Abstract

This paper employs the distribution dynamics framework for assessing labour productivity convergence, in the period 1980–1995, among 28 developed and developing countries, in different manufacturing compartments, identified as according to their research and development intensity. Three competing hypotheses are considered: absolute, conditional and club convergence. The key result of the analysis is twofold. First, consistently with very recent evidence, absolute convergence is found in manufacturing as a whole. Second, convergence tendencies are sector specific. In particular, club convergence characterizes traditional and medium- technology compartments, while the absolute one qualifies high-tech productions. Overall, these findings support the view that cross-country labour productivity convergence might be hindered by the sub-optimal structural reallocation from nonconvergence to convergence activities. Moreover, as the clustering dynamics in traditional and medium-tech sectors is related either to physical capital stock or technological development, laggard economies should purse ad hoc catching-up strategies. Finally, the result of high tech provides supportive evidence for the theory of dynamic comparative advantages. Thus, it seems desirable that emerging countries enter into technology-intense markets and that they develop the necessary capabilities for exploiting such endogenous advantages.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the late 1990s, the twin-peaks dynamics of world GDP per capita distribution together with the contemporaneous reduction in intra-distributional inequality triggered new research interests on cross-country convergence (Quah 1997; Durlauf and Quah 1999). The question at issue being whether or not developing countries will catch-up with their richer counterparts, in terms of income per capita or labour productivity.Footnote 1 With these respects, the most recent literature documents the existence of nonlinearities in the growth process that are at the origin of multiple equilibria (Graham and Temple 2006; Bloom et al. 2003; Jones 1997), convergence clubs (Fiaschi and Lavezzi 2003; Desdoigts 1999) and distinct growth regimes (Owen et al. 2009; Eicher and Turnovsky 1999). Among other things, these findings have undermined support for the use of linear econometric techniques in convergence analysis.

Moreover, in the same period, the influential studies of Caselli et al. (1996) and Bernard and Jones (1996a, b) have demonstrated that the potential for productivity growth is both country and sector specific. In particular, empirical and descriptive evidence suggest that the higher the technological content of production, the faster the value-added growth and thus the expected convergence rate. For example, Rajan and Zingales (1998) have shown that financial development facilitates economic growth in High-Technology sectors, which are the most dependent of external finance. Hausmann et al. (2006) underpinned, instead, that successful exporters are the ones who transfer resources from lower productivity activities to the higher productivity goods that are characterized by huge discovery costs and are human capital intensive. Finally, UNIDO (2009) descriptively motivated that low- and middle-income countries’ economic growth is closely linked to diversity and product sophistication in manufacturing.

The aim of this paper was to assess empirically distinct convergence hypotheses within different manufacturing sectors, characterized by specific research and development (i.e. R&D) intensity. More in detail, this study investigates labour productivity convergence tendencies, in the period 1980–1995, among 28 developed and developing countries. The manufacturing compartments are identified, following Lall (2000) technological taxonomy, as Resource Based, Low Technology, Medium Technology and High Technology. For the sake of completeness, the whole manufacturing sector is considered as well. Tables 1 and 2 report sample’s and sectors’ details. Moreover, the distribution dynamics framework is employed to face the intrinsic difficulties related to linear econometric techniques, Quah (1996a).

The competing convergence hypotheses under scrutiny are absolute, conditional and club convergence.Footnote 2 Absolute convergence predicts that contemporaneous labour productivity differences will be null in the long run because poor economies grow faster than rich ones, Sala-i Martin (1996). Conditional convergence asserts, instead, that labour productivity equalization will arise only among countries that have similar structural characteristics, such as accumulation rates, Barro (1991). Finally, when Club convergence hypothesis is not rejected, countries will cluster within small groups, and thus, convergence will come up only if both countries’ structural characteristics and initial conditions will be evened out, Galor (1996). With respect to initial conditions, the present work considers the ones related to physical capital stock, as in the tradition of critical thresholds (Azariadis and Drazen 1990; Durlauf and Johnson 1995), and the ones concerning technological transfer, as according the technological catch-up models (Baumol 1986; Durlauf 1993). It must be mentioned that both sectoral capital stock and total factor productivity (i.e. TFP) series have been originally estimated. Full details on capital stock and TFP estimates can be found, respectively, in the Data Appendix and in the TFP dedicated Appendix.

As for its aim, the present study fits in the debate on developing countries’ industrial policy design, recently reviewed by Harrison and Rodrguez-Clare (2009). The key result of the present analysis is twofold. First, absolute convergence is found in manufacturing as a whole. This is in line with the recent evidence provided by Rodrik (2013) and Benetrix et al. (2012). Second, convergence tendencies are sector specific. In particular, club convergence characterizes Resource Based, Low and Medium Technology, while absolute convergence qualifies High Technology. Thus, as for the clustering dynamics in traditional and medium-tech sectors, there seems to be room for ad hoc catching-up strategies. The finding on high-tech compartments, instead, provides supportive evidence for the theory of dynamic comparative advantages (Amsden 1989; Wade 1990). Employing the terminology of Harrison and Rodrguez-Clare (2009), this means that laggard economies should enter into technology-intense markets and that industrial policy should undertake the necessary steps to transform a “latent” comparative advantage in these productions into an “actual” one, Redding (1999). Overall, the present findings provide support to the thesis put forward by Rodrik (2013) in order to explain the lack of cross-country convergence. According to Rodrik (2013), in fact, the successful path of cross-country labour productivity convergence might be hindered by the sub-optimal “speed of structural reallocation from nonconvergence to convergence activities”.

The present work represents a significative and novel contribution to the literature because it is the first study that assesses competing hypotheses concerning labour productivity convergence between advanced and laggard economies, in manufacturing sectors, employing distribution dynamics. In fact, previous analyses on alternative convergence predictions have been focused on the behaviour of GDP per capita or aggregate labour productivity, either using parametric or nonparametric techniques.Footnote 3 Moreover, when convergence tendencies have been investigated in different economic sectors (i.e. agriculture, mining, services,...) or sub-sectors (i.e. manufacturing industries), the majority of the studies has considered OECD countries only. More in detail, the sectoral studies of Broadberry (1993) and Bernard and Jones (1996a) failed to find convergence in manufacturing, while the sub-sectoral ones of Dollar and Wolff (1988, 1993), Boheim et al. (2000) and Carree et al. (2000) confirmed such an hypothesis in all industrial compartments. To the best of my knowledge, the only two studies in the field that consider emerging economies are represented by Dal Bianco (2010b) and Rodrik (2013). In particular, applying standard linear techniques to a panel data set of 50 countries, Dal Bianco (2010b) found supportive evidence for the convergence hypothesis in all Lall’s manufacturing sectors. It is important to note that these results are consistent with the ones of the present work.Footnote 4 Rodrik (2013), instead, provided supportive evidence for absolute convergence in manufacturing as a whole, employing fixed effects estimators to different samples of advanced and emerging economies, observed along five different decades (i.e. 1965–2005).

The rest of the paper is organized as follows. The second part is aimed at providing the methodological motivations for the study of manufacturing sectors, identified as, according to Lall’s technological taxonomy, the choice of the time period and the countries under analysis. A synthetic description of distribution dynamics approach is also presented. The third illustrates and discusses the results obtained. Final comments together with policy implications and possible lines for the future research conclude. Specific details on the variables employed and data sources are reported in the Data Appendix. Full details on TFP estimation as well as on distribution dynamics technique are presented in two dedicated appendices.

2 Methodology

2.1 On manufacturing sectors, time period and sampled countries

“Not only is industrialization the normal route to development, but as a result of the globalization of industry, the pace of development can be explosive(...). This potential for explosive growth is distinctive to manufacturing”, UNIDO (2009), p. xiii.

This quote provides an authoritative and convincing explanation for the study of convergence in manufacturing. In fact, as industrial growth rate in developing countries is expected to be high, cross-country labour productivity equalization in manufacturing as well as in its compartments should take place. And, if it does not, it is compelling to understand why.

