Abstract

The financial services industry is at a crossroads around the world due to successive waves of innovation from mainframes, databases, desktop and personal computing, business software, big data, Internet of Things (IoT), and Artificial Intelligence (AI). Many start-ups such as Financial Technology (FinTechs) providers are challenging the traditional banking system by offering faster services without compromising compliance or risk especially in Gulf Cooperation Council (GCC). The collective nominal GDP for the GCC is nearing US$2trn in 2020. Recent unprecedented developments in big data, virtual reality, e-commerce, machine learning, and AI offer enormous business opportunities to financial institutions. On the other hand, the development might be hindered due to knowledge, attitude, and perceptions of professionals working in the GCC region. This research is developed through an online and paper-based questionnaire with responses from 157 professionals in the six GCC countries. The study uses descriptive and inferential statistics to analyse the data using SPSS. The findings show that the overwhelming majority of respondents in the GCC countries are familiar with AI from a business and finance perspective. The findings also identify participant’s concerns about ethical, security, and data privacy issues.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

Artificial Intelligence (AI) implementation in Gulf Cooperation Council (GCC) countries can boost the Middle East into new silicon hub and hydrocarbon-based economy. These countries are economically and financially strong with a collective nominal GDP nearing US$2trn in 2020 and average literacy rate around 94%. However, one cannot ignore the humanistic aspect of financial services industry practitioners in these countries. This chapter aims to analyse the knowledge, attitude and perceptions of professionals towards the use and implementation of AI in the Gulf Cooperation Council (GCC). According to Deloitte (2018), AI refers to a broad field of science encompassing not only computer science but also psychology, philosophy, linguistics, and other areas. AI is concerned with getting computers to do tasks that would normally require human intelligence. Currently, the use of AI in the financial system is at its initial stages, but it is gaining momentum with the passage of time.

Nowadays, the efficiency of computer machines and their low operating costs is playing an important role in adopting AI by financial institutions (Shalf & Leland, 2015). The world has gone through the fourth industrial revolution and stepped into the fifth industrial revolution. AI and the Internet of Things (IoT) are considered as pillars in this revolution (Bogale et al., 2018). Sharma and Tiwari (2015) states, The IoT is comprised of smart machines interacting and communicating with other machines, objects, environments, and infrastructures. In other words, IoTs is making the world a global digital house where globally disbursed people are connected via internet define a community.

1.1 Application of Artificial Intelligence

The application of AI is multi-faceted and ubiquitous and thus has found application multiple fields in recent years, such as in healthcare, optical communication, network planning, logistics, financial industry, and media (Gunning & Aha, 2018). The core of AI’s is machine learning that consists of algorithms used to process information as well as computing calculations and mathematical operations. The roots of AI systems lay in machine language, based on various complex algorithms that communicate with each other in high-speed based on given conditional logic. These technical procedures make it possible for computer machines to have super decision-making ability (Mata et al., 2018).

AI is expanding its horizon in the financial and banking industry, and in the view of Mannino et al. (2015) AI-based computer systems are more efficient and superior than human experts in processing information and computations. Thus, the usage of AI in the banking sector can make the operations more impactful and hassle-free (Manning, 2018).

The financial industry is one of the most critical sectors of the economy. AI has redefined the banking sector by the emergence of automation, blockchain, and FinTech (Manning, 2018). AI technology is integrated into mobile and internet banking, automated teller machines (ATM), cash deposit machines, SMS, and emails (Zawya, 2018). This integration provides an AI system with more data to analyse, allowing it to explore more information from the data.

In the current era of AI, its role is increasing because of the ability to value addition and efficient performance in the business process as its efficiency and reaction time is much better than a manual system to discover information from the database (Davenport et al., 2020). The essential areas that can use AI in financial services are portfolio management, customer services, data analysis, and risk management. Furthermore, analysing different economic scenarios to predict the future of the economic and financial industry to near accuracy is possible with AI.

