Abstract

Screening of overseas upstream oil and gas venture is a multi-attribute decision-making issue. In view of the shortcomings of insufficient existing evaluation indicators especially without integrating environmental aspects, artificial dependency for determining subjective and objective preferences in weights calculation, and low resolution and the resulting difficult decision-making due to inability of existing models to deal with the relationship between distance and curve similarity, an evaluation indicators system and an improved multi-attribute decision-making workflow for overseas oil and gas venture were proposed. Firstly, classification criterions were determined quantitatively based on probability distribution of different types of data from 630 overseas oil and gas venture. Pearson correlation coefficient and principal component analysis were then used to eliminate redundant indicators, and final comprehensive indicator system were established fully reflecting technology, economy, commercial strategy and environment risk aspects of overseas oil and gas venture. Secondly, minimum discriminant information principle was introduced to quantitatively calculate comprehensive weights representing subjective and objective impacts. Thirdly, the relationship between distance and curve similarity of decision-making models were reasonably expressed by introducing a preference coefficient, a distance function equation for quantitatively calculating the preference coefficient was derived, and candidate schemes were projected to ideal schemes through the principle of vector projection, thereby a new derived parameter called comprehensive proximity projection coefficient was given to reflect the quality of an oil and gas venture, which was finally integrated with three quantitative or semi-quantitative models derived from classical fuzzy multi-attribute to form the overall screening workflow. The feasibility and validity are verified by actual data from overseas projects. Compared with existing methods, evaluation indicators of new method is more comprehensive, taking into account subjective and objective effects in both decision-making model and weight, as well as the resulting more comprehensive and flexible decision-making rules and more reasonable weight, with fast speed and higher resolution, and therefore more suitable for comprehensive screening and decision-making of overseas oil and gas venture.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Overseas oil and gas venture

- Multi-attribute decision-making

- Vector project principle

- Comprehensive weighting technique

- Principal component analysis

1 Background

Overseas oil and gas assets evaluation is an important aspect of business development of oil companies, and is a multi-disciplinary, comprehensive and time-sensitive business loop of technology, economy and strategy. In order to seize fleeting investment opportunities in the complex and changeable international investment environment, it is often necessary for the evaluators to not only take into account factors of technology, economy, business strategy and environmental risk, but also to help the leadership to make a quick decision to buy or abandon. In addition, overseas assets are widely distributed and of various types, thus evaluation process has greater uncertainties and risks. The traditional technology economic evaluation method at present is to conduct a systematic appraisal of assets from five aspects: geological, reservoir engineering, drilling, facility and economic evaluation [1], final economic indicators such as discounted cash flow (NPV) and internal rate of return (IRR) are generally used for decision-making, which require long cycle, large workload and impossible to quantify uncertainty and risk. To meet needs of comprehensive and rapid decision-making, another kind of method, known as multi-attribute decision-making method, can solve this issue by synthetically considering multiple attributes of multiple assets at a time and sorting them through an aggregate indicator. Up to now, there are many widely used methods of this type, but without exception, these methods still have some limitations, such as mathematical grading method [2] is more qualitative and subjective; utility function of utility theory [3] is difficult to determine and largely depend on decision-makers’ preference; decision rules of rough set [4] are unstable and attribute reduction, one of the important procedure, is difficult to solve; information entropy [5] uses “entropy” to measure information amount contained in variables, with strong sample dependence, often ignoring subjective intentions of decision makers, and is not flexible enough; Technique for Order Preference by Similarity to Ideal Solution (TOPSIS) [6] can reflect total similarity degree of alternatives and ideal scheme, but it cannot reflect the difference between the changing trend of each factor and the ideal scheme. Grey Relational Analysis (GRA) [7, 8] judges the correlation degree between indicators by curve similarity, but selection of reference sequence and resolution coefficient often leads to great difference in correlation degree, and slightly deficient on overall evaluation of the scheme. In view of uncertainties and fuzziness of overseas oil and gas assets [2, 9, 10], application is mainly based on fuzzy decision-making [11]. The common methods are: Comprehensive Decision Queuing and IHS Global Window. Comprehensive Decision Queuing is actually based on Analytic Hierarchical Process (AHP) to determine the weight and then weighted grey relational degree to rank multiple assets, and widely used in the rapid screening and evaluation of overseas projects in the five major cooperation zones of CNPC. Global Window is a more commonly used tool for global asset strategy screening developed by IHS, a well-known international oil and gas consulting agency, which covers 460 global asset data, a built-in screening tool and database continually updated by powerful team of oil and gas evaluation experts, so decision results have a certain reliability. However, there are still some shortcomings in the application of these two tools: (1) evaluation indicators are not enough and spurious, mainly focusing on technical and economic indicators, ignoring subjectively political, fiscal and environmental risk of resource countries [9, 10], and especially redundancy of factors; (2) decision-making methods cannot represent the relationship between distance and curve similarity well, which results in low resolution and difficulty in decision-making; and (3) weight calculation has strong artificiality in dealing with subjective and objective preferences, lack of theoretical basis. In view of the above shortcomings, an comprehensive evaluation indicator system with additionally reflecting subjective and environmental risks is constructed, thereby an improved multi-attribute decision-making method is established, which can rapidly screen out subsets from a large number of assets before carrying out traditional time-consuming evaluation, further rank assets already systematically assessed, and effectively reduce evaluation cost, providing an effective means to avoid risks and quickly identify high-quality assets.

