Abstract

This survey paper synthesizes theory and evidence on processes of firm-level aging. We discuss why anthropomorphic analogies are not helpful for understanding firm aging, because of differences in population pyramid shapes (with around 50 % of firms exiting after just 3 years), no upper bound on firm ages, and no deterministic change in performance with firm age. We discuss the liabilities of newness, adolescence, and senescence and obsolescence, and define what we mean by the direct and indirect causal effects of age. Our causal model also helps clarify previous confusion about why controlling for size in regressions of firm age on survival can reverse the results (Simpson’s paradox and the ‘bad control’ problem). While aging processes can occur at many levels (employee-level, firm-level, cohort-level, etc.), we focus on the firm-level. We summarize empirical work on firm age and conclude that the most interesting age effects occur within the first 5–7 years, which underscores the importance of datasets that do not under-represent young firms.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

This paper seeks to complement the other papers in this Special Issue by providing a broader discussion of firm age as a variable, drawing upon the recent theoretical and empirical literature to shed light on our current understanding of firm age, to clarify some previous confusion, and draw attention to potentially fruitful areas for further research.

We survey the literature on firm age in an attempt to improve our understanding of firms of different ages – to better understand how firm behaviour and performance relates to the demographics of the business population. Of course, age as a variable can hardly be experimentally manipulated – one cannot recommend a firm to stop aging, or to suddenly become 10 years older. Instead, studies of firm age are generally based on cross-sectional comparisons across age groups (although a valuable strand of research tracks the developments within individual firms over long time periods). Despite their limitations, empirical analyses on firm age may be of interest to firms that seek to plan ahead, or to counter the effects of aging, or the policy-maker to better understand the needs and challenges of firms of different ages, perhaps in order to design a more effective policy that may be targeted to a certain age group (e.g. young tech-based firms who suffer from liabilities of newness).

We also admit that the specific channels through which age has its effects (e.g. accumulation of routines, gradual increase in legitimacy) might be of more interest than a focus on age itself. The direct causal effects of age on performance may be relatively minor, with most of the interesting age-related effects operating through certain mediating variables (e.g. routinization, reputation, product’s fit to market tastes, position on a possible learning curve). Age may primarily proxy for changes in other causal variables, such as internal organizational processes, that vary more or less predictably over time (Thornhill and Amit 2003, p499). Nevertheless, given the difficulties in measuring these particular intermediaries establishment of routines, legitimacy, etc.), it is generally considered that age is a valid proxy for these underlying variables.

The next section compares firm aging with human aging, given our irresistible urge to think in terms of anthropomorphic analogies, and discusses some key differences between the two. Section 4 presents some theoretical propositions regarding firm performance and age: namely, the liabilities of newness, adolescence, senescence and obsolescence. Section 4 also presents a causal model of the direct and indirect causal effects of age on performance. Section 4 highlights that processes affecting firm-level aging take place on many levels, such as processes occurring at the level of employees and routines. Section 5 surveys the empirical literature and presents some key findings. Section 6 concludes.

2 Limits to anthropomorphic analogies

“A large literature uses the “human aging” analogy of birth to growth to decline to death when analyzing the path of development and management of companies” (Davila et al. 2014, p4).

Scholars often reveal the existence of anthropomorphic analogies in the backs of their minds when discussing firm age. Building on this anthropomorphic predisposition, we take the contrast between human aging and firm aging as a pedagogical device in order to highlight some salient features of firm aging. If the analogy of human aging is taken as the ‘null hypothesis’, we will show how firm aging shows some ‘significant’ departures from this baseline position.

Humans face conspicuous limits in the ages they can reach. The current world record for longevity among humans is 122 years for females and 115 years for males.Footnote 1 Limits to the ages that humans can reach are clearly set out by the role of telomeres in cell division. Telomeres are regions of repetitive nucleotide sequences at the ends of chromatids, which serve as protective buffers for the ends of the chromosomes against deterioration or fusion with neighbouring chromosomes. Telomeres are truncated during each cell division, and over time the telomere ends become shorter until they are depleted (Aubert and Lansdorp 2008). Firms, however, face no obvious upper limits on the ages (nor the sizes: Penrose 1959) they can attain. Table 1 shows that firms can remain in operation for well over a millennium. Even though the ‘half-life’ of firms may be only 3 or 4 years (i.e. 50 % of firms will exit after 3–4 years; more on this in Section 5.2), nevertheless other firms may survive for over a thousand years. This yields very different population pyramids for firm vs human populations. The median age at death for 2010 (England and Wales) was 82 for males and 85 for females (ONS 2012, p3), while the median age at death for firms is just 3–4 years.

Related to the existence of an upper limit on human longevity, is that humans may act strategically in later life out of awareness that they have a limited time left to live, according to a ‘shadow of death’ effect. For example, they may be less enthusiastic about investing in learning new skills if they plan to retire soon. As a consequence, employers might be reluctant to invest in training for older workers, if these latter might soon leave (Skirbekk 2004, p136). Older individuals may also have a higher sense of personal powerlessness than their younger counterparts (Ross and Mirowsky 2008, p2397).Footnote 2 Firms, however, face no upper limit on the ages they can reach. Although some scholars have observed a ‘shadow of death’ effect where firm growth is observed to slow down in the years before exit (e.g. Almus 2004), this would appear to be because these firms are underperforming and hence exit (i.e. reverse causality), rather than because of any particular insuperable age barrier.

Humans also undergo several recognizable stages in their aging that are generally pre-determined by genes, hormones, and biological factors. For example, after a few months babies may speak their first words; primary teeth begin to emerge after about 6 months and are replaced by permanent adult teeth after about 12 years; puberty occurs between ages 10–17; bone mass peaks in the thirties; the metabolic rate slows down; then menopause and perhaps alopecia (hair loss) affect older women and men, respectively. Firms, however, have so such stages in their aging. At the time of birth, firms lack routines and capabilities, employees lack the benefits of job experience, and the firm has no reputation of its own -- but beyond these initial difficulties, there do not appear to be any developmental stages through which firms must pass.Footnote 3 Aging firms may face difficulties relating to the repetitive nature of their routines, and their chances of being ‘locked in’ to a trajectory that strays from what might be an optimal fit for the industry landscape. These developmental processes associated with the aging of routines may have some predictive power for some firms in some contexts, but nevertheless firms can replace their routines, and introduce new routines, which impedes deterministic predictions or attempts to generalize.

One area in which there may be some apparent overlap between humans and firms relates to the observation that older adults take longer to heal and recover from accidents and illnesses. The firm-level counterpart might be that firms that have become increasingly routinized might take longer to recover after the loss of key employees, customers or suppliers. More generally, due to the shift from codified to tacit knowledge as firms continue with their routines, firms with older routines might have more problems in adapting to disruptions in these routines. I am not aware of any empirical evidence on this matter, but it would be worth investigating.

Theories of firm-level aging may also feed back into our understanding of human aging. Although cognitive decline is often associated with old age, nevertheless the literature has observed that some individuals who engage in complex tasks (Sturman 2003) and keep mentally active in the sense of making efforts to learn new skills (Whalley 2001), can maintain their high productivity. For example, older individuals who introduce new ‘routines’ through e.g. learning a new language may thus keep cognitive decline at bay. An alternative, and speculative, theory of aging would be that it is not the passing of time per se that makes us old, but rather the processes of routinization and repetition that neglect our capabilities of learning and thinking, and instead bring on the dulling of the senses through monotony, shifting our mental states towards the semi-automatic operation of routines. In this sense, the aging of firms and individuals could be staved off by the perpetual introduction of new routines.

