Abstract

This paper gives a general picture of China’s economic system reform, including its background, problems, policies, achievements and prospects. The necessity and urgent need of the reform is reviewed and the Chinese government’s decision to adopt policies for reforming its economic system is explained. China’s economic reform and stabilization policies are examined from two basic viewpoints: 1. the efforts to find the best way of introducing market mechanism into a centrally planned economy, and 2. the open-door policy that let China play an active part in the international division of labor. The lesson from China shows that an economic system can and should be regarded as an important input for economic growth and development besides labor, capital and technology. Timely and proper economic system reform could greatly increase the efficiency of the economic system utilization.

This paper has been prepared while I was a visiting researcher at the World Institute for Development Economics Research (WIDER). It is a part of the project on Economic Reforms and Stabilization Policies in Socialist Countries. I world like to express my gratitude to Prof. G. Kolodko, Dr. K. Mizsei, Prof. M. Ostrowski, Dr. D. Rosati, Dr. A. Torok and Dr. A. V. Vernikov for their useful and constructive comments on the first draft of this paper. Also I want to thank WIDER’s staff members for their support in preparing the final manuscript of this paper.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Summary

Ever since 1978, China has been making more and more progress in her economic system reform and gaining popularity around the world. This paper gives a general picture of China’s economic system reform: its background, problems, policies, achievements and prospects.

The Stalinist model was almost entirely copied by China as a means of organizing the economic life and industrializing her economy in the early 1950s. By doing so, China had made some achievements before 1978s, but as time passed, China’s national economy lost impetus and was soon left far behind by developed countries. Not long after the downfall of the ‘Gang of Four’ in 1976, Mr. Deng Xiaoping and his close associates came to power. They were aware of the fact that there were not a few problems in China’s economic system: over-centralization in the economic planning gave rise to widespread unrest and hindered faster economic development.

Being an agricultural country, it is not surprising at all that China started her economic system reform in the countryside, aimed at solving the problem of feeding her huge populating and gaining the farmers’ support for this reform. China introduced the Responsibility System (RS) in her rural reform in 1978. In this system, a farming household can sign a contract with the production brigade and become the user of land. Accordingly, the individual household will be obliged to hand over or sell an agreed quota of grain or cotton to the production brigade after harvest. At the same time, farmers may thus have incentives to make full use of the resources which would finally improve the efficiency of production.

Another important aspect of China’s rural reform, is the rapid development of “township enterprise” which was highly encouraged by the central government. Township enterprise is a kind of collective enterprise, located mainly in the countryside and run by the production brigade or township government. This may be the special way through which China would continue her industrialization.

RS has been also widely applied to urban reform, which followed China’s rural reform. Managers with relative autonomy like farmers can sign a ‘contract’ with local authorities or ministries concerned. In such contracts, both sides decide how to share the profit and make arrangements about production quotas. Products covered by those quotas will be distributed at officially fixed prices among state-owned enterprises. Products above quotas can be marketed at so-called floating prices (with their bases and ceiling under state regulation).

China’s open-door policy is an integral part of her economic system reform. By implementing this policy, China intends to play an active role in the international division of labor and also to take advantage of new forms of management used by joint ventured and of new technology.

Rural reform also had some negative aspects. For example, farmers refused to invest in land, and on the contrary, they have been very much interested in pursuing short-term profits. As a result, the growth rate of grain production declined in 1986. The explanation for this could be that RS’s potential has neatly been used up.

The realization of urban reform has not been completely smooth, either. Under RS, the manager has to pay a fine if he or she fails to fulfil the contract. This sanction is, however, not big enough for compensating for the loss caused by bad management. On the other hand, the state is likely to be reluctant to see any enterprise going bankrupt. That is why RS does not seem to be able to eliminate soft budget constraints for managers. Irrational pricing system is another reason for concern. This has been damaging the national economy by misleading resource allocation. Moreover, any changes in the pricing system may give the impression of simple price hikes. Population pressure is still a special problem which the Chinese leaders have to take into account.

China’s central government has promised not to change current RS in the rural areas, in at least the next 15 years. The leadership has implemented some flexible policies to encourage co-operation between farmers on a voluntary basis. As an important step in the urban reform, China is introducing a share-holding system. As to the irrational pricing system China’s reform architects are trying to work out far-reaching corrections. In addition, a bolder experiment is being undertaken in the newly-formed Hainan province, where market mechanism will play a dominant role. The opening of coastal areas is intended to promote a better integration with the world economy.

It can be expected that many other substantial changes will take place in China in the years to come as economic system reform progresses.

2 Introduction

Since the beginning of China’s economic system reform, ten years have passed. Everyone who is interested in the Chinese economy and has been to China must have been impressed by the great changes taking place in China. As the biggest developing and socialist (in terms of population) country in the world, what has happened and is happening in China, in particular the economic system reform, is gaining more and more attention in the outside world. Generally speaking, China’s economic reform and stabilization policies can be examined from two basic viewpoints. One is the efforts to find the best way of introducing market mechanism into a centrally planned economy. The other is the open-door policy, letting China play an active part in the international division of labor. Certainly, these two aspects are closely related. This paper will briefly review the necessity and urgency of the reform, explaining why China had to choose the way to reform its economic system and the policies for which the Chinese government opted to promote the reform. As often happens, some difficulties and problems, such as inflation, seem inevitable in the process of reform. This paper will also examine the further efforts China has made to solve this sort of problem. Great attention will be paid to the next immediate steps that China is likely to take. It is well known that the past ten years saw a rapid growth of China’s economy, which should be mainly attributed to the economic system reform and stabilization policies. This might be of some interest for other countries, especially less developed countries (LDCS) and the same might go for the lessons drawn from China’s economic reform. The author eagerly hopes that this paper may provide some constructive and valuable references and information about the experience of China.

3 The Background of China’s Economic System Reform

Shortly after the founding of the People’s Republic of China in 1949, the Stalinist economic model was almost entirely copied by China as the means of organizing economic life, as East European countries did. It has to be said that China had benefited a lot from following the Soviet path during its three decades of construction since 1949, but as time passed, this model showed itself more and more inappropriate. Economic system reform thus became the most natural choice for the leadership. This conclusion can be found on the following assessment of the situation China was facing in 1978.

-

1.

The slow-down of growth rate of National Income

There were two major setbacks in China’s economic development. From Table 1.1 we can see that China’s economy suffered a great deal between 1958 and 1962 from its so-called Great Leap Forward, natural disasters and especially the withdrawal of Soviet technicians and the suspension of economic aid. We also see that China’s economy growth had kept dropping after 1966. The later situation gave new Chinese leaders an alarming signal.

-

2.

The disappearance of Chinese enthusiasm

There are some strict prerequisites for the centralized system to work. One of them is the people’s enthusiasm that they are willing to sacrifice their own interests for some holy goals such as state interests. It should be stressed that such kinds of enthusiasm could last for two decades at most. The incentive system based on spiritual or moral encouragement, adopted in China before 1978, had been losing its influences upon the generation growing up in post-revolutionary China. Unfortunately and naturally, this kind of enthusiasm has disappeared, which means China should find a new incentive system in replacement of the old one.

-

3.

