Abstract

An empirical land allocation model is developed and fit to production data of the top five crops in the USA and to crop output prices adjusted for direct payments and subsidies. The land allocation model based on the theory of the multiproduct firm allows for jointness in production, and it is extended to handle non-allocable inputs. Specifically, the model is used to analyze whether the Food Security Act of 1985, known as the 1985 Farm Bill, increased flexibility in land allocation decisions by comparing responsiveness of land allocation among the crops, before and after the passage of the 1885 Farm Bill, to changes in total land availability and changes in crop output prices. The results confirm that a structural change in land allocation dynamics took place after the passage of the 1985 Farm Bill. We show that more crops (wheat and soybeans, in particular) become more acreage responsive to the changes in total land available for production after 1985. For example, the results indicate that competition for acreage between corn and wheat is associated with the implementation of the 1985 Farm Bill. The results provide evidence that the onset of the increased acreage allocation flexibility by farmers originated in the policies of the 1985 Farm Bill. The study also demonstrates that a policy targeting a particular crop will inadvertently affect production of other crops. This study quantifies these indirect effects on the five major crops grown in the USA.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The twentieth century witnessed extraordinary population growth. In 2011, world population reached the seven billion mark (U.S. Bureau of Census 2016, and according to the United Nations (U.N.), world population will cross the eight and a half billion mark in 2030 (United Nations Department of Economic and Social Affairs, Population Division 2016). Due to population growth, the farming industry faces significant pressure to expand agricultural production, especially the staple grains sector (Hertel 2011).

In the USA, total land in agricultural production peaked in 1981 at 366 million acres (Fig. 1), a 12% increase relative to that in 1960, and then it declined by 12.5% less than the 1981 peak (National Agricultural Statistics Service 2016). Still, even if marginal land were pulled into production (e.g., from the Conservation Reserve Program), it would not be enough to sustain the expansion needed to feed projected population (Hertel 2011).

Source: National Agricultural Statistical Service (2016)

Land in production during 1960–2013.

The paradigm of increasing demand for acreage for some crops and the relative quasi-fixity of US agricultural land in production leads to an interesting question: How is land allocated in the face of the increasing and competing demands for acreages among various crops? In addition, if a demand changing policy is designed for a specific crop, how does the change affect that crop’s acreage and the allocation of acreages of the other crops in the system?

This paper investigates land allocation dynamics in the USA from 1960 to 2013. This period is critical because it includes two of the key US farm bills: (1) Food Security Act of 1985 (also known as the 1985 Farm Bill), which initiated production flexibility policies as well as the Conservation Reserve Program (CRP), and (2) Federal Agriculture Improvement and Reform Act of 1996 that further expanded production flexibility policies of the 1985 Farm Bill.

Studies in the past have analyzed policy effects of farm bills (e.g.,Sumner 2003; McIntosh et al. 2007; Coble et al. 2008; Bhaskar and Beghin 2009; Kropp and Katchova 2011). Several studies focus on the CRP’s impact on land usage and main factors in CRP enrollment (e.g., Rausser et al. 1984; Hoag et al. 1993; Wu 2000, 2005). However, no studies to our knowledge investigate policy effects in the face of production jointness. Shumway et al. (1984) defined jointness in production as “technical interdependence in production of multiple products.” Such modeling can be accomplished best if jointness is explicitly incorporated into a multiproduct firm framework.

This study assesses the effects of price changes on land allocation dynamics before and after the 1985 Farm Bill. The paper develops and fits a land allocation model to prices adjusted for direct payments and subsidies as well as production data of the top five crops for the 1960–2013 period.

We examine whether the effect of the 1985 Farm Bill gave flexibility in land allocation decisions and fit a land allocation model to capture the effects of changes in land allocation in response to the crops own- or cross-price changes as well as additional land availability for production before and after 1985. Structural change in land allocation starting with the 1985 Farm Bill is tested within the model, and market prices are subsidy-adjusted in the period from 1996 to 2010.

An empirical model of input allocation with joint production for the multiproduct firm was theoretically derived by Laitinen (1980) and empirically formulated by Seale et al. (2014). This study extends the empirical model of Seale et al. (2014) by including a dummy variable that makes it possible to statistically test for policy effects on the allocable response of land to crops’ price changes and changes in the additional land input.

The structure of the paper consists of the following subsections. We summarize relevant literature on input allocation and jointness in production and discuss farm bill policies that allow farmers to change their land-use decision based on price signals from the market. Next subsection describes the data used in this study. Later, an empirical land allocation model is developed as well as land-volume and price elasticities. In the results section, likelihood ratio tests are used to test imposed restrictions on the model as well as proposed enhancements to the model. Next, empirical results are presented and discussed including parameter estimates and calculated elasticities. Finally, major implications of the study are summarized and conclusions are drawn.

2 Input allocation with jointness in production theory

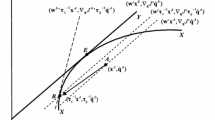

Within joint production, the decision making of the multiproduct firm includes allocating scarce inputs in such a way that the same input type is used at the same time to produce multiple outputs when we account for economies of scope (Panzar and Willig 1981; Nehring and Puppe 2004). The major constraint in such a joint production process is that allocating a portion of input to one output means a smaller portion of input available for production of another output. However, the empirical applications of input allocation models usually neglect jointness or assume non-joint production even though input jointness is central to the decision making in allocation models (Lau 1972; Cherchye et al. 2013).

The allocation of fixed inputs, for example income, wealth, or land, necessitates multiproduct systems for modeling input demand and output supply (Shumway et al. 1984). The jointness definition varies with references to technical independence, cost, or profit function (Samuelson 1966; Lau 1972). Laitinen (1980) mentioned the terms of output independence or dependence. In this paper, we use jointness to refer to simultaneous production of two or more goods by processing a common, potentially limited resource. Following Laitinen’s (1980) logic, our definition is categorized as output dependence.

Laitinen’s input allocation theory, however, has not been used empirically because of its complex structure. Therefore, previous allocation models are developed based on other jointness definitions or non-jointness assumptions that are more restricted relative to Laitinen’s (1980) original definitions (e.g., Chambers and Just 1989; Coyle 1997; Thomas 2003; Arnberg and Hansen 2012; Gorddard 2013). Although some studies developed several methods to test statistically the assumption of input–output separability, the validity of these tests have been debated in the numerous subsequent studies (e.g., Shumway et al. 1984; Just et al. 1983; Chambers and Just 1989).

