Abstract

This study examines the monetary policy effectiveness of five major Asian countries (China, Hong Kong, India, Japan, and South Korea) using a quantile vector autoregression (QVAR) model-based spillover estimation approach of Balcilar et al. (2020b) at different quantile paths. To do this, we first obtain the spillover index from interest rate to industrial production and consumer price index under the high and low levels of uncertainty. The full sample results from our analysis provide partial supporting evidence for the economic theory, which asserts that monetary policy efficiency must fall during periods of high economic uncertainty. Furthermore, this approach also allows us to uncover the asymmetric effects of economic policy uncertainty and lending rate on macroeconomic indicators. The impacts of interest rate and domestic and foreign (US, EU) uncertainty shocks on major Asian markets present significant asymmetric characteristics. Moreover, our time-varying results suggest that monetary policy shocks are more effective and potent on Asian economies during very low and very high uncertain times than normal economic periods.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The theoretical literature establishes a connection between monetary policy effectiveness and uncertainty through two important mechanisms:the nonlinearities in the interest rate and the credit transmission channel. The nonlinearities theory argues that the monetary policy efficiency decreases during high uncertainty states due to real options effects, precautionary savings, and uncertainty-dependent price-setting mechanisms (Vavra 2013; Bloom 2014). Another reason why monetary policy effectiveness deteriorates future expectations is that companies adopt a wait-and-see attitude and postpone their investment choices to minimize the expense of irreversible investments, according to real options theory (see, e.g., Bloom 2009, 2014). The precautionary savings theory, on the other hand, claims that investors prefer precautionary saving and shift their expenditures to the future owing to present uncertainty circumstances (see, e.g., Bloom 2014). And last, the uncertainty-dependent price-setting mechanism attributes the decrease in the effectiveness of monetary policy to the continuous price adjustment of firms due to uncertainty (Vavra 2013). Thus, economic agents are less responsive to policy shocks in these situations where uncertainty and unpredictability prevail. Hence, this makes central banks more aggressive in reaching their monetary policy goals such as price stability, maximum employment, and currency stability.

The evidence from various empirical studies confirms this view (see, among others, Bernanke 1983; Dixit et al. 1994; Bloom 2009; Aesveit et al. 2017; Balcilar et al. 2017; Castelnuovo and Pellegrino 2018; Pellegrino 2018; Lien et al. 2019; Cekin et al. 2020). For instance, Aastveit et al. (2017) investigate the macroeconomic influence of monetary policy changes during different uncertainty states in the USA by utilizing the interacted VAR methodology. Later, they extend their analysis to include Canada, the UK, and Norway economies by adding the US uncertainty measure as the interacted variable. Their empirical findings provide evidence that the impact of monetary policy on an economy weakens significantly during periods of increased uncertainty, particularly for Canada and the USA. Furthermore, Balcilar et al. (2017) examine the role of the US economic policy uncertainty on the effectiveness of monetary policy in the Euro area and find evidence in favor of the policy ineffectiveness hypothesis contingent on the economic policy uncertainty of the USA. Moreover, Gupta and Jooste (2018) investigate the unconventional monetary policy effectiveness in eight OECD countries (Canada, Germany, France, Italy, Japan, Spain, UK, and USA) that implemented unconventional monetary policy in the wake of the 2007 subprime mortgage crisis due to zero-bound rate problem. They reach the same conclusion as previous studies.

The credit transmission channel theory, unlike nonlinearities in the interest rate, argues that monetary policy shocks are more effective and potent on economies during financial crises since firms suffer from liquidity constraints due to the rise of external finance premiums (see, among others, Morgan 1993; Bernanke et al. 1999; He and Krishnamurthy 2013; Brunnermeier and Sannikov 2014). Many studies in the literature provide differing empirical evidence for this theory. For instance, Balke (2000) and Li and St-Amant (2010) find that monetary shocks have a larger impact on output in times of tight credit, or high financial stress, than in normal times, and that contractionary monetary shocks have a larger impact than expansionary monetary shocks by using a threshold vector autoregression (TVAR) model. Using Markov switching models, Garcia and Schaller (2002) and Lo and Piger (2005) conclude that monetary policy has greater effects during recessions than during expansions. More recently, Fry-Mckibbin and Zheng (2016) examine the impact of monetary policy during periods of low and high financial stress in the US economy by utilizing the TVAR model. They find evidence indicating that expansionary monetary policy has a higher proportionate effect on output during periods of high financial stress than normal times. Furthermore, Jannsen et al. (2019) show that monetary policy has significantly larger effect on output and inflation and other macroeconomic indicators such as credit, asset prices, uncertainty, and consumer confidence during financial crises for twenty advanced economies. Similar conclusions are also reached by Burgard et al. (2019), who show that monetary policy can be a powerful tool for economic stimulus during crisis times in the euro area. However, these expansionary monetary policy impacts are observed to be short-lived.

The empirical methodology used in most of the above studiesFootnote 1 is a constant coefficient mean-based multivariate vector autoregressive model, which models interactions on the mean of the relevant conditional distribution and ignores interactions on other parts. The constant-coefficient linear VAR model focuses on the forecast of analyzed variables conditioned on the mean distribution, constraining it exclusively to a specific location of the conditional distribution, and ignores succession of small and varied shocks, which might have a crucial impact on the structure of the economic model. Furthermore, these mean-based multivariate models underestimate the contagion from larger economic shocks during recession and expansion times. On the other hand, Barunik et al. (2016) developed a new approach to capture the asymmetric volatility spillovers among seven US sub-sector stock market indices. They calculate bad and good volatility spillovers considering the return direction (negative and positive returns) in the analysis period. Although the method they have developed is attractive in detecting asymmetry, estimation of volatility spillovers in good and bad economic conditions is also based on a mean-based multivariate vector autoregressive model. This consequence implies that the mean-based models need to be altered to capture the effect of larger shocks at the tails of the distribution. The quantile vector autoregression (QVAR) model extends the linear VAR approach and can model richer effects than mean-based models. The QVAR model does not restrict itself to the conditional mean. Therefore, it permits to draw of the state-dependent shocks at different locations, thus offering a global view on the relationships between variables (Montes-Rojas 2017). Hence, this study brings a new perspective to the literature that deals with how real economic indicators react to interest rate changes at high and low uncertainty levels.

