Abstract

The twofold purpose of this chapter is to provide a detailed literature review on the relationship between intellectual capital and firm value and to present an empirical study of this relationship in developing countries. The originality of this study lies in the use of the multilevel modeling method to analyze a large cross-country data set of 12,331 firms from 26 countries. The efficiency of intellectual capital is measured with value-added intellectual coefficient. Market value, earnings quality, return on asset, and return on equity are employed as proxies of firm value and performance. Variance coefficient and random intercept models are estimated. The findings imply that the efficient management of intellectual capital increases the profitability of sample firms. However, no significant relationship is detected between intellectual capital and market value. These results indicate that intellectual capital increases firm profitability in developing countries. However, investors in these countries do not count intellectual capital in their valuation processes. Managers can increase their firms’ profitability by efficient management of intellectual capital in developing countries.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

According to corporate finance theory, the main objective of management is to maximize a firm’s value (Brigham & Ehrhardt, 2013; Jensen, 2001; Ross et al., 2016). Estimating the value of a firm and understanding its determinants are vital for managerial decision-making (Damadoran, 2007). There are different ways to measure the value of a firm. Intrinsic value and market value are the two most relevant for this chapter. The intrinsic value of a firm is a function of the magnitude and risk level of its future free cash flow streams. In contrast, the market value is decided in the free market. It is identical to the intrinsic value under perfect market conditions. Although information asymmetry prevalent in the real world causes market imperfections, the market value equates with intrinsic value in equilibrium. The market value of a firm is a function of various firm-, industry-, and country-specific factors. Corporate governance structure, capital structure, and dividend policy decisions are the main drivers of the market value (Antwi et al., 2012; Chen et al., 2019; Makhija & Spiro, 2000; Naceur & Goaied, 2002). An alternative measure is the book value, which is defined as total asset value on the balance sheet. Edvinsson and Malone (1997) define the difference between market and book values as Intellectual Capital (IC), which comprises intellectual property of a firm and the expertise of its employees. IC is an intangible asset that can create tangible profit (Sullivan, 2000). However, there is no generally accepted definition of IC (Sardo & Serrasqueiro, 2017). Lin et al. (2015) state that “IC comprises intangible assets, including skills, know-how, brands, corporate reputation, organizational capabilities, relationships with customers and suppliers, employee innovativeness, and other identifiable intangible assets such as patents and royalties”. During the 1990s, researchers proposed tools for measuring the efficiency of IC, such as the balanced scorecard and the Skandia navigator (Bontis, 2001; Edvinsson & Malone, 1997; Kaplan & Norton, 2005). Among these tools, the value added intellectual coefficient (VAIC) model is the most popular one (Pulic, 1998, 2000). Recently, some researchers have suggested modifications to the VAIC approach to increase its effectiveness (Bayraktaroglu et al., 2019; Nadeem et al., 2017; Ulum et al., 2014; Xu & Li, 2019). Notwithstanding the limitations of VAIC (Stahle et al., 2011), it is still frequently used in IC research due to its simplicity, reliability, and comparability.

A recent trend is to consider IC as a component of a regional or national ecosystem (Pedro et al., 2018; Svarc et al., 2020). Bellucci et al. (2020) state that “the diverse meaning that IC management can assume in particular local contexts, such as economically advanced countries or developing countries, democratic countries rather than oligarchic or even dictatorial regimes, liberal market economies or coordinated market economies, etc.” requires additional research. Lin and Edvinsson (2020) point out the need for comparative studies. The twofold purpose of this chapter is to provide a detailed literature review on the relationship between IC and firm value and to present an empirical study of this relationship in developing countries. A panel data set of 12,331 firms from 26 developing countries for the 2012–2018 period is analyzed using a multilevel modeling approach. Multilevel analysis is a tool for modeling hierarchical/nested data structures to examine the relationship between variables measured at different levels (De Leeuw et al., 2008). This method is particularly useful in studying cross-country panel data sets due to their multilevel structures. The data set consists of time, firm, and country levels. Multilevel modeling makes it possible to analyze the effects of each level separately (Skondral & Rabe-Hesketh, 2008).

The rest of the chapter proceeds as follows. Section two highlights the main theoretical approaches and empirical findings on the relationship between IC and firm value. Research methodology and the data are explained in section three. Results of the empirical analysis are presented in section four. Finally, section five concludes with a discussion of the findings and their implications for research and practice.

2 Literature Review

2.1 Theoretical Background

The agency theory of firm implies that managers are agents of the shareholders, and their main objective should be the maximization of shareholder wealth (Jensen & Meckling, 1976). The objective becomes the maximization of the stock price for publicly listed firms under the assumption that there is not any asymmetric information nor agency problem between managers and shareholders (Ross et al., 2016). The stakeholder theory rejects this view and suggests that managerial decision-making should consider the interests of any individual or group who affects and/or is affected by the corporate activity (Donaldson & Preston, 1995). Similarly, Resource-Based View (RBV) theory implies that a firm’s unique resources generate its value (Barney, 1991). As Jensen (2001) states, stakeholder theory cannot be accepted as a substitute to the value maximization approach since it fails to provide a single objective for the management. This single objective enables managers to find their way along the jungle of possible investment, financing, and dividend decisions. It also improves social welfare (Jensen, 2002). The continuing debate between these two views shows the necessity of a more mutualistic approach (Freeman et al., 2020). The stakeholder theory states that the success of a firm is decided by the total wealth generated for its stakeholders (Riahi-Belkaoui, 2003). On the other hand, the value maximization approach emphasizes firm value, which can be defined as book, market, or intrinsic values. The book value is equal to the total assets in the balance sheet. Actually, it is an unrealistic measure due to the historical cost assumption of accounting. It is assumed that the value of assets should be recorded at their initial costs on the balance sheet. Even though some depreciation or amortization adjustments are made for the long-term assets over the years, the book value of a firm rarely reflects its fair value. Besides, it is extremely difficult to decide fair values of the assets due to market inefficiency and the low probability of finding similar assets on sale in the market at the time of valuation. Even if the fair values of the assets are known, the going concern value of the firm might be different from the sum of the fair values of its assets. Thus, the total value of assets reported in the balance sheet may be far from reflecting the actual firm value. That discussion implies that the off-balance-sheet assets also affect the value of a firm.

