Abstract

This paper analyses the empirical relationship between inflation and growth using a panel data estimation technique, multiple-regime panel smooth transition regression, which takes into account the nonlinearities in the data. By using a panel data set for 10 countries in the Southern African Development Community permitting us to control for unobserved heterogeneity at both country and time levels, we find that a statistically significant negative relationship exists between inflation and growth for inflation rates above the critical threshold levels of 12 and 32% which are endogenously determined. Furthermore, we remedy the cross-section dependence with the common correlated effects estimator.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The inflation–growth relationship stands central to sound macroeconomic policy formulation. To this effect, nonlinearities in the inflation-growth nexus have received increased attention in the literature in recent years. There seems to be consensus that the relationship is indeed nonlinear, implying the existence of a threshold level of inflation below which inflation either has no impact, or a positive impact on economic growth, and above which inflation has a negative impact on economic growth. Empirical threshold analysis has, however, provided mixed results, varying with the level of economic development of the countries under investigation and methodology adopted. In general, developing countries seem to have higher threshold levels when compared to more advanced and developed economies.

Through this study, we contribute to the literature by applying a multiple-regime panel smooth transition regression (MR-PSTR) model, developed from the original work by González et al. (2005) on PSTR, which provides for the endogenous determination of threshold levels. We further extend the methodology used by Omay and Kan (2010) and Omay et al. (2015). The panel under investigation include countries in the Southern African Development Community (SADC).Footnote 1 We believe that this model may give new insights into threshold effects in the inflation–growth relationship with its advantages over older techniques like the panel threshold regression (PTR) model,Footnote 2 which is used by Khan and Senhadji (2001) and Drukker et al. (2005) for finding appropriate threshold levels in the inflation–growth nexus. The PTR model may not be appropriate for a sample of countries with different timing of threshold effects, the reason being that regime shifts take place suddenly and this heterogeneity of countries with respect to timing for threshold effects is then best captured by smooth transition models. We therefore also improve upon the results of Seleteng et al. (2013) who report a single threshold value for the region. Furthermore, there are numerous problems in applying panel estimation that needs to be controlled for, such as heterogeneity, endogeneity and cross-section dependence. Heterogeneity is automatically controlled for by PSTR and/or multiple-regime PSTR (MR-PSTR) estimation (Omay and Kan 2010). The estimation using a nonlinear panel is then left with problems of endogeneity and cross-section dependence, which both receive attention in this study.

One of the first papers to examine the possibility of nonlinearities in the inflation–growth nexus is that of Fischer (1993). Using a panel of 93 countries consisting of both developed and developing countries, Fischer uses spline regression techniques and arbitrarily divides the sample into three threshold levels or breaks, namely inflation rates \({<}\)15%, inflation rates between 15 and 40%, and inflation rates above 40%. The results depict the presence of nonlinearities in the relationship between inflation and growth. However, the fact that the thresholds are determined exogenously by dividing the sample arbitrarily, using breaks to represent the thresholds, presents a limitation in this case. Similarly, Bruno (1995) investigates the inflation–growth relationship among 127 countries, consisting of both developed and developing countries and finds that growth rates only decline when inflation rates move beyond 20–25% and that growth increases as inflation rises up to the 15–20% range.

Sarel (1996) tests for a structural break in the inflation–growth relationship using panel data for 87 countries for the period 1970–1990. The results reveal a significant structural break at an annual inflation rate of 8%, implying that below this rate, inflation does not have a significant effect on growth, while above 8% the inflation has a negative and statistically significant impact on growth. More studies that exogenously determine the threshold level of inflation include Bruno and Easterly 1998 and Ghosh and Phillips 1998. The latter study finds the inflation-growth relation to be convex, so that the decline in growth associated with an increase from 10 to 20% inflation is much larger than that associated with moving from 40 to 50%.

Khan and Senhadji (2001) estimate the threshold levels separately for industrial and developing countries using panel data of 140 countries for the period 1960–1998. They make use of a nonlinear least squares (NLLS) estimation technique and estimate the threshold levels to be 1–3 and 11–12% for industrial and developing countries, respectively. Their results suggest that inflation below these threshold levels have no effect on growth, while inflation above these levels have a significant negative effect on growth.

Moshiri and Sepehri (2004) use a nonlinear specification and the data from four groups of countries at various stages of development and examine the possibility of various thresholds (rather than a single threshold) across countries at different stages of development. They find the thresholds levels varying widely from as high as 15% per year for lower–middle-income countries to 11% for low-income countries, and 5% for the upper–middle-income countries. Their results also depict no statistically significant relationship between inflation and economic growth in the Organisation for Economic Cooperation and Development (OECD) countries.

Drukker et al. (2005) investigate the nonlinearities in the inflation-growth relationship using data of 138 countries over the period 1950–2000. Their results reveal one threshold value of 19.2%, below which inflation do not have a statistically significant effect on growth and above which inflation has a negative and statistically significant impact on long-run growth. Pollin and Zhu (2006) examine the nonlinear relationship between inflation and economic growth for 80 countries over the 1961–2000 period, using middle-income and low-income countries. The paper finds an inflation threshold of between 15 and 18%, above which inflation is detrimental to economic growth and below which inflation is beneficial to economic growth. Li (2007) estimates a nonlinear relationship between inflation and economic growth for 27 developing and 90 developed countries over the 1961–2004. The results suggest threshold levels of 14 and 38% for the developing countries in the sample. When the inflation rate is below 14%, the effect of inflation on growth is positive and insignificant. Between 14 and 38%, the effect is strongly negative and significant and above 38% the effect diminish but remain significantly negative.

Schiavo and Vaona (2007) use a nonparametric and semiparametric instrumental variable (IV) estimator to assess the nonlinearities between inflation and economic growth. They use a dataset of 167 countries, comprising of developed and developing countries, covering the period 1960–1999. The results reveal the existence of a threshold level of 12% for developed countries. Below this level, inflation seems not to be harmful to growth, while above this level, inflation is harmful to growth. Due to the variability in growth performance of developing countries, the study did not find a precise threshold level of inflation for this group of countries.

Espinoza et al. (2012) use a smooth transition regression (STR) model to investigate the speed at which inflation beyond a threshold becomes harmful to growth. The study employed a panel of 165 countries covering the period 1960–2007. The results show that for developing countries, inflation above 10% quickly hurts growth. For advanced economies, the study finds no specific threshold: in the medium term, i.e., higher inflation hurts growth for any initial level of inflation, suggesting that there is a real cost to maintaining higher inflation as a buffer, even though higher levels of inflation may create more space for using monetary policy to reduce nominal and real interest rates during financial crisis.

Omay and Kan (2010) re-examined the threshold effects in the inflation–growth nexus with a cross-sectionally dependent nonlinear panel of six industrialized economies (Canada, France, Italy, Japan, UK and USA) covering the period 1972–2005. They used a panel smooth transition regression (PSTR) to control for unobserved heterogeneity at both country and time levels. The results reveal a threshold level of 2.5%, above which inflation negatively affects economic growth. Similarly, Ibarra and Trupkin (2011) use a PSTR model with fixed effects to investigate the nonlinearities in the inflation–growth nexus among 120 countries for the period 1950–2007. Their results depict a threshold level of 19.1% for non-industrialized countries and a high speed of transition from low to high inflation regimes. At the same token, Mignon and Villavicencio (2011) also rely on a PSTR model to investigate the nonlinearities in the inflation–growth relationship among 44 countries covering the period 1961–2007 and report a threshold level of 19.6% for lower-middle- and low-income countries. Seleteng et al. (2013) focus on countries in the Southern African Development Community (SADC) over the period 1980 to 2008, also making use of a PSTR model to determine a single threshold value for the region endogenously. Their results reveal a value of 18.9%, above which inflation is detrimental to economic growth in the SADC region. Below the threshold of 18.9% the impact coefficient also carries a negative sign; however, it is smaller in magnitude and not statistically significant.

