Abstract

By integrating the literature on urban specialization and externalities, this paper proposes that the industrial sector is likely to reduce regional inequality between core cities and surrounding small and medium-sized cities through its effects on city size, while core cities that focus on these advanced producer services (APS) contribute to greater regional inequality. The mechanisms by which the industrial sector influences regional inequality are examined using China’s regional systems. The results support the hypothesis that large core cities with a high concentration of manufacturing reduce regional inequality through positive local spillover effects. On the other hand, cities with a high concentration of high value-added services have lower spillover effects, which in turn increases regional inequality.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Problems of spatial inequality have long been of interest to economists and geographers (Achten and Lessmann 2020). Focusing on specific regions, the centre-periphery model was developed to explain spatial inequalities (Krugman 1998; Klimczuk and Klimczuk-Kochańska 2019). In empirical studies, the differences between the centre and the periphery have largely crystallized as an urban–rural divide. Moreover, both Kuznets (1955) and Krugman (1998) have emphasized the crucial role of competition between the agricultural and industrial sectors of the economy for the urban–rural divide in the process of industrialization. Therefore, regional inequality is typically conceptualized as urban versus rural and industrial versus agricultural, especially in developing countries such as China (Kanbur and Venables 2005; Hill 2021; Gao et al. 2022). Wei (2015) argued that unlike the USA, where inequality between cities is the main issue, regional inequality in Asia is mainly between rural and urban areas. However, we believe that the issue of regional inequality at the urban level should also be taken seriously, for developing countries. On the one hand, the differences between cities within regions in developed countries such as the USA are not well understood. This is partly due to the fact that the field of urban and regional economics is independent. Kim (2008) noted that it is extremely difficult to develop a unified theoretical framework for regions and cities in a satisfactory manner. Regional and urban inequality are considered as two separate phenomena. On the other hand, developing countries, including China, have experienced rapid urbanisation since the twenty-first century. Today, more than half of Southeast Asia's population livesin ASEAN cities (Sharif 2022), and in China it is almost 65%. This figure is expected to reach 3.9 billion by 2030 and 5 billion by 2050 (Montgomery 2008). There is no historical parallel for the emergence of hundreds of large cities and the development of urban agglomerations. With the increasing degree of urbanisation, differences between cities have become an important dimension of regional inequality (Beauregard 2018).

Another point that needs to be clarified is that inequality in this study refers to differences in city size. Unequal income distribution is a traditional topic on which there is much important literature in the study of spatial inequality (Rey 2004; Sun et al. 2017; Khan and Siddique 2021). In addition, industrial locations, technological innovation, urban infrastructure and amenities, and environmental health, which have emerged in recent years, have also attracted much attention (Rodríguez-Pose and Storper 2020; Du et al. 2022; Wang and Zhu 2020). The study will shed light on the spatial inequality of city size within regions and especially between core cities and their neighboring cities. Although Krugman’s theoretical model assumes that the peripheral regions are a homogeneous rural area, in reality the periphery also consists of numerous cities of different sizes. Especially in a period of urban dominance, the difference in size between the populous core city and the many smaller cities that surround it is striking in the regional system. More importantly, the size of cities matters. Regardless of whether it is the global city defined by Sassen (2013) or city networks, as Meijers et al. (2012) emphasized, the cities that occupy a central position are always cities with a large population. Such size not only attracts more market investment and skilled labour, etc., but also receives priority and greater support from higher levels of government such as the federal and state governments in terms of public investment in transportation infrastructure and development policies (Maxwell 2019; Duranton and Pugal 2001; Shen et al. 2019). In some Asian countries, where government investment is the main driver of economic growth, this inequality in public investment and facilities has even more far-reaching implications due to differences in the size of cities. Venables (2005, p. 4) also writes: “If a country’s spatial structures are wrong, this can reduce the returns to modern sector investment and thus impair long-term growth”. The differences in size between cities and their spatial distribution determine the spatial structure of a region.The mechanisms of the emergence and development of regional inequalities in size differences between such central and peripheral cities remain unclear. Studies have shown that spatial agglomeration leads to inequalities between central and peripheral cities or developed and backward regions (Li and Sun 2020; Zhao et al. 2022; Farrokhi 2021), but the concentration of resources in large cities does not always lead to a highly polarised regional urban system. Storper (2013) argues that European urban systems are more regionally balanced between large and medium-sized cities than the US urban system. The literature has shown that industrial heterogeneity influences the size of the city itself (Au and Henderson 2006; Hong et al. 2020). Given the strong industrial linkages between cities, this study extends the effects of industrial heterogeneity on city size to cities between cities. We will shed light on the process by which the industrial heterogeneity of a central city affects the development of other cities in the region differently, thereby exacerbating or mitigating regional inequality.

Empirically, we focus on China. After the reform and the removal of migration barriers, a large number of people began to move from the countryside to the cities in China. This phenomenal growth has led to a rapid increase in both the number and size of cities. According to the United Nations (https://esa.un.org), China is now the country with the most cities with more than 300,000 inhabitants. With the growth of cities, China has formed a number of regional systems with distinct differences. The Yangtze River Delta region, which is based on the core of Shanghai, is also less unequal than the Beijing–Tianjin–Hebei region, which is led by Beijing (Wu e et al. 2015; Chen and Sun 2017; Lu et al. 2020). The diverse regional urban systems make China a good case study area for examining regional inequality.

The rest of this paper is organised as follows. In the next section, we provide an overview of the relevant literature on urban specialisation and externalities as well as regional inequality. This is followed by a conceptual framework that describes the processes through which tangible goods industries and industries based on intangible products influence regional inequality. We then empirically analyse the effects of industrial heterogeneity on regional inequality using the example of China's regional urban system. Finally, we discuss the results as well as the policy implications and the research agenda.

2 Literature review: urban specialization, urban externalities and regional inequality

Uneven urban systems attracted the attention of scholarship more than 80 years ago. Jefferson (1939) proposed the primacy city, in which one or two cities dominate a system of cities. Institutions, culture, language, etc. are held responsible for this inequality (Kim and Law 2016; Soo 2014; Bo and Cheng 2021). These factors have yet to be tested for differences between countries and are of little help in understanding urban inequality at the regional level within countries. Giesen and Suedekum (2011) argue that studies at the regional level provide a better understanding of the urban growth process than at the national level. In the following, we review the literature on the two main lines of urban specialization and urban externalities arising from agglomeration economies. It not only highlights the shortcomings of related studies, but also emphasizes the complementarity of urban specialization and urban spillover effects and brings together the two theoretical frameworks to explain the emergence and evolution of regional inequality from the perspective of industrial heterogeneity.

