Abstract

Internet of Things (IoT) industry is one of the most dynamic sectors in India. This US$ 150 billion-strong industry employs 3.8 million people and contributes more than 9% to Indian GDP. However, this largest private-sector employer has been experiencing stress due to fast-changing business models, increased competition from other countries, restrictive visa policies, upsurge in anti-outsourcing sentiments and, most importantly, technological disruptions. These disruptive technologies—captured in a moment in the history of technological transformations as the Fourth Industrial Revolution or Industrie 4.0—principally include such developments as cloud computing, big data and analytics, Internet of Things (IoTs), automation, robotics and blockchain. While Industrie 4.0 has rendered conventional engineering expertise and low-end IT services redundant, it has the potential of creating new employment opportunities in a host of sectors including administration, banks, retail trade and online marketing. Disruptive technologies have a strong chance of transforming the nature and composition of the Indian IT industry in a big way, including endangering India’s position as the software superpower in the world. Albeit, the Indian IT industry has historically proved itself to be extraordinarily resilient and fortified during turbulent shocks of the dotcom bubble, the sub-prime crisis and US visa restrictions. Based on secondary data, this paper aims at mapping the changing nature and composition of the Indian IT industry during recent years. It tries to identify contemporary challenges to employment and business opportunities in the Indian IT industry. The paper includes policy suggestions for enhancement of relevant technological and skill capabilities in the country.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- IT industry

- Fourth industrial revolution

- Technological disruptions

- Internet of Things

- Robotics

- Automation

- India

JEL Codes

1 Introduction

Developing economies, including India, had been deeply influenced by the post-World War II industrialisation strategies that relied mostly on state-led approaches and, to promote import-substitution strategies, undermined the potential of export markets; this was the case at least till the early 1980s. The importance of participating in global markets—as could be facilitated through a lowering of tariffs and relaxing (or, getting rid of) domestic trade and industrial laws—towards promoting a competitive industrial system had come to dominate policy discourse by mid-1980s. During the subsequent years—till the early 2000s—“Governments still mattered but market forces were also critical, and exports were central to achieving scale. Import-competition was critical to ensuring market discipline” (Baldwin 2011: 2).

Experiences with global trade of some of the dynamic emerging economies, including India, appeared in line with what the new trade theory (based on monopolistic firm strategies to product differentiation to remain competitive), attributed to Dixit-Stiglitz model that was perfected in Krugman (1979) had envisaged (Ahmed 2012). However, the later approaches of the developing economies in dealing with ‘liberalised’ trade were increasingly focused on firm-level differences, especially when ‘outsourcing’ as an activity dominated trade clearly by the turn of the century (Melitz 2003; Antràs and Helpman 2004). The Indian IT sector rise may be best understood through the rise of what has come to be known as the ‘new’ new trade theory (NNTT) where the individual firm’s strategic responses to challenges and opportunities of global market assume greater significance than the sector per se.

The information technology (IT) industry is one of the most accomplished and dynamic sectors in India that has been globally recognised. The industry’s phenomenal and historic rise at the turn of the millennium following its unmatched solution to sort out what is termed the ‘dotcom bubble’ or ‘millennium bug’ remains a high point in India’s technological supremacy in the sphere of the software. India is in the forefront of the rapidly evolving global IT-Business Process Outsourcing (BPO) or, as now known as the Business Process Management (BPM) market and is well established as a ‘destination of choice’. It has grown into an over US$ 150 billion industry accounting for two-thirds of the total export of software in the world, and it has created direct employment to the tune of about 3.8 million and indirect employment around 10 million (NASSCOM 2017). Even as the industry could weather a steep fall during the sub-prime crisis in 2008–09, this sector is under stress as during recent times, due to a host of unforeseen obstacles like changing business models, increased competition from other countries, restrictive US and UK visa policies and technological disruptions. However, the most formidable of these is the technological disruptions which are impacting the industry in a big way.

The Fourth Industrial Revolution—also known as Industrie 4.0—includes developments in previously disjointed fields such as artificial intelligence and machine learning, robotics, nanotechnology, 3-D printing, and genetics and biotechnology (WEF 2016: 3). The inevitable acceleration of technology will ‘disrupt’, radically and fundamentally, global employment and the nature of work. For instance, robots can work continuously, as they become more flexible and easier to train for new tasks, they will become an increasingly attractive alternative to human workers, even when wages are low (Ford 2015: 9). Digital platforms and improvements in communication technologies have been squeezing transaction costs and information asymmetries (Productivity Commission 2016: 25). For instance, innovations in power storage battery and metering would disrupt the traditional models of power generation, transmission and monitoring.Footnote 1 Digital technologies offer greater scope for the market use of household assets, including labour (Productivity Commission 2016: 19). E-commerce has set in the fierce competition in the retail business (Kaur 2015). Industrie 4.0 will transform labour markets in the next five years, leading to a net loss of over 5 million jobs in 15 major developed and emerging economies.Footnote 2

With this backdrop, this paper attempts to identify the emerging services in the IT industry and tries to map new opportunities and challenges of the transformation from traditional low-end IT services of the back office and other repetitive tasks to high-end technical skilled-based ones. It tries to map the impact of technological disruptions on the IT industry in India. It is important to note that due to paucity of the relevant database on several dimensions of the impact of new technology, arguments and concluding statements have generally been drawn upon reports and newspaper articles published by responsible institutions. The remaining part of the paper is divided into four sections. Section 2 discusses the growth and composition of the IT Industry in India in recent decades. Section 3 deals with the present phase of transformation in the IT services through technological innovations like mobile applications, cloud computing and automation. Section 4 attempts to identify opportunities and challenges for the IT industry in India. Concluding observations and policy suggestions have been presented in Section 5.

