Abstract

We study the matching of workers to firms in which workers choose an observable and contractable effort after the match. If there are complementarities between a worker’s ability and a firm’s technology, positive assortative matching (PAM) is the only matching in any equilibrium and is the unique efficient matching. We investigate the effect of a policy that changes the matching of firms to workers from any matching to PAM, such as implementing a centralized clearing house. We characterize two sets of sufficient conditions on the production and cost functions under which the total output and welfare both increase. Under the first set of conditions, the increase in total output is an upper bound for the efficiency gain. In contrast, under the second set of conditions, the increase in total output is a lower bound for the efficiency gain. We identify a third set of conditions under which the total output decreases while welfare increases.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A classic question in economics is the welfare consequences of different allocations of heterogeneous workers to heterogeneous firms. The total surplus of all firms and all workers, welfare, is unobservable because the cost of providing effective labor to the workers is not observable by researchers. Many researchers in the empirical literature use the change in the total output as a proxy for the change in welfare. We study a standard one-to-one matching model of heterogeneous workers to heterogeneous firms in which workers choose an observable and contractable effort after the matching. The effort can be either the hours of labor a worker supplies or another contractable measure of effective labor, such as production of a worker in a piece rate contract (e.g., see Lazear 2000). Within our model, the total output measures the welfare, the total surplus of workers and firms, only if the effective labor supplied by workers does not depend on the firm they are matched with. If labor is a complement to or a substitute for a firm’s technology, then the marginal product of labor is different when a worker is matched with a more productive firm; therefore, a worker’s effort choice is different when he/she matches with a more productive firm. We specify a set of conditions on the production function such that the increase in welfare as a result of moving from any matching of workers to firms to the positive assortative matching, which is the only equilibrium matching in the model, can result in a lower output. This opposite movement of welfare and output is due to the fact that better workers work less at better firms; hence, production falls even though welfare has improved. Moreover, when the increase in welfare coincides with an increase in total output, we provide conditions where the increase in total output is an upper or lower bound for the increase in welfare.

We show that when one considers the endogenous labor choice of workers, relaxing the assumption of fixed hours of labor supply, the total output can be a misleading measure of welfare: Change in total output may be an upper or lower bound for an increase in the total surplus; moreover, the total output may decrease when the total surplus increases. We characterize three sets of sufficient conditions on the production and cost functions. Under the first set of conditions, if the total surplus increases, the total output increases more. Under the second set of conditions, if the total surplus increases, the total output increases but the increase is less than the increase in the total surplus. Under the third set of conditions, if the total surplus increases, the total output decreases. To our knowledge, we are the first to model this problem formally. We show that the change in the total output is a misleading measure of efficiency gains. We specify whether the bias is upward or downward and when the total output changes in the opposite direction of welfare.

We develop a model in which firms post personalized wage schedules before matching with workers, and in which, after the matching stage, workers choose an amount of labor.Footnote 1 An equilibrium outcome in this setting is a collection of wages, the induced matching, and the induced effort levels that we formally define in Sect. 2.1. Bulow and Levin (2006), Crawford (2008), and Jungbauer (2021) study equilibrium behavior in matching markets with wage posting. We study the similar problem of matching with wage posting; however, in our model, there is an endogenous effort choice after the matching. Moreover, in those models, the main question is the comparison of equilibrium outcome and competitive outcome. In our model, these two coincide and the main question is the comparison between welfare and output. In Bulow and Levin (2006), there is a gap between wages in equilibrium outcome and competitive outcome. Crawford (2008) shows that allowing multiple contracts for each job causes this gap to vanish. Jungbauer (2021) shows that in many to one matching with wages there is an inefficiency in allocation of workers to firms that is not present in one-to-one matching with wage posting. Shahdadi (2021) studies the matching with an endogenous effort choice after the matching stage. While one may find certain similarities in the intuition for some of the results, the models in Shahdadi (2021) and this paper are completely different. Unlike the present model, the effort choice is neither observable nor contractable, utility is non-transferable, and neither equilibrium nor the stability of the matching is discussed in Shahdadi (2021). In contrast, in our model, there are multiple contracts for each job and the effort is observable and contractable. Moreover, we study a transferable utility setting in which a firm can motivate higher effort by paying more money. First, we find all equilibria, which we define by combining both notions of stable matching and Nash equilibrium; then, we study the properties of these equilibria compared with other assignments of workers to firms. Finally, our main results are about the disconnect of welfare and output resulting from the cost of effort. In Shahdadi (2021), the cost of providing effort does not play any role in the results and is not studied. Note that none of these four papers study the relationship between welfare and output or any other proxy for welfare.

We use the effort as an arbitrary contractable measure of effective labor supplied by workers. A natural interpenetration is the number of hours of labor that are observable. There is evidence against fixed hours of labor in multiple literatures. In the business cycle literature, Ohanian and Raffo (2012) states that: “we show that employment is a poor proxy for labor input in many OECD countries, as changes in hours per worker are about as large as changes in employment.” In the macro search literature, Lise et al. (2015b) report that they “find mixed evidence in support of the assumption of fixed hours of labor supply.” In the CEO compensation literature, the flexibility in hours of labor that a CEO provides is a standard assumption.Footnote 2 On the other hand, we can interpret the effort as the output of the worker. Given this interpretation, the assumption of constant effort, fixed output per worker, is not plausible when we look at the performance pay compensation systems. For example, in Lazear (2000), there is evidence of change in output per worker as a result of a change in the compensation contract. Note that any measure of performance that one uses to pay a worker can be used as effort in our model. In other words, effort can be any observable and contractable measure that a performance-related pay scheme uses.

The model is consistent with some empirical finding that may seem in contradiction with the assumption that there is a complementarity between the worker’s ability and the firm’s technology. For example, our results are consistent with better workers working fewer hours compared with other workers. More concretely, if the production function is submodular in labor and worker’s ability, submodular in labor and firm’s technology, and supermodular in worker’s ability and firm’s technology, better workers match with better firms and they work less. In other words, in any equilibrium, the most able worker is matched with the firm with the highest technology and the most able worker works less than all other workers. Hagedorn et al. (2017)’s findings is one example. They use a large German matched employer-employee data set to estimate the production function. They find that output-maximizing assignment of firms and workers delivers higher output than under PAM.Footnote 3 Hence, they state that the production function is not globally supermodular. We show that, even if the production function is globally supermodular in workers’ type and firms’ type, the output-maximizing assignment can be different from PAM because of the labor choice of workers.

