Abstract

We examine the short- and long-term effects of market phases on the wealth creation potential of mergers and acquisitions. We argue that transactions in weak market environments create more long-term value for shareholders than transaction in booming markets. The analysis focuses in particular on transaction in depressed markets to identify drivers of outperformance. The results show that more selective, smaller and cash financed acquisitions significantly increase shareholder wealth in weak market environments. However, acquisitions of distressed firms are highly value decreasing.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Empirical evidence shows a positive relation between merger and acquisition (M&A) activity and market valuation level (Mitchell and Mulherin 1996; Jovanovic and Rousseau 2008). The experience of the last two decades strongly supports this view. The amount and volume of M&As have reached the highest levels in history during the boom years of 1998/1999 and 2006/2007. With the collapse of stock markets in 2001 and 2008 M&A activity also declined steeply compared to the last year of the stock market boom: \(-\)58 % (2001) and \(-\)55 % (2008), as measured by total transaction value and \(-\)35 % (2001) and \(-\)32 % (2008), as measured by number of transactions.Footnote 1

Less evident is the value effect of acquisitions in strong and weak markets for acquirers’ shareholders. Merger waves in booming stock markets are often considered rational reactions to industry shocks caused by new technologies, changes in factor costs, or deregulation. Using M&As to encounter such changes and to quickly adapt to a new market situation can be value creating for bidders (Mitchell and Mulherin 1996; Harford 2005). A growing body of literature argues that, from a behavioral perspective, boom markets generate agency costs instead of shareholder value. In this view, high valuations in strong markets lead managers to pursue transactions motivated by personal interest, which in turn leads to a reduction in firm value (Jensen 2005; Gorton et al. 2009; Goel and Thakor 2010). Weak markets, on the other hand, may offer a favorable environment for M&As. Low valuations, reduced competition for acquisition targets, and troubled companies that are willing to sell valuable assets can make takeovers attractive during lean times. M&As can also pose a challenge that may prove too big to handle when company sales fall and inventories grow. Additional complexity from integration and the need to finance a large M&A investments when financial resources become scarce are a risky choice and can lead to failure.

Our analysis contributes to the discussion by providing empirical evidence on value creation of M&As in different market phases. The examination builds on and adds to Bouwman et al. (2009) who suggest that US transactions created less long-term value when announced in markets with high valuation levels. We closely examine transaction characteristics that drive differences in shareholder wealth creation across market phases. In particular we want to shed light on the success criteria of M&As in depressed market environments. Our data set also provides rare insights into the shareholder wealth creation of European acquirers.

First, value creation in dependence of market valuation is determined. Second, specific differences in transaction characteristics of acquisitions in high and low markets are analyzed. In order to gain a comprehensive view on value creation for acquirers’ shareholders, different perspectives on M&A success are taken. The short-term value effect is addressed with an analysis of abnormal stock returns at the transaction announcement. Long-term returns are determined in event-time using buy-and-hold abnormal returns and in calendar time by applying a four factor market model. The analysis is based on a data sample of 2002 completed transactions by European acquirers that were announced between January 1st, 1989 and December 31st, 2006.

We show, in accordance with results of Bouwman et al. (2009), that transactions in strong markets outperform acquisitions in low valuation markets during the days surrounding the official announcement. In the long run, however, acquisitions in low markets generate more value for bidders’ shareholders than M&A transactions in booming markets. Cash transactions perform better than transactions paid in stock in all market environments. The positive differential to stock transactions, however, is highest in low valuation markets where share payment leads to significant value destruction. We also find some indication that smaller sized acquisitions with lower complexity and financing requirements create value for shareholders in weak markets driving long-term outperformance compared to transactions in strong market phases. Takeovers of firms in financial distress, on the other hand, destroy shareholder value in depressed markets.

The remainder of this paper is structured as follows. Section 1 gives an overview of the related research and develops the underlying hypotheses for this study. Section 2 describes the data sample and introduces the methodology. In Sect. 3 the results are discussed in detail. Section 4 summarizes and concludes the article.

2 Literature and predictions

2.1 Related literature

Corporate finance research describes the influence of the prevailing market environment usually on M&As either from a neo-classical or a behavioral perspective. The neo-classic research views merger activity as a rational reaction to industry wide shocks in demand or technology (Mitchell and Mulherin 1996). Particularly in strong market environments the access to capital should be easier and therefore merger waves emerge, which should increase shareholder wealth by increasing the firms’ productivity (Harford 2005; Eisfeldt and Rampini 2006). The behavioral explanation of M&As and merger waves, on the other hand, argues that selfish behavior of managers is a main driver of M&A activity, leading to a reduction in shareholder wealth rather than an increase (Roll 1986). Jensen (2005) argues that agency conflicts tend to be particularly strong when companies are overvalued in booming markets. Operational pressure on managers is limited and shares of highly valued company serve as an inexpensive transaction currency paving the way for irrational M&A decisions. Gorton et al. (2009) observe an “eat or be eaten” behavior during merger waves. Managers try to protect their jobs by acquiring before they get acquired during boom markets. Therefore, depending on the on whether one views M&As from the neo-classical or a behavioral perspective, opposing shareholder wealth effects may be expected.