2 Evaluation Indicator System of Overseas Oil and Gas Assets

2.1 Primary Indicator

A good new overseas oil and gas asset should not only have abundant resources, good exploitation conditions and low cost, but also have superior financial taxation system and investment environment in the resource country where the asset is located. The advantages and disadvantages of an oil and gas asset project are a complex of the underground condition of oil and gas resources quality, capital expenditure of exploration and development, and the aboveground condition of national financial and taxation, economy, policy and environmental index of the assets. The procedure to determine preliminary indicator system is as following, Taking historically assessed 630 overseas oil and gas evaluation assets as samples, analyzing objective and subjective factors of these projects to find the most influential ones, referring to the experience of internal expert and IHS database, 26 indicators are preliminarily selected for further screen and evaluation, as shown in Table 1.

The preliminary indicators comprehensively consider subjective and objective aspects of an oil and gas asset, divided into Under Ground and Above Ground 2 categories. Under Ground represents subsurface technical and cost aspects, while Above Ground shows the economic profits and business strategy aspects, covering the whole life cycle from exploration, development, operation, to final abandonment, which can fully reflect the opportunity and risk of assets.

It is worth noting that when used in the rapid screening or opportunities evaluation stage of a new project before the systematically technical economic evaluation have been done, there are usually few data available, even no information for some indicator, commercial databases such as Wood Mackenzie, IHS and C&C is recommended to be used to sort out the required 26 required indicators by analogy to the assets with same attributes. When used in further optimization of projects that had been systematically evaluated, actual physical data can be directly used for preliminary indicators.

2.2 Classification Criteria

For qualitative indicators, expert judgment is used to set the evaluation set as “excellent”, “good”, “general”, “bad” and “poor”. In order to avoid the influence of 0 values on statistical analysis, the minimum value of evaluation is set to 0.2. For benefit-oriented indicators, they are assigned 1, 0.8, 0.6, 0.4, and 0.2 in turn; for cost-oriented indicators, they are assigned 0.2, 0.4, 0.6, 0.8 and 1.

For quantitative indicators, classification criteria of indicators are determined as follows: (1) Defining 5 grade indicators [12]; (2) Analyzing the probability distribution of 26 evaluation indicators for 630 projects; (3) Determining the upper and lower bounds for each grade of 4 types of probability distribution, basic principle is as follows: ① choosing μ − σ, μ − σ/2, μ + σ/2, μ + σ as reference point for normal distribution; ② choosing 15%, 30%, 70%, 85% of cumulative probability for “First Rise Then Fall” type distribution; ③ choosing 10%, 30%, 60%, 80% of cumulative probability for “Declining” type distribution; ④ choosing 20%, 40%, 60%, 80% of cumulative probability for Uniform distribution, as shown in Fig. 1.

