Abstract

This paper assesses the impact of legal institutions on firm dynamics in a model where entrepreneurs have heterogeneous risk aversion, credit constraints and may default. Entrepreneurs choose firm size, capital structure, consumption, default and whether to incorporate. We find that less risk-averse entrepreneurs tend to incorporate while more risk-averse entrepreneurs do not; this occurs because leaving some personal assets exposed by not incorporating allows more risk-averse borrowers to credibly commit to lower default rates. We show that incorporation is determined by two effects: the standard effect that bankruptcy insures low firm returns and a new “scale effect”—more risk-averse entrepreneurs run smaller firms and default more often. The more risk-averse choose to leave some personal assets unshielded in bankruptcy due to a commitment problem that dominates the value of insurance. The less risk-averse run larger firms, default less and incorporate.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Supporters of the U.S. Bankruptcy Act of 1800 argued that “unforeseen accidents” were ruining respectable merchants and that there was substantial social value in returning these merchants to active business. See Mann (2003), note 11, pp. 57, 73. The fact that bankruptcy provides insurance against ruinous outcomes is well established. We call this the standard “insurance effect” of bankruptcy. In this paper we introduce a new “scale effect” in bankruptcy and show how the two effects impact an owner’s decision to incorporate a firm. The key idea is that when firm size (i.e., scale of production) is a choice variable, less risk-averse entrepreneurs operate larger firms.

The U.S. Bankruptcy Code specifies a statutory period during which the owner of a bankrupt firm cannot manage it.Footnote 1 This mandated shutdown period creates an opportunity cost for entrepreneurs that depends on their firm’s scale of production. Because more risk-averse entrepreneurs run smaller firms, their loss from not being able to operate a firm during the statutory period is smaller than the loss of less risk-averse entrepreneurs. We show that by remaining unincorporated, entrepreneurs who do not have this high opportunity cost can demonstrate their commitment to a lower default rate by leaving some assets unshielded, i.e., choosing not to incorporate the firm.

Historically, the fundamental role of corporate law was to limit personal liability for business debts; Hovenkamp (1991), pp. 49–55. An incorporated firm is a separate legal entity, which protects owners’ personal assets from seizure in bankruptcy to pay firm debts. If a firm remains unincorporated, owners’ assets are not shielded and they are personally responsible for firm liabilities. In the U.S. roughly half of all entrepreneurs are unincorporated, exposing owners to substantial personal risk. Why would some entrepreneurs choose to forego the protection of personal assets that incorporation affords? Even more surprisingly, when businesses incorporate why do some entrepreneurs “undo” this protection by pledging personal assets as collateral for business loans?

We construct a dynamic model with credit-constrained borrowers who differ with respect to risk aversion and choose whether or not to incorporate their firms. The model shows that the answer to the questions is linked to differences in entrepreneurs’ ability to commit to a lower default rate. The model focuses on dynamic firm scale, capital structure and default choices, and abstracts from incorporation costs, taxes and information asymmetry.Footnote 2 Crucially, entrepreneurs choose either to incorporate or to remain unincorporated. As noted at the outset, two countervailing forces affect the incorporation decision: the well-known insurance benefit of personal asset protection in corporate bankruptcy versus the effect that firm scale has on the decision to default. We show that it can be optimal for the owners of smalls firms not to protect personal assets by incorporating because small borrowers are more likely to default. Leaving some private assets exposed by not incorporating, or pledging personal assets as collateral, gives small borrowers tools to credibly commit to a lower default rate.

Our analysis builds on the model by Herranz et al. (2015) with a risk-neutral lender and many long-lived agents who differ in their willingness to bear risk. Each period, agents choose consumption and whether to run a firm with idiosyncratic return risk. If they run a firm, they choose its size, capital structure (mix of personal funds and outside loans), and whether to default. Risk cannot be diversified because owners run a single firm, not a portfolio of firms, and firms may be credit constrained. Default sometimes occurs in equilibrium, with the lender recovering only a fraction of the loan and the firm unable to obtain credit for several periods. We add the decision to either incorporate or remain unincorporated to the model.

Owners’ personal assets are protected if the firm incorporates. If the firm remains unincorporated, the lender can seize a fraction of the owner’s personal assets. Firms weigh the effect of default today against access to future credit, given bankruptcy rules. A bankruptcy rule specifies three things: the court’s cost of transferring assets, a statutory period during which the owner loses control of the firm and any returns, and a statutory percentage of personal assets the court can seize in bankruptcy (zero when the firm is incorporated.) We take the rule as given and do comparative statics in order to understand the implications of alternative legal environments.

The model shows that entrepreneurs that are more willing to bear risk choose to operate larger firms with more self-finance, default only in very bad states,Footnote 3 and they tend to incorporate in order to protect their personal assets. In contrast more risk-averse agents may not run firms, but if they do their firms will tend to be small with higher default and lower future value. We show that it may be optimal for such owners to leave some personal assets at risk in bankruptcy by remaining unincorporated because this allows them to credibly commit to a lower default rate. Crucial determinants of incorporation are an entrepreneur’s degree of risk aversion and the characteristics of the firm’s investment project, which in turn affect the insurance and scale effects. When projects have a high expected return and low variance, it is beneficial to protect private assets by incorporating.

Our paper is related to a large literature on entrepreneurship.Footnote 4 We build on Herranz et al. (2015), who show how entrepreneurs who incorporate use firm size, capital structure and default to manage non-diversifiable firm return risk. Our paper complements recent analyses of the quantitative effects of bankruptcy rules in dynamic models with limited commitment and incomplete markets begun in Athreya (2002). Chatterjee et al. (2007) and Livshits et al. (2007) show that U.S. consumer bankruptcy provides partial insurance against bad luck due to health, job, divorce or family shocks, but it drives up interest rates, which impedes intertemporal smoothing. In the latter paper the insurance effect slightly dominates the interest rate effect, while the former finds the reverse. Meh and Terajima (2008) extend the model to study the effect of consumer bankruptcy on unincorporated entrepreneurs and find large benefits from eliminating the personal bankruptcy exemption, but losses from eliminating consumer bankruptcy entirely. Davila (2016) derives and optimal exemption for consumer bankruptcy.

In a paper that focuses on different aspects of incorporation, Glover and Short (2011) document that incorporated entrepreneurs operate larger businesses, accumulate more wealth, and are more productive than unincorporated entrepreneurs on average. They do a counterfactual exercise to determine whether reducing incorporation costs can account for an increase in U.S. wealth inequality. In our model less risk-averse entrepreneurs tend to incorporate while more risk-averse entrepreneurs do not. This outcome may seem counterintuitive, but we show that leaving some personal assets at risk in bankruptcy mitigates the commitment problem that the more risk-averse face. Our paper is also related to a large literature on collateral, which we discuss in the concluding remarks.

The paper proceeds as follows. Section 2 contains the model. Section 3 considers two examples in a one-period model to build intuition for the “scale” and “insurance” effects. Section 4 states the dynamic problem, where entrepreneurs choose whether or not to incorporate. The model calibration is in Sect. 5 and numerical comparative static exercises are in Sect. 6. Section 7 concludes.