Even though many economists have noted that the total output (GDP) is a flawed measure of economic welfare, many researchers in the empirical literature, especially in the macro search literature, use GDP instead of the total surplus as a proxy for welfare. Hsieh et al. (2019) use aggregate output per worker to measure the macroeconomic consequences of the convergence in the occupational distribution between white men, women, and blacks, which captures the change in the allocation of talent to occupations.Footnote 4 Hagedorn et al. (2017) use output as the objective of the optimal assignment of workers to firms under different assumptions about the production function of a matched worker-firm pair. Lise et al. (2015a) develop an empirical search-matching model to estimate the potential gain from optimal regulation. They define optimal policy as the policy that maximizes total output and home production. Jones and Klenow (2016) states “Leisure, inequality, mortality, morbidity, crime, and the natural environment are just some of the major factors affecting living standards within a country that are incorporated imperfectly, if at all, in GDP.” In our model, we shut down all the channels that make GDP a flawed measure of economic welfare, such as inequality, mortality, morbidity, crime, and the natural environment, except for the cost of labor that workers supply, even though the workers are compensated for the cost of labor that they provide. Stated differently, we show that the change in effective labor supply can result in a disconnect between changes in GDP and changes in welfare because the GDP does not take into account the change in the cost of labor for workers.

In Sect. 2, we formally describe the model and define the appropriate notion of equilibrium for this model. In Sect. 3, we define a benchmark contract between a given worker and a firm in this setting and the induced effort choice under this contract; then, we show that the social planner chooses this effort level for any matched worker-firm pair. Moreover, the social planner chooses positive assortative matching as the efficient matching. In Sect. 4, we show that an equilibrium exists, and the equilibrium outcome is unique and efficient. In Sect. 5, we provide an example in which the production function is strictly supermodular in firm’s technology and worker’s ability. However, the total output is the same under any matching. In this example, the total surplus is strictly higher under PAM than under any other matching. The main results are presented in Sect. 5, where we show that the efficiency always increases when all frictions in a labor market are eliminated; however, the increase or decrease in the total output depends on the sign and magnitude of the third derivative of the production function.

2 Model

There is a finite set of workers I and a finite set of firms J, where \(|I|=|J|\). Worker \(i \in I\) has an ability, or the worker’s type; we denote worker i’s ability by i. If \(i < i^\prime\), then worker i has a lower ability than worker \(i^\prime\). Firm \(j \in J\) has a technology, the firm’s type, which we denote by j. If \(j < j^\prime\), then firm j has a lower level of technology than firm \(j^\prime\). The types of all firms and workers are common knowledge. A matching is a one-to-one mapping \(\mu : I \rightarrow J\) that assigns each worker to a firm. Worker i chooses an effort \(e \in [0,1]\) after assignment to a firm. We use the words effort and labor interchangeably. Effort is observable and contractable. Worker i’s utility from being matched to firm j and exerting effort e is \(u(i,j,e)= w(i,j,e) - c(e)\), where w(i, j, e) is the wage worker i gets if he/she matches with firm j and exerts effort e and c(e) is the cost of exerting effort e.Footnote 5 The reservation wage is zero for all workers. Firm j’s production (output) when matched with worker i who exerts effort e, is v(i, j, e); hence, firm j’s profit is \(\pi (i,j,e) = v(i,j,e)- w(i,j,e)\). Denote the surplus of the matched pair of firm j to worker i who exerts effort e by \(s(i,j,e)= u(i,j,e) + \pi (i,j,e) = v(i,j,e) - c(e)\).

The market unfolds in four stages:

-

(i)

Firms announce personalized wage schedules: \(\{ w(i,j,e) \}_{e \in [0,1], i \in I, j \in J}\).

-

(ii)

Firms and workers match in the matching stage.

-

(iii)

Each worker chooses a utility maximizing effort level given the matching and wage schedule.

-

(iv)

Each worker receives a wage based on the wage schedule and effort choice.

We model the matching stage as a cooperative game. For any worker-firm pair, given the wage schedule and the anticipated worker’s effort choice, the worker knows the utility that he/she gets from the match. Moreover, given the wage schedule and the anticipated worker’s effort choice, the firm knows its profit in the match. We assume that, if a worker is indifferent between two firms, he/she will rank firms based on the firm technology; i.e., ties are broken in favor of the most efficient match.

We derive our results under a set of standard assumptions, as we want to show that, even under these assumptions, a change in the total output does not measure the change in the total surplus.

Assumption 1

-

1.

v(i, j, e) and c(e) are three times continuously differentiable.

-

2.

c(e) is strictly increasing and convex.

-

3.

v(i, j, e) is strictly increasing, v(i, j, e) is concave in effort, and \(\frac{\partial ^2 (v(i,j,e)-c(e))}{\partial e^2} < 0\).

-

4.

\(\forall i, j: v(i,j,0) =c(0)=0, \exists \epsilon> 0: v(i,j,\epsilon ) - c(\epsilon ) >0\), and \(v(i,j,1) - c(1) < 0\).

-

5.

s(i, j, e) has strictly increasing differences in worker’s type i and firm’s type j; i.e., \(s_{i j}(i,j,e) > 0\).

The first four parts are mainly technical assumptions which ensure that the problem of maximizing the surplus of a worker-firm pair over different labor choices has an interior solution. The last part states that there is a complementarity between a firm’s technology and a worker’s ability in the production.Footnote 6 All five parts of Assumption 1 are standard assumptions.

Assumption 2

-

1.

s(i, j, e) has increasing differences in worker’s type i and effort; i.e., \(s_{i e}(i,j,e) \ge 0\).

-

2.

s(i, j, e) has increasing differences in firm’s type j and effort; i.e., \(s_{j e}(i,j,e) \ge 0\).

Assumption 3

-

1.

s(i, j, e) has decreasing differences in worker’s type i and effort; i.e., \(s_{i e}(i,j,e) \le 0\).

-

2.

s(i, j, e) has decreasing differences in firm’s type j and effort; i.e., \(s_{j e}(i,j,e) \le 0\).

Under Assumption 2, there is a complementarity between labor and the firm’s technology and between labor and the worker’s ability. In contrast, under Assumption 3, labor is a substitute for the firm’s technology and for the worker’s ability. Most of our results hold under either of these assumptions.

2.1 Contracting Equilibrium

In this section, we define a contracting equilibrium and the outcome of an equilibrium. The definition of equilibrium combines two notions of equilibria, cooperative and noncooperative, with the requirement that they hold for all histories. This equilibrium definition is not restricted to a frictionless market.Footnote 7

Following Cole et al. (2001), we define a contracting equilibrium as wage schedules for all firms and workers (on and off the equilibrium path) \(\{ {\hat{w}}(i,j,e) \}_{e \in [0,1], i \in I, j \in J}\), workers’ effort choice \(\{{\hat{e}}(i,j)\}_{i \in I, j \in J}\), and the matching of firm and workers such that:

-

1.

Firms maximize their profits given other firms’ and workers’ strategy.

-

2.

