Abstract

The optimal income tax model under the threat of migration of Simula and Trannoy (J Public Econ 94:163–173, 2010; Soc Choice Welf 39(4):751–782, 2012) is extended to include indirect taxes and public goods. This enables us to conclude that: (1) optimal income tax rates are higher than in the absence of indirect taxation, and may be positive at the top of the skills distribution; (2) indirect taxes, à la Corlett and Hague, may help mitigate the loss of redistributive capacity arising from income taxation caused by migration threats; (3) migration encourages the provision of the public goods preferred by the most productive workers; (4) optimal tax and public goods provision policies against the emigration of the highly-skilled are connected through the conditions for Pareto efficiency; (5) if the number of potential migrators is large, it may be desirable to violate classical tax rules to retain the most able in the home country; (6) when migration costs are exogenously given and utility is weakly separable, Simula and Trannoy’s results are restored; (7) if migration costs are endogenous, the Atkinson and Stiglitz theorem breaks down and the taxation of country-specific goods becomes desirable, even if utility is strongly separable.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, migration of the highly skilled has been growing, in both absolute and relative terms, as increasing economic integration has reduced migration costs (OECD 2002). This has caused problems for governments, which are witnessing their most productive workers being recruited by countries that have not contributed toward their education.

According to economists such as Mirrlees (1982) and Piketty and Saez (2012), high top tax rates may induce the most productive workers to emigrate to countries with low top tax rates. Empirically, this has been corroborated by Liebig et al. (2007) and Kleven et al. (2013, 2014), who estimate substantial migration elasticities for highly skilled workers in response to taxation.

Although governments may address human mobility through migration policies, we shall suppose that emigration and immigration are almost deregulated, as is the case in the context of the European Union (EU). In principle, there appear to be several different changes that could be made to the tax system to discourage the phenomenon of emigration by highly skilled workers. First, there is the possibility of modifying income tax rates for groups with a large share of potential emigrants. This strategy has been studied by, among others, Osmundsen (1999) and Simula and Trannoy (2010, 2012), with the use of type-dependent participation constraints in an optimal taxation framework. In their approach, an individual emigrates if her utility abroad, net of migration costs, surpasses her domestic utility, with both utilities and costs depending on productivity. As a result, these authors identified a new trade-off between redistribution and the goal of preserving national productive capacities, aside from the traditional trade-off between equity and efficiency, and also arrived at quite interesting conclusions on the subject. One of these is that—contrary to what happens in a closed economy—highly skilled individuals can have negative income tax rates when confronted with the choice of staying in their country or migrating abroad. This conclusion is in line with the observable pressure that is imposed by competition on nation states to sacrifice progressivity in favor of a tax system that is generous to capital and mobile labor.

As a second strategy to reduce the emigration of highly skilled workers, there is the possibility of reducing taxes and increasing subsidies on those goods and services that are consumed more by the most productive workers. Surprisingly, however, the theoretical literature has not explored the use of commodity taxes and subsidies to deter emigration, in spite of their presence in all Western countries and the general tendency for their significance in the fiscal system to increase.Footnote 1

A third possibility is to combine the two strategies mentioned above, with the aim of shifting part of the tax burden from income to consumption and thereby providing less of an incentive for highly skilled individuals to migrate. This seems to be precisely the policy followed in recent years by most EU members, which have lowered the tax rates on mobile bases, such as skilled labor and capital income, while increasing the tax rates on consumption.

Finally, an alternative procedure, also neglected in the public finance literature, is the provision of those public goods more preferred by highly skilled individuals; governments may affect migration decisions in this way as they do through taxes and transfers. We think of public goods as those that are publicly produced and made available to citizens without charge. According to Blomquist et al. (2010), in OECD countries the amount of public spending on goods such as schooling, health care, public transport, housing, and day care ranges from 20 to 30% of GDP.

To evaluate the four strategies mentioned above, this paper extends the standard optimal income tax framework to include both linear commodity taxes and public goods provision in environments in which highly skilled workers may vote with their feet. The seminal work on optimal mixed taxation in the presence of public goods is Mirrlees (1976, sections 5 and 6). The application of Mirrlees’ approach to modeling migration responses has enabled the identification of the kinds of qualifications that must be made when the emphasis is put on the use of mixed taxation and public goods, rather than solely on the use of income taxation as in Osmundsen (1999) and Simula and Trannoy (2010, 2012).

Our main theoretical results can be summarized as follows (most policy implications are discussed in the conclusion section). Relatively simple tax formulae are obtained in terms of empirically relevant elasticities. These formulae indicate that the optimal income tax under the threat of migration is very different if the income tax is levied together with commodity taxes, rather than levied alone. On the one hand, this is because the tax burden on labor supply also includes the indirect effect caused by commodity taxes; on the other hand, it is because the optimal income tax rate may be positive at the top of the skills distribution.

Another finding that arises from these formulae is that the possibility of compensating the loss of redistributive capacity due to migration threats depends crucially on whether or not the optimal commodity taxes satisfy the Corlett and Hague (1953), in terms of taxing (subsidizing) goods that are complementary with leisure (labor). In the affirmative case, the resulting income tax rates are higher than they are in absence of commodity taxes and positive at the top; conversely, if optimal indirect taxes fail to meet the Corlett and Hague condition, the income tax rates are lower and negative at the top. The economic intuition is that the superior incentives for work effort under the Corlett and Hague rule offset—in part—the deadweight loss involved in higher income tax rates. This can be explained using the incentive constraints argument in Edwards et al. (1994) and Nava et al. (1996).

Apart from this, the formulae indicate that policies that shift the tax burden from labor income to consumption make sense on distributional grounds only when indirect taxation fails to support the Corlett and Hague rule. Otherwise, such policies may lead to a drop in redistributive capacity because the benefits in terms of fewer migration threats, since top income tax rates are lower after the shift, can be inferior to the losses in terms of tax revenues, since the total tax burden on labor is also lower after the shift.

To stress the policy relevance of our formulae, we identify three examples of utility specifications that lead to optimal commodity taxes à la Corlett and Hague, provided that migration threats are not too high. Moreover, such commodity taxes present different degrees of tax differentiation, ranging from the almost uniform case to the totally differentiated case, and include the optimal tax scheme that contains a finite number of tax rates, as is found in practice, each applying to a distinct group of consumption goods. However, when potential migrators represent a significant part of the population, the formulae suggest that the Corlett and Hague tax rule may not apply for the three examples, in which case the indirect tax system should focus more on retaining the productive workers in their home country. This highlights that it is important not to neglect migration aspects when designing optimal policies.

In connection with the optimal provision of public goods, our formulae show that the standard Samuelson rule is modified by three additional terms, related to the self-selection constraint, the revenue from indirect taxes, and the migration threat. Interestingly, the third term indicates that migration opportunities encourage the provision of those public goods preferred by the most productive individuals. At the redistribution level, the provision of public goods is justified because it has a positive sign in the participation constraint, through the indirect utility function. As the impact is greater when the public goods are preferred by the most skilled individuals, a larger provision relaxes the participation constraint to a greater extent. As a result, the associated decline in the number of potential migrators entails a lower migration term in the optimal income tax formula, and therefore a higher marginal income tax rate.

In addition, after combining the formulae for mixed taxation and public goods provision, we observe that unless the separability of preferences is assumed, optimal tax and expenditure policies become interconnected through the conditions for Pareto efficiency.Footnote 2 These suggest that when the Corlett and Hague rule is satisfied, commodity taxation favors the provision of public goods preferred by the more productive workers. It thus follows that besides helping to compensate for the loss of redistributive capacity derived from the migration of the highly skilled, indirect taxes may be used to reduce the migration threat by relaxing the participation constraint through the provision of public goods.

If utility is weakly separable between public and private goods (taken together), and leisure, the Atkinson and Stiglitz (A–S) theorem concerning the undesirability of indirect taxes continues to be valid, as in the case of a closed economy. As a result, Simula and Trannoy’s (2010, 2012) findings are restored as a relevant guide for tax reform in economies in which agents may vote with their feet. As to the provision of public goods, the classical Samuelson condition is also confirmed, as the terms related to incentive compatibility, the revenue from indirect taxes, and the migration threat vanish when the agent’s utility function is weakly separable.