2 Model

The model builds on Herranz et al. (2015). The economy has \(t=0,1,\ldots \) time periods, with a risk-neutral competitive lender and many infinitely lived agents. We assume the lender has an elastic supply of funds and makes one-period loans. This composite lender supplies all liabilities (bank loans, trade credit and other liabilities) and can infer borrower risk aversion. The average maturity on loans to small firms is less than 1 year in the Federal Reserve’s Survey of Terms of Business Lending because small firms lack audited financial statements, payment or profit histories, or verifiable contracts with workers, suppliers or customers. Agents have a common discount rate \(\beta \) and preferences that are heterogeneous with respect to risk aversion parameter \(\rho \ge 0\). Given \(\rho \), each agent’s CRRA utility function over consumption is given by

At \(t=0\), agents have endowment \(w_0\) and access to an ex-ante identical constant returns to scale technology. If operated, the technology produces output x per unit of assets invested A. The firm’s return is given by random variable X with cumulative distribution function F(x) and probability density function f(x), which is strictly positive on support \([\underline{x},\bar{x}]\), with \(\underline{x}\le 0\), \(\bar{x} >0\), and iid across time periods. A negative realization means that firm losses in a year exceed its current assets; the owner must either use personal funds to stay solvent or default. In all periods \(t \ge 1\), agents’ net-worth \(w_t\) is derived from the return on investment and is known at the beginning of the period. We assume that all agents also have access to an alternative investment opportunity with return r.

Entrepreneurs are agents that choose to operate a firm, which means \(A>0\), and they raise firm assets at time t by equity and debt. Equity is self-finance from the agent’s personal net-worth \(w_t\), which incurs real opportunity cost r. Debt is a loan, secured by business assets, at interest rate \(r_L=\bar{v}/(1-\epsilon )\), where \(\bar{v} A\) is the total loan amount that must be repaid in the next period (principal plus interest) and \((1-\epsilon )\) is the fraction of debt finance. If agents do not wish to run a firm, they set \(A=0\) and consume \(w_t\).

The model has three interest rates: \(r_L\) is the business loan interest rate, determined endogenously for each entrepreneur by the model; the risk-free rate is \(r_f\) and r is the entrepreneur’s opportunity cost of providing equity to the firm. Net-worth w consists largely of illiquid assets, such as home equity or retirement savings. The entrepreneur’s opportunity cost r of using personal funds to provide equity to the firm is thus higher than risk-free rate \(r_f\), the lender’s opportunity cost of funds, meaning that lenders (banks) have better access to funds than entrepreneurs. Since entrepreneurs default with positive probability in equilibrium, the lender’s loan rate \(r_L\) generally exceeds r. Given a level of business assets A in a period, the entrepreneur determines the optimal financial structure by choosing the fraction of self-finance \(\epsilon \). Total equity is \(\epsilon A\) and total debt is \((1-\epsilon )A\) at the beginning of the period, while at the end of the period the firm has assets xA and liabilities \(\bar{v}A\).

The firm faces a borrowing constraint, \((1-\epsilon )A\le bw\), which limits business loans to fraction b of entrepreneur net-worth. If the model were static, this constraint would be identical to Evans and Jovanovic (1989). In contrast, our constraint depends on agent net-worth w, which evolves over time and includes both firm and personal assets.Footnote 5 Firm assets, and sometimes personal assets, can be seized when the firm is bankrupt. The constraint indicates that the lender also takes account of the fact that the entrepreneur will use personal assets to “bail out the firm” when this is optimal.

We augment the legal system in Herranz et al. (2015) to allow the entrepreneur to remain unincorporated. Parameters \(\delta \), T and \(\gamma \) describe bankruptcy institutions. After firm return x is realized the entrepreneur chooses whether to repay loan \(A\bar{v}\) or default.Footnote 6 Parameter \(\delta \) is a deadweight bankruptcy loss (e.g., firm assets are sold at a loss). When bankruptcy occurs the court determines the total value of firm assets and transfers \(1-\delta \) to the lender. In addition, the entrepreneur does not have access to the firm’s returns for T periods after bankruptcy.Footnote 7 Parameter \(\gamma \) is the percentage of personal assets the court can seize in bankruptcy. If the entrepreneur is incorporated, \(\gamma =0\) and only firm assets can be seized. If the entrepreneur is unincorporated, \(\gamma \) is set at the statutory rate \(\bar{\gamma }>0\). Whether the firm is incorporated to not, the entrepreneur has the option to pay firm debt with personal funds if this is optimal.

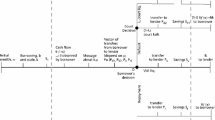

The timing of events for firms is as follows:

-

1.

Beginning of period t (ex-ante) entrepreneur net-worth is w. There are two cases:

-

(a)

The entrepreneur did not declare bankruptcy in any of the previous T periods Choose consumption c, firm assets A, self-finance \(\epsilon \) (debt is \(1-\epsilon \)), and amount \(\bar{v}\) to repay per unit A, subject to the lender receiving at least ex-ante expected payoff \((1-\epsilon )(1+r_f)\).

-

(b)

The entrepreneur declared bankruptcy k periods ago The owner cannot operate the firm for the next \(T-k\) periods. Hence, only current consumption is chosen.

-

(a)

-

2.

At the end of the period (ex post) the firm’s return on assets, x, is realized. Total end-of-period firm assets are Ax. The entrepreneur decides whether or not to default. Consider the implications of each choice.

-

(a)

Default Personal assets are invested at outside interest rate r.

-

(i)

Incorporated Only firm assets are seized. The entrepreneur retains personal net-worth \((1+r)(w-\epsilon A-c)\).

-

(ii)

Unincorporated Firm and personal assets are seized. The entrepreneur retains personal net-worth \((1-\bar{\gamma })(1+r)(w-\epsilon A-c)\).

-

(i)

-

(b)

No default Entrepreneur net-worth is \(A(x-\bar{v})+(1+r)(w-\epsilon A-c)\), which includes both net-equity in the firm and the return on personal assets.

-

(a)

3 Incorporation choice in the one-period model

In this section we show by means of examples that a firm’s legal status impacts its capital structure and size. The standard reason to incorporate is to protect private assets if bankruptcy occurs. We call this the “insurance effect,” where more risk-averse entrepreneurs incorporate to insure against the possibility of losing personal assets when the firm has bad realizations. In general the cost of this insurance is reflected in a higher loan rate, which the more risk averse are willing to pay. In contrast, less risk-averse entrepreneurs would be better off remaining unincorporated (ceteris paribus) because they value bankruptcy insurance less and avoid the loan rate increase. This basic observation leads to a puzzle. If firm size (i.e., scale of production) is a choice variable, then entrepreneurs face two countervailing factors: Less (more) risk-averse entrepreneurs will tend to operate larger (smaller) firms, which exposes owners to greater (less) risk, but they also value bankruptcy insurance less (more). In this section we focus on better understanding the standard “insurance effect” and our new “scale effect,” and how they impact a firm’s incorporation decision.

