Abstract

In this paper we build forecasts for Chilean year-on-year inflation using both multivariate and univariate time series models augmented with different measures of international inflation. We consider two versions of international inflation factors. The first version is built using year-on-year inflation of 18 Latin American countries (excluding Chile). The second version is built using year-on-year inflation of 30 OECD countries (excluding Chile). We show sound in-sample and pseudo out-of-sample evidence indicating that these international factors do help forecast Chilean inflation at several horizons by reducing the root-mean squared prediction error of our benchmarks models. Our results are robust to a number of sensitivity analyses. Several transmission channels from international to domestic inflation are also discussed. Finally, we provide some comments about the implications of our findings for the conduction of domestic monetary policy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The objective of this paper is to evaluate the predictive content of an international inflation factor (IIF) to forecast Chilean headline inflation. Our motivation relies on two important results shown by a vast recent literature. In the first place, several papers report a poor performance of Phillips curve-based forecasts for the US. Atkeson and Ohanian (2001), Clark and West (2006) and Stock and Watson (2008) are just a few examples of this regularity. For the case of Chile, Pincheira and Rubio (2015) also report a similar phenomenon, suggesting that measures of domestic activity are not very good predictors for headline inflation. In the second place, a few relatively recent articles report an important pass-through from some measures of industrialized international inflation to local inflation. In particular Ciccarelli and Mojon (2010) and West (2008) find that local inflation in OECD countries is importantly driven by a common inflation factor. Other interesting papers on this topic are Mumtaz and Surico (2006) and Neely and Rapach (2011).

The disconnection between activity measures and inflation has been remarkably strong in Chile during the last years. For instance, for the period March 2010–October 2013, the average quarterly GDP growth rate in Chile was 5.5 %, whereas the inflation rate during the same period was only 2.6 %, below the target of 3 % and below the average of 3.2 % since 2000, when Chile was in the early stages of a stationary inflation targeting regime. Recently, in 2014 Chile experienced an opposite situation, with a scant GDP growth of only 1.9 % and a high year-on-year inflation rate of 4.6 % in December 2014. In summary, in the last years the Chilean economy experienced a period of rapid growth with no inflation and then moved toward a period with little growth and high inflation. Out of the many possible reasons that might explain this situation, we place our attention on the relationship between Chilean domestic inflation and international inflation.

While we focus on the predictive side of the question, it is important to mention some possible channels that may help to understand the linkages between international and domestic inflation for a small open economy like Chile. We find a first channel in the international impact of monetary policy via exchange rates. Let us elaborate. If for some reason domestic demand in European countries, for instance, is generating inflation in Europe, this will probably lead to a tightening in European monetary policy, which, via uncovered interest parity, will generate a depreciation of the Chilean peso which will induce higher local inflation. Second, there is a trade channel through which Chile may be importing foreign inflation by buying goods from abroad. A third channel operates through arbitrage in tradable goods. The main force here is the simple arbitrage underlying the theory of Purchasing Power Parity (PPP). This theory, in its variety of versions, claims that sooner or later fluctuations in international prices will generate movements in domestic prices as well, provided that these movements are not 100 % absorbed by exchange rates. Finally, like many other countries, Chile can be hit by “common shocks” or shocks that affect a number of countries in a similar way. Commodity shocks and international financial crisis are typical examples of shocks that might affect several countries in the world in a relatively similar manner. All these channels may be playing a role in explaining the linkage between international and domestic inflation. It is important to warn the reader that the purpose of this paper does not involve the identification of the specific transmission channels that might potentially explain the linkage between international and domestic inflation. Instead, the objective of this paper is to evaluate whether international inflation has predictive information for Chilean domestic inflation, beyond that contained in good univariate and multivariate benchmarks. Therefore, we leave more fundamental questions about the identification of the main possible transmission channels for further research. Our contribution to the relevant literature is mostly empirical, as to our knowledge, there are no papers addressing this question for an emerging small open economy like Chile. Previous works like those of Ciccarelli and Mojon (2010) and West (2008) analyze only a set of OECD countries for a sample period in which Chile was not a member of this selected group of economiesFootnote 1.

With this in mind, we construct two International Inflation Factors (IIFs). The first factor is built using year-on-year inflation of 18 Latin American countries (excluding Chile). The second factor is built using year-on-year inflation of 30 OECD countries (excluding Chile). We show sound in-sample and pseudo out-of-sample evidence indicating that these international factors do help forecast Chilean inflation at several horizons by reducing the root-mean squared prediction error (RMSPE) of our benchmarks models. We also carry out a number of different robustness checks. For instance, we compute the international factors using different strategies, we consider both direct and iterative methods for the construction of multistep ahead forecasts and we also consider rolling and expanding windows in our out-of-sample exercises. Irrespective of the number of robustness checks, our main conclusion holds true: The IIF does help to predict domestic Chilean inflation at several horizons.

The rest of the paper is organized as follows. In Sect. 2 we develop our econometric framework, describe our data and show the construction of the international inflation factors. In Sect. 3 we report the results of our in-sample and pseudo out-of-sample exercises. In Sect. 4 we show some robustness checks. Finally, Sect. 5 concludes.

2 Data and econometric setup

2.1 Data

For our main analysis, we consider the Consumer Price Index (CPI) of a total of 49 countries at a monthly frequency. The data cover the sample period from January 1994 to March 2013. Our set of countries includes Chile plus 30 OECD economies, displayed in Table 1, and 18 Latin American (LATAM) countries, which are listed in Table 2. We obtain the CPI for Chile directly from the National Statistics Institute, which is the government agency in charge of the construction of the CPI. For the rest of the 30 OECD countries, we obtain CPI series from the Main Economic Indicators section of the OECD web page. For the 18 LATAM economies we use either their central banks or the corresponding national statistics institutes as source for the data.

