Abstract

We examine potential heterogeneity in the capacity to benefit from knowledge spillovers in metropolitan areas between foreign-owned and domestic multinational enterprises, and between small and large firms. The study is restricted to R&D firms in the manufacturing sector and utilizes an unbalanced sample of 1073 Swedish firms covering a 16-year period with close to 11,000 observations. We apply linear and nonlinear approaches to test the importance of knowledge spillovers on labour productivity and patent applications. The overall result shows that not all R&D firms benefit from knowledge spillovers as a result of their presence in an agglomeration area.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Research and development (R&D) spillovers have been a major topic in the economic and regional science literature for many decades. While theoretical studies have explained mechanisms of knowledge spillovers, a growing body of empirical papers tries to determine the magnitude of spillovers both at the industry level (Wolff 2012) and at the firm level (Lychagin et al. 2010).

It is a well-established fact that the performances of firms are influenced not only by technological closeness to other firms, but also by geographical proximity. Research in this field has produced a large variation in the results, but the majority of studies are centred on the conclusion that a doubling of the local density creates a productivity increase of about 4–8 % (Glaeser and Gottlieb 2009).

The location of a firm influences not only its economic performance but also its innovation process. Bettencourt et al. (2007) report that large metropolitan areas have disproportionately more patents than smaller areas, implying that increasing returns to innovation exist as a function of city size.

Why is geographical proximity influencing firms’ innovation and productivity? Combes et al. (2012) test two main hypotheses: firm selection and agglomeration economies. According to the first topic, only the most productive firms survive in places with many competitors, while the latter assumes that larger cities and more dense milieus promote interactions that increase productivity. Using French establishment-level data, Combes et al. (2012) show that firm selection cannot explain spatial productivity differences. Hence, agglomeration per se stimulates productivity.

A large quantity and wide variety of studies offer theoretical explanations why density and spatial proximity are beneficial for firm performance. Theories of agglomeration economies include: endogenous growth (knowledge spillovers, see i.e. Romer 1986, 1990), Marshallian (specialization) or Jacobian (variation) externalities. A wide spectrum of knowledge resources and qualification and competence profiles of the labour supply provide rich opportunities for knowledge exchange and creative interaction between firms and individuals in the region. Transport costs, the rate of return on human capital and innovation will benefit from the increased proximity (Glaeser and Gottlieb 2009).

Cohen and Levinthal (1989) demonstrate that a firm’s internal R&D increases its ability to assimilate knowledge from its economic environment. The general assumption is that there are positive externalities from knowledge spillovers. But demonstrating this empirically has proved to be challenging for a variety of reasons. One major issue is the huge firm-level heterogeneity in both R&D performance and output performance. A second issue is that since both absorptive capacity and location decisions are endogenous, these must be dealt with econometrically by considering that firm performance, R&D investments and locations are jointly determined. A third issue is the importance of a credible and rich dataset covering large number of observations both across firms and within firms over time. Most existing studies suffer from deficient data in this respect.

By exploiting the growing access to more detailed firm-specific datasets, it is possible to both deepen and extend the spillover literature in several directions. Recognizing the huge heterogeneity in areas such as R&D strategies and performance across firms, technological specialization and geographical conditions, the present paper will address some of these research issues. In particular, we will study firm heterogeneity in terms of ownership and size and the firms are observed in two types of locations, namely within and outside metropolitan areas. We also distinguish between high-technology firms and other manufacturing firms.

The paper considers relationship between both R&D and productivity and between patent and productivity. Our justification for two different knowledge measures is the simplified assumption that R&D represents creation of new knowledge, while patent represents exploitation of new knowledge.

Upon applying our two categories of models on an unbalanced panel dataset of R&D performing manufacturing firms in Sweden observed over a 16-year period covering almost 11,000 firm-level observations, the following main results emerge: (i) the productivity effect from agglomeration spillovers is restricted to large, high-technology firms and foreign-owned multinational enterprises in non-high-technology sectors and (ii) location in agglomeration areas has a significant positive effect on patent application rates among domestically owned, multinational firms in high-technology sectors.