With the aim of extending our results to a more general background, we further consider an endogenous migration cost function, capturing the opportunity cost derived from the so-called ‘country-specific goods,’ in line with Armington (1969). This change means that the government may affect the participation constraint by modifying the prices of such country-specific goods, and with these the opportunity costs of migration. The conclusion that can be drawn from this is that all of our previous findings are reinforced, not only because of the presence in the formulae of a new term reflecting the opportunity cost of migrating, but also because any reduction in the price of country-specific goods lowers the incentives for the highly skilled to migrate. The consequence of this is that even when utility is weakly separable, the government may use taxes and subsidies to relax the migration constraint and favor redistribution, given that the A–S theorem is shown to break down in this new background. Intuitively, weak separability does not yield uniform commodity taxes under endogenous migration costs since, although the effects on the labor supply resulting from changes in prices vanish along the intensive margin, labor supply is still affected along the migration margin. When utility is strongly separable, the subsidization of country-specific goods continues to be desirable, and should be implemented in direct proportion to marginal migration costs and in inverse proportion to the elasticity price of compensated demand. Under this assumption of strong separability, the A–S theorem is shown to be true only in the polar case, in which the demand functions of country-specific goods become perfectly elastic.

Recent years have witnessed the appearance of several proposals arguing that indirect taxes should be uniform, and that distributional concerns should be left solely to direct taxes and welfare benefits (Mirrlees et al. 2011; European Commission 2013; International Monetary Fund 2014). Although the main arguments are based on practical issues, such as administrative and compliance burdens, spill-over costs and anti-lobbying policies, some theoretical economists have regarded the uniform case as a reasonable benchmark. In this context, our analysis provides a compelling counter-argument by showing the benefits of deviating from the uniform benchmark in the presence of migration threats, even when individual preferences are strongly separable.Footnote 3

The next section sets up the model. Sections 3 and 4 discuss the formulae that characterize the optimal tax mix when agents may vote with their feet. Section 5 is devoted to the optimal provision of public goods under the threat of migration by the highly skilled. The case in which preferences are weakly separable is considered in Sect. 6. Section 7 explores the extent to which all the previous results are modified if migration costs are endogenously determined. The paper ends in Sect. 8 with a discussion of some policy conclusions. Most of the proofs and analytical results can be found in the working paper version of this paper (Ruiz del Portal 2015).

2 Model and problem

The population is represented by a single parameter \(\theta \) that is distributed on [\(\underline{\theta },\overline{\theta }]\subseteq {\mathbb {R}}^{+}\) according to a continuous density function \( f (\theta ) \equiv F'(\theta ) > 0\). The parameter \(\theta \) denotes productivity and is considered as private knowledge in second-best environments.

There are two countries, the home country A and the foreign country B. Their economies are composed of gross labor income z, a numéraire good \({x}_{0},n\) private goods \(x=(x_{1} ,x_{2} ,\ldots ,x_{n} )\) and N public goods \({\varvec{g}}=(g_{1},\ldots ,g_{N})\). It is assumed that \(\theta > z \ge 0, x_{0} \ge 0, \mathbf{x} \ge 0\) and \( \mathbf{g} \ge 0\).

All individuals have the same preferences, defined by \(u(x_{0} ,\mathbf{x,g},z;\theta ),\) a twice continuously differentiable utility function concave in \(\{x_{0} ,\mathbf{x,g},z\},\) increasing in \(\{x_{0} ,\mathbf{x,g}\}\), and decreasing in z. This utility function further satisfies:

Assumption (a)

\(u({x_0},\mathbf{x,g},z;\theta )\equiv U({x_0},\mathbf{x,g},\ell )\), where \(\ell = {z / \theta }\) denotes labor. Moreover, leisure \(1-\ell \) is a normal good and the Spence–Mirrlees single crossing condition between z and \(x_{0} \) is supposed to hold.

In addition to the provision of public goods, country A’s government levies linear taxes \(\tau _{h} \) on goods \(h =\) 1,..., n, and a nonlinear tax T(z) on gross income z, so that \(y =z-T(z)\) stands for after-tax labor income; the numéraire good \(x_{0} \) remains untaxed.Footnote 4 Country B is assumed to remain passive to country A’s domestic policies, so that considerations of tax competition are excluded from the analysis.

Let \(q_{h} =1+\tau _{h} \) stand for the consumer price of good h. All \(\theta \)-persons in country A choose the optimal amount of private goods and gross income \(\{ {x_{0\mathrm{{A}}}}(\theta ),{\mathbf{x}_\mathrm{{A}}}(\theta ),{z_\mathrm{{A}}}(\theta )\} \). to maximize their utility, subject to the budget constraint imposed by the government \({x_0} + \sum \nolimits _{h = 1}^n {{q_h}{x_h}}=z - T(z).\) This can be expressed (by the Revelation Principle) in terms of the incentive compatibility condition:

where \(V_\mathrm{{A}}(\theta )\) denotes the indirect utility function \(u(x_{0\mathrm {A}} (\theta ),\mathbf{x}_\mathrm{{A}} (\theta ),\mathbf{g},z_\mathrm{{A}} (\theta ),\theta )\) for individuals of country A. As is well known, condition (IC) implies that the tax schedules T(z) and \(\tau _{h} \) are incentive-compatible if and only if when those schedules are implemented individuals living in country A have an incentive to reveal their productivity truthfully.

In addition to (IC), the government must consider the constraint that \(V_\mathrm{{A}}(\theta )\) should be higher than the best option abroad, defined as the maximum utility that a person from country A may obtain in country B, net of migration costs, i.e. \(V_\mathrm{{B}} (\theta )-c(\theta )\). Let \(R(\theta )= V_\mathrm{{A}} (\theta )-V_\mathrm{{B}}(\theta )+c(\theta )\) be the location rent of a \(\theta \)-person, understood as the excess of her indirect utility in country A over her reservation utility. As the government ignores the agents for whom \(R(\theta ) = 0\), the following participation constraint must be taken into account:

Concerning migration costs, we think of \(c(\theta )\) as having two parts: a fixed part \(\bar{{K}}\) accounting for material aspects such as moving costs and the transport costs of visiting family, friends in the home country, etc.; and a part that is proportional to the indirect utility received abroad, \(\alpha {V_\mathrm{{B}}}(\theta ),\) which accounts for psychological aspects such as homesickness, the cost of adapting to a foreign culture, etc. Therefore, we write:

(Although for the sake of simplicity we consider function (1) in most of the paper, in Sect. 7 we introduce a more complex, endogenous costs function) As it stands, constraint (PC) implies both a necessary and a sufficient condition for a \(\theta \)-individual to remain in country A, assuming he will leave if and only if \(R(\theta ) < 0\) . However, one of the difficulties here lies in the fact that \(R(\theta )\) is not necessarily monotonic. This is because, in part, highly productive workers have better outside options, i.e. \(V_\mathrm{{B}}'(\theta )- c'(\theta )\ge 0\), according to empirical studies that provide evidence that the propensity to migrate increases with \(\theta \). As a result, constraint (PC) can a priori bind on any subset of [\(\underline{\theta } ,\bar{{\theta }}]\), even at isolated points. Because of this, to make the optimization problem manageable we shall focus on those tax schemes satisfying:

Assumption (b)

Constraint (PC) cannot bind for an individual if it does not bind for all individuals with higher productivity levels living in country A.

Among other advantages, assumption (b) tells us that there is a productivity level \(\theta ^{*}(\le \bar{{\theta }})\) above which constraint (PC) is binding if it binds for \(\bar{{\theta }}.\) Therefore, the introduction of assumption (b) defines a situation in country A with an interval \([\underline{\theta },\hbox { }\theta ^{*})\) where constraint (PC) is inactive and another \([\theta ^{*},\bar{{\theta }}]\) where it binds. We say that individuals with \(\theta \in [\theta ^{*},\bar{{\theta }}]\) ‘are threatening to migrate’.

In principle, there is no guarantee that assumption (b) will be fulfilled by the optimal solution. Even so, it is possible to find examples where it is fulfilled. This is what happens, for instance, when the preferences satisfy \(u_{{x_0}\theta } =0\), which is a case considered in Ruiz del Portal (2015, Appendix) that encompasses most of the specifications on individual preferences considered in the literature.