2 Growth of the Indian IT Industry

Reasons behind the growth of the IT industry in India have varied over time. As summarised in Table 1, the 1980s witnessed cost arbitrage through software development and time and material (T and M) pricing as the prime reason behind the growth of the IT industry in India. During the 1990s through greater collaborative efforts, Indian IT firms contributed notably towards improving standards and productivity of western buyers even through non-critical functions. The period 2000–10 experienced value addition through a non-linear growth, end-to-end services and partnerships in the IT industry. In the current period, automation platforms, smart technology and innovations have emerged as dominant features.

The Indian IT industry grew at a snail’s pace till the end of the previous century but, thereafter, a major shift upward was observed during 2000–15. The revenue shot up from around US$ 1 billion during 1980–90 to US$ 167 billion during 2015–18 (Fig. 1). The Indian IT industry was in a nascent stage during the 1980s with about 1000 firms employing a mere 0.06 million people. However, during 2010–15, there were more than 16,000 IT firms employing about four million people (Figs. 2 and 3). That the future of employment in the IT industry is quite uncertain may take exceptional turns have been a matter of emerging concerns. For instance, it is estimated that in the period up to 2022, around 75 million jobs across industries may be displaced by a shift in the division of labour between humans and machines, while 133 million new roles may emerge that are more adapted to the new division of labour between humans, machines and algorithms (WEF 2018: 10). For instance, around 20–33% out of the 1.5 million engineering graduates every year run the risk of not getting a job at all in India due to sharp fall in the demand for IT-related jobs in India due to non-linear growth models of IT companies and a lesser number of men required to handle the same jobs as before due to a higher degree of automationFootnote 3. This industry enjoys the distinction of being the single largest private-sector contributor to the GDP at 9.3% (Fig. 4). Even, IT exports rose at a CAGR of 12.9% from US$ 26 billion in the 2010s to US$ 117 billion in 2017 and its share was over 56% in total services exports from India (Fig. 5).

Source Drawn on data obtained from http://www.nasscom.in/impact-indias-growth

Revenue from the IT industry in India.

Source Drawn on data obtained from http://www.nasscom.in/impact-indias-growth

Employment in the IT industry in India.

Source Drawn on data obtained from http://www.nasscom.in/impact-indias-growth

Number of firms in the IT industry.

Source Drawn on data obtained from http://www.nasscom.in/impact-indias-growth

Share of the IT industry in Indian GDP.

Source Drawn on data obtained from http://www.nasscom.in/impact-indias-growth

Share of the IT industry in Indian services exports.

According to NASSCOM, the IT-BPM sector had generated revenue of US$ 150 billion and had made exports worth US$ 100 billion in 2017. Indian IT companies have set up over 600 delivery centres across the world and are engaged in providing services with their presence in over 200 cities across 78 countries and India continues to maintain a leadership position in the global sourcing arena accounting for almost 56% of the global market share in 2017.

Although India has had significant success in the IT services, it is yet to strike gold with IT products and intellectual property (Sadagopan 2012). Given that TCS, Infosys, Wipro and Genpact are renowned brands from India, there is no single IT product company yet like Microsoft, Facebook or Google. Bengaluru, Chennai, Mumbai and Hyderabad have earned their names as IT hubs, but the Silicon Valley of USA dominates in the field of IT innovations. Mani (2014) identifies three reasons for Indian IT firms not being able to break into the highly oligopolistic market of IT products. First, Indian IT firms did not have the domain expertise to create products. Second, they did not want to take risks. Third, India was not a big market for IT products in the past. Majority of the Indian IT firms operate on business-to-business (B2B) models, and not many have adopted the business-to-consumer (B2C) model.

Hailed as a global giant, paradoxically, the Indian IT industry predominantly provides low-end IT services like BPO and IT software services. Figure 6 suggests that IT services and IT-BPO accounted for around 80% of the export earnings from this industry in 2012–13. As per Fig. 7, IT Services exports accounted for the largest share of 57% of about US$ 86.0 billion, Engineering R & D and software products has emerged as the second-largest segment with 21.8% share followed by BPO exports contributing 21.2%. Interestingly, while there is a continuous rise in the absolute value of the software product and engineering services, its relative share is just one-fifth of the total exports of this industry. In fact, from both the figures it is clear that the software products, engineering services, R and D that are categorised as high-end IT services had reported only a marginal rise from 20 to 22% during the five years between 2012–13 and 2017–18.

Source Dawn on data sourced from https://meity.gov.in/content/performance-contribution-towards-exports-it-ites-industry

Export revenue from sub-sectors of the IT industry (2017–18).

According to the National Policy on Software Products,Footnote 4 “The total revenue of the software product industry in India was US$ 6.1 billion, of which US$ 2 billion was from exports. However, comparing the Indian software product industry with its Western counterparts, it is still in its infancy” (p. 4). The IT services, software product and engineering services and IT-ITES-BPO have almost tripled between 2009–10 and 2018–19 (Fig. 8) and the compound annual growth rate (CAGR) for the industry has been 12.26% during the same period. The CAGR during 2013–2018 for IT services, IT-BPO and software product and engineering services were recorded as 10.07%, 9.19% and 13.09% respectively, and the CAGR for the entire industry was estimated to be 10.32% during this period (Fig. 9).

Source Drawn on data from https://www.ibef.org/uploads/industry/Infrographics/large/it-and-ite-nov-2018.pdf

Segment-wise export revenue trends in the IT industry.

Source Drawn on data from http://deity.gov.in/content/performance-contribution-towards-exports-it-ITES-industry

CAGR of revenue of IT industry in India, 2013–18 (per cent).

3 Employment Implications

3.1 Data and Methodology

The empirical analyses relate to data on the IT sector and GDP Services for the years 1999–2017. As indicated earlier, the Indian IT industry had taken off since 1999 following the solution to the Y2K problem contributing significantly to the generation of employment, exports and GDP of India. Since the industry was typically dominated by low-end IT services, the introduction of ‘disruptive’ technologies like cloud, big data and analytics and automation in certain spheres has emerged as a challenge to the sustenance of existing jobs or creation of future jobs and obtaining orders from global buyers. Further, as IT-ITeS form an important component of the services sector, GDP Services is likely to be affected by technological disruptions. Hence, as shown in Table 2, variables such as employment, market size, exports and GDP Services have been included in the empirical analysis; all the values are in current prices.