A prediction that small firms should incorporate while large firms do not would be counterfactual. Data from the Survey of Small Business Finances show that large firms are more likely to incorporate. When size is measured by firm assets, the percentages of firms with assets below $25,000 with unlimited liability (small and unincorporated) in the respective survey years are: 41% in 1993, 50% in 1998, and 49% in 2003 and the corresponding numbers with limited liability (small and incorporated) are 16% in 1993, 21% in 1998, and 22% in 2003. For firms with assets above $1 million, the percentages of firms with unlimited liability (large and unincorporated) in the respective survey years are 3.1% in 1993, 2% in 1998, and 2.9% in 2003 and the corresponding numbers for firms with limited liability (large and incorporated) are 13.3% in 1993, 12% in 1998, and 11.9% in 2003. The pattern is the same when firms are measured by number of employees. See Herranz et al. (2009), Tables 3 and 4, for all remaining firms size bins.

The “flaw” in an argument that suggests that small, rather than large, firms should incorporate is that the choice of incorporation itself will affect firm scale A and capital structure \(\epsilon \). In order to isolate the “scale” and “insurance” effects we construct two examples. The first example focuses on the firm scale effect by fixing risk aversion at \(\rho = 1\) (log utility), and exogenously varying firm size from “small” to “large.” The second example fixes the amount the firm can borrow, which means that owner provided self-finance, \(\epsilon \), is the only way to increase firm size, leading to greater potential loss of personal assets in bad states. Risk aversion is varied from \(\rho = 1\) to \(\rho = 3\) to gauge the insurance effect. Example 1 shows that if a firm can expand its scale, incorporation can reduce its risk, ceteris paribus. Example 2 shows that more risk-averse entrepreneurs will run unincorporated firms, ceteris paribus.

Both examples assume one time period and that:

-

1.

The riskless interest rate is zero.

-

2.

The loss from transferring assets in the case of bankruptcy is \(\delta =0.5\).

-

3.

If the firm is unincorporated, half of private assets can be seized in bankruptcy, \(\gamma = 50\)%.

The goal of the examples is to better understand how entrepreneurs use incorporation to protect personal assets. We abstract from other reasons that affect the incorporation decision, such as taxes and incorporation costs.Footnote 8

Example 1

Let the distribution of firm returns, x, be discrete with return 0.2 in the “bad state” and 3 in the “good state,” with each state occurring with probability 0.5. The entrepreneur’s endowment is \(w=2\). The ratio of equity and outside capital (debt) is \(\epsilon =0.5\). Suppose there are two funding levels for the firm:

-

(a)

The entrepreneur can borrow 0.1 units of capital and operate the firm at scale \(A=0.2\).

-

(b)

The entrepreneur can borrow 1 unit of capital and operate the firm at scale \(A=2\).

We evaluate the two exogenous firm scales under each legal status, incorporated or unincorporated.

(a) Small firm If the firm is incorporated, then the entrepreneur will default in the bad state, retaining 1.9 units of capital. In order to break even, a risk-neutral lender must charge a loan rate \(r_L\) that satisfies: \((0.5)(1-\delta ) 0.2 A+(0.5)A(1-\epsilon )(1+r_L)=A(1-\epsilon )\). Thus, \(r_L=80\%\). Hence the payoff to the entrepreneur in the good state is \(1.9+3A-(1-\epsilon ) A (1+r_L)=2.32\).

If the firm is unincorporated, then default never occurs, in which case the loan rate is \(r_L=0\%\). If the bad state occurs and the firm repays, the payoff is \(1.9-0.1+0.2A=1.84\), while the payoff would be \((1-\gamma )1.9=0.95\) in the case of default. Given that the loan rate is 0%, the payoff in the good state is therefore \(1.9+3A-(1-\epsilon )A=2.4\).

(b) Large firm If the firm is incorporated, then the entrepreneur’s payoff in the bad state is 1. The loan rate satisfies the same equation as in case (a), with \(r_L=80\%\). As a result, the payoff to the entrepreneur in the good state is \(1+3A-(1-\epsilon ) A (1+r_L)=5.2\).

If the firm is unincorporated, again it is better not to default in the bad state and the loan rate is 0%. The resulting payoff is \(1+0.2A-(1-\epsilon )A=0.6\). The payoff in the good state is \(1+3A-(1-\epsilon )A=6.0\).

Summary Overall, an individual entrepreneur has the choice of four different options, which are summarized in Table 1. The table includes the expected utility given Bernoulli utility function \(\ln (x)\), which corresponds to the case of risk aversion \(\rho =1\). Incorporation results in two possible outcomes 1.9 and 2.32, whereas remaining unincorporated results in outcomes 1.84 and 2.4. It follows immediately that a more risk-averse individual would choose to incorporate in order to enjoy the advantages of bankruptcy protection, whereas a less risk-averse agent would run an unincorporated firm in order to get a lower interest rate.

In Table 1 risk aversion is \(\rho =1\). The entrepreneur would choose to remain unincorporated if the only investment option is (a). When option (b) is available and raising the scale of production is possible, the entrepreneur would be better off protecting personal assets through incorporation.

Example 1 shows that when a firm faces restrictions on its scale of production, it may choose to be unincorporated. For the small firm there is no benefit from protecting private assets because the owner has little to lose if the firm fails. If the firm can expand its scale, however, incorporation becomes a very important tool for reducing return risk, even in a one-period model. This “scale effect” would be even more important in a dynamic model. Moreover, if incorporation is not an option, the firm may choose to remain small.

Example 1 fixed risk aversion and investigated the effect of exogenously changing firm scale on a entrepreneur’s incorporation decision. Example 2 studies the effect on incorporation when the amount that the entrepreneur can borrow is fixed, but scale change occurs due to exogenous changes in the entrepreneur’s fraction of self-finance, \(\epsilon \). We show that a higher level of self-finance reduces the entrepreneur’s incentive to default and hence more closely aligns entrepreneur and lender incentives. As a consequence, it may be optimal for the entrepreneur to incorporate in order to protect assets in very bad states. In contrast if \(\epsilon \) is small, higher levels of default may occur unless the firm is unincorporated.

Example 2

Suppose there are three states l, m, h, with realizations 0, 0.9 and 1.3. The states occur with probabilities 0.01, 0.49, and 0.5, respectively. As in Example 1, assume \(\delta =0.5\), \(\gamma =0.5\) and that the risk-free rate is zero. The entrepreneur’s endowment is now \(w=1\). Suppose that the entrepreneur can only take a loan of size 0.2. There are two options: (a) \(\epsilon =0\), in which case the scale of production is \(A=0.2\), and (b) \(\epsilon =0.8\), in which case \(A=1\).

Option (a), \(\epsilon =0\): Suppose the firm is incorporated. Then default will occur at least in states l and m. The loan rate must satisfy \(0.49(1-\delta ) A (0.9)+0.5 A (1+r)=A\). Thus, \(r=55.9\%\). Because \(1+r\) exceeds the return in state h, it is therefore optimal to also default in state h. As a consequence, it is not feasible for the entrepreneur to receive funding, and payoffs are \(w=1\) in each state.

