is found as

Naturally, the motion of average inverse product cycle length depends on relative innovation rates. Setting \(\dot{\chi }=0\), we obtain a steady-state condition for the ratio of innovation rates and average inverse product cycle length:

This steady-state locus has a positive slope, as shown by the \(\dot{\chi }=0\) curve in Figs. 3 and 4. Evaluating \(\partial \dot{\chi }/\partial \chi = - (\iota + (1-\gamma ) \mu ) <0\) around \(\dot{\chi }=0\), we find that average inverse product cycle length is rising for values of \(\chi \) to the left of the \(\dot{\chi }=0\) curve, and falling for values of \(\chi \) to the right of the \(\dot{\chi }=0\) curve.

A closer look at (27) and (29) reveals that the threshold level of average inverse product cycle length for investment in incremental innovation (\(\chi _M\)) is the key determinant of the existence of an interior equilibrium, since the \(\dot{\chi }=0\) curve lies strictly above the \(R_M=R_Q\) curve at \(\chi = \chi _Q\) in both Figs. 3 and 4. In particular, the \(\dot{\chi }=0\) and \(R_M=R_Q\) curves tend to infinity as they approach the vertical asymptotes at \(\chi =1\) and \(\chi = \chi _M\). As such, \(\chi _M<1\) is a necessary condition for the existence of an interior equilibrium with positive rates of productivity and quality growth. When this condition is not satisfied, the economy converges to a corner solution with productivity growth if \(\alpha /\beta < 1\), and to a corner solution with quality growth if \(\alpha /\beta > 1\).

Combining information on the threshold values for average inverse product cycle length, \(\chi _M\) and \(\chi _Q\), with the results of Lemma 1, we obtain the following proposition:

Proposition 1

The economy converges to a long-run equilibrium with stable product cycles for \(\alpha /\beta >1\) and \(\chi _M<1\).

The stability of an interior equilibrium with product cycles depends on how changes in average inverse product cycle length affect relative rates of return to innovation. Assuming that the economy is initially at an interior equilibrium, with the rates of return equalized, consider the effect of a small negative shock to average product cycle length. The technology gap between industry leaders and rival firms is small if product cycles are short and large if product cycles are long. Thus, referring back to (17) and (18), an increase in \(\chi \) raises the return to incremental innovation (\(R_M\)) by increasing the marginal profit associated with potential productivity improvements, but lowers the return to breakthrough innovation (\(R_Q\)) as per-period profits and firm value fall. As such, \(R_M > R_Q\), and an adjustment in the innovation behavior of industry leaders is necessary to restore equilibrium in the investment market, with industry leaders either increasing or decreasing their purchases of incremental innovations.

On the one hand, when \(\alpha /\beta < 1\), industry leaders raise firm value by reducing purchases of incremental process innovations, as the positive effect of lower costs on current per-period profits is greater than the potential benefit of higher future profits associated with investment in incremental innovation. This shift in innovation behavior causes the return to breakthrough innovation (\(R_Q\)) to increase more than the return to incremental innovation (\(R_M\)), returning the rates of return to equality. The relative increase in investment in breakthrough innovation induced by the rise in \(\chi \) leads to a further increases in \(\chi \), and the interior equilibrium is therefore unstable with investment dynamics driving the economy to a corner solution with quality growth alone, as illustrated in Fig. 3. On the other hand, when \(\alpha /\beta > 1\), industry leaders raise firm value by increasing their purchases of incremental innovations, as the negative effect of higher costs on current per-period profits is dominated by the positive effect of raising future profits by reducing production costs. The return to incremental innovation (\(R_M\)) falls more than the return to breakthrough innovation (\(R_Q\)), and rates of return are once again equalized. In this case, therefore, a rise in \(\chi \) subsequently causes a fall in \(\chi \) through adjustments in investment behavior, and the interior equilibrium is stable as shown in Fig. 4.

Alternatively, we can consider the investment dynamics associated with a small positive shock to average product cycle length that lowers \(\chi \) below its steady-state level and raises the return to breakthrough innovation above the return to incremental innovation (\(R_M < R_Q\)). When \(\alpha / \beta < 1\), industry leaders raise firm value by increasing purchases of incremental innovations, inducing further decreases in \(\chi \) as relative investment in breakthrough innovation falls. As depicted in Fig. 3, the interior equilibrium is therefore unstable with the economy converging to a corner solution with productivity growth alone. In contrast, when \(\alpha /\beta > 1\), firm value can be increased by lowering investment in incremental innovation, causing \(\chi \) to rise. Thus, in this case the interior equilibrium is once again stable as shown in Fig. 4.

