Abstract

Blockchain is a distributed database of records. Although blockchain is mostly known for its insinuation with Bitcoin—it has surely come a long way since then. Nowadays, blockchain is gaining tremendous attention in a wide variety of applications and industries such as health care, finance, and, of course, insurance. The paper presents a bibliometric analysis of the applications of blockchain within the Insurance Industry.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Blockchain

- Insurance

- Smart contract

- Bibliometric analysis

- Health insurance

- Auto insurance

- Insurance industry

- InsureTech

1 Introduction

Blockchain and distributed ledgers have been attracting attention for several years now. This technology started becoming a solution to problems related to the ownership of an asset, especially in the financial industry. The financial crisis showed that even in financial services, pinpointing the owner of an asset is not always possible [42]. In computer science, many articles have been published revolving around blockchain-related topics. These have analysed consensus algorithms and proposed new concepts on how to deal with issues regarding the privacy of smart contracts [51]. Together with the significant benefits that this technology brings, there are also drawbacks discussed in various literature pieces [35]. The vast number of benefits blockchain brings shows its great potential to permanently affect and change aspects of societies' different operations. Swan [50] highlights how blockchain and its disruptive potential may be broken into three main categories. These include Blockchains 1.0, 2.0 and 3.0 [50].

Blockchain 1.0 refers to the currency aspect of blockchain. This denotes the use of cryptocurrencies within the application for things such as currency transfers, modern digital payment infrastructure and fee payments [50].

Blockchain 2.0 started with the introduction of Ethereum, facilitating developers to develop decentralised apps (dApps). It refers to smart contracts and their potential to heavily impact the entire economy. Blockchain contracts enable better secure, trustless transactions with respect to bonds, stocks, loans, smart property and smart contracts [50]. However, Blockchain 2.0 suffers from scalability, slow processing, heavy-weight applications and astronomically high energy consumption.

Blockchain 3.0 refers to all other use cases apart from currency, finance and markets. Thus, this would include health, art, science and government implementations [50]. It facilitates ‘Smart everything’ and claims to solve the issues of its previous generation.

Gatteshci et al. [25] defined blockchain as a distributed ledger heavily maintained by network nodes, continuously recording transactions completed by the nodes. Information found within the blockchain is of public interest and accessible by anyone, and it cannot be modified or erased. The insurance sector was at the forefront of this new technology and is widely being investigated by small and large companies and consultancy firms. Moreover, in 2016, a B3i was founded—a company that was the first blockchain-centred insurance firm [25].

2 Blockchain Background

Many of the world's biggest revolutions started from a quiet disruptor [29]. One can say that we are currently during another quiet disruptor—blockchain. Blockchain may be defined in various ways. However, IBM defines it as a ‘shared, immutable ledger for recording transactions, tracking assets and building trust’ [37]. One can say it is a decentralised distributed database of records. In other words, it is a public ledger responsible for storing digital events implemented by partaking groups [12]. Blockchain, though still relatively new to the industry of technologies, is on its way to being the ‘bedrock’ of record-keeping systems [29]. The idea of blockchain was first thought of by two scientists, S. Haber and W. Stornetta, back in the eighteenth century. The idea included a practical computational solution that enabled digital documents to be timestamped, thus hindering the backdating or tampering of any documents [29]. Later, in 2004, computer scientist Hal Finney introduced the ‘Reusable proof-of-work system’. This system worked by receiving a non-exchangeable hash cash-based proof-of-work token and, in return, created an RSA-signed token that could then be transferred from person to person. This system helped in solving the double-spending problem. This was possible by storing the ownership data of tokens on a secure and trusted server. Moreover, the server allowed various types of users to verify the integrity and overall correctness of the data. Moreover, in the late stages of 2008—a white paper titled ‘Bitcoin: A Peer-to-Peer Electronic Cash System’ by Satoshi Nakamoto mainly highlighted the inner working of blockchain architecture. Essentially, Bitcoins are ‘mined’ or executed for a reward using the proof-of-work mechanism by independent miners and then authenticated by the decentralised nodes found within a network. In early 2009, Bitcoin came into existence—having been mined by Satoshi Nakamoto—having a reward of 50 bitcoin—later, the first transaction took place with Hal Finney being the recipient of 10 Bitcoin. Some years later, in 2013, smart contracts were created due to the scripting language—Ethereum [37]. Although blockchain is mainly known for its insinuation with Bitcoin—it has undoubtedly come a long way since then. Nowadays, blockchain is gaining tremendous attention in various applications and industries, such as health care [10, 23], finance and insurance.

