Abstract

We assess the contribution of economic and financial factors in the determination of euro area corporate bond spreads over the period 2001–2015. The proposed multi-market, no-arbitrage affine term structure model is based on the methodology proposed by Dewachter et al. (J Bank Finance 50:308–325, 2015). We model jointly the ‘risk-free curve’, measured by overnight index swap (OIS) rates, and the corporate yield curves for two rating classes (A and BBB). The model includes four spanned and six unspanned factors. We find that, in general, both economic (real activity and inflation) and financial factors (proxying risk aversion, flight to liquidity and general financial market stress) play a significant role in the determination of the spanned factors and hence in the dynamics of the risk-free yield curve and corporate bond spreads. Across the risk-free OIS curve, macroeconomic and financial factors are each responsible on average for explaining 30 and 65% of yield variation, respectively. For A- and BBB-rated corporate debt, the selected financial variables explain on average 50% of the variation in corporate spreads during the last decade.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The global financial crisis starting in late 2008 had a wide-reaching impact on financial markets and led initially, before central bank interventions, to a significant increase in sovereign and corporate bond spreads. It also affected the overall bank lending capacity and ultimately led to a significant economic downturn in several countries. This period of exceptional financial market gyrations has sparked an increasing interest of market participants, policy institutions and the academic literature in the determinants of financial market pricing. This concerns in particular the relative importance of financial-sector-specific factors versus macroeconomic fundamentals as drivers of asset prices. In this paper, we contribute to this literature by presenting an empirical approach for identifying the contribution of macroeconomic and financial risk factors in the joint determination of risk-free rates and corporate bond spreads.

Our model is part of the still growing literature on affine term structure models, initiated by Duffie and Kan (1996) with the use of latent factors and summarized by Dai and Singleton (2000). Ang and Piazzesi (2003) provided new stimulus to this line of research with the inclusion of macroeconomic variables together with unobservable factors. A number of studies followed their lead with the implementation of models that either gave latent factors a clear macroeconomic interpretation or were structural in nature (e.g. Bekaert et al. 2010; Dewachter and Lyrio 2006; Hördahl et al. 2008; Rudebusch and Wu 2008). Gürkaynak and Wright (2012) provide an extensive survey of the literature. Further developments in this area also led to the inclusion of financial factors, next to the standard macroeconomic fundamentals (e.g. Dewachter and Iania 2011). This strand of models has also been applied to corporate bonds, but to a much lesser extent compared to the host of studies on their sovereign counterparts. Amato and Luisi (2006), for example, use a combination of macroeconomic and latent variables in an affine term structure model to study the US corporate bond market. They use different bond rating classes to compute a default event risk premium. Mueller (2009) extends the framework proposed by Ang and Piazzesi (2003) to investigate the forecasting power of the term structures of Treasury yields and credit spreads for future GDP growth. Using US data, his results point to the existence of a pure credit factor during the period 2006–2008. Wu and Zhang (2008) also use a no-arbitrage model to assess the effect of inflation, real output growth and financial market volatility on the US term structure of Treasury yields and corporate bond spreads.Footnote 1

The above models, however, suffer from two important shortcomings. The first is the numerical burden and the presence of identification issues when estimating such models using maximum likelihood in a state space framework.Footnote 2 This first difficulty is overcome by the method proposed by Joslin et al. (2011). These authors propose the use of a limited set of observable yield portfolios (spanned factors) to model in a consistent way the cross-sectional features of the yield curve. The second shortcoming of affine term structure models, including macroeconomic variables, was emphasized by Joslin et al. (2014). Standard formulations of those affine yield curve models imply that the macroeconomic (and financial) risk factors are spanned by—i.e. can be expressed as a linear combination of—bond yields. This implication of standard models is, however, overwhelmingly rejected by standard regression analysis, which shows that there is no perfect linear relation between yields and such variables. These authors, therefore, propose the introduction of macroeconomic variables as unspanned factors in otherwise standard affine models. While unspanned factors do not impact directly on bond yields, they may still have predictive content for risk premiums over and above the information contained in bond yields. In other words, these factors do not affect the shape of the yield curve directly, but carry relevant information to forecast developments in spanned factors and hence excess bond returns.