If the firm is unincorporated, then default will only occur in state l. The loan rate must satisfy \((0.01)\gamma +(0.99)(1+r)A=A\), and hence \(r=-1.5\%\). The entrepreneur’s payoffs in the three states are therefore 0.5, \(1+A(0.9-(1+r))=0.983\) and \(1+A(1.2-(1+r))=1.063\).

Option (b), \(\epsilon =0.8\): Even if the firm is incorporated it will no longer default in state m. The loan rate satisfies \((0.99)(1+r)A=A\), i.e., \(r= 1\%\). Thus, payoffs are 0.2, 0.898, and 1.298. Similarly, one can show that the payoffs from remaining unincorporated are 0.1, 0.903, 1.303.

Summary Table 2 displays the payoffs with expected utilities for risk aversions \(\rho =1\) and 3, respectively; the utility maximizing choices are in bold. The less risk-averse entrepreneur chooses to use more personal funds and runs an incorporated firm. In contrast, the more risk-averse individual prefers to use less personal funds and it is now optimal to be unincorporated. This ensures that the incentive to default is reduced, making it possible for the entrepreneur to raise funds.

If a firm is unincorporated, the fact that the entrepreneur must pay debts in part from personal funds results in a lower level of default, which may improve ex-ante efficiency. The key point is that agents are ex-ante unable to commit to a “default strategy.” This differs from Glover and Short (2011), p. 14 where “incorporated entrepreneurs can always at least mimic the unincorporated entrepreneur.” This type of mimicking is not possible in our model because of the inability to commit not to default. This commitment problem matters more if \(\epsilon \) is small, which is the case for more risk-averse individuals. It may therefore be optimal for such types to remain unincorporated, even though incorporation is costless in our model. In contrast, entrepreneurs would incorporate in Glover and Short (2011)’s model with positive costs.

The rationale for the more risk-averse type to remain unincorporated is that it reduces the incentive to default. This dominance of remaining unincorporated is solely generated by a fundamental commitment problem. Ex-ante it is optimal for the \(\rho =3\) entrepreneur to commit not to default in state m, while protecting assets in the worst state, l, by choosing to incorporate. However, there is no “commitment technology” to guarantee the borrower will not default on the loan. Announcing a strategy ex-ante to “not default” is merely cheap talk.

In order to illustrate the value of commitment see Table 3. Consider again investment option (a) where \(A=0.2\), \(\epsilon =0\), but assume that commitment is possible. The interest rate is 1%, since \(0.99(1+r)A=A\). Payoffs in the three states are 1, \(1+A(0.9-(1+r))=0.978\), and \(1+A(1.2-(1+r))=1.038\). The ability to commit to repay in state m, and enjoy protection against seizure of private assets in state l, yields a higher payoff than from remaining unincorporated (since the firm does not default in state m when unincorporated in the no commitment case, adding commitment does not increase the entrepreneur’s payoff.) However, if state m occurs the entrepreneur has an incentive ex post to renege on the promise, as it would raise the entrepreneur’s payoff from 0.978 to 1.

One might expect that making a commitment to a lower default probability is easier in a dynamic model. If entrepreneurs who default are unable to raise capital to restart their firms for several periods, default becomes more costly. However, the size of the loss from not being able to operate a firm depends on the scale of production. Since more risk-averse individuals run smaller firms, their loss from not being able to operate a firm is lower than that of less risk-averse individuals. As we will see, this means that in a dynamic model committing to refrain from default remains difficult for more risk-averse entrepreneurs, but it is easier for the less risk-averse types who will therefore choose to incorporate.

4 The dynamic problem

We now describe the dynamic investment problem of an infinitely lived individual entrepreneur. The problem consists of the repeated one-period investment decisions discussed in Sect. 2. At the beginning of each period the entrepreneur must choose the scale of the project, and the amount of personal funds (equity) and outside funds (debt) to invest. At the end of the period, a random project return is realized and entrepreneurs must decide whether or not to repay the outside debt.

Entrepreneur funds and previous default choices link periods together and determine the states. Consistent with U.S. bankruptcy law we assume that if an entrepreneur defaults, then the project cannot be operated for T subsequent periods. After these shutdown periods are over, there is no memory of the default. The state space is therefore given by (w, D) where w is the entrepreneur’s funds at the beginning of a period and D tracks the default history. If \(D=S\), then no default is on record. If, instead, a previous bankruptcy is on record, then \(D=(B,t)\), where t denotes the time since the bankruptcy occurred. We write the value function for the dynamic problem below by \(V_S(w)\) and \(V_{B,t}(w)\).

Consider first the case in which no default is on record. The entrepreneur solves the following optimization problem.

Problem 1

Subject to:

In the objective function, \(\mathfrak {B}\) is the set of all realizations for which the entrepreneur defaults. After default has occurred, the lender receives all remaining project returns, in addition to a fraction \(\gamma \) of the entrepreneur’s private assets \((1+r)(w-\epsilon A-c))\). Note that \(w-\epsilon A - c\) is the entrepreneur’s assets after investment \(\epsilon A\) in the project and consumption c. Over the period, the entrepreneur receives return r on these assets. The entrepreneur also chooses whether or not the lender can obtain some of the entrepreneur’s private assets when bankruptcy occurs. Constraint (4) shows that the entrepreneur can choose \(\gamma =0\), in which case no private assets can be seized, or \(\gamma =\bar{\gamma }>0\). In the first case the entrepreneur’s firm is incorporated, and in the second case it is not. Bankruptcy statutes determine the fraction, \(\bar{\gamma }\), of private assets that a lender can obtain, which we take as given.

The first constraint of the optimization problem specifies that the lender’s return must equal the costs of funds, \(r_f\). The lender’s constraint is normalized by assets. Thus, the payment in bankruptcy states made out of the entrepreneur’s personal assets is divided by A. The first term allows for the possibility of negative realizations, which occur in the data. In this case, the lender absorbs these losses and adjusts the interest rate in order to break even. The second term is the case where bankruptcy occurs but some firm assets remain. In this case, the lender receives a fraction \(1-\delta \) of firm assets. Parameter \(\delta \) accounts for the possibility that transferring assets from the firm to the lender is costly, or that the assets are firm specific and have a lower value to outsiders. The third term is private entrepreneur assets seized by the lender. If the firm is incorporated, then this term is zero because \(\gamma =0\). Finally, the fourth term indicates that if no bankruptcy occurs the lender receives fixed payment \(\bar{v}\) stipulated in the debt contract.

Constraint (2) specifies that entrepreneurs default whenever their payoff from default exceeds that from not defaulting. The next constraint is a borrowing constraint, which specifies that entrepreneurs can borrow up to a fraction b of their funds w. Below we calibrate b to fit Survey of Small Business Finances data; see Herranz et al. (2015). In addition, they show that b can be chosen such that this borrowing constraint is locally slack. This would not affect our results qualitatively. Finally, (4) specifies non-negativity restrictions, \(\epsilon \le 1\) requires entrepreneur self-finance to not exceed 100%, and the choice of \(\gamma \) is specified above.