As our main objective is to predict Chilean inflation using an IIF, we consider two options for the construction of such a factor. The first one follows Ciccarelli and Mojon (2010) to build an OECD-based factor. The second option considers only LATAM countries, which in general share some common features with the Chilean economy like dependence on commodities, international trade agreements and relatively similar levels of income per capita. This last point is important as low- to middle-income countries have a larger share of food in their consumption bundle with respect to rich countries. This feature might play a relevant role in the dynamics of the CPI. It is important to mention that for the construction of our factors, we rule out some countries from the total OECD and LATAM countries due to data availabilityFootnote 2.

Our basic unit of analysis corresponds to year-on-year (y-o-y) inflation rate computed according to the following simple expression:

We depart from Stock and Watson (2002) and Ciccarelli and Mojon (2010) in that we focus only on forecasting year-on-year inflation rate at different horizonsFootnote 3. We also depart from those articles in the construction of multistep ahead forecasts because we not only consider a direct forecasting strategy but also we use a dynamic or iterated forecasting set up for the construction of forecasts at long horizons.

With the year-on-year transformation, we end up with a total of 219 observations from January 1995 to March 2013. Tables 1, 2 in the appendix of Pincheira and Gatty (2014) display descriptive statistics of the different inflation series.

We also consider several domestic and international variables that might potentially have the ability to predict headline inflation in Chile. The list of domestic variables includes the annual growth rate of the Chilean Activity Index (CHAI), the unemployment rate (Un), the annual growth rate of the monetary measure M3 (MM3) and the annual growth rate of the Chilean exchange rate against the US dollar (ER12). This last variable was recently pointed out as one of the most important factors leading inflation in Chile in the December 2014 issue of the Monetary Policy Report released by the Central Bank of Chile. See Central Bank of Chile (2014). All these variables were obtained from the web page of the Central Bank of Chile.

The list of international variables includes the annual growth rate of the IMF commodity price index (CCOMM), the 3-month interest rate of the US Treasury bill (US-TB), the US industrial production (US-IP) and the annual growth rate of the Dow Jones Industrial Average Index (DOW12). While the commodity price index was obtained from the International Monetary Fund, data from the US industrial production and US Treasury bill were obtained from the Federal Reserve Bank of St. Louis. The Dow Jones Industrial Average Index was downloaded from Yahoo finance.

2.2 The international inflation factor (IIF)

We construct one IIF for each group of economies (OECD and LATAM). The factors are constructed as the weighted average of the first two principal components of the set of year-on-year inflation rates for each group of economies (OECD and LATAM excluding Chile).

The weights \({w}_{ i} \) are constructed as the share of the corresponding eigenvalue over the sum of the two relevant eigenvalues

We judgmentally consider only two principal components for the construction of our international factors. Nevertheless, as robustness check we also considered the case in which the international factor is constructed as the main principal component. Qualitative results do not change much between these two strategies.

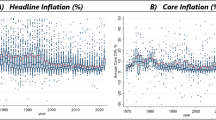

Figure 1 shows the evolution of Chilean inflation and the two international factors. On the one hand, this figure shows that the dynamics of Chilean inflation has been fairly similar to the evolution of the IIF constructed with OECD economies. On the other hand, it is quite obvious that the factor built with Latin American countries displays an upward bias. This is not much of a concern for our analysis, as we work with the first difference of the international factors as it will be clear in next sections. All in all, it is very impressive how our international factors seem to move in tandem with Chilean inflation.

2.3 Forecast evaluation framework

We evaluate the predictive ability of our benchmark models against their augmented versions with the IIF both in-sample and out-of-sample. To describe the out-of-sample exercise, let us assume that we have a total of \(T+1\) observations of \({\pi }_{ t}\) for Chile. We generate a sequence of P(h) h-step-ahead forecasts estimating the models in rolling windows of fixed size R. For instance, to generate the first h-step-ahead forecasts, we estimate our models with the first R observations of our sample. Then, these forecasts are built with information available only at time R and are compared to the observation \({\pi }_{{R}+{h}}\). Next, we estimate our models with the second rolling window of size R that includes observations through \(R+1\). These h-step-ahead forecasts are compared to the observation \({\pi }_{{R}+{h}+1} \). We iterate until the last forecasts are built using the last R available observations for estimation. These forecasts are compared to the observation \({\pi }_{{T}+1} \). We generate a total of P(h) forecasts, with P(h) satisfying \(R+(P(h)-1)+h=T+1\). So

Forecast accuracy is measured in terms of RMSPE. Because this is a population moment, we estimate it using the following sample analog:

where SRMSPE stands for “Sample Root-Mean Squared Prediction Error” and \(\hat{\pi }_{ {t}+{h}|{t}}\) represents the forecast of \({\pi }_{ {t}+{h}}\) made with information known up until time t.

We carry out inference about predictive ability by considering pairwise comparisons between each model and its augmented version. Inference is carried out within the frameworks developed by Giacomini and White (2006) (henceforth GW) and Clark and West (2007) (henceforth CW). We first focus on the unconditional version of the t type statistic proposed by GW. This test has the distinctive feature of allowing comparisons between two competing forecast methods instead of two competing models. This is desirable for our purpose, which is mainly focused on the forecasts generated by different models estimated with rolling windows of fixed size.

According to the unconditional version of the test developed by GW, we test the following null hypothesis

against the alternative:

where

and \(\hat{\pi } _{1, {t}+{h}|{t}}\) and \(\hat{\pi } _{2, {t}+{h}|{t}} \) denote the h-step ahead forecasts generated from the two models under consideration. Model 1 is the parsimonious or “small” model that is nested in the larger model 2. In other words, model 2 would become model 1 if some of its parameters would be set to zero.

We focus on one-sided tests because we are interested in detecting forecast superiority. Our null hypothesis poses that forecasts generated from the nested model perform at least as well as forecasts generated from the larger model. Our alternative hypothesis claims superiority of the forecasts generated by the larger model.

Second, we focus on the Clark and West (2007) statistic, which is mainly aimed at evaluating models in an out-of-sample fashion. With the CW test we evaluate whether the international factor provides additional information to that already contained in our benchmarks.

