Abstract

Background

It is vital to enquire into cost of health care to ensure that maximum value for money is obtained with available resources; however, there is a dearth of information on cost of health care in lower–middle-income countries (LMICs). Our aim was to develop a reproducible costing method for three routes of hysterectomy in benign uterine conditions: total abdominal (TAH), non-descent vaginal (NDVH) and total laparoscopic hysterectomy (TLH).

Methods

A societal perspective with a micro-costing approach was applied to find out direct and indirect costs. A total of 147 patients were recruited from a district general hospital (Mannar) and a tertiary care hospital (Ragama). Costs incurred from preoperative period to convalescence included direct costs of labour, equipment, investigations, medications and utilities, and indirect costs of out-of-pocket expenses, productivity losses, carer costs and travelling. Time-driven activity-based costing was used for labour, and top-down micro-costing was used for utilities.

Results

The total cost [(interquartile range), number] of TAH was USD 339 [(308–397), n = 24] versus USD 338 [(312–422), n = 25], NDVH was USD 315 [(316–541), n = 23] versus USD 357 [(282–739), n = 26] and TLH was USD 393 [(338–446), n = 24] versus USD 429 [(390–504), n = 25] at Mannar and Ragama, respectively. The direct cost of TAH, NDVH and TLH was similar between the two centres, whilst indirect cost was related to the setting rather than the route of hysterectomy.

Conclusions

The costing method used in this study overcomes logistical difficulties in a LMIC and can serve as a guide for clinicians and policy makers in similar settings.

Trial registration

The study was registered in the Sri Lanka clinical trials registry (SLCTR/2016/020) and the International Clinical Trials Registry Platform (U1111-1194-8422) on 26 July 2016.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Costing of health-care interventions in developed countries is done by allotting costs to diagnosis related groups (DRGs) which have become the basis because it increases transparency and efficiency [1, 2]. Assigning costs to DRGs is a complicated process and is usually done by an independent authority using data from numerous hospitals within a country [3]. Despite this, evidence shows considerable cost variation due to patient and provider characteristics, the efficiency level, the underlying clinical activity and, most importantly, the costing method [4].

Although there are numerous costing methods, there is a lack of standardisation and agreement [5,6,7]. A two-step classification process of hospital costing methods is currently being used [8]. Initially, cost components are identified at aggregate level (gross costing) or at patient level (micro-costing). Then, cost components are valued either by assigning costs from comprehensive sources (top-down approach), or by identifying resource consumption at patient level (bottom-up approach) [9]. Thus, if top-down micro-costing was used it will result in average unit costs per patient, whereas if bottom-up micro-costing was used patient-specific unit costs would be obtained. The method used depends on availability of patient-level cost data for each country [9]. It is generally accepted that the method of costing significantly affects the cost estimates [8, 10, 11]. Mercier recommends a time-driven activity-based costing based on analysis of cost components to reveal variations in use of resources at patient level [9].

The picture from lower–middle-income countries (LMICs) is less promising as there is a dearth of information on costing of surgical procedures [12,13,14,15]. Most studies use extrapolation from other studies, do not involve local practice or are based on essential care which is a basic necessity which would make it unethical not to do it because it raises questions of fairness and equality which override economic aspects [13]. There was only one study which looked at costs of elective hysterectomy in LMICs [14].

It is vital that LMICs such as Sri Lanka enquire into cost to ensure that maximum value for money is obtained with the limited resources at hand. Despite this, information on costs related to health-care interventions in Sri Lanka is limited possibly due to a misconception of ‘free health’ among citizens despite money being obtained from general taxation [16]. Citizens and government officials view that it is the obligation of the government to provide free public health care. However, in a developing country health-care costs also rise with the improvement in living conditions and wages which will in turn burden the system as resources are invariably limited. It is in this backdrop that costing and cost-effectiveness can be considered as the ‘elephant in the room,’ especially for LMICs with publicly funded health-care systems.

Therefore, our aim was to develop a reproducible costing method for abdominal, non-descent vaginal and laparoscopic hysterectomy in Sri Lanka.

