Abstract

Soft-data-based microcredit can bring financial inclusivity for those who are likely to be left out of financial services due to the lack of credit history or other hard data the traditional credit scoring models require. This study aims to investigate whether borrowers’ credit risks are predictable through their psychological characteristics, particularly: self-control, conscientiousness, neuroticism, risk-taking, attachment, integrity, money attitude, and money management. We attempted to develop a psychometric credit scoring including the above factors (validated through Confirmatory Factor Analysis) and experimented with providing small loans for individuals using the psychometric credit scoring, through a mobile lending application, Zeely. Anyone above 18 years old who wish to borrow from Zeely and received at least 70% score on the psychometric test were eligible to become a customer. The main analyses were conducted on SPSS.25 using the linear regression and MANOVA, with the data of 12,627 borrowers who received microcredits between January 2021 and June 2022. Results revealed that money management, self-control, risk-taking, and conscientiousness predicted credit overdue days, self-control and risk-taking predicted credit default, delinquency, and normal repayment group differences, and money management, self-control, and conscientiousness predicted overall loan history-based cluster differences (or ideal and non-ideal borrowers). Male gender and younger age were related to significantly higher credit risks, yet, all four psychological factors added a significant amount of explained variances to credit overdue days after adjusting to age and gender. Therefore, it is concluded that psychological factors can be used as alternative data for credit scoring in the cultural context. Limitations, implications, and future directions are discussed.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

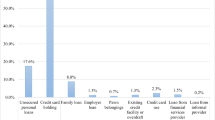

Financial inclusivity through soft data-based loans can bring positive changes in people’s lives, especially those who are likely to be left out due to a lack of credit history and other hard data the traditional lending models require (Leong et al., 2017). The recent developments in the fintech sector—integrating technological advancements in facilitating financial services (Arner et al., 2015), such as a mobile lending application—may foster such soft-data-based loans and financial inclusivity in many countries (Menat, 2016; Muganyi et al., 2022). In Mongolia, the Financial Regulatory Commission (2021) reported that 80.4% of total borrowers, or 1.4 million people received loans through mobile lending applications in 2021, which accounted for 15.3% of the total annual loans. That is, the number of fintech borrowers in Mongolia increased 2.1 times from the previous year, or 85 out of 100 people aged 18–64 borrowed from mobile lending applications in 2021. This shows that mobile lending applications have become a popular way of requesting microcredit for Mongolians. Microcredit is defined as a very small sum of loans for individuals who are usually unable to receive such loans from commercial banking services (Hayes, 2020). However, the credit scoring systems of those fintech services in Mongolia are still inclined to use traditional demographic and financial data which are largely determined by regular full-time employment status and monthly social insurance payment amount proportionally deducted from the monthly salary. As a result, those with low or irregular income and a lack of financial history are still at risk of being discriminated against in receiving financial services. Therefore, to make fintech services more accessible, it is important to develop alternative credit scoring that is not limited to or even exclusive of those traditional data. It is also important for such an alternative scoring to accurately predict credit risk, as microcredits tend to face greater default risk than traditional loans (Serrano-Cinca et al., 2015). According to the Financial Regulatory Commission (2021), credit risks may include overdue days, credit delinquency (30–90 days overdue), and credit default (more than 90 days overdue).

Psychological factors, or the characteristics variable of the 5C approach of lending (Thomas, 2000), is one of the increasingly studied alternative predictors of credit risks. That is, aside from macroeconomic situations, borrower’s personal characteristics, or his/her psychological, attitudinal, and behavioral characteristics tend to explain the large variances in credit risk (Ford, 2018). Previous studies argued that while financial information might predict the borrower’s ability to repay, psychological information might help predict the more crucial factor, the willingness to repay (Ladas et al., 2014). There might be situations where the borrower chooses not to pay back despite their full ability to repay (Goel & Rastogi, 2021). Therefore, some bankers in England reported they put more emphasis on the applicant’s personal characteristics, such as pleasantness than financial net worth when making lending decisions (Wilson et al., 2007). Also, an Indonesian fintech reported their psychological lending method produced an excellent repayment rate (Rabecca et al., 2018). However, according to Trönnberg and Hemlin (2012), neither extended access to financial information nor extensive reliance on relationship lending (i.e., soft-data-based lending method) relates to better lending decisions. Regarding the latter, they argued some borrowers might not honestly reveal their personal characteristics in high-stake situations, and loan officers’ personal bias might affect rational lending decisions. Therefore, to keep objectivity and bias-free evaluation in soft-data-based lending, it is crucial to quantify personal characteristics through statistical credit scoring instead of relying on the intuitions of the loan officers. Besides, as the microcredit demands grow larger, the loan officers cannot evaluate each loan requester’s personal characteristics without an automated scoring system.

To sum up, although financial information and other market situations are predictive of loan repayment, the personal characteristics of the borrower can be used as alternative data for credit scoring, especially when there is a lack of financial history. Moreover, keeping objectivity is important when evaluating credit scores through personal characteristics.

When it comes to the relationships between personal characteristics and credit risk, the most cited, influential studies (i.e., Lea et al., 1995; Livingstone & Lunt, 1992; Tokunaga, 1993) and recent systematic reviews (i.e., Çallı & Coşkun, 2021; Goel & Rastogi, 2021) suggest various psychological, behavioral, attitudinal, and even financial literacy-related factors as the potential predictors of credit risks. In particular, Goel and Rastogi’s (2021) systematic review suggested self-control as one of the strongest predictors of loan repayment as it inhibits and regulates impulsive spending due to emotional instability (Goel & Rastogi, 2021; Webley & Nyhus, 2001). It was repeatedly found that irresponsible, impulse-driven spending leads to over-indebtedness (Hughes, 2014; Ladas et al., 2014; Lea et al., 1995; Livingstone & Lunt, 1992). In that sense, self-control refers to self-discipline, which inhibits the impulsive behaviors (Baumeister, 2002; Shilton, 2020). Compare to other variables, self-control seems to be consistently supported by the previous studies, making it one of the soundest predictors of loan repayment.