1.2 Artificial Intelligence in the GCC Region

It is estimated that AI will contribute as much as $15.7 trillion to the global economy by 2030. The AI industry in UAE and Saudi Arabia would/could get nearly 14 and 12.4 per cent, respectively, of their GDP in 2030 taking the lead; both the countries are in the list of top 60 countries in the Global Innovation Index (GII)-an index measuring the innovation progress and performance of 127 economies. In 2018, Abu Dhabi unveiled a Strategy for Artificial Intelligence to implement AI in different sectors while Saudi Arabia plans to build Arabian Silicon Valley with an estimated cost of $500 billion for a futuristic megacity called Neom (Sophia, 2018).

Intel Corporation, IBM Corporation, Microsoft Corporation, Facebook, and Google LLC are a few big names contributing to AI in GCC. Moreover, AI is affecting the financial sector, as Gulf countries are among the wealthiest countries of the world, due to abundant reserves of oil and gas (Global Ethical Banking, 2018). The availability of financial resources and centralized government systems is attracting the international companies to provide IT services. This is catalysed by the stable economic conditions and relatively high penetration rate of information technology in the region (Augustine, 2018).

Various emerging technologies like data science, blockchain, and cloud computing are pursuing the financial industry not only to invest in these technologies but also to adopt these technologies for their usage and benefit. This development is transforming the financial industry in the Gulf region. The most significant impact of advancement in the world of AI is observed in the financial and banking sector (Manning, 2018). Therefore, AI will be transforming the banking industry permanently in profound ways for the coming years.

Chatbot is a software that automates the communication in a pre-programmed manner without human interaction. Chatbot is a source of value addition and allows for more efficient communication and problem resolution for customers. Its use is increasing with the passage of time as an application of AI. The computerized algorithm enables the Chatbot to formulate an appropriate response against any query from the customer (Manning, 2018). This 24/7 availability of services with more efficiency and less cost is alluring the international IT companies to increase their market share in the Gulf region (Sophia, 2018).

1.3 Use of Artificial Intelligence in Gulf Cooperation Council Countries

Governments, financial institutions, and businesses across the Middle East have realized ongoing technological disruption and the global shift of the traditional financial system towards sophisticated AI-based advanced financial system. Some financial institutions and banks have taken steps to adopt AI technology. These institutions are creating a confident atmosphere for other institutions to think about this technology and adapt it with the passage of time. According to Jain (2019), the Middle East is estimated to add 2% of the total worldwide benefits of AI in 2030. This benefit is equivalent to US$320 billion. Therefore, the penetration rate of AI is expected to be quite high in the future.

For instance, the Kuwait Finance House (KFH), the first Islamic bank established in 1977 in the State of Kuwait and one of the most notable Islamic financial institutions globally, has decided to implement AI Robotic Process Automation (RPA) to enhance business quality (IFN Fintech, 2018). In order to enhance the customer service experience, KFH has introduced AI Chabot developed by Microsoft technologies. This initiative will enable the bank to answer customer queries 24/7 and will support better decision-making by offering deep insights into the data collected (IFN Fintech, 2018).

Al Rayan Bank, a Qatar-based Islamic bank, is using cloud technology and is planning to incorporate AI-based management information and business intelligence system. In 2014, 85% of the bank’s business was based on the latest information technology which was 57% in 2012 (Mckenna, 2015). Qatar is the most developing county of the Gulf region, and it is considered as the future of the Gulf region with a high possibility of leaving behind other countries of the region (Gremm et al., 2015).

One of the major hubs for AI penetration in the Gulf region is the Kingdom of Saudi Arabia (KSA). In absolute monetary terms, KSA is leading the region, and it is expected that KSA will have invested over US$135.2 billion in AI until 2030 that is equivalent to 12.4% of GDP. In relative terms of GDP, UAE is ahead of KSA, and it is expected to contribute 14% to the GDP in 2030 (Jain, 2019). While UAE is creating opportunities for AI adoption in its economy, this is expected to have a positive spillover effect on the overall economy by taking full advantage of available opportunities.

The Saudi Investment Bank is incorporating AI partnering SAP (a software company based in Germany) to facilitate its loyal customers (Argam, 2019). PayTabs, a Saudi-based payment solution provider, uses a combination of technologies, including AI to faster the payment processor such as remittances and SME transactions. PayTabs also aims to reduce financial fraud in payment processing. The scalability of PayTabs will affect financial institutions in the KSA to reduce the workforce and hence decrease the number of bank branches (Argam, 2019).