3.2 An Empirical Analysis

An attempt has been made through econometric analyses to establish the relationship between employment and growth of the IT industry, especially in terms of rising market demand, domestic as well as foreign. The massive rise in jobs in the IT sector in the country has often been cited as a high point in this sector’s contribution to the economic progress of the country and also an acknowledgement of the quality of Indian IT-ITES personnel. The demand for labour in each industry is a derived demand. The size of the demand for the final product produced by the industry, hence, is a critical factor affecting the industry employment level. In the case of the Indian IT industry, the size of the market can be taken to be consisting of two components, namely, the domestic market (DM) and export market (EM). The growth of the Indian IT industry is historically driven by exports while the size of domestic IT market has been comparatively small. It is predicted that both these components of the IT market will favourably affect employment generation in the Indian IT industry.

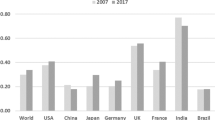

In addition to the size of the market for IT, the employment level in the Indian IT industry can be expected to be related to the size of the services sector (SS). The growth of different areas of the services sector like finance, e-commerce, marketing, etc., has strong linkages with the IT industry. Higher the size of services sector greater is the employment level in the IT industry. Moreover, the global financial crisis may have affected the employment generation in the Indian IT industry. The period 2007–08 to 2009–10, during which the global financial sector had seen huge uncertainty had dragged the overall global growth. This shrinking global demand was likely to hurt the employment level in the Indian IT industry.

Keeping the above postulations, the study has used the following empirical framework to examine the determinants of employment in the Indian IT industry:

where explanatory variables are as measured in Table 3 and εt is the random error term.

Equation 1 was estimated for the Indian IT industry for data concerning the period 1999–2000 to 2016–17. Given that issues of non-stationarity could arise only for a long period, and our study period is 18 years, the study has used the OLS method of estimation. The estimation results are presented in Table 4.

The initial problem faced by the study was that our sample suffered from strong multicollinearity as the mean value of variance inflating factor (VIF) for the independent variables was 22.47 while the condition number was 299. The VIF values for lnEMt, lnSSt and lnDMt, respectively, stood at 45.14, 22.79 and 20.04.

To overcome the severity of this problem, the study preferred a modified Gram–Schmidt orthogonalisation procedure (Golub and Van Loan 1996) and created a new set of orthogonal for these three variables. In this successive orthogonalisation process, we have arranged lnEMt, lnDMt and lnSSt by their theoretical importance in affecting employment. Industry output, namely, lnEMt and lnDMt are the most important determinants compared to the size of the services sector in the economy. Re-calculation of the VIF on the new matrix of transformed explanatory variables reveals a mean VIF of 1.47 and a condition index of 2.67. The maximum VIF for individual explanatory variables is 1.93. This suggests that orthogonalisation of concerned explanatory variables has contained the severity of multicollinearity in the sample.

Within the Indian IT industry, the two segments that have grown notably since the late 1990s are i. the IT services and ii. The IT-BPO/BPM segment. These were also the segments where external demand had remained high, and the major share of jobs had been concentrated. To estimate the correlation coefficient between employment and exports by these segments, a bivariate Pearson correlation was run (on SPSS 16). The results have been presented in Table 5. It is obvious that the correlation between exports and employment in both segments has been strong and significant.

4 Emerging IT Services and New Technologies

Till around 2005, the Indian IT industry was largely dominated by call centres that focused on outsourcing services in business processes at costs considered low internationally. However, the industry has subsequently diversified in terms of IT services and the IT firms have grown into strategic business partners for their western clients. The number of BPO deals has been decreasing since 2013 with organisations typically looking for alternative options for cost reduction, such as greater use of shared service. It remains to be seen as to whether this points to a shrinking share of business process offshoring (KPMG 2016).

Key growth drivers for global businesses for technology and BPM spending in 2019, according to the NASSCOM’s (2018–19: 12) CEO Survey, would be to digitise the core and build a truly digital organisation, build customer value through enhanced customer experience, unlock growth with new revenue opportunities, enhanced efficiency and modernisation and cost optimisation in their decreasing order. Digitizing business than just silos and enhanced customer experience are the top two spending areas for IT and BPM. However, cost optimisation was a much lower priority. Further, the top technology priorities for global businesses in 2019 were advanced analytics and AI, hybrid cloud, cybersecurity, devices and IoTs and blockchain. Advanced Analytics and AI are the top priorities for over 50% of the CEOs, and hybrid cloud and cybersecurity are witnessing increased spending (NASSCOM 2018–19: 12).

New IT services have emerged, and this industry has been adopting new business models over the last 15 years or so. The IT industry is a knowledge-based and services-centric sector and, hence, has been passing through a major technological transition. Such developments have posed a challenge before the Indian IT industry to assert its leadership position again. Constant innovations in Software Mobile Analytics Cloud (SMAC) technologies have been recognised as both a serious threat as well as a source of ‘new’ employment in the sector. Firms in India are exploring new opportunities in SMAC that have a tremendous potential to fulfil the demand not only in the so far untapped domestic market but also in other Asian and African countries. Newly set up firms during the last half a decade are attempting to exploit the SMAC technologies for their businesses in agriculture, healthcare and education.

