Abstract

This study investigates how structural change that leads to increasing output variety was gradually perceived by economists and eventually incorporated into models of economic growth. We trace the evolution of growth models from exclusively macroeconomic models to those that include micro and meso levels of aggregation, and further, to those that permit explicit and endogenous representation of innovation and technological change. We consider the structure of an economic system as constituted by (i) a variable number of industrial sectors producing highly diversified goods and services, (ii) an increasing range of other activities, such as education or healthcare—which, while not being strictly economic, interact heavily with industrial sectors, and (iii) a series of interactions between these sectors and activities, the intensity of which can vary in the course of economic development. As a consequence, structural change consists of (i) the emergence of new sectors and activities and the reduction or extinction of older ones, (ii) increase in quality and differentiation of sectoral output, and (iii) the changing interactions between industrial sectors and other activities. In this paper, structural change is not considered an epiphenomenon of economic development but one of its fundamental mechanisms, since the emergence of new sectors and activities and their internal diversification contribute to overcoming the development bottleneck. This type of structural change gives rise to a growing diversification of the system through the co-evolution of industrial sectors, other activities, technologies, and institutions. This growing diversification of economic systems has recently been confirmed by an abundance of research, both theoretical and empirical: those studies are examined and analyzed in detail here.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this essay, we discuss the relationship between structural change and economic development. It is our conviction that in the long run, economic growth cannot be sustained without changes in the structure of the economic system; or as a corollary, that structural change is a determinant of growth. We start by examining approaches to economic growth and development that analyze growth without structural change. Subsequently, we analyze the relationship between structural change and variety, pointing to the importance of variety enhancing structural change in recent research. Our discussion is based on a broader concept of structure than the one adopted by the early literature on structural change. Our conception of structure is systemic, based on the components of a system and on their interactions.

In this paper, we endeavor to show that neither economic development nor economic growth, could have taken place without structural change. Furthermore, we refer to recent developments in the literature that point toward a type of structural change which is both variety and complexity enhancing. The type of structural change we are discussing leads to diversification of the economic system and is necessary to maintain long-term growth. Thus, in this paper, we explain why and by what mechanisms structural change diversifies the economic system and contributes to long-term economic growth and development. The study is not a general survey of growth or of structural change, but narrowly focuses on the type of structural change that leads to increasing output and the overall variety of the economic system. For this, we divide and classify a few models and theories of economic development into different groups, depending on the level of aggregation at which they are conceived and their underlying assumptions. This study does not intend to survey models of growth or of structural change, but instead attempts to map the path along which models of economic growth emerged from previous growth models that were created within different schools of research with different assumptions and at different levels of aggregation. The path involves a review of the evolution of growth models from those that connect different macro variables; to the incorporation of some microeconomic elements and the inclusion of structural change; to the explicit representation of multiple sectors; and to the emergence of an increasing and endogenously variable number of sectors.

We start by laying out some stylized facts that guide the explanation of certain phenomena and processes and provide a testing ground for our theories and models. These stylized facts are concerned with the long term, because we believe that some important trends and mechanisms occur over long periods with respect to the average human life span and the typical time horizon of organizations. Despite their apparent distance in time, some long-run trends do affect our present everyday activities, and economic systems need to continually adapt to them to take advantage of opportunities and limit potential damage.

2 From stylized facts to theoretical understanding

2.1 Stylized facts

A stylized fact that is very important to our study is the gradual diversification of economic systems, which occurred during the course of human history. One of the earliest forms of diversification occurred with the transition from hunters and gatherers to settled agriculture. Higher efficiency in food production was accompanied by the emergence of other (non-food related) activities, such as trading, priests, and administration. (Diamond 1997; Jacobs 1969). In a way, the use and production of tools was the basis for the diversification of human activities. Although this trend has certainly accelerated since the time of the industrial revolution, and even more so since the beginning of the XXth century, Adam Smith was already aware that developed economic systems were more diversified than the less developed ones:

Though in a rude society there is a good deal of variety in the occupations of every individual, there is not a great deal in those of the whole society.. In a civilized state, on the contrary, though there is little variety in the occupations of the greater part of individuals, there is an almost infinite variety in those of the whole society.” (Smith 1982, p. 430).

Two types of division of labor were the basis of this diversification: the first (called Smithian, because it remains closely associated with Adam Smith), consists of breaking down a production process (for example, of pins) into steps, where each worker would carry out one step and pass the result on to the next worker; the second, consists of creating new technologies, which can give rise to new production processes and new types of output. Both of them were included in Adam Smith’s theories, although the former was described in much greater detail and remained closely associated with his name. The latter form of division of labor was arising from:

"those who are called philosophers or men of speculation, whose trade is not to do anything but to observe everything; and who upon that account are often capable of combining together the powers of the most distant and dissimilar objects. In the progress of society philosophy, or speculation, it becomes the principal or sole trade and occupation of a particular class of citizens. (Smith 1982, p. 115)

The second type of division of labor is the result of innovation, and we call it Schumpeterian because it was much more central to Schumpeter’s work than Adam Smith’s. In a sense, changes in both forms of division of labor are the result of innovation: the former due to a kind of organizational innovation and the latter, a form of technological innovation. However, these two types of innovation would not have been enough to generate the economic systems of contemporary societies. Although innovations may be created by Schumpeterian entrepreneurs in environments which do not have appropriate institutions, their subsequent development cannot occur without such environments. To be appropriate to an innovation, institutions need to make sure that the positive effects of that innovation outweigh its negative ones. This control function is often accompanied by other functions that broaden the scope of the technologies embodying such innovation. For their markets to expand, the technologies which embody the innovation need appropriate infrastructure and rules of use. The automobile, aircraft, or portable telephone industries had to collaborate with motorways, airports, and transmission networks and their accompanying legislation to protect citizens’ welfare. The joint development of technologies and institutions is a form of coevolution (Nelson 1994; Murmann 2003)Footnote 1. In this sense, institutions are appropriate to particular technologies when they are complementary to them. As a consequence, we use the term “innovation” in a general sense to include technological, organizational, and institutional innovation. In what follows, we see that the process of diversification of economic systems (SESs) is due to the interaction and co-evolution of the three types of innovation. The diversification of SESs led to a change in their structure through the emergence of new constituents (new sectors, institutions, and organizational forms) and by their changing interactions.

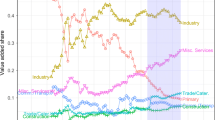

Three stylized facts which have heavily affected the diversification of the SES since the industrial revolution, and even more so since the beginning of the XXth century are: the increasing efficiency of productive processes (SF1); the rise in the number of industrial sectors (SF2); and the improving output quality and internal diversification of the existing sectors (SF3).

-

SF1) The efficiency of productive processes increases in the course of time. (Productive efficiency is defined below.)

-

SF2) The net number of distinct industrial sectors resulting from the emergence of new sectors and the elimination of pre-existing ones increases in the course of time.

