Abstract

Background

Since 1997, the Fellowship Council (FC) has evolved into a robust organization responsible for the advanced training of nearly half of the US residency graduates entering general surgery practice. While FC fellowships are competitive (55% match rate) and offer outstanding educational experiences, funding is arguably vulnerable. This study aimed to investigate the current funding models of FC fellowships.

Methods

Under an IRB-approved protocol, an electronic survey was administered to 167 FC programs with subsequent phone interviews to collect data on total cost and funding sources. De-identified data were also obtained via 2020–2021 Foundation for Surgical Fellowships (FSF) grant applications. Means and ranges are reported.

Results

Data were obtained from 59 programs (35% response rate) via the FC survey and 116 programs via FSF applications; the average cost to train one fellow per year was $107,957 and $110,816, respectively. Most programs utilized departmental and grants funds. Additionally, 36% (FC data) to 39% (FSF data) of programs indicated billing for their fellow, generating on average $74,824 ($15,000–200,000) and $33,281 ($11,500–66,259), respectively. FC data documented that 14% of programs generated net positive revenue, whereas FSF data documented that all programs were budget-neutral.

Conclusion

Both data sets yielded similar overall results, supporting the accuracy of our findings. Expenses varied widely, which may, in part, be due to regional cost differences. Most programs relied on multiple funding sources. A minority were able to generate a positive revenue stream. Although fewer than half of programs billed for their fellow, this source accounted for substantial revenue. Institutional support and external grant funding have continued to be important sources for the majority of programs as well. Given the value of these fellowships and inherent vulnerabilities associated with graduate medical education funding, alternative grant funding models and standardization of annual financial reporting are encouraged.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

When Minimally Invasive Surgery (MIS) techniques were introduced in the early 1990’s and subsequently rapidly adopted, the need for additional robust training opportunities became evident. To address this need, the Minimally Invasive Surgery Fellowship Council (MISFC) was established in 1997. This organization evolved further to incorporate specific areas of gastrointestinal (GI) surgery and was renamed the Fellowship Council (FC). The goals of establishing the FC were to (1) define and unify an application and selection process for fellowship candidates; (2) establish a forum for programs to exchange ideas; (3) standardize the quality of fellowship training through guidelines and accreditations [1]. Fellowship types currently include: Advanced Colorectal, Advanced GI, Advanced GI/MIS, Advanced Thoracic, Bariatric, Flexible Endoscopy, and Hepatopancreaticobiliary (HPB). Even with the substantial growth in the number of these fellowships, the FC has succeeded in providing high-quality educational offerings [2]. Impressively, the demand for these fellowships has risen substantially. When the matching process was established in 2004, there were 80 programs offering 113 positions to 130 applicants with a match rate of 87%. By comparison, in 2020, there were 153 programs offering 195 positions to 353 applicants with a match rate of 55% [3].

Despite the rigorous nature of its accreditation processes, the FC has chosen to remain outside of traditional Accreditation Council of Graduate Medical Education (ACGME) oversight [4]. This alternative pathway has allowed the FC to be nimble and creative [5]. For example, the FC framework allows substantial opportunities for graduated autonomy [6]. To become a member of the FC, a program must incorporate a transition-to-practice component by implementing a curriculum “designed such that transition to independent practice is emphasized” [7]. In fact, many institutions under the FC umbrella provide their fellows with a junior faculty level appointment. Such experiences with independent practice and call responsibilities are consistent with the educational goals of graduating practice-ready surgeons. Additionally, many programs are able to generate revenue by their fellows billing for such independent services. Given the significant difficulties associated with funding Graduate Medical Education (GME) training, this has become particularly relevant in recent years [8].

Traditionally, many FC programs received funding directly from industry for fellowship salary support. However, over the past decade, such relationships between healthcare providers and industry faced increased scrutiny [9]. The Physicians Payment Sunshine Act was implemented in 2010 to better enforce transparency of such financial relationships [10]. Leaders from the FC and its sponsoring societies decided that a new method for handling grant funding was needed [11]. As a result, the Foundation of Surgical Fellowships (FSF) was created in 2010. The FSF was charged with the goal of providing an independent body to receive grant funding from industry and other partners, and to establish a structured process for distribution of funds [12]. Moreover, obtaining FSF funding has been a competitive process with awards based on applications deemed most meritorious based on clinical volume, scholarly work, and other relevant metrics.

