Abstract

We use time series methods to analyse the long- and short-run dynamics and inter-relationships between government savings, private savings, investment, and the current account balance in the USA for the period 1947Q1–2017Q3. We control for the impact of the nonlinear dynamics of GDP growth over the business cycle on the evolution of these variables. A few important results stand out. The relationships among the variables are time varying as we find three structural periods: (I) 1947Q1–1984Q3, (II) 1984Q4–1999Q4, and (III) 2000Q1–2017Q3. The impact of nonlinearities in GDP growth matters in each period, but the twin deficit hypothesis is supported only in the first period. Generally, we also find no evidence to conclude that the Ricardian equivalence hypothesis holds over the full sample period. Finally, we cannot conclude that the Feldstein–Horioka puzzle with respect to private or government savings holds over the three structural periods.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The USA has had a recurring current account deficit since 1984, and it has become particularly chronic from the early 1990s. In this paper, we discuss the relationship among the current account balance, government saving, private saving, and investment, use time series methods applied to US data over the 1947Q1–2017Q3 period to conduct a related statistical exercise, and then discuss our findings. The current account deficit is directly measured by the net exports of goods and services plus net factor income from abroad. Alternatively, from a national accounting perspective, it can also be measured as the excess of saving over investment. From this standpoint, one can argue that the main reason for a deficit is lower domestic saving compared to domestic investment. However, if the deficit is due to an excess of imports over exports, then this suggests that the cause could be an uncompetitive international trade position of the domestic economy. On the other hand, if the deficit is being driven by saving being less than investment, then the implication is that a productive and strong economy could be the main driver (Ghosh and Uma 2006). Mann (2002) asserts, depending on what one purports to be the driving force behind a current account deficit, the USA is either “living beyond its means” or is an “oasis of prosperity”.

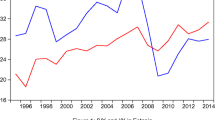

Partly because of these contrasting assertions, understanding the dynamics between saving, investment, and the current account deficit has garnered considerable interest among policymakers and academicians alike. One area of particular interest in the literature has been the study of the interactions between government saving, domestic saving, investment, and the current account balance. There are two prominent views that have emerged from this literature pertinent to our paper. The first one is the twin deficit hypothesis. According to this view, a budget deficit (government dissaving) that is financed by public debt increases consumption and consequently reduces national saving. Therefore, it is the government balance that changes the current account balance, with both variables having a positive relationship with each other. From an empirical methodological perspective, if we can establish a long-run cointegrating relationship between both variables and a short-run positive causal relationship running from the government balance to the current account balance, we can conclude there is evidence to support the existence of the twin deficit hypothesis. As shown in Fig. 1, for the USA, since the early 1990s the joint evolution of the current account balance and government saving seem to be incongruent with the predictions of the twin deficit hypothesis as these variables show no marked regular co-movement over this period. The second view is the Ricardian equivalence hypothesis. According to this view, budget deficits that are financed by public debts do not increase consumption because rational economic agents expect a higher tax to pay back the public debts in the future.

Source US Bureau of Economic Analysis (2018)

Government saving and current account balance ($billions).

The seminal work of Feldstein and Horioka (1980) sparked a marked increase in research that focused on the saving and investment relationship. They empirically examined the argument that under perfect capital mobility across countries there should be little if any relationship between domestic investment and domestic saving because the latter would flow to the most attractive investment projects globally. A finding of a strong relationship between domestic investment and domestic saving is known as the Feldstein–Horioka puzzle. In this paper, we focus on answering three questions using unit root, vector autoregression (VAR), cointegration, and vector error correction (VECM) methods: (1) Is the twin deficit hypothesis supported empirically? (2) Is there any empirical evidence to support that the current account impacts government saving, private saving and investment? and (3) Is there a long-run time-consistent relationship between private saving, government saving, and investment? For this question, we focus on investigating the Feldstein–Horioka puzzle in the USA within the context of analysing government savings and private savings separately. We acknowledge that the convention is to use total domestic savings to examine the puzzle. However, the focus of this paper is not so much the puzzle in the traditional sense. Instead we aim to characterise the different behavioural dynamics of each type of savings with respect to investment and the current account. Therefore, we focus on examining each type of savings separately as much as allowed by the empirical results.

We contribute to the existing literature in four ways. First, although there have been many studies examining cointegration between saving and investment, there is a dearth in those extending the analysis to include the current account deficit. Second, we control for the potential impact of the nonlinear response of GDP growth to recessionary and expansionary periods on the joint evolution of these variables by including the current depth regression (CDR) effect. This effect is the so called “bounce back effect” of GDP growth wherein there is a tendency for GDP to grow at a faster rate when recovering from downturns compared to expansions. If such an effect is important and omitted, it could lead to incorrect inferences being drawn (Beaudry and Koop 1993; Altissimo and Violante 2001). This effect will enter the empirical analysis as an exogenous parameter and measured as a share of current dollar GDP. Third, while most of the previous studies mainly focused on how the current account deficit is affected by saving and investment, we will investigate the bidirectional effects among these variables as well. Fourth, we cover one of the longest periods among the studies in the extant literature and use the most recent data that would have benefited from the latest comprehensive revisions to the US National Income and Product Accounts.

