Abstract

In the following chapter Hu, Zhang and Zhao examine the relationship of patents to technology innovation. The development of patents is conventionally regarded widely as a significant part of the innovation process in many modes of innovation. Patents are often used as an indicator of technology innovation, and China’s patenting surge raises the question whether China has become as innovative as her patent numbers suggest? If patents measure innovation output, a measure of inputs to the innovation process is R&D expenditures. China’s R&D spending has more than kept pace with the rapid growth of GDP in China. R&D as a share of GDP increased from 1.4 in 2007 to 1.8% in 2011, which was not far from the OECD average. However, patent numbers have been growing even faster than the increase in R&D expenditure. The number of invention patents granted to resident, non-individual applicants per 10 million dollars of R&D expenditure (in 2011 purchasing power parity prices) was 3 for China and 2 for the U.S. in 2007. In four years, the ratio for China rose to 6.3, and that for the U.S. increased more modestly to 2.4. While not impossible, it would seem unlikely that this large and widening disparity in patents to R&D ratio can be explained by the difference in the productivity of R&D of the two countries. The objective of this chapter is to explore both innovation and non-innovation-related explanations of China’s patenting surge and to discuss their policy implications. “The conventional role of patents lies in preventing copying and pre-empting unauthorized entry, the need for which rises when new technologies are created, thus implying a tight connection between technology innovation and patenting.” Recent experience in developed countries, particularly the U.S., indicates that applying for patents has also been driven by firms’ concerns that an unfavorable court ruling over the ownership of intellectual property could inflict significant financial damages on them. This has led firms to build up a war chest of patents that might increase their bargaining power in anticipation of such intellectual property disputes. The propensity to apply for patents can increase, when the underlying rate of technology innovation has not significantly, but when developments in legal institutions and public policy change the firms’ perception of the need for such strategic maneuvers.

This chapter is adapted from Hu, Zhang and Zhao (2017).

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

Introduction

China’s State Intellectual Property Office (SIPO) became the busiest patent office in the world in 2011, having seen its resident patent applications growing at 30% in the preceding decade. In comparison, the growth rate had been −2.8, 6.5 and 3.4% respectively for Japan, South Korea and the U.S. during the same time. To the extent that patents are often used as an indicator of technology innovation, China’s patenting surge raises the question whether China has become as innovative as her patent numbers suggest.

If patents measure innovation output, a measure of inputs to the innovation process is R&D expenditures. China’s R&D spending had more than kept pace with her rapid growth of GDP—R&D as a share of GDP increased from 1.4 in 2007 to 1.8% in 2011, which was not far from the OECD average.Footnote 1 However, patents had been growing even faster. The number of invention patents granted to resident, non-individual applicants per 10 million dollars of R&D expenditure (in 2011 purchasing power parity prices) was 3 for China and 2 for the U.S. in 2007. In four years, the ratio for China rose to 6.3, and that for the U.S. increased more modestly to 2.4. While not impossible, it would seem unlikely that this large and widening disparity in patents to R&D ratio can be explained by the difference in the productivity of R&D of the two countries.Footnote 2

The objective of this chapter is to explore both innovation and non-innovation-related explanations of China’s patenting surge and to discuss their policy implications. The conventional role of patents lies in preventing copying and pre-empting unauthorized entry, the need for which rises when new technologies are created, thus implying a tight connection between technology innovation and patenting. However, recent experience in developed countries, particularly the U.S., indicate that applying for patents has also been driven by firms’ concerns that an unfavorable court ruling over the ownership of intellectual property could inflict significant damages on them and by their intention to build up a war chest of patents that would increase their bargaining power in anticipation of such disputes. The propensity to apply for patents can increase, when the underlying rate of technology innovation has not, when developments in legal institutions and public policy change the firms’ perception of the need for such strategic maneuvers.

An important non-innovation-related driving force of the patenting surge in China has been the Chinese government’s encouragement of the acquisition of intellectual property as part of its push for raising the level of technology innovation in the Chinese economy. For instance, the 12th Five-Year Plan of Science and Technology Development, which covers the five-year period from 2011 to 2015, set an explicit target for patents: it aimed to increase the number of SIPO invention patents in force per 10,000 people from 1.7 in 2010 to 3.3 in 2015. To execute plans such as this, Chinese government at various levels has introduced incentives to promote patent applications.

We present evidence based on a novel data set to ascertain the contributions of both innovation and non-innovation-related forces to China’s patenting surge. In our data set SIPO patents have been matched to Chinese industrial firms at the firm level. This database spans the population of China’s large and medium size industrial enterprises, which account for the majority of R&D conducted in Chinese industry.

A key finding of our analysis is that the association between patents and R&D and between patents and labor productivity had weakened in China’s large and medium size enterprises from 2007 to 2011. This trend is particularly conspicuous for utility models, which require no substantive examination at the patent office for them to be granted, and for firms and regions that had patented relatively less in the past, i.e., the extensive margin of growth. These results lend credence to the role of non-innovation related forces in driving the patenting surge.