In sum, however, we caution that biological analogies do not go very far in identifying stages of aging for firms. Firms can start with 1 employee and finish with 1 million (or else always stay with one employee). Firms can also fundamentally rejuvenate and transform themselves by entering new sectors, such as Nokia which transitioned from timber to rubber to telecommunications, or John Brooke and Sons that switched from textile manufacturing to becoming a business development park (O’Hara 2004). Firms may therefore evolve in ways that could not have been predicted from any initial ‘genetic base’.

3 Liabilities and age

In this section, we will present the liabilities of newness, adolescence, senescence and obsolescence. These liabilities have been put together in an integrative theoretical model in Le Mens et al. (2011).

3.1 Liability of newness

In what has become a highly cited book chapter, Stinchcombe (1965) observed that: “As a general rule, a higher proportion of new organizations fail than old” (p148), and expounded why this might be. New organizations involve new roles, that must be learned; these roles take time and effort to establish and define; young organizations lack routines; they lack social capital and are not well networked; and they lack stable ties to customers.

Indeed, many reasons why young firms might face disadvantages can be mentioned, for example by referring to investors who might have more information on older firms, or because older firms have more discipline (thanks to their established routines), a clearer strategic outlook, better business processes, more experiential market knowledge, and better incentive systems as well as other types of organizational infrastructure. Subsequent work has generally confirmed that young firms have lower survival rates, and has sought to investigate how young firms might have ‘liabilities of newness’ that affect other dimensions of performance, besides survival. Subsequent work has also provided new explanations for why young firms might face certain disadvantages.

3.2 Liability of adolescence

An extension to the phenomenon of liability of newness is the ‘liability of adolescence’, which explains that firms will not have the highest exit probability on their very first day of operation, but that they will enjoy a ‘honeymoon’ period during which they can use their initial resource endowments to stay in operation, even if they face a run of misfortune immediately after entering (Bruderl and Schussler 1990; Fichman and Levinthal 1991; Levinthal 1991). Even if a new organization has a disastrous first day, or first month, or first year, it will persevere, because of its initial stock of assets, favourable prior beliefs, trust, goodwill, psychological commitment and financial investments, etc. (Deeds and Rothaermel 2003). The liability of adolescence effect has been demonstrated for a number of samples of organizations, where the datasets have observations with a frequency of less than 1 year (e.g. Bruderl and Schussler 1990; Coad et al. 2013a), and also where observations occur at an annual frequency (Fichman and Levinthal 1991). The liability of adolescence effect can be seen as a way of ‘tweaking’ the standard liability of newness effect: it qualifies the liability of newness model, but does not invalidate it (Le Mens et al. 2011).

3.3 Liabilities of aging

Following on from the liability of newness, where young firms were observed to have lower survival rates than older firms, attention has also focused on ‘liabilities of aging’, according to which age might bring about problems and difficulties for firms that would reduce their overall performance (such as lower growth rates: Barron et al. 1994). Old firms have higher levels of reliability and accountability, which have a number of benefits (such as development of trust and smoothly-working relationships) but these can be sources of inertia. Older firms may be less agile and less responsive, and hence miss out on market opportunities.

The liabilities of age are often decomposed into a ‘liability of senescence’ and a ‘liability of obsolescence’ (Barron et al. 1994).

3.3.1 Liability of senescence

The ‘liability of senescence’ refers to the internal changes brought on by age – how accumulated rules, routines and structures lead to organizational ossification and structural rigidity, and thus have a negative influence on firm performance. Employees in stable established firms are more willing to invest in organization-specific skills, and as time goes by they develop vested interests, which make the organization more inert (Hannan and Freeman 1984). When discussing senescence, Ranger-Moore (1997, p904) presents the anthropomorphic analogy of “atherosclerotic” organizations.

The liability of senescence does not vary with the organizational context, but instead it will be the same for all firms of the same age, whatever environment they operate in, even if they differ in terms of size, degree of technological turbulence, geographic region and macroeconomic context, etc. Ranger-Moore (1997) writes that: “Senescent processes cause “internal decay” that increases failure rates independent of environmental conditions. This is a causal effect of aging.” On a practical level, therefore, the liability of senescence can be observed from analyses that pool together firms from different industries, because all that matters for senescence is an organization’s age rather than external factors.

3.3.2 Liability of obsolescence

The liability of obsolescence relates to the organization’s fit to the environmental context. Firms may be very efficient at what they do, but they will suffer from obsolescence if they cannot keep up with industry evolution (for example, due to new technologies) or drifts in consumer tastes. In this situation, new firms, that have established themselves to cater for the latest generation of consumers, will be better positioned to thrive. As firms age, they will therefore need to adapt to avoid offering a product that is too far removed from the ever-changing tastes of their target market. Maintaining one’s position in the market becomes all the more difficult if a firm’s adaptive capacity is assumed to decrease with age, such that old producers have a very low ability to adapt to environmental change (Le Mens et al. 2014). If the industry is stable, however, then there will be no liability of obsolescence, and any liability of age can be attributed to internal factors (i.e. the liability of senescence).

Given that the liability of obsolescence depends on the environmental context, empirical investigations of the liability of obsolescence have preferred to focus on particular industries that are tracked over long periods of time, preferably with time periods that include periods of stability as well as periods of industry turbulence (Barron et al. 1994; Ranger-Moore 1997; Sorensen and Stuart 2000).

3.4 Causal effects of age

In calculating the effects of firm age on performance, one question that has dogged empirical research concerns the choice of control variables:

“The age dependence of failure hazards for old organizations tends to be negative when the analysis does not control for age-varying organizational size. Once such controls are added, the estimated effect of age on the hazard of mortality tends to change from negative to positive.”

(Le Mens et al. 2014, p13)

Controlling for age might at first seem to be a good idea, in order to alleviate concerns about omitted variable bias. Barron et al. (1994) argued strongly in favour of controlling for size when investigating the effect of age on survival, and they have had considerable influence on subsequent work (e.g. Ranger-Moore 1997; Henderson 1999).

Perhaps surprisingly, Barron et al. (1994, p414) conclude that: “The evidence from this and other studies may now be strong enough for the liability of newness hypothesis to be finally laid to rest.” However, it seems puzzling to claim that the liability of newness hypothesis can be dismissed, when analysis of survival rates by age (e.g. Fig. 3: top left) clearly show that survival rates are low in the years immediately after entry, but then increase until they reach a plateau.

We find ourselves in an instance of Simpson’s Paradox, whereby the inclusion of control variables (e.g. size) can lead to a reversal of the estimated effect (that of age on survival). Although the common view is perhaps that ‘the more control variables the better’, e.g. to remove omitted variable bias (Angrist and Pischke 2009), nevertheless the decision of which variables to include requires thinking about the underlying causal model.

Figure 1 clarifies the relationship between age, size and performance (e.g. survival). Arrows represent causal effects. No variable can increase or decrease age, which implies that there are no arrows entering into age, and which also implies that any correlation between age and size should be interpreted as a causal effect of age on size. The causal effects of age on performance may be mediated by other variables (such as size). The direct causal effect of age on performance operates via the solid line only, while the total causal effect of age on performance is represented by the sum of the solid line and the long-dashed lines. Controlling for mediating variables such as size might be interesting if the researcher seeks to decompose the age effect into its constituent elements (e.g. Heyman 2007), but these mediating variables should not be included if the task is to calculate the overall ‘liability’ of age.

