Abstract

Above the solid base founded by Alfred Marshall, Robert Solow, Paul Romer, and other famous economists around the world, this article focuses on exploring new aspects of economic growth based on the Romer Economic Growth Model. By adding two new variables, the heterogeneity and the ability to absorb knowledge, into the model, which are two main conditions that allows the spillover effect of knowledge, this article realizes that such an effect is, in fact, a mutual communication between industries, in which they absorb knowledge from each other. In order to set up a new model based on the Romer Economic Growth Model, this article imports the two variables into the model, and finally achieve a new endogenous economic growth model. Theoretically, this will be a more inclusive economic growth model: Romer Economic Growth Model, Solow Growth Model, and AK Model are all special situations of this model. Mathematically, since this model emphasizes the impact of ability to absorb knowledge in the economic growth, comparing to previous economic growth models, this one will hold a stronger point in explaining endogenous economic growth.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Seeking the origin of economic growth is one of the most archaic and crucial problems in Economics in the history of the globe. In the 17th century, William Petty had proposed that “Labour is the Father and active principle of wealth, as lands are the Mother.” Afterward, Adam Smith labeled “capital” as a new factor of production. With the growth of the modern economy, knowledge and innovation started to be noticed as essential roles in economic growth, which indicated new standards of theories in explaining how this growth happened continuously. A large number of famous economists around the world, such as Kenneth Arrow, Nicholas Kaldor, Robert Solow, and Hirofumi Uzawa, had emphasized that knowledge, technique, and innovation represent the major elements in pushing modern economic growth [1,2,3,4]. However, what they built in their models, normally, illustrates that the improvement of technique and the acquisition of new knowledge are exogenous, which means they happen naturally. That actually limited the most tremendous momentum of economic growth into a box. Whereas, Paul Romer (1986), the winner of the Nobel Memorial Prize in Economics, thought differently [5]. In his model, the production of new knowledge and the activity of innovation are nominated as variables, explained how market mechanism and economic policies spur the forward research and innovation in enterprises, which, in the deepest degree, gave the problem a reasonable explanation in the modern world. Romer’s theory is still called “the Endogenous growth theory” (1998) [6].

The dimensions of society, such as culture, politics, laws, etc., can be varied from country to country, it seems impossible for Romer and all successors to create a single model to explain the world. Therefore, Romer pinpointed knowledge as his variable to have further research. The best part of Romer’s Endogenous growth model is to endogenesis the knowledge and technique innovation, which excluded the intervention of government policies. While Romer believes that since new knowledge cannot be rigged by a single company, which means when new knowledge has been produced, all other enterprises can learn the knowledge totally and use it for their own good to create profit. However, is gaining new knowledge as easy as it tells us? Therefore, this article will dig more into knowledge, based on Romer’s Endogenous growth model.

Experiences of years of studying tell the story that learning consumes time and wealth. Riches can always acquire better education sooner and faster than the poor. Such a theorem can be applied in the economic growth that abilities to learn, absorb, and transform knowledge of different companies are different. For example, the management philosophy of large enterprises and small enterprises are different. While a large company gives birth to a new management philosophy, which could be regarded as new knowledge in the economic system, the ability of small enterprises to learn is tiny. Whatsmore, Romer’s Endogenous growth model suggests that the economy of large countries will always develop faster than small countries, which is challenged by the fact that large countries, such as India, are not necessarily growing faster, now. The purpose of this article is to import two new variables about knowledge based on Romer’s Endogenous growth model to make the model more convincing and explanatory.

However, limitations of the Romer Economic Growth Model is amplified due to the progress of modern economic system, which can be described as two major points: (1) it had not detailed the necessary preconditions of the spillover effect of knowledge; (2) though it was not obvious yet in 1986, now we can find a dilemma that, according to Romer, large countries will always be able to develop faster than small countries; however, it can still not be able to explain why large countries like India are not necessarily develop faster than small countries [7]. In this article, two new variables (preconditions) will be imported to improve the Romer Economic Growth Model. After all, the Endogenous Growth Model will be more convincible and explanatory.

2 The Romer Economic Growth Model

The Romer Economic Growth Model hypothesizes that the production function of the identical industry can be contributed by the private knowledge k, the total knowledge that a society obtains K, and other inputs x. First of all, Romer supposed that no other inputs other than knowledge growth, which can be refer to \(x=\overline{x }\). Therefore, the production function of the industry can be represented by:

In the function, F indicates that for k and x, the returns to scale remains unchanged, and for k and K, it’s a progressive increase model for return. In the Romer Economic Growth Model, the total knowledge of society K measures the externalities of knowledge, or technique, to the contribution of output. Therefore, when private industries are deciding about new investments, they do not have to consider K as a changing variable, which means K(t), as the level of the total knowledge, is fixed. However, for social planners, such as politicians, will need to consider the change of K and how its internality and externality will affect the output when deciding on new investment. For these social planners, the total knowledge of society K is the sum total of knowledge possessed by each individual industry in the given society, which can be figured by \(K=sk\). There are some constraint conditions for the increasing rate of knowledge of the private industry, which can be referred to as the relationship between the total investment for producing new knowledge l and knowledge production \(\dot{k}\). The rate of increase in private industry’s knowledge possession is the ratio between the private industry’s investments and the private industry’s knowledge possession, which can be expressed by:

In this function, g is an increasing function which has an upper limit \(\gamma \), \(g\left(0\right)=0\), \({g}^{\mathrm{^{\prime}}}\left(x\right)>0\), \({g}^{\mathrm{^{\prime}}\mathrm{^{\prime}}}\left(x\right)<0\). We can have the conclusion that the profits of producing new knowledge is decreasing.

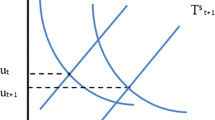

Under this circumstance, the artificial planning \({P}_{\infty }(K)\) and social planning \({PS}_{\infty }\) can be expressed by:

Romer explained the beingness of these two questions and gave an assumption that competitive equilibrium and social optimum are inconsistent. Competitive equilibrium is a condition of social suboptimum, since all the competitive industries in the market regard K(t) and price of set values and the private marginal product of knowledge is \(\frac{\partial }{\partial k}f(k,K)\). However, for social planners, the social marginal product of knowledge is \(\frac{\partial }{\partial k}f\left(k,K\right)+s*\frac{\partial }{\partial K}f(k,K)\). Since the private marginal product of knowledge is smaller than the social marginal product of knowledge, the producers will choose a knowledge production that is lower than the social optimum level, which will eventually lead to the increasing rate of competitive equilibrium being smaller than the increasing rate of social optimum [8]. Therefore, Romer stood steady on the side of government intervention.

3 Improved Model

Because of the heterogeneity of k, the total knowledge that society obtains K cannot be simply equal to sk; instead, it should be related to the heterogeneity degree of the information of knowledge each industry possesses. Moreover, the spillover effect of the total social knowledge should be related to the ability that each industry absorbs different kinds of knowledge, such as management and techniques. Depend on all discussed above, we can set a more realistic expression about the total social knowledge K:

In the expression, \(0\le \alpha \le 1\), \(0\le \beta \le 1\), \(\alpha \) represents the ability that an industry absorbs specific new knowledge, which is largely related to the level of education, and \(\beta \) represents the diversity of the new knowledge (in other words, how different is the new knowledge compare to the existing ones). If one of \(\alpha \) and \(\beta \), or both, equals 0, which means, if the knowledge obtains by different industries remains consistent and/or the industry’s ability to absorb new knowledge is none, the knowledge will not experience spillover effect. On the other hand, if and only if \(\alpha =1\) and \(\beta =1\), we can conclude that knowledge has a total spillover effect. When \(0<\alpha <1\) and/or \(0<\beta <1\), the knowledge has a partial spillover effect.

After the modification from \(K=sk\) to \(K={(sk)}^{\alpha \beta }\), the new artificial planning \({P}_{\infty }(K)\) and social planning \({PS}_{\infty }\) can be expressed by:

Theorem 1: The existence of solutions in social planning situation. We suppose that U, f, and g are real continuous functions, and U and g are concave functions. If \(f\left(k,{(sk)}^{\alpha \beta }\right)\le \mu +{k}^{\rho }\), \(\rho >0\), \(0\le g(x)\le \gamma \), and \(\mu \),\(\rho \),\(\gamma \) are real numbers. If \(\gamma \rho \) is smaller than the discount rate \(\delta \), and the value of \(\alpha \beta \) is equal to the critical value, which leads to \(k\to \infty \), the marginal profit of \(f\left(k,{(sk)}^{\alpha \beta }\right)\) about k is a constant \(m>\delta \), or when the value of \(\alpha \beta \) is larger than the critical value, \({PS}_{\infty }\) has the equilibrium solution of the increasing rate over 0. When the value of \(\alpha \beta \) is equal to 0 or the value of \(\alpha \beta \) cannot exceed the critical value, which makes the marginal profit of \(f\left(k,{(sk)}^{\alpha \beta }\right)\) about k decreases, the equilibrium increasing rate of the social optimum is going to be 0.

Because of \(f\left(k,{(sk)}^{\alpha \beta }\right)\le \mu +{k}^{\rho }\) and the upper limit of \(g(x)\) is \(\gamma \), the upper limit of the increasing rate of spending c is \(\gamma \rho \), \(\gamma \rho \) smaller than the discount rate \(\delta \) will guarantee the existence of finite solutions.