In conclusion, the long-run pattern of product evolution most likely features stable product cycles when labor productivity is higher in incremental innovation than in breakthrough innovation (\(\alpha /\beta >1\)), and the discrete quality increment (\(\lambda \)) is small, ensuring that the interior equilibrium exists (\(\chi _M<1\)).

Before leaving this section we consider the price trends generated by the heterogeneous product cycles that occur within each industry in a stable interior equilibrium. Figure 5 provides an illustration how the stochastic arrival of breakthrough innovations combines with deterministic incremental innovation to produce industry-level price dynamics, with two features that match the stylized price trends introduced by Flamm (1993) and reproduced in Fig. 1. First, incremental innovation drives a gradual decline in quality-adjusted price (\(p_i/\lambda ^{j(i)}\)) over the product cycle, as technology spillovers cause the limit price to fall. Second, the new breakthrough innovations that arrive at times I, II, and III shift the quality-adjusted price curve down as new industry leaders enter the market, raising product quality from \(\lambda ^{j(i)}\) to \(\lambda ^{j(i)+1}\) and updating the limit price to reflect the current state-of-the-art production technology.Footnote 6

3.6 Product cycle length, growth, and welfare

In this section we consider the relationships that arise between product cycle length, economic growth, and welfare in a long-run equilibrium with stable product cycles, by examining the effects of changes in model parameters.

As households only consume the state-of-the-art product in each industry, the instantaneous utility of a representative household is \(\log u(t) = \log x(t)/L + I(t) \log \lambda \), where the first and second terms are the utilities derived from the quantity and quality of goods consumed, and \(I(t) = \int _0^t \iota (s) ds = \beta L_Q t/L\) indicates the expected number of quality improvements invented before time t (Grossman and Helpman 1991). With constant average employment levels, instantaneous utility can be used to derive the steady-state rate of economic growth, as summarized in the following proposition.

Proposition 2

With stable product cycles, economic growth derives from both productivity growth (\(\mu \)) and quality growth (\(\iota \log \lambda \)):

Proof

Time differentiation of \(\log u(t) = \log m(t) L_X /L + (\log \lambda ) \beta L_Q t/L\). \(\square \)

In a long-run equilibrium with stable product cycles, aggregate economic growth decomposes into the average rates of productivity and quality growth (Acemoglu and Cao 2015), where productivity growth rates may differ across industries at different points along the product cycle and quality growth is a jump process. Returning to (25) and (26), adjustments in model parameters affect growth both directly and indirectly through changes in average inverse product cycle length. Growth is determined independently of population size and is therefore not biased by a scale effect.Footnote 7

Given the equilibrium growth rate, we calculate the steady-state welfare level of a representative household as

where \(w = \beta /(\beta + \rho )\) and initial product quality and productivity are set to one; that is, \(I(0) = m(0) = 1\). In addition to the growth channel captured by (30), parameters influence welfare through average product price, with higher wages, larger quality increments, or longer product cycles, leading to higher prices and lower welfare levels.

Turning now to a study of the effects of changes in model parameters, we obtain the following proposition for product cycle length:

Proposition 3

With stable product cycles, average inverse product cycle length (\(\chi \)) is decreasing in \(\alpha \), and increasing in \(\beta , \gamma \), and \(\lambda \).

Proof

Equating (27) and (29) yields \(2(1-\chi )(\chi _Q-\chi )\chi _M = (1-\gamma )\lambda (\chi -\chi _M) \chi \). We use this condition to obtain the following steady-state comparative statics:

where \(\Phi \!=\! 1/(\chi (1-\chi )) \!+\! (\chi _Q \!-\! \chi _M)/((\chi \!-\!\chi _M)(\chi _Q \!-\! \chi )) \!>\! 0\) for \(\chi \!\in \! (\chi _M,\chi _Q)\). \(\quad \square \)

On the one hand, from (17) the rate of return on investment in incremental innovation is increasing in labor productivity (\(\alpha \)). Therefore, an increase in \(\alpha \) shifts the \(R_M=R_Q\) curve to the left in Fig. 4, raising the relative rate of productivity growth (a fall in \(\iota /\mu \)) and lowering average inverse product cycle length. On the other hand, from (18) the rate of return on breakthrough innovation is increasing in labor productivity (\(\beta \)) and the quality increment (\(\lambda \)). Accordingly, increases in \(\beta \) and \(\lambda \) shift the \(R_M=R_Q\) curve to the right, causing a faster relative rate of quality growth (a rise in \(\iota /\mu \)) and shorter product cycles. In contrast, technology spillovers from industry leaders to their closest rivals mitigate the effects of industry leader productivity growth on average inverse product cycle length. Thus, an increase in \(\gamma \) causes a downward shift in the \(\dot{\chi }=0\) curve, and \(\iota /\mu \) falls as \(\chi \) rises.