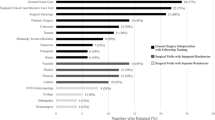

Unfortunately, due to economic constraints and changes in corporate strategies, the monies available from FSF grants have decreased considerably. For instance, in 2011, the average award amount was $62,500 per program and 142 programs received funding. By comparison, in 2019, the average award amount was $20,000 per program and 138 programs received funding (Fig. 1). Fortunately, this change occurred over a multi-year period and allowed FC members to explore alternative sources of funding. As a result, the number of programs within the FC did not seem to be affected. However, it has become evident that a wide variety of practices have evolved. The specific methods of how programs are garnering sufficient financial resources to cover the salary and expenses of their fellows has not been closely examined. The purpose of this project was to investigate current funding models of FC fellowships and to identify examples of models that have been particularly successful.

Materials and methods

This project was approved by the UT Southwestern Medical Center Institutional Review Board, the FC Research Committee and Board of Directors, and the FSF Executive Committee.

The total cost and sources of funding for current FC-accredited fellowships were assessed through two different data sources, namely through the FC and the FSF. In both methodologies, the components that determined the total cost of a fellowship included salary, benefits, malpractice, and academic allotment (support for attending meetings, educational materials, moving allowances, licensing fees); similarly, the components for sources of funding included departmental, hospital, grants (FSF grant, industry, endowments), and billing by the fellow. The FSF survey also included a specific question which asked whether their program billed for their fellow. A subset of programs offer two or more years of fellowship training; in these instances, data were collected only for first year fellows.

For data collected through the FC, an electronic survey was administered to all FC-accredited programs (n = 167); the identity of these programs was not blinded. The survey was distributed by the FC as part of an organization-sponsored project. Two rounds of follow-up email reminders were conducted in an effort to maximize the response rate. Additionally, a single trained research team member (JL) contacted all programs with incomplete survey data; for programs that responded, scripted phone interviews were conducted to complete the data collection. Data collected during phone interviews (average call lasting 10–15 min) were mainly gathered from program coordinators and more rarely from program directors. For data collected through the FSF, financial information was obtained via a de-identified data set from the 2020–2021 fellowship grant applications collected by the FSF from 116 fellowship programs.

Initial analysis of data calculated the total cost and funding received per program for both the FC and FSF data sets. These values were evaluated to determine either a positive, negative, or neutral revenue per program. For both methodologies, if individual data fields were left incomplete or unknown by the program, the group mean for that parameter was used to calculate the total cost for each program in that data set.

To evaluate the relationship between the overall cost and the Cost of Living (COL) for the state in which the program resided, a correlation analysis was performed on SigmaPlot using a Linear Regression (Systat Software, San Jose, CA). Only FC data for programs in the USA were used. Outliers were defined as programs having total cost beyond the 95th percentile or below the 5th percentile for the group and were excluded. The remaining programs were grouped by state, and the average total cost per program within each state was used for the COL analysis. COL values were obtained from publicly available information and calculated based on the average cost of housing, gas, food, clothing, and other everyday items in a specific state [13]. The base COL value is set at 100 with higher values indicating a higher cost of living.

Results

Data were obtained from 59 programs (35% response rate) via the FC survey and 116 programs via FSF applications. Out of the 531 data fields in the FC data set, 35 fields (6.6%) were missing. Out of the 1044 data fields in the FSF data set, 47 fields (4.5%) were missing. For both data sets, missing fields were confined to the categories of malpractice and fringe benefits, and the group parameter means were used to calculate total cost for each program.

Range and average total cost with breakdowns for salary, benefits, malpractice, and academic allotment per fellow from both methodologies are shown in Table 1. The results from the FC and FSF data indicated that the total average cost to train one fellow per year was $107,957 and $110,816, respectively. Both methods indicated similar average cost for each of the four components and total cost; considerable variability in ranges was noted across programs (Fig. 2).

Figure 3 represents the percentage of programs that received funding from each of the four sources, regardless of the amount. The majority of programs received funding from departmental and grant sources. The FC data indicated that 75% of programs were awarded grants and the FSF data showed that 98% of the programs received grants. Of the programs receiving grants, only one program received grants exclusively from non-FSF funding ($65,000 industry grant) and all other programs received FSF grant funding ($20,000) with or without additional grants. The additional grant sources included industry (8.5% of all programs per FC data (range $5000–65,000) and 1.7% per FSF data (range $4500–22,174)) and endowments (16.9% of all programs per FC data (range $1600–44,658) and 2.6% per FSF data (range $15,695–31,026)).