-

SF3) The output quality and internal diversification of most sectors increases with the passage of time. Footnote 2

Each of these trends constitutes a long-term trajectory. As a consequence of these trajectories and their interactions, the output variety of the industrial subsystem increases at both the inter-sectoral and at the intra-sectoral levels of aggregation.

These changes in production were accompanied by a number of institutional changes, such as the emergence of the factory system (Mokyr 1990); of the modern firm (Rosenberg and Birdzell 1986); of different types of corporations (U and M form) (Chandler 1962, 1977; Williamson 1975); of the R&D function (Freeman and Soete 1997); and the diffusion of education (Goldin and Katz 2009). Furthermore, a number of reforms in workers’ rights, healthcare and social assistance gave rise to what is called a welfare state (Trattner 2007; Fraser 1973). These changes amounted to a profound modification of the structure of the economic system by introducing many new components and interactions. Furthermore, the same changes made the boundaries between economic and non-economic activities fuzzier, rendering the concept of “homo economicus” more challenging. In some cases, the new components existed previously but were of marginal importance in the societies of their time, while they now employ a larger share of manpower and are the source of important economic activities. For example, in advanced industrialized countries, the healthcare system generates a large part of the demand for pharmaceutical products and medical equipment and provides more employment.

The considerable increase in the average level of education of the population in industrialized countries, combined with the exponential growth of knowledge production, gave rise to a knowledge-based society and economy, in which knowledge is the most important factor in economic growth and development. The emergence of the knowledge-based society was not a sudden phenomenon but a gradual one, which began in the second half of the XIXth century and gained momentum in the XXth century. The development of a knowledge-based society includes the emergence of a new economic function—R&D (Freeman and Soete 1997); considerable increase in the importance of education (Goldin and Katz 1998, 2001, 2009); and growing importance of human capital relative to physical capital (Becker 1962, 1964).

The previous stylized facts do not provide a complete description of the economic development which occurred in the XIXth and XXth centuries, but highlight two trends: first, the diversification of the economic system was not limited to the productive sectors of the economy but involved other activities and institutions, which were not previously considered as economic, but which affected the economic system profoundly; second, the new activities did not emerge and develop independently but interacted over time, giving rise to considerable changes in the structure of the SES. In other words, there was a coevolution of productive and other activities which, affected overall economic activity.

2.2 Efficiency and creativity

To begin the discussion, we need to define some fundamental concepts. First, we define efficiency in an unusual way, to take into account the material nature of production processes. Efficiency is defined as the ratio of the output obtained to the inputs used when the type of output remains qualitatively constant. Thus, for example, the efficiency of shoe-making would increase if the share of inputs (e.g., leather, glues, labor) used to make a pair of shoes were to reduce, provided that the pair of shoes remained qualitatively unchanged. If we simultaneously changed the efficiency and the type of shoes, the change in the ratio of output to inputs would measure a combination of efficiency and value, the latter being determined by output quality.

Productivity, whether of labor or a total factor, is usually considered to be a factor affecting the growth capacity of a country or a region. Productivity is assigned this important role due to the expectation that it measures the efficiency of a national or a regional economy. We introduce a different definition of efficiency because we think that both labor or total factor productivity measure not just efficiency but a combination of efficiency and value. To understand this, we need to introduce a second concept in addition to efficiency. We call creativity the capability to conceive new products and services that are qualitatively different from any pre-existing ones. The distinction between qualitative and quantitative change can be quite straightforward, but ambiguities may arise in some cases. Thus, a car and a computer are clearly qualitatively different, while it is less obvious whether a car and a horse-drawn mail coach are qualitatively or quantitatively different.Footnote 3 Here, we rely on an intuitive understanding of the difference between qualitative and quantitative change. However, it should be noted that the difference between qualitative and quantitative change can play an important role in economic development. Thus, a new sector will be classified in a new statistical category if it is qualitatively different from any pre-existing one. Furthermore, even if a new sector is created by a qualitatively new good or service, during the subsequent evolution of the sector, any further modification of the given good or service can constitute an incremental and mostly quantitative change. Here, we reserve the term efficiency for the cases in which a qualitatively unchanged product is produced with a decreasing quantity of inputs and the term creativity for the cases in which either a complete and qualitatively new product is created or the quality of pre-existing products is improved. Here, we are in the presence of two types of creativity, which differ due to their inherent uncertainty; radical uncertainty for the case in which a completely new product is created and a more moderate uncertainty, almost merging with calculable risk, for the creation of a new model of a given product. Consequently, the two types of creativity are considerably different. While the creation of a completely new product gives rise to a new sector, the creation of a new model within an existing sector only contributes to the internal differentiation of the same sector. We can term the former strong creativity and the latter weak creativity. Both types of creativity are different from efficiency, but have very different implications for the life cycles of technologies and sectors.

To stress that efficiency and creativity are easy to separate conceptually, but their separation may be more difficult in practice, we can consider the following case. A machine or a process that increases efficiency (e.g., the mule, the steam engine, the assembly line) is clearly the result of creativity. They increase efficiency only if the output they produce is qualitatively invariant, before and after the adoption of the given machine or process. Of course, the new machine or process can also be used to increase both the efficiency and the quality of a good or service. In this case it might be difficult in practice, although possible in principle, to separate efficiency from creativity.

The process of economic development, especially since the industrial revolution, has always been due to a combination of efficiency and creativity. Thus, human beings can not only increase the efficiency with which pre-existing goods and services are produced, but also create new types of goods and services. Until the industrial revolution, most innovations created new types of capital goods, which enhanced the efficiency of existing functions/tasks. Thus, windmills ground wheat or barley more efficiently and the wheelbarrow increased the efficiency of carrying weights (Mokyr 1990). Starting from the industrial revolution, and through to the XXth century and beyond, an increasing number of consumer goods and services were created, giving rise to a corresponding number of new industrial sectors.

Thus, both efficiency and creativity have contributed to the observed process of economic development. However, the two variables did not act independently, but interacted continuously. To understand this point, we can ask whether output growth could continue indefinitely in an economic system with a constant structure; an economic system that is constituted by the same activities and sectors, but in which there was only efficiency growth. In this case, the same type of outputs would be produced all the time with a constantly decreasing amount of labor per unit of output. In particular, the labor intensity of the production processes could be expected to reduce as production efficiency increases. The unit cost of outputs would then decrease and, unless demand for them increased to the same extent, labor displacement could follow. This could be avoided by several mechanisms that we generally call compensation. For example, compensation for the labor displacement due to increasing productive efficiency could occur if the decreasing cost and price of output induced a sufficient rise in their demand to raise employment to produce a higher output. Other compensation mechanisms have been discussed in the literature since Ricardo, and the main ones have been reviewed by Vivarelli (2007a, b, 2014):

-

1

New machines.

-

2

New investments.

-

3

Decrease in wages.

-

4

Increase in incomes.

-

5

New products.