Agglomeration economics has inspired the study of urban inequality at the regional level from two perspectives. One is industrial concentration and urban specialization. Scholars have found that the concentration of industries in specific geographic areas is driven by exchange, adaptation, learning, and high-value amenities (Duranton and Puga 2004; Krugman 2011; Giuliano et al. 2019). More importantly, the results of empirical studies show that the degree of agglomeration varies by industry (Duranton and Overman 2005; Crafts and Mulatu 2006; De Propris and Storai 2019). In addition, industrialization has promoted a specialized division of labour in cities, and participation in regional, national and global production networks has become an important pillar of urban development. Thus, there is a multifaceted relationship between urbanization and production specialization (Duranton and Puga 2000; Duranton and Jayet 2011; Kang et al. 2020). Su (2018) found that absolute specialization in China is negatively correlated with city size.

There is some more direct evidence that specialised functions of cities and their size are related. Au and Henderson (2006) have shown that if the ratio of value added in manufacturing to value added in services is 1, the employment of a city at maximum productivity in China is about 1.3 million. If the ratio is 2.7, the number of employees at the peak of productivity is just under 250,000. This means that the population in manufacturing cities that reach their maximum productivity is lower than in service sector cities. The correlation between urban specialization and city size is not unique to China. Hong et al. (2020) analysed the industrial characteristics of US cities of different sizes and found a strong correlation between them. The results show that small cities are characterized by agriculture and mining, medium-sized cities by manufacturing and retail, and large cities with more than 1.2 million inhabitants by cognitive industries such as management and professional services in the USA. A number of other studies have produced similar results (Youn et al. 2016; Florida 2019). But it is clear that no city is isolated. The development of cities not only affects other cities through spillover effects, but is also influenced by other cities. In short, every city is part of an urban system. As such, its development not only depends on itself, but is also influenced by other cities in that system, the latter perhaps even more so as cities are involved in the regional division of labour. Agglomeration economics also sheds light on the importance of urban externalities that arise for urban growth through the interdependencies between cities. In contrast to the relatively consistent results for urban specialisation, the effects of urban externalities on the imbalances between cities has been very different in the available studies. Krugman (1993) formulated factors of first and second nature to explain the linkages between cities. The second nature factors are developed to capture pecuniary externalities or inter-firm industrial linkages between cities that are enabled by low trade and transportation costs. Within the NEG model, negative externalities are predicted for small cities surrounding large cities, namely “agglomeration shadows” (Fujita and Krugman 1995; Fujita et al. 2001). A shadow effect of agglomerations on their surroundings means that growth in the vicinity of (higher-lying) cities is limited due to competition effects (Dobkins and Ioannides 2001). Burger et al. (2015) show that larger cities on average cast a shadow on smaller neighbouring cities by exploiting their support base and not the other way around. However, there are also empirical studies that question the justification of NEG shadows. Partridge et al. (2009) found that population growth in small urban areas is positively related to proximity to a higher-level urban centre. Camagni et al. (2016) also found that second-tier cities in Europe can overcome the lack of agglomeration through innovation and city networks.

In contrast to the agglomeration shadows, borrowed size emphasize the spread of positive urbanization effects through the connection in networks, especially the connection to large cities. The concept of “borrowed size” was originally proposed by Alonso (1973) to explain the apparent discrepancy between the size and function of small cities that are part of a metropolitan region. The basic idea is that good connections between cities bring important benefits. "Borrowed size" is extended to "urban network externalities" to capture the economic advantage that arises from networked relationships between cities, not just geographical proximity (Camagni 2017; Capello 2000; Burger and Meijers 2016). Meijers and Burger (2017) recently revisited the concept by emphasizing that borrowing of size generally occurs when a city has urban functions that are normally associated with larger cities. Many empirical studies has shown that cities that are well embedded in networks tend to perform better (Camagni et al. 2017; Shi and Pain 2020; Tong et al. 2023). Sohn et al. (2022) argued that the externalities of urban networks resulting from multicentric urban regions are an important driver of urban growth and performance.

However, as with agglomeration shadows, the borrowed size and externalities of the network do not always have an effect. Tong (2023) argued that as infrastructure improves, increasing urban network externalities may have a generative effect for the region as a whole, but this may also hide a distributional effect. Meijers et al. (2012) also found that some cities benefit from externalities, but others lose out due to improved accessibility and increased competition. Although McCann and Acs (2011) believe that connectivity is now more important for urban performance than size, there are studies that show that being well embedded in regional networks generally does not necessarily lead to higher levels of metropolitan functions and better performance (Meijers et al. 2012). Even in the age of ‘overcoming distance’ technologies, some functions are difficult to transfer to smaller cities (Mejer et al. 2016). This means that the size of the city still plays a role in urban networks. Both agglomeration shadows and urban externalities point to the importance of inter-urban linkages for urban performance, but the inconclusive empirical results suggest that these linkages are complex and diverse. Most studies are blind to the diversity of inter-city linkages. Agglomeration shadowing is based on backward and forward linkages in manufacturing, while empirical studies have used market potential as a characterizing variable for linkages (Ioannides and Overman 2004; Bosker and Buringh 2017). The literature on network externalities has focused on transportation networks, participation in projects and intra-firm networks (Derudder and Taylor 2018; Huang et al. 2020; Tong et al. 2023). Only a few studies mention the variability of inter-city linkages. Fujita and Mori et al. (2005) agree that the agglomeration shadow is sector-specific. Meijer et al. (2016) found that network connectivity is crucial for metropolitan functions in the areas of business, international institutions and science, but not in the areas of culture and sport. And it is the variability of linkages between cities that may hold the secret to the different empirical results. Simply put, the linkages between cities are important, and they are not undifferentiated and meaningless.

Urban externalities affect regional inequalities in a similar way, as different specializations lead to differences in city size, which in turn lead to inequalities in regional urban systems. The agglomeration shadow clearly leads to regional inequality, while urban network externalities contribute to relatively even urban systems due to their close association with polycentric urban systems (Meijers and Burger 2017; Sohn et al. 2022). But the difference that urban specialization emphasizes is precisely what urban externalities ignore, and the inter-city connections they ignore are precisely what the latter emphasize. Our paper attempts to integrate the two literatures on urban specialization and urban externalities by highlighting the importance of the heterogeneity of inter-city linkages for regional inequality. The extent and patterns of spatial linkages in tangible manufactured goods differ from those in service-based intangible goods such as knowledge and information.

Overall, previous research has the following gaps: (1) regional inequality is often studied in terms of urban–rural differences, ignoring differences between cities, (2) the literature on urban externalities focuses on network connectivity but neglects the complexity and diversity of links between cities, and (3) given the differences in agglomeration and spillover effects of different industries, industrial heterogeneity plays a role but has so far been overlooked. In the next section, we present an analytical framework to conceptualize the impact of sectoral differences on regional inequality.

3 Conceptual framework

As already indicated, this paper aims to develop a new framework for a better understanding of the process of the emergence and development of regional inequality by including urban specialization and urban externalities. The previous section has shown that there is a consensus on the impact of urban specialization on city size differences, i.e. that cities dominated by manufacturing are smaller than those dominated by services, while the impact of urban externalities is uncertain. In the following, we focus on the differences in diffusion patterns between industries to explain why the empirical results on urban externalities differ. Finally, industrial heterogeneity is used to integrate urban specialization and externalities, leading to a theoretical framework for regional inequality.

