Abstract

For the first time in the literature, this paper uses survey-based measures of inflation expectations to examine the relationship between inflation and relative price variability (RPV). Using quarterly consumer price index data for 74 consumption categories in Australia from 1989 to 2014, we estimate the basic linear and piecewise liner models to investigate the impacts of expected and unexpected inflation on RPV. Both headline and core inflation measures are used. The results show a statistically significant and robust positive impact of unexpected inflation on RPV. There is little evidence of asymmetry between the effects of positive and negative inflation shocks. This paper further investigates the specific functional form of the inflation-RPV relationship. While the results suggest a J-shaped nonlinear relationship between inflation and unexpected inflation, there is little evidence of any specific functional form for an expected inflation-RPV relationship. Finally, two structural breaks in the inflation-RPV relationship are identified: 2003Q2 and 2007Q2 for headline inflation and 2000Q2 and 2006Q2 for core inflation. The first two regimes are characterized by a positive and convex association between RPV and unexpected inflation, which disappears in the third regime. The results are qualitatively similar when the model is re-estimated using standard forecast-based inflation expectation measures, suggesting that the traditional approach captures the inflation-RPV relationship reasonably well, at least for Australia.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A substantial literature examines the effect of inflation on relative prices.Footnote 1 As changes in relative prices influence the behavior of buyers as well as sellers, evidence of inflation-induced changes would provide a channel for this nominal variable to affect the real economy. Because of its economy-wide implications, the relationship between inflation and distribution of relative prices has drawn considerable attention of theoretical as well as empirical researchers.

Measures of relative price variability (RPV) are not unambiguously defined in the empirical literature and have at least two variants that are first noted by Parsley (1996). The first variation, recently highlighted by Hajzler and Fielding (2014) and Fielding et al. (2017), arises from the distinction between the dispersion of relative price changes, referred to as relative inflation variability (RIV), and the dispersion of relative price levels. The second variation stems from whether such dispersions are measured for different items within a location (city, state, country) or for a homogenous commodity across locations. Although these distinctions are important, we adhere to the majority of empirical literature that uses the standard deviation of relative price changes across different consumption items (both goods and services) as the measure of RPV.Footnote 2

The literature makes a clear distinction between expected and unexpected inflation and examines their separate or joint impacts on RPV. However, precise measurement of expected (and, therefore, unexpected) inflation has proved to be a formidable challenge in examining their relationships with RPV. The existing literature uses estimates of expected inflation obtained from a range of forecast models. In contrast, we use survey-based measures of expected inflation that are not only more reliable, but also provide an elegant way to circumvent the problems associated with synthetic measures of expected inflation. Using quarterly consumer price index (CPI) data for 74 consumption categories from 1989 to 2014 in Australia, we investigate the impact of expected and unexpected inflation on RPV. We use both headline and core inflation measures. Furthermore, in line with the recent literature, we examine the functional form and stability of the inflation-RPV relationship. Finally, we re-estimate the equations with standard forecast-based expected inflation measures and contrast the results with those obtained using survey-based expectation measures.

The theoretical literature on the effect of inflation on RPV traditionally encompasses three different model frameworks: the signal extraction model, the menu cost model and the monetary search model. The signal extraction model, pioneered by Lucas (1973), contends that an unexpected rise in inflation gives confusing signals to firms and households reducing their ability to distinguish between absolute and relative price changes. This confusion leads economic agents to misinterpret sectoral real shocks as aggregate shocks and to adjust price more than output. Consequently, unexpected inflation is predicted to increase RPV (Barro 1976; Hercowitz 1981; Cukierman 1983).

The menu cost model assumes that nominal price changes are costly and, therefore, firms set prices discontinuously. However, when firms set prices for a given time horizon they take into account anticipated overall inflation during that period. The duration between successive price changes depends on firm-specific menu costs, leading to staggered price changes and distorted relative prices with implications for RPV. In contrast to the signal extraction model, it is the expected part of inflation that influences RPV positively in the menu cost model (Sheshinski and Weiss 1977; Rotemberg 1983; Benabou 1992).

Unlike the signal extraction or menu cost models, both expected and unexpected inflation affect RPV in monetary search models, but in different directions. The underlying assumption of these models is that buyers have incomplete information about the prices offered by different sellers and therefore incur search costs to find the lowest prices. One strand of this literature predicts that an unexpected rise in inflation would increase search costs, raising sellers’ market power and resulting in a positive relationship between unexpected inflation and RPV. An alternative view claims that higher expected inflation lowers the purchasing power of money, thereby reducing search costs as well as sellers’ market power. In this case, a higher expected inflation will be associated with lower RPV (Reinsdorf 1994; Peterson and Shi 2004; Head and Kumar 2005). In summary, although these models concur that the transmission mechanism runs from inflation to RPV, they ascribe different roles to expected and unexpected inflation as the dominant channel of transmission.

Hajzler and Fielding (2014) extend the search theory framework of Reinganum (1979) and Bénabou and Gertner (1993) to provide a potential explanation for the observed differences in the unexpected inflation-relative price relationship when relative price variability is measured in levels vis-à-vis changes. Their model predicts unanticipated inflation to have a negative monotonic relationship with dispersion of relative price levels, and a U-shaped relationship with relative price change variability for sufficiently persistent relative marginal costs and prices. These predictions are consistent with the empirical results reported in Fielding et al. (2017).