Directed Acyclic Graph (DAG) of the effect of age on performance, inspired by Pearl (2009). The relationship between age and performance may be mediated by variables that lie on the causal path between age and performance. The direct causal effect of age on performance is represented by the solid line. The long-dashed lines represent the mediated (indirect) causal effects of age on performance. The bi-directional arrow denotes possible feedback

If the researcher controls for either the advantages of age, or the drawbacks of age, then this would provide a misleading estimate of the total causal effect of age on performance. Since the advantages of age, and the drawbacks of age, lie on the causal path running from age to performance, these are ‘bad controls’ (Angrist and Pischke 2009, Section 3.2.3) that should not be included. Estimating the effects of age on performance, where the benefits accruing with age (i.e. size) are controlled away, but where all the drawbacks remain attributed to age, will – not surprisingly – lead to an unflattering and biased evaluation of the effects of age on performance.Footnote 4

An example might help to illustrate the idea. If one wished to investigate the role of drinking beer on inebriation, the usual positive effect would disappear if one could ceteris paribus control for blood alcohol levels. However, it makes no sense to hold blood alcohol levels constant, they will differ systematically between treatment and control groups because they lie on the causal path from drinking beer to inebriation. Relatedly, a statistician could probably show that Russian roulette is a safe way to make money, if you ceteris paribus control for ballistic trauma.

Scholars who are adamant that investigations of the effect of age on survival should control for firm size have put forward some strange results: implausibly large liability of aging effects, and no liability of newness. For example, Ranger-Moore (1997), which is described as some of “the best empirical evidence” by Le Mens et al. (2014, p551), observes that 1 year old companies have an age-related exit hazard that is 4 times smaller than a 10-year old company, and 15 times smaller than that of a 100-year old company. This is hard to reconcile with unconditional death rates that are highest for young firms, and decrease in the years after entry. I suggest that these strong estimates of liabilities of aging are due to the bias introduced by ‘bad controls’.

4 Aging processes on many levels

Firms are affected by aging processes on many different levels. These levels may be independent (e.g. a firm’s age may be unrelated to the ages of its products), but in many cases they are inter-related and they can also interact. For example, the age of a firm may be positively correlated with the age of its capital, and the tenure of its employees (Brown and Medoff 2003). In the case of a solo self-employed individual, the changes in firm age correspond exactly with changes in the entrepreneur’s age. Age effects may also be moderated by other variables such as firm size (for example, the effect of age on firm performance may differ between small firms and large firms). Furthermore, our understanding of firm age can be enriched by better understanding the phenomenon of aging that occurs at other levels of aggregation.

4.1 Individual-level

At the level of individuals, performance generally increases with age until a certain point – the ‘golden age’ – after which it deteriorates (Skirbekk 2004; Posthuma and Campion 2009; Frosch 2011). This inverted-U shaped effect of age on performance can be split into the two ‘arms’ of the U (Sturman 2003, p614). On the one hand, performance increases with age as learning enables an individual to accumulate valuable knowledge and experience, although the strength of these learning benefits will decrease over time. On the other hand, above a certain point performance will decrease with age, as the vitality of youth fades.

4.1.1 Benefits of aging

On the positive side, age is accompanied by learning and the accumulation of experience. The benefits of learning can be either conscious and effortful (referred to as ‘declarative’ learning) or they may accumulate without an individual being aware that learning is taking place (referred to as ‘non-declarative’ learning; Whalley 2001). An example of the former would be training programmes, whereas an example of the latter would be the passive familiarity with a firm’s routines (at the individual-level), or the passive improvement in a firm’s credit score if the bank’s algorithm is a function of a firm’s age (at the firm-level).

An increase in productivity with age may contribute to the observed positive association between age and earnings (e.g. Strober 1990). However, the increase in earnings over an individual’s career may also be partly unrelated to productivity and instead be due to psychological factors (i.e. adaptation to reference income and preferences for earnings that increase over the life course in order to optimise well-being, Clark et al. 2008, p105) whereby prime age workers are underpaid and older workers may be paid above their productivity levels (Lazear 1979; Skirbekk 2004). If older workers are paid above their productivity levels while younger workers are underpaid, this may lead to preferences for younger workers and age-related discrimination (Posthuma and Campion 2009).

The rate of knowledge accumulation decreases over time, as the individual becomes more familiar with the new role, as the amount of unknown material (arguably) decreases, and as routinization sets in and begins to dull the mind. Learning may also decrease if an individual’s aging brain undergoes cognitive slowing (Hedden and Gabrieli 2004).

Experience may build up at different rates in different contexts, and it is reasonable to expect that competence in complex tasks will take longer to achieve than for simpler tasks (Skirbekk 2004). Ilmakunnas et al. 1999, cited in Skirbekk 2004) find that job performance improves with job duration for only 3.8 years, in their analysis of Finnish manufacturing employees. Ericsson and Lehmann (1996), however, suggest that it takes about 10 years to achieve expert competence in games and situations that prioritize strategic and analytic competence (such as the game of chess).

4.1.2 Drawbacks of aging

When we reach the age of around 50, we begin to experience a decrease in cognitive abilities, as well as declines in psychomotor performance (Whalley 2001; Hedden and Gabrieli 2004). However, the drawbacks of aging may begin much earlier. Age-related declines in mental speed and intelligence, as well as losses in sensory ability (hearing loss in particular) begin in early adulthood, from around the age of 25 years (Whalley 2001). Even more drastic is the observation that “if we were to count the number of brain cells at various stages during our life span, then the brain would reach its apex somewhere around the third year of life and decline thereafter.” (Whalley 2001, p11).

In addition to physiological changes, there are socio-technical factors, relating to the skill obsolescence that affects older workers who have gained expertise on technologies that have since become outdated. Indeed, there might be ‘switching costs’ (Schwartz 1976) that discourage older workers from adopting new tools/practices/technologies that are instead readily adopted by younger workers, and these switching costs might explain some of the differences in productivity between younger and older workers.Footnote 5

Older workers may nevertheless remain productive even if they experience decreases in mental speed and intelligence. Psychologists distinguish between fluid intelligence and crystallized intellectual abilities (Salthouse 1996; Gordo and Skirbekk 2013). Fluid intelligence relates to the cognitive abilities to process new information, and this declines from early adulthood onwards. Crystallized intelligence instead relates to the stock of experiential knowledge. Although older workers may learn new knowledge at a slower rate, nevertheless they can access a larger stock of accumulated knowledge and experience. Older workers may therefore thrive in stable work environments that value their knowledge and experience (Kunze et al. 2013).

Another reason why older employees may remain productive is that they may learn how to deal with their slowing mental faculties and find alternative ways of achieving a certain level of functioning when deterioration occurs in a specific domain. Older workers may maintain high productivity despite decreasing mental abilities by selecting new goals, optimizing with alternative goal-relevant means, and compensating for domain-specific losses via alternative routes (Kunze et al. 2013). For example, a decline in one’s memory can be compensated for by an increasing reliance on a computer’s memory.

Overall, therefore, individuals may remain highly productive even into old age. It has been suggested that employee age is often less important than individual skill and health in predicting job performance (Posthuma and Campion 2009).

A number of stereotypes relating to older workers are identified and examined in Posthuma and Campion (2009). For example, older employees are often assumed to be more resistant to change, although the empirical evidence suggests otherwise (Kunze et al. 2013). Older employees are often assumed to have a shorter future tenure, and therefore provide a shorter horizon over which employers can reap the benefits of training investments, but this suggestion does not survive a closer empirical analysis (Posthuma and Campion 2009).