Arnberg and Hansen (2012) have previously attempted to impose instead of assume jointness, but succeeded only partially—they were able to only impose input jointness. They used gross margins instead of profit function to include input jointness. Such input jointness was effective only for intertemporal effects.

Gorddard (2013) developed an estimable multicrop production model for a profit-maximizing firm with a constraint on the total acreage linking land-use models and production decisions. He derives an input use decisions model that permits imposing, but does not structurally incorporate jointness in production by including the shadow price of the input land into the formulation. This way the price change in one output (crop) can be at least indirectly linked to the production of other crops. He uses a simulated dataset. However, such a formulation severely limits the possibility of substitution among outputs when it comes to land being allocated among crops because such an input as land is neither marked to market nor is traded every year, and thus the changes in the land prices do not occur often enough to match the decision making. Since the non-joint production assumption does not reflect the broad implications of multiproduct firm theory, this study models input allocation for a multiproduct firm by structurally incorporating jointness in production as a part of the model’s specification.

3 Production flexibility farm bill programs

The history of government-sponsored programs in US legislation goes back to the establishment of land-grant universities in 1862. Since then, sponsored programs gradually increased subsidy amounts until today (Edwards 2016). Each farm bill includes various programs such as target price, export subsidies, risk management, research funding, direct payments. Some farm bill programs allow farmers to change their production based on price signals from the market. Others aim to reduce the environmental impact of agriculture by retiring land through payments to support farmers who own the eligible land. Through its policies, the federal government has made a significant impact on the agricultural production decision making.

3.1 The 1985 farm bill and the conservation reserve program

The Food Security Act of 1985 included two new policies that played important roles in the farmers’ land allocation decisions. First, 1985 Farm Bill initiated production flexibility programs for farmers, which removed previously set planting restrictions and controls (United States Department of Agriculture—Farm Service Agency (USDA-FSA) 2016) and increased the competitiveness of US products in the international market (Ferris and Siikamäki 2009). Consequently, starting in 1986, allocation of land in production driven in big part by relative crop-price changes resulted in crops competing for the existing and any additional acreage.

Second, the same farm bill also established and enacted the Conservation Reserve Program (CRP) program, one of the primary agricultural land retirement programs to protect environmentally vulnerable land, and it is still in effect today. CRP paid cash rents to farmers to retire the most marginal land into a land bank. Thus, land allocation processes experienced a liberating effect from one side (production flexibilities) and a constraining effect on the other (CRP).

Specifically, the CRP is one of the primary agricultural land retirement programs in the USA (Ferris and Siikamäki 2009). It is a voluntary program, offering 10- to 15-year contracts to producers with eligible land to establish long-term land retirement (Osborn et al. 1995). The CRP benefits the environment through the reduction of soil erosion, protection of soil productivity, reduction in sedimentation, water quality improvement, and fish and wildlife habitat improvement. It also benefits farmers through prevention of commodity surplus production and provision of income support (USDA-FSA 2016). USDA distributed $1.63 billion in rental payments and other incentives to retire 26.8 million acres of cropland into the CRP in 2013 (USDA-FSA 2016).

Several studies focus on the CRP’s impact on land usage and main factors in CRP enrollment. For instance, Reichelderfer and Boggess (1988) showed that programs like the CRP would decrease the cost per ton of soil erosion reduction. Ribaudo (1986) calculated the contribution of the offsite benefits of the CRP such as sediment filling of reservoirs, navigation channel blocking, water conveyance systems interference, the effect on aquatic plant life, and recreation resource degradation. Babcock et al. (1996) estimated that the CRP increases the benefits of water erosion even with a low budget.

Some studies argue that CRP may cause farmers to convert non-cropland to cropland, possibly defeating the purpose of CRP (Roberts and Bucholtz 2005). Wu (2000) conducted an analysis to see if land retirements under the CRP increase conversions of non-cropland to cropland by focusing on 12 states. He uncovered a slippage effect in the CRP program. This argument was discussed in a following article by Wu (2005) as well as by Roberts and Bucholtz (2005, 2006).

This paper approaches the effect of the 1985 Farm Bill and the CRP differently than do previous studies. Although some previous studies mention the impact of the 1985 Farm Bill on crop and land prices, to our knowledge, none of the studies has tested the effect of these programs on the substitution relationship among the crops in the land allocation processes.

3.2 The 1996 farm bill and direct payments

The Federal Agriculture Improvement and Reform Act of 1996, also known as the 1996 Farm Bill, marks a transition from the deficiency payments to the decoupled direct subsidies. This change provided another noteworthy planting flexibility for farmers in that the new program no longer influenced the farmer’s production decision to any crop (Hennessy 1998). Therefore, when modeling input allocation, augmenting output prices according to the issued subsidies is necessary in order for the model to yield reasonable results.

After the Uruguay Round of the General Agreement on Tariffs and Trade/World Trade Organization (GATT/WTO) negotiations in the 1980s and 1990s, transfer programs were reformulated in 1996 as a result. The new farm bill aimed to reduce conventional export subsidies and increase market access. The transfer programs such as conservation programs, research and extension, and domestic food aid payments were considered to be minimally trade distorting. Such expenditures are not subject to limitations on overall domestic support. The Agricultural Market Transition Act of the 1996 Farm Bill introduced production flexibility contract payments. This allowed farmers to allocate their acreage to any crop with the exception of fruits and vegetables, effectively decoupling payments from any particular crop. Therefore, the payments are not subject to the negotiated reductions in support. This program also allowed farmers greater flexibility in their planting decision and moved toward pro-market agriculture reform.

However, some studies debate that the direct payments are not truly decoupled from production decisions, and this debate resulted in the elimination of direct payments and in higher insurance support for helping risk management for growers. Interestingly, the increase in the total agricultural subsidies and the change in the land allocation decision raise a new debate on the elimination of direct payments replaced by insurance payments. This paper also examines the effect of this production flexibility program on the land allocation decision.

The early studies on decoupled payments showed that direct payments do not distort production decisions in the current period because farmers receive the market price for the last unit they produce, and the marginal production decision is not altered (Alston and Hurd 1990; Blandford et al. 1989; Borges and Thurman 1994; Rucker et al. 1995; Sumner and Wolf 1996). However, later studies suggested that decoupled payments have the potential to distort production in the current period. These claims can be classified as decoupled payments that decrease the coefficient of absolute risk aversion (wealth effect) and income variability (insurance effect) (Hennessy 1998; Sckokai and Moro 2006); easing of credit constraints faced by farmers (Roe et al. 2003; Goodwin and Mishra 2006); influences on the labor supply decisions of farmers by affecting the choice between leisure and total labor supply or between on- and off-farm labor supply (El-Osta et al. 2004; Ahearn et al. 2006); and increased land values and rents since they are non-stochastic and are paid based on historical acreage (Goodwin et al. 2003a, b; Roberts et al. 2003).