Empirical evidence on the impact of inflation on RPV is mixed. In line with the predictions of the menu cost and signal extraction models, several studies find inflation to have a positive effect on RPV for various countries (Parks 1978; Glezakos and Nugent 1986; Parsley 1996; Debelle and Lamont 1997; Aarstol 1999; Jaramillo 1999; Chang and Cheng 2000; Nautz and Scharff 2005). Parks (1978) and Parsley (1996) report qualitatively similar results for the effects of inflation on variability of both relative price levels and changes. In contrast, a negative relationship between inflation and relative price level variability is documented for the USA during the early 1980s (Reinsdorf 1994). That the inflation-RPV relationship is not always positive is also reported for several European countries (Fielding and Mizen 2000; Silver and Ioannidis 2001). Lastrapes (2006) shows that the relationship between US inflation and RPV broke down in the mid-1980s. Becker and Nautz (2009) further demonstrate that the impact of expected inflation on RPV disappeared in the USA during the periods of low inflation. Fielding et al. (2017) use city-level retail price data from Japan, Canada and Nigeria to show that the impact of inflation on price change variability differs from its effect on price level variability.

More recent evidence suggests that the relationship may be nonlinear and the impact of inflation on RPV may differ between high-and low-inflation periods, in line with implications of the monetary search model. For example, evidence of threshold effects is provided by Caglayan and Filiztekin (2003) for Turkey, Caraballo et al. (2006) for Spain and Argentina, Bick and Nautz (2008) for US cities, and Nautz and Scharff (2012) for Euro area countries. While Caglayan and Filiztekin (2003) and Caraballo et al. (2006) choose the number and location of inflation thresholds exogenously, Bick and Nautz (2008) and Nautz and Scharff (2012) use a panel data technique suggested by Hansen (1999, 2000) to determine the number and location of the inflation thresholds endogenously. While Fielding and Mizen (2008) find evidence of a U-shaped relationship for the USA, Choi (2010) documents that the fitted U-shaped relationships are not stable over time, at least for the USA and Japan. The current paper contributes to this literature by presenting Australian evidence using actual survey-based expected inflation data.

The estimation of our basic model provides robust evidence of a significant positive impact of unexpected inflation on RPV. There is little evidence of asymmetry between the effects of positive and negative inflation shocks. The results from our investigation of the functional form suggest that the relationship between unexpected inflation and RPV is J-shaped. However, we fail to find strong evidence of any specific functional form of RPV’s relationship with expected inflation. There is some evidence of asymmetry between the effects of positive and negative inflation shocks in this nonlinear model, particularly when we use headline inflation. Furthermore, we find two structural breaks in the inflation-RPV relationship: 2003Q2 and 2007Q2 for headline inflation and 2000Q2 and 2006Q2 for core inflation. The nonlinearity of unexpected inflation significantly affects RPV for both headline and core inflation during the first two regimes, but not during the third regime. Expected inflation plays a significant role in the transmission mechanism only during the second regime. Finally, forecast-based expectation measures of inflation yield qualitatively similar results suggesting that carefully generated synthetic measures of inflation can be reasonable proxies for survey-based measures of expected inflation, at least for Australia.

To the best of our knowledge, ours is the first study to use actual survey data on expected inflation, opening a new avenue of research that can be replicated for other countries where survey data on inflation expectations are available. Use of survey-based measures instead of their predicted values allows one to avoid the generated regressor problems that are common in the literature. Furthermore, this is the only known study to examine the relationship between inflation and RPV using recent data for Australia. The other publicly available study (Clements and Nguyen 1981) predates the beginning of our sample period.Footnote 3

The rest of the paper is organized as follows. In Sect. 2, we describe the data. Section 3 presents the empirical results for the basic models that assume linear or piecewise linear relationship between RPV and inflation. The results from our investigation of the functional form and stability of the inflation-RPV relationship are presented and discussed in Sect. 4. Section 5 presents the results from the re-estimation of the models using standard forecast-based expectation measures and contrasts them with those reported in the previous sections. The last section includes our concluding remarks.

2 Data

We use quarterly CPI data on 74 expenditure items from 1989:Q3 to 2014:Q4, obtained from the Australian Bureau of Statistics (ABS) Consumer Price Index, Australia, ‘Tables 1–2. All Groups, Index Numbers and Percentage Changes’, Time series spreadsheet, cat. no. 6410.0, available at: http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6401.0Mar%202018?OpenDocument. These items cover about 82% of the consumption basket in Australia. The selection of the sample period is dictated by the availability of data on these expenditure items.Footnote 4 We also obtain quarterly data on 3 months ahead ‘business inflation expectations’ from the Reserve Bank of Australia (RBA) Web site. These data are based on the National Australia Bank Quarterly Business Survey respondents’ expectations for increases in final product prices over the next 3 months. Each original data series is adjusted for seasonal variations using the Census X-12 method.

Following the empirical literature, RPV in period t is defined as the square root of the weighted sum of squared deviations from mean inflation across expenditure items.

where πi,t = 100 × (ln Pi,t − ln Pi,t−1) is the quarterly price change with Pi,t denoting CPI of the ith expenditure category in period t, \( \bar{\pi }_{t} = \sum\nolimits_{i = 1}^{n} {w_{i} \pi_{i,t} } \) is the weighted mean price changes across consumption items in period t, and wi is the time-invariant weight assigned to item i. Thus, the RPV measure essentially reflects variations in changes of relative prices across consumption items.Footnote 5 Since our sample of expenditure items does not cover the entire consumption basket, we normalize the weights so that \( \sum\nolimits_{i = 1}^{n} {w_{i} = 1} \), where n denotes the number of expenditure items in the sample.