2.1 Blockchain Technology

Blockchain is a distributed database of records. It can also be described as a public ledger of digital events (or transactions) executed [12]. Every transaction needs to be verified, and data cannot be erased. This series of records have a timestamp. These are regulated by a group of computers not possessed by one person or organisation. All these blocks of data are stored securely and connected using cryptographic principles. Since this network does not have a central authority figure, information is open and available to everyone. Anything uploaded to a blockchain is transparent, and people can be held accountable for their actions [46]. Information that is stored on a blockchain exists as a shared database. The database is held in several locations to ensure security. The records ‘are truly kept public and easily verifiable’ [46]. The blockchain contains three crucial components: blocks, nodes and miners. Each chain has numerous blocks, and, in turn, each of the blocks contains the following basic features: the data within the block, a nonce and the hash. A nonce is a 32-bit number which is generated randomly when a block is initially created and then generates a block header hash. A hash is a 256-bit number that is linked to the nonce. It is tiny and thus begins with a lot of zeros. Once an initial block of a chain is made, the nonce produces a cryptographic hash. The block data is presumed as signed and tied to the nonce and hash unless it gets mined [5]. Blockchain is referred to as a Distributed Ledger Technology (DLT), where transactions are registered using an unchangeable cryptographic signature defined as a hash. The DLT refers to the decentralised database managed by several participants [16].

Miners are the function that creates the new blocks on the chain. This process is called ‘mining’. Mining a block is not an easy task, especially given large chains. This is because while every block in the blockchain has its nonce and hash, it also refers to the previous block’s hash. Special software is used to solve the problem of finding a nonce that generates an accepted hash due to its very complex nature. Since the nonce is 32 bit and the hash is 256 bit, billions of combinations possible must be mined before the right one is found. This is said to be ‘the golden nonce’ [5]. It is so complex to manipulate blockchain technology because altering a block demands the re-mining of not only that block getting alterations but even those following it. This is ‘safety in math’. Nodes are any electronic device that contains copies of the blockchain and keep the network functioning [5]. Decentralisation is one of the most important aspects of blockchain. No computer or organisation owns the blockchain. Public information is combined with a system of checks-and-balances which aids in the blockchain maintaining integrity and creating a sense of assurance among its users.

From a technical perspective, blockchain has the following features: decentralisation, traceability, transparency and immutability. Decentralisation refers to the fact that the information is not stored in one area. Everyone in the network owns the information. There is no governing authority. Transactions using blockchain can be conducted anywhere in the world between various users. Decentralisation is the process of ‘verifying, storing, maintaining and transmitting on the blockchain’ based on a distributed system's structure. Mathematical methods build trust between nodes rather than the centralised organisation [28]. Immutability is permanence. Once something has been inputted into the blockchain, it cannot be altered. This property comes from cryptographic hash work [33]. Data is only included in a block once everyone on the network approves it. This ensures confidential transactions. Transparency refers to the ‘straightforwardness’ of blockchain technology. While the person's actual personality remains secure, one can observe every one of the exchanges conducted within their location. All transactions are stored chronologically in the blockchain. Since a block relates to another two blocks through the cryptographic hash function, every transaction can be tracked (hence traceability) [28]. These features tie in with blockchain’s important feature, increased security. Without a central authority, one cannot alter the characteristics of the network as one like and tailor it to their benefit [32]. Adding encryption also ensures a layer of security for the system.

Blockchain is also consensus-driven. Each block on the chain is verified independently using Consensus models that provide rules for validating a block [49]. They also use proof to show that effort was made, such as computing power. This works without a central authority figure or a third party (like a trust-granting agent). An important part of the blockchain is the fact that it allows the use of smart contracts. This is an agreement between two parties in the form of computer code. These run on the blockchain, so they are kept on a public database, making them unchangeable. The blockchain is responsible for processing transactions that occur in a smart contract. There is no need for third-party involvement because they can be sent automatically. This also means there is no need to rely on anyone [7]. Furthermore, the transactions only happen when conditions in the agreement are met. This means there is no third party, so there are no issues with trust.

2.2 Blockchain Concepts

The blockchain is a chain of blocks. Initially, the main objective of blockchain was to facilitate the secure transaction of bitcoin. Within the context of bitcoin, the blockchain’s role was to act as the ledger, recording transactions and ensuring the transfers went to the correct end-user. This was done with the use of cryptographic signatures.

Gatteschi et al. [25] state that blockchain has six core concepts: transactions, blocks, nodes, majority consensus, mining and wallet.

Transactions: Transactions within the blockchain are permanently recorded and cannot be erased.

Blocks: A block comprises a group of transactions primarily grouped based on the period in which they took place.

Nodes: Rather than being kept in a centralised database server, the blockchain is stored over several computers connected to a network, these computers are referred to as nodes, and they contain an updated copy of the blockchain.

Majority Consensus: This refers to the fact that since there is no official authority for decision-making, blockchain follows a consensus or majority-based approach. Each node is responsible for modifying the blockchain’s local copy based on the status of many of the other nodes.