The rest of this paper is organized as follows: Sect. 2 links the paper to its antecedents in the theoretical and empirical literature on knowledge spillovers. Section 3 presents the data. Section 4 discusses econometric issues and introduces the empirical models. Section 5 reports the empirical findings and conclusions are in Sect. 6.

2 Literature

While social returns to R&D are estimated to be at least twice as high as the private returns (Wolff 2012; Bloom et al. 2013), a growing number of more recent studies focus on differences in knowledge spillovers across geographical areas and differences in the capacity to benefit from external knowledge across firm. However, there has been little empirical work, on the combined effects of location and firm capabilities. Our paper contributes to the literature by studying two overlapping categories of firms and two different types of location.

Recent studies attempt to estimate whether the importance of proximity and local spillovers have diminished in the light of the rapidly increasing connectivity through telecommunications, globally networked information technologies and travelling. Surveying the literature, Bettencourt (2014) notices two general findings. First, online and ICT networks are local. More online content is available in larger cities so that these new technologies tend to reinforce, rather than replace, the connectivity dynamics of larger places. Second, the use of the Internet and local social networks tend to be integrated and tend to complement, rather than substitute, one another.

There are several approaches to study the impact of spillovers. A common method in micro-econometric analysis is to measure the stock of R&D or patents generated by other firms in the same industry or geography as the focal firm. Controlling for the firm’s own R&D, this variable shows the additional explanatory power of extramural R&D. Bernstein and Nadiri (1989) represent an early study using this methodology. Others approaches, such as Jaffe (1986) and Acemoglu (2007), assume that industries and firms are more likely to benefit from knowledge spillovers that are close in terms of technology. Some studies compare the importance of technological and geographical closeness and find that geographical closeness is more important (Pinkse and Slade 2010). Our paper is restricted to investigate the importance of geographical spillovers.

Existing research on knowledge spillovers consider two offsetting effects of firm A’s R&D on the performance or value of firm B [e.g. Cassiman and Veugelers (2002, 2006)]. The first is positive and implies that firm B can apply and benefit from external knowledge in its internal innovation activities. The second effect (product market rivalry) is ambiguous, and the outcome depends on whether the substitute or complementary effect dominates. The substitution effect is negative since A’s ideas will leapfrog B’s ideas, while the complementary effect will increase the potential of B’s ideas. Typically, this research finds that the positive effect of knowledge spillovers dominates.

A central problem in the prior spillovers literature based on firm level data is lack of information on firms’ R&D engagement. In their seminal paper, Cohen and Levinthal (1989) provide criticism against the view of spillovers as a public good, likening it to smoke pollution that affects all firms in the neighbourhood. Since there are also costs associated with appropriating knowledge spillovers, a firm cannot passively assimilate externally available knowledge. It must invest in its own knowledge creation or knowledge exploitation to absorb any of the R&D output of its competitors. In line with this assumption, we restrict our analysis to only R&D firms.

The objective of our research is to examine potential heterogeneity in the capacity to benefit from knowledge spillovers in metropolitan areas between foreign-owned and domestic multinational enterprises (MNEs), and between small and large firms. The latter analysis includes both MNE firms as well as domestic firms that are not part of a multinational group. We observe manufacturing R&D firms within and outside metropolitan areas in Sweden. Consider first the MNEs which comprise 80 % of the firms in our sample. A growing literature reports that firms’ innovation activities tend to be home-biased, for instance Patel and Pavitt (1991), Le Bas and Sierra (2002) and Belderbos et al. (2012). One explanation is that innovative firms are part of a complex and geographically close network, which means that they need to be embedded in the region’s innovation system. A logical extension of this finding is that international firms tend to adapt their home-generated technological capabilities to local circumstances in a foreign country. At the same time, they try to exploit foreign knowledge bases to expand and develop already existing capabilities. These two explanations on the differences between foreign- and domestically owned MNEs may be reflected in the differences in return on R&D with respect to productivity and patent applications, respectively. However, we do not find any robust guidance in the literature on how these differences varies across locations and technology sectors. Thus, based on the literature, we hypothesize that domestically owned MNEs have lower marginal returns on R&D with respect to productivity (return to knowledge generation) as compared to the foreign-owned counterpart, while the situation is the opposite regarding patent (return to knowledge exploitation). We also assume that the difference in return to generation and exploitation of knowledge, respectively, is neutral with respect to technology sector and firm location.