From the above discussion, the lack of consensus regarding the critical threshold level is evident. Insufficiency of techniques stems, in part, from exogenous determination of threshold levels, failure to control for unobserved heterogeneity at both country and time levels, or failure to account for cross-sectional dependence. Therefore, this important issue calls forth a further investigation in parallel to the theoretical improvements in nonlinear estimation techniques. As mentioned earlier, in this study we apply a multiple-regime panel smooth transition (MR-PSTR) model, which provides for the endogenous determination of threshold levels. In addition to heterogeneity which is automatically controlled for by MR-PSTR estimation, we control for endogeneity and cross-section dependence.

We know that when inflation is not exogenous in a growth–inflation regression, the coefficient estimates may be biased, posing a serious problem for the related estimation. The estimation method used in studies by Khan and Senhadji (2001) and Drukker et al. (2005)Footnote 3 has not been extended to standard econometric methods of handling simultaneity like the method used by Omay and Kan (2010), which method is also applied in this study. Khan and Senhadji (2001) do not address the issue directly, but state that the seriousness of the problem will depend, to a large extent, on whether the causality runs mainly from inflation to growth, in which case the endogeneity problem may not be serious, or the other way round, in which case bias may be present. Fischer (1993) found that causality is more likely to run predominantly from inflation to growth. Also, Andres and Ignacio (1997) use instrumental variables in a study of OECD countries and find that causality runs from inflation to growth. On the other hand, Fouquau et al. (2008) apply an IV estimation technique to a PSTR model and conclude that the PSTR estimation technique limits the potential endogeneity bias. Moreover, Hineline (2007) states that aggregate supply shocks may be driving inflation and output in opposite directions, in which case the direction of causality is reversed and the regressions which are run for this purposes are simply detecting supply shocks. Instead of using IV estimation techniques, he proposes a method which is using a proxy for aggregate supply shocks in estimating growth regressions. One of his potential variables is terms of trade and the other one is a time dummy.

Furthermore, in order to eliminate cross-section dependence, which may occur due to spillover effects, common shocks etc., spatial matrices or common factors are included in the analysis. These common factors can proxy the aggregate supply shocks. Therefore, eliminating cross-section dependence by including common factors in the model may also eliminate the endogeneity bias which may occur in the growth-inflation nexus. From the discussion above, we can conclude that the main problem therefore is cross-section dependence; thus, we concentrate on this problem in the remainder of this study.

For cross-section dependence, we adapt Pesaran’s (2004) \(\text {CD}_\text {LM}\) test for the nonlinear context and extend Pesaran’s (2006) method to a nonlinear formation which makes use of cross-sectional averages to provide valid inference for stationary panel regressions with a multifactor error structure in order to eliminate cross-section dependence from the PSTR model. We follow the methodology of Omay and Kan (2010) in using the common correlated effects (CCE) estimator for the MR-PSTR model. With all these contributions, we anticipate that the MR-PSTR model will be the best method to obtain a specific inflation threshold level. By applying this model to a sample of 10 countries in the SADC,Footnote 4 we find that the critical threshold level for inflation above which it becomes harmful for growth is smaller than previously suggested threshold levels (e.g., Mignon and Villavicencio 2011; Ibarra and Trupkin 2011 and Seleteng et al. 2013) who all report threshold values between 18 and 19.6% for developing and non-industrialized countries.

In the first stage of our analysis, we estimate a two-regime PSTR with and without cross-section dependence. The results depict that the estimated threshold value is around 32%. The estimated threshold value is high in comparison to the older studies. This two-regime PSTR model does however not pass all misspecification tests. Consequently, we proceed to estimate the MR-PSTR model. To obtain a STAR model that allows for more than two genuinely different regimes, it is useful to distinguish two cases, depending on whether the regimes are characterized by a single transition variable \(s_{t}\) or by a combination of several variables \(s_{1t};{\ldots };s_{mt}\) (Van Dijk 1999). We use the most general model and obtain two threshold levels which is 12% for the low threshold and 32% for the high threshold. In the low regime, the estimated effect of the inflation on growth is negative and statistically significant. In the middle regime, the estimated effect of the inflation on growth is negative and statistically insignificant with a smaller impact coefficient than in the low regime. Finally, in the high regime the estimated effect of the inflation on growth is negative, statistically significant and has the largest impact. In the existing literature, studies do not consider cross-section dependence bias, hence, reported results will be biased. In addition, other studies only report one threshold level where our results shows that two threshold levels are more likely for the SADC countries in the sample. Therefore, this correctly estimated threshold level gives accurate signals to policy makers. For example, if the threshold level is below 12%, depending on old studies, policy makers would most likely not react to this inflation level, however, we see that this has a more harmful effect on the selected sample of countries than in the second or middle region. Hence, we can conclude that obtaining incorrect threshold levels may potentially lead to a more harmful effect on the economies than expected. Finally, we see that both very low levels and high levels of inflation are also harmful for countries with a lesser degree of development.

The remainder of the paper proceeds as follows: Sect. 2 briefly reviews PSTR models and provides results for the linearity test (homogeneity test) against STR type nonlinearity; it presents a sequence of F tests for determining the order of the logistic transition function. Section 3 proceeds with estimation of a linear fixed effects panel model and PSTR model, providing a new technique which eliminates cross-section dependence from the nonlinear panel estimation. Section 4 offers some robustification for empirical results obtained in Sect. 3, while Sect. 5 concludes.

2 Specification and estimation of PSTR model

Panel smooth transition regression (PSTR) permits for a small number of extreme regimes where transitions between regimes are smooth (González et al. 2005). Let us first deal with the simplest case, namely a two-regime PSTR:

for \(i=1,\ldots ,N\), and \(t=1,\ldots ,T\), where N and T denote the cross section and time dimensions of the panel, respectively. The dependent variable \(\Delta y_\textit{it} \) is a scalar and denotes growth rates of real GDP for the ten African countries, inflation (\(\pi _t\)) is included as exogenous regressor, x, while \(\mu _i\) represents the fixed individual effects, and \(u_\textit{it} \) the error term. The transition function \(F(s_\textit{it} ;\gamma ,c)\) is a continuous function of observable variable \(s_\textit{it} \). It is normalized to lie between 0 and 1, which denote the two extreme values for regression coefficients (González et al. 2005). Following Granger and Teräsvirta (1993), they consider the following logistic transition function for the time series STAR models:

where \(c=(c_1 ,\ldots ,c_m )^{{\prime }}\) is an m-dimensional vector of location parameters, and the slope parameter \(\gamma \) denotes the smoothness of the transitions. A value of 1 or 2 for m, often meets the common types of variation. In cases where \(m=1\), low and high values of \(s_\textit{it} \) correspond to the two extreme regimes. Given that \(\gamma \rightarrow \infty \), the logistic transition function \(F(s_\textit{it} ;\gamma ,c)\) becomes an indicator function I[A], which takes a value of 1 when event A occurs and 0 otherwise. Thus, the PSTR model reduces to Hansen’s (1999) two-regime panel threshold model. And for \(m=2\), \(F(s_\textit{it} ;\gamma ,c)\) takes a value of 1 for both low and high \(s_\textit{it}\), minimizing at \((\frac{c_1 +c_2}{2})\). In that case, if \(\gamma \rightarrow \infty \), \(F(s_\textit{it} ;\gamma ,c)\) reduces to a three-regime threshold model. Indeed given\(\gamma \rightarrow 0\), the transition function \(F(s_\textit{it} ;\gamma ,c)\) will reduce to a homogeneous or linear fixed effects panel regression for any value of m.Footnote 5

The empirical specification procedure for PSTR models consists of the following steps (González et al. 2005):

-

1.