The market value of a firm is the sum of the market values of its debt and equity. The market value of debt is usually accepted to be very close to its book value. However, this is not the case for the market value of equity. It is a function of the stock price and the number of shares outstanding for a publicly listed firm. If the efficient market hypothesis holds and if the markets are at equilibrium, market value is equal to intrinsic value. The intrinsic value of a firm can be estimated by the Discounted Cash Flow (DCF) method (Damodaran, 2007). Since Fisher (1930) first provided a formal definition of the DCF concept, it became the most well-known and broadly used valuation method. DCF states that the present value of an asset is the sum of the present values of its future cash flow streams. In this context, the value of a firm can be formulated as follows:

Here, \({V}_{0}\) is the intrinsic value of the firm at present time (at time 0), \({FCF}_{t}\) is the expected future free cash flow at time t and \({WACC}_{t}\) is the weighted average cost of capital of the firm at time t. \({WACC}_{t}\) reflects both the risk of \({FCF}_{t}\) and the financing mix used to raise the necessary capital. \(FCF\) is calculated as follows:

Here, EBIT is earnings before interest and taxes, \({{\varvec{t}}}_{{\varvec{c}}}\) is the corporate tax rate and \(\Delta NWC\) is the change in the networking capital. The firm values estimated using DCF and Economic Value Added (EVA) approaches are equivalent if the assumptions about growth and reinvestment are the same (Damodaran, 2007; Shrieves & Wachowicz, 2001). Both estimations are based on EBIT (Iazzolino, 2014). Thus, firm value is a function of profits generated by its tangible and intangible assets. Initially, the term IC is used as synonymous with the intangible assets of a firm (Edvinsson & Malone, 1997; Sullivan, 2000). Later, it became clear that it is a subset of the intangible assets (Petty & Guthrie, 2000). IC is the value-generating knowledge and capacities based on intangible assets of a firm (Pedro et al., 2018).

The IC literature has evolved four stages since the first introduction of the term by Galbraith in (1969) (Lin & Edvinsson, 2020; Pedro et al., 2018; Roos & O’Connor, 2015). During the first stage, which lasted until the early 2000s, researchers have focused their attention on raising general awareness of IC management (Dumay & Garanina, 2013; Petty & Guthrie, 2000). Some early attempts to measure the efficiency of IC are made (Edvinsson & Malone, 1997; Kaplan & Norton, 2005). The value added intellectual coefficient (VAIC) approach, developed by Pulic (1998, 2000), becomes the most widely adopted measurement tool (Iazzolino et al., 2014). From 2000 to 2003, the second stage of the literature is developed with the emergence of empirical studies on measurement and disclosure of IC (Lin & Edvinsson, 2020). Petty and Guthrie (2000) emphasize that the distinction between the first two stages should not be chronological. According to their view, research works should be classified based on content. The three components of IC are defined as human, relational, and structural capital in the second stage (Guthrie et al., 2012). Human capital refers to the knowledge, competence, and inter-relationship ability of employees (Chen et al., 2004). Structural capital is the knowledge embedded in the organizational structure and the processes of a firm. Relational capital is the knowledge embedded in customers and external relations of the firm (Guthrie et al., 2012). The third stage of IC research emerges from critical analyses of IC management in practice (Guthrie et al., 2012). Lastly, the fourth stage constitutes the state-of-the-art in IC research and considers IC as a component of a regional or national ecosystem (Mahmood & Mubarik, 2020; Pedro et al., 2018; Svarc et al., 2020).

