Abstract

In this paper, we introduce a twofold role for the public sector in the Goodwin (1967) model of the growth cycle. The government collects income taxes in order to: (a) invest in infrastructure capital, which directly affects the production possibilities of the economy; (b) finance publicly-funded research and development (R&D), which augments the growth rate of labor productivity. We study two versions of the model, with and without induced technical change; that is, with or without a feedback from the labor share to labor productivity growth. In both cases we show that: (i) provided that the output-elasticity of infrastructure is greater than the elasticity of labor productivity growth to public R&D, there exists a tax rate that maximizes the long-run labor share, and it is smaller than the growth-maximizing tax rate; (ii) the long-run share of labor is always increasing in the share of public spending in infrastructure; (iii) different taxation schemes can affect the stability of growth cycles.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The seminal paper on the growth cycle by Goodwin (1967) provides a representation of the interaction between the accumulation of capital and the functional income distribution in a market economy with two classes, ‘workers’ and ‘capitalists’. Savings out of profit incomes finance investment in physical capital. Capital accumulation raises the demand for labor, which in turn puts upward pressure on real wages relative to labor productivity, thus increasing the share of output accruing to workers. Once the labor share picks up, profitability suffers, and accumulation slows down. Employment will recede, and real wages will fall relative to labor productivity. At this point, profitability is restored, and accumulation can pick up again. As a result, the model produces endless counterclockwise cycles of employment and labor share around their steady state values. Since the steady state is never reached, the distributional conflict determining the growth cycle is never settled (van der Ploeg 1987).

The goal of the Goodwin model was to provide a mathematical representation of Karl Marx’s arguments about distributive conflict and the reserve army of labor, but it is interesting that Goodwin-type cycles in the distribution of income and the employment rate seem actually to occur in industrialized countries, and the US in particular. In fact, the direction of the cycles in the employment rate and the labor share appears to follow the counterclockwise motion predicted by the Goodwin model (Barbosa-Filho and Taylor 2006; Barrales and von Arnim 2015; Flaschel 2009; Fiorio et al. 2013; Harvie 2000). Yet, both the period of the cycles and the steady state around which the cycles happen appear quite volatile (as documented in Barrales and von Arnim 2016; Tavani and Zamparelli 2015). A natural question to ask is what kind of shocks can explain the shifts in the model’s equilibrium and, in particular, whether policy shocks can have an effect to this extent. Unfortunately, the Goodwin (1967) framework is of little help in devising a role for economic policy, because the traditional parameters that shift the steady state of the model are basically policy-invariant. On the one hand, the long-run employment rate only depends on the exogenously given growth rate of labor productivity and degree of labor market conflict, as captured by the slope of a real-wage Phillips curve. On the other hand, the long-run labor share is a function of parameters unrelated to policy: the growth rate of population, labor productivity growth, the level of capital productivity, and the saving rate of the asset-owning class (capitalists).

It is therefore important to identify explicit policy variables in order to extend the relevance of the model. And yet, efforts of this kind are limited in the literature. Some attention has been paid to the labor market: Glombowski and Kruger (1984) introduced taxation and unemployment benefits; Flaschel et al. (2012) considered minimum and maximum wages in an economy with a dual labor market; while in Chiarella et al. (2012), the government sector acts as an employer of ‘first’ resort, by hiring all workers not employed in the private sector. Fiscal policy for demand-management purposes is studied in Goodwin (1990, Chapter 8), while stabilization policies, both fiscal and monetary, are central in the contributions by Asada (2006) and Yoshida and Asada (2007), the latter with a specific attention to the role of policy lags. An alternative modeling channel is to endogenize the growth rate of labor productivity. Tavani and Zamparelli (2015) took insights from the endogenous growth literature (Aghion and Howitt 1992; Romer 1990) to look at both the long-run and short-run effects of private research and development (R&D) and policy variables such as R&D subsidies, and found that such modification does indeed improve the explanatory power of the framework.

This paper also builds on the endogenous growth literature, but highlights two additional roles played by the public sector: investment in infrastructure capital, on the one hand, and investment in R&D, on the other. The accumulation of public capital increases the productivity of private capital stock, while public R&D augments the growth rate of labor productivity.

Analyzing this twofold role of the public sector in the Goodwin model is relevant for several reasons. First, infrastructure spending in order to boost job creation and wage growth is one of the few issues in the US Congress for which there is bipartisan support, even though there are sharp differences among the two parties about the financing schemes for such spending. A higher level of public infrastructure enables private capital to employ more workers, and the resulting tightening of the labor market is bound to increase real wages. Second, recent influential work by Mazzucato (2013) has highlighted the importance of public investment in innovation. She argued that the role of public sector is not only to intervene when market outcomes are inefficient, but rather to act in an ‘entrepreneurial’ way, fostering private innovation through public R&D funding. Accordingly, active industrial policies and a strong involvement of governments in the development of new technologies become of crucial importance in the growth process. However, if the ultimate effect of R&D investment is to foster labor productivity growth, this might act in the opposite direction to infrastructure investment by lowering the labor share. Third, the productive role of public infrastructure – or government spending in general – on GDP growth and income distribution is well understood in the mainstream economic literature (Aschauer 1989, 2000; Barro 1990; Devarajan et al. 1996; Glomm and Ravikumar 1997; Holtz-Eakin 1994; Irmen and Kuehnel 2009; Turnovsky 2015), and several empirical contributions have studied the effects of public R&D on growth and on private R&D (see for example Cohen et al. 2002; Levy 1990); but the theoretical literature on public research – be it mainstream or not – is surprisingly thin (exceptions being Konishi 2016; Spinesi 2013).

A framework based on distributive conflict is particularly well-suited to address the double role of the ‘infrastructure state’ vs. the ‘entrepreneurial state’. By focusing on balanced government budgets, we can study the implications of the trade-off between the two types of public investment: we argue that both the size and the composition of government expenditure between infrastructure and R&D affect the distribution of income, the growth rate, and the employment rate in the long run. Assuming that productivity growth depends on public R&D investment makes long-run growth and employment dependent on fiscal policy. Moreover, embedding public R&D in the Goodwin model emphasizes the distributive implications of promoting innovation, as the equilibrium labor share and employment rate are affected by labor productivity growth in opposite ways. Distributional considerations, as they pertain to the active role of the state on innovation, are mostly absent in Mazzucato (2013). Finally, fiscal policy can also affect the distribution of income through the infrastructure channel. Shifting the composition of public investment in favor of infrastructure raises labor demand relative to the exogenous labor supply, thus putting pressure on the labor market and raising the wage share.

To gain intuition on these linkages, we first study a special case in which labor productivity growth depends entirely on public research and show that, provided that the output-elasticity of public infrastructure is greater than the elasticity of labor productivity growth to public R&D, there exists a tax rate τω that maximizes the labor share at the steady state; while maximizing growth – or equivalently employment – demands a tax rate higher than τω. Further, the steady state labor share is always increasing in the share of taxes spent in infrastructure investment; but there is a growth maximizing composition of public expenditure.

