Abstract

This study attempts to investigate the relationship between international tourism, trade, and economic growth in India over the period from April 1991 to July 2012. To account for potential asymmetries in the relationship, we make use of new asymmetric Granger-causality tests and frequency analysis. We show that there is bidirectional Granger-causality between trade and tourism in positive components, whereas unidirectional Granger-causality runs from tourism to trade for negative components. Moreover, we find evidence of bidirectional Granger-causality between economic growth and tourism in positive components, but unidirectional Granger-causality running from economic growth to tourism for negative components. On the other hand, the results from frequency analysis provide evidence of Granger-causality between trade and tourism, and also between economic growth and tourism, at different frequency bands.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Research on the role of international tourism in international trade and economic growth has been gaining ground in recent years. Whether international tourism Granger-causes trade and economic growth or vice versa is an important question that need clear-cut answers. In this study, we address this issue in the Indian context. Our investigation relies on the combination of the recently developed asymmetric Granger-causality tests and the wavelet coherence analysis, which allows us to examine the Granger-causal interactions in both time and frequency domain.

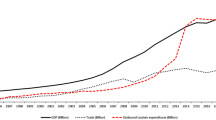

India has rich tourism resources such as historical monuments, pilgrimages centres, and natural beauty. Many state governments are seeking to develop their tourism sector and brands. For example, while Goa and Himachal Pradesh are, respectively, famous for beaches and natural beauty, Kerala which is branding itself as “God’s Own Country” has attracted global attention for its natural beauty. Over the last two decades, India has made significant progress in attracting foreign tourists, especially since 2002. In 2002, India ranked \(37{\mathrm{th}}\) in the world for total tourism receipt with only 0.64% market share. In 2011, its rank is \(17{\mathrm{th}}\) and it doubled its share to 1.60%. The World Travel and Tourism Council (2013) estimates indicate that the inbound tourist spending in 2012 accounts for 19.7% of the total spending in India’s travel and tourism sector, which contributes 2% of the GDP. The visitor exports (i.e. spending within the country by international tourists for business, leisure trips, and transport) were 1091 billion Rupees in 2012 and are expected to increase to 1892 billion Rupees in 2023.

Theoretically, the international tourist arrivals can increase the image of the domestic goods in international markets and, in turn, drive up the demand for exports of goods. They may also increase the demand for imports of goods and services to the domestic economy. Business travels are another possible way that influences the interactions between international tourism, trade, and economic growth. Indeed, business travels account for 15% of the world tourist arrivals and these travels may stimulate export and import flows. The increased in the business travels would thus generate more trade flows and further tourist arrivals as a result of further trading opportunities (Katircioglu 2009).

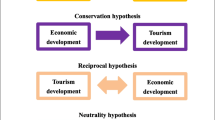

The academic literature in the field is still limited, and the existing studies often provide inconclusive results on the relation between trade and tourism, and between tourism and economic growth (e.g. Easton 1998; Kulendran and Wilson 2000; Katircioglu 2009). More precisely, Easton (1998) examines the link between tourism and trade in the Canadian context and find that these variables are interrelated. Kulendran and Wilson (2000) investigate the relationship between international trade and international travel flows for Australia using Australia’s trade and tourism data with its four main trading partners (UK, USA, New Zealand, and Japan). Their results support the hypothesis that international trade leads to international tourism and inversely. Katircioglu (2009) find long-term and short-term relationships between international trade and international tourism in Cyprus. In the context of developing economies, Shan and Wilson (2001) document two-way Granger-causality relationships between international tourism and international trade for China. Fry et al. (2010) explore the link between tourism and trade in South Africa and show evidence of bidirectional Granger-causal relationship between them from a panel data of South Africa’s tourist arrival and trade with major countries. For India, Suresh et al. (2011) find that international tourism has a long-term relationship with international trade and economic growth by using the Johansen cointegration technique. Several studies have particularly focused on the relationships between tourism and economic growth in developing countries (e.g. Lean and Tang 2010 for Malaysia; Narayan 2004 for Fiji; Gunduz and Hatemi-J 2005; Gokovali 2010 for Turkey; and Kweka et al. 2003 for Tanzania). The obtained results globally confirm the tourism-led growth hypothesis for the countries under consideration. For example, Gokovali (2010) finds that the elasticity of tourism revenue to output is 0.53 in the Turkish context. Narayan (2004) documents, from a computable general equilibrium model, that a 10% increase in the tourism expenditure would imply a 0.5% increase in the GDP in the long term.

