Abstract

The supplemental poverty measure (SPM)—which serves as an indicator of economic well-being in addition to the official poverty rate—was introduced in 2010 and explicitly adjusts for geographic differences in the cost of housing. By embedding housing costs, the SPM diverges from official measures in some instances, offering a conflicting view on family well-being. However, there is limited direct evidence of the impact of housing costs on household well-being, and virtually all of it focuses on food insecurity. This study examines the impact of local housing costs on household well-being using the “basic needs” data from the Survey of Income and Program Participation. Across a wide variety of specifications, no evidence is found that housing costs impact well-being. In contrast, local labor market conditions do impact the well-being measures in many specifications. The findings call into question one of the key motivations for the SPM—that geographic cost differences are a major factor for household well-being.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The most recognized metric in the USA to summarize household well-being is the official poverty measure. The poverty line—defined as having annual family income under a particular size-adjusted threshold—was created more than 50 years ago, and living in poverty is correlated with a host of consequences for children and adults (Brooks-Gunn and Duncan 1997). The key benefit of the official poverty measure is its simplicity: although the line itself is somewhat arbitrary, it provides a concise metric with which one can easily compare the status of various demographic groups at a point in time or over time. In 2013, 14.5% of households lived in poverty, being particularly acute among children, racial minorities, and the disabled (DeNavas-Walt and Proctor 2014).

The official poverty measure is not without problems. It was originally constructed as a function of food expenditure to assess eligibility for government assistance programs and has been subjected to only minimal revisions since its inception (Short 2012). There are five principal criticisms (Citro and Michael 1995). First, the definition of income ignores some key government policies, such as payroll taxes or Supplemental Nutrition Assistance Program (SNAP), that change disposable income. Second, the official measure ignores work expenses that in turn lower disposable income. Third, the measure ignores differences in health insurance coverage and medical costs. Fourth, it does not adjust for important changes in family structure, such as cohabitation among unmarried couples. Finally, and most relevant for this study, it does not adjust for geographic differences in the cost of living, most notably for the cost of housing.

These long-standing problems have motivated the recent use of the supplemental poverty measure (SPM) (Short 2012). One of the differences is that the SPM adjusts poverty thresholds to reflect geographic variation in the cost of living (Meyer and Sullivan 2012). The SPM can generate substantially different conclusions about societal well-being by geography. For example, the official poverty rates in California and Texas are 16 and 18.4%, respectively. The SPM—driven by cost-of-living differences—increases the rate to 22.4% in California and lowers it to 16.4% in Texas. Economic decisions—like state-to-state migration—appear consistent with the logic of the SPM being a measure of well-being: 183 Californians moved to Texas for every 100 Texans who moved to California (Cowen 2013).Footnote 1

Incorporating the cost of living into a poverty measure has the ability to change conclusions about household well-being. The biggest driver of cost-of-living differences is due to housing, which constitutes the largest share of a typical household’s budget (Newman and Holupka 2015). In fiscal year 2014, for example, the Department of Housing and Urban Development’s (HUD) Fair Market Rent (FMR) of $1,956 for a two-bedroom apartment in San Francisco, CA, was nearly 3 times higher than the FMR of $705 in Louisville, KY.Footnote 2

It does not necessarily follow that households are worse off in higher-cost areas. Amenities and wages vary by geography, and these in turn also affect overall household well-being (Meyer and Sullivan 2012).Footnote 3 Thus, the key question this study examines is whether a household’s basic needs are affected by an area’s housing costs. To do so, I rely on more direct measures than can be captured by a comparison of family income to either the official poverty line or SPM: household responses to questions identifying particular hardships. Starting in 1992, the Survey of Income and Program Participation (SIPP) asked questions to households about their well-being, and respondents generally had little problem with the topic matter (Kominski and Short 1996). These questions addressed food adequacy, untreated health concerns, capacity to meet monthly expenses, and general housing conditions. These questions—although having been asked for more than 20 years—have rarely been used in research.