Materials and methods

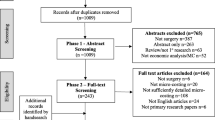

This costing study was part of a pragmatic randomized controlled trial to provide evidence on the optimal type of hysterectomy in terms of cost-effectiveness by way of a three-arm randomized controlled trial (RCT) between NDVH, TLH and TAH in a low resource setting [16]. The three approaches to hysterectomy were total abdominal (TAH), non-descent vaginal (NDVH) and total laparoscopic hysterectomy (TLH). A total of 147 patients (49 per arm) were recruited from two public sector hospitals, a district general hospital (Mannar) and a tertiary care hospital (Ragama). The cost evaluation took a societal perspective which included both direct costs related to allocation of health-care resources in the hospital and indirect costs borne by the patient. Both direct and indirect costs were calculated from the time of presentation to the gynaecology clinic until treatment was concluded.

A micro-costing approach was adopted to calculate direct costs for each surgery. Main drivers (cost categories) of direct costs (labour, investigations, equipment, drugs and utility costs) and indirect costs (out-of-pocket costs, productivity losses, carer costs and travelling) are shown in Table 1. Time-driven activity-based costing for labour costs and bottom-up micro-costing for medications were the most accurate methods to calculate these costs [4, 5, 9]. Although bottom-up micro-costing would have been the ideal for investigations, equipment and utilities, it would have added only a little improvement in accuracy at the cost of considerable time, effort and money. Therefore, top-down micro-costing was done for these costs; it is accepted practice to sacrifice a little accuracy to overcome feasibility issues if it is unlikely to significantly impact the result [4].

Labour costs

A time-driven, activity-based costing method was adopted to calculate labour costs. Therefore, labour cost per minute for each category of staff was calculated (supplementary file 1, Eq. 1) and was used to cost the various activities based on amount of time spent.

Equipment costs

Cost of equipment and drugs were obtained from the medical supplies division (MSD) of the Ministry of Health, Sri Lanka. The cost of an equipment per patient was calculated, assuming it lasts for 10 years (supplementary file 1, Eq. 2).

Investigation costs

Investigation costs included laboratory and imaging costs for preoperative period and postoperative period. The cost for a particular test considered the equipment cost, labour cost and reagent cost (supplementary file 1, Eq. 3). The equipment cost was obtained as explained above (supplementary file 1, Eq. 2). The labour cost per test was calculated using the laboratory technician’s labour cost per minute and time spent per test. The reagent cost per test was based on the number of tests per year and the amount of reagents used for that time period.

Drug costs

Cost of drugs was obtained from the (MSD) of the Ministry of Health, Sri Lanka.

Utility costs

Utility costs were calculated per patient per day for space, water, electricity, food, administrative, cleaning services, telephone services and security costs. The rental value for ward space was obtained from the National Housing Development Authority. The space cost per patient per day was calculated (supplementary file 1, Eq. 4). The other utilities were calculated using the respective monthly bills divided by the average midnight total of patients to obtain the cost of a particular utility per patient per day [e.g. electricity cost (supplementary file 1, Eq. 5)]. Cost of food obtained from the hospital was calculated considering the food cost and labour (supplementary file 1, Eq. 6). A total utility cost per patient per day was obtained including the sum all of the above subcategories.

The direct and indirect costs were grouped into four chronological periods (preoperative, operative, postoperative and convalescence periods) in the treatment pathway for purposes of clarity and convenience (Table 2).

Data analysis

Cases with missing data were not excluded from the analysis as there was a likelihood of either overestimating or underestimating the cost if an uncomplicated case or a complicated case was excluded, respectively. Therefore, all cases were included in the analysis using multiple imputation for missing data which was less than 5%. The costs are reported in USD (exchange rate, 1 USD = LKR. 144.9625, as at 01/01/2017). A sensitivity analysis was done to assess the robustness of costing assumptions adjusting the duration of surgery (+30 to −30 min), hospital stay (+1 to −1 day), life span of equipment (5-year vs. 10-year life span), complications, readmission and utility costs (doubling complications/readmission and utility versus no complications/readmissions and retaining utility costs). The economic cost of equipment was calculated using the replacement value, life span and a discount rate of 10% using a standard discount table [4]. Indirect costs were readjusted to account for productivity losses assigning a value (governmental minimum wage of LKR 400 per day versus LKR 1500/day) to the time to recover from surgery [17].