Our methodology combines the methods proposed by Joslin et al. (2011) and Joslin et al. (2014) and can be seen as a reduced-form approach of the models for defaultable bonds proposed by Duffie and Singleton (1999). Such combination has been used previously by Dewachter et al. (2015) in the context of euro area sovereign bonds. These authors propose a two-market model consisting of overnight index swap (OIS) rates, seen as their benchmark market, and the sovereign bond market for a specific country of the euro area. In this paper, we further extend the latter model by incorporating several markets at once. Our focus is on the corporate bond market. The first market represents the benchmark risk-free rates, measured as the OIS yield curve. The second market is represented by the yield curve for corporate bonds with an A rating, while the third market represents the yield curve of lower-ranked BBB-rated corporate debt. Due to the availability of data, we only use these two rating classes. The modelling approach, however, allows the inclusion of as many rating classes as necessary. The proposed framework is applied to the euro area corporate bond market using monthly data for the period from August 2001 to April 2015. Our model includes a total of ten factors: four observable ‘spanned’ factors explaining the yield curves of OIS rates and corporate bonds of the two rating classes (A and BBB), and six ‘unspanned’ factors. As common in the literature, the spanned factors are essentially portfolios of yields. The unspanned factors include standard macroeconomic variables (economic activity and inflation) and financial risk factors, which capture the cost of borrowing for non-financial corporations, global tensions, systemic risk and liquidity concerns in the financial market. To simplify interpretation, these factors are divided into three groups: economic, financial and idiosyncratic (i.e. rating-class-specific corporate spread) factors.

Our results show that, overall, both economic and financial factors play a significant role in the determination of OIS rates and corporate bond spreads. For OIS rates, economic shocks are the most important source of variation for a 1-month forecasting horizon and for bonds with maturities up to two years. For intermediate and lower frequencies, financial shocks are the main source of variation in OIS rate dynamics. For corporate bond spreads, financial shocks are the dominant drivers for all maturities and almost all forecasting horizons, the exception being the 1-month horizon.

Apart from its empirical findings, the paper offers a blueprint for modelling the joint yield curve dynamics of risk-free rates and several corporate bond market segments. The approach presented here may thus be applied in an analogous fashion to other combinations of rating classes or for industry-group-specific analyses.

The remainder of this paper is organized as follows. Section 2 presents the multi-market, affine term structure model and the VAR system used to determine the influence of macroeconomic and risk-related financial factors on corporate bond spreads. Section 3 summarizes the data, describes briefly the estimation method and discusses the results. This includes the analysis of impulse response functions (IRFs) and variance decompositions of the OIS rates and corporate bond spreads. Section 4 concludes the paper.

2 Modelling framework and data

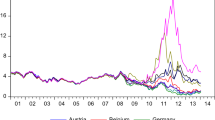

Dewachter et al. (2015) combine the methods proposed by Joslin et al. (2011) and Joslin et al. (2014) and extend the standard affine yield curve model to a multi-market, single-pricing kernel framework. In their set-up, one of the markets represents the risk-free yield curve and the other the sovereign bond market of a specific country. This framework is applied to analyse the developments of sovereign yields in a number of euro area countries (i.e. Belgium, France, Germany, Italy and Spain) during the sovereign debt crisis period.

In our set-up, the first market also represents the risk-free benchmark (the OIS rate), while the second and third markets are represented by the yield curves on corporate bond indices of different rating classes (A and BBB).

The framework adopted by Dewachter et al. (2015) is particularly useful since it allows us to fit the three yield curves with a reasonable precision and also to choose the relevant set of unspanned factors in order to forecast excess bond returns. Since the methodology is explained in detail in Dewachter et al. (2015), we restrict ourselves to the modifications made in the original framework to fit our purpose.

As is common in this literature, this type of model imposes the no-arbitrage restriction in the context of Gaussian and linear state space dynamics. As suggested by Joslin et al. (2011), we adopt a limited set of spanned factors—yield portfolios—to model the cross section of the yield curve. And as suggested by Joslin et al. (2014), we model the dynamics of the yield portfolios under the historical measure by means of a standard VAR, including besides the yield curve portfolios, a number of macroeconomic and risk-related variables. Based on the VAR dynamics, and the affine yield curve representation implied by the risk-neutral dynamics, we assess the relative contribution of the respective macroeconomic and risk-related variables in explaining yield curve dynamics. Below, we describe briefly the multi-market affine yield curve model proposed by Dewachter et al. (2015) and present the assumptions imposed in the VAR system.

2.1 A multi-market affine yield curve model for corporate bonds

There are K unobserved pricing factors for the yield curve of all markets collected in the vector \(X_{t}=\left[ X_{1,t},\dots ,X_{K,t}\right] ^{\prime }\). These factors reflect fundamental sources of risk and their dynamics under the risk-neutral measure (Q) which is given by a VAR(1):

where \(\Phi _{X}^{Q}\) is a diagonal matrix containing the (assumed) distinct eigenvalues of \(\Phi _{X}^{Q}\) and \(\Sigma _{X}\) is a lower triangular matrix. We assume that the K factors determine the risk-free one-period interest rate (\(r_{0,t}\)) and each of the market-specific, short-term interest rates in market m (\(r_{m,t}\)), with \(m=1,\dots ,M\), as follows:

where \(\rho _{0}^{0}+\rho _{0}^{1}X_{t}\) represents the risk-free rate \(r_{0,t}\) and \(s_{j,t}=\rho _{j}^{0}+\rho _{j}^{1}X_{t}\) represents the one-period spreads between bond yields of each rating class and the next rating class with a better rating. In this way, the model allows the introduction of several bond markets, all conditioned on the same pricing kernel. The differences across bond markets depend on a constant (\(\rho _{j}^{0}\)) and the market-specific factor sensitivities to the respective fundamental factors, \(\rho _{j}^{1}\), \(j=1,\dots ,M.\) We use a three-market set-up comprising the risk-free rate plus two corporate bond markets, i.e. \(M=2\). Market 0 is therefore the benchmark risk-free rate, market 1 represents corporate bonds of the highest rating class in our sample (A in our case), and market 2 represents corporate bonds of the second highest rating class (BBB in our case).

In this setting, we assume that the benchmark (risk-free) short-term interest rate (the 1-month OIS rate in our case) is given by a constant and the sum of the first two spanned factors. The third spanned factor determines the dynamics of the spreads between bond yields of the highest rating class (A) and the risk-free rate (OIS). The fourth spanned factor determines the dynamics of the spreads between bond yields of our second highest rating class (BBB) and our highest rating class (A). We have therefore that:

Dewachter et al. (2015) also impose a series of identification restrictions in the model. In a similar fashion, we set \(C_{X}^{Q}=0\) and the parameter \(\rho _{0}^{0}\) becomes the unconditional average (under the risk-neutral measure) of the risk-free short-term interest rate.

Given the above structure, Dai and Singleton (2000) show that zero-coupon bond yields can be written as an affine function of the state vector. Denoting the time-t yield in market m (\(m=0,1,2\)) and maturity n by \(y_{m,t}(n),\) we have that:

where the functions \(A_{m,n}(\Theta _{m})\) and \(B_{m,n}(\Theta _{m})\) follow from the no-arbitrage condition (see e.g. Ang and Piazzesi 2003) with \(\Theta _{m}\) representing the parameter vector for market m, i.e. \(\Theta _{m}=\left\{ C_{X}^{Q},~\Phi _{X}^{Q},~\Sigma _{X},~\rho _{0}^{0},~\rho _{0}^{1},~\rho _{m}^{0},~\rho _{m}^{1}\right\} .\)Dewachter et al. (2015) show that once you collect the N yields per market and stack all yields for all markets, one can obtain the following yield curve representation:

with appropriate components for \(A(\Theta )\) and \(B(\Theta )\). It can also be shown that a suitable rotation of the pricing factors \(X_{t}\) based on yield portfolios (\(P_{t}\)) allows an equivalent yield curve representation. These yield portfolios, \(P_{t}\), are linear combinations of yields and are assumed to be perfectly priced by the no-arbitrage restrictions and observed without any measurement error. Assuming that the yield portfolios are constructed based on a certain matrix W, \(P_{t}=WY_{t}\), one can express the yield curve as an affine function of the yield portfolios \(P_{t}\), rather than as a function of generic latent risk factors \(X_{t}\):

2.2 Decomposing the yield curve dynamics

We keep the framework of Dewachter et al. (2015) and adopt a first-order Gaussian VAR model to assess the relative importance of macroeconomic and risk-related financial shocks in the yield curve dynamics.

While the spanned factors \(P_{t}\) completely explain the risk-free and corporate yield curves as outlined above, the unspanned factors \(M_{t}\) will help forecast the spanned factors. \(P_{t}\) and \(M_{t}\) are jointly modelled in a VAR(1) under the physical measure \(\mathbb {P}~\)as:

where \((\varepsilon _{M,t}^{\mathbb {P}},\varepsilon _{P,t}^{\mathbb {P}})^{\prime }\sim N(0,I)\) and \(\Sigma \) is a lower triangular matrix. Below, we describe the variables included in the unspanned and spanned factors.

2.3 Estimation method

Our estimation procedure follows the methodology proposed by Joslin et al. (2011), which is also described in detail by Dewachter et al. (2015). This methodology uses an efficient factorization of the likelihood function, arising from the use of yield portfolios as pricing factors. It also allows for an efficient two-step maximum likelihood estimation procedure, which involves: (i) the estimation of the VAR system in Eq. (7) using standard OLS regressions; and (ii) the estimation of the remaining parameters to fit the OIS curve and the bond spread curves for each rating class using a maximum likelihood procedure.

2.4 Data

We estimate the model on monthly data over the period from August 2001 to April 2015 (165 observations per series). The data used can be sorted in two groups: one group featuring macro and financial data, and another comprising yield curve data.