UAE-based Commercial Bank of Dubai is using AI to solve critical business problems, improve efficiency, and identifying new business opportunities. Since 2015, the RAKBANK is using AI to implement anti-money laundering (AML) solutions (George, 2018). Recently, the RAKBANK has expanded its ‘strategic partnership to include the adoption of SAS Analytics’ (SAS, 2016). Mashreq Bank, another prominent financial institution based in the UAE embracing AI technology in the area of consumer banking and it plans to reduce workforce up to ten per cent in the coming years (Mashreq Bank, 2018).

Alizz Islamic Bank of Muscat has incorporated AI system to manage their data. This system is known as Vision Banking Business Intelligence (BI) and is developed by Sunoida Solutions. Suleman Dossani, Managing Director and CEO of Sunoida Solutions, said We have designed and built all important components based upon industry best practices within our Vision Banking BI solution, and we continue to innovate to provide the best services to our growing client base (Alizz Islamic Bank, 2019).

One recent development in customer banking is from the Bank Muscat, which has engaged the AI system through SAS (a software technology company) to implement customer relationship management (CRM) channel integration for their growing business demands’. The bank integrated multiple customer data touchpoints with the SAS Marketing Automation analytics engine to analyse the customer behaviour in cross-sell offers, digital offers, and promotions (SAS, 2018).

One of the major factors that might impede the development of AI-based systems in GCC is the human aspect. These countries are characterized by a growing youth population, however, lacking in skills (El Shazly & Lou, 2020). Additionally, major hiring is carried out from SAARC countries (namely India, Pakistan, and Sri Lanka). This hiring is mostly of personnel with low computer literacy rate. World Bank projects that the GCC’s labour force will exceed 20.5 million by 2020.

Therefore, this chapter focuses on the knowledge, attitude, and perceptions of customers towards AI use in the financial services industry in the GCC region. It takes into consideration the GCC countries such as the KSA, Kuwait, Oman, Bahrain, UAE, and Qatar. The research intends to analyse the future benefits and challenges for the financial services industry. This research will enable the stakeholders in the GCC region to ascertain knowledge, motivations, and behaviour of their employees to this new technology. The following are the main research questions:

-

1.

What are the knowledge, attitude, and perceptions of financial services industry employees towards AI in the GCC region?

-

2.

What will be the impact of AI on the economy in the future?

-

3.

What are the prospects and challenges of AI?

The rest of the chapter is organized as follows: In Sections 2 and 3, the literature review is presented, hypotheses are discussed and research methodology is elaborated. Section 4 highlights results and discussion. Section 5 is the conclusion, policy implications and research limitations.

2 Literature Review

In the 1990s, AI came first to simply replicate and then improve upon human intelligence in pattern recognition and prediction. This was a different ambition which required breaking the shackles of traditional human resource (Shediac & Samman, 2010). Since the 2010s AI research has fast emerged as a dominant science passing milestones; as Sergey Brin, co-founder of Google says, the new spring in artificial intelligence is the most significant development in computing in [his] lifetime.

Likewise, use of AI in the financial and banking sector is attracting substantial attention. The availability of abundance of data by the passage of time and the future expectations for adopting AI is playing an important role to persuade entrepreneurs to invest in AI-based projects and ventures. The study by Eisazadeh et al. (2012) shows that in most countries in the Middle East public sector banks dominate the banking industry. The intervention of government in the private sector banking sometimes results in issues related to liquidity, credit, and interest rates.

A recent study conducted by the Alizz Islamic Bank in 2019 states that most managers focus on reporting aspects using a typical Business Intelligence (BI) system. However, to deliver successful business solutions in financial reporting, there are three main components to be considered; first, flexible and efficient extracting data from all sources, second is the banking data modelling, and the third is the dashboards and reports. The use of AI is not only helping the executive management to receive a current and accurate view of the business at any time through many interactive dashboards and Chatbot, but it also ensures that the compliance and regulatory issues are handled with utmost diligence and efficiency (Alizz Islamic Bank, 2019).