These mechanisms have different effectiveness in compensating for the labor displacement due to increasing productive efficiency. Vivarelli finds that “new products” are the most effective in this respect. However, we emphasize that new products can only include those which are qualitatively different from pre-existing ones, those which give rise to new sectors, or new variants of pre-existing products. We consider that the most important compensation mechanism is the creation of new economic activities and new sectors resulting from the emergence of new products and services. Then, the potential labor displacement due to increasing productive efficiency could be compensated by the emergence of new sectors, which could re-employ the potentially displaced labor.

We consider this the most important compensation mechanism because (i) there is growing empirical evidence that many new sectors have been created since the industrial revolution, which have contributed enormously to economic growth (Chandler and Hikino 1994) and (ii) the output and employment share of incumbent sectors keeps declining with the passage of time (Metcalfe et al. 2005; Fabricant 1940, 1942). None of the mechanisms listed by Vivarelli could have contributed alone to lasting economic growth. In particular, price elasticity of demand was unlikely to provide full compensation, irrespective of the rate of price fall for the outputs of existing sectors. The emergence of new sectors can be explained by the relative rates of growth of income elasticity of demand and of the price elasticity of demand (Saviotti 2001, 2007): when income per capita increases, consumers prefer to purchase new goods and services rather than have more of the old ones. This stylized fact was first observed by Engel (1857), who noticed that, as their income increased, households spent a declining share of it on food and necessities. However, even if the total saturation of incumbent sectors assumed by Pasinetti (1981, 1993) does not always occur (Chai and Moneta 2010), in general, the rate of growth of demand for a given output type tends to decline in the course of time (Saviotti et al. 2016) providing inducement for the emergence of new sectors.

So far, we have deliberately left aside the possibility of growth due, for example, to an increase in population or to the discovery of raw materials. We excluded the contribution of these factors to growth because we wanted to focus on the structural change induced by innovation and on the growth patterns that this would generate. Although we have not done any formal work on this, we expect that in the absence of innovation, an increase in population, for example a sudden wave of highly capable immigration, could only raise output temporarily, but not lead to prolonged growth. Furthermore, in the simulations we carried out there is no formal assumption of a fixed output. Rather, the range of conditions explored tended to focus on situations in which there is a positive, if limited growth rate. Demand coevolves with innovation in that demand depends on the disposable income, consumer preferences and on output quality for each sector. When co-evolution works well, when disposable income and output quality increase, the system grows. The aggregate system can grow even when some sectors do not, if the growing sectors more than compensate for the slow ones. We could expect a demand-only-policy to bring output up to its maximum potential for each set of variables and parameter values. In a model involving the co-evolution of innovation and demand, we do not expect demand alone to lead to long-term growth.

Thus, we have established that the creation of qualitatively new economic sectors be due not to productive efficiency alone, but also the presence of both creativity and efficiency, as defined above. To complete our analysis, we explain how creativity originates. For this, we can use the distinction between routines and search activities introduced by Nelson and Winter (1982) and consider that all economic activities can be classified into one of these two categories. All economic activities can be placed on a scale ranging from simple routines to search activities of increasing uncertainty. The creation of a qualitatively new product requires high-uncertainty search activities, whereas the creation of a new version of a well-known good or service is an almost routine-like activity entailing reduced uncertainty. The transformation of a qualitatively new good or service to the new version of a well-known good or service can occur during the life cycle of an industry or technology. Saviotti and Pyka (2008, 2013) discuss two types of search activities: fundamental and sectoral search activities. The former rises from a share of the investment in the economic system while the latter are funded in proportion to the demand in the corresponding sector.

We expect existing routines to contribute to the continuously increasing efficiency of productive processes, thus creating a surplus which can be used to finance search activities. In turn, search activities can become the source of a pool of new ideas that can be developed to create new sectors. Thus, in the same way in which an economic system driven only by productive efficiency would encounter a bottleneck, search activities cannot be carried out without the surplus generated by rising productive efficiency. In other words, efficiency and creativity are complementary, and search activities are the source of creativity. For search activities, profitability cannot be regarded as being situated in the same time horizon as current production. Search activities produce knowledge as output, for which there may not be an immediate payoff, or which cannot be directly appropriable. Furthermore, as they are complementary to current production, they will be supported even when not immediately profitable.

Search activities scan the external environment to understand its constituent entities and the laws governing them. As a consequence, search activities enhance our ability to modify our external environment, contributing to the creation of future production routines that will substitute or complement existing ones. The necessary consequence of this is the change in the structure of the economic system, through the emergence of new activities and by the changing share of all activities, new and old. Thus, structural change occurs and is a necessary condition for the long-run continuation of economic development. However, not only do new sectors emerge and old sectors disappear, but the net effect is a surplus. There is growing empirical evidence that growth is accompanied by a growing output variety, defined as the number of distinguishable types of output of the production system (Funke and Ruhwedel 2001a, b; Frenken et al. 2007; Saviotti and Frenken 2008; Hidalgo et al. 2007; Hidalgo and Hausmann 2009; Felipe et al. 2012; Freire 2017). This implies that more new sectors have been created than the ones substituted. Thus, although cars, buses and trains have substituted horse-drawn carriages, we still produce food, clothing, and housing. Furthermore, radio, television, telephones substituted the sending of messages. Also, new materials such as plastics did not completely substitute wood and steel but created many new possible uses. Therefore, on the whole, the number of activities constituting the economic system has been increasing in the course of economic development and this has compensated for the potential labor displacement by improving productive efficiency in the existing sectors. In other words, not only does structural change occur, but it occurs in the direction leading to the increasing diversification of the economic system.

If we were now to ask the question, if economic development could have been due to creativity alone, our answer would have to be negative. Search activities require resources; the requirement would have been small while individual scientists or inventors carried them out, but has now become very substantial in modern economic systems. Such resources can be created through the surplus obtained from growing productive efficiency. Thus, productive efficiency needs creativity, but creativity too needs productive efficiency. In the course of time, both creativity and productive efficiency alter the structure of the economic system, the former by adding new sectors and eliminating some existing ones, the latter by changing the output shares of the existing sectors. Thus, structural change is not an epiphenomenon of economic development, but an essential component of it. Furthermore, the structural change involved here is unidirectional, in which higher levels of development are achieved by increasing the output variety of the economic system. This implies that the Schumpeterian concept of creative destruction cannot be interpreted as the substitution of pre-existing goods, services, and processes by new ones, because this would lead to the output variety remaining constant in time. However, creative destruction still exists, because the output share of incumbent goods, services, and processes tends to reduce in the course of time. Creative destruction is based on the joint effect of productive efficiency and of creativity.

2.3 Structural change, diversification, and economic development

The previous conclusion needs to be placed in context: although there is growing evidence that increasing output variety can provide an important form of compensation for the potential displacement of labor due to increasing productive efficiency, it is not the only possible compensation mechanism. Not only can the compensation mechanisms listed by Vivarelli (2007a, b, 2014) play a role, but we also think that the differentiation of the economic system can occur in various ways, in addition to the creation of new output types.