Between 1992 and 2003, these well-being measures are linked to housing and labor market conditions for households in approximately 100 metropolitan areas. The empirical model nets out time-invariant fixed local amenities and links changes in local housing costs to changes in household well-being. Two principal results emerge. First, for a wide variety of individual measures and aggregated well-being measures, housing costs are both economically and statistically insignificant. Increasing housing costs from the 10th to 90th percentile (a movement of $477 per month in constant 2003 dollars) lead to an insignificant change in well-being for each of the 9 individual measures and 3 aggregate measures. All of these measures relate to meeting basic household needs, such as the ability to meet essential expenses for such things as mortgage or rent payments, utility bills, or important medical care during the previous year. For example, the average Z-score summary index of the 9 individual measures shows an insignificant change of less than 0.01 of a standard deviation from such an increase in costs. This finding holds not only for the full sample, but also for renters and the near-poor, where housing wealth effects would be inconsequential.Footnote 4 Second, for virtually all well-being measures, local labor market measures strongly influence well-being. Increasing the employment-to-population ratio from the 10th to 90th percentile leads to a 0.21 standard deviation change in the average Z-score summary index.Footnote 5

Why don’t local housing costs matter for meeting basic expenses? The most straightforward explanation is that households adjust to higher housing prices in ways that are not necessarily captured with the measures. For example, higher prices could lead a family to occupy in a lower quality unit. Alternatively, an individual or family could also live in less traditional housing arrangements, such as “doubling up” with roommates or other relatives.Footnote 6 It is also possible that those households who have the greatest difficulty meeting basic expenses simply migrate to lower cost-of-living areas. Despite these alternative explanations, the finding of no measurable impact of housing costs across a wide variety of measures and specifications calls into question a key motivation—the geographic adjustment—for the SPM.

The remainder of the paper is arranged as follows. Section 2 provides a discussion of the existing literature. Section 3 describes the principal parts of the data exercise—the SIPP, HUD FMRs, and BEA data. Section 4 presents some aggregate statistics, while Sect. 5 specifies the empirical model. Section 6 discusses the results, and Sect. 7 concludes.

2 Literature review

Although there is sizable literature on the effect of homeownership on child outcomes summarized nicely in Newman and Holupka (2013), and some evidence on subsidized housing (Currie and Yelowitz 2000; Jacob 2004), there is far less focus on the direct impact of housing market costs and rents on objective measures of well-being.Footnote 7 Of the literature that focuses on housing costs and market rents, the principal studies include Bartfeld and Dunifon (2006), Harkness et al. (2009), and Fletcher et al. (2009).Footnote 8

Bartfeld and Dunifon (2006) include statewide median rents from the 2000 Census as a partial proxy for local cost of living and find a large and robust relationship between housing costs and food insecurity using data from the Current Population Survey (CPS). Fletcher et al. (2009) find that a $500 increase in yearly rental costs is associated with nearly a 3 percentage point increase in food insecurity and that the effect matters for renters but not owners using data from the Early Childhood Longitudinal Study, Birth Cohort (ECSL-B). In contrast, Harkness et al. (2009) use the Panel Study of Income Dynamics (PSID) and find no impact on child outcomes.

This study makes several contributions relative to previous work. First, it examines an extensive set of measures that relate to basic needs. Although food insecurity is an important measure of household well-being, it is not as comprehensive as the measures explored in this study. Second, this study uses measures from local housing markets (metropolitan statistical areas), not statewide measures. General agreement exists that such disaggregation is more appropriate (Beck et al. 2012; Yelowitz et al. 2013). Third, the model includes controls for time-invariant metropolitan characteristics, leading to a more compelling source of identification than cross-sectional comparisons.

3 Data description

The primary source of data is the Survey of Income and Program Participation (SIPP). Within a SIPP panel, respondents are split into four rotation groups where each group is interviewed once every 4 months. The same primary core questions are asked during each interview month, and each rotation of respondents is supplemented with additional questions in a “topical module.” A new topical module is initiated at the beginning of a new wave, or the start of the next 4 month rotation of respondents. This study uses the SIPP well-being topical modules from the 1991 panel (wave 6), the 1992 panel (wave 3), the 1993 panel (wave 9), the 1996 panel (wave 8), and the 2001 panel (wave 8). These coincide with the calendar years 1992, 1995, 1998, and 2003. Although the SIPP is a longitudinal dataset, the well-being questions are asked only once per panel; thus, the analysis below is better thought of as pooling several cross-sectional datasets together. The well-being modules continue on past the 2001 panel, but local geographic identifiers are only available in the public-use datasets up to this point.

Although the SIPP contains many measures of hardship, this study focuses on nine specific measures that appear across all five panels and would fall into the domain of “meeting basic needs.” The questions ask whether: (1) the household did not have enough to eat, (2) essential expenses were not met, (3) a utility bill was not paid in full, (4) rent or mortgage payment was not paid in full, (5) a member of the household had need to see a dentist but was unable to go, (6) a member of the household had need to see a doctor but was unable to go, (7) a telephone was disconnected, (8) utilities were disconnected, and (9) a household was evicted from place of residence.Footnote 9

These measures were chosen as opposed to other well-being measures contained in the SIPP (such as questions regarding the state of repair of the respondent’s residence) because they relate to the ability of households to effectively allocate funds across monthly expenses out of their given monthly budget. The construction of the SPM underlies the concern that households living in higher-priced localities may have less disposable income remaining after making rent and mortgage payments and, therefore, find it more difficult to meet other requirements of their limited income.