Macro and financial data These data are used to construct the six unspanned factors included in the model. They are: (i) the Purchasing Managers’ Index (PMI), which is based on surveys of business conditions in manufacturing and in services industries. This index is used directly as our proxy for economic activity in the euro area and is obtained from Markit Financial Information Services (markit.com); (ii) the year-on-year growth rate of the Euro area Harmonized Consumer Price Index (INFL) is our measure for inflation in the euro area. We collect the data from Datastream; (iii) the spread between the cost of borrowing for corporations and the average of OIS rates. This is our cost of borrowing factor (COST), and the data are from the ECB; (iv) a market volatility index based on EURO STOXX 50 options prices (VSTOXX). This is our measure for the general tension in financial markets. The data are collected from STOXX Ltd. (stoxx.com); (v) the Composite Indicator of Systemic Stress (CISS) in the financial system. This index incorporates a total of 15 financial stress measures and was proposed by Holl et al. (2012).Footnote 3 The data are from the European Central Bank (ECB); and (vi) the spread between the yield of the German government-guaranteed KfW (’Kreditanstalt fur Wiederaufbau’, a government-owned development bank) bond and the German sovereign bond, averaged across maturities of 1, 2, 3, 4, 5, 7 and 10 years. This represents our liquidity or flight-to-liquidity factor (F2L). The data for both series are from Bloomberg.

Yield curve data We use the OIS rate for maturities of 1, 2, 3, 4, 5, 7 and 10 years, representing the risk-free benchmark rate for the euro area. Finally, we collect data for two indices of corporate bond yields for the rating classes A and BBB. These indices are computed by and collected from Bloomberg. We use the same maturities as for the OIS rate.

2.5 Unspanned and spanned factors

As mentioned before, we include a total of six unspanned factors. The first two of them represent macroeconomic conditions, proxied by (PMI) and (INFL). The last four factors are financial factors expressing the cost of borrowing faced by non-financial corporations (COST), the global tension in financial markets (VSTOXX), the presence of a systemic risk (CISS) and the existence of liquidity concerns (F2L). We therefore have the following vector of unspanned factors:

We adopt a total of four spanned factors, i.e. yield portfolios. The first two factors are used to explain the dynamics of the OIS yield curve. They are computed as the first two principal components of the OIS rates for the seven maturities included in the sample (\(PC_{t}^{rf,1}\) and \(PC_{t}^{rf,2}\)). Although we could choose any linear combination of observed yields to form such portfolios, this choice avoids fitting perfectly a set of specific yields and underfitting the others. The last two factors are used to explain the dynamics of corporate bond spreads. The first of these factors, \(PC_{t}^{spr,1}\), is computed as the first principal component of the seven yield spreads between A bond yields and the OIS rate, one for each maturity. In the same way, the second of these factors, \(PC_{t}^{spr,2}\), is computed as the first principal component of the seven yield spreads between BBB and A bond yields. The vector of yield portfolios can then be expressed as:

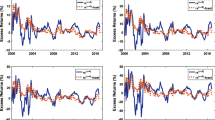

All ten unspanned and spanned factors are displayed in Fig. 1, where the unspanned factors are standardized. The yield curves for the OIS rate and for the two corporate bond rating classes are shown in the next section where we evaluate the yield curve fit for each case.

Unspanned and spanned standardized factors. Note The figure shows the 6 unspanned and 4 spanned factors. The unspanned factors are standardized: PMI is the Purchasing Managers’ Index, which is based on surveys of business conditions in manufacturing and in services industries (source: markit.com); INFL is the year-on-year growth rate of the Euro area Consumer Price Index (source: Datastream); COST is the spread between the cost of borrowing for corporations and the average of OIS rates (source: ECB); VSTOXX is a market volatility index based on EURO STOXX 50 real-time options prices (source: stoxx.com); CISS is the Composite Indicator of Systemic Stress in the financial system which incorporates 15 financial stress measures [source: Holl et al. (2012)]; and F2L is the spread between the yield on the German government-guaranteed bond (KfW) and the German sovereign bond, averaged across maturities (source: Bloomberg). The spanned factors are the following: PC(rf,1) and PC(rf,2) are the first two principal components of the OIS rates for the seven maturities included in the sample (1, 2, 3, 4, 5, 7, 10 years); PC(spr,1) is the first principal component of the seven yield spreads between A bond yields and the OIS rate; and PC(spr,2) is the first principal component of the seven yield spreads between BBB and A bond yields. For all series, the sample period goes from August 2001 to April 2015 (monthly, 165 obs.)

