Abstract

This study identifies the incidence of high-growth firms (HGFs) in Ethiopia with their corresponding business obstacles and growth determinants. The research is based on data from the World Bank’s Enterprise Survey dataset (World Bank Enterprise Survey. The World Bank, Washington, DC, 2015). The survey covered 848 firms distributed over six major regions in the country—Addis Ababa, Oromia, Amhara, SNNP, Tigray and Dire Dawa. The analysis was done using OLS and QR. HGFs were concentrated in the capital city and in the services sector while medium-sized firms dominated the HGFs. Like non-HGFs, access to finance was the biggest perceived obstacle for HGFs followed by tax rates as compared to the informal sector’s activities for non-HGFs. Region-wise, access to finance was the key problem only for firms operating in Addis Ababa and Tigray while the informal sector dominated in Oromia region. In Amhara region, corruption was the most significant obstacle. The econometric estimation results show that firm growth was negatively related to firm size. Growth were associated positively with firms’ products and process innovations, resources and firms website. The research fails to show any significant difference among firms’ growth based on gender of ownership, competition, capacity utilization and nationality of ownership. The heterogeneity in business obstacles across regions and performance of firms can be taken as important lessons for policy interventions.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The process of firms’ growth has attracted the attention of economists for long. According to Sutton (1997) Robert Gibrat’s work was the first formal model dealing with the dynamics of firm size and industry structure. According to Gibrat, the rate of firm growth is independent of its size and is framed as the law of proportionate effect (LPE) (Gibrat 1931, cited in Sutton 1997). This law stipulates that the capacity to grow is the same for all firms, regardless of their initial size. There are several empirical works on this with somewhat inconclusive findings.

Following the well-documented role of entrepreneurial firms in creating employment and generating wealth, more recent studies have turned their attention to the prevalence and determinants of high-growth firms (HGFs) in addition to measurement and definition issues. Researchers have suggested several alternative measures to classify firms as high-growth firms with employment being the most studied output variable although productivity, sales, wages and revenue have also been used as indicators (Daunfeldt et al. 2013a).

Attempts to identify the prevalence of HGFs in different countries and industries have shown that HGFs are only a small percentage of all firms and are found in all countries across all industries. A meta-analysis by Henrekson and Johansson (2010), for instance, fails to show any evidence in support of the view that HGFs are over-represented in high-technology industries. They note that there were more HGFs in service industries relative to sectors such as manufacturing. Daunfeldt et al. (2013a) updated Henrekson and Johansson’s (2010) work by incorporating nine additional studies published after 2009 on HGFs. One of their key findings is the significant difference in characteristics of HGFs depending on the growth indicator used and how it is measured. They found that absolute and relative measures of HGFs led to ‘most pronounced difference between HGFs’ with HGFs defined in relative terms as being younger and smaller than HGFs defined in absolute terms for most of the indicators.

Further, understanding the persistence and incidence of HGFs has become an important task for policymakers as better insights into the existence, characteristics and stimulating factors of high-growth firms could be a key breakthrough in sustainable economic growth. The shareholders are concerned about knowing what stimulates the growth of their firm while for policymakers it is the issue of sustaining firm growth and capitalizing on the incidence of HGFs.

A new research initiative has been undertaken to know if HGFs can be sustained. The aim of this initiative is to find out if firm growth can be sustained for a long period of time and whether firm growth is a random process. The initiative also seeks to find out whether the probability of repeating high-growth rates was high. We know that governments spend considerable amounts of money to support specific types of firms based on either size and/or industry type to encourage them to grow. It is difficult to target policies towards certain groups of firms if growth is unsustainable. A dominant empirical work in this regard is by Daunfeldt and Halvarsson (2014) who argue that high-growth firms are one hit wonders and the probability of repeating high-growth rates is very low. Despite such findings, the role played by HGFs is well documented.

Studies have shown that high-growth firms play an important role in creating jobs and fostering innovative behavior. Bravo-Biosca (2010), for instance, shows that a small number of high-growth firms accounted for a disproportionate 35–50% of all jobs created by all firms with ten or more employees in a large number of countries that they considered.

The role of business environment in deterring firm performance is not well-studied. Firms have heterogeneous abilities and entrepreneurs could perceive environmental challenges differently. For firms operating in different regions and sectors, the effects of the obstacles could vary and this is another dimension of our study.

The purpose of our study is to provide an insight into the incidence of HGFs in Ethiopia by firm characteristics (such as size, age, location, ownership and industry type). Further, our study also explores perceived obstacles in a firm’s performance and the firm’s growth determinants.

In general, HGFs have attracted considerable attention from researchers, policymakers and practitioners. Our research adds to literature by investigating the incidence of high-growth firms and business obstacles by region, industry type and the relationship between size and growth using the Enterprise Survey (ES) database on Ethiopia. Ours is perhaps the first research of its kind in Ethiopia.

2 Literature Review

Firms have long been recognized as one of the determinants of economic growth and the factors affecting their performance have attracted lots of researchers among which Robert Gibrat’s work is recognized as the first formal model dealing with the dynamics of firm size and industry structure (Sutton 1997). His work has been called Gibrat’s Law which states that the rate of a firm’s growth is independent of its size although empirical studies conducted later have predominantly rejected this.

Firm growth is viewed as a result of continuous discovery and use of productive knowledge which requires an institutional framework that determines the incentives to acquire and utilize knowledge (Henrekson and Johansson 2010).