4.1.3 Where is the peak?

Having investigated the advantages and drawbacks of individual age on performance, it is natural to ask where the optimum lies. Table 2 provides an overview of estimates of the age associated with optimal performance. It is important to recognise, however, that the onset of decline depends on the nature of the work. Although some aspects of cognitive information processing (such as processing speed) tend to decline all along the adult life-span, other tasks (that are well-practiced or involve knowledge) show “little or no decline in performance until very late in life” (Hedden and Gabrieli 2004, p88). Individuals may take longer to reach peak performance with complex tasks, and they may remain at high productivity levels for a long time. It may even be the case that, for some tasks, performance only improves with age, and that an age-related decline in performance does not occur. “When jobs are of high complexity, the relationship is non-linear but not an inverted U-shape” (Sturman 2003, p626), because experience is highly valued for complex tasks.

When considering the ages of individuals working in a firm, there is interest in the optimal average age for employees, as well as the optimal variation in ages of the employees (because there may be some valuable complementarity between older and younger workers). Indeed, diversity in team age can be beneficial. Beyond the inverted-U shaped relationship between employee age and performance, Grund and Westergaard-Nielsen (2008) find an inverted-U shaped effect for the standard deviation of employee ages on firm-level performance (i.e. Value Added per worker), such that the highest performance is associated with an intermediate level of variation in employee ages. Overall, their results indicate that: “Firms with a mean age of 37 years and a standard deviation of age of 9.5 years have the highest value added per employee.” (Grund and Westergaard-Nielsen 2008, p417).

4.2 Firm-level

When a firm first begins its operations, it starts without a reputation and struggles to achieve legitimacy. Customers may be unfamiliar with the firm’s products or services, potential employees may be wary of their career prospects, and investors may be wary of the firm’s ability to survive and pay back any investments. Young firms may lack a network on whom they can call for support in difficult times. Young firms with little reputation may have incentives to renege on previous agreements (Baker et al. 1994), until they become better established.

New firms that struggle to set up production routines may engage in more ‘bricolage’ (Baker and Nelson 2005), as they improvise with the resources at hand in order to produce their outputs. There may be theoretical reasons, based on their lack of reputation and lack of stable routines, for suspecting that younger firms may neglect certain ethical standards such as pollution standards and corporate social responsibility, although this remains to be explored. Nevertheless, firms with ambitions to grow and to scale up their routines, must pay special attention to establishing principled production methods, because otherwise their lack of compliance with industry standards could constrain their growth (Baker and Nelson 2005). New firms that ‘cut corners’ with inferior routines run the risk of getting into bad habits, leading to bad routines that are difficult to unlearn and unsuitable for replication, thus jeopardising their growth prospects.

The nature of a firm’s capital may also change with age (as well as the cost of capital), although the evidence on this is scant. New firms have the opportunity to invest in recent vintages (Salter 1960) and set up new machines and modern production processes, if they can assemble the financial resources to do so. Older firms, with better access to finance, may be more capital intensive than their younger counterparts.

Theoretical work has suggested that the level of slack may increase with firm age (Sharfman et al. 1988 p605; George 2005). This could be because routinization prevents firms from recognizing opportunities to improve their production efficiency, because long-tenured employees have a lower adaptive capacity (Le Mens et al. 2014), or perhaps because employees learn about safe ways to shirk undetected. Relatedly, from an accounting perspective, Dixon (1953) describes how costs have a tendency to rise as time goes by, leading to inefficiencies in aging firms. Empirical investigations on these issues would be welcome.

4.2.1 Routines and aging

A key consideration for firm-level aging occurs at the level of routines. Organizational routines refer to standard operating procedures and recurrent interaction patterns that are applied by an organization to achieve its goals (Becker 2004). Firms and their routines are intimately linked. There are difficulties in defining and delimiting routines, and progress in empirical work has been slow (Becker et al. 2005). Although firms start out without routines, firms will inevitably develop routines, and although they can introduce new routines and modify existing routines as time goes by, nevertheless it is uncertain whether they can ever rid themselves of their old routines or meta-routines.

New firms, who initially have no routines, must deliberate before reaching any decision. “New firms are hampered by their need to make search processes a prelude to every new problem they encounter. As learning occurs, benefits can be obtained from the introduction of a repertoire of problem-solving procedures. […] eliminating open search from the problem-solving response greatly reduces the labour and time required to address recurrent problems.” (Garnsey 1998, p541). In contrast, old experienced firms will rarely be surprised, and will have rules and routines are in place for nearly every eventuality. Routines allow employees to increase their productivity, because employees learn how to perform routines semi-automatically, with decreased costs of attention. As routines are put in place, “early challenges are replaced with repetitive grind.” (Garnsey 1998, p542). Routines allow firms to reach higher productivity, faster throughput, more efficient use of raw materials, and fewer defects, as well as freeing up cognitive attention to focus on other areas. Routines may also lead to inertia, however, as individuals approach new situations with accumulated habits rather than with fresh eyes. Routines may mean that potentially valuable opportunities are neglected. Routines may also lead to inappropriate generalizations (based on previous experiences) about the best courses of action in new situations, as well as the inappropriate ‘misfiring’ of chains of actions based on certain recognised triggers (Cohen and Bacdayan 1994). Old firms may become so ingrained in their routines that they may have difficulties in perceiving the shortcoming of their behavioural patterns, or in observing that the business environment is no longer well suited to these routines. As Cohen (1991, p138) writes: “there are practices in organizations that are performed regularly long after the actors have ceased to be able to give a convincing account of their purposes.” Routinization may also become problematic if the routines are imperfectly replicated over time, such that they ‘mutate’, unnoticed, and thus develop features that are either unhelpful or possibly counterproductive.

The liabilities of age, discussed earlier in Section 3, may come into effect at the level of routines. On the one hand, the liability of senescence arises as the firm becomes ossified through the accumulation of rules, routines and organizational structures (Barron et al. 1994). On the other hand, the liability of obsolescence becomes a problem when a firm’s business environment has changed and drifted away from the original landscape for which the routines were initially designed. Routinization, and the inertia it engenders, may reduce a firm’s adaptive capacity and lead to problems of poor fit to the target market.

Finally, one can conjecture that the more complicated the routine, the longer it takes to establish. Capabilities must be in place before dynamic capabilities can be developed. Routines for innovation may take longer to set up, hence the liability of newness for innovative firms may last longer, and age effects may be observed over a longer time period. To the extent that there is a hierarchy of routines and capabilities, from lower-level capabilities (corresponding to individual tasks) to higher-level capabilities (such as those coordinating many tasks, or dynamic capabilities relating to innovation or diversification; Helfat and Peteraf 2003), then it is reasonable to expect that higher-order routines and dynamic capabilities will take longer to establish, and hence the initial liability of newness will last for longer and peak performance will only be reached relatively late.

4.3 Cohort-level

At the cohort-level, the characteristics and performance of firms may change over time because of selection effects, even if the individual firms themselves do not change (e.g. Jovanovic 1982). For example, if low-productivity firms exit while high-productivity firms remain in operation, then the average productivity of the cohort increases with time even if none of the individual firms increase in productivity over time:

where πi is the productivity of firm i, and \( \overline{\pi} \) is the average productivity for the surviving N firms.

In reality, however, individual firms will change over time (Pakes and Ericson 1998), and cohort-level selection effects will distort the representation of firm-level aging when viewed at the population level.

4.4 Industry-level

The effects of firm age on behaviour and performance can be moderated by the stage of industry development. As industries develop, the competitive emphasis may change from functional product performance and a period of instability which culminates in the emergence of a dominant design, to product variation, before then focusing on process innovation, scale economies, and cost reduction (Abernathy and Utterback 1978).

Klepper (1996) identifies several further regularities in the evolution of industries. The number of firms grows initially until a ‘shakeout’ period, after which it declines and the number of entrants becomes small, despite continued industry growth. As the industry matures, the leadership of the industry stabilizes, and the emphasis moves from product innovation to process innovation.