Given the matching and wage schedule, each worker chooses an effort that maximizes his/her utility on and off the equilibrium path; i.e., \({\hat{e}}(i,j) \in \textrm{argmax}_{e \in [0,1]} u(i,j,{\hat{w}}(i,j,e))\).

-

3.

The matching is stable. More concretely, (i) there is no worker, firm, wage schedule between them, and an effort choice such that both the worker and the firm strictly prefer it to their current match (no blocking pair). (ii) Each worker gets at least zero utility, and each firm makes a positive profit (individual rationality).

We assume that, if a worker is indifferent between two or more effort levels, he/she will choose the highest effort level.

This equilibrium notion combines a noncooperative notion (Nash) and a cooperative notion (stability), with the requirement that the stability holds after all histories and workers choose the optimal effort level after all histories.Footnote 8 Observe that each firm is best replying to the other firms’ strategy and that the future consequences of any strategy is correctly foreseen.

The outcome of a contracting equilibrium consists of:

-

1.

a matching \({\hat{\mu }}\),

-

2.

an effort \({\hat{e}}(i)= {\hat{e}}(i, {\hat{\mu }}(i))\) for worker i,

-

3.

a wage \({\hat{w}}(i)= w(i, {\hat{\mu }}(i),{\hat{e}}(i))\) for worker i.

Therefore, given the outcome of a contracting equilibrium, we have:

-

1.

a utility \({\hat{u}}(i) = {\hat{w}}(i) - c({\hat{e}}(i))\) for worker i,

-

2.

an output \({\hat{v}}(j)=v({\hat{\mu }}^{-1}(j),j,{\hat{e}}({\hat{\mu }}^{-1}(j)))\) for firm j,

-

3.

a profit \({\hat{\pi }}(j) = {\hat{v}}(j) - {\hat{w}}({\hat{\mu }}^{-1}(j))\) for firm j,

-

4.

a surplus \({\hat{s}}(i,j)= {\hat{v}}(j) - c({\hat{e}}(i)) = {\hat{\pi }}(j) + {\hat{u}}(i)\) for a matched pair (\(j={\hat{\mu }}(i)\)).

3 Efficiency

In this section, we characterize the efficient matching and the efficient labor choice for any matched pair by solving the social planner’s problem. We specify a benchmark contract for a given worker-firm pair; the benchmark contract is the optimal contract from firm’s point of view when the firm makes a take-it-or-leave-it offer to a single worker. Subsequently, we show that the social planner selects this contract for any given worker-firm pair (Sect. 3.2). In Sect. 3.3, we characterize the efficient matching. Observe that, given the matching and effort level induced by the wage contract, we can find the total surplus in the economy.

3.1 Benchmark Contract

We consider a benchmark contract between a pair of worker-firm (i, j) that are matched together, where the worker has the outside option of r(i, j) from leaving the match. Firm j’s problem is as follows:

where r(i, j) is an outside option of the worker that depends only on firm and worker type. Note that, in this contract, the incentive compatibility constraint is irrelevant, since the effort is observable. However, the individual rationality constraint is binding:

Hence, firm j’s problem becomes:

The solution to this problem is the induced effort choice in the benchmark contract. Note that, under Assumption 1, this effort is unique and maximizes the firm’s profit.

3.2 Efficient Effort

In this section, we show that the induced effort choice in the benchmark contract is the social planner’s effort choice for any given matched worker-firm pair. The social planner’s problem is:

Lemma 1

The social planner’s effort choice, for any matched pair, is the effort that the firm chooses in the benchmark contract.

Proof

Given Assumption 1, the solution to the benchmark contract, firm’s profit maximization problem, is unique. Moreover, the solution to the social planner’s surplus maximization problem is unique, too. The surplus of a match is equal to the profit of the firm up to a constant in the benchmark contract. Because in the firm j’s profit maximization problem, problem 1, we have: \(s(i,j,e)=\pi (i,j,e) + r(i,j)\). Hence:

The social planner’s effort choice is the same as the firm’s effort choice in the benchmark contract. \(\square\)

We call this effort the efficient effort level for (i, j) pair. We denote the surplus at the efficient effort by \(s^*(i,j) = \max _{e} s(i,j,e)= \max _{e} \pi (i,j,e) + r(i,j)\).

3.3 Efficient Matching

Consider the problem of a social planner who wants to maximize the total surplus in the economy. The social planner can choose the matching and the effort level of each matched pair. Recall that the social planner selects the efficient effort level for any matched pair. The following lemma shows that the total surplus at the efficient effort level is strictly supermodular; therefore, positive assortative matching maximizes the total surplus and the social planner selects positive assortative matching.

Lemma 2

Under Assumption 1:

-

1.

Given Assumption 2 or 3, the total surplus at the efficient effort level is strictly supermodular.

-

2.

Given Assumption 2, the efficient effort \(e^*(i,j)\) is increasing in the worker’s type and the firm’s type.

-

3.

Given Assumption 3, the efficient effort \(e^*(i,j)\) is decreasing in the worker’s type and the firm’s type.

Proof

-

1.

By the proof of Lemma 1, the efficient effort level maximizes the surplus of a match. Therefore, by first order condition, we have:

$$\begin{aligned} s_e(i,j,e^*(i,j)) =0. \end{aligned}$$(4)We want to show that, the total surplus at the efficient effort level is supermodular under either Assumption 2 or 3. By taking cross partial derivative of the surplus, at the efficient effort level, we have:

$$\begin{aligned} s^*_{i j} = s_{i j} + s_{i e} e_j^* + s_{j e} e_i^* + s_{e e} e_i^* e_j^* + s_e e^*_{i j}. \end{aligned}$$By equation (4), \(s_e\) is zero at the efficient level of effort:

$$\begin{aligned} s^*_{i j} & = s_{i j} + s_{i e} e_j^* + s_{j e} e_i^* + s_{e e} e_i^* e_j^* \\ \Rightarrow \qquad s^*_{i j} & = s_{i j} + s_{i e} (-\frac{s_{e j}}{s_{e e}}) + s_{j e} \left( -\frac{s_{e i}}{s_{e e}}\right) + s_{e e} \left( -\frac{s_{e i}}{s_{e e}}\right) \left( -\frac{s_{e i}}{s_{e e}}\right) \\ \Rightarrow \qquad s^*_{i j} & = {} s_{i j} -\frac{s_{i e} s_{e j}}{s_{e e}}-\frac{s_{e i} s_{j e}}{s_{e e}} + \frac{s_{e i}s_{e j}}{s_{e e}} \\ \Rightarrow s^*_{i j} & = {} s_{i j} -\frac{s_{i e} s_{e j}}{s_{e e}}. \end{aligned}$$(5)Note that \(s_{i j}= v_{i j}\); which is strictly positive by Assumption 1. Moreover, \(s_{e e}\) is strictly negative by Assumption 1. Therefore, if \(s_{i e} s_{e j} \ge 0\), then the total surplus at the efficient effort level is strictly supermodular. Under Assumption 2, we have that \(s_{i e} s_{e j} \ge 0\), because \(s_{i e}\ge 0\) and \(s_{e j} \ge 0\). Under Assumption 3, we have that \(s_{i e} s_{e j} \ge 0\), because \(s_{i e}\le 0\) and \(s_{e j} \le 0\). Hence, the surplus at the efficient effort level is strictly supermodular under either Assumption 2 or Assumption 3.

