Abstract

Since the financial crisis, financial networks, such as interbank lending networks, have been highly concerned by regulators in terms of their vulnerability. To study the risk contagion power of financial networks deeply, this paper integrates short-term and long-term lending data among commercial banks and stress tests the Chinese interbank lending network by using the extended distress and default contagion model. The results show that the reconstructed short-term lending network utilizing information on bank assets exhibits a core–periphery structure with systemically important banks at its core. Stress test results suggest that an interbank lending network that does not consider long-term lending data underestimates the network’s systemic risk when market conditions are poor. In addition, we find that the Chinese interbank lending network has gradually become more risk-resistant over time, and the vulnerability of the network after the outbreak of COVID-19 is lower than that before. Finally, we suggest that regulators can make full use of ancillary data, such as long-term interbank lending data, to stress test financial networks, thereby accurately capturing the network’s structure and preparing for ex-ante interventions before a crisis strikes to mitigate network systemic risk.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The 2007–2009 financial crisis highlighted the importance of network structure in amplifying initial shocks that spread throughout the financial system, leading to financial disasters (Elliott et al. 2014; Tafakori et al. 2022; Hasse 2022). To capture the risk amplification effects from the network perspective, policymakers have made stress testing more macroprudential by incorporating network utilities into their testing exercises (Cetina et al. 2015; Anderson 2016). Although it has been found that stress tests can help policymakers maintain financial stability through ex-ante intervention measures, the global economy has fallen into recession in recent years amid high inflation. For example, on October 11, 2022, the International Monetary Fund (IMF) released its Global Financial Stability Report, which noted that the global economy will fall into recession in 2023 amid high inflation and as many as 29% emerging market banks are in breach of capital adequacy requirements, requiring more than US $ 200 billion to rebuild buffers and close capital gaps.Footnote 1 Encouraged by the inflated and potentially downward economic spiral of recent years, we will refocus our attention on financial network stress testing and hope to accurately capture information about the risks of financial networks, such as which agents are vulnerable and need to be more prepared to intervene ex-ante to mitigate the systemic risks that may realistically arise.

Following the 2008 financial crisis and the 2011 subprime crisis, the largest losses suffered by financial institutions during the financial crisis were not due to actual defaults by counterparties, but rather to mark-to-market revaluations of debt following the deterioration of creditworthiness of counterparties. On February 16, 2023, in a letter to G20 Finance Ministers and Central Bank Governors, the Chair of the Financial Stability Board emphasized that, while several severe shocks in recent years had withstood multiple stress tests, asset valuations in some key markets were stretched, and posed a serious threat to financial stability.Footnote 2 Thus, ex-ante valuation is crucial to the investigation of systemic risk contagion in financial networks (Veraart 2020). This study will reconstruct stress test models with asset valuations and strive to focus on the impact of default events on financial networks.

The existing literature either does not take into account the ex-ante asset valuation when doing financial network stress tests, such as Elliott et al. (2014), Feinstein (2017), and Ghamami et al. (2022) or it considers the asset valuation but does not make full use of the agent data in the network that can be accessed to further analyze the network risk accurately such as Gandy and Veraart (2017), Veraart (2020), and Chen et al. (2021). To fill the above research gaps, this paper studies the distress and default contagion problem in interbank lending networks based on aggregated short-term lending data and long-term lending data. The model we construct is based on an existing static modeling framework in Veraart (2020), and this constructed model is applied to stress test the Chinese interbank lending network. Data were sourced from reports of 30 publicly traded Chinese banks regarding their total assets, total liabilities, and total short-term interbank lending for the period 2013 to 2022. Meanwhile, we obtain long-term interbank lending data for the above 30 banks from the Corporate Alert Link database.Footnote 3

The main work of this paper is as follows. First, this study develops a flexible and tractable framework for quantifying distress and default contagion in interbank lending networks using long-term lending data. Second, we utilize the Bayesian approach mentioned by Gandy and Veraart (2017) with the aggregate short-term lending data to reconstruct the short-term lending network. Furthermore, we combine observable long-term bank lending data with the recovered short-term lending network to obtain the total lending network. Finally, this paper utilizes data from 30 Chinese commercial banks to compare the reconstructed short-term lending network with the designed total lending network. The results show that the introduction of long-term lending data can better reveal the vulnerability of interbank lending networks and avoid the underestimation of systemic risk when only short-term lending data are considered. We reconstruct some lending networks for selected years from 2013 to 2022 (2013, 2019, 2020, and 2022). We find that the visualized Chinese interbank lending network exhibits a core–periphery structure, with the core banks being on the list of Systemically Important Financial Institutions (SIFIs). By performing stress tests on the reconstructed short-term lending network and total lending network in 2013, 2019, 2020, and 2022, we find that when the market conditions are favorable, i.e., when the exogenous recovery rate is high and the capital cushion parameter is low, the vulnerability of the total lending network is approximated to that of the short-term lending network. When market conditions are bad, i.e., when the exogenous recovery rate is low and the capital cushion parameter is low, the vulnerability of the total lending network is higher than that of the short-term lending network. Particularly, the Chinese interbank lending network is less systemically risky in the aftermath of COVID-19 than it was before the outbreak, which is a reflection of the success of China’s anti-pandemic efforts.