In order to measure inflation, we use quarterly changes in ‘all groups CPI.’ In addition to this ‘headline inflation’ measure, we also use the ABS data on ‘all groups CPI excluding the volatile items’ (i.e., fruit and vegetables and automotive fuel) to construct a ‘core’ inflation measure.Footnote 6 We use the core inflation measure as an alternative to headline inflation to avoid any endogeneity bias in the estimation that may result from common supply shocks affecting inflation and RPV simultaneously.Footnote 7

Table 1 presents summary statistics. The mean quarterly headline inflation for the sample period is 0.67%, and the mean core inflation is 0.71%. At annualized rate, they are 2.68 and 2.84%, respectively. A higher average for core inflation is primarily due to the presence of outliers (and more negative values of headline inflation), as indicated by the fact that median core inflation is lower than median headline inflation. We also report estimated pairwise correlation coefficients between RPV and headline inflation, core inflation and expected inflation. All three are positive and barring correlations with expected inflation are statistically significant at the 1% level. In order to estimate meaningful regression models of RPV and various inflation measures, the relevant series must be stationary. Therefore, we conduct stationarity tests on these series and report the results in Table 1. In particular, we conduct Augmented Dickey–Fuller (ADF) unit root tests and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) stationarity tests and find that all four series: RPV, headline inflation, core inflation and expected inflation are stationary.

3 Inflation-RPV relationship: the basic models

Following the convention in the literature, we first estimate basic models that assume a linear or ‘piecewise linear’ relationship. As discussed earlier, the theoretical literature has developed into two major strands—one predicting significant effects of expected inflation on RPV and the other ascribing a dominant role to unexpected inflation for explaining relative price variability. Thus, we estimate the following linear regression model that incorporates these two strands.

where π e t denotes expected inflation and, therefore, πt − π e t represents unexpected inflation in period t. Because some studies (e.g., Aarstol 1999) also highlight the asymmetric effects of positive and negative values of unexpected inflation (or inflation shock), we further modify this model to allow for such asymmetries.

where (πt − π e t )+ and (πt − π e t )− represent positive and negative inflation shocks, respectively. We use ordinary least squares (OLS) method to estimate the model parameters. Newey–West HAC (heteroscedasticity and autocorrelation consistent) standard errors are estimated.

Table 2 presents regression results for the basic models in Eqs. (2) and (3). The results for headline inflation are shown in columns (1) and (2), and those for core inflation are reported in columns (3) and (4). For both cases, only unexpected inflation has a positive and significant impact on RPV. Thus, in Australia, the larger the deviation of actual inflation from its expected value, the higher is relative price dispersion. This finding is in line with the prediction of the Lucas-type signal extraction models. The result from a formal F test suggests that, in the case of headline inflation, the effects of the estimated coefficients for expected and unexpected inflation on RPV are significantly different at the 10% level. However, this difference is not significant in case of core inflation.

Furthermore, as columns (2) and (4) show, positive inflation shocks have significant positive effects on RPV in the case of headline as well as core inflation. However, negative shocks have a statistically significant impact only in case of headline inflation. Nevertheless, we find little evidence of any significant asymmetry in the effects of positive and negative inflation shocks, as indicated by the results from the F test of equality between the estimated coefficients for those shocks.

Overall, the results from the basic models suggest that the finding of a positive impact of unexpected inflation on RPV in Australia is a robust result. Thus, when inflation is unexpected, it seems to create confusion and lead to higher RPV. Similar effects of unexpected inflation have been documented in Parks (1978), Parsley (1996), Debelle and Lamont (1997), Aarstol (1999), Jaramillo (1999), Chang and Cheng (2000), and Nautz and Scharff (2005). Our results are in sharp contrast with Reinsdorf (1994), Fielding and Mizen (2000) and Silver and Ioannidis (2001), who report a negative inflation-RPV relationship.

4 Functional form and stability of the inflation-RPV relationship

Several of the recent studies discussed above focus on functional forms and stability of the inflation-RPV relationship, with some reporting evidence of specific nonlinearity and structural breaks (e.g., Choi 2010). Therefore, we investigate if a nonlinear relationship fits the Australian data and estimate the appropriate nonlinear models. We further test for the existence of any significant structural break(s) in the inflation-RPV relationship. In these models, we attempt to accommodate features from the major theories that have been proposed to explain the observed relationship.