The CW test can be considered either as an encompassing test or as an adjusted comparison of Mean Squared Prediction Errors (MSPE). The adjustment is made in order to make a fair comparison between nested models. Intuitively, this test removes a term that introduces noise when a parameter, which should be zero under the null hypothesis of equal MSPE, is estimated.

The core statistic of the Clark and West (2007) test is constructed as follows

where \(\hat{e} _{1,{t}+{h}} {}={\pi }_{{t}+{h}} -\hat{\pi } _{1,{t}+{h}|{t}} \) and \(\hat{e} _{2,{t}+{h}} {}={\pi }_{{t}+{h}} -\hat{\pi } _{2,{t}+{h}|{t}} \) represent the corresponding forecast errors.

With some little algebra, it is straightforward to show that \(\hat{z} _{{t}+{h}} \) could also be expressed as follows

This statistic is used to test the following null hypothesis

against the alternative

Clark and West (2007) suggest a one-sided test for a t type statistic based upon the core statistic in (10). They recommend asymptotically normal critical values for their test.

It is important to emphasize here that both tests, GW and CW, are different in a number of aspects. One of the most important differences, however, is that they are designed for different purposes. While the GW test is comparing the ability of two different forecasting methods, the CW test evaluates model adequacy. In other words, it is testing whether the larger model is more appropriate than the smaller model. Put differently, the most important difference between the GW and CW tests relies on the fact that the version of the GW test that we use here is a standard normal test for the differences in MSPE between two models, whereas the CW test is a standard normal test comparing the same MSPE differences but after a very specific adjustment is made. Using simulations, Clark and West (2007) show that their adjustment generates a test with adequate size and much more power than normal tests comparing unadjusted differences in MSPE, like the GW test. They also show that unadjusted tests are severely undersized when comparing nested models. Consequently, we expect these two tests to deliver different results. Most likely, due to the higher power reported in simulations, we expect the Clark and West test to be able to show more rejections of the null hypothesis than the GW testFootnote 4.

2.4 Forecasting approach

We use several different forecasting strategies to evaluate the ability of the IIF to predict domestic Chilean inflation. Our basic strategy considers the comparison of forecasts coming from a benchmark model with forecasts coming from the same benchmark model but augmented with the international inflation factor. We group all our strategies in four different categories: First, we focus on simple univariate benchmarks to construct multistep ahead forecasts with and without the aid of the IIF. In this strategy, multistep ahead forecasts are constructed using an iterative indirect approach. Consequently, we label this strategy univariate indirect approach. Second, as many economic factors may be driving inflation in a small open economy like Chile, we build multistep ahead forecasts for Chilean inflation using a more complex multivariate model. Because we still compute these multistep ahead forecasts using an iterative indirect approach, we label this strategy multivariate indirect approach. Third, we consider direct autoregressions for the construction of multistep ahead forecasts in line with the works of Ciccarelli and Mojon (2010) and Stock and Watson (2002). We label this approach univariate direct approach. Finally, we also use a multivariate direct approach for the construction of multistep ahead forecasts. We label this approach multivariate direct approach. We provide a detailed description of these four approaches next:

2.4.1 Univariate indirect approach

Table 3 shows the three benchmark models we use in this approach. These models are part of an extended family of ten benchmarks that are shown to produce competitive out-of-sample forecasts at short and long horizons when compared to traditional univariate benchmarks used in the literature. This is shown for Chile, but also for a number of different countries experiencing either stable or unstable inflation. See Pincheira and García (2012) and Pincheira and Medel (2015) for details. While we carried out forecasting exercises using the ten aforementioned models, we only present the results of three models for the sake of brevity. Results for the rest of the models are available in the working paper version of this article (Pincheira and Gatty 2014).

Although the three models in Table 3 have an ARIMA representation, we label them as S [1], S [2] and S [3], where S stands for SARIMA or Seasonal ARIMA. It turns out that the original family of ten benchmarks includes some models with multiplicative seasonality and that is why we use the S to denote our specifications. It is important to mention that in our original exercises, results were fairly robust across the family of ten benchmark models. As mentioned before, just to save space we only show results here for three models. First, we consider S [1] because it helps us to connect our findings with the theory of Purchasing Power Parity (PPP), as it will be clearer in Sect. 5. Second, we consider S [2] because it generates the most accurate forecasts out of the ten models considered in our original family, see Pincheira and Gatty (2014). Therefore we consider S [2] because of its high out-of-sample accuracy. Finally, we consider S [3], which is nothing but a random walk, because is traditionally used as a benchmark in the forecasting literature, see for instance Ciccarelli and Mojon (2010) and Atkeson and Ohanian (2001).

We compare each of these univariate specifications with their augmented versions. These augmented versions are denoted FASARIMA [j], j = 1, 2, 3 where FASARIMA stands for Factor Augmented SARIMA. We also use FS [j], j = 1, 2, 3 as a shorter notation for the models. Table 4 summarizes the FASARIMA specifications under consideration.

In Tables 3, 4 \({\pi }_{ t} \) represents Chilean year-on-year inflation rate, \(\varepsilon _{ t} \) represents a white noise process and \(f_{ t} \) represents the international inflation factor.

To create multi-step ahead forecasts, we use the iterated method relying on the following ARIMA specification for the international factor:

where \({u}_{{t}} \) is a white noise process and both \(\alpha \) and \({\varphi }\) are positive real parameters. This model is basically the same model S[2] in table 3, but of course, aimed at modeling the dynamics of the IIF.

Table 5 next shows in-sample statistics related to model (13) when fitted to our IIFs. We see that model (13) seems to fit fairly well both international factors. In particular our coefficients \(\alpha \) and \({\phi }\) are statistically significant, the coefficient of determination is greater than 50 % and the Durbin–Watson statistic is close to 2, providing no evidence of first-order serial autocorrelation in the residuals. While it is widely known that a good in-sample fit does not necessarily imply a good forecasting performance out-of-sample, we think that is important to show both in-sample and out-of-sample evidence to check for the robustness of our results.