We then study a more general model with induced technical change where, as is well known in the literature, the distributive conflict is resolved in the long run because of a positive feedback running from the labor share to labor productivity growth (Shah and Desai 1981; van der Ploeg 1987; Foley 2003; Julius 2006). Accordingly, the steady state – a center in the Goodwin model – becomes a stable spiral. However, our comparative statics results are very similar to those established in the special case: the long-run value of the labor share is maximized at the same tax rate, and again it is always increasing in the share of taxes spent in infrastructure investment. Maximizing growth and employment can be achieved by levying a tax rate in excess of τω, but generally different from the growth-maximizing tax rate in the special case. In both cases, our analysis shows that the wage share- and growth-maximizing tax rates do not coincide: thus, a policymaker interested in both the distribution of income and its growth rate faces a trade-off when choosing the desired fiscal policy.

Finally, our paper makes a contribution with respect to the role of public finance in shaping the dynamic unfolding of the distributive conflict. We show that the relative incidence of taxes between the two classes can alter the stability properties of the model’s equilibrium. As pointed out already, when the same tax rate is levied on both wage incomes and profit incomes, the dynamics of the model reproduces what is already known in the literature. Conversely, with differential tax rates, stability (instability) will prevail even without induced technical change, as long as profits are taxed relatively less (more) then wages. This result depends on the fact that differential taxation introduces a feedback from income distribution to labor productivity growth through the public R&D channel: stability requires a positive feedback from the labor share to the growth rate of labor productivity, which will be achieved when taxation affects wages more than profits in relative terms.

The remainder of the paper is organized as follows. Section 2 outlines the main features of the model. A special case without induced technical change is analyzed in Section 3, while Section 4 studies the general model with induced technical change. Section 5 discusses the role of different taxation schemes on the stability properties of the model’s steady state. Section 6 concludes. Results are stated as propositions: proofs are provided in the Appendices.

2 Basic elements of the model

2.1 Production, income shares, and accumulation

We consider a closed economy with a government sector. The final good Y is produced by competitive firms using fixed proportions of aggregate capital stock \(\tilde {K}\) and effective labor AL:

We follow Tavani and Zamparelli (2016) in assuming aggregate capital to be a twice continuously differentiable, linearly homogeneous function \(H:\mathbb {R}_{+}^{2}\to \mathbb {R}_{+}\) of public capital X and private capital K, which amounts to impose imperfect substitutability between the two stocks. Denoting the public-to-private capital ratio by χ, we have that \(\tilde {K}=H(X,K)=KH\left (\frac {X}{K},1\right )\equiv Kh(\chi ).\) Profit maximization requires no payment for idle productive factors, so that Y = Kh(χ) = AL. Notice that this implies a labor demand equal to L = Y/A. At each moment in time, firms take the output/capital ratio h(χ) as a given. For concreteness, we assume that h(χ) = χη, where η ∈ (0,1) is the constant elasticity of output to the public-to-private capital ratio. Each of the L = h(χ)K/A employed workers in the economy receives the same real wage w. Using the labor demand defined above, the share of labor in output is given by ω ≡ wL/Y = w/A, and firms’ profits before taxes are π = Y − wL = Y (1 − ω).

As is customary in two-class models, we assume that savings occurs out of capital income only. In order to derive closed-form solutions to our model, we assume a constant saving rate s ∈ (0,1) and rule out depreciation. With time flowing continuously, the growth rate of capital stock is

where τ ∈ [0,1] is the the tax rate on profits. Finally, we impose a constant size of the labor force N.

2.2 Government

In the baseline model, the government sector taxes both profits and wages at the same rate τ ∈ [0,1]. This is equivalent to levying an income tax on the overall economy. In fact, total tax receipts for the government are τ(wL + π) = τ[ω + (1 − ω)]Y = τh(χ)K. Taxes collected by the government have two purposes: on the one hand, they finance the accumulation of public capital \(\dot {X}\). On the other hand, tax revenues finance publicly-funded R&D investment RG. Denoting by 𝜃 ∈ [0,1] the fraction of government spending that goes to public investment, and imposing a balanced budget, we have the following relations:

2.3 Innovation

We restrict labor productivity growth gA to be log-linear in the share of public R&D in output RG/Y and on the labor share via induced technical change:

Our innovation technology has two components. The first is based on the endogenous growth literature, which generally considers the flow of newly produced technologies \(\dot {A}\) to depend positively on R&D inputs (RG), and on the existing level of technology itself (A). This specification, in turn, has two features: a linear spillover from the stock of technology to the production of new ideas, which is useful to produce endogenous growth; and a normalization of R&D investment, which excludes explosive growth. The latter is typically justified with the argument of increasing complexity of discovering new ideas, or the dilution argument of R&D investment over an increasing number of sectors (Segerstrom 1998). Furthermore, new ideas are made available freely to the private sector. The peculiarity of our assumption is that R&D investments are carried out of by the public sector only: while being an obvious simplification, it highlights the importance of the ‘entrepreneurial state’ emphasized by Mazzucato (2013).

The role of the private sector in promoting labor productivity growth is captured by the second component of the innovation technology. We follow the induced innovation hypothesis (Drandakis and Phelps 1965; Funk 2002; Kennedy 1964) in assuming that the aggregate growth rate of labor productivity depends on the share of labor in national income. A higher labor share represents higher unit labor costs for individual firms, which then have an incentive to save on labor requirements and introduce labor-saving innovations.Footnote 1

2.4 Dynamics of the public-to-private capital ratio

One of the main implications of introducing infrastructure spending by the government sector is that the public-to-private capital ratio becomes a state variable of the model. Its law of motion is:

2.5 Dynamics of the employment rate

As in the basic Goodwin model, we consider the employment rate e ≡ L/N as a state variable of our setup. Given the definition of \(\tilde {K}\) and the assumed constancy of population, the evolution of the employment rate over time is:

2.6 Dynamics of income shares

The third state variable of the model is the labor share. In typical Goodwin (1967) fashion, we assume that the real wage grows with employment, according to a real-wage version of the Phillips Curve: \(\dot {w}/w=f(e),\:f'(\cdot )>0\). Therefore, using Eq. 5, we have:

Goodwin (1967) assumed a strictly convex function f(e). In what follows, we impose f(e) = e1/δ,δ ∈ (0,1).

We thus have a three-dimensional dynamical system formed by Eqs. 6, 7, and 8. We first focus on a special case where there is no role for induced technical change, that is, with β = 0. This is in line with the lack of distributive considerations in Mazzucato (2013). This case is very tractable and quite close to the original Goodwin (1967) model. An important difference, however, is that fiscal policy matters in the long run.

3 The model with public R&D only

Let us consider the dynamical system made up of Eqs. 6, 7 and 8 under the assumption of no induced technical change, that is β = 0.