4.1 Functional form

As Fielding and Mizen (2008) argue, the knowledge of a precise functional form of the relationship between inflation and RPV is important for monetary policy, particularly because functional specification has important bearings on the choice of the optimal inflation rate. To that end, we now consider the following general specification of the model:

where Xt is a (p + q) × 1 vector of the regressors that include lagged terms of RPV and inflation. G(·) and H(·) are unknown functions of contemporaneous expected and unexpected inflation, respectively. To fix ideas about the functional form of G(·) and H(·), we first fit nonparametric kernel regressions through the scatter plots of RPV and expected inflation and that of RPV and unexpected inflation as shown in Fig. 1a–c. These graphs are used only as indicators of potential functional form of G(·) and H(·) in Eq. (4), which we estimate parametrically. Note that these kernel fits are generated using local polynomial regression, which, instead of fitting a local mean, fits a local pth-order polynomial. Local polynomials of higher-order exhibit better bias properties, compared to the Nadaraya–Watson estimator (local polynomial of degree zero), and do not require bias correction at the boundary of the regression space (Fan and Gijbels 1996). Given a relationship: yi = m(xi) + ɛi, where m(xi) is of unknown form, the procedure involves repeatedly fitting local polynomial regressions yi = α + β1(xi − x0) + β2(xi − x0)2 + ··· + βp(xi − x0)p + ηi, to estimate m(x0) = E(yi|xi = x0), weighting the observations in relation to their proximity to the focal value x0. A Gausssian kernel density function Kh(xi − x0) with bandwidth h is used as a common weight. Thus, the local polynomial smooth is obtained by specifying a smoothing grid consisting of a series of x0s and then, for each x0 in the grid, implementing the above weighted regression and collecting the estimated intercept term \( \hat{\beta }_{0} = \hat{m}(x_{0} ) \). We choose a polynomial of degree three for RPV-expected inflation plot, and polynomials of degree one for the rest. Following Fox (2002), we choose odd degree polynomials that are more advantageous. The confidence bands for \( \hat{y}_{i} \) are computed using the standard errors of the weighted polynomial regressions and the critical values from a normal distribution.

Kernel fits of the relationship between RPV and expected and unexpected inflation. Note: These graphs represent scatter plots of RPV with expected and unexpected (both headline and core) inflation with kernel fits (based on local polynomial regressions using Gaussian kernel and Bowman–Azzalini optimal bandwidths)

The choice of the bandwidth h is critical in the smoothing procedure. There is little agreement on the choice of bandwidth. Fox (2002), among others, proposes visual estimation of an optimal bandwidth by selecting the smallest possible value that provides a smooth fit. We take a more objective approach of computing the ‘optimal’ bandwidths suggested by Bowman and Azzalini (1997) that are compatible with the Gaussian kernel. The optimal bandwidth h is given by \( h = \hat{\sigma }(4/3n)^{0.2} \), where n is the sample size, and \( \hat{\sigma } \) is a robust estimate of the standard deviation of the distribution of Y, computed as \( \hat{\sigma } = {{{\text{median}}\{ \left| {y_{i} - {\text{median}}(y_{i} )} \right|\} } \mathord{\left/ {\vphantom {{{\text{median}}\{ \left| {y_{i} - {\text{median}}(y_{i} )} \right|\} } {0.6745}}} \right. \kern-0pt} {0.6745}} \).Footnote 8 Clearly, the kernel fits between RPV and unexpected headline and core inflation in Fig. 1b, c are J-shaped and suggest a quadratic functional form for H(·). The kernel fit between RPV and expected inflation seems to have a somewhat inverted U-shape with a long left tail.

Next, using the visual insights from these graphs we carry out a quantitative estimation of Eq. (4). We adopt a general-to-specific approach to model specification. Thus, in addition to the contemporaneous linear and quadratic terms of expected and unexpected headline inflation, we include lagged terms of RPV and inflation. Because we use quarterly data, we start with four lags and pare it down to no lag. We then use the Akaike Information Criterion (AIC) and Schwarz Information Criterion (SIC) to choose the best model. Both information criteria choose a specification with three-quarter-lagged RPV, a linear term of expected inflation and a quadratic term of unexpected inflation as the best model for headline inflation. The same model specification is chosen for core inflation as well. Note that information criteria involve a tradeoff between goodness of fit and parsimony. They ensure goodness of fit by appropriately penalizing potential overfitting. Furthermore, to examine if positive and negative unexpected inflation affect RPV differently, we include their quadratic terms separately and conduct a formal test of equality of the respective coefficients. Table 3 presents the results for these specifications for both headline as well as core inflation.

The estimated coefficients for three-quarter-lagged RPV are positive and statistically significant. The effect of expected inflation is not statistically significant. However, the estimated coefficient of the quadratic term for unexpected inflation is not only positive but also statistically significant for both headline and core inflation. In fact, the estimated coefficients retain their statistical significance at conventional levels even when we include positive and negative inflation shocks separately. These results are consistent with the shape of the fitted curve in Fig. 1 and in line with the prediction of the signal extraction model. Furthermore, the F test results for equality of estimated coefficients indicate that positive and negative inflation shocks have significantly different effects on RPV in case of headline inflation, but not for core inflation.

The J-shaped functional form of inflation-RPV relationship is consistent with the findings of Fielding and Mizen (2008) and Choi (2010) who document U-shaped relationships for the USA. Choi (2010) also finds a similar relationship for Japan during the disinflationary period. However, this functional form makes the choice of appropriate policy quite challenging. Since RPV falls with inflation when inflation is low, and rises when inflation is high, any predetermined monetary policy rule could be counterproductive. Thus, disinflationary policies may reduce price volatility if inflation level is high, unambiguously improving welfare by reducing misallocation of resources. However, reducing inflation is worthwhile only up to a certain point. At lower levels of inflation, disinflationary policies may not improve welfare if the cost of increased price volatility outweighs the benefits of lower inflation.