There are several key results. To preview, they indicate that the relationships among the variables, all measured as shares of current dollar GDP, are time varying. There are three structural periods: (I) 1947Q1–1984Q3, (II) 1984Q4–1999Q4, and (III) 2000Q1–2017Q3. The twin deficit hypothesis holds only in the first period. Further, we cannot conclude that Ricardian equivalence hypothesis holds in any period. However, controlling for the nonlinear growth in GDP is important in each structural period. Finally, we do not find that the Feldstein–Horioka puzzle is a contemporary phenomenon in the USA with respect to government or private saving.

In what follows, in Sect. 2, we review the perspectives on saving, investment, and the current account deficit. We start with a discussion of the theoretical linkages among the current account, savings and investment. We then discuss the persistence of the current account deficit in the USA post-1984. We then provide a review of the related literature that contextualizes our paper’s contribution to it. Section 3 describes the data and the methodology. Section 4 is a discussion of the results, and we conclude in Sect. 5.

2 Perspectives on saving, investment and the current account deficit

2.1 Theoretical linkages between the current account, savings and investment

There are two key theoretical approaches that link the current account, savings and investment, namely the savings–investment balance and intertemporal optimization model. The savings–investment balance approach comes from the fundamental national income identity in which the period by period constraint of the relationship between the current account, savings and investment can be expressed asFootnote 1:

Here \( {\text{CA}}_{t} \) is the current account balance and \( {\text{NX}}_{t} \) is the trade balance (exports over imports). The stock of net foreign assets is \( {\text{A}}_{t} \) and \( r_{t} \) the associated interest earned, so that \( r_{t} {\text{A}}_{t} \) is net factor income from abroad. \( {\text{GNP}}_{t} \) is the gross national product and \( {\text{C}}_{t} \), \( {\text{G}}_{t} \), and \( {\text{I}}_{t} \) denote consumption, government, and investment spending, respectively. Recognizing that \( {\text{GNP}}_{t} - \left( {{\text{C}}_{t} + {\text{G}}_{t} } \right) \) is equal to national savings (\( {\text{S}}_{t} \)), for which the latter can be further broken down into private savings (\( {\text{Sp}}_{t} \)) and government (\( {\text{Sg}}_{t} \)), we can rewrite Eq. (1) as:

Equation (2) is the basic savings–investment balance approach relationship. For the twin deficit hypothesis to hold, \( {\text{Sg}}_{t} \) and \( {\text{CA}}_{t} \) should have a long-run cointegrating relationship, and in the short run, there should be a unidirectional causality from \( {\text{Sg}}_{t} \) to \( {\text{CA}}_{t} \).

The intertemporal optimization model approach is the iteration of Eq. (2) period by period such that the current account balance is determined from a rational forward-looking perspective that is a result of the dynamic interaction of agents making optimizing investment and savings decisions given their consumption preferences as they trade resources across time. As noted by Obstfeld and Rogoff (1995), current account optimization models can be of the deterministic or stochastic variant. The deterministic models mean perfect and complete information in regards to the path of future macroeconomic variables sufficient to make the optimal investment and savings decisions. Without any loss of generality, the basic deterministic form of the model can be written as:

Here \( \mu_{t} \) is an intertemporal discount factor that is a function of \( r_{t} \) and the complimentary slackness condition of the optimization problem solved over \( t \) periods.

Our paper is an examination of US twin deficits and Feldstein–Horioka puzzle over time. Taking the savings–investment balance approach (Eq. 2) and the intertemporal optimization model (Eq. 3) together we can see how the interplay of the saving, investment and current account balance relationship relate at a point in time and overtime as nations trade resources. From Eq. (2), we note that a government dissaving \( ({\text{Sg}}_{t} < 0) \), all else constant, has a negative impact on the current account balance. If this dissaving is sufficiently large, then this gives rise to the twin deficits. With respect to the Feldstein–Horioka puzzle, at its core is that in a regression over time across countries of the ratio of investment to GDP on the ratio savings to GDP, the coefficient of the latter is positive and significantly different from zero at conventional levels of statistical significance.

If there were no puzzle, reflecting a high degree of capital mobility and that savings and investment have almost a null correlation, then one expect that current account balance and government saving to show a high degree of regular co-movement over time. Further as resources are traded across time, as represented by the intertemporal optimization model in Eq. (3), in a world of perfect capital mobility, the limit in Eq. (3) goes to zero over time. Consequently, the present value of the net international investment position is simply the discounted value of the external balance (trade surpluses or deficits). Thus Eq. (3) is dynamically representing the intertemporal budget constraint of the economy, which is tied directly to Eq. (2).

2.2 The persistence of US current account deficit post 1984

As shown and discussed in Fig. 1 above, the USA has had a recurring current account deficit since 1984, and it has become more pronounced and unprecedentedly persistent since the early 1990s. Understanding the cause of this persistence and if it should even matter has occupied academicians and policymakers alike. We discuss briefly the possible causes of this persistence but not its importance, as the latter would take us far outside the scope of this paper.Footnote 2 From a theoretical perspective, as noted by Coakley et al. (2004), recurring shocks to the current account within finite time spans may lead to persistent current account deficits. We can identify at least five of these which had a role to play in the persistence and strength of the negative US current account balance.Footnote 3