Personality might be another potential psychological predictor of loan repayment. In particular, people who are low on neuroticism, but high on conscientiousness were found to demonstrate better repayment behaviors (Anderson et al., 2011; Chhatwani, 2022; Donnelly et al., 2012; Letkiewicz & Heckman, 2019). Neuroticism is characterized by a frequent display of negative emotions, including anxious and depressive-irritable emotions, mainly as a result of high sensitivity to environmental stimulus, while conscientiousness is characterized by a high sense of responsibility and rule obedience, making conscientious people highly reliable (Cobb-Clark & Schurer, 2012). That is, the irrational emotionality of highly neurotic people might lead to irrational, impulsive financial decisions and that may cause financial problems. As opposed to that, highly conscientious people might manage their finance better as they are more responsible. However, as the feelings of responsibility can create worries and anxiety, some people might demonstrate high neuroticism and conscientiousness simultaneously (Beckmann et al., 2010). In that instance, neuroticism can be a positive indicator of loan repayment. However, previous findings are inconsistent as some studies reported no effect of conscientiousness (Klinger et al., 2013) and neuroticism (Ganbat et al., 2021) on loan repayment, therefore, showing the need for more studies.

Risk-taking tendency might also be responsible for credit risk. People who were high in risk-taking tended to involve in problematic behaviors such as gambling, driving under the influence, and unprotected sexual behavior (Zuckerman & Kuhlman, 2000), and such risk-taking were correlated with risky financial decisions as well (Adams & Moore, 2007). Worthy et al. (2010) found that college students who scored higher in sensation-seeking also reported a higher level of risky behaviors and more problematic financial outcomes. Similar findings were found in some non-western samples as well (Flores & Vieira, 2014). Therefore, there seems to be a relatively clear relationship between risk-taking and financial problems. However, there are still a number of studies that reported no relationship between risk-taking and indebtedness at all. For instance, Meyll and Pauls (2019) argued not the risk-taking attitude but other factors, such as the initial loan purpose, explain the over-indebtedness. Nevertheless, the majority of the previous studies supported risk-taking as a potential predictor of credit risks.

Moving further, attachment insecurity might also relate to the credit risk. According to Hughes (2014) and Li et al. (2020), attachment insecurity was related to emotional and irresponsible spending (similar to low self-control and high neuroticism) and lack of financial planning, thus leading to financial problems such as over-indebtedness. Adulthood attachment is conceptualized by the personal belief system about one’s self and others, or the degree to which one believes in own self-worth and the trustworthiness of others (Weiss, 2006). Negative beliefs about one’s self and others create a fear of rejection and loss, thus people with insecure attachment tend to have relational issues with significant others. Hughes (2014) suggested that as negative emotionality is linked with irregular and irresponsible buying, emotional distress and conflicts due to insecure attachment may result in credit risk. However, compared to the other factors, the influence of attachment on loan repayment is relatively less investigated. Moreover, some studies reported finding integrity to predict loan repayment (Dlugosch et al., 2018; Sohn, 2016; Wang et al., 2020). It could be that a higher level of honesty and moral principles, the elements of integrity, bring a higher willingness to repay (Goel & Rastogi, 2021). But then again, the effect of integrity was investigated less than other commonly investigated factors.

In addition to these psychological variables, financial literacy-related factors such as money management skills and attitude towards money are other potential determinants of loan repayment (see review by Çallı & Coşkun, 2021). Studies found people who carefully plan their finance, such as by using various financial management resources, and those who are confident in their financial management knowledge and skills demonstrate better repayment behaviors (Baidoo et al., 2020; Ksendzova et al., 2017; Lea et al., 1995). Moreover, Tokunaga (1993) found that problematic debtors had more problematic attitudes toward money or saw money as a source of anxiety, power, prestige, and a tool for compulsive purchasing. Such people tend to impulsively purchase and make other impulsive financial decisions to either increase the feelings of power and pleasure or to decrease the anxiety of having money, which tends to create difficulties in sticking with the loan repayment plan (Hughes, 2014).

Taken as a whole, previous studies suggested various psychological, behavioral, and attitudinal predictors of loan repayment and credit risk, although with some common limitations. First, the majority of those studies were conducted in western countries and targeted credit card users and bank loan users. Relatively little is known from the non-western samples and how these factors relate to fintech users (Baklouti, 2014). Second, the dependent variables or the chosen credit risks of the previous studies varied hugely from overdue days to credit default, and that may have produced inconsistent results. Lastly, and more importantly, very few studies developed credit scoring systems based on such psychological factors and tested them in real-life microlending practice. To the best of our knowledge, by far, there is only one fintech in Indonesia that has been successfully providing microloans based on the performance of their psychometric test (Rabecca et al., 2018). However, their model is exclusively for small and medium enterprises and entrepreneurs. Hence, there is a need to examine the effectiveness of such credit risk-predicting psychometrics in different contexts, particularly, in non-entrepreneur borrowers from a different country.

The present study intends to contribute to the literature by testing whether the proposed factors can be used as alternative data for microfinance credit scoring in the Mongolian context. To quantify these soft factors, psychometric credit scoring was developed and implemented at a local microcredit issuing mobile application Zeely,Footnote 1 by Khatan-Suudal Invest non-bank financial institution, and the relationships between the psychometric credit scores and various credit risks were examined. Based on previous studies’ findings, the following hypotheses were developed.

H1: The proposed factors, self-control, conscientiousness, neuroticism, risk-taking, attachment, integrity, money attitude, and money management, will significantly predict credit overdue days.

H2: The proposed factors, self-control, conscientiousness, neuroticism, risk-taking, attachment, integrity, money attitude, and money management, will significantly differ among normal repayment, credit delinquency, and credit default groups.

H3: The proposed factors, self-control, conscientiousness, neuroticism, risk-taking, attachment, integrity, money attitude, and money management, will significantly differ among the overall loan history-based clusters (or ideal and non-ideal borrowers).