4.2 Structural breaks

In addition to the functional form, the question of stability of the inflation-RPV relationship is also important, particularly for policy implications of our study. In this section, we probe for any significant structural break(s) in the relationship and examine how the relationship varies over different regimes. Thus, we use a number of formal tests for structural break(s) suggested by Bai (1997) and Bai and Perron (1998, 2003). The number of breaks and their timing are endogenously determined by a series of sequential and global testing procedures. Following Bai and Perron, we exclude 15% of the observations at both ends of the sample period while searching for structural breaks. Furthermore, the maximum number of breaks is set to five and the minimum regime size is set to 5% of the sample. To examine the stability of the RPV-inflation relationship, we test whether the coefficients of expected and squared unexpected inflation vary significantly across breakpoints.

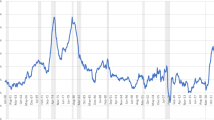

Table 4 presents the number of breaks and break dates detected by various test procedures. The two sequential testing methods find no breaks in the model with headline inflation. The global break tests based on Unweighted Double Maximum (UDMax) and Weighted Double Maximum (WDMax) and the Schwarz Information Criterion (SIC) identify two breaks in 2003Q2 and 2007Q4 for headline inflation. Furthermore, a hybrid global plus sequential test procedure detects an additional break in 1997Q2. For core inflation, the sequential tests, the global L breaks test, and the hybrid test pick two breaks in 2000Q2 and 2006Q2. However, the global SIC picks only one break in 2006Q2 and Liu–Wu–Zidek (LWZ) criterion picks none. To get a sense of the significance of these breaks, we plot inflation and RPV side-by-side and mark the break dates in Fig. 2. As we can see from the graphs, the period between 2003Q2 and 2007Q2 includes the two largest RPV measures. Furthermore, RPV is more volatile during post-2007Q2.Footnote 9 For core inflation, the second regime that spans from 2000Q2 to 2006Q2 includes large RPV measures at the beginning and the end of the period. In contrast, expected inflation is relatively more stable for both headline and core inflation during the respective second regimes when inflation shocks are mostly positive. Unexpected inflation becomes more volatile for headline inflation after 2007Q2 and for core inflation after 2006Q2 and it remains mostly positive during the third regimes.

We next re-estimate the nonlinear models for the three regimes: Regime 1 (1989Q4–2003Q1), Regime 2 (2003Q2–2007Q1), and Regime 3 (2007Q2–2014Q4) for headline inflation; and Regime 1 (1989Q4–2000Q1), Regime 2 (2000Q2–2006Q1), and Regime 3 (2006Q2–2014Q4) for core inflation. These regime-shifts roughly match with the distinct changes in Australian economic structure with potential implications for inflation dynamics and its effects on RPV. For example, Regime 1 for headline and core inflation was mainly characterized by a recession in 1990–1991 followed by an acceleration in productivity growth and expansion of employment during 1993–1998, partially triggered by a significant increase in business investment accompanied by increased inflow of immigrants.Footnote 10 These developments may have generated inflationary shocks through shifts in aggregate demand, which in turn affected RPV. Despite high interest rates, high inflation volatility seems to have sent confusing signals to market participants thereby increasing relative price dispersion.

Regime 2 for both headline and core inflation roughly coincide with a shock in the form of 10% tax on goods and services (GST) introduced in July 2000, resulting in a mild slowdown in 2000–2001, marking a time period around the first breakpoints. This was followed by a surge in economic growth and inflation—mainly driven by sharply rising world commodity prices—until 2006–2007, the time period around the second breakpoints. Expected inflation had a significant positive effect on RPV during this regime (see Table 5). It is likely that in high inflationary environments such as Regime 2, firms’ inflation expectations and price setting behavior are more tightly anchored to the central bank’s official inflation target (in this case, 2–3% over the medium run).

Not surprisingly, the third regime coincided with the global financial crisis and the great recession. The large decline in equity prices and wealth of Australian households coupled with widespread business pessimism led to a sharp drop in expected inflation during 2009 (see Fig. 2). Furthermore, the volatility of global crude oil prices increased considerably during Regime 3, which may have created widespread price dispersions between energy-intensive and other sectors.Footnote 11

The results incorporating structural breaks are reported in Table 5. The estimated coefficients for expected inflation are positive for headline inflation in all three regimes but statistically significant at the 10% level only in Regime 2. In the case of core inflation, the coefficient is negative in Regime 1 and positive in the other two regimes but statistically significant only in Regime 2. The coefficient estimates for squared unexpected inflation are positive and statistically significant at the 1% level for both headline and core inflation in Regimes 1 and 2. The estimated effect is quantitatively larger for headline inflation in Regime 2 and for core inflation in Regime 1.

Inflation (both expected and unexpected) do not seem to have any explanatory power for RPV in Regime 3 irrespective of whether we use headline or core inflation. The results for the earlier regimes provide evidence in support of the signal extraction theory both for headline and core inflation in that unexpected inflation is a significant determinant of RPV. The results also bear out the predictions of the menu cost model for both measures of inflation in Regime 2. Overall, the results point to an unstable relationship between inflation and RPV. However, literal interpretation of the results is problematic due to potential estimation biases resulting from short durations of the identified regimes. In particular, Regime 2 has only 16 observations in case of headline inflation and 24 observations in case of core inflation. The estimated coefficients are likely to be imprecise and therefore unfit for drawing strong inferences.

5 A comparison with estimation results using standard forecast-based expectation measures

As mentioned above, almost all known empirical studies use forecast values from a range of inflation models—simple to complex—as measures of inflation expectations for examining the inflation-RPV relationship. In this section, we conduct a similar exercise to highlight the differences in the results between forecast-based and survey-based measures of inflation expectations.