Taking “2P Reserves” as an example, it shows a nearly normal distribution with a wide range, sample points are mainly distributed in 10–90 MMboe, accounting for 52% of total samples. According to the normal distribution mean and standard deviation, the grade of 2P Reserves is determined to be 5 classes, [0, 10), [10, 30), [30, 90), [90, 185) and larger than 185 MMboe. Finally, all the classification criteria for 26 primary indicators are shown in Table 2.

2.3 Correlation Analysis and Principal Component Analysis

The range of primary indicators is wide and there may have structure similarities between some indicators, which lead to extra computational cost and statistical accuracy decrease. In order to select better independent indicators and improve statistical analysis, correlation coefficient is used to consider the interaction between the indicators. Pearson correlation coefficient is calculated used as the distance measure of the indicators, and the similarity matrix is built to reflect correlation of indicators, in our approach, the threshold value of Pearson correlation coefficient is set at 0.8. Applying the method to all 26 indicators, 8 derivative indicators are finally determined to eliminate and can be explained as follows: Resource Quality (P1) of an asset are reflected in the 2P remaining reserves (P2), Full Exploration Cost (P5) and Abandonment Fee (P11) can be covered by Entrance Fee (P6), Exploration and Development Potential (P12) can be reflected in Resources (P3), overall Business environment (P16) can be used to replace the redundant 3 indicators of Potential for Strategic Upside (P18), Incumbent Company Profile (P21), Entrenched Operators (P22); and Government Attitude towards trade (P23) can be replaced by Deal Flow (P24).

Further to validate the conclusion drawn by Correlation Analysis, Principal Component Analysis (PCA) [13] is applied to both primary 26 indicators and 18 indicators after Correlation Analysis to analyze the variance and redundancy. The threshold of eigenvalue and cumulative contribution of variance is set to 0.75 and 90%, respectively. Figure 2 shows the plot of eigenvalue varying with principle components by PCA, 18 indicators after Correlation Analysis satisfy independent conditions, that is, all eigenvalues are greater than 0.75 and cumulative contribution of variance is greater than 95%. In addition, eigenvalues of the 18 indicators are all larger than that of primary 26 indicators, which indicates that information amount embodied in each indicator has increased, so the procedure is reasonable. Finally, a comprehensive evaluation indicator system consisting of 18 indicators is determined shown in Fig. 3.

3 Improved Multi-attribute Decision Making Method

3.1 Modified TOPSIS-GRA Based Vector Projection Decision Method (T-GRA-Pro)

Different decision methods are developed based on different rules. In order to improve the comprehensiveness of decision rules, this paper introduces preference coefficient to combine two slightly different decision rules of TOPSIS and GRA to integrate distance and curve shape similarity between samples, and establishes a new multi-attribute hybrid decision making method (T-GRA-Pro) based on the principle of vector projection [14]. In our approach, the positive and negative ideal solutions calculated by the modified TOPSIS with vertical distance improvement [6] are used as the reference sequence, and modified gray correlation coefficient between the candidate and positive and negative ideal solutions is calculated.

Where \( \xi_{ij}^{ + } \), \( \xi_{ij}^{ - } \) denotes the gray correlation coefficient between the candidate and the positive, the negative ideal solutions, respectively; \( \Delta_{ij}^{ - } = \left| {y_{ij} - y_{j}^{ - } } \right| \); \( y_{j}^{ + } = \sum\limits_{i = 1}^{n} {S_{j}^{\prime - } \times t_{ij} } \), \( y_{j}^{ - } = \sum\limits_{i = 1}^{n} {S_{j}^{\prime - } \times \left( {S_{j}^{' - } - t_{ij} } \right)} \) denotes, respectively, vertical distance between the candidate and the positive and negative ideal solutions; \( S_{j}^{\prime - } \) denotes the negative ideal solution after coordinate transformation; \( t_{ij} \) denotes the weighted decision matrix [6]. The smaller \( y_{i}^{ + } \) is, the closer the candidate is to the ideal solution.