According to Verma (2017), AI can be essential in altering customer engagement with the banking sector in the Middle East. Some banks in the Middle East have deployed Chatbot for providing customers with a better-personalized experience. The use of Chatbots and other automation of systems in the financial sector with favourable outcomes are creating a conducive environment for other financial institutions to adopt this technology in the future (Verma, 2017).

Alzaidi (2018) studies the adoption of AI by employees. The study gathers the data from an extensive/widespread area, and a sample of 200 bank employees, collected from selected banks in the Middle East region. This study indicates that although the application of AI in the financial services industry especially ‘banking sector is in quite an early phase, with the use of sophisticated algorithms’, there could be risk that is more efficient and ‘asset management in the banking sector that can further optimize financial policies of the Middle East banks’. Therefore, banks in the Gulf region can use fast and effective AI systems that can allow banking organizations to evolve more ‘revenue generation models using smart financial AI management tools’ (Alzaidi, 2018).

2.1 Financial Market of Gulf Cooperation Council Countries

The Gulf region has a relatively high per capita income due to an abundance of oil and gas resources. Shirish et al. (2016) state that this high per capita income propels cutting-edge information technologies, and there has been an increase in the demand for AI-based technologies. The study shows that there is a starting of a new era of digital banking in the Gulf region, especially in UAE, Qatar, and KSA. Millions of people of these countries are adopting AI-based technologies, especially in the financial and banking sectors. In banking and financial institutions, interconnected mobile banking systems by using wearables, tablets, and smartphones do most of the tasks from buying e-commerce products and services to make e-payments.

Shirish et al. (2016) cited the McKinsey research report and stated that UAE has a 92% internet penetration rate, and KSA has a 65% penetration rate. This study highlights that 80% of consumers favour the internet relying on tablets, personal computers, smartphones, and they visit branches and call service in urgent needs.

Although there is an optimistic view about AI in the Gulf region, however, cyber security is considered to be a significant threat/challenge for the financial institutions in this regard. The relationship between financial institutions and customers is based on trust, and any security concern can deteriorate this trust level. To address this issue, KPMG suggests financial institutions, especially banks, must consider this security issue from a customer point of view (Pera, 2018). Thereof, trust must be considered as an essential element to analyse the perception and future of AI in the Gulf region.

2.2 Labour Market of Gulf Cooperation Council Countries

The recent technological development has increased the urbanization in the world. According to UN forecasts, by 2050 the share of the urban population will reach 64.8%, while in high-income countries it will reach 88.4%. The GCC countries presently have relatively urbanized population; however, the UN forecasts that, by 2050, more than 90% of the population of these countries will live in cities. Moreover, these cities have potential to act as hub for digitalization of the economic. E-government development strategy is being devised to address this issue.Footnote 1

GCC countries need to develop the necessary infrastructure to digitalize the economy, where human resource is an integral part. AI enables labour to become more productive in pretty much all of the activities and tasks that it performs. However, new technologies do not necessarily increase labour productivity. Automation technologies normally reduce the labour’s share in value added, reduce overall labour demand because they displace workers from the tasks they were previously performing (Acemoglu & Restrepo, 2020).

AI creates jobs; however, technology also eliminates the traditional jobs creating an imbalance in workforce requirements. McKinsey reports that by 2025, the region reaches the same proportion of digital employment that the EU has today, then approximately 1.3 million new digital jobs could be created, including more than 700,000 in Saudi Arabia alone. McKinsey also reports that nearly 45% of the jobs will be technically automatable in 2019. Resultantly, AI could lay off 2.8 million full-time employees. At the same time, it could help save around $366.6 billion in wages.

Thus, a benefit is accompanied by a risk of disruption by new technologies. It is estimated that 37% of people have become ‘technophobic’ and fear their jobs could be taken over by robots and other AI software. This is more prevalent in expatriates working in GCC countries.

In general, there is a lack of research about the perceptions, attitude, and knowledge of professionals towards AI working in financial institutions. However, above-mentioned few studies highlight the current developments and importance of AI in the GCC region. Therefore, the present research aims to fill this research gap.

Based on the literature discussed above, following are the hypotheses of this study:

-

1.

Financial services industry professional’s knowledge of AI follows average of industry.