5.1 Modeling inflation

Following the literature, we resort to univariate time series modeling technique to obtain forecast values of inflation, which are then used as expected inflation measures. Since both headline and core inflation are found to be stationary, we begin with an autoregressive moving-average (ARMA) model.Footnote 12 We use the Akaike Information Criterion (AIC) and the Schwarz Information Criterion (SIC) to determine the respective orders of AR and MA terms. We further test for autoregressive conditional heteroskedasticity (ARCH) or, more generally, generalized autoregressive conditional heteroskedasticity (GARCH). Based on both AIC and SIC, we choose ARMA (2, 2) for headline inflation.Footnote 13 We fail to find any evidence of ARCH/GARCH effects. The selected model is as follows:

We now obtain the forecast values of headline inflation from the estimated model for the entire sample period and use them as the measures of expected inflation. Subtracting these forecast values from actual values of headline and core inflation, we obtain respective unexpected inflation or inflation shock measures.

5.2 Results for the basic models

The results for headline inflation are shown in column (1) and (2) of Table 6 while those for core inflation are shown in column (3) and (4). Similar to the results presented in Sect. 3, we find that unexpected inflation has a significant positive impact on RPV in both cases of headline and core inflation. Additionally, expected inflation has a significant positive effect when core inflation shocks are included separately. The F test results suggest that, in case of headline inflation, the differences in the effects of expected and unexpected inflation on RPV are much stronger than before. Furthermore, in contrast to the findings of Sect. 3, there is some evidence of asymmetry in the effects of positive and negative shocks to core inflation.

5.3 Results for the nonlinear models

Like the tests of Sect. 4, the model selection criteria generate a specification with three-quarter-lagged RPV, a linear term of expected inflation and a quadratic term of unexpected inflation as the best model for headline as well as core inflation. Table 7 presents the results.

The estimated coefficients for three-quarter-lagged RPV are positive and highly statistically significant suggesting some degree of persistence in the dynamics of RPV. Expected inflation does not have a statistically significant impact when positive and negative inflation shocks are included separately. While the estimated coefficient of the positive shocks is positive and statistically significant for headline and core inflation, the coefficient of the negative shock is no longer significant in case of core inflation. Despite this difference, there is no evidence of asymmetric effects of core inflation shocks. In contrast, in case of headline inflation, the asymmetry is even stronger than before.

Table 8 presents a qualitative comparison of the results from the models using survey-based and forecast-based measures of expected inflation. For parsimony, Table 8 reports results from only the full specifications—that is, columns (2) and (4) of Tables 2, 3 and 6, 7, and only includes the effects that are statistically significant at the 5% level.

Clearly, the two sets of results are qualitatively very similar. For the basic model, the only major exception is that the forecast-based model reports a significant positive effect of expected core inflation on RPV. Given that survey-based measures represent ‘actual’ expected inflation, this discrepancy must be due to overestimation of the effects of expected inflation in the forecast-based models. Likewise, the qualitative results are quite similar for the nonlinear models. The difference in the effects of expected inflation disappears here. The only distinction is, unlike the survey-based model, the forecast-based model reports a significant differences between the effects of positive and negative inflation shocks under headline inflation.

Overall, despite quantitative differences the models using survey-based and forecast-based measures of inflation expectations are remarkably similar, and both agree on the positive and significant impact of unexpected inflation on RPV.Footnote 14 However, the results also warrant a cautionary note. The models using forecast-based measures of inflation expectations may yield an upward-biased estimate of the coefficient of expected inflation, as reported in Tables 6 and 7. This bias, when unrecognized, could potentially lead to misguided policy prescriptions. Our analysis underscores the importance of validating the forecast-based results by using more accurate survey-based measures of inflation expectations wherever the latter are available.

6 Concluding remarks

In this paper we use, for the first time in the literature, actual survey-based inflation expectation measures to examine the relationship between inflation and RPV. We conduct the analysis for Australia. The use of actual survey-based measures provides a more reliable and elegant way of avoiding problems associated with estimated measures of expected inflation commonly used so far. Our results indicate that a significant positive impact of unexpected inflation on RPV is a robust result. There is little evidence of asymmetry in the effects of positive and negative inflation shocks. Investigating the inflation-RPV relationship reveals a J-shaped relationship between RPV and unexpected inflation. No such relationship between RPV and expected inflation is evidenced. The role of unexpected inflation has cautionary implications for monetary policy. Just like high inflation, low inflation should be avoided in order to minimize RPV, because unexpected disinflationary policy shocks may result in increased RPV in a low-inflation environment. It is important to know the threshold below which RPV rises with unexpected inflation. Potential costs of an ‘unexpected’ rise in RPV stemming from unexpected disinflation should be taken into consideration when setting the lower bound of the target inflation rate, especially if this bound is close to the threshold.

We also investigate the stability of the inflation-RPV relationship over time and find two structural breaks: 2003Q2 and 2007Q2 for headline inflation and 2000Q2 and 2006Q2 for core inflation. The nonlinear effects of unexpected inflation on RPV are positive and significant for both headline and core inflation during the first two regimes, but have no significant effect during the third regime. Expected inflation seems to have a significant positive effect on RPV only during the second regime, marked by commodity price driven economic expansion and central bank commitment toward inflation targeting.