The gap or disparity between China and developed countries had kept widening

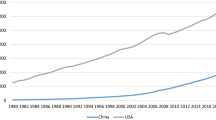

In 1960, China’s GNP was nearly the same as Japan’s but in 1979 GNP of China only equaled about one-fifth of that of Japan. Moreover, some developing countries and regions enjoyed more rapid economic growth and development. One of the most essential reasons for China’s present reform might be that Chinese people have had the sense of identity crisis, i.e., China seemed to face a threat of being a country of the fourth world, even if it has a long history and a splendid culture.

-

4.

Changes in China’s political field

It is well known that at the end of 1970s, Mr. Deng Xiaoping came to power again acting as the designer of the reform’s blueprint. In our view, the change of top leaders can be regarded as a turning point for a country, especially a socialist country. To some extent, this hypothesis could be tested and then also supported by some other socialist countries’ experience, the USSR, for instance. Doing something different is sometimes a choice in front of the new leaders. If the social-economic situation is far from satisfactory (it is hardly exaggerated to say that China’s national economy was on the brink of collapse in 1978) then drastic changes seem to be the only option.

-

5.

The international setting and introspection

It is well known that at the end of 1970s, Mr. Deng Xiaoping came to power again acting as the designer of the reform’s blueprint. In our view, the change of top leaders can be regarded as a turning point for a country, especially a socialist country. To some extent, this hypothesis could be tested and then also supported by some other socialist countries’ experience, the USSR, for instance. Doing something different is sometimes a choice in front of the new leaders. If the social-economic situation is far from satisfactory (it is hardly exaggerated to say that China’s national economy was on the brink of collapse in 1978) then drastic changes seem to be the only option.

The fact of the slow-down of national income growth rate and widening disparity between China and some other countries or regions forced Chinese leaders and elite to reconsider the economic system China had been implementing prior to 1978. The natural question emerged why some developed countries (such as Japan and Federal Germany) and developing countries or regions (such as so-called Asia’s Four Little Dragons Hong Kong, Taiwan, Singapore and South Korea) could succeed in their economic growth and development. Chinese leaders and elite (being well aware of the fact that China was at a crucial moment in her history) came to recognize that what both brought about such results to China and what should be blamed for most of the problems was the economic system China had chosen. Now that the rigid and out-of-date economic system was perceived as an impediment to economic development, it could also be used as at rigger for a take-off of China’s economy, if it could be improved or reformed in a correct way. This judgement was based on the fact that the economic system one chooses is closely reflected in some parameters of the economy of efficiency, growth rate, etc. That is why the Chinese government decided to achieve its modernization by reforming the Stalinist model it had followed. As far as economic policies are concerned, we might regard them as tools or instruments for promoting economic system reform.

-

6.

The Impact of Reform Waves of Socialist Countries

In early 1950s, Yugoslavia initiated economic reform after breaking with the Soviet Union; later, economic system reform was launched in Hungary and Czechoslovakia in the mid 60s. This may be regarded as another reason why China decided to reform her economic system in a way which bore some resemblance to the ones introduced earlier in East European countries.

After many years of political struggle and economic stagnation, there was a strong desire for great changes among the Chinese people. At the same time, there was also a powerful and compelling resistance against any kind of man-made disasters from almost the whole Chinese people in all the fields. To meet such a desire and avoid further economic stagnation, the Chinese leaders started the economic system reform and open-door policy in 1978.

4 The Evolution of the Reform

Although there are some similarities between China’s economic reform and that of East European countries, events in China had many distinguishing features. For example, unlike other socialist countries which usually started economic reform in industry enterprise management and/ or the role of the government and enterprise, China introduced the new system first to the countryside instead of urban zones. The reasons for such distinguishing features need to be discussed here in more detail.

China is the largest developing and agricultural country in the world with four-fifths of the total population living in the countryside. From the viewpoint of Chinese history, it is true that those who can obtain the support of peasants will finally win the game in China. This implies that it is the reform in the agricultural sector that would bring China’s economy into motion. So long as Chinese peasants could gain some tangible profits from the reform they would become the most important force supporting overall reform in China.

On the other hand, the previous system failed to realize its potential in agriculture. By comparing communes’ crops per cultivated land with that of private plots’, you will find striking differences between them, which exactly shows the significant losses of efficiency. Thus, the rigid system failed to stimulate peasants to work hard and efficiently on the communes’ land. Farmers were told or ordered by cadres of the bureaucratic hierarchy what and how to grow and, to make matters worse, how much farmers earned did not depend on their work but on the so-called ‘big pot’—a Chinese common saying describing equalitarianism. No wonder China’s agriculture remained backward for a long time, which resulted in the problem of feeding the huge Chinese population remaining unsolved. It is believed that total increase of grain production could hardly meet the demand of the newly-born babies in the years prior to 1978.

At the time of introduction of economic reform in China, the East European Countries, perhaps with exception of Romania and Bulgaria, had been already more advanced in their industrialization than China. The gap of economic development between them seemed to play an important part in initiating their economic reform in different sectors—agricultural or industrial sector.

By the way, the responsibility system (RS), which characterized the China’s economic reform in rural areas and will be analyzed later, had been introduced in some provinces during the period of readjustment (1963-1965) with quite satisfactory consequences.

-

1.

Rural (Agricultural) Reform via Responsibility System (RS)

The first essential step of China’ s economic system reform was the reform of the agricultural management system. It was introduced in several poorest provinces (such as AnHui and SiChuan provinces) together with the so-called “responsibility system” (RS) in 1978. During the first three years, there existed various RS models according to the contracting parties involved which meant that different parties (individual families, smaller responsibility groups and production team) signed contracts with production brigades—the agents of local government. The contents of contracts were also different (contracts linked to special tasks or to general output or delivery quotas) as well as methods used for accounting and establishing wages (systems based on distribution of production). However, the essential features of various RS models were almost the same: farmers signed contracts with the production brigade and then became the managers or users of the land they were responsible for, with the obligation of handing over or selling an agreed quota of grain and cotton to the production brigade after reaping. Step by step, in particular in 1984, the liberal form of RS, “output contract with the family”, was spreading all over the country. This implied that farm land was divided and distributed (only as far as utilization rights are concerned) equally among the individual households, and more significantly, on the basis of the number of active members per family. Meanwhile, the distribution of farmland was adjusted according to quality. Initially, contracts were signed for about 3 to 5 years and later, in 1984, enlarged to 15 years, with the aim of attracting peasants to invest in land.

Along with the establishment of RS (accounting for 94% of peasant households in 1984), mandatory quotas for sown area and output were eliminated and purchase (compulsory procurement) quotas were reduced, with the sale of above-quota output on the free markets. Up to present state purchase quotas (mainly for grain and cotton) depend on different regions and counties, and there are no exact data concerning them. Quotas contracted are sold at contracting prices which were increased in 1979 at a level of 203 over that of a year before and, once more in 1980, the purchase of procurement price of agricultural goods jumped 7.18 above the previous year. Since 1979, Chinese peasants have begun to have rights to decide what, how and how many to plant or grow as long as they were bound by the contract.

