Abstract

This volume has gathered a great deal of evidence on industrial development, structural transformation and employment generation in the South Asian region. In this concluding chapter, we recapitulate the cumulative evidence and insights drawn from the chapters. For various practical reasons, South Asia shares a common development context and demography. Economies in South Asia had initiated economic liberalisation more than two decades back. This resulted in an increase in capital intensity in the manufacturing sector together with falling employment intensity, even as some improvement in labour productivity is observed during this phase. However, rise in capital intensity in the industry has not necessarily contributed to technological deepening measured in terms of value addition perhaps, due to serious innovation shortfall. Although India has overwhelming presence in the region, it has almost similar challenges and opportunities in the traditional industries that are pursued in the region. India definitely has much wider industrial base and is better placed in terms of technology-intensive manufacturing.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

This volume has gathered a great deal of evidence on industrial development, structural transformation and employment generation in the South Asian region. In this concluding chapter, we recapitulate the cumulative evidence and insights drawn from the chapters. For various practical reasons, South Asia shares a common development context and demography. Economies in South Asia had initiated economic liberalisation more than two decades back. This resulted in increase in capital intensity in the manufacturing sector together with falling employment intensity, even as some improvement in labour productivity is observed during this phase. However, rise in capital intensity in the industry has not necessarily contributed to technological deepening measured in terms of value addition perhaps, due to serious innovation shortfall. Although India has overwhelming presence in the region, it has almost similar challenges and opportunities in the traditional industries that are pursued in the region. India definitely has much wider industrial base and is better placed in terms of technology-intensive manufacturing.

The importance accorded to industrial development in South Asia reflects both frustration and aspiration. However, frustration with regard to industrial development in South Asia even though widespread can be at times misplaced. Higher economic growth in the region has not necessarily been riding on commensurate industrial growth—however, performance of the industrial sector needs nuanced understanding. UNIDO has stressed that the economy receives dynamism brought about by industrialisation which acts as engine of long-run growth and catch-up. It is also effective for prolonging episodes of economic growth by reducing volatility.

Industrial development as it appears from the experience of South Asia has not strictly conformed to standard predictions of structural transformation but can potentially respond positively to foundations of technological capacities and accumulation of physical and human capital in the near future. Rapid economic growth for large populations with low per capita income is not sustainable if the economies ignore production that caters to domestic needs. Import dependence in manufactured items in South Asian countries has sharply grown even as these economies are more integrated with world markets. This necessitates promotion of industrial activity in these economies. However, low per capita income imposes constraints in terms of market size in the initial phase. Export-driven models would crucially promote industrialisation in such scenarios. Examples of export-driven growth models with matching domestic demand push have been a successful industrialisation strategy for the large and newly industrialised developing countries. Keeping in view dependence on agriculture in South Asia, transition from the agriculture and integration of agriculture in industrial strategy is very important for these countries.

The desire for an appropriate structural transformation that deepens industrialization needs well-informed strategy. Industrial development in South Asia has been held back due to a variety of reasons. Expansion of industrial base alone may not be helpful. Structural constraints not only interfere in the process of industrial growth but actually contribute to persistence of inefficiencies, reduced competitiveness and come in the way of economies of scale. Overall, industrial resurgence is linked with 3S—Size (of the firm linked with capital investment), Scale (in production linked with market size) and Skill (of the labour force). The ultimate policy objective is to promote and robustly facilitate the three preconditions. Industrial policy (that includes trade policy), macroeconomic policy (that generates investible surpluses) and public policy (for quality of employment and skills) all play distinct role in this regard.

The predominant character of South Asian industrial performance is that of persistent dualism. Productivity and efficiency differentials between firms (of different sizes) are the source of duality within the manufacturing sector. Dualism has been a prominent characteristic of Indian manufacturing industry dominated by a very large number of small and medium firms. Conventional approaches to measurement of productivity (for example TFPG) carry relevance only in case of organised manufacturing industry for which adequate time-series data is available. It is observed that distinct movement of the production frontier captured by TFPG, over the longer time horizon, has contributed modestly to the process of technological catch-up of the Indian industry indicating no apparent differences between large and small firms with regard to productivity. But, beyond productivity, efficiency and technological competence of firms are functions of a variety of factors including access to finance, physical and digital infrastructure, connectivity, human resources, knowledge, etc. These are also profoundly shaped, directly, by easier access to world markets through efficient trade facilitation and indirectly through regulatory reforms (easy entry and exit rules, clearances, tax benefits, etc.) popularly dubbed as ‘ease of doing business’. Larger firms have stronger command over multiple resources, mentioned earlier, leading to dualism. This is an important policy lesson and South Asia is in urgent need of minimising dualism for significant improvement in value addition and competitiveness and in widening the scope of better quality jobs.