FC and FSF data indicated that programs received an average of $109,118 and $110,816, respectively. Regarding the amount of revenue generated by each funding source, departmental sources accounted for the largest portion of overall funding for both FC and FSF data (Fig. 4). Funding amounts were similar for hospital and grant contributions between data sets.

Additionally, 36% (FC survey) of the programs indicated that they billed for their fellow. Of note, 45 (39%) programs from the FSF data set indicated that they billed for their fellow, but only six of these programs reported the amount of revenue generated from this source. For programs that declared a dollar amount for billing, the FC data indicated that they generated an average of $74,824 (range $15,000–200,000) in revenue, which accounted for 57.7% of their total funds; by comparison, FSF data indicated an average of $33,281 (range $11,500–66,259) in billing revenue, which accounted for 33.8% of total funds for these programs. When analyzing the amount of revenue generated by billing for fellows across all the programs, FC data indicated that billing revenue accounted for 21% of all funds received and FSF data indicated that billing accounted for only 2% of all funding (Fig. 4).

FC data indicated that 8 (14%) programs generated a net positive revenue [average surplus of $16,722 (range $205–57,848)] and 51 (86%) programs were budget-neutral. For the revenue-generating programs, six programs billed for their fellows, six received grant funding, and five did both. Only one program received all support needed from billing for their fellow. FSF data revealed that none of the programs generated net positive revenue and that all programs were budget-neutral.

For the COL analysis, of 59 programs in the FC data set, five were outside of the USA and three were excluded as outliers (two were above the 95th percentile and one was below the 5th percentile). The remaining 51 programs represented 22 states. The analysis showed a significant correlation (R = 0.65, p < 0.0011) between total cost and COL (Fig. 5).

Discussion

Most educators would agree that the funding model for GME learners in the USA is outdated and insufficient. For example, to receive funding from Medicare, ACGME-accredited programs must use an obsolete system in which the number of funded positions was capped in 1997 and funding amounts were fixed at 1984 levels. Non-ACGME programs, such as FC fellowships, are abundant and may offer learning opportunities without some of the constraints associated with the ACGME pathway, but are not eligible for Medicare funding. We undertook this study to better understand the funding mechanisms currently used by FC programs. The best available information was collected from FC and FSF sources. Our data indicated that the average total cost of hosting a fellowship for 1 year was $107,957–110,816. According to both data sets, the most frequent sources of funding were grants and departmental sources followed by billing and hospital support. These results seem robust given the overall agreement between data sets.

The most notable difference between data sets was the revenue amount generated from billing. FC data indicated that 36% of programs billed for their fellow, and this source generated an average of $72,824 from the 21 programs that reported a value. FSF data stated that 45 (39%) programs billed for their fellow but only six programs reported billing revenue as part of their funding, with an average amount of $33,281. A possible explanation for this stark difference could be the method with which the data were collected. Even though the FSF does not promote or state financial need as a factor in making their grant decisions, programs may still perceive that exhibiting a financial need is a determining factor. Hence, programs might be motivated to underreport funding such as billing revenue, especially if doing so would show any net positive balance on their grant application. However, through the FC survey, these confounding influences were likely not present. Indeed, of the eight programs that reported net positive revenues in the FC data set, six programs billed for their fellows and five of the six programs’ funds were heavily impacted (61–100%) by billing. Moreover, FC data showed that for all programs that billed, 57.7% of cost was covered by this single source. Despite the substantial positive financial impact, both data sets indicated that well less than half of the programs utilized billing for fellows. The reason that many programs do not bill for their fellow are not well documented, but issues related to institutional regulations, such as an inability to appoint fellows as junior faculty may play a role. Additionally, fellows on various visas may not be eligible for faculty appointments. Given the apparent utility in billing as a means of providing significant support for fellowship costs, we hope that our data may be useful for programs to justify more widespread adoption of this practice.