In addition to the (IC) and (PC) constraints, the revenue constraint under a linear production technology is written as:

Here \(p_{i} \) denotes a producer price for \(g_{i} \) and \(\bar{{E}} \) a per capita income that is not redistributed. When \(\bar{{E}} =\) 0, the tax policy turns out to be purely redistributive.

Regarding social preferences, we might consider all of the three criteria in Mirrlees (1982), namely the National criterion, the Citizen criterion and the Resident criterion. Nevertheless, while all the results below continue to hold under the Citizen and Resident criteria, it is not very informative to consider these. Because of this, our attention will be restricted, for the sake of simplicity, to the National criterion, so the social welfare function in country A is given by:

Here \(G(\cdot )\) is a twice differentiable, increasing and concave function whose degree of concavity captures the inequality aversion. Now, our problem may be expressed as:

Set-up 1 Under assumptions (a) and (b), find the tax-schedules T(z) and \(\tau _{h},h =\) 1,..., n, together with the provision of public goods \(g_{i},i =\) 1,..., N, that maximize \(W_\mathrm{{A}}\) subject to the constraints (IC), (PC) and (RC).

3 A general income tax formula

3.1 The optimal income tax under the threat of emigration

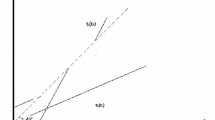

Simula and Trannoy (2012) explore the features of the optimal income tax in an economy where taxpayers may vote with their feet and where there exists a single consumption good \(x_{0} ,\) so that \(n =\) 0. Note that this is equivalent to assuming the absence in our model of indirect taxation and public goods. Following the approach in Saez (2001), Simula and Trannoy (2012) express the optimal marginal tax rate in terms of empirical elasticities by means of the following tax formula:

The terms \(A(\theta ) =\frac{1+\xi ^{M}(\theta )}{\xi ^{H}(\theta )}\) and \(C(\theta )=\frac{1-F(\theta )}{\theta f(\theta )}\) correspond to the efficiency and demographic factors in Saez (2001), with \(\xi ^{H}(\theta )\) and \(\xi ^{M}(\theta )\) denoting the Hicksian and Marshallian elasticities of labor supply with respect to the after-tax wage rate for a \(\theta \)-individual. The efficiency–equity trade-off is captured by the term:

where \(\Xi = 1,B_{1} (\theta )> 0\) on \((\underline{\theta },\bar{{\theta }})\)and \(B_{1} (\bar{{\theta }})=B_{1} (\underline{\theta })=0\). Consequently, in the absence of the term \(B_{2} (\theta )\), formula (3) implies the well-known result that the optimal income tax exhibits an ‘S’ shape, with positive marginal tax rates everywhere except at the endpoints of the skills distribution, where they vanish (see Ebert 1992, among others).

The novelty in Simula and Trannoy (2012) work consists in the introduction of a migration margin, represented by the term:

Since the Lagrange multipliers \(\pi (\theta )\) and \(\iota (\theta )\) satisfy \(\pi '(\theta )\ge 0\) and \(\iota (\bar{{\theta }})\ge 0\) (see Ruiz del Portal 2015), it follows that \(B_{2} (\theta )\ge 0.\) In fact, \(B_{2} (\theta )>0\) is only possible where the (PC) constraint binds, and therefore where taxpayers may vote with their feet.

As a result, equation (3) extends Saez’s formula to take into account the threat of migration by the highly skilled when the government has decided to maintain the maximum national productive capacity by preventing its citizens from leaving the country. Note that, since \(B_{1} (\theta )> 0\) on \((\underline{\theta },\theta ^{*})\), \(B_{2} (\theta )=0\) on \((\underline{\theta },\theta ^{*})\) and \(B_{1} (\bar{{\theta }})=0,\) we must have (recall that \(\theta ^{*}\) is the minimum ability of those individuals who are threatening to migrate):

Conditions (6) and (7) imply that the classical characterization of the optimal income tax may only be re-established when \(\theta ^{*}= \bar{{\theta }}\), and therefore in the absence of migration threats. However, when some individuals threaten to migrate, two qualitative properties of the optimal income tax are changed: marginal tax rates can be strictly negative at the top and, by continuity, non-positive at interior points of the tax schedule. Moreover, to show that the migration margin results in changes to Mirrlees’ formula that favor a decrease in the optimal tax rates, Simula and Trannoy (2010, 2012) apply a small tax reform perturbation around the optimal tax scheme à la Piketty and Saez.Footnote 5 Otherwise, it would have been questionable that the resulting tax scheme could be compared to the benchmark without migration, since the terms \(B_{1} (\theta )\) and \(B_{2} (\theta )\) are endogenously given.

3.2 Optimal mixed taxation under the threat of emigration

Taking Simula and Trannoy’s formula (3) as a benchmark, we shall express the optimal tax rates in terms of an ABCD formula instead of an ABC formula. Consider the following definitions:

\(\xi _{x_{h} y} =q_{h} \frac{\partial x_{h} }{\partial y}:\) Uncompensated elasticity of commodity demand with respect to net income \(y=z-T(z)\).

\(\xi _{x_{j} \ell } = \left. {\frac{\ell }{x_{j} }\frac{\partial x_{j} }{\partial \ell }} \right| _{z=\hbox {const.}} :\) Conditional elasticity of commodity demand with respect to labor supply.

Proposition 1

Let \(\gamma \ge 0, \iota (\theta )\) and \(\pi (\theta )\ge 0\) denote the multipliers for constraints (RC), (IC) and (PC). In the absence of bunching and a binding second-order condition for incentive compatibility,Footnote 6the optimal marginal income tax rate is given by:

where \(A(\theta ),B_{1} (\theta ),B_{2} (\theta )\) and \(C(\theta )\) are as above, with \(\Xi = 1-\sum \limits _{h=1}^n {\frac{\tau _{h} }{1+\tau _{h} }} ,\) and:

Formula (8) generalizes the above formula (3) to include linear indirect taxes and \(n+1\) goods. When \(B_{2} (\theta )=\) 0, we are back to the equivalent conditions (86)–(87) and (96)–(97) in Mirrlees (1976). By contrast, if \(D(\theta )=\) 0 and \(n = 0\) we get formula (22) in Simula and Trannoy (2012).

The possibility of using indirect taxes poses the question of how they should be used to minimize the loss of redistributive capacity due to migration threats by the highly skilled. Looking at formula (8) we see that one way of preserving redistribution through income taxation would be to implement an indirect tax policy that enables the interval \([\theta ^{*},\bar{{\theta }}]\) to be reduced. Since the term \(B_{2} (\theta )\) continues to be non-negative with indirect taxation, a smaller length for this interval implies, by formula (8), higher income tax rates. Clearly, such a policy could consist of reducing taxation or even subsidizing those goods and services with country-specific characteristics that make them imperfect substitutes for goods from country B. This issue is discussed in Sect. 7 below with the help of a more general costs function.

However, in addition to \(B_{2} (\theta ),\) we also have the term \(D(\theta )\) in (8). It can easily be checked that \(D(\theta )\) is positive or negative depending on the level of commodity taxation and on particular cross-substitution patterns. To understand the role of \(D(\theta )\) we need to interpret, following the work of Jacobs and Boadway (2013), the expression \(A(\theta )B_{1} (\theta )C(\theta )\) as a given ‘social desire to redistribute income through income taxation’. Consequently, the expression \(A(\theta )[B_{1} (\theta )-B_{2} (\theta )]C(\theta )\) coincides with the same ‘desire to redistribute income net of the migration threats’. For a given net social desire to redistribute income, the income tax rate will be greater if \(D(\theta )< 0\) and lower if \(D(\theta )>0\). The explanation would be that the higher (lower) incentives for work effort with (without) Corlett and Hague taxation offset (boost), in part, the deadweight loss involved in higher income tax rates.