3.1 Steady state and policy

We start by setting gχ = ge = gω = 0, and restrict our attention to the non-trivial steady state involving positive values for all three variables under consideration. From gχ = 0, we obtain the public-to-private capital stock ratio as a function of the labor share:

Next, setting ge = 0 and remembering h(χ) = χη, we find:

In order to obtain the steady state value of the labor share, substitute the value χ from Eqs. 9 into 10:

The steady state share of labor is always increasing in the proportion of tax revenues spent on the accumulation of public capital (𝜃). Investment in public capital raises labor demand, while public R&D allows firms to economize on labor requirements. Thus, a shift in the composition of government expenditure in favor of public investment puts pressure on the exogenous labor force, which is then able to capture a larger share of output.

With respect to the tax rate, if the output-elasticity of public capital η is greater than the innovation-elasticity of public research ϕ, the steady-state labor share is hump-shaped in the tax rate. In fact, we can state the following result.

Proposition 1

Suppose that1 > η > ϕ.Then, there exists an interior value\(\tau _{\omega }=\frac {\eta -\phi }{1-\phi }\in (0,1)\)such that the steady state labor share is maximized independently of thecomposition of public expenditure.

Proof

See Appendix 1. □

The intuition for this result is the following. Government spending has two effects on the labor share. On the one hand, public infrastructure investment reinforces capital accumulation: it increases employment, everything else equal, thus putting pressure on real wages relative to labor productivity. The strength of this effect on the labor share depends on the output-elasticity of public capital η. On the other hand, public R&D increases labor productivity, thus lowering unit labor costs in production, everything else equal. The strength of this effect on the labor share is captured by the R&D elasticity ϕ. If η < ϕ, the labor share is always decreasing in the tax rate. The negative effect of innovation on labor demand is stronger than the positive capital accumulation effect: labor demand falls relative to the labor force, and the labor share decreases. In this case, distributive considerations would push the government sector to levy a tax rate as small as possible; but this would reduce funds for both infrastructure and R&D spending. If instead η > ϕ, the public sector can levy taxes in such a way that the two effects balance each other, and the labor share is maximized. As we argue in Section 3.3, the evidence on the relative elasticities points toward the required inequality to be satisfied for US data.

Next, we can find the steady state public-to-private capital stock ratio by plugging ωss into Eq. 9:

Intuitively, the long-run public-to-private capital ratio rises with the tax rate and the share of government expenditure employed in public physical capital investment. Finally, the steady state employment rate is found, from Eq. 8, as:

With real wages being an increasing function of employment, a higher labor productivity growth requires a higher employment rate to stabilize the labor share. At a steady state, gY,ss = gA,ss = f(ess), so that per-capita growth and employment move together in the long run: the (labor productivity) growth-maximizing policy and the employment-maximizing policy coincide. Higher taxes and a higher share of tax revenues invested in public R&D simultaneously raise both labor productivity growth and the employment rate. Notice, however, that a policy maker interested in maximizing the growth rate of labor productivity and employment cannot simply set τ = 1 and 𝜃 = 0. In fact, the set of feasible (𝜃,τ) must be restricted to ensure economically meaningful factors shares and public-to-private capital stock ratio. First, χss > 0 requires τ > 0,𝜃 ∈ (0,1). Next, from Eq. 11 we can impose

Using the second inequality, we show in Appendix 2 that a feasible fiscal policy must satisfy: a composition \(\theta \in [\bar {\theta },1)\) where \(\bar {\theta }=m^{-1}\left [\frac {\eta -\phi }{1-\phi }^{\frac {\eta -\phi }{1-\phi }}\left (\frac {1-\eta }{1-\phi }\right )s/\lambda ^{\frac {1}{1-\eta }}\right ]\) and m− 1 is some decreasing function; and a tax rate τ ∈ [0,τmax(𝜃)] where τmax(𝜃) is an increasing function of 𝜃 with image set [τω,1). That is to say that, for any feasible \(\theta \in [\bar {\theta },1)\), there is an upper bound τmax to the tax rate compatible with a non-negative profit share. The upper bound is itself a function of 𝜃, and rises from the wage share maximizing tax rate (τω) corresponding to \(\theta =\bar {\theta }\), to just below one when 𝜃 approaches its upper bound. Since the economy’s growth rate and employment are monotonically increasing in the tax rate – recall that τ is also the share of government spending in GDP – we can be sure that, for any feasible composition of public expenditure 𝜃, the growth-maximizing tax rate (τg) is the highest feasible tax rate: τg = τmax(𝜃). As a consequence, we can formulate:

Proposition 2

Suppose that1 > η > ϕ,and let\(\bar {\theta }\)be as defined above. Then, the growth-maximizing tax rate isat least as large as the wage share-maximizing tax rate: i)\(\tau _{g}(\theta )>\tau _{\omega },\forall \theta >\bar {\theta ;}\)ii)\(\tau _{g}(\bar {\theta })=\tau _{\omega }.\)

Proof

See Appendix 2. □

This result shows that a policy-maker aiming at simultaneously maximizing growth and the wage share faces a trade-off when choosing the desired fiscal policy. Notice, however, that for all τ < τω, raising the tax rate raises both the growth and the wage share. This result is also remarkable once compared with the basic classical growth model where higher growth uniformly demands a lower wage share (see, for example, Foley and Michl 1999, Chapter 6).

The maximal attainable labor productivity growth rate (\(\tilde {g}_{A,ss}\)) can be written as a mere function of the of public expenditure composition as \(\tilde {g}_{A,ss}(\theta )=\lambda \left [(1-\theta )\tau _{g}(\theta )\right ]^{\phi }.\) Letting 𝜃g be the growth-maximizing composition of public expenditure, we can state:

Proposition 3

Suppose that1 > η > ϕ :i) if∃\(\theta ^{*}\in (\bar {\theta },1)\)such that\((1-\theta ^{*})=\tau _{g}(\theta ^{*})/\tau _{g}^{\prime }(\theta ^{*})\),then𝜃g = 𝜃∗;ii)\(\theta _{g}=\bar {\theta }\)otherwise.

Proof

See Appendix 2. □

The composition of public expenditure has two opposite effects on labor productivity growth. On the one hand, a higher 𝜃 reduces the share of public R&D spending, with a negative effect on productivity growth. On the other hand, a rise in 𝜃 increases the highest feasible tax rate; as a consequence, more public funds are available to finance public R&D investment and growth. If there is a feasible composition of public expenditure where, at the margin, the two effects offset each other we have a maximum as per (i) above. Otherwise, growth is always decreasing in 𝜃, and achieving the highest possible growth rate demands to set 𝜃 equal to its lower bound as per (ii).

3.2 Stability

Regarding the stability properties of the steady state, Appendix 4 proves the following result.