All the deprivation questions are asked in the affirmative; in the subsequent tables, they are inputted similarly, meaning the nine individual outcomes of interest are negative (e.g., “yes” for “Not meeting essential expenses”). Measures are also created for any basic need difficulty, multiple difficulties, and a summary index encompassing all hardships for each household. Following Kling et al. (2007) and Chetty et al. (2011), I construct a summary index of nine outcomes which improves statistical power to detect effects that go in the same direction within a domain. In what follows, the standardized average Z-score measure is coded so that the good outcome is one rather than zero. Each of the nine outcomes is standardized by subtracting its mean and dividing it by its standard deviation. Then, the nine standardized outcomes are summed up and divided by the standard deviation of the sum to obtain an index that has a standard deviation of one. A higher value of the index represents more desirable outcomes. The summary index should be interpreted as a broader measure of ability to meet basic needs.

Each housing unit has a designated “reference person” who is reported as the head of household. The well-being measures are asked at the household level and are merged with the socioeconomic characteristics of the reference person. Approximately 40% of observations are dropped because they do not map into metropolitan statistical areas (MSAs) and such individuals will not have a matching FMR in the HUD data file.

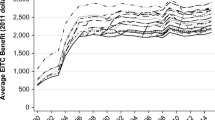

The data on FMRs come from HUD; data for two-bedroom units in a given year are used as a proxy for market rents.Footnote 10 The FMRs represent the 45th percentile of the distribution of rents until 1994 and the 40th percentile from 1995 onwards. I convert later FMRs (from 1995, 1998, and 2001) to the 45th percentile by creating a ratio of the 45th percentile to the 40th percentile from a bridge file for the year 1995, where HUD purposefully provided both percentiles.Footnote 11 After adjusting relevant FMRs to the 45th percentile, all nominal values were converted into constant 2003 dollars using the CPI-U.

The local labor market data come from the publicly available Bureau of Economic Analysis’ Regional Economic Accounts (REA) databases. The data are used to create a measure of labor market conditions for each MSA and year, by constructing the employment-to-population ratio.

4 Aggregate statistics on meeting basic needs

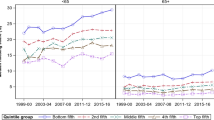

The basic need measures are illustrated in Table 1 across the USA. Where available, these number exactly replicate Census publications; the row for 1995 replicates Table 2 in Bauman (1999), while the percentages in 1998 and 2003 replicate those in Table 3 of Siebens (2013). The SIPP well-being modules reveal that roughly 60 million people—nearly 25% of population—had at least some difficulty meeting basic needs in 1992. Less serious deficiencies—like not meeting essential expenses/falling behind on bills—were quite common (10% or more), while more serious problems—hunger, eviction, and utility disconnection—were quite rare (less than 3% of respondents). Overall, the fraction having a difficulty is considerably higher than the official poverty rate.

The general patterns for each difficulty do not change in 1995, 1998, or 2003, and perhaps surprisingly, it is not clear the business cycle had much effect on meeting basic needs. In 1998, an identical fraction of individuals—23.3%—had difficulty meeting basic needs as in 1992, yet the unemployment rate was 4.5% in 1998, far lower than the 7.5% rate in 1992. In 2003, when the unemployment rate was 6%, the fraction with any difficulty was lower than five years earlier. This time series evidence calls into question the role of economic conditions in terms of meeting basic needs, an issue explored in depth in the subsequent regressions. Despite this impression, there is compelling evidence that economic conditions do reduce food insecurity. For example, there was a sharp increase in food insecurity associated with the Great Recession and the effect of unemployment on food insecurity at the state level is quite strong (Coleman-Jensen et al. 2014; Gundersen et al. 2014).