While billing seemed to be a particularly important funding source, our data indicated that programs almost universally relied on multiple sources. Institutional resources, including departmental and hospital support, provided 59–79% of funding and represented a substantial portion. Moreover, the vast majority of programs (90% per FC data and 100% per FSF data) received such institutional support (Fig. 4). These findings seem to indicate that institutions recognize the educational quality and value of these fellowships. Certainly, having a fellowship program yields numerous additional benefits. Productivity of the program director and teaching faculty may be one of the most important aspects to acknowledge. Fellows are integrated into both outpatient and inpatient settings and function at a high level; many surgeons would argue that their fellows allow them to care for many more patients than they would be able to otherwise. Similarly, by seeing consults, supervising residents, and supplanting the need for attending involvement in a variety of circumstances, faculty are freed up for other responsibilities, such as administrative duties or research pursuits. In many environments, fellows obviate the need for a second attending or a surgical first assistance to scrub on complex cases. Numerous programs also assign their fellow to take emergency general surgery call, often to fulfill the FC requirement for programs to have a transition-to-practice component. While these factors were not directly accounted for in the financial analysis of our study, it is clear that FC fellowships provide important benefits. Certainly, increased financial, administrative, and academic productivity are solid arguments to justify the level of institutional support our study documented for the majority of programs.

Most programs (75–98%) relied on grant funding as well, with both data sets indicating that about 20% of overall funds were obtained via grants (Figs. 3 and 4). All but one of these programs received grant funding from the FSF. Although the FSF grant amount was only $20,000 per program, these findings suggest that FSF funding remains a core part of funding for the majority of programs. It is also important to note, that many programs which receive FSF funding have more than one fellowship position and all of their positions are often not funded. For example, the FSF had applications from 118 programs for 2020–2021, but support was requested for 161 positions. Thus, many fellowship positions remain unfunded by this mechanism and there is still a substantial need to fund more positions. Interestingly, our data indicated that up to 24% (FC data) also received funding from industry grants or endowments, which was somewhat surprising given the overall scrutiny of relations between institutions and industry.

The variability in cost among programs was dramatic. For instance, salary varied by as much as $50,000 and malpractice cost varied by as much as $119,500 according to FC data; even higher variations were seen according to FSF data (Table 1). With regard to salary, the amount has been left up individual institutions with the expectation that it should be set at the PGY-6 level; however, specific criteria have not been delineated in the FC Core Program Requirements [14]. Our findings suggest that the FC may wish to explore whether there is a need for more uniform expectations and monitoring of salary levels as part of its accreditation process. Variability in costs may also be heavily influenced by regional differences. Certainly, the variability in malpractice supports this premise, as cost can differ greatly between states. Indeed, our analysis found a significant correlation (R = 0.65) between total cost for programs and the COL for their state (Fig. 5). A COL-based approach may be helpful in developing standards for salary levels and for grant agencies in tailoring their awards to recognize regional differences in costs.

While this study represents the most complete examination of FC fellowship funding cost to date, we encountered significant challenges in conducting this study and there were inherent limitations. First, these data were difficult to obtain. Despite having full FC support and sending out multiple reminders, we had to rely on a dedicated research assistant and a phone interview process in an attempt to get complete FC survey data from a representative cohort of programs. These intensive efforts yielded a response rate of 35%, which likely represents a hesitancy for programs to share financial information that is considered to be sensitive by many. Fortunately, this equated to 59 programs from a wide geographic area, including 22 states, and seemed to be a reasonable representation. Additionally, 16 of these programs did not receive FSF grants and provided unique information compared to the FSF data. The majority of these data were obtained from program coordinators (rather than program directors), who may not have had access to all relevant financial information. Even with complete access, it may be difficult to delineate the exact sources of funding given the complex accounting practices of many academic institutions. Nonetheless, only 6.6% of individual data parameters were missing in the FC data set. Second, the FSF data were much easier to obtain and offered an opportunity to corroborate the FC data set but were associated with their own limitations. By definition, these applications were submitted by programs desiring financial assistance. Hence, these data may have been skewed toward programs with higher expenses. However, the cost data (Table 1) document similar cost between FC and FSF data. With regard to funding sources, we suspect that the FSF data were skewed toward providing incomplete information about billing revenue, as mentioned above, and all programs were budget-neutral. Thus, it is conceivable that some of these programs may have generated positive revenue, as seen in 14% of programs according to FC data. Additionally, the FSF data were de-identified such that a direct comparison of FC and FSF data was not possible, nor was inclusion in the COL analysis. We also did not collect any information regarding moonlighting and whether monies generated from such activities were counted in the funds reported. Hence, it might be optimal moving forward for the FC to collect confidential financial information from all programs on a regular basis such that programs would become adept at reporting accurate and complete information and feel comfortable doing so. Such information may be useful in establishing standards, identifying best practices, documenting trends over time, and garnering external support for programs in need.