To see why a Corlett and Hague tax policy enables higher income tax rates, we shall use the reasoning in Edwards et al. (1994) and Nava et al. (1996) based on incentive constraints. Thus, the role of commodity taxes can be viewed as a mechanism to prevent highly-skilled individuals from mimicking low-skilled individuals, with the aim of working less and thus enjoying more leisure hours. If \(\xi _{x_{j} \ell } <0\), then a more productive individual who mimics an individual with lower skills has the same after-tax earnings but, since he takes more leisure, consumes more of the good. If one increases \(\tau _{i} \) and redistributes the revenue so as to keep the utility of the mimicked person unaltered, the utility of the mimicking individual will fall since the reduction in the income tax will not be sufficient to compensate him for the commodity tax increase. This policy relaxes the (IC) constraint and allows the government to adjust income tax to improve social welfare. The opposite argument applies for \(\xi _{x_{j} \ell } > 0\).

When the Corlett and Hague rule is violated, the resulting tax policy coincides with that recommended by many multinational bodies, such as the OECD and the EU Commission, and followed by many European countries, and consists in a shift of tax bases from labor income to consumption. Previous studies seem to suggest that such a shift might indeed strengthen economic growth and increase employment. Interestingly enough, what formula (8) reflects in this respect is that this policy only makes sense when \(D(\theta )>0\). This is because, if \(D(\theta )<0\), the shift leads to a net drop in redistributive capacity, given that both \(T'(z_\mathrm{{A}} (\theta ))\) and \(D(\theta )\) are then reduced. Since, as will be shown, optimal indirect taxes are more likely than not to satisfy the Corlett and Hague rule, formula (8) confirms the conclusion of many studies about the regressive impact of the shift in taxes at an unchanged overall revenue level.Footnote 7

Proposition 2

Optimal top marginal income tax rates satisfy:

Condition (10) says that the non-positive marginal tax rate result at the endpoints proposed by Simula and Trannoy (2010, 2012) applies only to the total tax burden on income and consumption. The implication is that, when the Corlett and Hague tax rule is in force, so that\(_{ }D(\bar{{\theta }})< 0\), the income tax rate fails to be necessarily non-positive at the top, as is the case without indirect taxes. In fact, the top income tax rates turn out to be strictly positive whenever \(R(\bar{{\theta }})> 0\). This confirms that, even when there is a risk of migration by high income earners because \(R(\bar{{\theta }})=\) 0, the use of indirect taxes may render the income tax schedule more progressive. However, condition (10) also implies that, when \(D(\bar{{\theta }})\ge \)0, one is taken back to \(T'(z_\mathrm{{A}} (\bar{{\theta }}))\le \) 0, or in fact to \(T'(z_\mathrm{{A}} (\bar{{\theta }}))<0\) if \(D(\bar{{\theta }})>0\).

To elucidate an economic intuition for why the result for the negative marginal tax rate at the top is either overturned or confirmed according to the sign of \(D(\bar{{\theta }}),\) recall that the critical role of commodity taxation à la Corlett and Hague is to alleviate distortions and boost the labor supply (see, for instance, Nava et al. 1996). Consequently, while potential migration renders the tax schedule less progressive, or even decreasing, indirect taxation has exactly the opposite effect if it satisfies the Corlett and Hague rule. However, if optimal indirect taxes violate the Corlett and Hague rule, the regressive pattern imposed by migration threats is even reinforced, as can be checked from inequality (10).

Due to differential income tax rates at the top across EU countries, there has been much discussion on brain-drain issues (Piketty and Saez 2014, p. 37). Our analysis sheds light on this discussion by indicating when indirect taxation may or may not be of some help in solving the redistribution problem. Recall in this respect that not all VAT tax rates and excise taxes need to be the same among the different Member States.

The main conclusions that arise from Propositions 1 and 2 are contained in Corollary 1.

Corollary 1

The optimal income tax under the threat of migration is different when levied along with linear commodity taxes. If commodity taxes satisfy the Corlett and Hague rule, income tax rates are higher and at the top can be positive. On the other hand, any shift in tax bases and rates from labor income to consumption will have a regressive impact on distribution and poverty. These results are reversed if optimal commodity taxes violate the Corlett and Hague tax rule.

4 Optimal commodity taxation

We have observed that the Corlett and Hague tax rule is crucial for achieving redistribution goals through income taxation, provided that the negative sign of \(D(\theta )\) then implies an upward adjustment of marginal income tax rates, for given values of the terms \(A(\theta )\), \(B(\theta )\), and \(C(\theta )\). However, since \(D(\theta )\) is determined endogenously, unless one imposes structure on the utility function one cannot make unambiguous statements as to whether the optimal linear commodity taxes obey or violate the Corlett and Hague rule. Before considering such a structure, we shall nevertheless derive a formula for commodity taxes under both income taxation and migration threats.

4.1 A formula for optimal commodity taxes

Consider the following definition:

\(\xi _{x_{j} q_{h} }^{c} = -\frac{q_{h} }{x_{j} }\frac{\partial x_{j}^{c} }{\partial q_{h} }\): Compensated elasticity of commodity demand with respect to price.

Proposition 3

The optimal marginal commodity tax rates are given by:

In this expression, the ‘bar’ symbol means a commodity demand-weighted variable, e.g. \(\overline{\xi _{{x}_{j} q_{h} } } \equiv \; \Big [\int _{\underline{\theta }}^{\overline{\theta }} {\xi _{{x}_{j}q_{h}} (\theta )\cdot x_{j} (\theta )\cdot } dF \Big ] \Big [\int _{\underline{\theta }}^{\overline{\theta }} {x_{j} (\theta )\cdot dF \Big ]}^{-1}.\) Formula (11) incorporates the migration margin \(B_{2} (\theta )\) into the condition for optimal indirect taxation in a closed economy, i.e. condition (86) in Mirrlees (1976). The term on the left is an index for the encouragement/ discouragement of consumption of the different commodities for \(\xi _{x_{j} \ell } > 0/ \, \xi _{x_{j} \ell } < 0\) (see Mirrlees 1976, p. 347). In the absence of migration, and under certain assumptions to ensure \(B_{1} (\theta )\ge \) 0, by encouraging (discouraging) the consumption of good j, when j is complementary with labor (leisure), the government reduces the distortions of the income tax thereby stimulating labor supply.

Under migration conditions, however, the index of encouragement (discouragement) is reduced (increased) by the term \(\overline{B_{2} (\theta )C(\theta )\xi _{x_{j} \ell } (\theta )} \). This can be explained because, by boosting the labor supply of the highly-skilled individuals, the government incites them to migrate, in which case the negative effects of commodity taxes on labor supply along the extensive margin will dominate the positive effects along the intensive margin. Note that this can only happen if indirect taxes reduce a person’s indirect utility enough for her to violate the (PC) constraint.

4.2 Commodity taxes à la Corlett and Hague: three examples

Condition (11) indicates that commodity taxes \(\tau _{i} \) relate in a complex way to the elasticities \(\xi _{x_{j} q_{h} }^{c} \) and \(\xi _{x_{j} \ell } \) plus the distortion caused by income taxation. Even so, in the special cases considered below, we shall see that \(\xi _{x_{j} \ell } \) and \(\tau _{i} \) present an opposite sign for all \(\theta \), so as to guarantee a negative \(D(\theta )\) term.

Case 1: For all \(j\ne h=1,2,\ldots ,n,\) it is assumed that \(\xi _{x_{j} q_{h} }^{c} =\) 0.

In other words, no cross-price effects for compensated demands exist for any two goods other than the numéraire. In particular, the simplest situation in which this happens is when \(n = 1\), so that the utility specification takes the form \(u(x_{0} ,x_{1} ,\mathbf{g},z;\theta )\) studied Nava et al. (1996). Also worth noting, on the other hand, that when \(n > 1\), the zero cross-price elasticity of compensated demands does not mean that the goods are independent, in the sense of being neither complements nor substitutes.