3 Empirical results

3.1 Model evaluation

The model fits the OIS and most maturities of the two corporate bond yield curves rather well.Footnote 4 Figures 2, 3 and 4 show the fit of the observed bond yields and spreads (continuous line) together with their fitted values (dashed line). Summary statistics of these fitting errors are provided in the last two columns of Table 1. For OIS rates, the fitted and observed series are very close to each other (Fig. 2). The fitting errors—obtained with our two spanned factors—are quite low (standard deviation between 3 and 8 basis points) and of a similar order of magnitude as usually found in the literature on affine term structure models. The dynamics of corporate bond spreads are also well captured by our model, which is remarkable, given the limited number of spanned factors. However, the standard deviation of the fitting errors for corporate bond spreads is somewhat higher than for OIS, ranging between 5 and 12 basis points for A-rated, and between 9 and 28 basis points for BBB-rated debt. The larger residual size for corporate debt may indicate the need for additional spanned factors. At the same time, as the corporate yields are constructed from an index, one may want to allow for a larger margin of ‘measurement error’ in this case, i.e. residuals of a size comparable to OIS rates may not be desirable for corporates. We leave a refinement of this analysis to future research.

Fit of the OIS yield curve. Note The figure shows the fit of the OIS yield curve for the maturities of 1, 2, 3, 4, 5, 7, 10 years. The continuous line shows the observed (actual) data, while the dashed line shows the fitted values. Yields measured in decimals, e.g. 0.04 corresponds to 4% per annum. The sample period goes from August 2001 to April 2015 (monthly, 165 obs.)

Fit of the A bond yield spread. Note The figure shows the fit of the spread between the A bond yield and the OIS rate for the maturities of 1, 2, 3, 4, 5, 7, 10 years. The continuous line shows the observed (actual) data, while the dashed line shows the fitted values. Spreads measured in decimals, e.g. 0.02 corresponds to 2 percentage points. The sample period goes from August 2001 to April 2015 (monthly, 165 obs.)

Fit of the BBB bond yield spread. Note The figure shows the fit of the spread between the BBB bond yield and the OIS rate for the maturities of 1, 2, 3, 4, 5, 7, 10 years. The continuous line shows the observed (actual) data, while the dashed line shows the fitted values. Spreads measured in decimals, e.g. 0.02 corresponds to 2 percentage points. The sample period goes from August 2001 to April 2015 (monthly, 165 obs.)

We also compare the risk premiums for the OIS, A and BBB yield curves, i.e. expected excess returns for a 1-year holding period, with the realized excess return for the same holding periodFootnote 5 (Figs. 5, 6, 7). The details of computing the risk premium are shown in Appendix A. In all cases, we see that expected excess returns, i.e. risk premia, co-move considerably with the ex post realized excess returns: for all maturities and rating classes, the correlation is above 0.65. It is higher for corporate bonds than for the risk-free curve, it is higher for BBB-rated than for A-rated corporates, and it tends to decrease with the maturity of the underlying bond (Table 2).

Finally, it is interesting to observe the risk premium differential between corporate bonds and our benchmark risk-free rate. This is shown in Figs. 8 and 9 for A- and BBB-rated corporate bonds, respectively. These figures show that for both rating classes the risk premium differential increases with maturity. As expected, we also observe a sharp increase in the risk premium differential after the beginning of the 2008 financial crisis.

Next, we focus on the dynamics of corporate bond yield spreads as a function of our ten unspanned and spanned factors. This is done through the analysis of IRFs and variance decompositions. In order to facilitate interpretation, for the variance decomposition we divide the ten factors in three groups, as explained below.

3.2 Impulse response functions

We analyse the dynamic properties of the model by means of IRFs. This allows us to visualize the response of corporate bond yield spreads to a one-standard-deviation shock to each of the 10 variables included in the model. The estimated VAR(1) system under the historical (\(\mathbb {P}\)) measure is as follows:

where the elements of \(\varepsilon _{F,t}^{\mathbb {P}}\) all have unit variance and are contemporaneously independent, and \(\Sigma _{F}\) is a lower triangular matrix. The ordering of the variables in the VAR is as follows:

We start with the unspanned factors followed by the spanned factors. The unspanned factors include first the variables representing the macroeconomic situation of the euro area and then the risk-related financial factors. This ordering implies that the spanned factors—and hence yield curves—are allowed to react contemporaneously to economic activity and inflation shocks as well as to shocks to the unspanned risk factors, but not vice versa.

Fit of the risk premium: OIS yield curve. Note The figure considers a 1-year holding period. It shows the risk premium (continuous line) and the realized excess return (dashed line) for the OIS rates with maturities of 1, 2, 3, 4, 5, 7, 10 years. Risk premium measured in decimals, e.g. 0.1 corresponds to 10% excess return per annum. The sample period goes from August 2001 to April 2015 (monthly, 165 obs.)

Fit of the risk premium: a bond yield curve. Note The figure considers a 1-year holding period. It shows the risk premium (continuous line) and the realized excess return (dashed line) for the A bond yields with maturities of 1, 2, 3, 4, 5, 7, 10 years. Risk premium measured in decimals, e.g. 0.1 corresponds to 10% excess return per annum. The sample period goes from August 2001 to April 2015 (monthly, 165 obs.)