There is a persistent concern that unavailability of skills has made structural transformation (towards industrialisation) fragile. This is essentially a skill conundrum that these countries are faced with despite enjoying demographic dividend. Skills are an essential precondition for kick-starting a fresh process of industrialisation in South Asian countries that have been lagging so far. As we are aware, industrialisation has experienced distinct shifts from mechanisation to automation and from mass production to production networks. Moreover, industrialisation has traditionally followed technologies originating in high-income countries having advanced innovation ecosystems. Technical progress and catch-up in newly industrialising countries are dependent on domestic technological/absorptive capabilities that are linked with knowledge and skills eventually shaped through the national innovation system. Capability development is fundamentally based on education of the workforce and the allocation of human capital and investment in research and development (R&D). To bridge the gap of technological knowledge and advance in the process of catch-up, the developing countries are required to develop absorptive capacities. It is significant to note that the determinants of absorptive capacities are continuous investment in human capital. There is robust evidence that industrial development in the developing economies is experiencing significant transition and becoming increasingly more technology intensive. Thus, it would be important for a developing country to reap benefits of this manufacturing transition while simultaneously investing in generating skilled technicians, scientists and engineers.

2 Country Case Studies

2.1 Bangladesh

In Bangladesh, the structure and composition of the manufacturing sector have experienced shifts since the introduction of economic liberalisation policies in 1980 (with trade liberalisation initiated in the late 1980s). With preferential market access in developed countries since the late 1970s the RMG industry has achieved export-oriented growth and also made significant contribution to employment creation in the following decades. Over the last decades, non-traditional manufacturing industries have made considerable progress. These non-traditional establishments include chemical products, electrical equipment, leather products, paper products, basic metals, rubber and plastic products. However, it is also observed that a number of industries have experienced reduction in the number of establishments such as in textiles and pharmaceuticals.

Majority of enterprises across sectors are domestic market oriented. Domestic market-oriented industries include coke and refined petroleum, machinery and equipment, motor vehicles and trainers, installation of machinery and recycling, etc. Export-oriented industries include RMG (95% of total production), transport equipment (82%), leather and leather goods (74%) and textiles products (57%). A few other industries also have limited export shares, for example, paper and paper products, computer, electronic and optical products and electrical equipment, etc. Lack of competitiveness, limited capacity, poor network with buyers, low quality of products and lack of competent human resources constrain domestic market-oriented enterprises from exporting.

Majority of export-oriented industries that have experienced rise in share and increase in employment are RMG, leather, pharmaceuticals and rubber. Similarly, in the segment of domestic market-oriented industries such industries include paper products, chemical products, basic metals and furniture. Some of the sectors have diminishing contribution to employment generation. For example, a number of domestic market-oriented industries such as tobacco, wood and cork, recorded media, fabricated metal, electrical equipment and a few export-oriented industries such as food and beverages have lost their share in manufacturing employment. Without improving the level of competitiveness, these sectors would not grow fast and thereby would not contribute much to employment generation. Overall, in Bangladesh, employment in the manufacturing sector is highly concentrated in a few sectors. Also, compared to other South Asian countries, the performance of Bangladesh’s manufacturing sector in terms of generating employment has not been satisfactory. In fact, share of employment in the manufacturing sector is behind those of major South Asian economies (India and Sri Lanka). It is highlighted that Bangladesh lacks diversified manufacturing base which limits opportunities for employment.

2.2 Nepal

Industrialisation in Nepal has traditionally suffered from low levels of investment. Although FDI commitment has been relatively high, the actual inflow has always been extremely low. This is notwithstanding economic reforms undertaken in the last two decades. In the total inflow, the share of Indian investment has been above 40% followed by China and other countries.