2.1 The Role and Prevalence of High-Growth Firms

There is an increased interest among academicians and policymakers in the prevalence of HGFs in an economy. Some of the questions that they have tried to address include size, age, industry type and region of HGFs.

The role of HGFs in the job creation process has been examined in a number of empirical studies most of which have showed that job creation is accounted for by a few firms. Several recent researchers have verified the role played by HGFs in job creation (Acs et al. 2008; Anyadike-Danes et al. 2013; Autio et al. 2000; Coad et al. 2014; Davidsson and Henrekson 2002; Daunfeldt et al. 2013b; Delmar et al. 2003; Henrekson and Johansson 2010; Moreno and Coad 2015; Nesta 2009; Schreyer 2000; Storey 1994).

Coad et al. (2014), for instance, presents HGFs’ disproportionate job creating role as a stylized fact. Daunfeldt et al. (2013b) show that 6% of the fastest growing firms in the Swedish economy contributed 42% of the jobs in Sweden during 2005–08. Nesta (2009) documents that 6% HGFs in UK generated 49.5% of all new jobs created by operational firms in UK during 2002–08 while Storey (1994) found that 4% firms created 50% of the jobs. Although the roles of HGFs may depend on how they are measured, Daunfeldt et al. (2013a) found that they play a key role in the economy as sources of economic growth, employment growth and sales and productivity growth.

2.2 Determinants of Firm Growth

Several researches have been done to address the question of what determines firm growth. Moreno and Coad (2015) give two types of theoretical explanations of the determinants of firm growth where one relates to dynamic strategic choices within the firm while the other considers growth as purely random. Other recent studies have tried to classify determinants of firm growth as firm size, firm age, firm innovation and capabilities, entrepreneurship characteristics and resources.

Proponents of the strategic choice theory argue that a firm’s output will depend on the owner’s behavior, which is determined by knowledge, skills and ability to access and capitalize on key resources. This theory relates to the contribution of human capital in the form of formal education and experience (industry, managerial and/or prior business experience). The theory proposes that human capital and firm resources together with entrepreneur-specific capabilities allow some entrepreneurs to enter profitable niches and enjoy sustained superior performance compared to others (Moreno and Coad 2015). According to this explanation, HGFs can be seen as skilled firms with the ability to identify entrepreneurial opportunities to create a competitive advantage.

The second argument about determinant of firm growth argues that growth is a product of random events. It argues that patterns that are identified in stochastic methods are confused and used to fit a specific theory of convenience. Hence, it argues that it would be difficult to fully understand the systematic drivers of sustained superior performance unless the effect of randomness is known in a large population of firms (Henderson et al. 2012).

2.3 Business Environment and Firm Performance

Policymakers and entrepreneurs have also been interested in the role of a business environment for firm growth and improved performance. The World Bank’s publication Doing Business has been widely used to give a general picture about the business environment in an economy and policymakers have been advocating reforms that will improve their country’s ranking.

Nguimkeu (2013) investigated the main barriers of doing business in Cameroon using 2009 ES data on retailing firms. His findings show that taxation, illicit trade, lack of infrastructure, lack of access to credit, administrative delays and an incompetent labor were the major obstacles for retailing firms in Cameroon. Using a structural econometric analysis, the author shows that factors related to the business climate reduced domestic traders’ annual gross margins significantly.

Using their study on the prevalence and determinants of high-growth enterprises in 11 SSA countries, Goedhuys and Sleuwaegen (2009) show that electricity and access to finance were the major constraints in all surveyed countries among the listed elements of a business environment.

Hallward-Driemeir and Aterido (2007) did a comprehensive study on the role of business environment in sub-Saharan Africa relative to the rest of the developing world using the World Bank’s ES data for 2001. They found that employment growth in the region was relatively concentrated in the smallest firms. According to their findings, medium and large firms grew less rapidly as compared to other parts of the world. This could be due to the fact that firms in Africa faced greater challenges in accessing finance, reliable infrastructure services and other public services deemed crucial for growth which may have hindered the growth of large firms relative to small firms.

3 Methods

3.1 Defining and Measuring High-Growth Firms

It is difficult to do an analysis of the prevalence and determinants of HGFs without setting out working definitions of HGFs. Several approaches have been used for this although the following four and their derivatives are widely used in literature:

-

i.

Top 1 or 5% firms in terms of revenue, employment, profit and labor productivity as measured in growth rates, absolute change, log changes, index etc.

-

ii.

Firms with 20 or more employees for the period under investigation (Autio 2007).

-

iii.

Firms with annualized growth rates of at least 20% over a 3-year period and at least ten employees (Eurostat-OECD 2007).

-

iv.

Establishments which have achieved a minimum of 20% sales growth each year over the interval starting from a base-year revenue of at least $100,000 (Birch 1987).

In literature earlier estimates of high-growth firms defined HGFs as the share of firms with the highest growth during a particular period, for instance, the 1 or 5% of firms with the highest growth rate. The problem with this approach is it is difficult to create consistent time series data of high-growth firms because the threshold that defines the top firms is higher during the expansion phase of the business cycle than during the contraction phase. It is also inconvenient to compare the share of HGFs across time or across countries.