2 Methodology

2.1 Instrument Development

To test the hypotheses, a new credit scoring instrument was developed including the proposed factors. When creating the items, the researchers (first, second, and third author) consulted previously tested western questionnaires regarding each factor and attempted to adapt the most relevant items (through face validity) in accordance with the current need. In doing so, three things were considered important. First, the items should be easily understood in the cultural context or should not be perceived as some translated sentences that have ambiguous meanings. Second, the adapted items should be worded carefully and not worded in a way that skews respondents toward a certain answer. It is especially important because based on our previous experiences (Ganbat et al., 2021), people tend to choose “the obviously right answers” when performing psychometric credit scoring and that creates a problem with data accuracy. For instance, items “I am a highly responsible person” or “I manage my finance well” often produced higher mean scores that did not relate to the loan repayment outcomes. Therefore, we aimed to prevent making similar mistakes in this study. Third, the instrument should replicate the theoretical structure of each factor. For instance, according to previous studies, three distinct components of self-control, emotional instability, emotional behavior/buying, and self-discipline seemed to predict loan repayment, while two components of money attitude, money as a source of power and prestige, and negative beliefs about money such as seeing money as a source of conflicts were related to loan repayment, and so on. As a result, the current instrument was estimated to consist of 16 subscales (Table 1). Initially, ten items were developed for each subscale, with an expectation that low quality ones will be removed resulting in fewer items. All item responses were recorded on a five-point Likert scale, ranging from 0 (not at all) to 4 (very much like me). Higher scores indicate higher self-control, conscientiousness, integrity, money management, and positive money attitude, but lower attachment insecurity, neuroticism, and risk-taking. That is, the latter three factors or the risk factors were reverse-coded to reflect a scoring scheme that higher scores indicate better performance.

Pilot study. A pilot study was conducted to examine the internal consistency and structural validity of the newly developed instrument and to get a loose orientation on the proposed factors’ predictive ability of loan repayment. As of 200 Zeely borrowers who agreed to voluntarily participate and filled the survey anonymously through Survey Monkey, 170 responses were included in the data analyses after removing incomplete responses and those who failed the quality check (e.g., completed the survey too quickly or deliberately chose the same answers repeatedly). Informed consent was obtained when completing the online survey. The average age of the respondents was 25.5 (SD = 4.2), 63.7% were female and 36.3% were male.

Firstly, internal consistency reliability was analyzed using the item mean and standard deviations, item-total correlations (ITC), and Cronbach’s alpha. 86 items with low ITC (<0.3) and non-normal distributions were removed. As a result, all 16 subscales reached a relatively acceptable level of Cronbach’s alpha (ranging from 0.600 to 0.869) as shown in Table 1.

After reaching acceptable internal reliabilities, Confirmatory Factor Analyses (CFA) were performed on Amos.26 (Arbuckle, 2019) to check the factor structure and model fits. All CFA models produced a relatively acceptable fit and the anticipated number of factor structures. Particularly, attachment insecurity, risk-taking, and integrity produced the most acceptable fit indices, however, self-control, conscientiousness, neuroticism, money management, and money attitude produced less acceptable fit indices but many of the requirements of an acceptable model were demonstrated in each model (Table 2). All items were loading above 0.40 as recommended by Stevens (1992), except for an item of negative attitudes toward money and an item of risk-taking. Removal of those two items did not produce significantly improved model fits, thus, the items were retained. Therefore, the final version of the instrument consisted of 74 items as shown in Table 1. Moreover, all latent variables were significantly correlated (p < 0.01), at low to moderate levels (from 0.353 to 0.633), except for money attitude and conscientiousness scales where no significant correlations were found among their subscales.

Lastly, the pilot study’s participants were asked “Have you ever failed to pay your loan on time?” to roughly examine the proposed factors’ predictive abilities on loan repayment (i.e., due to anonymity, their data recorded on the Zeely database were not usable). 29.4% answered “yes”, and 70.6% answered “no”. For participants who answered “yes”, 92% repaid in less than 30 days overdue or before the loan history proceeded to delinquency, and 8% paid in more than 30 days. As shown in Table 3, significant differences were found between participants who always pay their loans on time and those who occasionally pay late regarding all factors, except for emotional instability, risk-taking, moral principles, and seeing money as power and prestige. That is, the pilot study’s participants tended to evaluate themselves as relatively emotionally stable, have higher moral principles, and relatively higher in risk-taking and seeing money as a source of power and prestige, regardless of their loan repayment behavior. Higher risk-taking could be due to the relatively young mean age (25.5) and seeing money as a source of power and prestige could be a cultural effect that relatively lower economic growth and higher corruption rate (Sergelenbat, 2021) of Mongolia might be producing this effect. Moreover, some of these significant differences in t-tests became insignificant in the multivariate analysis. The emotional instability (p = 0.041, odds ratio = 2.94, SE = 0.527), emotional buying (p = 0.002, odds ratio = 0.155, SE = 0.613), self-discipline (p = 0.021, odds ratio = 0.285, SE = 0.544), moral principles (p = 0.012, odds ratio = 3.06, SE = 0.444), responsibleness (p = 0.014, odds ratio = 3.71, SE = 0.536), and unplanned spending (p = 0.000, odds ratio = 0.128, SE = 0.510) remained significant, suggesting these might be the strongest predictors in loan repayment in the cultural context. Nevertheless, no scale or subscale was removed based on the pilot results.

2.2 Participants and Procedure

Around 15,000 people received microcredits through the Zeely mobile lending application between January 2021 and June 2022 based on their performance on the above instrument. New borrowers or those who used the loan for less than 28 days were excluded from analyses due to lack of loan repayment data. As a result, data of 12,627 borrowers were analyzed. The consent was taken from each borrower when signing the loan agreement that their data could be used anonymously for research purposes. The average age of the borrowers included in the data analyses was 30 (SD = 7.1, ranging from 19 to 79). 58.2% were female, and 41.8% were male.