Without considering any nonlinearity features, specify an appropriate linear (homogeneous) panel estimation model for the series under investigation. Hence, the following step is a diagnostic check for the linear model as we test whether the model specification is linear or not.

-

2.

Test the null hypothesis of linearity (homogeneity) against the alternative of PSTR-type nonlinearity. If linearity is rejected, select the appropriate transition variable \(s_\textit{it} \) and the form of the transition function \(F\left( {s_\textit{it} ;\gamma ,c} \right) \).

-

3.

Estimate the parameters in the selected PSTR model.

-

4.

Evaluate the model using diagnostic tests.

-

5.

Modify the model if necessary.

-

6.

Use the model for descriptive purposes.

Linearity (homogeneity) tests are necessary for estimation of PSTR models which contain unidentified nuisance parameters. To overcome this problem, one may replace the transition function \(F(s_\textit{it};\gamma ,c)\) by its first-order Taylor expansion around \(\gamma = 0\) following Luukkonen et al. (1988). This will yield the following auxiliary regression:

where \(\beta _1^{{\prime }*} ,\ldots ,\beta _m^{{\prime }*} \) are the parameter vectors. Consequently, testing \(H_0 :\gamma =0\) in (1) is equivalent to testing the null hypothesis \(H_0^*:\beta _1^*=\cdots =\beta _m^*=0\) in (3). This test can be implemented by an LM test. Denoting the panel sum of squared residuals under \(H_{1}\) as \(\text {SSR}_{1}\) (which is the two-regime PSTR model), the corresponding F-statistic is then defined by:

with an approximate distribution of \(F\left( {mk,TN-N-m(k+1)} \right) \). A set of candidate transition variables are tested to detect the one for which linearity is strongly rejected. Besides, linearity tests also serve to determine the appropriate order of m of the logistic transition function in Eq. (2). Teräsvirta (1994) proposed a sequence of tests for choosing between \(m=1\) and \(m=2\). Applied to the present situation, this testing sequence reads as follows: Using the auxiliary regression (3) with \(m=3\), test the null hypothesis \(H_0^*:\beta _1^*=\beta _2^*=\beta _3^*=0\). If it is rejected, test \(H_{03}^*:\beta _3^*=0\), then exclude \(\beta _3^*=0\) and test \(H_{02}^*:\beta _2^*=0\left| {\beta _3^*=0} \right. \) and \(H_{01}^*:\beta _1^*=0\left| {\beta _2^*=\beta _3^*=0} \right. \):

These hypotheses are tested by ordinary F tests and denoted as \(F_{3}, F_{2}, \) and \(F_{1}\), respectively. The decision rule is as follows: \(m=2\) transition function is selected for cases where p value corresponding to \(F_{2}\) is the smallest and \(m=1\) transition function is chosen for all other cases, and therefore if \(F_{1}\) or \(F_{3}\) is the smallest, then the \(m=1\) transition function is selected.

Once the transition variable and form of the transition function are selected, the PSTR models can be estimated by using nonlinear least squares (NLLS), using good starting values in the optimization algorithm. For fixed values of the parameters in the transition function, \(\gamma \) and c, the PSTR model is linear in parameters \(\beta _0^{\prime } \) and \(\beta _1^{\prime } \) and, therefore, can be estimated by using OLS. Hence, a convenient way to obtain reasonable starting values for the NLLS is to perform a two-dimensional grid search over \(\gamma \) and c, and select those estimates that minimize the panel sum of squared residuals.

After parameter estimation, we perform a diagnostic check to evaluate the estimated PSTR model. Particularly, misspecification tests are used to test for parameter constancy and additive nonlinearity (or remaining heterogeneity), as suggested by González et al. (2005). For cross-section dependence, we follow Omay and Kan (2010) who suggested the use of an adapted version of the Pesaran ’s (2004) cross-section dependence test.Footnote 6 If the estimated model passes all misspecification tests, then it can be used for descriptive purposes.

3 Empirical analysis: data and results

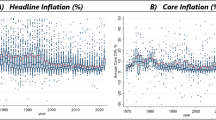

In this study, we consider annual data from 10 African countries in the SADC (including Botswana, Lesotho, Madagascar, Mauritius, Malawi, Namibia, Republic of South Africa, Swaziland, Seychelles and Tanzania) spanning the period 1980–2011. The average growth rates and inflation rates for the countries included in this study are depicted in Fig. 1. The data set for the dependent variable \(\Delta y_\textit{it}\) is constructed from annual real GDP growth. The independent variable of inflation, \(\pi _\textit{it} \), is computed from Consumer Price Index figures. All variables are extracted from the World Bank Africa Development Indicators (ADI) database. For the period under consideration, the average inflation rate is 11.8%, while the average real GDP growth rate is 4%. All countries included in the sample fall under the Southern African Customs Union (SACU) and are part of the Free Trade Area. With the aim of increasing monetary integration in the region, the SADC Committee of Central Bank Governors is leading cooperation among central banks (SADC 2016).

We begin modeling the growth–inflation relationship by estimating a balanced panel data model for output growth, \(\Delta y_\textit{it} \), with inflation, \(\pi _\textit{it} \).

Following Omay and Kan (2010), we investigate the stochastic properties of the dependent and independent variables. For this purpose, we apply the linear IPS test which considers cross-section dependence, in addition to two nonlinear panel unit roots tests proposed by Ucar and Omay (2009) and Emirmahmutoğlu and Omay (2014).Footnote 7 These tests, henceforth labeled UO and EO, have good power when the series under investigation follows nonlinear and asymmetric processes, respectively (Table 1).

The test results examined within the sample obtained from the UO, EO and IPS test rejects the null hypothesis of a unit root in the examined series at the 1 and 5% significance levels. From both linear and nonlinear panel unit root tests, we can conclude that both variables are I(0). Furthermore, the series in the study exhibit strong nonlinear properties as suggested by the test results obtained from the UO and EO tests. Both of the tests have nonlinear stationarity in their alternatives; hence these tests can be taken as a nonlinearity test, as well. Therefore, based on UO, EO and asymmetry test results which suggest symmetric nonlinearity, we can conclude that these variables must be modeled with a nonlinear model. Moreover, we can claim that these tests are an early warning of potential significance of the linearity test which will be presented in Table 3. However, we first present the result of the linear (homogeneous) fixed effect panel data model in Table 2.

The inflation variable has a statistically significant and negative effect on growth. We thus proceed with the identification procedure as set out in Sect. 2. After estimating the linear model, we apply the \(\mathrm{LM}_F\) test of linearity (homogeneity), mentioned in Sect. 2, using lagged inflation as transition variable to test linearity (homogeneity) of the coefficients of \(\pi _\textit{it} \) (inflation). For this purpose, the \(\mathrm{LM}_F\) test for \(m=1, 2\), and 3 is applied to auxiliary regressions in Eq. (3) and the results are displayed in Table 3.

Linearity (homogeneity) is significantly rejected for the first lag of the transition variable inflation for the model. By noting the small p values, we find a lag order of one is an appropriate transition variable and the most suitable transition function for this selection is \(m=1\). This shows that the inflation–growth nexus exhibits different dynamics in both regimes (heterogeneous) and that the relationship is nonlinear.

Following this homogeneity test, we apply a sequence of F-tests in order to check whether the order m is indeed one or not. The results of the specification test sequence are given in Table 4.

The decision rule is as follows: \(m=2\) transition function is selected for the cases where p value corresponding to \(F_{2}\) is the smallest and \(m=1\) transition function is chosen for all other cases. The result of the specification test sequence in Table 4, point out that for our model, \(F_{3}\) has the strongest rejection which means that the \(m=1\) transition function is selected. In the next level, we start a grid search, which was explained in Sect. 2, in order to obtain the initial values for the nonlinear fixed effect panel estimation. The two-regime PSTR model results obtained by using these initial values are presented in Table 5.