Most output types, new or old, are not homogenous but become increasingly internally differentiated as their product or industry life cycles advance (Klepper 1996, 1997; Jovanovic and MacDonald 1994; Pyka and Nelson 2018). This allows the quality and the internal differentiation of each sector to increase in the course of time. This contributes both to the differentiation of the economic system and to the compensation discussed before. Saviotti and Pyka (2013) compared two scenarios called Low Quality (LQ) and High Quality (HQ), where the former consisted only of inter-sector diversification while the latter included both inter- and intra-sector diversification. Interestingly, the macroeconomic growth path of the two scenarios turned out to be very different. While the rate of growth of employment would have been higher in the LQ scenario, this result would have been obtained by holding wages and the quality of human capital constant in the course of economic development. Wages would have remained constant because they depend on labor productivity, which increases or remains constant depending on the value of the goods. In turn, the value of goods depends positively on their quality. In a high-quality economy, the value of goods increases in the course of time while in a low-quality economy, the value of goods remains constant. The quality of human capital increases because (i) it is a requirement for the production of higher-quality goods, and because (ii) by contributing to higher wages, it leads to a higher purchasing power. Furthermore, despite constant wages, during the early phases of economic development, the rate of income creation would have been higher in the LQ scenario, but would have become higher in the HQ scenario during later phases. On the contrary, after an initial period, the HQ scenario would have led to increasing wages and the quality of human capital, and then to a higher rate of growth of income.

These results imply that if there had been a choice between favoring full employment or favoring a higher rate of growth of income, the former would have been chosen initially and the latter in subsequent phases. This shift is due to the combination of an asymmetry in the nature of consumption and due to the rate of growth of productive efficiency. Although diversification consists of the emergence of new sectors, these sectors are not all the same. First, some of the sectors correspond to the production of “basic necessities” of biological origin, without which human beings cannot survive. These necessities include food, clothing and housing. Unless these needs are satisfied, the supply and demand of other types of goods and services corresponding to “higher” forms of consumption cannot be created. In other words, if all of a consumer’s income had to be spent on basic necessities, no disposable income would have been left for the purchase of other goods and services corresponding to higher forms of consumption. The creation of the disposable income required to purchase higher types of goods and services involved an increase in the productive efficiency of basic necessities which gave rise to a surplus, which in turn became the disposable income enabling the purchase higher types of goods and servicesFootnote 4. Thus, the diversification of the economic system requires a productive efficiency higher than the one needed to supply basic necessities. There is historical evidence that such threshold productive efficiency arose only in the XXth century in the most advanced countries (Hobsbawm 1968). The observed path of economic development can then be described as a transition from necessities to imaginary worlds (Saviotti and Pyka 2013).

Let us assume that, according to data quoted by Hobsbawm (1968) during the whole of the XIXth century, working class households in the UK (the world’s richest country then) earned an income just enough to purchase basic necessities. This corresponds to Marx’s analysis (1887) and to his conclusion, that capitalism would only pay workers enough to ensure their physical survival. The question which then arises is: why did this change in the XXth century? Was it simply the automatic result of a natural increase in productive efficiency; was it the rise of the working class and its capacity to challenge the established capitalist order; or was the transition to imaginary worlds, a compensation mechanism required to avoid the efficiency induced bottleneck previously described? To separate these mechanisms is likely to be extremely difficult. It is possible, even likely, that these different mechanisms have operated together in a co-evolutionary fashion.

Finally, let us assume that the transition from necessities to imaginary worlds represents a unidirectional path, unlikely to be reversed unless a dramatic decline in productive efficiency occurs. The process of economic development can then be interpreted as a gradual move away from a human life dominated by biological constraints to one in which man-made constraints increasingly dominate human history.

The above discussion was centered on manufacturing, but most employment today is in services. In a sense, the gradual shift to services can be considered another compensation mechanism contributing to preserving employment in the presence of the labor substituting effect of increasing productive efficiency. Although services are a residual and heterogeneous category, some general features can be found for this sector (Miles 2005; Windrum 2007):

-

1

Many service products are intangible ones.

-

2

Many service products are often consumed and produced in the course of supplier-client interaction at a particular time and place.

-

3

Many services are highly information intensive with a preponderance of office-based work or communicative and translational activities.

However, intangible services are not as different from manufactured goods as we might think. From the twin characteristics representation of physical products (Saviotti and Metcalfe 1984) it follows that today most production is the production of services, whether in an embodied or disembodied form. Services are supplied in an embodied form by heterogeneous multi-characteristics physical products having a material-based internal structure and supplying services. In this case, the knowledge-base of producers needs to cover aspects related to the manipulation of matter (e.g., melting and shaping materials, the nature of combustion processes) and related to the needs and wants of consumers. However, for disembodied, or direct services, knowledge related to the manipulation of matter is likely to be relatively less important than knowledge related to the needs and wants of consumers.

Historically the scientific fields that progressed more rapidly from the early part of the industrial revolution to the second half of the XXth century (chemistry, physics, metallurgy, etc.) greatly improved the capacity of human beings to produce energy and to manipulate matter. This gave rise to a very rapid increase in the output of some manufacturing sectors (textiles, steel, chemicals, etc.). During the second half of the XIXth century, the relationship between science and technology became more systematic and intense through the creation of Technical Universities promoting engineering knowledge in the German University system and the institutionalization of industrial R&D (Sanderson 1988; Aldcroft 1964; Mowery and Rosenberg 1991). This led to the creation of new sectors or subsectors, such as fine chemicals, pharmaceuticals and electricity (Chandler and Hikino 1994; Kindleberger 1975; Mowery and Rosenberg 1991). The enormous increase in output that the innovations induced, gave rise to an increased administrative workload, but there was no corresponding improvement in the technology required to document and process the increased flows in matter, energy and information. Innovations such as the typing machine facilitated the task of representing, classifying and communicating the information about these increased flows, but was not enough. In other words, the increasing efficiency in matter manipulation had not been matched by a corresponding increase in information storage and processing. In the presence of this mismatch it became possible to reduce employment per unit of output in matter manipulation faster than in the corresponding activities involved in information storage and processing. As a consequence, the share of employment involving information processing (what we can call administrative activities), increased at the expense of the activities involving matter manipulation. This is likely to have happened to an extent higher than shown by employment statistics, since today, even in manufacturing sectors the highest employment is in office-based administrative functions. The differential rate of growth of efficiency in manufacturing, relative to services is likely to reduce in the future due to the progress in ITCs. Although ITCs increased the efficiency of both matter manipulation and of information processing, they are likely to have affected the latter more than the former (Miles 2005). Consequently, one of the possible compensation mechanisms that in the past contributed to keeping employment high could become less effective (Brynjolfsson and McAfee 2011; Frey and Osborne 2017).

Other service activities that are less closely related to manufacturing, such as education, healthcare and tourism, have enormously increased in advanced industrialized societies. These would not have been considered economic in the past, but they interact heavily with manufacturing activities. As examples of these interactions we can think about the impact of healthcare policies on the pharmaceutical industry or of innovations in transport and telecommunications on tourism. The emergence of all these activities redefined the structure of the economic system and heavily affected the distribution of employment.