In evaluating the credit scoring, users were asked to respond to one randomly selected item from each subscale or a total of 16 items, as the total instrument was considered too long. Resultantly, the credit scoring was able to be calculated within less than three minutes. All items were coded in a way that lower scores indicate a higher likelihood of credit risks. In other words, if the user selected “4” or “very much like me” on negative items such as “People say that when I face obstacles, I easily become irritated”, the score was reversed to “0”. Users who received at least 70% of the total score were considered as passed the scoring and therefore received the microcredits (i.e., as microcredits face greater default rate, applying cut-off score was necessary). That is, the credit score was calculated by the sum of the scores of all 16 subscales. As a quality check, the users were asked to enable their front camera while responding to the items. Lastly, users’ demographic information, age and gender, was asked, only for research purposes.

2.3 Data Analysis

Data analyses were performed on SPSS. 25 (IBM Corp, 2017). To test H1, or whether the proposed factors predict credit overdue days, linear regression analyses were carried out for each proposed factor, adjusting for age and gender. When there is more than one loan account per borrower (meaning the borrower received more than one loan), the maximum overdue day was used, and the overdue days ranged from 0 to 464 (Mean = 26.38, SD = 62.15, median = 2.00).

For H2 and H3, MANOVA tests were carried out to analyze the differences between the groups regarding the independent variables. For H2, three groups were created using maximum overdue days, normal repayment group (i.e., zero to 29 days overdue), credit delinquency group (i.e., 30 to 90 days overdue), and credit default group (i.e., more than 90 days overdue). 10,316 borrowers or 81.7% were classified into the normal repayment group (61.0% were females and 39.0% were males), 1106 borrowers, or 8.8% were classified into the credit delinquency group (44.6% were females and 55.4% were males), and 1205 borrowers or 9.5% were classified into credit default group (45.9% were females and 54.1% were males).

For H3, four groups were created based on their overall history of loan repayment. That is, while H2 groups were created based on each borrower’s “worst” possible repayment history, H3 attempted to cluster the borrowers based on their overall loan history on Zeely. Particularly, (1) total loan accounts, (2) total overdue accounts, (3) total overdue days, and (4) total number of days that the borrower has used the loan were used to build the cluster model on R version 4.2.1 (R Core Team, 2013). Before comparing the different variables, the numeric variables were standardized. The k-means method was applied in building clusters, and to determine the number of optimal clusters, the elbow method was used. Elbow is a simple visual technique in which the number of clusters is determined by the “elbow” shaped point (Humaira & Rasyidah, 2020). As shown in Fig. 1, larger value differences were observed between Cluster 1, 2, 3, and 4, and starting from Cluster 4 to 5 small differences were observed, making the elbow point. Hence, the visualization demonstrated that the optimal number of clusters was four.

As shown in Table 4, 838 borrowers (6.6%) were classified into Cluster 1, the non-ideal borrowers, with the highest total overdue days (M = 231.78) and the lowest total account (M = 3.24). 2318 borrowers (18.4%) were classified into Cluster 2, or the regular borrowers, with a higher number of total accounts (M = 8.17) and relatively lower total overdue days (M = 31.40). 6664 borrowers (52.8%) were classified into Cluster 3, the new borrowers with thinner history, with even lower total overdue days (M = 12.56) and relatively lower total accounts (M = 4.77). Lastly, 2807 borrowers (22.2%) were classified into Cluster 4, the ideal borrowers, with the lowest total overdue days (M = 3.68) and the highest total accounts (M = 15.55). In other words, Cluster 4 borrowers use the loan application most frequently and almost always repay before the due date.

3 Results

3.1 The Associations Between Psychological and Financial Literacy Factors and Credit Overdue days

Adjusting for age and gender, emotional buying, rule obedience, responsibleness, risk-taking, and money management knowledge and resources were negatively associated with credit overdue days, as shown in Table 5. Negative associations were due to all negative variables (in this case, emotional buying and risk-taking) were reverse-coded. That is, lower levels of emotional buying and risk-taking but higher levels of rule obedience, responsibleness, and money management knowledge and resources predicted decreased credit overdue days. All associations added a significant amount of effect size after controlling for age and gender, although the effect sizes were small. Other variables had no significant association with the credit overdue days. Age and gender both significantly predicted credit overdue days negatively that increased age and female gender predicted decreased credit overdue days. In which, the effect of gender was stronger. Therefore, H1 was partially supported.

3.2 The Associations Between Psychological and Financial Literacy Factors and Credit Delinquency, Default, and Normal Repayment Groups

The multivariate analysis supported there was a significant effect of the psychological and financial literacy-related independent variables on the group differences (Wilks’ Lambda = 0.996, F (32, 25,218) = 1.44, p = 0.049, partial η2 = 0.002). As shown in Table 5, the group differences occurred regarding emotional buying and risk-taking, although both with small effect sizes (partial η2 = 0.004). The effect sizes estimate the magnitude of the differences between groups. In this case, the partial eta squared statistics are telling us there were very small effects (<0.06) of the independent variables, emotional buying and risk-taking, on the dependent variable or the group differences. Therefore, emotional buying, Tukey–Kramer’s post hoc test showed a significant difference was observed between the normal repayment group and credit default group (mean difference = 0.031, p = 0.016) that the normal repayment group was lower on emotional buying than the credit default group, although the difference was small. The credit delinquency group did not significantly differ from both credit default and normal repayment groups. For risk-taking, differences were observed between the normal repayment and credit default groups (mean difference = 0.023, p = 0.042) as well as between credit delinquency and credit default groups (mean difference = 0.034, p = 0.024). That is, the normal repayment group was lower than the credit delinquency group, while the credit delinquency group was lower than the credit default group on risk-taking. No mean difference was observed between the normal repayment and credit delinquency groups regarding risk-taking. Both age and gender differences were observed. Regarding age, the normal repayment group significantly differed from both credit delinquency (mean difference = 0.95, p = 0.000) and credit default groups (mean difference = 1.00, p = 0.000). That is, the mean age of the normal repayment group was older than both credit delinquency and default groups. No age difference was observed between credit delinquency and default groups. Significantly more females were in the normal repayment group than credit delinquency (mean difference = 0.16, p = 0.000) and credit default groups (mean difference = 0.15, p = 0.000). No difference was observed between credit delinquency and default groups in terms of gender. The effect size of the gender (partial η2 = 0.015) was slightly higher than age (partial η2 = 0.003). Therefore, H2 was partially supported.