-

2.

Financial sector experience level and knowledge of employees about AI is not affected by country, education level and financial sector in the GCC region.

-

3.

The financial sector experience level of employees does not have a significant effect on the level of AI knowledge.

-

4.

The financial sector experience level of employees and AI knowledge level does not have a significant effect on the level of future optimism of AI.

3 Summary of Research Methods

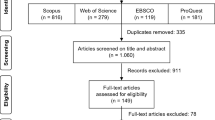

There are two methods used to collect data from professionals working in different financial organizations in the GCC. An online questionnaire was developed and it was circulated through professional networks in the GCC region. The same questionnaire in paper-form was also distributed using personal contacts at various institutions. The data was collected during April and May 2019. The questionnaire for this research consists of closed questions and mostly Likert scale-based questions. In total, 180 responses were obtained out of 280 distributed questionnaires, but 157 responses were taken in the analysis because 23 responses were incomplete. Data is analysed by using a statistical tool, namely SPSS. The data is collected from banks and insurance firms in the GCC region.

Analysis of Variance (ANOVA) shows a significant difference in the mean response of variables. It is used to check the significant difference among responses of respondents, obtained from the survey. The study used the Principal Component Analysis (PCA) technique to analyse the data. PCA technique enables us to obtain latent variables from the survey data, enabling the segregation of different variables into different groups based on appropriate theories.

The study used the PCA technique to reduce the data and constructed six variables to check the established hypotheses. The six constructed variables are; financial market work experience level, knowledge level about AI, future expectations from AI, transparency and efficiency in the financial system in the future due to the implementation of AI technology, impact of AI on the economy and security and ethical concerns related to AI in the future.

Cronbach’s Alpha that illustrates about consistency among variables checks the consistency among different variables. The value of more than 0.7 is considered reliable for internal consistency. The study uses the Ordinary Least Square (OLS) technique to regress different variables.

4 Results and Discussion

This section provides information about various analyses conducted and additionally, interprets the findings. There are 23 questions in the questionnaire. Eighteen of these questions follow Likert scale, while five questions deal with the personal characteristics of the respondents.

Before discussing different inferential statistics, it is worth highlighting the descriptive statistics. There are 157 respondents in this study. Table 1 shows the descriptive statistics of the respondents such as professional background, education level, and country of origin. Table 2 shows information such as the level of experience of professionals, the number of years served in the financial industry and level of familiarity with AI.

Most of the respondents of the questionnaire were professionals having a bachelor’s degree (64%), followed by a master’s degree (34%). More than half of the respondents have less than five years of financial industry experience. With familiarity with AI, most of the professionals are familiar with the use of AI in the business industry (61%), followed by professionals who are familiar with both, the use of AI in business as well as with data science (25%).

The internal consistency of overall data was checked using Cronbach’s Alpha. The Cronbach’s Alpha for the data is 0.89, and that is more than 0.7, which is considered well enough for internal consistency. The study uses binary data to analyse the knowledge, attitude, and perceptions of respondents about AI. The respondents having above-average responses about knowledge of AI were assigned the binary signal of 1 and employees knowing below average are assigned 0. Table 3 shows the results of knowledge and familiarity with AI.

The probability is less than 5%, and it shows that the knowledge and perceptions of financial professionals about AI are above average, which means they have sufficient information about AI. It also shows that most of the employees of the financial sector consider that they have above-average knowledge regarding the use of AI in the financial sector.

The results of the test of equality to check the mean difference among different GCC countries and financial sector experience levels are shown in Table 4.

The results show in Table 4 that there is no significant difference in the mean level of experience among countries. The average financial industry level of experience does not depend on countries, but education and financial sectors have a significant effect on the level of experience perception. The results also show that employees having a master’s degree consider that their financial industry experience and exposure to the use of AI in the financial industry is relatively higher than employees having a bachelor’s degree. An employee having a higher degree is capable of obtaining more experience from professional work than the employee having a lower degree and education. Similarly, employees of the banking sector consider that their experience level is higher than employees of insurance and other firms. The reason would be that banking is widespread with its scope being more comprehensive compared to insurance. The ANOVA results for the level of knowledge of AI are shown in Table 5.

