Abstract

Modelling the monetary impacts of climate change globally requires quantitative analysis of a very broad range of environmental, economic and social issues. Integrated Assessment Models (IAMs) provide a useful tool in this regard. Their estimates provide an important foundation for later work, and their results are valuable for informing policy. This chapter provides an overview of the existing models including the Mendelsohn, Dietz and Stern models. In addition it reviews the Indian models which include the NCEAR, TERI, IRADe and the McKinsey model. It also discusses the co-benefits approach proposed by Dubash (Econ Polit Weekly 48(22):47–62, 2013) in the Indian context.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1 Introduction

The world energy consumption is expected to grow by 56% between 2010 and 2040. Much of the growth in the energy consumption is expected from countries such as China and India, and will be driven by strong, long-term economic growth. For the past two decades, both these countries have been among the world’s fastest growing economies; they have led the economic recovery from the recession has been led by these countries. Since 1990, their combined energy consumption accounted for 10% of the total world energy consumption in 1990, and 24% in 2010.

This paper reviews the key factors that feed into existing models of climate change.

2 Review of the Models

Modeling the monetary impacts of climate change globally is very challenging: it requires quantitative analysis of a very broad range of environmental, economic and social issues. Integrated Assessment Models (IAMs) provide a useful tool in this regard. Their estimates provide an important foundation for later work, and their results are valuable for informing policy. However, these models are limited to snapshots of climate change at temperatures now likely to be exceeded by the end of this century. Below are three important examples of models of this category.

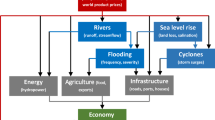

The Mendelsohn model (Mendelsohn et al. 2000) estimates impacts only for five “market” sectors: agriculture, forestry, energy, water, and coastal zones. The Tol model (Tol 2002) estimates impacts for a wider range of market and nonmarket sectors: agriculture, forestry, water, energy, coastal zones, and ecosystems, as well as mortality from vector-borne diseases, heat stress, and cold stress. The Nordhaus model (Nordhaus and Boyer 2000) includes a range of market and nonmarket impact sectors: agriculture, forestry, energy, water, construction, fisheries, outdoor recreation, coastal zones, mortality from climate-related diseases and pollution, and ecosystems. It also includes, what were at that time, pioneering estimates of the economic cost of catastrophic climate impacts.

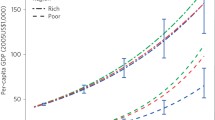

Most formal models use 2–3 °C warming as a starting point. In this temperature range, the cost of climate change could be equivalent to a loss of 0–3% in global GDP from what could have been achieved in a world without climate change. Models differ on whether low levels of global warming would have positive or negative global effects. But all agree that the effects of warming above 2–3 °C would reduce global welfare, and that even mild warming would harm poor countries. Their results depend on key modeling decisions, including how each model values the costs to poor regions and what it assumed about societies’ ability to reduce costs by adapting to climate change.

The existing estimates of monetary costs of climate change also omit significant factors such as such as extreme weather events, social and political instability, and cross-sectoral impacts.

Stern (2008) points out that business-as-usual (BAU) temperature increases may exceed 2–3 °C by the end of this century. Using an Integrated Assessment Model, and with due caution about the ability to model, he estimated the total cost of BAU climate change to equate to an average reduction in global per capita consumption of 5%, at a minimum, now and forever. Stern uses the PAGE2002 IAM (Hope 2006), which can take account of the range of risks by allowing outcomes to vary probabilistically across many model runs, with the probabilities calibrated to the latest scientific quantitative evidence on particular risks. He runs the model under two different assumed levels of climatic response. The “baseline climate” scenario is designed to give outputs consistent with the IPCC’s Third Assessment Report (TAR) (IPCC 2001). The “high climate” scenario adds the risk of amplifying natural feedbacks in the climate system. Preliminary estimates of average losses in global per capita GDP in 2200 range from 5.3 to 13.8%, depending on the size of climate system feedbacks and what estimates of “nonmarket impacts” are included. In all scenarios, the highest impacts are in Africa and the Middle East, and India and Southeast Asia. In all scenarios, the consequences of climate change become disproportionately more severe with increased warming. Stern finds that the welfare costs of BAU climate change are very high. Climate change is projected to reduce average global welfare by an amount equivalent to a permanent cut in per capita consumption of a minimum of 5%. The reductions are larger if nonmarket impacts, feedbacks and regional costs are included. Putting these three factors together would probably increase the cost of climate change to the equivalent of a 20% cut in per capita consumption, now and forever.