Proposition 4

For any meaningful value of the parameters, the (non-trivial) steady state of the model without induced technical change is locally unstable but the dynamics gives rise to a limit cycle.

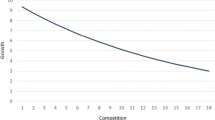

The dynamic behavior of this model is thus similar to the Goodwin (1967) model, though it involves the additional state variable χ. As the simulations in Fig. 1 show, given initial conditions, the employment rate and income distribution approach the limit cycle and starts oscillating perpetually around the steady state. Thus, the distributive conflict never comes to an end just as in the original Goodwin model: the mere presence of a public sector levying an income tax for competing uses is not enough to determine a change in the dynamic behavior of the system. However, we will show in Section 5 that different tax schemes in general will have an impact on the stability properties of the model’s steady state.

3.3 Simulation results and some empirical considerations

The dynamical system described by Eqs. 6, 7, and 8 can be parameterized for the United States and simulated numerically.Footnote 2 We start with the output elasticity of public capital for the US. Despite the fact that the initial estimates by Aschauer (1989) were in the magnitude of 40%, more recent research, surveyed in Isaksson (2009), suggest calibrating η at .15. On the other hand, Guellec and Van Pottelsberghe 2004, Table B3), using a panel of sixteen countries between 1980 and 1998, offer estimates of the elasticity of productivity growth to public R&D that range from .04 to .09. We use an average value and set ϕ = .065 for this simulation round.Footnote 3 Observe that the calibration of the two relevant elasticities to public spending is in accordance with the interesting case in our model, namely η > ϕ. Furthermore, the corresponding labor share-maximizing tax rate is about 9.1%.

In order to calibrate an actual value for the share of government spending on infrastructure and R&D in GDP, a figure for government spending on water and transportation infrastructure can be obtained from the US Congressional Budget Office. The post-war federal average for the US is 2.6% of GDP which, since in our model \(\dot {X}=\theta \tau Y\), anchors 𝜃τ = .026. On the other hand, we found National Science Foundation figures for the share of public financing of innovation in GDP around 1.1% = (1 − 𝜃)τ. We can thus calibrate both the composition parameter 𝜃 and the tax rate τ using these two equations.Footnote 4 The resulting values are 𝜃 = 70.2%,τ = 3.6%. We can then internally solve for λ, the scale parameter in the innovation function (5), and the wage-Phillips curve parameter δ in order to match a long-run growth rate of 2% and a long-run unemployment rate of 5%. The final parameter to calibrate is the saving rate, which can be calibrated using Eq. 11 to match a long-run value for the labor share of 2/3, which is the typically-used value for US data after World War II. We thus use s = .06 for this round.Footnote 5

Figure 1 displays the simulation results over 400 periods. From an initial condition with a labor share of .7 and an employment rate of .89, the dynamics approaches the limit cycle showing the familiar counterclockwise cycles in the (e,ω) plane (left panel). The right panel displays a time series plot of the labor share, the employment rate, and the public-to-private capital ratio.

It is also interesting to determine what is the period of the cycle implied by the model. With two complex conjugate eigenvalues ± bi with zero real parts in the Jacobian matrix, the period of the cycles is given by 2π/b; under our baseline parameterization, b = .229451, so that a full cycle lasts 27.38 periods.Footnote 6 As pointed out by Atkinson (1969), the periodization of the model depends on the time scale of the parameters imposed in the simulation runs: with annual averages, one period amounts to a year. Accordingly, our model describes very long-run cycles similarly to the original Goodwin (1967) model, as highlighted by Atkinson (1969).

An empirical implication of our model is that, provided that the share of government spending on infrastructure and public R&D in GDP τ is less than its labor share-maximizing level (as appears to be the case given the data we used to calibrate the model), a decrease in public spending should be associated with a decrease in the labor share. We collected water and infrastructure data from the Congressional Budget Office (CBO 2015) and public R&D data from the National Science Foundation (NSF 2016, data for Figure 4.2), both as shares of GDP in order to construct a series that exactly corresponds to the tax rate τ in our model. We also collected data on the labor share in the Nonfarm Business Sector from the Bureau of Labor Statistics (BLS 2017). The plots in Fig. 2 span the period in which the two series fully overlap: the direct correlation between the two variables is apparent. While a full-fledged econometric exercise to establish causal relations between the policy variables and the endogenous variables in our model is beyond the scope of this paper, this cursory observation appears encouraging enough about the empirical relevance of our conclusions.

4 Public R&D and induced technical change

Let us now consider the more general case of the innovation technology (5) that allows for a positive influence of the labor share on labor productivity growth via induced technical change.

4.1 Steady state and policy

Public and private capital accumulation are independent of labor productivity growth, so that the evolution of the public-to-private capital ratio χ in the general model is not affected by the generalization in the innovation technology. The latter does, however, change the dynamics of employment and income shares. First, setting ge = 0 in Eq. 7 when β > 0, and using Eq. 9 yields the steady state labor share as the solution to

Next, setting gω = 0 in Eq. 8 solves for the steady-state employment rate, which under β > 0 becomes:

The induced innovation hypothesis establishes a direct relation between the steady state employment rate and labor share. This feature of the model appealingly fits with the notion of a wagecurve, as estimated by Blanchflower and Oswald (1995).

Finally, the fact that both the evolution and the steady state value of the labor share are affected by the presence of induced innovation has the following implication for the long-run value of the public-to-private capital ratio: while Eq. 12 still gives the solution to gχ = 0, the corresponding long-run value χss will be different than in the model without induced technical change.Footnote 7

Although Eq. 14 cannot be solved explicitly, we will show in Appendix 3 that it has a unique solution. As a consequence, we have the following result.

Proposition 5

The non-trivial steady state of the model with induced technical change is unique.

Proof

See Appendix 3. □

Equation 14 show that the tax rate and the composition of public expenditure have the same effect on the labor share as in Eq. 11. In fact, the following result, parallel with Proposition 1, holds.

Proposition 6

Suppose that1 > η > ϕ.Then, there exists an interior value\(\tau _{\omega }=\frac {\eta -\phi }{1-\phi }\in (0,1)\)such that the steady state labor share is maximized independently of thecomposition of public expenditure.

Proof

See Appendix 1. □

With respect to the composition of public expenditure, notice that the left hand side of Eq. 14 is increasing in the labor share. The right hand side is increasing in 𝜃, so that raising the share of taxes spent on the accumulation of public capital has a positive effect on the labor share.

With respect to growth and employment effects of fiscal policy we have the following result.

Proposition 7

The growth- and employment-maximizing tax rate satisfies \(\tilde {\tau }_{g}>\frac {\eta -\phi }{1-\phi }.\)

Proof

See Appendix 1. □

The intuition is clear. Productivity growth depends on the tax rate both directly, as taxes finance public R&D investment, and indirectly via the influence of the tax rate on the labor share. Since the first effect is always positive, the growth-maximizing tax rate must be higher than the labor share-maximizing one. Notice also that \(\tilde {\tau }_{g}\neq \tau _{g}=\tau _{max}(\theta _{g})\), unless by a fluke.