This paper acquires some economic insights. First, compared with the existing literature, we construct an extended distress and default contagion model with interbank long-term lending information. Second, we make full use of Chinese long-term interbank lending data and analyze the vulnerability of China’s interbank lending network in recent years through stress tests. Finally, we suggest that regulators make full use of publicly available data while stress testing the interbank system, which will make the test results more consistent with realistic scenarios.

The structure of this article is as follows. Section 2 analyzes the existing literature. Section 3 introduces the extended distress and default contagion model under the utilization of long-term lending data. Section 3.1 constructs the extended distress and default contagion model based on long-term lending and recovered short-term lending data. In Sect. 3.2, we recover the short-term lending network among banks using Bayesian methods with aggregate short-term lending data. Section 4 presents the empirical results of our empirical analysis of the Chinese interbank lending network. Section 5 concludes the paper.

2 Literature review

Our research involves three sub-areas, the first is financial network risk contagion, the second is valuation loss contagion, and the third is network reconstruction. There are two streams of literature focusing on the analysis of default contagion. The first branch is based on Eisenberg and Noe (2001) and subsequently extended by Cifuentes et al. (2005), Rogers and Veraart (2013), Elliott et al. (2014), Feinstein (2017), and Ghamami et al. (2022). This literature explores agents’ payment and clearing strategies for financial networks. Because of the interconnectivity in networks, this literature fulfills the need for agents to make consistent debt payments and liquidate assets. The second branch is based on the default cascade model and has been applied in Furfine (2003), Amini et al. (2016), and Amini (2023). These models portray large financial networks and incorporate linear threshold models to explore the default process of agents in the network.

The second sub-area is valuation loss contagion. There is a large literature on valuation loss contagion, such as the DebtRank model proposed by Battiston et al. (2012) and subsequently developed by Bardoscia et al. (2016), Bardoscia et al. (2017), Diem et al. (2020), and Chen et al. (2021). These models are characterized by the fact that the recovery rate and the probability of default determine the size of the contagion loss. Specifically, Veraart (2020) defined the contagion of such losses as distress contagion. Following the work by Veraart (2020), our study utilizes the equity revaluation model to delineate solvency contagion risk.

The third sub-area is network reconstruction. Both the study of default contagion and distress contagion mechanisms require knowledge of inter-network debt data, yet such data are difficult to access. For example, for interbank lending networks, scholars can only obtain aggregate exposures without being able to extract more detailed information (Gandy and Veraart 2017). Consequently, several approaches to reconstructing network structures have emerged, such as the entropy method, minimum density method, sampling-based reconstruction methods, and Bayesian approach (Upper and Worms 2004; Cimini et al. 2015). Our paper implements the Bayesian model introduced by Gandy and Veraart (2017) for reconstructing the financial network, incorporating the implications of bank asset size and interbank liability size during parameter selection.

Our paper is related to the Silva et al. (2018) and Roncoroni et al. (2021) studies on risk contagion in the banking system, but there are many differences. The contribution of our work differs from Silva et al. (2018) in two aspects: First, our multilayers are not reflected in the interbank interactions with real firms and the financial sector, but rather in the length of the interbank lending period. Thus, our study always focuses on interbanks and layers of the network with the length of the debt maturity. Second, compared to Silva et al. (2018), we use the total exposure of each bank in the network as a basis for determining whether the bank is a significant financial institution, and find that all of these important banks are on the list of systemically important financial institutions published by China. The findings of our work also differ from Roncoroni et al. (2021). On the one hand, we focus on direct risk contagion channel research and consider multilayer networks, while they tend to focus on indirect risk contagion channels. On the other hand, the systemically important banks we describe are categorized according to their direct exposures, which they classify as loans, long-term debt securities, money market fund shares, and so on.

3 Default contagion and network reconstruction

3.1 The extended distress and default contagion model

Consider an interbank lending network constituted by N agents, each denoting a bank. These agents are indexed by the set \(\mathcal {N}=\{1,\cdots ,N\}\). In the real-world interbank market, the duration of interbank loans can vary. This paper simply categorizes them into two basic types: short-term lending and long-term lending. The short-term interbank liabilities and the long-term interbank liabilities are denoted by matrices \(\textbf{L}^{s}=(L^{s}_{ij})_{N\times N}\) and \(\textbf{L}^{l}=(L^{l}_{ij})_{N\times N}\), respectively, where \(L^{s}_{ij}, L^{l}_{ij}\in \mathbb {R}^+_0\) for all \(i,j=1,2\dots , N\). The term \(L^{s}_{ij}\) refers to the short-term interbank liability from bank i to bank j, whereas \(L^{l}_{ij}\) represents the long-term interbank liability from bank i to bank j. An important structural constraint of this network is the absence of self-loops, i.e., \(L^{s}_{ii}=L^{l}_{ii}=0\) for \(i \in \mathcal {N}\). Considering bank i, its external or non-network related assets and liabilities are defined as \(A_{i}^{e}\) and \(L_{i}^{e}\), respectively. The balance sheet of bank i can be expressed as

where the interbank assets and liabilities held by bank i are defined as \(A^{B}_{i}=\sum _{j=1}^{N}L^{s}_{ji}+\sum _{j=1}^{N}L^{l}_{ji}\) and \(L^{B}_{i}=\sum _{j=1}^{N}L^{s}_{ij}+\sum _{j=1}^{N}L^{l}_{ij}\), and \(\omega _{i}\) denote the net worth of bank i. Consistent with the supposition proposed in Amini (2023) and Chen et al. (2021), our analysis necessitates the network to maintain a closed structure. This implies that the total interbank assets are equal to the total interbank liabilities, expressed mathematically as \(\sum _{i=1}^{N}A^{B}_{i}=\sum _{i=1}^{N}L^{B}_{i}\).