Our second analysis on R&D and absorptive capacity considers firm size. There is no broad agreement on the issue in previous literature: Aghion and Jaravel (2015) show that the theoretical predictions of knowledge spillovers are that small companies may have a larger marginal effect on learning , while the opposite is found in an empirical study by Bloom et al. (2013). The latter study explains its results by the tendency of smaller firms to operate in technological niches with more specific sources of knowledge. In the empirical analysis, we will test whether the findings by Bloom et al. (2013) can be confirmed on Swedish data and whether it can be confirmed on both creation and exploitation of knowledge. Addressing the potential differences in benefiting from external knowledge between R&D firms operating in high-technology sectors and other R&D firms, we assume that only highly specialized firms irrespective of size are more dependent on the combination of their own R&D as well as relevant complementary knowledge from targeted locations globally. Regarding other R&D firms in high-technology and non-high-technology sectors, we hypothesize that both small and large firms will benefit from metropolitan location.

3 Data

We use several firm-level data sources: R&D data, accounting data (value added, employment, physical capital etc.), and data on industry classification, education, localization and ownership come from Statistics Sweden, and the patent data come from the EPO Worldwide Statistical Database PATSTAT. Employing a unique firm identifier, we match the different data sources into an unbalanced panel covering the period 1997–2012. We deflate value-added and physical capital by the Swedish producer price index. The matched sample consists of an unbalanced panel of 1073 unique firms with at least four observations between 1997 and 2012. The total number of observations is around 11,000. On average, a firm is observed for 10.1 years.

The matching process starts with data from and R&D survey conducted by Statistics Sweden. The survey includes information on total R&D expenditures for the period 1997–2012. The whole population of manufacturing firms with 200 or more employees and research institutes are covered by the survey. In addition, the survey contains annual from different representative sample of R&D firms with 50–199 employees.

Table 1 presents the summary statistics of the key variables used in the analysis. We separate the data into four overlapping subgroups. The two first consists of foreign- and domestically owned MNE, respectively. The two remaining subsamples are the two size classes SMALL and LARGE divided by the median employment. The firms in the sample have two distinct locations. The first is within Sweden’s largest metropolitan areas: Stockholm-Uppsala, Malmo and Gothenburg. We label these areas as Metro, and they include 18 % of the firms in the sample. The other firms are located outside Metro. We also consider inflow to, and outflow from the Metro area. Less than 1 % of the time, firms move in to the Metro area, and also around 1 % of the time, they move out to other areas. The majority of the firms, almost 80 %, belong to a multinational group. The average firm applied for 8 patents per year.

4 Method

We are interested in investigating two relationships. The first is the relationship between labour productivity and R&D, and the other is between patent applications and R&D. We distinguish between firms located within or outside metropolitan areas, domestic or foreign ownership of multinational enterprises, and small and large firms. We also compare the impact of R&D among high-technology and non-high-technology firms. Formally, we identify the relationships with the following equations:

where the outcome variables for firm i at time t is \(\hbox {LP}_{it}\), \(\triangle \hbox {LP}_{it}\), and \(\hbox {Patent}_{it}\). The variables in the equations are defined as follows: LP is log value added per employee (labour productivity), LK is log physical capital per employee, RD is log R&D expenditures per employee, HT is high technology, NHT is non-high technology, and M is location in a metropolitan area. \(X_{it}\) is a vector of controls, and the error term is \(u_{it}\). The vector of control variables \(X_{it}\) consists of \(Move\, in\) and \(Move\, out\) variables indicating whether the firm has changed its geographical location with respect to M. It also includes ownership dummies. FMNE is foreign-owned multinational firm, DMNE is domestically owned multinational firm, DUNI is domestic uni-national firm, and DIND is domestic independent firm, and year dummies. \(\hbox {Patent}_{it}\) is number of patent application and the outcome variable in Eq. (3), where we also control for size which is log number of employees. Our main variables of interest are \(\hbox {RD}\times \hbox {HT}\) , \(\hbox {RD}\times M\times \hbox {HT}\) and \(\hbox {RD}\times \hbox {NHT}\) , \(\hbox {RD}\times M\times \hbox {NHT}\): the interaction between R&D expenditure, technology group and metropolitan areas.

There are three econometric issues to address in the equations. They are unobserved heterogeneity, endogeneity and dynamics. We assume that the most severe problem is endogeneity. Therefore, the central issue in the present study is to empirically distinguish R&D spillovers from correlated shocks related to opportunities in the geographical milieu. If some opportunities arise exogenously in a given local area (M), then all firms in that area will do more R&D and may improve their productivity and apply for more patents. Not controlling for this simultaneity effect will be picked up by our spillover measure M.

In the empirical analysis, we use two different approaches: instrumental variables general method of moments (IV-GMM) Footnote 1 and negative binomial regressions (NBREG).

Our IV-GMM estimator is the Arellano-Bond approach (Arellano and Bover 1995; Blundell and Bond 1998). This approach combines equations in differences of the variables with equations in levels of the variables. The validity of the instruments in the model is evaluated with the Sargan Hansen test of over-identifying restrictions, whereas the Arellano-Bond auto-regressive test is used for identifying possible second-order serial correlation.

An advantage with the system GMM estimator is that it requires fewer assumptions about the underlying data-generating process and uses more complex techniques to isolate useful information (Roodman 2009). The estimator allows for a dynamic process, with current realizations of the dependent variable influenced by past values, and some regressors may be endogenous. Moreover, the system GMM estimator also accounts for individual specific patterns of heteroskedasticity and serial correlation of the idiosyncratic part of the disturbances.

The final model, the nonlinear NBREG controls for unobserved heterogeneity, but otherwise it is similar to the OLS model in the sense that it does not account for dynamic panel data biases, and we only account for endogeneity by lagging the RD-variable. Observing a pre-sample period for patenting, Blundell et al. (1995) introduce a method that reduces the risk of endogeneity in a patent equation, similar to ours, but unfortunately such information is not available in our equations. Regarding the dynamic panel bias, it is more serious for short t than for long t. The time dimension of our panel is relatively long, so the dynamic panel data bias is likely to be small [(see Nickell (1981)].

Our final discussion in this section is on the error term \(u_{it}\). In Eqs. (1), (2) and (3), we will assume that it is composed of firm fixed effects\((\eta )_{i}\), a full set of time dummies \((\tau _{t})\), and an idiosyncratic component \((\nu _{it})\) that we allow to be heteroskedastic and serially correlated.

Lychagin et al. (2010) and Lööf and Nabavi (2014) implemented related but distinct methods of examining geographical R&D spillovers. Both found that geographical spillovers are important in increasing productivity, and Lööf and Nabavi (2014), showed that the importance of geographical spillovers increases with both proximity to other firms and absorptive capacity as proxied by firm’s innovation strategy. A major distinction between the present paper and Lööf and Nabavi (2014) is that our study focuses only on firms with a persistent or almost persistent innovation strategy, while they considered firms that are persistent and temporary R&D investors, as well as firms that never engaged in R&D.

5 Results

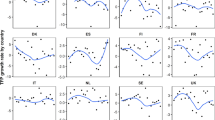

Tables 2, 3 and 4 present the GMM and NBREG estimates of the effects of R&D in high-technology sectors HT and non-high-technology sectors NHT sectors, and the combined effect of R&D in these sectors when the firm is located in a metropolitan areas. In the tables, there are two endogenous outcome variables: labour productivity and patent applications.