Regarding the composition of public expenditure, it has two opposite effects on growth and employment. The share of tax revenues spent on capital accumulation increases the labor share, and has a positive influence on productivity growth through this channel; at the same time, however, it may harm growth by reducing public R&D investment. We show in Appendix 2 that there may exist a growth-maximizing composition of public expenditure (\(\tilde {\theta }_{g}\)) where the two effects, at the margin, offset each other. In general, \(\tilde {\theta }_{g}\) will be a function of the elasticities of infrastructure spending and public R&D, of the private incentives to save on labor costs, and of the overall saving rate of the economy; but we cannot find a closed-form solution for these relations.

4.2 Stability

As far as stability is concerned, in Appendix 4 we prove the following

Proposition 8

For any meaningful value of the parameters, the (non-trivial) unique steady state of the model with induced technical change is locally stable.

This result is in line with the literature featuring a dependence of labor productivity growth on the labor share in the Goodwin model (Foley 2003; Julius 2006; Shah and Desai 1981; van der Ploeg 1987). Figure 3 shows the results of a 400 periods simulation round obtained under β = .25, while Fig. 4 displays the results of a simulation run under β = .5. The initial conditions on the labor share and the employment rate are the same as above: in both figures, the left panel presents a two-dimensional slice of the plot, and it clearly displays both the counterclockwise movement and the converging path to the steady state. The right panel displays the time series plots as before. It is clear that convergence to the steady state occurs faster the higher the value of the elasticity parameter β.

5 Discussion: public finance and stability

The baseline model we studied above features a public sector levying the same tax rate on both classes in the economy. A stark conclusion of the analysis is that the presence of a government sector does not affect the stability properties of the steady state, that is, the resolution (or the lack thereof) of the distributive conflict in the long run. Thus, a question to be addressed is whether alternative public financing schemes can alter the stability properties of the steady state, both with and without induced technical change. The answer is affirmative: as long as either class faces a higher tax rate than the other, the dynamic behavior of the model will change.

Consider the following more general taxation scheme, where a tax rate τπ ∈ [0,1) is levied on profits and a tax rate τw ∈ [0,1) is charged on wages, with τπ≠τw. Imposing as before a balanced budget requirement for the government, we have: G/Y = τπ(1 − ω) + τwω = τπ − ω(τπ − τw) ≡ τ(ω). Hence, public infrastructure investment obeys \(\dot {X}=\theta \tau (\omega )Y\), while the share of public R&D in GDP becomes RG/Y = (1 − 𝜃)τ(ω). Furthermore, \(\tau ^{\prime }(\omega )=-(\tau _{\pi }-\tau _{w})\lessgtr 0\iff \tau _{\pi }\gtrless \tau _{\omega }\). Accordingly, the wage share dynamics features an additional feedback from the labor share in addition to the induced technical change effect: gω = f(e) − λ[(1 − 𝜃)τ(ω)]ϕωβ. The inequality relation between the two tax rates defines whether the new channel acts as a stabilizing or destabilizing force. It is easy to show that with differential tax rates a condition for \(\partial \dot {\omega }/\partial \omega <0\) at a steady state is \(\tau _{w}>\tau _{\pi }[1-\frac {\beta }{\omega (\beta +\phi )}]\). When there is no induced technical change and β = 0, the condition simply reduces to τw > τπ or τ′(ω) < 0; when β > 0, the condition becomes less stringent because the positive effect of the labor share on productivity growth due to the induced innovation hypothesis can offset the instability arising from a tax scheme that favors profits over wages. We have emphasized above that when induced technical change is assumed in the Goodwin model, the distributive conflict vanishes thanks to the positive feedback from the labor share to productivity growth. An asymmetric taxation scheme introduces an additional influence of the labor share on the growth rate of labor productivity that can either strengthen or counterbalance the induced innovation channel.

To sharpen these conclusions, consider the interesting extreme cases that arise when either τπ = 0 or τw = 0, that is, when public spending is financed exclusively either through taxes on wages, or on profits. Consider first taxes being levied on profit incomes only. We are able to identify a bifurcation in the dynamic behavior of the system, and this result is interesting enough to be stated as a proposition.

Proposition 9

In a version of the model with asymmetric taxation andτπ > 0 = τwthe stability of the steady state undergoes a Hopf bifurcation at\(\beta =\phi \omega _{ss}/(1-\omega {}_{ss})\equiv \bar {\beta }\).

Proof

See Appendix 4.Footnote 8□

When the induced technical change channel is strong, that is, when \(\beta >\bar {\beta }\), the destabilizing effect of profit taxation is more than compensated and the long-run equilibrium of the model is stable. Conversely, as the strength of induced technical change decreases and approaches \(\bar {\beta },\) the two effects tend to balance each other and the economy is characterized by a limit cycle. Finally, when the taxation prevails and \(\beta <\bar {\beta }\), the steady state becomes fully unstable.Footnote 9

Consider next the case of taxation affecting wages only. When the induced technical change channel is turned off (β = 0), levying taxes only on wages makes labor productivity growth increasing in the labor share. As we show in Appendix D.4, the condition η < ωss proves sufficient to dampen the growth cycle.

6 Conclusion

In this paper, we introduced a government sector as the provider of public infrastructure investment as well as public R&D investment in a simple growth cycle model based on Goodwin (1967), with and without induced technical change. We showed that such modification delivers important insights toward an understanding of the role of policy-making in shaping the growth, employment, and distribution path of an economy. On the one hand, the accumulation of public capital fosters employment and wage growth, as well as having a positive level effect on GDP; on the other hand, public R&D increases labor productivity, which keeps the labor share in check.

A general conclusion of our model is that the growth-maximizing and the labor share-maximizing fiscal strategies do not coincide, with the implication that a workers-friendly policy maker interested in high labor shares, employment rate and productivity growth faces a trade-off when choosing an economy’s steady state growth and distribution path. The extent of the difference depends on the elasticities of infrastructure spending and public R&D, on the private incentives to save on labor costs, and on the overall saving rate of the economy. In this regard, our model provides additional channels to evaluate the impact of policymaking on long-run growth and employment, on the one hand, and income distribution on the other.