Later, Birch’s original proposition was dropped and a new index called the Birch Index was introduced as an alternative measure of firm growth (Coad et al. 2014; Hölzl 2011; Schreyer 2000). The Birch Index corrects the inherent bias of using absolute and relative measures of growth since several studies have documented that small firms exhibit larger relative growth rates of employment while bigger firms show larger absolute growth rates. The Birch Index considers both the relative and absolute employment growth rates and is based on a multiplicative combination of the absolute growth rate and the relative growth rate. The value of this index for our study is calculated as (Coad et al. 2014; Hölzl 2011):

Under this index, firms can be classified as HGFs by deciding on the cut-off point to be used like firms with BI values of top 1, 5 and 10%. Some studies define 10% of the firms with the highest Birch Index as high-growth firms (Lopez-Garcia and Puente 2012; Schreyer 2000).

For our study although we can use one or a combination of these approaches, customizing the criteria is required due to availability of data and the economic situation of the country under investigation. Application of the GEM approach does not show firms’ potential for growth since it ignores the number of years required to reach the threshold employment level. On the other hand, threshold levels of growth rates and initial employment recommended by OECD need to be adjusted by considering that there are limited numbers of entrepreneurial firms in Ethiopia. According to Daunfeldt et al. (2013a, b) findings the OECD criteria will exclude close to 95% of all surviving firms in Sweden over the period 2005–08 and about 40% of all created private jobs. Similarly, based on the ES data for Ethiopia, the standard Eurostat-OECD definition of HGFs will exclude more than 95% of the firms in the sample.

Based on Goedhuys and Sleuwaegen (2009), the threshold level of the initial size of firms was at least five employees and the growth rate is calculated for four years owing to data availability problem from 2010 to 2014 while the threshold is set to be a minimum of 10% average growth rate per annum. Accordingly, high-growth firms are firms with annualized growth rate in excess of 10% over the period 2010–14 and with at least five employees in 2010.

In our study, owing to the low incidence of HGFs in Ethiopia and in order to generate comparable number of HGFs to the Eurostat-OECD for the Birch Index measure of HGFs, we used the top 20% firms.

The World Bank’s ES reports sales data for all firms only for two years (2012 and 2014) leading to too narrow a measurement of firm growth in terms of sales. Therefore, we ignore growth of an establishment measured by sales growth as the survey does not report sales data for 2010.

Using the relative measure of growth, 137 firms were classified as HGFs while there were only 109 HGFs using BI. The number of HGFs further decreased to 86 and 56 if one adopted the top 15 and 10% cut-off points in BI. Like Eurostat-OECD, a 10% cut-off point on BI will exclude 90% of the sample firms.

In our analysis, we selected fast-growing firms with the modified Eurostat-OECD definition as HGFs and firms selected on the basis of the modified Birch Index as BHGF.

3.2 Measuring Business Obstacles

The questionnaire gives two groups of questions on business obstacles. The first group asks about the severity of an obstacle in a Likert scale question format by listing each obstacle separately. Establishments are asked to express their perceptions about the magnitude of the obstacle caused by elements of the business environment with a 0 score implying that it is not an obstacle and a score of 5 implying that it is a very severe obstacle. The second type of questions ask firms to select the single most important obstacle among a list of possible challenges. In the second approach, firms are expected to compare obstacles and select the one they believe to be the biggest obstacle relative to all listed obstacles while in the first approach they are exposed to one challenge at a time and asked to state if it is an obstacle or not.

Since the sampling design for the World Bank Enterprise Survey is a stratified random sampling, individual observations should be properly weighted when making inferences about the population. Under stratified random sampling, unweighted estimates are biased unless sample sizes are proportional to the size of each stratum. This is important because individual observations may not represent equal shares of the population.

To identify key business obstacles, our analysis is based on the percentage of firms that reported the listed elements as a major or severe obstacle (score of 3 or 4) from the first group of questions. To identify the most important perceived obstacles among the given list of challenges, the frequency with which a given obstacle was selected by firms as its biggest obstacle was computed.

3.3 Modeling Determinants of Firm Growth

We used both descriptive and econometric techniques in our data analysis. The descriptive analysis was used to explore the distribution of HGFs in Ethiopia using firm characteristics and other relevant factors.

Although several researchers have modeled the determinants of firm growth differently, the empirical model for our research is based on Goedhuys and Sleuwaegen (2009) who modeled firm growth as a function of firm age and size after controlling for other relevant factors which they classified into three major categories as firm characteristics, technological characteristics and firm resources. Firm characteristics refer to variables such as firm age and size, sex of the entrepreneur and education levels of the top management while resources refer to firm level resources to deal with constraints arising from poor infrastructure, insecurities and financial constraints. Further, we used the nature of a firm concerning export status, licensing technology from foreign-owned companies, ownership of a website and delivery of training as a proxy for a firm’s technological characteristics.

Owing to poor data availability and the high rate of non-responses in some of these variables, some of these characteristics were dropped and other new variables were included (see Eq. 10.4 for the model):

Given that there are several approaches for measuring HGFs we used the two most frequently used ones. These are the modified Eurostat-OECD definition and the modified Birch Index.

To measure firm growth using the modified Eurostat-OECD definition we used the logarithmic difference in the number of employees over a 4-year period:

where, GROWTH4 is the growth rate for firm i, and Si,2014 and Si,2010 are firm sizes measured by the number of employees in 2014 and 2010 respectively.

We prefer quantile regression (QR) to OLS for estimating the results because OLS estimates how the mean of the (conditional) distribution of firm growth rates changes systematically with its covariates assuming a well-shaped normal distribution of growth around the mean. In other words, it provides the marginal effect of the explanatory variables at the mean of the growth distribution (Goedhuys and Sleuwaegen 2009).