2.4 Structure, order and change

The concepts of order and structure imply that the most elementary components of an economic system cannot be assembled randomly but that they need to be organized according to some order. Such order, or structure, is not invariable in the course of time, but can undergo both qualitative and quantitative changes. Quantitative changes modify the size of the whole system or the relative sizes of its components. The structure of a complex economic system is constituted by its components and by their interactions. The structure of an economic system can be defined at several levels of aggregation ranging from micro to meso and to macro (Dopfer et al. 2004; Dopfer and Potts 2008; Dopfer 2012). In principle, we can expect aggregate outcomes, such as overall output, employment or growth to depend on the structure of the economic system, taking into account all the possible levels of aggregation. The calculation of such aggregate outcomes with all the possible levels of aggregation would be extremely costly, if not impossible. Thus, approximate representations taking into account only some levels of aggregation are developed. The simplest such representation is the macro-macro, in which aggregate outcome (e.g., growth) can be calculated by starting from other macro variables (e.g., labor or capital). Despite its simplicity a macro-macro representation is insufficient, because it neglects the potential influence of micro and meso variables on aggregate outcomes. In particular, a macro-macro representation eliminates structural change.

To understand what growth would resemble if there were no structural change, let us consider the hypothetical case in which the economic system had a constant number of components/sectors but their output could grow in the course of time. Furthermore, if the rate of growth of output were to be the same for all components/sectors, there would be growth without structural change since the output share of all components/sectors would remain constant over time. Such a growth pattern does not resemble that of any country over any extended period of time. In this case, of what can be called proportional growth, there would be only quantitative growth. On the contrary, typically over the long run, growth occurs with the emergence of new sectors, with their internal diversification and with changing sectoral output and employment shares (Metcalfe et al. 2005; Fabricant 1940, 1942). According to Pasinetti (1981, 1993), the above type of growth pattern could occur if the rate of growth of efficiency were the same for all sectors and if it were the same as the rate of growth of demand for all sectors. Such conditions are not observed in general and their absence explains why structural change is systematically associated with growth.

Qualitatively new goods and services are usually created by Schumpeterian entrepreneurs in situations of limited knowledge and without the institutions required for the new technology to develop fully. Furthermore, new technology needs complementary infrastructures and industries supplying inputs or services. The classic example is, of course, the automobile, which needed institutions to define and explain how it had to be used for the benefit of mankind; roads and motorways on which it could travel; and industries producing the required fuel and lubricants. In addition to these direct interactions, the new technology induced indirect interactions with the structure of cities and with tourism, enabling both of them to occur over much larger spaces than it would have been possible before. The process described here for the automobile is an example of the coevolution of technologies, infrastructures and institutions (Nelson 1994; Perez 1983; Murmann 2003). We wish to stress that co-evolution is by no means a rare process but that it plays a fundamental role in economic development by accelerating the emergence of new technologies and by amplifying their potential markets. In a network representation we can expect a new node corresponding to a new economic species and to a new technology to induce (a) the shrinking or disappearance of older nodes and links, and (b) the formation of new nodes and links contributing to dynamically changing the structure of the economic system. If we represent an economic system as a network, the variety of the economic system is likely to increase as the number of new activities and corresponding nodes can in general be expected to be greater than that of the disappearing activities. Thus, we expect (i) the variety of the network representing a given economic system to increase in the course of economic development, and (ii) the density or connectivity of the network to rise or fall depending on the ratio of the rates of creation of new nodes and of the formation of new links.

The discussion so far implies that economic development could never have occurred without structural change. Does this statement then allow us to say that structural change is a determinant, or even a cause of economic growth? The term “cause” should be reserved for factors such as labor, capital, raw materials, energy, or even innovation and knowledge. These are primary determinants which modify the structure of the economic system. The extent of structural change depends on the balance between efficiency and creativity. In turn, the resulting growth depends on the rate at which new sectors are created; on the shape of their industry life cycles; and on the market size corresponding to each sector. Thus, rather than a cause of growth, structural change can be considered a mechanism that transforms primary factors into a given quantity and quality of outputs. If such factors were combined in ways that do not lead to structural change, growth would be unlikely to be economically sustainable in the long run. This shows that the determinants of growth cannot be located only at the microeconomic level but also at intermediate (meso) levels of aggregation, where the structure of the system changes. Furthermore, the concept of causality becomes problematic in the presence of coevolution. In this case, if two or more factors interact with a positive feedback reinforcing each other, can we then say which one is the cause? For a given set and quantity of primary factors, the resultant growth depends on the strength of interactions in the feedback loops. As a consequence, we can still say that structural change is a mechanism of growth and that it enables the continuation of growth in the long run.

2.5 A typology of models

2.5.1 Level of aggregation

All models of growth establish relationships, or connections, between several variables that are descriptors of the economic system. All existing growth models can be classified according to the level of aggregation at which such variables are measured. All models can then be classified as Macro to Macro (MAMA), f (MEMA), or Micro to Macro (MIMA).

MAMA models cannot be based on structural change since, by definition, they exclude the structure of the system. However, some MAMA models, although formally excluding system structure from their mathematical treatments, could contain important insights about structural change. The advantages of MAMA models lie essentially in their simplicity, in that they considerably reduce the number of variables required to represent the economic system and the computational costs involved. Furthermore, they produce results that are intuitive and quite suitable for conversion into policies. Their obvious limitations stem from their lack of structure: macro policies are affected by the internal structure of the system, but in ways that the MAMA models cannot reveal.

MIMA models connect micro and macro variables of the system. They are the “best” models in that they are the most complete and provide the most exhaustive representation of the economic system. They can produce the same results as MAMA models, plus much more. In particular, they can predict the effects of changing both micro and macro variables on the structure of the system. Clearly, MIMA models are superior to MAMA, but their obvious disadvantages are the extremely high data requirements and computational costs. Even today MIMA models are prohibitively expensive.

MEMA models are an intermediate case between MAMA and MIMA in that they connect meso (Dopfer et al. 2004; Dopfer and Potts 2008; Dopfer 2012) and macro variables of the system. In complex systems there are several meaningful intermediate levels of aggregation, as opposed to infinitely many intermediate levels of aggregation. Fifty biological cells or twenty-five individuals are not meaningful levels of aggregation unless they are connected by interactions that make them interdependent, as they would be in a biological organ or in a firm. Thus, the meso levels of aggregation are themselves part of the structure of the economic system in that two economic systems with the same micro-components but with different meso-components are likely to perform differently. MEMA models are less complete than MIMA models but much more, complete than MAMA models. As a consequence, both their data requirements and their computational costs fall between the other two model.

Clearly, both MIMA and MEMA models are explicitly structuralist, in that they contain a representation of the structure of the economic system. Early growth models were generally MAMA models. This can partly be explained by their much lower data requirements and computational costs. Recently, increasing information about micro and meso aspects of economic systems have been incorporated into growth models.