In model estimation, the transition function is chosen to be logistic, order \(m=1\). The implication of this choice for model coefficients is that it constitutes two regimes. The coefficient estimate \(\beta _{\pi _\textit{it}}\) corresponds to the sub-regime which refers to the low inflation regimes since the transition variable is inflation. The following coefficient estimate \(\tilde{\beta }_{\tilde{\pi }_\textit{it}}\) when summed with lower regime coefficient, \(\beta _{\pi _\textit{it}}\), yields the coefficient estimates for high inflation periods. For the low inflation regime, inflation coefficient is found to be \(-0.134\), statistically significant at the 1% level. For the high inflation regime, on the other hand, the model yields inflation coefficient estimates of \(-0.116\), significant at the 5% level. Seleteng et al. (2013), Mignon and Villavicencio (2011) and Ibarra and Trupkin (2011) also report negative relationships on both sides of the threshold level. However, the threshold level estimated with our model is higher than the threshold levels reported by these studies, namely 32% versus threshold levels of between 18 and 19.6% for the aforementioned studies. The threshold level of 32%, when controlling for cross-sectional dependence is obtained at the 1% level of significance.

The estimated values of the location (threshold) parameter c and transition parameter gamma and the graph of the estimated transition function as a function of \(\pi _{it-1}\) provides useful information about the features of the transition itself and the interpretation of the model. Figure 2 shows the transition function. We see a high transition speed from one regime to another with gamma = 125.57.

The estimated threshold value of 32.296 is half way of the transition; this means that when \(\pi _{it-1} = c\), \(F(s_\textit{it} ;\gamma ,c)=1/2\). It indicates that the threshold value is at the half-way point between the low inflationary and high inflationary regimes for African countries.

There are not that many observations in the upper regime (\(F(s_\textit{it} ;\gamma ,c\)) takes a value of 1), implying that the existence of two distinct regimes may be problematic. These regimes can be defined with respect to the values of the past values of \(\pi _\textit{it} \) relative to the estimated threshold value. That is, \(\pi _{it-1} <32.296, F(s_\textit{it} ;\gamma ,c) = 0\), is associated with low inflationary regimes, while \(\pi _{it-1} >32.296, F(s_\textit{it} ;\gamma ,c)=1\), is associated with high inflationary regimes.

Moreover, we see different parameter estimates for different regimes. Therefore, the PSTR model implies asymmetric responses of covariates to output growth. As we pointed out in the panel unit root test stage, the test results provide an early warning of the identification of the model that will be estimated. Thus taking all results into consideration, we continue with diagnostic checking as to whether we have obtained the true model or not, since the results we report above indicate the possibility that there can be another regime, which leads to a MR-PSTR model specification.

From Table 6, the two-regime PSTR model exhibits model misspecification. For this purpose, we extend the model to a MR-PSTR by relying on the results from the misspecification tests. The state variable of the second transition function is selected to be \(\pi _{i,t-3} \). The model does not exhibit time-varying nonlinearity. We also notice that the cross-section dependence decrease but is not fully eliminated in the model. An important finding from the misspecification tests is that if the model is not specified correctly, the remedy used for cross-section dependence (in our case we use CCE), will not remove the bias.Footnote 8

To obtain a STAR model that allows for more than two genuinely different regimes, it is useful to distinguish two cases, depending on whether the regimes are characterized by a single transition variable \(s_{t}\) or by a combination of several variables \(s_{1t};{\ldots }; s_{mt}\) (Van Dijk 1999).Footnote 9 The MR-PSTR model is as follows in the second situation:

However, we are using the form of the MR-PSTR model below:

This model is more appropriate for obtaining the two threshold values in the growth–inflation nexus. Following Omay and Kan (2010) and Omay (2014), we derive the CCE version of the MR-PSTR pooled version as follows:

The nonlinear model with a single factor is specified as follows:

where

Notice here that \(f_t \) and \(\tilde{f}_t \) are different factor variables that affect dependent, independent, and state-dependent variables, respectively. By applying the relevant algebra, we obtain the auxiliary regression in line with Omay and Kan (2010) and Omay (2014):

Now we can estimate the models by this transformation in order to eliminate the cross-section dependence. The obtained estimated CCE pooled MR-PSTR is:

First threshold = 11.534; 12% inflation

Second threshold = 31.961; 32% inflation

Parameter estimates of the regimes | States |

|---|---|

\(\beta _0^{\prime } =\beta _0 =-0.120\) | \(\pi<c_1 <c_2 \) |

\(\beta _1^{\prime } =\beta _1 -\beta _0 =-{0.120}-({-0.081})=-0.039\) | \(c_1<\pi <c_2 \) |

\(\beta _2^{\prime } =\beta _2 -\beta _1 =-0.120-{0.244}=-0.386\) | \(c_1<c_2 <\pi \) |

\(\beta _3^{\prime } =\beta _0 -\beta _1 -\beta _2 +\beta _4=-0.120-(-0.081)-0.244-{0.093}=-0.376\) | \(c_1<c_2 <\pi \) |

Indeed the most widely accepted relationship in the literature is that inflation has an adverse effect on economic growth only after it crosses a certain threshold level, below which level it has a positive or insignificant effect on growth (Singh and Kalirajon 2003). In our 10 African country case, the dynamics of the growth–inflation nexus differs from developed countries. As expected in the developing countries case, until a certain threshold (first threshold), the level of inflation effects growth negatively. In our MR-PSTR case, we see that in the first region where the inflation is at the lowest level, we find a parameter estimate of \(-0.120\). This estimate is bigger than the second regions’ parameter which shows us that the harmful effect is decreasing; however, in the third and fourth region the harmful effect of the inflation on growth increase and is bigger than in the first region. By using a MR-PSTR model, we manage to see the exact relationship of growth and inflation in a selection of African countries. These findings overlap with the findings of Fischer (1993) to some extent. He implicitly estimate two thresholds or three-regime model and found that the effects of inflation are decreasing. On the other hand the three-regime model is shown to be a better fit to developing countries data. Based on our estimation results, the best or optimal region for economic growth where the inflation settled is between two threshold levels, \(c_1<\pi <c_2 \). Therefore, for the policy makers in these countries it may prove beneficial to contain the inflation rate within these regions. From a theoretical perspective, to justify that a threshold value as high as 12% can be conducive to economic growth, one can consider a Barro (1990)-type endogenous growth model with productive public expenditures as in Basu (2001), with money introduced through cash-reserve requirements in the banking system—a standard characteristic of developing market banking sector (Bittencourt et al. 2014). The reserve requirement serves as a wedge between deposit rate and loan rate. While the real gross loan rate is still constant being tied with the constant marginal productivity of capital, and independent of the inflation rate, the real gross deposit rate will be a function of the inflation rate due to the wedge created by the reserve requirement.

Suppose the productive public expenditures is financed by both taxes and seigniorage. Then an increase in inflation would lead to an increases in seigniorage which will initially increase the growth rate. However, beyond a certain point increases in inflation will reduce the real interest rate on deposits thus driving investment and growth down. In developing countries characterized by tax evasion and a less-developed public debt market, seigniorage is considered as a very relevant channel of financing government expenditures (Roubini and Sala-i-Martin 1995). Hence, this line of reasoning leading to a threshold effect of inflation and growth can be easily motivated theoretically.

So, clearly, there can be a possible threshold that characterizes the relationship between growth and inflation theoretically, which in this case happens to be 12% empirically. For studies with double-digit threshold levels for developing countries, refer to Fischer (1993), Drukker et al. (2005), Li (2007), and Seleteng et al. (2013), among other.