Understanding what has been behind China’s patenting surge is important for assessing technological progress in China. While it is beyond the scope of the current paper to analyze the consequences of patenting motivated by non-innovation related forces, they are unlikely to be innocuous. For example, the rapid increase in patent applications has increased the workload at SIPO, potentially reducing the amount of time examiners spend on each application, which in turn may lead to undeserving patents to be granted. The policy incentives may create distortionary effect on technology innovation by shifting too much resources to activities that would lead to patents.

China’s Great Leap Forward in Patenting: An International Comparison

Patent applications at SIPO have experienced exponential growth. In Fig. 8.1 we plot the number of resident patent applications (in logarithm) filed at four national patent offices: Japan Patent Office, Korea Patent Office, SIPO and US Patent and Trademark Office. From 1985 to 2012, resident patent applications at USPTO had been increasing at an annual rate of 5.5%—inviting much commentary and analysis of what is called the U.S. patent explosion (Kortum and Lerner 1999; Jaffe and Lerner 2004; Hall 2004). In contrast, resident patent applications at SIPO registered an annual growth rate of 20%, with significant acceleration in recent years.

Resident patent applications at the Japan Patent Office had been rising from the mid 1980s to the late 1990s (Sakakibara and Branstetter 2001; Nagaoda 2009), but started declining after that, with the number of applications filed in 2012 similar to that for 1985. South Korea, a country that has made the transition from imitation to innovation (Kim 1997), started in the mid 1980s with a similar number of resident patent applications as China, but only grew its patent applications at a lower rate of 16 per cent per annum. If resident patent applications at SIPO had followed similar growth patterns as those at the USPTO and South Korea’s patent office up until 2005, they clearly embarked on a much faster growth trajectory after that.

Comparison of resident patent applications filed at national patent offices is subject to a home bias. For large countries, the domestic market represents the largest opportunity for inventors to realize the returns to their inventions, and thus the inventors tend to seek out patents in their home country first. The cost of obtaining a foreign patent is also higher than that for a domestic one, contributing to the home bias in resident patent applications. Thus we plot in the right panel of Fig. 8.1 the numbers of applications from the four countries at a single national patent office, the USPTO, to try to account for the home bias. Given the home “advantage” of U.S. applicants at the USPTO, we focus on the comparison between China, Japan and South Korea. China’s USPTO patent applications, although growing at a faster rate, are still outnumbered by those of Japan and South Korea.

One potential explanation of the underperformance of Chinese applicants at the USPTO could be that many of the Chinese high-tech companies have not turned the U.S. into a major market for their products. Nevertheless the incongruence between the two figures raises questions about the technological significance of China’s patenting surge.

The Literature

Hu and Jefferson (2009) provided the first economic analysis of China’s patenting surge when it was still at an early stage and the driving forces behind it appeared to be somewhat different from those of today. They estimated a patent production function using a dataset of Chinese large and medium size manufacturing enterprises from 1995 to 2001. The results showed that increasing R&D expenditure could only explain a fraction of the patent explosion. A novel feature of the Chinese patent explosion that is absent in other episodes of rapid patent growth is the role of foreign direct investment, which they found to have prompted Chinese firms to file for more patent applications. They also found that both the strengthening of the Chinese patent law and ownership reform that has clarified the assignment of property rights have increased Chinese firms’ propensity to patent.

Hu (2010) focused on the rapid growth of foreign (non-resident) applications at SIPO. He investigated two hypotheses in explaining the foreign patenting surge in China: market covering and competitive threat. With foreign companies more deeply engaged with the Chinese economy, returns from protecting their intellectual property in China have increased. As domestic Chinese firms’ ability to imitate foreign technology gains strength and competition between foreign firms intensifies in the Chinese market, such competitive threat heightens the urgency to protect intellectual property. Using a database that comprises SIPO and USPTO patents, he found support for the competitive threat hypothesis.

Li (2012) investigated the impact of Chinese government’s patent subsidy programs on China’s patenting surge, using province-level aggregate data for the period from the mid 1990s to 2007. His results showed that patent applications increased after a province launched a patent application fees subsidy program.

Investigating the rapid growth of Chinese patent applications at the USPTO, Branstetter et al. (2015) found that much of the surge of Chinese patenting in the U.S. has been driven by multinational corporations’ R&D activity in China, rather than indigenous Chinese firms’ inventions.

