Abstract

This study analyses and compares estimates of labour productivity growth and total factor productivity growth for the Indian economy as provided by four databases, viz., India KLEMS (IKLEMS), Asian Productivity Organization (APO), Penn World Tables (PWT9.1) and The Conference Board’s Total Economy Database (TED) over the period 1981–2015. It investigates determinants of productivity growth of the Indian economy based on measures of productivity growth from the four datasets using GMM method. It also examines the trends and determinants of productivity growth of the major components of industry and services sectors, viz., manufacturing and market services, respectively. The study finds that while there are differences in the estimates of productivity growth across various datasets that may be attributed to differences in the definitions, methods of measurement and revisions of databases, the trends are broadly similar. Further, the econometric results of the study are robust across all databases and indicate that capital deepening, technological progress, government size, institutional quality, share of agriculture in GDP and openness are significant determinants of productivity growth of the Indian economy over the period 1981–2015. Further, results on the disaggregate analysis indicate that capital deepening, technology, government size, productivity growth of the other sector and openness are significant determinants of labour productivity growth of both manufacturing and market services of India over the period 1981–2015. A comparison of results across the two sectors further suggests that while there exist significant spillover effects between sectors, the impact is stronger from services to manufacturing than the other way around.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

JEL Classification

1 Introduction

The Indian economy has emerged as one of the largest economies of the world in the last few years with a considerable rise in its share in world GDP (7.9% in 2019) and a consistently high rate of growth of GDP over a long period of time, as seen in the World Economic Outlook, IMF (2020). The correlation between growth in the economy and increase in productivity is well established. In fact, studies based on India KLEMSFootnote 1 database have shown that both labour productivity as well as total factor productivity witnessed remarkable growth in the Indian economy in the post liberalization period, as seen in Goldar (2018) and Erumban and Ark (2018). At the same time, there have been developments in constructing productivity measures for the Indian economy both at the national as well as international level. Thus, it may be insightful to examine if there are differences in the estimates of productivity growth for the Indian economy across various datasets.

Since growth in productivity leads to economic growth and can sustain it in the long run, it becomes imperative to examine the factors that lead to growth in productivity and hence that in output of the Indian economy. Moreover, the Indian economy has undergone significant structural changes over the past three and a half decades with decline in the share of agriculture and increase in that of services.Footnote 2 In particular, services sector has emerged as the largest sector of the economy accounting for more than half of the economy’s GDP. Furthermore, within services, the market services of trade, transport and communication, financial and business services, etc. have shown maximum growth as compared to other constituents of services contributing to the growth of overall services sector, as seen in Goldar (2018).

Against this backdrop, the current study examines trends in various measures of productivity growth for the Indian economy based on different databases, viz., India KLEMS, Penn World Tables version 9.1, The Conference Board’s Total Economy Database and Asian Productivity Organization data (IKLEMS, PWT9.1, TED and APO from now on) and makes a comparison thereof over the period 1981 to 2015. The study further investigates the determinants of productivity growth on the basis of a comprehensive model using GMM estimation. Since market services have shown most growth in GDP and productivity, the paper also investigates the trends and determinants of labour productivity growth and total factor productivity growth of the major components of industry and service sectors, viz., manufacturing and market services, respectively.

The paper is structured as follows. Section 2 discusses trends in productivity growth in India since 1981 and a comparison of measures of productivity growth. The theoretical and empirical literature on determinants of productivity growth is elaborated upon in Sect. 3, while Sect. 4 discusses the econometric methodology used to estimate the model. The data used in the study is discussed in Sect. 5 which is then followed by econometric results in Sect. 6. Section 7 gives the conclusions.

2 Productivity Growth in the Indian Economy: Measures, Definitions and Trends

2.1 Concepts of Productivity Growth

Productivity refers to output per unit of input. The growth in productivity indicates growth in output that is net of growth in inputs. We may define productivity either partially (a single factor productivity like labour productivity or capital productivity) or totally (total factor productivity). Labour productivity and total factor productivity are the two most widely used measures of productivity. While total factor productivity is a more comprehensive measure of productivity as it controls for growth in both labour and capital inputs, labour productivity is a useful indicator of the overall welfareFootnote 3 of an economy.

2.1.1 Labour Productivity Growth

Labour productivity growth is defined as the rate of growth of output net of the rate of growth of labour input. Labour input can be further classified into total employment (persons engaged) or hours worked by the persons engaged. Hours worked are considered as a better measure of labour input as compared to actual persons engaged as they reflect the actual input of labour in the production process and can easily account for full-time employment or part-time employment or absenteeism, OECD Manual (2001). However, obtaining data on hours worked is much more difficult, especially at a disaggregate level as compared to data on persons engaged.

2.1.2 Total Factor Productivity Growth

Total factor productivity (TFP) may be defined as output per unit of combined inputs. There are two approaches to calculate TFP: gross output approach and gross value-added approach. Under the gross output approach, TFP is calculated as the ratio of gross output to a combined input which is a weighted sum of inputs, viz., energy, materials, services, labour and capital. On the other hand, under the gross value-added approach, TFP is defined as the ratio of gross value added to a combined input which is a weighted sum of labour and capital. Thus, the TFP based on gross output approach is a broader concept than that based on gross value-added approach as it takes into consideration the contribution of primary inputs apart from labour and capital. Considering gross value-added approach, rate of growth of TFP can be written as:

where dot above each variable denotes its rate of growth; y is gross value added or GDP, \({s}_{L}\) and \({s}_{K}\) are the shares of labour and capital in GDP and add up to one under the assumption of constant returns to scale; \(Emp\) is the total employment, \(labqual\) is the measure of quality of labour; \(kserv\) is the measure of capital services. Thus, under the gross value-added approach, TFP growth is calculated as the residual left after deducting weighted sum of rates of growth of inputs from the rate of growth of output where the weights are taken to be shares of the respective inputs in total income.

While labour quantity is measured either by persons engaged or average hours worked by persons employed and indicates the quantity of labour input, it does not incorporate composition and hence quality of labour input. Since there are different types of labour employed in the production process based on the skill and education levels, they may contribute differently to production. Thus, calculating TFP using only labour quantity may hide these differential contributions of labour input and may lead to overestimation of TFP.

Further, different types of capital inputs are used in the production process, for instance, residential buildings, machinery, structures, information technology, communication technology, etc. These inputs differ in terms of their rates of depreciation and hence in terms of their rates of return. Thus, data on capital servicesFootnote 4 instead of capital stock is constructed which gives a true measure of the actual contribution of each capital input into the production process.

2.2 Different Concepts of Productivity Growth for the Indian Economy

The data on labour productivity and total factor productivity for the Indian economy is available with many databases. These databases differ both in terms of the coverage as well as definitions and measurement of variables used to estimate various productivity measures.Footnote 5 We discuss each of these databases separately in the following sub-sections.