-

2.

Follows from Topkis Theorem (Topkis 1998).

-

3.

Follows from Topkis Theorem (Topkis 1998).

\(\square\)

The main point in the proof of Lemma 2 is that the super-modularity or sub-modularity of the efficient effort does not affect the super-modularity and sub-modularity of the total surplus at the efficient effort level. Therefore, the curvature of the marginal product of effort or the marginal cost of effort does not affect the efficiency of PAM because the total surplus is evaluated at the surplus maximizing effort level. In Sect. 5.1, we show that whether PAM has a higher or lower total output compared with other matchings depends on the curvature of the marginal product of effort and the marginal cost of effort. Similarly, whether PAM has a higher or lower total labor compared with other matchings depends on the curvature of the marginal product of effort and the marginal cost of effort.

4 Equilibrium Existence and Uniqueness

First, we constructively prove the existence of an equilibrium. Second, we show uniqueness by proving that the outcome of any contracting equilibrium involves the efficient matching and efficient effort level for any matched worker-firm pair.

In Sect. 3.1, we used r(i, j) as an outside option for a worker. The outside option for a worker for a given contract differs from the outside option of the worker leaving the labor market, which is zero. More concretely, in the equilibrium that we construct below, for any worker \(i \ge 2\), the offer by firm \(i-1\) to worker i serves as the outside option of worker i when we find the contract between firm i and worker i. Therefore, firm j has to pay worker j a rent due to the competition from firm \(j-1\). We denote this rent by \(b_j\) which is large enough to make worker j indifferent between working at firm \(j-1\) and firm j. The lowest ability worker does not get any rent from the competition, so \(b_1\) is equal to the outside option of worker 1 leaving the labor market. For other workers, \(b_j\) is pinned down by the offer of firm \(j-1\) to worker j, which depends on the profit of firm \(j-1\) from matching with worker \(j-1\) and paying worker \(j-1\) a rent equal to \(b_{j-1}\). The following lemma shows equilibrium existence by constructing one equilibrium.Footnote 9

Lemma 3

Under Assumptions 1 and 2, the efficient effort for each worker-firm pair, positive assortative matching, and a wage schedule consistent with the following conditions form a contracting equilibrium:

-

1.

\({\hat{w}}(1,1,e^*(1,1)) = c(e^*(1,1))\), \(b_1=0\),

-

2.

\({\hat{w}}(j+1,j,e^*(j+1,j)) = v(j+1,j,e^*(j+1,j)) -( v(j,j,e^*(j,j)) - b_j - c(e^*(j,j)) )\) for \(j \ge 1\),

-

3.

\({\hat{w}}(j,j,e^*(j,j)) = b_j + c(e^*(j,j))\) for \(j>1\),

-

4.

\({\hat{w}}(i,j,e) = 0\) for any other match or effort level.

Proof

In the appendix. \(\square\)

In this equilibrium, firm j offers worker j a rent for working at firm j plus compensation for the cost of exerting the efficient amount of labor. Moreover, firm j offers worker \(j+1\) a wage such that the firm’s profit when hiring worker \(j+1\) is equal to its profit when the firm hires worker j, given that both workers will exert the efficient effort. In other words, firm j competes with firm \(j+1\) for worker \(j+1\). Therefore, the rent that firm \(j+1\) pays the worker \(j+1\) is pinned down by firm j’s wage offer to worker \(j+1\).

The following lemma shows that, in any contracting equilibrium, the effort on the equilibrium path for any matched worker-firm pair is unique and efficient.

Lemma 4

Under Assumptions 1 and 2 or Assumptions 1 and 3, in any contracting equilibrium, on the equilibrium path, workers choose the efficient effort level \({\hat{e}}(i) = e^*(i,{\hat{\mu }}(i))\).

Proof

In the appendix. \(\square\)

Given that the effort choice on the equilibrium path is efficient, we show that, in any contracting equilibrium, the matching is unique and efficient.

Theorem 1

Under Assumptions 1 and 2 or 1 and 3, in any contracting equilibrium, the matching is positive assortative.

Proof

In the appendix. \(\square\)

This result holds under either Assumption 2 or Assumption 3. Recall that, under Assumption 3, the best worker works less than any other worker at the best firm. Moreover, given the efficient matching, the best worker works less than all other workers. Similarly, the least able worker has the highest working hours in the economy.

Corollary 1

Under Assumptions 1 and 3, in any contracting equilibrium, the best worker is matched with the best firm and works less than any other worker. In contrast, the least able worker works more than any other worker.

To summarize, a contracting equilibrium exists, and matching and the effort levels on the equilibrium path are unique, so the total output and the total surplus in any contracting equilibrium are the same.

5 Eliminating All Frictions

In Sect. 5.1, we analyze the effect of eliminating all frictions in a labor market on the total surplus and total output. If there is no friction in the marker, the unique matching in any equilibrium is PAM. We consider any departure from PAM to be a friction in the labor market. Note that given any matching in the labor market, we assume that the effort choice of any matched worker-firm pair is the efficient effort for that pair. Stated differently, if the observed matching in a labor market is not PAM, then there are some frictions in the labor market. Following Adachi (2003), we interpret search frictions as the search cost. Adachi (2003) states that “the term ‘search’ refers to the condition that agents have to incur costs (in this paper, time) to find a partner in the absence of a central matchmaker.” Adachi (2003) shows that as the search frictions disappear, the set of equilibria of the search model coincides with the set of equilibria from using the Gale-Shapley algorithm, which is PAM in our model. Alternatively, we can think about frictions as a set of restrictions on the set of feasible worker-firm pairs. In other words, infeasible pairs cannot be part of an equilibrium or block an equilibrium due to a set of exogenous restrictions on contracts or matching.

We show that, under Assumption 1 and either Assumption 2 or Assumption 3, the frictionless market has a higher total surplus than a labor market with some frictions but it may have lower total output. First, we provide an example where the production function is strictly supermodular in firm’s technology and worker’s ability. At the efficient level of effort, all firms produce the same amount of output irrespective of their matched workers. Therefore, the total output is the same under any matching, but the total surplus is strictly higher under PAM than under any other matching. We characterize three sets of sufficient conditions and provide simple examples for each set of conditions. Under the first set of conditions, the total output increases when all frictions are eliminated; however, this increase is an upper bound on the increase in the total surplus. Under the second set of conditions, the total output increases, but the increase in the total output is a lower bound for the increase in the total surplus. However, under the third set of conditions, the total output decreases when all search frictions are eliminated. In Sect. 5.2, we show that, fixing an equilibrium, the total profit of all firms always increases when all search frictions are eliminated.