Shleifer and Vishny (2003) combine neo-classical and behavioral views and argue that managers will rationally conduct share transactions when valuation levels are high and shares are likely to be overvalued in order to exploit potential market misvaluation. This strategy should lead to wealth increases for shareholders of the acquirer (see also Rhodes-Kropf and Viswanthan 2004; Ming et al. 2006; Ang and Cheng 2006; Brown and Fung 2009 for support of this argument). The empirical evidence is, however, somewhat contradictory. Lin and Fu (2008) examine effects of overvaluation on individual firm level. They conclude that overvalued companies destroy value when acquiring with shares. Savor and Lu (2008) achieve opposite results. They find that the long-term buy and hold returns favor shareholders of overvalued firms after a share transaction.

Bouwman et al. (2009) follow a different approach to shed light on the debate by taking a market-level perspective on M&As during different valuation phases. They determine high, neutral, and low valuation phases based on relative price–earnings levels of the S&P 500 index. Based on the analysis of 2944 transactions of US acquirers between 1972 and 2002 they argue that transactions during times of low market valuation levels create less value at announcement than boom market transactions. Low market transactions, however, outperform in the long run. Adding to previous behavioral hypotheses Bouwman et al. (2009) identify managerial herding as a possible explanation for weak performance during times of boom market M&A. They argue that managers engage in M&As imitating their successful peers to repeat the success of prior transactions, despite lower value creation potential of the remaining takeover opportunities.

Bouwman et al. (2009) look at M&A transactions in general, omitting a discussion of different transaction types. Previous studies have, however, identified abnormal value creation of specific M&A transaction types. An interesting string of research looks at industry and geographic diversification. With regard to industry diversification results show that diversifying transactions create less value than focused transactions. A frequent explanation is the increased complexity and lack of industry knowledge of managers when buying assets in non-core industries (Hoberg and Philiips 2010; Devos et al. 2009; Hyland and Nail 2006; Berger and Ofek 1995). The value creation potential of cross-border transaction for shareholders of the bidder remains unclear. Studies report positive value effects of cross-border acquisitions (Gleason et al. 2002; Chari et al. 2010 for emerging market targets) neutral effects (Gregory and McCorriston 2005), and negative effects (Aw and Chatterjee 2004; Ferreira et al. 2010).

Carapeto et al. (2010) analyze acquisitions of distressed targets. They find that the share of bankrupt and financially distressed acquisition targets increases in weak markets. Their results indicate that capital markets, in general, expect positive value effects from distressed transactions based on abnormal announcement returns. The performance improvements after the transactions, however, show decreasing operative performance of acquirers.

This paper contributes to the discussion of acquisition quality across market phases by adding an analysis of transaction characteristics that drive differences in shareholder wealth creation in different market environments. Our focus is M&As in weak markets. We want to shed light on value creation opportunities from takeovers in challenging market environments. We take a European perspective adding to the US focused analysis of Bouwman et al. (2009) and introduce several adjustments in the design to, e.g., account for industry specific valuation levels.

2.2 Specific predictions

From a behavioral perspective, stock market overvaluation generates agency costs which are value destroying for bidders’ shareholders (Jensen 2005). Low market transactions on the contrary should display a number of positive effects on value creation. First, these transactions should be less exposed to agency costs. Second, bidder competition for targets may be smaller than in strong markets because potential strategic investors are focused on internal operational improvements and struggle to free up sufficient financing for M&A. Gell et al. (2008) propose that companies apply better target selection when investment decisions have to be thoroughly examined in uncertain market environments. Therefore, we expect higher value creation for shareholders of weak market acquirers compared to boom market transactions.

H1: M&A transactions in low valuation markets create more value for bidders’ shareholders in the mid- to long-run

Market valuation levels are expected to affect the choice and value creation potential of different transaction types. Hence, specific predictions are made with regard to payment methods and target characteristics across market valuation phases.

The payment method is predicted to have a significant influence on M&A performance in different markets. Shleifer and Vishny (2003) argue that overvalued shares used as transaction currency to acquire real assets benefits bidders’ shareholders in boom markets, at least from a short-term perspective, when a valuation differential can be exploited. Therefore, transaction payment should be more frequent in shares during high valuation markets than during weak markets. Ang and Cheng (2006) provide empirical evidence for the value effect of share transactions of highly valued companies. They find that overvalued firms that acquire relatively lower valued targets generate sustained wealth gains for shareholders of buyers in the short- and long-term. Assuming a market induced part of firm overvaluation as proposed by Rhodes-Kropf and Viswanthan (2004), this leads to the prediction that takeovers using shares as payment method are more favorable for shareholders of the acquirer in strong markets. During weak markets acquirers are more likely to have undervalued stock and would potentially over-pay for assets when using shares instead of cash.

H2: Share transactions perform stronger in boom markets while cash transactions are favorable in weak markets

Recent studies document that conglomerate and cross-border transactions may create less value for shareholders of bidders (Devos et al. 2009; Hoberg and Philiips 2010; Aw and Chatterjee 2004). A frequently provided explanation is the increased complexity of transactions in new industries and markets caused by more difficult integration processes. We expect that especially in a challenging business environment additional complexity should have a strong adverse effect on M&A success.

Following the same intuition we also look at relative transaction size and financial health of the target. In general, larger acquisitions are more likely to create larger synergies (Martynova et al. 2006; Devos et al. 2009). They also create more integration risk. In weak markets smaller targets mean less uncertainty in terms of integration success and financing. Distress transactions are considered particularly complex and found to fail in most situations (Carapeto et al. 2010).