QR, on the other hand, estimates the effects of the different explanatory variables at different quantiles of the growth distribution. Since the HGFs are located in the extreme tail of the conditional growth distributions, factors that affect the upper deciles can be considered as factors that generate a significant number of high-growth firms. Using quantile regression avoids regression to the mean and shows the marginal effects at various deciles of growth distribution.

4 Data

4.1 Data Source

Our research is based on the World Bank’s Enterprise Survey (ES) data on Ethiopia for 2015 which was a sample survey conducted using stratified random sampling with industry, establishment size and region representing the three levels of stratification. The survey covered 848 firms including micro, small, medium and large firms. For our study the 26 micro firms were excluded owing to their insufficient representation with the result that we had 822 firms. Further cleaning of the data by considering firms with positive employment history in 2010 (to calculate growth rates over four years), dropping firms with no/error response to employment size and defining outliers in employment data as observations that were more than three standard deviations away from the mean in 2014 to purge out the effects of a few outliers left us with 547 firms. After removing the outliers, nearly 97% of the enterprises had 5–290 employees.

A number of questions were asked in the questionnaire to capture important dimensions of a firm’s performance, infrastructure availability and business obstacles. The questionnaire has 14 major components with relevant sub-sections for each. It starts by getting control information (biography) on firm size, size of locality, industry classification and region of operations. The general information section asks questions related to ownership type and sex of the top manager while the next section asks questions related to infrastructure and services. Questions related to sales and supplies, degree of competition, innovation, capacity utilization, land and permits, incidence and cost of crimes, sources of finance, business-government relations, labor, business environment and firm performance are all integral part of the questionnaire. The questionnaire distributed to manufacturing firms and service sectors had comparable contents with some minor differences.

The survey covered firms operating in the six major geographic regions in the country—Addis Ababa, Oromia, Amhara, SNNP, Tigray and Dire Dawa—while the size stratification was defined as small if the employment was between 5 and 19 employees, medium if employment was between 20 and 99 employees and large if a firm had more than 99 employees. Half of the sample firms were operational in Addis Ababa with Oromia and Tigray hosting 15% of the sampled firms each. Dire Dawa represented the smallest number of firms while Amhara and SNNP accounted for about 8% of the sampled firms each.

The survey was conducted for all categories of businesses. Two questionnaires were used in the survey (one for manufacturing and the other for the services sector) with common questions (core module) and additional questions to capture sector specific issues. The distribution of the sample by industry classification shows that the highest number of enterprises were in wholesale (16%) followed by the food industry (11%). The retail trade sector accounted for the third highest number of firms in the sample (11%). In terms of gross classification in services and manufacturing, 56% of the firms were from the services sector while the remaining 44% were from the manufacturing sector. Small firms accounted for just over half (51%) while the remaining half was accounted for by medium (33%) and large (16%) firms (Tables 10.1 and 10.2).

5 Empirical Results

5.1 The Prevalence of HGFs

Using the two measures we identified two cohorts of HGFs. The Eurostat-OECD classified 137 firms as HGFs while from BI there were 109 HGFs. Compared to BI, the Eurostat-OECD measure identified 25% of the surveyed firms as HGFs while the BI showed that 20% of the firms can be considered as HGFs in Ethiopia (Table 10.3). The relaxation of assumptions in the Eurostat-OECD measure could lead to different levels and types of HGFs. Using the standard Eurostat-OECD definition of a 20% annualized growth rate and a minimum of ten employees at the start of the study period, only 6% of the sampled firms were HGFs. These results are consistent with Petersen and Ahmad (2007), Goedhuys and Sleuwaegen (2009).

Irrespective of the type of measurement, 369 firms (over two-third of the establishments) were non-HGFs. On the other hand, more than 50% of the HGFs identified through the relative criteria remained HGFs when evaluated using the Birch Index while 86% of the HGFs identified using the Birch Index remained in the same category when the Eurostat-OECD measure was used. This result is consistent with previous research findings which show that different HGF measures lead to different firms being selected as high-growth firms.

The two cohorts of HGFs identified in Ethiopia in our study had similar features. In terms of age, for example, the mean age was around 12 years compared to the mean age of the non-HGFs which was close to 15 years (14 years for all the firms). Under both the measures, HGFs were found to be younger by 3 years on average than non-HGFs. Concerning ownership structure, the Eurostat-OECD measure identified around 53% HGFs as the sole ownership type while 25% were operational under the limited partnership form of ownership. The Birch Index, on the other hand, showed that 70% of the BHGFs were sole ownership and limited partnerships with each contributing half of the proportion. All these results were found to be statistically significant. The search for gazelles, firms which were HGFs and younger than 5 years was unsuccessful as there were no such firms in the economy (Table 10.4).

Persistence of high-growth firms was not studied due to data problems. Since most of the firms in Ethiopia are small sized firms, there is a high tendency for firms to fall below the threshold level of employment. Ayenew (2015) study based on CSA data of large and medium sized manufacturing firms showed that on average 22% of the firms were new entrants while 19% of them left the category in the same year with the exit level reaching as high as 46%. This makes it difficult to analyze persistent of HGFs.