2.2.1 India KLEMS Database

The IKLEMS 2018 dataset is a comprehensive database released by RBI that provides annual data on many variables, viz., gross output, gross value added (GVA), capital stock, capital services,Footnote 6 employment, labour quality, energy input, materials input, services input, factor income shares, labour productivity and total factor productivity (TFP) growth for 27 industries from all the sectors of the Indian economy over the period 1980–81 to 2015–16.

2.2.2 Penn World Tables [9.1 Database]

Penn World Tables version 9.1 (PWT 9.1)Footnote 7 is a recently released database by Feenstra et al. (2015) that provides comprehensive data on many variables including GDP, employment, hours worked, capital stock, capital services, human capital index, labour productivity and total factor productivity for 184 countries (including India) around the world over the period 1950–2017. The data on all the aforementioned variables is provided at the aggregate level only. Furthermore, all the variables are available in levels that may be converted to rates of growth.

2.2.3 The Conference Board’s Total Economy Database (TED)

The Conference Board’s Total Economy Database (TED) provides annual data on Gross Domestic Product (GDP), population, employment, hours worked, growth of capital services, labour productivity and its growth and total factor productivity (TFP) growth for 124 countries (including India) of the world from 1950 to 2017. Since this database provides data on rates of growth of total factor productivity and that of capital input unlike PWT database, therefore it is useful to analyse rates of growth. The data is available at the aggregate economy level on aforementioned variables.

2.2.4 Asian Productivity Organization (APO) Database

Asian Productivity Organization (APO) database provides data on Gross Domestic Product (GDP), employment, hours worked, capital stock, capital services, labour productivity, total factor productivity (TFP) at an aggregate level for 34 Asian economies (including India) over the period 1970–2016. The database also provides data on Gross Domestic Product (GDP) and total employment of the broad sectors and their sub-sectors, viz., agriculture, forestry and fishing, mining and quarrying, manufacturing,Footnote 8 construction, utilities,Footnote 9 wholesale and retail trade, transport, storage and communications, financial intermediation, real estate, rentingFootnote 10 and business and community, personal and social services of these economies. Further, the data on TFP is available only at aggregate economy level.

2.2.5 Comparison of Variants of Labour and Total Factor Productivity Growth Across the Four Databases

A comparison of definitions of productivity and its growth across the four databases reveals the following differences across them as given in Tables 1 and 2.

First of all, while the three international data sources provide data on various measures of productivity at an aggregate economy level or at a broad sectoral level, India KLEMS provides data at the level of industry for 27 industries of the Indian economy across all sectors.

Furthermore, IKLEMSFootnote 14 database has only one measure of quantity of labour input available that is total employment, while other three databases have data on hours worked as well.

Moreover, while IKLEMS defines labour productivity in terms of gross value added at market price, the international sources define it in terms of Gross Domestic Product. This could clearly lead to differences in the estimates of productivity depending upon the magnitude of differences between GVA and GDP.

While IKLEMS, PWT9.1 and TED account for labour quantity, labour quality and capital services for constructing total factor productivity, APO database only controls for labour quantity and capital services, and hence, it may be an overestimate of TFP as compared to the other three databases, see Eq. (1) above.

Furthermore, while IKLEMS approach controls for labour quality as well as capital services, their approach is industry based in which the variables are first constructed at industry level and then added up to get the aggregate economy variables.

Thus, the industry approach may give different estimates as compared to the aggregate one. On the other hand, both TEDFootnote 15 and PWT9.1 control for capital services and labour quality while constructing TFP and also follow the aggregate approach. However, the two databases construct their own measures of capital services and labour quality that may lead to differences in the overall measure of TFP across them. We discuss trends in various measures of productivity growth across various definitions at both aggregate and disaggregate level subsequently.

2.3 Trends in Labour and Total Factor Productivity Growth

2.3.1 Aggregate Economy

-

1.1

Trends in Labour Productivity Growth

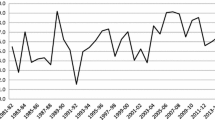

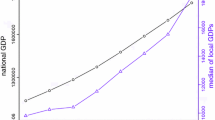

We now discuss the trends in labour productivity growthFootnote 16 of the aggregate economy over the period 1981–2015. The trends as shown in Fig. 1 reveal that labour productivity growth rate increases over the period 1981–2015. While the sub-period of 1981 to 1992 was one of moderate growth, the growth rate rose sharply in 1990s and further in 2000s. The growth rate declined considerably during the macroeconomic crisis of 1991 and recovered soon after. While the trends in growth rate of labour productivity show some differences in absolute numbers across various estimates, the broad trends are the same. In fact, simple correlations between trends in labour productivity growth from various databases, as shown in Table 3, and decadal averages (as shown in Fig. 2) show similar trends across various databases. Goldar (2018) also finds similar results while comparing estimates of labour productivity growth from IKLEMS database and TED over the period 1981–2011.

-

1.2

Trends in Total Factor Productivity Growth

We now discuss trends in TFP growth rate for the Indian economy. As depicted in Fig. 3, TFP growth has shown cyclical growth over the period 1981–2015. Further, the broad trends in TFP growth are same across all the four variants of TFP. In fact, the TFP growth is in tandem with the GDP growth rate of the Indian economy over the period 1981–2015, see Fig. 3. Further, simple correlations between trends in TFP growth of various databases are strong, see Table 4.

The decadal averages of annual growth rates of TFP as shown in Fig. 4 further indicate that the magnitudes differ substantially across the four datasets. These differences can be attributed to differences in methods of estimations of TFP growth, especially to estimates of labour quality and capital services by the different databases. For instance, the estimates of TFP growth in APO’s database are much higher in magnitude than those of other databases as labour quality is not accounted for while calculating TFP growth in APO estimates. These differences in the trends are in tandem with the explanations for differences in definitions of productivity growth as discussed above.

-

1.3

Trends in Sectoral Labour and Total Factor Productivity Growth

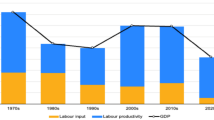

The Indian economy has undergone significant structural transformation over the last three and a half decades with services sector emerging as the largest sector of the economy accounting for more than 50% of GDP currently. Furthermore, while agriculture sector has shown considerable decline in its share, the share of industry has remained stable. Thus, industry and services account for more than 75% of the GDP of the Indian economy as of 2018, WDI (2019).

Further, the data shows that manufacturingFootnote 17 accounts for the maximum share of industry, while market services constitute the largest sub-sector of services (with manufacturing and market services accounting for more than 60% of industry and services GDP, respectively). In fact, market services have contributed more than the non-market services to the growth of overall services sector over the period 1981–2015, Goldar (2018). Thus, we deal with the manufacturing and market services sectors in this study.