As for the hypotheses here assessed, the factors which eventually inhibit cross-country absolute convergence can be either structural characteristics alone (i.e. conditional convergence) or structural factors together with relevant initial conditions (i.e. club convergence). As customary in the literature, the steady state proxies here considered are the accumulation rates in both physical and human capital and a development stage dummy (Quah 1996a; Durlauf et al. 2005; Sala-I-Martin et al. 2004).Footnote 5 The relevant initial conditions are identified, instead, as the physical capital stock and the total factor productivity gap (i.e. TFPgap) interacted with schooling. It is worth clarifying that the interacted TFPgap proxies for the effective technological catch-up, Griffith et al. (2004). In technology diffusion models, in fact, where countries are divided into the leader–innovator (i.e. the country having the highest labour productivity) and the followers–imitators (i.e. all the others), followers’ technological progress depends on both their technological distance from the leader (i.e. TFPgap) and their absorptive capability, which is the ability to identify, assimilate and exploit outside knowledge, Cohen and Levinthal (1989).Footnote 6 As suggested by the results of Gemmell (1996), secondary schooling attainment rate is taken as absorption capability proxy.Footnote 7

Studying convergence within specific manufacturing compartments is of particular interest because it becomes possible to shed some light on the relative merits of distinct industrial policies (Harrison and Rodrguez-Clare 2009) as well as on sectoral reallocation policies (Rodrik 2013; McMillian and Rodrik 2011). Moreover, for the reasons explained in the Introduction, it is necessary to consider products’ sophistication. Lall (2000) technological taxonomy fulfils this requirement. In fact, this classification distinguishes manufacturing compartments according to their research intensity, measured as R&D expenditure to sales ratio. In particular, Resource- Based industries are the ones in which the value of production is essentially given by the possession of primary resources (e.g. processed food, manufactured tobacco, refined petroleum products); Low Technology includes productions whose R&D expenditure is below 1 % of sales’ value (e.g. garments, footwear, pottery and cutlery); in Medium Technology, R&D expenditure to sale ratio is between 1 and 4 % (e.g. automotive industry, agricultural machinery, perfumery and pesticides), and in High Technology, such ratio is greater than 4 % (e.g. electronics and scientific instruments). Moreover, Lall (2000) taxonomy has a 1-to-1 correspondence with the International Standard Industrial Classification (i.e. ISIC) at the 3-digit level (Revision 2), which is the one followed by UNIDO for the collection of sub-sectoral manufacturing data employed for the present analysis.Footnote 8 This feature represents a major advantage with respect to other classifications, like the one of Pavitt (1984) that, although effective in distinguishing industrial compartments, present huge overlaps between their categories and ISIC’s ones. See Table 2 for correspondence between ISIC and Lall’s classifications.

Turning now to data sources, the present analysis makes use of the data collected in UNIDO Industrial Statistics Database 2004, at 3-digits of ISIC Code (Revision 2), which is shortly labelled as INDSTAT3. Such a dataset collects data since 1960 and it has been preferred to both INDSTAT2 and INDSTAT4. The underlying reasons are the following. For what concerns INDSTAT2, such a dataset has good coverage of countries and it starts in 1960, but the disaggregation is at the ISIC 2-digit level, and thus, it is not possible to construct the desired 1-to-1 correspondence with Lall’s taxonomy. Regarding INDSTAT4, it offers more disaggregated data at the ISIC 4-digit level, but it covers fewer countries and has spotty information for the years before 1990. In particular, it lacks the necessary country coverage on sectoral investment rates in physical capital and employees making both the estimation of physical capital stock and the calculation of sectoral labour productivity very difficult.

The dataset here employed comprises 15 developed and 13 developing countries, observed at yearly intervals between 1980 and 1995, in 28 manufacturing industries. Full details on the sampled countries and industries can be found in Table 1 and in the first column of Table 2. Such a choice has been mainly driven by data availability, in the sense that the greatest countries’ overlap in the longest possible time span has been the main parameter for country/period inclusion. As observed by Rodrik (2013), the longer the chosen time span, the smaller the number of countries that can be included.

More in details, for what concerns the cross-sectional dimension, in order to minimize the measurement error, the selected countries are the ones for which the relevant data coverage is at least 80 % in the period under analysis. This leaves with 28 countries overall. It must be noticed that Rodrik (2013) assesses industry-specific convergence tendencies in the period 1995–2005, employing a sample of 30–40 countries, observed in 23 distinct industries. Thus, it is somehow reassuring that the cross-sectional dimension of the present exercise is very closed to Rodrik’s lower bound.Footnote 9

Passing now to the time span, which is 1980–1995, and leaving aside the already mentioned data availability issues, such a period appears of particular interest. In fact, UNIDO (1995) describes the 1980s as a decade of change on a scale virtually unprecedented since the Second World War and it identifies the 1995 as a turning point, in the sense that a new phase of (slower) growth did begin. More recently, UNIDO (2009) points out that, in the period considered, the majority of low income economies entered world’s manufacturing production. Moreover, the same report documents the increasing sophistication of manufactures and thus productions’ technical upgrading. Further, Eberhardt and Teal (2007) show that the so-called global shifts in manufacturing (i.e. developing countries entering higher value-added forms of production) happened exactly during the 1980s. Thus, convergence tendencies, if any, should be relatively strong in these years. Finally, it must be noted that a time dimension of just 15 years does not undermine support for distribution dynamics’ exercises. In fact, the literature in the field comprises both studies having a time-series dimension longer than 15 years (Desmet and Fafchamps 2006; Fiaschi and Lavezzi 2003; Quah 1997, 1996a) and shorter (Fiaschi et al. 2009; Magrini 2007; Maffezzoli 2006).

2.2 Distribution dynamics

This section outlines the main features of distribution dynamics, as originally developed by Quah (1996a, 1997) and Desmet and Fafchamps (2006). The reader might refer to the dedicated Appendix for a complete description of the econometric techniques here employed.

In the study of convergence, the main motivation for employing distribution dynamics, instead of standard linear estimators, is that the convergence prediction concerns how each economy performs relatively to all the others along time. It is well known, in fact, that standard parametric estimators provide indications on the behaviour of the average economy only. When distribution dynamics is embraced, instead, the stochastic kernel allows to track countries’ relative position. More technically, the stochastic kernel serves to retrieve the evolution of the probability distribution of a random variable along time, Quah (1993).

In the present analysis, the random variable of interest is sectoral labour productivity.Footnote 10 Following the methodology of Quah (1996a), unconditioned stochastic kernels are employed for assessing the absolute convergence prediction and conditioned stochastic kernels for evaluating both conditional and club convergence. By definition, in fact, unconditioned stochastic kernels measure the transition probabilities from a labour productivity status to another one, in a given time span, and conditioned stochastic kernels allow to identify the factors that eventually lead the changes of (and into) the distribution with respect to the unconditioned case. Long-run convergence tendencies are retrieved from the ergodic distribution, which is the stationary distribution of labour productivity.

More formally, \(f_{Y_t}(y_t)\) stands for the cross-country labour productivity distribution at time \(t\) in sector \(j\), where the sector index has been omitted for notational convenience, and \(Y_t\) indicates the corresponding random variable. In the unconditioned case (i.e. absolute convergence), the object of interest is represented by the transition probabilities of labour productivity, which are encoded by the conditional density function \(g_{Y_{t+1}|Y_t}\). It is assumed that \(g_{Y_{t+1}|Y_t}\) follows an homogenous Markow process, so that only previous period labour productivity distribution impacts on next period one and that the transition probabilities do not vary with the time. As for its definition, in the empirical implementation, the conditional distribution is obtained simply dividing the joint distribution by the marginal distribution:

where the joint distribution \(f_{Y_{t+1},Y_t}\) is estimated nonparametrically using a bivariate kernel density estimator and the marginal distribution \(f_{Y_t}\) is obtained integrating the joint distribution.Footnote 11

The ergodic \(f\) is the distribution that will be approached in the long run should the current dynamics persist and certain technical conditions hold.Footnote 12 Formally, this is the distribution that solves the following functional equation:Footnote 13

As the ergodic distribution encodes long-run tendencies, cross-country convergence can be claimed if the ergodic is unimodal and has a low variance.