Fit of the risk premium: BBB bond yield curve. Note The figure considers a 1-year holding period. It shows the risk premium (continuous line) and the realized excess return (dashed line) for the BBB bond yields with maturities of 1, 2, 3, 4, 5, 7, 10 years. Risk premium measured in decimals, e.g. 0.1 corresponds to 10% excess return per annum. The sample period goes from August 2001 to April 2015 (monthly, 165 obs.)

Figures 10 and 11 show the IRFs for the 5-year corporate bond yield spreads for the A and BBB rating classes, respectively. These figures also show the 90% confidence interval (dashed lines) obtained by a standard bootstrapping procedure. The horizontal axis is expressed in months.

First, we analyse the impact of shocks to the macroeconomic condition in the euro area. We see that in both cases (A and BBB bonds) a one-standard-deviation shock to the \(PMI \) index, representing an improvement in economic activity, initially decreases corporate bond spreads in line with economic intuition. The impact is significant for up to around 6 months, after which it dies out. The impact of this shock reaches a maximum of 7 basis points for BBB-rated bonds. As regards shocks to inflation (INFL), there is arguably less ex-ante expectation on the sign and size of the reaction. Based on our sample, we find that the reaction of corporate spreads is slightly negative but not significant.

Second, we study the effect of shocks to the financial factors. A one-standard deviation shock to the cost of borrowing (COST) has an initially significant and positive impact on bond spreads. A shock to financial market uncertainty as reflected in \(VSTOXX \) has the strongest impact on bond spreads, with the initial reaction of BBB bonds amounting to around 9 basis points. The impact is significant for the first 6 months after the shock for both rating classes. The initial effect of a shock to our systemic risk measure (CISS) is positive, in line with intuition, and significant for around the first 16 months after the shock. Finally, shocks to our proxy for liquidity concerns in the financial market (F2L) have a significantly positive impact on bond spreads, but only with a lag of around 3 months, lifting BBB bond spreads by close to 9 basis points.

3.3 Variance decompositions

We construct variance decompositions in order to assess the relative contribution of each factor to the unexpected fluctuations in risk-free yields and corporate bond spreads. Since we have a total of 10 factors in the model, in order to facilitate interpretation, we divide these factors in three groups: (i) economic factors summarize the overall economic condition of the euro area and the dynamics of the risk-free rate (PMI, \(INFL,PC_{t}^{rf,1},PC_{t}^{rf,2}\)); (ii) financial factors capture global tensions, systemic risk, and liquidity concerns in the financial market and the cost of borrowing for non-financial corporations (COST, VSTOXX, CISS, F2L); and (iii) idiosyncratic corporate bond factors include the residual dynamics not explained by economic or risk-related financial factors (\(PC_{{}}^{spr,1}\) and \(PC_{{}}^{spr,2}\)).

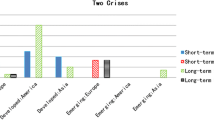

Figure 12 shows the variance decomposition of the OIS yield curve. Financial factors are the most important drivers across most of the maturities and forecasting horizons. Across all maturities and forecasting horizons, these shocks account for about 65% of the variation of the OIS yield curve. Economic shocks are the predominant source of variation only for short-term maturities (up to two years) and very short forecasting horizons (one month). Nevertheless, across all maturities and forecasting horizons these shocks account on average for 30% of the fluctuations in the OIS yield curve.

Risk premium differential: a bond yields w.r.t OIS rate. Note The figure considers a 1-year holding period. It shows the risk premium differential between A bonds and our benchmark risk-free rate (the OIS rate). This is done for bond yields with maturities of 1, 2, 3, 4, 5, 7, 10 years. Risk premium differential measured in decimals, e.g. 0.1 corresponds to a 10 percentage points difference in excess returns. The sample period goes from August 2001 to April 2015 (monthly, 165 obs.)

Risk premium differential: BBB bond yields w.r.t OIS rate. Note The figure considers a 1-year holding period. It shows the risk premium differential between BBB bonds and our benchmark risk-free rate (the OIS rate). This is done for bond yields with maturities of 1, 2, 3, 4, 5, 7, 10 years. Risk premium differential measured in decimals, e.g. 0.1 corresponds to a 10 percentage points difference in excess returns. The sample period goes from August 2001 to April 2015 (monthly, 165 obs.)