We now discuss the trends in labour and total factor productivity growth of these sectors subsequently over the period 1981–2015. It may be noteworthy that only two variants of labour productivity growth are available at disaggregate level, viz., IKLEMS and APO databases. The trends in labour productivity growth of manufacturing sector as shown in Table 5 suggest that there has been a rise in the growth rate over the period 1981–2015 according to both variants. However, there are differences in the actual estimates of productivity growth across the two variants. One plausible reason for differences is that output measure in IKLEMS is GVA while that in APO is GDP.

As far as market services are concerned, while the rate of growth of productivity was moderate in the period 1981–85, the rate increased considerably during 1986–90 on an average. Thus, the labour productivity of market services shows remarkable growth over the period 1981–2015 according to both variants, and the differences in rate of growth of labour productivity across the two variants are only marginal.

As far as TFP growth is concerned, we notice that only one estimate of TFP growth (in IKLEMS) is available at the disaggregate level. The trends in TFP growth as shown in Table 6 indicate that there was a considerable improvement in the productivity growth of manufacturing sector over the period 1981–2015 and some improvement in the case of market services sector.

3 Determinants of Labour Productivity Growth

3.1 Aggregate Economy Model

Labour productivity may be determined by a number of variables including capital deepening, workforce skills, technology, inflation, and financial development, quality of institutions and macroeconomic variables, Dua and Garg (2019a). We briefly discuss each of these determinants subsequently.

3.1.1 Capital Deepening, Human Capital and Technological Progress

Dua and Garg (2019a) and references cited thereinFootnote 18 suggest that aggregate labour productivity (\({\varvec{P}}{\varvec{r}}{\varvec{o}}{\varvec{d}}\)) may be positively influenced by physical inputs of capital deepening (\({\varvec{k}}\)) and human capital (\({\varvec{H}}{\varvec{K}}\)) and also technological progress (\({\varvec{T}}{\varvec{e}}{\varvec{c}}{\varvec{h}}\)). While increase in capital deepening and human capital add to productivity of labour by adding physical capital and skills for every unit of labour, more technological progress in terms of innovative activities undertaken by firms create and add to the knowledge base and thus raise the productivity of labour.

3.1.2 Macroeconomic Factors

-

2.1

Domestic Factors

Certain macroeconomic factors may also influence productivity of an economy. These have been classified into domestic and external factors by Dua and Garg (2019a). We follow their model and incorporate these variables in our model of productivity. Among domestic factors are the policy variables of monetary (\({\varvec{M}}\)) and fiscal policy. Two indicators of monetary policy are generally used, money supply and interest rate. An increase in money supply reduces interest rate that in turn induces more investment and hence capital accumulation and therefore leads to increase in labour productivity.

Government size \(({\varvec{G}})\) used as a fiscal indicator may influence productivity either positively or negatively. An increase in the role of government may reduce productivity if government and private sectors compete for resources and government’s expenditure is not efficient, while if government’s expenditure is more of complementary in nature and is done efficiently, it may boost investment by the private sector and may in turn increase productivity. Thus, an increasing role of government could either be more beneficial or harmful for the overall productivity of an economy and the net impact may depend upon relative magnitudes of the two impacts.

-

2.2

External factors

Trade openness (\({\varvec{T}}{\varvec{r}}{\varvec{a}}{\varvec{d}}{\varvec{e}}{\varvec{o}}{\varvec{p}}{\varvec{e}}{\varvec{n}})\) and financial openness (\({\varvec{F}}{\varvec{i}}{\varvec{n}}{\varvec{o}}{\varvec{p}}{\varvec{e}}{\varvec{n}}\)) are the external factors that are expected to boost productivity in an economy.Footnote 19 In particular, it is argued that trade openness, i.e. imports of new machinery and other capital goods from developed economies may increase the knowledge base in an economy which in turn leads to technological progress in the host economy, thus increasing labour productivity. Moreover, by exporting products to other countries, the exporting firms become more competitive which in turn affects their productivity positively.

Furthermore, financially more open economies tend to have higher productivity both because more financial openness brings in more FDI as well as more financially open economies tend to have better domestic financial markets, improvements in institutions, etc. Kose et al. (2009). Thus, it can be concluded that increased openness (either in terms of exchange of goods and services or exchange of capital) of an economy to the rest of world leads to higher overall labour productivity of that economy.

Apart from the above factors of basic inputs, technological progress and macroeconomic factors, Dua and Garg (2019a) suggest additional factors that may influence productivity of an economy. These are discussed below.

-

2.3

Additional Factors: Inflation (π)

Inflation is expected to affect productivity negatively as an increase in inflation increases uncertainty that either delays the decisions by entrepreneurs to do investments or makes them choose inputs in sub-optimal combinations. Increased inflation also diverts resources away from productive activities towards the non-productive activities (costs of fighting inflation) and hence affects the productivity of labour adversely, as seen in Jarrett and Selody (1982).

-

2.4

Additional Factors: Financial Development (\({\varvec{F}}{\varvec{i}}{\varvec{n}}{\varvec{D}}{\varvec{e}}{\varvec{v}})\)

Financial development is considered to be another determinant of labour productivity. It is argued that the more financially developed an economy, the better will be the channelization of savings and hence more capital accumulation and technological progress in the economy (Levine, 1997). Thus, more financial development of an economy is productivity enhancing.

-

2.5

Additional Factors: Quality of Institutions (\({\varvec{I}}{\varvec{n}}{\varvec{s}}{\varvec{t}})\)

Economic institutions such as the structure of property rights and the presence of markets may be important for economic growth because they influence the structure of economic incentives in a society (Acemoglu et al., 2004). In other words, stronger system of property rights incentivizes individuals to undertake more investment in both physical as well as human capital which in turn increases productivity. Hence, quality of institutions is expected to affect productivity positively.

-

2.6

Additional Factors: Share of agriculture in GDP (\({{\varvec{S}}}^{{\varvec{G}}{\varvec{D}}{\varvec{P}}})\)

Recently, Loko and Diouf (2009) show that a fall in the share of agriculture sector in GDP of a developing economy leads to rise in total factor productivity of that economy. The argument comes from a dual-economy model developed by Poirson (2000) in which as factors of production move away from traditional sector, which is assumed to be less productive to the modern sector, a relatively high-productivity sector, the overall productivity in the economy goes up.

Thus, on the basis of the above discussion, we may write the model for aggregate labour productivity as follows:

The expected signs of the coefficients of all the variables as discussed above are summarized in Table 7 below.

While the above model is for the levels of labour productivity, we apply it to rates of growth of labour productivity and transform the other variables accordingly.

3.2 Sectoral Model

The above sub-section dwells on various potential factors that may influence labour productivity of an economy along with their explanations on the basis of the stylized model developed by Dua and Garg (2019a). In the current sub-section, we discuss factors that may affect productivity of various sectors of an economy. Dua and Garg (2019b) develop a stylized model of productivity of a sector and apply it to various sectors and sub-sectors of the panels of developing and developed economies of Asia–Pacific. We adopt the model from that study and apply it to the manufacturing and market services sectors of India in the current study.