But the government sector can also affect the dynamic unfolding of the distributive cycle over time. When differential taxation schemes are introduced, our framework provides not only interesting long-run policy effects on the steady state, but also channels through which the public sector can affect the dynamics of the model. The existing literature on induced technical change has highlighted the differences in dynamic behavior that result from turning off or on the induced technical change effect on labor productivity growth. This is the well-known ‘structural instability’ of the Goodwin growth cycle: the endless cycles predicted by the model are not robust to small modifications of its main assumptions. See, for example, Mohun and Veneziani (2006) for a survey, or recent contributions by Sordi and Vercelli (2014) and Dosi et al. (2015) where the introduction of an autonomous investment function opens up the possibility of chaotic motions and Hopf bifurcations in the Goodwin model. Here, the type of financing of public spending for allocation purposes on infrastructure and innovation provides an additional channel through which the distributive conflict is resolved in the long run (van der Ploeg 1987): a positive feedback going from the labor share to the growth rate of labor productivity is necessary to achieve convergence to the steady state. As noted first by Shah and Desai (1981), such a mechanism will break the symmetric bargaining positions of the two classes in the economy by endowing the capitalist class with the additional ‘weapon’ of endogenous productivity growth, thus ensuring the resolution of the distributive conflict in the long run. Our analysis has shown that the public sector can achieve the same outcome through a tax incidence that favors profit incomes over wages.

Notes

We used Mathematica11 for the simulations. The code is available from the authors upon request.

Guellec and Van Pottelsberghe (2004, p.366) conclude that the elasticity of productivity growth to public research is around 0.17. However, that estimation results from using the stock of R&D, measured as the cumulated value of past R&D investment, as independent variable. This measure is inconsistent with our model, which is concerned with R&D investment flows. Accordingly, we have based our calibration on estimations found in the section of the paper where R&D investment flows are considered (Appendix 2, Table ??).

Observe that, given the small size of the two average values for government spending to match, the solution will return a pretty low tax rate (which is the variable that scales government spending in our model). This, however, is harmless, because in our framework the only two uses of government spending are infrastructure spending and public R&D. Thus, the values obtained for τ and 𝜃 using our calibration strategy are those consistent with an admittedly hypothetical government sector only performing these two roles and running a balanced budget.

Observe finally that the simulated employment rate can, in principle, leave the unit square, even though under our calibration it does not. This is a well-known limitation of the Goodwin model, pointed out by Desai et al. (2006). Avoiding the issue altogether would imply to drastically modify the wage-Phillips curve, and would come at the expenses of the tractability of the model.

The third eigenvalue is purely real and equal to − .02, implying convergence to the limit cycle.

Even thoughωssis an endogenous variable in the model, its steady state value is determined implicitlyby an equation that is formally similar to Eq. 14. Thus, the threshold value\(\bar {\beta }\)is fully determined once the model is parameterized.

While the dynamics become unfeasible in mathematical terms, neither the employment rate nor the labor share can escape the unit box. Thus, full instability means that there will be a limit cycle corresponding to the edges of the unit box in the (e,ω) plane.

References

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Asada T (2006) Stabilization policy in a Keynes-Goodwin model with debt accumulation. Struct Chang Econ Dyn 17(4):466–85

Aschauer D A (1989) Is public expenditure productive?. J Monet Econ 23 (2):177–200

Aschauer D A (2000) Do states optimize? Public capital and economic growth. Ann Reg Sci 34(3):343–363

Atkinson T (1969) the time scale of economic models: how long is the long run? Rev Econ Stud 36(2):137–152

Barbosa-Filho N, Taylor L (2006) Distributive and demand cycles in the US economy – a structuralist Goodwin model. Metroeconomica 57(3):389–411

Barrales J, von Arnim R (2015) Demand-driven Goodwin cycles with Kaldorian and Kaleckian features. Rev Keynesian Econ 3(3):351–373

Barrales J, von Arnim R (2016) Longer run distributive cycles: wavelet decomposition for US, 1948-2014, University of Utah, mimeo

Barro R J (1990) Government spending in a simple model of endogenous growth. Q J Econ 98(5):S103–25

Blanchflower D, Oswald A (1995) The wage curve. MIT Press, Cambridge

Congressional Budget Office (2015). Public Spending on Transportation and Water Infrastructure, 1956 to 2014. Supplementary data retrieved at www.cbo.gov.publication/49910

Chiarella C, Flaschel P, Hartmann F, Proaño C (2012) Stock market booms, endogenous credit creation and the implications of broad and narrow banking for macroeconomic stability. J Econ Behav Org 83(3):410–423

Cohen W M, Nelson R R, Walsh J P (2002) Links and impacts: the influence of public research on industrial R&D. Manag Sci 48(1):1–23

Desai M, Henry B, Mosley A, Pemberton M (2006) A clarification of the Goodwin model of the growth cycle. J Econ Dyn Control 30(12):2661–2670

Devarajan S, Vinaya S, Zou H (1996) The composition of public expenditure and economic growth. J Monet Econ 37(2–3):313–344

Dosi G, Sodini M, Virgillito M (2015) Profit-driven and demand-driven investment growth and fluctuations in different accumulation regimes. J Evol Econ 25(4):707–728

Drandakis E M, Phelps E S (1965) A model of induced invention, growth and distribution. Econ J 76(304):823–40

Flaschel P (2009) The Goodwin distributive cycle after fifteen years of new observations. In: Topics in classical micro- and macroeconomics. Springer, Berlin, pp 465–480

Flaschel P, Greiner A, Logeay C, Proaño C (2012) Employment cycles, low income work and the dynamic impact of wage regulations. A macro perspective. J Evol Econ 22(2):235–250

Fiorio C, Mohun S, Veneziani R (2013) Social Democracy and Distributive Conflict in the UK, 1950-2010. Working Paper No. 705, School of Economics and Finance, Queen Mary University of London. ISSN 1473–0278

Foley D K (2003) Endogenous technical change with externalities in a classical growth model. J Econ Behav Organ 52(2):167–189

Foley D K, Michl TR (1999) Growth and distribution. Harvard University Press

Funk P (2002) Induced innovation revisited. Economica 69(273):155–171

Glombowski J, Kruger M (1984) Unemployment insurance and cyclical growth. In: Goodwin RM, Vercelli A, Kruger (eds) Nonlinear models of fluctuating growth, Berlin

Glomm G, Ravikumar B (1997) Productive government expenditures and long-run growth. J Econ Dyn Control 21(1):183–204

Goodwin R (1967) A growth cycle. In: Socialism, capitalism, and economic growth. Cambridge University Press, Cambridge

Goodwin R M (1990) Dynamical control of economic waves by fiscal policy in chaotic economic dynamics. Clarendon Press, Oxford and New York

Guellec D, Van Pottelsberghe de la Potterie B (2004) From R&D to productivity growth: do the institutional settings and the source of funds of R&D matter?. Oxford Bull Econ Stat 66(3):353–78

Harvie D (2000) Testing Goodwin: growth cycles in OECD countries. Camb J Econ 24(3):349–376

Holtz-Eakin D (1994) Public-sector capital and the productivity puzzle. Rev Econ Statist 76(1):12–21

Irmen A, Kuehnel J (2009) Productive government expenditure and economic growth. J Econ Surv 23(4):692–733

Isaksson A (2009) Public Capital, Infrastructure and Industrial Development, Research and Statistics Branch Working Paper No. 15/2009, UNIDO