5.1 The Total Output

Suppose that the labor market is not efficient because of a friction in labor market. Consider a policy that decreased the total output. Can we conclude that efficiency has decreased as the result of this policy? In this section, we answer this question.

Given two pairs of matched worker-firm pairs, \((i,j),(i^\prime ,j^\prime )\), we define meet of the two vectors as the coordinate-wise minimum of the two vectors \((i,j) \wedge (i^\prime ,j^\prime ) = (\min \{i,i^\prime \},\min \{j,j^\prime \})\) and join of the two vectors as the coordinate-wise maximum of the two vectors \((i,j) \vee (i^\prime ,j^\prime ) =(\max \{i,i^\prime \},\max \{j,j^\prime \})\). The join operation in our setting is equivalent to forming a blocking pair after a random meeting of two matched pairs in which a worker in one pair and a firm in the other pair prefer each other to their current match. Suppose we have two matched pairs in the labor market, (i, j) and \((i^\prime ,j^\prime )\), such that \((i,j) \vee (i^\prime ,j^\prime )\) is either \((i,j^\prime )\) or \((i^\prime ,j)\). It follows from Theorem 1 that if these two pairs meet randomly, then \((i,j) \vee (i^\prime ,j^\prime )\) is a blocking pair; i.e., \(\max \{i,i^\prime \}\) and \(\max \{j,j^\prime \}\) will leave their current match. We assume that after \(\max \{i,i^\prime \}\) and \(\max \{j,j^\prime \}\) form a new pair, their previous partners \(\min \{i,i^\prime \}\) and \(\min \{j,j^\prime \}\) form another pair. Therefore, this random meeting results in two new matched pairs: \((i,j) \vee (i^\prime ,j^\prime )\) and \((i,j) \wedge (i^\prime ,j^\prime )\). We can interpret this random meeting, if the new matched pairs differ from the original matched pairs, as a reduction of search friction in the labor market. Note that if we interpret search friction as a set of restrictions on a feasible pair of worker-firm, then a reduction of one such restriction allows an infeasible pair to meet and form a blocking pair. If they form a blocking pair, the blocking pair is \((i,j) \vee (i^\prime ,j^\prime )\); note that we match their partners as well, i.e., \((i,j) \wedge (i^\prime ,j^\prime )\) forms another pair. In such cases, a reduction from the set of infeasible worker-firm pairs is equivalent to a reduction of search friction.

The following lemma shows that, starting from any matching in a labor market, a finite sequence of these random meetings exists that will result in the equilibrium matching, i.e., PAM. Intuitively, if the matched pair that involves the firm with the highest technology randomly meets the pair that has the highest ability worker, then these two will form a blocking pair. We assume that after they leave their current match, their partners will form another pair. In the next random meeting, the matched pair that has the firm with the second highest technology meets the matched pair that has the second highest ability worker. Repeating these meetings n times will result in PAM. Note that in Sect. 5, we talk about eliminating all frictions in the labor market; however, all of the results are true for a reduction of search friction in the labor market; i.e., any random meeting of two pairs in which \((i,j) \vee (i^\prime ,j^\prime )\) and \((i,j) \wedge (i^\prime ,j^\prime )\) form two new matched pairs will have the same consequences as changing matching to PAM.

Lemma 5

Given any matching \(\mu\), there exists a sequence of meet and join operations with length n such that the resulting matching is PAM.

Proof

In the appendix. \(\square\)

In the following example, there is a complementarity in the production function between worker’s type and firm’s technology. Hence, one may think that, by facilitating the match between the best worker and the best firm, production will increase (by allowing the matched pair to choose the efficient effort). However, considering the efficient labor choice, the production of a firm is constant. Moreover, the production of all firms is the same independent of which worker they are matched to. Stated differently, by changing the matching, the total surplus changes but the total output is constant. Therefore, if a researcher uses the output to measure the efficiency gain (or loss) from a policy regrading a change in labor market frictions, the conclusion will be wrong.

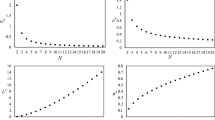

Example 1

where \(k \in [1.69,2]\) and \(I, J \subset [1,1.3]\). Note that \(s_{i j}>0, s_{e i}<0, s_{e j}<0\).

The efficient effort is \(e^*(i,j)= k - ij\); hence, the efficient effort is submodular. The total output at the efficient effort is \(v(i,j,e^*(i,j)) = log(k)\). The total surplus at the efficient effort is \(s(i,j,e^*(i,j))= log(k) - k + ij\). The total output is constant for any matching. Therefore, PAM maximizes the total surplus but it minimizes the total labor. However, changing the matching does not affect the total output.

It is not always the case that the total output is constant at the efficient effort level. Consider the following example:

Example 2

where \(k>0\) is large enough to satisfy Assumption 1; i.e., \(\forall i \in I, j \in J: k > ij\).

The efficient effort is \(e^*(i,j)= \frac{ij}{2k}\); hence, the efficient effort is supermodular. The total output at the efficient effort is \(v(i,j,e^*(i,j)) = \frac{(i j)^2}{2k}\). The total surplus at the efficient effort is \(s(i,j,e^*(i,j)) = \frac{(i j)^2}{2k} - \frac{(i j)^2}{4k} = \frac{(i j)^2}{4k}\). Therefore, PAM maximizes the total surplus, the total labor, and the total output.

We characterize a set of sufficient conditions under which positive assortative matching maximizes the total surplus and total output, i.e., if the total output increases as a result of a change in the labor market, then we know that the total surplus has increased as well. However, the increase in the total output is an upper bound on the increase in the total surplus under Assumption 2. We use the result from Shahdadi (2021) to find that whether the argmax of the firm’s profit maximization problem is supermodular or submodular.Footnote 10

Condition 1

The marginal surplus of effort is supermodular and convex in effort:

with at least one strict inequality.

Shahdadi (2021) shows that if the marginal profit of labor is supermodular and convex in labor, then the efficient labor choice is supermodular. The following theorem states that if the marginal profit of labor is supermodular and convex in labor, then PAM maximizes the total labor, total surplus, and total output. Moreover, it states that the increase in the total output from reducing search frictions in the labor market is an upper bound for the increase of total surplus.

Theorem 2

Under Condition 1:

-

1.

Given Assumptions 1 and 2 or Assumptions 1 and 3, the frictionless labor market, compared with a labor market with some frictions, has a higher total surplus, higher total output, and higher total labor.

-

2.