The basic model for sectoral productivity remains same as that for the aggregate economy except that variables are defined at sectoral level. Thus, labour productivity of sector m \(({{\varvec{P}}{\varvec{r}}{\varvec{o}}{\varvec{d}}}^{{\varvec{m}}})\) may be influenced positively by capital deepening \(({{\varvec{k}}}^{{\varvec{m}}})\), human capital (\({{\varvec{H}}{\varvec{K}}}^{{\varvec{m}}}\)) and technological progress (\({{\varvec{T}}{\varvec{e}}{\varvec{c}}{\varvec{h}}}^{{\varvec{m}}})\) of that sector. However, the effect of these variables may vary across sectors. For instance, since manufacturing sector is more capital and R&D intensive, the impact of capital deepening and R&D is expected to be higher on it as compared to services sector, Efthyvoulu (2012).

Further, sectoral inflation (\({{\varvec{\pi}}}^{{\varvec{m}}})\) has been identified as important determinant of productivity of a sector. While aggregate inflation is expected to affect productivity negatively, the empiricsFootnote 20 suggest that the sign and significance of the impact may depend upon the structure of an industry when examining the impact of sector-specific inflation.

While a plethora of studiesFootnote 21 have examined the impact of trade openness on productivity and have found mixed results, studiesFootnote 22 examining impact of sectoral trade openness \({({\varvec{T}}{\varvec{r}}{\varvec{a}}{\varvec{d}}{\varvec{e}}{\varvec{o}}{\varvec{p}}{\varvec{e}}{\varvec{n}}}^{{\varvec{m}}})\) on productivity across sectors find that the impact of trade openness may vary across sectors. For instance, it is argued that goods sectors are more trade intensive than services that in turn may cause a stronger impact of trade openness on goods sectors than on services, therefore considering sectoral trade openness may bring out the differential impact of trade openness on each sector’s productivity better than aggregate trade openness.Footnote 23

Apart from above variables, productivity of a sector may be affected by productivity of another sector because of presence of inter linkages across sectors. For instance, manufacturing sector may use output of services sector as an input into its production process and may in turn supply some of its output to the services sector as its input. Given such interdependence, an exogenous positive shock to the productivity of manufacturing sector leads to more production in manufacturing, in turn affecting the productivity and hence growth of services sector and vice-versa, as seen in Balakrishnan et al. (2017). Thus, we consider another variable, namely productivity of sector \(n\) \(({{\varvec{P}}{\varvec{r}}{\varvec{o}}{\varvec{d}}}^{{\varvec{n}}})\) into our model of labour productivity of sector.

Finally, productivity of a sector may also be affected by certain aggregate level variables like policy variables, institutional quality and financial openness. They have already been explained in Sect. 3.1 above under aggregate economy model. Thus, on the basis of above discussion, we can write the model for labour productivity of sector \(m\) as follows:

where

- m, n:

-

= Manufacturing or Market services.

The expected signs of the coefficients of all the variables as discussed above are summarized in Table 7 above. A comparison of the aggregate and sectoral models as given in Eqs. (2) and (3) respectively suggests that the variables: capital deepening, human capital, technological progress and openness affect not only the productivity of aggregate economy but also that of various sectors. However, considering these variables at the sectoral level may lead to differential impacts across sectors depending upon the nature of these sectors.

Further, policy variables and institutional quality are common to sectors and the aggregate economy because they are determined from external forces and may be taken as exogenous variables. Finally, share of agriculture is considered as an indicator of structural shifts that may have an impact on aggregate productivity instead of sectoral productivity. Due to inter-sectoral linkages between the sectors, an additional factor, viz., productivity of other sector is considered in sectoral model.

While the model set out in Eq. (3) is for the levels of labour productivity of a sector, we use it for rates of growth of labour productivity and transform rest of the variables also in rates of growth terms. We discuss the econometric methodology used to estimate the models set out in Eqs. (2) and (3) in the subsequent sections.

4 Econometric Methodology

We first check the stationarity properties of our series using Dickey Fuller-Generalized Least Squares (DF-GLS) test proposed by Elliot et al. (1996) and another test that assumes null of stationarity developed by Kwiatkowski et al. (1992). If both the tests suggest that the series is stationary, then we conclude that the series is stationary.

Having checked the stationarity properties of all our variables, we estimate the model of productivity growth as set out in Eq. (2) for the aggregate economy and Eq. (3) for the sectors above. We use Generalized Method of Moments (GMM) estimation technique for the purpose as it allows for endogeneity of variables and does not require any assumptions about the data generating process. The GMM estimator requires only the specification of a set of moment conditions that are deduced from the assumptions underlying the econometric model to be estimated. Moreover, the method may be useful to researchers who deal with a variety of moment or orthogonality conditions derived from the theoretical properties of their economic models.

We discuss the GMM estimation technique subsequently. Suppose that a sample of T observations \(({z}_{1},{z}_{2},\dots \dots \dots \dots {z}_{T})\) is drawn from the joint probability distribution function

where \({\theta }_{0}\) is a \(q\times 1\) vector of true parameters, belonging to the parameter space, \(\Theta \). Here, \({z}_{t}\) would typically contain one or more endogenous variables and a number of predetermined and/ or exogenous variables. Let \(m(.)\) be an r-dimensional vector of functions, then a population moment condition takes the form

In particular, the GMM estimatorFootnote 24 of \(\theta \), \(\widehat{{\theta }_{T}}\), based on Eq. (4), is

where \({A}_{T}\) is a \(r\times r\) positive semi-definite, possibly random, weighting matrix.

We assume that \({A}_{T}\) converges to a unique, positive definite, non-random matrix and \({M}_{T}\left(\theta \right)=\frac{1}{T}{\sum }_{t=1}^{T}m\left({z}_{t},\theta \right)\).

Since we expect our variables such as capital deepening, productivity growth, share of agriculture, openness to be endogenous, estimating the model using OLS may lead to inconsistent estimates. Hence, we conduct the Hausman (1978)’s test for the consistency of OLS. Under the null hypothesis of no misspecification, the OLS estimator is consistent, asymptotically normal and asymptotically efficient. If the null hypothesis is rejected, using OLS may give biased and inconsistent estimates, and hence, use of GMM may be justified.

The estimation of a model using GMM technique also requires specification of instruments due to the presence of endogenous variables. Thus, we use the first and second lags of variables such as productivity growth, capital deepening, government size and certain exogenous variables like money growth, etc. as instruments in our analysis.

We conduct Hansen (1982)’s test to check validity of the overidentifying restrictions. Finally, in order to ensure that the estimated model does not suffer from serial correlation, we conduct the Cumby and Huizinga (1992) test. The test has an advantage over the standard LM, Breusch and Pagan (1980) test for serial correlation as it allows for the presence of endogenous regressors.