2.5.2 General theoretical assumptions

Models and theories can differ on assumptions, such as those related to the nature of the knowledge used by economic agents or the existence of a general equilibrium. The typical model classes are neoclassical, structural, neo-Keynesian, and evolutionary. Such different theoretical assumptions are often associated with different approaches to modelling, which in turn are affected by the recent progress in computational capacity.

2.5.3 Exogenous vs. endogenous

Growth models differ in the way they treat innovation and technological change, considering it to be either exogenous or endogenous. In the former case, technological change is not represented explicitly, but its presence and entity can be indirectly measured as part of a residual, as in Solow’s production function. However, even the explicit representation of factors leading to technological change, such as R&D, does not make it endogenous to the economic system. Technological change is endogenous when the resources required to generate it come from within the system through normal economic processes.

2.5.4 Statics vs. dynamics

In this context, it is not sufficient to discuss just the presence of dynamics, but its nature also needs to be discussed. In principle any model containing equations that describe the change of some variables in the course of time, is by definition a dynamic model. However, we stress that quantitative and qualitative dynamics need to be distinguished: the former consists of the change of a set of known variables; the latter can encompass the emergence of new entities and variables that change the structure of the economic system. This distinction is going to be crucial in comparing general and unidirectional, or variety enhancing, structural change. The emergence of qualitatively new sectors and activities is a phenomenon which is impossible to explain within even the context of perfect knowledge and of general equilibrium, since it is impossible to predict it accurately.

3 Structural change and differentiation in the literature on economic growth and development

3.1 Models

In this section we intend to review the main trends in the literature on economic growth and development, to see the extent to which structural change was accounted for and, in particular, the type of unidirectional structural change that leads to a growing diversification of the economic system. We stress that this study does not intend to be an exhaustive survey of all the papers ever published on growth and structural change, but that it is more narrowly focused on the evolution from the early growth models. An evolution from typically MAMA to unidirectional, or variety increasing, growth models, by the gradual inclusion of some structural features, of endogenous technological change and of an endogenously variable number of sectors. We discuss the papers we choose using the typology presented in the previous section, bearing in mind that some papers can be members of more than one of the classes defined herein.

With very few exceptions, most of the papers we discuss in this section date from after the Second World War, when research on economic growth became an important subject. Two previous papers stand out for their importance. The first by Young (1928) focused not on growth but on increasing returns, a subject that long worried economists because of its incompatibility with perfect competition and general equilibrium. Following Marshall, Young distinguished between internal and external economies that at the firm level could give rise to increasing returns. He maintained that even when a firm had achieved relative stability in its internal operations, it would still need to adapt to the changes occurring in its external environment. Among these, Young explicitly mentioned, “new products are appearing, firms are assuming new tasks and new industries are coming into being” (p. 528). Thus, the structure of the economic system affected firms (being partly responsible for increasing returns), and firms in turn contributed to modifying their external environment.

Young’s paper did not have a great immediate impact, although recently it has resurfaced and is being increasingly referred to. Two papers, Harrod (1939) and Domar (1946) had a very considerable impact on the subsequent literature. The two papers were published independently on different dates. We follow mainly Harrod’s paper. Harrod considered that the previous economic literature had been concerned with the analysis of static systems and aimed at constructing a proper dynamic theory of economic change. He concluded that a static equilibrium could be restored after a disturbance, while any deviation from a dynamic equilibrium could be amplified by adaptive reactions occurring within the system (Harrod 1939, p. 22). In other words, growth was intrinsically unstable. This prediction by Harrod worried neoclassical growth theorists but anticipated the perspective of evolutionary economists (Nelson 1995; Dosi and Nelson 1994; Nelson and Winter 2002). As far as the objectives of this study are concerned, Harrod’s growth model was a MAMA, and thus it was non-structural. Furthermore, it acknowledged the presence of technological change only implicitly, as a possible influence on the capital output ratio or on the difference between natural and warranted rates of growth.

The Harrod Domar (HD) model had a considerable influence on both the economic literature and economic policy, concerned in particular with LDCs. The HD model suggested that LDCs needed to increase investment in productive equipment, something that could be achieved by increasing the rate of saving or by international aid. The impact the HD model had on the economic literature was somewhat different. Neoclassical economists were concerned about the prediction of growth instability emerging from the HD model.

However, before examining the neoclassical growth models created to remedy this perceived failure, we need to take into account another development in economic theory which emerged in the 1930s in Cambridge, UK; which was subsequently called the Cambridge capital controversy. This was initiated by Sraffa (1963) who questioned the possibility of measuring capital at a macroeconomic level. Sraffa’s critique was based on two points: first, capital is a highly heterogeneous entity that could contain, for example, electric motors, steam engines, tractors or lasers, that were qualitatively different and that could not simply be added up; second, capital depended on the rate of profit, but in turn, the rate of profit depended on capital. Thus, there was an undesirable circularity in reasoning. The fact that these two critiques are quoted here, is not just due to the importance they have in the history of economic thought, but for their relevance for this paper. The heterogeneous nature of capital and the fact that its components are qualitatively different could imply that even if it were possible to additively aggregate different types of capital at a given time, the subsequent development of the economic system would depend on the differential rates of growth of its meso and micro components. If we were to model growth only at the macro level, as in a MAMA model, we would never know which one of the potentially infinite combinations of micro and meso development paths would correspond to a given macro path. This is a very important point since no macro policy can be complete without a proper understanding of the behavior of its micro and meso components. Furthermore, the potential circularity identified by Sraffa is not just a mistake or a rare occurrence, but an example of the co-evolution of two interdependent variables. While that seemed to be an anomaly in the 1930s, it could be perceived as quite a normal mechanism of economic development today.

The Cambridge capital controversy continued until the 1950s, when a new category of neoclassical growth models followed the seminal one by Solow (1956, 1957). As far as Sraffa’s critique was concerned, it was swiftly dealt with by the assumption that qualitatively different types of capital could be combined in value through their prices. Although this deceptively easy answer relied on ancillary conditions which were far from being straightforwardly acceptable, the neoclassical category of growth models occupied center stage until the late 1980s. Another objective of neoclassical economists was to address the perceived shortcomings in the HD model, particularly the instability of its solution, that by the late 1950s, led to the development of the Solow’s model.

Solow’s model was a path-breaking one, in which for the first-time technical progress played an explicit, although exogenous, role. It was an entirely macroeconomic model, or a MAMA model, and by definition did not include the concepts of structure and of structural change. Furthermore, in this model, technical progress was considered exogenous, thus belonging to the realm of science and not affected by the decisions of the economic actors. As a consequence of its macro-macro nature, Solow’s model represented technical progress as a residual, or what was left over after the contributions of labor and capital to growth had been accounted for. Some of the early criticisms of the model could have opened the way for the introduction of structural change but this was not the immediate effect. Among the notable exceptions were Abramowitz (1986) and Denison (1962) The former pointed out that the residual was not a proper representation of technical progress but that it included many other possible contributions to growth, and called it a measure of human ignorance about growth. Denison deconstructed the residual into a number of components, such as scale economies, the increasing level of education of the labor force, and the growing participation of women in the labor market. At the time of their appearance, these criticisms did not have a great impact on the growth literature.