We expect relatively more complex transaction such as cross-border, diversifying, distressed and large scale transaction to perform poor in weak market environments.

H3: In weak market conditions less complex transactions are more successful in creating shareholder value than highly complex transactions

3 Data and methodology

3.1 Data selection process

The M&A data is based on completed transactions included in Thomson Reuters SDC Platinum database. All European transactions announced between January 1st 1989 and December 31st 2006 have been considered. Transactions with the following characteristics have been selected for the analysis:

-

1.

The buyer is based in Europe with headquarters in one of the European countries including the Eastern European states and Russia. The buyer is also listed on a European stock exchange.

-

2.

Transaction value equals or exceeds EUR 10 million and constitutes at least 1 % of the acquirer’s market capitalization at the day of announcement.

-

3.

The acquirer owns more than 50 % of the target’s equity after completion of the transaction.

-

4.

The buying firm belongs to the 200 largest companies of one of the industry sectors classified by the Industry Classification Benchmark (ICB) measured by market capitalization on December 31th 2008.Footnote 2

-

5.

Financial institutions incl. real estate and private equity companies (ICB sector Financial Institution) are excluded from the analysis to fully focus on strategic M&A.Footnote 3

All financial information, including capital market, balance sheet, and income statement data is obtained from Datastream, Thomson Financial, and Worldscope. Studies show that Datastream share prices have to be handled with care due to a number of data errors (Ince and Porter 2006; Espenlaub et al. 2009). Ince and Porter (2006) provide evidence that Datastream share information contains a considerable share of security miss-classification and incorrect share returns mainly for small firms. The focus on larger industry constituents mostly mitigates this potential pitfall. All analysis results are trimmed removing 1 % of extreme values and manually checked for illogical data entries. After cleaning the data, 2002 transactions remain for which all required financial information and suitable control firms for the BHAR analysis are available. Table 1 provides an overview of the applied data sample.

3.2 Classification of market valuation levels

In order to analyze M&A value creation in different market phases the European stock market is classified on the basis of valuation levels. The chosen approach builds on the methodology developed by Bouwman et al. (2009). Periods of high, neutral, and low market valuation are determined using trailing price-to-earnings (P/E) multiples. Due to a general upward trend in P/E ratios and extreme valuation spikes in 2000 and 2001 the P/E multiples are de-trended by removing the best straight line fit of the classified month and the preceding five years. The de-trended P/E multiples are then divided at their median. The top half of the above median months are classified as high valuation markets, the lower half of the below median months as low markets, and the rest as neutral markets.Footnote 4 In addition to Bouwman et al. (2009) this analysis is performed based on index P/Es for the nine considered ICB industries. This approach is chosen because valuation phases were found to differ significantly between industries. An overall market perspective would falsly classifiy industries with less volatile or unaffected P/E levels.

The classification of the applied data samples yields 423 transactions in low markets, 919 in neutral markets, and 660 in high valuation markets.

3.3 Approach to determine quality of M&A transactions

In order to determine the value effect of M&As for acquiring companies in different valuation phases multiple perspectives are applied. First, an univariate analysis is conducted. Abnormal announcement returns (CAR) are used to examine short-term value effects. Buy-and-hold returns (BHAR) are applied to analyze longer term value creation. In addition to the event-time view, a calendar-time perspective using a four-factor model based on Fama and French (1993) and Carhart (1997) is added to the long-term perspective (FF4F). In a second step, based on the univariate results, a multivariate regression model is estimated.

3.3.1 Methodology for assessing short-term value creation

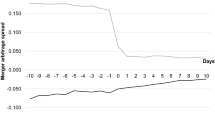

To determine the short-term value effect of acquisitions for shareholders of the acquiring company the cumulative abnormal returns around the announcement date (CAR) are calculated. The examined event window consists of 41 days, starting 20 days before and ending 20 days after the announcement day of the analyzed transactions. To determine the short-term abnormal return the market model as proposed by Brown and Warner (1980) and Brown and Warner (1985) is applied (Eq. 1).

R\(_\mathrm{it}\) represents the stock return of company i in period t while R\(_\mathrm{mt}\) describes the return of the specific European industry index of the acquiring company’s industry as classified by ICB. The market model parameters are calculated using ordinary least squares (OLS) regression over a period of 180 trading days prior to the analyzed event window. Cumulative abnormal returns (CAR) are then calculated by summing the abnormal returns over different event windows (Eq. 2).

To test the statistical significance the parametric cross-sectional z-Test proposed by Boehmer et al. (1991) is applied. In addition, the non-parametric generalized sign test (GST) introduced by Cowan et al. (1990) is calculated. Bartholdy et al. (2007) show that non-parametric tests have larger power to detect abnormal returns, especially for thinly traded stocks.