Under Assumptions 1 and 2, a reduction of search friction or eliminating all frictions in the labor market results in a higher total output and efficiency gain; however, the increase in the total output is greater than the increase in the total surplus.

Proof

In the appendix. \(\square\)

Under the second set of conditions that we characterize, if the total output increases as a result of a policy change related to labor market frictions, then we can conclude that the total surplus increased as a result of this policy; moreover, the increase in the total surplus is at least equal to the increase in the total output. Consider the following example:

Example 3

where \(\forall i \in I, j \in J: 0< (i^{\frac{1}{\rho }}+j^{\frac{1}{\rho }})^\rho < \frac{1}{k+1}\).

The efficient effort is \(e(i,j)= (i^{\frac{1}{\rho }}+j^{\frac{1}{\rho }})^{\frac{\rho }{k}}\). \(\frac{\rho }{k}<1\); hence, the efficient effort is submodular. The total output at the efficient effort is \(v(i,j,e^*(i,j)) = (i^{\frac{1}{\rho }}+j^{\frac{1}{\rho }})^{\frac{\rho (1+ k)}{k}}\). The total surplus at the efficient effort is \(s(i,j,e^*(i,j)) = (\frac{k}{k+1})(i^{\frac{1}{\rho }}+j^{\frac{1}{\rho }})^{\frac{\rho (1+ k)}{k}}\). Therefore, PAM maximizes the total surplus and the total output, but it minimizes the total labor.

Condition 2

The marginal surplus of effort is submodular and concave in effort:

with at least one strict inequality. Moreover,

Theorem 3

Under Condition 2:

-

1.

Given Assumptions 1 and 2 or Assumptions 1 and 3, the frictionless market, compared with a market with some frictions, has a higher total surplus, higher total output, and lower total labor.

-

2.

Under Assumptions 1 and 3, a reduction of search friction or eliminating all frictions in the labor market results in higher total output and efficiency gain; moreover, the increase in the total surplus is greater than the increase in the total output.

Proof

In the appendix. \(\square\)

It is not always the case that an increase in the total output implies an increase in the total surplus. Under the third set of conditions that we characterize, if the total output decreases as a result of policy in the labor market, the total surplus increases as a result of this policy.

Example 4

where \(k \in (2.69, 3)\) and \(I, J \in [1,1.3]\). Note that \(s_{i j}= \frac{1+e}{(ij+e+1)^2} - \frac{1}{(ij+3)^2}>0, s_{e i}<0, s_{e j}<0\).

The efficient effort is \(e(i,j)= k - ij -1\); hence, the efficient effort is submodular. The total output at the efficient effort is \(v(i,j,e^*(i,j)) = log(k) - ((\frac{1}{3})(log(ij+3)))\); hence, the total output at the efficient effort is submodular. The total surplus at the efficient effort is \(s(i,j,e^*(i,j)) = log(k) - ((\frac{1}{3})(log(ij+3))) + \frac{ij}{k} - 1 +\frac{1}{k}\). Therefore, PAM maximizes the total surplus and total leisure. However, PAM minimizes the total output and total labor.

Condition 3

The marginal surplus of effort is submodular, concave in effort, and:

with at least one strict inequality.

Theorem 4

Under Condition 3:

-

1.

Given Assumptions 1 and 2 or Assumptions 1 and 3, the frictionless market has the highest total surplus, lowest total output, and lowest total labor.

-

2.

Given Assumptions 1 and 2 or Assumptions 1 and 3, a reduction of search friction or eliminating all frictions in the labor market results in a lower total output and higher total surplus.

Proof

In the appendix. \(\square\)

5.2 The Total Profit

In this section, we show that, for a given equilibrium wage schedule, if a policy eliminates frictions in the labor market, then the total surplus and the total profit move in the same direction.Footnote 11

Theorem 5

Given a contracting equilibrium,

-

1.

if the total surplus is supermodular at the optimum level of effort, then the total profit of firms is supermodular, and

-

2.

if the total surplus is submodular at the optimum level of effort, then the total profit of firms is submodular.

Proof

In the appendix. \(\square\)

The change in total output does not track the change in total surplus because the total output is disconnected from the cost of effort. On the other hand, the total profit of firms takes into account the cost of effort because the firm has to pay a wage such that the workers get a rent due to the competition in the labor market in addition to the compensation for the cost of effort to that worker. Therefore, for a given equilibrium wage schedule, the change in the total profit of firms is a better proxy for the change in welfare.

6 Conclusion

If the effective labor supplied by workers does not depend on the firm they are matched with, then the total output measures the welfare. However, if labor is a complement to or a substitute for a firm’s technology, then a worker’s labor choice changes when he/she matches with a more productive firm. We show that PAM is efficient and occurs in any contracting equilibrium. However, PAM may minimize or maximize the total output. Therefore, if one considers the endogenous labor choice of workers, then the total output can be a misleading measure of welfare: The change in the total output may be an upper or lower bound for an increase in the total surplus; moreover, the total output may decrease when the total surplus increases. We specify the role that the cost of effort plays in the disconnect between the total surplus and the total production. We provide three sets of sufficient conditions under which one can use an increase or a decrease of the total output as a signal for an increase in the total surplus of workers and firms.

Notes

See, e.g., Scheuer and Werning (2017).

“Solving the optimal output maximizing assignment problem we find that optimally assigning individual workers to individual firms increases output only by \(4.47\%\). In contrast, reassigning workers to the main diagonal, as would be optimal given the typical assumption of a globally supermodular production function would imply a \(1.43\%\) decline in output.”

In our model, change in the allocation of workers to firms is similar to what Hsieh et al. (2019) calls the change in the allocation of talent to occupations.

We use c(e) for simplicity. All results hold if the cost function depends on both workers’ and firms’ type c(e, i, j).

Note that \(s_{i j}(i,j,e) = v_{i j}(i,j,e)\); i.e., the assumption is about production function.

One can model a market with frictions as a set of restrictions on the set of feasible worker-firm pairs. Infeasible pairs cannot be part of an equilibrium or block an equilibrium.

This equilibrium definition satisfies the no regret condition.

We assume that \(I= J= \{1, 2, 3, \ldots , n\}\) for clarity in this lemma.

However, if firms react to changes in labor market frictions by changing the wage schedule that they offer to workers, the total profit may decrease while the total surplus increases.