Nepal is facing problem of declining share of manufacturing in output, export and employment. Despite economic integration with SAARC countries, Nepal, which is a landlocked country, has not been able to derive the expected benefits from this arrangement. Moreover, opportunities for global value and supply chain have not been adequately internalised in the policymaking process so that the manufacturing sector is able to attract domestic and foreign investment. A flourishing manufacturing sector in Nepal would have added to sustaining the current phase of economic growth. It is imperative that a new approach on industrial policy is adopted which addresses market, government and coordination failures more effectively which in addition to enhancing growth could contribute to creating jobs.

A need is being felt for review of regional cooperation strategies encompassing investment and trade for ensuring benefits for Nepal from the regional integration. It is suggested that promotion of intra-regional value chains should be integral to regional cooperation arrangements to generate adequate benefits for countries like Nepal. With the promulgation of new constitution in Nepal and political transition, some consensus is emerging among political parties on the imperatives of rapid economic transformation and job creation.

In case of Nepal, expansion and restructuring of industries grounded on comparative advantages will be necessary. At the same time, such a strategic shift requires investments in social and physical infrastructure including investment in new technologies, know-how and innovation. This is expected to create productive synergies within and between sectors of the economy and contribute to enhancing exports through diversification, quality improvement and changes in the structure of production and trade, among others.

2.3 Pakistan

Due to significant forward and backward linkages, manufacturing sector is considered a major and indispensable source of economic growth and job creation in Pakistan. The manufacturing sector in Pakistan contributed 13.5% to GDP and 13.8% to employment in the fiscal year 2016–17. However, lack of adequate physical infrastructure has dampened prospects of industrialisation in Pakistan. Infrastructure bottleneck is particularly serious in the case of power generation capacities. The economy moved from agriculture to services sector without consolidating the industrial sector. This is one of the probable reasons behind massive labour force remaining unemployed. The manufacturing sector is expected to provide jobs for a range of skills and can absorb more labour as compared to the service sector. This is particularly true for unskilled and semi-skilled jobs. The bypassing of manufacturing in Pakistan has left lesser room of job creation and has weakened the growth foundations of economy.

The textile industry in Pakistan is presented in detail as part of the country case study in view of its overwhelming importance in the industrial landscape of Pakistan. The textile industry in Pakistan contributes over 60% to total exports and accounts for 46% of the total manufacturing output. Production, trade and employment in this sector have been analysed with important policy lessons. The future of manufacturing (and textile) sector depends on how efficiently Pakistan moves towards export promotion-led growth and development. A well-organised plan for product diversification can contribute substantially to the future growth of the industrial sector. This requires a massive paradigm shift in policymaking towards technology enhancement, global value chains and skills, and increase in labour productivity. However, these are all longer term solution, and therefore, short-term answers might look far more attractive. The comparative advantage does exist for textiles, but it is often squandered in terms of inadequate energy supply, low quality of products and lack of price competitiveness. Essentially, industry-driven growth in Pakistan is linked to exports, which in turn is linked to a revamped policy focused on sophistication and integration into global value chains. With rising unpredictability with traditional trading partners, Pakistan should be exploring new markets for its industrial products.

Employment statistics related to the textile sector in Pakistan is seldom available mainly because of decline in textile sector capacity over time, which has badly injured employment prospects and has effectively restricted the entry of the new workforce. Non-availability of textile sector employment data is also due to the absence of comprehensive surveys. Historical trend of total employment in textile sector shows a downward trend since 2006–2007.

2.4 Sri Lanka

Sri Lanka has the most impressive record of social sector development in South Asia and has high scores on development indicators. Sri Lanka now aspires to gradually and resolutely develop an export-oriented manufacturing sector with emphasis on developing a sophisticated, high-value export portfolio. This is expected to trigger viable growth momentum by expanding export potential and increasing supply capacity. Simultaneously, such policy focus will entail a larger shift to capital-intensive production processes that increase labour productivity. However, Sri Lanka is at disadvantage with regard to its demography (the only exception in South Asia) with an ageing population that may have serious implication for an industrialisation strategy. The island’s geographic proximity to large emerging economies (including India) and strategic maritime routes linking vital economic corridors makes it an ideal hub for producers wishing to target multiple high-value markets. However, a brief perusal of past history suggests that Sri Lanka has encountered mixed success in implementing reforms with regard to international trade. The advancements made in clustered waves of liberalisation have been offset by periods of economic uncertainty instigated by nationalist reforms.