As indicated earlier, our study is related to the above literature and seeks to provide insights about the relationship between international tourism, international trade, and economic growth in the Indian context. It differs from the existing studies in two major aspects. First, we analyse the asymmetric Granger-causality between the variables of interest, which has not been taken into account in previous works. The potential of asymmetric Granger-causality can be explained by the fact that the tourism sector is highly sensitive to negative and positive news about the destination country. To the extent that a tourist’s decisions on his travel plans is typically influenced by a variety of factors (e.g. terrorist attacks, news about possible attacks, law and order problems, political developments, natural calamities, and business environment in the home and host country), the international trade and national income are likely to react asymmetrically to tourist flows. Second, we examine the Granger-causal links between the variables of interest in the time–frequency domain which allows for the detection of Granger-causality of both short-run and long-run components (periodicities). This investigation is of paramount important as our variables are likely to vary across business cycles under the effects of frequent shifts of government fiscal, monetary, and economic policies.

Using monthly data from April 1991 to July 2012, our asymmetric Granger-causality test provides evidence of bidirectional Granger-causality between trade and tourism in positive components, whereas unidirectional Granger-causality runs from tourism to trade for negative components. There is also evidence of bidirectional Granger-causality between economic growth and tourism in positive components, but unidirectional Granger-causality running from economic growth to tourism for negative components. Finally, our results from the time–frequency domain analysis provide evidence of Granger-causality between trade and tourism, and also between economic growth and tourism, both through time and across different frequency bands.

The rest of the article is organised as follows. Section 2 introduces the methodology. Section 3 presents the data and discusses the empirical results. Section 4 concludes the article and provides some policy implications.

2 Methodology

2.1 Asymmetric causality test

Since its apparition, the Granger (1969) causality test has been extensively used to examine the causal relationship between economic (financial) variables. The causality hypothesis in the sense of Granger (1969) states that a variable causes another variable if the information contained on the former can improve the forecast of the latter. The causality test is usually implemented within the framework of the vector autoregression (VAR) model, introduced by Sims (1980). Assume that we are interested in testing for causality between two variables, \(\psi _{1t} \) and \(\psi _{2t} \). Then, we can estimate the following VAR(k) model:

where \(\varepsilon _{1}\) and \(\varepsilon _{2}\) are random error terms. \(p_{01}, p_{02}\), and \(p_{ij,l}\) are the constant parameters. If the null hypothesis that \(p_{12,1} =p_{12,2} =\cdots p_{12,k} =0\) cannot be rejected, then \(\psi _{2t} \)does not cause \(\psi _{1t} \). Inversely, if the null hypothesis that \(p_{21,1} =p_{21,2} =\cdots p_{21,k} =0\) cannot be rejected, then \(\psi _{1t} \) does not cause \(\psi _{2t} \). It should be noted that if these variables are integrated, additional unrestricted lags must be included in the VAR model (Toda and Yamamoto 1995).

Obviously, the above-described traditional framework for Granger-causality analysis assumes that the Granger-causal impact of a positive change is the same as the Granger-causal impact of a negative change. However, it is widely agreed that economic variables react more to negative news than the positive ones (Campbell and Hentschel 1992; Engle and Ng 1993; Veronesi 1999). There is thus need for taking the asymmetry into account when analysing Granger-causal relationships. Hatemi-J (2012) suggests the use of cumulative sums of positive and negative components of the variables under consideration, which are computed as \(\psi _{1t}^+ =\sum _{i=1}^t {\Delta \psi _{1i}^+ } , \psi _{1t}^- =\sum _{i=1}^t {\Delta \psi _{1i}^- } , \psi _{2t}^+ =\sum _{i=1}^t {\Delta \psi _{2i}^+ } \), and \(\psi _{2t}^+ =\sum _{i=1}^t {\Delta \psi _{2i}^+ } \), where \(\Delta \psi _{1i}^+ =\max \left( {\Delta \psi _{1i} ,0} \right) \), \(\Delta \psi _{2i}^+ =\max \left( {\Delta \psi _{2i} ,0} \right) \), \(\Delta \psi _{1i}^- =\min \left( {\Delta \psi _{1i} ,0} \right) \), and \(\Delta \psi _{2i}^- =\min \left( {\Delta \psi _{2i} ,0} \right) \).