Meanwhile, resolution coefficient ρ is an important parameter affecting final gray correlation ranking result. In general, ρ is set to 0.5 according to experience, which often leads to little difference of correlation degree between different decision schemes and difficult to make decision [15]. In order to obtain better resolution, the following formula is recommended to dynamically adjust ρ:

Where, \( \varepsilon \left( j \right) = \frac{{\Delta_{v} \left( j \right)}}{{\mathop {\hbox{max} }\limits_{i} \mathop {\hbox{max} }\limits_{j} \Delta_{ij} }} \); \( \Delta_{v} \left( j \right) = \frac{1}{n}\sum\limits_{i = 1}^{n} {\Delta_{ij} } ,\;j = 1,2, \ldots ,m \). The resolution coefficient ρ in (2) is a dynamic value, and the resolution can be effectively improved depending on the influence on each comparison point, so the result is more realistic.

Finally, a preference coefficient is introduced to combine all these to achieve a reasonable decision taking into account distance and curve shape, and then comprehensive closeness coefficient representing proximity of the candidate to the ideal is obtained in the following:

Here, \( c_{ij}^{ + } \) and \( c_{ij}^{ - } \) respectively represent comprehensive closeness coefficient of the positive and negative ideal solutions; wj represents the weight of the j th index, j = 1, 2, …, m; i = 1, 2, …, n; α, β are preference coefficients reflecting the preference of decision-makers for distance and curve shape, respectively. In order to make the difference between distance similarity and curve similarity consistent with the selected preference coefficient, vertical plane distance D with the gray relation degree should be equal to the difference between the two preference coefficients, thereby constructing the following equations:

Solving (4) yields:

According to vector projection principle [14], each candidate can be regarded as a row vector, and angle θi between candidate Ai and the ideal one A* is called projection angle. The length of Ai is called modulus di. A projection Di, representing the consistency between the candidates with the ideal solution, is defined as the product of cos θi and the modulus di. The larger Di represents more consistent relationship of the candidate with the ideal solution.

In order to ensure that the best candidate is closest to positive ideal solution and far away from negative ideal solution, it is easy to get the comprehensive close projection coefficient Ei.

Where, \( D_{i}^{ + } \) and \( D_{i}^{ - } \) are the projection of the positive and negative ideal schemes, respectively.

As seen from Eq. (6), the weight wj is remarkably different as indicators. Specifically, it can include two aspects: subjective aspect, reflecting the empirical judgment of decision-maker on the indicator; objective aspect, reflecting the usefulness of information quantity of the indicator. The weights used in existing methods are either based on experience (subjective weights) or by statistical analysis (objective weights), often failing to comprehensively reflect the actual influence of indicators.

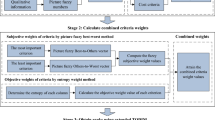

3.2 Comprehensive Weighting Method Based on Minimum Discriminating Information

In order to simultaneously reflect subjective experience and objective statistics of sample data, minimum discriminating information (MDI) in information theory [16] is introduced to construct comprehensive weights. In our approach, subjective weight λ is calculated by the 3-scale AHP [17] and least squares method [18] and objective weight η is determined by PCA, then a comprehensive weight w is calculated according to MDI. The cost function of minimizing the identification information is established, so comprehensive weight wj is as close as possible to λj and ηj, as shown in the following.

Apparently, finding optimal wj is a conditional optimization problem. The general solution to this problem is to construct a Lagrangian function (change to unconstrained optimization problem) using the Lagrange multiplier method:

It is easy to derive comprehensive weights:

In addition, comprehensive weight wj can effectively eliminate the adverse effects caused by the correlation between indicators because of PCA used. Therefore, comprehensive weights can comprehensively measure the importance of various indicators of overseas oil and gas assets.

Finally, comprehensive close projection coefficient E = {E1, E2, …, En} can be obtained by (3), (7) and (10). The larger Ei implies the better candidate i.

4 Workflow

Up to now, comprehensive decision-making indicator system has been constructed, and a new multi-attribute hybrid decision-making method (T-GRA-Pro) has been established. On the basis of this, four quantitative or semi-quantitative decision-making models as follows.

Model 1 (M1).

