Abstract

RF-MEMS, i.e. microelectromechanical-systems for radio frequency passives, have been around for about two decades. Across a remarkable haul of 20 years, looking at RF-MEMS from the market perspective, disappointments seem to overweight success cases. Nevertheless, full deployment of such a technology has still to come, and future mobile (5G) standards might be the perfect ground for such a potential to manifest. The target of this short article is to trace the current state of RF-MEMS market and to build some considerations on future scenarios, based upon the legacy trail of ups and downs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since the first research articles published in the second half of the 1990s, RF-MEMS passives, like micro-relays and variable capacitors (varactors), emerged for the remarkable characteristics in terms of low-loss, high-isolation, broad tuning range and wideband operability. In addition, their assembly in higher-order devices, like programmable phase-shifters and multi-state impedance tuners, triggered the discussion of various hypotheses around mass-market exploitation of RF-MEMS technology.

Among various visions, the one outlined by Nguyen in the first years of the 2000s is certainly one of the most enlightened (Nguyen 2001). Bearing in mind the classical transceiver (transmitter/receiver) architecture of mobile handsets, the deployment of RF-MEMS would have followed two subsequent paths. In the first phase, high-performance RF passives in MEMS technology, like antenna switches, RF/IF—intermediate frequency—filters, LC-tanks and resonators, were expected to replace standard counterparts, thus boosting the performance of the whole system. Subsequently, the development of high-complexity RF-MEMS devices, like multi-channel selectors with embedded filtering functions as well as hybrid mixer-filters, would have led to rethinking transceivers architecture (second phase). Leveraging on low-loss and wide reconfigurability of RF-MEMS, the block diagram of RF systems was meant to be simplified, reducing the number of low noise amplifiers (LNAs) and extending the operability of the transceiver according to multiple standards and services. In other words, there would have been, on one side, reduction of hardware redundancy and power consumption, and increase of functionalities, on the other hand.

Nonetheless, if one looks at what happened from that moment on, the evolution of facts followed a radically different path. From 2002 to 2003 and for about one entire decade, market forecasts predicted a massive penetration of RF-MEMS technology in the consumer segment of mobile phones (Iannacci 2015a). The hundreds of $M (millions of US dollars) estimates were systematically downsized, analysis after analysis, and the expected consolidation, in factual terms, never took place.

Such a fluctuating behaviour is well explained by an empirical graphic tool, known as hype curve (Gartner Hype Cycle 2017). When a novel technology starts to be discussed, expectations around its employment in market products climb up very fast (see Fig. 1).

Anyhow, as soon as possible exploitations are analysed into details, the initial enthusiasm drops quite steeply to a minimum. This happens because of various reasons, among which scarce maturity of the technology, integration/qualification issues and costs, are certainly relevant. On the other hand, the drop of expectations is also a fundamental trigger, driving the effort towards the just mentioned weaknesses, and enabling technology advancement in compliance with market needs and requirements. This leads to the final part of the hype curve cycle, which is the consolidation of a certain technology in one or more market application/s and segment/s.

2 The early days of RF-MEMS technology

Fitting the evolution of RF-MEMS technology into the boundaries of a classical hype curve cycle does not seem a simple task. Staring at one decade of market studies, forecasts and rumours, it is like if the hype curve of MEMS-based RF passives underwent two subsequent peaks of inflated expectations—and, consequently, two (harsh) drops (Iannacci 2015a).

The first deflation, dated around the years 2003–2004, was mainly driven by technology intrinsic factors. In particular, reliability—mechanical/electrical; medium-/long-term—, packaging and integration of RF-MEMS with standard technologies were the main factors impairing the employment of such devices into the market (Iannacci et al. 2010b; Iannacci 2013, 2015b). From that moment on, the efforts of research targeted the mentioned issues, leading to significant progress. Up to here, evolution of RF-MEMS followed the standard pace of hype curve cycles.

Improvements at reliability, packaging and integration level, triggered a second peak of inflated expectations around 2009–2010, followed by another steep fall, afterwards. The motivation of such a singular behaviour can be attributed to extrinsic factors, linked to the surrounding market environment rather than to RF-MEMS technology itself. As a matter of fact, mobile applications up to 3G–3.5G were not really demanding for components with the boosted characteristics of MEMS-based RF passives. In other words, the approach to exploitation of RF-MEMS, biased by the remarkable performance achieved, has always been more oriented to a technology push rather that market pull philosophy (Iannacci 2015a).