Dietz and Stern (2014) assessed the series of Dynamic Integrated Climate-Economy (DICE) models (Nordhaus 1991). These models have inbuilt assumptions on growth, damages, and risk, which together result in gross underassessment of the overall scale of the risks from unmanaged climate change. The authors show that if the analysis is extended to take into account three essential elements of the climate problem—the endogeneity of growth, the convexity of damages, and climate risk—optimal policy comprises stronger controls. With the extended models, BAU trajectories of greenhouse gas emissions give rise to potentially large impacts on growth and prosperity in the future, especially after 2100. These impacts are large enough to feed back into future emissions via reduced activity, but the feedback is too small and too late for the system to self-regulate. As a guide, the authors find that the extended DICE models suggest the carbon price in a setting of globally coordinated policy, such as a cap-and-trade regime or a system of harmonized domestic carbon taxes, should be in the range $32–103/tCO2 (2012 prices) in 2015.

3 Results from the Indian Modeling Exercises

Appendix 3.1 A–3.4 A lists the various assumptions and results obtained from the various models.

India is one of the lowest emitters of greenhouse gases (GHGs) in the world on a per capita basis. At 1.4 tCO2/person in 2010, India’s emissions were less than one-third of the world average of 4.5 tCO2/person, less than one-fourth that of China’s, and one-twelfth that of the US’s. But India is still threatened by the impact of global warming and climate change. Enthusiastic about its global responsibility, in December 2009, it announced that it would reduce the emissions intensity of its GDP by 20–25%, over the 2005 levels, by the year 2020. India is resolute about ensuring sustainable growth based on low carbon principles.

But this is not an easy task. The Low Carbon Society Vision 2050 India (2009) states that India faces challenges in economic development which have to be met with limited resources, minimal externalities, and in the presence of large uncertainties with respect to climate.

The Expert Group on Low Carbon Strategies for Inclusive Growth (2014) has evolved a macro-model to fully elucidate the inter-sectoral implications of different mitigation measures and ensure that the low carbon strategies being recommended are mutually consistent.

The model’s output is summarized in two end-point scenarios: the BIG (Baseline, Inclusive Growth), and the LCIG (Low Carbon, Inclusive Growth). While inclusive actions remain unchanged between the two scenarios, low carbon strategies span the vector space between them. Pursuit of Low Carbon Strategies brings down the average GDP growth rate by 0.15 percentage points, while per capita CO2 emissions (in 2030) fall from 3.6 tons in the BIG scenario to 2.6 tons in the LCIG scenario. However, in both scenarios, the total carbon emissions continue to rise up to the year 2030.

The cumulative costs of low carbon strategies have been estimated to be 834 billion US dollars at 2011 prices, over the two decades between 2010 and 2030. While total power demand remains unchanged between the two scenarios, emission intensity of GDP declines by 22%, over 2007 levels (by 2030) in the BIG scenario, as compared to 42%, over 2007 levels (by 2030) in the LCIG scenario. Further, due to a massive change in the energy mix by 2030, demand for coal comes down from 1568 Mt in the BIG to 1278 Mt in the LCIG scenario, demand for crude oil comes down from 406 Mt in the BIG to 330 Mt in the LCIG scenario, while demand for gas marginally rises from 187 bcm in the BIG to 208 bcm in the LCIG scenario. At the same time, the installed wind and solar power capacities need to be increased to 118 and 110 GW respectively, by the year 2030, in the LCIG scenario.

Low Carbon Society Vision 2050 India (2009) assesses two paradigms for transiting to low carbon future in India. The first pathway assumes a conventional development pattern together with a carbon price that aligns India’s emissions to an optimal 450 ppmv CO2e stabilization global response. The second emissions pathway assumes an underlying sustainable development pattern characterized by diverse response measures typical of “sustainability” paradigm. An integrated modeling framework is used for delineating and assessing the alternate development pathways having equal cumulative CO2 emissions during the first half of the twenty-first century.

The base case scenario assumes future economic development along a conventional path. In the case of a developing country, such as India, the scenario assumes that future socioeconomic development will mimic the resource-intensive development path followed by the developed countries. Two paths are considered as part of Low Carbon Scenarios: the Conventional Path, Carbon Tax (CT) Scenario, and the Sustainable Society (SS) Scenario.

The CT scenario presumes a stringent carbon tax (or permit price) trajectory compared to a milder carbon regime assumed under the base case while sustainability is the rationale for the ST scenario. The perspective is a long-term one, aiming to deliver intergenerational justice by decoupling economic growth from the highly resource-intensive and environmentally unsound conventional path. In the SS scenario, mitigation choices are more diverse and include measures that are designed to influence several development indicators simultaneously. It pays greater attention to public investment decisions, such as infrastructure which lead to modal shifts in the transport sector; and institutional interventions that alter the quality of development. In the CT scenario, the mitigation measures are more direct and have a greater influence on private investments (Figs. 3.1 and 3.2).