In the stress test, we assume that only external assets are subject to direct shocks \({\varvec{\delta }}=(\delta _{1},\cdots ,\delta _{N})^{\prime }\), where \(\delta _{i}\in [0, A^{e}_{i}]\). As a result, the net worth \(\omega _{i}\) accordingly suffers the same amount of losses. After the reduction in net assets, i.e., equity, the solvency of the bank will decrease, leading to a corresponding reduction in the value of loans held between banks, which in turn will cause a change in the equity of the bank, so we need a model to revalue the equity of all banks after the shock. We have used the extended distress and default contagion model proposed by Barucca et al. (2020) and Veraart (2020), which is defined as shown below.

Definition 1

(Equity revaluation) For a financial system \((\textbf{L}^{s},\textbf{L}^{l},\textbf{L}^{e},\textbf{A}^{e})\), we obtain the equity valuation for the bank i:

where \(\mathbb {V}: \mathbb {R}^{N}\rightarrow [0,1]^{N}\) denote the interbank valuation function that satisfies non-decreasing and right-continuous, \(\mathcal {M}:=\{i\in \mathcal {N}|L^{all}_{i}>0\}\) is the set of positive total liabilities, \(E_i\) is the equity of bank i, \(\textbf{A}^{e}=(A^{e}_{1},\cdots , A^{e}_{N})^{\prime }\) and \(\textbf{L}^{e}=(L^{e}_{1},\cdots , L^{e}_{N})^{\prime }\).

In Definition 1, \({\varvec{\Phi }}\) is an equity valuation function for a financial system \((\textbf{L}^{s},\textbf{L}^{l},\textbf{L}^{e},\textbf{A}^{e})\) with shock vector \({\varvec{\delta }}\). The revalued equity vector \(\textbf{E}\) satisfies:

Equation (3) can be regarded as a fixed-point problem with the resolution method being accessible in Veraart (2020). It is worth noting that our model can degenerate into a linear Debtrank model in Silva et al. (2018) when \(L^{\ell }_{ij}=0\) and \(\mathbb {V}\left( \frac{E_j(t)+L^{all}_j(t)}{L^{all}_j(t)}\right) =\min \left[ \frac{E_j(t)}{E_j(t-1)},1\right] \), which reflects the robustness and innovation of our model. For each bank i, \(E^{*}_{i}\) denotes the optimal fixed point. We adopt an indicator \(\Lambda ^{\mathbb {V}}\) to quantify the losses-relative system loss:

From Eqs. (2) and (4), we know that the form of \(\mathbb {V}\) has an impact on the results of the stress test, so later in the empirical section we investigate the impact of the choice of parameters in \(\mathbb {V}\) such as the exogenous recovery rate on the systemic risk.

3.2 Network structure reconstruction

To apply the model detailed in Sect. 3.1, the network liability relationships must be revisited and reconstructed. As mentioned earlier, this paper divides interbank lending into short-term and long-term lending. Relevant data on long-term lending are available through the Corporate Alert Link database. Unfortunately, there is no public repository for short-term lending data. For each bank i, the only directly observable data are the total short-term liabilities \(A^{s}_{i}\) and \(L^{s}_{i}\).Footnote 4 Therefore, a Bayesian model is constructed to reconstruct the network of short-term interbank lending.

Drawing on the principles of the classic ER model (Erdős and Rényi 1960), we define the adjacency matrix \(A=(A_{ij})_{N\times N}\), representing short-term lending relationships. If a short-term lending relationship does exist between bank i and bank j, then \(A_{ij}=1\), otherwise \(A_{ij}=0\).Footnote 5 Actual financial networks frequently exhibit a core–peripheral structure (Li and Ma 2022). Drawing inspiration from this observation, this paper posits that the likelihood of debt transactions between two banking institutions is positively associated with the size of their assets. This implies that banks with larger asset sizes are more likely to form connections with other banks, while those with smaller asset sizes forge fewer connections. To express this concept in mathematical terms, directed edges from i to j are generated through Bernoulli trials with the parameter \(p_{ij}=p(A^{all}_{i}, A^{all}_{j})\in [0,1]\). Here, \(p(A^{all}_{i},A^{all}_{j})\) signifies an increasing function associated with \(A^{all}_{i}\) and \(A^{all}_{j}\). Moreover, it is also hypothesized that the magnitude of short-term loans owed by bank i to bank j is influenced by the total short-term borrowing of bank i and the total short-term lending of bank j. The weights assigned to the existing edges conform to an exponential distribution with the parameter \(\lambda _{ij}=\lambda (L^{s}_{i}, A^{s}_{j})\in (0,+\infty )\). In the formula, that is:

It merits emphasizing that when selecting parameters, it is necessary to ensure that the expected sum of all entries of \(L^{s}\) is equal to the observed sum, i.e., \(\sum _{i=1}^{N}\sum _{j=1}^{N}\mathbb {E}(L^{s}_{ij}|{A_{ij}=1})=\sum _{i=1}^{N}L^{s}_i\). In the later empirical study, we specify \(p(A^{all}_{i},A^{all}_{j})=\frac{\log {(A^{all}_{i}+A^{all}_{j})}}{1+\log {(A^{all}_{i}+A^{all}_{j})}}\) and \(\lambda (L^{s}_{i},A^{s}_{j})=\frac{1}{c(L^{s}_{i}+A^{s}_{j})}\). To satisfy the constraints mentioned earlier, we let

where c is a constant. Compared to Roncoroni et al. (2021), our reconstruction regarding the connected edges of the interbank network and the level of liabilities considers the core–periphery characteristics of the network and information on each bank’s aggregate exposures. Algorithm 1 in Appendix A shows the process of recovering the short-term lending network.

In the following section, we present empirical results derived from the application of the proposed model and interpret these findings within the context of our data.

4 Empirical analysis

4.1 Data from Chinese banking system

This paper uses data from 30 listed Chinese commercial banks from December 2013 to December 2022. The labels and names of the 30 banks are shown in Table 1 in Appendix B. Specifically, the data include the balance sheet of each bank from 2013 to 2022 and the long-term interbank lending network. The total assets, total liabilities, total short-term borrowing, and total short-term lending required for research can be directly obtained from the balance sheet. Figure 1 shows the change in total equity (total assets minus total liabilities) and exposures (total interbank lending) of the 30 banks over the 10 years from 2013 to 2022.

Through Fig. 1, we find that the amount of interbank lending (interbank exposure) is much higher in 2019 than in 2020 (CNY115822.888 billion, compared to CNY4,364.854.6 billion in 2020). The epidemic triggered an economic tentative and thinned out interbank lending activities, resulting in a significant decline in interbank lending exposure in 2020 compared to 2019. The People’s Bank of China has introduced several policies to counteract the negative impact of the epidemic. Regarding the interbank lending dimension, the central bank reduced the interbank lending rate on February 3, 2020, to stimulate interbank lending activities and help banks lend out. Although banks were not able to earn more interest on their interbank lending activities, the above initiative was aimed at reducing their financing costs and thus increasing the resilience of the interbank lending network to risks.

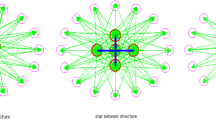

Figures 2 and 3 illustrate the short-term lending network and the total lending network for the years 2013, 2019, and 2022, respectively.Footnote 6 The magnitude of each circle denotes the degree of the bank. To better show the interbank lending network for the above three years, we shrink the 2019 one by a factor of six. Both the short-term lending network and the total lending network show a clear core–periphery structure, which indicates that the introduction of long-term lending data only increases the degree of nodes without destroying the core–periphery structure of the interbank network. The core banks depicted in Figs. 2 and 3 are largely synonymous with SIFIs.Footnote 7 For example, in 2013, both the short-term lending network and the total lending network show that the core banks are labels 22 (ICBC), 27 (BOC), 6 (BOCOM), 26 (ABC), 24 (CMBC), and 20 (CMB). These banks are on the list of SIFIs. An interesting topic is how the insertion of long-term lending networks will affect the stability of interbank lending networks and their risk contagion tolerance. Next, we will stress test the total lending network and the short-term lending network.

4.2 Stress testing

Having reconstructed the short-term loan network, we next conduct a stress test using the equity revaluation in Definition 1, where the valuation function \(\mathbb {V}\) plays a crucial role. Similar to the settings in Veraart (2020) and Chen et al. (2021), we will focus on the impact of different parameters on solvency contagion and default in the short-term and total lending networks. The valuation function is specified as follows:

where \(k\ge 0\) is the capital cushion parameter, \(\beta \in [0,1]\) is the actual exogenous recovery rate, and \(R\in [0,1]\) is the perceived recovery rate. Moreover, \(F(\cdot )\) refers to the cumulative distribution function of the beta distribution with parameters \(a>0\) and \(b>0\). R determines the lower bound of the distress contagion branch, and \(\beta \) determines the upper bound of the default contagion branch. To satisfy monotonicity, we have \(R\ge \beta \). If y denotes the asset value, different levels of asset value in different intervals correspond to different valuation results. When \(y\ge 1+k\), the true value of the total assets equals the nominal value. When \(1\le y<1+k\), the bank is in the distress contagion branch. Although the total nominal assets are greater than nominal liabilities, the mark-to-market value of total assets shrinks. When \(0\le y<1\), the bank is in the default contagion branch, where regular default occurs. When \(y<0\), the total nominal assets are zero.

Figure 4 illustrates the total losses incurred in the stress test from 2013 to 2022. The total loss in each year is equal to the sum of the difference between the pre-shock and revalued equity of all banks in that year. Because this paper focuses on the contagion of risk across the interbank network, we simply set the initial shock in the stress test to a fixed proportion of external assets, i.e., \(\delta _i=kA_{i}^e\), where k takes the same value for all banks. As can be seen in the figure, the total losses are increasing year by year, which is due to the fact that the external shocks we impose are related to the external assets of the bank.