Mining: Nodes within the blockchain could participate in the blockchain in two ways. They can inactively store the local copy or participate in the upkeep and updating of the blockchain, often referred to as mining. During the mining process, nodes check for transaction verification; each time a new block is added to the blockchain, a complex mathematical problem must be solved. The mathematical problem was designed to limit the possible chances of an entity attempting to fabricate previous transactions.

Wallet: In the case of a transfer using cryptocurrencies, digital wallets are used. Unlike a tangible wallet, a digital wallet does not store memory of your current balance but a history of previous transactions; thus, only your specific and complex credentials are stored. Each wallet is associated with a unique address, and the recipient's address must be known for a transaction to take place.

2.3 Smart Contracts

Smart contracts are increasing in popularity. This innovation might eliminate the need for certain lawyers and banks to be involved in contracts dealing with selling and purchasing assets, which they have been a part of for years [42]. Smart contracts are a mechanism involving many digital assets between two or more groups of people. In a smart contract, these digital assets are reallocated among the people groups according to a code instruction structured around data readily available to the people when the contract was written [35]. Contract terms and assets to be transferred are specified and may be coded mathematically into open-sourced, consensus-based chains, and their execution is verified autonomously. The code cannot be tampered with by either party involved. This means that a smart contract enabled by blockchain will instantly conclude, irrespective of how long the process is to take or whether either person from the group has doubts or changes about the contract being executed [35].

A self-ruling organisation managed by smart contracts whose operation is as far removed as possible from the day-to-day input of managers, employees or owners is called a Decentralised Autonomous Organisation (DAO). These are said to tackle a widespread problem of governance that scientists and economists refer to as the leading-agent dilemma [36]. This problem occurs when an organisation's principal agent has the decision-making power on behalf of, or even impacts, the principal (another person or entity in the organisation) [2, 3]. DAOs provide an operating system for people and institutions that do not know, and hence do not trust each other. They might also not be in the same geographical area, differ in languages and be subject to varying jurisdictions. DAOs involve a group of people that are collaborating on a self-enforcing open-source protocol. Blockchains and smart contracts, therefore, decrease transaction costs of management at an increased level of transparency, connecting the interests of all stakeholders by the consensus rules tied to the native token [2, 3]. These tokens are sometimes referred to as ‘protocol tokens’. They are a part of the incentive scheme of blockchain infrastructure. Their main purpose is to encourage a diverse group of people who do not know each other to coordinate around the purpose of a specific blockchain [2, 3].

2.4 Public, Private and Hybrid Blockchains

2.4.1 Public Blockchains

A blockchain is considered public if all participants can read and use a blockchain to carry out transactions. Furthermore, on a public blockchain, everyone is integrated into the process of creating the consensus. In this type of blockchain, ‘nodes on the network validate choices discussed and initiated by the developers by deciding whether to integrate the proposed modifications’ [13]. This is based on ‘crypto-economics’, the combination of economic incentives and verification mechanisms that use cryptography. This system has shown its strength and resilience because it is based on a community approach to the economy [13].

2.4.2 Private Blockchains

A blockchain is considered private if the consensus process may only be reached by a limited and pre-established number of participating parties. Accessing to writing is only possible if given by the organisation, and read permissions may be made public, or they can also be restricted. A preselected group of nodes restricts the consensus process. This type of blockchain ‘does not necessarily use mechanisms based on cryptography’ [13]. Moreover, private blockchains have no mining, working proof or remuneration. This distinguishes the ‘two types of storage and transmission technologies’ [13].

2.4.3 Hybrid Blockchains

A hybrid blockchain serves as an in between of the two extremes, which are public and private blockchains. This type of blockchain can therefore enjoy characteristics from both private and public blockchains. The members of this blockchain or a particular entity with higher power can establish which transactions remain publicly available and which must be restricted to fewer people. The hybrid blockchain that consists of the public and private state of the network ensures that transactions are private but still verifiable by an immutable record on the public state of the blockchain. In a public state, ‘every transaction gets approved by a large network and is secure and trustworthy’ [34]. This means a central governing body or an exhaustive chain of intermediate parties to supervise processes is not required. The hybrid blockchain technology ‘can be used to build enterprise-grade implementations of the open-source technology across different trades leading to real-world use cases’ [34].

3 Blockchain in Insurance

3.1 Blockchain Merits

Though still a relatively new and up-and-coming technology, it is already quite apparent the instant and great benefits blockchain can bring when implemented within the insurance industry. This section will further emphasise essential drivers to increase efficiency and usability [41]. The implementation of blockchain may be matched with the use of smart contracts in the day-to-day running of business activities. Such business activities may include identity authentication, validation, data management, document formations and payment options. Thus, as a result of this implementation, additional personalised products can be offered to potential and current customers [28]. These new and improved products reap various advantages by being better priced and transparent, benefitting increased reliability, improving automated processes and preventing fraud.