While the effects of parameter changes on average inverse product cycle length depend on the relative responses of incremental and breakthrough innovation, the results for growth and welfare also depend on absolute adjustments in innovation rates that tend to make an analytical investigation intractable. As an alternative, we present several numerical examples in Table 1 to illustrate the relationships that arise between average product cycle length, growth, and welfare with changes in parameters. First, an increase in \(\alpha \) raises product prices, by lowering average inverse product cycle length, and accelerates the rate of growth. The growth effect dominates, however, allowing for a welfare improvement. Second, an increase in \(\beta \) raises average inverse product cycle length, while increasing wages, with ambiguous results for product prices. The growth rate increases, however, and welfare improves. Third, a rise in \(\gamma \) decreases product prices by increasing average product cycle length and stimulates growth, causing a welfare improvement. Fourth, increases in \(\lambda \) have both a positive direct effect and a negative indirect effect, through \(\chi \), on product prices, and accelerate growth. Either of these effects may dominate, with ambiguous results for welfare.

4 R&D subsidies

Continuing to focus on a long-run pattern of product evolution with stable product cycles, this section considers how R&D subsidies affect average inverse product cycle length, growth, and welfare. We suppose that the government introduces a lump-sum tax on household income to finance subsidies \(s_M \in [0,1)\) and \(s_Q \in [0,1)\) to incremental and breakthrough innovation. With household expenditure normalized to one, the addition of R&D subsidies only requires the following adjustments to innovation costs: \(p_m = (1 - s_M)\beta L /(\alpha (\beta + \rho ) m)\) and \(v = (1 - s_Q) L/(\beta + \rho )\). These adjustments yield the following revised innovation rates:

where \(\chi \) is now bound by \(\chi _M \equiv (1-s_M)\lambda \beta /(\alpha (1-s_Q) + \beta (1-s_M))>0\) and \(\chi _Q \equiv (\alpha (\beta + \rho ) - (\alpha (1-s_Q) - \beta (1 - s_M)) \rho )\lambda /(2 \alpha (\beta + \rho ))>0\). The ratio of these expressions yields the investment condition described by the \(R_M=R_Q\) curve (27). In addition, R&D subsidies have no effect on the \(\dot{\chi } = 0\) curve (29).Footnote 8

Beginning with the relationship between R&D subsidies and average inverse product cycle length, we obtain the following proposition:

Proposition 4

With stable product cycles, average inverse product cycle length (\(\chi \)) decreases with a subsidy to incremental innovation (\(s_M\)) and increases with a subsidy to breakthrough innovation (\(s_Q\)).

Proof

The steady-state comparative statics for subsidies are

where \(\Phi = 1/(\chi (1-\chi )) + (\chi _Q - \chi _M)/((\chi -\chi _M)(\chi _Q - \chi )) > 0\) for \(\chi \in (\chi _M,\chi _Q)\).\(\square \)

Intuitively a subsidy to incremental innovation raises the return to investment in productivity improvements and shifts the \(R_M=R_Q\) curve to the left in Fig. 4. As a result, the rate of productivity growth increases relative to the rate of quality growth, and average inverse product cycle length falls. Similarly, subsidizing breakthrough innovation improves the return to investment in quality improvements, leading to a rightward shift in the \(R_M=R_Q\) curve that causes a rise in the relative rate of quality growth and increases average inverse product cycle length.

Once again, model tractability prevents the derivation of analytical results. In Table 2 we consider several numerical examples to illustrate the effects of R&D subsidies on growth and welfare.Footnote 9 Subsidies to incremental innovation raise product prices by decreasing average inverse product cycle length through an increase in the rate of productivity growth relative to the rate of quality growth. The increase in the rate of economic growth generates a welfare improvement. Similarly, subsidies to breakthrough innovation raise the rate of quality growth relative to the rate of productivity growth, leading to an increase in average inverse product cycle length. Prices fall, growth accelerates, and welfare improves. In conclusion, the numerical examples suggest that subsidies to either type of innovation increase the rate of growth and improve welfare. This positive relationship between R&D subsidies and economic growth is a standard result of the innovation-based endogenous growth literature (Grossman and Helpman 1991).Footnote 10