Figure 3 shows the transition functions of this analysis.

From Table 7 it is evident that the two-regime MR-PSTR model does not exhibit any model misspecification. Firstly, the model does not exhibit any time-varying nonlinearity. Cross-section dependence decreases and is eliminated in this model (\(p>0.05\)). The most interesting result is again the CD test results. When the model exhibits any kind of misspecifications, the CD test tends to reject the null of no cross-section dependence. Therefore, we can conclude that the remedy CCE for CSD efficiently works when the model is correctly specified.

4 Robustification of the estimation results

First of all, we are very thankful to an anonymous referee for requesting robustification of this new methodology. We would like to point out that we may also have followed other robustification methodologies, but since the investigation in this section is already substantially detailed, we confine ourselves to these results.

In the first round of the robustification, we start with the general to specific methodology similar to the estimation procedure followed for STAR type estimation. We repeat the procedure for TAR type estimation to investigate whether the MR-PTR model produce results that are supportive of the MR-PSTR results. At this stage of the estimation, we ignore certain details in order to simplify the estimation procedure. Therefore, we assume a cross-sectionally independent panel, with no endogeneity problem. We also assume two regimes and threshold-type nonlinearity to exist. In Fig. 4, we have estimated 49 PTR models for all threshold values and obtained the low and high regime estimates. These estimates give all possible relationships between inflation and growth with respect to both regimes (low inflationary and high inflationary periods). Therefore, this figure serves as is a summary from which we can detect, regime wise, where a stronger negative relationship between growth and inflation can be expected.

The shaded areas indicate that in the low inflation regime, inflation has a more severe negative effect on economic growth than in the high inflation regime. Hence, we can conclude that the two-regime model most probably contradicts previous studies which all confirm that in the high inflation regime, inflation must have a more severe effect on growth. However, this is an early result which ultimately depends on the MR-PSTR estimation result in which we have found four regimes to exist through the use of misspecification tests. Next, we use the Chan (1993) consistent TAR estimation in order to find the threshold value. Figure 5 shows the threshold estimation result for the two-regime PTR model.

The shaded area shows us the threshold value obtained from this estimation. The threshold estimation for the growth-inflation equation is 32 by using integer increments, with the first lag of inflation used as state (threshold) variable. By using this result, we estimate the following two-regime PTR model:

As is evident from the estimation result, it is contradicting prevailing literature. The low regime estimate has a stronger and more significant negative relationship than the high regime inflation estimate—which is not surprising given the estimation results displayed in Fig. 4.

Next, we proceed with estimation of a PTR model specification with three regimes. Following a similar approach as above, we obtain the low, medium, and high regime estimates from all threshold values by fixing the first threshold value as explained in Gonzalo and Pitarakis (2002) (Fig. 6).

Once again, the shaded areas suggest that in the low regime, inflation has a more severe negative effect on economic growth than in the middle regime. Hence we can conclude that the three-regime model may confirm the empirical observation which claims that in the middle regime, inflation must have a more severe effect on growth than in the low regime in nearly the half of the estimation results. The three-regime PTR estimation seems to give better results relative to the two-regime PTR estimation, in line with previous empirical literature findings. Therefore, following Gonzalo and Pitarakis (2002), we proceed with the threshold estimation by using the sequential procedure. This process yields a threshold estimate of 23 by using integer increments, and the result is shown graphically in Fig. 7.

This threshold is a second-best threshold value. By using this estimation results we estimate the following three-regime PTR model:

As it is seen from the estimation result, it is contradicting prevailing literature. The low regime estimate has a stronger and more significant negative relationship than the middle and high regime estimate. Once again this is not surprising given the estimation results displayed in Fig. 8. Half of the threshold space, given the obtained estimation result from Eq. (13), also belongs to these shaded regions.

Therefore, we proceed with estimation of a four-regime PTR model, following the same procedure as before, with fixing \(\tau _1 =32\) and \(\tau _2 =23\).

The shaded areas show us that the low regime has a more severe negative effect than the middle regime. Hence we can conclude that the four-regime model may confirm the empirical observation which claims that in the middle regime inflation may have a more severe effect on growth than in the low regime in nearly half of the estimation results. The four-regime PTR estimations indeed seem to give better results relative to the two and three-regime PTR estimations in terms of economic theory. Therefore, following Gonzalo and Pitarakis (2002), we proceed with the threshold estimation by using the sequential procedure, which yield a third threshold value of 12 by using integer increments, as displayed in Fig. 9.

This threshold value is indicated in Fig. 9 as a second-best threshold value. Using this estimation result, we estimate the following MR-PTR model:

Finding the threshold values as \(\tau _1 =32\), \(\tau _2 =23\) and \(\tau _3 =12\) we can conclude that the dominant threshold value is \(\tau _1 =32\). This issue is explained in Gonzalo and Pitarakis (2002). This phenomenon has presented itself in PSTR as well as and MR-PSTR estimation. We have found the threshold value for the two-regime PSTR as 32.296 (20.382) which is well approximated by the PTR estimation. On the other hand, this dominant threshold value survives in the MR-PSTR estimation as well, the estimated threshold for the high regime is 31.961 (37.217). However, from the MR-PSTR estimation we realize that the second threshold value \(\tau _2 =23\) is not the second dominant threshold value in the estimation process. The third threshold value \(\tau _1 =12\) is the second-best threshold value in the MR-PSTR estimation, as we have found this value to be 11.584 (3.300). The MR-PSTR estimation reveals that the smooth transition type of estimation have advantages over the MR-PTR estimation. In the first step, STAR models are the generalization of TAR models which nest the TAR estimation as a special case as \(\gamma \rightarrow \infty \). On the other hand, it is estimating all the nonlinear parameters simultaneously, giving the significance level. Lastly, it has a more realistic way of modeling real life data due to the reason that STR modeling takes the regime shifts as a smooth process (Omay and Hasanov 2010).

At this stage, in order to well approximate our MR-PTR model to the MR-PSTR model, we are changing the state or the transition variable of the second threshold value to \(\pi _{it-3} \) as it has been found to be the third lag of the inflation variable. In TAR models there is no explicit procedure to find state variables. However, we can confidently use this methodology in MR-PTR estimation depending on our MR-PSTR model linearity test results.

The shaded areas show that in the low regime inflation has a more severe negative effect on economic growth than in the middle regime. However, from Fig. 10, we can also conclude that the three-regime model may confirm the empirical observation which claims that in the middle regime inflation must have a more severe effect on growth than the low regime in roughly half of the estimation periods. In previous findings in the empirical literature, the three-regime PTR estimations seem to give better results when compared to a two-regime PTR estimation. Following Gonzalo and Pitarakis (2002), we proceed with a second threshold estimation, using the sequential procedure.

As evident from Fig. 11, two potential threshold values occur; one of them being 23, and the other, 12. These two threshold values are obtained in the three-regime and four-regime PTR estimations, respectively. However, in this case the second threshold is found to be 12, or in a dominant threshold sense, the second dominant threshold is found to be 12. This last sequential threshold estimation fully confirms the threshold value that we have obtained in the MR-PSTR estimation in Sect. 3.Footnote 11

As can be seen from the estimation result, it does not stand in contradiction to prevailing literature. Now the middle regime estimate has a stronger (and statistically significant) negative relationship than in the low regime, which is not unexpected when we look at the estimation results presented in Fig. 10. 71% of the threshold space, given the obtained estimation result from Eq. (15), belongs to the non-shaded regions.