In order to produce more accurate critical values and ensure the robustness of the estimation results, Hatemi-J (2012) suggests a bootstrap algorithm with leverage corrections. This algorithm is also employed in our study. Empirically, the asymmetric Granger-causality test will be applied to the original data to explore the potential Granger-causal relationship between variables of interest.

2.2 Continuous wavelet transforms (CWT) Footnote 1

A wavelet is a function with zero mean, which is localized in both frequency and time spaces. Accordingly, it is possible to characterize a wavelet by how it is localized in time (\(\Delta t)\) and in frequency (\(\Delta \omega \) or the bandwidth). One particular wavelet, the Morlet, which is used in our study and has been successfully applied to economic and financial data, can be defined as

where \(\omega _0 \) is dimensionless frequency and \(\eta \) is dimensionless time. For optimal balance, we set \(\omega _o =6\) following Torrence and Compo (1998) so that \(f(s)=\omega _0 /2\pi s\approx 1/s\). Since the idea behind CWT is to apply the wavelet as a band pass filter to the time series, the wavelet is stretched in time by varying its scale s, so that \(\eta =s\cdot t\) and normalizing it to have unit energy. To facilitate interpretation, it is convenient to convert from scale to period, which will require applying the following formula to obtain the (Fourier) period:

where \(\lambda \) is the Fourier wavelength. For the Morlet wavelet function, \(\lambda =4\pi /[\omega _o +(2+\omega _o^2 )^{1/2}]\) (see Table 1 in Torrence and Compo 1998). Thus, the Fourier period (Ft) for the Morlet wavelet function is \(Ft\approx 1.033s\). This conversion will be useful for the geometric presentation of our result.

Note that the main idea behind the CWT is to apply the wavelet as a band pass filter to the time series. Indeed, the wavelet is stretched in time by varying its scale (s) so that \(\eta =s\cdot t\) and normalizing it to have unit energy. For the Morlet wavelet (with \(\omega _0 =6\)), the Fourier period (\(\lambda _{wt})\) is almost equal to the scale (\(\lambda _{wt} =1.03\hbox {s}\)). The CWT of a time series (\(x_n ,n=1,...,N\)) with uniform time steps \(\delta t\) is defined as the convolution of \(x_n\) with the scaled and normalized wavelet such as

We define the wavelet power as \(\left| {W_n^X (s)} \right| ^{2}\). The complex argument of \(W_n^X (s)\) can be interpreted as the local phase. The CWT has edge artifacts because the wavelet is not completely localized in time. It is thus useful to introduce a cone of influence (COI) in which edge effects cannot be ignored. We take the COI as the area in which the wavelet power caused by a discontinuity at the edge has dropped to \(e^{-2}\) of the value at the edge. The statistical significance of wavelet power can be assessed relative to the null hypothesis that the signal is generated by a stationary process with a given background power spectrum (\(P_k )\).

Although Torrence and Compo (1998) have shown how the statistical significance of wavelet power can be assessed against the null hypothesis that the data generating process is given by an AR(0) or AR(1) stationary process with a certain background power spectrum (\(P_k)\),one has to rely on Monte Carlo simulations for more general processes. After computing the white noise and red noise wavelet power spectra, Torrence and Compo (1998) derive the corresponding distribution for the local wavelet power spectrum at each time n and scale s as follows

where v is equal to 1 for real and 2 for complex wavelets.

2.3 Cross-wavelet transform

Following Grinsted et al. (2004), the cross-wavelet transform (XWT) of two time series, \(x_n \) and \(y_n \), can be defined as \(W^{XY}=W^{X}W^{Y*}\), where \(W^{X}\) and \(W^{Y}\)are the wavelet transforms of x and y, respectively, and * denotes the complex conjugation. We further define the cross-wavelet power as \(\left| {W^{XY}} \right| \). The complex argument arg(\(W^{xy})\) can be interpreted as the local relative phase between \(x_n \) and \(y_n \) in time–frequency space. As pointed out by Torrence and Compo (1998), the theoretical distribution of the cross-wavelet power of two time series with background power spectra \(P_k^X \) and \(P_k^Y \) is given by

where \(Z_v (p)\) is the confidence level associated with the probability p for a probability density function, defined by the square root of the product of two \(\chi ^{2}\) distributions.