3.1 Material goods industries, the spread of contagion effects and positive urban externalities at the regional level

The interdependencies of material product-based industries tend to take the form of contagion diffusion that reinforces positive urban externalities at the regional level. Spatial proximity plays an important role in the production of material goods. Industrial linkages develop largely through the exchange and transportation of material goods. Greater distances between cities mean higher costs for establishing connections. Division of labour and business networks in the material goods industry tend to promote linkages in neighboring cities. The spatial spread of inter-city networks is driven by the diffusion of contacts, as a significant economic geography literature suggests that inter-firm interactions between cities are reinforced by proximity, especially cognitive proximity (Boschma and Frenken 2011).

Moreover, specialization of production and division of labour between cities reinforce the diffusion effect. Specialization can effectively improve productivity, which is why cities tend to specialize in a few products or production steps. Due to backward and forward linkages, the division of labour reinforces linkages between cities, which in turn causes centrifugal diffusion between neighboring cities.

3.2 Intangible product-based industries, hierarchical diffusion and negative urban externalities at the regional level

In contrast, hierarchy-led diffusion in the service industry strengthens the links between large cities that are far apart but have a similar urban rank. This reduces spillover effects on neighboring small and medium-sized cities, which contributes to negative urban externalities. On the one hand, industries with intangible products may concentrate in a small area of the city because of the importance of “buzz” and personal interactions (Storper and Venables 2004). However, intangible products are then transferred over longer distances with the help of information and communication networks. Firms in such industries, especially high-value services in the advanced producer services (APS) sector, face fewer constraints on the spatial distribution and dispersion of activities in the regional system. High-value services also require a larger market and greater market diversity, which are more likely to be found in large cities.

However, since large cities require a certain market hinterland, this is not conducive to the formation of several large cities that are close to each other. It seems reasonable to expect service-oriented large cities to form ties with distant large cities rather than with small neighboring cities, leading to hierarchical diffusion.

3.3 A theoretical framework for regional inequality at the urban level

Manufacturing is typically a tangible product industry, while intangible product industries are dominated by services such as finance, information and R&D. Au and Henderson (2006) have shown that productive efficiency determines the optimal potential size of different types of specialized cities. Moreover, capital substitution is difficult in the service sector compared to manufacturing. As a result, the population size of service-oriented cities that achieve agglomeration imbalances is much larger than that of manufacturing cities. This also means that core cities dominated by service industries can accommodate a higher population, contributing to greater regional inequality compared to manufacturing-oriented cities.

Related to the urban externalities, the core cities with a strong manufacturing sector have a relatively small potential size and large spillover effects on the neighboring small and medium-sized cities, and the regional city systems centred on them are relatively balanced, while the service-oriented core cities are just the opposite and the regional city systems are therefore more unequal (Table 1). In a regional city system centred on cities with a high share of manufacturing, the optimal potential size of the core city is small due to maximum production efficiency and capital substitution. This means that the core city attracts relatively few resources at the expense of neighboring smaller cities. At the same time, the positive externality of the core city for small and medium-sized cities is strong due to the proximity diffusion effect and the spillover effect. Ultimately, the difference in size between the core city and neighboring cities is relatively small, so that the urban system is relatively balanced. Core cities, which are dominated by services, have pronounced polarization effects on the surrounding cities due to their larger potential size, while their external and spillover effects are weaker. This ultimately leads to an unequal regional urban system with a core of service-oriented cities.

Our study conceptualizes the impact of industry on regional inequality more explicitly by emphasizing the nature of spatial diffusion in shaping the connections between cities. More specifically, we hypothesize that tangible product-based industries tend to amplify the externalities of core cities, while the opposite is true for intangible product-based industries, and these differences affect regional inequality. Indeed, there is some empirical evidence to support the above conceptual framework. While studies have found that core cities at the top of the network have greater advantages than other cities in the network (Taylor et al. 2014; Derudder and Taylor 2020), their neighbors do not necessarily have the same advantages. Fainstein (2001) argued that there are significant inequalities in global city-regions. Boschken (2022) also found that the higher the “global city status” index score, the greater the socioeconomic inequality in large US metropolitan areas.

4 Data and model

4.1 Data

This study is based on data from the United Nations Department of Economic and Social Affairs (UN DESA). The selected cities (“urban agglomerations” in UN DESA parlance) each had a population of 300,000 or more in 2015—a criterion that describes some 392 cities in China. As reliable data on employment opportunities was not readily available, two cities—Yushu and Yining—were excluded. In general, four city levels can be derived from the data: “province”, “prefecture”, “county town” and “county”. The cities analysed in this study are at the county level and above.

The UN’s data contains figures for the annual population of these cities, which are collected every five years, from 1980 to 2015. According to the estimates, the population of the 390 cities has increased rapidly since 1980, and especially since 1990 (Table 2). The large number of cities in China has resulted in the development of a number of regional systems, which are centred on a few core cities such as Beijing, Shanghai, Tianjin, Chongqing, Guangzhou, and Shenzhen. These six megacities are each host to more than 10 million population in 2015. The total population of these six largest core cities was nearly 100 million in 2015. This constituted almost one-fifth of the total population of the 390 cities. However, China’s non-core cities can also be quite large: large non-core cities host between three million and 10 million people, while medium non-core cities contain between 0.5 and three million people. Small cities are home to less than 0.5 million people, and the smallest cities are below 250,000 people.

Except for population data, all other data are from the China City Statistical Yearbook, including the industrial structure of core cities and employment, average wages, and the number of doctors in non-core cities. Missing data for some years were supplemented by estimates based on data from previous years or from other cities in the same province.

The industrial structure of the core cities is worth mentioning. The industrial structure is used to characterize the industrial heterogeneity, i.e. the industries based on tangible products and the industries based on intangible products. As mentioned above, manufacturing is a representative sector of the tangible product-based industries. Despite the fact that the final products of manufacturing are tangible in nature, there are differences between industries within manufacturing. In particular, industries with high product prices and small size and weight, such as chip manufacturing, whose products are suitable for air transportation, and industrial networks are therefore more global than local. These industries are therefore largely characterized by intangible, product-related industries. In the services sector, which represents the intangible product-based industries, there are also a few industries that have the characteristics of physical goods-based industries, such as transportation and wholesale and retail trade. However, in the empirical analysis, manufacturing is still used to characterize the tangible goods-based industries and the service sector is used to characterize the intangible goods-based industries. In addition to data availability, this is also due to the fact that the Chinese standards for the classification of industries were revised three times between 1980 and 2015 and the division into manufacturing and services, while stable and reliable, has not been sufficiently refined.