2.2 Empirical Studies

Firm profitability, leverage ratio, asset tangibility, size, and growth opportunity are the well-known determinants of market value (Buchanan et al., 2018; Desai & Dharmapala, 2009; Maury & Pajuste, 2005). Some researchers document significant relationships between efficiency of IC and firm value (Chen et al., 2004; Maditinos et al., 2011; Nadeem et al., 2017; Singla, 2020; Soetanto & Liem, 2019; Wang, 2008, 2013). Others fail to detect any relationship. (Firer & Williams, 2003; Ghosh & Mondal 2009; Mosavi et al., 2012; Tan et al., 2007). The empirical knowledge about the relationship between IC and firm value is mostly based on single-country studies. In an early study, Bozbura (2004) shows that human and relational capital increases firm value and structural capital has correlations with human and relational capitals in Turkey. Using a survey method, Tseng and James Goo (2005) found that the efficient management of IC increases firm value in Taiwan. Chen et al. (2005) have shown that IC has a positive impact on both market value and performance in Taiwan. Veltri and Silvestri (2011) find that human capital has a more significant effect on firm value than structural capital in Italy. Clarke et al. (2011) report a positive relationship between the IC and the performance of Australian firms. Liang et al., (2011) use a panel dataset to investigate the mediating role of IC on the relationship between corporate ownership and firm value in Taiwan. They find that IC has a mediating role in high-tech industries. Wang (2013) detects a positive relationship between IC and firm value in Taiwan. Using a large sample of Chinese listed firms, Li and Zhao (2018) use a GMM estimation approach to analyze the dynamic effect of IC on firm value. They fail to detect a significant impact of human capital on firm value. However, significant relationships between current and past organizational capitals and firm value have been documented. Thus, even though intellectual capital investments have a decreasing effect on the current firm value, they increase future value. Ahmed et al. (2019) document the positive impacts of organizational and human capital on firm performance in Pakistan. Bayraktaroğlu et al. (2019) report positive relationships between Turkish firms’ IC components and firm performance. In addition, they detect that innovation has a moderating role between structural capital and performance. Similarly, Soetanto and Liem (2019) find a positive effect of IC on firm performance in Indonesia. Singla (2020) show that IC affects the performance of Indian infrastructure firms. Ting et al. (2020) report a negative relationship between Taiwanese electronic firms’ IC and firm performance. They attribute this finding to the relative weight of capital employed efficiency in their IC measure. Xu and Liu (2020) investigate the relationship between IC and firm performance in South Korea. They find that human capital efficiency increases performance while relational capital decreases it. Structural capital does not affect firm performance for this country.

There are some cross-country studies on the relationship between IC and firm value. Using the system GMM estimation method, Nimtrakoon (2015) finds the efficient management of IC increases firm performance in ASEAN countries. Sardo and Serrasqueiro (2017) use the same methodology to analyze non-financial listed firms from 14 Western European countries. They show that human capital is a key indicator of firm value. Nirino et al. (2020) reach the same conclusion using a data set that contains 345 European firms. Recently, several systematic literature reviews on IC are published (Alvino et al., 2020; Bellucci et al., 2020; Crupi et al., 2020; Lin & Edvinsson, 2020). They reveal the necessity of developing better methods to measure IC as well as an ecosystem-oriented and interdisciplinary research agenda. In addition, the relationship between IC and firm value in advanced or developing countries is suggested as a further research topic (Bellucci et al., 2020; Lin & Edvinsson, 2020). It can be assumed that the relationship between IC and firm value in developing countries may be different from that in developed countries. The remaining part of the chapter aims to contribute to this literature by analyzing the impact of IC on firm value in developing countries.

3 Data and Methodology

3.1 Sample and Variables

The sample comprises 12,331 firms from 26 developing countries selected from the upper and lower-middle-income groups of the World Bank’s country classifications by income level (World Bank Group, n.d.). Financial statement data of sample firms are obtained from the Compustat database. The sample period covers nine years between 2010 and 2018. Financial firms are excluded from the sample because their balance sheets have a different structure from those of nonfinancial firms. Firms with negative equity are also excluded from the sample because they are financially troubled. As can be seen in Table 1, the number of firms varies from country to country and across time. The total sample consists of 100,041 firm-year observations. China and India have the highest numbers of firms with 30,104 and 28,825 firm-year observations, respectively. Botswana, Ghana, and Zambia are countries with the lowest number of firms in the sample with 98, 117, and 114 firms, respectively. The sample panel data set has an unbalanced structure since observations for some firms in some years are missing.

Market value (MV), earnings quality (EQ), return on asset (ROA), and return on equity (ROE) are the dependent variables in this study. MV is natural logarithm of the market value of equity and the book value of liabilities. The market value of equity is estimated by multiplying the number of shares outstanding by the year-end stock price. Following Xu and Li (2019) natural logarithm of earnings before taxes is used as a proxy of earning quality. Also, ROA and ROE are employed as indicators of firm profitability. Following Pulic (2000), intellectual capital is measured by the value added intellectual coefficient (VAIC). It is the sum of human capital efficiency (HCE), structural capital efficiency (SCE), and capital employed efficiency (CCE). HCE gives the unit value added (VA) for one unit increase in human capital (HC). HC is equal to salaries and wages expense. VA is estimated as the sum of operating profit and HC. SCE measures the structural capital (SC) as a percentage of value added. SC is estimated as the difference between value added and salaries and wages expense. CEE gives the unit value added for one unit increase in physical and financial capital (CA). CA is equal to tangible assets. Following Xu and Li (2019) and Ting et al. (2020), market leverage (LEV), firm size (SIZ), market to book ratio (MtB), asset tangibility (TAN), current ratio (CUR), and research and development (RD) are employed as control variables. LEV is measured as the financial debt over the total invested capital. Financial debt is the sum of short and long-term debt. Total invested capital is the sum of the financial debt and the market value of equity. SIZ is measured as the natural logarithm of total assets. MtB is the ratio of market value to book value. TAN is representation of fixed assets as a percentage of total assets. CUR is measured as the ratio of current assets to current liabilities. The last variable is a dummy variable (RD), which takes a value of 1 when the firm reports a research and development expense and takes the value of 0 otherwise. Variable definitions are given in Table 2.

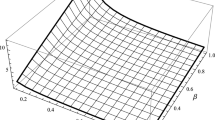

The line graphs of the mean values of dependent variables and VAIC are displayed in Fig. 1. The mean value of MV decreases between 2010 and 2013. It increases each year for the rest of the sample period. A similar pattern exists for EQ and VAIC. The mean values of ROE and ROA increase only between 2015 and 2017.

