Abstract

Rapidly growing urbanization in developing countries has led to high level of traffic demand and vehicle emissions. Consequently, the rail-based transport system is preferred in growing metropolises as an advanced transport mode, potentially resolving mentioned problems. The huge capital requirement of urban metro projects, however, far exceeds the availability of the state or central government funding. To meet the gap in finance, the public sector has implemented public–private partnership (PPP) framework to build the system. This contract form offers valuable benefits, such as access to finance, appropriate risk allocation, and efficient management ability. Nevertheless, international experience in metro plans reveals that the successful application of PPP in this transport mode is significantly challenged by various critical issues. Hence, prior to engaging in PPP urban metro projects, key elements justifying the benefits and possible threats, need to be evaluated. This paper, by reviewing international experience, intensively from emerging markets, and by carrying out an in-depth case study, attempts to clarify key issues, and strategy implications to promote successful PPP mechanism for urban metro system in Vietnam.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Due to the effect of urbanization, especially in developing countries, high population density and inadequate space are putting high pressure to the transport system. Cities have been recognizing that it could be uneconomic in time and space enhancing road capacity [1]. Scientists suggest that large cities require Metro Rapid Transit (MRT) to assist the transport network and provide alternatives to public transport [2]. Time savings, environmental improvements, and increased land values are fundamental benefits of a metro system [3].

Despite the benefits of urban metro system, limitation of budget from the public funding has been challenging any government as significant constrain. Long-term debt, and deficit limits are typically hidden fiscal struggles of functioning metro lines [4, 5]. Developing this system only using the public finance is impractical in various growing cities. Hence, the private sector has been encouraged to deliver urban metro infrastructure and its related services [6].

Although the utilization of PPP into the rail sector is well-known, international experience has revealed mixed results. The complexity and the long-term agreement could generate extra hazards from the project’s early stage through its life cycle [7]. With regard to Vietnamese market, PPP has been operated in this country in the areas of highway, water, and waste cycling projects. Nevertheless, there is a lack of practice and research exploring the potentiality and constrains of employing PPP to urban metro in growing cities in this nation. The experience from other sectors cannot be directly functioned for metro as this system differs significantly in terms of technical and capital requirement [8]. Accordingly, it is significantly valuable to gather the experience and evidence from the international background and practices. This papers, by reviewing PPP metro projects worldwide, with a focus on the developing markets, attempts to highlight possibly critical issues of PPP in urban metro projects in Vietnam, and suggest implications for policy to encourage urban metro network using PPP structure.

2 Data Collection and Analysis Method

To explore critical issues possibly occurring in implementation of PPP metro project in Vietnam, important issues are reviewed based on international experience and evidence, particularly in developing countries. Reviewed critical factors are then delivered to group of 47 experts in PPPs Vietnamese market, including decision makers, investors and academics. These experts were selected based on their experience in policy making, investing in PPP transport projects, and relevant research publication. Policy makers were chosen from both the central government level and local authority.

In analytical process, issues are evaluated as a function of probability of occurrence and the degree of impact. Linguistic judgments are converted to numeric values. Five numeric values of probability and impact are employed, namely, 0.9; 0,7; 0,5; 0,3; 0,1 are for “very high”, “high”, “medium”, “low”, and “very low”, respectively. Mean ranking technique is applied to rate scores and variation level is computed using Standard deviation.

Score of issue i evaluated by respondent j:

-

\({Fr}_{j}^{i}\): Frequency of occurrence of risk i assessed by respondent j

-

\({Im}_{j}^{i}\): Degree of impact if risk i assessed by respondent j

Mean score of issue i:

3 Result and Discussion

Table 1 displays the rating of critical issues, forecasted by group of experts, which need to be cautiously considered in implementing PPP framework to urban metro system in Vietnam. In general, private sector can be considered as more risk adverse compared to the public sector. Most critical and notable issues are discussed in relation with actual situation of the market.

3.1 Most Critical Issues

Land Acquisition and Resettlement (Co5). Co5 refers to involuntary process in which the interest of land owners is not satisfied in negotiation with other parties. As lawful expropriation, land owners have obligation to support the public infrastructure projects, and conflicts occur as financial offer from the developers does not meet the landlord’s condition. The expenditure to acquire land requires a huge part of construction project capital in Vietnam. Cost of land acquisition and resettlement could account for 80% the total investment, and this compensation, however, does not satisfy the affected citizens in big cities [9]. For urban metro lines, Co5 could be more considerable as projects are constructed in a high density area resulting in extremely high land price. The existence of a two-land-price system containing market price and the state price is also forcing land acquisition more complicated as citizens demand compensation being equivalent to the market level.