The central research topic is to examine potential heterogeneity in the capacity to benefit from knowledge spillovers in metropolitan areas between foreign-owned and domestic MNEs, and between small and large firms. The literature discussion in Sect. 2 suggests that foreign firms with access to home-based R&D may be relatively more engaged in knowledge exploitation (reflected in productivity) than knowledge exploration (reflected in patent). Concerning firm size, the literature is ambiguous regarding the benefit of external knowledge in the local milieu. Highly specialized firms that need complementary knowledge might be less distance sensitive than other firms. Aghion and Jaravel (2015) suggest that the marginal rate of return from spillovers is larger for smaller firms, while Bloom et al. (2013) argue that smaller firms can be expected to have significantly lower advantage of external knowledge since they tend to operate in technological “niches” where few other firms operate in the same technology fields.

In general, the results show that external metropolitan knowledge adds to internal R&D in the productivity equation for large firms in high-technology sectors and foreign-owned MNEs in non-high-productivity sectors, when accounting for endogeneity. These results have a causal interpretation. The patent equation shows that the metropolitan bonus is restricted to domestically owned firms.

The tables are organized in the following way: Column (1) shows the results for the entire sample, while columns (2) and (3) report results for the two subsamples foreign MNE, domestic MNE. Columns (4) and (5) present results for the whole sample split into Small and Large firms, where the latter category has more than 150 employees in average. In all columns, our focus is on the two interaction variables between R&D and sector, and the two interaction variables between R&D, metropolitan and sector. While the two first variables show the impact of R&D, the two latter report the additional effect of R&D as a result of their presence in a metropolitan area. These two variables are our spillovers indicators.

5.1 IV-GMM estimates

In Tables 2 and 3, we apply the two-step IV-GMM model on Eqs. (1) and (2). Table 2 presents the result for the relationship between labour productivity and its determinants. In column (1), the lag of labour productivity (LP) is positive and highly significant, showing the persistency of this performance variable. The sum of the contemporaneous and lagged KL-variable (physical capital per employee) is also positive, and in accordance with the literature. R&D has a positive and highly significant association with productivity for both high-technology firms and other manufacturing firms. The size of the estimate is 0.06 and 0.07, respectively. When we examine the spillover effect, measured as the additional impact on R&D from firms presence in a metropolitan region, the coefficient estimate is 0.02 for high-tech firms and 0.08 for non-high-tech firms. Only the latter is significantly different from zero. Concerning the controls for firm mobility, we find that moving to or from a metropolitan area has no instant productivity effect. Finally, we find that the MNEs have higher productivity than other companies, ceteris paribus. The test statistics in the bottom part of the table report that there is no serial correlation in the original error and that the validity of the instrument cannot be rejected. The satisfactory test statistics allow us, in principle, to give a causal interpretation of the estimates. Our first conclusion is that we find a spillover effect, though only significant for non-high-technology firms. The result supports the view that more knowledge or technology-intensive and specialized firms tend to seek complementary knowledge in a more geographically dispersed area compared with other companies.

Next, we consider columns (2)–(5) and the results for the two categories of MNE and for the two size groups. For brevity, we only discuss the spillover effect and compare the elasticity of productivity with respect to R&D when firms are present in metropolitan region with the corresponding R&D estimate for all firms. Column (2) considers foreign multinationals and suggests spillover effect only for non-high-technology firms. Column (3) shows that the spillover coefficient for domestic MNEs is non-significant irrespective of technology sector. In column (4), we find no evidence on spillover effect among Small firms. Column (5), however, reports a positive and significant estimate for Large firms when high-technology firms are considered. The estimate for other R&D firms is not significantly different from zero. The test statistics are satisfactory across column (2)–column (5)

Table 3 presents our results for the growth equation. Focusing on the spillover effect and the subsamples, the results are similar to the level equation. The coefficient estimates are positive only for foreign-owned multinational non-high-technology firms (column 2) and large firms in the high-technology sector (column 5). The bottom part of the table reports that the test statistics for serial correlation and overidentifying restrictions are satisfactory.