In Case 1, the left-hand term of formula (11) satisfies:

Hence, assuming that migration threats are not too high, we will have \(\overline{-[B_{1} (\theta )-B_{2} (\theta )]C(\theta )\xi _{x_{j} \ell } (\theta )} < 0 \) if commodity j is complementary with labor and \(\overline{-[B_{1} (\theta )-B_{2} (\theta )]C(\theta )\xi _{x_{j} \ell } (\theta )} > 0\) if it is a substitute. Since \(\xi _{x_{j} q_{j} }^{c} > 0\), as may easily be checked, we find that condition (12) together with formula (11) implies:

According to (13), the optimal marginal commodity tax rate is positive (negative) if the cross-elasticity of commodity demand with respect to labor supply is negative (positive). The binding incentive constraints associated with the intensive margin of labor supply matter enough in this case to justify the standard argument that commodity taxes should be employed only to deter highly-skilled types from mimicking those with lower skills.

Lemma 1

Assume that preferences are as in Case 1. Then, if migration threats are not too high,optimal commodity taxes satisfy \(\tau _{j} > 0\) if \(\xi _{x_{j} \ell }< 0, j = 1,\ldots , n\).

Case 2: \(u(x_{0} ,x,\mathbf{g,z};\theta )\equiv \) \(\sum \limits _{r=1}^\omega {u^{1}[a_{r} } (x_{r} +\cdots +x_{r+\hat{{\omega }}} ),\mathbf{g},z;\theta ]+ u^{2}[a_{\omega +1} (x_{\omega +\hat{{\omega }}+1} +\cdots +x_{m} ) ,\mathbf{g},z;\theta ]+ u^{3}[a_{\omega +2} (x_{m+1} +\cdots +x_{n} ), \mathbf{g},z;\theta ]+ u^{4}(x_{0},\mathbf{g},z;\theta )\)

Note that this specification contains \(\omega +\) 3 sub-utility functions. It implies independence between any two goods belonging to different sub-utility functions but not between any two belonging to the same sub-utility function. It follows that, unlike in Case 1, the present assumption allows for utility functions such that \(\xi _{x_{j} \tau _{h} }^{c} \ne \) 0 for some \(j\ne h.\)

Lemma 2

Assume that utility is defined as in Case 2. Then,if migration threats are not too high, optimal marginal tax rates are uniform within each of the \(\omega + 2\) groups of goods, displaying a positive sign if \(\xi _{x_{j} \ell } < 0\) for \(j = 1,\ldots , n\).

Clearly, this is a realistic case since the resulting optimal tax schedule contains, as is found in practice, a finite number of tax rates each applying to a distinct group of consumption goods.

Case 3: \(u(x_{0} ,\mathbf{x,g},z;\theta )\equiv v(x_{0} ,a({\varvec{x}}),{\varvec{g}},z;\theta ),\) where \(a(x)= a(x_{1} ,\ldots ,x_{n} )\) is homothetic.

This utility function is found in Deaton (1979). It involves weak separability between non-numéraire goods, labor and the numéraire. The next result says that uniform taxation should be optimal concerning those goods other than the numéraire.

Lemma 3

If utility is defined as in Case 3 and migration threats are not too high, optimal indirect taxes are uniform (i.e. \(\tau = \tau _{h} , h = 1, 2,\ldots , n \)) and satisfy \(\tau > 0\), if \(\xi _{x_{j} \ell }^{c} < 0\) and \(\tau < 0 \), if \(\xi _{x_{j} \ell }^{c} > 0\).

It should be noted that the taxed commodities need to be weakly separable from the numéraire and the public goods. If instead we had assumed as in Proposition 6 below that \(x_{0} \) is included into the sub-utility function \(a(\mathbf{x}),\) uniformity would extend to all commodities, which means, since \(\tau _{0} \hbox { }=0,\) that \(\tau _{j} =0\) for all \(j=0,1,2,\ldots , n\), so that all commodity taxes would become superfluous.

The tax scheme in Lemma 3 is close to the one proposed in the Mirrlees Review of the UK tax system (see Mirrlees et al. 2011), especially if it is assumed that \(x_{0} \) in our model denotes child care. This influential work has concluded that, aside from externalities and those goods consumed in conjunction with labor supply, such as child care, there is no justification for the present differential rates in the VAT system, provided that any moves toward uniformity can be compensated through appropriate adjustments in income tax.

The conditions assumed in Lemmas 1, 2 and 3 offer some intuition about what optimal indirect taxes on non-numéraire commodities should be like. Of course, many other structures of preferences could be found leading to similar conclusions and, in particular, to condition (13).

Comparing the three lemmas, they describe how high incomes respond to taxes along both the intensive and the migration margins. The case in Lemma 1 is the one that involves a higher degree of tax differentiation, while that in Lemma 3 represents the converse case of uniform taxation for all goods other than the numéraire. In between these two polar situations comes the tax schedule in Lemma 2.

It should be recalled, on the other hand, that it has been assumed that the interval \([\theta ^{*},\bar{{\theta }}]\) is relatively small compared to the interval \([\underline{\theta },\hbox { }\theta ^{*}).\) However, if the number of potential migrators is high, it may happen that \(\overline{-[B_{1} (\theta )-B_{2} (\theta )]C(\theta )\xi _{x_{j} \ell } (\theta )} > 0\) when j is complementary with labor and \(\overline{-[B_{1} (\theta )-B_{2} (\theta )]C(\theta )\xi _{x_{j} \ell } (\theta )} < 0\) when it is a substitute. In this situation we would have \(\tau _{j} >0\), if \(\xi _{{x}_{j} \ell }> 0\), and \(\tau _{j} < 0\) if \(\xi _{{x}_{j} \ell }< 0\), so inequalities (13) should be reversed and it would be desirable to break the Corlett and Hague rule. The explanation for this striking result has to lie in the fact that, when the proportion of taxpayers threatening to migrate is high, their welfare turns out to be the government’s priority. Since their utility can be increased with the help of indirect taxes, by rewarding leisure and punishing labor, the result follows once it has been noted that highly-skilled workers value goods associated with leisure more than workers with lower skills do. Clearly, this possibility cannot be discarded in those countries where the proportion of skilled workers is significant and fiscal policies give rise to a risk of brain drain.

Corollary 2

In the most interesting cases, optimal commodity taxes satisfy the Corlett and Hague rule.Consequently, the impact on redistribution from an increase in the number of taxpayers who threaten to migrate may be offset by a suitable increase in commodity taxes and subsidies. However, if potential migrators involve a significant part of the population, it may be desirable to violate the Corlett and Hague rule.

The importance of Corollary 2 must be evaluated in the light of Simula and Trannoy’s (2010) result that, even when the proportion of potentially mobile workers is low, the threat of migration has a great impact on the magnitude of income tax rates. This suggests that indirect taxation may be very useful for preserving redistributive goals through discouraging migration by the highly skilled.

5 The optimal provision of public goods

5.1 Effects on redistribution

Looking at the (PC) constraint, one immediately finds that the provision of public goods is justified because they appear in the indirect utility function \(V_{A} (\theta )\) with a positive sign. Since this means a more relaxed (PC) constraint, the associated reduction in the number of potential migrators will generally lower the term \(B_{2} (\theta )\) in formula (8), thereby favoring a higher income tax rate \(T'.\)But apart from this, we will now see that, when the public goods are preferred by the most skilled, the relaxing effect on the (PC) constraint will be greater, and, therefore, so will be the increase in \(T'.\)

The following proposition characterizes the optimal provision of public goods in the presence of migration threats by the highly skilled.

Proposition 4

Let \(S^{i}\equiv {u_{g_{i} }}/{u_{0}}\) denote the marginal rate of substitution between \(g_{i} \) and the numéraire, \(i = 1,\ldots , N\). Then the optimal provision of public goods is given by:

Clearly, the standard Samuelson rule is modified by three additional terms related to the self-selection constraint, the revenue from indirect taxes and the migration threat. For \(B_{2} =\) 0 (or \(\theta ^{*}=\bar{{\theta }}),\) Eq. (14) coincides with Mirrlees (1976, p. 352) condition (121), with the only difference being that in his analysis labor, instead of \(x_{0} ,\) is the numéraire. The first integral on the left-hand side is a direct estimate of the social value of the good, adding marginal rates of substitution \(S^{i}\) in the usual way. The second integral corrects this estimate to take account of distributional considerations, given that \(B_{1} (\theta )\) expresses the unitary distortion on labor created by mixed taxation. Following Mirrlees’ argument, the correcting term is negative if the more able have a stronger preference for the public good, and positive if the less able have (note that \(S_{\theta }^{i} < 0\) in the first case, and \(S_{\theta }^{i} > 0\) in the second). Therefore, the equation encourages the provision of public goods valued by the poor and discourages the provision of public goods valued by the rich.