Julius A J (2006) Steady state growth and distribution with an endogenous direction of technical change. Metroeconomica 56(1):101–125

Kennedy C (1964) Induced bias in innovation and the theory of distribution. Econ J 74(295):541–547

Konishi K (2016) Public research spending in an endogenous growth model, macroeconomic dynamics, available on CJO2016. https://doi.org/10.1017/S1365100515000759

Levy D M (1990) Estimating the impact of government R&D. Econ Lett 32 (2):169–173

Mazzucato M (2013) The entrepreneurial state. Anthem Press

Mohun S, Veneziani R (2006) Structural stability and Goodwin’s growth cycle. Struct Chang Econ Dyn 17(4):437–451

National Science Foundation, National Center for Science and Engineering Statistics. National Patterns of R&D Resources (annual series) Science and Engineering Indicators (2016)

Romer P (1990) Endogenous technical change. J Polit Econ 98(5):Part 2:S71–S102

Segerstrom P S (1998) Endogenous growth without scale effects. Amer Econ Rev 88(5):1290–1310

Shah A, Desai M (1981) Growth cycles with induced technical change. Econ J 91(364):1006–10

Spinesi L (2013) Academic and industrial R&D: are they always complementary? A theoretical approach. Oxf Econ Pap 65(1):147–172

Sordi S, Vercelli A (2014) Unemployment, income distribution and debt-financed investment in a growth cycle model. J Econ Dyn Control 48(C):325–348

Turnovsky S J (2015) Economic growth and inequality: the role of public investment. J Econ Dyn Control 61(C):204–221

Tavani D, Zamparelli L (2015) Endogenous technical change, employment and distribution in the Goodwin model of the growth cycle. Stud Nonlin Dyn Econometr 19(2):209–226

Tavani D, Zamparelli L (2016) Public capital, redistribution and growth in a two-class economy. Metroeconomica 67(2):458–476

U.S. Bureau of Labor Statistics, Nonfarm Business Sector: Labor Share [PRS85006173], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PRS85006173

van der Ploeg F (1987) Growth cycles, induced technical change, and perpetual conflict over the distribution of income. J Macroecon 9(1):1–12

Yoshida H, Asada T (2007) Dynamic analysis of policy lag in a Keynes–Goodwin model: stability, instability, cycles and chaos. J Econ Behav Org 62(3):441–469

Acknowledgements

We wish to thank participants to: the Analytical Political Economy Workshop 2016 at Queen Mary University London; the Crisis 2016 conference in Ancona and Lisa Gianmoena and Mauro Gallegati in particular; URPE at ASSA 2017 Session E1; Leila Davis for helpful comments on a previous draft; and two anonymous referees. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The authors declare that they have no conflict of interest.

Appendices

Appendix A: Proof of propositions 1 and 6

1.1 A.1 The model with public R&D only

Maximizing the labor share is equivalent to minimizing the natural logarithm of its complement (that is, the share of profits) 1 − ωss as written in the RHS of Eq. 11. We have that

and

Because the steady state profit share is a convex function of τ, the first order condition ∂ ln(1 − ωss)/∂τ = 0 is necessary and sufficient for a minimum. It has an interior solution in

1.2 A.2 Public R&D and induced technical change

In order to prove the same result in the general model, totally differentiate Eq. 14 with respect to ω and τ to find

hence,

The denominator is always positive. It follows that \(Sign\frac {d\omega }{d\tau }=Sign[\eta -\phi -\tau (1-\phi )]\), which proves that the labor share is maximized by \(\tau _{\omega }=\frac {\eta -\phi }{1-\phi }.\)

Appendix B: Composition of public expenditure

1.1 B.1 The model with public R&D only

Start with

and re-write the second inequality as

m(𝜃) is monotonically decreasing in 𝜃, with \(lim_{\theta \rightarrow 0^{+}}=\infty \), and m(1) = 0.h(τ) is hump-shaped, has a maximum in \(\tau _{\omega }=\frac {\eta -\phi }{1-\phi }\), with h(0) = h(1) = 0, and \(h(\tau _{\omega })=\frac {\eta -\phi }{1-\phi }^{\frac {\eta -\phi }{1-\phi }}\left (\frac {1-\eta }{1-\phi }\right )s/\lambda ^{\frac {1}{1-\eta }}\). We need \(m(\theta )\leq h(\tau )\leq \frac {\eta -\phi }{1-\phi }^{\frac {\eta -\phi }{1-\phi }}\left (\frac {1-\eta }{1-\phi }\right )s/\lambda ^{\frac {1}{1-\eta }},\) so that \(\theta \geq m^{-1}\left [\frac {\eta -\phi }{1-\phi }^{\frac {\eta -\phi }{1-\phi }}\left (\frac {1-\eta }{1-\phi }\right )s/\lambda ^{\frac {1}{1-\eta }}\right ]\equiv \bar {\theta }\). For any feasible \(\theta >\bar {\theta }\) there is a tax rate τmax(𝜃) such that m(𝜃) = h[τmax(𝜃)]. Since h(.) is decreasing in the relevant range, it follows that τ ≤ τmax. Moreover, τmax(𝜃) is an increasing function because, for \(\theta \geq \bar {\theta }\), both m(.) and h(.) are decreasing functions.

1.1.1 B.1.1 Proof of proposition 2

i) Since \(\tau _{max}(\bar {\theta })=\tau _{\omega },\) then \(\tau _{g}(\bar {\theta })=\tau _{max}(\bar {\theta })=\tau _{\omega }.\) Next, ii) since \(\tau _{max}(\theta )\in (\tau _{\omega },1),\forall \theta >\bar {\theta }\), it follows that τg(𝜃) = τmax(𝜃) > τω.

1.1.2 B.1.2 Proof of proposition 3

Start with \(\tilde {g}_{A,ss}(\theta )=\lambda \left [(1-\theta )\tau _{g}(\theta )\right ]^{\phi }.\) Let G(𝜃) ≡ (1 − 𝜃)τg(𝜃), so that \(\tilde {g}_{A,ss}(\theta )=\lambda [G(\theta )]^{\phi }\) and \(\tilde {g}_{A,ss}^{\prime }(\theta )=\lambda \phi G^{\prime }(\theta )/[G(\theta )]^{1-\phi }\). We have \(sign(\tilde {g}_{A,ss}^{\prime })=sign(G^{\prime }),\) which implies that \(\tilde {g}_{A,ss}\) and G have the same stationary points. Let us now analyze \(G^{\prime }(\theta )=(1-\theta )\tau _{g}^{\prime }(\theta )-\tau _{g}(\theta ).\) All we know about \(\tau _{g}^{\prime }(\theta )\) is \(\tau _{g}^{\prime }(\theta )>0\), while we know that τg(𝜃) is an increasing function from τω to arbitrarily close to 1. This implies \(lim_{\theta \rightarrow 1^{-}}G^{\prime }(\theta )=-1\) so that gA(𝜃) is decreasing in a left neighborhood of − 1. Starting from − 1, a reduction in 𝜃 increases the growth rate \(\tilde {g}_{A,ss}\) as long as G′(𝜃) < 0. There is no guarantee that G′(𝜃) will go through 0 as 𝜃 moves from 1 to \(\bar {\theta }\). If it does, there is a stationary point 𝜃∗ that solves \((1-\theta ^{*})=\tau _{g}(\theta ^{*})/\tau _{g}^{\prime }(\theta ^{*})\) and it is a maximum; if it does not, growth is maximized by the lowest admissible composition of public expenditure \(\bar {\theta }.\)