Insurance companies are well known for not being transparent and hiding consumer data. Consumers have little to no information about what data insurance companies have, how it is used and which third parties it is shared with. This, in turn, creates a sense of distrust between clients and insurance agencies, especially when the time comes to open a claim or receive compensation [36]. However, with the implementation of blockchain technology, various benefits emerge for the insurance company and the potential client. First, insurance companies would now be able to build a more reliable and complete customer profile, thus eliminating duplicated data. Since data within a blockchain cannot be modified, there is no doubt that the data entered is reliable and authentic. Secondly, clients can now visibly see what data insurance companies have about them and what is being done with them. Thirdly, blockchain enables third-party claims to be automatically verified and processed through personal devices. More importantly, the insurance company can see the transactions in the blockchain transparently [36].

Moreover, another advantage of implementing blockchain within the insurance industry is the prevention of fraudulent activities. In America, it is said that fraudulent insurance claims accumulate to over 40 million dollars. Thus, it is no surprise that why opening up an insurance claim can seem daunting [45]. However, when employing a blockchain infrastructure, these issues are solved. This is because the data stored on the blockchain is secured using a cryptographic signature and consent settings. Different groups can share, verify and authenticate client data without revealing personal data. Using a decentralised ledger enables companies to foresee suspicious patterns and prevent activities such as clients attempting to open multiple claims, insurance being sold by unlicensed brokers or policyholders manipulating ownership. Also, insurance companies are now providing their clients with specifically encrypted electronic ID Cards [36]. Blockchain can also facilitate decentralised patient IDs (generation) [8].

3.2 Blockchain Applications in Insurance

Blockchain is likely to change the way insurance companies do business. This technology can help carriers save time, reduce costs, enhance transparency, comply with regulations and produce better products and markets [11]. The technology of blockchain has potential uses that are apparent in every part of the insurance value chain. This means from the financing and valuation of their services and goods, their sales and supply, to the continuous product control and processing of claims [43]. Blockchain is a promoter and stimulus to quicken digitisation, encourage change and transformation and increase a sense of innovation. While reading through different types of literature, it was apparent that insurance companies are so eager to start implementing this new emerging technology to its close-to-instant benefits with regard to fraud detection, pricing, cost savings and growth opportunities [53]. Caitlyn Long, Chairman and President of Symbion, states that blockchain and DLT technologies greatly aid insurers and financial institutions in managing security claim settlements [30]. In the following, attention will be given explicitly to the potential and current uses of blockchain within the insurance sector and the benefits that can be achieved.

3.2.1 Better Customer Experience and Decreased Operating Costs

In the case of creating better experiences for customers, Valentina Gatteschi et al. [25] mention how the combination of smart contracts and blockchain could be used to speed up claim processing times, as well as reduce the costs which are often associated with human error. A simple use case scenario includes programming the smart contract to issue an automatic refund if the customer gets his, for example, injuries examined by a certified doctor. The refund would occur once the doctor sends the transaction to the smart contract to verify his identity. Moreover, a more complex use case would be with the involvement of oracles. In crop insurance, for example, the oracle would be responsible for periodically checking the data and updating it within the blockchain. The smart contract would then be able to read this data and, based on a pre-set list of requirements, issue a payment to customers in the case of, say, storms or terrible weather. A real-life prototype like the cases mentioned above was used in travel insurance. The idea in this scenario was to use flight delay data and automatically issue a refund to customers whose flight was delayed [25].

3.2.2 Claim Processing

Usually, this process requires manual steps where the policyholder inputs their details into a report and makes a call to communicate the claim to the insurance company. Insurers verify the proof of the claimed event and might also assess the damage. Then the insurer pays out the claim. The product conditions are inputted using blockchain into a piece of code, which is the smart contract. The claim is automatically paid out once it receives the correct requirements. The trigger event of the claim can be verified from publicly available data but is also dependable—for example, flight delays or natural catastrophes [43]. Claims are documented on the blockchain to get audited and eliminate numerous claims reported for the same insured event. This defends against insurance fraud. Implementing blockchain also improves a customer’s experience.

3.2.3 Reinsurance and Swaps

Reinsurance is insurance for insurers. This happens when insurers transfer a part of their risk portfolios to other parties in some form of agreement to decrease the chances of having to pay a large sum that results from a claim. This is typically settled in 2 to 3 months, from the time the insurer pays out a claim to the time recovery is received from the reinsurer. This results from the time taken to compute the data for claims, determine reinsured claims and premiums, coordinate claims and premiums and resolve conflicts, to name a few. Reinsurance treaties/swap terms can be written into smart contracts using blockchain that automatically execute payments (premiums and claims) to and from reinsurers when pre-established agreements are satisfied. ‘Experience data is recorded on the blockchain, tamper-resistant and immediately auditable’ [43]. All people involved in reinsurance, like insurers, reinsurers, third-party data providers and asset managers, record data on the blockchain so anyone can access it without needing to ask someone for it. Cleansed data can also be stored on the blockchain and cannot be tampered with, and everyone can see what alterations have been made. ‘All transactions (premiums and claims) are recorded on the blockchain for visibility to future transacting parties’ that may need the information [43].