A surge of foreign investment into labour-intensive segments provided added impetus to Sri Lankan manufacturing. The Textile and Apparel sector emerged as the most significant manufacturing sector, accounting for around 60% of aggregate manufacturing output and over 45% of export earnings in 2016. As some of the other South Asian peers, Sri Lanka has proved to be an ideal destination for apparel-led investments after liberalisation as the sector held comparative advantage in unskilled and semi-skilled labour. In the last 40 years, manufacturing sector composition has increased by a mere 2.2% (textile and garments, the largest export-oriented sector, has stagnated between at the 20–25% over the last decade). In comparison, the services sector has expanded by 14.1% within a similar time period. On the bright side, processed rubber products—pneumatic tyres and industrial gloves, in particular—witnessed a surge in export revenue in the latter half of the previous decade. Subsequent drops in exports can be explained by a steep decline in the price of natural rubber which resulted in a contraction in the value of agricultural exports.

3 Manufacturing Sector and Jobs: The Indian Context

The Indian context has been captured elaborately in two dedicated chapters. These chapters complement each other given the fact that the first chapter explores influence of trade on manufacturing and associated employment generation in India from a product export perspective (product-level analysis) and the other from industry export intensity perspective (disaggregated industry-level analysis), with both having a significant focus on the impact on employment.

3.1 Manufacturing Exports and Employment

There are many unresolved issues relating to the current debate on trade and employment which need to be examined in the context of India. Despite persistence of global recession, some countries are posting robust performance in manufacturing export as compared to India. As the global demand for imports is shrinking, high export performing countries are adopting inward oriented strategies for promoting their domestic absorption and also continuing with the export sector to employment in the domestic economy. However, the extent of employment generation depends upon commodity structure demanded by importers. Therefore, selection of countries/RTAs for trade partnership needs to be undertaken in such a manner that it may optimise national objects of employment generation alongside technology intensive trade for higher export earnings.

The Chapter concludes that employment intensity of exports is significant for India in certain regions in the world. India’s strong export linkage with Asia is important since it serves India’s export and employment interest. India’s employment generation through export is expected to be in select regions such as Asia, North and West Africa, Canada and the Oceania. India’s future trade engagement in the form of BFTA/FTA/CEPA/CECA with these countries can give leverage to India in generating large employment at home.

It is evident from the global trade that substantial trade takes place through the regional route since trade flows are mostly guided by the preferential trade practices. For promoting trade, India needs to engage in the process of regionalism as an emerging economy, aspiring to reach the level of $ 5 billion economy by 2025. Export activities in trade destinations are subdued due to prolongation of the global recession, but return of buoyancy to the world economy may spur export activities in those countries. If India is to enter into the exclusive club of top five economies by 2025, export has to take the driving seat to steer growth. In this context, India is likely to sign number of RTAs to strengthen its external sector engagement. The results show that 28 RTAs from the total of 84 RTAs, that have been studied, can generate high employment in India. About 37 of them would ensure moderate level and 19 of them can have low level of employment in the domestic economy.

In terms of employment generation in India, the RTAs across the globe are clearly identified in terms of their employment generation capacity. From this perspective, RTAs from Africa can generate high level of employment, followed by Asia with medium level, Europe with mix of medium and high level, LAC with low and Oceania with medium level of employment in India. In terms of levels of employment intensity of exports, specific RTAs in particular regions can be identified for BFTA/CEPA/CECA/FTA negotiations.

With rising wage rate and declining size of employment happening during the last two decades, the share of high technology trade in the total trade is rising. These phenomena are partially pointing towards gradual substitution of more of blue collar jobs by less number of white collar jobs in India. However, SMEs and cottage industry sectors have more employment-output ratio than corporate sectors. For generating more employment in the economy, SMEs need to be promoted and with support for integration with GVCs.

3.2 Industry Performance and Employment

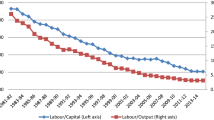

The second study highlights that the Indian manufacturing sector has been experiencing rising output but diminishing value added in total output with the trend becoming more pronounced since mid-1990s. The share of value of production in overall value added decreased from 23% in 1996 to 18% in 2004 with a marginal increase up to 20% in 2008 and declined thereafter. The declining manufacturing value added indicates an increase in resource intensity of the manufacturing sector in India. However, it is important to note that the growth of exports is found to be higher than the growth of value-added and employment indicating increasing trade performance. However, the share of manufacturing in total merchandise exports increased from 79% in 1990 to 87% in 2002 and declined marginally thereafter.