Next, we investigate the influence of the exogenous recovery rate, R, over the years. Figures 5 and 6 show the relative systemic loss and the number of defaulted banks associated with the short-term lending network and the total lending network in 2013, respectively, as well as the differences between the two networks. As the exogenous recovery rate R increases, both the number of defaulted banks and relative systemic loss decrease and increase with the capital cushion parameter k. These results are consistent with economic principles. Larger values of R imply a higher recovery rate of total asset value in the presence of solvency contagion, which correspondingly reduces systemic risk (Figs. 7 and 8). Conversely, a larger k value indicates a lower discount rate for total nominal assets, which inevitably makes systemic risk higher. The results show that the relative systemic losses and the number of defaulted banks after the stress test under the total lending network are higher than those under the short-term lending network when the exogenous recovery rate is not very high.

The impact of exogenous recovery rates on the number of defaulted banks under the short-term and total lending networks in 2013 (\(R=\beta \), \((a,b)=(1,1)\), difference in the number of defaulted banks = number of defaulted banks in the total lending network - number of defaulted banks in the short-term lending network)

The impact of exogenous recovery rates on the number of defaulted banks under the short-term and total lending networks in 2022 (\(R=\beta \), \((a,b)=(1,1)\), difference in the number of defaulted banks = number of defaulted banks in the total lending network - number of defaulted banks in the short-term lending network)

Figure 9a and b depicts the difference in relative systemic loss and the number of defaulted banks in 2013 and 2022, respectively. As seen in Fig. 9, relative systemic loss in 2022 is lower than in 2013, and the number of defaulted banks is less than in 2013. This result indicates that the risk of the banking system in 2022 is lower than in 2013. We have done stress tests for all ten years, which are not shown here due to space constraints. The results illustrate that the resilience of the Chinese interbank network is increasing over time.

The relative systemic loss ratio and differences in the number of defaulted banks between 2013 and 2022 (\(R=\beta \), \((a,b)=(1,1)\), the relative systemic loss ratio = relative systemic loss in 2022 / relative systemic loss in 2013 and difference in the number of defaulted banks = number of defaulted banks in 2022 - number of defaulted banks in 2013)

We further compare the interbank lending networks before and after the outbreak of the pandemic. Figures 10 and 11 illustrate the relative systemic loss and the number of defaulted banks associated with the short-term lending network and the total lending network in 2019, respectively. Similar to the 2022 scenario, the number of defaulting banks continues to increase after the introduction of long-term lending data, although relative systemic losses may decrease.

The impact of exogenous recovery rates on the number of defaulted banks under the short-term and total lending networks in 2019 (\(R=\beta \), \((a,b)=(1,1)\), difference in the number of defaulted banks = number of defaulted banks in the total lending network - number of defaulted banks in the short-term lending network)

The impact of exogenous recovery rates on the number of defaulted banks under the short-term and total lending networks in 2020 (\(R=\beta \), \((a,b)=(1,1)\), difference in the number of defaulted banks = number of defaulted banks in the total lending network - number of defaulted banks in the short-term lending network)

Figure 12c shows that the lower capital cushion parameter results in lower relative systematic losses in the total lending network than in the short-term lending network after the epidemic. When the capital cushion parameter is high, the relative systemic loss has similar values under the two networks. From Fig. 13c, we find that the number of defaulting banks in the total lending network is higher than the number of defaulting banks in the short-term lending network almost everywhere (except around \(R = 0.5\)). From an economic perspective, the total lending network with the long-term lending data is vulnerable relative to the short-term lending network (even if the vulnerability of the two networks is similar under some certain parameters).

The relative systemic loss ratio and differences in the number of defaulted banks between 2019 and 2020 (\(R=\beta \), \((a,b)=(1,1)\), the relative systemic loss ratio = relative systemic loss in 2020 / relative systemic loss in 2019 and difference in the number of defaulted banks = number of defaulted banks in 2020 - number of defaulted banks in 2019)

The difference in relative systemic loss and the number of defaulted banks in 2019 versus 2020 is displayed in Fig. 14. In Fig. 14, the 2020 results are almost lower than the 2019 results in terms of relative systemic losses and the number of defaulted banks (except for some lower capital cushion parameters such as \(k=0.01\) and higher exogenous recovery rates such as \(R=0.9\)). We interpret this as the vulnerability of the total lending network is higher in the post-epidemic than in the pre-epidemic when the market conditions are better, i.e., when the exogenous recovery rate is high and the funding buffer parameter is high, and vice versa. However, for risk aversion reasons, regulators often consider bad scenarios, i.e., low exogenous recovery rates and low capital cushion parameters. However, for risk aversion reasons, regulators often consider bad scenarios, i.e., low exogenous recovery rates and low capital cushion parameters. In this case, our design of the total lending network responds that the vulnerability of the total lending network is lower in the post-epidemic than in the pre-epidemic period.