The same technique is employed to assess conditional and club convergence. In particular, under the conditional convergence hypothesis, cross-country productivity equalization will not be found in the original labour productivity distribution \(f_{Y}\), but in the conditioned one, \(f_{Y|X}\), where \(X\) denotes steady state proxies. Then, the objects of interest will become the transition probabilities of the part of labour productivity not explained by the steady state variables, which are formally written as \(g_{Y_{t+1}|Y_t,X_t}(y_{t+1}|y_{t},x_t)\). Similarly, in the case of club convergence, the pertinent conditional density will be \(g_{Y_{t+1}|Y_t,X_t, Z_t}(y_{t+1}|y_{t},x_t, z_t)\) , where \(Z\) indicates relevant initial conditions (i.e. physical capital stock or interacted TFPgap). Exploiting Chamberlain (1984) results, the part of labour productivity orthogonal to auxiliary variables is computed as the ordinary least squares residuals of the projection of labour productivity growth on each of the steady state or initial condition proxies. In both conditional and club convergence cases, long-run tendencies are evaluated through the corresponding ergodic distribution.

Finally, the following steps are taken for assessing the three distinct convergence predictions. First, evaluate absolute convergence. This is done by analysing the sector-specific ergodic distribution, as estimated via unconditioned stochastic kernel. If such a distribution is multipeaked and highly dispersed, absolute convergence is discharged and conditional convergence assessed. Second, evaluate conditional convergence through the erogodic obtained from the stochastic kernel conditioned to steady state proxies (i.e. physical and human investment rates and the development dummy). Then, by the same tokens as before, if conditional convergence is discharged, club convergence is claimed. Third, assess whether the resulting clubs originate from insufficient capital accumulation or from a lack of technological catch-up. In this case, the set of auxiliary variables comprises not only the steady state indicators but also initial conditions’ variables.

To conclude, it is worth noticing that the reliability of the kernel density estimations presented in this paper has been checked through a number of statistical inference routines. In particular, for each convergence hypothesis and for all manufacturing sectors under scrutiny, following Fiorio (2004), the asymptotic 95 % confidence intervals for kernel density estimation have been calculated, employing Silverman’s optimal bandwith.Footnote 14 Moreover, the number of modes of the estimated kernel densities as well as their values has been assessed following the ASH-WARPing procedure, Scott (1992) and Haerdle (1991), and finally, the nonparametric assessment of multimodality has been done through the Silverman test, Silverman (1981). Full details on the inference procedures employed can be found in the Appendix on Distribution Dynamics, section “Statistical Inference”.

3 Results

The key result of the present analysis is twofold. First, absolute convergence is found in manufacturing as a whole (i.e. TOT). Second, convergence tendencies are sector specific. More precisely, technological initial conditions are found to be the club determinants in Resource Based (i.e. RB); differences in physical capital stock drive the result in Low Technology (i.e. LT); the dynamics of Medium Technology (i.e. MT) is less clear cut and both technological and capital initial conditions seem to matter; and finally, High Technology (i.e. HT) is predicted to converge in absolute sense. This evidence can be retrieved from Fig. 1, which depicts sector-specific ergodic distributions under alternative convergence hypotheses and by Table 3, which reports the support of labour productivity distribution in 1996 purchasing power parity dollars (i.e. PPP) together with some descriptive statistics.Footnote 15 Table 4 reports, for each convergence hypothesis and for all manufacturing sectors under scrutiny, Silverman’s optimal bandwith and the results of the ASH-WARPing procedure for the number and values of the modes as well as the Silverman test for multimodality. The results of the aforementioned inference routines confirm the reliability of the kernel estimations here presented.Footnote 16

For the sake of clarity, the discussion of the aforementioned findings is organized in subsections.

3.1 Absolute convergence in manufacturing

Consistently with the recent evidence provided by Rodrik (2013) and Benetrix et al. (2012), manufacturing as a whole is found to converge in absolute terms. More in details, Bernard and Jones (1996a), Dollar and Wolff (1988, 1993) and Dal Bianco (2010b) show that the aggregate converges faster than its parts, because the cross-sectional dispersion is lower for the aggregate than for the parts. Looking to the coefficients of variations under the absolute convergence hypothesis reported in Table 3, it could be seen that this kind of explanation holds also in the present case.Footnote 17 Further, it is worth noticing that the similar patterns of HT and TOT cannot be automatically interpreted as if the technology-intense compartments were leading the whole industrial performance. In fact, if on the one hand it is true that, in the period considered, HT has grown faster than all the other sectors (i.e. 8 vs 4 % on average); on the other, HT accounts for only the 12 % of total manufacturing production.Footnote 18

3.2 Conditional convergence

The present analysis does not provide supportive evidence for the conditional convergence hypothesis in any of the sectors considered. This finding can be interpreted in the light of the established literature. Basile (2009) and Bandyopadhyay (2006) show, employing regional series, that the process of economic growth is characterized by nonlinearities. Fiaschi and Lavezzi (2003) and Quah (1996a) reach the same result using national data. More in detail, these studies demonstrate that structural factors, although relevant for enhancing the level of labour productivity in each region or country and thus the cross-sectional average, are unable to affect the dynamics of the entire distribution. In other words, the predictions of the standard neoclassical growth model are rejected in favour of the ones of critical thresholds or poverty traps, Azariadis and Stachurski (2005). Looking to (a)–(c) in Fig. 1 and to Table 3, it is easy to see that the same evidence is found here. In fact, when steady states differences are taken into account, the location of the ergodic distributions of RB, LT and MT shift towards higher values, with some countries overtaking the leader (i.e. log-relative productivity greater than zero), but such distributions are not characterized by unimodality and low dispersion.

3.3 Capital and technology predicted dynamics

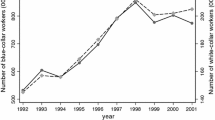

Before getting into the details of sector-specific convergence tendencies, which are depicted in Fig. 1 and 2, it is worth showing that labour productivity convergence tendencies are consistent with the predicted dynamics of capital stock and technological proxy. This is in the spirit of the theoretical works of Jones (1995) and Eicher and Turnovsky (1999), which have demonstrated that capital and technology might differ strikingly in their convergence paths and speeds, and of Feyer (2008) and Johnson (2005), who found that TFP and capital stock behaviour shapes the long-run distribution of labour productivity.

Figures 3 and 4 report, respectively, the ergodic distributions of physical capital stock per worker and the interacted TFPgap, while Table 5 synthetically offers the main lines for interpreting this evidence. Starting from HT and TOT, (d) and (e) of Figs. 3 and 4 show that both capital and technology are predicted to converge in the long run. This makes club convergence quite unlikely. On the contrary, passing to LT and then to panel (b) of the same graphs, it is evident that the ergodic distribution of capital stock is bimodal while the technology one is not. So that, one might expect that capital stock would be the key determinant of club convergence in LT. Or, put in other terms, that cross-country convergence will be reached only if capital stock differences will be evened out. By the same tokens, technological clubs in RB and MT can be inferred from panels (a) and (c) of the aforementioned figures.

3.4 Sector-specific convergence: intra-sectoral dynamics

Passing now to the analysis of sector-specific convergence tendencies, manufacturing compartments will be ordered from the less to the most technology intense (i.e. from Resource Based to High Technology). In particular, the discussion will refer to the evidence provided by Table 3 and Fig. 1, which depicts the predicted long-run scenarios in all the manufacturing sectors under scrutiny. This way of presenting the results allows to make some considerations about the growth-inequality trade-off arising from alternative convergence predictions within the same sector.

As mentioned, it has been found supportive evidence of “technological club convergence” in Resource-Based sectors. This means that dissimilar structural characteristics and technological initial conditions prevent cross-country convergence.Footnote 19 This result is in line with the ones of Jones (1997) who, employing a panel of 74 developed and developing countries between 1980 and 1990, found that GDP per capita long-run distribution will exhibit convergence behaviour only if technological differences will be evened out. As for how the technological proxy was constructed (i.e. interacted TFPgap), the lack of technological catch-up might be due either to a limited in scope imitative potential and to insufficient absorptive capabilities. With these respects, it is interesting to note that, in the last 30 years, multinational corporations (i.e. MNCs) have been investing mainly in High-Tech and Low-Tech sectors and that Resource-Based productions became increasingly more mechanized.Footnote 20 Thus, on the one hand, as suggested by Lall (2001), limited MNCs investments in traditional sectors, which still account for the 77 % of developing countries’ manufacturing value added,Footnote 21 might have made the relevant frontier technology, in the sense put forward by Baumol (1986), quite stagnant and this might have lowered the potential for technological upgrading. But, on the other, following the argument of Cohen (1996), developing countries’ technical backwardness might be due to their poor endowment of knowledge or, sharing the view of Comin et al. (2008), to some lags in technology usage. Finally, that in RB compartments, technological initial conditions are relatively more important, from the growth-equity perspective, than the ones related to physical capital stock is indirectly demonstrated by Table 3. Here it could be seen that the predicted average labour productivity under technological club convergence lies between the one of conditional and capital club convergence. Thus, on the one hand, the higher the technological gap (i.e. under conditional convergence), the faster the growth, and on the other, further accumulation of capital (i.e. capital club convergence) is not associated neither with growth nor with a less dispersed distribution.