In contrast to Western cities, where consumption and services dominate, China's major cities still have a well-developed manufacturing industry. Since the reform and opening-up, the growth of Chinese cities has relied heavily on development zones centred on manufacturing (Yang and Wang 2008; Herlevi 2017). The same is true for core cities. Statistics show that, with the exception of Shenzhen and Chongqing, the share of manufacturing in the other four core cities continued to decline in the period from 1980to 2010. In 2010, only in Beijing was the share of manufacturing below 30%. The share of manufacturing in Shanghai was almost 40% (38.08%), and Shenzhen, Chongqing and Tianjin all reached over 40%. In Chongqing and Tianjin, the share of the manufacturing sector was still higher than that of the services in 2010. In fact, manufacturing has dominated in all six core cities since 1980. In Shanghai, the share of the manufacturing sector even exceeded 70% at times. The importance of manufacturing in Chinese cities will not diminish as competition for manufacturing increases between countries (Schneider-Petsinger 2021; Marsh 2022).

Surprisingly, the disparity in the share of services between the six core cities is considerable. For example, in Beijing, where services account for 75% of the economic base, FIRE (finance, insurance and real estate) accounted for almost half of employment in the services sector. In Shanghai, services accounted for less than 60%, and in Chongqing the share was only 36.350% in 2010. For this reason, we expect industry concentration to influence regional inequality, a relationship we explore in the next section.

4.2 Model

4.2.1 Empirical model

The study focuses on regional inequalities resulting from differences in population size between central and peripheral cities. Regional inequality increases when the population of the core city grows faster than that of the peripheral cities and vice versa. The difference or ratio is often used to measure changes in inequality between centre and periphery (Leichenko 2011; Fumagalli and Kemmerling 2022). For urban scale growth, the first nature and second nature proposed by Krugman (1993) provides a good theoretical framework. Using this framework and adding the industrial heterogeneity we are interested in and some control variables, a baseline model of regional inequality is constructed as follows:

where \({{\text{Inequality}}}_{jt,it}\) is \(\Delta {{\text{POP}}}_{it}-\Delta {{\text{POP}}}_{jt}\), and captures the difference in population growth between non-central city i and central city j over the period t to t − 1. The higher the value, the lower the inequality.

For \({{\text{location}}}_{i}\), this is proxied by the population of city i in year 1980 (\({\text{Pop}}1980i\)), which was when China began its reform, kicking in a process of urbanization and industrialization. \({\text{Pop}}1980i\) captures NEG’s “first nature” locational factor (natural geographical advantages) and is commonly used in the literature (Krugman 1993). But for cities to consolidate their dominance, they also need “second nature” factors, specifically the establishment of industrial linkages to reinforce market growth and access. Second nature factors of inter-firm backward and forward linkages generate agglomeration economies that lead to spillovers. \({\text{Agglomeration}}\;{\text{economies}}_{i}\) is measured by market potential (MP) of city i (Cronon 1991). The third vector, \({{\text{industry}}}_{jt-1}\), measures industrial heterogeneity through the cities’ industrial concentration (IC), its square term, and the interaction of IC and MP. IC denotes a core city’s share of manufacturing (ICmm) or services (ICs). The quadratic term is to account for possible nonlinearity, while the cross-term measures the impact of industrial concentration on spillover effects from the core cities. Finally, \({{\text{control}}}_{i}\) consist of employment, wage-capturing firm, urban amenities, population density and distance to the second-tier and the third-tier centres. Details of the variables are provided in Table 2, and their justification is further elaborated below.

While the use of \({\text{Pop}}1980\) and MP to measure location and agglomeration economies is relatively common, MP also needs some clarification. In this paper, MP is a measure of a city’s population and distance between two cities following Ioannides and Overman (2004) and Bosker and Buringh (2017). Meijers et al. (2016) also have used population potential as an indicator for network connectivity. While not perfect, availability and stability of demographic data from China are rather difficult in the time period examined here. Data on transportation networks and headquarter branches, which were considered as proxies, are unfortunately spotty before 2000. For a particular city, we measure MP for two groups of the city: (1) the market potential of all cities (MPAC) and (2) the market potential of core cities (MPCC). The former is the sum of the population of all other cities divided by the distance to that city, which is the sum of the market potential that the city attracts from all other cities. Since the influence of the industrial structure of core cities on spillovers is our focus, we measured separately the market potential of the core city to the non-core city. Following Harris (1954) and Black and Henderson (2003), MPCC and MPAC are defined as:

Here, \({{\text{MPCC}}}_{it-1}^{k}\) is the market potential of city i in the initial year of the period t − 1 for core city k; \({POP}_{t-1}^{k}\) is the population of core city k in the initial year of the period t − 1; and \({{\text{distance}}}_{i}^{k}\) refers to the Euclidean distance between city i and core city k. Likewise, \({{\text{MPAC}}}_{it-1}\) is the market potential of city i in the initial year of the period t − 1 from all other cities; \({{\text{POP}}}_{t-1}^{j}\) is the population of city j in the initial year of the period t − 1; and \({{\text{distance}}}_{i}^{j}\) refers to the Euclidean distance between city i and city j. Manufacturing and service concentrations are expected to increase MP’s effect on growth of non-core cities from regional spillovers, or conversely, to decrease the effect of MP because of agglomeration “shadow”. Agglomeration shadow is said to develop when growth of cities in the region is impeded because contagion diffusion forces that help to form backward and forward linkages are weak. To reduce the problem of multicollinearity caused by quadratic and cross-terms, both IC and MP were normalized as Z-scores.

Control variables consist of employment, wage level, population density and amenities (number of doctors/10,000 population). Studies have shown that wage level and population density have a significant impact on rural–urban and inter-city migration and urban growth in China. This is especially the case in the early years of reform, and in the less developed areas of central and western regions (Song et al. 2018; Rodríguez-PoseA and Zhang 2019; Zhao et al. 2022). Dutta and Das (2019) show that basic amenities influence inequality between metropolitan and smaller surrounding towns in India. Healthcare amenities are a good proxy for urban amenities because their concentration in core cities influences regional inequality. We also considered distance effect because proximity to large cities and their markets influences growth of small and medium-sized cities (Krugman 1991; Han and Ke 2016). Partridge et al. (2008) found that distance from higher-tier centres affects smaller cities’ growth. If spillovers are regionally limited, they are more likely to hinder the growth of non-core cities. Conversely, wider spillovers tend to enhance lower-tier cities’ growth through extensive trade, industrial linkages, and borrowed functions from core cities. In this paper, distance effects are applied to core cities and their proximity to two lower levels of cities in the regional system. While core cities are host to about 1 million of service employees, the second level consists of regional centres that have populations of 0.5 to one million people (e.g. Wuhan). Third-level cities are regional cities with 200,000 to 500,000 people and tend to be provincial capitals such as Taiyuan. Following Partridge et al. (2008), incremental distance to the second-level service centre is calculated by taking the distance to the nearest second-level centre and subtracting the distance from the nearest third-level city. If a city is close to a second-level high-order service city, then the incremental distance to the third-level city is zero.