3.2.4 Peer-To-Peer Insurance

This has been around for some time. It refers to individuals purchasing premiums and pooling them to insure against a risk. Blockchain technology brings new opportunities due to the decentralised autonomous organisation (DAO) principle. Smart contracts are a representation of the first level of the decentralised application. They often involve human input, especially when the contract is to be signed by several different parties. DAOs allow P2P insurance to be available on a large scale. This is due to their capacity to manage complex rules among many stakeholders. Both established insurers and new players can position themselves more efficiently in the P2P market [44]. The peer-to-peer models currently being used within the industry aren’t technically peer-to-peer models but rather modified models. The implementation of smart contracts could reap serious benefits with the implementation and creation of DAOs. A prototype example of this is DYNAMIS (Dynamic InsurTech) [31], based on the currently used Ethereum blockchain. DYNAMIS uses Ethereum to provide a peer-to-peer insurance model for unemployment insurance and similar niche markets. DYNAMIS’s main aim is to create a DAO to restore trust between clients and insurance providers. This can be done by using consensus-based infrastructures that circulate the costs and processes traditionally applied by insurance companies. It is important to note that this level of implementation of peer-to-peer insurance is still in its initial stages and is not readily available to the public. Moreover, a recent study concluded that customers are more willing to pay extra costs to interact with intermediaries rather than benefit from lower costs and do it themselves [25].

3.2.5 Micro-Insurance/Pay-Per-Use

Blockchain implementation in the insurance industry also can open income opportunities for insurance firms, irrespective of their size. Pay-Per-Use insurance policies were hard to finance and implement in the past due to high administrative costs and high levels of human intervention needed. However, with the intervention of smart contracts, the possibility of quick and cheap policies is enabled. Car renting is a use case of this in action, and GPS data may automatically calculate the premium while driving the car [25]. Companies could potentially rely on the public blockchain. The smart contract would collect funds from customers and keep them until a specified period has passed, then pass them on to the insurance company. From the point of view of the insurance firm, employing this type of new technology could further differentiate them from their competition and attract a new type of young market.

3.2.6 Other Examples of Blockchain Use in Insurance

The InsurTech Company, Etherisc, started building blockchain-enabled products and testing them publicly in October 2017. Etherisc has designed a decentralised insurance protocol to build insurance products collectively [15]. The Co-founder of Etherisc, Stephan Karpische, explained how blockchain technology could ease some of the problems that arise in traditional insurance practices. He also explained how it could enable the production of new insurance products. ‘In traditional insurance practices, you have an inherent conflict of interest’—Stephan explained [14]. Using smart contracts makes processes much easier because they eliminate having to balance out shareholders’ and customers’ interests. This decentralised approach also brings various features, such as fairness and transparency, low conflict of interest, lower cost and faster time to market. Since smart contracts are open source, they can be accessed and verified. Also, they do not need to earn money as decentralised insurance is not run by multiple intermediaries that take a cut of the premium. The decentralised approach to insurance products means lower operating costs. Moreover, with blockchain technology and smart contracts, new insurance products can be developed in weeks and sometimes even days.

Etherisc is also developing insurance solutions such as weather-based crop insurance, multi-signature wallet insurance and collateral protection for crypto-backed lending. [14]. Another example of how Etherisc utilises blockchain is through their ‘cryptocurrency-based flight delay program’ that lets passengers buy flight insurance ‘using either cryptocurrency or fiat money’ [6]. Then they receive pay-outs automatically after a qualifying event [6]. The smart contracts that Etherisc uses can autonomously verify claims by using various ‘oracles’ of data sources. An example of this would be when dealing with a crop insurance claim. Etherisc can examine satellite images, data from weather stations and videos and pictures captured by drones provided by the insured person. This automated inspection can uncover fraudulent claims before they are submitted for human review, allowing insurers more time for urgent and complex tasks.

3.3 Limitations of Blockchain Use in Insurance

Previously, the advantages and benefits of implementing blockchain technology within the insurance industry were highlighted. However, as with any other technology, blockchain has drawbacks and limitations. The primary limitations blockchain has when being adopted within the insurance industry include security, scalability and standardisation and regulations.

3.3.1 The Security

Although blockchain is very secure, there are still some unlikely instances in which security is an issue. This instance is referred to as a ‘51% Attack’. A 51% attack refers to an attack on the proof-of-work blockchain, where an attacker, usually a group of miners, takes control of 51% or more of the computing power, putting them in control [48]. Also, another security concern is smart contracts. Smart contracts often rely on external data from sources known as ‘oracles’. Oracles are centralised data point which contains large amounts of data. Since oracles are found in a centralised manner, they are prone and vulnerable to attacks. Also, oracles cannot understand their processing data; thus, shared data may be invalid, outdated and even unusable. This situation brings up what is known as the ‘oracle problem’. This problem refers to the fact that the process of smart contracts could be heavily impacted by unreliable or invalid data given by the oracles [43].