Turning now to Low-Technology manufactures, the result of capital club convergence might have been expected, considering both the characteristics of the sector and the established literature. First of all, Lall (2000, 2001) document that LT industries employ mature technologies, which use is widespread by definition. Then, Boheim et al. (2000) show that LT production has shrunk very fast in developed countries, between 1989 and 1997. And so have done the innovative activities. From developing countries’ perspective, these facts imply that the imitative potential in LT is very low. Further evidence on the tiny technological gap in LT is provided by Dollar and Wolff (1988) and Carree et al. (2000). Overall, they analyse OECD countries from the early 1980s until the late 1990s and they found that, thanks to low knowledge barriers, the convergence process has been comparatively very fast in these industries.Footnote 22 It is also interesting to note that the predicted average labour productivity associated with technological club convergence is well below the one related to capital club convergence, see Table 3. This latter finding shows that not only cross-country convergence but also the growth potential is related to the scale of production in these industries. Thus, if a laggard economy is willing to catch-up in LT, it should invest in physical capital.

For what concerns Medium-Technology manufactures, the findings here presented are indicative of club convergence but in this sub-sector, both capital and technological initial conditions seem to matter. In fact, if on the one hand, technological differences seem to drive the club convergence result (i.e. Figs. 3, 4c), and on the other, nor capital or technological differences alone can ensure cross-country convergence (i.e. Fig. 1c). Moreover, conditional convergence must be discharged, although an almost unimodal ergodic distribution, on the basis of an increasing cross-sectional dispersion with respect to the absolute convergence case. See Table 3 for details. From the theoretical perspective, these results support the thesis of Aghion and Howitt (1998), according to which capital accumulation and innovation can be complementary for long-run growth. It is interesting that, employing US and UK data, they show that R&D intense industry have an above average capital intensity. Thus, innovation goes together with accumulation. In conclusion, as MT industries have complex technical requirements and demand for large-scale production, developing countries’ productivity gap in these compartments will shrink once both the technological and capital gap will be closed. Consistently with this line of explanation, the statistics reported in Table 5 show that laggard economies’ MT sectors are the ones with the lowest capital stock and quite a wide TFPgap.

Turning now to High Technology, it is evident from (d) of Fig. 1 that these industries are predicted to converge in the absolute sense. That is, in the long run, countries will converge to the same productivity level, regardless their structural characteristics and initial conditions.Footnote 23 This result provides supportive evidence for the theory of dynamic or endogenous comparative advantages. Paraphrasing Redding (1999), dynamic comparative advantages are related to entering sectors where an economy currently lacks a comparative advantage, but may acquire it as a result of the potential for productivity growth, which is due to self-reinforcing mechanisms driven by country and sector- specific external economies. As a matter of facts, developing countries are historically characterized by comparative advantages in traditional sectors. Nonetheless, according to World Bank’s data, their high-technology exports to manufacturing exports ratio has reached in 2007 the level of advanced economies’, which was around one fifth.Footnote 24 Moreover, as previously mentioned, UNCTAD (2005) shows that top 50 world multinational corporations have been heavily investing in HT sectors, both in advanced and laggard economies. Finally, Doucouliagos et al. (2010) and Bruno and Campos Ferreira (2011) have recently found that foreign direct investment is a major source of knowledge spillover. Thus, as predicted by the models of Lucas (1988) and Young (1991), the most technologically progressive industries open the “right” specialization pattern, which allows the rise of long-run growth rate and then labour productivity convergence.

Moreover, this finding is in line with the established empirical evidence. Redding (2002) employs distribution dynamics for analysing the specialization dynamics in OECD’s manufacturing industries. He finds that there has been a secular decline in low-tech industries and a secular rise in high-tech ones and that there is a substantial mobility in the patterns of specialization, although with no evidence of production’s concentration in few compartments. This result is further qualified by Brasili et al. (1999), who tackle the same issue employing the same nonparametric tools and adding emerging South Asian countries into the picture.Footnote 25 Interestingly, they show that emerging economies’ specialization pattern is highly mobile and that their production concentration is higher than the one of advanced economies. Thus, (successful) laggard countries seem to have shaped their specialization patterns on the basis of the inter-relationship between international trade and the rates of technological change, as in Krugman (1987) and Lucas Lucas (1988), rather than on static comparative advantages linked to factor endowments or domestic technology.

3.5 Sector-specific convergence: inter-sectoral dynamics

The comparison of predicted inter-sectoral dynamics hinges upon the evidence provided in Table 3 and Fig. 2. This way of presenting the results allows to make some considerations about the growth-inequality trade-off arising from the comparison of different manufacturing compartments. Looking to the table and to panel (a), which depicts sector-specific long-run scenarios without conditioning factors, it could be seen that the highest cross-sectional mean and the lowest dispersion are associated with High Technology. The most interesting point is that this result is reached without any coeteris paribus condition. This means that cross-country labour productivity differences in HT are just transitory. Panel (b) instead shows that, when sector-specific convergence hypothesis is fulfilled, Resource- Based sectors are the ones that open the better prospects: highest mean income and lowest dispersion. Conditional to smoothing out technological differences, this result might be interpreted in the light of the results of Redding (2002), who found that the patterns of trade and international competitiveness in traditional sectors are shaped, in the long-run, by factor endowments rather than external economies. Finally, when comparing the scenarios with the highest intra-sectoral mean, as in panel (c), it could be seen that, again, HT industries ensure the better combination in terms of long-run labour productivity and cross-sectional dispersion.

Overall, these findings support the hypothesis of Lall (1997) according to which High-Tech compartments ensure the highest productivity gains. This is because in HT sectors even labour- intensive activities, such as assembly, are more stable, skill creating and positive externality generating than in traditional ones. Moreover, although as stated by Singh (2006) developing countries might have acted just as MNCs’ outdoor plants assembling foreign intermediates and re-exporting them, Chandra and Kolavalli (2006) show that thanks to proper industrial policy, aimed at developing local capabilities, emerging economies can progress beyond the assembly of imported components.

4 Conclusions and policy recommendations

This paper has employed distribution dynamics for assessing cross-country labour productivity convergence in manufacturing sectors, characterized by different R&D intensities, between 1980 and 1995. In particular, 15 developed and 13 developing countries have been chosen on the basis of data availability and reliability. The time period, instead, has been selected because in the 1980s laggard economies’ industrial growth was particularly high, and thus, convergence tendencies should have eventually arisen. In fact, the majority of emerging countries entered world’s manufactures market and, in particular, higher value-added forms of production. As for these facts, it is extremely important to distinguish between Low and high-tech productions, and thus, Lall (2000) technological taxonomy has been adopted.

The key result of the present study is twofold: first, manufacturing as a whole is found to converge in the absolute sense, and second, convergence tendencies are sector specific. The first result is consistent with the recent evidence provided by Rodrik (2013) and Benetrix et al. (2012) while, with respect to the second finding, club convergence characterizes three out of the four identified sub-sectors (i.e. Resource Based, Low Technology and Medium Technology) and absolute convergence qualifies only High Tech.

Overall, the present findings provide support to the thesis put forward by Rodrik (2013) in order to explain the lack of cross-country labour productivity convergence. According to Rodrik (2013), in fact, the successful path of cross-country labour productivity convergence might be hindered by the sub-optimal “speed of structural reallocation from nonconvergence to convergence activities”.