4 Model

4.1 Data

The data span years 1960–2013 and are collected from the National Agricultural Statistical Service (NASS) (NASS 2016). The data consist of the annual quantity of five staple crops (i.e., corn, cotton, hay, wheat, and soybeans) plus 12 other crops whose quantities are aggregated to the category “other crops” (NASS 2016). The category “other crops” contains rice, potatoes, beans, peas, rye, oats, barley, tobacco, flaxseed, peanuts, sweet potatoes, and sorghum. In the USA, the quantities of the crops produced in “other crops” are significantly lower than the total of the top five staple crops.

The annual prices for each crop are collected from NASS (2016).Footnote 1 The data on the acreage used for each crop produced are also from NASS (2016).Footnote 2 The land for each crop is the acreage used in the production of that crop, and the land share is expressed as a percentage of acreage allocated to a specific crop out of total farmland in production of these crops.

For an allocable input, the allocation of an input to one commodity essentially decreases input availability for the other commodities (Burnell 2001). Moreover, non-allocable input means that the input use on one commodity does not affect the availability of this input for the other commodities, such as seed, energy, fertilizer, pesticide. The non-allocable input data are collected from Agricultural Productivity in the US data at NASS.

The data for implicit quantities of farm inputs for the USA include total capital (durable equipment, service buildings, land, inventories), total labor (hired labor, self-employed and unpaid family labor), and total intermediate goods (feed and seed, energy, fertilizer, pesticides, purchased services and other goods). Lastly, subsidy data for direct payments and countercyclical payments are collected from 1996, 2002, and 2008 USDA Farm bills.Footnote 3

4.2 Methodology

In this study, our starting point is the empirical input allocation model of the multiproduct firm of Seale et al. (2014) who extended empirically the theoretical multiproduct firm input allocation model of Laitinen (1980). We extend the empirical model of Seale et al. (2014) by including non-allocable inputs. The resulting input allocation model for the multiproduct firm is

where \(f_{i_t} =w_{i_t} q_{i _t} /\sum _i {w_{i_t} q_{i _t} } \) is the ith input’s share of total costs (\(i = 1, 2, {\ldots }, n\)) at time t, and n is the number of inputs; \(q_{i_t}\) is the quantity of the ith input at time t; \(w_{i_t} \) is the price of the ith input at time t; \(p_{rt}\) is the price of the rth output (\(r = 1, 2, {\ldots }, m\)) at time t, and m is the number of outputs; and \(d(\ln Q)_t =\sum _i {f_{i_t} d(\ln q_i )_t}\) is a Divisia input quantity index at time t. The volume share parameter of the model is \(\bar{{\theta }}_i =\sum _r {\theta _r^*\theta _i^r } \) such that \(\sum _i {\sum _j {\bar{{\theta }}_{ij}}} =\sum _i {\bar{{\theta }}_i} =1\) where \(\bar{{\theta }}_{ij} s\) are normalized coefficients, \(\theta _r^*=\sum _i {\bar{{\theta }}_i \bar{{\theta }}_r^i } \), \(\bar{{\theta }}_r^i =\partial (p_r z_r )/\partial (w_i q_i )\) is the revenue the firm gains from additional production of the rth product for an additional dollar’s worth of the ith input, \(\theta _i^r =\partial (w_i q_i )/\partial (p_r z_r)\) is the additional expense of the ith input used in the production of an additional dollar’s worth of the rth output, and \(\sum _i {\theta _i^r } =1\). Letting \(a_{h _t}\) represent the quantity of the hth non-allocable input at time t, \(d(\ln A)_t =\sum _h {k_{h _t} d(\ln a_h )_t } \) is a Divisia non-allocable input index at time t where \(k_{h _t} =w_{h _t} a_{h _t} /\sum _h {w_{h _t} a_{h _t} } \) is the hth non-allocable input’s share of total costs of non-allocable inputs (\(h = 1, 2, {\ldots }, l\)), and l is the number of non-allocable inputs at time t; and \(w_{h _t} \) is the price of the hth input at time t. The non-allocable input share parameter of the model is \(\bar{{\xi }}_i\). Lastly, the price coefficients are \(\pi _{ij} =-\bar{{\psi }}(\bar{{\theta }}_{ij} -\bar{{\theta }}_i \bar{{\theta }}_j )\) and \(\pi _{ir}^*=\bar{{\psi }}(\theta _{ir}^*-\bar{{\theta }}_i \theta _r^*)\) where \(\theta _{ir}^*\) is the revenue the firm gains from additional production of the rth product for specific input i.

From (1) we develop a land allocation model for the multiproduct firm. Due to data limitations, we have one land price for each year but do not have land prices and non-allocable input prices differentiated by crop usage. Accordingly, the term \(\sum _j {\pi _{ij} d(\ln w_j )} \) goes to zero yielding.Footnote 4

where \(f_{it} =w_t q_{it} /\sum _i {w_t q_{it} } =q_{it} /\sum _i {q_{it} } \) is a land share of ith crop at time t, and \(d(\ln Q)_t \) is a Divisia land index, \(d(\ln Q)_t =\sum _i {f_{it} d\ln q_{it} } \). Similarly, \(k_{ht} =w_{ht} a_{ht} /\sum _h {w_{ht} a_{ht} } =a_{ht} /\sum _h {a_{ht} } \) is the quantity share for non-allocable inputs since the price of non-allocable inputs would be the same for all crops, and \(d(\ln A)\) is a Divisia non-allocable input index, \(d(\ln A)=\sum _h {k_h d\ln a_h } \). Let \(q_i \) represents land acreage for crop r, and \(p_{r}\) represents the price of the rth crop. In our case, when land is allocated to such output crop, the input number is equal to the output number (\(i,r=1, 2,{\ldots },n=m)\).Footnote 5

The parameterization of Eq. (2) for empirical estimation is

where \(\bar{f}_{it} =(f_{i,t} +f_{i,t-1} )/2\), \(dx_t =\ln x_t -\ln x_{t-1} \) where x represents q, p, and a, and \(\varepsilon \) is an error term at time t. Output prices are lagged by 1 year to represent expected prices by the multiproduct firm. Note that the adding-up conditions are: \(\sum _i {\bar{{\theta }}_i =1} \); \(\sum _i {\bar{{\xi }}_i =0} \); and \(\sum _i {\pi _{ir}^*} =0.\) The homogeneity condition is \(\sum _r {\pi _{ir}^*=0} \), and the symmetry restriction is \(\pi _{ir}^*=\pi _{ri}^*\;\forall i,r\) since, in our case \(n=m\), the \(n \times m\) matrix \(\varvec{\pi }^{*}=[\pi _{ir}^*]\) can obey symmetry.