In the analysis, attention is focused on metropolitan areas, not rural areas. As shown in Table 1, difficulty in meeting basic needs is virtually the same for MSAs as for the entire US. Since cost of living tends to be higher in urban areas, the similarity to the entire USA starts to call into question the idea that housing costs matter greatly for basic needs (although other confounding factors like income differentials would affect basic needs, too).Footnote 12

One issue in assessing the role of cost of living, especially given the importance of housing costs, is confronting housing wealth effects. Two factors come into play. First, rising prices may be beneficial for owners, but not renters (and house prices and apartment rents are positively correlated with each other). Second, some metro areas—superstar cities—have experienced sustained above-average appreciation over time, dramatically lowering the “user cost” of owning a home (Gyourko et al. 2013; Himmelberg et al. 2005). Table 1 shows much higher rates of basic need deprivation among renters. For example, even though there are far more owners than renters in metro areas (i.e., in 2003, 123.2 million people lived in owner-occupied homes and 56.4 million lived in renter-occupied homes), the absolute number who had any difficulty was about the same (between 17.5 and 19.9 million). Deprivation rates are approximately three times higher for renters. This suggests that the negative impact of higher housing costs might be concentrated among them (and, in fact, higher housing costs might benefit owners). Although ownership may be endogenously determined, some of the subsequent specifications stratify the data on tenure status.

Finally, individuals are divided into these areas based on their 2003 FMRs. If housing costs matter, then one might expect to see higher rates of deprivation in high cost-of-living areas. That pattern is not borne out in the data. For virtually any difficulty, deprivation rates are nearly the same for the two groups.Footnote 13

In summary, the basic tabs of the data reveal high absolute levels of deprivation, yet potential questions remain on the importance of housing costs and the business cycle in affecting those levels. The regression analysis will explore these issues more formally.

5 Empirical model

In order to assess the impact of housing costs and the labor market on well-being, I estimate linear models of the form:

where \({\hbox { BAD}}\_\mathrm{OUTCOME}_h \) represents one of the numerous well-being measures that I use (9 individual measures and 3 aggregated measures), each a measure of meeting basic household needs.Footnote 14 In addition, \({\hbox {FMR}}_{j,t} \) represents local housing costs, as proxied by HUD’s Fair Market Rent, measured in constant 2003 dollars, and \({\hbox {EMP/POP}}_{j,t} \) represents the local employment-to-population ratio as measured in the BEA data and is a proxy for the local labor market. The vector \(X_h \) represents household/head characteristics, including age, gender, race/ethnicity, real household income, education, marital status, number of children, and owner/renter status, and \(\delta _j \) and \(\delta _t \) represent MSA and year fixed effects. Since the housing cost and labor market proxies are grouped at the MSA-year level, in all specifications, standard errors are clustered for non-nested two-way clustering by MSA and year (Cameron et al. 2011). Although some of the household variables—in particular household income and owner/renter status—are arguably endogenous, their inclusion or exclusion is not central for the conclusions about housing costs or labor market conditions.

By including fixed effects for MSA location and time, the identification strategy estimates the effects on basic need from within-MSA changes in housing costs or labor market conditions. As such, the empirical specification nets out some amenities that remain fixed over time—such as warmer temperatures or better public transportation—that might in turn affect some of the outcomes (like the ability to pay utilities or meet expenses). A concern, however, is that by including these fixed effects there may be little remaining variation in housing costs. This is explored in Table 2, where the ratio of maximum-to-minimum FMR is presented across the four years that comprise the sample. For some MSAs, there is considerable movement in real FMRs. For example, 26 MSAs had rental rates move up and down at least 20%. In some of the specifications, those households are examined alone, yet the results are little changed.

6 Results

6.1 Main results

Table 3 presents results from a variety of specifications. In the first three specifications, additional controls for household/head characteristics and then the employment-to-population ratio are incrementally included. The labor market variable is included because it is thought that a more vibrant economy, by increasing employment, may lead to increases in rents and also improvements in basic needs. By not including such a control, housing costs may have a zero or positive effect on basic needs, driven by this omitted variable.Footnote 15 Many of the findings are similar and can be illustrated with the main specification—“Specification 3” that includes the FMR, the employment-to-population ratio, and household/head characteristics. In none of the specifications—for either the individual or aggregate measures—do housing costs matter. All coefficients are insignificant and economically small. Note that moving from the 10th to 90th percentile of FMRs is a change of $477 per month (from $577 to $1054 per month, expressed in constant 2003 dollars); thus, the implied change in basic needs is often less than 0.5 percentage points, from baseline rates that are often greater than 10% (see the MSA-specific rates in Table 1, for example). Large swings in rental prices lead to very small and always imprecise impacts on ability to meet basic needs.

In contrast, raising the employment-to-population ratio—also identified from within-MSA changes over time—has significant and positive effects on the ability to meet basic household needs. For example, moving from the 10th to 90th percentile (approximately an 11 percentage point change in the ratio, from 44 to 55%) yields an increase in the average Z-score index of nearly 0.21 standard deviations. Across many specifications, better labor market conditions translate into higher likelihood of meeting basic needs.