From an economic perspective, 2019 is on the eve of the outbreak, with the domestic economy in good shape, and China has also announced a series of policies to encourage the development of small- and medium-sized enterprises and promote bank lending to these enterprises, resulting in an unprecedented expansion of the interbank lending market, which has doubled in size compared to 2018. Such rapid scale expansion has significantly increased the risk to the banking system. In the first year after the outbreak, 2020, the global economy was affected and the Chinese interbank lending market shrank sharply, reducing to the level of two years ago, but the country enacted a series of policies to maintain economic stability, so the risk of the interbank system was much lower in 2020 compared to 2019.

In addition to the Chinese interbank lending network, we also present a risk contagion analysis of the US interbank lending network. See Appendix C for specific analysis results.

5 Conclusion

This paper studies the impact of long-term lending data on bank default contagion in the interbank lending network. The introduction of long-term lending data allows the recovered short-term lending data to overlap with long-term lending data to form a total lending network. The distress and default contagion of the total lending network under stress testing are investigated. Specifically, the results are shown below:

We recovered the short-term lending network by a Bayesian approach by using the aggregate short-term lending data of 30 Chinese listed banks. Second, we introduce long lending data to extend the distress and default contagion model in Veraart (2020), which we define as the extended distress and default contagion model. We selected 30 Chinese commercial banks for our research. The results suggest that incorporating long-term data amplifies network vulnerability, indicating that solely considering short-term interbank lending may result in underestimating systemic risk. By comparing the outcomes of stress tests conducted in 2013 and 2020, we discover that the resilience of the Chinese banking system has incrementally improved over time. Furthermore, a comparison of the 2019 and 2020 results indicates that the banking system’s risk decreased post the COVID-19 outbreak, attributing to appropriate control measures. The empirical results also provide some insights for regulators. Regulators should focus on the differences between defaulting banks in the lending network before the introduction of long-term lending data and in the total lending network after the introduction of long-term lending data, and monitor those banks with these differences so that they can intervene in a timely manner to assist in the event of a crisis.

This paper has some limitations and future research directions. One of the limitations is that we use aggregate interbank lending risk exposure information in recovering the interbank short-term lending network without focusing on the impact of long-term lending data on short-term lending data. The approach of recovering networks based on partial information in Pang and Veraart (2023) can be used to improve future research. Another limitation is that we compress the maturity of long-term lending and short-term lending into a unified time point for clearing, which is in line with the assumptions of a part of the existing literature but still a bit far from reality. We can dynamize the liquidation process by compressing the maturity of short-term lending to a single time point while compressing the maturity of long-term lending to a later time point. In this way, our liquidation process is more in line with realistic scenarios. Specifically, we can follow the method of Banerjee et al. (2018) for subsequent research.

Notes

See https://politics.gmw.cn/2022-10/12/content_36080810.htm for more details.

See https://www.fsb.org/publications/g20-reports/ for more details.

See https://www.qyyjt.cn/ for more details.

\(A^{s}_{i}=\sum _{j=1}^{N}L^{s}_{ji}\) denotes the total short-term lending of bank i, and \(L^{s}_{i}=\sum _{j=1}^{N}L^{s}_{ij}\) represents the total short-term borrowing of bank i. They can be directly observed on the balance sheet of bank i.

A value of \(A_{ij}=0\) does not exclude the existence of edges between bank i and bank j. It merely indicates the absence of short-term lending but does not negate potential long-term lending relationships.

The total liabilities of bank i to bank j are the summation of the short-term liabilities \(L^{s}_{ij}\) and the long-term liabilities \(L^{l}_{ij}\).

For additional information, refer to http://www.gov.cn/xinwen/2022-09/10/content_5709293.htm.

See https://www.fdic.gov/about/ for more details.

References

Amini H (2023) Contagion risks and security investment in directed networks. Math Financ Econ 17(2):247–283

Amini H, Cont R, Minca A (2016) Resilience to contagion in financial networks. Math Financ 26(2):329–365

Anderson RW (2016) Stress testing and macroprudential regulation: a transatlantic assessment. Stress Testing and Macroprudential Regulation, p 1

Banerjee T, Bernstein A, Feinstein Z (2018) Dynamic clearing and contagion in financial networks. arXiv preprint arXiv:1801.02091

Bardoscia M, Barucca P, Brinley Codd A, Hill J (2017). The decline of solvency contagion risk. https://doi.org/10.2139/ssrn.2996689

Bardoscia M, Caccioli F, Perotti JI, Vivaldo G, Caldarelli G (2016) Distress propagation in complex networks: the case of non-linear debtrank. PLoS ONE 11(10):e0163825

Barucca P, Bardoscia M, Caccioli F, D’Errico M, Visentin G, Caldarelli G, Battiston S (2020) Network valuation in financial systems. Math Financ 30(4):1181–1204

Battiston S, Puliga M, Kaushik R, Tasca P, Caldarelli G (2012) Debtrank: too central to fail? financial networks, the fed and systemic risk. Sci Rep 2(1):1–6

Cetina J, Lelyveld I, Anand K (2015) Making supervisory stress tests more macroprudential: considering liquidity and solvency interactions and systemic risk. Technical report, BCBS Working Paper

Chen Y, Jin S, Wang X (2021) Solvency contagion risk in the chinese commercial banks’ network. Physica A 580:126128