Descriptive statistics of variables are presented in Table 3. The mean and the median values of dependent variables are close. Their skewness values indicate approximately symmetric distributions. However, kurtosis values show that their observations are heavily accumulated around the mean. VAIC has a skewed distribution with a much higher peak even after trimming at 1–99%.

Pearson correlation coefficients are shown in Table 4. Significant correlations exist between all pairs of dependent variables. Furthermore, VAIC has positive and significant correlations with all of the dependent variables. In addition, SIZ, MtB, and TAN have significant correlations with VAIC. Nevertheless, the magnitudes of these coefficients are smaller than or equal to 10%. Thence, none of them indicates multicollinearity.

3.2 Methodology

The estimation method employed in this study is chosen considering the multilevel structure of the sample data. Cross-sectional and over-time heterogeneity both exist in this structure. Additionally, an extra level of heterogeneity is created when firms are nested in countries. The unbiasedness and efficiency of the ordinary least squares estimation depend on the validity of several assumptions. One of them is random error terms’ not being correlated with each other. This assumption is not satisfied in the case of a hierarchical data structure. The two-stage least squares estimation method can be used to overcome that problem. However, such an approach decreases the degree of freedom, especially with a large number of groups. Another solution is to include explanatory variables that measure group characteristics instead of dummy variables. However, it may not be possible to find variables that can accurately measure group effects. If the group effects are not taken into account, the estimates of the standard errors are biased. This bias leads to narrow confidence intervals and smaller p-values. As a result, the probability of making type 1 error increases (Steele, 2008). The multilevel estimation method makes it possible to model group-level variability (Raudenbush & Bryk, 2002). Besides, it provides the opportunity to examine the group-level effects (Woltman et al., 2012). Panel data, which is formed by combining cross-sectional and time-series data, has a very suitable structure for a simple multilevel model. In this structure, the time dimension constitutes the second level while the cross-section units are located at the first level (Snijders & Bosker, 1999). If the cross-sectional units are also grouped within themselves, the model turns into a three-level hierarchical structure. Multilevel models can be used even if the panel data is unbalanced (Skondral & Rabe-Hesketh, 2008). Simultaneous analysis of within-level and cross-level relationships is possible via multilevel analysis (Woltman et al., 2012). Multilevel models can be used even if the panel data is unbalanced.

In this study, the data set has three levels where time and firm are identifiers of the third and the second levels, respectively. Firms are nested in countries to create the first and the highest level. Two types of multilevel models are employed in this study. The first one is the Variance Components Model (VCM). It shows the impact of each level on the variance of the dependent variable. The VCM equations for each dependent variable are specified as follows:

where, \({MV}_{kit},\) \({EQ}_{kit},\) \({ROE}_{kit}\) and \({ROA}_{kit}\) are MV, EQ, ROE and ROA values at time \(t\) for the \(i\) th firm in \(k\) th country, respectively. \({\alpha }_{0}\), \({\beta }_{0}\), \({\gamma }_{0}\) and \({\delta }_{0}\) are mean values of the dependent variables. \({\eta }_{k}\), \({\theta }_{k}\), \({\tau }_{k}\) and \({\sigma }_{k}\) are the country level error terms for the \(k\) th country. Thus, mean values of the dependent variables for the \(k\) th country are \({\alpha }_{0}+{\eta }_{k},\) \({\beta }_{0}+{\theta }_{k}\), \({\gamma }_{0}+{\tau }_{k}\) and \({\delta }_{0}+{\sigma }_{k}\). Similarly, \({\mu }_{ki}\), \({\pi }_{ki}\), \({\lambda }_{ki}\) and \({\zeta }_{ki}\) are firm level error terms for the \(i\) th firm in \(k\) th country. Lastly, \({\nu }_{kit}, {e}_{kit}\), \({\varepsilon }_{kit}\) and \({\epsilon }_{kit}\) are time level error terms for the \(i\) th firm in \(k\) th country at time \(t\). Error terms at all levels are assumed to have normal distributions with zero means and constant variances.

Random Intercept Model (RIM) is the second multilevel model employed in this study. The RIM equations for each dependent variable are specified as follows:

where, \({VAIC}_{kit}\) is VAIC value at time \(t\) for the \(i\) th firm in \(k\) th country and \({X}_{m,kit}\) is the value that \(m\) th control variable takes at time \(t\) for the \(i\) th firm in \(k\) th country. Control variables included in the models are LEV, SIZ, RD, MtB, TAN CUR and RD. Since profitability is a well-known determinant of firm value, ROE is also included in the first model as an additional control variable. \({\alpha }_{1}\), \({\beta }_{1}\), \({\gamma }_{1}\) and \({\delta }_{1}\) are the coefficients of the focus variable and \({\alpha }_{m}\), \({\beta }_{m}\), \({\gamma }_{m}\) and \({\delta }_{m}\) are the coefficients of \(m\) th control variable. All coefficients except the intercept are accepted as fixed in RIM. The models are estimated using the maximum likelihood (ML) estimation method. Since ML is an asymptotic method, its consistency relies on the sample size. Hox et al. (2010) states that both the coefficient and standard error estimates are getting more accurate when sample sizes are increased at each level. The following hypotheses were formulated for this study:

H1: There is no relationship between a firm's IC and its value in developing countries.

H2: There is no relationship between a firm's IC and its profitability in developing countries.