Using both foreign (US and EU) and domestic economic policy uncertainty, we utilize the quantile spillover estimation approach of Balcilar et al. (2020b) to examine how monetary policy effectiveness for these five major Asian economies (China, Hong Kong, India, Japan, and South Korea) changes conditional on different economic policy uncertainty levels. The QVAR model allows investigating potential dynamic heterogeneity not covered by the impulse response function of mean-based VARs. This approach also allows us to construct different fictitious cases (quantile paths) by analyzing the multivariate quantile indices. Expressing differently, we estimate the spillover indices from interest rate to macroeconomic variables (industrial production and consumer price inflation) in two different extreme economic cases in addition to the median response. The first case represents the economic environment where the central bank dramatically cuts its policy rate in a recession with high economic policy uncertainty, while the second case represents the economic situation where the central bank raises interest rates in an expansion to combat inflation and moves to prevent the economy from overheating during low uncertainty times. In so doing, we attempt to detect asymmetries between these two cases and explore the possible changes in monetary policy efficiency of Asian economies during extreme low/high economic policy uncertainty times by comparing them with the median response.

To analyze the response of macroeconomic variables to monetary policy shocks from the QVAR model, we utilize the Diebold and Yilmaz spillover index (hereafter the DY index due to Diebold and Yilmaz 2009, 2012). The literature using the DY index in the fields of finance and macroeconomics is very large. It has found applications in many contexts such as equity markets (Diebold and Yilmaz 2009; Baruník et al. 2016), foreign exchange markets (Baruník et al.2017; Baruník and Kocenda 2019), sovereign and corporate credit spreads (Greenwood-Nimmo et al. 2019), asset markets, and international spillovers (Balcilar et al. 2019; Balcilar et al. 2020a, b). It provides a dynamic interaction among multivariate time series by structural inference, whereas constant coefficients characterize the conventional linear VAR model. For spillover dynamics, several authors draw attention to the asymmetric spillover dynamics of macroeconomic shocks (see, e.g., Neftci 1984; Granger 2003; Engle and Manganelli 2004; Balcilar et al. 2020b). This feature was pointed out by Fisher (1933) and Keynes (1936) as early as in the 1930s.

This study contributes to the existing literature mainly in these aspects. Firstly, this study is the first attempt to discuss monetary policy effectiveness in different economic policy uncertainty states by the quantile spillover estimation approach of Balcilar et al. (2020b).Footnote 2 In so doing, we have the opportunity to compare the spillover effect from monetary policy changes with two different extreme scenarios where economic uncertainty is either high or low. Thus, we provide strong evidence whether these countries need to implement more aggressive monetary policy in environments where uncertainty is higher than the normal times. Secondly, our approach allows us to examine heterogeneous responses depending on the state of the economy and to uncover the asymmetric effects. The determination of the existence of the asymmetric effect is important to reveal whether the shocks have a permanent or transitory effect in economies that are in transition from low to high uncertainty state. Our third contribution to literature is that we use a large set of variables that have not been used before. These variables include consumer price index (CPI), prime lending rate (LR), industrial production index (IP), Brent crude oil price (BRENT) in the local currency, domestic news based economic policy uncertainty (EPU), the US EPU, and the European Union EPU. Moreover, the monthly frequency data covers 1992M4–2021M9 for China; 1998M4-2021M5 for Hong Kong; 2003M1–2021M8 for India; 1987M1–2021M8 for Japan; 1990M1–2021M1 for South Korea.

Our main findings are multifold. First, these five Asian economies respond differently to monetary policy shocks in good and bad times, which can be seen as evidence of an asymmetrical effect. The asymmetric spillover indices from economic policy uncertainties and interest rates to industrial production and consumer price index have different magnitudes across countries, and these asymmetric effects are sometimes stronger during low uncertainty periods and sometimes during high uncertainty periods. Second, based on the full sample results, we provide partial evidence to support the economic theory claiming that monetary policy is less effective when economic uncertainty is high. We find that responses of output and inflation to monetary policy shocks vary across the high and low uncertainty times, and weaker responses may occur during high uncertainty times. However, the time-varying analysis gives us a clearer picture regarding the view that the effectiveness of monetary policy declines in an environment of high uncertainty. That said, episodes of monetary policies of Asian central banks are more effective when they take serious monetary policy action even during the high and low uncertainty states. Hence, we can say that our empirical findings are in line with previous studies that support credit transmission channel theory. Lastly, the median spillover effects from interest rates to macroeconomic indicators are almost always lower than those spillovers obtained in the high and low uncertainty states. Hence, this study provides invaluable information for policymakers by unveiling the relationships between interest rates and other macroeconomic variables for major Asian countries.

The rest of the paper is organized as follows. Section 2 details the methodology. Section 3 describes the data and reports the empirical results. The last section concludes the paper.

2 Methodology

This study utilizes the DY spillover index approach of Balcilar et al. (2020b), which is based on the forecast error variance decomposition (FEVD) of a quantile vector autoregression. The QVAR-based DY index depends on the multivariate quantile estimation of Montes-Rojas (2017, 2019). Following Balcilar et al. (2020b), we can shortly describe the procedure starting with the reduced form QVAR model at the quantile \(\theta\) as follows:

where \(Q\) is an \(n \times 1\) vector, which corresponds to the multivariate quantiles of the \(n\) random variables, \(A_{\theta } = \left( {A_{\theta ,1}^{^{\prime}} ,A_{\theta ,2}^{^{\prime}} , \ldots ,A_{\theta ,n}^{^{\prime}} } \right)^{\prime}\) is an \(n \times k\) matrix of coefficients with \(A_{\theta ,i}\), for each \(i \in 1,2, \ldots ,n\), representing \(1 \times k\) vector of coefficients for the \(j\) th element of \(Y_{t}\), and \(C_{\theta }\) is an \(n \times 1\) vector of coefficients. In this study, we utilize a multivariate directional quantile approach, which estimates the conditional quantile of variable \(i\), as proposed by Montes-Rojas (2017), based on the covariates and quantiles of all other variables.Footnote 3

To obtain the DY spillover index, we first calculate the generalized impulse response functions (GIRF) and then obtain FEVDs from these IRFs. To get the FEVDs, we use the counterfactual change approach of Montes-Rojas (2019). Let us define the lag polynomial \(A\left( {\theta ,L} \right) = \mathop \sum_{j = 1}^{p} A_{\theta , \cdot j} L^{j}\) in the lag operator \(L\), where the \(h\)-lag coefficient vector \(A_{\theta , \cdot h} = \left( {A_{\theta ,1,h} ,A_{\theta ,2,h} , \ldots ,A_{\theta ,n,h} } \right)\) is \(1 \times n\) and defined on all endogenous variables in \(Y_{t}\), for \(j = 1,2, \ldots ,p\). The QVAR model in Eq. (1) can be written as

where \(A_{\theta } X_{t} = A\left( {\theta ,L} \right)Y_{t} = \mathop \sum_{j = 1}^{p} A_{\theta , \cdot j} Y_{t - j}\).