Equation 1 however does not account for spatial dependence and may be treated as the base model. To account for spatial dependence and interactions, we applied the spatial Durbin model (SDM). Following Elhorst (2012), the base model in Eq. 1 is reformulated and expressed below:

The SDM model in (4) allows us to tackle the spatially lagged values of both the dependent and independent variables. The parameter ρ quantifies the impact of change in inequality of nearby cities on the change of a city, namely the average of the spatially lagged \(\Delta Inequality\) values. Under the assumption of no spatial interaction where the coefficients of ρ and the lagged terms of the independent variables are zero, then Eq. (4) produces the non-spatial base model in Eq. (1) (Table 3).

5 Results

Before presenting the model results, we measured the spatial dependence of the independent variables and the change in the extent of the regional urban system. The obvious spatial dependence confirms the need for spatial econometric models. However, as the key variable in this study is spillover effects, this is largely the indirect effect addressed by LeSage and Pace (2009). Therefore, the direct and indirect effects of the variables are no longer estimated and analysed in this study.

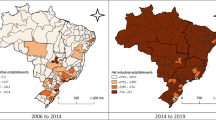

5.1 Spatial dependence and changes of regional urban system

Before estimating the model, we tested for spatial dependence. Table 4 shows that the global Moran's I index of growth differences between core and non-core cities is significant. This suggests that spatial dependence may be significant. Next, we conducted LM and LR tests to show that the SDM model fits our panel data. The Hausman test suggests that fixed-effects models should be chosen. Due to the importance of spatial distance in this study, the inverse distance weighting (IDW) matrix is also used. The spatial weighting matrix was created on the basis of a distance cut-off.

As China’s geography is relatively compact, some core cities are relatively close to each other, e.g. Guangzhou and Shenzhen. Nevertheless, both seem to be able to maintain a sufficiently high level of competitive effects that allows each city to remain relatively influential. Partidge et al. (2009) found that the growth of large cities remains relatively unaffected by proximity to each other and they are able to maintain their dominance in their regional systems. Consequently, the definition of MP in terms of the influence of a core city on the regional system is quite reasonable. Although Shenzhen is a relative newcomer to the "club" of core cities, it is mainly a trade and electronics centre. The city’s economic influence was negligible between 1985 and 1995, but this has changed dramatically since then. Beijing and Shanghai have the largest regional systems, with 134 and 157 secondary cities, respectively, in 1985, but the growth of other core cities has meant that the geographical influence of the two cities has shrunk. In 2015, the number of cities in the Beijing and Shanghai regional systems had fallen to 131 and 155, respectively. The number of small- and medium-sized satellite cities of Shenzhen rose from zero in 1980 to twelve in 2015, while the regional urban systems of Guangzhou and Chongqing remained stable: both were home to an average of 40 to 44 cities during this period.

5.2 Model estimation

Tables 5 and 6 show the regression results. The results of the base model (Eq. 1) are shown in the first three columns, while the next three columns show the SDM model with fixed effects. Models 1 (both the base model and the SDM model) do not include agglomeration economies and industry variables. Model 2 takes into account the possible non-linearity of IC. Model 3 is the complete base and SDM models, which include all variables from Eq. 4. As described above, the interaction term was added to capture the influence of the industrial concentration of the core cities (IC) on the growth of the smaller non-core cities within the regional system. To account for possible endogeneity, all independent variables in the model are lagged variables. In addition, we conducted a test for the selection ratio for possible omitted variables (Altonji et al. 2005), and the ratio was 2.06. The existing literature has shown that it is less likely that the estimation of the main variable, namely IC, is due to the selectivity of unobservable variables when the selection ratio is greater than 1 (Aidt and Franck 2015; Bertrand et al. 2015).

Three important observations can be derived from Tables 5 and 6. First, both tables show that the signs for the manufacturing and services model are consistent with the predictions of the conceptual model in Table 1: IC mm (concentration in manufacturing) is positive, while IC s (concentration in services) is negative. Moreover, the results do not change in all three base models as well as in the SDM models, indicating that they are relatively robust. Next, the spatial dependence parameter (ρ) is large and negative and also statistically significant, suggesting that as the inequality gap between a non-core city and a core city decreases, such a gap also increases between neighboring cities and core cities. This partly reflects competitive effects between non-core cities. Third, the r-squares of the SDM models are relatively higher than those of the base models, suggesting a better fit of the SDM models. In addition, the r-squares are highest for SDM models 4 and 5, so the full model better explains the factors contributing to regional inequality. Tables 5 and 6 confirm the positive effect of manufacturing on reducing inequality between core and non-core cities, while the negative estimate for the services has the opposite effect and increases regional inequality. These results support our hypothesis of differential effects of industrial heterogeneity and diffusion. The effect of industrial concentration remains significant when additional variables are added to the base model, and the signs do not change. More importantly, this differential effect appears to operate by influencing the market potential of core cities (MPCC). Table 5 shows that MPCC* ICmm is positive, so that as manufacturing becomes more concentrated, second-order pecuniary externalities from industrial linkages are likely to develop and boost the growth of the region’s non-core cities. On the other hand, FIRE service functions tend to be more locally concentrated and regional spillover effects are lower, resulting in negative MPCC* ICs in Table 6.

A non-linear, inverted U-shaped relationship between ICmm and regional inequality can be seen at 0.1% for both the base model and the SDM model. However, the estimates for ICs are not significant for the base models, but significant for the SDM models. As the SDM model accounts for spatial dependence, it avoids bias due to omitted variables and model specification errors and is likely to be the better specified model. In any case, the quadratic coefficients for both manufacturing and services are significantly negative in the SDM specifications, suggesting that higher level of manufacturing and services above a certain threshold increase inequality between core cities and non-core cities in the region. In other words, regional inequality tends to be highest when the concentration of manufacturing and services is very low and very high. One explanation for this is that cities become more influential as the share of manufacturing or services increase, and that if industrial concentration is too high, spillover effects also become weaker due to overspecialization. This means that too high or too low an industrial concentration is not conducive to the development of small and medium-sized non-core cities. This could in turn increase regional inequality, which is consistent with the findings of Au and Henderson (2006).

MPCC is significantly positive for SDM3 in Table 5, but negative for MPAC. However, while MPCC is significantly positive for SDM3 in Table 6, it is not significant for MPAC. This indicates that MPCC contributes to the reduction of regional inequality. As described above, market potential is an indicator of industrial and trade linkages that arise from agglomeration-related spillover effects. These tend to result from spillover effects from core cities in the manufacturing sector. Although non-core cities also contribute to interdependencies, this is limited to cities that focus on manufacturing. Cities with a concentration on service functions do not appear to have the same effect, as SDM3 shows, although Table 6 shows that the coefficient for SDM2 is significant. Here, MPAC is also negative, indicating possible negative externalities due to a lack of diffusion and trade linkages with smaller surrounding cities. The study of Chinese urban growth by Han and Ke (2016) showed negative spillover effects in the eastern region due to competition between coastal cities, and this appears to be the case here as well.