Next consider the problem of a firm that defaulted \(t\le T\) periods ago. After T periods the firm can operate again, thus \(V_{B,T}(\cdot )=V_S(\cdot )\). Let \(w'\) denote net-worth next period:

Problem 2

\(V_{B,t}(w)=\max _{w'\ge 0} \ \Biggl \{ u\left( w - \frac{w'}{1+r}\right) +\beta V_{B,t+1}(w') \Biggr \}\)

The objective is expected ex-ante utility with budget constraint \(\mathcal {C}(1+r)+w'\le w(1+r)\) substituted in, satisfied at equality. If default occurred the entrepreneur cannot run the firm for T periods.

We now proceed along the lines of Herranz et al. (2015) to show that the value functions are of the form \(V_s(w)=w^{1-\rho }\) in the solvency and default states denoted by \(s=S,D\). To see this suppose that the entrepreneur’s wealth is \(\lambda w\) and consumption is changed to \(\lambda c\), the firm’s assets to \(\lambda A\), while \(\epsilon \) remains unchanged. It follows that the constraints of Problem 1 are satisfied and that \(V_S(\lambda w)=\lambda ^{1-\rho } V_S(w)\). Similarly, it follows again that \(V_B(\lambda w)=\lambda ^{1-\rho } V_B(w)\). Thus, we get the optimization problem below.

Problem 3

Subject to:

Problem 3 is non-convex because the timing of decisions leads to a commitment problem: c, A, \(\epsilon \), \(\bar{v}\), \(\gamma \) are chosen ex-ante, but the bankruptcy decision is made ex post and the firm cannot commit to refrain from bankruptcy. This implies that default set cutoff \(x^*\) is determined by (6). Lotteries cannot be used to convexify the problem because independent randomization over A, \(\epsilon \), c, \(\bar{v}\) and \(x^*\) is not possible.Footnote 9 Herranz et al. (2015) show that if \(\gamma =0\) a solution to the problem exists when \(\rho \ge \underline{\rho }\) and \(\bar{r}>\frac{1}{\beta }-1\) for some \(\underline{\rho }<1\). If there is more than one solution to the recursive problem, then the solution with the maximal \(v_S\) corresponds to the solution of the infinite horizon problem where agents select sequences for consumption, assets, debt-equity and default.

5 Model calibration

We use the Herranz et al. (2015) parameterization for the U.S. economy.

In Table 4 the lender’s opportunity cost of short-term funds \(r_f\) is given by the average real return on 6 month Treasury bills between 1992 and 2006.Footnote 10 The interest rate charged by the lender is strictly higher than \(r_f\) because of bankruptcy costs. The entrepreneur’s opportunity cost of funds r is the real rate on 30 year mortgages over the period. Discount factor \(\beta =0.97\) is approximated by \(1/(1+0.5r_f+0.5r)\), with r and \(r_f\) weighed equally (firm risk cannot be diversified since a portfolio of small firms does not exist). The bankruptcy parameters are \(T=11\) because in the U.S. after 10 years past default is removed from a credit record, and \(\delta =0.1\) is the bankruptcy deadweight loss in Boyd and Smith (1994) and the midpoint of 0–20% in Bris et al. (2006).

Finally, we must determine the distribution F(x). Realization x is the return on total investment A, which is entrepreneur funds \(\epsilon A\) and loans \((1-\epsilon )A\). F(x) therefore corresponds to a return on assets (ROA). We use the ROA computed by Herranz et al. (2009) for incorporated firms. As in our model, they assume that firms have constant returns to scale and the choice of \(\epsilon \) is not relevant for the computation. As a consequence, incorporated and unincorporated firms have the same distribution over x. This is helpful because available data are sufficient to compute ROA for incorporated firms. This is not possible for unincorporated firms because the data do not contain the entrepreneur’s wage or the opportunity cost of running the firm. We will also use the normal distribution in counterfactual experiments to show robustness of results to other distributions.

6 Numerical comparative statics

We now conduct two comparative static computational experiments. Overall we show that incorporation depends on an entrepreneur’s degree of risk aversion and the characteristics of the project. The first experiment shows the main result of the paper. If entrepreneurs could commit to a particular level of default (\(x^*\)), then default and interest rates would be lower than in the case where commitment is not possible, and welfare would be higher. The second experiment is a robustness exercise on the distribution of return on assets, F(x). When projects have a higher expected return with lower variance, it is beneficial to protect private assets (i.e., to incorporate).

6.1 The benefits and costs of incorporation

Bankruptcy parameter \(\gamma \) determines the percentage of personal assets a court can transfer to lenders to cover a bankrupt firm’s debts. A higher \(\gamma \) makes entrepreneurs less likely to default. We would expect this reduction in default to be larger for more risk-averse individuals, as Example 2 in Sect. 3 shows. This is the standard “insurance effect”—a more risk-averse entrepreneur is more adversely affected by the risk that private assets could be seized than an individual who is less risk-averse. Example 1 shows there is also a “scale effect”—less risk-averse individuals operate larger projects and derive a larger fraction of their income from them. As a consequence, they have more to lose if they are unable to operate the firm for the T shutdown periods required by bankruptcy law. The threat of losing this income is increasing in firm size, which means the interests of these less risk-averse entrepreneurs and the lender are more aligned. In other words, the fact that the lender knows that these entrepreneurs have a higher opportunity cost of foregone profits if the firm defaults provides credible commitment that their default rates will be lower.

To see that this is the case consider Fig. 1. We compare our model to a world in which it is possible ex-ante to fully commit to a default cutoff \(x^*\) and all firms are incorporated (\(\gamma =0\)). Critical realization \(x^*\) determines the default set: For all firm project realizations \(x\le x^*\) the firm defaults, and for all realizations above \(x^*\) the firm repays its debts. The top line in Fig. 1 is the default rate as a function of risk aversion for the model when no commitment to default is possible. This is our benchmark model with all firms incorporated. The bottom line is the case where the entrepreneur and lender contract ex-ante and the entrepreneur can commit to default cutoff \(x^*\). The gap between the two lines shows the impact of commitment on default. Observe that the gap is smallest for the least risk-averse (low \(\rho \)) types. The fact that the least risk-averse types would forgo the most profit if the firm was shutdown for the mandated T periods in bankruptcy causes the gap to be small.

The top line in Fig. 1 shows that default is low for firms with low levels of risk aversion (about 3.5%) and it increases to 5.5% for firms whose owners are more risk-averse when they cannot commit to refrain from default. The kink occurs where the borrowing constraint becomes slack. Entrepreneurs with risk aversion above \(\rho =2.2\) no longer wish to borrow \(b=21.5\)% of their wealth. Herranz et al. (2015) show the top line is given by:

The full commitment curve in Fig. 1 is U-shaped (see the bottom line). Entrepreneurs with low \(\rho \)’s run larger firms and as a consequence need more insurance against low realizations, which is reflected in a higher \(x^*\) and thus an initially higher default probability of about 3% in the bottom curve, which then falls. For higher \(\rho \) this scale effect is less prominent and is dominated by the insurance effect—more risk-averse individuals want more bankruptcy insurance, resulting in a higher \(x^*\) and a return to a default probability near 3%. We call the difference between the two commitment cases (the top and bottom lines) the commitment premium.