4.1 Cloud Computing

Cloud computing is proving to be a breakthrough innovation as it offers benefits in terms of storing huge volumes of data with security with no investment in hardware. With the explosion of voice and visual data, it has become untenable for every organisation to cater to their requirements individually, thereby making the public cloud an attractive option to store important data (Cherian 2014). Most small businesses that have migrated to the cloud have reduced their cost of running applications as the cloud service provider has been investing in infrastructure and not the business firms. In the IT sphere, cloud computing includes Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS) and Software-as-a-Service (SaaS) and provides a perfect platform on which unorganised data could be loaded, crunched and analysed (Sen 2015: 78–79). Cloud computing has opened up a whole world of possible industry disruptions allowing start-ups and SMEs to compete successfully with long-established enterprises (Bhattacharya 2016) and SaaS is the preferred model of over 50% of Indian product companies. Software and services revenue crossed US$ 150 billion during 2017–18 (NASSCOM 2018: 6). In India, 65% of large enterprises is making use of cloud technology, services and solutions as part of their IT infrastructure (Bhattacharya 2016).

Firms in the business of cloud computing possess sophisticated monitoring systems, multi-layered security safeguards and centralised management. Cloud-based applications, hosted by third-party vendors, have been helping replace the traditional warehouse management system that requires substantial investments in physical infrastructure and its maintenance and software licenses. People from across places could share/store data in the public domain of cloud services.

They are outsourcing IT software functions to distant data storage open doors to new security threats such as security breaches, data theft and service traffic hijacking. The risk in cloud computing is much more serious, particularly if it leads to a security breach or data loss by a bank or defence company or national security agency. The possible threats to cloud security identified by experts of the Cloud Security Alliance (CSA) are data breaches, data loss, account or service traffic hijacking, insecure interfaces, denial of services, malicious insiders, abuse of cloud services, insufficient due diligence and shared technology vulnerabilityFootnote 5. There were more than 10,000 cases of cybercrime in India in 2016. India is ranked third after the United States and Japan among the countries most affected by online banking malware (Dawar and Lacy 2017).

India needs a large number of cybersecurity experts to protect firms from the increasing number of cyber frauds, cyberattacks and theft of sensitive information. Government departments like vigilance, police, intelligence and defence demand cybersecurity experts for their requirements. There is a whole range of demand arising from state agencies, corporate sector and even households and for investigation, surveillance and even spying.

4.2 Internet of Things (IoT) and Automation

IoT is a technology that connects devices such as mobile phones, digital watches, fitness bands and other digital machines through the internet, WiFi or GPS to share information among concerned persons. It allows physical objects to be sensed and controlled remotely across existing network infrastructure, creating opportunities for more direct integration between the physical world and computer-based systems and resulting in improved efficiency, accuracy and economic benefits (Modi 2015). Examples could include drone, driverless car and chatbot. According to World Bank estimates, automation threatens 69% of the jobs in IndiaFootnote 6 but at the same time can potentially create numerous business opportunities to expand product and services offerings. It permits IT firms to harvest data on an unimaginable scale through devices that provide rich streams of data continuously. In the long run, the size of data generated will increase exponentially, creating new avenues for data managers, researchers and analysts to map consumer tastes and preferences to obtain business insights. As Shrikanth (2015: 12) predicted: “By 2020, there will be 50 billion networked devices and this level of connectivity will have profound social, political and economic consequences.”

As per the Business Process Management Report, technology and automation are fast emerging as one of the key levers to create best-in-class business process management outcomes and Robotic Process Automation (RPA) is now emerging as an unassisted automation approach that offers high-value creation at relatively lower risk along with the opportunities of significant cost savings, better service delivery and manageability, and quicker time-to-value. The chatbots function as robotic customer service representatives for a host of companies such as taxi, e-commerce, news and weather and are increasingly being deployed globally and in India (Agrawal 2016a). The chatbots could spell the significant loss of revenue for BPOs along with leading to erosion of low-end repetitive jobs (Agrawal 2016b). Automation, with significant implications for employment in the Indian IT industry, is increasingly becoming a change enabler for Indian IT services. In 2018, an average of 71% of total task hours across the 12 industries covered in the report were performed by humans, compared to 29% by machines; but by 2022 this average is expected to have shifted to 58% task hours performed by humans and 42% by machines (WEF 2018: 10).

4.3 Big Data, Analytics and E-Commerce

Big data will enable implementing and monitoring several interconnected systems managing public amenities and services and features that will support ‘smart’ aspects of smart cities. Big data and analytics are going to play a pivotal role in checking illegal use of resources like water and electricity and would prevent various types of wastage. Improving citizen security, optimisation of water supply, and efficient power distribution are just a few examples of what big data could do to take the smart cities concept to the next level (Kiran 2015).

Big data and analytics are helping business firms to predict consumer tastes and preferences. The e-commerce industry has brought a mixed bag of opportunities and threats. While this sector has created new employment opportunities for a range of other sectors the challenges of predatory pricing, sale of poor quality products, delivery of wrong products and non-payment of claimed refunds remain some of its grey areas. Further, there have been cases of illegal trade and smuggling of endangered animals, their body parts and rare species of plants on e-commerce portals.

Cloud computing, e-commerce and domestic technology services grew at 43%, 17% and 10%, respectively, during 2017–18 (NASSCOM 2018: 5). The online business has been creating employment opportunities for transporters, courier and packaging companies. Having experienced cuts in their profit margins, even small retailers are increasingly going online. Smartphones have fuelled the growth of the e-commerce industry in India. Social media, particularly, Facebook and WhatsApp, have been extensively used in promoting online business in India. Although no country-level information is available yet, global estimatesFootnote 7 suggest that these disruptive technologies are likely to have a trillion-dollar economic impact, viz., mobile technology (US$ 3.7–10.8 trillion), automation and robotics (US$ 5.2–6.7 trillion), IoT (US$ 2.7–6.2 trillion) and cloud computing (US$ 1.7–6.2 trillion) every year. These technologies can potentially be used in almost all sectors of the economy creating ample job opportunities for technicians, IT professionals and engineers. It is important to mention that 3D printing is another field that could potentially transform manufacturing in the entire world, including India. Although 3D printing is in its nascent stage, it could create an economic impact of US$ 230–550 billion every year.