Results

The distribution of direct costs in terms of time periods (preoperative, operative and postoperative) and cost categories are shown in Fig. 1 and supplementary file 2. The median direct cost [(interquartile range), number] of TAH was USD 297 [(287–319), n = 24] versus USD 272 [(260–297), n = 25], NDVH was USD 280 [(255–309), n = 23] versus USD 277 [(253–302), n = 26], and TLH was USD 326 [(306–358), n = 24] versus USD 366 [(332–385), n = 25] at Mannar and Ragama, respectively. There was a significant difference between direct costs for TAH at the two centres (Mann–Whitney U test, p < 0.01) but not for NDVH (Mann–Whitney U test, p = 0.984) and TLH (Mann–Whitney U test, p = 0.16). In terms of cost categories, labour costs account for biggest proportion of direct costs.

The distribution of indirect costs in terms of time periods and cost categories are shown in Fig. 2 and supplementary file 3. The median indirect cost (interquartile range) of TAH was USD 29 (15–88) versus USD 68 (36–119), NDVH was USD 30 (15–57) versus USD 75 (41–239), and TLH was USD 46 (19–89) versus USD 52 (34–148) at Mannar and Ragama, respectively. There was a significant difference between indirect costs for TAH (Mann–Whitney U test, p < 0.05) and NDVH (Mann–Whitney U test, p < 0.01) between the two centres but not for TLH (Mann–Whitney U test, p = 0.28). Overall, indirect costs for surgery done at Ragama were significantly more than that at Mannar. The postoperative period had the highest indirect costs except for NDVH at Ragama where the convalescence costs were the biggest contributor. In terms of cost categories, transport costs account for biggest proportion of indirect costs.

The median total cost (interquartile range) of TAH was USD 339 (308–397) versus USD 338 (312–422), NDVH was USD 315 (316–541) versus USD 357 (282–739), and TLH was USD 393 (338–446) versus USD 429 (390–504) at Mannar and Ragama, respectively.

The sensitivity analysis is shown in Table 3. Scenario A shows the current best possibility, whilst scenario B illustrates the combination of baseline direct cost and minimum wage of LKR 400 per day with scenario C showing the combination of best case of direct costs and LKR 1500 per day for productivity losses.

Discussion

This study may be the first attempt at publishing the costing of an elective surgical intervention in a LMIC that includes the preoperative, postoperative and convalescence costs. In terms of total cost, NDVH appears to be the cheapest option for the district hospital, whereas TAH appears to be the cheapest for the tertiary hospital. The direct costs do not appear to be different among the two centres in terms of time periods and categories. However, TLH costs more than NDVH and TAH at both centres. The cost of a NDVH was slightly less than TAH at the district hospital, whereas the cost of TAH was slightly less than NDVH at the tertiary hospital.

As expected, labour costs accounted for the biggest proportion in terms of cost type for direct costs [15, 18]. Indirect costs were related more to the centre rather than the route of hysterectomy which may illustrate the socioeconomic differences among the two centres, one an urban setting and the other a remote setting. The comparatively lower socioeconomic indices of the remote setting may be reflected in the lower indirect costs except the TLH group who had significantly higher ‘out-of-pocket’ and carer costs compared to TAH and NDVH groups at Mannar. Contrary to what was seen in the region, the biggest proportion of indirect costs was transport costs rather than productivity losses [15]. The actual cost of transport was valued at a much higher level than the productivity losses by these women. This was due to the fact that most were housewives with no monetary remuneration.