4 Results

Table 5 presents the results of the VCM models given in Eq. 3. Overall (grand) mean values of the dependent variables are displayed in the first part of the table. The variance components of each level are presented in the second part. Lastly, the interclass correlation coefficients (ICC) are given in the third part. ICCs are estimated by proportioning the variability of the dependent variable at each level to the total variability.

63% of the total variability in MV across sample firms are caused by country-level factors. Similarly, 33% of the variability in MV comes from firm-level factors. Only 4% of it is due to time level. The ICCs at country, firm, and time levels have similar percentages in EQ. Thus, more than half of the variabilities in MV and EQ are coming from the country-level factors. These initial findings validate the employed methodology in this study. The country-level ICCs are only 2% and 4% for ROE and ROA, respectively. The time level is found to have the highest effect on the variability of these two profitability measures. As can be seen in Table 6, the variance components change with the inclusion of independent variables in the RIM model. The country-level variabilities of MV and EQ have decreased when RIM model is estimated. These findings show that a multilevel methodology is a useful approach for investigating the role of IC as a determinant of firm value in a cross-country context.

Table 6 presents results for the RIM models given in Eq. 4. The focus variable, VAIC, is found to have statistically significant and positive effects on EQ, ROE, and ROA. Thence, H2 is rejected against its alternative. In line with the previous literature, these findings show the importance of IC investments for firm profitability (Bayraktaroğlu et al., 2019; Li & Zhao, 2018; Singla, 2020). However, no significant relationship is detected between VAIC and MV. Thus, the null hypothesis H1 cannot be rejected. These findings imply that the present efficiency of IC is not an indication of future efficiency in developing countries. Previous studies have found a positive relationship between IC and firm value in developed countries (Nirino et al., 2020; Sardo & Serrasqueiro, 2017). Present market value reflects the expectations of shareholders about future firm performance. According to these findings, investors in developing countries do not consider the current intellectual capital in their valuation process.

As for the control variables, the findings are consistent with those of the mainstream literature. ROE is found to have a positive effect on MV. The investors accept current profitability as an indicator of future profitability. ML has negative and significant coefficients in all models. Firms with high levels of indebtedness are less profitable with lower market values. The coefficient of SIZ is positive and significant for all models in Table 6. Since large firms are unlikely to go bankrupt, they are less likely to suffer from indirect bankruptcy costs. These costs may decrease both profitability and value. RD of a firm is found to have a positive effect on MV, EQ, and ROA. Firms with a reported research development expense have higher firm values, better earnings qualities, and a higher return on assets. MtB has positive and significant effects on MV, EQ, and ROE. Thus, firms with a higher growth opportunity are more valuable and more profitable. TAN has a positive and significant effect on MV. However, its significance level is only 10%. Like firm size, asset tangibility is an indicator of the financial strength of the firm. All other things equal, firms with a larger number of fixed assets are more valuable. On the other hand, TAN has a negative and highly significant effect on EQ, ROE, and ROA, an increase in fixed asset investments decreases current profitability. Lastly, CUR has a negative and significant impact on MV and EQ. The current ratio is an indicator of the working capital investment. Investing in working capital decreases the market values of firms. CUR has a positive effect on ROA. When the total assets are constant, an increase in CUR is either the result of a decrease in TAN or an increase in long-term debt. Decreasing TAN increases profitability for service firms, which operate in more knowledge-based and less capital-intensive industries.

As a robustness check, the models presented in Eq. 4 are re-estimated with decomposing VAIC into HCE, SCE, and CEE components. The results are displayed in Table 7. CEE is found to be the most influential predictor of firm performance. In line with the findings of Ting et al. (2020), it has a negative effect on MV. However, the magnitude of the coefficients is not large enough to offset the insignificant effects of HCE and SCE on MV. Overall, these results indicate that firms can increase their value in the short run by reducing CEE. The results indicate that CEE has positive and significant effects on EQ, ROE, and ROA, which is consistent with the previous literature (Chen et al., 2005; Clarke et al., 2011), These findings imply that CEE is the most crucial component of IC in developing countries. SCE does not affect any of the dependent variables except EQ. Similarly, HCE is found to have a significant effect only on EQ. Quality of earnings decreases with HCE and increases with SCE. These findings indicate that firm profitability increases with the efficiency of IC in developing countries. Results related to control variables are similar to the results of the models presented in Table 6.

5 Conclusion

This chapter provides a detailed literature review on the relationship between IC and firm value and it presents an empirical study on that relationship. Some studies have documented a positive relationship between IC and firm value. Some other studies have found that all or some of the IC components do not affect or negatively affect firm value. In a recent literature review, Bellucci et al. (2020) suggest analyzing the impact of IC on firm value in advanced and developing countries as a further research topic. Following their suggestion, this chapter investigates the impact of IC management on firm value in developing countries.

IC is measured using VAIC. The proxies of firm performance are determined as market value, earnings quality, return on asset, and return on equity. The results indicate that IC has a positive effect on earnings quality and profitability of sample firms. The relationship between VAIC and firm value is considered insignificant in this study. CEE is found to be the most effective component of VAIC. It has a negative effect on market value and has a positive effect on profitability. According to the results, SCE and HCE only affect earnings quality. Even though IC increases the current profitability, it does not affect the market value of the firm. These results imply that IC efficiency increases firm profitability in developing countries. However, investors in these countries do not value IC efficiency apart from its effect on the current profitability.