The IT industry is a major employer of the urban youth in India. As shown in Fig. 10, more and more jobs were created in this industry between 2012–13 and 2017–18. It is estimated that about 3.97 million people were employed in this sector in 2017–18. Within the IT industry, the sub-sectors, namely, export-driven IT services and BPO have the largest share in total employment. Domestic market of this industry had increased from 0.699 million to 0.793 million between 2012–13 and 2017–18. However, it makes just one-fifth of the total employment in the sector. Moreover, the net addition to the direct employment in 2017–18 is reduced to its one third in 2013–14.

Source Drawn on data sourced from https://meity.gov.in/content/employment

Direct employment in the IT sector in India.

In the changing context of the rise of disruptive technologies as a business driver, it is imperative that IT service providers not only reduce costs but deliver business outcomes in terms of value and impact (Nair 2015). The large IT corporate firms in India are increasingly becoming fast solution providers for their clients.

The IT industry has been moving into Tier-II cities as well. Among the IT landscape, a greater number of firms belongs to enterprise software, fintech, healthtech and adtech category (Fig. 11). It may be observed that the Indian IT industry provides service somewhere at the low-end or middle of the IT value chain. Looking at IT verticals, BFSI (18%), across sectors (17%), healthcare (17%) and next-generation commerce (15%) occupy the dominant share (Fig. 12). As per the NASSCOM’s Product Compendia Beta, the concentration of IT firms was found the highest in Bengaluru followed by Delhi NCR, Mumbai, Chennai, Hyderabad and Pune, in that order.Footnote 8 All these developments point to a maturing of the IT industry in India and building up of potential to handle high-end technology services.

Source Drawn on data obtained from http://www.productsmade.in/. Note Product Compendia Beta for Landscape refers to digital technologies available as products for digital solutions across sectors

Firms in India: Landscape.

Source Drawn on data obtained from http://www.productsmade.in/. Note Product Compendia Beta for Verticals refers to a particular digital technology available for common problems across sectors

Firms in India: verticals.

5 Opportunities and Challenges

Digital technologies have unleashed what is being called the Fourth Industrial Revolution. A combination of technological advancements is transforming consumer lives, creating value for the business, and unlocking broader societal benefits at an unprecedented scale. The potential value at stake is estimated at a massive US$ 100 trillion over the next 10 years. In India alone, digitalisation can lead to benefits valued at more than US$ 5 trillion. The IT company Accenture estimated the impact of technological disruptions as follows: Virtual collaboration and talent portals can reduce hiring costs by approximately 10%, cloud-based accounting systems and AI-driven automation can reduce costs by approximately 40%, cloud computing can reduce IT system costs by 25–50%, autonomous transport and sensors for monitoring supply chains can cut costs by 50%, crowdsourcing and AI can improve productivity by 20–40% (Dawar and Lacy 2017). As technological breakthroughs rapidly shift the frontier between the work tasks performed by humans and those performed by machines and algorithms, global labour markets are undergoing major transformations, however, if these transformations are managed wisely, could lead to a new age of good work, good jobs and improved quality of life for all, but if managed poorly, pose the risk of widening skills gaps, greater inequality and broader polarisation (WEF 2018: 9).

Automation has the potential to bring revolutionary changes in the Indian IT industry. Automation, being seen as a labour-replacing technology, could also create new jobs. As, in all likelihood, it may eradicate the need for human intervention in different areas, especially high-volume, repetitive tasks, jobs related to IT support, remote infrastructure, and business processes may be adversely impacted. Additionally, the IT firms find a high rate of labour attrition as a major concern. Therefore, they are switching over to newer technologies that involve limited human intervention. Seeing the potential of IoT, the government is promoting IoT to capitalise on the business opportunities by improving the supply chain, better delivery of services by smart cities and closer monitoring of production lines. For example, to make Andhra Pradesh a hub for IoT by 2020, the state government has been creating 10 IoT hubs by providing land on lease on easy terms, offering relaxed fiscal and administrative procedural norms for companies, and building world-class IT infrastructure (The Times of India 2016a).

As the Fourth Industrial Revolution unfolds, companies are seeking to harness new and emerging technologies to reach higher levels of efficiency of production and consumption, expand into new markets, and compete on new products for a global consumer base composed increasingly of digital natives (WEF 2018: 9). According to a report by Great Learning, “Over 50,000 positions in the fields of data science and machine learning are vacant in the country owing to a lack of skilled workforce”.Footnote 9 As, in all likelihood, it may eradicate the need for human intervention in different areas, especially high-volume, repetitive tasks, jobs related to IT support, remote infrastructure, and business processes may be adversely impacted. Therefore, they are switching over to newer technologies that involve limited human intervention.Footnote 10

6 The Threat of Technological Disruptions

Most of the big IT companies in India are investing heavily in automation of processes in their traditional businesses like BPO, application management and infrastructure management (The Times of India 2016b). At this stage, only big IT firms can create tools and platforms for automation in infrastructure, application, testing and BSP service due to their capability in terms of investment, sophisticated technology and business network with multinational corporations. This will have a two-fold impact on employment; firstly, drop in hiring and second, removing some of the existing labour. It has been argued that while all jobs are at risk of automation, it is the “routine” and “predictable” jobs that will be impacted most (Ford 2015: 10). To shift to automation, major IT companies in India are reducing their employee strength in recent times (Fig. 13). As shown in Fig. 14, the headcount of six top IT companies—TCS, Cognizant, Infosys, Wipro, HCL and Tech Mahindra—put together dropped by 4157 in the first six months of 2017–18 compared to an increase of almost 60,000 during the same period last fiscal year (Das and Phadnis 2017). New sets of skill required for the existing workforce, automated machines replacing labour for repetitive tasks and artificial intelligence are important factors behind this shift in recruitment in the industry.

Source Drawn on data sourced from Das and Phadnis (2017)

Employment in major IT-ITES companies in India.

Source Drawn on data sourced from Das and Phadnis (2017)

Impact of automation on jobs in select Indian IT-ITES companies.