Cifuentes R, Ferrucci G, Shin HS (2005) Liquidity risk and contagion. J Eur Econ Assoc 3(2–3):556–566

Cimini G, Squartini T, Garlaschelli D, Gabrielli A (2015) Systemic risk analysis on reconstructed economic and financial networks. Sci Rep 5(1):1–12

Diem C, Pichler A, Thurner S (2020) What is the minimal systemic risk in financial exposure networks? J Econ Dyn Control 116:103900

Eisenberg L, Noe TH (2001) Systemic risk in financial systems. Manage Sci 47(2):236–249

Elliott M, Golub B, Jackson MO (2014) Financial networks and contagion. Am Econ Rev 104(10):3115–3153

Erdős P, Rényi A et al (1960) On the evolution of random graphs. Publ Math Inst Hung Acad Sci 5(1):17–60

Feinstein Z (2017) Financial contagion and asset liquidation strategies. Oper Res Lett 45(2):109–114

Furfine CH (2003) Interbank exposures: quantifying the risk of contagion. J Money, Credit Bank 35:111–128

Gandy A, Veraart LA (2017) A Bayesian methodology for systemic risk assessment in financial networks. Manage Sci 63(12):4428–4446

Ghamami S, Glasserman P, Young HP (2022) Collateralized networks. Manage Sci 68(3):2202–2225

Hasse J-B (2022) Systemic risk: a network approach. Emp Econ 63(1):313–344

Li Z, Ma K (2022) Contagious bank runs and committed liquidity support. Manage Sci 68(12):9152–9174

Pang RK-K, Veraart LAM (2023) Assessing and mitigating fire sales risk under partial information. J Bank Finance 155:106989

Rogers LC, Veraart LA (2013) Failure and rescue in an interbank network. Manage Sci 59(4):882–898

Roncoroni A, Battiston S, D’Errico M, Hałaj G, Kok C (2021) Interconnected banks and systemically important exposures. J Econ Dyn Control 133:104266

Silva TC, da Silva Alexandre M, Tabak BM (2018) Bank lending and systemic risk: a financial-real sector network approach with feedback. J Financ Stab 38:98–118

Tafakori L, Pourkhanali A, Rastelli R (2022) Measuring systemic risk and contagion in the European financial network. Emp Econ 63(1):345–389

Upper C, Worms A (2004) Estimating bilateral exposures in the German interbank market: is there a danger of contagion? Eur Econ Rev 48(4):827–849

Veraart LAM (2020) Distress and default contagion in financial networks. Math Financ 30(3):705–737

Acknowledgements

We are grateful to the editor and the anonymous referees for their helpful comments and suggestions.

Funding

This work was supported by the National Social Science Fund of China (No. 22BTJ027).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Appendix B

Appendix C

In addition to using Chinese interbank data, this paper also analyzes the US interbank data. We collected asset and liability data for 20 US commercial banks from the Federal Deposit Insurance Corporation (FDIC) (FDIC) for the period from 2013 to 2022.Footnote 8 Figure 2 shows the names and labels of 20 US commercial banks.

Figure 15 illustrates the change in total equity and total exposures for 20 US banks from 2013 to 2022. In contrast to Fig. 1, 15 shows that total US interbank exposures are higher than total equity and that total equity in the US banking system shows a clear downward trend in 2019. These differences suggest that the US banking system data have implications for policymakers analyzing systemic risk contagion.

Figures 16 and 17 show that both the short-term lending network and the total lending network show a core–periphery structure for the US interbank lending network. Figures 18 and 19 show how relative system losses and the number of banks in default vary with the exogenous recovery rate R in the stress test for the short-term and total lending networks in the US in 2013, respectively, as well as the differences between the two networks. As the exogenous recovery rate R increases, both the number of defaulted banks and the relative systemic loss decrease with an increase in the exogenous recovery rate R and increase with an increase in the capital cushion parameter k. Compared with the stress test results of the short-term lending network and the total lending network, we find that when the exogenous recovery rate is not very high, the relative systemic loss and the number of bankrupt banks under the total lending network are similar to that of the short-term lending network, and only after \(R>0.7\) do the two show a difference. When \(0.7<R<0.85\), both relative systemic losses and the number of bankrupt banks under the total lending network are higher than those under the short-term lending network, and the opposite is true when \(0.85<R<1\).

The impact of exogenous recovery rates on relative systemic loss under the short-term and total lending networks of the USA in 2013 (\(R=\beta \), \((a,b)=(1,1)\), the relative systemic loss ratio = relative systemic loss of the total lending network / relative systemic loss of the short-term lending network)

The impact of exogenous recovery rates on the number of defaulted banks under the short-term and total lending networks of the USA in 2013 (\(R=\beta \), \((a,b)=(1,1)\), difference in the number of defaulted banks = number of defaulted banks in the total lending network - number of defaulted banks in the short-term lending network)

Figures 20 and 21 show the relative systemic losses and the number of defaulted banks associated with the short-term and total lending networks, respectively, for the USA in 2022. While relative systemic losses are largely lower for the total lending network than for the short-term lending network, the number of defaulted banks is higher for the total lending network than for the short-term lending network when the exogenous recovery rate is higher. From the comparison of the stress test results in 2013 and 2022, we draw similar conclusions to those of the Chinese banking system, i.e., considering only the short-term lending network underestimates the risk of the banking system, and the integration of the long-term lending data can better reveal the resilience of the interbank liability network.