The findings are useful for both researchers and managers. As best known to the author, this is the first attempt for using a multilevel modeling approach to investigate the relationship between IC and firm value. Furthermore, the sample data set is one of the largest in terms of the number of sample firms and countries. These results can be used as a basis of comparison in future cross-country researches.

The results regarding VAIC and capital employed efficiency, which are shown to have positive effects on quality of earnings and profitability can be useful for managers in developing countries. Efficient management of IC can help them in increasing firm profitability. However, they should humble their expectations regarding the positive effect of IC efficiency on firm value.

References

Ahmed, S. S., Guozhu, J., Mubarik, S., Khan, M., & Khan, E. (2019). Intellectual capital and business performance: The role of dimensions of absorptive capacity. Journal of Intellectual Capital, 21(1), 23–39. https://doi.org/10.1108/JIC-11-2018-0199

Alvino, F., Di Vaio, A., Hassan, R., & Palladino, R. (2020). Intellectual capital and sustainable development: A systematic literature review. Journal of Intellectual Capital. https://doi.org/10.1108/JIC-11-2019-0259

Antwi, S., Mills, E. F. E. A., & Zhao, X. (2012). Capital structure and firm value: Empirical evidence from Ghana. International Journal of Business and Social Science, 3(22), 103–111.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Bayraktaroglu, A. E., Calisir, F., & Baskak, M. (2019). Intellectual capital and firm performance: An extended VAIC model. Journal of Intellectual Capital, 20(3), 406–425. https://doi.org/10.1108/JIC-12-2017-0184

Bellucci, M., Marzi, G., Orlando, B., & Ciampi, F. (2020). Journal of Intellectual Capital: A review of emerging themes and future trends. Journal of Intellectual Capital. https://doi.org/10.1108/JIC-10-2019-0239

Bontis, N. (2001). Assessing knowledge assets: A review of the models used to measure intellectual capital. International Journal of Management Reviews, 3(1), 41–60. https://doi.org/10.1111/1468-2370.00053

Bozbura, F. T. (2004). Measurement and application of intellectual capital in Turkey. The Learning Organization, 11(4/5), 357–367. https://doi.org/10.1108/09696470410538251

Brigham, E. F., & Ehrhardt, M. C. (2013). Financial management: Theory & practice (13th ed.). Cengage Learning.

Buchanan, B., Cao, C. X., & Chen, C. (2018). Corporate social responsibility, firm value, and influential institutional ownership. Journal of Corporate Finance, 52(2018), 73–95. https://doi.org/10.1016/j.jcorpfin.2018.07.004

Chen, J., Zhu, Z., & Xie, H. Y. (2004). Measuring intellectual capital: A new model and empirical study. Journal of Intellectual Capital, 5(1), 195–212. https://doi.org/10.1108/14691930410513003

Chen, M. C., Cheng, S. J., & Hwang, Y. (2005). An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. Journal of Intellectual Capital., 6(2), 159–176. https://doi.org/10.1108/14691930510592771

Chen, Y. S., Lin, Y. H., Wu, T. H., Hung, S. T., Ting, P. J. L., & Hsieh, C. H. (2019). Re-examine the determinants of market value from the perspectives of patent analysis and patent litigation. Scientometrics, 120(1), 1–17. https://doi.org/10.1007/s11192-019-03119-7

Clarke, M., Seng, D., & Whiting, R. H. (2011). Intellectual capital and firm performance in Australia. Journal of Intellectual Capital, 12(4), 505–530. https://doi.org/10.1108/14691931111181706

Crupi, A., Cesaroni, F., & Di Minin, A. (2020). Understanding the impact of intellectual capital on entrepreneurship: A literature review. Journal of Intellectual Capital. https://doi.org/10.1108/JIC-02-2020-0054

Damodaran, A. (2007). Valuation approaches and metrics: A survey of the theory and evidence. Now Publishers Inc.

De Leeuw, J., Meijer, E., & Goldstein, H. (2008). Handbook of multilevel analysis. Springer.

Desai, M. A., & Dharmapala, D. (2009). Corporate tax avoidance and firm value. The Review of Economics and Statistics, 91(3), 537–546. https://doi.org/10.1162/rest.91.3.537

Donaldson, T., & Preston, L. E. (1995). The stakeholder theory of the corporation: Concepts, evidence, and implications. Academy of Management Review, 20(1), 65–91.

Dumay, J., & Garanina, T. (2013). Intellectual capital research: A critical examination of the third stage. Journal of Intellectual Capital, 14(1), 10–25. https://doi.org/10.1108/14691931311288995

Edvinsson, L., & Malone, M. S. (1997). Intellectual capital: Realizing your company’s true value by finding its hidden brainpower. Harper Business.

Firer, S., & Williams, S. M. (2003). Intellectual capital and traditional measures of corporate performance. Journal of Intellectual Capital, 4(3), 348–360.

Fisher, I. (1930). Theory of interest: As determined by impatience to spend income and opportunity to invest it. Macmillan.

Freeman, R. E., Phillips, R., & Sisodia, R. (2020). Tensions in stakeholder theory. Business and Society, 59(2), 213–231. https://doi.org/10.1177/0007650318773750

Galbraith, J. K. (1969). Intellectual capital. Wiley.

Ghosh, S., & Mondal, A. (2009). Indian software and pharmaceutical sector IC and financial performance. Journal of Intellectual Capital, 10(3), 369–388.