The results in Table 5 show that the level of knowledge about AI does not depend on the country, education or in the financial sector. The reason would be that as use of AI in the financial sector is at its initial level, and the personal interest of employees is the primary factor to be familiar with AI and usage of AI in different sectors.

The relationship between the level of financial sector experience and AI knowledge is shown in Table 6.

The result shows that there is no significant relationship between the level of work experience and AI knowledge. There is a possibility that an employee having lesser experience in the financial industry may have more knowledge than the employee with more experience. This finding is in support of previous results that knowledge about the use of AI in the financial industry is mostly due to self-interest, and it does not depend on education.

The relationship of the financial sector working experience level with other constructed future expectations of AI variables is shown in Table 7.

The results manifest that there are significant relationships among the variables with the financial sector work experience level mentioned in Table 7. It means that if an employee possesses more or additional financial sector knowledge, the more he or she is optimistic about the future of AI in the financial sector, positive impact of AI on the economy and work efficiency and transparency in the system due to the incorporation of AI. Meanwhile, the employee is more concerned about ethical and security issues related to AI in the future.

The results in Table 8 illustrate that there are no significant relationships of all the above variables with the AI knowledge level. It means that employees knowing AI are indifferent about the future of the use of AI in the financial sector, the positive impact of AI on the economy, work efficiency and transparency in the system due to AI and ethical and security issues related to AI. A summary of the constructed hypotheses is shown in Table 9.

5 Conclusion

Artificial intelligence (AI) is an emerging field of computer science, and its impact on the financial sector and economy are increasing by the passage of time. The use of AI in the financial sector is at its initial stage. As the financial sector adopts AI technology to take advantage of it, different issues like data security, ethical issues, impact on the economy and bottom line of financial statements of companies will arise.

The implementation of AI and other technologies in the GCC region is gaining attention. However, only in recent years, financial institutions have realized the scope of these technologies. AI is influencing the banking sector of GCC and has vast potential due to the presence of high-value-added capability and efficiency of this technology in the economy.

Moreover, issues related to human knowledge, attitude, and perceptions are important considerations that needing investigation. The humans regard AI is a competitor to them as well as a threat to their job security. This premise can be more prevalent in GCC countries where an aggressive drive is underway towards AI adoption. On the other hand, many part of labour force are from low literate countries like India, Pakistan, and Sri Lanka. Therefore, knowledge, attitude, and perceptions of employees affected by AI cannot be ignored at all.

We studied the humanistic aspect of employees dealing with AI in GCC countries. In the survey, respondents were asked about their AI familiarity and awareness from a general business and finance and data science perspectives. The findings show that the overwhelming majority of the participants are familiar with AI from a business and finance perspective. The research also shows that an overwhelming majority of the respondents in the GCC countries are concerned about ethical, security, and data privacy issues.

In terms of policy implications, the financial institutions can adopt AI by the passage of time and these companies have to train their employees to handle this new technology. This adoption will have a positive impact on the bottom line of financial statements of the financial institutions due to an increase in efficiency and decrease in management and operating costs. On the other side, governments that play a vital role in transformational changes in the economy must reckon issues and challenges arising from the AI. Therefore, it will be essential to consider these issues while making further advancements in AI in the region.

Thus, technical training of the labour force is essential to meet these challenges in the future. Governments must equip the labour force with modern technology so that proper demand from the consumer side could be maintained. AI presents an excellent opportunity for GCC countries to leverage it for sustainable growth and development.

Finally, it is worth noting some limitations of the current work. This research was based on data collected from professionals working in the financial industry in the GCC region through a survey. The sample size was relatively small and can be expanded in future research. Moreover, the research did not use any macro-economic data like production, imports, exports, to shed more light on the and real impact of AI in the GCC region. AI is still considered as a nascent field in the region, but more research is needed and expected to address the stated gaps.

Notes

- 1.

UAE has UAE National Agenda 2021, Saudi Arabia has National Transformation Program 2030, Qatar National Vision 2030, Oman Vision 2040 as National Program for Enhancing Economic Diversification, Kuwait follows Kuwait National Development Plan 2035 and Bahrain has outlined Economic Vision 2030.