A more consistent departure from Solow’s approach was forwarded in the 1990s with the so-called endogenous growth models, the most important examples of which were those by Romer (1990), Aghion and Howitt (1992), and Grossman and Helpman (1994)Footnote 5. As their name implies, these models endogenized technical progress as resulting from investment in R&D. By doing this, they introduced (in different ways) the presence of several sectors in the economic system. They differed on the consequences it had on the variety of the economic system. According to Romer, R&D led to the creation of blueprints and to the subsequent introduction of new types of capital goods, in turn giving rise to new sectors. The new capital goods were different from the previous ones and their number increased during economic development, thus leading to a growing variety in the economic system. However, these different sectors accumulated one on top of the other without interacting in a meaningful way. For Aghion and Howitt, R&D increased the average quality of capital goods because new capital goods of higher quality substituted a vintage of lower quality. In consequence, the number of distinguishable types of capital goods would remain constant, leading to a constant output variety. Thus, for Aghion and Howitt, the variety of the economic system could be expected to remain constant during the process of economic development. They considered their model to be the true Schumpeterian one, in that the substitution of older capital goods by new higher-quality ones exemplified Schumpeter’s creative destruction. As we have already seen, both empirical evidence and modelling work indicate that output variety increases in the course of economic development. An increase in the average quality of a constant number and type of capital goods can perhaps qualify as a limited case of structural change, but not the unidirectional structural change leading to increasing output variety that we can observe today.

Thus, it seems that new sectors created by new capital or consumer goods do not systematically substitute existing ones, but tend to accumulate in the economic system. As previously pointed out, creative destruction cannot refer only to the substitution of existing sectors by new ones. Furthermore, existing empirical evidence seems to imply that diversification occurred both at the inter- and intra-sectoral levels. Only the first one was present in Romer, none in Aghion and Howitt. Product quality was included in Grossman and Helpman’s (1994) model, but its relationship with inter-sector variety or its long-term trends were not clearly defined. In other words, although the concept of system structure appears in these models, it is not clearly defined in terms of its components and of their interactions.

A further limitation of was that they were purely supply-based. To discuss the relationship between supply and demand, we now need to turn from neoclassical growth models toward other models which arose either from the Cambridge capital controversy or parallelly to it.

Kaldor (1956, 1957) aimed to construct a coherent economic theory by combining Keynesian macroeconomics with the theory of imperfect competition. Reflecting the time in which he was working, and departing somewhat from the Keynesian approach, he assumed the existence of a mechanism that generated full employment. Furthermore, Kaldor thought that his theory should be able to explain some stylized facts, such as constancy in the capital/output ratio, the share of profit, and the rate of profit. His model not only managed to achieve these objectives but also provided an explanation for the transition from XIXth century capitalism (referred to as Marxian) to the type of capitalism he observed. According to Kaldor, the driving force of both stages was a dramatic rise in the technical progress function, which led to a high equilibrium rate of productivity growth. The observed increases in savings, investments (both as a proportion of income and of capital), and in the rate of population growth were consequences, and not its initiating causes. In the Marxian stage, profit was equal to the surplus of output over subsistence wages. However, contrary to Marx’s predictions, stage 1 would not have lasted indefinitely or ended in the collapse of capitalism. According to Kaldor, technical progress would have inevitably led to a transition post which the mechanism for the production of output and for the distribution of profits and wages would have changed radically. Wages would no longer have been limited to subsistence levels but could meet higher-level needs. Correspondingly, the share of profits would have been determined by a Keynesian mechanism, by the propensities to invest and to save. Furthermore, the share of profits in income would have remained approximately constant, thus confirming one of Kaldor’s stylized facts. The transition between the Marxian and Keynesian stages would have occurred when a “desired capital” had been attained. The concept of desired capital is not specified further, but it could indicate an intensity of capital of a given quality. Although Kaldor’s work was essentially macroeconomic of the MAMA type, in a joint article with Mirrlees (Kaldor and Mirrlees 1962), he introduced the concept of capital vintage: more modern machines make a greater contribution to productivity growth.

As far as this study is concerned, the most important parts of Kaldor’s work consist of (i) the use of a technical progress function rather than of a production function; (ii) the rejection of the concept of general equilibrium (1972), and (iii) the use of the concept of cumulative causation, first introduced by Myrdal, in which variables are linked in the determination of major processes. According to Kaldor (1957), it was impossible to distinguish between technical change induced by the scarcity of labor from that resulting from technological innovation. As a consequence, the distinction between moving along the production function to change techniques and moving to a new production function to adopt a new technology is irrelevant. Any change involves some type of innovation. The concept of cumulative causation stresses explicitly the importance of the structure of final and intermediate demand and its changes in the very process of cumulative causation growth (1966, 1972, 1981). Furthermore, it anticipates the concept of coevolution, and the rejection of general equilibrium anticipates one of the assumptions later made by evolutionary economists.

In Hick’s early works, such as Value and Capital (1939, 1946) he greatly contributed to integrating the work of Keynes within neoclassical economics by stressing the stabilizing role of the price mechanism. Amongst his many contributions, the one which is most relevant for this paper is the concept of traverse, which he introduced late in his work. Hicks (1965) thought that an economy could not be in a state of equilibrium all the time, but that it would spend at least part of the time in transition, or in a traverse, between different equilibrium states. The traverse had a sectoral and time dimension. The sectoral dimension arose from the need to adapt the nature of the labor force and of the capital equipment to that required to attain the state of equilibrium. The time dimension arose from the fact that any such transition occurred at a finite speed, in historical rather than in logical time. It is then important to distinguish analytically between the time at which inputs are used and the time at which outputs are produced.

Hicks inherited the non-equilibrium nature of economic transformations from Kaldor (1972) and from Robinson (1972). In this way, the work of Hicks and of his followers (Amendola and Gaffard, 1998) opened the way for the analysis of a system out of equilibrium. Both dimensions of the traverse find a natural interpretation in complex and interactive multisectoral models of economic development. In such models the introduction of any innovation can in principle affect all the interactions of existing and new components. Furthermore, the non-simultaneity of different processes can be generalized by admitting that interacting processes are present in the evolution of economic systems and but at intrinsically different speeds. Examples could be the different life cycles of scientific and technological paradigms, or the different speeds at which production methods and their impact on the environment occurred. This literature contributed to reinforcing the Schumpeterian idea that innovation is essentially a disequilibrium phenomenon without which economic development would not occur.