5 Data

We use growth of labour productivity and growth of total factor productivity as our dependent variables where labour productivity is defined on the basis of total persons engaged for the Indian economy on an aggregate basis as well as for the manufacturing and market services sectors over the period 1981–2015. We use aggregate-level data for human capital and technological progress for manufacturing and market services sectors due to paucity of data on sectoral basis.

The definitions of variables used for potential determinants of productivity growth at both aggregate and sectoral levels are provided in Table 8 below along with the sources of data.

6 Econometric Results

The current section reports the econometric results of the estimation of model of productivity growth for the Indian economy. We first estimate the model of labour productivity growth (see Sect. 6.1.1 for details) at the aggregate level for each of the four variants by IKLEMS, APO, PWT9.1 and TED. These databases provide different estimates of labour productivity growth and capital deepening.Footnote 25 Therefore, these two variables differ across the four models, while measures of other determinantsFootnote 26 of productivity growth as set out in Sect. 3.1 remain same.

The study then estimates the model of TFP growth using four variantsFootnote 27 of TFP growth as provided by four datasets, viz., IKLEMS, APO, PWT9.1 and TED. This is discussed in Sect. 6.1.2.

We also estimate the model of labour productivity growth of two sub-sectors, viz., manufacturing and market services of the Indian economy using definition of productivity growth and capital deepening of each sector from each of the two databases, viz., IKLEMS and APO. The results for the manufacturing and market services sectors are reported and discussed in Sects. 6.2.1 and 6.2.2, respectively.

In each case, the estimation involves three steps, viz., checking the stationarity properties of the variables, estimating the model using GMM and conducting diagnostic tests to check the robustness of estimated models.

6.1 Aggregate Economy

6.1.1 Labour Productivity Growth

The results on unit rootFootnote 28 tests suggest that labour productivity growth, total factor productivity growth, capital deepening, labour quality, money growth and government size are all stationary in levels. On the other hand, inflation, share of agriculture, institutional quality, trade openness, financial openness are all non-stationary in levels and stationary in first differences, that is I(1).

To maintain consistency in the order of integration across variables, we consider first difference of variables that are I(1) and levels of variables that are I(0) and estimate the model set out in Sect. 3.1. The additional instruments considered in our analysis are first and second lags of endogenous variables (productivity growth, capital deepening and share of agriculture), exogenous variables, viz., government size and institutional quality and predetermined variables of technological progress and openness and their lags.

We estimate four models of productivity growth using different variants of productivity growth (as mentioned above), and the results suggest that capital deepening, technological progress, institutional quality, government size, openness and share of agriculture in GDP influence productivity growth in all the four models. The signs of all the coefficients conform to economic theory.

The diagnostic testsFootnote 29 conducted to check the validity of the models suggest that Hansen’s J-statistic for overidentifying restrictions and the CH test for serial correlation are not rejected at 1% level of significance, see Table 9 above. This indicates that the overidentifying restrictions are valid, as shown in Table 9, in the case of all four models and the models do not suffer from any serial correlation. Thus, all the four models estimated are robust to the diagnostic tests conducted.

Thus, the determinants of labour productivity growth are robust to the variant of productivity used. Further, while the estimated coefficients differ in their absolute magnitudes across the four models, the results are qualitatively same, see Table 9. These differences in the magnitudes of coefficients could be attributed to differences in the definitions and measurement of productivity growth and capital deepening (as explained in Sect. 3 above) and of revisions in their estimates across the four databases.

The empirical results (as shown in Table 9) suggest that an increase in growth of capital deepening is associated with an increase in productivity growth of the Indian economy. The result corroborates with the findings of Goldar et al. (2017) who show that capital services was a major contributor to economic growth of India over the period 1980–81 to 2014–15 using IKLEMS database. Further, Nomura (2018) also shows that capital stock contributes the most to economic growth of Asian economies over the period 1970–2014 using APO database. The results suggest further that while capital deepening is an important factor in influencing labour productivity growth of Indian economy, technological progress as measured by R&D expenditure may also affect productivity growth positively and may thus be encouraged.

A shift of resources away from agriculture to industry and services as measured by a decline in the share of agriculture in GDP may enhance labour productivity growth of the Indian economy. This may be indicative of structural changes and their impact on the Indian economy. Krishna et al. (2017) also find that structural change in the Indian economy has contributed positively to the growth of labour productivity over 1980–81 to 2010–11 using IKLEMS database. The result further finds support from studies by Mcmillan and Rodrik (2011) and Vu (2017) who find a positive and significant impact of structural change on labour productivity growth of Asian economies.

The results further suggest that expansionary fiscal policy as indicated by higher government expenditure may be productivity enhancing. This indicates that in the case of Indian economy, more government expenditure has a crowding-in effect on private business investment and thus leads to more capital accumulation and hence higher productivity growth. Better institutions as measured by increase in Economic Freedom Index further increase productivity growth of the Indian economy.

Finally, more openness of the economy to the rest of the world not only brings in more capital for the firms but also better technology and a more competitive environment to work with and thus adds to the labour productivity growth of the economy.

6.1.2 Total Factor Productivity (TFP) Growth

We now discuss the results of model of productivity growth as set out in Eq. (2) using TFP growth as the dependent variable and how these results compare with those in previous sub-section. It may be noted that capital deepening will no longer be a determinant here because capital input is already incorporated while constructing the estimates of TFP growth. Further, while TFP growth (the dependent variable in the model) varies across the four models, the measures of determinants of productivity growth are kept same across them. Thus, we proceed with the same model as in Eq. (2) above but without capital deepening on the right-hand side.

The unit root testFootnote 30 results suggest that the TFP growth based on all four databases is stationary in levels. Thus, we proceed to estimate the model set out in Eq. (2) using GMM using each of the four variants of TFP growth. The results (see Table 10) indicate that technological progress, share of agriculture, government size, institutional quality and openness are significant determinants of TFP growth over the period 1981–2015. While technological progress, government size, institutional quality and openness affect productivity growth positively, the impact of share of agriculture is negative. The results are robust to the different variants of TFP growth, see Table 10. All the models estimated are robust to diagnostic tests.

Thus, the results indicate that capital deepening; technological progress, government size, institutional quality, openness and share of agriculture are significant determinants of productivity growth of the Indian economy over the period 1981–2015 using all the four variants of TFP growth. However, the magnitudes of coefficients of variables on the RHS vary across the four models which is as expected given the differences in the estimates of TFP growth across four models.