Under such conditions, farmers’ productive potential had been nearly fully used because they knew they could earn more than before if they tried their best to work both efficiently and on a scientific basis. At present they explicitly understand that they work not only for the state but also for themselves. It is clear that RS and increase in foodstuff prices exerted a good impact upon the performance of peasants who had benefited much from first two years’ rural reform- the total income of Chinese PROTOTS was raised by 30 billion yuan (equaling 9.8% of 1978 national income). This is the reason why Chinese peasants have become unflinching supporters of the economic system reform.

Furthermore, the state relaxed control over all of the prices of agricultural products except for that part of rationing grain and edible oil in 1985. Meanwhile, agricultural tax also was collected in cash instead of in products (grain and cotton). By doing so, the role of market mechanism has been enhanced in rural areas.

The picture would be incomplete if we neglected the other side of Chinese rural reform. That is, in general, the rapid development of township enterprises which were highly encouraged by the state. Here, township enterprise we discuss is one kind of collective enterprise run and funded by the production brigade or township government—the lowest grade in China’s government system. Township enterprises are scattered in the countryside or small cities and their value of production is included in the total value of agricultural products. Thus, we refer to the development of township enterprise as a part of China’s rural reform. The following points summarize the most important reasons which lead to the rapid development of these enterprise.

There was a large number of excessive labor force in the countryside who farmed their land but were underemployed. Therefore, the conditions for development of labor-intensive industries in China’s countryside have been favorable.

Besides some township enterprises set up during the past three decades and inherited by their successors, the leaders of production brigades and officials of township government showed much interest in expanding these enterprises and establishing new ones, because they explicitly recognized that a chance of becoming rich could be found in managing township enterprises.

The most important impetus to the township enterprises’ development was that the way in which government controlled or coordinated them has deeply changed. They were almost independent from the state mandatory plan, and had decision-making rights about what, how and how much should be produced. Both because of their large number and scattered location around the whole country, China’s central government had to make full use of so-called economic levers of tax, price and credit policies rather than administrative direction to achieve the macro-economic targets in rural areas. Here we can come to the conclusion that this deliberate choice is a very important step in the process of introducing market mechanism in China.

The flourishing development of township enterprises shows that China intends to industrialize her economy in a specific way, i.e., the excessive rural labor force might be employed by those enterprises. As a consequence, the problems which are caused by the over-flow of peasants into big cities in some developing countries, to a great degree, have been solved properly by China.

As a result of the reform in rural areas, the gross value of agricultural output increased rapidly (see Table 1.1), indicating a clear success of agricultural reform in China. Moreover, a rapid rise in crops was achieved in spite of the decrease of the share of agriculture in new investment and of the overall diminution of disposable land.

What should be stressed here is that the introduction of RS might mean nothing to farmers in other countries, but it is something to Chinese farmers who had lost the autonomy and “eaten the meal from the big pot” for decades. This denotes that any improvements in the previous rigid economic system is likely to generate sometimes unexpectedly good effects.

Now let us briefly sum up Chinese rural reform experiences. First, gaining support from the nation’s basic group or class is a precondition to the success of reform. As a corollary, how far the reform can go and at what level the reform will be successful mainly depend on their attitudes towards the changes surrounding them. Second, it seems very dangerous to persist in any specific doctrine or text. The success of Chinese rural reform in part should be attributed to the change in the way of thinking. As for China, this change brought the term “socialism with Chinese characteristics” into common parlance.

Third, more theoretically, the success of China’s rural reform should contribute to the elimination of the “big pot” philosophy—equalitarianism of distribution—that would naturally undermine any incentive system. In order to achieve this goal, we have to let participants of economic activities clearly see the losses and benefits stemming from their behavior: working hard or not. This requires granting autonomy to them (decentralization) and letting them know their obligations and rights explicitly (the right of using land for example), which is prerequisite for autonomy. Correspondingly, the market mechanism should play a great part in allocating resources and deciding who ought to earn more (or less). All of the three aspects including autonomy (or transition from centralized economy to the decentralized), clear right of utilization or even owning the means of production, and market mechanism are overlapping and/or tied to each other and form the economic system. However, they can and should influence the incentive system. It is the new incentive system introduced by economic reform that motivates the peasants to work efficiently, for households naturally are profit or income maximisers and have little chance to get additional support from the state when they run at a loss.

-

2.

Urban (Industrial) Reform

The success of rural reform paved the road for urban reform. At the same time when rural reform was under way, China had already readjusted the relationship between government and enterprises. For example, the state adopted a policy to share profits with some enterprises. A part of profits retained were allowed to be used as bonus or welfare funds. Managers enjoyed a limited autonomy in the sense that they could decide who deserved more (or less) and how to fulfil state plan targets. The urban reform carried out before 1983 had only an experimental character.

It is the success of rural reform that had created the preconditions for accelerating urban reform. On the basis of these preconditions, the Chinese communist party adopted a document entitled “A Decision of the Central Communist Party of China on Reform of Economic Structure” in October, 1984. That document focused on urban economic reform and listed the major defects of the previous economic system:

-

the lack of a distinction between the functions of government and enterprises;

-

bureaucratic and geographical barriers to the functioning of the market;

-

excessive and rigid state control of enterprises;

-

failure to attach adequate importance to the law of value and the regulatory role of the market;

-

–egalitarianism in distribution which has sapped the initiative and creativity of enterprises and workers.

In the terminology of modern economy, there existed both allocative inefficiency and X-inefficiency on a grand scale.

The fundamental and essential objectives of urban reform are to eliminate the defects or shortcomings inherent in the traditional Stalinist model. Being encouraged by the successful agricultural reform, several measures or policies were worked out to solve these problems.

-

(1)

Responsibility System: A Lesson from Rural Reform

Like the situation of rural reform at its beginning, there existed a few substantial differences between various models of responsibility system (RS) introduced in urban areas, and the most basic meaning of RS of urban reform was almost the same as that of rural reform. It is impossible for us to analyze various models of RS in detail in this paper, so we will concentrate on discussing one of them which embodies the essence or core of RS -Asset Management Responsibility System (AMRS).

Prior to 1978, what the managers or directors of enterprises could and should do was to fulfill the state mandatory plan, with the absence of (or with strictly limited) material incentives. The failure to work out the mandatory plan in such way that it could practically and properly reflect the social demand was the basic obstacle to gain allocative efficiency. In fact, attempts at increasing allocative efficiency are no more than an illusion even if we can take advantage of modern technology large scale computer facilities. On the other hand, the X inefficiency should be imputed to excessive control from the center, together with restrictions on the utility of material incentives of any kind, because they strongly dampened the energies and enthusiasm of workers and managers. The principal purpose of applying RS to urban reform, especially to the state-owned big and medium-sized enterprises,was to provide a solution to the problems above.