In order to proceed with robustification of our MR-PSTR estimation, we can introduce the interaction of the regimes as it is done in the MR-PSTR model. However, as explained in Van Dijk (1999), if \(s_{1t} =s_{2t} \equiv s_t \) that is, if a single variable governs the transitions between regimes, and if \(\tau _1 <\tau _2 \), the first transition function changes from zero to one prior to the second transition function for increasing values of \(s_t\) and, consequently the product of two transition functions will be equal to zero for almost all values of \(s_t \), especially if the gammas (\(\gamma _1 \) and \(\gamma _2\)) are large. In our case, the second condition holds automatically due to the fact that we have used a TAR model in which the transition speed equals \(\gamma =\infty \). On the other hand, we are using the third lag of the same variable as second transition variable, which may be taken as \(s_{1t} \cong s_{2t} \) nearly equal to each other. Thus, after the necessary computation, we find that we have only one point for the mixed regime with a four-regime PTR estimation. In the MR-PSTR case, the transition speed for the first estimation is found to be \(\gamma _1 =8.124\) and for the second transition variable \(\gamma _2 =11.001\), which do not satisfy the above-mentioned criteria. On the other hand, we have found 123 data points which can be seen as a mixed regime, but only 15 of them really belong to this regime in which the transition function takes the value around 0.90. This number of observations seems to be sufficient for estimating the four-regime PSTR model, supporting our decision to opt for a four-regime PTR model with mixed regime. Therefore, we have decided to continue our analysis with the three-regime TAR estimation by introducing cross-section dependence and other neglected assumptions such as exogeneity and smooth transition of the regimes which were imposed at the beginning of our robustification analysis.

In order to introduce the cross-section dependence, we use a similar method with specification given in Eq. (10).

This way we have remedied the cross-section dependence from the three-regime PTR estimation, and the estimation results have the same economic explanation as that of Eq. (15). Next, we can apply GMM estimation to the MR-PTR model as it is done by Kremer et al. (2013). However, they point out that if the initial income is included in a growth regression, the endogeneity problem arises. In this case, however, following Omay and Kan (2010) and Drukker et al. (2005), we have excluded initial income from our growth regressions to avoid the endogeneity problem. Therefore, we will not analyze the inclusion of initial income in the specification any further.

Now we can estimate a three-regime PSTR model with the guidance of the PTR modeling, and hence, we relax the threshold type of behavior assumption which was imposed at the beginning. Now for the time being, we fix the dominant threshold at 32 and search for the second threshold as it is described in Gonzalo and Pitarakis (2002). We have two transition speed variables gamma1 and gamma2, and hence for each of these gamma parameters, we have to change the values. These four nonlinear parameters namely gamma1, gamma2, threshold1, and threshold2, need to be initialized by grid search analysis as explained in previous sections. However, we are not aiming for a regular estimation of a three-regime PSTR model, our main consideration is to prove the consistency of the MR-PSTR estimation, which is obtained in Sect. 3, hence, we proceed with the methodology which is used in this section with modification to the MR-PSTR estimation. Therefore, we are searching for (\(\gamma _1 =1\) and \(\gamma _2 =1\)), (\(\gamma _1 =10\) and \(\gamma _2 =10\)), (\(\gamma _1 =100\) and \(\gamma _2 =100\)) and (\(\gamma _1 =500\) and \(\gamma _2 =500\)). For the \(\gamma \) values from our previous estimation MR-PSTR results, we have found \(\gamma _1 =8.124\) and \(\gamma _2 =11.001\) which can be represented by (\(\gamma _1 =10\) and \(\gamma _2 =10\)). Therefore, the first gamma bundle represents a very smooth transition, the second represents a smooth transition, the third one represents a moderate smooth transition, while the last one represents the threshold type of behavior. Fixing the first threshold value to 32 (as it is found to be the dominant threshold), we search for the beta parameters in the threshold space with different gamma bundles. Therefore, for all possible threshold values, we see the values of the beta estimates.

From Figs. 12, 13, 14 and 15 we have seen that for different values of the second threshold value, the regime parameters are given. For the four cases of sequential estimation with given nonlinear parameters we apply the Gonzalo and Pitarakis (2002) methodology. In almost all instances for second threshold parameter regions, we detect that the middle and high regime inflation have a more severe negative effect on growth than the low regime inflation. At the same time, middle regime inflation has a more severe negative effect on growth than the high regime inflation in all cases and almost in all regions of the second threshold. From Figs. 13 and 14, it can be observed that for second threshold values between 6 and 14, high inflation regimes have a more severe negative effect than the middle regime. These regions are representing what is traditionally found in the prevailing economic growth–inflation nexus. The shaded areas are again showing the supremacy of the low inflation regime.

Next we proceed with the same model, but we increase the complexity and let the nonlinear square estimation find the beta estimates of the three-regime model. Thus, we are giving initial values and let the nonlinear square finds the second threshold value. The results for the beta estimation are contained in Fig. 16.

These regime estimates are in line with results in Figs. 13 and 14. Now we only restrict our parameters to the (\(\gamma _1 =10\) and \(\gamma _2 =10)\) gamma bundle, given that these are the most compatible with the original MR-PSTR model. The sequential threshold estimation procedure, using the results obtained in the MR-PSTR estimation in Sect. 3 yields the following three-regime MR-PSTR estimation results:

Parameter estimates of the regimes | States |

|---|---|

\(\beta _0^{\prime } =\beta _0 =-{0.138}\)(t-stat \(=-2.234)\) | \(\pi<c_1 <c_2 \) |

\(\beta _1^{\prime } =\beta _1 -\beta _0 =-{0.138}-(-{0.004})=-{0.134}\)(F-stat \(~=6.835(0.001))\) | \(c_1<\pi <c_2 \) |

\(\beta _2^{\prime } =\beta _2 -\beta _1 =-0.138-{0.025}=-{0.163}\)(F-stat \(=2.501(0.081))\) | \(c_1<c_2 <\pi \) |

Through controlling for all the possibilities, we obtain a result similar to the MR-PSTR estimation of Sect. 3, by means of a simpler nonlinear methodology namely TAR. This leads us to conclude that we can we confidently use the MR-PSTR estimates for economic interpretation.

Finally, one more important question can be asked, namely are there resemblances among the countries in the sample apart from their similarities based on geographical location? This is an important question because the threshold obtained in a panel data approach is more complex than the time series case. In the panel context, the threshold variable can divide the sample with respect to the time and cross-section dimension. Hence, it is better to analyze this heterogeneity effect by splitting the sample country wise without considering the time effect of the threshold variable. In order to do this, we first consider the inflation variable with threshold values obtained from the MR-PSTR model, and by graphical inspection, we may deduce countries that are the similar (or dissimilar).

As can be seen from Fig. 17, the shaded areas all belong to higher levels of inflation which are above 21.0 and these shaded areas belong to 3 countries.Footnote 12 If we graphically present average inflation the two country groups separately, the effect is clear.

Figure 18 displays the average inflation of the two groups of countries separately. The high inflationary countries have a mean inflation rate of 18.836, while the low inflationary countries’ mean is found to be roughly half of that, namely 9.215. As can be readily seen from Fig. 18, only one observation of the low inflationary countries is greater than the mean of high inflationary countries. To get a better picture of the heterogeneity present, we normalize the upper 1% of the low inflationary countries and lower 1% of the high inflationary countries which can be regarded as outliers, and obtain the upper and lower bound of the two groups of countries.

As can be readily seen from Fig. 19, the lower bound of the two groups of countries are the similar, while the upper bound of the low inflationary country group settles around the mean of the high inflationary country group. From our analysis in the previous section, we notice from the misspecification test result that a two-regime PSTR model is not sufficient to describe this panel of countries. The graphical exposition proves that the three or more regime PSTR model is more suitable for this group of SADC countries. As we also explained in the methodology section, in a panel data approach the explanation of the threshold variable is twofold; one of them is coming from the time index and the other one is coming from the cross-section index. Figure 19 is explicitly showing the heterogeneity of the two groups of countries where the obtained threshold is directly derived from this heterogeneity.Footnote 13 Given this fact, we estimate two separate PTR specifications for the two groups of countries in order to more deeply understand the inflation-growth nexus dynamics. Thus, estimated threshold obtained from this estimation procedure will show us the time effect of the nonlinearity within the groups of countries since splitting the countries into two groups provides group homogeneity. The graphical exposition of the two-regime PTR estimation for the low inflationary country group is depicted in Fig. 20.