3.3.2 Methodology for assessing mid- to long-term value creation

The approach to determine longer term capital market returns of M&A transactions is two-fold. In order to address the often discussed statistical challenges that accompany the calculation of long-term abnormal stock performance both commonly used methodologies, the calendar-time approach proposed by Fama and French (1993) including Carhart’s (1997) momentum factor (FF4F) and the buy-and-hold abnormal return in event time proposed by Barber and Lyon (1997) and Lyon et al. (1999), will be pursued.Footnote 5

First, BHAR of acquiring companies are determined following the matching control firm approach, e.g., applied by Brown and Fung (2009). To measure abnormal performance of acquirers, non-merging control firms with comparable characteristics are selected as benchmarks. As proposed by Lyon et al. (1999) market-to-book ratios (M/B) and the size measured by market value are used to select control firms. In addition to the common approach, special attention is put on finding control companies with matching industry specific characteristics. The following three steps are applied:

-

1.

End of June market values and previous fiscal year’s M/B ratios are determined for all European companies included in the data sample for every year.

-

2.

For each acquiring firm all non-merging firms within the same ICB sub-sector (114 sub-sectors) and with market values between 70 and 130 % of the bidder’s market value at announcement day are identified. If less than three matching firms could be found, companies within the same three-, two-, and one-digit ICB codes are considered consecutively.

-

3.

From the list of similar sized firms the one with the smallest absolute difference in M/B value is selected as control firm.

By selecting control firms within the same industry sub-sectors and with comparable relative market valuations, effects from potential individual firms misvaluation (as found, e.g., by Ang and Cheng 2006; Brown and Fung 2009) are mitigated. The identified control firms for each transactions are used as a benchmark to calculate the buy-and-hold abnormal returns of each acquirer in the corresponding sample. Equation (3) describes the computation of the BHARs.

R\(_\mathrm{it}\) and R\(_\mathrm{controlfirm,t}\) describe the monthly returns of the bidder and the control firm respectively. The BHARs are calculated for a 12, 24, and 36 months period. The statistical significance is tested using a t-test. The analysis focuses on equally weighted BHAR to reflect returns to investors allocating funds equally among investment choices. (A value weighted perspective including a description of the weighting approach is available upon request.)

The second long-term approach follows the calendar time methodology introduced by Fama and French (1993). The four factor model (FF4F) addresses some of the shortcomings of the BHAR methodology, e. g., the cross-sectional correlation of firms in event time (Mitchell and Stafford 2000). It is however, potentially exposed to other pitfalls, e.g., heteroscedasticity. The FF4F determines excess returns of a portfolio of sample firms by regressing the time series of (1) the market excess return, (2) the differences in return between small and big firms, (3) the excess returns of high vs. low book-to-market (B/M) companies, and (4) the Carhart momentum factor. The model takes the form of Eq. 4.

R\(_\mathrm{pt}\) is the return of a continuously changing portfolio of companies or sub-groups of these companies that conducted acquisitions within the preceding 36 months. The acquirer portfolio is re-constructed on a monthly basis when new bidders are included and inactive companies leave after the 36 month period. \(\mathrm{R}_\mathrm{mt} - \mathrm{R}_\mathrm{ft}\) represents the market factor, calculated by subtracting the risk free rate (3 months Euribor after 1999, Libor until 1999) from the value waited market portfolio (Europe DS-Total Market index). SMB is the size factor. The companies of the Europe DS-Total Market index are ranked based on their market value on the last trading day of June each year. The median is used to split the companies into big (B) and small (S) portfolios. HML is the B/M factor which is formed by subtracting high B/M value stocks and low B/M growth stocks. The portfolios are formed by ranking the companies according to their B/M level and distributing the top and bottom 30 % to the respective portfolios (H and L) and the remaining 40 % in a medium portfolio (M). Six portfolios are created each year (S/L, S/M, S/H, B/L, B/M, and B/H). The SMB portfolio is supposed to replicate the risk factor in returns related to size. It is calculated using the average of the monthly returns on the three small (S) portfolios minus the three big (B) portfolios. The HML portfolio mimics the risk factor related to B/M valuation and is calculated in the same way using the two high (H) and the two low (L) portfolios. Due to simple averaging of the portfolios the factors should be largely free of the other factor’s effect.

In addition, a momentum factor is included to account for portfolio momentum effects as proposed by Carhart (1997). PR1YR is the return differentials of two equally weighted portfolios constructed out of firms with the highest and lowest 30 % of 11 months returns prior to the announcement month. The coefficients b\(_\mathrm{p}\), s\(_\mathrm{p}\), h\(_\mathrm{p,}\) and m\(_\mathrm{p}\) determine the loading of the respective factor, indicating the composition of the sample portfolio and the factor’s effect on returns. The a\(_\mathrm{p}\) coefficient finally represents the monthly return of the sample portfolio over a 36 months period that cannot be explained by the four factors. The sum of the error terms e\(_\mathrm{pt}\) is assumed to be zero. The statistical significance is tested using a t-test.

4 Empirical results

4.1 Descriptive results

The results of the announcement effects (CAR) for the entire sample are summarized in Table 2. We find that, overall, M&As resulted in significant positive shareholder wealth effects for the bidding firm, ranging from 0.67 % for the \([-10,+10]\) day event window to 0.90 % for the \([-5,+5]\) day event window (Panel A). Of special interest is the performance difference between high and low market announcements. The difference in means shows a significant over-performance of high market transactions of between 0.71 and 1.52 %. This outcome is consistent with Bouwman et al. (2009).