1.2 B.2 Public R&D and induced technical change

1.2.1 B.2.1 Proof of proposition 7

Taking logs in Eq. 5 evaluated at the steady state, we have \(\ln g_{A}=\ln \left [\lambda (1-\theta )^{\phi }\tau ^{\phi }\omega (\tau ,\theta )_{ss}^{\beta }\right ]=\ln \lambda +\phi \ln (1-\theta )+\phi \ln \tau +\beta \ln \omega (\tau ,\theta )_{ss}.\) Hence, \(\frac {d\ln g_{A}}{d\tau }=\cfrac {\phi }{\tau }+\cfrac {\beta }{\omega }\frac {d\omega }{d\tau }\). Setting \(\frac {d\ln g_{A}}{d\tau }= 0,\) while using Eq. 16 we have

or

which requires τg(1 − ϕ) > η − ϕ, or \(\tau _{g}>\frac {\eta -\phi }{1-\phi }.\)

1.2.2 B.2.2 Growth-maximizing composition of public expenditure

With respect to the growth-maximizing composition of public expenditure (𝜃∗), totally differentiate Eq. 14 with respect to ω and τ to find

Next, set \(\frac {d\ln g_{A}}{d\theta }=\cfrac {-\phi }{1-\theta }+\cfrac {\beta }{\omega }\frac {d\omega }{d\theta }= 0\), to find

Appendix: C: Uniqueness of the steady state in the model with induced technical change

Rewrite Eq. 14 as

where Γ(τ,𝜃) > 0. Raise both sides of the equation to the power 1/β and rearrange to find:

The left hand side is the difference between two continuous functions of ω, with ω ∈ [0, 1]. The first one increases linearly from 0 to 1; the second one is a power function decreasing from \(\left ({\Gamma }(\tau ,\theta )\right )^{\frac {1}{\beta }}\)to 0. Therefore, the left hand side is a continuous function that starts from \(-\left ({\Gamma }(\tau ,\theta )\right )^{\frac {1}{\beta }}\)and increases monotonically to 1: it crosses the horizontal axis once and only once. By Eqs. 12 and 13, both χss and ess are monotonic functions of the labor share: if the steady state value of the latter is unique, so are the former.

Appendix D: Stability analysis

1.1 D.1 Proof of proposition 8 - income tax with induced technical change

Linearization of the system formed by Eqs. 6, 7 and 8 around its steady state position, when β ∈ (0, 1), yields the following Jacobian matrix:

with

The Routh-Hurwitz necessary and sufficient conditions for stability of the steady state require that:

- 1.

TrJ < 0. We have that TrJ = J11 + J33 < 0 as required.

- 2.

DetJ < 0. We have that DetJ = J11 × (−J23J32) < 0 as required.

- 3.

PmJ > 0, where PmJ denotes the sum of the principal minors of J. In fact, PmJ = −J23J32 + J11J33 > 0 as required.

- 4.

Finally, we need to check that − PmJ + DetJ/TrJ < 0. Since TrJ < 0, the condition can be rewritten as DetJ > TrJ(PmJ). We have \(-J_{11}J_{23}J_{32}>\left (J_{11}+J_{33}\right )\left [-J_{23}J_{32}+J_{11}J_{33}\right ]=-J_{11}J_{23}J_{32}-J_{33}J_{23}J_{32}+J_{11}^{2}J_{33}+J_{11}J_{33}^{2}\), ⇔\(0>J_{33}\left (-J_{23}J_{32}+J_{11}^{2}+J_{11}J_{33}\right ),\) which is always true.

Notice that the stability conditions hold for any value of the main parameters of the model s ∈ (0, 1],τ ∈ (0, 1),𝜃 ∈ (0, 1],η ∈ [0, 1).

1.2 D.2 Proof of proposition 4 - income tax with public R&D only

Linearization of the system formed by Eqs. 6, 7 and 8 around its steady state position, evaluated at β = 0, yields the following Jacobian matrix:

with

The Routh-Hurwitz necessary and sufficient conditions for stability of the steady state require that:

- 1.

TrJ < 0. We have that TrJ = J11 < 0 as required.

- 2.

DetJ < 0. We have that DetJ = J11 × (−J23J32) < 0 as required.

- 3.

PmJ > 0, where PmJ denotes the sum of the principal minors of J. It is easy to check that, in fact, PmJ = −J23J32 > 0 as required.

- 4.

Finally, we need to check that − PmJ + DetJ/TrJ < 0. This condition is violated. In fact, DetJ/TrJ = Pm1J = PmJ, so we have − PmJ + PmJ = 0. As illustrated by Julius (2006), when the fourth condition goes from negative (see the previous appendix) through zero, the Hopf bifurcation theorem implies that the system has a family of closed orbits in a neighborhood of the steady state. This is happening as β goes from positive to zero.

Notice that, as long as β = 0, the above properties are not sensitive to alternative parametric specifications: the entries of the Jacobian matrix will not change signs as long as s ∈ (0, 1],τ ∈ (0, 1),𝜃 ∈ (0, 1],η ∈ [0, 1). Thus, the limit cycle is robust in the parameter space.

1.3 D.3 Proof of proposition 9 - profit tax

The Jacobian matrix evaluated at the steady state has the following structure:

with

With \(\beta \in [0,\frac {\phi \omega _{ss}}{1-\omega _{ss}})\), J33 > 0 and the steady state is unstable. With \(\beta =\frac {\phi \omega _{ss}}{1-\omega _{ss}},J_{33}= 0\), which is the limit cycle case. With \(\beta >\frac {\phi \omega _{ss}}{1-\omega _{ss}},J_{33}<0\), and the steady state is stable.

1.4 D.4 Wage tax with public R&D only

The Jacobian matrix evaluated at the steady state has the following structure:

with

The condition η < ωss is sufficient for J23 < 0, which ensures local stability. This condition is verified under our parameterization: as mentioned in Section 3.3, estimates for η are around 15%, way below the long-run value of the labor share.

Rights and permissions

About this article

Cite this article

Tavani, D., Zamparelli, L. Growth, income distribution, and the ‘entrepreneurial state’. J Evol Econ 30, 117–141 (2020). https://doi.org/10.1007/s00191-018-0555-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-018-0555-7