References

Adachi H (2003) A search model of two-sided matching under nontransferable utility. J Econ Theory 113(2):182–198

Bulow J, Levin J (2006) Matching and price competition. Am Econ Rev 96(3):652–668

Cole HL, Mailath GJ, Postlewaite A (2001) Efficient non-contractible investments in finite economies. Adv Theor Econ 1(1):20011003

Crawford VP (2008) The flexible-salary match: a proposal to increase the salary flexibility of the national resident matching program. J Econ Behav Org 66(2):149–160

Gale D, Shapley LS (1962) College admissions and the stability of marriage. Am Math Mon 69:9–15

Grossman SJ, Hart OD (1983) An analysis of the principal-agent problem. Econ J Econ Soc:7–45

Hagedorn M, Law TH, Manovskii I (2017) Identifying equilibrium models of labor market sorting. Econometrica 85(1):29–65

Hsieh C-T, Hurst E, Jones CI, Klenow PJ (2019) The allocation of talent and us economic growth. Econometrica 87(5):1439–1474

Jones CI, Klenow PJ (2016) Beyond GDP? Welfare across countries and time. Am Econ Rev 106(9):2426–57

Jungbauer T (2021) Strategic wage posting with fixed quotas. Available at SSRN 3616411

Lazear EP (2000) Performance pay and productivity. Am Econ Rev 90(5):1346–1361

Lise J, Meghir C, Robin J-M (2015) Matching, sorting and wages. Rev Econ Dyn 19:63–87

Lise J, Seitz S, Smith J (2015) Evaluating search and matching models using experimental data. IZA J Labor Econ 4(1):1–35

Niederle M (2007) Competitive wages in a match with ordered contracts. Am Econ Rev 97(5):1957–1969

Ohanian LE, Raffo A (2012) Aggregate hours worked in oecd countries: new measurement and implications for business cycles. J Monet Econ 59(1):40–56

Scheuer F, Werning I (2017) The taxation of superstars. Q J Econ 132(1):211–270

Shahdadi BK (2021) The effects of student composition on teachers’ effort and students’ performance: implications for tracking, school choice, and affirmative action. Games Econom Behav 130:384–399

Shapley LS, Shubik M (1971) The assignment game i: the core. Int J Game Theory 1(1):111–130

Topkis DM (1998) Supermodularity and complementarity. Princeton University Press, Princeton

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This paper is a revised chapter of my Ph.D. thesis at University of Pennsylvania. I am deeply indebted to Rakesh Vohra for his guidance and continuous support. I am grateful to SangMok Lee and Eduardo Azevedo for their valuable advice. I also thank Amir Kermani, George Mailath, Iourii Manovskii, Steven Matthews, Guido Menzio, Zahra Mohammadi, Andrew Postlewaite, Alvaro Sandroni, Alireza Sepahsalari, and Ali Shourideh for their helpful comments and suggestions.

Appendix A Proofs

Appendix A Proofs

Proof of Lemma 3

We need to show that there is no blocking pair. Suppose \(i^\prime , j^\prime\) and \(\{w^\prime (i^\prime , j^\prime ,e)\}_{e \in [0,1]}\) is a blocking pair. First observe that if this wage schedule doesn’t induce the efficient effort then the same worker and firm can block with a different wage schedule that induces the efficient effort. Under this wage schedule the worker will choose an effort \(e^\prime\) and will receive \(w^\prime\).

Note that under the efficient effort firm j is indifferent between matching with worker \(i=j\) and worker \(i=j+1\):

Moreover, worker \(i+1\) is indifferent between matching with firm \(j=i+1\) and firm \(j=i\):

Furthermore, because total surplus is strictly supermodular, we have:

Similarly we can show:

Adding these two inequalities and using the fact that \(u(i+1,i+1,e^*(i+1,i+1)) + \pi (i+1,i+1,e^*(i+1,i+1))= s^*(i+1,i+1)\) we have:

Moreover, by supermodularity of \(s^*\) (lemma 2) we have:

Hence:

We can do the same process for any \(i^\prime > i\). Hence no worker i and firm j were \(i>j\) can block this CE.

Now consider \(i < j\). First observe that:

Hence \(i+1,j=i\) can’t block. Moreover, by supermodularity of total surplus:

Hence \(i+2,j=i\) can’t block.

Note that each worker gets at least zero utility and each firm makes positive profit, firms are best replying, and workers are choosing the utility maximizing effort level. \(\square\)

Proof of Lemma 4

Suppose not, then there exists at least one pair of worker-firm such that the worker is not choosing the efficient effort. Therefore, there is another contract that induces the efficient effort and increases the surplus of the match. Hence, there is a wage schedule that induces the efficient effort, gives the worker a strictly higher utility, and strictly increases the firm’s profit. Therefore, a blocking pair exists, a contradiction. \(\square\)

Proof of Theorem 1

Suppose not, then there exists at least two pairs of worker-firm in a contracting equilibrium such that \(i < i^\prime\), \(j > j^\prime\), \({\hat{\mu }}(i) = j\), and \({\hat{\mu }}(i^\prime ) = j^\prime\). By Lemma 2, the total surplus is strictly supermodular in the types of firms and workers, given the efficient effort for every firm-worker pair. Since the total surplus is strictly supermodular, if we match i with \(j^\prime\) and \(i^\prime\) with j and let them choose the efficient effort, the total surplus increases:

Hence, either \((i,j^\prime )\) or \((i^\prime ,j)\) is a blocking pair. \(\square\)

Proof of Lemma 5

The following algorithm with n steps proves the result. Do the following step for \(i = n, n-1,\ldots , 1\): In step i: Select the following two pairs of matched worker-firm pairs: The pair that has firm i as the firm and the pair that has worker i as the worker. If these are different pairs, use meet and join on these two pair, otherwise go to the next step.

In each step i, worker i will match with firm \(j=i\) as the result of join operation. Hence, after n steps, the matching is positive assortative matching. \(\square\)

Proof of Theorem 2

-

1.

By taking cross partial derivatives of production function at the efficient effort, we have:

$$\begin{aligned} v^*_{i j}= & {} v_{i j} + v_{i e} e_j^* + v_{j e} e_i^* + v_{e e} e_i^* e_j^* + v_e e^*_{i j} \\ \Rightarrow v^*_{i j}= & {} s^*_{i j} + c_{e e} e_i^* e_j^* + v_e e^*_{i j}. \end{aligned}$$Recall that, \(s^*_{i j} < 0>\). By Assumption 1, \(c_{e e}>0, v_e >0\). Given Assumption 2 or 3, \(e_i^* e_j^* >0\). Shahdadi (2021) proves that, under Condition 1, the argmax (the efficient effort) is strictly supermodular, i.e., \(e^*_{i j} >0\). Therefore, the total output at the efficient effort is supermodular. Because the total profit, total surplus, and efficient effort are supermodular, reducing search friction in the labor market results in an increase of the total profit, total surplus, and total effort. By Lemma 5, after a finite sequence of these random meetings, the matching is PAM. Note that if we start from any matching different from PAM, some of these random meetings result in a new worker-firm pairs; hence, the total profit, total surplus, and total effort increases by moving to PAM. We can conclude that PAM has the highest total surplus, highest total output, and highest total labor.