For realizing the vision of a Low Carbon Society for India, the study listed policy actions required to implement mitigation measures such as sustainable transport, low carbon electricity, fuel switching, building design, material substitution and recycling, reduced consumption and device efficiency, urban planning, resource management, governance, and financing.

Dubash et al. (2013) propose and develop a methodology for operationalizing a co-benefits approach to climate policy formulation. They use the technique of multi-criteria analysis (MCA), which requires making choices between and examining trade-offs across multiple objectives of policy, such as growth, inclusion, and environment. MCA is the general term for a family of analytical techniques that are particularly relevant when assessing likely policy outcomes relative to multiple objectives, when values and consequent prioritization across those values may differ, and where it is important to assess both quantifiable monetary impacts and unquantifiable impacts. The authors argue that adopting an MCA-based co-benefits approach will likely bring gains to both domestic policymaking and India’s international climate stance. Domestically, this approach would increase the coherence of policymaking early in the decision process. Internationally, a well-specified co-benefits approach will be a necessary first step to articulating India’s policy approach based on the centrality of the principle of “common but differentiated responsibility and respective capabilities”. In addition, the authors develop a framework for consideration of implementation issues (Tables 3.1, 3.2, 3.3 and 3.4).

References

Dietz S, Stern N (2014) Endogenous growth, convexity of damages and climate risk: how Nordhaus’ framework supports deep cuts in carbon emissions. Centre for Climate Change Economics and Policy, Working Paper No. 180

Dubash N, Raghunandan D, Sant G, Sreenivas A (2013) Indian climate change policy. Econ Polit Weekly 48(22):47–62

Hope C (2006) The Marginal Impact of CO2 from PAGE 2002: an Int grated assessment model incorporating the IPCC’s five reasons for concern. Int Assess J 6(1):19–56

Indian Institute of Management Ahmedabad (IIMA), National Institute of Environmental Studies (NIES), Kyoto University (KU), Mizuho Information and Research Institute (MIZUHO) 2009 Low Carbon Society Vision 2050: India. Collaborative report prepared by Indian Institute of Management Ahmedabad, India, National Institute of Environmental Studies, Japan, Kyoto University, Japan, and Mizuho Information and Research Institute, Japan. (November 2009)

Intergovernmental Panel on Climate Change (2001) Synthesis Report. Cambridge University Press, Cambridge, UK

International Energy Agency (2007) World Energy Outlook. OECD/IEA, Paris, France

Mendelsohn R, Dinar A, Dalfelt A (2000) Climate change impacts on African agriculture. Preliminary analysis prepared for the World Bank, Washington, District of Columbia, p 25

MoEF (2009) India’s GHG emissions profile: results of five climate modelling studies. Climate Modelling Forum, supported by Ministry of Environment and Forests, Government of India, New Delhi, India. http://www.moef.nic.in/downloads/home/GHG-report.pdf

National Council of Applied Economic Research (2009) Climate Change Impact on the Indian Economy—A CGE Modelling Approach. NCAER, New Delhi, India

Nordhaus WD (1991) To slow or not to slow: the economics of the greenhouse effect. Econ J 101(407):920–937

Nordhaus WD, Boyer JG (2000) Warming the World: economic models of Global Warming. MIT Press, Cambridge, MA

Planning Commission (2014) The Final Report of the Expert Group on Low Carbon Strategies for Inclusive Growth. Planning Commission, Government of India, New Delhi, India. Available online at http://planningcommission.nic.in/reports/genrep/rep_carbon2005.pdf

Shukla PR, Garg A, Dholakia HH (2015) Energy-emissions trends and policy landscape for India. Allied Publishers

Stern N (2008) The American Economic Review, vol 98, No. 2. In: Papers and proceedings of the one hundred twentieth annual meeting of the American Economic Association

Tol RSJ (2002) Estimates of the damage costs of climate change, Part 1: benchmark estimates. Environ Resource Econ 21:47–73

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Indian Council for Research on International Economic Relations (ICRIER)

About this chapter

Cite this chapter

Ray, S., Bandyopadhyay, K. (2018). Low Carbon Pathways for Growth in India: Assessment of Climate Models. In: Kathuria, R., Ray, S., Bandyopadhyay, K. (eds) Low Carbon Pathways for Growth in India. India Studies in Business and Economics. Springer, Singapore. https://doi.org/10.1007/978-981-13-0905-2_3

Download citation

DOI: https://doi.org/10.1007/978-981-13-0905-2_3

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-13-0904-5

Online ISBN: 978-981-13-0905-2

eBook Packages: EnergyEnergy (R0)