Costing is particularly difficult in the hospital setting due to case heterogeneity, labour intensity and the complexity of the service delivery processes [9]. Costing needs considerable resources and depends on the accurate grouping of patients which needs large-scale funding, something that is hard to come by for LMICs, where the need for efficiency is actually much more than for developed countries [19]. However, the use of time-driven, activity-based costing of labour can overcome the drawbacks of conventional bottom-up micro-costing, resources in terms of training, time and money. The combination of this with bottom-up micro-costing for medications and top-down micro-costing for equipment, utilities and investigations was a pragmatic method of overcoming these issues.

When calculating proportionate equipment costs for each procedure, the rate of utilization of an equipment would vary during its life span as well as per procedure. Thus, for practical purposes the average rate of utilization was considered as there was no information available for the duration of all procedures. There was also a difficulty in quantifying utility cost in terms of surgical procedure as the degree of utilization of space, electricity and water would vary according to speciality and clinical problem. This problem was further compounded by the fact that there were only single meters for electricity and water at both hospitals. Therefore, apportioning the costs for basic utilities was done using the average midnight total for the entire hospital assuming that each in-patient would consume a similar proportion of basic utilities. However, utility costs (space cost, water, electricity etc.) were not considered for clinic patients as the clinic time is approximately 15 min per patient and, as such, is unlikely to be of much significance considering other costs incurred in this study. Similarly the cost of space was not considered for theatres as the duration of theatre time used for hysterectomy compared to total hospital stay was insignificant. In the same way, the cost of equipment at clinics and ward was not considered as they were assumed to be insignificant compared to cost of surgical and anaesthetic equipment. The cost of basic utilities was also not considered separately for theatre as it was likely be reflected in the utility cost calculated using midnight totals.

An advantage in our study was that transference of direct hospital costs to patient-related indirect costs was identified as patients who had preoperative private consultations did not have preoperative visits in the hospital clinic. In such patients, private consultations were considered as out-of-pocket costs under indirect costs.

The sensitivity analysis looked at modifying reported costs or altering our assumptions in order to see how the overall costs would change. Whilst acknowledging that discount rates may be time and country specific, especially for LMICs, a rate of 10% was considered as the Treasury bill rates vary around this figure in Sri Lanka. We also wanted to examine the change in circumstances with the addition of a minimum wage cost to the time to recover to reassess the productivity losses. The governmental minimum wage of LKR 400/per day along with a more pragmatic LKR 1500/per day was considered for indirect costs in the sensitivity analysis. Whilst scenario A is the lowest baseline cost based on reported data, scenario B or C may be more applicable for a more affluent urban setting. This may also be relevant in the future where productivity losses are more likely to be appreciated. What is noticeable is that the difference in costs between the conventional TAH and NDVH or TLH decreases with scenarios B and C, to the extent that it is cheaper in some instances in addition to a faster recovery.

Whilst these costs are generic to hysterectomy at the hospitals concerned, hysterectomy costs in a given public sector hospital in Sri Lanka may be similar to either the urban (Ragama) or peripheral (Mannar) setting. The societal perspective in calculating costs in this study is likely to generate an accurate picture of both direct hospital-related and indirect patient-related costs for hysterectomy. The use of time-driven activity-based costing for the main driver, labour and the use of top-down micro-costing for fixed costs helped to overcome logistical difficulties in a LMIC setting and may serve as a template for surgeons and hospital administrators in any setting to cost any surgical intervention with little modification to address procedure-related issues.

References

Fetter J, Shin Y, Freeman JL et al (1980) Case mix definition by diagnosis-related groups. Med Care 18(2):1–53

Busse R, Geissler A, Aaviksoo A et al (2013) Diagnosis related groups in Europe: moving towards transparency, efficiency, and quality in hospitals? BMJ (Clin Res ed.) 347(7916):1–7

Independent Hospital Pricing Authority (2015) The AR-DRG classification system. https://www.ihpa.gov.au/admitted-acute-care/ar-drg-classification-system. Accessed 19 April 2017