First, there was the dot com investment boom that started in the early 1990s. This propelled the rate of investment relative to savings and this increased the current account deficit. Second, there was the Asian financial crisis that made the USA more attractive to investors who were more concerned with return of capital than return on capital. This crisis began in the late 1990s. Consequently, coupled with the dot com boom, there was a huge inflow of funds into the USA and thus a marked increase in investment; this necessarily meant, given the fundamental national income identity, concomitant increases in the capital account surplus and the current account deficit. Third, at the same time as the dot boom turned to a bust in the early 2000s, continued growth in US fiscal deficits (government dissaving) and weakening personal savings rates meant that the current account deficit remained persistently chronic and large. Fourth, there was a global savings glut in the many emerging economies in the early 2000s, particularly China, as these economies moved from being net borrowers to net lenders. As these countries increased their foreign exchange reserves, this had a deleterious effect on the current account balance of developed economies. The USA being in the midst of rising productivity and technological innovations was particularly attractive place to invest (Bernanke 2005, 2007). Fifth, post the financial crisis experienced during the Great Recession of 2007–2009, investors all around the world found US treasury bills a relatively safe investment; as once again their concern was return of funds invested more than the rate of return earned. During the recession, the current account deficit improved somewhat as investment fell globally across all financial markets including in the USA.

The Asian financial crisis and the Great Recession of 2007–2009 ended and US savings rates have somewhat improved, but the US current account deficit has been stubbornly persistent, though not as large as the pre-recession levels. It follows that there are other factors at play in maintaining, though at times improved, the US current account deficit position. We can get some insights into some of these possible other factors based on the study of Katsimi and Zoega (2016). They examined the Feldstein–Horioka puzzle in the context of the European Union in order to shed light on the determinants of the joint evolution of savings and investment and by extension the current account balance. From their results, we can draw parallels for the USA that the current account balance will be affected by domestic institutions, exchange rate risk, and credit risk through the impact of these factors on savings and investment. In addition to these factors, the USA still has relatively high consumer debt loads in comparison with personal savings, and there is still continued strength in its rate of government dissaving.

Taking a general view of what we have just discussed, we conclude that the genesis and persistence of the US current account deficit position is due to a complex nexus of domestic and international factors that impact the relative weight of savings and investments. These factors partly account for the persistence in the US current account deficit since 1984. At the same time, Katsimi and Zoega (2016) also note that part of the relationship between savings, investment, and the current account balance is just not explained by fundamental economic factors. Our paper does not delve into examining the factors of the current account deficits based on economic fundamentals. However, it does underscore the importance and relevance of deepening the understanding of the dynamics of private savings, government savings, investment, and the current account balance, if we are to tie their causes more closely to economic factors.

2.3 A brief review of the literature

There are numerous studies on the relationship between saving, investment, and the current account. Theoretically, in a closed economy, saving and investment must cause each other. This is because in such an economy an increase in saving decreases the interest rate, and this causes investment to rise. Conversely, an increase in investment increases GDP which in turn will cause saving to increase. On the other hand, in an open economy with capital mobility across countries, the link between domestic saving and domestic investment is weaker.

Feldstein and Horioka (1980) examined a sample of 16 OECD countries over the period 1960–1974; they found that most of a country’s domestic saving was not invested internationally. They concluded that the level of international capital mobility was in fact very low. This finding is well known as the Feldstein–Horioka puzzle. Numerous later studies also found similar results.Footnote 4 In some of the studies spawned by the work of Feldstein and Horioka (1980), it has been argued that the puzzle no longer exists. For example, Obstfeld (1986), Tesar (1991), and Baxter and Crucini (1993) asserted that a high correlation between saving and investment cannot be interpreted as an indicator of the capital mobility across countries because common factors or exogenous disturbances affecting both saving and investment could be the cause of their co-movements. Furthermore, Blanchard and Giavazzi (2002) showed that in highly integrated regions such as the European Union, the Feldstein–Horioka puzzle no longer appears as saving and investment are increasingly uncorrelated. Our paper is partly a re-examination of the Feldstein–Horioka puzzle for the USA using the most up-to-date data that has benefited from revised sources and new methods.

Since the pioneering work of Engle and Granger (1987), cointegration analysis has been widely used to find the empirical relationship between saving and investment (e.g., Miller 1988; Gulley 1992; Husted 1992; Jansen 1996; Coakley and Kulasi 1997). One study of note is Coakley et al. (1996). They connected saving and investment behaviour to the current account for OECD countries and showed that over time the current account is stationary because of the solvency constraint. Therefore, saving and investment cointegrate with a unit coefficient irrespective of the degree of capital mobility. That is, they argued that the Feldstein–Horioka puzzle is not a puzzle but a statistical artefact of the cross-sectional regression.

The interest in examining the relationship between the current account, saving, and investment in the USA increased with the recurring current account deficits that began in the 1980s. The intertemporal approach has been developed since that time; it views the current account balance as the result of agent’s forward-looking actions on the dynamics of saving and investment (Buiter 1981; Sachs 1981; Obstfeld 1986; Obstfeld and Rogoff 1995). In this respect, Sachs (1981) and Baxter and Crucini (1993) argued that the current account deficits of the USA were driven more by investment than saving. Summers (1988) argued that business tax reductions that stimulate domestic investment without affecting domestic saving must inevitably cause a country’s current account balance to worsen. Bernanke (2005, 2007) contended that the transformation of many emerging-market countries from net borrowers to net lenders gave rise to a global saving glut; this was part of the contributing factor for the current account deficits of the USA as also noted in Sect. 2.2. Kraay and Ventura (2000, 2003) proposed “a portfolio view” wherein the current account deficit reflects portfolio growth. They argued that a change in the deficit is equal to the change in saving generated by the income shock multiplied by the country’s share of foreign assets in total assets. In addition, they separated countries into creditors and debtors and showed that investment and the current account is positively correlated among the creditors but negatively correlated among the debtors (see also Ventura 2003).