Summarizing the productivity estimates, the results suggest that only large firms are able to absorb knowledge spillovers from the nearby knowledge milieu, when the high-technology sector is considered. This is in line with Bloom et al. (2013). Our tentative explanation is that small high-technology firms are more dependent on specialized external knowledge that might be accessible outside the local milieu. Regarding low-technology firms, we only find a significant positive spillover effect among foreign-owned firms. Here, our tentative interpretation is that this category of firms is less connected to knowledge networks outside the metro area compared to domestic firms.

5.2 Patent equations

Table 4 reports the results of negative binomial model on Eq. (3). The dependent variable is number of patent applications. In all five columns, there is a positive and statistically significant coefficient on the size variable, while the coefficient on capital intensity is not significant. Rows 3, 4, 5 and 6, respectively, show that the summary effect of the lagged R&D variables is positively associated with patent. Rows 7 and 8 report evidence on spillovers for high-technology firms and rows 9 and 10 spillovers effect on non-high-tech firms.

The combined effect of the first and second lag of interaction variable between R&D and metropolitan location is close to zero for the total sample. The spillover effect is negligible for both high-technology and non-high-technology firms. Column (2) reports negative effect on patent (exploitation of knowledge) from presence in a metropolitan area when the sample represent foreign MNEs. This conclusion applies to both high- and low-tech firms. Column (3) suggests that location in agglomeration areas has a significantly positive impact on patent among domestically multinational firms in high-technology sectors. No corresponding effect is found in other sectors. Concerning firms size and spillovers, column (4) reports estimates that are not statistically different from zero for small firms, and column (5) indicates a negative impact for large firms, controlling for corporate ownership. The results reported in column (4) and column (5) are the same for both high- and low-technology firms.

The home-based hypothesis discussed in Sect. 2, suggesting that domestic firm have a comparative advantage in knowledge creation. Using patent as a proxy for knowledge generation, our results give some evidence that this advantage is related to spillover effects among high-technology firms.

6 Conclusion

Geographical and technology spillovers are present in all sectors. Firm performance is potentially affected by knowledge spillovers which can be positive through complementary knowledge or negative business stealing effects. Spillovers can also be neutral or very limited if firms lack sufficient absorptive capacity or operate in technological niches where few other firms operate in their field.

Increased access to extensive and detailed firm-level data enables us to learn more about the complex and largely unobserved knowledge. This paper considers geographical spillovers and potential heterogeneity across technology sectors and size classes. The study is restricted to R&D firms in the manufacturing sector, with an unbalanced sample of 1073 Swedish firms and data covering a 16-year period with close to 11,000 observations.

Our paper contributes to the literature in several ways. First, we use an extensive dataset which enables us to capture heterogeneity between firms in various dimensions. Second, by studying two different categories of output, we consider the impact of spillovers on both generation and exploitation of knowledge. Third, we exploit econometric methods that are able to handle the endogeneity issues which otherwise might contaminate the empirical results.

We apply linear and nonlinear approaches and test the importance of knowledge spillovers on labour productivity and patent applications. The overall result shows that not all R&D firms benefits from knowledge spillovers captured by presence in an agglomeration area. Using a dynamic production function approach and examining labour productivity in both level and growth dimension, we find robust, causal effect from local spillovers to productivity for large firms and for foreign-owned multinational firms in non-high-technology sectors. Location in agglomeration areas has a significant positive effect on patenting among domestically owned multinational firms in high-technology sectors. Concerning size, we find a negative spillover impact on patenting among large firms.

There are various possible extensions to the line of research conducted in this paper. One interesting area is to expand the impact on patents by using cite-weighted granted patent, rather than only number of patent applications. Another possibility is to use a structural model to study how knowledge spillovers influence both the decision to engage in R&D and the outcome of R&D-efforts, perhaps using a spatial econometrics approach. A third area is to include trade, technology and geography in the same approach and investigate in greater detail how the various mechanisms of spillovers separately and combined influence firm performance. The most connected extension to the paper is to deepen the analysis on the distinct differences in spillover effect between domestically and foreign multinational firms located in agglomeration areas.