Finally, re-estimation of the models with forecast-based expectation measures yields qualitatively similar results. The major differences include evidence of a significant positive impact of expected inflation on RPV in the case of core inflation and asymmetry between the impacts of positive and negative core inflation shocks on RPV in the basic models. Assuming that Australian data is fairly representative, the broader similarity can be taken as validation of the practice of using ARMA-based forecasts as measures of inflation expectations in the empirical literature on inflation-RPV relationship. In general, insight from this analysis should foster the collection and use of survey-based measures of inflation expectations in other countries leading to a more reliable evaluation of the impact of expected (and unexpected) inflation on RPV than are available today.

Notes

There is a broader literature on the relationship between inflation and distribution of relative prices that allows for two additional possibilities: one of different moments of relative price distribution affecting inflation and the other of both inflation and different moments being simultaneously affected by some common factors. For example, Ball and Mankiw (1995) consider relative price variability/skewness as aggregate supply shocks that drive inflation. Balke and Wynne (2000) argue that sectoral technology shocks can lead to relative price changes and aggregate inflation. Fischer (1981) gives a good summary of all three possibilities discussed in the larger literature.

A formal definition is included in Sect. 2.

In a related study, Lourenco and Gruen (1995) examine the effect of relative price shocks on inflation. They find that a rise in the economy-wide dispersion of shocks is inflationary only when expected inflation is high.

Appendix Table 9 lists these expenditure items along with their respective weights.

Since Parks’ seminal work in 1978, the majority of empirical literature has been using variations in relative price changes as a measure of RPV. However, as Danziger (1987) and Hajzler and Fielding (2014) show, variability of relative price changes (they call it relative inflation variability-RIV) does not always capture RPV. In this paper, inflation is an increase in the general price level as opposed to changes in prices of different expenditure items. Furthermore, the theoretical discussion on the distinction between RPV and RIV focuses on the variability across locations, not across commodities as in this paper. Therefore, following the convention in the empirical literature, we stick to the RPV measure as defined in Eq. (1).

Alternatively, we could construct a core inflation measure based on all groups CPI excluding food and energy (i.e. food and non-alcoholic beverages except restaurant meals, electricity, gas and other household fuels, and automotive fuel), similar to that used in the United States and other countries. However, this measure exhibits volatility very similar to headline inflation, particularly until about 2000.

The computational procedure is handled by a Stata plug-in, called lpoly. The Stata plug-in bypasses the need to compute full-blown nonparametric regressions required for each point in the smoothing grid, and only estimates the intercepts from the polynomial regression fitted around \( x_{0} \). Therefore, considerable efficiency is gained relative to that required in obtaining bootstrapped standard errors.

The mean and standard deviation of RPV for the period: 1989Q4–2006Q1 were 2.04 and 0.84 and, for 2006Q2–2013Q3, they were 2.71 and 1.46 respectively.

For example, as per the US Energy Information Administration, the standard deviation of West Texas Intermediate prices increased from 11.65 during 2000Q1–2005Q4, to 18.26 during 2006Q1–2014Q4. Available at: https://www.eia.gov/forecasts/steo/query/; accessed on Jan. 13, 2016.

It is often difficult to beat the forecasting performance of univariate time series models of inflation. For example, see Stock and Watson (2007).

We believe that people’s expectations are about headline inflation and, therefore, we model headline inflation only.

Note that the pairwise correlation coefficient between survey-based and forecast-based inflation expectation measures is 0.54 which is highly statistically significant. It also implies that the inflation forecasts based on an ARMA(2,2) model fairly represent the expectations of businesses about inflation in Australia.

References

Aarstol M (1999) Inflation, inflation uncertainty, and relative price variability. South Econ J 66(2):414–423

Bai J (1997) Estimating multiple breaks one at a time. Econ Theory 13:315–352

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66:47–78

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Econom 18:1–22

Balke NS, Wynne MA (2000) An equilibrium analysis of relative price changes and aggregate inflation. J Monet Econ 45:269–292

Ball L, Mankiw NG (1995) Relative price changes as aggregate supply shocks. Q J Econ 110:161–193

Barro RJ (1976) Rational expectations and the role of monetary policy. J Monet Econ 2:1–32

Becker SS, Nautz D (2009) Inflation and relative price variability: new evidence for the United States. South Econ J 76(1):146–164

Benabou RJ (1992) Inflation and efficiency in search markets. Rev Econ Stud 59:299–329

Bénabou R, Gertner R (1993) Search with learning from prices: does increased inflationary uncertainty lead to higher markups? Rev Econ Stud 60:69–93

Bick A, Nautz D (2008) Inflation thresholds and relative price variability: evidence from U.S. Cities. Int J Cent Bank 4(3):61–76

Bowman AW, Azzalini A (1997) Applied smoothing techniques for data analysis: the kernel approach with S-Plus illustrations. Clarendon Press, Oxford

Caglayan M, Filiztekin A (2003) Nonlinear impact of inflation on relative price variability. Econ Lett 79(2):213–218

Caraballo MA, Dabús C C, Usabiaga C (2006) Relative prices and inflation: new evidence from different inflationary contexts. Appl Econ 38(16):1931–1944

Chang EC, Cheng JW (2000) Further evidence on the variability of inflation and relative price variability. Econ Lett 66(1):71–77

Choi CY (2010) Reconsidering the relationship between inflation and relative price variability. J Money Credit Bank 42(5):769–798