The land-volume elasticity \((\eta _{i})\), non-allocable input elasticity \((\delta _{i})\), and output price elasticity \((\eta _{ir})\), respectively, of the land allocation model are calculated as:

Additionally, an interaction dummy variable, D, is incorporated into the model to test for structural change after the policy changes of the 1985 Farm Bill. Specifically, we distinguish the years 1960–1985 (for which \(D=0\)) from the years 1986–2013 (for which \(D=1\)). This yields to a variant of the empirical input allocation model:

where \(\bar{{\theta }}_i^k \), \(\bar{{\xi }}_i^k \), and \(\pi _{ir}^{*k} \) are additional parameters to be estimated representing the differences of marginal share on land, the parameters of the non-allocable input share, and the parameters of the output prices, respectively, between the 1960–1985 and 1986–2013 periods. Note that the adding-up conditions for the interactions parameters are: \(\sum _i {\bar{\theta }_i^k =0} \); \(\sum _i {\bar{\xi } _i^k =0} \); and \(\sum _i {\pi _{ir}^{*k} =0} \). The homogeneity condition is \(\sum _r {\pi _{ir}^{*k} =0} \), and the symmetry condition is \(\pi _{ir}^{*k} =\pi _{ri}^{*k} \).

Interaction parameters provide us the land-volume elasticity (\(\eta _i^k\)), non-allocable input elasticity (\(\delta _i^k\)), and output price elasticity (\(\eta _{ir}^k\)) for the period 1986–2013, respectively, by dividing the sum of estimated coefficients by the sample mean of the land share for that period:

Finally, the differences in the elasticities between the two periods are computed as the differences in the land elasticities, \(\eta _i^d\), in the non-allocable input elasticities, \(\delta _i^d \), and in the output price elasticities, \(\eta _{ir}^d \), as:

One of the limitations of the model is that the input allocation model is built on the assumption that a multiproduct firm allocates resources in production of outputs in order to maximize revenues and profits; however, the model is fit to aggregate-level data. Aggregate-level data are necessary because the study looks at allocation decisions on the national level. We apply the multiproduct revenue maximizing firm model to the aggregate data of US agricultural production with the assumption that, in the long run, this model approximates firms’ behaviors aggregated across many firms. One of the implications of this limitation is that all coefficients and elasticities should be considered as long-run results and may not be suitable for short-run considerations.

5 Results

5.1 Parameter estimation

The parameters are estimated with maximum likelihood by iterative seemingly unrelated regressions (SUR) using time series processor (TSP) (Hall and Cummins 2005). As the covariance matrix of the full system is singular, the “other crops” equation is dropped for estimation purposes (Barten 1969). Then, instead of the last equation, the first equation is dropped and the model is re-estimated to check the consistency and validity of the previously estimated coefficients. For each variable, the model uses log differences of the current and the previous year’s values.

As suggested by economic theory, homogeneity and symmetry conditions are imposed. Log likelihood ratio (LR) tests are conducted to identify how well these restrictions hold. As shown in Table 1, the LR test confirms that homogeneity cannot be rejected at the 5% significance level. The LR test statistic is 17.38 for the model, which is lower than the chi-square critical value of 18.31 for 10\(^{\circ }\) of freedom.

Next the restrictions of symmetry are tested with the LR test. The result is also displayed in Table 1. The chi-square test statistic is 19.89 for the model, and it is less than the critical value of 31.41 for 20\(^{\circ }\) of freedom at the 5% significance level. Thus, symmetry cannot be rejected at the 5% significance level. In accordance, homogeneity and symmetry conditions are imposed on the parameters of the model, and reported results are those of the homogeneity and symmetry restricted model.

The LR tests in Table 2 indicate whether additional variables should be included into the base model developed by Seale et al. (2014). The base model only includes crop prices and the Divisia land index. We introduce the non-allocable Divisia input parameters and dummy variables for the 1985 Farm Bill, separately. The first LR test compares the base model with the model that contains non-allocable input to test the inclusion of the non-allocable Divisia input index into the model. The chi-square test statistics is 3.97 for the homogeneity and symmetry imposed model, and this value is lower than the chi-square critical value of 11.07. This means the rejection of the inclusion of non-allocable inputs.Footnote 6

Second, we test whether there is any structural change in the US land allocation dynamics by the introduction of the 1985 Farm Bill. The LR test compares the model without the dummy variable (Eq. 3) to that with the dummy variable (Eq. 7). The chi-square test statistics of 32.07 for the homogeneity and symmetry imposed model is higher than the chi-square critical values of 31.41. This means that we cannot reject the statistically significant change in the model’s parameters after the introduction of the 1985 Farm Bill.

Table 3 reports the coefficients and asymptotic standard errors for the period 1960–1985, and Table 4 reports the coefficients for the 1986–2013 period. The land coefficient, \(\bar{{\theta }}_i ,\) represents a marginal land share, and it measures the unit change in land allocation to a crop when total land changes by one unit. For the 1960–1985 period, the estimates of the marginal share indicate that, for a one-unit increase in total land, the land allocated to corn, wheat, cotton, and soybeans would increase by 0.49, 0.30, 0.09, and 0.08 units, respectively. All coefficients are significant at the 5% level except for soybeans, which is significant at the 10% level, as displayed in Table 3.

The magnitudes of the marginal share estimates change in the 1986–2013 period. For example, for a one-unit increase in total land, the land allocated to corn, wheat, soybeans, and other crops would increase by 0.39, 0.39, 0.16, and 0.16 units, respectively. All coefficients are significant at the 5% level except that of soybeans, which is significant at the 10% level. Interestingly, an increase in an additional unit of land results in 0.12 units decrease in the land allocated to cotton during the latter period (Table 4).