RS adopted in urban reform can be presented in the following way: The managers of enterprises, to some extent, with relatively large autonomy just like peasants, sign a contract with local authorities or ministries to which the enterprises belong. The contract stipulates how much profits or tax the specific enterprise must deliver to the state and, at the same time, government departments at various levels should not manage or operate any enterprise directly. Like individual families, enterprises are independent entities of commodity producers, responsible for their own profits and losses, acting as a “legal person” with specified rights and obligations. The obligations not only require the enterprises to guarantee a fix share in profits to the state, but also stimulate the enterprises to ensure specific products quotas sold to the state at the fixed prices fixed in the contract. This part of fixed products-contract quotas, which is very similar to the state order, would be distributed at the same prices among different enterprises. Products above the quotas could be marketed by each enterprise at so-called floating prices which are usually much higher than the fixed ones. How much the enterprises can earn, in terms of bonus which can be flexible, mainly depends on whether they fulfil the profit as well as product quotas. In general, the more goods enterprises produce above the quotas, the more money they can earn. The money they earn should be used as bonus, collective welfare funds for workers, and funds for updating equipment and for investment. The rights of using depreciation fund had been transferred from the state to enterprises and, according to the state statistical bureau (China Statistical Yearbook 1987), the depreciation rate for state-owned enterprises was raised from 3.7% in 1978 to 4.7% in 1985.

Under such conditions, however, the managers probably will misuse the capital or assets of their enterprises for short-run purposes, such as refusing to use retaining profit for investment and embezzling the depreciation for workers’ bonus or welfare during the contract period. This kind of unhealthy phenomenon undoubtedly is against what the reform’s architects expect, and it is especially harmful to improve the allocative and x efficiency.

It is in this set of conditions that China’ s reform designers introduced AMRS in 1985. Its features are as follows:

-

In addition to the obligations or duties as mentioned above, managers have to take the fixed asset increment stipulated in contract seriously, on account of that the fixed asset increment is closely related to the profits he or she will earn when their contracts approach expiry.

-

The way in which the managers are chosen or selected have deeply changed from being appointed by government departments at various levels to public bidding. The group of tender-inviters is often composed of the representatives from ministries, local government departments, the workers’ committee, bank, notary bureau and layers. Those who offer the most favorable bidding will finally defeat their opponents.

-

Certainly, there exist some kinds of sanctions for failing to fulfil the contract for two successive years during the contract period usually between four and six years. For instance, such managers would receive no bonus and have half of salaries deducted. The workers’ wages would also be reduced by a certain degree.

It is necessary to briefly describe the other two models of RS, which have been adopted in China widely. One is Contracts Based on Losses, the other is Contracts Based on Progressive Increases in Profits Paid to the State. The contract term of the former one is usually for one year. Central and provincial authorities initiate this RS for annual losses and issue financial subsidies accordingly for each enterprise. At the end of the year, if the losses incurred exceed these limits, no more subsidies will be granted. If the losses fall below the limits, any remaining subsidies will be retained by the enterprise. The later one applies to enterprises experiencing stable growth in production, marketing and profits. The term of the contract is often two to four years. The government and enterprises discuss and decide on a base sum to be handed over to the state treasury in profits, and an annual growth rate. Any amount exceeding the progressive growth rate may either be retained by the enterprise or shared by the state and the enterprise. By controlling excessive enterprise expenditure and encouraging production expansion, the authorities usually stipulate that a certain percent (e.g. 60%) of profits retained by enterprises should go towards enterprise construction.

-

(2)

Reforming centrally planned economy in accordance with RS

Now let us look at RS from a different angle. For those who are interested in China’s economic reform, one of the most important literature is that “Decision” we have mentioned (see page 12 above). This made clear that the Chinese economy would remain a planned economy, but planning does not necessarily mean the predominance of mandatory planning. In addition, the scope of mandatory planning should be reduced in favor of guidance planning and regulation by free-market forces. This is the key step for China to incorporate market forces into the planning process. Practically, as referred to above, under RS the state mandatory planning has been replaced with the contract quotas which are tantamount to the state order. In other words, the state mandatory planning has taken another form. Even though a number of big and medium-sized state-owned enterprises still receive mandatory production plans from the state planning commission, their managers’ obligations and rights are almost the same as those under RS.

There has now been a relatively large change in the willingness of the state to overmanage and overcontrol enterprises. For example, the state Planning Commission’s mandatory production plans now cover only 60 types of products making up 20% of total production value, down from 123 types and 40% in 1980. This indicates that a relatively large part of the mandatory plans has been taken over by contract quotas even though there are not accurate data about it. The number of materials allocated by the state plan has decreased from 256 in1980 to 23 types by 1987. Among these 23 types, the proportion distributed by the state mandatory plan has also been reduced to a great degree. For example, for steel materials decreasing from60% to 55.4%, for lumber decreasing from 80% to 35.2%, for coal decreasing from 53.7%to 47.3%, for cement decreasing from 33.9% to 19%, and deliveries of mechanical and electrical products (other than motor vehicles) semiconductors, and industrial boilers, have been completely transferred to the market. The number of products administered by the Commercial Department has already decreased from 188 types in1978 to 23 types in 1987.

As to the way of distributing raw materials and semi-finished products two aspects may be discussed here. First, the State Planning Commission, whose rights have been largely shared by a newly-established ministry of materials and products, still plays an important part in it even if its rights have been greatly reduced as shown above. Its limited rights of allocation focus on products of vital importance to the national economy, steel, energy and the like. The state Planning Commission allocates those materials and products among various regions, sectors and big state-owned enterprises at fixed prices in order to guarantee the fulfilment of the contracts and mandatory plans. In general, the raw materials and products distributed by the state cannot meet the needs of their productive capacity. For the sake of making more profits, these enterprises have to enter the market searching for sellers, the latter also have to do so because only a part of their products—raw materials and semi-finished goods—can be “bought” by the state. Consequently, enterprises have been “forced” into entering market and encountering competition.

As far as the so-called guidance planning is concerned, its real meaning is, to some degree, easy to be understood. We have learnt that the state mandatory planning has been giving way to RS and the mandatory quotas have been greatly reduced in order to gradually introduce market mechanism to centrally planned economy as a means of improving allocating efficiency as well as X efficiency. For the sake of avoiding economic chaos, e.g. wrong or irrational investment and blind expansion of production, the state planning commission also gives guidance plans to enterprises, hinting to managers what kind of products or investment and their quantities can or probably satisfy both the state and market demand. Meanwhile, the state tries to utilize the macroeconomic policies (or so-called economic levers)—pricing, credit (differentiated interest rate) and fiscal policies to affect enterprises’ decisions. These levers, as means of influencing managers’ decision-makingplay an increasingly important role to fulfil the state’ s wishes—featured by guidance plan, or more vividly, indicative plan—to be achieved. Guidance plan exerts stronger impacts upon both collective (including township enterprises) and private individual enterprises than that of big and medium-sized state-owned ones.

As for small state-owned enterprises (including mini-commercial service enterprises), a new measure is being taken in China: leasing them to individuals (leasing system). Managers under this leasing system enjoy more autonomy than those under RS. They receive no mandatory plans, nor any quotas except for the obligations of paying rent and tax to the state. By the way, some well-known Chinese economists are suggesting that it would be convenient and beneficial to sell some of them, which are losing money, to citizens even though the state earns only one yuan (Li Yining, World Economic Herald, May 23, 1988).

-

(3)

Dual pricing system: another look at RS

In fact we have already touched on the pricing system when we described the RS, e.g., enterprises can sell their above-quota (or contract quota) products at so-called floating prices on the market, while the products within the contract quota must be “bought” by the state at the fixed prices. So far, we have two kinds of prices. Generally speaking, floating price is the price that can be altered in accordance with demand and supply in the market place between ceiling and base levels set by the state planning commission.