The long-term perspective, however, shows opposing results (see Table 3). The overall sample exhibits significantly positive returns 12 and 24 months after announcement of 2.36 and 3.22 %, respectively. The comparison of high and low market returns suggest over-performance of low market acquisitions between 7.13 and 8.12 % compared to boom-market transactions. A four factor calendar-time regression (FF4F) in Table 4 supports the finding. High market acquirers (Panel B.) show monthly excess returns of 0.15 % (5.38 % over 36 months) significant within the 10 % confidence interval. Low valuation-market bidders realize monthly excess returns of 0.37 % (13.45 % over 36 months) significant within the 1 % confidence interval. These results support our first hypothesis, as transactions in low valuation markets indeed create more value for the bidders’ shareholders in the mid- to long-run than acquisitions undertaken in high valuation markets. Therefore, the results indicate that markets do not reflect the entire value creation of a transaction at the announcement.

In a second step we examine the value effect of different transaction types across market cycles. Six criteria are tested: (A) payment method share or cash; (B) acquisitions in existing or new/diversifying fields, based on the four-digit SIC code of acquirer and target; (C) cross-border and domestic transactions based on SDC country code; (D) relative size of transaction value in relation to bidder’s market capitalization at announcement (sample divided at 5 % based on the median relative size of transactions); (E) acquisitions of targets in financial distress or bankruptcy based on labeling in SDC and negative operative performance in the quarter (year if no quarterly data is available) before the announcement. Tables 5 and 6 summarize the results.

Cash transactions in high and neutral markets outperform comparable transactions in low valuation markets. Share transactions also consistently underperform in the long-run (Panel A). The highest value differential of BHAR is found in low markets with a mean difference of 46.63 % between cash and share transactions (Table 6 Panel A). The results indicate that low valued shares used as acquisition currency in weak markets significantly reduce shareholder wealth in the mid- to long-run. Cash transaction in low valuation markets, on the other hand, significantly outperform those made in high valuation markets in the long-run with a mean difference of 9.42 %. In contrast, share transactions in boom markets do not appear to significantly outperform share transactions in low valuation markets. Therefore, we only find partial support for our second hypothesis. While cash transactions in weak markets appear to be favorable to the bidding firms’ shareholders compared to those in high valuation markets, there does not appear to be a stronger performance of share transactions in boom markets.

The diversification sub-samples remain largely inconclusive across market phases (Panel B). Cross-border acquisitions, however, create more value in weak markets (Panel C). This result indicates that international diversification is favorable from a capital market perspective when local markets deteriorate despite higher integration complexity of cross-border transactions. Announcement returns of transactions with high relative value are significantly higher for acquisitions in high and neutral markets (Panel D). From a long-term perspective smaller acquisitions significantly outperform larger transactions in weak markets. This can be seen as first tentative evidence in favor of our third hypothesis, as smaller, and therefore probably less complex, acquisition in weak market conditions outperform larger ones.

Panel E shows that distressed transactions significantly destroy value in weak markets with a mean difference in BHAR of 26.81 % (24.38 % value weighted) compared to takeovers of healthy targets. In strong markets this relation is inversed with a long-term outperformance of distressed takeovers (9.40 % equally weighted, 18.38 % value weighted). Announcement returns are positive in high markets and negative resp. insignificant in neutral and low markets.

4.2 Multivariate analysis

To examine the descriptive observations in more detail, a multivariate regression analysis is used to determine the combined effects of different transaction characteristics. Short-term announcement effects (CAR) of the 3- and 21-day event windows, as well as 24-month long-term buy-and-hold abnormal returns (BHAR) are used.

The HighValDummy takes the value 1 for transactions that have been announced in high valuation months. For all other months it is 0. High valuation is determined by classifying the months between January 1st 1989 and December 31st 2006 in high, neutral, and low valuation months based on the de-trended industry specific P/E multiple. The LowValDummy is 1 or 0 respectively. The ShareDummy takes the value 1 for all transactions that are fully paid for by common or preferred stock as well as by share options of the acquiring company. For all other considerations the dummy value is 0. LogRelativeSize is the common logarithm of the ratio between transaction value and market value of the acquiring company. The bidder’s market value is taken from the day of the announcement or the last trading day before the announcement. Dang and Li (2015) point out that alternative measure of firm size based on, i.e., book value of company assets or sales may affect research results. We limit our examination to market capitalization because we have insufficient access to reliable data other than transaction valuation for private targets in the SDC database. We acknowledge that this approach may have shortcomings when using this measure to proxy the operational complexity of integration compared to, e.g., book value of assets. The CrossBorderDummy is 1 if the country of residence according to the country code on announcement date in the SDC database differs between target and acquirer. If it is equal the dummy takes the value 0. DiversificationDummy is 1 for all transactions in which the acquirers’ four-digit SIC codes in the SDC database differs from the four-digit code of the target at the announcement day. If the SIC codes are equal the value is 0. The DistressedDummy takes the value 1 when the transaction is labeled bankruptcy or restructuring related in the SDC database. Acquisitions are also considered distress related when the target company has had negative operating income (EBIT) in the last financial quarter (or the last full fiscal year depending on data availability) before the transactions. The classification of distress is imperfect as data availability is limited especially for private and divestment transactions. Therefore, the results have to be interpreted with caution.