3.3 The Associations Between Psychological and Financial Literacy Factors and Overall Loan History-Based Clusters

The multivariate analysis supported that there was a significant effect of the psychological and financial literacy-related independent variables on the cluster differences (Wilks’ Lambda = 0.995, F (48, 37,500) = 1.32, p = 0.050, partial η2 = 0.002). As shown in Table 5, significant differences were observed among clusters regarding emotional buying, rule obedience, and money management knowledge and resources, although with small effect sizes (partial η2 ranged from 0.006 to 0.009). In other words, these variables had only small effects in terms of determining the differences between these groups. Tukey–Kramer’s test showed that, for emotional buying, significant differences were observed between cluster 1 (non-ideal borrowers) and cluster 3 (new borrowers), that cluster 1 borrowers were higher on emotional buying than cluster 3 borrowers (mean difference = −0.04, p = 0.012), and between cluster 2 (regular borrowers with occasional overdue repayments) and cluster 3 (new borrowers) that cluster 2 borrowers were higher on emotional buying than cluster 3 borrowers (mean difference = −0.03, p = 0.013). No other differences were observed regarding emotional buying. Regarding rule obedience, the significant difference observed between cluster 1 (non-ideal borrowers) and cluster 3 (new borrowers) that new borrowers were slightly higher on rule obedience (mean difference = −0.02, p = 0.050). Regarding money management knowledge and resources, the significant difference observed between cluster 1 (non-ideal borrowers) and cluster 3 (new borrowers) that new borrowers were slightly higher on money management knowledge and resources (mean difference = −0.02, p = 0.05). Both age and gender significantly differed among clusters. Particularly, the mean age of cluster 1 (non-ideal) borrowers was significantly younger than cluster 3 (new borrowers, mean difference = −0.72, p = 0.030) and cluster 4 (ideal borrowers, mean difference = −1.25, p = 0.000). Cluster 2 (regular borrowers with occasional overdue repayments) had significantly younger mean age than cluster 3 (new borrowers, mean difference = −0.77, p = 0.000) and cluster 4 (ideal borrowers, mean difference = −1.31, p = 0.000). Cluster 3 (new borrowers) had significantly younger mean age than cluster 4 (ideal borrowers, mean difference = −0.54, p = 0.000), or cluster 4 (ideal borrowers) had significantly older mean age than all other clusters. Cluster 1 (non-ideal borrowers) had significantly more males than cluster 2 (regular borrowers, mean difference = −0.11, p = 0.000), cluster 3 (new borrowers, mean difference = −0.10, p = 0.000), and cluster 4 (ideal borrowers, mean difference = −0.22, p = 0.000). Cluster 2 (regular borrowers) and 3 (new borrowers) had significantly more males than cluster 4 (ideal borrowers, mean difference = −0.11 and −0.12, p = 0.000). Therefore, H3 was partially supported.

4 Discussion

This study investigated the predictive abilities of psychological (and some financial literacy) variables in credit risks in the Mongolian context. Particularly, this study was interested in whether psychometric credit scoring, including self-control, conscientiousness, neuroticism, risk-taking, attachment, integrity, money management, and money attitude would predict microcredit risks, therefore be successfully used as an alternative scoring in the microlending practice. As of 12,627 borrowers who received microcredits between January 2021 and June 2022, 10,316 borrowers, or 81.6%, repaid the loan within the due day or before reaching credit delinquency, 1106 borrowers, or 8.8%, repaid in 30 to 90 days overdue, and remaining 1205 borrowers, or 9.5%, reached credit default or did not pay back within 90 days overdue. The fact that every eight out of 10 borrowers paid back, mostly on time, shows that the psychometric credit scoring was largely successful.

Particularly, the analyses showed that the emotional buying subscale of self-control, rule obedience and responsibleness subscales of conscientiousness, risk-taking, money management knowledge, and resources subscale of money management had significant effects on loan repayment. Among these, emotional buying was the only factor that predicted each risk respectively, or higher scores on emotional buying were related to increased overdue days, and increased risk for credit default, therefore, more likely to fall for cluster 1 or non-ideal borrowers’ group. This finding replicates previous findings, in another country, that people who lack self-control tend to be more impulsive and make emotional financial decisions such as emotional buying which results in loan repayment difficulties (Baumeister, 2002; Goel & Rastogi, 2021). However, it is possible that why some people are more prone to emotional buying than others can be explained through other factors, such as social comparison than self-control (Lea et al., 1995). It was suggested in previous studies that some people may adopt an inappropriate reference group and compare themselves with people who have more economic resources than them, which puts them in danger of overspending (Lunt & Livingstone, 1991). In other words, it might be that the feelings of comparing one’s self with more fortunate others may cause impulsivity to buy things one cannot afford. Yet, even in that case, self-control seems still to play an important role to regulate such impulsive desire to “keep up with the Joneses”. Moreover, the finding also appears to support Ottaviani and Vandone (2011), who suggested emotional buying and over-indebtedness more relate to unsecured loans such as credit card use and personal loans. That is, for the borrowers of this study especially for the regular borrowers, the microcredits might be serving as consumer credit, hence, might explain why emotional buying was found to predict various credit risks while most of the other factors failed to do so. In the future, it might need to be investigated how the purpose and usage of such microcredits moderate or mediate the associations found in this study.

Furthermore, in line with Anderson et al. (2011) and Ganbat et al. (2021), current findings suggest conscientious personality indeed predicts better loan repayment or obeying rules and being responsible are likely to be important characteristics that need to be assessed when deciding whether to grant credit. Moreover, higher risk-taking was associated with increased credit overdue days and increased chances of credit delinquency and default, in line with previous findings from other countries (Adams & Moore, 2007; Flores & Vieira, 2014; Worthy et al., 2010). The association between risk-taking and credit risks was largely explained by Zuckerman’s (1979) sensation-seeking theory. Zuckerman argues that although sensation-seeking is a normal, genetically influenced personality trait that is characterized by the need for varied, novel, and complex experiences and willingness to take social and physical risks for the sake of such sensations, the maladaptive form of sensation-seeking may cause problematic risky behaviors such as extreme gambling, substance abuse, unsafe sexual activities, and so on. Such behaviors were related to problematic financial outcomes as well (Adams & Moore, 2007). That is, people with higher risk-taking tendencies may excessively abuse their credit for the sake of high arousal experiences, and that perhaps cause problems with loan repayment.