In practice, full commitment to \(x^*\) is not possible. A key finding from our paper is that one way to reduce the default differential in Fig. 1 is to post collateral by remaining unincorporated. Entrepreneurs with higher risk aversion optimally choose to keep some personal assets “unshielded” to settle firm debt in bankruptcy by choosing \(\gamma >0\). This lowers default and the interest rate on loans. However, raising \(\gamma \) too high may not be optimal because it increases the risk of bad x realizations to the entrepreneur by weakening bankruptcy insurance. In response, the entrepreneur may shrink the size of the firm. The owner of an incorporated firm could also achieve \(\gamma > 0\) by pledging private assets, such as a house, as collateral for firm debt, to “undo” the corporate bankruptcy shield.Footnote 11

Now consider Fig. 2. The two panels on the left measure the entrepreneur’s “payoff loss” if fraction \(\gamma \) of private assets are seized in bankruptcy. This payoff loss is measured as follows. Suppose a person with risk aversion \(\rho \) receives a lifetime utility of v. We convert this utility into a constant consumption stream, c, which would yield the same utility. Clearly, c is defined by equation

Let c be consumption for \(\gamma =0\) and \(\tilde{c}\) denote the consumption for some other \(\tilde{\gamma }>0\). We compute the percentage change in consumption between c and \(\tilde{c}\). This is the value on the vertical axis of Fig. 2.

A larger level of unshielded personal assets \(\gamma \) implies that the entrepreneur is less likely to default, and hence, the default probability in Fig. 2 falls. However, since some private assets are seized in the case of bankruptcy, entrepreneurs will reduce the scale of production to limit their exposure to risk, which reduces welfare. Figure 2 shows that the scale effect dominates for lower levels of risk aversion, and hence, protecting all private assets is optimal for individuals with the low levels of risk aversion in the top panel (\(\rho =0.8\) and \(\rho =1.55\)). In contrast, the bottom panel shows that when risk aversion is higher (\(\rho \) between 2 and 3), there are welfare gains from leaving some personal assets unshielded because the default probability is higher and remaining unincorporated is a way for a firm to credibly commit to lower default.

If entrepreneurs remain unincorporated, a fraction of their private assets can be seized, but in practice the amount that can be taken will differ among entrepreneurs. For example, if an individual has equity in a house, depending on the U.S. state of residence, part of the equity can be retained in bankruptcy. In contrast, if the individual does not own a house, this way of shielding private assets is not possible. In all three risk aversion cases in the lower panel remaining unincorporated and personally liable for some firm debts is better than incorporating (\(\gamma =0\)) if more than about 20% of private assets can be seized. Thus, an individual who can protect a somewhat larger fraction of private assets (e.g., through retirement savings, which cannot be seized in bankruptcy) will be more likely to remain unincorporated. Further, recall that we assume that incorporation costs are zero. Consider now an individual with risk aversion \(\rho =3\) and suppose that bankruptcy would result in a loss of 30% of private assets. This individual would lose about 4% of consumption. If the incorporation costs are equivalent or larger than 4%, remaining unincorporated would be optimal.

In the context of consumer rather than firm bankruptcy, \(\gamma \) would determine the level of asset exemption that the bankruptcy code allows. In particular, \(\gamma =0\) means that all private assets outside the firm are shielded, while increasing \(\gamma \) in our model corresponds to reducing exemptions. When \(\gamma =1\) all assets (firm + personal) can be seized. It is interesting to compare our result to those of Davila (2016) who considers consumer bankruptcy. In his case a strictly positive exemption level is always optimal. In our calibration, \(\gamma =0\) may be optimal and it is never optimal for firms to choose \(\gamma =1\). A key difference between consumer and firm bankruptcy is that firm assets in default are never protected and therefore provide an upper bound for the amount of bankruptcy protection that an entrepreneur can receive.

6.2 Changing project risk and return

We next want to determine how project risk and return affect an entrepreneur’s incorporation decision. For convenience, we switch from our empirical distribution to a normal distribution in order to do comparative statics with respect to mean \(\mu \) and standard deviation \(\sigma \). Figure 3 shows the results of comparative statics with respect to these parameters for an agent with risk aversion \(\rho =3\). Our benchmark values are \(\mu =1.2\) and \(\sigma =0.5\), which results in model solutions that most closely mimic those generated by the empirical distribution.

The top panel of Fig. 3 shows the results of comparative statics with respect to \(\sigma \). In contrast to the empirical distribution, welfare does not decrease but remains constant for sufficiently large \(\gamma \). The reason for this is that the default probability goes to zero, as the right panel shows. Thus, for the normal distribution a person with risk aversion \(\rho =3\) would not incorporate, independently of the fraction of assets that can be seized in bankruptcy. The reason is that the benefit of remaining unincorporated is increasing in the project’s standard deviation. Riskier projects are more likely to default (see the right panel), and therefore, reducing default is more beneficial. The result for changing the project’s return \(\mu \) is similar in the lower panel. A project with a better return is less likely to result in default. Hence, remaining unincorporated to commit to lower default is less beneficial.

Figure 4 shows that the incorporation decision also depends on project characteristics and risk aversion. The left panel shows that a person with risk aversion of \(\rho =1.5\) is worse off when private assets are seized if the project’s return is slightly higher, \(\mu =1.3\), relative to when \(\mu =1.2\), \(\sigma =0.5\) and risk aversion is \(\rho =1.5\). In contrast, if the project’s return is \(\mu =1.2\), then raising \(\gamma \) raises welfare. As a consequence, an individual with level of risk aversion \(\rho =1.5\) would not want to incorporate if the project has the baseline productivity and would be better off incorporating if the project has the higher productivity (\(\mu =1.3\)). Intuitively, a less productive project makes it more difficult to get funding unless private assets are used as collateral.

A related comparative static holds with respect to project risk. In the right panel the entrepreneur is better off not incorporating when \(\sigma =0.5\), while for \(\sigma =0.4\) raising \(\gamma \) lowers welfare, and hence, protecting private assets is optimal. When the project is risky, improving the conditions for external finance by using private assets as collateral is optimal, while for safer projects protecting private assets is a better strategy.

Finally, one may ask why all risk-averse entrepreneurs with a commitment problem do not simply incorporate and pledge collateral. Consider the following example. The owner of a small, unincorporated firm with retirement assets has two options: (1) Withdraw funds from the retirement account and post them as a bond with the lender. This is costly due to early withdrawal penalties and because long-term assets earn higher returns than more liquid investments. (2) Leave the funds in the retirement account but promise to use them to cover business debts. The problem with the second strategy is that seizing retirement assets is not enforceable by a U.S. court, but more generally agents may renege on the promises they make ex-ante. Remaining unincorporated effectively provides collateral when \(\gamma \) is known to all parties and enforced by bankruptcy courts at low cost.