In summary, funding models have evolved from direct industry support to support through the FSF and other sources. This study documented the ways in which programs have adapted to decrease in traditional grant support. Current models rely on a blend of internal and external sources. The most financially successful practices include a significant component related to billing, and more widespread adoption of this practice is encouraged. Additionally, further work on the financial aspects of FC fellowships represents an opportunity to help this area evolve further.

References

Swanstrom LL, Park A, Arregui M, Franklin M, Smith CD, Blaney C (2006) Bringing order to the chaos: developing a matching process for minimally invasive and gastrointestinal postgraduate fellowships. Ann Surg 243(4):431–435

Weis JJ, Alseidi A, Jeyarajah DR, Schweitzer M, Hori Y, Scott DJ (2019) Providing complex GI surgical care with minimally invasive approaches: a survey of the practice patterns of fellowship council alumni. Surg Endosc. https://doi.org/10.1007/s00464-019-06929-1

Matching Process Statistics [Internet]. https://fellowshipcouncil.org/fellowship-programs/matching-process-statistics Accessed 25 Feb 2020

Fowler DL, Hogle NJ (2013) The fellowship council: a decade of impact on surgical training. Surg Endosc 27(10):3548–3554

Weis JJ, Goldblatt M, Pryor AD, Schultz L, Scott DJ (2019) SAGES advanced GI/MIS fellowship redesign: pilot results and adoption of new standards. Surg Endosc 33:3056–3061

Richardson JD (2013) ACS transition to practice program offers residents additional opportunities to hone skills. Bull Am Coll Surg 98(9):23–27

Membership Requirements and Application [Internet]. https://fellowshipcouncil.org/fellowship-programs/membership-requirements-and-applications/. Accessed 25 Feb 2020

Evensen A, Duffy S, Dawe R, Pike A, Nelson BD (2019) Status of global health fellowship training in the United States and Canada. Can Med Educ J. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6892312/. Accessed 25 Feb 2020

Buyske J, Easter D, Forde K, Holzman M, Melvin WS, Schirmer B, Schwaitzberg S, Scott D, Smith CD, Talamini M (2010) Society of American Gastrointestinal and Endoscopic Surgeons (SAGES) statement on the relationship between professional medical associations and industry. Surg Endosc 24:742–744

Richardson E (2020) The physician payments sunshine act [Interne]. Health Affairs, Bethesda. https://www.healthaffairs.org/do/10.1377/hpb20141002.272302/full/ Accessed 25 Feb 2020

Schultz L (2020) An update from the foundation for surgical fellowships: growing need requires broader support [Internet]. Bariatric Times, Westchester. https://bariatrictimes.com/an-update-from-the-foundation-for-surgical-fellowships-growing-need-requires-broader-support/ Accessed 25 Feb 2020

Learn [Internet]. Foundation for Surgical Fellowships, Los Angeles. https://www.surgicalfellowships.org/about/learn Accessed 26 Feb 2020

Cost of Living Index by State 2020 [Internet]. Missouri Economic Research and Information Center, Jefferson City. https://worldpopulationreview.com/states/cost-of-living-index-by-state/ Accessed 27 Feb 2020

Fellowship Council Accreditation, Core Curriculum and Program Requirements [Internet]. The Fellowship Council. https://fellowshipcouncil.org/about/program-guidelines/. Accessed 13 Mar 2020

Acknowledgements

This manuscript was reviewed and approved by the Fellowship Council (FC) Board of Directors and the Foundation for Surgical Fellowships (FSF) Board.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Disclosures

Ms. Hori reports being the employee-executive director for The Fellowship Council, outside the submitted work. Ms. Schultz reports being the employee-executive director for the Foundation for Surgical Fellowships (FSF). Drs. Lee, Weis, Talamani, Nagaraj, and Scott have no conflicts of interest or financial ties to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Podium Presentation at SAGES 2020 Annual Meeting, Cleveland, Ohio.

Rights and permissions

About this article

Cite this article

Lee, J.H., Weis, J.J., Talamini, M.A. et al. Thriving or surviving? A critical examination of funding models for fellowship council fellowships. Surg Endosc 36, 2607–2613 (2022). https://doi.org/10.1007/s00464-021-08553-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00464-021-08553-4