In addition to the factors examined in the analysis in Sect. 4.1, some additional aspects are examined and controlled for in the regression analysis. First, we include an independent variable for public and private targets. Research from Fuller et al. (2002) and Moeller et al. (2004) suggests that private targets provide larger value creation potential. PublicDummy is 1 for all publicly listed targets on announcement day. DivestmentDummy assumes the value 1 if the target status as indicated by the SDC database is subsidiary. It remains 0 for public or private targets.

The HostileDummy variable as an additional transaction characteristic is included. It assumes the value 1 when the transaction is labeled hostile in the SDC database. Because only 20 (1 %) transactions show this attribute in the overall data sample its predictive power is limited and it is only included in the regression of all transactions. Previous research yielded contradictory results with regard to value creation. One line of argumentation assigns positive long-term effects to completed hostile transactions because they are hypothesized to have superior synergies that lead managers to engage in a hostile transaction despite higher transaction costs (Martynova et al. 2006).

The regression model also controls for the effect of pre-announcement capital market performance to test whether relative strong acquirers benefit most from M&As in low valuation markets. RelPreAnnReturn is the relative return of the acquirer in the 12 months preceding the month of announcement. To determine the relative return industry specific benchmark portfolios are constructed. The industry reference portfolios are created by ranking all companies of the respective ICB industry group by previous year-end M/B ratios and market capitalization on the last trading day of June in every year. Companies are then divided in three M/B groups and three size groups. The resulting nine M/B-size portfolios are created in every of the nine ICB industry groups. For the 81 reference portfolios average monthly returns are calculated as a benchmark to determine the relative performance of bidding companies prior to a transaction announcement. RelMtoB is calculated for every transaction year by subtracting the median industry M/B ratios of the respective 2-digit SIC industry from the M/B ratio of the acquirer. The difference proxies for the relative over- or under-valuation of the divesting company in the year of the announcement. The M/B variable controls for effects from relative individual firm valuation (Ming et al. 2006). Previous results with regard to the effects of relative company valuation have been mixed. Both variables, relative M/B and previous performance, also serve as a control for effects that pertain to the behavioral view on M&A value creation (Harford 2005). Multiple regression are estimated for all transactions to test the effect of market valuation level on overall results. In addition, high and low market transactions are regressed separately to analyze the role of the tested independent variables on abnormal performance in the respective market environment. The regression findings are summarized in Table 7.

The intercept of Panel A can be interpreted as neutral market abnormal returns and operational improvements for domestic, private acquisitions in the same industry that have been financed with cash or a mix of cash and shares. The CAR intercepts show positive announcement returns. Transactions in low valuation markets have a significantly negative effect on announcement returns of \(-\)2.15 % in the 21-days window. This finding confirms the negative reaction of investors to transaction announcements in depressed market environments. Long-term BHAR, on the other hand, show a negative sign for high-market transactions. The finding supports H1 for the long-term perspective. However, it should be noted that in the short-term event windows boom market transactions perform significantly better, giving partial support to H2.

The payment method does not show a significant short-term effect. Yet, increasing relative size has a positive effect on CAR and BHAR indicating higher synergies from larger transactions. A significantly negative coefficient (3-day window) for transactions with a public target is consistent with results of Fuller et al. (2002), as private transactions appear to increase shareholder value at announcement. Cross-border and conglomerate announcements do not significantly influence CAR. The announcement effect of transactions involving a distressed target is also insignificant. The announcement of successful hostile takeovers has a positive valuation effect. This result in combination with the positive long-term returns supports the view that hostile transactions show higher potential synergies (Martynova et al. 2006).

A relative over-performance of acquirers prior to the announcement increases returns in the three day window around the announcement day. High relative M/B valuations of the acquirer, on the other hand, have a negative effect. This result potentially indicates that strongly performing acquirers benefit from transactions while potentially overvalued acquirers are not rewarded by investors. Panel A. also shows a significantly negative impact from high market takeovers and share payments on long-term results (BHAR).

Panel B shows regression results for the boom market transactions. The CAR results largely correspond with regression results of the entire data sample. Share transactions, however, have a significantly negative effect on announcement returns in high markets. This underlines the finding that markets appear to anticipate agency costs of share transactions, as market-induced overvaluation may affect management behavior. The BHAR regression only shows a significant negative coefficient for share transactions.

Panel C shows the results for low markets. The regression of the three day CAR does not yield a significant outcome. The 21-days event window, however, shows a significantly negative intercept at \(-\)3.13 %. A highly negative effect of share payment on long-term performance of \(-\)46.16 % supports this finding. H2 is supported with regard to negative long-term effects of share transactions in weak markets.

The effect of transaction size is insignificant. The results only provide an indication that smaller transactions result in higher long term value creation in weak markets as suggested by the descriptive results. Cross-border transactions positively influence the announcement return. Transactions involving distressed targets are highly value destroying in weak markets as indicated by the descriptive findings. The results only partially support H3 with regard to the negative effects of more complex transaction in weak markets.

Additional findings include a significant positive effect of transactions with public targets in weak markets. This finding suggests that higher transparency in declining markets increases the value creation potential of acquisitions in uncertain market environments.