In practice, remaining unincorporated and pledging collateral may be substitutes, and the desirability of each alternative will depend on opportunity and enforcement costs. Furthermore, the effective amount of personal asset exposure (\(\gamma \)) will differ significantly among entrepreneurs. As noted previously, if most of an entrepreneur’s net-worth is in home equity and the entrepreneur resides in a state that exempts home equity in bankruptcy, \(\gamma \) will be very low, while if the state permits home equity to be seized \(\gamma \) will be higher.Footnote 12 Thus, the model suggests that more risk-averse entrepreneurs are more likely to be unincorporated, but it does not imply a strict cutoff level of \(\rho \).

7 Conclusion

Bankruptcy protection is widely accepted as beneficial because it provides insurance in bad return states, which encourages entrepreneurs to run businesses when they are subject to exogenous risk. However, about 50% of firms do not incorporate, which means that owners’ personal assets can be seized if the firm defaults. In addition, many lenders require the owners of incorporated firms to pledge private assets as collateral. This suggests there could be a benefit to keeping some personal assets exposed in bankruptcy. We identify a “scale effect” as a countervailing factor to the standard “insurance effect” of bankruptcy that can explain these facts.

We also analyze the amount of private assets to seize in bankruptcy. We find that less risk-averse entrepreneurs who run projects with good characteristics incorporate. The fact that the less risk-averse incorporate seems counterintuitive absent the model. More risk-averse entrepreneurs choose to leave some personal assets unshielded because they face a commitment problem, which generates a large premium, that dominates the value of insurance. In contrast, entrepreneurs that operate larger firms find that default would entail a significant opportunity cost—they would forgo large returns from operating a bigger firm during the statutory bankruptcy shutdown period.

An important feature of our model is that it directly links firm legal status to heterogeneous owner risk aversion. Bankruptcy protection encourages entrepreneurs with lower levels of risk aversion to run larger firms, which provides these agents with a credible incentive to not default. Entrepreneurs who are more risk-averse run smaller firms, and therefore lack the benefit of a significant commitment premium. To offset this, they choose to leave some assets unshielded in bankruptcy. Placing some personal assets at risk of seizure allows the more risk-averse entrepreneurs to reduce default by effectively posting collateral a postiori.

Our paper contributes to a large theoretical literature on collateral, e.g., see Geanakoplos and Zame (2014) and the references therein. Unlike much of the literature, where collateral is always essential, in our model collateral is optimal in some instances but not in others.Footnote 13 We find that endogenous default and an optimal level of collateral are driven by the fact that collateral reduces the effectiveness of bankruptcy insurance. More risk-averse entrepreneurs choose to run small firms and use less of their own money ex-ante in order to be able to self-insure ex post by leaving some of their personal assets exposed.

We also note that there is an empirical literature that examines the effect of bankruptcy and default rules. However, the focus of this literature is largely on consumption patterns and security prices, e.g., Fay et al. (2002), Lustig and Nieuwerburgh (2005), and Calomiris et al. (2016). A recent empirical analysis of the student loan market by Looney and Yannelis (2015), which focuses on default and borrower characteristics, seems closest to our model in key respects.Footnote 14 Unfortunately, most data sets on small firms do not contain data on loans sizes and default rates, which makes a direct empirical test of our model impossible.

Finally, our model shows that information problems, lack of rationality, or market power by lenders are not necessary to justify an entrepreneur’s decision to remain unincorporated or pledge personal assets for incorporated firm debt. Nonetheless, these problems are important in many settings and our model is not inconsistent with them. In addition, if the legal system is too costly, slow, or corrupt, then bankruptcy and the ability to choose the legal form of a firm will not improve outcomes.

Notes

The U.S. Bankruptcy Code permits firms to be liquidated (Chapter 7) or to operate (Chapter 11) under receivership. The owner cannot manage the firm in either case.

Incorporation costs and tax treatment are important, but they cannot be the only determinants of an entrepreneur’s choice of legal status. For example, unincorporated S-corporations impose low reporting costs on entrepreneurs. As a consequence, if costs were the only barrier to incorporation, a lower fraction of unincorporated firms should have been observed after legal changes made S-corporations more advantageous. However, Herranz et al. (2009) and Campbell and DeNardi (2009) document there was no significant decrease in unincorporated firms. Instead, there was a shift from C-corporations to S-corporations, i.e., firms that were incorporated took advantage of the tax advantages of S-corporations. Entrepreneurs whose firms were unincorporated did not change their legal status. Therefore, we abstract from taxes and incorporation costs.

The option value of maintaining the firm to realize future returns limits default. Owners will “bail out” a firm today with personal funds if they expect sufficient future returns, which is the firm’s option value.

See Quadrini (2009) for an excellent survey of three branches of entrepreneurship: (1) factors that affect the decision to become an entrepreneur, (2) aggregate and distributional implications of entrepreneurship for savings and investment, and (3) how entrepreneurship affects economic development and growth.

The risky technology and \(w_0\) are ex-ante identical, but net-worth (and consumption) evolve stochastically over time due to differences in risk aversion and return realizations. As \(b\rightarrow \infty \), borrowing is unconstrained.

A firm may default if it is unable to repay \(A \bar{v}\) (firm plus personal assets are less than A) or unwilling to repay. Owners can “bail out the firm” with personal assets to forestall bankruptcy, but cannot be forced to do so. In our model personal credit histories affect business loans, causing a credit interruption. Mester (1997) p. 7 finds that in small business loan scoring models, “the owner’s credit history was more predictive than net-worth or profitability of the business” and “owners’ and businesses’ finances are often commingled.”

This has two interpretations. First, the firm may be liquidated (Chapter 7 in the U.S. Bankruptcy Code). Because bankruptcy remains on a credit record for a period of time, creditors and customers would be unwilling to do business with the entrepreneur during this period. Second, the firm may continue to operate, but is owned by the debt holders who make investments and receive payments, or shut it down (Chapter 11). After T periods the credit record is clean, and the entrepreneur can either restart a new firm or regain control of the original firm, in Chapter 7 or 11, respectively.

This is the monthly data for T-Bill rates, adjusted by the monthly CPI reported by the BLS.

The U.S. Small Business Association and many banks require business owners to pledge their house as part of the loan collateral. See http://blog.projectionhub.com/how-much-collateral-does-the-bank-need-for-a-business-loan/.

The U.S. Bankruptcy Code is a federal law, but the exemptions are determined at the state level.

Some papers identify a role for the government to provide collateral when collateral is in short supply.

Looney and Yannelis (2015) construct a novel data set for the U.S. student loan market. They show that students from selective institutions have significantly larger loans but much lower default rates. Selective institutions are a proxy for higher quality schools, higher quality students, or both, and students at more selective institutions have significantly higher median annual earnings. In our model, better earnings potential corresponds to “better projects.” They also find that borrowers with smaller loans have significantly higher default rates, as our model predicts. This appears to be an empirical example of our “scale effect.” They do not identify an insurance effect. As noted in the introduction, Livshits et al. (2007), among others, focus on the insurance effect.