A testable topic related to the current account and Feldstein–Horioka puzzle is the twin deficit hypothesis, which has also been widely studied since the early 1980s (e.g., Hutchison and Pigott 1984; Bernheim 1988; Darrat 1988; Bachman 1992; Bussière et al. 2005; Corsetti and Müller 2006). It is very common place among these studies to find inconsistent evidence with regards to the twin deficit hypothesis. For example, Bartolini and Lahiri (2006) found that the link between fiscal and current account deficits was too weak to support the view that reductions in the budget deficit of the USA would contribute to improving its current account deficit. Further, Kim and Roubini (2008) suggested that twin divergence could be a more common feature in the USA when the main driver of the two balances is an output shock. With twin divergence, the budget balance worsens, and the current account balance even improves and vice versa.

Olivei (2000), whose study is somewhat similar to our own, examined the relations between saving, investment and the current account empirically in the USA using a solvency constraint framework. He found that most of the adjustment to the current account imbalance has been caused by changes in investment. In this framework, higher saving or lower investment must follow high current account deficits to avoid a country defaulting on its debt obligations. While we do not consider the solvency constraint explicitly in our analysis, we do similarly examine the direction of causation among these variables of interest but over seven decades and across different structural periods.

3 Data and methodology

We used quarterly data for the period 1947Q1–2017Q3 from the US Bureau of Economic Analysis. The measures of the current account balance (CA), national saving (S), private saving (SP), government saving (SG), and domestic investment (I) were obtained at seasonally adjusted at annual rates. We transformed each measure by dividing it by current dollar seasonally adjusted GDP (Y). In the results that follow, the transformed variables are denoted as s = S/Y, i = I/Y, sp = SP/Y, sg = SG/Y and ca = CA/Y, respectively. Given the long period that we examine, we proceed in the first step of our analysis by determining whether there were statistically significant structural changes in the relationship among the variables of interest. In order to do this, we run Eq. (4) by the method of the least square with break and conduct the Bai–Perron test (Bai and Perron 1998).

The results from this test are then used to split the full sample period into structurally homogenous sub-periods for which we empirically examine separately the relations among the variables of interest.

The second step of our analysis is testing for the presence of unit roots in each sub-period. To determine whether the transformed levels of the measures are stationary, we carry out the Philip–Perron (PP) unit root test (Phillips and Perron 1988) which corrects the test statistics for autocorrelations and heteroscedasticity in the error term. Given the true data-generating process of our measures are unknown, we follow Dolado et al. (1990) and start with, without the loss of generality, the least restrictive form of the test model with a time-trend and intercept as shown in Eq. (5) below

where the null hypothesis is that \( x_{t} = x_{t - 1} + \varepsilon_{t} \) where \( \varepsilon_{t} \sim{\text{NID}} \left( {0,\sigma^{2} } \right) \).

If the variables are non-stationary in levels but stationary in first differences, we proceed to examine whether there exist a long-run equilibrium relationship wherein a linear combination of the variables is stationary by way of the Johansen test (Johansen and Juselius 1990). The test has two forms: the trace test and the maximum eigenvalue test. If the trace statistic and the maximum eigenvalue statistics yield conflicting results, we examine the estimated cointegrating relations and choose the number of cointegrating relationship based on the interpretability of the relations. The weakness of Johansen approach is that it is sensitive to the lag length. Therefore, before the Johansen cointegration test was performed, we needed to select an optimal lag of the vector error correction model (VECM).

The optimal lag of the VECM is selected based on that of the underlying VAR model. We select the lag length of this model with guidance from the reported final prediction error (FPE), Akaike’s information criterion, Schwarz’s Bayesian information criterion, the Hannan and Quinn information criterion, and likelihood-ratio test statistics. If there are cointegrating relationships among the variables, we proceed to the VECM to find the long-run relationship. If a long-run relationship does not exist among the variables, then a vector autoregression (VAR) model is estimated with the variables transformed to be stationary. In the case of the latter, we also report Granger causality tests to tease out more explicitly the causal relations.

The potential impact of asymmetric responses of GDP growth during business cycles on our main measures is incorporated in the VAR and VECM estimations with the exogenous inclusion of the CDR as shown in Eq. (6).

where \( Y_{t} \) is the logarithm of the current level of output at time \( t \). \( { \hbox{max} }(Y_{t} )_{s = 0}^{t} \) is historical maximum of \( Y_{t} \) level from time 0 to \( t \).

The CDR captures the nonlinear tendency of GDP to grow faster when recovering from recessions than expansions; it is also measured as a share of GDP.

4 Results and discussion

Table 1 shows the results of the Bai–Perron test for the least square with break. We conclude that there are two break points and hence three sub-periods: (I) 1947Q1–1984Q3 (151 observations) (II) 1984Q4–1999Q4 (61 observations), and (III) 2000Q1–2017Q3 (71 observations).

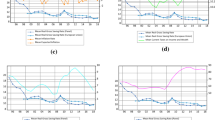

Figure 2 shows the evolution of gross domestic saving, gross domestic investment, government saving, and the current account balance as share of current dollar output over the three sub-periods.