5 Conclusion

The survival of firms in a competitive market place is intrinsically tied to innovation activity across several dimensions. In this paper, we have investigated the determinants of product cycles arising within an environment of creative destruction, where market entrants develop breakthrough product designs to displace vintage product lines and incumbent firms invest in incremental innovation to improve technologies and reduce production costs. In particular, we study the relationship between competing incentives for incremental and breakthrough innovation and the average length of product cycles across the economy, and establish three potential patterns for product evolution in a given industry: productivity growth alone, quality growth alone, and product cycles with both productivity and quality growth. Parameter conditions determine which pattern arises in long-run equilibrium, with stable product cycles more likely to occur if labor productivity is greater in incremental innovation than in breakthrough innovation, and if incremental quality improvements are small. Although average product cycle length is constant at the aggregate level in a long-run equilibrium with both types of growth, at the industry level heterogeneous processes of product evolution are generated by the stochastic interaction between breakthrough quality innovation and incremental process innovation, with some industries exhibiting short product cycles and others long product cycles. Simple numerical examples suggest that when stable product cycles arise as a market outcome, subsidies to either type of innovation raise the rate of economic growth and improve welfare.

Notes

Bayus (1992), for example, presents similar price trends for compact disk players, record players, and various models of telephones. Similarly, Nemet (2006) illustrates declining price trends for the photovoltaics used in solar power. In addition, declining product price patterns are studied for laptop computers in Chwelos (2003), for personal digital assistants in Chwelos et al. (2008), and for televisions in Bayus (1992) and Nakano and Nishimura (2013).

Following Dean (1950), in the management science literature a broad body of research has considered the product life cycle. In the economic literature, the product life cycle has been studied using a number of different approaches. Several examples are Filson (2002), Allanson and Montagna (2005), and Lambertini and Mantovani (2010).

In each industry, competition results in the survival of a single firm that we refer to as the industry leader in order to differentiate it from potential rival firms (Grossman and Helpman 1991).

Given \(r=\rho \), the transversality condition associated with optimal purchases of productivity improvements is \(\lim _{t \rightarrow \infty } e^{-\int _0^t (\rho + \iota (i , s)) d s} p_m(i, t) m(i, t) = 0\).

We set \(\gamma \in (0,1)\) in order to ensure that the second term in \(\dot{\overline{m}}(i)\) is positive when \(\mu (i)>0\) and that technology spillovers from the industry leader to its closest rival generate declining prices over the product cycle.

In our model, quality-adjust prices shift down at the end of the product cycle, rather than up as in Fig. 1. Enabling vintage products to maintain positive market shares by introducing heterogeneous preferences over new and old product vintages is a model extension that might generate the end-of-product-cycle price adjustments in Fig. 1. We leave this issue as a topic for future research.

With R&D subsidies, stable product cycles require \(\alpha (1 - s_Q) > \beta (1 - s_M), \chi \in (\chi _M,\chi _Q)\), and \(\chi _M<1\), where \(\chi _Q - \chi _M = (\alpha (1-s_Q) - \beta (1 -s_M))(\alpha (\beta + \rho ) - (\alpha (1 - s_Q) + \beta (1 - s_M))\rho ) \chi _M/(2 \alpha \beta (\beta + \rho )(1 - s_M))>0\), for all \(s_M,s_Q\in [0,1)\) if \(\alpha > \rho \), as required for \(\mu >0\).

The numerical examples in Table 2 use the parameter values for the benchmark case. We have checked the results for the full range of parameter values in Table 1, and found that although subsidies to breakthrough innovation dampen productivity growth for large values of \(\beta \) and \(\lambda \), the results do not change for average inverse product cycle length, economic growth, or welfare.

References

Acemoglu D, Cao D (2015) Innovation by entrants and incumbents. J Econ Theory 157:255–294

Allanson P, Montagna C (2005) Multiproduct firms and market structure: an explorative application to the product life cycle. Int J Ind Organ 23:587–597

Bayus B (1992) The dynamic pricing of next generation consumer durables. Mark Sci 11:251–265

Cheng L, Dinopoulos E (1996) A multisectoral general equilibrium model of Shumpeterian of growth and fluctuations. J Econ Dyn Control 20:905–923

Cheng L, Tao Z (1999) The impact of public policies on innovation and imitation: the role of R&D technology in growth models. Int Econ Rev 40:187–207

Chwelos P (2003) Approaches to performance measurement in hedonic analysis: price indexes for laptop computers in the 1990’s. Econ Innov New Technol 3:199–224