A comprehensive closeness projection coefficient E derived by T-GRA-Pro, is the main model used in this paper for quantitative screening candidates.

Model 2 (M2).

Derived from classic fuzzy [11], called comprehensive score matrix S, used as an auxiliary model to qualitatively determine the risk of the project.

Here, S is a 2 × n matrix, and the first and second rows of vectors respectively represent the comprehensive value of the underground and above-ground indicators to be evaluated, respectively; W and W′ are the comprehensive weight vectors of the underground and above-ground indicators, respectively; Z and Z′ are the judgment matrices of underground and above-ground indicators; n denotes overseas assets number to be evaluated, and each asset has m evaluation indicators.

Model 3 (M3).

The distance-based measurement using multidimensional space Euclidean distance formula, as an auxiliary model can achieve quantitative analogy with reference assets, reflects the pros and cons of an asset. The larger the Li, the larger the comprehensive value of the underground and the ground, and the higher the quality of the project.

Model 4 (M4).

Sensitivity impact matrix, can visually reveal the sensitivity of each indicator to each asset, and help to analyze the commonalities and differences of various assets.

Implementation of Decision Model M1

-

(1)

Change indicators to be dimensionless by vector normalization method [19];

-

(2)

Construct normalized matrix Y, and coordinate origin is moved to the ideal solution by the coordinate transformation, calculate positive ideal solution S+ and negative ideal solution S−.

-

(3)

Obtain vertical distance of each candidate to both positive ideal and negative ideal solution.

-

(4)

Calculate gray correlation coefficient \( \xi_{ij}^{ + } \), \( \xi_{ij}^{ - } \) through (1) and (2);

-

(5)

Compute preference coefficients α and β according to (5)

-

(6)

Compute comprehensive closeness coefficient Cij according to (4);

-

(7)

Calculate comprehensive weight w according to (10);

-

(8)

Calculate positive and negative projection of each candidate \( D_{i}^{ + } \), \( D_{i}^{ - } \) by (6), and approximate the final comprehensive closeness projection coefficient E by (7).

The same procedure can be applied to M2, M3 and M4.

The overall workflow for assets screening and ranking is proposed as shown in Fig. 4.

5 Application and Discussion

Taking 5 overseas typical oil and gas assets evaluated by CNPC as an example (denoted by A, B, C, D, and E) to apply and verify the new method, the detailed data are listed in Table 3. Among which A, B, and C are assets in exploration, D, E are developed assets, covering two types of contracts (mining tax, product sharing), different development stages (to be developed, developing in the middle and late period), lithology (sandstone, carbonate rock) and water depth (A, B are Ultra Deep water, C, D, E are shallow water). The 5 assets have already experienced systematic technical economic evaluation, the data and conclusions are thought to be reliable through repeatedly test by experts at all levels. Through a comparative study of key indicators from five aspects: geological resource quality, reservoir physical properties, production profile, offshore investment, and contract terms and economic benefits, finally the comprehensive order of the projects is determined as D, E, B, A, C mainly based on economic indicators. In order to facilitate the application of the new method, the corresponding codes are compiled in VBA language, and the tabular data can be quickly invoked to implement rapid screening of 5 assets. Finally, Comparison with the 3 existing tool (traditional technical economic evaluation, Comprehensive decision queuing, and Global Window Platform is analyzed.

5.1 Comprehensive Closeness Projection Coefficient (M1)

Applying the procedure in Sect. 4, and implement indicators normalization [19], we can obtain dynamic resolution coefficient ρ, preference coefficients α = 0.46, β = 0.54 calculated according to (5), the final comprehensive weight w and comprehensive closeness coefficient C.

Using (6), (7) and comprehensive weight w, then projection coefficient D and the final projection coefficient E are calculated as follows.

It can be seen from matrix E that the difference of each element is obvious, so the resolution is enough higher, which indicates that the sensitivity of the new method is higher and the resolving power of the model can be improved. According to E, the ranking of these 5 projects can be easily determined, D, E, B, A, C.