Source Authors’ calculation using data from the US Bureau of Economic Analysis (2018)

Current account balance, private saving, government saving, investment and national saving as % of GDP.

This figure is consistent with our breakpoints and the discussion in Sect. 2.2 on the persistence, trends, and possible causes for the USA’s current account balance since 1984. First, we note that the current account balance of the USA has been in a deficit since 1982Q3, with a sharp deterioration until 1986Q3 (− 3.3%), a short-lived reversal until 1991 Q2 (+ 0.8%), a prolonged long-term deterioration which peaked at 2006Q3 (− 6.2%), and then a dramatic improvement after the global recession of 2008. As discussed in Sect. 2.2, the period during the Great Recession was associated with a fall in investment that allowed the current account balance position to improve. Second, saving (s) and investment (i) showed a high tendency to co-move, even if the correlation appears to have weakened over time.Footnote 5 Third, the level of government savings has been very volatile since the mid-1970s, with the lowest being − 8.2% in 2009Q3 and the highest being + 4.7% in 2000Q1. Also, we find that the budget deficit only led to a deterioration of the current account balance in certain periods. In contrast to the theoretical prediction based on the national income identity, the twin deficits phenomenon seems only to be a feature of the first half of 1980s and 2000s. Therefore, government saving and the current account balance lack regularity in their co-movement.

Table 2 reports the Philips–Perron unit root test results by period.Footnote 6 The results are based on the inclusion of an intercept and trend.Footnote 7 We find that for the first period (1947Q1–1984Q3) all variables are stationary in levels, integrated of order zero. For the second period (1984Q4–1999Q4), private saving is stationary in levels and all other variables are only stationary in first difference. For the third period (2000Q1–2017Q3) all the variables are non-stationary in levels but stationary in first difference.

Given the results from the unit root tests (Table 2), for the first period we estimate simple bivariate ordinary least-squares (OLS) regressions of the current account balance and government savings in order to test the twin deficit hypothesis, which is one of the objectives of this paper. With these variables being stationary, OLS is statistically robust and is able to provide an indication of the long-run relationship between these two variables (Pindyck and Rubinfeld 1998). For the first period, we also estimate VAR for all the variables under consideration in order to establish their joint dynamics with respect to causal ordering. The results of the OLS regression are reported in Table 3, and those of the VAR are reported in Table 4.

From the OLS regression results in Table 3, we observe that the relationship between the current account balance and government saving is positive and statistically significant at less than the 1% level. We also note that approximately 22% of the variation of the current account balance from its mean is explained by the movement in government savings and vice versa. From the basis of the OLS regression, we conclude that there is a long-run relationship between the current account balance and government savings. Therefore, there is a statistical evidence to support the existence of the twin deficit hypothesis in 1947Q1–1984Q3 period.

We next turn to the results from the VAR. These results are reported in Table 4 based on two lags as determined by the various lag selection criteria aforementioned in the description of the methods.

The significance of the variables is different across equations of the VAR. The current account is only statistically significant in its own equation. The coefficients on the CDR effect terms are negative across all specifications and are statistically significantly at conventional levels in the private saving, government saving, and investment equations. The negative coefficients on the CDR effect indicate that the bounce back effect of GDP growth on savings (government and private) and investment was positive as the US economy recovered from downturns. Alternatively, downturns in GDP had a negative impact on the growth in savings and investment. However, the bounce back effect of GDP growth had no statistically significant impact at conventional levels on the evolution of the current account balance. In addition, the CDR effect was greater for investment than any form saving (private or government) for the first period. Government saving is statistically significant in its own equation and negatively affected by the second lag of private saving. The effects of the other variables on investment are noteworthy: investment is positively affected in its own equation; a higher current account deficit leads higher investment at one quarter lagged, and lower investment at two quarter lagged; a higher government saving increases investment with one quarter lag but decreases it in the following quarter.

While the coefficients in a VAR model can shed light on some interrelations among the variables, with all variables being treated endogenously and exogenously, the VAR is somewhat of an enigma and as such it is difficult to infer meaningful conclusions from the coefficients. Consequently, we turn to the Granger causality test results to establish causal ordering and to draw more meaningful inferences. These results are reported in Table 5.

From the results provided in Table 5, we find that there is bidirectional causality between private saving and government saving (from the χ2 values of 9.53 and 10.86) in the first period. In practical terms, this means that, on the one hand, households and business are shifting their private savings in response to government taxation and expenditure decisions. On the other hand, the fact that private savings decisions impact government saving decisions suggests an interventionists approach by the government in response to changes in the former. Interestingly, although there is an interdependency between private and government savings, only government savings Granger causes the changes in the current account balance. This suggests that the changes induced in government savings by changes in private savings is not one for one, and that during this first period it is changes in the government fiscal account position that were primarily responsible for changes in the current account balance.

We note from our results that the current account balance does not cause either measure of saving. This means that there is no current account targeting, which means the current account balance causing the budget balance. However, the current account balance and government saving both Granger cause investment; this is consistent with the VAR results reported in Table 4. We also note that investment Granger causes private and government saving. From the results of the VAR and the Granger causality test, we conclude that there is strong statistical evidence that the current account affected investment rather than being affected by investment or saving, particularly private saving, in the first period. It is worth pointing out that these last set of results are at odds with Olivei (2000), which is like our paper in some respects.