3 Current state of market exploitation

The wind commenced to change with the advent of 4G-LTE mobile devices—4th generation; long term evolution. Introduction of full screen devices (with touch technology), integration of antenna inside the handset and increasing difficulty to include ad-hoc performance boosting circuitry, triggered a degradation trend in the quality of communications (Allan 2013). It was estimated that the ratio of theoretical versus actual RF signal quality was decreasing with a pace of about 1 dB per year for over a decade. Because of the afore-mentioned factors, smartphones antennas were not working in optimal conditions anymore, leading to slower download speeds, reduced quality of voice, lower energy efficiency and more dropped calls. Therefore, fixed impedance matching between the transmitting/receiving antenna and the RF front end (RFFE) classically adopted in previous mobile handsets generations, was not anymore the best option.

Such a changed scenario started to demand for reconfigurability and tunability of passive components, that RF-MEMS technology has always been capable to address. In 2012 the information about presence of RF-MEMS-based adaptable impedance tuners manufactured by WiSpry within the Samsung Focus Flash Windows smartphone circulated (IHS iSuppli 2012). Then, in fall 2014, Cavendish Kinetics (CK) announced the commercial adoption of its RF-MEMS-based antenna tuning solution in the Nubia Z7 smartphone, manufactured by the Chinese ZTE Corporation (Cavendish Kinetics 2017). In early 2017, CK went public with the adoption of its RF-MEMS solutions by more than 40 LTE smartphones, including the Samsung Galaxy A8 (Cavendish Kinetics 2017). Other important players, like Qorvo, are extending the functionalities of commercial RFFEs by adopting RF-MEMS switching units, scoring remarkable figures in terms of market volumes (Morra 2017).

In conclusion, it seems RF-MEMS technology, after a nearly 20 year long trail of visions, flattering expectations and harsh disappointments, is making its way along the hype curve, towards the so-called plateau of productivity (see Fig. 1). Nonetheless, and unexpectedly enough, the main scope of this article is to point out that the just sketched scenario is not at all the conclusion, but most probably the beginning of something else.

4 The future perspective of the 5G scenario

Further ahead stands the next generation of mobile networks and devices, better known as 5G. The discussion around technical requirements and facing challenges is so broad and hectic at the moment that trying to summarise it would exceed the scopes of this article. On the other hand, gathering the driving high-level trends 5G will pursue is a much more useful exercise.

Despite transition from 4G-LTE will be rather smooth and partially overlapped in terms of early deployment, 5G will realise a complete different paradigm. Several among the services we are using today, like WiFi Internet access and video streaming, will be covered by the 5G umbrella, together with classical functionalities, like voice calls and Internet on the move access. Also importantly, machine to machine (M2M) communication data are envisaged to travel through 5G (Xiang et al. 2017). Just to mentioned a few M2M applications, autonomous driving vehicles, remote surgery and remote manufacturing are valuable examples. In simpler terms, a relevant part of the Internet of Things (IoT) data traffic will weight on 5G.

Given this landscape, it is straightforward that the demand in terms of data throughput will be massive. Many predictions appeal for an enhancement in 5G transmission capacity as huge as 1000 times with respect to 4G-LTE, delivering 10 Gb/s to each individual user. In addition, latency will need drastic reduction to millisecond-level. In order to embrace the importance of the latter requirement, one can simply wonder about how low-latency can be crucial for applications like Vehicle to Vehicle (V2V) communication. Finally yet importantly, leveraging on M2M applications, cloud computing, IoT and so on, more symmetry between downlink and uplink data transmission capacity will be demanded to 5G standard.

The way this (sort of) revolution will be made possible at implementation level, is still a hot topic for discussion. Nonetheless, some high-level trends already started to emerge quite clearly. 5G Radio Access Technologies (RATs) will leverage on three main pillars to increase the amount of transmitted data (Gammel et al. 2017):

-

(1)

Order of modulation.