Looking at industry type, the two measures refer to nearly the same types of firms where the services sector is over-represented in the HGF classification with a share of over 90 and 85% under the Eurostat-OECD and Birch Index measures respectively. The Eurostat-OECD measure shows that services in motor vehicles (section G) had the highest incidence of HGFs (around 27%) followed by the construction sector (around 21%) with both belonging to the services sector while under BI, wholesale businesses represented the highest incidence of HGFs (29%) followed by services in motor vehicles (section G) at 22% of BHGFs. Under the two measures, services in motor vehicles, wholesale businesses and the construction sector represented the top-3 dominant sources of HGFs. In the manufacturing sector, only food, non-metallic mineral products and plastics and rubber accounted for a noticeable proportion of HGFs as they accounted for 4% of the HGFs using the Eurostat-OECD measure while the percentage doubled to 8% using BI. The domination of HGFs in the services sector in Ethiopia is consistent with the findings of Henrekson and Johansson (2010) who did a meta-analysis of the role of HGFs. The incidence of high-growth firms in the manufacturing sector was very low in Ethiopia with only 4–8% of the HGFs in this sector (Table 10.5; Fig. 10.1).

Coming to the size of firms, both the measures showed somewhat similar cohorts of HGFs since medium sized firms (with 20–99 employees) dominated the proportion of HGFs. Under the Eurostat-OECD measure they constituted 60% of the HGFs while in BI they accounted for 75.5% of the HGFs. The essential difference between the two measures is that the Eurostat-OECD measure showed that the incidence of HGFs tended to be the least for large firms (only 2.4%) while it was the least in small firms under BI (less than 1%). This finding could be due to the inherent bias of relative growth measures such as the Eurostat-OECD measure towards small firms while BI controls for such a bias (Coad et al. 2014; Hölzl 2011).

Another indicator of the prevalence of HGFs that we used is their regional distribution. Nearly all the HGFs were concentrated in Addis Ababa regardless of the type of measurement used (over 90%) while Oromia region was the second largest host of HGFs (around 4.5%) under BI and 2.4% under the Eurostat-OECD measure. The regions showed a higher share of HGFs when BI was used relative to the Eurostat-OECD measure. This result is not surprising as Addis Ababa accounted for over 80% of the sampled establishments with a significant percentage of them being medium sized firms (35%) with high incidence of HGFs in the survey; the differences were found to be statistically significant (Table 10.6).

Table 10.7 gives average statistics on firm performance for the two cohorts of firms. It shows that HGFs had a growth rate which, on average, was three times that of non-HGFs under the two measures. HGFs also showed a higher number of employees on average with nearly twice the number of employees as the non-HGFs using BI. They also had a higher proportion of export engagement and a significantly large proportion of firms were owned by foreigners.

5.2 Perceived Business Obstacles by Establishments

An analysis of business obstacles was done based on the two inter-related groups of questions asked in the questionnaire. Measuring the proportion of firms that reported the business environment as a major obstacle or a very severe obstacle, 33% of all the firms reported supply of electricity as a major or severe obstacle making it the top obstacle in doing business followed by corruption and tax rates. Corruption was perceived to be a top obstacle by around 29% of the establishments while 28% of them ranked tax rates either as a major or very severe obstacle. Problems related to tax administration and informal sector competition were found to be the 4th and 5th major or severe obstacle to doing business in Ethiopia. Hence, tax rates and their administration posed a severe threat to doing business. Figure 10.2 gives details of the perceived obstacles by firms.

Source The World Bank Enterprise Survey (2015)

Percentage of firms reporting business obstacles as a major or very severe obstacle.

The World Bank Enterprise Survey which covers 139 countries and over 125,000 firms (The World Bank 2015) presents an excellent opportunity to do a global comparison of the business environments in which firms operate. Figure 10.3 gives the global picture of business obstacles that firms believe hinder their growth. It locates Ethiopia close to the center next to the high-income OECD countries using most of the indicators which shows that firms in Ethiopia work under a better environment relative to most of the countries surveyed. For example, compared to SSA, Ethiopia was better in nearly all the indicators.

Source The World Bank Enterprise Survey (2015)

Global picture of perception about business obstacles by firms.

Further, the Bank also asks establishments to identify the biggest obstacle among a given list of 15 obstacles. Over 40% of the establishments selected access to finance as the number one problem while customs and trade regulations and electricity supply were rated as the biggest obstacle by 12 and 10% of the establishments respectively. Tax administration and the practices of the informal sector were reported as the biggest obstacles by approximately 8 and 6% of the establishments respectively. Figure 10.4 gives the details.

Source The World Bank Enterprise Survey (2015)

Single most important obstacle to doing business in Ethiopia (%).

Taken together, the two types of questions reveal that access to finance and shortage of electricity were the two most important obstacles which were followed by customs and trade regulations and corruption with tax rates emerging as other important obstacles.

A decomposition of the analysis on the biggest obstacles using firm growth achievements shows that perceived business obstacles were not the same for the two cohorts of firms. Access to finance was perceived as the biggest obstacle by both cohorts of firms with the problem being more severe for non-HGFs. For HGFs, tax rates and customs and trade regulations represent the 2nd and 3rd biggest obstacles while electricity and corruption completed the list of the top-5obstacles. For non-HGFs, informal sector, electricity, tax administration and customs and trade regulations were among the top-5obstacles in order of importance (see Fig. 10.5 for details). These findings show that access to finance was the dominant challenge affecting a significant number of firms irrespective of their nature of growth. The differences in perceived obstacles by the two groups of firms was tested using Chi-2 test of independence and the results confirm the presence of statistically significant differences at the 5% significance level.

Source The World Bank Enterprise Survey (2015)

Top-five obstacles in Ethiopia by firm growth category.