Then, we obtain \(h\)-step forecast of \(Y_{t}\), each step associated with a \(n \times 1\) quantile vector \(\theta_{j}\), which is related to quantile forecast path \(\theta_{1 \cdots h} = \left\{ {\theta_{1} ,\theta_{2} , \ldots ,\theta_{h} } \right\}\). Accordingly, the \(h\)-step quantile forecast is given by

where \(Q_{{\theta_{1 \cdots k} }} \left( {Y_{t + k} {|}X_{t} } \right) = Y_{t - k}\) if \(L^{k} \left( {t + h} \right) \le t\) and \(Q_{{\theta_{1 \cdots k} }} = \left\{ {\theta_{1} ,\theta_{2} , \ldots ,\theta_{k} } \right\}\) is the \(k\)-step quantile path for \(k = 1,2, \ldots ,h - 1\). From the definition in Eq. (2), the \(h\)-step forecast can be written as

Using Eq. (3), we can calculate the counterfactual change, \(\delta = \left( {\delta_{1} ,\delta_{2} , \ldots ,\delta_{n} } \right)^{^{\prime}}\), and forecast \(Q_{{\theta_{1 \cdots h} }} \left( {Y_{t + h} + \delta {|}X_{t} } \right)\) for \(\delta \in {\mathcal{Y}} \subseteq {\mathbb{R}}^{m}\) in a similar way. Hence, we can extend the GIRF of Koop et al. (1996), Pesaran and Shin (1998), Lanne and Nyberg (2016) to quantile generalized impulse response function (QIRF) by utilizing the \(h\)-step ahead forecast \(Q_{{\theta_{1 \cdots h} }} \left( {Y_{t + h} {|}X_{t} } \right)\) and the \(h\)-step ahead change forecast \(Q_{{\theta_{1 \cdots h} }} \left( {Y_{t + h} + \delta {|}X_{t} } \right)\) for a given quantile path \(\left\{ {\theta_{1} ,\theta_{2} , \ldots ,\theta_{h} } \right\}\) and shock \(\delta\) as follows:

The quantile-specific FEVD can be defined as:

where \(\lambda_{\theta ,ij} \left( h \right)\) denotes the \(h\)-step-ahead generalized FEVD, while \(i\) and \(j\) represent variable and shock, respectively. Hence, the sum over all shocks in each variable equal to one, i.e., \(\sum_{j = 1}^{n} \lambda_{\theta ,ij} \left( h \right) = 1\), and total decomposition of all series sum to \(n\), i.e., \(\sum_{i,j = 1}^{n} \lambda_{\theta ,ij} \left( h \right) = n\) by construction. Using the quantile variance decomposition in Eq. (5), we can obtain various valuable indices at different quantiles. For example, the total spillover index, which calculates the contribution of spillovers of shocks across the variables under consideration to the total forecast error variance for quantile \(\theta\), can be obtained as follows:

where \(S_{\theta }^{T} \left( h \right)\) represents the total spillover index. Furthermore, one may also obtain the directional spillover received by variable \(i\) from all other variables \(j\) to understand the relationship between related variables. This can be computed as follows:

Similarly, we get the directional spillovers transmitted by variable \(i\) to all other variables j as:

Finally, subtracting the results obtained in Eq. (7) from the results in Eq. (8), the net spillover for variable \(i\) is at quantile \(\theta\) is computed as:

3 Data and empirical results

In this study, we use monthly data of Brent crude oil price (BRENT) in the local currency, consumer price index (CPI), industrial production index (IP), prime lending rate (LR), and news-based economic policy uncertainty (EPU) for five big Asian countries, i.e., China, Japan, Hong Kong, India, and South Korea. Besides representing international economic policy uncertainty, we obtain the US and European Union EPU indices for the primary goal of the study. We use year-on-year growth rates for CPI, IP, and BRENT, natural logarithm transformation for all EPU series, and LR is in annual percentage. Furthermore, we seasonally adjust the CPI and IP series to remove their seasonal dynamics. The BRENT, CPI, IP, and LR data are derived from Thomson Reuters DataStream, while the EPU indices are obtained from www.policyuncertainty.com. The observation periods across countries vary due to data availability. In order to use longest span available, we do not use the same time span for each country. We collect monthly observations from April 1992 to September 2021 for China, from April 1998 to May 2021 for Hong Kong, from January 2003 to August 2021 for India, from January 1987 to August 2021 for Japan, and from January 1990 to January 2021 for South Korea.

Figure 6 exhibits the time series plots of all series for the corresponding countries over the study period. As shown in this plot, the year-on-year growth of CPI and IP fluctuates over the analysis period. Nonetheless, we see a mild upward trend in Hong Kong, while this is reflected in the South Korean inflation series as a downward trend. The inflation rate in India starts to fall after a steady increase from the beginning of the observation period to 2010. In general, we can say that policy rates are decreasing in all countries over time. The policy interest rate, which tended to increase in almost all countries before the 2007 subprime mortgage crisis, was rapidly reduced to cope with the economic contraction. Generally speaking, we notice that important economic events result in a sudden change in macroeconomic indicators, as mentioned by Bloom (2009) and Baker et al. (2016). They provide evidence that economic shocks tend to increase uncertainty in the economy, which in turn produces a rapid drop, rebound, and overshoot in macroeconomic indicators such as stock price, investment, unemployment rate, aggregate output, and productivity growth. On the other hand, it is crucial to state that the economic policy uncertainty indices for all Asian countries, except India, have a slightly increasing trend. Finally, we can deduce that the corresponding Asian central banks have to conduct monetary policy in a more uncertain global environment, as evident in Figure 6, after the 2007 subprime mortgage crisis.