The impact of exogenous recovery rates on relative systemic loss under the short-term and total lending networks of USA in 2022 (\(R=\beta \), \((a,b)=(1,1)\), the relative systemic loss ratio = relative systemic loss of the total lending network / relative systemic loss of the short-term lending network)

The impact of exogenous recovery rates on the number of defaulted banks under the short-term and total lending networks of USA in 2022 (\(R=\beta \), \((a,b)=(1,1)\), difference in the number of defaulted banks = number of defaulted banks in the total lending network - number of defaulted banks in the short-term lending network)

The relative systemic loss ratio and differences in the number of defaulted banks in the USA between 2013 and 2022 (\(R=\beta \), \((a,b)=(1,1)\), the relative systemic loss ratio = relative systemic loss in 2022 / relative systemic loss in 2013 and difference in the number of defaulted banks = number of defaulted banks in 2022 - number of defaulted banks in 2013)

Figure 22a and b describes the difference in relative systemic loss ratios and the number of defaulted banks in the US banking system in 2013 and 2022, respectively. Here, we use the total interbank lending network for stress testing. The results show that for the same shocks, the relative systemic loss in 2022 is higher than that in 2013 and the number of defaulted banks is also higher than that in 2013, contrary to the results of the stress test of the Chinese banking system. This result suggests that the US banking system will be less resilient in 2022 than it was in 2013.

The impact of exogenous recovery rates on relative systemic loss under the short-term and total lending networks of USA in 2019 (\(R=\beta \), \((a,b)=(1,1)\), the relative systemic loss ratio = relative systemic loss of the total lending network / relative systemic loss of the short-term lending network)

The impact of exogenous recovery rates on the number of defaulted banks under the short-term and total lending networks of USA in 2019 (\(R=\beta \), \((a,b)=(1,1)\), difference in the number of defaulted banks = number of defaulted banks in the total lending network - number of defaulted banks in the short-term lending network)

We further compare the results of stress tests of the US interbank lending network before and after the pandemic outbreak. Figures 23 and 24 show the relative systemic losses and the number of defaulted banks in 2019 for the short-term and total lending networks, respectively, after the shock.

The impact of exogenous recovery rates on relative systemic loss under the short-term and total lending networks of USA in 2020 (\(R=\beta \), \((a,b)=(1,1)\), the relative systemic loss ratio = relative systemic loss of the total lending network / relative systemic loss of the short-term lending network)

The impact of exogenous recovery rates on the number of defaulted banks under the short-term and total lending networks of USA in 2020 (\(R=\beta \), \((a,b)=(1,1)\), difference in the number of defaulted banks = number of defaulted banks in the total lending network - number of defaulted banks in the short-term lending network)

Figures 25 and 26 show the relative systemic losses and the number of defaulted banks in the short-term and total lending networks of the US banking system in 2020 after the shock, respectively. Figure 25c shows that the relative systemic loss of the total lending network is lower than that of the short-term lending network when the exogenous recovery rate \(R>0.8\) after the pandemic. Figure 25c shows that the relative systemic loss of the total lending network is lower than that of the short-term lending network when the exogenous recovery rate \(R>0.8\) after the pandemic. Figure 26c shows that the number of defaulted banks in the two networks differs only when the exogenous recovery rate R takes on larger values. When the exogenous recovery rate \(0.8<R<0.9\), the total lending network has a higher number of defaulted banks than the short-term lending network, and when \(0.9<R<1\), the total lending network has a lower number of defaulted banks than the short-term lending network. Combining the results of the short-term and total lending network stress tests for these four years, examining the total lending network, which contains long-term lending data, can help us get a better handle on the risk resilience of the US banking system.

The relative systemic loss ratio and differences in the number of defaulted banks in the USA between 2019 and 2020 (\(R=\beta \), \((a,b)=(1,1)\), the relative systemic loss ratio = relative systemic loss in 2020 / relative systemic loss in 2019 and difference in the number of defaulted banks = number of defaulted banks in 2020 - number of defaulted banks in 2019)

Figure 27 shows the difference between the ratio of relative systemic losses and the number of defaulted banks in the US banking system in 2019 versus 2020. Here, we use the total interbank lending network for stress testing. The results suggest that the potential risk to the US banking system in 2019 on the eve of the pandemic outbreak is higher than in the aftermath of the outbreak. Notably, the US banking system still has a higher risk of bank failures in 2020 when the economic environment is not favorable enough (i.e., when the exogenous recovery ratio perceived satisfies \(0.8<R<0.9\)).

Integrating the analysis of the stress test results of the Chinese banking system before and after the epidemic, we find that before the epidemic, the banking systems of both countries have a high potential risk. However, when the pandemic occurred, the potential risk of the banking system in both countries was instead reduced due to the intervention of governmental departments.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jin, S., Song, L., Shu, L. et al. Systemic risk in Chinese interbank lending networks: insights from short-term and long-term lending data. Empir Econ (2024). https://doi.org/10.1007/s00181-024-02617-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s00181-024-02617-9