For what concerns the sector-specific policy implications, as for the clustering dynamics in traditional and medium-tech sectors, there seems to be room for ad hoc catching-up strategies. In particular, for what concerns traditional and medium-technology sectors, the prediction of club convergence implies that emerging economies will be stuck at low labour productivity levels in the long run. Thus, developing countries should, first of all, align physical and human capital investment rates with the ones of developed economies. Then, they should foster technological transfer in Resource-Based compartments, increase the scale of Low-Tech productions and combine both strategies in Medium-Technology industries. The story is different for High Technology. As this compartment is predicted to converge in the absolute sense, the present analysis supports the theory of dynamic comparative advantages. These are related to entering sectors where an economy currently lacks a comparative advantage, but may acquire it as a result of the potential for productivity growth, which is due to self-reinforcing mechanisms driven by country and sector-specific external economies. So that, the most technologically progressive industries seem to open the “right” specialization pattern. Moreover, the study has also shown that in the long-run high-tech compartments not only ensure the lower labour productivity cross-sectional dispersion but also the highest mean. Thus, the key policy recommendation for laggard economies is to enter into technology-intense markets and to develop the necessary capabilities for exploiting the endogenous comparative advantages.

To conclude, it would be important to check for the robustness of these results employing a larger cross section of countries and a longer time span. This is left for the future research.

Notes

For an exhaustive review on the different convergence hypotheses and the so-called controversy on convergence, in its theoretical foundations and empirical assessments, see the articles of Durlauf (1996), Bernard and Jones (1996b), Galor (1996), Quah (1996b) and Sala-i Martin (1996), all collected in The Economic Journal Vol. 106, No. 437.

It might be useful to know that the larger time-series and cross-sectional dimensions which characterize Dal Bianco (2010b) is due to the choice of relying on investment rates in physical capital (i.e. gross fixed capital formation to manufacturing value-added ratio) rather than on the estimation of physical capital stock, which is a data-thirsty process. See Data Appendix and next paragraph’s discussion for further details.

The inclusion of the development stage dummy is inspired by Quah (1996a), which includes a dummy for Africa in its cross-sectional analysis. The underlying idea being the attempt of purging out some common but time-invariant factors that characterize laggard countries.

Gemmell (1996) shows that economic growth in middle-income countries, which are well represented in the sample here considered, is strongly related to secondary rather than to primary and tertiary education.

In particular, Lall (2000) technological taxonomy was originally developed employing the Standard International Trade Classification (i.e. SITC) (Revision 2). Thanks to Eurostat tables, which put in correspondence ISIC Revision 2 with ISIC Revision 3, SITC Revision 2 with SITC Revision 3 and, finally, SITC Revision 3 with ISIC Revision 3, is then possible to obtain a 1-to-1 relation between UNIDO data and Lall’s manufacturing sectors.

See Rodrik (2013, p. 184) for details.

See the Data Appendix for further details on the variables employed.

Stochastic kernels were estimated through STATA and MATLAB. All programs are available from the author upon request.

To save some space, the corresponding figures have not been reported but they are available upon request.

Due to space reasons, sector-specific conditional density functions estimated through stochastic kernels are not reported. They are all available in the working paper version of the present work: Dal Bianco (2010a), Figures 3–16.

As tests’ results reported in Table 4 are clear cut, they will not be commented further. The interested reader can refer for more details to the section on Statistical inference of the Appendix on distribution dynamics.

The coefficient of variation (i.e. standard deviation divided by the mean) is the preferred measure of cross-sectional dispersion because this indicator overcomes the problems related to a changing mean.

Author’s calculations based on INDSTAT3, UNIDO Industrial Statistics Database 2004.

More formally, technological (capital) club convergence result refers to the stochastic kernel conditioned to steady state variables and initial technology (physical capital).

UNCTAD (2005, 2001) show that top 50 world MNCs have been investing in High-Technology industries, while top 50 developing countries’ MNCs, 33 of which are from South Asia, operate in Low-Technology and service sectors. United Nations Food and Agricultural Organization (i.e. FAO) documents, instead, the mechanization of farm product processing, FAO (2006).

Author’s calculations based on UNIDO Industrial Statistics Database 2004.

More precisely Dollar and Wolff (1988) study 13 industrialized countries from 1963 to 1982, distinguishing manufacturing industries into “heavy, medium and light”, while Carree et al. (2000) analyse manufacturing sectors in 28 OECD economies, in the period 1972–1992, employing the ISIC 3-digits classification.

To confirm the robustness of absolute convergence prediction, HT labour productivity distributions conditioned to steady state proxies alone and together with capital or technological initial conditions have been used as counterfactuals. As these ergodics are multipeaked, the absolute convergence prediction is validated. For space reasons, these results are not reported, but they are available upon request.

Author’s calculations based on World Bank, World Development Indicators 2010.

More precisely, Brasili et al. (1999) investigate the dynamics of trade patterns of the six largest industrialized countries (i.e. France, Germany, Italy, Japan, UK and USA) and of the old and new Asian Tigers (i.e. Hong Kong, Singapore, South Korea and Taiwan; Indonesia, Malaysia, Philippines and Thailand).

Although new versions of the PWT have been released, the current exercise relies on PWT 6.1, in order to employ the most robust real GDP estimates in the present context. As recently demonstrated by Johnson et al. (2013), different PWT releases provide different real GDP estimates, despite being derived from very similar underlying data and methodologies. In particular, such a variability is greater the farther the estimate from the benchmark year, at higher data frequencies and for smaller countries. Following this argument, as the data availability is very limited in terms of frequency and country coverage, the robustness of the present exercise can be improved only selecting the closest benchmark year, which is 1996 and it corresponds to PWT 6.1.

Exact literally means that the resulting index is not an approximation. For details, see Diewert (1976) and its result on the use of Tornqvist-Theil approximation to the Divisia index. Flexible is an aggregator function that can provide a second-order approximation to an arbitrary twice differentiable linearly homogeneous function.

This notation implies that only one homogeneous output is produced using only one homogeneous input. For further details on productivity measurement in this simple and more complex environments (i.e. multiple output-multiple input technologies), see Diewert (1992).

This reduced form directly comes from the translog production function with constant returns to scale hypothesis.

The results of the aforementioned tests are not reported but they are available upon request.

Please note that in what follows ‘relative labour productivity’ and ‘labour productivity’ are used interchangeably.

Bivariate stochastic kernel estimation is performed using the command kdens2 in STATA 12. Marginal, conditional and ergodic distributions are calculated in MATLAB. All programs are available from the author upon request.

To avoid crude ergodic calculations, it is necessary to work with a sufficiently high \(N\). The present calculations have been done for \(\hbox {N}=50\). Using \(\hbox {N}=200\) does not alter any conclusions, but it has the disadvantage of slowing down computer’s routines.

This constraint must hold for the definition of probability

As Quah (1996a) explains, this technique exploits the cross-sectional variation of conditioning variables to compute the initial value of productivity explained steady state proxies.

All the mentioned test have been carried using the statistical software STATA.12

In this case, the STATA command “bandw” has been employed.

The STATA routine employed is called “asciker”.

The STATA routine here employed is called “warpdenm”. It is worth recalling that, following Haerdle (1991), the number of averaged shifted histograms used to calculate the required density estimations has been set to 10 and that the Gaussian kernel has been chosen as weight function, i.e. mval(10) and k(6).

The bootstrapped samples have been generated using the STATA command “boot bootsam”, where the routine has been iterated for 50 times and the Silverman optimal bandwith has been used; the Silverman test has been carried employing “silvtest” for an increasing number of modes, and it has stopped following the previously mentioned rule of thumb.