2.4 Wavelet coherence

As in the Fourier spectral approaches, wavelet coherence (WTC) can be defined as the ratio of the cross-spectrum to the product of the spectrum of each series (Aguiar-Conraria et al. 2008; Torrence and Webster 1999).

where S is a smoothing operator. Without smoothing, coherence is identically 1 at all scales and times. The WTC can be viewed as the local correlation between two time series, in both time and frequency domains. Two series exhibit high similarity of the value of the wavelet coherence which is close to one and no relationship if it is close to zero. While the wavelet power spectrum depicts the variance of a time series with times of large variance showing large power, the cross-wavelet power of two time series measures the covariance between these time series at each scale or frequency.

It is also possible to write the smoothing operator S as a convolution in time and scale such as

where \(S_{scale} \) denotes smoothing along the wavelet scale axis and \(S_{time} \)denotes smoothing in time. The time convolution is done with a Gaussian smoothing operator, and the scale convolution is performed with a rectangular window (Torrence and Compo 1998). For the Morlet wavelet, a suitable smoothing operator is given by

where \(c_1 \) and \(c_2 \) are normalization constants and \(\Pi \) is the rectangle function. The factor of 0.6 is the empirically determined scale de-correlation length for the Morlet wavelet (Torrence and Compo 1998). In practice, both convolutions are done discretely, and therefore, the normalization coefficients are determined numerically. Since theoretical distributions for wavelet coherence have not been derived yet, we resort to Monte Carlo simulation methods in order to assess the statistical significance of the wavelet coherence estimates.

Note that our empirical analysis will use the wavelet coherence rather than the wavelet cross-spectrum because the wavelet coherence is normalized by the power spectrum of the two time series. On the other hand, the wavelets cross-spectrum may lead to spurious significance tests, owing to strong peaks even in case of independent processes (Aguiar-Conraria and Soares 2011).

2.5 Cross-wavelet phase angle

The cross-wavelet phase is a useful tool to investigate the phase difference between the components of the two time series. To quantify the phase relationship, the circular mean of the phase over regions with higher than 5% statistical significance, which are outside the COI, can be used. Precisely, the circular mean of a set of angles (\(a_i ,i=1,...,n)\) is defined as

In practice, it is difficult to calculate the confidence interval of the mean angle reliably since the phase angles are not independent. The number of angles used in the calculation can be set arbitrarily high simply by increasing the scale resolution. However, we are able to apprehend the scatter of angles around the mean by defining the circular standard deviation as

where \(R=\sqrt{(X^{2}+Y^{2}).}\) The circular standard deviation is analogous to the linear standard deviation in that it varies from zero to infinity. It gives similar results to the linear standard deviation when the angles are distributed closely around the mean angle.

The statistical significance level of the wavelet coherence is estimated using Monte Carlo simulation methods. We generate a large ensemble of surrogate data set pairs with the same AR(1) coefficients as the input data sets. For each pair, we calculate the wavelet coherence and then the significance level for each scale using only values outside the COI.

3 Data and empirical results

We use monthly data on index of industrial production (IIP), tourist arrivals, and total trade (sum of total imports and exports, measured in million US dollar) of India over the period from April 1991 to July 2012. The data on tourist arrivals are provided by the Center for Monitoring Indian Economy (CMIE) online database. The data for the trade activity and the IIP which we use to proxy economic activity are obtained from the Reserve Bank of India (RBI) database on Indian economy. We report, in Table 1, the summary statistics of the data used. All the variables are expressed in logarithm.

Table 1 shows that the highest volatile variable is trade, followed by tourism and economic growth. All the series are positively skewed and have a kurtosis coefficient below 3, suggesting that their probability distributions are platykurtic relative to a normal distribution. The Jarque–Bera test for normality shows that all the series are highly non-normal. Overall the summary statistics provide evidence that in order to accurately analyse the relationship between variables, Granger-causality tests should enable to capture some kind of asymmetry in the data generating processes.

Table 2 provides the results for asymmetric Granger-causality tests. We find that both negative and positive changes in international trade help in forecasting tourism significantly. Inversely, we found evidence for positive changes in international tourism helps in forecasting international trade. We find that both positive and negative change in industrial production helps in forecasting international tourism. However, only the positive changes in international tourism Granger-cause industrial production. These findings are thus consistent with those of previous studies focusing on developing countries (e.g. Narayan 2004; Gunduz and Hatemi-J 2005; Lean and Tang 2010; Gokovali 2010) and suggest that economic growth Granger-causes the flows of international tourists to India.