5.2 Comprehensive Score Matrix (M2)

The specific application of M2 model is usually based on the Boston map. Taking the score of the above-ground indicators as X, and the score of the underground indicators as Y, by (11), the whole 2D region is divided into four quadrants by the reference above-ground and underground score (3 used in our approach) to form the Boston map. In the first quadrant, both above-ground and underground risk is low, indicating better assets conditions, which is strategic preferred target area; The second quadrant shows high risk aboveground risk and low underground risk, so choice for these assets may be strategically careful, especially environmental risks; In the third quadrant, above-ground and underground risks are both higher, active avoidance for assets to be evaluated or divestment for existing project should be taken; In the fourth quadrant has low aboveground risk but high underground risk, so the feasibility should be carefully verified especially from a technical perspective. Using the location of the asset in the Boston map, the risk can be qualitatively determined and analogy can be achieved.

According to (10) and (11), weights and comprehensive score of underground and above-ground indicators of these 5 assets are: A (2.8, 3.38), B (2.82, 3.46), C (2.65, 3.5), D (3.3, 3.75), E (3.25, 3.5), respectively. Figure 5 visually shows the location of each asset in the 2D Boston map.

As shown in Fig. 5, asset D and E are in the first quadrant of the Boston map, which is a strategic priority project, above-ground and underground risks are relatively low; A, B, C assets are in the second quadrant, above ground risk is high, these assets has a high environmental risk, corresponding strategy should be cautious, intuitively judge the risk of 2 development assets D, E is much smaller than 3 exploration assets A, B, C, but the quantitative measurement of advantages and disadvantages of assets in the same quadrant cannot be determined.

In addition, by comparing with the reference positions representing the average level of assets of the same oil and gas system and the same fiscal and taxation terms with the 5 candidates (A′, B′, C′, D′, E′), Fig. 5 shows that the comprehensive values of the 2 development assets to be evaluated were higher than the reference position, especially E changed the most, and the underground risk was much lower than the average level, indicating that the 2 assets are better than the average level. In contrary, the 3 exploration assets are generally slightly worse than the average level of similar asset portfolios. Although the underground risks of the 3 exploration assets have been reduced, the above-ground conditions have become unclear, resulting in a slightly worse.

5.3 Distance-Based Measurement (M3)

Table 4 shows a distance-based measurement calculated by (12). It is worth noting that although the pros and cons of assets can be qualitatively and intuitively determined according to comprehensive score matrix (M2), the quantitative ranking cannot be generally obtained, so Generally, a distance-based measurement (M3) are established as the criteria for quantitative comparison of the candidate and the reference assets from same region and same resource type. According to the distance-based measurement, a final ranking for 5 assets to be evaluated is D, E, A, B, C.

5.4 Sensitivity Impact Matrix (M4)

According to (13), the sensitivity impact matrix of 18 evaluation indicators of 5 projects can be calculated, which can visually show the sensitivity of each indicators to the asset, reveal the commonality and particularity of the asset. Assume that when the sensitivity impact value of an indicator is located at 4–5, indicating that the indicator has a greater impact on the risk-benefit assessment of an asset to be evaluated, the corresponding indicator can be very concerned about the indicator; similarly, when the sensitivity impact value ranges 3–4, indicating that the impact is moderate, suggesting you can pay some attention to the indicator; when the sensitivity impact value is less than 3, indicating that the impact is low, it is not necessary to pay much attention to it (see Fig. 6).

As can be seen from Fig. 6, the 3 exploration assets focus on subsurface conditions such as reserves and prospect potential, emphasizing the importance of the success rate of commercial discovery and concern for monetization risks; while the 2 development assets focus on the remaining reserves and infrastructure quality issues. Emphasize the company’s competitive advantage over other competitors, focusing on the possibility of implementing the transaction and the net profit per barrel.