References

Aghion P, Howitt P (1998) Capital accumulation and innovation as complementary factors in long-run growth. J Econ Growth 3(2):111–130

Amsden AH (1989) Asia’s next giant: South Korea and late industrialization. Oxford University Press, Oxford

Arslanalp S, Bornhorst F, Gupta S, Sze E (2010) Public capital and growth. IMF Working Paper, WP/10/175

Azariadis C, Drazen A (1990) Threshold externalities in economic development. Q J Econ 105(2):501–526

Azariadis C, Stachurski J (2005) Poverty Traps. In: Aghion P, Durlauf SN (eds) Handbook of economic growth, 1st edn, vol 1, chap 5. Elsevier

Bandyopadhyay S (2006) Rich states, poor states: convergence and polarisation in India. Oxford discussion papers, 266

Barro RJ (1991) Economic growth in a cross-section of countries. Q J Econ 106(2):407–443

Barro RJ, Lee JW (2013) A new data set of educational attainment in the world, 19502010. J Dev Econ 104:184–198

Basile R (2009) Productivity polarization across regions in Europe: the role of nonlinearities and spatial dependence. Int Reg Sci Rev 31:92–115

Baumol W (1986) Productivity growth, convergence and welfare: what the long run data show. Am Econ Rev 76(5):1072–1085

Benetrix AS, O’Rourke KH, Williamson JG (2012) The spread of manufacturing to the periphery 1870–2007: eight stylized facts. NBER working paper no 18221

Bennell P (1996) Rates of return to education: Does the conventional pattern prevail in sub-Saharan Africa? World Dev 24(1):183–199

Bernard A, Jones C (1996a) Comparing apples to oranges: productivity convergence and measurement across indutries and countries. Am Econ Rev 86(5):1216–1238

Bernard A, Jones C (1996b) Technology and convergence. Econ J 106:1037–1044

Bloom D, Canning D, Sevilla J (2003) Geography and poverty traps. J Econ Growth 8(4):355–378

Boheim M, Pfaffermayr M, Gugler K (2000) Do growth rates differ in European manufacturing industries. Austrain Econ Q 2:93–104

Brasili A, Epifani P, Helg R (1999) On the dynamics of trade patterns. Liuc papers n. 61, Serie Economia e Impresa, 18

Broadberry S (1993) Manufacturing and the convergence hypothesis: what the long-run data show. J Econ History 53(4):772–795

Bruno RL, Campos Ferreira N (2011) A systematic review of the effects of foreign direct investment on economic growth in low income countries. Mimeo, DFID

Carree MA, Klomp L, Thurik AL (2000) Productivity convergence in OECD manufacturing industries. Econ Lett 66:337–345

Caselli F (2005) Accounting for cross-country income differences. In: Aghion P, Durlauf S (eds) Handbook of economic growth 1st edn, vol 1, chap 5. Elsevier

Caselli F, Esquivel G, Fernando L (1996) Reopening the convergence debate: a new look at cross-country growth empirics. J Econ Growth 1:363–389

Caselli F, Wilson DJ (2004) Importing technology. J Monet Econ 51(1):1–32

Caves D (1982) Multilateral comparisons of output, input and productivity using superlative index numbers. Econ J 99:73–86

Caves D, Christensen L, Diewert E (1982) The economic theory of index numbers and the measurement of input, output and productivity. Econometrica 50(6):1393–1414

Chamberlain G (1984) Panel data. In: Hanbook of econometrics, vol 2, pp 1247–1318

Chandra V, Kolavalli S (2006) Chandra V (ed) Technology, adaptation, and exports: How some countries got it right, chapter 1 in technology, adaptation and exports. World Bank Publications, Washington

Cohen D (1996) Tests of the “convergence hypothesis”: some further results. J Econ Growth 1(3):351–361

Cohen WM, Levinthal DA (1989) Innovation and Learning: the two faces of R&D. Econ J 99(397):569–596

Cohen WM, Levinthal DA (1990) Absorptive capacity: a new perspective on learning and innovation. Adm Sci Q 35(1):128–152

Comin D, Hobijn B, Rovito E (2008) Technology usage lags. J Econ Growth 13(4):237–256

Dal Bianco S (2010a) Going clubbing in the eighties: convergence in manufacturing sectors at a glance. Quaderno di Dipartimento N.258, University of Pavia

Dal Bianco S (2010b) New evidence on classical and technological convergence in manufacturing. Rivista Italiana degli Economisti XV(2):305–336

Desdoigts A (1999) Patterns of economic development and the formation of clubs. J Econ Growth 4(3):305–330

Desmet K, Fafchamps M (2006) Employment concentration across US counties. Regional Science and Urban Economics 36:482–509

Diewert E (1976) Exact and superlative index numbers. J Econom 4(2):115–145

Diewert E (1992) Fisher ideal output, input, and productivity indexes revisited. J Product Anal 3:211–248

Dollar D, Wolff EN (1988) Convergence of industrial labour productivity among advanced economies, 1963–82. Rev Econ Stat 70:549–558

Dollar D, Wolff EN (1993) Competitiveness, convergence and international specialization. The MIT Press, Cambridge

Doucouliagos H, Iamsiraroj S, Ulubasoglu MA (2010) Foreign direct investment and economic growth: a real relationship or wishful thinking? Economics Series 2010 N.14, Deakin University

Durlauf SN (1993) Nonergodic economic growth. Rev Econ Stud 60(2):349–366

Durlauf SN (1996) On the convergence and divergence of growth rates. Econ J 106(437):1016–1018

Durlauf SN, Johnson PA (1995) Multiple regimes and cross-country growth behaviour. J Appl Econom 10:365–384

Durlauf SN, Johnson PA, Temple JR (2005) Growth econometrics. In: Aghion P, Durlauf SN (eds) Handbook of economic growth, vol 1A. North-Holland, Amsterdam, pp 555–677

Durlauf SN, Quah D (1999) The new empirics of economic growth. In: Taylor JB, Woodford M (eds) Handbook of macroeconomics, vol (1.A). North Holland Elsevier Science, Amsterdam

Eberhardt M, Teal F (2007) Extent and causes of global shifts in manufacturing. Background paper, Centre for the Study of African Economies, Oxford University

Eicher TS, Turnovsky SJ (1999) Convergence in a two-sector nonscale growth model. J Econ Growth 4(4):413–428

Epstein P, Howlett P, Schulze M-S (2003) Trade, convergence and globalisation: the dynamics of the international income distribution, 1950–1998. Explor Econ Hist 44(1):100–113

FAO (2006) Addressing the challenges facing agricultural mechanization input supply and farm product processing. Discussion paper

Feyer J (2008) Convergence by parts. BE J Macroecon 8(1):1935–1960. doi:10.2202/1935-1690.1646

Fiaschi D, Gianmoena L, Parenti A (2009) The dynamic of productivity across Italian Provinces from 1995 to 2006: convergence and polarization. University of Pisa, Mimeo

Fiaschi D, Lavezzi AM (2003) Distribution dynamics and nonlinear growth. J Econ Growth 8(4):379–401

Fiorio CV (2004) Confidence intervals for kernel density estimation. Stata J 4(2):168–179

Galor O (1996) Convergence? Inferences from theoretical models. Econ J 106:1056–1069

Gemmell N (1996) Evaluating the impacts of human capital stocks and accumulation on economic growth: some new evidence. Oxford B Econ Stat 58(1):9–28

Graham BS, Temple JRW (2006) Rich nations, poor nations: how much can multiple equilibria explain? J Econ Growth 11(1):5–41

Griffith R, Redding S, Van Reenen J (2004) Mapping the two faces of R&D: productivity growth in a panel of OECD industries. Rev Econ Stat 87:475–494

Haerdle W (1991) Smoothing techniques with implementationchap, vol 1-2. Springer, Berlin

Hall P (1992) Effect of bias estimation on convergence accuracy of bootstrap confidence intervals for a probability density. Ann Stat 20:675–694

Harrigan J (1997) Technology, factor supplies and international specialisation. Am Econ Rev 87:475–494

Harrison A, Rodrguez-Clare A (2009) Trade, foreign investment, and industrial policy for developing countries. NBER working paper no 15261

Hausmann R, Hwang J, Rodrik D (2006) What you export matters. CEPR discussion papers 5444

Islam N (2003) What have we learned from the convergence debate? J Econ Surv 17:309–362

Johnson PA (2005) A continuous state space approach to “Convergence by parts”. Econ Lett 86:317– 321

Johnson S, Larson W, Papageorgioud C, Subramaniane A (2013) Is newer better? Penn world table revisions and their impact on growth estimates. J Monet Econ 60(2):255–274

Jones CI (1995) R&D based models of economic growth. J Political Econ 103:759–784

Jones CI (1997) Convergence revisited. J Econ Growth 2(2):131–153

Krugman P (1987) The narrow moving band, the Dutch disease and the competitive consequences of Mrs Thatcher: notes on trade in presence of scale economies. J Dev Econ 27:41–55

Lall S (1997) Learning from the Asian tigers: studies in technology and industrial policy. Palgrave MacMillan, Basingstoke

Lall S (2000) The technological structure and performance of developing country manufactured exports, 1985–1998. Oxf Dev Stud 28(3):337–369

Lall S (2001) Competitiveness, technology and skills. Edward Elgar, Cheltenham

Lucas RJ (1988) On the mechanics of economic development. J Monet Econ 22:3–22

Luenberger DG (1979) Introduction to dynamic systems. Wiley, New York

Maffezzoli M (2006) Convergence across Italian regions and the role of technological catch-up. BE J Macroecon 1(1):1–15