6 Discussion

The results suggest that the spillover effects of concentration in manufacturing and services tend to have opposite effects. These effects were first suggested by Au and Henderson (2006) and Hong et al. (2020). High-order service functions tend to have strong centrally acting agglomeration forces and lower local regional spillover effects. This exacerbates regional inequality by reinforcing the vertical hierarchy between large and smaller cities. The results shed light on why regional inequality patterns differ between Beijng-Tianjin-Hebei and the Yangtze River Delta (Fang and Yu 2017; Lu et al. 2020; Xiao et al. 2021). The concentration of the service sector has always been much higher in Beijing than in Shanghai. In 2010, the share of services in Beijing was over 75%, almost 18% higher than in Shanghai. Similarly, the total number of employees in the FIRE sector in Beijing was over 2.2 million, compared to only 0.83 million in Shanghai. This difference in industrial concentration could explain why the regional system in Beijing is more unequal than that in Shanghai. One implication is that with the increasing share of the service sector in the urban economy in major cities, regional inequality is likely to increase. The concentration of manufacturing in core cities reflects a phase of regional development in the 1990s when China experienced rapid industrial expansion and cities developed regional production networks and backward linkages (Yang and He 2017). This was a period when contact diffusion dominated. After 2005, however, the growth of manufacturing slowed, especially in small cities, as manufacturing became increasingly specialized in specific regions (Long and Zhang 2012). At the same time, the share of the service sector in core cities continued to grow, and as described in the literature on world cities, higher-order GSP functions were concentrated in a few core cities, and the diffusion of linkages tended to be hierarchical.

The results are not only to be found in China. Lessmann (2014) analysed data sets from 56 countries and found that regional inequality increased again at a very high level of economic development during the economic shift from manufacturing to services. Amos (1988) also found an inverted U process, although some more recent studies suggest that the non-linearity may take an N form. By and large, the results are consistent with other studies. Partridge et al. (2009) claim that metropolitan areas with a high concentration of high-value services significantly inhibit the development of surrounding small and medium-sized cities. Engelen and Grote’s (2009) study of German financial centres found that the dominance of financial services in first-tier cities led to the decline of second-tier cities, despite the forces of dispersion and falling trade costs resulting from the digital revolution (Krugman 2011). If regional urban systems have become increasingly unequal, as Zhao et al. (2017) conclude, then the financial and business services sector could be the driving factor.

Finally, two observations may be made about the control variables. First, studies have found that urban amenities attract population to the city and reduce regional inequality between core cities and smaller cities (Dutta and Das 2019). The results show that the opposite is true in our analysis: amenities are negative and significant, suggesting that they increase regional inequality. One reason for this could be the level of amenities, i.e. physician density. Healthcare facilities tend to exhibit a primacy effect in China as they are concentrated in core cities. Medical professionals are scarce in smaller cities, reflecting resource allocation issues where large Chinese cities control healthcare facilities (Zhao et al. 2018). Unlike many American cities, healthcare is predominantly publicly owned, and resource allocation correlates strongly with the administrative hierarchy of Chinese cities. Second, the effect of distance decomposition is not significant for both second-tier (“2nd RC distance) and third-tier (3rd RC distance) cities for SDM2 and SDM3, suggesting that the urban growth of smaller and non-core cities is largely influenced by trade and industrial linkages.

7 Conclusion

In this study, a conceptual framework was developed to explain how industrial concentration affects regional inequality. Industrial concentration not only affects the size of a city, but also has significant effects on the growth of surrounding cities that are not part of the core area. While the strengthening of tangible goods industries such as manufacturing increase spillover effects, this effect is reduced by the expansion of intangible product industries such as the GSP sector. However, an overrepresentation of manufacturing or services will increase regional inequality. The emphasis on industrial heterogeneity updates the traditional understanding of regional inequality in at least three ways: (1) In the post-industrial urban era, inter-urban differences have replaced rural–urban differences as a driver of regional inequality, and industrial differences may be a more important determinant of regional inequality; (2) spatial diffusion explanations are applied to shed light on differences in inter-city linkages, as differences in industrial linkages have a significant impact on the equalizing or polarizing processes of regional systems; (3) integrating perspectives from the literature on urban specialization and urban externalities can shed light on the evolution of regional inequality in the post-industrial era.

The results have some policy implications. Fang and Yu (2017) argue that the Beijing-Tianjin-Hebei region will gradually develop into a relatively balanced regional urban system, citing the Yangtze River Delta as an example. They see a process of regional convergence between core cities and smaller cities across China. Our results do not support this view. As Shanghai and other core cities transition to a more post-industrial status, regional inequality is likely to increase. Certainly, inequality may decrease when service concentration is very high, but we expect inequality to increase in most regional systems in China in the short to medium term. Institutions such as healthcare and employment in the APS and FIRE sectors will be concentrated in the core cities, leaving smaller cities with few opportunities for growth and development. To some extent, the Chinese government has begun to recognise this and has made efforts to address regional disparities. Specifically, the government aims to reduce regional inequality by reforming the budget registry, expanding infrastructure, distributing public and health facilities and increasing support for less developed smaller cities and towns. However, these measures cannot be viewed in isolation from the industrial processes in the core cities, as this paper has attempted to show. The high concentration of GSP activities in Beijing has not triggered regional spillover effects to smaller cities where hierarchical diffusion prevails. The realisation that the industrial structure of core cities influences the growth of smaller cities in a region remains an important consideration in addressing regional inequality.

While the results support our proposed conceptual framework for regional inequality, the empirical component has limitations. Due to data limitations, we have described industrial heterogeneity in the empirical study using a dichotomy of manufacturing and services. However, this distinction lacks precision, especially for the services sector. Regional spillovers differ between the services sector and the manufacturing sector and have different effects on inequality in each case. Therefore, future research needs to be cautious about industry heterogeneity in order to refine our understanding and improve the robustness of our results.

References

Achten S, Lessmann C (2020) Spatial inequality, geography and economic activity. World Dev 136:1–20

Aidt TS, Franck R (2015) Democratization under the threat of revolution: evidence from the great reform act of 1832. Econometrica 83(2):505–547

Alonso W (1973) Urban zero population growth. Daedalus 109:191–206

Altonji JG, Elder TE, Taber CR (2005) Selection on observed and unobserved variables: assessing the effectiveness of Catholic schools. J Polit Econ 113(1):151–184

Amos OM (1988) Unbalanced regional growth and regional income inequality in the latter stages of development. Reg Sci Urban Econ 18(4):549–566

Au CC, Henderson V (2006) Are Chinese cities too small? Rev Econ Stud 73(3):549–576

Beauregard RA (2018) Cities in the urban age. Cities in the urban age. University of Chicago Press

Bertrand M, Kamenica E, Pan J (2015) Gender identity and relative income within households. Q J Econ 130(2):571–614

Black D, Henderson V (2003) Urban evolution in the USA. J Econ Geogr 3(4): 343–372

Bo S, Cheng C (2021) Political hierarchy and urban primacy: evidence from China. J Comp Econ 49(4):933–946