In addition, there exist a great deal of collective and private enterprises, including township enterprises discussed above and collective enterprises in urban areas, as well as a new one related to foreign investment. Even though some of collective enterprises more or less sign contracts with local governments at various levels, their production and marketing activities are far from being controlled by the state. This suggests that in China there is a large number of goods (see Tables 1.3 and 1.4) that are being marketed at free market prices. Here, with a moreprice categories, we can come to a conclusion that, to a great extent, China’s present economic system can be deemed a tripartite mixed economy combining contract quotas (and some mandatory ones) and fixed prices for certain commodities, guidance planning via economic levers with floating prices for a wide range of industrial products and consumer goods, and free market production of non-staple foodstuffs and other items.

Of those three kinds of prices mentioned above, it is easy to understand both fixed and free-market prices. Thus, we are going to look at floating prices. Theoretically, floating prices should and can change between ceiling and base, but practically they would usually be divided into two sub-categories. One is equal to fixed prices because they are always at the ceiling instead of floating or being flexible; the other is so-called bargaining prices which are not under state control and hardly differ from free-market prices. We call this distinctive pricing in fact only two kinds of prices, which characterize RS as far as pricing system is concerned.

Now let us focus on the analysis of the economic levers which naturally elicits the changes in fiscal and financial policies in China. This paper has already mentioned some issues concerning them. Taking the profit-sharing between the state and enterprise as an example, it typically comes out that great changes have taken place in China’s fiscal system. What is more, China has started to use tax differentials to influence the decision-making of economic participants. For instance, enterprises began to pay a highly progressive bonus tax in 1984instead of abiding by the authorities’ arbitrary control over it. In order to encourage the development of primary products’ industries (mining and energy), this kind of fiscal policies also have been put into practice. Perhaps the most significant change in the fiscal and financial field is that China has been making efforts to convert government budget for assets investment into bank loans, e.g., when an enterprise wishes to invest it could ask for funds from government budget, which called for no compensation before 1980, and since then the investment funds backed up by government budget has been gradually replaced by bank loans which require compensation for both principal and interest (Table 1.5). Certainly, differentials in loans’ interest has been viewed as an effective instrument to influence managers’ decisions. What should not be neglected is the establishment of a new structure of China’s banking system in which People’s Bank of China acted as China’s Central Bank (see Fig. 1.1). This seems to be the first step to make the so-called specialized bank act as an enterprise rather than an executive organ of the Ministry of Finance.

-

(4)

China’s open-door policy

Owing to some political, economic, and especially ideological reasons, China had isolated herself from the outside world for a long time prior to 1978.Needless to say, this self-reliance (or close-door) policy played a part in the widening of the development gap between China and other countries, and had to be stopped in favor of the opposite one—open-door policy.

The first step on the road to opening towards the outside world, besides expanding foreign trade, was the establishment of four Special Economic Zones that is commonly regarded as China’s first step towards attracting massive foreign investment in 1979. By the end of 1986, the number of various contracts of foreign- economic cooperation signed in the four SEZs reached more than4.700 and the total foreign investment jumped to US$ 2.2 billion. On the basis of successful experience from SEZs, China speeded up her pace to stimulate cooperation with foreign countries. Along with foreign capital’s introduction, a lot of new types of enterprises appeared, for instance, joint ventures, joint operation firms and completely foreign-funded (owned) companies. Foreign investors invested around US $ 8.3 billion in China in total from 1979 to 1986. What China did in this field aimed at learning advanced managerial skills from the industrialized countries, up-grading productive capabilities and products with modern technology, and providing additional employment opportunities for populous China. These enterprises can take advantage of preferential policies, which are not applicable to the other three kinds of enterprises.

Here we need to keep in view the concrete form of preferential treatment offered by China for promoting joint ventures, which may be of interest for those countries that are going to implement similar policies to spur their further economic development. As of 1985, joint ventures with expiration terms over 10 years enjoyed a tax holiday during the first two years after they began to realize a profit and a 50% tax relief in the following three years. Joint ventures with relatively low profit expectation located in the inner-remote areas enjoyed a tax holiday during the first five years after they became profitable, and also possibly in the following 20 years with the approval of the ministries concerned. Joint ventures located in special economic zones were subject to a special income tax rate of 15%. Most joint ventures operating in the 14 coastal cities and Hainan island enjoyed a 20% deduction on the present tax rate, while joint ventures in energy, transport and harbor construction sectors enjoyed a low tax rate of 15%. Other projects which were technology-intensive or involve over 30 million US dollars in foreign investment may also enjoy a low tax rate of15% when they applied for and received approval from the Ministry of Finance. Imported equipment for production and management as initial foreign investment, construction materials, imported raw materials and components for manufacturing export production self-employed vehicles and office facilities were free from customs duties and the Consolidated Tax for Industry and Commerce. Export products (excluding those subject to state quotas and/or restriction) were free from customs duties and the Consolidated Tax for Industry and Commerce as well. In addition to all these sorts of favorable tax treatment, if foreign partners transferred advanced technology and equipment, a certain part of products made by the joint venture can be sold on China’s domestic market (Zhou Rongji: China’s Policy in International Cooperation, 1985).

In this respect, removing tight restrictions on private business has been one task of China’s economic system reform and stabilization policies. In early 1988, there were about 225.000 private enterprises in China with employment levels higher than seven. The total amount of hired labor was estimated at more than3.6 million, with an average number of 16 in each enterprise (the biggest one works with about two thousand employees. China Daily, July 1988). Private firms have enjoyed a sharp expansion in the past nine years from zero to today’s figure (refer to Table 1.6), and their futures certainly look bright. To promote private economy is a part of China’s policy of developing a diversified economic system with the publicly-owned economy maintaining a predominant position.

Now we have finished the brief summary of what has been achieved by China’s economic system reform before 1987. They mainly comprise implementation of RS in both rural and urban areas, reform of central planning system, introduction of dual-pricing system and open-door policy as well as development of a diversified economy.

5 Performances and Problems

-

1.

An Overview of Economic Development (1978–1987)

Great social and economic changes have taken place in China since economic system reform was undertaken in 1979. The annual growth rate of national income during the period of 1979 to 1986 was higher than that of 1953 to 1986 (Table 1.7 and also see Table 1.1), with a relatively more abundant market. Table 1.7 shows a definite improvement with the general tendency of industrialization of the macroeconomic structure.

Although many factors such as increase in capital and labor can contribute to economic development and growth, it goes without saying that a big part of China’s economic prosperity is due to a result of her economic system reform. Here we list the reasons why such a conclusion seems warranted. First of all, the new economic system has brought about an improvement in allocating efficiency. Central planners undoubtedly have improved their skills of planning, but with the increasing significance they have attached to the feedbacks from the market, the state-owned enterprises’ autonomy makes at least some of the managers produce and invest what is required by the market. Consumers needs have become decisive for collective and private enterprises. In other words, the market mechanism has started to influence resource allocation, which undeniably is accompanied by a higher allocating efficiency than the ambitious and overall centralized planning in the past.