5 Conclusion

The analysis presented shows that market valuation levels have had an influence on M&A success from 1989 to 2006. Overall the results indicate that low market acquisitions outperform M&A transactions in boom-markets in the long-run while the short-term abnormal returns are higher for takeovers in strong market environments. Investors appear to react reluctant to the announcement of takeovers when market prospects are uncertain. The long-run underperformance of takeovers in high valuation markets is consistent with the behavioral perspective on M&A. Strong markets and subsequent high valuation levels can create agency costs that lead to reduced value creation of M&A (Gorton et al. 2009; Bouwman et al. 2009; Goel and Thakor 2010). In the absence of market-induced overvaluation low market acquirers appear to use a superior target selection process and make more reasonable investment decisions.

The long-term success of down-market M&As depends on a number of transactions characteristics. Takeovers paid for with lowly valued shares destroy value for shareholders in weak markets. Distressed targets also have a clearly negative effect on value creation in the long-term. In down-markets turnarounds seem to be more difficult to achieve than in stronger market environments. Higher transaction complexity, assumed for cross-border and diversifying M&A transactions, does not appear to negatively influence acquisition performance in weak markets. The hypothesis that additional integration and value capturing complexity could overburden buyers in times when the market environment is challenging cannot be supported. The descriptive results provide an indication that small acquisition targets relative to the buyer’s size show larger positive long-term value creation in weak markets.

There are several limitations inherent in the present paper. Chief among them is the sole focus on Europe and that the sample period ends in 2006. However, this also presents a good opportunity for future research to validate the results for the past decade, particularly in light of the recent financial crisis, and to extend the study to M&As in the United States. In addition, several issues may arise using BHAR (see e.g. Lyon et al. 1999). Therefore, alternative methods to examine the robustness of our results in regard to the long-term success of M&As should be used in future research.

Nevertheless, our overall results strongly suggest that more difficult market environments indeed present good M&A opportunities for willing buyers, despite the internal challenges that may arise in weak markets. Our study is, however, limited to identifying relative performance differences of transaction types. We do not further explore reasons and test explanations for the success of different transaction types in weak markets. We strongly encourage further research on this matter.

Notes

Based on European M&A data from Thomson Reuters’ SDC Platinum Database.

The results remain robust when applying the 100, 150, 220 largest companies per industry.

The ICB is published and maintained by Dow Jones und Financial Times Stock Exchange (FTSE). It classifies companies based on their main sources of revenue in 10 industries with 114 sub-sectors. The considered industries are (i) oil and gas (0001), (ii) basic materials (1000), (iii) industrials (2000), (iv) consumer goods (3000), (v) health care (4000), (vi) consumer services (5000), (vii) telecommunication (6000), (viii) utilities (7000), and (ix) technology (9000). Financial Institutions (8000) incl. real estate and private equity companies are not considered due to often unclear differentiation between strategic acquisitions and trade sales as well as for the special properties of the applied financial rations (see Martynova et al. 2006).

Bouwman et al. (2009) discuss and contrast in depth different methodologies of classifying market valuation levels. Besides P/E ratios they examine market-to-book (M/B) and overall index levels of the S&P 500. They also test the robustness of their approach to changes in de-trended period and changes in the classification window from month to quarters.

Mitchell and Stafford (2000) discuss and contrast the BHAR and FF3F approach for different applications in event studies. Their results favor FF3F. Other studies, however, argue in favor of BHAR finding that FF3F has less power to identify abnormal returns.

References

Ang, J. S., & Cheng, Y. (2006). Direct Evidence on the Market-driven Acquisition Theory. Journal of Financial Research, 29, 199–216.

Aw, M. S. B., & Chatterjee, R. A. (2004). The performance of UK firms acquiring large cross-border and domestic takeover targets. Applied Financial Economics, 14, 337–349.

Barber, B. M., & Lyon, J. D. (1997). Detecting long-run abnormal stock returns: The empirical power and specification of test statistics. Journal of Financial Economics, 43, 341–372.

Bartholdy, J., Olson, D., & Peare, P. (2007). Conducting event studies on a small stock exchange. European Journal of Finance, 13, 227–252.

Berger, P. G., & Ofek, E. (1995). Diversification’s effect on firm value. Journal of Financial Economics, 37, 39–65.

Boehmer, E., Musumeci, J., & Poulsen, A. (1991). Event-study methodology under conditions of event-induced variance. Journal of Financial Economics, 30, 253–272.

Bouwman, C. H. S., Fuller, K., & Nain, A. S. (2009). Market valuation and acquisition quality: Empirical evidence. The Review of Financial Studies, 22, 633–678.

Brown, C., & Fung, C. (2009). Keiretsu affiliation and stock-market-diven acquisitions. Journal of Financial Research, 32, 479–503.

Brown, S. J., & Warner, J. B. (1980). Measuring security price performance. Journal of Financial Economics, 8, 205–258.

Brown, S. J., & Warner, J. B. (1985). Using daily stock returns: The case of event studies. Journal of Financial Economics, 14, 3–31.

Carapeto, M., Moeller, S., Faelten, H. (2010). The good, the bad, and the ugly: A survival guide to M&A in distressed times, working paper, cass business school.

Carhart, M. M. (1997). On persistence in mutual fund performance. Journal of Finance, 52, 57–82.

Chari, A., Ouimet, P. P., & Tesar, L. L. (2010). The value of control in emerging markets. Review of Financial Studies, 4, 1741–1770.

Cowan, A., Nandkumar, N., & Singh, A. (1990). Stock returns before and after calls of convertible bonds. Journal of Financial and Quantitative Analysis, 25, 549–555.