Drummond M, Sculpher M, Torrance G et al (2005) Cost analysis. In: Methods for the economic evaluation of health care programmes. Oxford University Press, Oxford pp 55–102

Gray AM, Clarke PM, Wolstenholme J, et al (2011) Defining, measuring, and valuing costs. In: Applied methods of cost-effectiveness analysis in health care, Oxford University Press, Oxford pp 119–142

Negrini D, Kettle A, Sheppard L et al (2004) The cost of a hospital ward in Europe. J Health Org Manag 18(3):195–206. https://doi.org/10.1108/14777260410548437

Lipscomb J, Yabroff KR, Brown ML et al (2009) Health care costing: data, methods, current applications. Med Care 47(7 Suppl 1):1–6

Tan SS, Rutten FF, van Ineveld BM et al (2009) Comparing methodologies for the cost estimation of hospital services. Eur J Health Econ 10(1):39–45

Mercier G, Naro G (2014) Costing hospital surgery services: the method matters. PLoS ONE 9(5):e97290. https://doi.org/10.1371/journal.pone.0097290

Riewpaiboon A, Malaroje S, Kongsawatt S (2007) Effect of costing methods on unit cost of hospital medical services. Trop Med Int Health 12(4):554–563

Larsen J, Skjoldborg US (2004) Comparing systems for costing hospital treatments: the case of stable angina pectoris. Health Policy 67(3):293–307

Hendriks ME, Kundu P, Boers AC et al (2014) Step-by-step guideline for disease-specific costing studies in low- and middle-income countries: a mixed methodology. Glob Health Action 28(7):23573. https://doi.org/10.3402/gha.v7.23573.eCollection2014

Grimes CE, Henry JA, Maraka J et al (2014) Cost-effectiveness of surgery in low- and middle-income countries: a systematic review. World J Surg 38(1):252–263

Ranson MK, John KR (2002) Quality of hysterectomy care in rural Gujarat: the role of community-based health insurance. Reprod Health Matters 10(20):70–81

Khan A, Zaman S (2010) Costs of vaginal delivery and Caesarean section at a tertiary level public hospital in Islamabad, Pakistan. BMC Pregnancy Childbirth 10:2

Ekanayake CD, Pathmeswaran A, Kularatna S et al (2017) Cost evaluation, quality of life and pelvic organ function of three approaches to hysterectomy for benign uterine conditions: study protocol for a randomized controlled trial. Trials 18(1):1–10

Parliment of the Democratic Socialist Republic of Sri Lanka (2016) The national minimum wage of workers act, no.3 of 2016. Sri Lanka

Chatterjee S, Laxminarayan R (2013) Costs of surgical procedures in Indian hospitals. BMJ Open 3(6):e002844. https://doi.org/10.1136/bmjopen-2013-002844

Wordsworth S, Ludbrook A, Caskey F et al (2005) Collecting unit cost data in multicentre studies: creating comparable methods. Eur J Health Econ 6(1):38–44

Ottosen C, Lingman G, Ottosen L et al (2000) Three methods for hysterectomy: a randomised, prospective study of short term outcome. BJOG Int J Obstet Gynaecol 107(11):5–1380

Acknowledgements

We are grateful to the Regional Director of Health Services-Mannar; Director, District General Hospital-Mannar; Director, North Colombo Teaching Hospital, Ragama. We acknowledge the contribution of the study participants and the staff of the two respective units. A special note of appreciation goes to the research assistants, Dr. Rienzie Pieris and Dr. Lakshika Liyanage.

Funding

This work was supported by the National Research Council Grant 16-086 from National Research Council of Sri Lanka.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

None

Ethics approval and consent to participate

Ethics approval was obtained from the ethics review committee of the Faculty of Medicine, University of Kelaniya (P/12/01/2016). All participants provided informed written consent to participate.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Ekanayake, C., Pathmeswaran, A., Kularatna, S. et al. Challenges of Costing a Surgical Procedure in a Lower–Middle-Income Country. World J Surg 43, 52–59 (2019). https://doi.org/10.1007/s00268-018-4773-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00268-018-4773-9