Guthrie, J., Ricceri, F., & Dumay, J. (2012). Reflections and projections: A decade of intellectual capital accounting research. The British Accounting Review, 44(2), 68–82. https://doi.org/10.1016/j.bar.2012.03.004

Hox, J. J., Moerbeek, M., & van de Schoot, R. (2010). Multilevel analysis: Techniques and applications. Routledge.

Iazzolino, G., Laise, D., & Migliano, G. (2014). Measuring value creation: VAIC and EVA. Measuring Business Excellence, 18(1), 8–21. https://doi.org/10.1108/MBE-10-2013-0052

Jensen, M. C. (2001). Value maximization, stakeholder theory, and the corporate objective function. Journal of Applied Corporate Finance, 14(3), 8–21. https://doi.org/10.1111/j.1745-6622.2001.tb00434.x

Jensen, M. C. (2002). Value maximization, stakeholder theory, and the corporate objective function. Business Ethics Quarterly, 12(2), 235–256. https://doi.org/10.2307/3857812

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Kaplan, R. S., & Norton, D. P. (2005). The balanced scorecard: Measures that drive performance. Harvard Business Review, 83(7), 172.

Li, Y., & Zhao, Z. (2018). The dynamic impact of intellectual capital on firm value: Evidence from China. Applied Economics Letters, 25(1), 19–23. https://doi.org/10.1080/13504851.2017.1290769

Liang, C. J., Huang, T. T., & Lin, W. C. (2011). Does ownership structure affect firm value? Intellectual capital across industries perspective. Journal of Intellectual Capital, 12(4), 552–570. https://doi.org/10.1108/14691931111181724

Lin, C. Y. Y., & Edvinsson, L. (2020). Reflections on JIC’s twenty-year history and suggestions for future IC research. Journal of Intellectual Capital. https://doi.org/10.1108/JIC-03-2020-0082

Lin, Y. M., Lee, C. C., Chao, C. F., & Liu, C. L. (2015). The information content of unexpected stock returns: Evidence from intellectual capital. International Review of Economics and Finance, 37, 208–225. https://doi.org/10.1016/j.iref.2014.11.024

Maditinos, D., Chatzoudes, D., Tsairidis, C., & Theriou, G. (2011). The impact of intellectual capital on firms’ market value and financial performance. Journal of Intellectual Capital, 12(1), 132–151. https://doi.org/10.1108/14691931111097944

Mahmood, T., & Mubarik, M. S. (2020). Balancing innovation and exploitation in the fourth industrial revolution: Role of intellectual capital and technology absorptive capacity. Technological Forecasting and Social Change. https://doi.org/10.1016/j.techfore.2020.120248

Makhija, A. K., & Spiro, M. (2000). Ownership structure as a determinant of firm value: Evidence from newly privatized Czech firms. Financial Review, 35(3), 1–32. https://doi.org/10.1111/j.1540-6288.2000.tb01419.x

Maury, B., & Pajuste, A. (2005). Multiple large shareholders and firm value. Journal of Banking and Finance, 29(7), 1813–1834. https://doi.org/10.1016/j.jbankfin.2004.07.002

Mosavi, S. A., Nekoueizadeh, S., & Ghaedi, M. (2012). A study of relations between intellectual capital components, market value and finance performance. African Journal of Business Management, 6(4), 1396–1403. https://doi.org/10.5897/AJBM11.1466

Naceur, S. B., & Goaied, M. (2002). The relationship between dividend policy, financial structure, profitability and firm value. Applied Financial Economics, 12(12), 843–849. https://doi.org/10.1080/09603100110049457

Nadeem, M., Gan, C., & Nguyen, C. (2017). Does intellectual capital efficiency improve firm performance in BRICS economies? A dynamic panel estimation. Measuring Business Excellence, 21(1), 65–85. https://doi.org/10.1108/MBE-12-2015-0055

Nimtrakoon, S. (2015). The relationship between intellectual capital, firms’ market value and financial performance: Empirical evidence from the ASEAN. Journal of Intellectual Capital, 16(3), 587–618. https://doi.org/10.1108/JIC-09-2014-0104

Nirino, N., Ferraris, A., Miglietta, N., Invernizzi, A. C. (2020). Intellectual capital: The missing link in the corporate social responsibility—Financial performance relationship. Journal of Intellectual Capital, https://doi.org/10.1108/JIC-02-2020-0038

Pedro, E., Leitão, J., & Alves, H. (2018). Intellectual capital and performance: Taxonomy of components and multi-dimensional analysis axes. Journal of Intellectual Capital, 19(2), 407–452. https://doi.org/10.1108/JIC-11-2016-0118

Petty, R., & Guthrie, J. (2000). Intellectual capital literature review: Measurement, reporting and management. Journal of Intellectual Capital, 1(2), 155–176. https://doi.org/10.1108/14691930010348731

Pulic, A. (1998). Measuring the performance of intellectual potential in knowledge economy. In 2nd McMaster world congress on measuring and managing intellectual capital, McMaster University, Hamilton.

Pulic, A. (2000). VAIC™—an accounting tool for IC management. International Journal of Technology Management, 20(5–8), 702–714. https://doi.org/10.1504/IJTM.2000.002891

Raudenbush, S. W., & Bryk, A. S. (2002). Hierarchical linear models: Applications and data analysis methods. (Vol. 1)Sage.