As the nature of IT, application in various processes would transform, it would seriously impact employment prospects for conventional tasks in different industries. Both the possibilities and limits appear beyond easy comprehension.Footnote 11 Google’s driverless car would reduce demand for the regular driver of cars. Similarly, repetitive tasks in a factory would be handled by robots in the future, replacing human labour again. Interestingly, the impact of labour-reducing and labour-replacing would be felt more at the bottom of the pyramid of work hierarchy, however, the top management of the companies would be least affected by robotics and smart machines. Technological disruptions such as robotics and machine learning—rather than completely replacing existing occupations and job categories—are likely to substitute specific tasks previously carried out as part of these jobs, freeing workers up to focus on new tasks and leading to rapidly changing core skill sets in these occupations (WEF 2016: 7).

In the absence of any comprehensive database on the manner in which the future of work in this sector would unfold, a recent survey-based study (FICCI et al. 2017: 72) estimated that by 2022 in the Indian IT-BPM sector would have 4.5 million jobs of which while 10–20% would be ‘new’ jobs (requiring hitherto-unavailable new skills) 60–65% jobs would require ‘changes’ in existing skills implying upgrading skills. By 2022, no less than 54% of all employees will require significant re- and up-skilling. Of these, about 35% are expected to require additional training of up to six months, 9% will require re-skilling lasting six to 12 months, while 10% will require additional skills training of more than a year (WEF 2018: 11). HfS Research (2016) taking note of the fast progress in the automation and digital technologies predicted that by 2021 demand for low-skilled and routine jobs would drop sharply by 30% globally and the number of loss of such low-end jobs would be around 0.64 million in India. However, new IT jobs in India would grow by 14% to about 0.16 million. Job cuts in Indian IT companies would be around 0.2 million per year in the next three years, due to under-preparedness in adopting newer technologies (Lakshmikanth 2017). Based on the job profiles of their employee base today, nearly 50% of companies expect that automation would lead to some reduction in their full-time workforce by 2022 (WEF 2018: 10).

Given the nature of employment-skill configuration in the Indian IT industry, as shown in Fig. 16, the greatest and earliest risk of job losses would be in the massive low-end jobs, while the few top-notch professionals might move up in career performance through re-skilling and resilience with alacrity (Fig. 15).

7 Concluding Observations

To make the Indian IT Industry move up the value chain and thereby sustain its growth trajectory, a paradigm shift in the industry’s strategy for the software sector is being observed. The focus of the IT industry is on software product development to contribute equitably and significantly along with IT services. The Indian IT industry is passing through a crucial phase of technological disruptions that demands deeper specialisation and constant innovations risking its ability and readiness to deliver quality IT services.

Cloud computing, big data and automation are creating tremendous business opportunities in India but then how to capitalise on such a situation falls in the domain of the stakeholders, including the state. Constant innovation, improving IT infrastructure and removing legal and administrative bottlenecks are the need of the hour for the Indian IT sector to sustain its leadership position and to take anew (Das and Sagara 2017). Though IT exports from India is largely dominated by corporates, there are numerous small firms working on highly technical, innovative and creative projects. Development of mobile applications and platforms for small business units is turning out to be a lucrative business opportunity for small IT firms and individual software developers.

In a joint study of Analytics India Magazine and Great Learning found that the artificial intelligence industry has grown by close to 30% during the financial year 2017–18 to US$ 230 million and the industry is witnessing a shortage of over 4,000 mid and senior-level qualified job positions in the country.Footnote 12 Digital transformation has the potential to unlock value at an unprecedented scale and adaptive organisations that understand, embrace, and prepare for this change can gain significant business value as part of this transformation. While digitalisation can be a net job creator in some industries and a destructor in others, there is a need to evaluate and up-skill employees to manage employment rates through relevant investment in enabling infrastructure.

New technologies can drive business growth, job creation and demand for specialist skills, but they can also displace entire roles when certain tasks become obsolete or automated (WEF 2018: 11). McGowan and Andrews (2015: 32) in their OECD Survey of Adult Skills suggested that while differences in skill mismatch across countries are associated with differences in the policy environment in different countries, skill mismatch is lower in countries with well-designed framework conditions that promote efficient reallocation, greater flexibility in wage negotiations and higher participation in lifelong learning as well as better managerial quality.

The Indian IT industry will have to cope with challenges concerning data security, the privacy of individuals, content management and cybercrimes. The lower level of digital literary, unreliable internet connectivity and shortage of power supply are major hindrances before the IT industry in India. It is predicted that India may experience a falling demand in the traditional BPO business, but with the setting up of adequate infrastructure and promoting constant innovations, India could hope to continue to dominate the world in the IT services in the future as well. Creation of relevant opportunities for ‘new’ jobs would hinge upon the nature and degree of proactive preparedness the state and even the private sector might show. There is a need for a comprehensive ‘augmentation strategy’, an approach where businesses look to utilise the automation of some job tasks to complement and enhance their human workforces’ comparative strengths and, ultimately, to enable and empower employees to extend their full potential (WEF 2018: 11).

For governments and businesses alike, there is a significant opportunity in strengthening cross-sectoral multi-stakeholder collaboration to promote corporate re-skilling and up-skilling among employers in affected countries and regions (WEF 2018: 34). The National Policy on Software Products (2016) aims at creating synergies of efforts by the government and industry to create a robust software product industry that would buttress large number of software product start-ups, promote development of an ecosystem encouraging R and D and innovation, open up multitude of opportunities of access to capital and help build and improve domestic demand.

Governments and businesses will need to change profoundly their approach to education, skills and employment, and their approach to working with each other and the governments will need to show bolder leadership in putting through the curricula and labour market regulation changes that are already decades overdue in some economies (WEF 2016: 9). It has been observed that the Digital India initiative of the Government of India has the potential to transform the entire service delivery system accelerating productivity, employment and literacy in areas that are not digitally connected in the country (Goel 2014). Similarly, the Smart City Project, according to NASSCOM, would create a massive business opportunity of US$ 30–40 billion for the IT industry over the next 5–10 years (Srikanth 2015). However, progress on these mega programmes has been sluggish and far from the promises made when these were formally announced.