An input-output model is a quantitative economic model that represents the interdependencies between different branches of a national economy or different regional economies. Wassily Leontief is credited with developing this type of analysis and earned the Nobel Prize in Economics for his development of this model. The economic system is represented by a number of sectors in such a way that the output of one sector becomes an input for a number of other sectors. Although the same idea had previously come to a number of other economists, including Francois Quesnay, who had developed a cruder version of this technique called “Tableau Economique,” and Léon Walras, in his Elements of Pure Economics, none of these precursors had the required data bases or computing power. The application of input-output analysis had to await the development of the computer after the Second World War. According to Leontief (1951, 1986) this was not just a new development in economic theory but a methodology that would allow economics to become an empirical science.

From the perspective of this study, input-output analysis was the first explicit representation of the structure of the economic system. Although it could be used at many different levels of aggregation, in terms of our previous classification, input-output analysis was essentially a MEMA model. It has been used in many applications for economic planning. It has been the basis for the development of computable general equilibrium models (Bandara 1991; Robinson 1991). According to Leontief (1951, 1986) input-output analysis owes its usefulness to the relative stability of economic systems which allow the economy to be represented by a constant set of sectors with slowly variable interactions. It is precisely this feature that, while making this technique very useful for the analysis of short-run change, does not allow it to be applied to the study of long-run changes. The input-output technique can only analyze structural change of a quantitative nature, consisting of changes in the flow between the constant number of sectors existing at a given time, but it cannot predict the emergence of new sectors qualitatively different from the existing ones. As already pointed out, it is this type of structural change, involving qualitative change and discontinuities, that is responsible for the increasing variety of the economic system and for the creation of new types of employment. As a consequence, the analysis of long-run economic change requires a modelling approach that is capable of generating an endogenously variable number of sectors, an outcome that by definition cannot be obtained from the use of input-output matrices with a constant number of rows and columns. These remarks are not intended to minimize or deny the usefulness of short-range dynamic analysis possible with the input-output technique. In particular, recent improvements in the technique have clearly expanded its scope of application (Los, 2001; Los and Verspagen 2002; Kurz and Salvadori, 2000). It is just to stress that long-run economic development requires more than a changing balance amongst a constant set of sectors.

The most important contribution to the creation of an explicit model of diversification of the economic system came from the work of Pasinetti (1981, 1993). He worked on the Cambridge capital controversy and followed in that intellectual tradition. However, he developed a theory of structural change and economic growth by combining the macro-dynamics of economic growth with input-output analysis. In his 1981 book, Pasinetti offered a unifying theoretical framework that could be a consistent alternative to that proposed by neoclassical theory. According to Pasinetti, the latter strand of theory, which began in the 1870s, constructed its theory of production in an artificially symmetric way with respect to utility and demand, as developed by neoclassical economics. This required the extreme assumption that capital goods could be considered equivalent to land in terms of being scarce resources, while the fundamental difference between the two was that land was “given” while capital goods were produced. Although he considered their approach to production as unsatisfactory, Pasinetti recognized that neoclassical economists had achieved a formally elegant and coherent theory by clearly, “presenting their arguments around the unifying problem of the optimum allocation or scarce resources and the unifying principle of the rational process of maximization under constraints” (1981, p. XI). Thus, Pasinetti proceeded to develop an alternative theoretical framework which incorporated the contributions of Keynes, Kalecki, Sraffa, Leontief, the macro-dynamics models of Harrod and Domar, and the distribution theory of the post-Keynesian economists in Cambridge.

The richness of Pasinetti’s work goes far beyond the creation of a multisectoral model of growth. However, as already pointed out, in this paper. we focus on the path leading to a model of growth through a type of structural change, including an endogenously variable number of sectors that lead to an increasing output variety. To show that growth requires structural change, Pasinetti analyzed an extremely simple growth model in which population grows at a steady percentage, while technical and demand coefficients (i.e., consumer preferences) remain constant over time. In this model of proportional growth, all sectors have the same growth rate and there is no structural change. Since no case of proportional growth was ever observed in long-term economic development, this shows that economic growth cannot occur without structural change.

In a more realistic scenario than in the proportional growth model, Pasinetti expected the time paths of the coefficients of productivityFootnote 6 and of demand to diverge as the former could be expected to increase indefinitely due to technological change while the latter were bound to stop growing due to demand saturation. This was a concept he inherited from Engel (1857) and extended to all sectors. Furthermore, both productivity and demand coefficients differed among different sectors. This asymmetry of the coefficients of production and demand within each sector and between different sectors entailed that structural change necessarily contributed to economic growth. However, at this point structural change could have consisted only of the changing output and demand share of a constant set of sectors. Pasinetti explains the potential emergence of new sectors by the imbalance between the continuously increasing productivity coefficients and the saturating demand ones. If left unchecked, this imbalance would have led to a bottleneck in economic development due the possibility of producing all demanded outputs with a declining share of required resources, including labor. Such a bottleneck could be overcome if technological change led to the emergence of new sectors, which would reabsorb the potential unemployment. Thus, Pasinetti showed that improving productivity, the rise of new sectors due to creativity and growing output variety were required to enable the long-term continuation of economic growth.

Pasinetti’s model expanded the capability of input-output analysis to represent a system with a constant number of sectors, by adding dynamic implications of differential rates of growth of productivity and demand, to the growth and flow of a constant set of sectors. Thus, the need for growing output variety was demonstrated implicitly, with a modelling technique that lacked the capacity to represent explicitly an economic system with an endogenously variable number of sectors. By “explicitly,” we mean a model that can give rise to the emergence of new sectors by mechanisms normally operating within the economic system. In terms of our previous classification Pasinetti’s would be a MEMA model, that is explicitly multisectoral but with only an implicitly variable number of sectors.

After the 1990s, a new category of evolutionary growth models appeared. They were conceived within a new paradigm which followed a series of innovation studies and the dissatisfaction of several scholars with the way neoclassical economics treated the phenomenon of innovation. Evolutionary economists, as they started calling themselves after Nelson and Winter’s (1982) book, objected to the acceptance of general equilibrium and of optimizing rationality, which were central to neoclassical economics. Following Schumpeter (1912, 1934), they maintained that innovation cannot be understood in terms of a general equilibrium since it can be expected to destroy any kind of pre-existing equilibrium. Furthermore, they followed Simon (1961) and Cyert and March (1972) by saying that economic agents, including entrepreneurs and innovators, did not have perfect knowledge and could not optimize, exhibiting only a satisficing behavior. Although they rejected the concept of general equilibrium, evolutionary economists did not believe that economic systems developed in a chaotic way but rather had a concept of order similar to the ones used by Hayek (1982) and in the emerging field of complexity science (Prigogine and Stengers 1984; Nicolis and Prigogine 1989; Haken 1983; Allen 2007; Arthur 2007). The style of modelling adopted in evolutionary economics was considerably different to that in neoclassical economics. In the latter, economic models were deductively derived from a series of axioms and general propositions, while evolutionary economists maintained that “appreciative theorizing,” or the qualitative articulation of a theory, should precede the construction of mathematical models. As a consequence, models in evolutionary economics were much more inductive than neoclassical ones.