6.2 Robustness checks on basic findings

Specifications (4)–(9) build on Specification (3) in various ways. First, some of the MSAs in the SIPP are quite small and likely do not contribute much in terms of identification. Specification (4) shows that by including larger MSAs (cell sizes of at least 100, 200, or 300 households for all years), the results are nearly identical. If anything, the estimated impact of the FMR is more often “wrong signed” but never significant. As before, better labor market conditions lead to a higher ability to meet basic needs.

One of the key findings in at least some of the work on food insecurity is that renters respond far more than owners to increases in rents (Fletcher et al. 2009). Specifications (5) and (6) separate out these two groups. For both groups, no effect is found from varying FMRs.Footnote 16 In contrast, the effect of improving labor markets is considerably more important for renters than owners. A similar movement in the employment-to-population ratio from the 10th to 90th percentile leads to an increase in the average Z-score index of nearly 0.25 standard deviations.

In contrast to the renters/owners comparison, breaking out the sample by near-poor (under 200% FPL) and not poor (over 200%) leads to results with a more nuanced story. As before, housing costs do not significantly affect any of the basic need measures. Yet, the improving labor market matters differently for meeting those needs across income strata. For the near-poor, improving labor market conditions appear to improve the ability to avoid severe deprivation (i.e., eviction or utility disconnection), while it allows more affluent households better access to the healthcare system (seeing dentists and doctors).

A final concern has to do with selective migration. It is possible—as suggested by Cowen’s (2013) analysis of California and Texas migration—that households respond to higher housing costs by moving outside of a locality. If households who have the most financial difficulties respond by moving when housing costs rise, then regression estimates of housing costs on well-being will be understated. To examine this, models were estimated where arguably exogenous household characteristics were regressed on the FMR (along with the employment-to-population ratio, MSA effects, and year effects). A number of demographics—age, gender, education, marital status, and renter status—were uncorrelated with the FMR. Two demographic variables—number of children and race—were correlated with FMR. Most importantly, the FMR is strongly positively correlated with household income. One interpretation – consistent with selective migration—is that lower-income households leave the MSA when housing costs goes up, leaving higher-income households. Another interpretation is that improving local labor market conditions both raise incomes of workers and drive up housing costs (in ways not fully reflected in the employment-to-population ratio). If higher housing costs were affecting migration, one might expect to see the poorest households leaving a locality and therefore a reduction in those living in poverty. However, when examining the relationship between the FMR and household poverty, there is no relationship between the two. When looking at somewhat higher thresholds (2\(\times \) or 3\(\times \) the poverty line), the results appear sensitive to the exact threshold.

In summary, one important caveat to the current findings is that selective migration may lead to effects on well-being that are understated. In principle, one could estimate instrumental variables models, taking the FMR from the household’s predetermined location in an earlier time period (for an example using the Medicaid program, see Marton et al. 2014). In practice, the SIPP’s “migration history” topical module is inadequate for doing so, because it identifies the previous state of residence, but not previous locality of residence.Footnote 17 Thus, at least with SIPP data, issues of selective migration must temper any conclusions on housing costs and well-being.

6.3 Other local policies

Although labor market conditions had little effect on the conclusion for housing costs, it remains possible that other local policies may be correlated with both housing costs and basic needs. In particular, three additional policies were explored: forms of local support for the poor, house prices (in addition to rents), and housing subsidies for the poor.

The SIPP asks household heads the following question about local charity: “If your household had a problem with which you needed help, how much help would you expect to get from other people in the community besides family and friends, such as a social agency or a church?” It could be the case that localities with higher rents also have greater local charity, which in turn offsets declines in meeting essential expenses. For each MSA and year, the fraction of individuals who reported that such charity would provide “all” or “most” of the help they needed was included as an additional variable to represent the strength of the social safety net. The local safety net itself affects the ability to meet basic expenses. For example, it significantly increases the summary index of good outcomes, reduces the likelihood of any difficulty, and significantly affects some of the individual measures such as seeing a doctor. Yet in none of the specifications do the conclusions about FMR change. In addition to local policies, some national transfer programs—such as SNAP—implicitly vary benefits by locality because net income is a function of house prices. All else equal, a household living in an area with more expensive housing will get higher SNAP benefits. In principle, this could affect the findings, especially for food insecurity. However, the fact that every measure of well-being is insensitive to housing costs suggests that this is not a large issue.