An analysis of business obstacles using region of operation as a reference point reveals that there was a systematic difference among regions (Fig. 10.6). Looking at these problems from a regional perspective, firms operating in different regions perceived different obstacles and these differences were found to be statistically significant. For example, 45% of the firms in Addis Ababa believed that the biggest obstacle was access to finance while only 21% firms operating in Oromia considered finance as the biggest obstacle and it was not reported in the list of top-3 problems for firms operating in the Amhara region and SNNP. For firms in these regions, corruption topped the list in Amhara while electricity was reported as the biggest obstacle in SNNP. Establishments in Oromia reported informal sector activities as their biggest obstacle (29%) while those operating in Tigray reported finance as a key problem (42%). The implication of this finding is that regions should take into account these differences when improving their business environments.

Source The World Bank Enterprise Survey (2015)

Top business obstacles by region of establishment.

Regrouping the obstacles into five major categories (Fig. 10.7), as infrastructure (comprising of electricity and transport), access to finance, institutions (composed of business licensing and permits, labor regulations, crime/theft, courts, customs and trade regulations, corruption, tax administration, tax rates and the informal sector), access to land and other obstacles including political instability and an inadequately educated workforce generated three dominant obstacles. According to this classification, institutions were the second biggest obstacle with 34% of the establishments reporting it as the biggest obstacle next to finance (42%). Further, 14% of the firms reported infrastructure as the biggest obstacle with these three obstacles being reported by nearly 90% of the establishments.

Source The World Bank Enterprise Survey (2015)

Top business obstacles classified into five major segments.

5.3 A Test of Gibrat’s Law

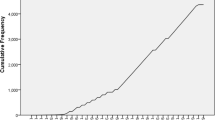

Gibrat’s Law of proportionate effect proposes that firm growth is independent of its size. This law can be easily tested by plotting the log size of a firm at a point. In Fig. 10.8, the normal line is presented by the dashed line while the unbroken line represents the kernel density curve. Looking at Fig. 10.8, the natural logarithm of size does not follow a normal distribution. The distribution has a peak around 8 employees and is skewed to the right. This is indirect proof against the law because small firms (as presented by the high density around 8 employees) grew faster than their medium and large counterparts.

Source The World Bank Enterprise Survey (2015)

Log normality plot of firm size using number of employees in 2014.

5.4 An Econometrics Analysis

We did an econometric estimation using OLS and QR and the results are given in Table 10.8. The first column gives the results of the OLS estimation while columns 2–10 give the QR results which show the marginal effects at various deciles of the distribution. The reference group consists of firms in Addis Ababa active in hotels and restaurants solely owned by male domestic entrepreneurs.

An analysis of the results from the OLS estimation shows that firm growth was negatively related to firm size and positively related to the squared term. The average marginal effect was found to be negative and significant implying a convex relationship between size and firm growth. The QR results also support the OLS estimation. From QR, the size effect was highly significant and negatively related to firm growth at each decile. The negative relationship shown here suggests that small firms grew faster than larger firms and this result is consistent with many global studies on the nexus between firm size and growth. The log normality plot of firm size introduced earlier is also in line with this finding. Using CSA data on Ethiopian manufacturing firms, Bigsten and Gebreeyesus (2007) found similar results.

Our analysis shows that there was a negative and convex relationship between age and growth under the OLS estimation. QR also shows a similar relationship between the two but the relationship was found to be significant only at the 60th, 70th and 80th growth deciles. For HGFs which would normally be located in the 90th decile, age was no more significant.

Other important variables of interest in the analysis are the role played by the gender and nationality of the owners of the establishments on firm growth. From the OLS regression, there was no statistically significant difference in the growth of firms based on the gender and nationality of the owner. This result is generally the same when evaluated using QR except for the 30th and 40th growth deciles for which female ownership had a statistically significant negative effect on growth at the conventional significance level.

Concerning technological and market factors that were hypothesized to determine growth, the OLS regression showed that firm level product and process innovations and ownership of a website had a positive and significant effect on firm growth. A unit increase in ownership of a website or product innovation led to 4% point increase in employment while the effect of process innovation was a bit lower (close to 3% points). Other explanatory variables in this category such as degree of competition, experience of the top management, training, degree of capacity utilization and export engagement were found to have an insignificant effect on firm growth.

An analysis of QR conveys more or less similar results on the effect of technological and market factors. From the QR findings, innovation (both product and process) positively and significantly affected growth at all deciles of the distribution. Both process innovation and product innovation could contribute a maximum of a 5% point increase in firm growth. Previous export engagement had a positive and significant effect on firms in the 90th decile. For most of the growth distribution, exporting firms had lower growth rates using QR. These results are significant for most of the growth deciles. Exporting firms’ growth might be better measured by other measures of growth such as sales or revenue growth. Goedhuys and Sleuwaegen (2009) also found similar relationships in their study. All the other technology and market factors were found to be insignificant in affecting HGFs.

From the resource dummies used in the regression, the OLS regression showed a positive relationship between ownership of generator and access to overdraft facility with growth. The mean growth is predicted to grow by 2 and 3% points for firms with generator and access to overdraft facility respectively. QR shows that the role of these resources was not the same for all firms. Ownership of generator enhanced growth for firms that fell in the 60th and 70th growth percentile while access to overdraft facility could increase firm growth by 6% points for the top growing firms.