Olivei (2000) found that investment was primarily responsible for rebalancing the current account in the long-run; however, this study was over a different time period (1960–1998) and used annual data which may not have been able to capture the full dynamics of these variables over the business cycle. Our data are quarterly and starts from 1947. In addition, Olivei (2000) did not check for the presence of structural breaks. We believe this check is important because, as discussed in Sect. 2.2, a number of economic events such as the dot com boom, Asian financial crisis, US fiscal deficits, a global savings glut and the Great Recession, altered the dynamics of the relationship between savings, investment, and the current account balance in the US, particularly post 1984. In other words, the USA relied on the international financial markets to balance shortfalls in income necessary to meet its spending commitments in response to the economic events. This reliance may have changed the dynamics of the relationship over time among the variables.

Next, we examine the second (1984Q4–1999Q4) and third (2000Q1–2017Q3) periods. The cointegration results are reported in Table 6. From these results, we reject cointegration for all variables (current account balance, total savings, and investment) taken together as a group for the second period based on the trace and maximum statistics. On the other hand, when pairwise combinations are considered we find that the current account and investment do have a long run cointegrating relationship. In contrast, for the third period, we find cointegration among the variables taken together as a group. However, there is no bivariate long-run cointegrating relationship between government savings and the current account balance.Footnote 8 We can only conclude that there is a short-run relationship between these variables and thus, we do not find any compelling evidence to support the twin deficit hypothesis, as a long-run phenomenon in the third period.

Based on the results from Johansen cointegration tests (presented in Table 6), we estimate a VAR in first differences of saving, investment and the current account for the second period. These results are reported in Table 7.

First of all, it must be noted that the relations among the variables are rather weak during the second period. However, we do note that in the saving equation we find a negative coefficient on the current account variable. This result is similar to Olivei (2000) who found on the basis of an intertemporal budget perspective evaluated in a VAR framework that higher current account deficits must eventually lead to higher saving. For the investment equation, the current account lagged two periods, investment lagged one period, and the CDR effect is statistically significant. We find that the CDR effect has a positive impact on the growth in the current account balance. This means that for the second period during recessions the current account balance actually gets better. This is congruent with the discussion in Sect. 2 and Fig. 1 where we saw that during the Great Recession of 2007–2009, the current account balance of the USA actually improved.

To shed light on causal ordering and add more meaning to the VAR, Granger causality testing results are reported for the second period as well. In Table 8, changes in the current account balance Granger causes changes in saving and investment but not vice versa. We know that the current account balance is equal to the difference between savings and investment, based on the investment balance approach discussed earlier, so these results indicate that changes in the components of the current account (net exports and net factor income) induced changes in the one step-a-head forecast of savings and investment. Also, as discussed earlier (Sect. 2.2), the second period was partly characterized by series of economic events on international financial markets, specifically the beginning of dot com boom and the Asian financial crisis. Therefore, it is not hard to envision that these events operating through factor incomes and net exports resulted in the current account having a lead lag relationship with investment and savings.

We report the VECM results for the third period in Table 9. In this table, the coefficients of the error correction term of government savings, private savings and investment are insignificant, but the coefficient of the first error correction term in the current account equation is negative and statistically significant. This means that the current account tends to move back into equilibrium over the long run. This convergence of the current account balance to equilibrium in the long run provides evidence that the solvency constraint prevents growth in the current account deficit that is not sustainable. Also, in the equation for the current account, we find a negative coefficient on the government saving and the private saving with one period lag, a positive coefficient on the investment with both one and two period lags. These results are inconsistent with the notion that higher current account deficits should be associated with lower saving and/or higher investment. Nevertheless, the coefficient on investment is greater than that on saving; this signifies that investment rather than saving was a more influential determinant for the change in the current account of the USA in the third period. The CDR effect term is statistically significant at conventional levels in all but one of the equations.Footnote 9 It is positive for current account and private savings equations, indicating that downturns in GDP were associated with increases in the current account balance and private savings. For investment, economic downturns had a negative impact on it. The CDR effect was not statistically significant for the government savings equation.

Finally, in the next step, we perform a dynamic Granger causality test within the VECM framework to explore the causal relationships among relevant variables for the third period. These results are presented in Table 10. The results show that both private and public savings Granger cause current account deficit but not vice versa. Hence, there is a unidirectional causality between current account deficit and each saving variable. As with the first period, the relationship between the current account balance and government savings is similar in the third period. Finally, these Granger causality tests show that there is a unidirectional causality running from investment to the current account deficit.

The validity of the Feldstein–Horioka puzzle for the third period merits a remark based on the cointegration and VECM results. On the one hand, the cointegration results indicate that there is a long-run relationship between private savings and investment. (See Period III, Table 6). On the other hand, the VECM indicates that the error correction representation of this relationship is neither stable nor mean reverting. This is due to the error correction term of the VECM being significant at conventional levels of statistical significance but positive. Therefore, we cannot conclude definitively that the Feldstein–Horioka puzzle holds in the third period with respect to private saving. For government saving, we find no evidence of a long-run relationship, which is also the same result for the first two periods.

5 Conclusion

In this paper, we thoroughly examined the joint co-movement of private saving, government saving, investment and the current account balance in the USA over the past seven decades, namely 1947Q1–2017Q3. We empirically analysed the long-run and short-run casual relations between these variables and the validity of the twin deficit hypothesis and the dynamics of government and private savings with respect to investment in the context of the Feldstein–Horioka puzzle. To conduct this assessment, we applied unit root, vector autoregression, cointegration, and vector error correction methods while controlling for the potential impact of the nonlinear dynamics of GDP growth over the business cycles.