We notice that in all our equations we have imposed a unit root in the models used to generate forecasts for Chilean inflation and for the international inflation factors. This is also in line with important papers in the forecasting literature, see Stock and Watson (2002) and Atkeson and Ohanian (2001) for instance.

Besides, Pincheira and Medel (2012) provide interesting insights regarding the use of models with unit roots to generate forecasts for stationary variables. We notice also that all the specifications under consideration are driftless expressions. That is done on purpose to avoid the presence of deterministic trends in long-run forecasts. To give a simple example, let us consider the case in which we add a drift “c” to expression (13) so we obtain the following new expression (14):

Following Box et al. (2008) the eventual or explicit form of the forecast function for (14) is given by

Here \(\hat{f}_{ t} \left( {h} \right) \) is the best linear forecast of \(f_{{t}+{h}} \) based on information available at time t. Furthermore \(a_t \) and \(b_t \) represents adaptive coefficients, that is, coefficients that are stochastic and functions of the process at time t (see Box et al. (2008)). Expression (15) shows that whenever the drift “c” is different from zero, optimal linear forecasts have a linear deterministic trend with slope \(c/(1-\alpha )\). This means that long-term forecasts will be divergent, which is not desirable in the case of a process like international inflation, which is a relatively stable processFootnote 5. This is the reason why we are considering driftless expressions, or expressions with the drift set to zero.

It is also worth noticing that most of the traditional unit root tests provide similar results when testing for unit roots in Chilean year-on-year inflation and in our international factors. Generally speaking, the null hypothesis of a unit root cannot be rejected at usual confidence levelsFootnote 6. See Tables 6–7 below.

Irrespective of the unit root test results, we use models in Tables 3 and 4, as well as expression (13) to generate our forecasts because of the vast evidence indicating that models with unit roots usually work well when predicting either unit–root processes, close to unit–root processes or processes with high levels of persistence. See, for instance, Clements and Hendry (2001), Pincheira and Medel (2012) and the references cited therein.

2.4.2 Multivariate indirect approach

Table 8 shows the three models we use in this approach. They are the same models shown in Table 4 but now augmented with two sets of exogenous variables that we collect in the vector variables \({X}_{t-1}^T\) and \({Z}_{t-1}^T.\) We label these models as FASARIMAX or simply FSX models. As we mentioned before, the idea of these exercises is to evaluate the predictive contribution of our international factors, beyond that contained in autoregressive components of Chilean inflation and also beyond that contained in additional variables that are used to either explain or predict inflation in the literature. We consider four variables in the vector \({X}_{t-1}^T\) inspired in the work by Ciccarelli and Mojon (2010), Stock and Watson (1999), Nicoletti-Altimari (2001), and Gerlach (2004) by setting a Phillips curve type of model where the first difference of year-on-year Chilean inflation is predicted with ARMA components and the first lag of the growth rate of the following variables: Chilean activity index (CHAI), commodity price index (CCOMM), monetary measure (MM3) and the Chilean exchange rate against the US dollar (ER12).

We also include another vector of variables \({Z}_{t-1}^T\) containing the unemployment rate as an alternative measure of economic activity plus three more variables aimed at capturing international economic conditions that may be affecting Chilean domestic inflation: the growth rate of US industrial production, US treasury bills interest rates and the growth rate of the Dow Jones index. We carry out exercises setting \(\delta =0\) and also estimating \(\delta \) as a free parameter. We always focus on the \({\gamma }\) parameter which measures the predictive ability of the international inflation factor for Chilean domestic inflationFootnote 7.

As in our previous exercise, to create multi-step ahead forecasts, we use the iterated method relying on expression (13) for the international factor and for most of our exogenous variables. For the particular case of the unemployment rate, we use a different model that has a considerable better in-sample fit. For the unemployment rate we use the following model:

where \(u_t \) corresponds to the unemployment rate and \(e_t \) represents a white noise process. Table 9 next shows in-sample statistics related to model (13) and (16) when fitted to our exogenous variables. We see that models (13) and (16) fit fairly well most of our exogenous variables with the only exception of the US Treasury bill interest rate for which we obtain a determination coefficient below 20 %. For the rest of the variables, the coefficient of determination is around 50 %. Besides the Durbin–Watson statistic is close to 2, providing no evidence of first-order serial autocorrelation in the residuals. In addition, all of the coefficients in Table 9 are statistically significant at usual levels, with the only exception of one coefficient in the model describing the evolution of the Dow Jones index.

2.4.3 Univariate direct approach

The strategies described in 2.4.1 and 2.4.2 relies, at least for long horizons, on the ability that equations (13) and (16) may have to correctly forecast our international factors and our exogenous variables. If these expressions are poor statistical representations, then the failure or success in the detection of predictability may be caused by a misspecification problem. We notice that this is only potentially troublesome when forecasting at horizons longer than 1 month. When forecasts are made one-step-ahead, equations (13) and (16) are no longer necessary so misspecifications concerns are of no relevance. Another technical issue that we need to consider when carrying out inference at longer horizons is that it is not clear whether size and power properties of the normal approximation for the Clark and West (2007) test are adequate. This is so because this approximation was introduced in the context of direct multi-step forecasts and not in the context of the iterated method that we use in Sects. 2.4.1 and 2.4.2. In order to avoid these shortcomings, in Sects. 2.4.3 and 2.4.4 we focus on direct methods for the construction of multi-step ahead forecasts. It is important to mention, however, that to our knowledge it is not clear whether the direct approach is more accurate or better than the iterated approach for the construction of multistep ahead forecasts. In words of Marcellino et al. (2006), “which approach is better is an empirical matter”. These authors point out that under correct specification of the exogenous variables models, the iterated approach should be more efficient. Nevertheless, the direct approach should be more robust to model misspecification.