-

(2)

Aggregated bandwidth.

-

(3)

Order of multiple input multiple output (MIMO) antennas.

If the first degree of freedom (DoF) is a challenge mainly at algorithm and electronic design level, the items (2) and (3) pose clear demands in terms of hardware reconfigurability. In particular, improving the aggregated bandwidth means increasing the number of carrier aggregation (CA) components. Translated in hardware specifications, this means RF transceivers will have to be highly reconfigurable and agile in fast hopping from one frequency band to another. On the other side, increasing MIMO order means having arrays/matrices of integrated antennas (e.g. 4 × 4) small enough to be employed in smartphones, and driven by high-performance RFFEs with improved switching and filtering characteristics, to minimise interferences and cross-talk.

From the point of view of mobile infrastructure, another trend on its way of consolidation is the frequency diversity across the backhaul portion of the network hierarchy. To this regard, a clear frequency divide will characterise 5G networks. The classical macro-cells, covering rather extended areas, will mainly work in the sub-6 GHz range. On the other hand, the tremendous data throughput mentioned above will be enabled via significant network densification. To this end, small-cells will be deployed, covering very limited spaces, like a single building or small metropolitan areas (e.g. the lobby of a train station or of a shopping mall). Such small-cells will enable massive data transfer working in the mm-Wave (millimetre wave) range, i.e. well-above 6 GHz. On the other hand, they will require arrays of reconfigurable antennas and RF drivers able to realise advanced beamforming and achieve, in turn, pronounced directivity and efficient area coverage.

In summary, from both perspectives of mobile handsets and infrastructure, 5G will urge for pronounced frequency agility and reconfigurability. RF transceivers will have to be very agile in aggregating multiple components, working at few GHz (below-6 GHz) as well as up to 60–70 GHz (mm-wave range). Furthermore, integrated arrays of antennas and RFFEs with boosted performance will be necessary, both for increasing MIMO order as well as to face the beamforming challenge.

Trying now to distil these functional characteristics into specifications to be achieved by RF passive components, we easily come up with the following wish list (Iannacci 2017):

-

(1)

Very-wideband switches and switching units (e.g. multiple pole multiple throw—MPMT) with low-loss (when ON), high-isolation (when OFF) and very-low adjacent channels cross-talk, working from 2 to 3 GHz up to 60–70 GHz (and more).

-

(2)

Reconfigurable filters with pronounced stopband rejection and very-low attenuation of passed band.

-

(3)

Very-wideband multi-state impedance tuners.

-

(4)

Programmable step attenuators with multiple configurations and very-flat characteristic over 60–70 GHz frequency spans.

-

(5)

Very-wideband multi-state/analogue phase shifters.

-

(6)

Hybrid devices with mixed phase shifting and programmable attenuation—functionalities described at point (4) and (5) blended into a unique device;

-

(7)

Miniaturised antennas and arrays of antennas, possibly integrated monolithically with one or more of the devices described in the previous points from (1) to (6).

5 Final discussion

Recalling the discussion developed around the market potential of RF-MEMS, a few conclusive considerations must be collected at this point. In the first place, the specifications above can be addressed with reasonably limited effort by MEMS technology. Moreover, RF-MEMS enable merging of diverse functionalities, thus opening interesting opportunities in terms of hardware complexity reduction. To this regard, it is worth mentioning the option to implement reconfigurable phase shifting and programmable attenuation of RF signals, by means of a unique passive components—point (6) above—, which could also be monolithically integrated with an array of mm-wave antennas—point (7) above.

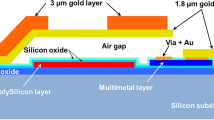

Therefore, if RF-MEMS-based products are currently on the way of consolidation in 4G-LTE applications, more room and larger market volumes are envisaged in the future 5G scenario, both concerning mobile handsets and ground infrastructures. At the moment, just a few scientific papers report RF-MEMS devices tested and verified against possible requirements of 5G (Iannacci et al. 2016, 2010a; Iannacci and Tschoban 2017) (see Fig. 2).

However, more work along this direction will be developed and made public later on. In the very end, after all the struggle RF-MEMS went through since the first discussion 20 years ago, the future of the hype curve cycle might more pleasantly look like the one in Fig. 3.