References

Acemoglu, D., & Restrepo, P. (2020). The wrong kind of AI? Artificial intelligence and the future of labour demand. Cambridge Journal of Regions, Economy and Society, 13(1), 25–35.

Alizz Islamic Bank. (2019). Alizz Islamic bank successfully deploys Sunoida’s vision—Banking Business Intelligence (BI) and data analytics platform [Online]. Available from: http://alizzislamic.com/Media-Centre/Press-Releases-Details/snmid/628/snmida/631/snid/190/sname/Alizz-Islamic-Bank-successfully-deploys-Sunoida-s-Vision-Banking-Business-Intelligence-BI-and-Data-Analytics-Platform. Accessed 18 June 2019.

Alzaidi, A. A. (2018). Impact of artificial intelligence on performance of banking industry in Middle East. IJCSNS International Journal of Computer Science and Network Security, 18(10), 140–148.

Argam. (2019). Saudi investment bank signs digital deal with SAP [Online]. Available from: https://www.argaam.com/en/article/articledetail/id/599536. Accessed 18 June 2019.

Augustine, B. D. (2018). Middle East’s banking industry headed for tech revolution [Online]. Available from: https://ifnfintech.com/islamic-bank-becomes-the-first-in-kuwait-to-integrate-ai/. Accessed 30 June 2018.

Bogale, T. E., Wang, X., & Le, L. B., (2018). Machine intelligence techniques for next-generation context-aware wireless networks [Online]. Available from: https://arxiv.org/abs/1801.04223. Accessed 18 June 2018.

Davenport, T., Guha, A., Grewal, D., & Bressgott, T. (2020). How artificial intelligence will change the future of marketing. Journal of Academy of Marketing Science, 48, 24–42.

Deloitte. (2018). Artificial intelligence [Online]. Available from: https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/deloitte-analytics/deloitte-nl-data-analytics-artificial-intelligence-whitepaper-eng.pdf. Accessed 22 October 2019.

Eisazadeh, S., Shaeri, Z., & Ali, B. (2012). An analysis of bank efficiency in the Middle East and North Africa. The International Journal of Banking and Finance, 9(4), 28–47.

El Shazly, M. R., & Lou, A. (2020). Modeling diversification and economic growth in the GCC using artificial neural networks. Journal of Advances in Economics and Finance, 5(1).

Global Ethical Banking. (2018). Kuwait is the past, Dubai is the present, Doha is the future [Online]. Available from http://www.globalethicalbanking.com/gcc-companies-financial-institutions-embrace-artificial-intelligence-ai/. Accessed 25 June 2018].

Gremm, J., Barth, J., & Stock, W. G. (2015). Kuwait is the past, Dubai is the present, Doha is the future. Journal of Islamic finance and Business Research, 1(1), 1–13.

Grorge, J. (2018). Rakbank to tie-up with three new fintech firms [Online]. Available from https://www.tahawultech.com/news/rakbank-to-tie-up-with-three-new-fintech-firms/. Accessed 30 July 2018.

Gunning, D., & Aha, D. (2018). ‘DARPA’s explainable Artificial Intelligence’, (XAI) Program. AI Magazine, 40(2), 44–58.

IFN Fintech. (2018). Islamic bank becomes the first in Kuwait to integrate AI [Online]. Available from https://ifnfintech.com/islamic-bank-becomes-the-first-in-kuwait-to-integrate-ai/. Accessed 30 June 2018.

Jain, S. (2019). The potential impact of AI in the Middle East [Online]. Available from https: https://www.pwc.com/m1/en/publications/documents/economic-potential-ai-middle-east.pdf. Accessed: 31 July 2019.

Manning, J. (2018). How AI is disrupting the banking industry [Online]. Available from https://internationalbanker.com/banking/how-ai-is-disrupting-the-banking-industry/. Accessed 30 July 2018.

Mannino, A., Althaus, D., Erhardt, J., Gloor, L., Hutter, A., & Metzinger, T. (2015). Artificial intelligence: Opportunities and risks. Policy paper by the Effective Altruism Foundation (2): 1–16.