Impulse response function: response of the 5-year A bond yield spread to factor shocks. Note The figure shows the impulse responses of 5-year A bond yield spreads for the maturities of 1, 2, 3, 4, 5, 7, 10 years to a one-standard-deviation shock in each of the 10 factors (six unspanned and four spanned). The dashed lines show the 90% confidence interval. Error bands are obtained by a standard bootstrapping procedure. Units are in basis points

Impulse response function: Response of the 5-year BBB bond yield spread to factor shocks. Note The figure shows the impulse responses of 5-year BBB bond yield spreads for the maturities of 1, 2, 3, 4, 5, 7, 10 years to a one-standard deviation shock in each of the 10 factors (six unspanned and four spanned). The dashed lines show the 90% confidence interval. Error bands are obtained by a standard bootstrapping procedure. Units are in basis points

Variance decomposition of OIS yield curve. Note The figure shows the variance decomposition of the OIS rates for the maturities of 1, 2, 3, 4, 5, 7, 10 years. Each graph shows the contribution of three groups of factors as follows: Economic factors—PMI, \(INFL,PC_{t}^{rf,1},PC_{t}^{rf,2}\); Risk-related financial factors—COST, VSTOXX, CISS, F2L; Idiosyncratic corporate bond factors —\(PC_{{}}^{spr,1}\) and \(PC_{{}}^{spr,2}\)

Regarding corporate bond spreads, Figs. 13 and 14 show for all maturities the variance decompositions for A- and BBB-rated bonds, respectively. First, we note that all three groups of factors are significant sources of variation in corporate bond yield spreads. Nevertheless, in both cases (A and BBB bonds), the bulk of the variation (around 50%) in corporate bond spreads is attributed to financial shocks: for all maturities and forecasting horizons, except for the 1-month forecasting horizon, these shocks are responsible for more than 50% of the forecast variance of corporate bond spreads. These results emphasize the importance of including such factors in the analysis of corporate debt pricing. Surprisingly, idiosyncratic factors play a significant role in the fluctuation of corporate bond spreads, especially for short forecasting horizons. Economic factors, on the other hand, are responsible for around 25% of the fluctuations in corporate bond spreads across all maturities and forecasting horizons.

Variance decomposition of A bond yield spreads. Note The figure shows the variance decomposition of A bond yield spreads for the maturities of 1, 2, 3, 4, 5, 7, 10 years. Each graph shows the contribution of three groups of factors as follows: Economic factors—PMI, \(INFL,PC_{t}^{rf,1},PC_{t}^{rf,2}\); Risk-related financial factors—COST, VSTOXX, CISS, F2L; Idiosyncratic corporate bond factors—\(PC_{{}}^{spr,1}\) and \(PC_{{}}^{spr,2}\)

Variance decomposition of BBB bond yield spreads. Note The figure shows the variance decomposition of BBB bond yield spreads for the maturities of 1, 2, 3, 4, 5, 7, 10 years. Each graph shows the contribution of three groups of factors as follows: Economic factors—PMI, \(INFL,PC_{t}^{rf,1},PC_{t}^{rf,2}\); Risk-related financial factors—COST, VSTOXX, CISS, F2L; Idiosyncratic corporate bond factors—\(PC_{{}}^{spr,1}\) and \(PC_{{}}^{spr,2}\)

4 Conclusion

This paper introduces a modelling framework for capturing the joint arbitrage-free dynamics of the risk-free term structure and corporate bond yield curves of various rating classes. The approach is based on methods proposed by Joslin et al. (2011), Joslin et al. (2014), and Dewachter et al. (2015).

We apply this multi-market term structure model for analysing the development of A- and BBB-rated euro area corporate bond spreads over the last decade, thereby focusing on the global financial crisis. The empirical model features overall ten factors, of which four are ‘spanned’, explaining the cross section (maturity structure) of risk-free and corporate yields, while the remaining six ‘unspanned’ factors help to explain the dynamics of the spanned factors and can hence account for time variation in bond risk premiums. Our spanned factors are essentially portfolios of risk-free and corporate bond yields, while the unspanned factors represent macroeconomic driving forces (real activity and inflation) as well as financial factors, which capture risk aversion, investors’ liquidity preferences and bouts of general stress levels in financial markets.

We find that both macroeconomic and financial factors are important driving forces for the risk-free yield curve and corporate bond spreads. According to our variance decomposition, macroeconomic and financial factors are each responsible on average for 30 and 65%, respectively, of the variation across the OIS yield curve. For corporate bond spreads, financial factors explain about 50% of the unexpected fluctuations in both A- and BBB-rated corporate bond spreads across all maturities. Macroeconomic factors are responsible for about 25% of the variation of A- and BBB-rated bonds, while the remaining 25% are explained by idiosyncratic market-specific factors.

The paper carries the idea of modelling bond yields via spanned and unspanned factors further to corporate bonds. The evidence that we find for the relevance of unspanned observable factors mirrors similar findings in the literature that focuses solely on government bonds. A natural extension of the presented framework is to also include government debt markets in order to shed light on the sovereign–corporate nexus, i.e. how strongly sovereign debt market tensions feed back towards the corporate sector and vice versa. In a similar vein, future studies may capture the interrelation of corporate bond markets from different euro area countries in order to explore potential asymmetries of those markets in their responses to shocks or to quantify spillovers.