It is also possible that house prices move differently than rents and, in particular, respond faster to economic shocks. For roughly 80% of the observations, a house price index was included at the local level, with data from the Federal Housing Finance Agency (FHFA).Footnote 18 With one notable exception, none of the conclusions on rents were changed. However, for evictions, higher rents lead to a greater likelihood of eviction. In addition, higher house prices lead to a reduction in foreclosures, consistent with the idea that owners can more easily sell their homes in a hot housing market.

Finally, the impact of subsidized housing was explored. Nationally, approximately 4.8 million low-income households—approximately 4% of all households—received housing assistance through housing choice vouchers, project-based assistance, or public housing in 2014 (CBO 2015). To explore whether subsidized housing impacts the results, the analysis here relies on the core module of the SIPP, which provides two questions to compute local participation in subsidized housing. The SIPP asks “Is this residence in a public housing project, that is, is it owned by a local housing authority?” and “Are you paying lower rent because the Federal, State, or Local government is paying part of the cost.” These variables are used to compute the fraction of households for each MSA and year that receive subsidized housing; the questions themselves are drawn from the same SIPP wave as the topical module dealing with well-being questions. Specifications similar to the ones on local charity were run; the results on both the FMR and employment-to-population ratio are unchanged. The fraction of the locality’s households who participate in subsidized housing does not significantly affect any of the well-being measures.

7 Conclusions

The results in this study point to two clear findings: housing market conditions do not impact well-being measures, while labor market conditions do matter in many specifications. Although this is the first study to use these well-being measures to explore the role of local housing costs on measures of basic needs, the results are consistent with Harkness et al. (2009), who find that children growing up in higher-priced housing markets appear to fare no worse than those in lower-priced markets. In addition, similar SIPP well-being measures were used to study impacts of minimum wages in Sabia and Nielsen (2015), and they found little evidence that state and federal minimum wages affected material hardship.

Returning to the main motivation, many would correctly argue that the official poverty has serious flaws. Yet if an alternative—like the SPM which adjusts for geographic costs—really does measure well-being, then it follows that well-being measures should respond to housing costs. This study finds no evidence for this.

Notes

California’s population is about 48% larger than Texas’ population, so if interstate migration rates were uniform and individuals randomly chose a new state of residence, one would still expect differences even without cost-of-living considerations.

The data can be found at: http://www.huduser.org/portal/datasets/fmr.html.

Blomquist et al. (1988) estimate pecuniary values for quality of life across 253 urban counties and note that income can be adjusted for the implicit quality of life due to variations in amenities. The fact that both wages and costs vary by locality means that housing affordability—usually measured as the ratio of housing cost to household income—is not interchangeable with housing cost. Affordability is often denoted as spending more than 30% of household income on housing (Stone 2006; Schwartz and Wilson 2007).

Hoynes (2000) finds that worsening local labor market conditions (such as the employment-to-population ratio) are associated with longer welfare spells and higher recidivism rates.

Glaeser et al. (2016) find a positive association between rents and subjective well-being in the Behavioral Risk Factor Surveillance System (BRFSS).

Between 9–14% of SIPP respondents do not answer the well-being questions depending on the SIPP panel. In early panels, responses are coded as missing, and in later panels responses are imputed using hot-deck methods. Non-response to the well-being questions was more likely among males, non-whites, and younger reference persons, while marital status and educational attainment were uncorrelated with non-response. The results on the key policy variables are insensitive to the inclusion or exclusion of these imputed values.

Although many households, especially those with children, will demand housing units with more than two bedrooms, the FMR in this study is meant to proxy for general housing costs in an area. HUD scales other bedroom sizes relative to the two-bedroom FMR using information from the decennial Census; thus, the changes within a metropolitan area over time will be highly correlated regardless of bedroom size.

Starting in 2001, HUD began calculating FMRs at the 50th percentile in a small number of metropolitan areas. However, no such bridge file was found to convert FMRs to the 45th percentile for the 2003 data. The objective in rescaling the FMR was to give housing authorities a tool to deconcentrate voucher program use patterns.