Lastly, increased money management knowledge and resources predicted decreased credit overdue days and decreased chances of clustering into non-ideal borrowers. According to Letkiewicz and Fox (2014), as financial products are becoming more and more complex, most people find basic financial concepts hard to understand, which may diminish one’s chances of financially thriving. To put it simply, people may overuse or mismanage their credits because of a lack of financial literacy. On the other hand, increased knowledge providing on how to manage one’s money effectively perhaps through the use of various financial management tools may increase one’s ability and confidence in money management and eventually have a positive effect on loan repayment (Baidoo et al., 2020; Ksendzova et al., 2017; Lea et al., 1995).

However, the effects of those four factors on credit risks were rather small, and neuroticism, attachment insecurity, integrity, and money attitude did not associate with credit risks at all. Therefore, other factors not included in this study may explain credit risks more effectively. Particularly, younger age and male gender predicted all credit risks much more strongly than the psychological factors. Suggesting that these demographic variables may need to be considered as important factors in soft-data-based lending. However, there are other perhaps more reasonable explanations as to why the proposed factors did not have large effects on the loan repayment outcomes. First, there is a possibility that borrowers rated themselves as positively as they could in the psychometric credit scoring, therefore, producing rather small differences between individuals. If a similar questionnaire was taken in low-stake situations or unrelatedly to the lending decisions, much higher variances may have been found. Second, the fact that all borrowers included in the analyses received 70% or above scores in the psychometric credit scoring may also account for the small individual differences. In case people who received lower credit scores were granted microcredits and were included in the analyses, the results might have been different. Nevertheless, the 81.6% success rate found in this study suggests psychological variables can be used as reliable alternative data in predicting credit risk in microcredit settings, especially when used in combination with demographic data.

5 Limitations, Implications, and Future Directions

The main limitation of the current study is it did not take potential confounding effects that could affect loan repayment into account. Particularly, the inflation rate increased significantly in Mongolia in recent years (according to Asian Development Bank 2022, the inflation rate was 7.10% in 2021 that was 3.41% increase from 2020, and forecasted at 14.7% in 2022 that is a 7.6% increase from 2021). As the macroeconomic situation is one of the most important factors that determine the loan repayment rate (Ford, 2018), the increased inflation rate may have caused some difficulties for some people to pay back their debt. Moreover, sudden adverse life events, such as illness and the death of significant someone, are other potential confounding effects that may have influenced the loan repayment rate (Tokunaga, 1993). These effects are encouraged to be controlled in further studies. The second limitation is that as this study did not grant loan for those who failed the psychometric credit scoring, the loan repayment rate differences between those who failed and passed the credit scoring is not computable. Resultantly, it is unknown whether the loan repayment rate of 81.6% was purely due to the performance on the psychometric credit scoring. Other factors might have influenced the loan repayment rate. For instance, it is possible that the low amount of microcredit (44 USD on average) was rather easier to repay than a more significant amount of loans. Lastly, the variables included in this study did not offer a comprehensive explanatory model, or the relationships and interactions between the predictors were not investigated.

Despite these limitations, this study is one of the first that experimented with using psychometric data for credit scoring. Previous studies showed enough that psychological factors relate to credit risks, however, very few developed psychological data-based statistical credit scoring and used it in real-life lending practice (Rabecca et al., 2018). Attempts to quantify borrowers’ soft information have become crucial, especially when the lending market is shifting from traditional credit scoring systems to alternative data-based more inclusive credit scorings.

Future studies are encouraged to investigate the relationships among the predictors and perhaps how they interact with demographic backgrounds, for developing an explanatory model of psychological determinants of credit risk. Future studies are also encouraged to control the confounding effects of macroeconomic situations and adverse life events, and examine whether the proposed psychological factors add significant predictive ability beyond those effects.

6 Conclusion

This study investigated the predictive abilities of some psychological and financial literacy-related factors in credit risks using data from 12,627 microcredit borrowers. The results showed that 81.6% of total borrowers who received microcredits through the psychometric credit scoring paid back their debt mostly on time or within a few days of the due day. Credit risks were negatively predicted by rule obedience, responsibleness, and money management knowledge and resources, and positively predicted by emotional buying and risk-taking. Age and gender both predicted credit risks. Hence, it is concluded that psychological variables can be used as alternative data for credit scoring in the microfinancing sector in Mongolia. The combination of psychological, financial literacy-related, and demographic factors might result in a more accurate prediction of credit risk.

Notes

- 1.

Zeely is a mobile lending application that has issued around 177,400 microcredits to around 52,000 borrowers (150,000 MNT or 44 USD on average) since 2018, based on their psychometric credit scoring. There are 36 other mobile lending applications in Mongolia that lend 237,000 MNT or 70 USD on average. However, Zeely differs from other fintech by its continued attempt to develop a psychometric credit scoring system to bring inclusivity in the financial services. As of 2022, 239,000 users passed the psychometric scoring out of 355,000 attempts, and 52,000 of them proceeded to request microcredit. The share of non-performing loans in the total loan portfolio is 6.4% as of December 2022, which is 0.9% lower than the industry average.

References

Adams, T., & Moore, M. (2007). High-risk he alth and credit behavior among 18-to 25-year-old college students. Journal of American College Health, 56(2), 101–108. https://doi.org/10.3200/JACH.56.2.101-108

Anderson, J., Burks, S., DeYoung, C., & Rustichini, A. (2011). Toward the integration of personality theory and decision theory in the explanation of economic behavior. In Unpublished manuscript. Presented at the IZA workshop: Cognitive and non-cognitive skills. https://doi.org/10.1016/j.socec.2016.04.019

Anuradha, N. (2020). Factors affecting non-performing loan portfolio in micro-lending: Evidence from Sri Lanka. International Journal of Science and Research (IJSR), ResearchGate Impact Factor (2018): 0.28| SJIF (2018), 7

Arbuckle, J. L. (2019). Amos (Version 26.0) [Computer Program]. Chicago: IBM SPSS.