But for the same reasons, and this should be emphasized, the presence of the migration term \(B_{2} (\theta )\) in Eq. (14) acts in the opposite direction, encouraging the provision of the public good \(g_{i} \) if it is greatly preferred by the rich. In fact, if the proportion of workers satisfying \(\theta \in [\theta ^{*},\bar{{\theta }}]\) becomes high enough, public goods preferred by the more productive workers should be produced in a superior proportion, given that then the correcting term will be positive (negative) if \(S_{\theta }^{i} <0\) (\(S_{\theta }^{i} > 0\)).

5.2 Interdependency between optimal mixed taxation and public goods

We know from Sect. 3 that indirect taxes à la Corlett and Hague favor redistribution through income taxation by relaxing the (IC) constraint, thereby increasing the absolute value of the term \(D(\theta )< 0\) in formula (8). Regarding public goods, we also found that their effects on redistribution are developed by easing the (PC) constraint, thereby lowering the migration term \(B_{2} (\theta )\) in formula (14). It follows that, although commodity taxes may also affect the (PC) constraint, and public goods the (IC) constraint, the objective of relaxing incentive compatibility encourages the use of commodity taxes, while the objective of reducing migration encourages the use of public goods.

To see how the roles played by indirect taxation and public goods are linked, let \(\frac{\tilde{{T}}'}{1-\tilde{{T}}'}= \frac{T'}{1-T'}+ D(\theta )\) stand for the marginal tax burden on labor,Footnote 8 or, equivalently, the marginal income tax rate under arbitrary commodity taxes.

Proposition 5

The optimal levels of public goods provision and tax burden on labor require:

These relations hold after solving for \(B_{1} (\theta )-B_{2} (\theta )\) in formulae (8) and (14). They allow us to calculate the optimal level of public goods provision once the optimal tax burden on labor is known, without further reference to the degree of inequality aversion contained in the social welfare function. Relations (15) therefore involve necessary conditions for Pareto efficiency.

Focusing exclusively on the efficiency side, relations (15) indicate that, unless separability applies (i.e. \(S_{\theta }^{i} = 0\)), the optimal tax and expenditure policies are interdependent. The higher the overall tax burden on labor, the higher the provision of public goods preferred by the more productive individuals and the lower the provision of public goods preferred by the less productive individuals.

It is also worth noting in this context that, when the Corlett and Hague rule is satisfied, any increase in the marginal commodity tax rates that is compensated for with a reduction in the income tax rates, so as to keep the utility of individuals unaltered, will unambiguously reduce \(\tilde{{T}}'.\) This means, according to Nava et al. (1996), that such a policy relaxes the (IC) constraint. But, in the light of relations (15), the same policy also relaxes the (PC) constraint by encouraging (discouraging) the provision of those public goods preferred by the more (less) productive workers.

Corollary 3

Migration threats encourage the provision of public goods preferred by the more productive workers. This is because, although the provision of any public good relaxes the participation constraint, the reduction in migration threats is greater when the public good is preferred by the more skilled individuals.

Optimal tax and expenditure policies are linked through the conditions for Pareto efficiency. These suggest that, when the Corlett and Hague rule is satisfied, commodity taxation favors the provision of public goods preferred by the more skilled individuals, and discourages the provision of public goods preferred by the less skilled individuals.

6 Separable preferences

In this section, it will be shown that all of the above conclusions on the role of optimal commodity taxes and public goods are relevant only if, as is the case in closed economies, consumption and leisure are interdependent.

Proposition 6

Assume that utility takes the weakly separable form \(u(b({x_0},\mathbf{x,g}),z,\theta ),\) with \(b(x_{0}, \mathbf{x,g})\) being a homothetic function. Then indirect taxes become superfluous under the threat of migration (i.e. \(\tau _{h} =0\) for all h) and:

Proposition 6 establishes the requirements for the A-S theorem to hold in open economies with a migration threat and publicly provided goods. It tells us that residence choices by the highly skilled are unaffected by the presence of commodity taxes if the government can also levy income tax.

Concerning the optimal provision of public goods, the three additional terms in condition (14) related to the self-selection constraint, the revenue of indirect taxes and migration threats, are shown to vanish because now the public good i is equally preferred by both the more skilled and the less skilled workers, so that \(S_{\theta }^{i} =0\), and \(\tau _{h} = 0\) for all h. As a result, we are taken back to the standard Samuelson rule, which prescribes that, on an average basis, consumers set their marginal rates of substitution equal to the price ratio or the marginal rate of transformation. Both Edwards et al. (1994) and Nava et al. (1996) have shown for the closed economy case that departures from the Samuelson rule are justified only to the extent that they enable the (IC) constraint to be weakened. Condition (16) in combination with (14) confirms this conclusion for the open economy case and for a more general model than the models considered by these authors.

It is also worth observing from Proposition 6 that, while differential commodity taxes are superfluous for redistribution purposes, public goods may help relax the (PC) constraint through the domestic indirect utility function even under separability conditions.

It should also be noted that a trivial implication of Proposition 6 is Corollary 4.

Corollary 4

Under the assumptions in Proposition 6, and without the provision of public goods, all results in Simula and Trannoy (2010, 2012) continue to apply even if the government has the power to levy indirect taxes on goods and services.

7 Endogenous migration costs function

Up to now we have assumed that migration costs are exogenously given. However, there are some country-specificities as regards available goods that may impose an opportunity cost, and these have not been taken into account in the migration costs function. For example, the weather and the food are not the same in southern California and in southern Denmark, and this may matter when Californians and Danes make location choices.

To mention just some country-specific goods, there are those related to family, national holidays, infrastructure endowment, the country’s scenery and climate, sporting activities, sociocultural attractions and local museums. In fact, the list can be quite long, since, according to Armington (1969) and as confirmed in empirical studies by Shiells et al. (1986) and Blonigen and Wilson (1999), even identical goods produced in different countries cannot be treated, from the consumer viewpoint, as perfect substitutes.Footnote 9

In what follows, we suppose that part of the migration costs are measured in the opportunity cost of forgoing certain consumable goods that are available in the home country but are unavailable (or are available only as poor substitutes) when migrating. In these circumstances, the government can affect the participation constraint by relatively subsidizing these particular goods thereby rendering the opportunity cost of migrating more expensive. This requires the set of private goods for the residence country to be redefined.

Suppose that, apart from labor income z, a numéraire good \(x_{0} \) and m consumption goods \(\mathbf{x}=(x_{1} ,x_{2} ,\ldots ,x_{m} ),\) the economy in country A is composed of \(n-m\) goods with country-specific characteristics \(\tilde{{\mathbf{x}}}=(x_{m+1} ,x_{m+2} ,\ldots ,x_{n} ).\) Further, think of \(c(\theta )\) as having an additional third part \(K(\cdot )\) capturing the opportunity cost in terms of the prices \(\tilde{\mathbf{q}} = ({q_{m + 1}},{q_{m + 2}},\ldots ,{q_n})\) of forgoing certain consumable goods that are not provided, or are underprovided, by country B, namely:

It seems reasonable to assume that \(K_{\tilde{{\mathbf{q}}}} \le 0 \), so that the opportunity cost of the country-specific good does not increase with its consumer price.

An important question here is the extent to which it is feasible to tax or subsidize certain country-specific goods such as, say, the enjoyment of the scenery, or the unspoilt nature or other natural assets of the country. An alternative can be to assume that, in these cases, the government can tax/ subsidize these goods indirectly, via taxing/ subsidizing those goods complementary to their consumption. This is what is meant, in what follows, by the prices \({\tilde{\mathbf{q}}}\) in the sense that they refer to country-specific goods and to their complements without distinction.