Notes

As a robustness check, pooled ordinary least squares (OLS) model is used. The results are available upon request.

References

Acemoglu D (2007) Equilibrium bias of technology. Econometrica 75(5):1371–1409

Aghion P, Jaravel X (2015) Knowledge spillovers, innovation and growth. Econ J 125(583):533–573

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68(1):29–51

Belderbos R, Duysters G, Sabidussi A (2012) R&D collaboration and innovative performance. In: Andersson M, Karlsson C, Johansson B, Lööf H (eds) Innovation and growth: from R&D strategies of innovating firms to economy-wide technological change, number 2005. Oxford University press, pp 160–181

Bernstein JI, Nadiri MI (1989) Research and development and intra-industry spillovers : an empirical application of dynamic duality. Rev Econ Stud 56(2):249–267

Bettencourt LMA (2014) Impact of changing technology on the evolution of complex informational networks. Proc IEEE 102(12):1878–1891

Bettencourt LMA, Lobo J, Helbing D, Kühnert C, West GB (2007) Growth, innovation, scaling, and the pace of life in cities. Proc Natl Acad Sci United States Am 104(17):7301–7306

Bloom N, Schankerman M, Van Reenen J (2013) Identifying technology spillovers and product market rivalry. Econometrica 81(4):1347–1393

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Blundell R, Griffith R, Reenen JV, The S, Journal E, Mar N (1995) Dynamic count data models of technological innovation. Econ J 105(429):333–344

Cassiman B, Veugelers R (2002) R&D cooperation and spillovers: some empirical evidence from Belgium. Am Econ Rev 92(4):1169–1184

Cassiman B, Veugelers R (2006) In search of complementarity in innovation strategy: internal R&D and external knowledge acquisition. Manag Sci 52(1):68–82

Cohen WM, Levinthal DA (1989) Innovation and learning: the two faces of R & D. Econ J 99(397):569–596

Combes P-P, Duranton G, Gobillon L, Puga D, Roux S (2012) The productivity advantages of large cities: distinguishing agglomeration from firm selection. Econometrica 80(6):2543–2594

Glaeser EL, Gottlieb JD (2009) The wealth of cities: agglomeration economies and spatial equilibrium in the United States. J Econ Lit 47:983–1028

Jaffe AB (1986) Technological opportunity and spillovers of R&D: evidence from firms’ patents, profits, and market value. Am Econ Rev 76(5):984–1001

Le Bas C, Sierra C (2002) Location versus home country advantages in R&D activities: some further results on multinationals’ locational strategies. Res Policy 31(4):589–609

Lööf H, Nabavi P (2014) Innovation, spillovers and productivity growth: a dynamic panel data approach. In: Working paper series in Economics and Institutions of Innovation, Royal Institute of Technology, CESIS—Centre of Excellence for Science and Innovation Studies

Lychagin S, Pinkse J, Slade ME, Van Reenen J (2010) Spillovers in space: Does geography matter? In: NBER Working Paper, No. 16188

Nickell S (1981) Biases in dynamic models with fixed effects. Econometrica 49(6):1417–1426

Patel P, Pavitt K (1991) Large firms in the production of the world’s technology: an important case of non-globalisation. J Int Bus Stud 22(1):1–21

Pinkse J, Slade ME (2010) The future of spatial econometrics. J Reg Sci 50(1):103–117

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Romer PM (1990) Human capital and growth: Theory and evidence. Carnegie-Rochester Conference Series on Public Policy 32:251–286

Roodman D (2009) How to do xtabond2: an introduction to difference and system GMM in Stata. Stata J 9:86–136

Wolff E (2012) Spillover, linkages, and productivity growth in the US economy, 1958–2007. In: Andersson M, Karlsson C, Johansson B, Lööf H (eds) Innovation and growth: from R&D strategies of innovating firms to economy-wide technological change. Oxford University Press, Oxford