5.5 Analysis and Discussion

The new method is compared with traditional technology economic evaluation, comprehensive decision queuing, and Global Window to verify the feasibility and reliability of the new method. We compare from six aspects: considerations, data sources, weight calculation, decision methods, applicability, and ranking results, as shown in Table 5. The following conclusions can be drawn:

Firstly, results of the new method are basically consistent with the traditional technical economic evaluation, indicating that the new method is feasible. In addition, the new method does not require a long-term system evaluation process (at least one month), which enables rapid quantitative screening of new projects before the system technical economic evaluation, and the main decision model (M1) takes into account distance and curve similarity, weight calculation can not only reflect the internal statistical features of indicators, but also reflect the decision-maker’s subjective experience, so the final resolution is high enough for decision-making.

The new method is more robust than Global Window. Although Global Window can achieve rapid screening of assets, the weight calculation methods are subjective expert scoring methods. The conclusions of different decision-makers are inconsistent and have poor robustness.

The decision result of the new method is more reasonable than the comprehensive decision queuing method. It is not difficult to find from Table 5 that only the results of the Comprehensive decision queuing method are different, and there is a clear contradiction with the empirical understanding. The analysis suggests that the weight may be calculated by a single and subjective AHP method, which may not effectively reflect the importance of indicators. That asset A is superior to asset B can be made by comprehensive decision queuing method. In fact, after systematic technical economic evaluation by industry experts, the depth of asset B is shallow, investment is relatively small, and economic benefits should be better than asset A. Generally speaking, asset B is better than asset A.

Last but not the least, It is also very important that the decision resolution of the new method is significantly higher than that of Global Window and comprehensive decision queuing. As we known, a multi-attribute decision-making problem generally does not have a so-called “optimal solution”, and only a satisfactory solution for all target values can be obtained. Decision makers judge all candidates and find satisfactory solutions, which require the decision-making method to have sufficient resolution to distinguish candidates. The decision resolution is defined as follows: suppose the comprehensive close projection coefficient of scheme Ai is αi, the comprehensive close projection coefficient of scheme Aj is αj, and αi > αj, then the decision resolution of the decision method for scheme Ai and scheme Aj is called for:

Obviously, the larger the \( \chi_{ij} \), the higher is the resolution of decision-making method.

The decision resolution between each decision candidate (New method, Global Window, Comprehensive Decision Queuing) are shown in Table 6, the resolution of the new method is significantly higher, and more reliable decision results are obtained. The main cause is that the algorithm takes into account the effect of distance and curve shape, and integrates the relationship between the candidate and the positive and negative ideal one as the basis for decision-making, thus avoiding the deviation in one direction and comprehensively reflect differences between the various candidates; followed by Global Window, and Comprehensive Decision Queuing has the worst resolution, different candidates are not clearly differentiated, and the reliability is relatively poor.

In addition, in the overall workflow, the introduced 3 auxiliary decision-making models have the advantage of intuitive results and more powerful functions, can visually display the underground and aboveground risks, quantitatively analogy between candidates and the reference one, and analyze the sensitivity impact of each indicator, reveal the attention and avoidance aspects, and provide useful supplements to decision-making management.

6 Conclusions

The method and workflow proposed in this paper can be used to quickly identify high-quality oil and gas assets and avoid investment risks usually in the period of upstream investment opportunity rapid screening, before the traditional technical economic evaluation stage, which can guide the company’s comprehensive assets screening, portfolio optimization and asset acquisition and divestment.

Comparing with existing methods, the improved decision-making method in this paper takes into account the consistency of distance and curve shape between candidates and the ideal one, as well as subjective and objective effects in weight calculation. Further, the proposed new method is mainly based on more comprehensive indicators system of underground conditions and aboveground strategic and environmental factors; therefore with fast speed and higher resolution, and more consistent with the actual oil and gas assets farming in experience.

The new method and workflow can be conveniently written as table-based tool to achieve fast and quantitative optimization projects. The model theory and approach is simple, and easy to implement and operate.

The general 4 steps workflow of indicators preprocessing proposed in this paper, primary selection, grading criteria establishment, correlation analysis and principal component analysis validation, can be used for evaluation indicators processing in any other research fields, with certain extension and application value.