Magrini S (2007) Analysing convergence through the distribution dynamics approach: Why and how? DSE working paper 13

McMillian M, Rodrik D (2011) Globalization, structural change and productivity grow. NBER working paper no 17143

Nehru V, Dhareshwar A (1993) A new database on physical capital stock: sources, methodology and results. Revista de Analisis Economico 8(1):37–59

Nelson RR, Winter SG (1982) An evolutionary theory of economic change. Harvard University Press, Cambridge

Owen AL, Videras J, Davis L (2009) Do all countries follow the same growth process? J Econ Growth 14:265–286

Pavitt K (1984) Sectoral patterns of technical change: towards a taxonomy and a theory. Res Policy 13:343–373

Quah D (1993) Galton’s fallacy and tests of the convergence hypothesis. Scand J Econ 95(4):427–443

Quah D (1996a) Convergence empirics across economies with (some) capital mobility. J Econ Growth 1:95–124

Quah D (1997) Empirics for growth and distribution: stratification, polarisation and convergence clubs. J Econ Growth 2(1):27–59

Quah DT (1996b) Twin peaks: growth and convergence in models of distribution dynamics. Econ J 106(437):1045–1055

Rajan RR, Zingales L (1998) Financial dependence and growth. Am Econ Rev 88(3):559–586

Redding S (1999) Dynamic comparative advantage and the welfare effects of trade. Oxf Econ Pap 51:15–39

Redding S (2002) Specialization dynamics. J Int Econ 58(2):299–334

Rodrik D (2013) Unconditional convergence in manufacturing. Q J Econ 128(1):165–204

Rogers M (2003) Knowledge, technological catch-up and economic growth. Edgward Elgar, Northampton

Sala-i Martin X (1996) The classical approach to convergence analysis. Econ J 106:1019–1036

Sala-I-Martin X, Doppelhofer G, Miller R (2004) Determinants of long-term growth: a Bayesian averaging of classical estimates (BACE) approach. Am Econ Rev 94(4):813–835

Salgado-Ugarte IH, Makoto S, Toru T (1995) Practical rules for bandwidth selection in univariate density estimation. Stata Tech Bull 27:5–19

Salgado-Ugarte IH, Shimizu M, Taniuchi T (1997) Nonparametric assessment of multimodality for univariate data. Stata Tech Bull 38:27–35

Scott DW (1992) Multivariate density estimation: theory, practice and visualization. Wiley, New York

Silverman BW (1981) Using kernel density estimates to investigate multimodality. J R Stat Soc Ser B 43(1):97–99

Silverman BW (1986) Density estimation for statistics and data analysis. Chapman & Hall, London

Sims CA (1972) Money, income, and causality. Am Econ Rev 62(4):540–552

Singh L (2006) Innovations, high-tech trade and industrial development. Theory, evidence and policy. UNU-wider research papers

Stockey NL, Lucas RE, Prescott EC (1989) Recursive methods in economic dynamics. Harvard University Press, Cambridge

UNCTAD (2001) Promoting linkages. Discussion paper

UNCTAD (2005) World investment report: TNCs and the internationalization of R&D. Discussion paper

UNIDO (1995) Industry and development. Global report. Discussion paper

UNIDO (2009) Industrial development report: breaking in and moving up: new industrial challenges for the bottom billion and the middle-income countries. Discussion paper

Vandenbussche J, Aghion P, Meghir C (2006) Growth, distance to frontier and composition of human capital. J Econ Growth 11:97–127

Wade R (1990) Governing the market: economic theory and the role of government in East Asian industrialization. Princeton University Press, Princeton

Young A (1991) Learning by doing and the dynamic effects of international trade. Q J Econ 106:396–406

Young A (1995) The tyranny of numbers: confronting the statistical realties of East Asian growth experience. Q J Econ 110(3):641–680

Acknowledgments

I would like to thank Carluccio Bianchi for invaluable guidance, Daniele Condorelli for helping all throughout the project, Danny Quah for helpful technical insights, Randolph Luca Bruno, Guido Ascari and all the participants to the 6th Conference on Growth and Development at ISI-Delhi for useful comments. Special thanks go to late Sanjaya Lall and Mark Rogers for encouragement and guidance. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendices

Data appendix

1.1 Labour productivity

This is the natural logarithm of relative labour productivity. Labour productivity is measured as manufacturing value added per worker in 1996 PPP dollars. Relative labour productivity consists in the natural logarithm of labour productivity in country i, sector j, at time t relative to the one of the USA (i.e. the leader) in the same sector and period, which is formally written as \(y_{ijt}=\hbox {log}(Y_{ijt}/Y_{USjt})\). Normalizing the data is important for removing some of the trend from the cross section and thus for avoiding degenerate long-run distributions. The choice of the normalizing variable was made following Quah (1996a) and Desmet and Fafchamps (2006), although other indicators could have been used (e.g. cross-country average, range, etc).

Sectoral relative labour productivity data were retrieved combining UNIDO Industrial Statistics Database 2004, at 3-digits of ISIC Code (Revision 2) (i.e. INDSTAT3), World Bank, World Development Indicators 2006 (i.e. WDI) and the Penn World Tables 2002 (i.e. PWT 6.1).Footnote 26

1.2 Steady state proxies

1.2.1 Log-relative sectoral investment rates in physical capital

They refer to the natural logarithm of gross fixed capital formation (i.e. GFCF) share to manufacturing value added in country i, sector j, at time t relative to the one of the USA. Relevant series come from the aforementioned UNIDO dataset.

1.2.2 Log-relative investment rates in human capital

They consist in the natural logarithm of the average years of schooling in the population over age 15 in country i at time t relative to the one of the USA. Data come from Barro and Lee (2013), which is the most up-to-date version of the well- acknowledged dataset. In particular, as original series are recorded at 5-year intervals, they were interpolated assuming a linear pattern. Moreover, population over 15 years was preferred to the one over 25 years because working age in developing countries can be quite low, Bennell (1996).

1.2.3 Development dummy

This is a dichotomous variable having as reference group the high-income economies, as defined in WDI.

1.3 Relevant initial conditions

1.3.1 Log-relative physical capital stock per worker

This is the natural logarithm of physical capital stock in country i, sector j, at time t relative to the one of the USA in the same sector and period, which is formally written as \(k_{ijt}=\hbox {log}(K_{ijt}/K_{USjt})\).

Since sectoral physical capital stock series are not available from international data sources, they were estimated applying to the UNIDO GFCF series the perpetual inventory method assuming an exponential depreciation rate of 6 %. This is a quite standard hypothesis, see, for example, Vandenbussche et al. (2006) and Jones (1997).

As customary in the literature (Vandenbussche et al. 2006; Caselli 2005 and Young 1995), initial capital stock was calculated employing the formula of steady state capital stock in the neoclassical growth model. Thus, initial capital stock is written as \(K_{t-1}=\frac{I_t}{g+0.06}\).

As UNIDO GFCF data start in 1960, \(g\) is the output growth rate in the first 5 years available (i.e. 1960–1965), \(K_{t-1}\) is the estimated capital stock in 1959 and \(I_t\) is the actual investment in 1960. Since the present econometric exercise begins in 1980, the measurement error on this initial value should have disappeared (Vandenbussche et al. 2006; Nehru and Dhareshwar 1993).

The estimated sectoral capital stock is denominated in 1996 PPP Dollars.

To conclude, it is important to make a note of caution on the use of the same depreciation rate of capital for different sectors and for different countries. That different levels of technological progress should imply also different levels of depreciation rates is well documented in the literature, see Arslanalp et al. (2010). Thus, as robustness checks, capital stock series were calculated employing a 4 % and a 15 % depreciation rate, respectively, used by Nehru and Dhareshwar (1993) and Caselli and Wilson (2004). The findings of the distribution dynamics exercise are qualitatively unaltered. The robustness checks are available upon request.

1.3.2 Interacted TFPgap

Following Griffith et al. (2004), sector- and year-specific TFPgap is calculated as the difference between leader’s TFP and the one of any other country, where TFP levels are obtained through the superlative index approach of Caves (1982) and Caves et al. (1982), see the Appendix on TFP estimation for full details. The natural logarithm of secondary schooling attainment rate in any country i normalized with respect to the one of United States serves, instead, as absorption capacity proxy.