We now turn to the time–frequency analysis of the tourism–trade–economic growth relationships. For this purpose, we examine phase differences and wavelet coherence and phase-differences measures which show the Granger-causal relationship between tourism and trade, and between tourism and economic growth in both time and frequency domains.

Figure 1 displays the estimated wavelet coherence and phase difference between international trade and tourism for the frequency scale from 2 to 64 months. The horizontal axis shows the time, and the vertical axis shows the frequency. The regions with arrows inside the white lines refer to those where the two variables under consideration co-vary (i.e. they have significant dependency). The regions outside the white lines indicate no dependency (i.e. the variables do not co-vary). Since the wavelet transforms at any point use information from the neighbouring points, Vacha and Barunik (2012) remark that the results at the beginning and the end of the period should be analysed with caution. It is clear from Fig. 1 that the tourism and trade variables co-vary at different time periods and frequencies with the co-movement is the strongest for the 4- to 8-month and 8- to 16-month frequencies (short- and medium time horizons). More precisely, the significant dependency between these two variable is found over seven sub-periods: the period from June 1997 to November 2002 with the frequency band from 32 to 64 months, the period from April 1994 to June 1997 with the frequency band from 8 to 16, the 1997–1999 period with the frequency band from 4 to 8 months, the 1998–2001 period with the frequency band from 3 to 4 months, the 2000–2002 period with the frequency band from 8 to 16 months, the 2002–2006 period with the frequency band from 4 to 8 months, and the 2007–2008 period with the frequency band from 8 to 16 months. In general, these periods of co-movement between tourism and international trade are likely to coincide with major economic, financial, and geopolitical events around the world such as the Asian financial crisis (1997–1998), the 2001–2002 dot-com bubble, and the recent US subprime and global financial crisis.

Coherence analysis of trade and tourism. The phase difference between trade and tourism is indicated by arrows. Arrows pointing to the left mean that the two variables are in the phase; to the left and down, the tourism lags behind; and to the left and up, the tourism leads. Arrows pointing to the right mean that the two variables are out of the phase; to the right and down, the tourism leads; and to the right and up, the tourism lags. “In the phase” indicates that the two variables have cyclical effects on each other, and “out of the phase” or “anti-phase” signifies that the two variables exert anti-cyclical effects on each other

The direction of arrows within the significant dependency regions provides useful information about the co-variation and lead-lag effects between international trade and tourism. We note in particular that over the period from June 1997 to November 2002 (or between observations 75 and 125), the 32- to 64-month scale arrows are right-up, indicating that the tourism is lagging indicating that the international trade helps in forecasting tourism flows . Around the \(125{\mathrm{th}}\) observation and at the \(30{\mathrm{th}}\) month frequency, the scale arrows are left-up, suggesting that the tourism is leading international trade. Between the \(25{\mathrm{th}}\) and \(75{\mathrm{th}}\) observations, the arrows are right-down, thus indicating that both variables are out of phase and that the tourism is leading international trade. The same result is found for the period November 1997 to March 2001 (corresponding to \(80{\mathrm{th}}\) to the \(120{\mathrm{th}}\) observation) at the 3- to 6-month frequency scale, as well as for the period after November 2007 (corresponding to \(200{\mathrm{th}}\) observation). During the period from November 2002 to March 2006 (corresponding to \(140{\mathrm{th}}\) to the \(180{\mathrm{th}}\) observations), the two variables are in the phase and the tourism is lagging indicating that the international trade helps in forecasting tourism as the associated arrows are left-down.