Riahi-Belkaoui, A. (2003). Intellectual capital and firm performance of US multinational firms: A study of the resource-based and stakeholder views. Journal of Intellectual Capital, 4(2), 215–226. https://doi.org/10.1108/14691930310472839

Roos, G., & O’Connor, A. (2015). Policy implications of intellectual capital: A manufacturing case study. Journal of Intellectual Capital, 16(2), 364–389. https://doi.org/10.1108/JIC-02-2015-0016

Ross, S., Westerfield, R., & Jaffe, J. (2016). Corporate finance. (8th ed.). McGraw-Hill Higher Education.

Skondral. A., & Rabe-Hesketh, S. (2008). Multilevel and related models of longitudinal data. In J. De Leeuw, E. Meijer & H. Goldstein, (Eds.), Handbook of multilevel analysis, (pp. 275–299). Springer.

Sardo, F., & Serrasqueiro, Z. (2017). A European empirical study of the relationship between firms’ intellectual capital, financial performance and market value. Journal of Intellectual Capital, 18(4), 771–788. https://doi.org/10.1108/JIC-10-2016-0105

Shrieves, R. E., & Wachowicz, J. M., Jr. (2001). Free cash flow (FCF), Economic value added (EVATM), and Net present value (NPV): A reconciliation of variations of discounted-cash-flow (DCF) valuation. The Engineering Economist, 46(1), 33–52. https://doi.org/10.1080/00137910108967561

Singla, H. K. (2020). Does VAIC affect the profitability and value of real estate and infrastructure firms in India? A panel data investigation. Journal of Intellectual Capital, 21(3), 309–331. https://doi.org/10.1108/JIC-03-2019-0053

Snijders, T. A. B., & Bosker, R. J. (1999). Multilevel analysis. An introduction to basic and advanced multilevel modeling. Sage.

Soetanto, T., & Liem, P. F. (2019). Intellectual capital in Indonesia: Dynamic panel approach. Journal of Asia Business Studies, 13(2), 240–262. https://doi.org/10.1108/JABS-02-2018-0059

Stahle, P., Stahle, S., & Aho, S. (2011). Value added intellectual coefficient (VAIC): A critical analysis. Journal of Intellectual Capital, 12(4), 531–551. https://doi.org/10.1108/14691931111181715

Steele, F. (2008). Multilevel models for longitudinal data. Journal of the Royal Statistical Society, 171(1), 5–19.

Sullivan, P. H. (2000). Value driven intellectual capital: How to convert intangible corporate assets into market value. Wiley Inc.

Svarc, J., Laznjak, J., & Dabic, M. (2020), The role of national intellectual capital in the digital transformation of EU countries. Another digital divide?. Journal of Intellectual Capital. https://doi.org/10.1108/JIC-02-2020-0024

Tan, H. P., Plowman, D., & Hancock, P. (2007). Intellectual capital and financial returns of companies. Journal of Intellectual Capital, 8(1), 76–95. https://doi.org/10.1108/14691930710715079

Ting, I. W. K., Ren, C., Chen, F. C., & Kweh, Q. L. (2020). Interpreting the dynamic performance effect of intellectual capital through a value-added-based perspective. Journal of Intellectual Capital, 21(3), 381–401. https://doi.org/10.1108/JIC-05-2019-0098

Tseng, C. Y., & James Goo, Y. J. (2005). Intellectual capital and corporate value in an emerging economy: Empirical study of Taiwanese manufacturers. R&D Management, 35(2), 187–201. https://doi.org/10.1111/j.1467-9310.2005.00382.x

Ulum, I., Ghozali, I., & Purwanto, A. (2014). Intellectual capital performance of Indonesian banking sector: A modified VAIC (M-VAIC) perspective. International Journal of Finance and Accounting, 6(2), 103–123.

Veltri, S., & Silvestri, A. (2011). Direct and indirect effects of human capital on firm value: Evidence from Italian companies. Journal of Human Resource Costing and Accounting, 15(3), 232–254. https://doi.org/10.1108/14013381111178596

Wang, J. C. (2008). Investigating market value and intellectual capital for S&P 500. Journal of Intellectual Capital, 9(4), 546–563. https://doi.org/10.1108/14691930810913159

Wang, M. C. (2013). Value relevance on intellectual capital valuation methods: The role of corporate governance. Quality and Quantity, 47(2), 1213–1223. https://doi.org/10.1007/s11135-012-9724-1

Woltman, H., Feldstain, A., MacKay, J. C., & Rocchi, M. (2012). An introduction to hierarchical linear modeling. Tutorials in Quantitative Methods for Psychology, 8(1), 52–69.

World Bank Group. (n.d). World bank country and lending groups. Retrieved December 11, 2020. https://datahelpdesk.worldbank.org/knowledgebase/articles/906519

Xu, J., & Li, J. (2019). The impact of intellectual capital on SMEs’ performance in China. Journal of Intellectual Capital, 20(4), 488–509. https://doi.org/10.1108/JIC-04-2018-0074

Xu, J., & Liu, F. (2020). The impact of intellectual capital on firm performance: A modified and extended VAIC model. Journal of Competitiveness, 12(1), 161–176. https://doi.org/10.7441/joc.2020.01.10

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Bilgin, R. (2021). The Role of Intellectual Capital as a Determinant of Firm Value. In: Shahbaz, M., Mubarik, M.S., Mahmood, T. (eds) The Dynamics of Intellectual Capital in Current Era. Springer, Singapore. https://doi.org/10.1007/978-981-16-1692-1_3

Download citation

DOI: https://doi.org/10.1007/978-981-16-1692-1_3

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-1691-4

Online ISBN: 978-981-16-1692-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)