An analysis of ownership type and region of operation dummies provides an interesting insight. Sole ownership had the upper hand in growth performance for some of the growth deciles against all other forms of ownership although the OLS estimation found it to be insignificant. Hence, the role of ownership on firm growth is not well established. Similarly, establishments whose business operations were located in the capital, as expected, were found to outperform others. The differences were found to be significant for firms in Oromia, SNNP and Tigray regions under the OLS estimation. The QR estimates confirm these findings although the top growing firms (firms in the 90th percentile) did not show statistically significant differences across regions. For firms in the Amhara and Dire Dawa regions, both estimation techniques failed to show any statistically significant difference from firms in Addis Ababa.

Concerning the relationship between sector of establishment and growth, the OLS estimation showed that there was no significant difference among firms except for the construction sector in which firms had a statistically significant superior growth performance relative to those in hotels and tourism. From QR, firms in the construction sector had a higher growth performance across most of the growth distribution with the exception of the fastest growing firms from the garment and textile industry. These firms outperformed the reference group in the 90th decile.

6 Summary, Conclusion and Recommendations

Our study was done with the aim of identifying the incidence of high growth firms with their corresponding growth determinants in Ethiopia using the World Bank’s ES database for Ethiopia collected in 2015. The survey covered 848 firms distributed over six major regions—Addis Ababa, Oromia, Amhara, SNNP, Tigray and Dire Dawa. Firm growth was measured by employment size over four years (2010–14). We also identified if these firms’ perceived challenges were different from those for non-HGFs. We discussed the incidence of high-growth firms and their perceived business obstacles and identified the drivers of firm growth across different growth distributions and econometric estimations using OLS and Quantile regression.

The Eurostat-OECD classified 137 (25%) firms as HGFs while from BI only classified 109 (20%) of the firms as HGFs. Compared to BI, the Eurostat-OECD measure identified a higher number of firms as HGFs. Regardless of the type of measure used, 369 firms (over two-third of the establishments) were non-HGFs. These percentages could have been significantly higher if the standard Eurostat-OECD definition was used.

Our study also showed that the HGFs were mostly located in the capital city and in the services sector and that the medium sized firms dominated HGFs in Ethiopia. Nearly all the HGFs were concentrated in Addis Ababa regardless of the type of measurement used (over 90%) while Oromia region was the second largest host of HGFs (around 4.5%) under BHGF and 2.4% under the Eurostat-OECD measure.

HGFs were found to be younger by 3 years on average than non-HGFs under both measures. In terms of ownership structure, a majority of these firms were sole ownerships followed by limited partnerships. Looking at the industry type, the two measures referred to nearly the same type of firms where the services sector was over-represented in the HGFs’ classification with a share of over 90 and 85% under the Eurostat-OECD and the Birch Index measure respectively. The domination of HGFs in the services sector in Ethiopia is consistent with the findings of Henrekson and Johansson (2010) who did a meta-analysis of the role of HGFs.

High-growth firms were also found to have growth rates which were on average over three-fold of those of non-HGFs under the two measures. HGFs also hired nearly twice the number of employees compared to non-HGFs. They also had a high proportion of export engagement and a significantly large proportion of foreign ownership.

Thirty-three percent of all the firms reported supply of electricity as a major or severe obstacle followed by corruption and tax rates. Corruption was perceived to be a top obstacle by around 29% of the establishments while 28% of them ranked tax rates either as a major or a very severe obstacle. Compared to other countries in the region such as SSA, the Middle East and North Africa which are also surveyed by the World Bank, firms in Ethiopia operated under a better environment.

Over 40% of the establishments reported access to finance as their number one problem while customs and trade regulations and electricity supply were rated as the biggest obstacles by 12 and 10% of the establishments respectively. Regrouping the obstacles into five major categories, institutional factors emerged as the second top obstacle next to access to finance.

An analysis of business obstacles using region of operation as a reference point showed that there was a systematic difference among the regions. For establishments in Addis Ababa and Tigray, the biggest obstacle was access to finance while it was the informal sector for firms operating in Oromia. Corruption topped the list for firms in Amhara while electricity was reported as the biggest obstacle by firms in SNNP and Dire Dawa. The implication of this is that regions should take into account these differences for improving their business environments.

Coming to sectoral aspects, although finance and electricity were reported as key problems by a significant number of firms from all industries showing a need for addressing these problems before resolving industry specific problems such as land (for leather, wood and furniture, metal products and other manufacturing), informal sector (for food, textiles and garments, leather, hotels), tax rates (for retail businesses) and corruption (construction sector and transport).

Considering perceptions about elements of a business environment and firm growth performance, like the non-HGFs even HGFs stated access to finance as the biggest perceived obstacle to growth. The key difference is that for HGFs tax rates were found to be the next biggest obstacle compared to informal sector activities for non-HGFs. Hence, the policy implication is giving priority to problems related to access to finance and tax rates for promoting HGFs.

We also discussed the determinants of firm growth. Firm growth was associated positively with firms’ product and process innovations and ownership of a website. Our research failed to show any significant difference among firms’ growth based on gender, degree of competition, capacity utilization and nationality of ownership. Export engagement, on the other hand, was found to have a negative relationship with growth. Facilitating innovation activities and technology acquisition such as website ownership and access to financial alternatives might be taken as policy tools.

When it comes to future research, alternative measures of firm growth could improve our research outcomes. Another concern is the persistence of HGFs. Daunfeldt and Halvarsson (2014) show that high-growth firms are one hit wonders and the probability of repeating high-growth rates is very low. This issue is more complicated in Ethiopia due to high entry and exit rates of firms in the manufacturing industry.