Experience in PPPs of Involved Parties (Re1). There has been no urban rail project implemented by PPP mechanism in Vietnam, and the experience from other sector cannot be directly applied for metro project due to the significant difference of technical and capital requirement [8]. Sufficient experience reflects to ability to reduce the chance of contract failure and create favorable environment containing competitive bids, assessing feasibility study, solving dispute process, which attract domestic and oversea stakeholders. Vietnamese evidence shows that the serious conflicts of interest amongst parties including investors who are stated owned organizations or credit organizations, requires intensively evaluated. Bankers may display strong fiscal capability, but deficient practice construction projects may appears as their drawbacks. Importantly, structuring a working mechanism in which the public sector has improved administrative power in Special Purpose/Project Vehicle (SPV) is also essential. International evidence concentrated that regulation should require a certain level of public budget in the equity of the SPV [10].

Project Approval Process (Le3). This issue is not a new phenomenon in the construction industry. Although timing scheme for each stage of the project is stated in the regulation documents, excessive approval procedures occur as a result of inefficient collaboration between sponsors and authorities, the complicated and multi-layers of the government. The approval procedure needs to pass all of required authorities, and the inconsistency between these administrative layers can exist. For instance, the development plan of the central government may have inconsistency with the local scheme. Besides, many of legal agencies do not have necessary power to make quick decision, thus, higher permission from higher authority layer is mandatory. The excessive approval process potentially leads to the variation of influential elements and dimension of uncertainty which are assessed in the initial project feasibility study. From the private partner perspective, Le3 seems to be external, and the strategy is to maintain close relationship with decision-making agencies [11].

Ridership Volume (Ma6). Demand shortfall is one of the most critical issues for PPP in transport sector, including metro network [12]. Tariff scheme is usually set at a specific level indicated in the agreement. Therefore, transit level directly links to operational incomes of sponsors. The shortfall, in fact, can lead to collapse or cancellation of projects and default of operators [13]. The variation of demand is usually embedded in the contractual clauses where renegotiation can be conducted and extended concession scheme is offered in case gross ridership reaches a set statistic. Despite of guarantee from the government, shortfalls are harmful to stakeholders as with the longer concession, more uncertainties arise and additional costs such as maintenance and loan interest likely emerge [14]. Experience from metro projects in Thailand, Malaysia, Spain showed that the shortfall of revenue due to inappropriate forecast can be 48% [13]. In fact, a long-lasting agreement creates more challenges to integrate to the other future transport networks affecting residents’ travel choices.

Financial Capacity of Investor (Ma2). Investors are responsible for providing finance developing the asset and operate the system for a long scheme. The financial capacity of investors, therefore, is not only required being strong but also sustainable. Ma2, according to current PPP regulation, is evaluated through reports in financial aspect and current projects involved. Loopholes in accessing financial capacity need to be removed. These ambiguities have been demonstrated in PPP projects in Asia, showing that, to better finance position, low capacity investors can join with well-known capacity partners. However, the participation of the reputational investors during the project life cycle is not substantial. Furthermore, PPP law allows investors to mobilize capital though the mix of debt and equity. Nevertheless, the financial mobilizing plan must be well-defined, and the process of following the obligations needs to strongly be recorded. If the portion of debt exceeds, expenditure cost increases as the cost of debt will be added and the tax efficiency is reduced.

3.2 Other Remarkable Issues

Maintenance Cost (Op2), Public skepticism (Po3), and Negative economic occurrences (Ma5) are remarkable issues for planning of metro PPPs, also highlighted by professionals. Noticeably, stockholders admitted that maintenance cost is usually predicted a based on the experience of previous construction projects. However, there is a lack of historical data about metro PPPs in Vietnam, thus the forecast seems to be less accurate. Regarding the skepticism of the public, the raise of concern about this issue reveals the similarity in comparison with international context [6, 15]. However, it is inconsistent with previous studies in Vietnamese market such as [16], where public opposition was not evaluated as serious matter. The possible reason is the current negative experience of particular PPPs in the transport sector in Vietnam. Inspection of previous BOT projects announced a number of problems where bias towards the private sector existed. Corruptions during implementation, impractical position of toll station, and other issues led to campaigns of drivers. Remarkably, negative economic occurrence is highlighted as a missing issue in proposal of a majority of projects. Its probability of occurrence is not sizeable, the impact is, however, extremely significant. The potential reason behind this highlight from specialists could be the current evidence of negative impact of SARS-CoV-2 disease on the public transport, with ridership significantly down due to public traffic link shut and social distancing, leading to the unstable future viability of numerous transport projects.