Arner, D. W., Barberis, J., & Buckley, R. P. (2015). The evolution of fintech: A new post-crisis paradigm. Georgetown Journal of International Law, 47, 1271.

Asian Development Bank. (September 2022). Asian Development Outlook 2022 Update. https://www.adb.org/countries/mongolia/economy

Baidoo, S. T., Yusif, H., & Ayesu, E. K. (2020). Improving loan repayment in Ghana: Does financial literacy matter? Cogent Economics & Finance, 8(1), 1787693. https://doi.org/10.1080/23322039.2020.1787693

Baklouti, I. (2014). A psychological approach to microfinance credit scoring via a classification and regression tree. Intelligent Systems in Accounting, Finance and Management, 21(4), 193–208. https://doi.org/10.1002/isaf.1355

Baumeister, R. F. (2002). Yielding to temptation: Self-control failure, impulsive purchasing, and consumer behavior. Journal of Consumer Research, 28(4), 670–676. https://doi.org/10.1086/338209

Beckmann, N., Wood, R. E., & Minbashian, A. (2010). It depends how you look at it: On the relationship between neuroticism and conscientiousness at the within-and the between-person levels of analysis. Journal of Research in Personality, 44(5), 593–601. https://doi.org/10.1016/j.jrp.2010.07.004

Çallı, B. A., & Coşkun, E. (2021). A longitudinal systematic review of credit risk assessment and credit default predictors. SAGE Open, 11(4), 21582440211061332. https://doi.org/10.1177/2158244021106133

Chhatwani, M. (2022). Mortgage delinquency during COVID-19: Do financial literacy and personality traits matter? International Journal of Bank Marketing. https://doi.org/10.1108/IJBM-05-2021-0215

Cobb-Clark, D. A., & Schurer, S. (2012). The stability of big-five personality traits. Economics Letters, 115(1), 11–15. https://doi.org/10.1016/j.econlet.2011.11.015

Dlugosch, T. J., Klinger, B., Frese, M., & Klehe, U. C. (2018). Personality-based selection of entrepreneurial borrowers to reduce credit risk: Two studies on prediction models in low-and high-stakes settings in developing countries. Journal of Organizational Behavior, 39(5), 612–628. https://doi.org/10.1002/job.2236

Donnelly, G., Iyer, R., & Howell, R. T. (2012). The big five personality traits, material values, and financial well-being of self-described money managers. Journal of Economic Psychology, 33(6), 1129–1142. https://doi.org/10.1016/j.joep.2012.08.001

Financial Regulatory Commission. (2021). Financial industry overview. http://www.frc.mn/resource/frc/Document/2022/05/19/y1j3ndbaqwnzmitq/Toim%202022%20I%20final.pdf

Flores, S. A. M., & Vieira, K. M. (2014). Propensity toward indebtedness: An analysis using behavioral factors. Journal of Behavioral and Experimental Finance, 3, 1–10. https://doi.org/10.1016/j.jbef.2014.05.001

Ford, J. (2018). The indebted society: Credit and default in the 1980s. Routledge.

Ganbat, M., Batbaatar, E., Bazarragchaa, G., Ider, T., Gantumur, E., Dashkhorol, L., & Namsrai, O. E. (2021). Effect of psychological factors on credit risk: A case study of the microlending service in Mongolia. Behavioral Sciences, 11(4), 47. https://doi.org/10.3390/bs11040047

Goel, A., & Rastogi, S. (2021). Understanding the impact of borrowers’ behavioural and psychological traits on credit default: Review and conceptual model. Review of Behavioral Finance. https://doi.org/10.1108/RBF-03-2021-0051

Hayes, A. (2020, November 30). Microcredits: Definition, how it works, loan terms. Investopedia. https://www.investopedia.com/terms/m/microcredit.asp

Hughes, D. J. (2014). Accounting for individual differences in financial behaviour: The role of personality in insurance claims and credit behaviour. The University of Manchester (United Kingdom).

Humaira, H., & Rasyidah, R. (2020). Determining the appropiate cluster number using Elbow method for K-Means algorithm. In Proceedings of the 2nd Workshop on Multidisciplinary and Applications (WMA)

IBM Corp. (2017). IBM SPSS statistics for windows, version 25.0. Armonk, NY: IBM Corp.

Klinger, B., Khwaja, A. I., & Del Carpio, C. (2013). Enterprising psychometrics and poverty reduction (Vol. 860). Springer.

Ksendzova, M., Donnelly, G. E., & Howell, R. T. (2017). A brief money management scale and its associations with personality, financial health, and hypothetical debt repayment. Journal of Financial Counseling and Planning, 28(1), 62–75. https://doi.org/10.1891/1052-3073.28.1.62

Ladas, A., Aickelin, U., Ferguson, E., & Garibaldi, J. (2014, December). A data mining framework to model consumer indebtedness with psychological factors. In 2014 IEEE International Conference on Data Mining Workshop (pp. 150–157). IEEE. https://doi.org/10.1109/ICDMW.2014.148

Lea, S. E., Webley, P., & Walker, C. M. (1995). Psychological factors in consumer debt: Money management, economic socialization, and credit use. Journal of Economic Psychology, 16(4), 681–701. https://doi.org/10.1016/0167-4870(95)00013-4

Leong, C., Tan, B., Xiao, X., Tan, F. T. C., & Sun, Y. (2017). Nurturing a FinTech ecosystem: The case of a youth microloan startup in China. International Journal of Information Management, 37(2), 92–97. https://doi.org/10.1016/j.ijinfomgt.2016.11.006

Letkiewicz, J. C., & Fox, J. J. (2014). Conscientiousness, financial literacy, and asset accumulation of young adults. Journal of Consumer Affairs, 48(2), 274–300. https://doi.org/10.1111/joca.12040