Table 5 shows the differences in the coefficients between these two periods. The statistically significant marginal land share coefficients in Table 5 indicate whether the differences in these parameters are statistically significant and associated with the introduction of the 1985 Farm Bill. The results show that, for a one-unit increase in total land, the land allocated to cotton decreases by 0.21 units after the introduction of the 1985 Farm Bill.

Results for own-output-price coefficients and the cross-output-price coefficients are also reported in Tables 3 and 4, respectively. All own-output-price coefficients are positive, and as expected, those for cotton, soybeans, and wheat are significantly different from zero at the 5% significance level in the 1960–1985 period, and those for corn, soybeans, and wheat are significantly different from zero at the 5% significance level for the 1986–2013 period.

The cross-output-price coefficient of corn–soybeans combination is negative and significant at the 10% level during 1960–1985 period. The cross-output-price coefficients of corn–soybeans, corn–wheat, and cotton–wheat combinations are negative and significant at the 10% level for 1986–2013, while the corn–cotton combination is positive and significant at the 5% level for the same period. A negative sign indicates that these combinations behave as substitutes, and a positive sign indicates complementarity. Lastly, Table 5 indicates that the changes in the own-output-price coefficient of cotton and in the cross-output-price coefficient of the corn–wheat combination are associated with the change in policies of the 1985 Farm Bill.

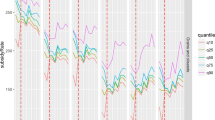

5.2 Elasticities estimation

Land-volume, own-output-price, and cross-output-price elasticities are calculated and reported in Tables 6, 7, and 8 for the periods 1960–1985, 1986–2013, and the difference between the periods, respectively, and the summary of statistically significant elasticities are depicted in Fig. 2. The statistically significant elasticity estimates in Table 8 indicate whether the changes are associated with the introduction of the 1985 Farm Bill. All elasticities are based on estimated parameters in the previous section and are computed at the sample means of the estimated periods.

5.2.1 Land-volume elasticities

The land-volume elasticity estimates are significant for corn, cotton, soybeans, and wheat in both periods at the 5% significance level except for soybeans, which is significant at the 10% level (Tables 6, 7). The land-volume elasticity for other crops is also significant in the later period at the 5% level. A land-volume elasticity measures the percent change in land allocated to crop i from a 1% change in total land volume. The land-volume elasticities in the 1960–1985 are 2.1, 2.3, 1.5, and 0.5%, respectively, for the land quantities of corn, cotton, wheat, and soybeans. Corn acreage turns out to be the most responsive to an expansion (contraction) of an additional unit of land.

The land-volume elasticities in the 1986–2013 period are 1.9, 1.7, 1.0, 0.9, and −3.1%, respectively, for the land quantities of wheat, corn, soybeans, other crops, and cotton. In this period, wheat’s acreage becomes more responsive to the additional total land changes than that of corn, and cotton’s acreage becomes negatively responsive to an expansion (contraction) of total land. Furthermore, Table 8 indicates that the change in the magnitude and the sign of the elasticity of cotton is associated with the introduction of the 1985 Farm Bill.

5.2.2 Own-output-price elasticities

Production theory suggests that own-output-price elasticities should be positive. For both periods, all own-output-price elasticities are positive, and the own-output-price elasticities for cotton, soybean, and wheat land in the 1960–1985 period as well as corn, soybean, and wheat land in the 1986–2013 period are statistically significant at the 5% level. In the 1960–1985 period, the own-output-price-elasticity estimates indicate that a 1% increase in own-output price, ceteris paribus, would increase the quantity of land allocated to cotton, soybeans, and wheat by 0.7, 0.3, and 0.2%, respectively. In the after 1986 period, however, a 1% increase in own-output price increases the land allocated to wheat, corn, and soybeans by 0.3, 0.3, and 0.2%, respectively.

Land allocated to cotton’s production is the most responsive to its own-output-price change in the 1960–1986 period indicating that, despite cotton remaining one of the most subsidized crops (Gokcekus and Fishler 2009), cotton producers are price responsive to own-output-price changes when it comes to land allocation. However, it becomes insignificant in the later period, and Table 8 points out that this change is associated with the 1985 Farm Bill.

5.2.3 Cross-output-price elasticities

A cross-output-price elasticity is a measure that indicates the percentage change of acreage for a particular crop in response to 1% change in the price of another crop (output). During the 1960–1985 period, there is only one combination of crops, corn–soybeans, for which the cross-output-price elasticity is statistically significant at the 10% level, and the elasticity is negative. This means that if the price of corn goes up (down) by 1%, then land allocated to soybeans decreases (increases) by 0.15%. The negative elasticity indicates that the corn–soybeans combination behaves as substitutes and compete for land.

In the 1986–2013 period, there are three crop combinations (i.e., corn–soybeans, corn–wheat, and cotton–wheat) for which cross-output-price elasticities are negative and significant at the 10% level. This means that if the price of corn goes up (down) by 1%, then land allocated to soybeans and wheat decreases (increases) by 0.20 and 0.22%, respectively. If the price of wheat goes up by 1%, the land allocated to cotton decreases by 0.29%. This indicates that, when it comes to land allocation, corn–soybeans, corn–wheat, and cotton–wheat combinations behave as substitutes and compete for land. Next, contrary to the previous relationships, corn and cotton behave as complements in the later period; if the price of corn increases by 1%, the land allocated to cotton increases by 0.37%.

It is noteworthy to mention that soybean acreage becomes more sensitive to the changes in corn price in the later period than in the initial period. In addition, competition for land between corn and wheat has surfaced only in the period after 1985. Contrasting the results up to 1985 and after 1985, only one crop combination has a statistically significant cross-output-price elasticity before 1986, but there are four crop combinations with statistically significant cross-output-price elasticities after 1985. This confirms the dynamics of increased competition for land, which makes sense given that the 1985 Farm Bill marks the first bill that focuses on relaxing land allocation restrictions.

Lastly, we test whether the differences in the two periods are associated with the 1985 Farm Bill. Table 8 displays the differences in parameters between the two periods and marks those that are statistical significant. It can be seen that a substitutive relationship between corn and wheat and complementary relationship between corn and cotton are associated with the 1985 Farm Bill.