4 Policy Implication for Vietnamese Market

4.1 Project Financial Model

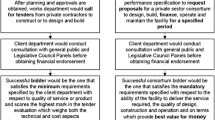

Develop a New Metro System. Amongst a number of adaptations of PPP to construct a new urban metro system, DBFO or BOT framework can be potential alternatives. BOT (Build–Operate–Transfer) has been typical used in Vietnam, whereas, in DBFO mechanism, the private investor is responsible for designing, building, financing and operating project. In DBFO, a contract, typical for 25–30 years, can be applied. The contract details information about payments, services, and other central issues. It should be noted that the key difference between DBFO and BOT is that in DBFO no actual fare are collected by the private sector. Investors recover capital by scheduled payments from the government based on standards and performance measures [6].

PPP for Subway Services, Infrastructure Maintenance. Core services of the underground system such as signaling, stations and trains, etc., could be assigned to private companies using PPP contracts. In this scheme, the advanced capacity of the private company in providing high quality services is utilized. However, it should be noted that a number of risks from the early stage of the project to the finishing of the construction still remain in the public sector. For example, operational contracts were granted for Stockholm Transport to operate key services including light rail system, railway services for 5–10 years. A 30-year contract was also awarded to Singapore’s Land Transport Authority to operate 20 km Northeast Line and two adjoining LRT systems, built by the public funds [15].

Equity Contribution from the Public Sector. The government can promote incentives by contributing to a certain portion of equity. More specifically, a minimum level of financial involvement by public sector is required. This, in turn, leads to a maximum level of investment by the private sector. Reference [12] emphasizes that reasonable rate of return for both sectors can be generated using this financial arrangement. Besides, the collaboration between two sectors can also be upgraded as the public has shared equity increasing transparency to the operation of the SPV. Experience from the United Kingdom suggests that the minimum level of public equity could be 30% of the total equity [10].

4.2 Revenue Streams

Subsidies. One of the strategies that PPP metro projects in Vietnam could apply to balance demand risk is the subsidy from the government. Although, government subsidies provide economic and social benefits, application of this support requires being cautiously assessed [13, 17] also stated that a minimum income guarantee (MIG) can be set to mitigate the risk of demand for investors. However, the government may face losses if information about revenue stream and real operation cost is inaccurate [18]. More specifically, SPV may announce shortfalls in revenue to obtain assistance from the government. Academics and decision makers have been applying real options theory, game theory, or genetic algorithm-based model to compute optimal MIG.

Employing Land Value Capture. The principle of LVC is based on the fact that the value of land surrounding urban metros project will increase and land can be used as potentially financial sources. To use LVC, type and form of land, distance to the station and geographical location should be judged determining property values [15]. Urban rail PPP projects in East Asian cities demonstrate that high density population is a favorable condition to apply LVC. Evidence from Hong Kong and Tokyo proves that the private sector has incentives to work with the government in planning cities’ land use [4]. One of the successful strategies employing LVC in PPP metro projects is the use of transit oriented development (TOD) in which space for residential, business and leisure is maximized. This maximization reduces the number of personal vehicles and builds a habitat where citizens are incentivized to use metro lines [19].

Industry Structure. The structure of railway industry is commonly separated into horizontal and vertical structure. The horizontal structure allows the railway managed by discrete geographic concentration, while managing infrastructure and operates the trains are separated by different contracts in the vertical structure [17]. This paper suggests that vertical structure is appropriate for cities in developing nations, including Vietnam. In fact, large population and high density of East Asian cities favors vertical integration [4]. More specifically, the large population and high density requires heavy metros. This creates a technical complexity and high density metro networks being better vertical integration. This structure can also promote transit, decrease gridlock and uncertainty, and generate multiple streams of income. Metro plans in Japan and Hong Kong can be explored to acquire valuable experience in operating super-vertically systems.

5 Conclusion and Future Research

This paper highlights the critical issues associated with PPPs in developing countries and suggests implication to effectively promote urban metro network in Vietnam.

Result demonstrates that Land acquisition and resettlement (Co5), Experience in PPPs of involved parties (Re1), Project approval process (Le3), Ridership volume (Ma6) and Financial Capacity of Investor (Ma2) are the most critical factors. The issue of lacking experience in PPPs is more considerable in Vietnamese market in comparison to other developing countries as there has been no metro system operated by applying PPP mechanism in Vietnam. Based on international experience, key implication strategies, namely, Project Financial Model, Subsidies, Land Value Capture, Industry Structure, and Governance are proposed for investors and decision makers.