Notes

There is also a vast literature that uses regression-based approaches to study the determinants of corporate bond spreads. See, for example, Collin-Dufresne et al. (2001).

The usual computational challenges faced by affine term structure models are well described by Duffee and Stanton (2008).

The CISS index also contains components related to stock market volatility. However, the VSTOXX and the CISS carry different information as evident from Fig. 1, and their correlation amounts to 0.62 (levels) and 0.35 (monthly changes), i.e. volatility and VIXX are not perfectly aligned.

The parameter estimates of the model are available upon request.

For every rating class, the risk premium is obtained under the condition of no default, i.e. it is assumed that the rating class considered does not default over the considered holding period.

References

Amato JD, Luisi M (2006) Macro factors in the term structure of credit spreads. BIS Working Papers 203, Bank for International Settlements

Ang A, Piazzesi M (2003) A no-arbitrage vector autoregression of term structure dynamics with macroeconomic and latent variables. J Monet Econ 50(4):745–787

Bekaert G, Cho S, Moreno A (2010) New-Keynesian macroeconomics and the term structure. J Money Credit Bank 42:33–62

Collin-Dufresne P, Goldstein RS, Martin JS (2001) The determinants of credit spread changes. J Finance 56(6):2177–2207

Dai Q, Singleton KJ (2000) Specification analysis of affine term structure models. J Finance 55(5):1943–1978

Dewachter H, Iania L (2011) An extended macro-finance model with financial factors. J Financ Quant Anal 46:1893–1916

Dewachter H, Iania L, Lyrio M, Perea MdS (2015) A macro-financial analysis of the euro area sovereign bond market. J Bank Finance 50:308–325

Dewachter H, Lyrio M (2006) Macro factors and the term structure of interest rates. J Money Credit Bank 38(1):119–140

Duffee GR, Stanton RH (2008) Evidence on simulation inference for near unit-root processes with implications for term structure estimation. J Financ Econom 6(1):108–142

Duffie D, Kan R (1996) A yield-factor model of interest rates. Math Finance 6:379–406

Duffie D, Singleton KJ (1999) Modeling term structures of defaultable bonds. Rev Financ Stud 12(4):687–720

Gürkaynak RS, Wright JH (2012) Macroeconomics and the term structure. J Econ Lit 50(2):331–367

Holl D, Kremer M, Duca ML (2012) CISS—a composite indicator of systemic stress in the financial system. ECB Working Paper Series, European Central Bank

Hördahl P, Tristani O, Vestin D (2008) The yield curve and macroeconomic dynamics. Econ J 118(533):1937–1970

Joslin S, Priebsch M, Singleton KJ (2014) Risk premiums in dynamic term structure models with unspanned macro risks. J Finance 69(3):1197–1233

Joslin S, Singleton KJ, Zhu H (2011) A new perspective on Gaussian dynamic term structure models. Rev Financ Stud 24(3):926–970

Mueller P (2009) Credit spreads and real activity. Working Paper

Rudebusch GD, Wu T (2008) A macro-finance model of the term structure, monetary policy and the economy. Econ J 118:906–926

Wu L, Zhang FX (2008) A no-arbitrage analysis of macroeconomic determinants of the credit spread term structure. Manag Sci 54(6):1160–1175

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Marco Lyrio is grateful for financial support from CNPq-Brazil (Project No. 308310/2016-0).

The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank or the National Bank of Belgium. We thank the editor and a referee for useful comments. We also thank comments by seminar participants at the 2015 Auckland Finance Meeting, 6th International Research Meeting in Business and Management, 2016 International Finance and Banking Society Conference, and X Luso-Brazilian Finance Meeting. All remaining errors are our own.

Appendix A: Risk premium computation

Appendix A: Risk premium computation

This appendix shows the computations for the risk premium (rp) considering a 1-year (12 months) holding period.

1. Bond risk premium (expected excess holding period return)

Yields are affine in factors, and factors follow a VAR(1):

Log bond prices are likewise affine in factors:

The risk premium is the expected return from holding an m-month bond for 12 months in excess of the risk-free 1-year rate:

where

Expressing the risk premium in terms of factors:

2. Risk premium per rating

3. Risk premium differential

The risk premium differential is computed as the difference between the risk premium on a specific corporate bond (A and BBB) and the risk premium on the benchmark risk-free rate (OIS rate).

Rights and permissions

About this article

Cite this article

Dewachter, H., Iania, L., Lemke, W. et al. A macro–financial analysis of the corporate bond market. Empir Econ 57, 1911–1933 (2019). https://doi.org/10.1007/s00181-018-1530-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1530-8