6.2 Disaggregate Economy

Two databases, viz., IKLEMS and APO provide data on labour productivity growthFootnote 31 for the Indian economy at disaggregate level as well. We therefore examine the determinants of productivity growth at disaggregate level using estimates of productivity growth from the two databases. We investigate two broad sub-sectors, viz., manufacturing and market services for the purpose and discuss the results for each sub-sector separately in the subsequent sections.Footnote 32

6.2.1 Manufacturing Sector

We discuss the econometric estimation of the model set out in Eq. (3) in Sect. 3.2 above for labour productivity growth of manufacturing sector using both variants (IKLEMS and APO) in the current section and that for market services in the next sub-section. The unit root testFootnote 33 results suggest that labour productivity growth, growth rate of capital deepening, human capital are stationary in levels, while trade openness is non-stationary in levels but stationary in first differences. Thus, we consider productivity growth of both manufacturing and market services sectors, capital deepening and labour quality in levels while trade openness in first differences. While these are all sector-specific variables, we also consider certain aggregate variables as discussed and considered in Sect. 3.2 above.

We estimate various models according to Eq. (3) set out in Sect. 3.2 above using GMM estimation technique and select the final model on the basis of the robustness of the overall fit. The results as reported in Table 11 suggest that labour productivity growth of manufacturing sector is influenced by capital deepening, technological progress, government size, institutional quality, productivity growth of services sector and openness. The results are consistent across the two variants of labour productivity growth for the manufacturing sector. Further, both models meet all the diagnostic tests conducted to check the robustness of the models, see Table 11.

Thus, the model of productivity growth of manufacturing sector as estimated above is robust to alternative variants of labour productivity growth used although there are differences in the magnitudes of coefficients across the two models.

One plausible explanation for these differences could be that the construction of productivity growth and capital deepening are based on different assumptions across the two databases which in turn lead to differences in their estimates.

Moreover, the signs of all the coefficients are as expected using both variants of labour productivity growth. Thus, the results suggest that more capital per unit of labour leads to increase in the growth of labour productivity of the manufacturing sector of India. Technological progress as measured by R&D expenditure as a ratio of GDP is another significant determinant of productivity growth in the manufacturing sector.

Furthermore, a rise in government size and better institutional quality are productivity enhancing for the manufacturing sector of the Indian economy. Thus, increase in government expenditure turns out to be complementary to the private investment leading to a rise in capital accumulation and hence more productivity growth in the sector. The results further indicate that opening up the manufacturing sector to the rest of the world may lead to higher productivity growth of the sector. Thus, allowing freer international flow of goods and capital in the manufacturing sector of the economy may be beneficial.

Another key finding of the study is that productivity growth of services sector has a positive and significant impact on productivity growth of manufacturing sector. It is well known that manufacturing sector requires a number of services to distribute its output like transportation, finance, real estate and communications. An improvement in productivity growth of these services sectors reduces the prices of their product which in turn benefits the manufacturing sector that could produce more output with fewer inputs. Thus, there exist significant spillover effects from services sector to manufacturing sector of the economy.

To conclude, productivity growth of manufacturing sector is not only influenced by factors specific to this sector namely capital deepening and trade openness but also cross-sectoral variables and aggregate-level variables.

6.2.2 Market Services Sector

We now discuss the results for market services sector using both variants of labour productivity growth, viz., IKLEMS and APO. The unit root test results suggest that productivity growth (both IKLEMS and APO definitions), capital deepening (both IKLEMS and APO definitions) and human capital growth are stationary in levels, while trade openness is non-stationary in levels and stationary in first differences. So, we consider trade openness in first differences so as to have consistency in order of integration across all variables.

We then estimate our model set out in Sect. 3.2 above using GMM estimation technique. The results as reported in Table 11 suggest that capital deepening, technological progress, government size, institutional quality, productivity growth of manufacturing sector and openness are significant determinants of productivity growth of services sector.

The model is robust to alternative variants of labour productivity growth for the market services sector. The results on diagnostic tests suggest that both the models meet the diagnostic tests.

Thus, the results indicate that capital deepening is a positive and significant determinant of productivity growth of market services sector of the Indian economy. Thus, further growth in physical inputs, viz., capital per worker is productivity enhancing for the services sector. The result is in line with the study by Goldar et al. (2017) which shows that capital stock has been the largest contributor of growth of Indian economy over the period 1980–81 to 2010–11 using IKLEMS database.

While technological progress also affects productivity growth of services sector positively, the impact is not significant. A plausible explanation for this could be that most of the R&D expenditure takes place in manufacturing sector and the aggregate level of R&D expenditure may not pick up the impact on productivity growth of market services sector. The results further indicate that better institutional quality and more government expenditure both influence productivity growth of market services sector positively and significantly.Footnote 34 Thus, a better economic institutional environment in terms of a more conducive business climate and labour laws is favourable for the services sector. Further, more government expenditure is not only beneficial to the manufacturing sector but also to the market services sector of the Indian economy.

Furthermore, the productivity growth of manufacturing sector has a positive impact on the productivity growth of market services sector though the impact is not significant. Balakrishnan et al. (2017) find similar result in the context of manufacturing and market services of the Indian economy over the period 1965–66 to 2009–10.

The results further suggest that both trade openness and financial openness have a positive and significant influence on the productivity growth of services sector. Thus, deregulation and more integration of the services sector of the Indian economy with the rest of the world may be fruitful.

The results for the two sub-sectors indicate that capital deepening, technological progress, expansionary fiscal policy, institutional quality, productivity of the other sector and openness are determinants of productivity growth of both manufacturing as well as market services sectors. However, the impact of these variables differs across the two sectors. First of all, while productivity growth of one sector affects that of other, the impact is stronger from services to manufacturing sector. Thus, the results suggest evidence of significant asymmetric spillover effects across the two sectors. The result finds support from a study by Balakrishnan et al. (2017) who show an asymmetry in the positive feedback mechanism across manufacturing and services sectors of the Indian economy over the period 1965–66 to 2009–10. This result also corroborates with the findings of Dua and Garg (2019b) in the context of manufacturing and market services of developing and developed Asia–Pacific economies over the period 1980–2014.

Secondly, while trade openness affects productivity growth of both manufacturing and services sectors positively, the impact is significant only in the case of services sector.Footnote 35 Given that services sector has emerged as the largest economic sector in the Indian economy post liberalization, the result may be expected. The result also corroborates with the findings of Abizadeh and Pandey (2009) who find that the impact of trade openness has been stronger for productivity growth of services sector as compared to agriculture and industry in the post-90 s period in the context of OECD economies over the period 1980–2000.

To conclude, above results suggest that while both manufacturing and services sectors are important for the Indian economy and both have contributed to the overall labour productivity growth, services sector has both a direct as well as indirect impact on productivity growth through other sectors. Moreover, the impact of greater openness of the services sector of the Indian economy to the rest of the world may indicate greater potential in this sector as compared to other sectors to exploit the openness policies.

7 Conclusion

The current study examines trends and determinants of various measures of productivity growth for the Indian economy at both aggregate as well as disaggregate levels using different variants of productivity growth. At the aggregate level, the study considers both labour and total factor productivity growth estimated by four databases, viz., India KLEMS, Asian Productivity Organization (APO), Penn World Table (PWT9.1) and The Conference Board’s Total Economy Database (TED).