Notes

- 1.

An impression about the nature and impact of such technological disruption may be had from the following example. “The Tesla Powerwall home battery is a household technology enabled by Li-ion battery storage and has the potential to be highly disruptive. The Powerwall is a battery module that enables large amounts of electricity to be stored at the user’s home. The battery can be charged using electricity from solar panels, or from the grid during non-peak energy use periods when rates are low. This stored electricity can then be used to power the home during peak hours” (Productivity Commission 2016: 208).

- 2.

- 3.

- 4.

https://cis-india.org/internet-governance/files/national-policy-on-software-products.pdf (accessed June 10, 2018).

- 5.

- 6.

http://www.thehindu.com/business/Industry/Automation-threatens-69-jobs-in-India-World-Bank/article 15427 005.ece (Accessed June 5, 2018).

- 7.

Drawn on information obtained from McKinsey Global Institute (2013).

- 8.

http://www.productsmade.in/ Accessed June 5, 2016.

- 9.

- 10.

This process is described thus: “Digital tools are creating a new informal “gig economy,” where workers can combine a number of disconnected tasks to earn their incomes. In many cases, these gig economy platforms have disrupted traditional markets in the ‘real world’ as well; for example, Uber has confronted taxi unions and regulators in a number of countries, while Airbnb (which allows someone to rent out their residence partly or in entirety) has challenged the hotel industry. Concerns about these platforms include the lack of price floors, little social safety nets, and difficulties in regulating the entry and behaviour of workers, customers, and the platforms themselves. Regulating these platforms has proven to be challenging” (World Bank Group 2015: 7).

- 11.

Regarding the possibilities and limits of new technologies, as these unfold through growing applications, “Opportunities exist to leverage analytics, algorithms, and drones in the near future to protect and potentially expand markets. In the medium to long term, robots and driverless cars will also likely gain adoption although, as with any technology, how they will be deployed will likely evolve over time. Factors affecting the adoption of the new technologies and business models examined in this paper include business profitability; environmental considerations that may accelerate the use the technology that save carbon emission, customary safety and trust concerns regarding new technology, labour issues with crowdsourcing and other models; and regulations governing drones, robots, and driverless cars” (Standard Business Graduate School 2016: 13).

- 12.

References

Agrawal, S. (2016a). BPOs beware! Chatbots are on their way. The Times of India, June 15. Retrieved on June 10, 2016 from http://timesofindia.indiatimes.com/tech/tech-news/BPOs-beware-Chatbots-on-their-way/articleshow/52757547.cms.

Agrawal, S. (2016b). How chatbots could soon put BPOs out of business. Retrieved on June 10, 2016 from http://economictimes.indiatimes.com/articleshow/52754634.cms?from=mdr&utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst.

Ahmed, G. (2012). Krugman trade theory and developing economies. China-USA Business Review, 11(12), 1557–1564.

Antras, P., & Helpman, E. (2004). Global sourcing. Journal of Political Economy, 112(3), 552–580.

Baldwin, R. (2011). Trade and industrialisation after globalisation’s 2nd unbundling: How building and joining a supply chain are different and why it matters. Working Paper 17716. Cambridge, MA: National Bureau of Economic Research. Retrieved on April 25, 2018 from http://www.nber.org/papers/w17716.

Bhattacharya, B. (2016). Cloud computing: The silver lining for SMEs and start-ups. PCQUEST, March 23. Retrieved on November 3, 2017 from http://www.pcquest.com/cloud-computing-the-silver-lining-for-smes-start-ups/.

Cherian, P. (2014, October 31). Mobility and scalability of the public cloud. Dataquest, 32(20), 60.

Das, A., & Phadnis, S. (2017, November 2). Infosys, Wipro’s headcount shows the kind of IT jobs will survive. The Economic Times. Retrieved on November 3, 2017 from https://economictimes.indiatimes.com/articleshow/61449803.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst.

Das, K., & Sagara, H. (2017). State and the IT industry in India: An overview. Economic and Political Weekly, 52(41), 56–64.

Dawar, S., & Lacy, P. (2017, August 8). Digital disruption: Capitalizing on the 4th Industrial Revolution fuelled by digital technologies. Live Mint. Retrieved on April 10, 2018 from https://www.livemint.com/Home-Page/2No24MFhEFWjwj4pNIEMML/Digital-disruption-Capitalizing-on-the-4th-Industrial-Revol.html.

FICCI, NASSCOM & EY. (2017). Future of jobs in India: A 2022 perspective. Retrieved on February 28, 2018 from http://www.ey.com/Publication/vwLUAssets/ey-future-of-jobs-in-india/$FILE/ey-future-of-jobs-in-india.pdf.

Ford, M. (2015). Rise of the robots: Technology and the threat of a jobless future. New York: Basic Books.

Goel, R. (2014, October 31). Digital India is the need of the hour. Dataquest, 32(20), 40–43.

Golub, G. H., & Van Loan, F. C. (1996). Matrix computations. Baltimore: The Johns Hopkins University Press.

HfS Research. (2016, July 5). Automation to impact 1.4 million global services jobs by 2021 with India the most affected. Retrieved on March 25, 2018 from https://www.hfsresearch.com/press-releases/automation-to-impact-14-million-global-services-jobs-by-2021-with-india-the-most-affected.

KPMG. (2016). Global IT-BPO outsourcing deals analysis, February. Retrieved on June 8, 2018 from https://assets.kpmg.com/content/dam/kpmg/pdf/2016/03/KPMG-Deal-Tracker-3Q15.pdf.

Kaur, B. (2015). Impact of E-Commerce on E-Retail. Journal for Studies in Management and Planning, 6(1). Retrieved on June 8, 2018 from https://edupediapublications.org/journals/index.php/JSMaP/article/view/1548.