Custodio, C., Metzger, D. (2010). The value of CEOs industry expertise—evidence from mergers & acquisitions. London School of Economics, Working Paper, 2010. Available at SSRN:http://ssrn.com/abstract=1647073.

Dang, C. & Li, F. (2015). Measuring firm size in empirical corporate finance. Working Paper University of Western Ontario.

Devos, E., Kadapakkam, P.-R., & Krishnamurthy, S. (2009). How do mergers create value? A comparison of taxes, market power, and efficiency improvements as explanations for synergies. Review of Financial Studies, 22, 1179–1211.

Eisfeldt, A. L., & Rampini, A. A. (2006). Capital reallocation and liquidity. Journal of Monetary Economics, 53, 369–399.

Espenlaub, S., Iqbal, A., & Strong, N. (2009). Datastream returns and UK open offers. European Journal of Finance, 15, 61–69.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33, 3–56.

Ferreira, M. A., Massa, M., & Matos, P. (2010). Shareholders at the gate? Institutional investors and cross-border mergers and acquisitions. Review of Financial Studies, 23, 601–644.

Fuller, K., Netter, J., & Stegemoller, M. (2002). What do returns to acquiring firms tell us? Evidence from firms that make many acquisitions. Journal of Finance, 57, 1763–1793.

Gell, J., Kengelbach, J., Roos, A. (2008). The return of the strategist: Creating value with M&A in a downturn. The Boston Consulting Group, 2008.

Gleason, K. C., Gregory, D. W., & Wiggins, R. A. (2002). Wealth effects of US acquisitions in the Pacific Rim. Journal of Business and Economic Studies, 8, 28–48.

Goel, A. M., & Thakor, A. V. (2010). Do envious CEOs cause merger waves? Review of Financial Studies, 23, 487–517.

Gorton, G., Kahl, M., & Rosen, R. (2009). Eat or be eaten: A theory of mergers and firm size. Journal of Finance, 64, 1291–1344.

Gregory, A., & McCorriston, S. (2005). Foreign acquisitions by UK limited companies: short- and long-run performance. Journal of Empirical Finance, 12, 99–125.

Harford, J. (2005). What drives merger waves. Journal of Financial Economics, 77, 529–560.

Hoberg, G., & Philiips, G. (2010). Product market synergies and competition in mergers and acquisitions. Review of Financial Studies, 23, 3773–3811.

Hyland, D. C., & Nail, L. (2006). Intersecurity wealth redistribution in conglomerate mergers: Re-examination over three decades. Corporate Ownership and Control, 3, 178–189.

Ince, O. S., & Porter, R. B. (2006). Individual return data from Thomson Datastream: Handle with care!. Journal of Financial Research, 29, 463–479.

Jensen, M. C. (2005). Agency costs of overvalued equity. Financial Management, 34, 5–19.

Jovanovic, B., & Rousseau, P. L. (2008). Mergers as reallocation. Review of Economics and Statistics, 90, 765–776.

Lin, L. & Fu, F. (2008). Mergers driven by stock overvaluation: Are they good deals? Singapore Management University, Working Paper, 2008. Available at SSRN:http://ssrn.com/abstract=1099842.

Loughran, T., & Vijh, A. M. (1997). Do long-term shareholders benefit from corporate acquisitions? Journal of Finance, 52, 1765–1790.

Lyon, J. D., Barber, B. M., & Tsai, C.-L. (1999). Improved methods for tests of long-run abnormal returns. Journal of Financial Economics, 54, S165–S201.

Martynova, M., Oosting, S., Renneboog, L. (2006). The long-term operating performance of European mergers and acquisitions. Working Paper, 2006. Available at SSRN:http://ssrn.com/abstract=944407.

Ming, D., Hirshleifer, D., Richardson, S., & Siew Hong, T. (2006). Does investor misvaluation drive the takeover market? Journal of Finance, 61, 725–762.

Mitchell, M. L., & Mulherin, J. H. (1996). The impact of industry shocks on takeover and restructuring activity. Journal of Financial Economics, 41, 193–229.

Mitchell, M. L., & Stafford, E. (2000). Managerial decisions and long-term stock price performance. Journal of Business, 73, 287.

Moeller, S. B., Schlingemann, F. P., & Stulz, R. M. (2004). Firm size and the gains from acquisitions. Journal of Financial Economics, 73, 201–228.

Rhodes-Kropf, M., & Viswanthan, S. (2004). Market valuations and merger wave. Journal of Finance, 59, 2685–2718.

Roll, R. (1986). The hubris hypothesis of corporate takeovers. Journal of Business, 59, 197–216.

Savor, P. G., & Lu, Q. (2008). Do stock mergers create value for acquirers? Journal of Finance, 64, 1061–1097.

Shleifer, A., & Vishny, R. W. (2003). Stock market driven acquisitions. Journal of Financial Economics, 70, 295–311.

Wang, C., & Chung, K. S. (2009). Corporate governance transfer and synergistic gains from mergers and acquisitions. Review of Financial Studies, 22, 829–858.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Erxleben, U., Schiereck, D. Wealth creation of mergers in downturn markets. J Manag Control 26, 317–345 (2015). https://doi.org/10.1007/s00187-015-0217-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00187-015-0217-y