Soybeans and corn are grown in similar agronomic conditions, so substitutability is relatively high between these two crops. It is interesting to note that, in contrast to cross-output-price elasticities of corn–wheat, corn–cotton, and wheat–cotton becoming significant for the first time in the post 1985 Farm Bill period, the cross-output-price elasticity between corn and soybeans is negative and significant even before the 1985 Farm Bill. The elasticity became more negative after the 1985 Farm Bill in the 1986–2013 period. This makes sense because soybeans were never a program crop. Thus, planting flexibility policies that originated in the 1985 Farm Bill may be associated with the intensification of the substitutive behavior between corn and soybeans when it comes to acreage allocation, but not the origination thereof.

Corn and cotton are agronomically perfect for the back-to-back, 1-year-rotation system. Corn and cotton are planted one after another in the Southern states of the USA because the practice has been known for improving corn yields while also return optimizing. Therefore, the planting choice between these crops is not mutually exclusive, but rather complementary. Our result that corn and cotton behave as complements when it comes to land allocation concurs with such dynamic.

Historically, corn is grown on prime quality land, that is, with better agronomic qualities of soil than that of wheat. However, with continuous genetic development, fertilizer effectiveness, changing climate, and increasing demand of corn destined for uses other than food (e.g., fuel and animal feed), corn acreage expanded into areas previously deemed less ideal for corn growing such as wheat land. This dynamic is evidenced by our result that corn and wheat behave as substitutes when it comes to land allocation. This is particularly true in the crossover states, states that can grow both wheat and corn such as Missouri, Indiana, Michigan, Illinois, and from North Dakota down to Texas.

6 Conclusion

This study presents an application of an empirical input allocation model with structurally incorporated jointness. A land allocation model is developed to fit US land and crop-price data of five major US crops plus other crops for the period 1960–2013. A dummy variable distinguishes the two periods of interest within the model, before and after the 1985 Farm Bill. It enables us to conduct policy–effect analysis of how land flexibility and CRP programs, initiated in the 1985 Farm Bill, impact land allocation dynamics.

The effects can be quantified by the comparison of the land-volume and output-price elasticities that measure the sensitivity of changes in land quantity allocated to a crop when total land-volume changes or output crop prices change. The model allows for joint production of outputs in contrast to more restrictive assumptions such as input–output separability or input independence. The model also satisfies adding-up conditions implied by production theory and allows one to impose and test for theoretical restrictions such as homogeneity and symmetry.

The results indicate that the model describes the dynamics of land allocation for the two periods 1960–1985 and 1986–2013. Findings suggest that, before 1986 as total land in crop production expands (contracts), land allocated to cotton increases (decreases) the most followed by corn, wheat, and soybeans in that order of magnitude. After 1986, cotton acreage remains the most responsive to the changes in land available in production. However, the elasticity changes sign meaning that cotton’s acreage decreases (increases) as total land in production expands (contracts) in the latter period.

Wheat, corn, and soybean acreages continue to be responsive to total land changes in the order of the magnitudes, while wheat’s responsiveness and soybeans’ responsiveness increase in magnitudes as compared to those of the prior-to-1986 period. The other crops category acreage becomes responsive to total land-in-production changes, whereas it was not responsive before 1986. Thus, LR test results confirm that indeed there is a change in the land allocation dynamics associated with the policies initiated by the 1985 Farm Bill. In turn, the model yields the land-volume elasticities that paint a detailed crop-by-crop picture, which shows that more crops have become acreage responsive to the changes in total land available for production after 1985.

Next, own-output-price-elasticity results highlight that, before 1986, cotton, soybeans, and wheat are acreage responsive to own-output-price changes in the order of the magnitudes. After 1985 wheat acreage responsiveness to its own-output price has increased in magnitude, while that of soybeans has decreased, and that of cotton ceased to be significant. Also after 1986, corn-acreage responsiveness to its own-output-price changes has become statistically significant, whereas it was not so prior to 1986. The result provides evidence that the onset of the increased acreage allocation flexibility by farmers originated in the policies of the 1985 Farm Bill.

This result tracks well within the historical accounts. The oversupply of agricultural commodities following World War II lingered into the 1960s. As a result, the policies of the 1961 and 1965 farm bills focused on reducing oversupply and controlling surplus commodities such as corn, wheat, cotton, rice, and a few other crops. Various forms of production restrictive policies including paying farmers to retire production acreage into conservation were used, and the acreage in production contracted.

In 1972, due to severe weather, Russia had a failed wheat crop. Consequently, US wheat exports to Russia shot up and so did wheat’s price. Increased production in the United States followed. Yet, in the face of this demand for crops, subsequent bills of 1970, 1973, and 1977, continued incentivizing farmers to restrict land in production, which indeed resulted in significant amount of acreage taken out of production. As a result, by 1986 a pent-up demand for corn formed. Thus, when acreage allocation flexibility originated by the 1986 Farm Bill, the acreage of corn increased significantly in response to the pent-up demand. The emergence of corn’s statistically significant own-output-price elasticity after 1986 confirms such dynamic.

Next, cross-output-price elasticities also confirm these historical accounts. In the period of 1960–1986, the cross-output-price elasticity of only the corn–soybeans combination is significant. However, in the period from 1986–2013, the intensity of corn–soybeans competition for land increases in magnitude, while competition for land between corn and wheat as well as wheat and cotton becomes significant for the first time. In the meantime, corn and cotton become complements when it comes to land allocation. Statistical significance of corn and wheat behaving as substitutes and corn and cotton as complements given the structure of the dummy variable highlights that the competition for acreage between corn and wheat is associated with implementation of the 1985 Farm Bill.

The complementary relationship between corn and cotton makes sense because in the Southwestern and Southeastern United States, corn and cotton are the crops of choice for a back-to-back rotation cycle since the rotation improves yields and profitability among alternative rotation systems. However, corn and wheat are never planted on a back-to-back rotation schedule anywhere in the United States because they cannot support healthy soil if planted one after another. As the 1996 Farm Bill continued the legacy of the 1985 Farm Bill’s land allocation flexibility policies, corn acreage expands and wheat acreage contracts almost in a symmetrical nature (Figs. 3, 4). The competition for land between corn and wheat is confirmed by the historical accounts. At the time when acreage retirement programs, incentivizing farmer to fallow land, are decreasing, land in production and corn acreage is expanding in response to the pent-up demand and higher prices. At the same time, wheat acreage has to contract.

Source: Author’s calculations using National Agricultural Statistical Service (2016) United States Department of Agriculture—Quick stats tools

Crops’ land shares.

Source: Author’s calculations using National Agricultural Statistical Service (2016) United States Department of Agriculture—Quick stats tools

Price ratio of crops to corn prices.