The degree of maturity of the industry will therefore have implications for firm age and performance. Young firms may thrive in the early stages of industry development, but may have difficulty competing with large oligopolistic incumbents in mature industries. Relatedly, the nature of the industry’s technological regime may also play a role (Winter 1984), where the distinction is between Schumpeter Mark I industries (which favour entrepreneurial entrants and product innovation) and Schumpeter Mark II industries (which favour incremental innovation undertaken by large incumbents, where technological progress is more cumulative). The age of the industry, as well as the nature or type of the industry, will therefore influence the ages of the firms observed in that industry. For example, one would expect to find many old firms in the food industry, but few old firms in biotech or ICT manufacturing.

Although most firms in an industry will be younger than the industry itself, nevertheless it is possible for firms to be as old as the industry (e.g. if they were the founding companies), or even for firms to be older than the industry in which they operate. An example of the latter would be Nokia, which was founded in 1865 as a wood pulp mill, long before the emergence of the modern ICT sector into which it subsequently diversified and in which it now primarily operates (Ali-Yrkkö et al. 2000).

4.5 Other levels

Still other levels of analysis are relevant to our understanding of firm-level aging. Product age may play a role, because new firms may be rejuvenated by the introduction of new products or entry into new sectors (Cucculelli 2014). CEO tenure age (Hambrick and Fukutomi 1991; Cucculelli 2014), or perhaps the founding entrepreneur tenure age, may also have a role on firm evolution and may be associated with phenomena of obsolescence/senescence or rejuvenation of the firm. Furthermore, Deeds and Rothaermel (2003) consider age effects for firms’ strategic alliances.

5 Empirical evidence

We begin by reviewing how age is measured (Section 5.1), before looking at the distribution of firm ages (Section 5.2), and then considering how age relates to firm size (Section 5.3) and firm performance (Section 5.4). Section 5.5 draws the empirical evidence together in the context of an integrative model.

5.1 Measuring age

The most obvious way of measuring age is by referring to the date of registration in the country’s mercantile register (e.g. Haltiwanger et al. 2013; Coad et al. 2013b). However, this data is not always available, perhaps because fiscal authorities and national statistical offices are less interested in age than in other variables such as profits or number of employees. In fact, Headd and Kirchhoff (2009, p548) recently commented on “the dearth of information by business age. Simply stated, industrial organization and small business researchers are deprived of firm-age data.” Since then, the situation has been improving however, and “[t]he recent addition of firm age to official statistics” (Decker et al. 2014, p.3) has resulted in a vibrant emerging empirical literature on the effects of firm age and performance.

Where data on age was lacking, scholars sometimes took alternative approaches to calculating age. Some authors imputed age from the time of first appearance in the dataset (e.g. Bellone et al. 2008; Lecuona and Reitzig 2014; Hsieh and Klenow 2014). This might be problematic, however, if inclusion in the dataset depends on being above a certain minimum size threshold, below which small young firms are considered to be unimportant. Another approach was to focus on ‘public age’, measured as the number of years since the firm has been listed on a stock market (e.g. Demirel and Mazzucato 2012). Industry studies have measured age as the number of years since entry into the focal industry (e.g. Sorensen and Stuart 2000; Agarwal et al. 2004). Still another approach was to measure the age of a business by referring to the time when it first opened its trading account with the bank (Coad et al. 2013a). Empirical analyses that define age in different ways will produce results that may appear to be conflicting, but that are not really comparable, and hence should be compared with caution.Footnote 6 The gold standard for measuring firm age is when age is measured in terms of initial business registration or when the firm started to trade (which ideally should coincide). Results obtained from other definitions (such as years since entry into the dataset, or years since IPO, or years since crossing a size threshold) should be taken with a pinch of salt.

5.2 Age distribution

The age distribution of a cross-section of a population of firms can be a helpful representation of industrial structure. Figure 2 presents the age distribution for several European countries for 2001. A first observation is that most firms are young, but that some firms can become very old. Considering that the y-axis is logarithmic, the distribution approximates a straight line of negative slope, which resembles an exponential distribution (Coad 2010; Barba Navaretti et al. 2014; Ishikawa et al. 2015; see also Daepp et al. 2015). Indeed, given a few reasonable assumptions (same number of entrants each year, constant exit hazard each year), we would expect the age distribution to be exponential (Coad 2010). However, a closer inspection reveals that the exit hazard appears to be higher in the years immediately following entry, and stabilizes a few years later. This suggests that the Weibull distribution would be a better fit than the exponential (Axtell 2016).

Age distribution in 2001 for three European countries. Source: Barba Navaretti et al. (2014)

The age distribution can shed light on a dataset’s possible under-representation of young firms. The Weibull or exponential distribution would predict that the mode of the distribution should correspond to the youngest age category (i.e. age 0, or perhaps age 1). The fact that the mode observed in empirical age distributions may be as large as around 10 years (Coad 2010) would indicate that young firms are under-represented in datasets, presumably because of the difficulty of tracking and observing new firms. This is problematic, given that many of the interesting age-related effects occur in the years immediately after entry (a point to be discussed later).

Impirical work into mortality rates of firms suggest that the ‘half-life of a firm’ (i.e. the median age at death, or the time after which 50 % of entrants will exit) is about 3 or 4 years (see Table 3 for a survey).Footnote 7 Hence datasets that under-represent firms under the age of 10 will suffer from the distortions of sample selection bias – for example, over-sampling large, profitable, innovative young firms while remaining uninformed about smaller, less successful young firms (Nightingale and Coad 2014). Considering that 50 % of entrants will exit in the first 3–4 years, there is something fishy about empirical work that claims to focus on young firms, but which analyzes samples with average ages of 15 years or above (see e.g. the literature on ‘new’ ventures surveyed in Bamford et al. 2004, p900).

5.3 How age correlates with size

According to the classic view on firm evolution, firm size increases with age, and these two are considered to be so closely related that they are taken as synonymous. For example, in the influential model of firm growth in Greiner (1998), firm size and age are linearly related (see e.g. the figure axes on page 58), and the stages of growth faced by growing firms (e.g. crises related to the introduction of new management layers and routines for monitoring and delegation as the number of employees grows) are assumed to also correspond to stages of aging.Footnote 8 However, this need not be the case if firms stay at the same size, or decrease, as they get older. In other cases, empirical work has taken firm size as a proxy for firm age (Winker 1999), or has combined size and age to create a single composite ‘size-age’ indicator that is used as an explanatory variable (Shimizu and Hitt 2005). However, firm size only corresponds closely to firm age in the cases of firms that experience steady growth, which corresponds to a minority of cases (Coad et al. 2013a). Indeed, many old firms are small (Coad and Tamvada 2012), many young firms are large (Veugelers and Cincera 2010; Haltiwanger et al. 2013), and many firms decrease in size in the years after entry (Hsieh and Klenow 2014). However, in a probabilistic sense, the average size of a cohort increases in the years after entry, and the entire distribution shifts gradually towards the left (Cabral and Mata 2003; Angelini and Generale 2008; Cirillo 2010).Footnote 9 This may not be observed in all countries, though: Hsieh and Klenow (2014, p20) observe that incumbent plants actually shrink with age in their analysis of Indian manufacturing plants.

5.4 Firm performance evolving with age

5.4.1 Survival rates improve with age

An exponential age distribution will arise in a cross-section of firms if entry rates remain constant over time, and exit rates are the same in each year as the cohort ages (Coad 2010). However, the empirical evidence suggests that exit rates actually decrease over time, or at least in the years immediately after entry. Some early evidence showed that older manufacturing plants had lower exit hazards (Dunne et al. 1989). Axtell (2016) analysed the population of US firms, and showed that although exit hazards decrease with age, nevertheless most of the improvement in survival rates occurs quickly after entry, with survival rates remaining relatively flat after about 7 years (See Fig. 3, top left). Similarly, Mueller and Stegmaier (2015) show that the bankruptcy rate is highest in the years immediately after entry, and tend to stabilize shortly afterwards. We interpret these higher death rates for new firms as strong evidence for a liability of newness.