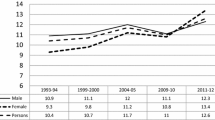

The share of workers (unskilled) in total employment has largely remained the same over years with minor variations. At the same time, the share of female in total employment has increased from 9.97% in 1995 to 15.15% in 2002. The share has gradually declined to 12.48% in 2012 with a minor improvement afterwards. However, the share of contract workers has seen an almost threefold increase in the share from 13.34% in 1995 to 26.42% in 2004 and further to 35.39% in 2014.

It is evident that in 1990 a little over 25% of the number of industries were employment–export champions and 36% of the industries were export champions but employment laggards. These two groups of industries that displayed higher employment intensity accounted for nearly 61% of the total number of industries in India’s manufacturing sector in 1991. As we move to 2000, their share further increased by 69% and declined marginally thereafter to reach 67% in 2014. The recent decline in their share notwithstanding it appears that high employment intensity appears to be the hallmark of an overwhelming majority of manufacturing industries in India. Further, there has been a steady increase in the share of export champions–employment laggards, which is evident from more than fourfold increase in the share of industries in this category from 3.6% in 1990 to over 16% in 2014. This indicates the increasing capital intensity in India’s manufacturing sector.

In terms of export performance, in 1990, the employment and export champions accounted for over 55% of the total manufacturing exports, which declined over the years to reach the present level of 20%. When it comes to employment, their share has shown fluctuations from year to year and yet their contribution is over 19% in 2014. Thus, we have a situation wherein, 22% of the manufacturing industries that we have designated as export–employment champions, today account for 19% of the employment and 21% of the exports. In case of employment champions–export laggards, while their export share has increased to reach as high as 21% in 2007, there has been a decline thereafter to reach the present level of 18%. When it comes to their employment contribution, it continues to remain as high as 59%. Therefore, it is evident that these two categories of industries put together account for nearly 78% of total employment, while they account for only 38% of the total exports. From the employment generation perspective, any attempt to enhance their international competitiveness is bound to give rich dividends in terms of employment.

One important finding is that export–employment champions provide higher jobs to unskilled workers as compared to skilled workers and employs higher proportion of female labour and low-contract workers. Second, export champions–export laggards generating industries also seem to be providing a better quality of employment as evident from their skill intensity, contract intensity and female employment intensity as compared to their capital-intensive counterparts. Hence, promotion of export orientation in these employment generating industries would further increase both quantity and quality of employment.

From a long-term development perspective, a large economy like India has to adopt a strategy of reaping both static and dynamic comparative advantages. It is rather salutary note that export champions–employment laggards that accounted for over 50% of total manufacturing exports in 2014–2015 are either medium- or high-tech industries. The presence of a few medium- and high-tech industries in the other two categories—employment–export champions and employment champions–export laggards is observed. However, the available evidence tends to suggest that most of these industries that are presumably reaping dynamic comparative advantage because of their high technological base are showing poor performance with respect to the quality of employment that they generate. Though these industries have the potential for building dynamic comparative advantage based on their deep science, technology and knowledge base, the current strategy appears to involve building competitiveness based on low labour cost advantage. Hence, we make the case for appropriate policy interventions towards dynamic comparative advantage based on product, process and other innovations. It also appears that there is the need for appropriate institutional interventions to ensure that innovation-induced value addition and depth of manufacturing contributes towards the generation of high-quality employment such that international competitiveness and growth leads to shared prosperity.

4 Industry, Employment and Competitiveness: Concluding Observations

Apart from industrialisation and the manufacturing sector, this volume (in Chap. 8) has looked into the question of employment in great detail against patterns of structural transformation in the context of South Asia and globally. This chapter brings out the rationale rather unambiguously why manufacturing needs to be relentlessly pursued as a policy objective in South Asia and how quality of employment may be improved in the process. This chapter also draws attention to the imbalances that services-led economic growth can bring for large developing countries.