From the results, it is clear that the same kind of regularities than in previous estimation results exist. The low regime prevails to induce a larger negative effect on growth than the high regime among the low inflationary countries. Nearly half of the potential threshold estimation results given in Fig. 20 depict negative and significantly low regime estimates which exceed those in the high regime. Now we can proceed with the sequential threshold estimation which is outlined in the previous part of this section.

The estimated first or dominant threshold is found to be 17 where the low inflation regime estimate of inflation has more severe negative effects than the high regime estimate as evident from the analysis displayed in Fig. 21. The second threshold is indicated as around 13% inflation in the same figure as a second local minima when we exclude 15% of threshold observations in both extremes (maximum and minimum values) of the threshold variable as explained in Chan and Tsay (1998). When we employ the sequential threshold estimation of Gonzalo and Pitarakis (2002), we find the estimation results depicted in Fig. 22.

From these threshold estimation results, we confirm the small threshold value obtained from the MR-PSTR model in this more simple setting. The above threshold estimations indicate that without considering the cross-country heterogeneity, the time-based threshold estimation confirms that there can be a threshold located around 12% inflation for this group of low inflationary countries where the cross-country heterogeneity is minimum.

Nest, we proceed to repeat the process for the high inflationary countries, using the same methodology. Figure 23 represents the threshold estimation through the threshold space and the PTR estimations’ regime-wise coefficients values. As can be seen from the result for the high inflationary countries, in the case of a two-regime PTR model estimation, the low regime persists to induce a larger negative effect on growth than in the high regime, in almost all regions of the potential threshold values. This is in line with what we have found for the MR-PSTR estimation and the results previously found in this section using the PTR estimation. Therefore, this result firmly confirms what we have found in the previous section. Now we can proceed with the sequential threshold estimation which is outlined in the previous part of this section.

Figure 23 explicitly shows two important results. Firstly, the dominant threshold is found to be 23 which is also found as second dominant threshold value for the three-regime PTR estimation of this section. Figure 23 also depicts that the 32% level of inflation is the second dominant threshold for this group of countries when we eliminate the country heterogeneity.

To summarize, in this section, we have verified and tested the results of the MR-PSTR models of the previous section by applying a more simple nonlinear estimation procedure, namely PTR. From all results presented in this section, the following general conclusions can be drawn: The first and apparent conclusion is that at all stages of the investigation, the higher inflation regime which is classified as the \(\pi _{t-1} >32.0\cong \tau \) in multiple regimes of the MR-PTR model is almost the less effective regime in the inflation-growth nexus as the parameter coefficient indicates the smallest negative effect in the estimated growth equation. However, when we change the threshold variable as \(\pi _{t-3} >32.0\cong \tau \) the relation is found to be reversed, in which case we can say that in the higher regime the effect on growth is the most severe; the second conclusion is that the low regime estimates are found to have a more negative effect than the middle regime through estimation of the growth equation in nearly half of the potential threshold estimates. In nearly half of the estimated PTR and PSTR models, we have found that the lowest regime has a more severe negative effect than the middle regime throughout the analysis as provided in this study. Therefore, obtaining such a result highly probable with this group of countries; lastly, including all these countries in a MR-PSTR type of model, lead to \(\tau _\mathrm{high} \cong 32.0\) and \(\tau _\mathrm{low} \cong 12.0\) thresholds. This phenomenon is confirmed in all the sequential threshold estimations. The potential of other threshold estimations \(\tau _\mathrm{high} \cong 23.0\) and \(\tau _\mathrm{low} \cong 17.0\) cannot survive when we include more dynamics to especially the middle regime by increasing the data availability with using the 10 SADC countries in the same sample of MR-PSTR and MR-PTR estimation. The MR-PSTR model well approximates the true data generating process of a heterogeneous group of 10 SADC countries. The other studies in the previous literature (eg. Seleteng et al. 2013; Mignon and Villavicencio 2011; Ibarra and Trupkin 2011) found threshold levels of between 18 and 19.6% which may confirmed by the low threshold value \(\tau _\mathrm{low} \cong 17.0\); however, they have reported the results of two-regime PSTR models. From all investigation carried out here, we have found that these 10 countries can only be modeled by a three- or four-regime MR-PSTR model without showing any misspecification. In contrast to MR-PSTR models, the other models most probably display misspecification errors if these countries are all included in a panel sample, and therefore, this indicates that most probably the diagnostic checks are not done appropriately.

The above arguments and all the other explorations of this section verify that; a three- or four-regime model is more suitable; the obtained threshold must be around \(\tau _\mathrm{high} \cong 32.0\) for high and \(\tau _\mathrm{low} \cong 12.0\) for low threshold values, with the \(\pi _{t-3} \) state or transition variable used in high regime estimates. Furthermore, the high regime must be the regime where inflation ia the most negatively related to growth; the middle regime inflation estimate is highly probable to be found to have a lower negative effect than the lower regime estimates when using these 10 SADC countries as a sample. Thus, the previous section MR-PSTR model all confirms these findings in its estimation result.

5 Conclusion

In this paper we revisit the inflation–growth nexus for a sample of African countries and provide new evidence on the nonlinear impact of inflation on real economic growth for the region.

Firstly, analyzing the relationship between inflation and growth when controlling for individual and time effects in a linear context, we find a statistically significant negative relationship to exist. Linearity (homogeneity) is, however, significantly rejected in the model for the first lag of the transition variable, namely inflation, and we show that the inflation–growth nexus exhibits different dynamics in the different regimes (heterogeneous).

We first present a two-regime PSTR model controlling for cross-sectional dependence, but due to misspecification present in the model, we extend our specification to a MR-PSTR model. We obtain the best results for a three-regime model with two threshold values, namely 12 and 32%. This result is supported by Li (2007) who suggests that while developed countries have a single threshold, developing countries have two thresholds.

Countries in the SADC region are striving toward common goals, and governments in the region have generally made strides in reducing inflation in recent years. The implications of MR-PSTR results obtained in this study are that inflation levels around 12% are less harmful to the economies of the sample group of countries. This result is consistent with the argument that a certain level of inflation enables economic growth. In conclusion, policymakers in these economies can achieve higher growth rates by reducing inflation below its second threshold level and stabilize it near the first threshold level in order to promote economic stabilization.

It must, however, be kept in mind that the threshold value of 12% is based on the average estimate of all the panel members taken together. In light of this, policy makers in countries with historically low inflation below this level, should be careful in inflating the economy to as high as 12%, with this value providing a tentative guideline.

Policy makers are well-advised to increase their inflation rates on a step-by-step basis to look for their own respective threshold. As part of future research, it would be interesting to conduct panel data analysis that allows us to obtain thresholds for each country by staying within the panel framework. At this stage, however, we are not aware of any studies that has obtained individual threshold values for the panel members using a PSTR model.

Notes

The Southern African Development Community (SADC) was established as a development coordinating conference (SADCC) in 1980 and transformed into a development community in 1992. The SADC is an intergovernmental organization whose goal is to promote sustainable and equitable economic growth and socioeconomic development through efficient productive systems, deeper cooperation and integration, good governance and durable peace and security among Southern African member states (SADC 2016).