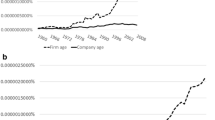

Top left: Axtell (2016) shows how survival rates increase in the years after entry, for the population of US firms. Top right: Evolution of growth rates of sales, labour productivity, and profits, for a sample of Spanish firms (Coad et al. 2010, Figure 7). Bottom left: Sensitivity of firm sales growth to lagged growth of profits (i.e. an indicator of whether profits are reinvested into the firm), taken from Coad et al. (2010, Figure 11) for a sample of Spanish firms. Bottom right: Evolution of the autocorrelation coefficient on sales growth with age (from Coad et al. 2014), for the population of Swedish limited liability firms

5.4.2 Growth slows with age

The empirical literature on post-entry growth (or ‘scale-up’) has found that firm growth rates are negatively related to age – or in other words, that younger firms have faster growth on average (Fizaine 1968; Evans 1987; Dunne et al. 1989; Nichter and Goldmark 2009) and that younger firms are an important source of job creation (Adelino et al. 2015). Quantile regressions (Reichstein et al. 2010) as well as an analysis of the growth rate distributions (Coad et al. 2013b; Barba Navaretti et al. 2014) suggest that this effect is mainly driven by the upper quantiles – that young firms are more likely to enjoy fast growth, although young firms and old firms are equally likely to experience fast decline.

Haltiwanger et al. (2013) show that, when age is included in a regression model, size is no longer a significant predictor of firm growth rates – “once we control for firm age there is no systematic relationship between firm size and growth.” (p347).Footnote 10 Moreover, Lawless (2014) and Anyadike-Danes and Hart (2014) show that the impact of age on growth is largely driven by young firms of up to 5 years who grow much faster than the others. Figure 3 (top right) shows how growth rates decrease considerably after a firm’s first 5 years.

Growth rate variance also decreases with age (Dahl and Klepper 2015; Coad et al. 2014). In terms of financial management, young firms are less likely to insure themselves against property damage and business interruptions due to infrequent shocks such as Hurricane Sandy, with the relationship increasing across all age quartiles (Collier et al. 2016).

Figure 3 also shows how other features of firm growth vary with firm age. Figure 3 (bottom left) shows that the relationship between financial performance and growth is positive for the first few years, after which it stabilizes around small negative levels, which is consistent with the explanation that young firms reinvest their available funds into growth for the first few years only. Figure 3 (bottom right) shows how the autocorrelation coefficient is positive for the first few years, but afterwards stabilizes at negative values – indicating that young firms ‘burst into life’ with a growth spurt that displays positive autocorrelation, after which firm growth seems less persistent and more erratic.

5.4.3 The nature of employment and firm age

New firms differ from their experienced counterparts in that all their employees have no job tenure experience. The years immediately after entry therefore correspond to a burst of activity as employees gain firm-specific experience as well as more general, industry-related experience. Older firms are more likely to have longer-tenure workers, with more experience (Brown and Medoff 2003), although of course there will be non-linearities here because these effects are of limited relevance for very old firms (that are, for example, older than 100 years).

Employment conditions in new firms can be chaotic, as these firms struggle to set up routines and establish themselves in the market place. New firms “tend not to have pension or health insurance plans when they start in business and gradually adopt them afterward” (Brown and Medoff 2003, p680). New firms may also be more likely to engage in informal ‘bricolage’ (Baker and Nelson 2005) as they make do with ‘whatever is at hand’ in order to assemble the resources needed to reach their intended goals (Sarasvathy 2001). These firms may improvise with non-standard and discarded inputs until they become established, after which they may standardize their routines as they prepare to scale up and grow.

Brown and Medoff (2003) investigate whether older firms pay higher wages, following on from their earlier work that found that larger firms consistently pay higher wages than smaller firms. Preliminary results indicate that older firms pay higher wages, although this effect disappears when they control for worker characteristics. In sum, the overall positive relationship between firm age and wages can be explained by factors such as firm size, profitability, capital intensity, and employee seniority (see also Heyman 2007). Ouimet and Zarutskie (2014) investigate the employees hired by young firms, and observe that young firms disproportionately employ younger workers. Interestingly, young firms have different pay structures than older firms, in that young employees in young firms earn higher wages than their young counterparts in older firms. Meanwhile, older employees in younger firms earn less than their older counterparts in older firms. One explanation could be that young firms place a higher value on the skills (such as innovation skills) possessed by younger workers.Footnote 11 On this point, Aubert et al. (2006) observe that new technologies enhance employment opportunities for younger workers much more than for older workers.

5.4.4 Value capture improves with firm age

Older firms are well-established in their networks and might be better attuned to selecting the most profitable business opportunities and capturing value from their customers. Foster et al. (2008) present evidence that young producers tend to charge lower prices than incumbents. Sakai et al. (2010) show borrowing costs decrease with age. Coad et al. (2013b) show that young firms engage in more employment growth, and are better able to convert employment growth into subsequent growth of sales, productivity and profits. This could be because younger firms are more flexible and better able to reconfigure their existing human resources as they internalize new workers. Older firms, however, are better able to convert sales growth into growth of profits.

5.4.5 Age of employees and firm-level outcomes

The relationship between an individual’s age and their performance was discussed in Section 3.1, whereas in this subsection we discuss links between the age of employees and firm-level performance. This latter research question has become popular, given the interest in the shifting shapes of human population pyramids, and the aging workforces found in developed countries (Chand and Tung 2014).

The average age of the workforce has generally been found to be negatively associated with firm-level performance. Rouvinen (2002) observes that increases in the average age of a firm’s workforce decreases the probability of introducing a process innovation. Similarly, Meyer (2011) finds that the probability of adoption of new technologies is negatively related to the average age of the workforce, in her sample of 356 German SMEs. Although older workers may have difficulty in adapting to new technology, and are negatively affected by unexpected variations in the rate of technological change (Bartel and Sicherman 1993), nevertheless appropriate training can offer protection to older workers and improve their employability (Behaghel et al. 2014). Schimke (2014) observes that employment growth is negatively affected by increases in the average age of the workforce, in her sample of 2100 German firms. Coad and Timmermans (2014) focus on the first 5 years of 3777 Danish start-up teams – entrepreneurial pairs. They observe that entrepreneurial teams of young individuals have faster growth, while teams of older individuals have higher survival chances.

While younger employees may be more familiar with new technologies such as computers and the internet, older employees with more tenure may have rich tacit knowledge about the firm’s structures and strategies (Schimke 2014). Decision-making approaches and reliance on heuristics also vary significantly with age (Besedeš et al. 2012). Hence employees of different ages may play complementary roles, such that an ideal workforce combines younger and older employees. Grund and Westergaard-Nielsen (2008) find an inverted-U shaped effect for the standard deviation of employee ages on firm-level performance (i.e. Value Added per worker), such that the highest performance is associated with an intermediate level of variation in employee ages.

5.4.6 Technology adoption and firm age

Older firms can be expected to have older capital and machinery, which may affect its expected performance outcomes. Dunne (1994) investigates this issue at the plant-level, and although he finds that larger plants are more likely than smaller plants to employ newer technologies, nevertheless plant age has no clear relationship with advanced manufacturing technology. “The basic finding is that plant age and technology use are relatively uncorrelated.” (Dunne 1994, p488). BarNir et al. (2003) investigate how firm age affects adoption of using the internet to conduct business (i.e. digitizing business processes) in a sample of 150 firms operating in the magazine publishing industry. They observe that older, established firms are more likely to digitize activities relating to marketing, administration, and communication, while newer firms are more likely to integrate digitization with their innovation efforts.