The implementation of our univariate direct approach considers the following specification inspired in Stock and Watson (1999, 2002):

where \({\beta }^{\left( h \right) }\left( {L} \right) =\sum _{j=0}^{q_h } \beta _j^{\left( h \right) } L^{j}\)represents a lag polynomial and L represents the lag operator such that

The lag order \(q_h \) is estimated by Bayesian Information Criterion (BIC) with \(1\le q_h \le 24\). We label this model simply as “Direct Model”Footnote 8.

2.4.4 Multivariate direct approach

The implementation of our multivariate direct approach considers the following specification inspired in Stock and Watson (1999, 2002) and Ciccarelli and Mojon (2010):

where \({\beta }^{\left( h \right) }\left( {L} \right) =\sum _{j=0}^{q_h } \beta _j^{\left( h \right) } L^{j}\)represents a lag polynomial as in the previous section, \({AI}_t \) represents the annual growth rate of the Chilean Activity Index, \({CI}_t \)represents the annual growth rate of the commodity index, and finally, \({MM}3_t \) represents the annual growth rate of the monetary measure M3. As before, the lag order \(q_h \) is estimated by Bayesian Information Criterion (BIC) with \(1\le q_h \le 24\). We label this model simply as “Direct Multivariate Model” or DMM.

2.5 Linkage with purchasing power theory

In this section we show that the model labeled FASARIMA[1] is consistent with a relative version of Purchasing Power Parity (PPP). Relative PPP can be derived from absolute PPP which state that

where \(S_t \) represents nominal exchange rate and \(P_t^*,P_t \) represent international and domestic price indexes respectively. See Rogoff (1996) for further details. Taking first differences we obtain what is known as relative PPP

Notice that absolute PPP implies relative PPP, but the converse is not true. Rather than taking first differences from absolute PPP, we could take annual differences to obtain

Now taking natural logarithm we get

Lower case letters denote natural logarithms. Notice that the logarithm approximation for annual foreign and domestic inflation is given by

With this notation expression (23) is equivalent to

Taking first differences we get

In the short run, a useful model for the exchange rates in logarithms is the driftless random walk (see Rogoff and Stavrakeva 2008 and the references cited therein). Therefore we also have that

where \(\varepsilon _t \) is a white noise process with variance \(\sigma _\varepsilon ^2 \). Putting together (27) and (28) we get

Now assuming that

where \(v_t \) is also a white noise process, independent of \(\varepsilon _t\), with variance \(\sigma _v^2 \), we have that

But we have used expression (13) as the law of motion for the international factor. Therefore we have

where \({u}_{ t}\) is also a white noise process with variance \(\sigma _u^2 \). This is equivalent to

Under the assumption that \({u}_{ t} \), \(v_t \) and \(\varepsilon _t \) are independent processes, expression (33) has the following representation

where \(\gamma =\beta \alpha \); \(\theta \) is the invertible solution (the solution with absolute value below unity) of the following equation

With

and \(w_{ t} \) is a white noise process with variance \(\sigma _w^2 \):

Details of this derivation are based on simple textbook material (see Box et al. 2008) and are available upon request. Expression (34) corresponds to our FASARIMA[1] model.

3 Empirical results

3.1 In-sample analysis

Tables 10 and 11 show the estimated value of the \(\gamma \) parameter for all the models described in section II. In Table 10, we present results when the international factor is calculated with OECD countries, whereas in Table 11 results are reported when the international factor is calculated with Latin American countries. Let us recall that the \(\gamma \) parameter is the parameter associated with the international inflation factor, so it is the parameter of interest. We notice that in the case of the direct specifications (Direct Model and DMM), we have reported in-sample results for the case \(h=1\) in order to make a fair comparison between the results of all the specifications. Tables 10 and 11 also show the t-statistics associated with this parameter and the corresponding coefficients and t-statistics for each independent variable in the case of the multivariate model. In addition to individual coefficient estimates, each table reports the coefficient of determination of the regressions to have a measure of the fit of the models. We notice that t-statistics are calculated using the Newey and West (1987) HAC estimator.

Figures in Tables 10 and 11 are quite impressive as for both measures of IIFs and for all the specifications reported in the tables, the \(\gamma \) coefficient is positive and statistically significant at very high confidence levels. The size of this coefficient is also remarkable. While it shows some heterogeneity, on average takes a value of 0.47, indicating that the predictive marginal pass-through from international to national inflation is far from negligible. The magnitude of the coefficient, however, is lower for multivariate specifications when compared to FASARIMA models.

Tables 10 and 11 also show estimates and t-statistics for some other variables included in the multivariate specifications FSX[1], FSX[2], FSX[3] and DMM. We only show results for the variables that are statistically significant at least at the 10 % significance level. We find that, for some specifications, the annual growth rate of the exchange rate, commodity price index and monetary measure M3 are significant and consistent with the theory. We notice also that the annual growth rate of the Dow Jones index is significant but with a negative sign, which is a little bit puzzling and might be indicating that our specifications are not perfect, yet useful.

3.2 Out-of-sample analysis

Our in-sample analysis clearly indicates that the international factors do help to predict Chilean inflation. In-sample analyses, however, are usually criticized because they are relatively different from a real-time forecasting exercise and also because they have shown a tendency to overfit the data. To mitigate these shortcomings, several out-of-sample tests of Granger causality emerged in recent years. As a first step, in this section we show results of one of such tests due to Clark and West (2007). Then, as a second step, we show results regarding forecast accuracy.