Chwelos P, Berndt E, Cockburn I (2008) Faster, smaller, cheaper: an hedonic price analysis of PDA’s. Appl Econ 40:2839–2856

Cohen W, Klepper S (1996) Firm size and the nature of innovation within industries: the case of process and product R&D. Rev Econ Stud 78:232–243

Davidson C, Segerstrom P (1998) R&D subsidies and economic growth. RAND J Econ 29:548–577

Dean J (1950) Pricing policies for new products. Harvard Bus Rev 28:45–50

Dinopoulos E, Unel B (2011) Quality heterogeneity and global economic growth. Eur Econ Rev 55:595–612

Etro F (2004) Innovation by leaders. Econ J 114:281–303

Filson D (2002) Product and process innovations in the life cycle of an industry. J Econ Behav Organ 49:97–112

Flamm K (1993) Measurement of DRAM prices: technology and market structure. In: Price measurements and their uses, pp 157–197

Gil P (2013) Animal spirits and the composition of innovation in a lab-equipment R&D model with transition. J Econ 108:1–33

Grimm B (1998) Price indexes for selected semiconductors, 1974–96. Surv Curr Bus 78:8–24

Grossman G, Helpman E (1991) Quality ladders in the theory of growth. Rev Econ Stud 58:43–61

Ha J, Howitt P (2007) Accounting for trends in productivity and R&D: a Schumpeterian critique of semi-endogenous growth theory. J Money Credit Bank 39:733–774

Klepper S (1996) Entry, exit, growth, and innovation over the product life cycle. Am Econ Rev 86:562–583

Klette T, Kortum S (2004) Innovation firms and aggregate innovation. J Polit Econ 112:986–1018

Laincz C, Peretto P (2006) Scale effects in endogenous growth theory: an error of aggregation not specification. J Econ Growth 11:263–288

Lambertini L (2003) The monopolist’s optimal R&D portfolio. Oxf Econ Pap 55:561–578

Lambertini L, Mantovani A (2010) Process and product innovation: a differential game approach to product life cycle. Int J Econ Theory 6:227–252

Madsen J (2008) Semi-endogenous versus Schumpeterian growth models: testing the knowledge production function using international data. J Econ Growth 13:1–26

Madsen J (2010) The anatomy of growth in the OECD since 1870. J Monet Econ 57:753–767

Nakano S, Nishimura K (2013) Welfare gain from quality and price development in the Japan’s LCD TV market. J Evolut Econ 23:889–908

Nemet G (2006) Beyond the learning curve: factors influencing cost reductions in photovoltaics. Energy Policy 34:3218–3232

Palokangas T (2008) Competition and product cycles with non-diversifiable risk. J Econ 94:1–30

Peretto P (1996) Sunk costs, market structure, and growth. Int Econ Rev 37:895–923

Peretto P, Connolly M (2007) The Manhattan metaphor. J Econ. Growth 12:329–350

Peretto P, Smulders S (2002) Technological distance, growth, and scale effects. Econ J 112:603–624

Peretto P, Valente S (2015) Growth on a finite planet: resources, technology, and population in the long run. J Econ Growth 20:305–331

Segerstrom P (1991) Innovation, imitation, and economic growth. J Polit Econ 99:807–827

Segerstrom P (1998) Endogenous growth without scale effects. Am Econ Rev 88:1290–1310

Segerstrom P (2000) The long-run growth effects of R&D subsidies. J Econ Growth 5:277–305

Smulders S, van de Klundert T (1995) Imperfect competition, concentration, and growth with firm-specific R&D. Eur Econ Rev 39:139–160

Steinmetz A (2015) Competition, innovation, and the effect of R&D knowledge. J Econ 115:199–230

Thompson T (2001) The microeconomics of an R&D-based model of endogenous growth. J Econ Growth 6:263–283

Young A (1998) Growth without scale effects. J Polit Econ 106:41–63

Acknowledgements

We are grateful for helpful comments from the associate editor, two anonymous referees, and participants of the 13th SAET Conference on Current Trends in Economics (2013). Part of this work was completed while Davis was visiting RITM at the University of Paris-Sud. He thanks them for their hospitality and support. We also acknowledge financial support from JSPS through a Grant-in-Aid for Scientific Research (C). All remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Davis, C., Tomoda, Y. Competing incremental and breakthrough innovation in a model of product evolution. J Econ 123, 225–247 (2018). https://doi.org/10.1007/s00712-017-0568-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-017-0568-y

Keywords

- Incremental innovation

- Breakthrough innovation

- Product evolution

- Product cycles

- Endogenous economic growth