Boschken HL (2022) Economic inequality in US global cities. J Urban Aff 45:1–19

Boschma R, Frenken K (2011) The emerging empirics of evolutionary economic geography. J Econ Geogr 11(2):295–307

Bosker M, Buringh E (2017) City seeds: geography and the origins of the European city system. J Urban Econ 98:139–157

Burger MJ, Meijers EJ (2016) Agglomerations and the rise of urban network externalities. Pap Reg Sci 95(1):5–15

Burger MJ, Meijers EJ, Hoogerbrugge MM, Masip TJ (2015) Borrowed size, agglomeration shadows and cultural amenities in North-West Europe. Eur Plan Stud 23:1090–1109

Camagni R (2017) From city hierarchy to city network: reflections about an emerging paradigm. Semin Stud Reg Urban Econ Contrib Impress Mind 2017:183–202

Camagni R, Capello R, Caragliu A (2016) Static vs dynamic agglomeration economies: spatial context and structural evolution behind urban growth. Pap Reg Sci 95(1):133–158

Camagni R, Capello R, Caragliu A (2017) The rise of second-rank cities: what role for agglomeration economies? Second Rank Cities in Europe. Routledge, pp 39–59

Capello R (2000) The city network paradigm: measuring urban network externalities. Urban Stud 37(11):1925–1945

Chen Y, Sun B (2017) Does “agglomeration shadow” exist in Beijing-Tianjin-Hebei region? Large cities’ impact on regional economic growth. Geogr Res 36(010):1936–1946 (in Chinese)

Crafts N, Mulatu A (2006) How did the location of industry respond to falling transport costs in Britain before World War I? J Econ Hist 66(3):575–607

Cronon (1991) Nature’s metropolis: Chicago and the great west. Norton, New York

De Propris L, Storai D (2019) Servitizing industrial regions. Reg Stud 53(3):388–397

Derudder B, Taylor PJ (2018) Central flow theory: comparative connectivities in the world-city network. Reg Stud J Reg Stud Assoc 52(8):1029–1040

Derudder B, Taylor PJ (2020) Three globalizations shaping the twenty-first century: understanding the new world geography through its cities. Ann Am Assoc Geogr 110(6):1831–1854

Dobkins LH, Ioannides YM (2001) Spatial interactions among US cities: 1900–1990. Reg Sci Urban Econ 31(6):701–731

Du M, Zhang X, Mora L (2022) Strategic planning for smart city development: assessing spatial inequalities in the basic service provision of metropolitan cities. Sustainable smart city transitions. Routledge 2022:113–132

Duranton G, Jayet H (2011) Is the division of labour limited by the extent of the market? Evidence from French cities. J Urban Econ 69(1):56–71

Duranton G, Overman HG (2005) Testing for localization using micro-geographic data. Rev Econ Stud 72(4):1077–1106

Duranton G, Puga D (2000) Diversity and specialisation in cities: why, where and when does it matter? Urban Stud 37(3):533–555

Duranton G, Puga D (2001) Nursery cities: urban diversity, process innovation, and the life cycle of products. Am Econ Rev 91(5):1454–1477

Duranton G, Puga D (2004) Micro-foundations of urban agglomeration economies. In: Handbook of regional and urban economics, vol 4. Elsevier, pp 2063–2117

Dutta I, Das A (2019) Exploring the dynamics of spatial inequality through the development of sub-city typologies in English Bazar Urban Agglomeration and its peri urban areas. GeoJournal 84(4):829–849

Elhorst JP (2012) Matlab software for spatial panels. Int Reg Sci Rev 35:1–17

Engelen E, Grote MH (2009) Stock exchange virtualisation and the decline of second-tier financial centres–the cases of Amsterdam and Frankfurt. J Econ Geogr 9(5):679–696

Fainstein SS (2001) Inequality in global city-regions. DisP-the Plan Rev 37(144):20–25

Fang C, Yu D (2017) Urban agglomeration: an evolving concept of an emerging phenomenon. Landsc Urban Plan 62:126–136

Farrokhi F (2021) Skill, agglomeration, and inequality in the spatial economy. Int Econ Rev 62(2):671–721

Florida R (2019) The rise of the creative class. Basic Books

Fujita M, Krugman P (1995) When is the economy monocentric?: von Thünen and Chamberlin unified. Reg Sci Urban Econ 25(4):505–528

Fujita M, Mori T (2005) Frontiers of the new economic geography. Pap Reg Sci 84(3):377–405

Fujita M, Krugman PR, Venables A (2001) The spatial economy: cities, regions, and international trade. MIT Press

Fumagalli M, Kemmerling A (2022) Development aid and domestic regional inequality: the case of Myanmar. Eurasian Geogr Econ 2022:1–30

Gao J, Liu Y, Chen J et al (2022) Demystifying the geography of income inequality in rural China: a transitional framework. J Rural Stud 93:398–407

Giesen K, Südekum J (2011) Zipf’s law for cities in the regions and the country. J Econ Geogr 11(4):667–686

Giuliano G, Kang S, Yuan Q (2019) Agglomeration economies and evolving urban form. Ann Reg Sci 63:377–398

Han F, Ke S (2016) The effects of factor proximity and market potential on urban manufacturing output. China Econ Rev 39:31–45

Harris CD (1954) The market as a factor in the localization of industry in the United States. Ann Assoc Am Geogr 44(4):315–348

Herlevi AA (2017) Economic growth or sowing the seeds of destruction? The role of economic development zones in China. J Chin Polit Sci 22:675–689

Hill H (2021) What’s happened to poverty and inequality in Indonesia over half a century? Asian Dev Rev 38(1):68–97

Hong I, Frank MR, Rahwan I et al (2020) The universal pathway to innovative urban economies. Sci Adv 6(34):eaba934

Huang Y, Hong T, Ma T (2020) Urban network externalities, agglomeration economies and urban economic growth. Cities 107:102882

Ioannides Y, Overman H (2004) Spatial evolution of the US urban system. J Econ Geogr 4:131–156

Jefferson M (1939) The law of the primate city. Geogr Rev 29:226–232

Kanbur R, Venables A (2005) World institute for development economics research policy brief, vol 3. United Nations University

Kang J, Xu W, Yu L et al (2020) Localization, urbanization and globalization: dynamic manufacturing specialization in the YRD mega-city conglomeration. Cities 99:102641

Khan MS, Siddique AB (2021) Spatial analysis of regional and income inequality in the United States. Economies 9(4):159

Kim S, Law MT (2016) Political centralization, federalism, and urban development: evidence from US and Canadian capital cities. Soc Sci Hist 40(1):121–146

Kim S (2008) Spatial inequality and economic development: theories, facts and policies. Working paper no. 16, commission on growth and development

Klimczuk A, Klimczuk-Kochańska M (2019) Core-periphery model. In: Romaniuk S, Thapa M, Marton P (eds) The Palgrave encyclopedia of global security studies. Palgrave Macmillan, Cham