3.2.1 Granger causality

Table 12 shows the t-statistics of the Clark and West (2007) test. One star indicates statistically significant predictive ability of the IIF at the 10 % level. Two stars indicate statistically significant predictive ability of the IIF at the 5 % level. We see that for all our specifications the Clark and West (2007) test is able to reject the null that the IIF is not useful to predict domestic Chilean inflation at short horizons (either one, three or six months ahead). This is important, because the out-of-sample results in Table 12 are consistent with the in-sample results in Tables 10 and 11. Some observations deserve mentioning. First, we notice that in the case of our iterative strategies (FS1, FS2, FS3, FSX1, FSX2 and FSX3) the Clark and West (2007) test is able to reject the null hypothesis when predicting one month ahead. This is very important, because it is not clear whether size and power properties of the normal approximation for the Clark and West (2007) test are adequate for these strategies at longer horizons. This is so because the normal approximation was introduced in the context of direct multi-step forecasts and not in the context of the iterated method to construct multistep forecasts. Second, in the last two rows of Table 12, we present results for models in which multistep ahead forecasts are constructed using the direct approach. In this context, the normal approximation of the Clark and West (2007) test should be adequate at every single horizon. We see strong rejection of the null hypothesis at short horizons with these models. The number of forecasts horizons in which the null hypothesis is rejected is lower when we include in the model additional predictors (DMM), but still we find strong rejections of the null hypothesis when forecasting one month ahead with the OECD factor and when forecasting six months ahead with the LATAM factor.

3.2.2 Forecast accuracy

As we mentioned in a previous section, the Clark and West (2007) test can be considered either as an encompassing test or as an adjusted comparison of MSPE. In other words, the Clark and West test evaluates potential but not raw gains in forecast accuracy when our models are estimated with traditional least squares methods. To have a notion of the accuracy of our models, Table 13 below shows sample RMSPE when forecasting with and without the IIF. This table reveals that there is an important amount of uncertainty surrounding Chilean inflation forecasts even at relatively short horizons. For instance, six months ahead, the lowest RMSPE reported in Table 13 corresponds to 150 basis points. Consequently, even with the aid of the IIF and additional predictors, forecasting uncertainty regarding Chilean Inflation is still high.

Italicized values in Table 13 highlight the lowest RMSPE at each forecasting horizon. For most forecasting horizons, the lowest RMSPE is obtained using either our simple SARIMA or our FASARIMA specifications. In only one case, the inclusion of additional variables does help to reduce RMSPE (see FASARIMAX model 2, h=1, LATAM factor). We notice that in our application, the iterative methods to produce multistep ahead forecasts are much more accurate than our direct methods. This is especially noticeable at longer horizons. It is also interesting to point out that in terms of forecast accuracy the use of the IIF based on OECD countries provides slightly more accurate forecasts than the factor based on Latin American countries.

Finally, Table 14 reports the RMSPE ratio between models with and without the IIF. Figures below one favor specifications with the IIF. Stars indicate rejection of the null hypothesis of the model without the IIF in favor of the model with IIF. Two stars indicate rejection at the 5 % level. One star indicates rejection at the 10 % level. Figures below 1 are predominant in Table 14 indicating that in most cases the IIF helps in increasing forecast accuracy. Similarly, several cells in Table 14 indicate that the inclusion of the IIF provides systematic reduction in RMSPE. In particular, when the IIF is computed using OECD countries, most of the cells display stars, especially at short horizons.

4 Robustness checks

We checked the robustness of our results in several dimensions. The main robustness checks are described next.

4.1 Number of principal components

As mentioned in Sect. 2, our international factors are constructed as the weighted average of the first two principal components of the set of year-on-year inflation rates for each group of economies (OECD and LATAM excluding Chile). We could also construct the international factors using only the first principal component. Table 15 next shows the RMSPE ratio of our FASARIMA models when the international factors are constructed with one and two principal components. Figures below one indicate that the models using the international factor computed with two principal components provide more accurate forecasts. Table 15 shows different results depending on the set of countries used for the construction of the international factor. When using OECD countries, most of the figures are below 1, indicating a better performance of the factor constructed with two principal components. When using LATAM countries most of the figures are above one, indicating a better performance of the factor constructed with only one principal component. This implies that gains over our simple univariate models are bigger than those reported in Table 14. Consequently, irrespective of the number of principal components considered, either one or two, our results confirm that the international factor does help to forecast domestic inflation in Chile.

4.2 Using a unique global factor

We computed an alternative international factor based on the total of 48 countries (LATAM plus OECD countries) that we label “global factor”. It is constructed as a weighted average of the two first principal components of the whole set of 48 inflation series. Table 16 shows the ratio of RMSPE corresponding to FASARIMA and SARIMA models. Forecasts from FASARIMA models are now constructed with the global factor. Figures in Table 16 are fairly similar to those of the OECD panel in Table 14. In summary, most figures are below 1 indicating a better predictive performance of the models with the global factor, and this performance is similar to that obtained with the factor constructed only with OECD countries.

4.3 Rolling versus expanding estimation windows

Out-of-sample evaluations are typically carried out using either rolling or expanding estimation windows. In stationary environments, the use of expanding windows generates more accurate estimates of the parameters as the estimation window size increases. While this tends to produce more accurate forecasts, it also may induce a non-stationary behavior in forecast errors which complicates standard asymptotic results in traditional tests. For instance, the Giacomini and White (2006) framework is built under the assumption that the estimation window size is bounded. This means that it is not clear whether the asymptotic results will still be true when using expanding windows. The Clark and West (2006) test is another example in which a rolling window framework is required for asymptotic normality. Besides these technicalities, in the presence of some breaks in the data, rolling estimation windows may be preferable because they induce a short memory in the forecasts. Therefore if old observations are of no consequence for current observations, it may be preferable to estimate the processes with rolling windows that automatically cut off very old observations. To check whether the use of expanding windows may alter our results, Table 17 shows RMSPE ratios for our SARIMA and FASARIMAX models when estimated using either recursive or rolling windows. Figures below 1 in Table 17 favor recursive estimates.

With the exception of our random walk model (SARIMA 3) which is not affected by the estimation strategy, most of the Figures in Table 17 are either below 1 or very close to 1, suggesting that the use of recursive windows may be slightly preferable. Nevertheless, figures are, in general, so close to one that we do not think that our qualitative conclusions may change by using recursive instead of rolling windows.