The 35 low-cost areas include: Adams County, IN; Albany, NY; Albuquerque, NM; Bakersfield, CA; Baton Rouge, LA; Beaumont, TX; Birmingham, AL; Buffalo, NY; Corpus Christi, TX; El Paso, TX; Fayetteville, NC; Fort Myers, FL; Fresno, CA; Greensboro, NC; Greenville, SC; Harrisburg, PA; Indianapolis, IN; Knoxville, TN; Lakeland, FL; McAllen, TX; Memphis, TN; Mobile, AL; Oklahoma City, OK; Palm Bay, FL; Pensacola, FL; Pittsburgh, PA; Rochester, NY; Rockford, IL; San Antonio, TX; Scranton, PA; Springfield, OH; Syracuse, NY; Toledo, OH; Tulsa, OK; Utica, NY. The 41 high-cost areas include: Atlanta, GA; Austin, TX; Boston, MA; Charlotte, NC; Chicago, IL; Cincinnati, OH; Cleveland, OH; Colorado Springs, CO; Columbus, OH; Dallas, TX; Denver, CO; Detroit, MI; Eugene, OR; Honolulu, HI; Houston, TX; Jacksonville, FL; Lansing, MI; Los Angeles, CA; Madison, WI; Miami, FL; Milwaukee, WI; Minneapolis, MN; Nashville, TN; New Orleans, LA; New York, NY; Norfolk, VA; Orlando, FL; Philadelphia, PA; Phoenix, AZ; Portland, OR; Raleigh, NC; Sacramento, CA; Salt Lake City, UT; San Diego, CA; San Francisco, CA; Seattle, WA; Springfield, MA; St. Louis, MO; Stockton, CA; Tampa, FL; W. Palm Beach, FL.

Angrist and Pischke (2009) discuss advantages of the linear probability model. For the preferred specification (“Specification 3”), the vast majority of the predicted probabilities lie within the 0/1 interval for each of the eleven binary variables (varying between 73 and 93%, depending on the outcome). Therefore, the potential bias in the linear probability model is reduced (Horrace and Oaxaca 2006). Each specification was also estimated as a probit model, and the substantive conclusions are unchanged.

For the 82 MSAs examined, the correlation between FMR and employment-to-population is weak; for example, the long-run pairwise correlation for the within-MSA changes in these two variables between 1992 and 2003 is −.12 and insignificant. The short-run pairwise correlations are −.36, .20, and −.07 between 1992/1995, 1995/1998, and 1998/2003, with the first two correlations being significant at the 10% level.

Approximately 15% of renters live in subsidized housing. It is possible that housing costs could affect unsubsidized renters differently than subsidized renters. However, the conclusions from Specification 5 on both the FMR and labor market are unchanged when only focusing on unsubsidized renters.

See, for example, http://thedataweb.rm.census.gov/pub/sipp/1991/s91tm2dd.asc (variable TM8706).

See http://www.fhfa.gov/DataTools/Downloads/Pages/House-Price-Index-Datasets.aspx . For households in localities without a corresponding FHFA index, the value was set to zero, and an additional dummy variable for “FHFA index missing” was included.

References

Angrist JD, Pischke JS (2009) Mostly harmless econometrics. Princeton University Press, Princeton

Bartfeld J, Dunifon R (2006) State-level predictors of food insecurity among households with children. J Policy Anal Manage 25:921–942

Bauman K (1999) Extended measures of well-being: meeting basic needs: 1995. U.S. Census Bureau, Current Population Reports

Beck J, Scott F, Yelowitz A (2012) Concentration and market structure in local real estate markets. Real Estate Econ 40:422–460

Blomquist GC, Berger MC, Hoehn JP (1988) New estimates of quality of life in urban areas. Am Econ Rev 78:89–107

Bostic R, Gabriel S, Painter G (2009) Housing wealth, financial wealth, and consumption: new evidence from micro data. Reg Sci Urban Econ 39:79–89

Brooks-Gunn J, Duncan GJ (1997) The effects of poverty on children. Future Child 7:55–71

Cameron AC, Gelbach JB, Miller DL (2011) Robust inference with multiway clustering. J Bus Econ Stat 29:238–249

Chetty R, Friedman JN, Hilger N, Saez E, Whitmore Schanzenbach D, Yagan D (2011) How does your kindergarten classroom affect your earnings? Evidence from Project STAR. Q J Econ 126:1593–1660

Citro CF, Michael RT (1995) Measuring poverty: a new approach. National Academy Press, Washington

Coleman-Jensen A, Rabbitt MP, Gregory C, Singh A (2015) Household food security in the United States in 2014 (ERR-194). U.S. Department of Agriculture, Economic Research Service, Washington

Congressional Budget Office (2015) Federal housing assistance for low-income households. https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/50782-LowIncomeHousing-OneColumn.pdf. Accessed 12 Aug 2016

Cowen T (2013) The United States of Texas: Why the lone star state is America’s future. Time Magazine, October 28

Currie J, Yelowitz A (2000) Are public housing projects good for kids? J Public Econ 75:99–124