Table 2 reports descriptive statistics of the series used in this study. According to Table 2, Asian countries’ year-on-year inflation rate is positive on average, except China, where negative growth rates are observed. The year-on-year growth of industrial production takes negative values just in China and Hong Kong. Moreover, the annual interest rates for all countries have a general declining tendency, particularly after the subprime crises. It should also be emphasized that, on average, the country with the highest interest rate is India, followed by South Korea. The most volatile variable is the crude oil price, among other indicators, as shown by the standard deviation. Interestingly, the average mean of the economic policy uncertainty index in China is highest among other economies, including the USA and EU, with considerable volatility. As for the oil price year-on-year growth, we observe a positive mean value with somewhat a high standard deviation. Furthermore, none of the series are normally distributed as revealed by skewness, kurtosis, and Jarque–Bera test statistics. For the autocorrelation, the Ljung–Box test statistics of first [Q(1)] and the fourth [Q(4)] autocorrelation tests are reported in Table 2. These test statistics fail to support the null hypothesis of the white noise process (i.e., i.i.d. process) for all series. Last, we examine the autoregressive conditional heteroskedasticity (ARCH) of all series employing the first [ARCH(1)]- and the fourth [ARCH(4)]-order Lagrange multiplier (LM) test and the null hypothesis of no ARCH effects is strongly rejected for all series.

We carry out four kinds of unit root test statistics, namely the augmented Dickey–Fuller (ADF) test (Dickey and Fuller 1979), Elliott–Rothenberg–Stock (ERS) test (Elliott et al. 1996), the Phillips–Perron (PP) test (Phillips and Perron 1988), and the KPSS stationarity test proposed by (Kwiatkowski et al. 1992). Table 3 reports the unit root tests performed on logarithms of CPI series, logarithms of IP series, logarithms of all EPU series, and LR series. As shown in Table 3, the unit root tests imply somewhat conflicting results. Based on the results in Table 3, we use the year-on-year growth rates of CPI, IP and BRENT series, log levels of EPU series, and levels the LR series in the estimation.

3.1 Full sample analysis

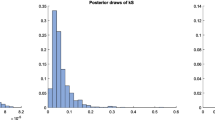

We estimate a seven-variable QVAR model for each Asian economy under different (high and low) economic policy uncertainty conditions. For the high and low EPU states, we use two different quantile vector paths as follows.

Case 1 (High EPU with recession): \(\theta_{{{\text{USEPU}}}} = \theta_{{{\text{EUEPU}}}} = \theta_{{{\text{EPU}}}} = 0.95,\theta_{{{\text{BRENT}}}} = 0.50,\theta_{{{\text{IP}}}} = \theta_{{{\text{CPI}}}} = \theta_{{{\text{LR}}}} = 0.05\).

Case 2 (Low EPU with expansion): \(\theta_{{{\text{USEPU}}}} = \theta_{{{\text{EUEPU}}}} = \theta_{{{\text{EPU}}}} = 0.05,\theta_{{{\text{BRENT}}}} = 0.50,\theta_{{{\text{IP}}}} = \theta_{{{\text{CPI}}}} = \theta_{{{\text{LR}}}} = 0.95\).

Case 1 reflects periods of high economic uncertainty (bad times). We assume that the central bank dramatically cuts its policy rate for achieving both inflation and growth objectives in these bad times. The internal and external economic policy uncertainty indices at 0.95 quantiles correspond to a high uncertainty environment. In contrast, the industrial production and consumer price index at 0.05 quantiles reflect a rapid decline in industrial production and demand. Case 2 is the opposite of Case 1. It represents periods of low economic uncertainty (good times). In times of low uncertainty, we assume that the central bank raises its policy rate to keep inflation low and prevent the economy from overheating. In these two cases, we prefer to keep the median quantiles for the oil market since we are not interested in examining spillover dynamics in Asian markets during different oil market states.Footnote 4

Using the two cases above, we calculate the quantile spillovers from US EPU, EU EPU, country-specific EPU, Brent oil price, and lending rate to industrial production and consumer prices during an economic boom and bust phase. It is assumed that uncertainty is low in economic boom periods and high in economic bust periods. We determine the lag order p of the QVAR models using the Akaike Criteria (AIC) in a mean-based VAR model. The lag order is determined as one for China and India, while it is selected as two for other countries. We order variables as US EPU, EU EPU, BRENT, EPU, IP, CPI, and LR. The order of the variables is chosen for the identification concerns using the Cholesky decomposition. In particular, first the external variables US EPU, EU EPU, and BRENT are placed in the given order, followed by the country specific variable from slow-moving to fast-moving (see, Kilian and Lütkepohl 2017). The QRIF step is 12 for all countries, i.e., \(h = 12\).

Table 1 reports spillover indices during the high and low economic uncertainty states. Besides, the right panel of Table 1 shows the asymmetric effect, which is obtained by subtracting low quantile spillover indices from high quantile spillover indices. As we can see from the table, considerable differences are observed between the high and low economic policy uncertainty quantile paths in some Asian economies. The full sample empirical findings also provide insights into the monetary policy effectiveness in these Asian economies, given the spillover effects from lending rate to industrial production and inflation outlook during good and bad times. We can postulate that monetary policy effectiveness should decrease with the increasing uncertainty in economic policy. One explanation for this is that the economic units such as households, firms, and investors do not react to the central bank’s expansionary monetary policy as in normal times. During very uncertain times, households prefer to save rather than consume, and firms may postpone their new investment decisions until confidence returns. Therefore, the asymmetric spillover effects from interest rate to industrial production and inflation, shown on the right panel of Table 1, should take a negative value. Nonetheless, not all findings support this assumption. The Indian and Japanese real economic activity and prices receive higher spillover effects from interest rates during bad times than good times. Although we have strong evidence to support the monetary policy effectiveness postulate, we cannot say that this argument receives full support in the other three Asian countries.

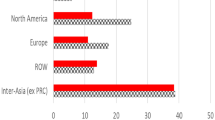

In addition to empirical findings regarding monetary policy effectiveness, the full sample results also give important information on the quantile asymmetric spillover effect from other variables (US EPU, EU EPU, domestic EPU, and oil market), but we do not enter into details in order not to wander from the subject. To highlight just a few important findings, we can say the following: (1) The asymmetric spillover from European Union uncertainty to Hong Kong industrial production is noteworthy in good times. (2) On the other hand, we observe high asymmetric effect of domestic economic policy uncertainty on the consumer price index of South Korea and the industrial production index of Japan in bad times. (3) As for India, we see that the foreign economic policy index spillover on consumer price in good times is bigger than those in bad times. (4) Last but not least, the spillover index from the oil market to inflation of Hong Kong during tranquil times is much greater than the one in a high uncertainty state. Hence, we provide evidence that some Asian markets stand out among others with large and quite asymmetric spillover from EPUs and the interest rate to economic activity.