5.4.7 Innovation and firm age

The standard view, perhaps, is that young firms are more innovative than old firms. An early contribution by Hansen (1992) observed that age tended to be inversely related to innovative output in his questionnaire data on manufacturing firms, when innovative output was measured in terms of the number of new products introduced, and the proportion of firm sales obtained from recently-introduced products.

Other studies have explored how the nature of innovation changes with age. Sorensen and Stuart (2000) show that age has a positive effect on the patent rate, as firms develop routines for innovative behaviour and become more efficient over time in executing these routines. However, older firms tend to build on their previous innovative activity. Obsolescence effects will lead to an increasing divergence between organizational competence and the current environmental demands, which decreases the value of the patents of old firms. Balasubramanian and Lee (2008) find that the technical quality of innovation (measured in terms of citations a patent receives) decreases with age. Kotha et al. (2011) focus on the effects of age and entry into new technological niches. Older firms have a higher quantity of output (more patents), while younger firms’ innovative output has a higher impact (in terms of patent citations). The lower impact of the innovation performance of older firms could occur as “the cognitive maps of scientists and managers become increasingly rigid” (Kotha et al. 2011, p1013), observing that “[o]lder firms are also likely to be constrained by ossified routines and structures that hinder exploration” (p1013), and that it is the “rigid mental models, dominant coalitions, and restricted communication channels that decrease the likelihood of high impact innovation in older firms” (p1014).

Young innovative firms enter life with neither routines nor capabilities, and face the challenges of setting up their basic production processes as well as higher-level capabilities relating to innovation. New firms may therefore be more inclined to innovate through investments in embodied technical change rather than intramural R&D (Pellegrino et al. 2012). New firms, however, are more flexible than established firms, in the sense that they need not fear cannibalization of their existing product lines. New firms can therefore be expected to engage in more radical innovation relating to the introduction of new products, whereas established firms would rather undertake more incremental innovation along existing technological trajectories. Coad et al. (2016b) show that R&D expenditure by young firms is a risky ‘double-edged sword’ in the sense that it either produces accelerated growth – or accelerated decline. Young firm R&D is also more likely than old firm R&D to result in employment growth.

Henderson (1999) investigates how the payoffs to technology strategy vary with age. A distinction is made between a proprietary strategy (with internally developed firm-specific technologies) and a standards-based strategy (where technologies confirm to open and publicly available specifications). Proprietary strategy firms are observed to have lower survival rates in their early years (as they struggle to carve out their own niche) but faster growth in the later years (once they have become established, and have few competitors).

Finally, problems related to young firms’ lack of track record, collateral and reputation can be expected to be more severe in innovative sectors. Young firms report that they are more vulnerable to cost-related barriers to innovation relating to the availability of internal and external finance (Pellegrino, 2016).Hence, the value of an inter-firm network, and endorsements from prestigious partners, are particularly valuable for new innovative firms (Zheng et al. 2010).

5.4.8 Internationalization and firm age

In the light of recent excitement about the phenomenon of ‘born global’ firms, researchers have investigated how the age of firms at the time of internationalization affects performance. Autio et al. (2000) find that firms that internationalize at an earlier age enjoy faster growth. However, it is also theoretically interesting to investigate whether age at internationalization decreases survival rates (Sapienza et al. 2006). Carr et al. (2010) observe the age of a firm at the time of internationalization has an effect on growth (i.e. younger internationalizing firms grow faster), although there was no conclusive evidence concerning whether young internationalizing firms had lower survival rates than their older counterparts.

I suggest that, besides interest in internationalization and firm age, it would be worth investigating how age might affect other modes of growth, such as diversification (i.e. the introduction of new products), or growth through mergers or acquisitions (M&A). Davidsson and Delmar (1998) present some preliminary evidence of a strong positive relationship between age and the share of growth via M&A.

5.5 Synthesis

Pulling the evidence together, the following picture of the aging process seems to emerge. The birth of a new firm stands out as a unique period in its life course, because, although firms may dispose of certain initial endowments (such as the business idea, a motivated team, human capital, as well as perhaps network capital and industry experience of the individuals), several variables or resource stocks start out at zero: routines are non-existent and must quickly be designed and implemented; capabilities must be developed; tacit knowledge is absent but must be gathered as codified knowledge is ‘digested’ through enacting routines; employees who have no experience in working together gradually acquire firm-specific knowledge and job experience, and firm-level reputation must be built up as the firm struggles to become established. This sudden burst of activity in the years immediately after birth corresponds to the struggle against an initial liability of newness (Stinchcombe 1965), which lasts for about 5–7 years, and after this period a plateau is reached and things seem to flatten out. Huynh and Petrunia (2010) observe that young firms have faster sales growth, but that “age effects level off at age seven” (p1004).

Complex routines may take longer than simpler routines to get set up. A basic set of routines and capabilities must be in place, before dynamic capabilities can be developed (Teece et al. 1997; Winter 2003). Routines relating to innovation activities may also be highly complex and may take a long time to reach levels of maturity.Footnote 12

After the initial liability of newness, however, growth rates slow down while stocks steadily accumulate. As time goes by, there will be an increase in average size, profits, productivity, and perhaps also profitability as firms grow older (Coad et al. 2013b). In the years after entry, the selection environment becomes clearer, and it becomes easier to predict which firms will survive (Coad et al. 2016a). The capital structure may change, as firms rely less on short-term debt, and long-term debt, and increase their equity ratio (Pfaffermayr et al. 2013; Coad et al. 2013b). These gradual effects of accumulation of stocks are nevertheless gentle compared to the initial struggle against the liability of newness. Most of the interesting age effects seem to occur within the first 5–7 years, after which firm performance tends to stabilize, at least in relative terms. This is consistent with Eurostat-OECD (2007) who define young high-growth firms (i.e. gazelles) as those up to 5 years, Van Praag and Versloot (2007) who define entrepreneurial firms as those under 7 years, and with Larraneta et al. (2014) who define new ventures as those aged 8 years or less. Datasets with poor coverage of the first 7 years will therefore miss most of the interesting age effects.

Another factor affecting how firms perform at certain ages relates to the change of CEO or founding entrepreneur. This situation corresponds to the interaction between human aging and firm aging processes. Founding entrepreneurs may start their new firm with the intention of staying at the reins for a long time, but inevitably they will have to leave at some point if the firm survives long enough. One may therefore expect a discontinuity or interruption to a firm’s performance around the time of the CEO transition, which can be expected to be all the more disruptive in the case of a small firm or a founder/family-managed firm than a large corporation that has a separation of management and control.Footnote 13 Succession events can be an opportunity for rejuvenation of the firm, while also threatening its ability to survive. Although it is difficult to generalize across heterogeneous firms regarding the timing of succession, nevertheless this phenomenon may occur at around 10–30 years of age. It could be that CEO succession is the reason behind the ‘blips’ in innovation performance observed in Huergo and Jaumandreu (2004, their Figure 3) at around 25–30 years, which have interestingly been replicated by Cucculelli (2014). Relatedly, the obsolescence of initial endowments (Agarwal and Gort 2002) might result in slight increases in hazard rates after about 15–20 years.