The analysis of the trends in labour productivity growth over the period 1981–2015 indicates that while there are differences in the absolute magnitudes of productivity growth rates estimated by the four databases, the trends are broadly similar. Further, the analysis of the trends in TFP growth using all the four databases indicates substantial differences in the estimates of productivity growth that may be explained by the differences in the definitions and estimation methods used for constructing the database on TFP growth.

Further, the study considers labour productivity growth at disaggregate level for the broad sub-sectors, viz., manufacturing and market services sectors of the Indian economy as provided by two databases, viz., IKLEMS and APO over the period 1981–2015. The investigation of trends of labour productivity growth of manufacturing and market services sectors reveals that the broad trends in productivity growth of the two sectors are similar across the two variants though they differ in magnitudes.

We use stylized model of labour productivity developed by Dua and Garg (2019a) at the aggregate level and the model of labour productivity developed by Dua and Garg (2019b) at the sectoral level to examine determinants of productivity growth using all the four databases.

Using GMM estimation technique, the study finds that capital deepening, technological progress, government size, institutional quality, share of agriculture and openness are significant determinants of aggregate labour productivity growth of Indian economy over the period 1981 to 2015. The results further indicate that while there are differences in the magnitudes of coefficients across the four databases of labour productivity growth estimates, the results are qualitatively similar. Thus, the determinants of productivity growth are robust to alternative variants of labour productivity growth used. Further, the results are also found to be robust to alternative measures of productivity growth, i.e. TFP growth and its estimates across various databases. The results are found to be broadly similar to those found in Dua and Garg (2019a) for the emerging and developing Asia–Pacific economies over the period 1980–2014.

The results on sectoral analysis indicate that capital deepening, technological progress, government size, institutional quality, productivity growth of other sector and openness are significant determinants of labour productivity growth of both sub-sectors. However, the impact of productivity growth of other sectors is stronger from services to manufacturing than other way around indicating greater response of manufacturing sector to productivity growth of services sector. Further, trade openness is found to have a stronger impact on the productivity growth of services than that of manufacturing sector. The results are further found to be robust to alternative databases of labour productivity growth used for the two sub-sectors. Similar results are also found by Dua and Garg (2019b) in the context of manufacturing and services sectors of emerging and developing Asia–Pacific economies over the period 1980–2014.

A comparison of results across aggregate and sectoral analysis indicates that while certain factors like capital deepening, technology, government size, openness, etc. are positive and significant determinants of both aggregate as well as disaggregate productivity growth, other factors like productivity growth of the other sector are relevant only for sectoral analysis. Moreover, there are differences in the influence of these factors across sectors. Thus, the study finds robust determinants of productivity growth both at aggregate and disaggregate levels for the Indian economy.

Questions to Think About

-

1.

The current study analyses the productivity growth of the Indian economy and its major sectors, viz., manufacturing and market services for the period 1981 to 2015. Do you expect any changes in the results if the analysis is extended up to 2019 (pre-Covid-19 period) and later?

Hint: Use updated data from the databases described in the chapter to re-estimate the models in the light of current data.

-

2.

How do the estimates of productivity growth of India compare with those of other major emerging Asian economies for which data is available?

Hint: APO database provides data for emerging Asian economies that can be used to study the productivity growth performance of these countries.

-

3.

Apply the model described in the chapter to other countries using panel framework.

Hint: One may use panel data techniques like Group-Mean Fully Modified OLS for the analysis. Refer: Dua and Garg (2019a)

Notes

- 1.

KLEMS stands for K-capital, L-labour, E-energy, M-materials and S-services.

- 2.

The share of agriculture declined from 34.5% (approx.) in 1981 to 16.5% (approx.) in 2015 while that of services rose from 38% (approx.) in 1981 to 58% (approx.) in 2015 (APO, 2018).

- 3.

Labour productivity is close to GDP per capita though not the same.

- 4.

It may be noted here that while capital services is a weighted sum of capital stock of each asset, capital stock is a simple sum.

- 5.

Please refer to Table 1 for details.

- 6.

While capital stock is a simple sum of capital stocks of all assets for an industry, capital services is a weighted average of capital stocks of each asset (calculated separately) with share of each asset in total capital income as the weight. Thus, capital services as opposed to capital stock controls for the heterogeneity across assets and thus quality of each capital asset and provides a better contribution of each asset into the production process. The 2018 version of the IKLEMS database was downloaded from RBI’s website: https://rbi.org.in/Scripts/KLEMS.aspx.

- 7.

This version of the database was released in April 2019 and is available from download at https://www.rug.nl/ggdc/productivity/pwt/.

- 8.

For certain countries, further disaggregated data on manufacturing industries is also provided.

- 9.

Utilities are also referred to as electricity, gas and water supply.

- 10.

The APO database additionally provides data on GDP and total employment of two components of the financial intermediation, real estate, renting and business services sector, viz., financial intermediation and real estate for all 34 Asian economies.

- 11.

IKLEMS provides TFP growth data for 25 2-digit level industries. In order to find TFP growth rate of aggregate economy and that of major economic sectors, we have used Production Possibilities Frontier approach following Goldar (2018).

- 12.

While capital services incorporate heterogeneity of capital assets and thus capital quality, capital stock assumes homogeneity of assets.

- 13.

The APO’s estimates of TFP do not incorporate labour quality changes, and hence, they tend to overestimate the TFP growth.

- 14.

Refer to Das et al. (2017) for further details on methodology.

- 15.

Refer to Vries and Erumban (2017) for further details.

- 16.

Labour productivity growth is employment based as this is the only measure consistently available across all four databases. Moreover, while IKLEMS uses GVA to compute labour productivity growth, other databases use GDP.

- 17.

It may be useful to note here that industry comprises four sectors, viz., mining, manufacturing, construction and electricity, gas and water supply, while services sector comprises market services, viz., trade, hotels and restaurants, transport and storage, financial services and business services, and non-market services that consist of public administration and defense, compulsory social services, education, health and social work and other services.

- 18.

See Dua and Garg (2019a) for details.

- 19.

See Dua and Garg (2019a) for details and more references.

- 20.

See for instance Bulman and Simon (2003).

- 21.

Refer to Dua and Garg (2019b).

- 22.

- 23.

See Dua and Garg (2019b) and the references cited therein for details.

- 24.

- 25.

While the databases provide data on capital services and employment, we calculate capital deepening as the ratio of capital services and employment for each database.

- 26.

While IKLEMS, PWT and TED provide their own estimates of human capital, APO does not have any estimates for human capital. Thus, we kept a single measure of human capital, viz., secondary school enrolment across all the four models.

- 27.

See Sect. 2.2.5 for definitions of TFP growth across four databases.

- 28.

Results on unit root tests are not reported here due to brevity of space, but they are available from authors upon request.