4 Results

One thing that worth to notice is that after modified artificial planning reaches equilibrium, it is going to be \(K={(sk)}^{\alpha \beta }\) instead of \(K=sk\) in the Romer Economic Growth Model. When \(\alpha =1\) and \(\beta =1\), which, as above, means the knowledge has a total spillover effect, the modified model will be in the same shape as the Romer Economic Growth Model. When one of \(\alpha \) and \(\beta \), or both, equals to 0, or the value of \(\alpha \beta \) cannot exceed the critical value, which makes the marginal profit of \(f\left(k,{(sk)}^{\alpha \beta }\right)\) about k decreases, the modified model will be regarded as the Solow Growth Model. If it happens, the competitive optimum and the social optimum will be the same. When the value of \(\alpha \beta \) is equal to the critical value, which leads to \(k\to \infty \), the marginal profit of \(f\left(k,{(sk)}^{\alpha \beta }\right)\) about k is a constant m, the modified model will be the same as the AK Model (Khaled Hussein & Thirlwall, A. 2000) [9].

In the modified model, the new private marginal product of knowledge is \(\frac{\partial }{\partial k}f(k,{(sk)}^{\alpha \beta })\); on the counterpart, for social planners, the new social marginal product of knowledge is \(\frac{\partial }{\partial k}f\left(k,{(sk)}^{\alpha \beta }\right)+s{(sk)}^{\alpha \beta -1}*\frac{\partial }{\partial K}f(k,{(sk)}^{\alpha \beta })\). Under this circumstance, in order to reach the Pareto Optimality (Yew-Kwang Ng, 1973) [10], Romer’s political advice will also need to be utilized as well. Since the private marginal product of knowledge and the social marginal product of knowledge are both increasing functions related to \(\alpha \beta \), the larger \(\alpha \beta \) is, the larger private and social marginal product of knowledge will be. The consequence is: not only both the socially optimal knowledge stock and equilibrium knowledge stock will be larger, but both the socially optimal rate of economic growth and the equilibrium optimal rate of economic growth will be larger.

5 Conclusion

By importing new variables about heterogeneity and the ability to absorb knowledge, there are several further conclusions can be made depend on the results above.

The spillover effect of knowledge is related to the diversity of the new knowledge \(\beta \). Therefore, duplicate construction will be tremendously harmful to one country’s economic power, since duplicate construction will result in lowering the index of the diversity of new knowledge, the marginal product of knowledge, socially knowledge stock (both the social optimal and the equilibrium optimal), and increasing rate of economic growth (both the social optimal and the equilibrium optimal).

From the modified model, we can conclude that international trade will have a positive effect on economic growth. During the international trade, the number of different kinds of knowledge that countries can learn will increase substantially; on the other side, it can also open a whole new market for a country, which as a result increasing the value of s, total industries in the function, and the marginal product of knowledge. Eventually, it will reflect to increasing the rate of economic growth.

The ability to absorb new knowledge \(\alpha \) is highly related to the citizen’s overall educational level. Therefore, reinforcing the investment in educational programs and stocking more and more high-valued human capitals will accelerate a country’s economic growth.

References

Arrow, K.J.: The economic implications of learning by doing. In: Readings in the Theory of Growth, pp. 131–149. Palgrave Macmillan, London (1971)

Kaldor, N.: A model of economic growth. Econ. J. 67(268), 591–624 (1957)

Solow, R.M.: A contribution to the theory of economic growth. Q. J. Econ. 70(1), 65–94 (1956)

Uzawa, H.: Optimum technical change in an aggregative model of economic growth. Int. Econ. Rev. 6(1), 18–31 (1965)

Romer, P.M.: Increasing returns and long-run growth. J. Polit. Econ. 94(5), 1002–1037 (1986)

Aghion, P., Howitt, P., Howitt, P.W., Brant-Collett, M., García-Peñalosa, C.: Endogenous Growth Theory. MIT Press, Cambridge (1998)

Barro, R.J.: Determinants of economic growth: a cross-country empirical study, No. w5698. National Bureau of Economic Research (1996)

Cass, D.: Optimum growth in an aggregative model of capital accumulation. Rev. Econ. Stud. 32(3), 233–240 (1965)

Hussein, K., Thirlwall, A.P.: The AK model of “new” growth theory is the Harrod-Domar growth equation: investment and growth revisited. J. Post Keynes. Econ. 22(3), 427–435 (2000)

Ng, Y.K.: The economic theory of clubs: Pareto optimality conditions. Economica 40(159), 291–298 (1973)

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Zhu, Z. (2021). Ability to Absorb Knowledge and Endogenous Economic Growth: Expansion of Romer Economic Model. In: Yuan, C., Li, X., Kent, J. (eds) Proceedings of the 4th International Conference on Economic Management and Green Development. Applied Economics and Policy Studies. Springer, Singapore. https://doi.org/10.1007/978-981-16-5359-9_46

Download citation

DOI: https://doi.org/10.1007/978-981-16-5359-9_46

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-5358-2

Online ISBN: 978-981-16-5359-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)