Kiran, P. C. (2015, September 15). When Smart Cities meet big data. Dataquest, 33(17), 52–53.

Krugman, P. (1979). Increasing returns, monopolistic competition, and international trade. Journal of International Economics, 9, 469–479.

Lakshmikanth, K. (2017, May 14). Indian IT firms to layoff up to 2 lakh engineers annually for next 3 years. Livemint. Retrieved on April 20, 2018 from https://www.livemint.com/Industry/Y0oIb1D6N1ADZDfq3BUhUM/Indian-IT-firms-to-layoff-up-to-2-lakh-engineers-annually-f.html.

Mani, S. (2014). Emergence of India as the world leader in computer and information services. Economic and Political Weekly, 49(49), 51–61.

McGowan, M. A., & Andrews, D. (2015). Skill mismatch and public policy in OECD countries. The Future of Productivity: Main Background Papers, Economics Department Working Papers No. 1210, ECO/WKP (2015) 28. https://www.oecd.org/eco/growth/Skill-mismatch-and-public-policy-in-OECD-countries.pdf.

McKinsey Global Institute. (2013). Disruptive technologies: Advances that will transform life, business, and the global economy. Retrieved on November 7, 2017 from file:///C:/Users/Lenovo/AppData/Local/Packages/Microsoft.MicrosoftEdge_8wekyb3d8bbwe/TempState/Downloads/MGI_Disruptive_technologies_Full_report_May2013.pdf.

Melitz, M. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Modi, D. (2015, December 23). IoT shall be the next big force to drive mobility. PCQUEST, 24–25. Retrieved on November 3, 2017 from http://www.pcquest.com/iot-shall-be-the-next-big-force-to-drive-mobility/.

Nair, E. (2015). The challenge of change. Dataquest, 33(13), 82.

NASSCOM. (2017). The IT-BPM Industry In India 2017: Strategic Review. Retrieved on June 7, 2018 from https://www.nasscom.in/knowledge-center/publications/it-bpm-industry-india-2017-strategic-review.

NASSCOM. (2018–19). CEO Survey: 2019–20 Industry Performance: 2018–19 and what lies ahead. https://www.nasscom.in/sites/default/files/Industry-Performance2018-19-and-what-lies-ahead_0.pdf.

Productivity Commission. (2016). Digital disruption: What do governments need to do? Commission Research Paper, Canberra, June. Retrieved on June 7, 2018 from https://www.pc.gov.au/research/completed/digital-disruption/digital-disruption-research-paper.pdf.

Sadagopan, S. (2012, September 13–16). IT in India. Yojana, 56.

Sen, A. (2015). Marrying IoT with big data: Not possible without a cloud home. Dataquest, 33(13), 78–79.

Shrikanth, G. (2015). A utopia called secured cloud. Dataquest, 33(13), 28–31.

Srikanth, R. P. (2015, September 15). Smart cities: An opportunity to transform India. Dataquest, 33(17), 8.

Standard Business Graduate School. (2016). Technological disruption and innovation in last-mile delivery. Stanford Value Chain Innovation Initiative in Collaboration with United States Postal Service Office of Inspector General GSB.Stanford.Edu/R/Vcii, White Paper, June.

The Times of India. (2016a, March 3). Andhra cabinet okays internet of things (IoT) policy. Retrieved on June 10, 2016 from http://timesofindia.indiatimes.com/good-governance/andhra-pradesh/Andhra-cabinet-okays-Internet-of-Things-IoT-olicy/articleshow/51237426.cms?.

The Times of India. (2016b, November 2). Amid IT layoffs, this could be a reason to cheer. Retrieved on November 2, 2017 from https://timesofindia.indiatimes.com/business/india-business/amid-it-layoffs-this-could-be-a-reason-to-cheer/articleshow/61459252.cms.

World Bank Group. (2015). The effects of technology on employment and implications for public employment services. G20 Employment Working Group Meeting Report, Istanbul, Turkey, May 6–8. Retrieved on June 7, 2018 from http://g20.org.tr/wp-content/uploads/2015/11/The-Effects-of-Technology-on-Employment-and-Implications-for-Public-Employment-Services.pdf.

World Economic Forum (WEF). (2018). The future of jobs: An insight report. Centre for New Economy and Society. http://www3.weforum.org/docs/WEF_Future_of_Jobs_2018.pdf.

World Economic Forum (WEF). (2016). The future of jobs employment: Skills and workforce strategy for the fourth industrial revolution. Global challenge insight report, Executive Summary, January. http://www3.weforum.org/docs/WEF_FOJ_Executive_Summary_Jobs.pdf.

Acknowledgements

We express our sincere gratitude to Dibyendu Maiti (DSE, Delhi) for the opportunity, encouragement and comments in writing this chapter. Towards improving the quality of the paper useful comments, suggestions and technical help were received from Pratap C. Mohanty (IIT, Roorkee), Jaya Prakash Pradhan (CUG, Gandhinagar), Itishree Pattnaik (GIDR, Ahmedabad), Tara Nair (GIDR, Ahmedabad), Fulvio Castellacci (TIK Centre for Technology, Innovation and Culture, University of Oslo, Norway) and Grace Kite (SOAS, London). Detailed comments from Pralok Gupta (Centre for WTO Studies, IIFT, New Delhi) contributed to improving the content and readability of the paper. We are grateful to all of them. The authors remain responsible for any errors and omissions that might remain.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Sagara, H., Das, K. (2020). Technological Disruptions and the Indian IT Industry: Employment Concerns and Beyond. In: Maiti, D., Castellacci, F., Melchior, A. (eds) Digitalisation and Development. Springer, Singapore. https://doi.org/10.1007/978-981-13-9996-1_4

Download citation

DOI: https://doi.org/10.1007/978-981-13-9996-1_4

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-13-9995-4

Online ISBN: 978-981-13-9996-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)