3.3.2 The Scalability

Since for a transaction to be verified, it needs to go through a consensus-based approach and continuous replications, the scalability of the blockchain quickly becomes an issue. Moreover, stored data is continuously becoming an issue as data within a blockchain is said to be immutable. Thus, if a record needs to be updated—a new one must be uploaded. The scalability issue can be seen when comparing a transaction done with Bitcoin through blockchain and a transaction done through VISA. Visa has the potential to process well over 65,000 transactions per second. However, Bitcoins’ maximum is only seven transactions per second—thus, it can be seen that although it may be more secure, it isn’t as efficient as it could be [43].

3.3.3 Regulations and Standardisation

Many finance and insurance industry regulators are starting to understand the potential blockchain could have on their industries and thus is forcing these regulators to reconsider regulations and laws. Although EU regulators are aware of these changes, they must also realise that technology is overtaking current regulations. EU regulators are aware of the high potential blockchain has and thus are monitoring its growth within the sector. While observing blockchain's features and elements, queries were raised about data ownership, different applications, transparency and solvency. For this reason, sandbox testing and monitoring need to pursue this technology. As a result of this, newer regulations and legislations will likely be published to protect better both the consumer and insurance agency [47].

4 Literature Review and Bibliometric Analysis

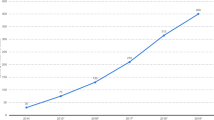

Figures 1 and 2 show the Google Trends for the search term ‘Blockchain Insurance’ since 2004 and for the last 5 years, respectively. These show that the interest in searching for Blockchain Insurance increased steadily from 2015 to 2017 and remained almost consistent in the previous 5 years.

While searching Blockchain and Insurance in Scopus, we got 619 articles. When carefully analysing these articles, we excluded 294 articles discussing general blockchain applications, including insurance. The remaining 325 articles presented blockchain applications in insurance. Figures 3, 4 and 5 show the distribution of these articles based on their publication year, country and article type, respectively. We can see steady growth in publication numbers during the last 6 years. The maximum number of articles were published by Indian authors, followed by Chinese and US authors. More than half (50.5%) of articles are conference papers, 38.2% are Journal articles and 7.7% are book chapters.

When analysed the articles based on the insurance type, the maximum proportion was health insurance (147), followed by general insurance or applying blockchain in the insurance industry as a whole (80), then auto insurance (50) and agri-insurance (18). Also, there were other insurance types, including Cyber Insurance (10), Parametric Insurance (7), Financial Insurance (6), Travel insurance (3), Liability Insurance (2) and property and casualty (P & C) insurance (2) as shown in Table 1.

5 Conclusion and Future Perspectives

As previously mentioned, blockchain is still well in its early stages of implementation within the insurance industry. However, the abundance of products it can offer us in the future is already apparent, and blockchain can heavily impact the macro- and micro-levels of the insurance industry [4]. At the macro-level, researchers believe that blockchain has the potential to overcome the high prices of data acquisition and modernise the ways data is shared, exchanged and stored. This would benefit small-to-medium-sized insurance agencies, enabling them to access high-quality, reliable, complete information. Moreover, this data would open newer and more diverse opportunities for smaller enterprises using better and more accurate pricing and improved niche market targeting with better product designs. Blockchain may be used in the future through short-term insurance or what is better known as micro-insurance. This type of insurance could utilise blockchain when used in car-sharing or renting accommodation. Currently, these insurance packages are often pre-purchased at higher rates by the service provider and then passed on to the end-users. However, with blockchain, clients can purchase insurance at any time. With this, clients can buy insurance for the time they need, based on their usage and expiring time and date. In the case of any claims, records of events will be far more accurate, and potential disputes will surely be avoided. Moving onto the micro-level of Insurance, blockchain can heavily impact product design, pricing and claims services. Blockchain may be implemented in various types of insurance, including parametric insurance. Firstly, parametric insurance covers the probability of a predefined event from happening [52]. As a result, large amounts of real-time analytics are needed and exchanged among third parties. Although this is proven to be an efficient risk management method, there is still room for improvement. Two examples of parametric insurance include agricultural insurance and flight delay insurance, as a lot of human intervention is required. With the use of blockchain, the data exchange process is greatly enhanced. Also, with smart contracts, human intervention error is significantly reduced; thus, the claim settlement and payment processes are significantly improved. This will lead to lower operational costs, increase efficiency and improve customer satisfaction. Health insurance providers can also exploit the advancement in health data analytics, [1, 17,18,19,20,21,22, 24, 26, 27, 38,39,40] to understand and forecast the healthcare resource requirements better, demand and estimate insurance premium. Furthermore, mobile health insurance systems [9] can facilitate better accessibility and broader reach.