Clements KW, Nguyen P (1981) Inflation and relative prices: a system-wide approach. Econ Lett 7:131–137

Cukierman A (1983) Relative price variability and inflation: a survey and further results. In: Brunner K, Meltzer AH (eds) Variability in employment, prices and money. Elsevier, Amsterdam

Danziger L (1987) Inflation, fixed cost of price adjustment, and measurement of relative-price variability: theory and evidence. Am Econ Rev 77:704–713

Debelle G, Lamont O (1997) Relative price variability and inflation: evidence from U.S. Cities. J Polit Econ 105(1):132–152

Fan J, Gijbels I (1996) Local polynomial modelling and its applications. Chapman & Hall, London

Fielding D, Mizen P (2000) Relative price variability and inflation in Europe. Economica 67:57–78

Fielding D, Mizen P (2008) Evidence on the functional relationship between relative price variability and inflation with implications for monetary policy. Economica 75:683–699

Fielding, D, Hajzler, C, MacGee, J (2017) Price-level dispersion versus inflation-rate dispersion: evidence from three countries. Bank of Canada Staff Working Paper 2017-3

Fischer S (1981) Relative shocks, relative price variability and inflation. Brook Pap Econ Act 2:381–431

Fox J (2002) Nonparametric regression: appendix to an R and S-PLUS companion to applied regression. http://citeseerx.ist.psu.edu/viewdoc/download;jsessionid=4B4BC12C75F8330F2AE7BC5615910FD1?doi=10.1.1.298.153&rep=rep1&type=pdf. Accessed 07 Sept 2017

Glezakos C, Nugent J (1986) A confirmation of the relation between inflation and relative price variability. J Polit Econ 94:895–899

Hajzler C, Fielding D (2014) Relative price and inflation variability in a simple consumer search model. Econ Lett 123(1):17–22

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econ 93:345–368

Hansen BE (2000) Sample splitting and threshold estimation. Econometrica 68:575–603

Head A, Kumar A (2005) Price dispersion, inflation, and welfare. Int Econ Rev 46:533–572

Hercowitz Z (1981) Money and the dispersion of relative prices. J Polit Econ 89(21):328–356

Jaramillo CF (1999) Inflation and relative price variability: reinstating parks’ results. J Money Credit Bank 31(3):375–385

Lastrapes WD (2006) Inflation and the distribution of relative prices: the role of productivity and money supply shocks. J Money Credit Bank 38(8):2159–2198

Lourenco RDA, Gruen D (1995) Price stickiness and inflation. Discussion Paper No. 9502, Reserve Bank of Australia

Lucas RE (1973) Some international evidence on output-inflation tradeoffs. Am Econ Rev 63:326–334

Maddala GS (1989) Introduction to econometrics. Macmillan Publishing Company, New York

Nautz D, Scharff J (2005) Inflation and relative price variability in a low inflation country: empirical evidence for Germany. Ger Econ Rev 6(4):507–523

Nautz D, Scharff J (2012) Inflation and relative price variability in the euro area: evidence from a panel threshold model. Appl Econ 44:449–460

Parham D (1999) The new E conomy? A new look at Australia’s productivity performance. Productivity Commission Staff Research Paper, AusInfo, Canberra

Parks RW (1978) Inflation and relative price variability. J Polit Econ 86:79–95

Parsley DC (1996) Inflation and relative price variability in the short and long run: new evidence from the United States. J Money Credit Bank 28(3):323–341

Peterson B, Shi S (2004) Money, price dispersion and welfare. Econ Theory 24:907–932

Reinganum JF (1979) A simple model of equilibrium price dispersion. J Polit Econ 87:851–858

Reinsdorf M (1994) new evidence on the relation between inflation and price dispersion. Am Econ Rev 84(3):721–731

Reserve Bank of Australia (RBA) (2012) The Australian economy and financial markets: Chart Pack, December, 2012

Rotemberg JJ (1983) Aggregate consequences of fixed costs of price adjustment. Am Econ Rev 73:433–436

Sheshinski E, Weiss Y (1977) Inflation and costs of price adjustment. Rev Econ Stud 44:287–303

Silver M, Ioannidis C (2001) Intercountry differences in the relationship between relative price variability and average prices. J Polit Econ 109(2):355–374

Stock JH, Watson MW (2007) Why has U.S. inflation become harder to forecast? J Money Credit Bank 39(1):3–33

Acknowledgements

The authors would like to thank two anonymous referees and the editor, Subal Kumbhakar, for their valuable comments and suggestions. An earlier version of the paper was presented at the 89th Annual Conference of Western Economic Association International held in Denver, Colorado (USA), on June 27–July 1, 2014. The authors are thankful to Professor Hiroaki Hayakawa and the members of the audience for their comments and questions. This paper was written when Nath was a Visiting Fellow at QUT, Australia. He is grateful to the School of Economics and Finance at QUT for its hospitality and support. The authors are solely responsible for all remaining errors and omissions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Nath, H.K., Sarkar, J. Inflation and relative price variability: new evidence from survey-based measures of inflation expectations in Australia. Empir Econ 56, 2001–2024 (2019). https://doi.org/10.1007/s00181-018-1422-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1422-y

Keywords

- Inflation

- Relative price variability

- Australia

- Survey-based measures of inflation expectations

- Menu cost model

- Signal extraction model

- Search model