Drukker et al. (2005) state that “In cross-sectional growth literature, some of these variables are treated as endogenous and instrumental (IV) estimates are used. The method used in this paper has not yet been extended to the case of instrumental variables. This paper assumes that any endogenous component are perfectly correlated with fixed effects, and therefore controlled by our fixed effect estimation procedure.” Moreover, they exclude initial income from their growth regression to avoid the endogeneity problem.

These countries include Botswana, Lesotho, Madagascar, Mauritius, Malawi, Namibia, Republic of South Africa, Swaziland, Seychelles and Tanzania.

For more detailed discussion, see González et al. (2005).

See Omay and Kan (2010) for details.

A similar simulation study for remedying cross-section dependence in nonlinear panel models is done by Emirmahmutoğlu (2014).

For the single transition variable the estimation results are available upon request.

Most probably this issue leads to a convergence problem in nonlinear estimation; however, these kinds of problems are not studied extensively in the literature due to the reason that the nonlinear estimations are still premature and an emerging field in econometrics. However, dominant threshold estimation in the case of second dominance by another threshold value should have been studied explicitly.

These three countries are Madagascar, Malawi and Tanzania where all three countries have experienced periods of hyperinflation in the past.

As we know from the nonlinear panel data literature, the linearity test is labeled as a homogeneity test. This terminology directly indicates that the nonlinearity is coming from the heterogeneity of countries included in to sample.

References

Andres J, Ignacio H (1997) Does inflation harm growth? Evidence from OECD countries. Working paper 6062. NBER, Cambridge

Barro RJ (1990) Government spending in a simple model of endogenous growth. J Polit Econ 98(5):S103–S126

Basu P (2001) Reserve ratio, seigniorage and growth. J Macroecon 23(3):397–416

Bittencourt M, Gupta R, Stander L (2014) Tax evasion, financial development and inflation: theory and empirical evidence. J Bank Finance 41(C):194–208

Bruno M (1995) Does inflation really lower growth? Finance Dev 32(3):35–38

Bruno M, Easterly W (1998) Inflation crisis and long-run growth. J Monet Econ 41(1):3–26

Chan KS (1993) Consistency and limiting distribution of the least squares estimator of a threshold autoregressive model. Ann Stat 21:520–533

Chan KS, Tsay RS (1998) Limiting properties of the least squares estimator of a continuous threshold autoregressive model. Biometrika 85:413–426

Chang Y (2004) Bootstrap unit root tests in panels with cross-sectional dependency. J Econom 120(2):263–293

Drukker D, Gomis-Porqueras P, Hernandez-Verme P (2005) Threshold Effects in the relationship between inflation and growth: a new panel-data approach. In: 11th international conference on panel data

Emirmahmutoğlu F (2014) Cross section dependency and the effects of nonlinearity in panel unit testing. Econom Lett 1:30–36

Emirmahmutoğlu F, Omay T (2014) Reexamining the PPP hypothesis: a nonlinear asymmetric heterogeneous panel unit root test. Econ Model 40(C):184–190

Espinoza R, Leon H, Prasad A (2012) When should we worry about inflation? World Bank Econ Rev 26(1):100–127

Fischer S (1993) The role of macroeconomic factors in growth. J Monet Econ 32(2):485–512

Fouquau J, Hurlin C, Rabaud I (2008) The Feldstein–Horioka puzzle: a panel smooth transition regression approach. Econ Model 25(2):284–299

Ghosh A, Phillips S (1998) Warning: inflation may be harmful to your growth. IMF Staff Pap 45(4):672–710

Gonzalo J, Pitarakis J-Y (2002) Estimation and model selection based inference in single and multiple threshold models. J Econom 110:319–352

González A, Teräsvirta T, Van Dijk D (2005) Panel smooth transition regression models, working paper series in economics and finance, No 604, Stockholm School of Economics, Sweden

Granger CWJ, Teräsvirta T (1993) Modelling non-linear economic relationships. Advanced texts in econometrics. Oxford University Press, New York

Hansen B (1999) Threshold effects in non-dynamic panels: estimating, testing and inference. J Econom 93:345–368

Hansen B (2000) Testing for structural change in conditional models. J Econom 97(1):93–115

Hineline DR (2007) Examining the robustness of the inflation and growth relationship. South Econ J 73(4):1020–1037

Ibarra R, Trupkin D (2011) The relationship between inflation and growth: a panel smooth transition regression approach. Working paper, Research Network and Research Center Program of Banco Central del Uruguay

Khan MS, Senhadji A (2001) Threshold effects in the relationship between inflation and growth. IMF Staff Pap 48(1):1–21

Kremer S, Bick A, Nautz D (2013) Inflation and growth: new evidence from a dynamic panel. Empir Econ 44(2):861–878

Li M (2007) Inflation and economic growth: threshold effects and transmission mechanism. Working paper, \(40^{{\rm th}}\) annual meeting of CEA, Canadian Economic Association, Montreal

Luukkonen R, Saikkonen PJ, Teräsvirta T (1988) Testing linearity against smooth transition autoregressive models. Biometrika 75:491–499

Mignon V, Villavicencio A (2011) On the impact of inflation on output growth: does the level of inflation matter? J Macroecon 33:455–464

Moshiri S, Sepehri A (2004) Inflation-growth profiles across countries: evidence from developing and developed countries. Int Rev Appl Econ 18(2):191–207

Omay T (2014) A survey about smooth transition panel data analysis. Econom Lett 1:18–29

Omay T, Hasanov M (2010) The effects of inflation uncertainty on interest rates: a nonlinear approach. Appl Econ Taylor & Francis J 42(23):2941–2955

Omay T, Kan ÖE (2010) Re-examining the threshold effects in the inflation-growth nexus with cross sectionally dependent nonlinear panel: evidence from six industrializes economies. Econ Model 27(2010):996–1005

Omay T, Apergis N, Özleçelebi H (2015) Energy consumption and growth: new evidence from a nonlinear panel and a sample of developing countries. Singap Econ Rev 60(2):1–30

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. Cambridge working papers in economics 0435. Faculty of Economics, University of Cambridge

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74:967–1012

Pollin R, Zhu A (2006) Inflation and economic growth: a cross-country non-linear analysis. J Post Keynes Econ 28(4):593–614

Roubini N, Sala-i-Martin X (1995) A growth model of inflation, tax evasion, and financial repression. J Monet Econ 35(2):275–301

SADC (2016) Southern African Development Community. Towards a common future. www.sadc.int. Accessed 28 Mar 2016

Sarel M (1996) Nonlinear effects of inflation on economic growth. IMF Staff Pap 43(1):199–215

Schiavo S, Vaona A (2007) Nonparametric and semiparametric evidence on the long-run effects of inflation on growth. Econ Lett 94:452–458

Seleteng M, Bittencourt M, Van Eyden R (2013) Nonlinearities in inflation-growth nexus in the SADC region: a panel smooth transition regression approach. Econ Model 30:149–156

Singh K, Kalirajon KP (2003) The inflation-growth nexus in India: an empirical analysis. J Policy Model 25:377–396

Teräsvirta T (1994) Specification estimation and evaluation of smooth transition autoregressive models. J Am Stat Assoc 89:208–218

Ucar N, Omay T (2009) Testing for unit root in nonlinear heterogeneous panels. Econ Lett 104:5–8

Van Dijk D (1999) STR models extensions and outlier robust inference. Tinbergen Institute Research Series no. 200

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Omay, T., van Eyden, R. & Gupta, R. Inflation–growth nexus: evidence from a pooled CCE multiple-regime panel smooth transition model. Empir Econ 54, 913–944 (2018). https://doi.org/10.1007/s00181-017-1237-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1237-2

Keywords

- Inflation

- Growth

- Threshold effects

- Multiple-regime panel smooth transition regression model

- Cross-section dependence

- Common correlated effects