References

Athreya, K.: Welfare implications of the bankruptcy reform act of 1999. J. Monet. Econ. 49, 1567–1595 (2002)

Boyd, J., Smith, B.: How good are standard debt contracts? Stochastic versus non stochastic monitoring in a costly state verification environment. J. Bus. 67, 539–561 (1994)

Bris, A., Welch, I., Zhu, N.: The cost of bankruptcy: chapter 7 liquidation versus chapter 11 reorganization. J. Finance 111, 1253–1303 (2006)

Calomiris, C., Larrain, M., Liberti, J., Sturgess, J.: How collateral laws shape lending and sectoral activity. J. Financ. Econ. 123(1), 163–188 (2017)

Campbell, J.R., DeNardi, M.: A conversation with 590 nascent entrepreneurs. Ann. Finance 5, 313–340 (2009)

Chatterjee, S., Corbae, D., Nakajima, M., Rios-Rull, V.: A quantitative theory of unsecured consumer credit with risk of default. Econometrica 75, 1525–1589 (2007)

Davila, E.: Using elasticities to derive optimal bankruptcy exemptions. Working Paper, NYU Stern (2016)

Evans, D.S., Jovanovic, B.: An estimated model of entrepreneurial choice under liquidity constraints. J. Polit. Econ. 97, 808–827 (1989)

Fay, S., Hurst, E., White, M.: The household bankruptcy decision. Am. Econ. Rev. 92, 706–718 (2002)

Geanakoplos, J., Zame, W.: Collateral equilibrium I: a basic framework. Econ. Theory 56, 443–492 (2014)

Glover, A., Short, J.: Bankruptcy, incorporation, and the nature of entrepreneurial risk. 2011 Meeting Paper No. 836, Society for Economic Dynamics (2011)

Herranz, N., Krasa, S., Villamil, A.: Small firms in the SSBF. Ann. Finance 5, 341–359 (2009)

Herranz, N., Krasa, S., Villamil, A.: Entrepreneurs, risk aversion and firm dynamics. J. Polit. Econ. 123, 1133–1176 (2015)

Hovenkamp, H.: Enterprise and American Law. Harvard University Press, Cambridge (1991)

Krasa, S., Villamil, A.: Optimal contracts when enforcement is a decision variable. Econometrica 68, 119–134 (2000)

Krasa, S., Villamil, A.: Optimal contracts when enforcement is a decision variable: a reply. Econometrica 71, 391–393 (2003)

Livshits, I., MacGee, J., Tertilt, M.: Consumer bankruptcy: a fresh start. Am. Econ. Rev. 97, 402–418 (2007)

Looney, A., Yannelis, C.: A crisis in student loans? The consequences of non-traditional borrowers for delinquency. Brook. Pap. Econ. Act. 2, 1–89 (2015)

Lustig, H., Nieuwerburgh, S.: Housing collateral, consumption insurance and risk premia: an empirical perspective. J. Finance 60, 1167–1219 (2005)

Mann, B.: Republic of Debtors: Bankruptcy in the Age of American Independence. Harvard University Press, Cambridge (2003)

Meh, C., Terajima, Y.: Unsecured debt, consumer bankruptcy and entrepreneurship. Working Paper, Bank of Canada (2008)

Mester, L.: What’s the point of credit scoring? Bus. Rev. 3, 3–16 (1997)

Quadrini, V.: Entrepreneurship in macroeconomics. Ann. Finance 5, 295–311 (2009)

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank Cristina De Nardi, Jamsheed Shorish and Yiannis Vailakis for useful discussions. We also thank an anonymous referee and seminar participants at Cambridge, Oxford, University of Iowa, University of London, Conference on GE at Warwick University, the SAET Conference, the SWET Conference at the University of Paris 1, and the Midwest Economic Theory Conference at the University of Kansas. We gratefully acknowledge financial support from National Science Foundation Grant SES-031839, NCSA computation Grant SES050001, the Academy for Entrepreneurial Leadership at the University of Illinois and Kauffman Foundation Grant 20061258. Any opinions, findings, and conclusions or recommendations expressed in this paper are those of the authors and do not necessarily reflect the views of the National Science Foundation or any other organization.

Appendix

Appendix

We now show that problem 1 is equivalent to problem 3. As a first step, we show that the value function has the form \(V_S(w)=w^{1-\rho }v_S\) and \(V_B(w)=w^{1-\rho } v_B\).

In order to see this, substitute these functional forms into problem 1. Thus,

Note that \(v_S=V_S(1)\) is the continuation utility from starting with an initial net-worth of one unit. Since utility is of the form \(u(x)=x^{1-\rho }/(1-\rho )\) it follows that \(v_S>0\) if \(\rho <1\) and \(v_S<0\) if \(\rho >1\). The right-hand side of (11) is therefore strictly increasing in x. Thus, \(\mathfrak {B}\) must be a lower interval, i.e., there exists \(x^*\) such that \(\mathfrak {B}=\left\{ x \bigm | x <x^*\right\} \). Further, for \(x=x^*\) Eq. (11) must hold with equality, i.e.,

Solving (12) for \(x^*\) yields constraint (6) of Problem 3.

Now let \(\lambda >0\). We show that \(V_S(\lambda w) = \lambda ^{1-\rho } V_S(w)\). Note that if we replace w by \(\lambda w\), A by \(\lambda A\) and c by \(\lambda c\) then the right-hand side of (10) becomes

Similarly, this substitution multiplies both sides of Eq. (12) by \(\lambda \), and hence \(x^*\) and the bankruptcy set \(\mathfrak {B}\) do not change. Constraint (1) does not change, since w, c and A enter the expression only as ratios w / A and c / A and are therefore unchanged. Replacing A by \(\lambda A\) and w by \(\lambda w\) in (3) multiplies both sides by \(\lambda >0\), and hence this equations are also unchanged. Finally, the non-negativity constraints in (4) also remain valid.

Thus, \(\lambda c\), \(\lambda A\), \(\epsilon \) and \(\bar{v}\) satisfy the constraints of our optimization problem at net-worth level \(\lambda w\). Equation (13) therefore implies that \(V_S(\lambda w)\le \lambda ^{1-\rho } V_S(w)\) for all \(\lambda ,w>0\). Now let \(\tilde{w}=w/\lambda \). Then

Hence \(V_S(w)=w^{1-\rho }v_S\). The argument for \(\rho =1\), i.e., for utility \(u(x)=\log (x)\) is similar.

We can apply the same argument to Problem 2 to show that \(V_B(w)=w^{1-\rho }v_S\). It is now immediate that Problem 1 is equivalent to Problem 3.

Rights and permissions

About this article

Cite this article

Herranz, N., Krasa, S. & Villamil, A.P. Entrepreneurs, legal institutions and firm dynamics. Econ Theory 63, 263–285 (2017). https://doi.org/10.1007/s00199-016-1026-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-016-1026-8

Keywords

- Entrepreneur

- Legal environment

- Incorporated

- Unincorporated

- Endogenous default

- Bankruptcy

- Commitment

- Insurance

- Firm size

- Risk aversion

- Heterogeneity

- Credit constraints

- Capital structure

- Debt