References

Barton M, McClean S, Garg L, Fullerton K (2010) Modelling costs of bed occupancy and delayed discharge of post-stroke patients. In: 2010 IEEE workshop on health care management (WHCM), February. IEEE, pp 1–6

Blockchainhub (2019) Tokenized networks: what is a DAO? https://blockchainhub.net/dao-decentralized-autonomous-organization/. Accessed Nov 2022

Blockchainhub (2019) Tokens, cryptocurrencies & other cryptoassets. https://blockchainhub.net/tokens/#:~:text=These%20native%20tokens%20%E2%80%93%20also%20referred,incentive%20scheme%20of%20blockchain%20infrastructure.&text=These%20relatively%20simple%20smart%20contracts,features%20of%20a%20fungible%20commodity. Accessed Nov 2022

Brophy R (2019) Blockchain and insurance: a review for operations and regulation. J Financ Regul Compliance 28(2)

Built In (2018) Blockchain. https://builtin.com/blockchain. Accessed Nov 2022

CBinsights (2019) How blockchain could disrupt insurance. https://www.cbinsights.com/research/blockchain-insurance-disruption/. Accessed Nov 2022

Christidis K (2016) Blockchains and smart contracts for the Internet of Things. IEEE 4:2292–2303

Chukwu E, Ekong I, Garg L (2022) Scaling up a decentralized offline patient ID generation and matching algorithm to accelerate universal health coverage: insights from a literature review and health facility survey in Nigeria. Front Digital Health 4

Chukwu E, Garg L, Eze G (2016) Mobile health insurance system and associated costs: a cross-sectional survey of primary health centers in Abuja Nigeria. JMIR mHealth uHealth 4(2):e4342

Chukwu E, Garg L (2020) A systematic review of Blockchain in healthcare: frameworks, prototypes, and implementations. IEEE Access 8:21196–21214

Consensys (2020) Blockchain in insurance. https://consensys.net/blockchain-use-cases/finance/insurance/. Accessed 12 Nov 2020

Crosby M (2016) Blockchain technology: beyond Bitcoin. AIR—Applied Innov Rev 1(2):6–18

Dominique (2017) Public blockchain versus private blockchain, s.l.: s.n.

Etherisc (2018) Democratizing insurance using blockchain. https://blog.etherisc.com/democratizing-insurance-using-blockchain-2cdac647e957. Accessed Nov 2022

Etherisc (2020) Make insurance fair and accessible. https://etherisc.com/. Accessed Nov 2022

Euromoney (2019) What is blockchain? https://www.euromoney.com/learning/blockchain-explained/what-is-blockchain#:~:text=Blockchain%20is%20a%20system%20of,computer%20systems%20on%20the%20blockchain. Accessed Nov 2022

Garg L, McClean S, Meenan B, Millard P (2009a) Non-homogeneous Markov models for sequential pattern mining of healthcare data. IMA J Manag Math 20(4):327–344

Garg L, McClean S, Meenan B, El-Darzi E, Millard P (2009b) Clustering patient length of stay using mixtures of Gaussian models and phase type distributions. In: 2009 22nd IEEE international symposium on computer-based medical systems, August. IEEE, pp 1–7

Garg L, McClean S, Barton M, Meenan B, Fullerton K (2010a) Forecasting hospital bed requirements and cost of care using phase type survival trees. In: 2010 5th IEEE international conference intelligent systems, July. IEEE, pp 185–190

Garg L, McClean S, Meenan B, Millard P (2010b) A non-homogeneous discrete time Markov model for admission scheduling and resource planning in a cost or capacity constrained healthcare system. Health Care Manag Sci 13(2):155–169

Garg L, McClean S, Meenan BJ, Millard P (2011) Phase-type survival trees and mixed distribution survival trees for clustering patients’ hospital length of stay. Informatica 22(1):57–72

Garg L, McClean SI, Barton M, Meenan BJ, Fullerton K (2012) Intelligent patient management and resource planning for complex, heterogeneous, and stochastic healthcare systems. IEEE Trans Syst, Man, Cybern-Part A: Syst Humans 42(6):1332–1345

Garg L, Chukwu E, Nasser N, Chakraborty C, Garg G (2020) Anonymity preserving IoT-based COVID-19 and other infectious disease contact tracing model. IEEE Access 8:159402–159414

Garg L, McClean SI, Meenan BJ, Barton M, Fullerton K, Buttigieg SC, Micallef A (2022) Phase-type survival trees to model a delayed discharge and its effect in a stroke care unit. Algorithms 15(11):414. https://doi.org/10.3390/a15110414

Gatteschi V, Lamberti F, Demartini C, Pranteda C, Santamaria V (2017) Blockchain and smart contracts for insurance: is the technology mature enough? Future Internet 10(2)