3.2 Time-varying analysis

In this section, we extend the previous analysis in two ways. Firstly, the full sample analysis assumes that the coefficients of QVAR models are persistent and do not change over time. This assumption is indeed very strong in the presence of conditions that cause structural changes in the economy, such as economic crises, natural disasters, epidemics, and wars. Therefore, the full sample analysis under this assumption may give misleading results. To address this issue, we estimate QVAR models by utilizing 120-months rolling window estimation and then calculate the time-varying spillover indices from this rolling estimation at various quantile paths. Secondly, we add two additional cases to investigate monetary policy effectiveness in five Asian countries. The two cases we included in the analysis are as shown below.

Case 3 (Median Response): \(\theta_{{{\text{USEPU}}}} = \theta_{{{\text{EUEPU}}}} = \theta_{{{\text{EPU}}}} = \theta_{{{\text{BRENT}}}} = \theta_{{{\text{IP}}}} = \theta_{{{\text{CPI}}}} = \theta_{{{\text{LR}}}} = 0.50\).

Case 4 (High external EPU): \(\tau_{{{\text{USEPU}}}} = \tau_{{{\text{EUEPU}}}} = 0.95,\tau_{{{\text{EPU}}}} = \tau_{{{\text{BRENT}}}} = \tau_{{{\text{IP}}}} = \tau_{{{\text{CPI}}}} = \tau_{{{\text{LR}}}} = 0.50\).

Thus, the rolling analysis adds third and fourth quantile paths to Case 1 and Case 2 to compare them with economic scenarios with normal economic conditions (Case 3) and high external EPU (Case 4). Case 3 represents the median quantile pathFootnote 5, and it is obtained by taking all variables at 0.5 quantiles. On the other side, we also calculate the monetary policy effectiveness of Asian economies only in times of high uncertainty of external economic policy uncertainty. To do this, we construct Case 4, which represents the economic environment when there is high external economic policy uncertainty. The external economic policy uncertainty indices at 0.95 quantiles correspond to a very high uncertainty environment in the USA and EU. It is important to reveal how the monetary policy of these Asian countries, which have intense foreign trade and capital flow relations with the USA and the EU, changes in cases where the uncertainty in the outside world is high. It should also be noted that we prefer to keep the median quantiles for the oil market in all cases since we are not interested in examining the dynamics of spillover in Asian markets during different oil market states in this study.

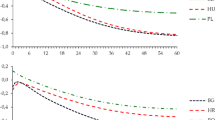

Figures 1, 2, 3, 4 and 5 show the time-varying spillover empirical findingsFootnote 6 under four cases explained above. The left panel (Panel 1) of Figs. 1,2,3,4 and 5 reports three time-varying spillover indices from interest rate to industrial production, inflation, and the sum of these two observed variables during high uncertainty, low uncertainty times, as well as periods of normal economic conditions. In so doing, we can compare the spillover index in a state where central banks cut (raise) the policy rates sharply to avoid an economic contraction (overheating) in different times of economic uncertainty with the spillover index obtained from the median shocks (\(\tau = 0.5\)), which represents the normal times. In this way, we can examine how the effectiveness of the monetary policy conducted by central banks changes in these scenarios that represent the high and low economic uncertainties. The time-varying QVAR analysis produces more robust and policy-oriented results than full-sample analysis because time-varying models relax the strict constant-coefficient assumption and take structural changes into account. The right panel (Panel 2) of Figs. 1,2,3,4 and 5 plots the spillover indices from the lending rate to industrial production, consumer price index, and others during a high external uncertain economic environment. The plots in Panel 2 of the figures allow us to evaluate central banks’ monetary policy effectiveness in times of high economic uncertainty in the USA and EU. As we discuss below, the fact that these values are close to zero means that the efficiency of monetary policy has decreased.

Spillover results from the lending rate to macroeconomic indicators under different cases for Hong Kong. See note to Fig. 1

Spillover results from the lending rate to macroeconomic indicators under different cases for India. See note to Fig. 1

Spillover results from the lending rate to macroeconomic indicators under different cases for Japan. See note to Fig. 1

Spillover results from the lending rate to macroeconomic indicators under different cases for South Korea. See note to Fig. 1

Analogous to the full sample results, we do not have supporting evidence for the hypothesis that monetary policy is less effective when uncertainty is high. As shown in Panel 1 of Fig. 1, the quantile spillover effects from interest rate to real economic activity and prices during Case 1 and Case 2 are very close to each other, implying that monetary policy effectiveness in China is nearly the same during the high and low economic policy uncertainty states. Hence, we do not obtain supportive evidence for the wait-and-see theory in China over the observation period, contradicting the empirical findings of Lien et al. (2019). Lien et al. (2019) investigate whether uncertainty has any influence on China’s monetary policy effectiveness by utilizing a smooth transition vector autoregression (STVAR) model and conclude that China’s monetary policy is less effective when uncertainty is high. One interesting fact is that the spillover effects of interest rate on macroeconomic variables during low and high uncertainty states are always higher than the spillover effect obtained by median shocks, namely normal conditions. Consequently, these empirical findings show that China’s easing monetary policy during high-uncertainty states and contractionary monetary policy during low-uncertainty states are more effective than monetary policy during normal conditions. This brings a crucial advantage to the Chinese economy because the effectiveness of monetary policy significantly affects industrial sector growth, as noted by Kutu et al. (2017). Furthermore, Ren et al. (2020) indicate that EPU shocks have a positive impact on credit, real estate, and fixed asset investment, which is consistent with our findings. This obviously suggests that China’s monetary policy is becoming more effective during high uncertainty times. Panel 2 of Fig. 1 shows the monetary policy effectiveness when the external economic policy uncertainty is high. The empirical finding shows that the rolling spillover index in this scenario is lower than those in Case 1 and 2.

Panel 1 of Fig. 2 illustrates that the spillover indices for Hong Kong industrial production are generally above the spillover index in normal times. However, the responses of inflation to monetary policy shocks during all cases do not take very different values from each other, suggesting that further policy action might have limited efficacy in controlling inflation during abnormal times (i.e., very low and very high uncertainty times). Moreover, from Panel 1 of Fig. 3, we can observe that monetary policy is more effective under the high and low uncertainty states compared to the normal economic state for India. This situation can be seen more clearly in Panel 1(c) of Fig. 3. Indeed, the fact that there is a higher spillover in good times than in bad times is encouraging for Indian monetary policy over most analysis periods. This might be seen as evidence of an unanticipated rise in uncertainty, which impedes private investment and erodes the productive potential of the Indian economy, as Pratap and Dhal (2021) observe. According to Pratap and Dhal (2021), uncertainty affects the inflation-output tradeoff for monetary policy in the Indian economy, requiring unconventional monetary policy instruments to preserve price stability while optimizing economic development. Furthermore, Kumar et al. (2021) indicate that, unlike in advanced economies, the policy response in developing economies cannot be lowering interest rates because the domestic uncertainty shock is similar to the inflationary supply shock. This confirms that the uncertainty weakens the impact of monetary policy interventions of the central bank of India, which is consistent with our findings.