Secondly, the new system encourages market-oriented production. State-owned enterprises, which formerly had to obey mandatory production plans, are given leeway to produce for themselves as well. This part of their production can be sold at prices set by the enterprises themselves. They are interested in maximizing profits. Enterprise behavior is redirected toward tapping their potential resources, organizing technical innovation, increasing production, and applying high-quality management. As a result, much progress has been made in improving X-efficiency.

Thirdly, an economic system is something like a set of rules which governs its participants’ behavior and provides incentives for them. In general, everyone is a profit or self-interest maximizer. But under different economic systems, or with different restraints of rules, people’s maximizing behaviors take different forms. We can take China’s old economic system as an example: how much a worker could get did not depend on his or her work, because of the equality principle in distribution or “big pot”, and doing what had been ordered to do was workers’ and manager’s only practical choice. Therefore, economic system reform is tantamount to rationalizing the “rules” so as to invigorate each system participant’s enthusiasm. Experiences of China’s new system show that what China has done is in the correct direction to rationalize her economic system step by step.

-

2.

Problems and Unstable Factors

As usual, however, every coin has two sides. China’s tremendous achievements are also accompanied by undesirable consequences or by-effects, most of which stemmed from the legacy of the long existence of the traditional system. In spite of this, those by-effects or problems still may undermine the reform and the modernization drive if ignored. Now we are going to enumerate the principal problems confronting China’s reform.

-

(1)

Problems accompanying rural reform

Although RS based on contract linking remuneration with output has yielded some good results, it obviously has several side effects. First and foremost, a large number of irrigation facilities built before the latest reform have almost broken down because of management by individual families. A lot of big and medium-sized tractors have been standing idle due to difficulties in distributing them among individual households. Furthermore, drastic changes in management methods also have given rise to some undesired effects beyond the expectations of experts speaking for the extension of rural reform into industry. This was most evident in the field of tractor production which used to concentrate on manufacturing big and medium-sized tractors. Under RS, in particular with the smaller pot management and plantation, what farmers need most were small tractors (two-wheel tractors, for instance), and this undoubtedly required readjustment of the former industrial structure which was under way in China. Such phenomena inevitably resulted in losses at some enterprises. It has to be stressed that economic reform or stabilization policy is closely associated with sometimes dramatic changes in industrial structure. Certainly, it probably is a good trend from a long-run viewpoint.

As mentioned above, under RS, in rural areas, the cultivated land, that was responsible by individual households, was distributed among peasant families on the basis of the number of active members per family and of the quality of land. To obtain the goal of equality, farm land was usually divided into several pieces for one household. This policy measure, together with the scarcity of land suitable for agricultural purposes (which gives an average of 0.1 hectare per capita in China), seemed inevitable to bring about the losses of efficiency caused by a lack of economy of scale.

In addition to the above problems, there is another problem making things worse. Farmers refused to invest into land, and on the contrary, they were much more interested in pursuing short-term profits. This was because the ownership of the land still belonged to the state and RS was only a preliminary measure to separate management from ownership. Most peasants were wondering if they can retrieve or take back the investment from the State’s land. That’s why they had preferred investing their money into house-building and buying sprees. Putting the case another way, since the state was the only owner of the land, nobody had a right to buy or sell plots. Such a system inevitably blocked the road to increasing scale economy which would be more efficient than the prevailing one, and did not help raise the agricultural productivity which was also a result of shortage of investment. As a consequence, the growth rate of crops dropped from about 6% during the period of 1979–1985 to 2–3% in 1986 (also see Table 1.2).

An explanation we can give of the situation is that RS’s potential has been nearly used up. In fact, the rapid growth rate of grain production during the period 1979–1985 for the most part should be attributed to RS that gave big incentives to farmers under special conditions. The situation now, however, is different. The present RS lacks further incentives for farmers to invest in land. Therefore, China has to change its manner, or carryout a new policy if she wants to maintain a high growth rate of crop production. Here, two steps are likely to be made: one is to complete or perfect present RS. In particular, much efforts might be made to let peasants know that they are both the real owner and manager of the plot they are cultivating, even though buying and selling land is not permitted. This may “kill two birds with one stone”, that means, on one hand, it can tempt peasants to invest capital into land they cultivate, on the other hand it helps put the ball under control of the best players and avoid the waste of land. Certainly, China will need other auxiliary measures if effective results are to be expected. That suggests the state has to raise stimulated purchasing prices of cereals again, because farmers would continue to refuse to invest unless they think they can really profit from investment.

-

(2)

Half-way urban reform: RS

Since China’s urban reform is a copy of rural reform to a great extent, it is not surprising that they have some similar by-effects. Here we pay attention to AMRS which is regarded as the best choice or form among all kinks of RS within the limits of current China’s social and economic conditions. Although RS has some functions of preventing managers from abusing their power, for instance, in pursuit of short-term profit at the expense of State’s and long-term interests, some shortcomings remain as follows. The manager has to pay attentions if he or she fails to honor the contract. The punishment or sanction, however, is never big enough to compensate fully the loss caused by poor or inappropriate management; moreover, the State remains reluctant to see any enterprise going bankrupt. That’s why we say RS does not eliminate soft budget constraint for managers. Thus, AMRS also has hindered mobility of resources (manpower, capital) from the most profitable sectors because managers had to concentrate on increasing assets. It stands to reason that they prefer investing in their own enterprises to other ones if they have to invest. Thus, we can draw a conclusion that one basic goal of China’s reform, i.e., establishing a market mechanism which can be used as an efficient tool for allocating scarce resources, has not been entirely achieved so far, even though AMRS has performed better than the old system. In fact, this goal cannot be attained unless there is a real capital market.

This conclusion will be supported by the following facts:

-

As matters stand, AMRS, to some extent, is only a substitute for mandatory planning and leaves ample room to the state to interfere with enterprise management, for officials are not willing to lose the influence and power they have had. At enterprises implementing the contract system, 85% of successful bidders for managerial seats are chosen by bid-inviters closely linked to authorities.

-

In addition to the above, problems facing the contract-enterprises remain. Admittedly, it is complicated and difficult for both State representatives and workers’ committee to evaluate the assets or capital value, especially in the absence of a well-developed and full-fledged capital market. Undoubtedly, these facts constitute a threat to AMRS.

-

Along with implementing RS, conflicts between managers and workers can be observed in some enterprises caused mainly by big income gaps and new relationships between them slightly reminiscent of relationships between employer and employee. Some workers have been complaining about the uselessness of worker’s committees or trade unions.

Generally speaking, China’s reform is marked with all kinds of RS carried out as a fundamental measure to reorganizing the national economy. However, whether RS belongs to the final set of reform objectives or not is still a pending question. According to the author’s estimation, RS will keep changing. As for the direction of movement, we shall discuss it later as part of reform perspectives in China.

Moreover, urban reform has up to now failed to solve the long-lived problems caused by egalitarianism. It is estimated that there are about 30 million employees who have nothing to do but nobody can fire them. In China, state-owned enterprises and departments have to spend 60 billion yuan (about 16 billion dollars) annually on supporting them.