- 29.

We also conduct the Hausman (1978) test for the consistency of OLS, and the null hypothesis of consistency of OLS is not rejected in all the cases, but we still proceed with GMM estimation technique.

- 30.

The unit root test results are not reported here due to brevity of space but are available from authors upon request.

- 31.

While IKLEMS database provides data on TFP growth at disaggregate level, it is not available with any other data source. We investigate the determinants of productivity growth using TFP for manufacturing and market services sectors and find that the results are robust to the use of TFP instead of labour productivity for the two sectors. The results are available upon request from authors.

- 32.

Refer to Sect. 2.3.2. for details on why we choose these two sub-sectors for the analysis.

- 33.

Unit root test results are not reported here but available from authors upon request.

- 34.

Both are significant up to 21% level of significance.

- 35.

The coefficient is significant at 21% level of significance in the case of services, while the p-value is 0.78 in the case of manufacturing sector.

References

Abizadeh, S., & Pandey, M. (2009). Trade openness, structural change and total factor productivity. International Economic Journal, 23, 545–559.

Acemoglu, D., Johnson, S., & Robinson, S. (2004). Institutions as the fundamental cause of growth, WP 10481. National Bureau of Economic Research.

Asian Productivity Organization (APO) Database (2019). Available for download at https://www.apo-tokyo.org/

Balakrishnan, P., Das, M., & Parameswaran, M. (2017). The internal dynamic of indian economic growth. Journal of Asian Economics, 50, 46–61.

Breusch, T. S., & Pagan, A. R. (1980). The lagrange multiplier test and its applications to model specification in econometrics. The Review of Economic Studies, 47, 239–253.

Bulman, T., & Simon, J. (2003). Productivity and inflation, paper no. 10, Reserve Bank of Australia Discussion Paper.

Cumby, R. E., & Huizinga, J. (1992). Testing the autocorrelation structure of disturbances in ordinary least squares and instrumental variables regressions. Econometrica, 60, 185–195.

Das, D. K., Erumban, A. A., Aggarwal, S., & Das, P. C. (2017). Measuring productivity at the industry level: The India KLEMS database. Data Manual.

Dua, P., & Garg, N. K. (2019a). Determinants of labour productivity: Comparison between developing and developed countries of Asia–Pacific. Pacific Economic Review, 24, 686–704.

Dua, P., & Garg, N. K. (2019b). Sectoral analysis of productivity in the developing and developed economies of Asia–Pacific. Indian Growth and Development Review, 13, 37–71.

Efthyvoulu, G. (2012). The impact of financial stress on sectoral productivity. Economic Letters, 116, 240–243.

Elliot, B. E., Rothenberg, T. J., & Stock, J. H. (1996). Efficient tests of the unit root hypothesis. Econometrica, 64, 13–36.

Erumban, A. A., & Van Ark, B. (2018). Productivity in the global economy. In D. K. Das (Ed.), Productivity dynamics in emerging and industrialized countries. Routledge.

Feenstra, R. C., Robert, I., & Timmer, M. P. (2015). The next generation of the penn world table. American Economic Review, 105, 3150–3182.

Goldar, B.N. (2018), Sources of Growth and Structural Changes in the Indian Economy since 1980, in Productivity Dynamics in Emerging and Industrialized Countries, ed. D.K. Das, Routledge, India.

Goldar, B., Krishna, K. L., Aggarwal, S. C., Das, D. K., Erumban, A. A., & Das, P. C. (2017). Productivity growth in India since the 1980s: The KLEMS approach. Indian Economic Review, 52, 37–71.

Hansen, L. P. (1982). Large sample properties of generalized method of moments estimators. Econometrica, 50, 1029–1054.

Hausman, J. A. (1978). Specification tests in econometrics. Econometrica, 46, 1251–1271.

IMF Database. (2020). World economic outlook—October. Available for download on https://www.imf.org/en/Publications/WEO/weo-database/2020/October

Jarrett, J. P., & Selody, J. G. (1982). The productivity-inflation nexus in Canada. The Review of Economics and Statistics, 64, 361–367.

Kose, M. A., Prasad, E. S., & Terrones, M. E. (2009). Does openness to international financial flows raise productivity growth. Journal of International Money and Finance, 28, 554–580.

Krishna, K. L., Erumban, A. A., Das, D. K., Aggarwal, S., & Das, P. C. (2017). Industry origins of economic growth and structural change in India, WP 273. Centre for Development Economics, DSE.

Kwiatkowski, D., Phillips, P. C., Schmidt, P., & Shin, Y. (1992). Testing the null hypothesis of stationarity against the alternative of a unit root. Journal of Econometrics, 54, 159–178.

Lane, P., & Milesi-Feretti, G. M. (2017). International financial integration in the aftermath of the global financial crisis, WP 115, IMF.

Levine, R. (1997). Financial development and economic growth: Views and agenda. Journal of Economic Literature, 35, 688–726.

Loko, B., & Diouf, M. A. (2009). Revisiting the determinants of productivity growth: What’s New, WP 225. IMF.

McMillan, M. S., & Rodrik, D. (2011). Globalization, structural change and productivity growth, WP 17143. National Bureau of Economic Research.

Nomura, K. (2018). Productivity growth in Asia and its country origins. In D. K. Das (Ed.), Productivity dynamics in emerging and industrialized countries. Routledge.

OECD. (2001). Measuring productivity—OECD manual: Measurement of aggregate and industry-level productivity growth. OECD Publishing. https://doi.org/10.1787/9789264194519-en

Park, D., & Shin, K. (2012). The service sector in Asia: Is it an engine of growth, WP 322. Asian Development Bank.

Pesaran, M. H. (2015). Time series and panel data econometrics. Oxford University Press.

Poirson, H. (2000). Factor reallocation and growth in developing countries, WP 94. IMF.

RBI (2018) Measuring productivity at the industry level—The India KLEMS database. https://rbi.org.in/Scripts/KLEMS.aspx

Vries, K. D., & Erumban, A. A. (2017). Total economic database: A detailed guide to its sources and methods. The Conference Board. https://www.conference-board.org/data/economydatabase/total-economy-database-methodology

Vu, K. M. (2017). Structural change and economic growth: Empirical evidence and policy insights from Asian economies. Structural Change and Economic Dynamics, 41, 64–77.

World Development Indicators Database. (2019). October, Available for download on https://www.imf.org/en/Publications/WEO/weo-database/2020/October

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Dua, P., Garg, N.K. (2023). Aggregate and Sectoral Productivity Growth in the Indian Economy: Analysis and Determinants. In: Dua, P. (eds) Macroeconometric Methods. Springer, Singapore. https://doi.org/10.1007/978-981-19-7592-9_7

Download citation

DOI: https://doi.org/10.1007/978-981-19-7592-9_7

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-7591-2

Online ISBN: 978-981-19-7592-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)