References

Acs, Z., W. Parsons, and S. Tracy. 2008. High-Impact Firms: Gazelles Revisited. Washington, DC: Office of Advocacy of the US Small Business Administration (SBA).

Anyadike-Danes, M., M. Hart, and J. Du. 2013. Firm Dynamics and Job Creation in the UK Taking Stock and Developing New Perspectives. ERC-White-Paper-No_6.

Autio, E. 2007. GEM’s Report 2007: Global Report on High Growth Entrepreneurship. London: Mazars/London Business School/Babson College.

Autio, E., P. Arenius, and H. Wallenius. 2000. Economic impact of gazelle firms in Finland. Helsinki University of Technology, Institute of Strategy and International Business. Working Paper Series 2000:3.

Ayenew, T. 2015. Essays on Firm Heterogeneity and Export: Productivity, Quality and Access to Finance. A dissertation submitted to the doctoral school of economics and management in partial fulfillment of the requirements for the Doctoral degree (Ph.D.) in Economics and Management.

Bigsten, A., and M. Gebreeyesus. 2007. The small, the young and the productive: Determinants of manufacturing firm growth in Ethiopia. Economic Development and Cultural Change 55: 813–840.

Birch, D. 1987. Job Creation in America: How Our Smallest Companies Put the Most People to Work. New York, NY: Free Press.

Bravo-Biosca, A. 2010. Growth Dynamics: Exploring business Growth and Contraction in Europe and the US. London, UK: NESTA Research report, November.

Coad, A., S.O. Daunfeldt, W. Hölzl, D. Johansson, and P. Nightingale. 2014. High-growth firms: Introduction to the special section. Journal of Industrial and Corporate Change 23 (1): 11–91.

Daunfeldt, S.O., N. Elert, and D. Johansson. 2013a. The economic contribution of high-growth firms: Do policy implications depend on the choice of growth indicator? Journal of Industry, Competition and Trade 14 (3): 337–365.

Daunfeldt, S.O., D. Halvarsson, and D. Johansson. 2013b. A cautionary note on using the Eurostat-OECD definition of high-growth firms. Sweden: HUI Research.

Daunfeldt, S.O., and D. Halvarsson. 2014. Are high-growth firms one-hit wonders? Evidence from Sweden. Journal of Small Business Economics 44 (2): 361–383.

Davidsson, P., and M. Henrekson. 2002. Determinants of the prevalence of startups and high-growth firms. Small Business Economics 19 (2): 81–104.

Delmar, F., P. Davidsson, and W. Gartner. 2003. Arriving at the high-growth firm. Journal of Business Venturing 18 (2): 189–216.

Eurostat, O.E.C.D. 2007. Eurostat-OECD Manual on Business Demography Statistics. Paris: OECD.

Goedhuys, M., and L. Sleuwaegen. 2009. High-growth entrepreneurial firms in Africa: A quantile regression. Small Business Economics 34: 31–51.

Hallward-Driemeier, M., and R. Aterido. 2007. Impact of Access to Finance. Corruption and Infrastructure on Employment Growth: Putting Africa in a Global Context. Unpublished.

Henderson, A., M. Raynor, and M. Ahmed. 2012. How long must a firm be great to rule out chance? Benchmarking sustained superior performance without being fooled by randomness. Strategic Management Journal 33: 387–406.

Henrekson, M., and D. Johansson. 2010. Gazelles as job creators: A survey and interpretation of the evidence. Small Business Economics 35 (2): 227–244.

Hölzl, W. 2011. Persistence, Survival and Growth: A Closer Look at 20 years of High Growth Firms and Firm Dynamics in Austria. Vienna: Austrian Institute of Economic Research.

Lopez-Garcia, P., and S. Puente. 2012. What makes a high-growth firm? A dynamic probit analysis using Spanish firm-level data. Small Business Economics 39 (4): 1029–1041.

Moreno, F., and A. Coad. 2015. High-Growth Firms: Stylized Facts and Conflicting Results. England: University of Sussex.

Nesta, 2009. The vital 6 per cent How high-growth innovative businesses generate prosperity and jobs. NESTA: Research summary.

Nguimkeu, P. 2013. Business Environment and Firm performance: The Case of Retailing Firms in Cameroon. Georgia: Andrew Young School of Policy Studies.

Petersen, D.R., and N. Ahmad. 2007. High-growth enterprises and gazelles: Preliminary and summary sensitivity analysis. Paris: OECD.

Schreyer, P. 2000. High-growth firms and employment. OECD STI Working Paper 2000 3. Paris: OECD.

Storey, J. 1994. Understanding the Small Business Sector. London: Routledge.

Sutton, J. 1997. Gibrat’s legacy. Journal of Economic Literature 35: 40–59.

The World Bank. 2015. World Bank Enterprise Survey. Washington, DC: The World Bank.

Acknowledgements

The researcher would like to thank the World Bank Enterprise Survey team for granting access to the data.

The researcher would like to thank Seid Ali (Ph.D.) for his comments and supervision.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Legesse, G. (2018). An Analysis of Firm Growth in Ethiopia: An Exploration of High-Growth Firms. In: Heshmati, A., Yoon, H. (eds) Economic Growth and Development in Ethiopia. Perspectives on Development in the Middle East and North Africa (MENA) Region. Springer, Singapore. https://doi.org/10.1007/978-981-10-8126-2_10

Download citation

DOI: https://doi.org/10.1007/978-981-10-8126-2_10

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-10-8125-5

Online ISBN: 978-981-10-8126-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)