The USA is one of the largest exporters of agricultural commodities and products making it important for global consumers, producers, and policy makers to assess and understand how land is allocated among major crops. Long-term trends and land allocation patterns, represented by the measures found in this study, indicate propensities and tendencies for acreage allocation in the USA. For example, the results illustrate that a policy designed for a particular crop or perhaps a land conservation issue will inadvertently affect production of other crops in the system, and the study quantifies these potential indirect effects among the chosen crops for study in the USA. For producers, the results indicate how land allocation among these crops responds to crop-price changes or land-volume changes, which can assist in planting decisions given that aggregate expansion in a crop may not be in the interest of a particular producer.

In addition to production, the results are also applicable for the international trade and resource allocation disciplines, especially in lieu of the increasing population and rising demand for food in the face of the pressure on soil, water, and natural resources conservation. Climate change and irregular weather patterns may cause some regions to become more suitable for growing previously unsuitable crops. The land allocation model makes it possible to quantify the intensity of competition between crops that are bound to compete in a particular area. Additionally, the land allocation model can be applied on a regional scale to answer more specific regional producer questions.

The concern remains that the scarcity of additional arable land is a problem not easily solvable in the near future. We can reasonably assume that, in the USA, the production process is at or close to full “employment” of the immobile factor, land. Therefore, the expansion of acreage of a given crop at some point must come at the expense of the acreage of other crops. Similarly, the empirical application of the model can be expanded to allocation decision making in storage, portfolio management, and other industries. Long-term elasticities help create benchmarks for tracking the dynamics of the changes in allocation as it occurs in the present relative to the past. In turn, comparing dynamics of the system-wide allocation in a given year to that of the benchmark can help in identifying significant deviations in the dynamics (which can be warranted or unwarranted). Such information can be useful for price risk management and decision making in the allocation in the subsequent years.

The resulting elasticities have several useful applications. For example, elasticities obtained in this study can be used in simple option or time value of waiting models to answer two questions: (1) In which year is it worth switching from one crop to the competing crop given the relative changes in the output prices of the competing commodities in a given year? and (2) what output price change should induce the producer to expand or contract the acreage in one particular year in accords with land usage and historical dynamics? Further, in future studies, the allocation models can be used in portfolio theory and other structures that require testing for structural changes and the effects of policies.

Notes

Prices for the additional 12 crops are aggregated for the category “other crops.”

The acreage of the “other crops” category is aggregated for the 12 other crops.

Subsidy data for direct and countercyclical payments are used to adjust crop prices from 1996 to 2010 when these programs were in effect. Prices of other years remain as unsubsidized price. Westcott et al. (2002) explain how to adjust prices for the direct payment subsidy and for countercyclical payments.

Let \(w_i =w_j =w\,\forall i,j\). In this case, the term \(\sum _j {\pi _{ij} d(\ln w_j )} =\sum _j {\pi _{ij} d(\ln w)} =0\). To see this, note that \(\sum _j \pi _{ij} d(\ln w)= \sum _j {-\bar{{\psi }}(\bar{{\theta }}_{ij} -\bar{{\theta }}_i \bar{{\theta }}_j )d(\ln w)} =d(\ln w)[-\bar{{\psi }}((\sum _j {\bar{{\theta }}_{ij} } )-(\sum _j {\bar{{\theta }}_i \bar{{\theta }}_j } ))]\). Using \(\sum _j {\bar{{\theta }}_{ij}} =\bar{{\theta }}_i\) and \(\sum _j {\bar{{\theta }}_j} =1\) (Seale et al. 2014), this term reduces to \(d(\ln w)\left[ -\bar{{\psi }}(\bar{{\theta }}_i -\bar{{\theta }}_i )\right] =0.\)

For example, land allocated to soybeans is treated as a different input from land allocated to corn and the other crops included in the system.

In the initial estimation of the model, we considered, in addition to land, the existence of non-allocable inputs such as fertilizers. However, in our case the effects of these other inputs were statistically insignificant. The inclusion of non-allocable inputs increased the number of equations in the system and lowered the degrees of freedom, leading to a smaller set of statistically significant coefficients compared to that of the model without non-allocable inputs. As a result, we did not include the non-allocable inputs in the system chosen for reporting elasticities.

References

Ahearn M, El-Osta H, Dewbre J (2006) The impact of coupled and decoupled government subsidies on off-farm labor participation of U.S. farm operators. Am J Agric Econ 88:393–408

Alston JM, Hurd BH (1990) Some neglected social costs of government spending in farm programs. Am J Agric Econ 72:149–156

Arnberg S, Hansen LG (2012) Short-run and long-run dynamics of farm land allocation: panel data evidence from Denmark. Agric Econ 43:179–190

Babcock BA, Lakshminarayan PG, Wu J, Zilberman D (1996) The economics of a public fund for environmental amenities: a study of CRP contracts. Am J Agric Econ 78:961–971

Barten AP (1969) Maximum likelihood estimation of a complete system of demand equations. Eur Econ Rev 1:7–73

Bhaskar A, Beghin JC (2009) How coupled are decoupled farm payments? A review of the evidence. J Agric Resour Econ 34:130–153

Blandford D, de Gorter H, Harvey D (1989) Farm income support with minimal trade distortions. Food Policy 14:268–273

Borges RB, Thurman WN (1994) Marketing quotas and random yields: marginal effects of inframarginal subsidies on peanut supply. Am J Agric Econ 76:809–817

Burnell A (2001) Synthesis of the evidence on the possible impact of commodity price decreases on land use and commodity production, and the incidence on the provision of non-commodity outputs. Paper presented at OECD directorate for food, agriculture and fisheries workshop on multifunctionality, Paris, France, 2–3 July

Chambers RG, Just RE (1989) Estimating multioutput technologies. Am J Agric Econ 71:980–995

Cherchye L, Demuynck T, De Rock B, De Witte K (2013) Nonparametric analysis of multi-output production with joint inputs. Econ J 124:735–755

Coble KH, Miller JC, Hudson MD (2008) Decoupled farm payments and expectations for base updating. Rev Agric Econ 30:27–42

Coyle BT (1997) Allocatable fixed inputs and two-stage aggregation models of multioutput production decisions. Am J Agric Econ 75:367–376

Edwards C (2016) Agricultural subsidies. CATO Institute https://www.downsizinggovernment.org/agriculture/subsidies. Accessed 10 Oct 2016