We obtain a similar finding for the Japanese economy, as reported in Fig. 4. We can say that the interest policy implemented by the Bank of Japan (BoJ) during the high and low uncertainty times is more effective than the monetary policy conducted in normal times, except for the period between 2004 and 2010, where the effectiveness of the monetary policy on industrial production and inflation takes similar values in periods when uncertainty is high or low. Further, we get mixed results regarding the economic situations in which monetary policy is effective in Japan. Indeed, our findings indicate that the Bank of Japan struggled with disinflation more forcefully in times of reduced uncertainty between 2003 and 2010. However, after 2010, the situation reversed. Yoshino and Taghizadeh-Hesary (2015) assert that the monetary policy cannot solve Japan’s economic problem since uncertainties about the future and the aging of Japan’s population do not let the private sector take appropriate action in low-interest-rate conditions. Their evidence is supported by our findings of declining policy efficiency on the consumer price index. Similarly, Yoshino et al. (2017) argue that Japan’s current monetary policy, notably its negative interest rate policy, would prevent the country from recovering from its long-term recession and addressing its long-standing deflation problem.

Lastly, the empirical findings for South Korea show that while the spillover effects from interest rate to macroeconomic indicators during low uncertainty states fluctuate significantly, those during high uncertainty states follow a stable path. The low uncertainty state spillover effect sometimes falls below the median spillover effect, implying that monetary policy effectiveness declines in some negligible sub-periods. Cheng (2017) examines the impact of international and domestic economic policy uncertainty shocks on South Korea and finds that both foreign and local policy uncertainty shocks have a negative and significant impact. Similar to our approach, Bahmani-Oskooee and Nayeri (2018) investigate the relationship between policy uncertainty and money demand based on the fact that rising and falling uncertainty may have different effects on economic variables. They find asymmetric long-run impacts of policy uncertainty on demand for cash in Korea.

In addition to these cases, we investigate the spillover effect from the lending rate to macroeconomic variables when the external economic policy uncertainty is high, as shown in Panel 2 of Figs. 1,2,3,4 and 5. The main purpose of this additional analysis is to examine whether the effectiveness of monetary policy decreases over time in an environment where the external economic policy uncertainty is high. Considering the history of the monetary policy actions, we know that foreign economic uncertainties are taken more seriously, especially after the 2007 subprime mortgage crisis, by countries in the recent past. Monetary policy of central banks may also take into account uncertainty in major advanced economies. In this context, it is unclear how the spillover effect from interest to macroeconomic variables would change Asian economies. Panel 2 of Figs. 1,2,3,4 and 5 does not have precise results on how monetary policy effectiveness changed in response to high external EPU. Overall, the spillover from interest rate to industrial production and consumer prices declined around 2013, but it has been low in all periods. Especially in South Korea, the monetary policy effectiveness weakened after the 2007 subprime mortgage crisis (see Fig. 5).

Overall, the evidence from our case-based analysis does not confirm that the monetary policy effectiveness of major Asian economies weakens during the high and low uncertainty states. In contrast, both industrial production and consumer price index are more responsive to the aggressive policy rate cut, and they both increase in these extreme cases. Hence, the Asian central banks should not refrain from the conduct monetary policy to combat recession (overheating) and inflation (deflation) problems when uncertainty is high (low). That is, our empirical findings under these scenarios primarily support the credit channel hypothesis, which asserts that monetary policy shocks are more effective and potent on economies during financial crises, as supported by many empirical studies such as Li and St-Amant (2010), Lo and Piger (2005), Fry-Mckibbin and Zheng (2016), Jannsen et al. (2019), and Burgard et al. (2019). In addition to the findings of these studies, the results obtained in this study are important for the following reason. While these studies show that the policy effectiveness of central banks is greater than in normal times in times of financial distress, we also conclude that this situation exists for the case when the central bank increases the rate significantly during very low uncertainty states. In other words, sharp interest rate hikes and interest rate cuts have significant impacts on Asian markets during the high and low uncertainty times, respectively.

4 Conclusions

This study examines the efficiency of monetary policy in five major Asian countries (China, Hong Kong, India, Japan, and South Korea) throughout different uncertain circumstances. To accomplish this, we compute the quantile spillover effects from lending interest rates to industrial production and the consumer price index, which central banks closely monitor after monetary policy actions. Unlike other studies on the same topic, we build distinct cases to describe the low and high uncertainty periods by drawing observations from different tails of the distribution for each variable. Furthermore, taking observations from extreme distributions helps us make more accurate political conclusions during unusual economic events than other non-linear models that take into account the mean value of observations. Hence, we contribute to the literature by examining monetary policy effectiveness in five major Asia countries using quantile spillover effects under different quantile paths.

We construct two monetary policy cases in both full-sample and time-varying analysis. The first case (bad times) represents the economic environment where the central bank dramatically cuts its policy rate in a recession with very high economic policy uncertainty, while the second case (good times) represents the economic situation where the central bank raises interest rates in an expansion to combat inflation and attempts to prevent the economy from overheating during a low uncertainty state. In so doing, we try to find whether the monetary policy effectiveness of Asian economies decreases during the high uncertainty times. Under the assumption that the Asian central banks follow the simple monetary policy rule suggested by Taylor (1993), it makes sense to create these two scenarios to measure the monetary policy efficiency and asymmetries. The full sample results show that the Indian and Japanese prices receive remarkably higher spillover effects from interest rates during good times than bad times, supporting the nonlinearities in the interest rate channel. During uncertainty times, the interest rate channel does not function adequately for Japan’s real economy. However, we do not get strong evidence to support this theory in China, Hong Kong, and South Korea.