Let us observe RS in urban areas from a different angle. We may be impressed very much by the flourishing development of township enterprise. Admittedly, township enterprises have some advantages in the aspects of location and resource available. But several disadvantages they have are also obvious. Considering technology- equipment and experience of both blue- and white-collar worker, state-owned enterprises are undoubtedly superior to township enterprises. A very significant and thought-provoking phenomenon is that a large number of township enterprises not only have survived the competition with state-owned ones, but they have been exerting great pressure upon them too. This fact exactly shows that, to a great extent, state-owned enterprises implementing RS still have to face some obstacles to realize their production potentials. By keeping this in mind, it seems not surprising that Zhao Ziyang (General Secretary of China’ s Communist Party) said that China is trying to deepen the urban reform by learning from the successful experiences of township enterprises’ management (People’s Daily, June 23, 1988). Those experiences consist of the relative hard budget constrains for and more management autonomy given to the managers.

There is another fact showing great losses of efficiency caused mainly by the half-way urban reform (RS and distortion of pricing system) as well as the disproportional industrial structure. China’s total amount of fixed assets is estimated to be around 700 billion yuan by the end of 1987 and the lack of funds is one of the biggest problems faced by China’s economic development. But at the same time, the fixed assets lying idle and enterprises’ business losses amounted to about one third of the total in 1987 of which large amount of assets lying idle belonged to machine building industry.

-

(3)

The irrational pricing system

We have mentioned the so-called dual-pricing system. It is mainly aimed at relatively expanding the enterprises’ autonomy and letting the market mechanism play a positive role, while the state is still capable of controlling the basic structural features of national economy via mandatory planning and contract quotas within RS. Dual-pricing system was the only acceptable choice, and it was a necessary step hardly skipped over at that time. Unfortunately but naturally, it has brought about some unhealthy effects undermining China’ s economic reform. It is easy to imagine that if one person has access to some raw and semi-finished materials at state fixed prices which are much lower than free-market ones, he or she will gain a lot from selling them on the “free market”. Inevitably, people have incentives to try their best to get such materials, distributed by state officials. In the process of getting them, corruption and bribery prevail and some government officials as well as the state institutions are getting more and more interested in engaging in business by using their power of distributing the materials. Such rampant corruption not only has damaged the national economy by misleading resources allocation and providing wrong incentives for economic participants, it also deeply hurt the feeling and enthusiasm of common Chinese people. It is not exaggerated to say that the reform will be ruined by corruption if China fails to effectively fight against it. From this point of view, the dual-pricing system should and must be replaced by a more rational solution.

On the enterprise side, dual-pricing system stimulates hypocritical behavior by managers. That means, on the one hand, that state-owned enterprises managers try to conceal their real production capacity when they “negotiate” the conditions of material-supply or contract quotas stipulated in contracts with the state or mandatory plans, so that they will get lower production quotas from the state; while, on the other hand, they strive to claim as large an amount of allocation of material as possible from the state. The materials distributed at lower price by the state tend to leak to the free market for profits. what is especially worrisome is that the situation is getting worse.

In China, the contract or state mandatory production quotas are usually based on enterprise performance during the past few years. Then a well-managed enterprise will receive or sign a contract with a bigger production quota from or with the State than a less efficient one, which will put this well-managed enterprise in a better position to produce extra commodities for its own profit through market. Chinese people vividly describe this phenomenon as “whipping the ox that goes fast”. Enterprises, competing under these confused norms or criteria which cannot reflect their practical profitability performance, are experiencing unfairness.

Besides the unexpected consequences caused by the dual-pricing system, i.e., as it is pointed out by the “Decision”, China’s present pricing system is still irrational in the following respects:

-

price differentials between products of varying quality are inadequate;

-

price ratios among different commodities are out of line, particularly the relatively low prices for mineral products and raw or semi-finished materials compared to manufactured goods;

-

retail prices of major farm products are lower than prices paid to producers;

-

the present price control system is over-centralized.

It is well known that one basic purpose or logic of China’s reform is to create an environment in which prices can reflect actual values of commodities, taking account of production cost, relative quality and market-determined factors of supply and demand. But under the present system, fixed prices are still a more influential factor in enterprises’ profitability than any other considerations of efficiency or quality, and it fails to play its due role as a set of signals for resources allocation. This implies that RS is built on sand, in theory at least, as there are no means to assess or evaluate the performances of contracted enterprises and, in other words, urban reform would be meaningless without reasonably adjusting the present pricing system.

The cost of holding retail prices low has reached a crippling level of subsidies for the state. The subsidies covering differences in purchase and retail prices of grain, cooking oil, coal for domestic use and foodstuffs were 3.2 billion yuan in 1984 (accounting for more than 203 of state revenue in 1984). This figure were 50 billion yuan in 1987. It obviously imposed an unbearable burden on government and has become a source of budget deficits. What is worse, this sort of subsidies has been given rise to waste.

-

(4)

Inflation: A challenge facing China’s reform

Not differently from some other socialist countries, China now is also facing a monster of inflation. It should be admitted that we can partly impute inflation to the irrational price system established simultaneously with a highly centralized economy in the 1950s. A broad range of retail prices have remained artificially low since then in a way of rationing some basic consumer goods, such as meat, cotton cloth, cooking oil etc. Rationing here, a usual way of holding prices low, is no more than inflation. That’s why the index of retail prices increased as soon as rationing was eliminated.

In addition to the high level of hidden inflation, there exist several other causes leading to price hikes. Since 1979, more attention was paid to rapid development growth rate demanding a large amount of fixed assets investment. Thus, investment waves and budget deficits occurred. To meet demands of them, the state began to issue more money, and in 1983, the state over-issued 26.2 billion yuan (about US $7 billion) which was nearly 50% higher than in 1984. The following years’ figure remained relatively high (see Table 1.9).

This, to a great degree, resulted in price hikes of 6% in 1986 and 7.3% in 1987 according to official statistics. The key to explain the difference between the high growth rate of money issuing and the relatively low inflation rate lies in the huge shortage of consumer goods equaling 7.4 billion yuan (making up about 8% of NI) in 1987. As a result, common Chinese people were keeping a large sum of cash in their purses, waiting for their favorite goods. During the first quarter of 1988, the retail price index grew rapidly and fiercely, 14.3% higher than the same period of last year in China’s main 32 big and medium-sized cities.

Let us here consider one of the most crucial things: the tolerance of ordinary Chinese people. Because of the high inflation rate, according to a survey conducted by Shenzhen Special Economic Zone Daily (May 19, 1988), 54% of households’ living standard dropped in 1987 as compared with 1986. As a result, low-paid families started withdrawing savings from banks for daily use. Bank runs in Guangdong Province (South of China), sparked off by rumors of large price rises starting from July 1st of 1988, denoted the extent to which people were sensitive to price hikes. Some influential Chinese economists held that the tolerance of the majority of Chinese people was much lower than that of developed and industrialized socialist as well as some developing countries. GNP per head of China was only around US$300. The dropping of living standard means different things to different people of different countries. As for West Europeans, when such a thing appears, they can reduce expenditures by travelling domestically rather than internationally. Under the same circumstances, what choice can common Chinese make? At present, any changes in the pricing system are no more than price hikes in the opinion of common Chinese. Inflation is likely to be the root cause of losing the people’s support for China’s economic system reform.