References

Mu, L., Pan, X., Tian, Z., et al.: The overseas hydrocarbon resources strategy of Chinese oil-gas companies. Acta Petrolei Sinica 34(5), 1023–1030 (2013)

Guo, R., Yuan, R., Zhang, X., et al.: Evaluation method for new investment projects of overseas oil-gas field development. Acta Petrolei Sinica 26(5), 42–47 (2005)

Li, Q., Zhang, J., Deng, B., et al.: Grey decision-making theory in the optimization of strata series recombination programs of high water-cut oilfields. Pet. Explor. Dev. 38(4), 463–468 (2011)

Wang, G., Cui, H., Li, Q.: Investigation of method for determining factors weights in evaluating slope stability based on rough set theory. Rock Soil Mech. 30(8), 2418–2422 (2009)

Qi, M., Fu, Z., Jing, Y., et al.: A comprehensive evaluation method of power plant units based on information entropy and principal component analysis. Proc. CSEE 33(2), 58–64 (2013)

Zhang, X., Liang, C., Liu, H.: Application of improved TOPSIS method based on coefficient of entropy to comprehensive evaluating water quality. J. Harbin Inst. Technol. 39(10), 1670–1672 (2007)

Deng, J.L.: Gray Theoretical Basis. Huazhong University of Science and Technology Press (2003)

Dong, X., He, Q., Cao, W.: Trans-national operation model for petroleum enterprises. J. Univ. Pet. China 25(2), 129–131 (2001)

Wang, Q., Wang, J., Wang, P., et al.: Methodology of technical and economical assessments of oversea exploration blocks. Acta Petrolei Sinica 33(4), 640–646 (2012)

Zabalza-Mezghani, I., Manceau, E., Feraille, M.: Uncertainty management: from geological scenarios to production scheme optimization. J. Petrol. Sci. Eng. 44, 11–25 (2004)

Zadeh, L.A.: A fuzzy-algorithmic approach to the definition of complex or imprecise concepts. Intl. J. Man-Mach. Stud. 8(3), 249–291 (1976)

Hu, S., Liu, G., Li, J., et al.: Geological parameters and grade standards of play assessment. Acta Petrolei Sinica 26(Suppl.), 73–76 (2005)

Zhou, S., Mao, M., Su, J.: Prediction of wind power based on principal component analysis and artificial neural network. Power Syst. Technol. 35(9), 128–132 (2011)

Meng, B., Zhao, X., Liang, C.: Application of multi-criteria decision grey relation projection method to hydro-engineering development plan decision-making. J. Wuhan Univ. Hydraul. Electr. Eng. 36(4), 36–39 (2003)

Dong, Y., Duan, Z.: A new determination method for identification coefficient of grey relational grade. J. Xi’an Univ. Arch. Tech. (Nat. Sci. Ed.) 40(4), 589–592 (2008)

Zhu, X.: Fundamentals of Applied Information Theory, pp. 256–258. Tsinghua University Press, Beijing (2001)

Teng, Q.-Z., Tan, X., Wu, Z.-Y., et al.: Comprehensive evaluation method in the cooling mode of large-scale hydro-generators. Acta Physica Sinica 64(17), 178802.1–178802.7 (2015)

Wang, Y., Fu, G.: Proof on theory of the weighted least-square priority method of AHP. Syst. Eng. Theory Pract. 1(1), 3–8 (1995)

Liao, Y., Liu, L., Xing, C.: Investigation of different normalization methods for TOPSIS. Trans. Beijing Inst. Technol. 32(5), 871–880 (2012)

Acknowledgments

This project is supported by National Science and Technology Major Projects (Number 2017ZX05030-001) and China National Petroleum Corporation’s Major Science and Technology Projects (Number 2017D-4406).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Yang, C. et al. (2020). Evaluation Indicators System and Improved Multi-attribute Decision-Making Model for Overseas Oil and Gas Venture. In: Lin, J. (eds) Proceedings of the International Field Exploration and Development Conference 2019. IFEDC 2019. Springer Series in Geomechanics and Geoengineering. Springer, Singapore. https://doi.org/10.1007/978-981-15-2485-1_165

Download citation

DOI: https://doi.org/10.1007/978-981-15-2485-1_165

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-15-2484-4

Online ISBN: 978-981-15-2485-1

eBook Packages: EngineeringEngineering (R0)