The time-varying analysis based on the rolling QVAR model (even if full sample analyzes provide mixed results) suggests that the effects of monetary policy shocks are generally higher during the high and low uncertainty times than those in normal times for these countries. When compared to its influence during times of low uncertainty, unexpected increases in uncertainty weaken the operation of the interest rate channel on the Indian economy’s productive capacity and inflation outlook. This illustrates that the impact of the Indian central bank’s monetary policy measures is weakened by uncertainty. Put it differently, the central bank of India needs to change interest rates more radically in times of high uncertainty than in times of low uncertainty. However, the time-varying analysis does not give substantial evidence of the theory's validity in other Asian countries. The difference between time-varying spillover effects from lending rate to macroeconomic indicators during high and low uncertainty periods changes over time. On the other hand, the interest rate spillover effects in the tails of the distribution are greater than the median response for all countries throughout almost the entire observation period. Thus, we conclude that the interest rate policy of major Asian central banks is more effective in extreme cases.

Notes

Aastveit et al. (2017), Balcilar et al. (2017), and Pellegrino (2018) use interacted VAR (IVAR) model to examine the effects of monetary policy shocks on macroeconomic variables for different countries. Even if IVAR model differentiates impulse responses of monetary policy shocks at the high and low levels of uncertainty by calculating above and below the mean of the historical distribution of the uncertainty, the parameters are based on a mean-based estimation and do not allow dynamics vary across the support of the distribution.

Although this study investigates the same Asian countries as Balcilar et al. (2020b) do, there are significant differences between these two studies. While Balcilar et al. (2020b) investigate the spillover effects from internal and external economic policy uncertainties to specifically on Asian financial markets (bond, stock, and exchange rate markets), this study attempts to measure monetary policy effectiveness in these markets by utilizing a case-based approach. To do that, we draw variables used in this study at different quantiles. For example, we build the high economic uncertainty condition by drawing economic policy uncertainty variables at 0.95 quantiles while drawing lending rate, inflation, and industrial production at 0.05 quantiles. Balcilar et al. (2020b) focus basically spillover to financial variables while this study investigates the effect of international uncertainty on real aggregate macroeconomic variables.

Unlike other equation-by-equation estimation methods (see, e.g., Cecchetti & Li 2008; Schüler 2014; White et al. 2015; Chavleishvili and Manganelli 2016; Linnemann and Winkler 2016; Zhu et al. 2016; Ando et al. 2018; Han et al. 2019), Montes-Rojas (2017) we develop a multivariate model approach that solves for a fixed point on the multivariate quantile space based on directional quantiles. This approach solves for multivariate conditional quantiles given the covariates.

In the presence of nonlinearities, one may also use Markov switching VAR (MS-VAR), threshold VAR (TVAR), smooth transition threshold VAR (STVAR), and time-varying parameter VAR (TVP-VAR) models. Each of these models has merits to answer different questions. MSVAR, TVAR, and STVAR models assume a small number of regimes while TVP-VAR models are suitable for cases where there are large number of regimes. However, all these nonlinear models fit to the conditional mean of the data, although conditional mean might be different in different regimes. Moreover, these models force all variables be in the same regime simultaneously. The QVAR model with different quintile paths is more suitable in our case, because we jointly model the US and EU economic uncertainty with macroeconomics aggregates of an Asian economy. We also have specific questions such as high EPU with recession and low EPU with expansion. The QVAR model flexibly allows us to condition on these assumptions and estimate the spillover under these assumptions. Regime switching models do not have the flexibility to incorporate extreme conditions we would like to analyze. Therefore, we should not expect to get similar results from these regime switching models because regimes may not correspond to our quantile path settings.

Generally, a canonical case fixed with \(\theta = \left\{ {0.5, \ldots ,0.5} \right\}\) for all \(i = 1,2, \ldots ,h\) delivers similar estimates to the mean-based VAR forecasts (Montes and Rojas, 2019). So actually, we can compare different economic scenarios with the standard VAR model result with this analysis.

To check robustness, we re-estimate time-varying spillovers from lending rates to macroeconomic variables in various cases after taking the first difference of lending rate series in logarithms. Results with first differenced interest rates are analogous to the results reported here. These additional empirical results are available upon request.

References

Aastveit KA, Natvik GJ, Sola S (2017) Economic uncertainty and the influence of monetary policy. J Int Money Financ 76:50–67

Ando T, Greenwood-Nimmo M, Shin Y (2018) Quantile connectedness: modelling tail behaviour in the topology of financial networks.https://doi.org/10.2139/ssrn.3164772

Bahmani-Oskooee M, Nayeri MM (2018) Policy uncertainty and the demand for money in Korea: an asymmetry analysis. Int Econ J 32(2):219–234

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131:1593–1636

Balcilar M, Demirer R, Gupta R, Van Eyden R (2017) The impact of US policy uncertainty on the monetary effectiveness in the Euro area. J Policy Model 39:1052–1064

Balcilar M, Usman O, Agbede EA (2019) Revisiting the exchange rate pass-through to inflation in Africa’s two largest economies: Nigeria and South Africa. Afr Dev Rev 31:245–257

Balcilar M, Ozdemir ZA, Ozdemir H, Wohar ME (2020a) Fed’s unconventional monetary policy and risk spillover in the US financial markets. Q Rev Econ Finance 78:42–52

Balcilar M, Ozdemir ZA, Ozdemir H, Wohar ME (2020b) Transmission of US and EU Economic Policy Uncertainty Shock to Asian Economies in Bad and Good Times. Institute of Labor Economics (IZA), IZA discussion paper No. 13274, Bonn, Germany. http://ftp.iza.org/dp13274.pdf

Balke NS (2000) Credit and economic activity: credit regimes and non-linear propagation of shocks. Rev Econ Stat 82(2):344–349

Baruník J, Kocenda E (2019) Total, asymmetric and frequency connectedness between oil and forex markets. Energy J 40:157–174

Baruník J, Kočenda E, Vácha L (2016) Asymmetric connectedness on the US stock market: bad and good volatility Spillovers. J Finan Market 27:55–78

Baruník J, Kočenda E, Vácha L (2017) Asymmetric volatility connectedness on the forex market. J Int Money Financ 77:39–56

Bernanke BS (1983) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98:85–106

Bernanke BS, Gertler M, Gilchrist S (1999) The financial accelerator in a quantitative business cycle framework. Handb Macroecon 1:1341–1393

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77:623–685

Bloom N (2014) Fluctuations in uncertainty. J Econ Perspect 28:153–175

Brunnermeier MK, Sannikov Y (2014) A macroeconomic model with a financial sector. Am Econ Rev 104:379–421

Burgard JP, Neuenkirch M, Nöckel M (2019) State-dependent transmission of monetary policy in the Euro Area. J Money Credit Bank 51(7):2053–2070