Mashreq Bank. (2018). Mashreq bank selects blue prism to drive innovation across all banking functions [Online]. Available from https://www.mashreqbank.com/uae/en/news/2018/february/mashreq-bank-selects-blue-prism-to-drive-innovation-across-all-banking-functions. Accessed on 27 August 2020.

Mata, J., Miguel, I., Duran, R., Merayo, N., Singh, S. K., Jukan, A., & Chamani, M. (2018). Artificial intelligence (AI) methods in optical networks: A comprehensive survey. Optical Switching and Networking, 28, 43–57.

Mckenna, B. (2015). Al Rayan Bank finds business agility in cloud applications [Online]. Available from: https://www.computerweekly.com/news/4500252667/Al-Rayan-Bank-finds-business-agility-in-cloud-applications. Accessed 20 June 2018.

Pera, E. (2018). New technologies set to disrupt UAE banking sector in 2018 [Online]. Available from https://www.menaherald.com/en/money/banking/new-technologies-set-disrupt-uae-banking-sector-2018-kpmg-banking-perspectives-report. Accessed: 21 June 2018.

SAS. (2016). SAS extends partnership with RAKBANK for analytics solutions to deliver efficient marketing strategies [Online]. Available from: https://www.sas.com/en_sa/news/press-releases/2016/july/sas-extends-partnership-with-rakbank-for-analytics-solutions.html. Accessed on 31 July 2019.

SAS. (2018). Bank muscat and SAP recognised for best data analytics initiative in the Middle East [Online]. Available from: https://www.sas.com/en_ae/news/press-releases/local/2019/bank-muscat-and-sas-recognised-for-best-data-analytics-initiative.html. Accessed on 31 July 2019.

Shalf, J. M., & Leland, R. (2015). Computing beyond moore’s law. Computer [Online]. Available from https://m-cacm.acm.org. Accessed on 31 July 2019.

Sharma, V., & Tiwari, R. (2015). A review paper on IoT & it’s smart applications. International Journal of Science, Engineering and Technology Research, 5(2), 472–476.

Shediac, R., & Samman, H. (2010). Meeting the employment challenge in the GCC: The need for a holistic strategy. Booz and Co.

Shirish, K., Jayantilal, S., & Haimari, G. (2016). Digital banking in the Gulf Keeping pace with consumers in a fast-moving marketplace [Online]. Available from https://www.mckinsey.com/~/media/McKinsey/Locations/Europe%20and%20Middle%20East/Middle%20East/Overview/Insights/Digital%20banking%20in%20the%20Gulf/Digital%20Banking%20in%20the%20gulf%20161116%20DIGITAL.ashx. Accessed: 31 July 2018.

Sophia, M. (2018). Banks are investing massively into IT Services. Forbes Middle East staff. Available from: https://www.forbesmiddleeast.com/en/banks-are-taking-note-as-fintech-spikes-customers-interest/. Accessed: 31 July 2019.

Verma, S. (2017). UAE banking on AI, and the results are showing [Online]. Available from https://www.khaleejtimes.com/editorials-columns/uae-banking-on-ai-and-the-results-are-showing. Accessed 30 July 2018.

Zawya. (2018). Bank Muscat and SAS recognised for best data analytics initiative in the Middle East [Online]. Available from: https://www.zawya.com/uae/en/press-releases/story/Bank_Muscat_and_SAS_recognised_for_Best_Data_Analytics_Initiative_in_the_Middle_East-ZAWYA20180809102646/. Accessed: 18 June 2018.

Acknowledgements

The author acknowledges the support of Mr. Ammad UlRehman in the data collection process.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Ashfaq, M., Ayub, U. (2021). Knowledge, Attitude, and Perceptions of Financial Industry Employees Towards AI in the GCC Region. In: Azar, E., Haddad, A.N. (eds) Artificial Intelligence in the Gulf. Palgrave Macmillan, Singapore. https://doi.org/10.1007/978-981-16-0771-4_6

Download citation

DOI: https://doi.org/10.1007/978-981-16-0771-4_6

Published:

Publisher Name: Palgrave Macmillan, Singapore

Print ISBN: 978-981-16-0770-7

Online ISBN: 978-981-16-0771-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)