Another issue relates to ‘new’ firms that are spun off or ‘spawned’ from existing firms (and also ‘new’ firms formed by merger). To the extent that these firms already have some familiarity with the relevant production routines as well as tacit knowledge associated with production experience, in addition to employees that have experience in working together, and firm-level reputation effects with financiers and stakeholders, these firms can be seen as being able to bypass, to some (imperfect) extent, the ‘liability of newness.’ They might not be able to entirely avoid the ‘liability of newness’, however, because of difficulties in transferring routines across heterogeneous contexts.Footnote 14 Although spin-off firms enjoy superior performance because of the industry experience they accumulated while at the parent firm (Agarwal et al. 2004), nevertheless these benefits of industry experience do not extend to all domains but appear to mainly affect non-technical areas such as marketing and regulatory processes (Chatterji 2009). ‘Spawned’ firms may be able to rapidly advance to a ‘post-liability’ stage. Franchising firms may also rapidly advance to a ‘post-liability’ stage because they can benefit from the reputation and legitimacy of the franchisor and from adopting their standardized routines (Aldrich and Auster 1986). Moreover, besides the liability of newness, these firms may experience several specific benefits usually observed with new entrants, such as higher growth rates and ease of internalizing new hires, because of the excitement and ‘buzz’ associated with a new entrepreneurial venture.

6 Conclusion

The start of operations of a newly founded firm stands out as a unique moment in the firm’s life course, because several key variables are set at zero – the firm has no routines, workers all have no firm-specific tacit knowledge or job tenure experience, and the firm has no reputation of its own. Our examination of the empirical evidence suggested that the most important age-related effects last for the first 5–7 years, after which firms become established in routines, growth rates slow, and stocks gradually accumulate. Future work could apply econometric models, such as threshold regression perhaps, to identify the statistical break-point in the trend where survival rates (and other performance indicators) no longer vary with age but reach a plateau.

Following on from interest in possible ‘stages of growth’, it is tempting to seek out stages in firm-level aging. A first observation is that firm-level aging does not display the same regularities observed in human aging processes. Anthropomorphic analogies to the aging process are not helpful here. Instead, there appear to be only two (or perhaps three) stages of aging. The first period corresponds to a burst of activity as surviving firms struggle against the initial ‘liability of newness.’ The ‘half-life’ of a firm is 3–4 years, in the sense that 50 % of new entrants will exit after 3–4 years. Surviving new firms face the challenge of planning and setting up new routines based on their codified knowledge. The second stage of aging is where firms become routinized and change is gradual. Firms have established themselves, to a certain extent, and have reached a certain level of maturity where they can efficiently apply their routines and proceed with ‘business as usual.’ A third stage would correspond to firms whose routines are so rigid as to lead to organizational ossification (the ‘liability of senescence’) and to lead to a poor fit to the ever-changing business landscape (the ‘liability of obsolescence’) – but this third stage may be avoided if the firm can innovate by introducing new routines and engage in ‘strategic renewal’ (Agarwal and Helfat 2009). There is no upper limit to the ages that firms can reach, however. Firms may live for longer than a millennium.

This survey has also found that theoretical work and empirical work have focused on different themes. Theoretical work has highlighted the importance of routines and capabilities as the mediators of firm-level aging effects, although empirical work into routines has made but slow progress (Becker et al. 2005). Instead, empirical work into firm aging has focused on the usual variables of survival, size and growth, profits and productivity, quantifiable indicators of innovation behaviour, and a few others.

Our survey has highlighted some implications for research and for policy. Practical implications for researchers are that performance has a non-linear relationship with firm age, which warrants empirical approaches that have quadratic terms for age (whereby performance may initially increase before ultimately decreasing with age), or logarithmic transformations (which favourably distorts the scale for age by correctly putting more weight on a firm’s early years, but do not allow performance to decrease in advanced ages). Furthermore, the suggestion that the most interesting age-related effects only last up to about 7 years should warn researchers of the limits of datasets that under-represent young firms. A first indication of under-representation of young firms can be obtained by evaluating the mode of the age distribution, which should be close to zero.

Our policy implications hinge on the observation that firms under 7 years are particularly vulnerable to a whole host of challenges related to the liability of newness. Firms above 7 years have already seen the worst and begin to settle down into their established production routines. It would therefore seem sensible to target support towards young firms, especially young small firms, rather than older (small) firms. Policy should therefore focus on age, rather than size (Lawless 2014). More specifically, we argue that fewer (rather than more) resources should be redirected to small firms, because policy interventions targeting small old firms can be dropped. This raises the possibility, however, that firms might be able to manipulate their official ages by feigning an exit and resurfacing with a new name (but with the same old employees, routines, capital, customers etc.). Policy support that is conditional on firm age runs the risk of generating excessive ‘churning’ of short-lived renascent businesses – hence any policies should be designed with care to distinguish between bona fide new firms and reincarnations.Footnote 15 Alternatively, policies could be designed that would appeal to young firms, but not to older firms (such as platforms for networking and information provision schemes,Footnote 16 instead of financial support, which would appeal to firms of all ages). The idea here would be that new firms would self-select towards such policy initiatives whereas older firms would not apply.

Notes

http://www.guinnessworldrecords.com, last accessed 1st December 2014.

This suggests the interesting conjecture that older CEOs might have less ambitious growth strategies than their younger counterparts.

Another possible ‘stage’ in the aging of firms might be the necessary replacement of a founding entrepreneur or CEO after a certain amount of time (Cucculelli 2014), or turbulence due to the obsolescence of initial endowments (Agarwal and Gort 2002). This effect might be dwarfed by other organizational changes such as employment growth and the introduction of new hierarchical layers, however.

Neither would it be a fair test to look at the effects of age on performance, while ‘holding constant’ all the negative effects of age (e.g. inertia, senescence, poor fit to the market environment), but without controlling for the advantages of age (such as size). By controlling away the drawbacks of age, but not the advantages, this would introduce a positive bias into the estimated effects of age on performance.

I am grateful to an anonymous reviewer for this suggestion.

Higher values for the ‘half-life’ of firms, or the median age at death for firms, that may have been found in other studies, are presumably due to under-representation of short-lived, young firms (see the discussion in Yang and Aldrich 2012, p479).

In fact, Greiner begins by presenting his stages of growth model in the context of stages of aging before discussing stages of growth (see Greiner 1998, p56).

One might see an interesting parallel with human aging here – in human cohorts, the variance in health increases with age (Whalley 2001, p85).

Not everyone would agree that with this latter quote, however – Huynh and Petrunia (2010) observe that, conditional on age, firm growth remains negatively related to size.

One may also conjecture that the age-pay structure could be a consequence of the particular institutional frameworks in place at the time of firm formation (e.g., stronger roles of unions in older firms). I am grateful to an anonymous reviewer for this suggestion.

One might therefore conjecture that it takes longer for the exit rate to decrease and reach a stable value for certain (high-tech) industries where firms require complex higher-level capabilities.

In the case of family firms, one would expect a higher rate of failed transformations brought about by the change of leadership, than in the case of large corporations with established monitoring mechanisms and shareholder pressure.

E.g. from a large parent firm to a new small firm that has been set up in a different location with different employees, a different product, and a different target market.

For example, to be counted as a bona fide new firm, there should be not only a change of name, but also a change of ownership, a change of industry, a significant change in the identity of the employees, and perhaps also a change of address.

References

Abernathy WJ, Utterback JM (1978) Patterns of industrial innovation. Technol Rev 80:40–47

Adelino M, Ma S, Robinson DT (2015) Firm age, investment opportunities, and job creation. Duke University, Mimeo

Agarwal R, Gort M (2002) Firm and product life cycles and firm survival. Am Econ Rev Pap Proc 92(2):184–190

Agarwal R, Helfat CE (2009) Strategic renewal of organizations. Organ Sci 20(2):281–293