Letkiewicz, J. C., & Heckman, S. J. (2019). Repeated payment delinquency among young adults in the United States. International Journal of Consumer Studies, 43(5), 417–428. https://doi.org/10.1111/ijcs.12522

Li, X., Curran, M. A., LeBaron, A. B., Serido, J., & Shim, S. (2020). Romantic attachment orientations, financial behaviors, and life outcomes among young adults: A mediating analysis of a college cohort. Journal of Family and Economic Issues, 41(4), 658–671. https://doi.org/10.1007/s10834-020-09664-1

Livingstone, S. M., & Lunt, P. K. (1992). Predicting personal debt and debt repayment: Psychological, social and economic determinants. Journal of Economic Psychology, 13(1), 111–134. https://doi.org/10.1016/0167-4870(92)90055-C

Lunt, P. K., & Livingstone, S. M. (1991). Everyday explanations for personal debt: A network approach. British Journal of Social Psychology, 30(4), 309–323. https://doi.org/10.1111/j.2044-8309.1991.tb00948.x

Menat, R. (2016). Why we’re so excited about FinTech. In The fintech book: The financial technology handbook for investors, entrepreneurs and visionaries (pp. 10–12). https://doi.org/10.1002/9781119218906.ch2

Meyll, T., & Pauls, T. (2019). The gender gap in over-indebtedness. Finance Research Letters, 31. https://doi.org/10.1016/j.frl.2018.12.007

Muganyi, T., Yan, L., Yin, Y., Sun, H., Gong, X., & Taghizadeh-Hesary, F. (2022). Fintech, regtech, and financial development: Evidence from China. Financial Innovation, 8(1), 1–20. https://doi.org/10.1186/s40854-021-00313-6

Ottaviani, C., & Vandone, D. (2011). Impulsivity and household indebtedness: Evidence from real life. Journal of Economic Psychology, 32(5), 754–761. https://doi.org/10.1016/j.joep.2011.05.002

R Core Team (2013). R: A language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. http://www.R-project.org/

Rabecca, H., Atmaja, N. D., & Safitri, S. (2018). Psychometric credit scoring in indonesia microfinance industry: A case study in pt amartha mikro fintek. In The 3rd International Conference on Management in Emerging Markets (ICMEM 2018) (pp. 620–631)

Sergelenbat, A. (2021). An effort to establish effective corporate governance practice, impacts on corruption, and sustainable development in developing countries: A case of Mongolia (Doctoral dissertation, University of the West of Scotland).

Serrano-Cinca, C., Gutiérrez-Nieto, B., & López-Palacios, L. (2015). Determinants of default in P2P lending. PloS One, 10(10), e0139427. https://doi.org/10.1371/journal.pone.0139427

Shilton, D., Breski, M., Dor, D., & Jablonka, E. (2020). Human social evolution: Self-domestication or self control? Frontiers in Psychology, 11, 134. https://doi.org/10.3389/fpsyg.2020.00134

Sohn, S. Y. (2016). Fuzzy analytic hierarchy process applied to technology credit scorecard considering entrepreneurs’ psychological and behavioral attributes. Journal of Intelligent & Fuzzy Systems, 30(4), 2349–2364. https://doi.org/10.3233/IFS-152005

Stevens, J. (1992). Applied multivariate statistics for the social sciences (2nd ed.). Erlbaum.

Thomas, L. C. (2000). A survey of credit and behavioural scoring: Forecasting financial risk of lending to consumers. International Journal of Forecasting, 16(2), 149–172. https://doi.org/10.1016/S0169-2070(00)00034-0

Tokunaga, H. (1993). The use and abuse of consumer credit: Application of psychological theory and research. Journal of Economic Psychology, 14(2), 285–316. https://doi.org/10.1016/0167-4870(93)90004-5

Trönnberg, C. C., & Hemlin, S. (2012). Banker’s lending decision making: A psychological approach. Managerial Finance. https://doi.org/10.1108/03074351211266775

Wang, X., Xu, Y. C., Lu, T., & Zhang, C. (2020). Why do borrowers default on online loans? An inquiry of their psychology mechanism. Internet Research, 30(4), 1203–1228. https://doi.org/10.1108/INTR-05-2019-0183

Webley, P., & Nyhus, E. K. (2001). Life-cycle and dispositional routes into problem debt. British Journal of Psychology, 92(3), 423–446. https://doi.org/10.1348/000712601162275

Weiss, R. S. (2006). The attachment bond in childhood and adulthood. In Attachment across the life cycle (pp. 74–84). Routledge.

Wilson, F., Carter, S., Tagg, S., Shaw, E., & Lam, W. (2007). Bank loan officers’ perceptions of business owners: The role of gender. British Journal of Management, 18(2), 154–171. https://doi.org/10.1111/j.1467-8551.2006.00508.x

Worthy, S. L., Jonkman, J., & Blinn-Pike, L. (2010). Sensation-seeking, risk-taking, and problematic financial behaviors of college students. Journal of Family and Economic Issues, 31(2), 161–170. https://doi.org/10.1007/s10834-010-9183-6

Zuckerman, M. (1979). Beyond the optimal level of arousal. Hillsdale, NJ: Lawrence Erlbraum Associates.

Zuckerman, M., & Kuhlman, D. M. (2000). Personality and risk-taking: Common bisocial factors. Journal of Personality, 68(6), 999–1029. https://doi.org/10.1111/1467-6494.00124

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Ganbat, M., Badrakh, A., Shijir, B., Altantsatsralt, K., Nemekh, M., Tseveendorj, N. (2023). Psychological Predictors of Credit Risk in Microcredit: A Microlending Case Study from Mongolia. In: Macaulay, P., Tan, LM. (eds) Applied Psychology Readings. SCAP 2022. Springer, Singapore. https://doi.org/10.1007/978-981-99-2613-8_3

Download citation

DOI: https://doi.org/10.1007/978-981-99-2613-8_3

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-99-2612-1

Online ISBN: 978-981-99-2613-8

eBook Packages: Behavioral Science and PsychologyBehavioral Science and Psychology (R0)