7.1 Non-separable utility

A remarkable fact is that the consideration of function (17) does not involve any relevant modification of the previous results, which are even reinforced, as illustrated in Ruiz del Portal (2015), by the potential effects on \(B_{2} (\theta )\) produced by changes in \(\tilde{\mathbf{q}}\) through the (PC) constraint. This, together with the presence in the right-hand side of formula (11) of the negative added term \(\int _{\theta ^{*}}^{\bar{{\theta }}} {\pi (\theta )K_{q_{j} } d\theta } \), \(j = m + 1, \ldots , n\), unambiguously favors both higher commodity tax rates and higher income tax rates.

The conclusion is that the taxation and subsidization of country-specific goods helps to improve redistribution in a different way than is done for other goods. While in the latter case the income tax rates are increased mainly through the terms \(B_{1} (\theta )\) and \(D(\theta )\) of formula (8), in the former case they are increased through \(B_{2} (\theta )\) and\(\int _{\theta ^{*}}^{\bar{{\theta }}} {\pi (\theta )K_{q_{j} } d\theta } \).

Interestingly, if we interpret the opportunity cost produced by migration as a negative externality, then \(\tilde{\mathbf{q}}\) can be viewed as a Pigouvian tax/ subsidy scheme targeted at ameliorating the depressive effects of migration on work effort along the extensive margin. Only in absence of the migration threat does the mentioned externality vanish.

7.2 Weakly separable utility

The next result is the counterpart of Proposition 6, since it shows that both the A-S theorem and the Samuelson rule fail to apply when country-specific goods are at stake.Footnote 10

Proposition 7

Suppose that utility takes the weakly separable form \(u(b(x_{0} ,\mathbf{x},\tilde{{\mathbf{x}}},\hbox { }{} \mathbf{g}),z,\theta ),\) with \(b(x_{0} ,\mathbf{x},\tilde{{\mathbf{x}}},\mathbf{g})\) being a homothetic function. Then:

Condition (18) indicates that the index of encouragement/ discouragement for each country-specific good must equal the aggregated marginal migration cost derived from a change in its price. Therefore, the condition implies that only in absence of migration threats, that is, if \(\theta ^{*}=\bar{{\theta }}\), may one infer that \(\tau _{h} = 0\) for all h, so as to restore the A–S theorem and, with it, the Samuelson rule in the light of condition (19).

7.3 Strongly separable utility

When preferences are strongly separable, the A-S theorem still breaks down, since \(\xi _{x_{j} q_{h} }^{c} = 0, \forall j\ne h,\) and condition (18) leads to \(\tau _{j} = 0, j = 1, 2, \ldots , m\), and:

As the denominator is positive and the numerator negative, the usefulness of the subsidization of country-specific goods persists as a function of the elasticity-price of commodity demand and the marginal migration costs. Moreover, it is exclusively the relationship between these two variables that determines the optimal subsidy. Clearly, the higher the value of the elasticity-price term with respect to the marginal migration costs term, the lower the amount of the subsidy. If the terms coincide, we have \(\tau _{j} = -0.5;\) if the second is double the first, the result is \(\tau _{j} = -0.3;\) if triple, \(\tau _{j}= -0.25;\) if quadruple, \(\tau _{j} =-0.2;\) and if it is five times the size, \(\tau _{j} =-0.1.\) In the polar cases where \(\xi _{x_{j} q_{j} }^{c} = \infty \) or \(K_{q_{j} } =\) 0, then \(\tau _{j} =\) 0; however if \(\xi _{x_{j} q_{j} }^{c} =\) 0 or \(K_{q_{j} } = -\infty \), then \(\tau _{j} = -1\).

Corollary 5 summarizes the conclusions reached in this section.

Corollary 5

Taxes and subsidies on country-specific goods help compensate the depressing effects from migration threats on redistribution to a greater extent than done by taxes and subsidies on other goods. This continues to hold if utility is weakly separable, because country-specific goods still affect labor supply along the extensive margin through the migration costs function.

When utility is strongly separable, country-specific goods should be subsidized in an inverse proportion to their elasticity-price and in direct proportion to marginal migration costs. Both the A-S theorem and the Samuelson rule are only restored in the polar cases where either the demand for country-specific goods becomes perfectly elastic or the marginal migration costs totally vanish.

8 Concluding comments

The threat of migration by the most productive workers represents a source of concern for many countries in an increasingly globalized world, despite the empirical evidence that mobile rich people are mainly capital holders (e.g., capitalists, retired persons, heirs). As a point of departure in this paper, we have shown that in the absence of non-separabilities in the utility function and country-specific goods, there is no role for differential commodity taxation/subsidization and public goods provision. Consequently, the resulting policy recommendations do not differ from those previously obtained by Simula and Trannoy (2010, 2012) for a home economy with two goods and a tax system composed exclusively of an income tax. Although interesting, this conclusion leads to a situation that is, however, rather at odds with what is observed in practice, where there are multiple kinds of indirect taxes, such as VAT, general sales tax, and other taxes on specific goods, besides a wide range of public goods. Moreover, working against such a conclusion is the fact that the general tendency in all Western countries is to increase the significance of both indirect taxation and public goods.

Apart from these criticisms, the two requirements mentioned for Simula and Trannoy’s results to apply may be questioned for other reasons. In part, this is because although the influence of country-specific goods on migration has long been ignored, their presence involves prima facie a higher opportunity cost of leaving the own country. We have taken profit of this aspect to demonstrate that in addition to taxing labor income, the home economy could do better by subsidizing country-specific goods, even if utility is strongly separable. But if we leave aside the effects of country-specific goods on migration, there is an additional argument in favor of the use of indirect taxes, namely that most empirical studies argue that the weak separability of preferences does not hold in the real world (see, among others, Browning and Meghir 1991; Crawford et al. 2010; Gordon and Kopczuk 2014 and Pirttilä and Suoniemi 2014).

All these reasons justify our investigation in this paper, exploring what happens in terms of an optimal tax mix when the weak separability property does not hold and country-specific goods are present in the economy. More specifically, we have derived a complete characterization in terms of empirical elasticities of an optimal mixed system in an environment with both public goods and country-specific goods. Not only is the optimal income tax that results very different from that in Simula and Trannoy (2010, 2012), but also the formulae reveal that governments have at their disposal three primary lines of action against high-skilled emigration. The first consists of applying a tax reform à la Corlett and Hague; the second is to produce those public goods that are preferred by the most productive individuals; the third lies in subsidizing those goods and services that present country-specific features. These results are, in our opinion, policy-relevant as they help preserve the redistribution program from migration threats, also favoring higher income tax rates.

In terms of the feasibility of such government actions, it should be recalled that in recent years different works, such as those of Iorwerth and Whalley (2002),West and Williams (2007), and Parry and West (2009), have identified important categories of consumption goods (e.g., food, gasoline, and alcohol) that are complementary to leisure. This implies that raising tax rates on both these goods and gross income, besides being convenient from a Corlett and Hague perspective, will afford a significant source of revenue to finance public goods (for which the most able display a stronger preference), and subsidize those goods and services that present country-specific components. With regard to how exactly the last should be done in connection with certain special goods, we are thinking in terms of the direct subsidization of items such as sporting activities, sociocultural attractions, local museums, or so-called ethnic goods, and the indirect subsidization, via complementary goods and services, of items such as national holidays, infrastructure endowment, or the country’s scenery and climate. According to our analysis in this paper, a simple tax reform like this could help achieve distributional goals in the face of migration threats.

Concerning the tax policy recommended by many multinational bodies, consisting in a shift of tax bases from labor income to consumption, it is not justified on distributional grounds by our analysis despite being beneficial for economic growth and employment creation. This is the case unless there is a significant part of the population threatening to migrate since, in such circumstance, the Corlett and Hague rule could be violated thereby increasing the indirect tax burden on labor and, with it, perhaps also the redistributive capacity of the tax system.

Change history

14 September 2017

We regret that in the original publication of the article, some equations were incorrectly published. A number of typesetting errors, mainly spacing errors, have been fixed in the article to improve the readability.

Notes

There is a voluminous literature on income taxation and migration, but this does not address indirect taxation. For a complete review, see the introduction to Blumkin et al. (2011).

Although some readers may not be happy with this terminology given that distortionary taxation is present, we use here and elsewhere the term Pareto efficiency to express that the resulting conditions do not depend either on the social welfare function or on the distribution of abilities, as in the optimal taxation literature (see for instance Mirrlees 1976 or Atkinson and Stiglitz 1976).