Krugman P (1991) Geography and trade. MIT Press, Cambridge

Krugman P (1993) First nature, second nature, and metropolitan location. J Reg Sci 33(2):129–144

Krugman P (1998) What’s new about the new economic geography? Oxf Rev Econ Policy 14(2):7–17

Krugman P (2011) The new economic geography, now middle-aged. Reg Stud 45(1):1–7

Kuznets S (1955) International differences in capital formation and financing. Capital formation and economic growth. Princeton University Press, pp 19–111

Leichenko RM (2011) Growth and change in US cities and suburbs. Growth Change 32(3):326–354

LeSage J, Pace RK (2009) Introduction to spatial econometrics. Chapman and Hall/CRC

Lessmann C (2014) Spatial inequality and development: is there an inverted-u relationship? J Dev Econ 106:35–51

Li J, Sun D (2020) Industrial composition and agglomeration shadow: evidence from China’s large urban systems. Complexity 2020:1–11

Long C, Zhang X (2012) Patterns of China’s industrialization: concentration, specialization, and clustering. China Econ Rev 23(3):593–612

Lu J, Sun D, Yu J et al (2020) “Local versus nonlocal” enterprise linkages of global cities: a comparison between Beijing and Shanghai, China. Complexity 8:1–13

Marsh SE (2022) Executive order 14005 “ensuring the future is made in all of America by all of America’s workers”: a study of potential impacts on aerospace supply chains. Johns Hopkins University

Maxwell R (2019) Cosmopolitan immigration attitudes in large European cities: contextual or compositional effects? Am Polit Sci Rev 113(2):456–474

McCann P, Acs ZJ (2011) Globalization: countries, cities and multinationals. Reg Stud 45(1):17–32

Meijers EJ, Burger MJ (2017) Stretching the concept of ‘borrowed size’. Urban Stud 54(1):269–291

Meijers E, Hoekstra J, Leijten M et al (2012) Connecting the periphery: distributive effects of new infrastructure. J Transp Geogr 22:187–198

Meijers EJ, Burger MJ, Hoogerbrugge MM (2016) Borrowing size in networks of cities: city size, network connectivity and metropolitan functions in Europe. Pap Reg Sci 95(1):181–198

Montgomery MR (2008) The urban transformation of the developing world. Science 319:761–764

Partridge M, Rickman D, Ali K, Olfert M (2008) Lost in space: population growth in the American hinterlands and small cities. J Econ Geogr 8:727–757

Partridge MD, Rickman DS, Ali K et al (2009) Do new economic geography agglomeration shadows underlie current population dynamics across the urban hierarchy? Pap Reg Sci 88(2):445–466

Rey SJ (2004) Spatial analysis of regional income inequality. Spat Integr Soc Sci 1:280–299

Rodríguez-Pose A, Storper M (2020) Housing, urban growth and inequalities: the limits to deregulation and upzoning in reducing economic and spatial inequality. Urban Stud 57(2):223–248

Rodríguez-PoseA ZM (2019) Government institutions and the dynamics of urban growth in China. J Reg Sci 59(4):633–668

Sassen S (2013) The global city: New York, London, Tokyo. Princeton University Press

Schneider-Petsinger M (2021) US and European strategies for resilient supply chains. Research paper

Sharif MM (2022) Capturing the urban opportunity in southeast asia https://theaseanmagazine.asean.org/article/capturing-the-urban-opportunity-in-southeast-asia/

Shen J, Wang S, Liu W et al (2019) Does migration of pollution-intensive industries impact environmental efficiency? Evidence supporting “Pollution Haven Hypothesis.” J Environ Manag 242:142–152

Shi S, Pain K (2020) Investigating China’s Mid-Yangtze River economic growth region using a spatial network growth model. Urban Stud 57(14):2973–2993

Sohn C, Licheron J, Meijers E (2022) Border cities: out of the shadow. Pap Reg Sci 101(2):417–438

Song J, Du H, Li S (2018) Smooth or troubled occupation transition? Urbanization and employment of former peasants in western China. China Rev 18(1):79–106

Soo KT (2014) Zipf, Gibrat and geography: evidence from China, India and Brazil. Pap Reg Sci 93(1):159–181

Storper M (2013) Keys to the city: how economics, institutions, social interaction, and politics shape development. Princeton University Press

Storper M, Venables AJ (2004) Buzz: face-to-face contact and the urban economy. J Econ Geogr 4(4):351–370

Su H (2018) Urban specialization of Chinese cities. Chin J Urban Environ Stud 6(01):1850005

Sun W, Fu Y, Zheng S (2017) Local public service provision and spatial inequality in Chinese cities: the role of residential income sorting and land-use conditions. J Reg Sci 57(4):547–567

Taylor PJ, Derudder B, Faulconbridge J et al (2014) Advanced producer service firms as strategic networks, global cities as strategic places. Econ Geogr 90(3):267–291

Tong W, Meijers E, Bao Z et al (2023) Intercity networks and urban performance: a geographical text mining approach. Int J Urban Sci 2023:1–22

Venables AJ (2005) Spatial disparities in developing countries: cities, regions, and international trade. J Econ Geogr 5(1):3–21

Wang Z, Zhu Y (2020) Do energy technology innovations contribute to CO2 emissions abatement? A spatial perspective. Sci Total Environ 726:138574

Wei YD (2015) Spatiality of regional inequality. Appl Geogr 61:1–10

Wu D, Xu Y, Zhang S (2015) Will joint regional air pollution control be more cost-effective? An empirical study of China’s Beijing–Tianjin–Hebei region. J Environ Manag 149:27–36

Xiao R, Yu X, Xiang T et al (2021) Exploring the coordination between physical space expansion and social space growth of China’s urban agglomerations based on hierarchical analysis. Land Use Policy 109:105700

Yang C, He C (2017) Transformation of China’s world factory? Production relocation and export evolution of the electronics firms. Tijdschr Econ Soc Geogr 108(5):571–591

Yang DYR, Wang HK (2008) Dilemmas of local governance under the development zone fever in China: a case study of the Suzhou region. Urban Stud 45(5–6):1037–1054

Youn H, Bettencourt LMA, Lobo J et al (2016) Scaling and universality in urban economic diversification. J R Soc Interface 13(114):20150937

Zhao SX, Guo NS, Li CLK et al (2017) Megacities, the world’s largest cities unleashed: major trends and dynamics in contemporary global urban development. World Dev 98:257–289

Zhao L, Liu S, Zhang W (2018) New trends in internal migration in China: profiles of the new-generation migrants. Chin World Econ 26(1):18–41

Zhao Z, Pan Y, Zhu J et al (2022) The impact of urbanization on the delivery of public service-related SDGs in China. Sustain Cities Soc 80:103776

Acknowledgements

This paper is supported by National Natural Science Foundation of China (No. 42171208).

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Li, J., Poon, J., Li, Y. et al. How manufacturing and service industries affect regional inequality? Evidence from China. Ann Reg Sci 73, 31–59 (2024). https://doi.org/10.1007/s00168-024-01260-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-024-01260-7