While our conclusions rest on many statistical assumptions, our paper contributes to the understanding of the long- and short-run dynamics of the current account balance, government and private savings, and investment over the past seven decades in the US. Empirically, we find that there are three structural periods, namely (I) 1947Q1–1984Q3, (II) 1984Q4–1999Q4, and (III) 2000Q1–2017Q3, that characterize the relationships among the variables. Over the full sample period, there is some evidence of a short-run causal link, in the Granger sense, between government saving and the current account balance. The fact that government saving is at times related, in the Granger sense, to the current account balance in the short run, indicates that there is no strong empirical evidence to support that the Ricardian Equivalence hypothesis holds in the USA.

Taking a general view from the results, two key findings for us stand out from our empirical exercise. The first is that there is no strong statistical evidence to support the twin deficit hypothesis in 1984Q4–1999Q4, and 2000Q1–2017Q3 structural periods as there does not exist a bivariate long-run cointegrating relationship between the current account balance and government saving. However, we find the evidence of the twin deficit hypothesis in the first period, namely 1947Q1–1984Q3. This is true even after controlling for the nonlinearities in the growth of GDP over the business cycle, which was found to be statistically significant in one form or another in each period across different empirical specifications. Second, we find no support for the Feldstein–Horioka puzzle with respect to government saving for all periods and no definitive evidence for private saving in the 2000Q1–2017Q3 period. In this period, for private savings and investment, the cointegration results indicate a long-run relationship, but the VECM reveals that this relationship is not mean reverting as the error correction term is statistically significant and positive.

A natural extension of this paper would be to further investigate what institutional features and economic fundamentals of the US economy are at the driving these results. Further, we think that another interesting extension would be to consider the impact of saving and the current account deficit in relation to investment by industrial or sectoral composition. Finally, consideration could also be given to the examination of the role of the national balance sheet of the USA in terms of its international investment position (net holdings of foreign assets versus incurrence of foreign liabilities) on the joint evolution of saving, investment, and the current account balance.

Notes

We follow and modify the final set of equations presented in Olivei (2000).

See Mann (2002) for a discussion on the sustainably of the US current account deficit and if it should matter.

The discussion of the first three of these shocks is based on the discussion in McKibbin and Stoeckel (2005).

The correlation between saving and investment has been one of the interesting themes in international economics since Feldstein and Horioka (1980). We calculated the correlation between saving and investment as a share of GDP for the three periods as follows: 0.739 (1947Q1–1984Q3), 0.714 (1984Q4–1999Q4) and 0.636 (2000Q1–2017Q3).

We also conducted the Augment Dickey Fuller (ADF) tests. The conclusions were the same as the PP test.

The inference drawn from the unit root tests were invariant to the inclusion or exclusion of the intercept and trend.

The long run coefficients can be estimated using the autoregressive distributed lag (ARDL) technique (proposed by Pesaran and Shin (1999) and Pesaran et al. (2001) while imposing appropriate restrictions). We recognize the importance of long run coefficients; however, this is beyond the scope of this paper, and hence, left for future research.

We also ran the VECM without the CDR effect term, but the results were basically unchanged.

References

Altissimo F, Violante GL (2001) The nonlinear dynamics of output and unemployment in the U.S. J Appl Econom 16(4):461–486

Apergis N, Tsoumas C (2009) A survey on the Feldstein–Horioka puzzle: What has been done and where we stand. Res Econ 63(2):64–76

Bachman D (1992) Why is the US current account so large? Evidence from vector autoregressions. South Econ J 59(2):232–240

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66(January):47–78

Bartolini L, Lahiri A (2006) Twin deficits: twenty years later. Federal Reserve Bank of New York. Curr Issues Econ Finance 12(7):1–7

Baxter M, Crucini MJ (1993) Explaining saving-investment correlations. Am Econ Rev 83(3):416–436

Beaudry P, Koop G (1993) Do recessions permanently change output? J Monet Econ 31(2):149–163

Bernanke BS (2005) The global saving glut and the U.S. current account deficit. In: Speech delivered at the Sandridge Lecture, Virginia Association of Economists, Richmond, Va., March 10

Bernanke BS (2007). Global imbalances: recent developments and prospects. In: Speech delivered at the Bundesbank lecture, Berlin, Germany

Bernheim BD (1988) Budget deficits and the balance of trade. In: Summers LH (ed) Tax policy and the economy, vol 2. MIT Press. Cambridge, MA, pp 1–32

Blanchard O, Giavazzi F (2002) Current account deficits in the euro area: The end of the Feldstein–Horioka puzzle? Brook Pap Econ Act 2:147–209

Buiter WH (1981) Time preference and international lending and borrowing in an overlapping generations model. J Polit Econ 89:769–797

Bussière M, Fratzscher M, Müller G (2005) Productivity shocks, budget deficits and the current account. ECB Working Paper 509

Coakley J, Kulasi F (1997) Cointegration of long run saving and investment. Econ Lett 54:1–6

Coakley J, Kulasi F, Smith R (1996) Current account solvency and the Feldstein–Horioka puzzle. Econ J 106:620–627