4.4 Stability of our results

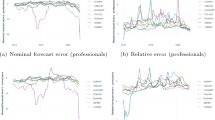

We have also explored the stability of our results using our FASARIMA models. To save space, we refer the reader to Figure 3 in the appendix of the working paper version of this article, (Pincheira and Gatty 2014). This figure depicts the evolution of the estimates for \(\gamma \) in different rolling windows for ten FASARIMA specifications including our FASARIMA models 1, 2 and 3. We see that these estimates are always positive and seem to be relatively stable with one important exception. Around the year 2008, all charts show a boost in the estimates from a value around 0.4 to a value around or above unity. This is an interesting pattern that might be associated with several economic reasons like the commodity boom of 2007 and the Lehman crisis in September 2008. Clearly, this topic deserves further analysis in future research.

5 Summary and concluding remarks

In this paper, we use monthly CPI data for a number of countries during the sample period January 1995-March 2013 to build forecasts for Chilean year-on-year inflation. These forecasts are built using univariate and multivariate time series models augmented with an international inflation factor (IIF). We construct two versions of this factor. The first version is constructed as a weighted average of the two first principal components of the year-on-year inflation of 18 Latin American countries (excluding Chile). The second family is built applying the same technique to year-on-year inflation of 30 OECD countries (excluding Chile). We show sound in-sample and out-of-sample evidence indicating that these two international factors do help forecast Chilean inflation at several horizons. In general, incorporating the international factors reduce the RMSPE of our benchmarks. While the forecast accuracy of the models incorporating the factors from LATAM and OECD countries is similar, we detect a modest edge in favor of the models using the international factor computed with OECD countries.

Our findings are an extension of the results presented by West (2008) and by the influential work of Ciccarelli and Mojon (2010). To our knowledge, this is the first paper showing a predictive relationship between an international inflation factor and domestic inflation for a small open economy like Chile, country that in most of our sample period was not an OECD memberFootnote 9.

We think that the set of findings reported in this paper are both interesting and useful for forecasting purposes. Our results provide to Chilean policy makers a new variable to forecast inflation. This is very important, especially in the context of recent years, in which variables of economic activity, traditionally used to predict inflation in Phillips curve type of models, have lost their predictive power. We think that our results should be considered seriously by Chilean policy makers and also by others from small open economies which may be experiencing a similar phenomenon.

Our discussion highlights four main drivers or channels for our results. The first channel acts through monetary policy and exchange rates. The idea here is that an inflationary shock overseas will cause a tightening in monetary policy abroad. The increment in external monetary policy will generate a depreciation of the Chilean peso, thus generating domestic inflation. A second channel is basically a trading channel and refers to imported inflation. This mechanism is also a causal one. A systematic rise in imported goods will import inflation from abroad. A third channel operates through arbitrage in tradable goods. The idea here is the same behind Purchasing Power Parity. This theory, in its variety of versions, claims that sooner or later fluctuations in international prices will generate movements in domestic prices as well, provided that these movements are not 100 % absorbed by exchange rates. We also identify a fourth channel that may be supporting our results: common shocks. In this case, a common inflationary shock affecting a number of countries in the world may be playing a role in our findings provided that the inflationary impact of these common shocks have different reaction speeds in the international factor and in Chilean domestic inflation. If, for instance, a rise in international commodity prices generates international inflation fairly quickly and after a few months generates inflation in Chile, then the international factor may be playing a leading indicator role for domestic local inflation. Differing from the first three channels, which offer a causal linkage between international and domestic inflation, this last channel is not causal, is only a predictive channel. Let us recall that in this paper we are not looking for the identification of specific transmission channels between international and domestic inflation. Instead, the objective of this paper is to evaluate whether international inflation has predictive information for Chilean domestic inflation, beyond that contained in good univariate and multivariate benchmarks. Therefore, the four channels that we mention as potential drivers of our results offer only hypothetical explanations that should be formally tested in further research.

Let us have a word regarding the independence of monetary policy. One could argue that the strong linkage between the international inflation factor and domestic Chilean inflation may leave domestic monetary authorities without room to control Chilean inflation. We do not subscribe that point of view for two main reasons. In the first place, our predictability findings are stronger at short horizons, whereas the common wisdom suggests that the impact of monetary policy over inflation acts in the medium term. In the second place, we have reported simple regressions indicating that at least two variables directly related to monetary policy play a role in characterizing the dynamics of Chilean inflation: the peso/dollar Exchange rate and the M3 monetary measure.

As a final remark, it is important to emphasize that irrespective of the economic reasons underlying our results, our measures of international inflation may be capturing the impact of several economic forces in just one variable. It is perfectly possible that in some periods domestic inflation may be driven by commodity shocks. But it is also possible that in some other periods domestic inflation may be driven by either aggregate demand shocks or international monetary policy shocks. It is within this plethora of different economic forces that the identification of one single factor (international inflation) capturing several different transmission channels is relevant and useful for forecasting purposes.

Notes

In our sample of OECD economies, we rule out the cases of New Zealand and Australia due to the unavailability of CPI information at a monthly frequency. We also rule out the case of Estonia due to data availability. For Estonia we only find data for the year 1998 onward. To reduce distortions coming from considerations of different sample periods, we just work with the list of 30 OECD economies with information at a monthly frequency during the entire sample period January 1994–March 2013. Finally, from the group of LATAM countries we remove Cuba because we were not able to find official CPI data at a monthly frequency.

We have a very simple justification for the choice of year-on-year inflation as a target variable: To our knowledge, every inflation targeting country in the world defines its target in year-on-year terms. For instance, the Czech Republic has a target of 2 % for the medium term. The UK has the same target but is supposed to be met at all times. In Thailand and Mexico, the target is 3 %. Some countries have a target of 2.5 % such as Iceland, Norway, Poland, Romania and North Korea. The list is long but all of these countries express their target in year-on-year terms. In particular, Chile has a target of 3 % and a tolerance band between 2 and 4 %. According to Chilean monetary authorities, year-on-year inflation in Chile is expected to lie within this band “most of the time”. Given that monetary authorities have defined their target in year-on-year terms, we think that forecasting year-on-year inflation is a reasonable thing to do.