Gillespie J, McClean S, Scotney B, Garg L, Barton M, Fullerton K (2011) Costing hospital resources for stroke patients using phase-type models. Health Care Manag Sci 14(3):279–291

Gillespie J, McClean S, Garg L, Barton M, Scotney B, Fullerton K (2016) A multi-phase DES modelling framework for patient-centred care. J Oper Res Soc 67(10):1239–1249

Chen G, Xu B, Lu M (2018) Exploring blockchain technology and its potential applications for education. Smart Learn Enviorn 5

Gupta V (2017). A brief history to blockchain. https://hbr.org/2017/02/a-brief-history-of-blockchain. Accessed Nov 2022

Harrington J (2017) The present use and promise of blockchain in insurance. Wells Media Group Inc., San Diego

Hugh T (2017) DYNAMIS—Ethereum-based DAO for distributed P2P insurance. https://www.the-digital-insurer.com/dia/dynamis-ethereum-based-dao-for-distributed-p2p-insurance/. Accessed Dec 2020

Iredale G (2018) 6 key blockchain features you need to know now. https://101blockchains.com/introduction-to-blockchain-features/. Accessed Nov 2022

Jain A (2019) What are the three pillars of blockchain technology? https://medium.com/@aniijain/what-are-the-three-pillars-of-blockchain-technology-9ed9ca3bd754. Accessed Nov 2022

Khekade A (2018) If you thought blockchain was amazing, wait till you read about hybrid blockchain. https://entrepreneur.com/article/307794. Accessed Nov 2022

Kosba A (2016) Hawk: The blockchain model of cryptography and privacy-preserving smart contracts. IEEE Symp Secur Privacy 55

Kot I (2020) Blockchain in insurance: 3 use cases. https://www.insurancethoughtleadership.com/3-big-use-cases-of-blockchain-in-insurance/. Accessed Nov 2022

Manley G (2019) The history of bockchain. https://www.section.io/engineering-education/history-of-blockchain/. Accessed Nov 2022

McClean S, Garg L, Meenan B, Millard P (2007). Using Markov models to find interesting patient pathways. In: Twentieth IEEE international symposium on computer-based medical systems (CBMS'07), June. IEEE, pp 713–718

McClean S, Barton M, Garg L, Fullerton K (2011) A modeling framework that combines markov models and discrete-event simulation for stroke patient care. ACM Trans Model Comput Simul (TOMACS) 21(4):1–26

McClean S, Gillespie J, Garg L, Barton M, Scotney B, Kullerton K (2014) Using phase-type models to cost stroke patient care across health, social and community services. Eur J Oper Res 236(1):190–199

Nam S (2018) How much are insurance consumers willing to pay for blockchain and smart contracts? A contingent valuation study. Sustainability 10(11):4332

Nofer M (2017) Blockchain. Bus Inf Syst Eng 59

Popovic (2020) Understanding blockchain for insurance use cases, s.l.: Institute and Faculty of Actuaries

PWC (2020) Blockchain, a catalyst for new approaches in insurance, s.l.: s.n.

Rawlings P (2017) Insurance fraud and the role of the civil law. Mod Law Rev 80(3):525–539

Rosic A (2019) What is blockchain technology? A step-by-step guide for beginners. https://blockgeeks.com/guides/what-is-blockchain-technology/. Accessed Nov 2022

Salmon J (2019) Blockchain and associated legal issues. Emcompass 63

Sayeed S (2019) Assessing blockchain consensus and security mechanisms against the 51% attack. Adv Blockchain Technol Appl 9(9)

Sultan K (2018) Conceptalizing blockchain: characteristics and applications. Int Conf Inf Syst 11:49–57

Swan M (2015) Blockchain—Blueprint for a new economy. 1st ed. O’Reilly Media, Sebastopol

Swanson T (2015) Consensus-as-a-service: a brief report on the emergence of permissioned, distributed ledger systems, s.l.: s.n.

Swiss Re (2018) What is parametric insurance. https://corporatesolutions.swissre.com/insights/knowledge/what_is_parametric_insurance.html. Accessed Nov 2022

Tarr JA (2018) Distributed ledger technology, blockchain and insurance: opportunities risks and challenges. Insurance Law J 29(3):254–268

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Garg, L., Bugeja, L., Formosa, C.M., Shukla, V. (2024). Blockchain Within the Insurance Industry: A Bibliometric Analysis. In: Roy, B.K., Chaturvedi, A., Tsaban, B., Hasan, S.U. (eds) Cryptology and Network Security with Machine Learning. ICCNSML 2022. Algorithms for Intelligent Systems. Springer, Singapore. https://doi.org/10.1007/978-981-99-2229-1_28

Download citation

DOI: https://doi.org/10.1007/978-981-99-2229-1_28

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-99-2228-4

Online ISBN: 978-981-99-2229-1

eBook Packages: EngineeringEngineering (R0)