Abstract

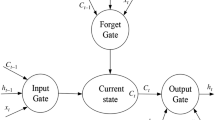

Prediction on the stock market is one of the most difficult tasks to do in real life. There are so many aspects on which the stock market depends—physical factors versus psychological, rational, and irrational behavior, etc. Proposed research work consists of different aspects on which stock markets are based on. It consists of three models to forecast a stock price on State Bank of India (SBI) stock data. In the current research, we proposed a hybrid model followed by recurrent neural network-long short-term memory (RNN-LSTM) to predict a next-day closing price of SBI. A hybrid model is the combination of two different aspects related to the prediction of stock price. The first technique used other companies’ stock data to predict the target company’s next-day closing price. Other companies lie in the same sector so that they are correlated to each other. For training and testing, we have used multilayer perceptron (MLP) regression model. It is a neural network model in deep learning. The second technique is to predict the stock price of an SBI company using historical data of the target company followed by the auto-regressive integrated moving average—gated recurrent unit (ARIMA-GRU) model. ARIMA-GRU model is a combined model which gives better accuracy for predicting stock price data. In the hybrid model, we take the result of both the models as an input. This paper aims to compare the proposed hybrid model with other two single-aspect models on which stock price depends and proves in terms of accuracy that the hybrid model of all aspects gives better results in comparison to single-aspect models.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Sharma, A., Bhuriya, D., Singh, U.: Survey of stock market prediction using machine learning approach. In: International Conference of Electronics Communication and Aerospace Technology, vol. 2, pp. 506–509. Coimbatore (2017)

Devadoss, A.V., Ligori, T.A.A.: Forecasting of stock prices using multi layer perceptron. Int. J. Comput. Algorithm 02, 440–449 (2013)

Tiwari, S., Bharadwaj, A., Gupta, S.: Stock price prediction using data Analytics. In: International Conference on Advances in Computing, Communication and Control, pp. 1–5. Kochi (2017)

Saha, S., Singh, N., Mohan, B.R., Naik, N.: A combined model of arima-gru to forecast stock price. In: Proceedings of the International Conference on Paradigms of Computing,Communication and Data Sciences, Chap. 80. Springer, Kurukshetra (2021)

Jeenanunta, C., Chaysiri, R., Thong, L.: Stock price prediction with long short term memory recurrent neural network. In: International Conference on Embedded Systems and Intelligent Technology & International Conference on Information and Communication Technology for Embedded Systems, pp. 1–7. Thailand (2018). https://doi.org/10.1109/ICESIT-ICICTES.2018.8442069

Hussain, R.: Predicting Stock Prices Using Multi-layer Perceptron (2018)

Mangalampalli, R., Khetre, P., Malviya, V., Pandey, V.: Stock price prediction with long short-term memory recurrent neural network. Int. J. Eng. Res. Technol. 09 (2020)

Sunny, A.I., Maswood, M.M.S., Alharbi, A.G.: Deep learning-based stock price prediction using LSTM and bi-directional LSTM model. In: 2nd Novel Intelligent and Leading Emerging Sciences Conference, October 24–26, pp. 87–92. Giza, Egypt (2020)

Bathla, G.: Stock price prediction using LSTM and SVR. In: Sixth International Conference on Parallel, Distributed and Grid Computing, pp. 211–214 (2020)

Qiu, J., Wang, B., Zhou, C.: Forecasting stock prices with long-short term memory neural network based on attention mechanism. PLoSONE 15, 0227222 (2020). https://doi.org/10.1371/journal.pone.0227222

Yao, S., Luo, L., Peng, H.: High-frequency stock trend forecast using LSTM model. In: 13th International Conference on Computer Science Education, pp.1–4 (2018)

Murtaza, R., Patel, H., Varma, S.: Predicting stock prices using LSTM. Int. J. Sci. Res. 6(4), 1754–1756 (2020)

Raju, N.V.G., Padullaparti, S.S.S., Allam, S.P.R.: Inclination of tech stocks using time series analysis and prophecy of returns using recurrent neural network. In: 3rd International Conference on Smart Systems and Inventive Technology, pp. 792–795 (2020)

Namini, S.S., Namin, A.S.: Forecasting economics and financial time series: Arima vs. LSTM (2018)

Nishitha, S.N.T., Bano, S., Reddy, G.G., Arja, P., Niharika, G.L.: Stock price prognosticator using machine learning techniques. In: 4th International Conference on Electronics, Communication and Aerospace Technology, pp. 1–7 (2020)

Mogha, A., Hamiche, M.: Stock market prediction using LSTM recurrent neural network. Procedia Comput. Sci. 170, 1168–1173 (2020)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Singh, N., Mohan, B.R., Naik, N. (2022). Hybrid Model of Multifactor Analysis with RNN-LSTM to Predict Stock Price. In: Gupta, D., Sambyo, K., Prasad, M., Agarwal, S. (eds) Advanced Machine Intelligence and Signal Processing. Lecture Notes in Electrical Engineering, vol 858. Springer, Singapore. https://doi.org/10.1007/978-981-19-0840-8_8

Download citation

DOI: https://doi.org/10.1007/978-981-19-0840-8_8

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-0839-2

Online ISBN: 978-981-19-0840-8

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)