We notice that in this paper we use the unconditional and univariate version of the GW test that follows an asymptotic normal distribution. In Pincheira (2013) there is a detailed discussion about the linkage between the Clark and West (2007) test and tests based on unadjusted comparisons of MSPE for the particular case in which the null hypothesis is a martingale difference model.

For instance, in the case \(c=0.02\) and \(\alpha =0.95\) the slope of the linear trend is 0.2. When forecasting 2 years ahead, \(h=24\), therefore the contribution of the deterministic term in (15) to the overall inflation forecast is 9.6 %. Furthermore, this contribution increases with the forecasting horizon.

The only exception is the case of the international inflation factor constructed with OECD countries when the Phillips-Perron test is used.

We also considered, as a robustness check, another exogenous variable: a Latin American exchange rate factor (LAERF). We computed this factor as the first principal component of the set of year-on-year variation of local exchange rates against the American dollar for 14 Latin American countries. We used monthly data from Bloomberg for the following countries: Argentina, Bolivia, Brazil, Colombia, Costa Rica, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru and Uruguay. This is basically the same sample of Latin American countries we used for the construction of the international inflation factor, but excluding Ecuador, Haiti, Dominican Republic and Venezuela. These countries were not considered due to missing observations in our database or because they had fixed exchange rates in long periods of our sample and consequently, in many of our out-of-sample estimation windows. Both in-sample and out-of-sample results with this additional exogenous variable are fairly similar to the results reported here. Accordingly, and for the sake of brevity, we do not report these additional results, but they are available upon request.

A referee pointed out that 24 lags “...seems an extremely high value”. To check this statement we also allowed \({q}_{ h} \) to take only the values 1, 2, 3 and 12 when computing our forecasts according to our specifications (17) and (19). Qualitatively our results were fairly similar. This is an important observation for policy makers because the computational time could be substantially reduced by considering a smaller set of lags for \({q}_{ h} \).

Chile is an OECD country since May 2010.

References

Atkeson A, Ohanian L (2001) Are Phillips curves useful for forecasting inflation. Quart Rev 25(1):2–11 Federal Reserve Bank of Minneapolis

Box G, Jenkins G, Reinsel G (2008) Time series analysis: forecasting and control, 4th edn. Wiley, USA

Central Bank of Chile (2014) Monetary policy report. December 2014

Ciccarelli M, Mojon B (2010) Global inflation. Rev Econ Stat 92(3):524–535

Clark T, West K (2006) Using out-of-sample mean squared prediction errors to test the martingale difference hypothesis. J Econom 135(1–2):155–186

Clark T, West K (2007) Approximately normal tests for equal predictive accuracy in nested models. J Econom 138:291–311

Clark T, McCracken M (2006) The predictive content of the output gap for inflation: resolving in sample and out-of-sample evidence. J Money Credit Bank 38(5):1127–1148

Clements M, Hendry D (2001) Forecasting with difference-stationary and trend-stationary models. Econom J 4:S1–S19

Engel C, Mark NC, West K (2012) Factor model forecasts of exchange rates. NBER, Working Paper 18382, Cambridge

Gerlach S (2004) The ECB’s two pillars. CEPR Discussion Paper No 3689

Giacomini R, White H (2006) Tests of conditional predictive ability. Econometrica 74(6):1545–1578

Marcellino M, Stock J, Watson M (2006) A comparison of direct and iterated multistep ar methods for forecasting macroeconomic time series. J Econom 127(1–2):499–526

Mumtaz H, Surico P (2006) Evolving international inflation dynamics: world and country specific factors. Manuscript, Bank of england, England

Neely C, Rapach D (2011) International comovements in inflation rates and country characteristics. J Int Money Financ 30:1471–1490

Newey WK, West K (1987) A simple, positive, semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55(3):703–708

Nicoletti-Altimari S (2001) Does money lead inflation in the Euro area? ECB Working Paper No 63

Pincheira P (2013) Shrinkage based tests of predictability. J Forec 32(4):289–384

Pincheira P, Gatty A (2014) Forecasting Chilean inflation with international factors. Working Paper No723 Central Bank of Chile

Pincheira P, García A (2012) En búsqueda de un buen marco de referencia predictivo para la inflación chilena. El Trimestre Económico LXXIX(1) No 313: 85–123

Pincheira P, Medel CA (2012) Forecasting inflation with a random walk. Working Paper N\(^\circ \) 669 Central Bank of Chile

Pincheira P, Medel CA (2015) Forecasting inflation with a simple and accurate benchmark: the case of the US and a set of inflation targeting countries. Finan a uvěr-Czech J Econo Financ 65, 2015, no. 1

Pincheira P, Rubio H (2015) El escaso poder predictivo de simples curvas de Phillips en Chile. CEPAL Rev 116:177–202

Rogoff K (1996) The purchasing power parity puzzle. J Econ Lit XXXIV:647–668

Rogoff K, Stavrakeva V (2008) The continuing puzzle of short horizon exchange rate forecasting. NBER Working Papers 14071

Stock J, Watson M (1999) Forecasting inflation. J Monet Econ 44:293–335

Stock J, Watson M (2002) Macroeconomic forecasting using diffusion indexes. J Bus Econ Stat 20:147–162

Stock J, Watson M (2008) Phillips curve inflation forecasts. NBER Working Paper No. 14322

West K (2008) Panel data forecasts of inflation (and nominal exchange rates). Presentation at the workshop on inflation forecasting, Central Bank of Chile, October 2008

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to Carlos Medel, Jorge Selaive and Eduardo Titelman for their valuable comments. We are also thankful for the comments received at the Macroeconomic Seminar of the Central Bank of Chile and at the 2014 Economics Meetings of the Central Reserve Bank of Peru. The views expressed in this paper do not necessarily represent those of the Central Bank of Chile or its Board members. All remaining errors are ours.

Rights and permissions

About this article

Cite this article

Pincheira, P., Gatty, A. Forecasting Chilean inflation with international factors. Empir Econ 51, 981–1010 (2016). https://doi.org/10.1007/s00181-015-1041-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-015-1041-9