References

Allan R (2013) RF MEMS switches are primed for mass-market applications. http://www.mwrf.com/active-components/rf-mems-switches-are-primed-mass-market-applications. Accessed 22 Nov 2017

Cavendish Kinetics (2017) News releases. http://www.cavendish-kinetics.com/news/news-releases/. Accessed 22 Nov 2017

Gammel P, Pehlke DR, Brunel D, Kovacic SJ, Walsh K (2017) 5G in perspective: a pragmatic guide to what’s next. http://www.skyworksinc.com/downloads/literature/Skyworks-5G%20White-Paper.pdf. Accessed 22 Nov 2017

Gartner Hype Cycle (2017). https://www.gartner.com/technology/research/methodologies/hype-cycle.jsp. Accessed 22 Nov 2017

Iannacci J (2013) Practical guide to RF-MEMS. Wiley-VCH, Weinheim

Iannacci J (2015a) RF-MEMS: an enabling technology for modern wireless systems bearing a market potential still not fully displayed. Springer Microsyst Technol 21:2039–2052. https://doi.org/10.1007/s00542-015-2665-6

Iannacci J (2015b) Reliability of MEMS: a perspective on failure mechanisms, improvement solutions and best practices at development level. Elsevier Disp 37:62–71. https://doi.org/10.1016/j.displa.2014.08.003

Iannacci J (2017) RF-MEMS technology for high-performance passives: the challenge of 5G mobile applications. IOP Publishing, Bristol. https://doi.org/10.1088/978-0-7503-1545-6

Iannacci J, Tschoban C (2017) RF-MEMS for future mobile applications: experimental verification of a reconfigurable 8-bit power attenuator up to 110 GHz. J Micromech Microeng (IOP-JMM) 27:1–11. https://doi.org/10.1088/1361-6439/aa5f2c

Iannacci J, Faes A, Mastri F, Masotti D, Rizzoli V (2010) A MEMS-based wide-band multi-state power attenuator for radio frequency and microwave applications. In: Proceedings of the 2010 NSTI nanotechnology conference and expo, vol 2, pp 328–331

Iannacci J, Repchankova A, Faes A, Tazzoli A, Meneghesso G, Dalla Betta G-F (2010b) Enhancement of RF-MEMS switch reliability through an active anti-stiction heat-based mechanism. Elsevier Microelectron Reliab 50:1599–1603. https://doi.org/10.1016/j.microrel.2010.07.108

Iannacci J, Huhn M, Tschoban C, Potter H (2016) RF-MEMS technology for 5G: series and shunt attenuator modules demonstrated up to 110 GHz. IEEE Electron Device Lett 37:1336–1339. https://doi.org/10.1109/LED.2016.2604426

IHS iSuppli (2012) teardown analysis service identifies first use of RF MEMS part, set to be next big thing in cellphone radios. http://news.ihsmarkit.com/press-release/design-supply-chain/ihs-isuppli-teardown-analysis-service-identifies-first-use-rf-mems. Accessed 22 Nov 2017

Morra J (2017) Chip makers build fortunes from RF MEMS. http://www.mwrf.com/semiconductors/chip-makers-build-fortunes-rf-mems?NL=MWRF-001&Issue=MWRF-001_20170601_MWRF-001_724&sfvc4enews=42&cl=article_1&utm_rid=CPG05000006522536&utm_campaign=11360&utm_medium=email&elq2=ceb10e54a8c5428886d074fe32a536dc. Accessed 22 Nov 2017

Nguyen CT-C (2001) Transceiver front-end architectures using vibrating micromechanical signal processors. In: Topical meeting on silicon monolithic integrated circuits in RF systems, pp 23–32. https://doi.org/10.1109/smic.2001.942335

Xiang W, Zheng K, Shen XS (eds) (2017) 5G mobile communications. Springer, Berlin. https://doi.org/10.1007/978-3-319-34208-5

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Iannacci, J. Surfing the hype curve of RF-MEMS passive components: towards the 5th generation (5G) of mobile networks. Microsyst Technol 24, 3227–3231 (2018). https://doi.org/10.1007/s00542-018-3718-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00542-018-3718-4