Coherence analysis of tourism and economic growth. The phase difference between trade and tourism is indicated by arrows. Arrows pointing to the left mean that the two variables are in the phase; to the left and down, the tourism lags behind; and to the left and up, the tourism leads. Arrows pointing to the right mean that the two variables are out of the phase; to the right and down, the tourism leads; and to the right and up, the tourism lags. “In the phase” indicates that the two variables have cyclical effects on each other, and “out of the phase” or “anti-phase” signifies that the two variables exert anti-cyclical effects on each other

Figure 2 shows the coherence analysis of tourism and economic growth. The results are very striking as the two variables co-vary strongly during the full sample period for the 8- to 16-month frequency. The dependency is also significant for the 4- to 8-month frequency since 1998 onwards. Another interesting feature of our analysis is that the direction of arrows (i.e. the direction of Granger-causality) changes after 2002 which is the year when India started the incredible India campaign. The nature of the tourism–growth nexus also varies across timescales. Indeed, the results indicate that scale arrows are right-down for the long-term horizon (low frequencies from 18 to 64 months) during the period May 1995–September 1998 (observations 50–90), the period August 2001–April 2003 (observations 120–145), and the period January 2007–July 2009 (observations 190–220). Accordingly, these two variables are out of the phase, but tourist arrivals leads economic growth. Inversely, the arrows are right-up over the entire period for the medium-term horizon (between the \(8{\mathrm{th}}\) and the \(16{\mathrm{th}}\) month) and from the \(90{\mathrm{th}}\) observation (1998 onwards) for the short-term horizon (between the \(4{\mathrm{th}}\) and the \(6{\mathrm{th}}\) month). These findings imply that the two variables are out of phase and that economic growth lags the tourist arrivals.

Overall, our results show evidence of significant phase differences (out of the phase) between tourism and trade, and between tourism and growth over the long-term horizons (16- to 64-month frequency). Tourist arrivals lag the international trade activities, while they lead economic growth. As for the medium- and short-term horizons, an out-of-phase behaviour between tourism and economic growth is found with economic growth as leading variable. The phase and lead-lag effects between tourism and trade differ greatly across time periods and across medium and high frequencies.

4 Conclusion

This study attempts to analyse the co-movement (phase differences) and lead-lag relationships between tourist arrivals, economic growth, and international trade for India over the period from April 1991 to July 2012. For this purpose, we make use of asymmetric Granger-causality tests and wavelet coherence analysis in order to provide robust estimation results.

The results from asymmetric Granger-causality tests show that negative and positive changes in international trade and economic growth Granger-cause changes in tourist arrivals. However, only positive change in tourist arrivals Grange-causes international trade and economic growth. Our results also provide evidence of significant co-movements between the variables of interest both, but the strength of these co-movements varies over time and across frequencies (different time horizons).

The phase differences between variables are also analysed, and the results indicate the presence of multiple lead-lag effects which change over time and are timescale dependent. In particular, we find evidence of out-of-phase behaviour in the relationships between tourism and trade, and between tourism and growth for long-term horizons. Tourist inflow is found to lag behind international trade, but to lead economic growth. When it comes to short- and medium-term horizons, the relationship between tourism and growth is also characterized by anti-cyclical interactions with the leading role of economic growth. The pattern of lead-lag interactions between tourism and trade is, however, quite different for different sub-periods and frequencies.

The empirical insights from our study are thus crucial for policymakers in India to build sound economic policies. Indeed, policymakers would have interest to develop the bilateral trade activities with foreign partners, which will in turn lead to promote the tourism sector and to boost economic growth. The destination branding strategies which have been adopted by a number of the state governments (e.g. the “God’s Own Country” campaign by Kerala government, and the “Unforgettable Himachal Pradesh” campaign by the Himachal government) seem to be efficient and particularly suitable. The fact that negative changes in the tourist arrivals do not significantly help forecasting international trade and economic growth in India strongly recommends the continuation of the economic diversification in India in order to sustain growth and ensure macroeconomic stability.

Notes

This section is heavily based on Grinsted et al. (2004). We are grateful to them for making codes available, which was utilized in the present study.

References

Aguiar-Conraria L, Soares MJ (2011) Oil and the macroeconomy: using wavelets to analyze old issues. Empir Econ 40(3):645–655

Aguiar-Conraria L, Azevedo N, Soares MJ (2008) Using wavelets to decompose the time-frequency effects of monetary policy. Phys A: Stat Mech Appl 387(12):2863–2878

Campbell JY, Hentschel L (1992) No news is good news: an asymmetric model of changing volatility in stock returns. J Financ Econ 31(3):281–318

Easton ST (1998) Is tourism just another commodity? Links between commodity trade and tourism. J Econ Integr 13(3):522–543. doi:10.11130/jei.1998.13.3.522