DeNavas-Walt C, Proctor BD (2014) Income and poverty in the United States: 2013. U.S. Census Bureau, Current Population Reports

Fletcher JM, Andreyeva T, Busch SH (2009) Assessing the effect of increasing housing costs on food insecurity. J Child Poverty 15:79–92

Glaeser EL, Gottlieb JD, Ziv O (2016) Unhappy cities. J Labor Econ 34:S129–182

Gundersen C, Engelhard E, Waxman E (2014) Map the meal gap: exploring food insecurity at the local level. Appl Econ Policy Perspect 36:373–386

Gyourko J, Mayer C, Sinai T (2013) Superstar cities. Am Econ J Econ Policy 5:167–199

Harkness J, Newman S, Holupka CS (2009) Geographic differences in housing prices and the well-being of children and parents. J Urban Affairs 31:123–146

Himmelberg C, Mayer C, Sinai T (2005) Assessing high house prices: bubble, fundamentals and misperceptions. J Econ Perspect 19:67–92

Horrace WC, Oaxaca RL (2006) Results on the bias and inconsistency of ordinary least squares of the linear probability model. Econ Lett 90:321–327

Hoynes H (2000) Local labor markets and welfare spells: Do demand conditions matter? Rev Econ Stat 82:351–368

Jacob B (2004) Public housing, housing vouchers, and student achievement: evidence from public housing demolitions in Chicago. Am Econ Rev 94:233–258

Kling JR, Liebman JB, Katz LF (2007) Experimental analysis of neighborhood effects. Econometrica 75:83–119

Kominski R, Short K (1996) Developing extended measures of well-being: minimum income and subjective income assessments. U.S. Bureau of the Census. SIPP Working Paper No. 228

Kurre JA (2003) Is the cost of living less in rural areas? Int Reg Sci Rev 26:86–116

Marton J, Yelowitz A, Talbert J (2014) A tale of two cities? The heterogeneous impact of medicaid managed care. J Health Econ 36:47–68

Meyer B, Sullivan J (2012) Identifying the disadvantaged: official poverty, consumption poverty and the new supplemental poverty measure. J Econ Perspect 26:111–135

Newman SJ, Holupka CS (2013) Looking back to move forward in homeownership research. Cityscape J Policy Dev Res 15:235–246

Newman SJ, Holupka CS (2015) Housing affordability and child well-being. Hous Policy Debate 25:116–151

Nord M (2000) Does it cost less to live in rural areas? Evidence from new data on food security and hunger. Rural Sociol 65:104–124

Rogers WH, Winkler AE (2014) How did the housing and labor market crises affect young adults’ living arrangements? IZA discussion paper no. 8568. http://ftp.iza.org/dp8568.pdf. Accessed 12 Aug 2016

Sabia JJ, Nielsen RB (2015) Minimum wages, poverty, and material hardship: new evidence from the SIPP. Rev Econ Household 13:95–134

Short K (2012) The research supplemental poverty measure: 2011. U.S. Census Bureau, Current Population Reports, P60-244

Siebens J (2013) Extended measures of well-being: living conditions in the United States: 2011. U.S. Census Bureau, Household Economic Studies, pp P70–136

Schwartz M, Wilson E (2007) Who can afford to live in a home? A look at data from the 2006 American Community Survey, U.S. Census Bureau. http://www.census.gov/housing/census/publications/who-can-afford.pdf. Accessed 12 Aug 2016

Stone ME (2006) What is housing affordability? The case for the residual income approach. Hous Policy Debate 17:151–184

Yelowitz A (2007) Young adults leaving the nest: the role of cost of living. In: Danzinger S, Rouse C (eds) The price of independence. Russell Sage, New York, pp 170–206

Yelowitz A, Scott F, Beck J (2013) The market for real estate brokerage services in low- and high-income neighborhoods: a 6 city study. Cityscape J Policy Dev Res 15:261–292

Author information

Authors and Affiliations

Corresponding author

Additional information

I would like to thank Timothy Harris, Matthew Larsen, Lisa Schulkind, Beth Yelowitz, and conference participants at the Federal Reserve Bank of Dallas and the 2014 Southern Economic Association Annual Meeting for their valuable comments. The paper also benefited from excellent feedback by the referees and editors. The data, program, and log file for the analysis are available at: http://www.Yelowitz.com/housingcosts.

Rights and permissions

About this article

Cite this article

Yelowitz, A. Local housing costs and basic household needs. Empir Econ 52, 901–923 (2017). https://doi.org/10.1007/s00181-016-1185-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1185-2