South Asian economies are labour-surplus dual economies. The GDP growth is independent of employment growth in such economies; labour is in excess supply so that no ‘labour constraint’ on growth exists. On the other hand, most people do not have access to any kind of institutionalised social security and must work to survive. This means that most of those who are in the labour force are also employed. But many engage in work sharing (in self-employment and in casual wage employment) and many others engage in very low-productivity work. Very few remain unemployed and these few are educated (hence looking for good jobs in the formal sector) and generally belong to relatively well-off households (so that they can afford to remain unemployed). The employment problem manifests itself in poverty (which results from underemployment and low-productivity employment) and not in unemployment (which does not imply poverty). Employment growth reflects labour force growth and tells us little about growth in the demand for labour associated with economic growth. In case of South Asia, except for Sri Lanka, the formal sector employs a very small proportion of the workforce; a large majority (between 80 and 90%) of the workers work in the informal sector, either as self-employed or as casual wage employees. Even in Sri Lanka, where the formal sector employs 37% of all workers, the majority is still in the informal sector.

Therefore, underemployment, not unemployment, shows up to be the major problem. However, the estimates of underemployment are not robust. In Nepal, for example, underemployment has almost certainly been seriously underestimated. In Sri Lanka, too, underemployment appears to be underestimated. Change in employment conditions, therefore, cannot be discerned from employment growth or change in unemployment. Employment growth in the formal sector and change in underemployment in the informal sector can tell us much about the change in employment conditions, but time-series data on these indicators are in general unavailable.

The pattern of growth in East Asia was far more effective in improving employment conditions than the pattern of growth in South Asia. This can be seen most clearly from a comparison of India’s experience during 2000–2015 with Korea’s during 1963–1990 (the period during which Korea’s economy underwent transformation from a low-income economy to a high-income economy). The growth rates of GDP in the two countries were not radically different: 7.2% in India and 7.5% in Korea. The rate of growth of agriculture was virtually the same: 3% in India and 2.9% in Korea. The rate of growth of non-agriculture was exactly the same: 8.2% in both countries. The big difference was in the composition of non-agricultural growth. This was driven by the growth of manufacturing (14.8% per annum) in Korea and by the growth of services (8.9% per annum) in India. Manufacturing recorded a growth of 7.5% in India and services recorded a growth of 6.6% in Korea.

We can draw two conclusions. First, the employment effect of growth depends on both the pace and the pattern of growth. In South Asian countries, growth did not significantly improve employment conditions due to the fact that economic growth remained suboptimum and at the same time did not allow desirable structural transformation. Only India had rapid economic growth but the particular pattern of this growth blunted its effectiveness in improving the employment conditions. Growth was slower in Nepal, Pakistan and Sri Lanka and the pattern of growth was similar to India; the improvement in employment conditions was naturally less significant in these countries than in India. Bangladesh did have manufacturing-led growth with better effects on employment but the growth was not rapid enough.

South Asian countries, the workforce is either disguisedly employed or employed in low productive economic activities that do not match with the skill requirements for competitiveness of their industrial sector and thus results in mass poverty. To overcome the industrial stagnation and skill formation gaps, the South Asian countries need to revamp their national innovation system for harnessing the ongoing industrial revolution and move onto the path of self-sustained economic development. On average, the mean years of schooling are very low across South Asian countries. The education among rural workforce is extremely low. The rural population in South Asian countries neither has skills to join manufacturing sector nor has enough skills to shift towards precision agriculture and agribusiness activities. Therefore, it can be inferred that the transformative skills across South Asian countries are in short supply. The task of economic transformation in the South Asian countries is relatively more complex and difficult, but there exists window of opportunity to leapfrog aided by manpower planning in sync with the production structure. Revamping of national innovation system that integrates economic actors and bridges the gap of innovation requirements for transition from a traditional to industrially advanced economy is strongly suggested.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Chaturvedi, S., Saha, S. (2019). Conclusion: Manufacturing and Employment in South Asia. In: Chaturvedi, S., Saha, S. (eds) Manufacturing and Jobs in South Asia. South Asia Economic and Policy Studies. Springer, Singapore. https://doi.org/10.1007/978-981-10-8381-5_10

Download citation

DOI: https://doi.org/10.1007/978-981-10-8381-5_10

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-10-8380-8

Online ISBN: 978-981-10-8381-5

eBook Packages: Economics and FinanceEconomics and Finance (R0)