Coakley J, Smith F, Smith RP (1998) The Feldstein–Horioka puzzle and capital mobility: a review. Int J Finance Econ 3:169–188

Coakley J, Fuertes A-M, Spagnolo F (2004) Is the Feldstein–Horioka puzzle history? Manch Sch 72:569

Corsetti G, Müller G (2006) Twin deficits: squaring theory, evidence and common sense. Econ Policy 48:597–638

Darrat AF (1988) Have large deficits caused rising trade deficits? South Econ J 54:879–887

Dolado J, Jenkinson T, Sosvilla-Rivero S (1990) Cointegration and unit roots: a survey. J Econ Surv 4(3):249–273

Dooley M, Frankel JA, Mathieson DJ (1987) International capital mobility: What do saving-investment correlations tell us? Int Monet Fund Staff Pap 34:503–530

Engle RF, Granger CWJ (1987) Cointegration and error correction representation: estimation and testing. Econometrica 55:251–276

Feldstein MS, Bachetta P (1991) National saving and international investment. In: Berheim D, Shoven J (eds) National saving and economic performance. University of Chicago Press, Chicago, pp 201–226

Feldstein MS, Horioka C (1980) Domestic saving and international capital flows. Econ J 90:314–329

Ghosh A, Uma R (2006) Do current account deficit matter? Finance Dev 43(4). IMF. http://www.imf.org/external/pubs/ft/fandd/2006/12/basics.htm#author. Accessed 15 Feb 2018

Gulley OD (1992) Are saving and investment cointegrated? Another look at the data. Econ Lett 39:55–58

Husted S (1992) The emerging U.S. current account deficit in the 1980s: a cointegration analysis. Rev Econ Stat 74:159–166

Hutchison MM, Pigott C (1984) Budget deficits, exchange rates and the current account: theory and U.S. evidence. Federal Reserve Bank of San Francisco. Econ Rev pp 5–25

Jansen WJ (1996) Estimating saving-investment correlations: evidence for OECD countries based on an error correction model. J Int Money Finance 15:749–781

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with applications to money demand. Oxford Bull Econ Stat 52:169–210

Katsimi M, Zoega G (2016) European Integration and the Feldstein–Horioka Puzzle. Oxf Bull Econ Stat 78(6):834–852

Kim S, Roubini N (2008) Twin deficit or twin divergence? Fiscal policy, current account, and real exchange rate in the US. J Int Econ 74:362–387

Kraay A, Ventura J (2000) Current accounts in debtor and creditor countries. Q J Econ 115(4):1137–1166

Kraay A, Ventura J (2003) Current accounts in the long and short run. Natl Bur Econ Res Macroecon Annu 2002(17):65–112

Mann CL (2002) Perspectives on the U.S. Current account deficit and sustainability. J Econ Perspect 16(3):131–152

McKibbin W, Stoeckel A (2005) The United States current account deficit and world markets. Econ Scenar 10:2–9. Retrieved from: https://www.brookings.edu/wp-content/uploads/2016/06/200502.pdf. Accessed 15 Feb 2018

Miller SM (1988) Are saving and investment cointegrated? Econ Lett 27:31–34

Obstfeld M (1986) Capital mobility in the world economy: Theory and measurement. In: Carnegie-rochester conference series on public policy, vol 24(Spring) pp 55–10

Obstfeld M, Rogoff K (1995) The intertemporal approach to the current account. In: Grossman G, Rogoff K (eds) Handbook of international economics, vol 3. North-Holland, Amsterdam, pp 1731–1799

Olivei GP (2000) The role of saving and investment in balancing the current account: some—empirical evidence from the United States. N Engl Econ Rev pp 3–14. Retrieved from https://www.bostonfed.org/economic/neer/neer2000/neer400a.pdf. Accessed 15 Feb 2018

Penati A, Dooley M (1984) Current account imbalances and capital formation in industrial countries, 1949–1981. IMF Staff Pap 31:1–24

Pesaran MH, Shin Y (1999) An autoregressive distributed-lag modelling approach to cointegration analysis. In: Strøm S (ed) Econometrics and economic theory in the 20th century: the Ragnar Frisch centennial symposium. Cambridge University Press, Cambridge, pp 371–413

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346

Pindyck R, Rubinfeld D (1998) Econometric models and economic forecasts, 4th edn. McGraw-Hill-Irwin, New York

Sachs J (1981) The current account and macroeconomic adjustment in the 1970s. Brook Pap Econ Act 12:1089–1092

Summer LN (1988) Tax policy and international competitiveness. In: Frenkel JA (ed) International aspects of fiscal policies, NBER conference report. Chicago University Press, Chicago, pp 349–375

Tesar LL (1991) Saving, investment and international capital flows. J Int Econ 31:55–78

US Bureau of Economic Analysis (2018) U.S. economic accounts. Retrieved on 28 July 2018 from https://www.bea.gov/

Ventura J (2003) Towards a theory of current accounts. World Econ 26(4):483–512

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Young Cheol Jung declares that he has no conflict of interest. Adian McFarlane declares that he has no conflict of interest. Anupam Das declares that he has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Rights and permissions

About this article

Cite this article

McFarlane, A., Jung, Y.C. & Das, A. The dynamics among domestic saving, investment, and the current account balance in the USA: a long-run perspective. Empir Econ 58, 1659–1680 (2020). https://doi.org/10.1007/s00181-018-1566-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1566-9