El-Osta H, Mishra A, Ahearn M (2004) Labor supply by farm operators under decoupled farm program payments. Rev Econ Household 2:367-38

Ferris J, Siikamäki J (2009) Conservation reserve program and wetland reserve program: primary land retirement programs for promoting farmland conservation. RFF Backgrounder, Resources for the Future, Washington, DC

Gokcekus O, Fishler R (2009) The cotton influence index: an examination of U.S. cotton subsidies. Am J Agric Econ 91:299–309

Goodwin B, Mishra A (2006) Are decoupled farm program payments really decoupled? An empirical evaluation. Am J Agric Econ 88:73–89

Goodwin B, Mishra A, Ortalo-Magne F (2003a) Explaining regional differences in the capitalization of policy benefits into agricultural land values. In: Moss CB, Schmitz A (eds) Government policy and farmland markets. Iowa State Press, Iowa, pp 97–114

Goodwin B, Mishra A, Ortalo-Magne F (2003b) What’s wrong with our models of agricultural land values? Am J Agric Econ 85:744–752

Gorddard RJ (2013) Profit-maximizing land-use revisited: the testable implications of non-joint crop production under land constraint. Am J Agric Econ 95:1109–1121

Hall BH, Cummins C (2005) TSP 5.0 reference manual. TSP International, Palo Alto

Hennessy DA (1998) Risk market innovation and choice. Int Rev Econ Finance 7:331–341

Hertel TW (2011) The global supply and demand for agricultural land in 2050: a perfect storm in the making? Am J Agric Econ 93:259–296

Hoag DL, Babcock BA, Foster WE (1993) Field-level measurements of land productivity and program slippage. Am J Agric Econ 75:181–189

Just RE, Zilberman D, Hochman E (1983) Estimation of multicrop production functions. Am J Agric Econ 65:770–780

Kropp JD, Katchova AL (2011) The effect of direct payments on liquidity and repayment capacity for beginning farmers. Agric Finance Rev 71:347–365

Laitinen K (1980) A theory of the multiproduct firm. In: Theil H, Glejser H (eds) Studies in mathematical and managerial economics, vol 28. North Holland, New York

Lau LJ (1972) Profit functions of technologies with multiple inputs and outputs. Rev Econ Stat 54:281–289

McIntosh C, Shogren J, Dohlman E (2007) Supply response to countercyclical payments and base acre updating under uncertainty: an experimental study. Am J Agric Econ 89:99–122

National Agricultural Statistics Service (2016) United States Department of Agriculture—Quick stats tools. http://www.nass.usda.gov/Quick_Stats/. Accessed 14 Feb 2016

Nehring K, Puppe C (2004) Modelling cost complementarities in terms of joint production. J Econ Theory 118:252–264

Osborn CT, Llacuna F, Linsenbigler M (1995) The conservation reserve program enrolment statistics for the signup periods 1–12 and fiscal years 1986–1993. USDA Economic Research Service Statistical Bulletin No. 925

Panzar JC, Willig RD (1981) Economies of scope. Am Econ Rev 71:268–272

Rausser GC, Zilberman D, Just R (1984) The distributional effects of land controls in agriculture. West J Agric Econ 9:215–232

Reichelderfer K, Boggess WG (1988) Government decision making and program performance: the case of the conservation reserve program. Am J Agric Econ 70:1–11

Ribaudo MO (1986) Consideration of offsite impacts in targeting soil conservation programs. Land Econ 62:402–411

Roberts MJ, Bucholtz S (2005) Slippage in the conservation reserve program or spurious correlation? A comment. Am J Agric Econ 87:244–250

Roberts MJ, Bucholtz S (2006) Slippage in the conservation reserve program or spurious correlation? A rejoinder. Am J Agric Econ 88:512–514

Roberts M, Kirwan B, Hopkins J (2003) Incidence of government program payments on land rents: the challenges of identification. Am J Agric Econ 85:762–769

Roe T, Somwaru A, Diao X (2003) Do direct payments have intertemporal effects. In: Moss CB, Schmitz A (eds) Government policy and farmland markets on U.S. agriculture?. Iowa State Press, Iowa, pp 115–139

Rucker RR, Thurman WN, Sumner DA (1995) Restricting the market for quota: an analysis of tobacco production rights with corroboration from congressional testimony. J Polit Econ 103:142–175

Samuelson PA (1966) The fundamental singularity theorem for non-joint production. Int Econ Rev 7:34–41

Sckokai P, Moro D (2006) Modelling the reforms of the common agricultural policy for arable crops under uncertainty. Am J Agric Econ 88:43–56

Seale JL Jr, Vorotnikova E, Asci S (2014) An empirical input allocation model for the multiproduct firm. Econ Lett 124:367–369

Shumway CR, Pope R, Nash E (1984) Allocatable fixed inputs and jointness in agricultural production: implications for modeling. Am J Agric Econ 66:72–78

Sumner DA (2003) Implications of the USA farm bill of 2002 for agricultural trade and trade negotiations. Aus J Agric and Resour Econ 47:117–140

Sumner DA, Wolf CA (1996) Quotas without supply control: effects of dairy quota policy in California. Am J Agric Econ 78:354–366

Thomas A (2003) A dynamic model of on-farm integrated nitrogen management. Eur Rev Agric Econ 30:439–460

United Nations Department of Economic and Social Affairs, Population Division (2016) World population prospects: the 2010 revision, highlights and advance tables. ESA/P/WP.220, New York, http://esa.un.org/unpd/wpp/. Accessed 17 Mar 2016

United States Bureau of Census (2016) U.S. & world population clocks. http://www.census.gov/popclock/. Accessed 17 Mar 2016

United States Department of Agriculture - Farm Service Agency (2016) Conservation programs. http://www.fsa.usda.gov/programs-and-services/conservation-programs/index. Accessed 23 Jul 2016

Westcott PC, Young CE, Price JM (2002) The 2002 farm act: provisions and implications for commodity markets. USDA Economic Research Service Bulletin No. 33745

Wu J (2000) Slippage effects of the conservation reserve program. Am J Agric Econ 82:979–992

Wu J (2005) Slippage effects of the conservation reserve program: reply. Am J Agric Econ 87:251–254

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Vorotnikova, E., Asci, S. & Seale, J.L. Joint production, land allocation, and the effects of the production flexibility program. Empir Econ 55, 1121–1143 (2018). https://doi.org/10.1007/s00181-017-1316-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1316-4