-

2.

Because the argmax (the efficient effort) is strictly supermodular, by eliminating all frictions in the labor market, the total effort increases. Given Assumption 2, the efficient effort is increasing in firm’s technology. Recall that, starting from any matching, there is a finite sequence of meet and join operations such that the final matching is PAM. Therefore, it is enough to prove the result for implementing meet and join operations once, i.e., for a reduction of search friction. Consider two pairs of worker-firm pairs, \((i,j), (i^\prime , j^\prime )\), where \(i < i^\prime , j > j^\prime\). Implementing meet and join operations are equivalent to assigning better worker \(i^\prime\) to the better firm j. The better workers, matched with the better firm, works more than the other worker matched with the better firm. Moreover, this increase in labor is more than the decrease in labor in the lower firm after implementing meet and join operations. Stated differently, the labor at the higher firm was higher at the initial matching, compared with the labor at the lower firm. Moreover, the increase in labor at the higher firm is greater than the decrease in the lower firm. Because the cost function is convex, the total cost of effort increases as the result of implementing meet and join operations.

\(\square\)

Proof of Theorem 3

-

1.

By taking cross partial derivatives of production function at the efficient effort, we have:

$$\begin{aligned} v^*_{i j}&= v_{i j} + v_{i e} e_j^* + v_{j e} e_i^* + v_{e e} e_i^* e_j^* + v_e e^*_{i j} \\ \Rightarrow v^*_{i j}&= s_{i j} + s_{i e} \left( \frac{- s_{e j}}{s_{e e}}\right) + s_{j e} \left( \frac{- s_{e i}}{s_{e e}}\right) + v_{e e} \left( \frac{- s_{e i}}{s_{e e}}\right) \left( \frac{- s_{e j}}{s_{e e}}\right) \\&\quad - v_e \left( \frac{s_{e e}^2 s_{e i j} + s_{e e e } s_{e i} s_{e j} - s_{e e i} s_{e j} s_{e e} - s_{e e j} s_{e i} s_{e e} }{s_{e e}^3}\right) \\ \Rightarrow v^*_{i j}&= \left( \frac{-1}{s_{e e}^3}\right) \big (s_{i j} (-s_{e e}^3) + 2 s_{i e} (s_{e j})(s_{e e}^2) + v_{e e} (s_{e i})( s_{e j})( - s_{e e}) \\&\quad + v_e s_{e e}^2 s_{e i j} + v_e s_{e e e } s_{e i} s_{e j} - v_e s_{e e i} s_{e j} s_{e e} - v_e s_{e e j} s_{e i} s_{e e} \big ) \\ \Rightarrow v^*_{i j}&= \left( \frac{-1}{s_{e e}^3}\right) \big ( ( s_{e i} s_{e j})(v_e s_{e e e } + 2 s_{e e}^2 - v_{e e} s_{e e} ) \\&\quad +(s_{e e}^2 )(v_e s_{e i j} - s_{i j} s_{e e}) - ( v_e s_{e e})( s_{e e i} s_{e j} + s_{e e j} s_{e i}) \big ) \\ \end{aligned}$$Shahdadi (2021) proves that, under Condition 2, \(e^*_{i j} <0\). Under Condition 2, the total output at the efficient effort is supermodular. Hence, PAM has the highest total surplus, highest total output, and lowest total labor.

-

2.

Because the argmax (the efficient effort) is submodular, the total effort decreases. Under Assumption 3, the efficient effort is decreasing in firm’s technology.

Recall that, starting from any matching, there is a finite sequence of meet and join operations such that the final matching is PAM. Therefore, it is enough to prove the result for implementing meet and join operations once. Consider two pairs of worker-firm pairs, \((i,j), (i^\prime , j^\prime )\), where \(i < i^\prime , j > j^\prime\). Implementing meet and join operations are equivalent to assigning better worker \(i^\prime\) to the better firm j. The better worker, matched with the better firm, works less than the other worker matched with the better firm. Moreover, this decrease in labor is more than the increase in labor in the lower firm after implementing meet and join operations. Stated differently, the labor at the higher firm was lower at the initial matching, compared with the labor at the lower firm. Moreover, the decrease in labor at the higher firm is greater than the increase in the lower firm. Because the cost function is convex, the total cost of effort decreases as the result of implementing meet and join operations.

\(\square\)

Proof of Theorem 4

-

1.

Recall that:

$$\begin{aligned} v^*_{i j}= & {} \left( \frac{-1}{s_{e e}^3}\right) \big ( ( s_{e i} s_{e j})(v_e s_{e e e } + 2 s_{e e}^2 - v_{e e} s_{e e} ) \\{} & {} + (s_{e e}^2 )(v_e s_{e i j} - s_{i j} s_{e e}) - ( v_e s_{e e})( s_{e e i} s_{e j} + s_{e e j} s_{e i}) \big ) \end{aligned}$$Shahdadi (2021) proves that, under Condition 2, \(e^*_{i j} <0\). Under Condition 3, the total output at the efficient effort is submodular. Hence, PAM has the highest total surplus, lowest total output, and lowest total labor.

-

2.

Eliminating frictions in the labor market results in PAM. By the first part of the theorem, PAM has the highest total surplus and lowest total output. The proof for a reduction of search friction follows from the proof of the first part of the theorem.

\(\square\)

Proof of Theorem 5

In a contracting equilibrium, if \(i< i^\prime\) and \(j< j^\prime\) where (i, j) and \((i^\prime ,j^\prime )\) are feasible matches, then \((i,j^\prime )\) and \((i^\prime ,j)\) are not part of a stable matching; i.e., it is not an equilibrium outcome, because either (i, j) or \((i^\prime ,j^\prime )\) is a blocking pair.

We want to show that for any given labor market with friction, if the total surplus in a contracting equilibrium is strictly supermodular in worker’s type and firm’s type, then the profit of the firm is strictly supermodular in worker’s type and firm’s type. Define \({\hat{r}}(i,j)= {\hat{w}}(i) - c(e^*(i,j))\) as the rent of worker i when he/she is matched with firm j, in a given contracting equilibrium \(<\{{\hat{w}}(i,j,e^*(i,j))\}_{e \in [0,1]},{\hat{\mu }}>\). Consider \(i< i^\prime\) and \(j< j^\prime\), where (i, j) and \((i^\prime ,j^\prime )\) are part of the induced matching in the contracting equilibrium. By revealed preferences, firm \(j^\prime\) prefers its current match compared with the worker assigned to firm j:

Therefore, the profit at the efficient effort level is strictly supermodular. Similar argument proves the second part of this theorem. \(\square\)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kamali Shahdadi, B. Labor market efficiency: output as the measure of welfare. Soc Choice Welf 62, 419–441 (2024). https://doi.org/10.1007/s00355-023-01496-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-023-01496-w