Of course, this does not constrain the model because, since profit income is zero, the equilibrium does not change if all prices are multiplied by a positive constant. Consequently, one may always choose any good as numéraire and normalize the prices in such a way that we have an untaxed good.

This dispenses with the need for us to apply another small tax reform perturbation in the analysis below.

In Mirrlees’ optimal income tax problem, bunching turns out to be equivalent to a binding second-order constraint. However, this is no longer the case, as is well known, when there are more than two goods.

See, for instance, Pestel and Sommer (2013). The European Commission (2006) states: ‘One problematic aspect of the tax shift proposal is that, in practice, it is likely to have substantial redistributive effects. Taxpayers with high incomes would probably benefit substantially, while medium and low incomes might well face an increase in the tax burden’.

We have borrowed this concept from Jacobs and Boadway (2013, p. 22 ), although, to be more precise, they refer specifically to the ‘tax wedge on labour’.

We can also include within the concept of country-specific goods the so-called “ethnic goods”. A treatment on them from the angle of the host country is found in Abdulloev et al. (2014).

In the same spirit, Kessing and Koldert (2013) have shown that the A-S theorem is violated in the presence of cross-border shopping and exogenously given taxes on non-transportable goods.

References

Abdulloev I, Epstein G, and Gang I (2014) Ethnic goods and immigrant assimilation. Centro Studi Luca d’Agliano Development Studies Working Paper No. 364. Available at SSRN: https://ssrn.com/abstract=2427775 or http://dx.doi.org/10.2139/ssrn.2427775

Armington P (1969) A theory of demand for products distinguished by place of production. Int Monet Fund Staff Pap XVI:159–178

Atkinson AB, Stiglitz JE (1976) The design of tax structure: direct versus indirect taxation. J Public Econ 6:55–75

Bastani S, Blomquist S, Pirtilä J (2015) How should commodities be taxed? A counterargument to the recommendation in the mirrlees review. Oxford Econ Pap 67(2):455–478

Blomquist S, Christiansen V, Micheletto L (2010) Public provision of private goods and nondistortionary marginal tax rates. Am Econ J Econ Policy 2(2):1–27

Blonigen B, Wilson W (1999) Explaining Armington: what determines substitutability between home and foreign goods? Can J Econ 32(1):1–21

Blumkin T, Sadka E, and Shem-Tov Y (2011) Labor migration and the case for flat tax. CESifo Working Paper Series No. 3471. https://ssrn.com/abstract=1855947

Browning M, Meghir C (1991) The effects of male and female labour supply on commodity demands. Econometrica 59(4):925–951

Corlett WJ, Hague DC (1953) Complementarity and the excess burden of taxation. Rev Econ Stud 21(1):21–30

Crawford I, Keen M, Smith S (2010) Value added taxes and excises. In: Mirrlees et al. (2011, Ch. 4), pp 275–422

Deaton A (1979) Optimally uniform commodity taxes. Econ Lett 2(4):357–361

Ebert U (1992) A reexamination of the optimal nonlinear income tax. J Public Econ 49:47–73

Edwards I, Keen M, Tuomala M (1994) Income tax, commodity taxes and public good provision: a brief guide”. Finanzarchiv 22:472–487

European Commission (2006) Macroeconomic effects of a shift from direct to indirect taxation: a simulation for 15 EU member states. Working Party No. 2 on Tax Policy Analysis and Tax Statistics, Paris, 14–16

European Commission (2013) Tax reforms in EU member states 2013, Eur Econ 5

Gordon RH, Kopczuk W (2014) The choice of the personal income tax base. J Public Econ 118:97–110

International Monetary Fund (2014) Fiscal policy and income inequality. IMF Policy Paper 23. IMF, Washington, DC

Iorwerth A, Whalley J (2002) Efficiency considerations and the exemption of food from sales and value added taxes. Can J Econ 35:166–182

Jacobs B, Boadway R (2013) Optimal linear commodity taxation under optimal non-linear income taxation. CESifo Working Paper No. 4142, CESifo, Munich

Kessing SB, Koldert R (2013) Cross-border shopping and the Atkinson–Stiglitz theorem. Int Tax Public Financ 20:618–630

Kleven H, Landais C, Saez E (2013) Taxation and international migration of superstars: evidence from the European football market. Am Econ Rev 103:1892–1924

Kleven H, Landais C, Saez E, Shultz E (2014) Migration and wage effects of taxing top earners: evidence from the foreigners’ tax scheme in Denmark. Q J Econ 129:333–378

Liebig T, Puhani P, Souza-Poza A (2007) Taxation and internal migration- evidence from the Swiss census using community-level variation in income tax rates. J Reg Sci 47(4):807–836

Mirrlees J (1976) Optimal tax theory: a synthesis. J Public Econ 7:327–358

Mirrlees J (1982) Migration and optimal income taxes. J Public Econ 18:319–341

Mirrlees J, Adam S, Besley T, Blundell R, Bond S, Chote R, Gammie M, Johnson P, Myles G, Poterba J (2011) Tax by design: the mirrlees review. Oxford University Press, Oxford

Nava M, Schroyen F, Marchand M (1996) Optimal fiscal policy and expenditure in a two class economy. J Public Econ 61(1):119–137

OECD (2002) OECD Annual Report 2002. OECD Publishing, Paris. doi:10.1787/annrep-2002-en

Osmundsen P (1999) Taxing internationally mobile individuals: a case of countervailing incentives. Int Tax Public Financ 6:149–164

Parry I, West S (2009) Alcohol/leisure complementarity: empirical estimates and implications for tax policy. Natl Tax J 62:609–634

Pestel N, Sommer E (2013) Shifting taxes from labor to consumption: efficient, but regressive? SOEPpapers on Multidisciplinary Panel Data Research 624, DIW Berlin, The German Socio-Economic Panel (SOEP)

Piketty T, Saez E (2012) Optimal labor income taxation. NBER Working Paper 18521

Pirttilä J, Suoniemi I (2014) Public provision, commodity demand and hours of work: an empirical analysis. Scand J Econ 116(4):1044–1067

Revesz JT (2014) A numerical model of optimal differentiated indirect taxation. Rev Public Econ 211(4):9–66

Ruiz del Portal X (2015) Optimal mixed taxation, public goods and the problem of migration by the highly skilled. doi:10.2139/ssrn.2549502

Saez E (2001) Using elasticities to derive optimal income tax rates. Rev Econ Stud 68(1):205–229

Shiells C, Stem R, Deardorff A (1986) Estimates of the elasticities of substitution between imports and home goods in the United States. Rev World Econ 122:497–519

Simula L, Trannoy A (2010) Optimal income tax under the threat of migration by top-earners. J Public Econ 94:163–173

Simula L, Trannoy A (2012) Shall we keep the highly skilled at home? The optimal income tax perspective. Soc Choice Welf 39(4):751–782

West S, Williams R (2007) Optimal taxation and cross-price effects on labor supply: estimates of the optimal gas tax. J Public Econ 91:593–617

Acknowledgements

Financial support from the Ministerio de Economia y Competitividad (Project ECO2012-37572) and the Generalitat de Catalunya (Contract 2014SGR0327 and XREPP) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

The original version of this article was revised: In the original publication of the article, some equations were incorrectly published. A number of typesetting errors, mainly spacing errors, have been fixed in the article to improve the readability.

A previous version of this paper has been circulated under the title ‘Optimal mixed taxation when agents may vote with their feet’. The author acknowledges comments made by the seminar participants at the 2014 LAGV conference (Aix en Provence) and at the 2015 IEB Workshop on Economics of Taxation (Barcelona), and would particularly like to mention Sebastian Kessing (University of Siegen) and Pierre Picard (University of Luxemburg). Comments from Igor Fedotenkov (Bank of Lithuania) were also appreciated.

An erratum to this article is available at https://doi.org/10.1007/s00712-017-0570-4.

Rights and permissions

About this article

Cite this article

Ruiz del Portal, X. Optimal mixed taxation, public goods and the problem of high-skilled emigration. J Econ 122, 97–119 (2017). https://doi.org/10.1007/s00712-017-0536-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-017-0536-6