Although scrapping the state subsidies and letting the prices of major farm products and industrial raw materials reflect what they are really worth would create a good climate for economic development, resentment and complaints will still accompany the price hikes. These disgruntled feelings could be bitter and contagious, posing seemingly insurmountable barriers to reform. This seems to be, at present at least, a bottle-neck the reform has to overcome.

-

(5)

Population pressure and deficiency in natural resources

Since the founding of the People’s Republic of China, we have been seeking the way out to provide more employment opportunities for the gradually increasing workforce and, during the disastrous period of the Cultural Revolution, China was forced to settle urban youth down in the countryside.

Today, the so-called rate of job-waiting—a Chinese expression for unemployment in cities on the average is around 2%. Most of urban youth reaching the age of employment might find working posts as industries develop, such as a tertiary industry and private business. In the countryside, however, unemployment—to be more exact, underemployment—remains a severe problem.

Up to now, people may give the explanation why China eagerly encouraged the development of township enterprises: these are aimed not only to fill the vacancy left or neglected by urban industries, but also to enlarge rural employment opportunities in order to lighten the burden of latent unemployment. From 1978 to 1986, township enterprises have absorbed a net number of 50 million farmers derived from agricultural sector, with the total number of 80 million (accounting for 10% of total agricultural population).

Although this strategy is a successful one, population pressure still is a problem because of China’s huge absolute population base. According to some experts’ calculation, about 16 million people will join the large contingent of workforce annually in the coming eight years, accompanying by a high fertility rate. Apparently, this burden is so heavy that it is nearly impossible to rely merely on both the development of urban and rural industries. Therefore, China needs an additional strategy or solution to solve this problem.

China is usually considered as a resource-rich country. Undoubtedly, she has ample and various types of resources, such as coal andiron ore, although most of them are located in remote areas (or far away from the industrial centers), and sometimes they are of low quality and generally difficult to exploit. By calculating known mineral resources on a per capita basis, China is far below the world average for most raw materials. This fact, together with the population pressure, calls for great attention of China’s economic system designers when they prepare policies.

It is impossible for China to transfer or reform its economic system from a centralized to a decentralized one with the market mechanism playing an active role at one stroke. The principal reason for this is that it must make Chinese people—plan-makers, managers, workers and farmers—get accustomed to the new environment so as to minimize the risks of economic reform. Therefore, we have to say that RS, even though it brought about several undesirable consequences mentioned above, is the best acceptable choice for China.

6 Solutions to Problems

It should be admitted that the problems or difficulties China is confronting are tough, and, in fact, only a few of them can be imputed to reform itself. China’s top leaders, of course, have attached great importance to the ways of solving them. The measures they have taken are observed as follows.

-

1.

Consolidation of the Progress Made in Rural Reform

It is hardly too much to say that China has benefited a lot from RS started in rural areas and, for the most part, China has attained its elementary objectives—raising grain output and gaining the populous peasants’ support. But as we mentioned above, there are still some problems briefly characterized by farmers’ refusal to invest in the land as a result of implicit ownership, and by the comparatively low contract procurement price which made grain-cultivating seldom lucrative in the environment of today’s scattered or decentralized family management.

With respect to implicit ownership of land, some economists suggested that the state take action to make property rights explicit—a new land reform letting the farmer be the owner of the land he or she is cultivating or responsible for. These experts believed that such a substantial action would attract investment by peasants and be conducive to increasing agricultural productivity by amassing land in the hands of the best farmers. Probably owing to the fear of widening the distribution gap between farmers in the way of land annexing, which may be source of unrest, this somewhat radical suggestion has been given up. As a substitute, China’s administration decided to promise to make current RS last for fifteen to fifty years. This implies that China wants to have these problems, caused by farmers’ nearsightedness, resolved by time. This measure, in fact, is tantamount to acknowledging or acquiescing in individual households as owners of the land, even though it is the state that nominally owns it.

The state has thus initiated some flexible policies to encourage cooperation on a voluntary basis among farmers’ families, and they are allowed to hire some people or lease the land to others if they have something more lucrative to be engaged in. The flexible policies comprise making it easier for those households that intend to conduct cooperation to get loans (sometimes with a lower interest rate) from the bank and to obtain a supply of agricultural inputs such as chemical fertilizers, pesticides and seeds. Meanwhile, authorities at various levels have applied flexible policies in an attempt to promote the development of the so-called specialized household that is a kind of farm enterprise (run by a single family) of above-average size, deriving most of their income from one agricultural product, e.g., the professional grain-cultivator or pig-raiser. They expect that these policy measures can generate new sources for both increasing rural income and improving incentives by specializing agricultural production.

As we see, China’ s government is put into an awkward position when it intends to cope with the problem of procurement price for agricultural products, especially for grain, oil seeds and the like. The state has to spend a large sum of money every year to subsidize urban consumers by holding foodstuff prices low. In this case, if the state decides to raise procurement prices further, a move to be certainly welcomed by peasants, more subsidies must be paid in order to silence the snowballing complaints of urban consumers about price hikes; if the state refuses to do so, farmers may lose interest in agricultural production. In order to get out of this dilemma, China’s central government undertook an experiment in abolishing foodstuff rationing in Guangdong province and, at the same time, freeing control on the price which lets market forces (supply and demand) determine the retail prices of foodstuffs. Consequently, in Guangdong retail prices were three or four times as high as in the rest of mainland China, with ordinary consumers receiving limited subsidies from local government. The principle purposes of doing this were to both get rid of the state’ s heavy burden of subsidizing and to introduce the market mechanism on a larger scale. Perhaps this experiment can generate two more profound changes: farmers may become real commodity producers, the only rule they must abide by is market price, the conflicts caused by inflation between consumers and the state may be changed to that between consumers and producers (or traders).

As for township enterprises, they are enjoying more and more autonomy than before, for instance, they can cooperate directly with foreign companies in the form of joint venture and the like, export their products and receive a part of foreign currencies from selling their products abroad, raise money by issuing stocks to workers within the factory or to society openly. The most’ significant achievement is that China’s central government is trying to force the township government or production brigade to stop interfering with affairs of enterprises so as to make these collective enterprises worthy of their name.

-

2.

Introduction of a Share-Holding System

The urban reform, especially the model of RS, must go forward in spite of its accompanying problems or difficulties. But the question is where to go. Perhaps China is unique among socialist countries in respect of theoretical preparation for economic reform. The notion which may embody the Chinese philosophy of reform most is “crossing the river by feeling stones beneath your feet”, which means that you may try any way you like as long as you can obtain the goal. Knowing that, we can better understand why formal limited companies could appear without many difficulties in January, 1985. A stock exchange was also established in Shanghai—the biggest city in China—in September 1986, the first one among the socialist countries. The appearance of this stock exchange might be viewed as a tentative and bold step to establish a real capital market in China although its business was far from booming today.

It should be stressed that the only policy China’s government has taken for introducing the share-holding system was that of a completely neutral attitude (doing nothing). The state does not want to get involved in this politically subtle affair, but it has adopted a watching position. Under the present socio-political circumstances, this neutral approach seems to be the strongest policy measure favoring or promoting the introduction of share-holding system in China.