Engle RF, Granger CWJ (1987) Co-Integration and error correction: representation, estimation, and testing. Econometrica 55(2):251. doi:10.2307/1913236

Engle RF, Ng VK (1993) Measuring and testing the impact of news on volatility. J Financ 48:78–1749

Fry D, Saayman A, Saayman M (2010) The relationship between tourism and trade in South Africa. S Afr J Econ 78(3):287–306. doi:10.1111/j.1813-6982.2010.01245.x

Geweke J (1982) Measurement of linear dependence and feedback between multiple time series. J Am Stat Assoc 77(378):304. doi:10.2307/2287238

Gokovali U (2010) Contribution of tourism to economic growth in Turkey. Anatol Int J Tour Hosp Res 21(1):139–153. doi:10.1080/13032917.2010.9687095

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37(3):424. doi:10.2307/1912791

Grinsted A, Moore JC, Jevrejeva S (2004) Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Process Geophys 11(5/6):561–566

Gronwald M (2009) Reconsidering the macroeconomics of the oil price in Germany: testing for causality in the frequency domain. Empir Econ 36(2):441–453. doi:10.1007/s00181-008-0204-3

Gunduz L, Hatemi-J A (2005) Is the tourism-led growth hypothesis valid for Turkey? Appl Econ Lett 12(8):499–504. doi:10.1080/13504850500109865

Hatemi-J A (2003) A new method to choose optimal lag order in stable and unstable VAR models. Appl Econ Lett 10(3):135–137

Hatemi-J A (2012) Asymmetric causality tests with an application. Empir Econ 43(1):447–456. doi:10.1007/s00181-011-0484-x

Hosoya Y (1991) The decomposition and measurement of the interdependency between second-order stationary processes. Probab Theory Relat Fields 88(4):429–444. doi:10.1007/bf01192551

Jammazi R (2012) Cross dynamics of oil-stock interactions: a redundant wavelet analysis. Energy 44(1):750–777. doi:10.1016/j.energy.2012.05.017

Kadir N, Jusoff K (2010) The cointegration and causality tests for tourism and trade in Malaysia. Int J Econ Financ 2(1):138

Katircioglu S (2009) Tourism, trade and growth: the case of Cyprus. Appl Econ 41(21):2741–2750. doi:10.1080/00036840701335512

Kulendran N, Wilson K (2000) Is there a relationship between international trade and international travel? Appl Econ 32:1001–1009

Kweka J, Morrissey O, Blake A (2003) The economic potential of tourism in Tanzania. J Int Dev 15:335–351

Lean HH, Tang CF (2010) Is the tourism-led growth hypothesis stable for Malaysia? A note. Int J Tour Res 12:375–378

Lemmens A, Croux C, Dekimpe MG (2008) Measuring and testing granger causality over the spectrum: an application to European production expectation surveys. Int J Forecast 24:414–431

Narayan PK (2004) Economic impact of tourism on Fiji’s economy: empirical evidence from the computable general equilibrium model. Tour Econ 10:419–433

Shan J, Ken Wilson (2001) Causality between trade and tourism: empirical evidence from China. Appl Econ Lett 8(4):279–283

Sims C (1980) Macroeconomics and reality. Econometrica 48:1–48

Suresh KG, Gautam V, Kumar M (2011) Analysing the relationships among tourism, trade, and economic growth in Indian perspective. J Int Bus Econ 12(1):1–11

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1):50–225

Torrence C, Compo GP (1998) A practical guide to wavelet analysis. Bull Am Meteorol soc 79(1):61–78

Torrence C, Webster PJ (1999) Interdecadal changes in the ENSO–monsoon system. J Clim 12(8):2679–2690

UNWTO (2013) Tourism highlights 2013 edition

Vacha L, Barunik J (2012) Co-movement of energy commodities revisited: evidence from wavelet coherence analysis. Energy Econ 34(1):241–247

Veronesi P (1999) Stock market overreactions to bad news in good times: a rational expectations equilibrium model. Rev Financ Stud 12(5):975–1007

WTTC (2013) The economic impact of travel & tourism 2013, India, http://www.wttc.org/site_media/uploads/downloads/india2013_1.pdf

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Suresh, K.G., Tiwari, A.K. Does international tourism affect international trade and economic growth? The Indian experience. Empir Econ 54, 945–957 (2018). https://doi.org/10.1007/s00181-017-1241-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1241-6