Castelnuovo E, Pellegrino G (2018) Uncertainty-dependent effects of monetary policy shocks: a new-Keynesian interpretation. J Econ Dyn Control 93:277–296

Cecchetti SG, Li H (2008) Measuring the impact of asset price booms using quantile vector

Çekin SE, Hkiri B, Tiwari AK, Gupta R (2020) The relationship between monetary policy and uncertainty in advanced economies: evidence from time-and frequency-domains. Q Rev Econ Finan 78:70–87

Chavleishvili S, Manganelli S (2016) Quantile impulse response functions. Working Paper, European Central Bank, 17

Cheng CHJ (2017) Effects of foreign and domestic economic policy uncertainty shocks on South Korea. J Asian Econ 51:1–11

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Diebold FX, Yilmaz K (2009) Measuring financial asset return and volatility spillovers, with application to global equity markets. Econ J 119:158–171

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28:57–66

Dixit AK, Dixit RK, Pindyck RS (1994) Investment under uncertainty. Princeton University Press

Elliott G, Rothenberg T, Stock J (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Engle RF, Manganelli S (2004) CAViaR: conditional autoregressive value at risk by regression quantiles. J Business Econ Stat 22:367–381

Fisher I (1933) The debt-deflation theory of great depressions. Econometrica. J Econ Soc 337–357

Fry-Mckibbin R, Zheng J (2016) Effects of the US monetary policy shocks during financial crises—a threshold vector autoregression approach. Appl Econ 48(59):5802–5823

Garcia R, Schaller H (2002) Are the effects of monetary policy asymmetric? Econ Inq 40(1):102–119

Granger CW (2003) Time series concepts for conditional distributions. Oxford Bull Econ Stat 65:689–701

Greenwood-Nimmo M, Huang J, Nguyen VH (2019) Financial sector bailouts, sovereign bailouts, and the transfer of credit risk. J Finan Market 42:121–142

Gupta R, Jooste C (2018) Unconventional monetary policy shocks in OECD countries: how important is the extent of policy uncertainty? IEEP 15(3):683–703

Han H, Jung W, Lee JH (2019) Estimation and inference of quantile impulse response functions by local projections: with applications to VAR dynamics. https://doi.org/10.2139/ssrn.3466198

He Z, Krishnamurthy A (2013) Intermediary asset pricing. Am Econ Rev 103:732–770

Jannsen N, Potjagailo G, Wolters MH (2019) Monetary policy during financial crises: Is the transmission mechanism impaired? Int J Cent Bank 15(4):81–126

Keynes JM (1936) The general theory of employment, interest and money. McMil’lan, London

Kilian L, Lütkepohl H (2017) Structural vector autoregressive analysis. Cambridge University Press, Cambridge

Koop G, Pesaran MH, Potter SM (1996) Impulse response analysis in non-linear multivariate models. J Econ 74:119–147

Kumar A, Mallick S, Sinha A (2021) Is uncertainty the same everywhere? Advanced versus emerging economies. Econ Model 101:105524

Kutu AA, Nzimande NP, Msomi S (2017) Effectiveness of monetary policy and the growth of industrial sector in China. J Econ Behav Stud 9:46–59

Kwiatkowski D, Phillips PC, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root. J Econ 54:159–178

Lanne M, Nyberg H (2016) Generalized forecast error variance decomposition for linear and non-linear multivariate models. Oxford Bull Econ Stat 78:595–603

Li F, St-Amant P (2010) Financial stress, monetary policy, and economic activity. Working Paper of Bank of Canada 2010–12. Bank of Canada, Ottawa, Canada

Lien D, Sun Y, Zhang C (2019) Uncertainty, confidence, and monetary policy in China. Int Rev Econ Financ 76:1347–1358

Linnemann L, Winkler R (2016) Estimating non-linear effects of fiscal policy using quantile regression methods. Oxf Econ Pap 68:1120–1145

Lo MC, Piger J (2005) Is the response of output to monetary policy asymmetric? Evidence from a regime-switching coefficients model. J Money Credit Banking 865–886

Montes-Rojas G (2017) Reduced form vector directional quantiles. J Multivar Anal 158:20–30

Montes-Rojas G (2019) Multivariate Quantile Impulse Response Functions. J Time Ser Anal 40:739–752

Morgan DP (1993) Asymmetric effects of monetary policy. Econ Rev-Feder Reserv Bank Kansas City 78:21–33

Neftci SN (1984) Are economic time series asymmetric over the business cycle? J Polit Econ 92:307–328

Pellegrino G (2018) Uncertainty and the real effects of monetary policy shocks in the Euro area. Econ Lett 162:177–181

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58:17–29

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346

Pratap B, Dhal S (2021) Monetary transmission mechanism, confidence and uncertainty: evidence from a large emerging market economy. In: Confidence and uncertainty: evidence from a large emerging market economy (June 1, 2021)

Ren Y, Guo Q, Zhu H, Ying W (2020) The effects of economic policy uncertainty on China’s economy: evidence from time-varying parameter FAVAR. Appl Econ 52(29):3167–3185

Schüler YS (2014) Asymmetric effects of uncertainty over the business cycle: a quantile structural vector autoregressive approach. University of Konstanz Department of Economics, 2014–02. Avaliable at: http://nbn-resolving.de/urn:nbn:de:bsz:352-0-275836

Taylor JB (1993) Discretion versus policy rules in practice. In: Carnegie-Rochester conference series on public policy 39:195–214

Vavra J (2013) Inflation dynamics and time-varying volatility: new evidence and an Ss interpretation. Quart J Econ 129:215–258

White H, Kim T-H, Manganelli S (2015) VAR for VaR: measuring tail dependence using multivariate regression quantiles. J Econ 187:169–188

Yoshino N, Taghizadeh-Hesary F (2015) Effectiveness of the easing of monetary policy in the Japanese economy, incorporating energy prices. J Comparat Asian Develop 14(2):227–248

Yoshino N, Taghizadeh-Hesary F, Miyamoto H (2017) The effectiveness of the negative interest rate policy in Japan. Credit and Capital Markets 50(2):189–212

Zhu H, Su X, Guo Y, Ren Y (2016) The asymmetric effects of oil price shocks on the Chinese stock market: evidence from a quantile impulse response perspective. Sustainability 8:766

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Balcilar, M., Ozdemir, Z.A., Ozdemir, H. et al. Effectiveness of monetary policy under the high and low economic uncertainty states: evidence from the major Asian economies. Empir Econ 63, 1741–1769 (2022). https://doi.org/10.1007/s00181-021-02198-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-021-02198-x