Although there is no fixed rule for successful implementation of PPP metro projects in any market setting, discovered issues and strategy implications require to be carefully analyzed. Future study may look further into each issue or strategy implementation.

References

Kulshreshtha, R., Kumar, A., Tripathi, A., Likhi, D. K..: Critical Success Factors in Implementation of Urban Metro System on PPP: A Case Study of Hyderabad Metro. Global Journal of Flexible Systems Management 18(5), 303–320 (2017).

Jong, M., Rui, M., Stead, D., Yongchi, M., Bao, X.: Introducing public private partnerships for metropolitan subways in China: what is the evidence? Journal of Transport Geography 18(2), 301–313 (2010).

Newman, P., Davies-Slate, S., Jones, E.: The Entrepreneur Rail Model: Funding urban rail through majority private investment in urban regeneration. Research in Transportation Economics 67, 19–28 (2018).

Chang, Z., Phang, S. Y.: Urban rail transit PPPs: Lessons from East Asian cities. Transportation Research Part A: Policy and Practice 105(C), 106–122 (2017).

Roumboutsos, A., Saussier, S.: Public-private partnerships and investments in innovation: The influence of the contractual arrangement. Construction Management and Economics 32(4), 349–361(2014).

Phang, S.: Urban rail transit PPPs: Survey and risk assessment of recent strategies. Transport Policy 14(3), 214–231(2007).

Sresakoolchai, J., Kaewunruen, S.: Comparative studies into public private partnership and traditional investment approaches on the high-speed rail project linking 3 airports in Thailand. Transportation Research Interdisciplinary Perspectives 5(0), 100116 (2020).

Gangwar, R., Raghuram, G.: Framework for structuring public private partnerships in railways. Case Studies on Transport Policy 3(3), 295–303 (2015).

The World Bank.: Compulsory Land Acquisition and Voluntary Land Conversion in Vietnam – The conceptual Approach, Land Valuation and Grievance Redress Mechanisms. The World Bank, Washington DC (2011).

HM Treasury.: A new approach to public private partnerships. HM Treasury, London (2012).

Patrick, X.W., Zhang, Guomin., Wang, J.: Identifying Key Risks in Construction Projects: Life Cycle and Stakeholder Perspectives. International Journal of Construction Management 9(1), (2014).

Oliveira, M., Ribeiro, J., Macario, R.: Are we planning investments to fail? Consequences of traffic forecast effects on PPP contracts: Portuguese and Brazilian cases. Research in Transportation Economics 59, 167–174 (2016).

Carpintero, S., O. H. Petersen.: PPP projects in transport: Evidence from light rail projects in Spain. Public Money Manage 34(1), 43–50 (2014).

Bray, D., P. Sayeg. Private sector involvement in urban rail: Experience and lessons from South East Asia. Research in Transportation Economics 39(1), 191–201 (2013).

Li, X., Peter, E. D. V.: Employing land value captures in urban rail transit public private partnerships: Retrospective analysis of Delhi's airport metro express. Research in Transportation Business & Management 32(0), 1004331 (2019).

Toan and Ozawa: Government’s Risk Management for Attracting Private Investment in BOT Infrastructure Projects in Vietnam. Graduate School of Engineering, The University of Tokyo (2008).

The World Bank.: Railway reform: A toolkit for improving rail sector performance. The World Bank, Washington DC (2017).

Hong, S.: When does a public–private partnership (PPP) lead to inefficient cost management? Evidence from South Korea’s urban rail system. Public Money Manage 36(6), 447–454 (2016).

Suzuki, H., Murakami, J., Hong, Y.H., Tamayose, B.:. Financing transit-oriented development with land values: Adapting land value capture in developing countries. The World Bank, Washington DC (2015).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Nguyen, M.N., Dinh, T.H. (2022). Implementation of PPP for Urban Metro System: Critical Issues for Developing Countries. In: Ha-Minh, C., Tang, A.M., Bui, T.Q., Vu, X.H., Huynh, D.V.K. (eds) CIGOS 2021, Emerging Technologies and Applications for Green Infrastructure. Lecture Notes in Civil Engineering, vol 203. Springer, Singapore. https://doi.org/10.1007/978-981-16-7160-9_155

Download citation

DOI: https://doi.org/10.1007/978-981-16-7160-9_155

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-7159-3

Online ISBN: 978-981-16-7160-9

eBook Packages: EngineeringEngineering (R0)