Appendix on TFP estimation

Total factor productivity (TFP) or Solow residual is the part of output growth not accounted for market transactions. It originates from growth accounting exercise, and it is conventionally employed to measure technological progress. Following Diewert (1976), Caves et al. (1982) derive an index number that allows TFP comparisons among countries. This index is superlative, meaning that is exact for the flexible aggregator function chosen (i.e. translog production function), and transitive, so that the choice of base country and year is inconsequential.Footnote 27

Formally, it is assumed that value added of a generic country i is a function of capital stock and employment, that is translog with identical second-order term, that constant returns to scale apply and that inputs are measured perfectly and in the same units for each observation. In symbols:

where constant returns to scale hypothesis requires \(\alpha _{1i}+\alpha _{2i}=1\) and \(2\alpha _{3}+\alpha _{5}=2\alpha _{4}+\alpha _{5}=0\).

In this Appendix, Caves et al. (1982) contribution is reviewed beginning with TFP index number for bilateral comparisons.

There are two countries, b and c, country b is the basis of comparison and the distance function \(D_{c}(y_{b},l_{b},k_{b})\) represents the minimum proportional decrease in \(y_{b}\) such that the resulting output is producible with the inputs and productivity levels of c. Or \(D_{c}(y_{b},l_{b},k_{b})\) is the smallest input bundle capable of producing \(y_{b}\) using the technology in country c. In symbols:

where \(x_{b}=\left( k_{b},l_{b}\right) \).Footnote 28 Assuming that producers are cost minimizers and price takers in input markets, it can be shown that the Malmquist index (i.e. the geometric mean) of two distance functions for any two countries c and b gives the following TFP index:

where a bar denotes an average over countries and \(\sigma _i=\left( \alpha _{i}+\overline{\alpha }\right) /2\), where \((\alpha _{i})\) stands for labour’s share in total costs for country \(i\).

Similar reasoning can be applied to derive the multilateral version of TFP index, which allows for TFP comparisons among more than two countries. Taking sectoral heterogeneity explicitly into account, TFP level in country \(i\), sector \(j\) at time \(t\) is

where a bar denotes the geometric average over all countries for a given sector \(j\) and a year t and \({\tilde{\sigma }_{i j t}}=(\alpha _{ijt}+\overline{\alpha _{j}})/2\), where \({\alpha _{ijt}}\) is labour share in country i and industry j and \(\overline{\alpha _{j}}\) is the cross-country average for industry j.

Then, taking natural logarithms, the previous expression becomes:

As originally noticed by Harrigan (1997), the variability in actual labour shares over value added makes difficult the empirical implementation of the equation above. To solve this problem, smoothed and not actual labour shares are usually employed.

Smoothed labour shares are simply obtained running a regression of actual labour shares on a constant and the capital to labour ratio:Footnote 29

Previous studies on developed countries, such as Harrigan (1997) and Griffith et al. (2004), consider only sectoral heterogeneity in slopes (i.e. \(\chi _{j}\)). As the sample of countries employed in the current contribution comprises developing countries, the original specification has been improved allowing for country and sector heterogeneity in both intercepts and slopes (i.e. \(\xi _{i}\), \(\xi _{j}\) and \(\chi _{ij}\)). In particular, to avoid a major loss in data variability, due to many dummies, manufacturing sectors have been grouped as according to Lall’s taxonomy and the sampled economies have been divided into developed and developing ones, using World Bank definitions. The diagnostics employed strongly reject the null hypothesis of nonheterogeneity in both intercepts and slopes among different sectors and countries. More precisely, using panel data F tests, intercept heterogeneity due to country and sector-fixed effects has been detected. Sector and country heterogeneity, in both slope and intercepts, has been confirmed through Chow type F statistics.Footnote 30

Appendix on distribution dynamics

1.1 Distribution dynamics and conditioning: a brief nontechnical summary

When distribution dynamics is employed, convergence tendencies among countries can be retrieved analysing the evolution along time of cross-country labour productivity distribution. In particular, the main question to be answered is whether all economies considered converge to same level of labour productivity, such that the cross-country distribution is single-peaked, or whether the economies converge only within small clubs, such that the distribution exhibits more than one peak.

Operatively, the changes along time of cross-country labour productivity distribution are retrieved using the stochastic kernel density estimator. In fact, this estimator allows to measure the probabilities of dynamic transitions from one labour productivity class to another, for each economy.

Intuitively, the stochastic kernel can be thought as a refinement of the histogram. In particular, while in histogram the frequency distribution is calculated for disjoint states, with kernel density estimator, the frequency distribution is estimated for a large number of overlapping class intervals, which gives a much smoother appearance, resembling a probability density function.

Two are the types of kernels employed in this paper:

-

1.

unconditioned kernels

-

2.

conditioned kernels

The unconditioned kernels give information on the likelihood that an economy, starting from a given relative position in the initial period \(t\), will end up improving or worsening its relative position in the final period \(t+s\). In other words, it can be said that unconditioned kernels measure the transition probabilities from \(t\) to \(t+s\).

Unconditioned kernels are used here to test the absolute convergence hypothesis.

Conditioned kernels are an extension of unconditioned ones. In particular, they allow to identify the factors that eventually lead club convergence dynamics. The effects of conditioning are identified by changes in shape and location of the kernel, with respect to the unconditioned case.

Conditioned kernels are here employed for testing both conditional convergence hypothesis and club convergence determinants.

In the case of conditional convergence, for example, if the unconditioned kernel shows twin-peaks feature and, after conditioning with respect to steady state proxies, it is found that the conditioned kernel is single-peaked, then it can be said that club dynamics is lead by structural differences and that conditional converge hypothesis is not rejected.

1.2 Unconditioned transition probability estimates

This section provides a technical illustration of the methodology employed to estimate unconditioned transition probabilities, which are used to test the absolute convergence hypothesis.

Sectoral convergence tendencies are inferred analysing the dynamic behaviour of cross-country distribution of log-relative labour productivity.Footnote 31

Individual country \(i\) labour productivity, in sector \(j\), at time \(t\) is called \(y_{it}\), where the sector index has been omitted for notational convenience (i.e. \(y_{it}=log(Y_{ijt}/Y_{USjt})\)). Cross- country, sector-specific, labour productivity distribution, at time \(t\), is denoted as \(f_{Y_t}(y_t)\), where \(Y_t\) indicates the corresponding random variable.

It is assumed that year-to-year changes in the distribution of labour productivity can be represented by an homogeneous Markow process, in such a way that, \(\forall t\):

-

1.

\(f_{Y_{t+1}|Y_t}(y_{t+1}|y_t)=f_{Y_{t+1}|Y_t}(y_{t+1}| y_t,y_{t-1},y_{t-2},...)\)

-

2.

\(f_{Y_{t+1}|Y_t}(y_{t+1}|y_t)=f_{Y_t|Y_{t-1}}(y_{t}|y_{t-1})\)

The first property guarantees that only previous period income distribution impacts on next period one (i.e. history does not matter). The homogeneity assumption in 2 ensures that the transition probabilities do not vary with time. Although quite restrictive, both hypotheses are necessary for estimating long-run transition probabilities given the available data.

Conditional density functions, \(f_{Y_{t+1}|Y_t}(y_{t+1}|y_{t})\), represent the cornerstone of distribution dynamics convergence analysis. This kind of distribution, in fact, encodes information about individual economies’ passages over time. Thus, it sheds light on both intra-distribution dynamics and external shapes, making inference about convergence tendencies possible. For example, observing conditional density mappings, is it possible to know whether poor countries are catching up with their richer counterparts, whether rich countries are still enriching, whether countries are converging overall or are clustering within clubs.

The empirical estimation of conditional densities is handled by nonparametric techniques. To begin, it is worth to recall the definition of conditional distribution, that is the joint distribution divided by the marginal distribution. In formal terms:

The joint distribution of \((Y_{t+1}, Y_{t})\) can be estimated nonparametrically using a bivariate stochastic kernel, while the marginal distribution of \(Y_{t}\) is obtained by numerical integration of the joint distribution. Finally, the conditional distribution is simply obtained by dividing one to the other, after appropriate discretization of the joint support.Footnote 32