The Data

The NBS-SIPO Firm-Level Patent Database

National Bureau of Statistics of China and SIPO started a collaboration in 2007 to match SIPO patents that have been granted to large and medium size Chinese industrial firms with these firms’ financial and technology indicators that are part of the large and medium size industrial enterprises (LME) census database. The resulting database is what we use for the current analysis, which covers the period of 2007 to 2011. For each LME, we know the numbers of their patent applications and grants by year. The patent counts are available for three types of patents: invention patents, utility models and designs.Footnote 3 In addition, the database also includes information on the number of patents that are “in force” for the three types of patents. These are patents that have been granted and have not lapsed because the firms have paid renewal fees to maintain their legal status. Since designs are usually considered a different and more rudimentary type of innovation from those protected by invention patents and utility models, for the current analysis we will concentrate on the latter two categories of patents.

There have been other efforts to match SIPO patents to the Chinese firms that own them. And all these researchers did the matching by comparing the name of a firm in a firm database with the name of a patent applicant in the SIPO database. For example, He et al. (2013) matched SIPO patents to publicly listed Chinese firms; Holmes et al. (2015) identified the SIPO patents for a sample of multinational corporations operating in China; and Xie and Zhang (2015) matched SIPO patent data with the widely diffused “above scale” Chinese industrial firm database.

Our database is unique in that it is constructed using the firm’s legal person code, rather than name in the matching. Each Chinese enterprise is assigned a unique legal person code by the General Administration of Quality Supervision, Inspection and Quarantine of China. And SIPO and NBS have used that code to link the SIPO patent database with the NBS large and medium size enterprise database. This approach has the advantage of eliminating the ambiguity and error created by the different ways a firm’s name is recorded in various databases.

The number of industrial LMEs, as reported in Table 8.1, ranged from 36,251 in 2007 to 60,391 in 2011. In 2011 NBS changed the criteria by which an enterprise qualifies as a large or medium size enterprise for the industrial census. This explains the large jump in the number of LMEs from 2010 to 2011. Manufacturing consistently accounted for around 90% of all LMEs. Among manufacturing LMEs, 19,546 enterprises appeared in all five years in the database. These firms constitute the balanced sample that our statistical analysis is based on.

How Representative Is the LME Sample in Accounting for Patenting at SIPO?

In its statistical reporting system, SIPO categorizes patents into domestic and foreign patents, based on the country of origin of the applicant of a patent. Within each category, patents are further classified into “service” and “non-service” patents, which are SIPO’s terms for non-individual and individual patents respectively, depending on the identity of the applicant of a patent. Within the domestic service patents category, patents are further classified into four categories based on the nature of business of the applicants: universities, research institutions, government and non-profit organizations, and enterprises.

The top panel of Table 8.2 tabulates the total numbers of patent applications and grants for inventions and utility models for all domestic enterprises.Footnote 4 From 2007 to 2011, invention patent applications have more than tripled and utility model applications have more than quintupled, while the grants of these two types of patents have more than quadrupled.Footnote 5 The second panel of the table reports LMEs’ share of all enterprise patents. By and large, the LMEs have maintained their shares of various patent counts at between 30 and 45%.

The manufacturing LMEs’ shares of all enterprise patents reported in the next panel indicate that manufacturing accounts for the vast majority of LME patenting, around 95% of all four counts in 2011. One notable trend is that the LMEs’ share of invention patent grants has increased over the years, while their share of invention patent applications has declined or maintained at the same level.

Finally, at the bottom of Table 8.2, we report the shares of total enterprise patents for firms in the balanced manufacturing sample, which had been declining, except for invention patent grants. We can compute the shares of the firms in the balanced manufacturing sample in total LME manufacturing patents by comparing the bottom two panels. For example, the balanced sample’s share of all manufacturing LMEs’ invention patent applications declined from 84% in 2007 to 60% in 2011. Similarly for utility models, the balanced sample’s share went down from 81 to 56% in five years. This has to do with the fact that the LME sample has been growing in size over time as more Chinese firms qualify for the LME status.

In sum, the LME sample captures a significant portion of SIPO domestic, non-individual patents. Moreover, if the average technological significance of patents increases with firm size, then the share of LMEs in the total number of technologically significant patents should be even higher than suggested here.

The “Democratization” of Patenting from 2007 to 2011

An important feature of the patenting surge from 2007 to 2011 is that many firms that were previously not patenting or only occasionally patenting account for the bulk of the patenting increase. That is, the extensive, rather than intensive, margin of growth of patenting has been a major contributor to the surge. We observe this both along the industry and geographical dimensions.

Extensive Versus Intensive Margin of Patenting Growth

We first examine the incidence of patenting and conducting R&D, measured as the share of firms engaging in the respective activity. As Table 8.3 shows, the incidences of filing invention patent and utility model applications more than doubled to 21 and 26% respectively during the period 2007 to 2011, while the incidence of receiving invention patent grants quadrupled from 3 to 13%. Although the share of LMEs conducting R&D also increased, from 30 to 41%, the increase is much more modest compared with that of patenting, suggesting that more LMEs were patenting without R&D activity than before.

We compute and report in Table 8.4 the average number of patents per firm and average R&D expenditures per firm for three samples: the full balanced sample, the invention sub-sample—comprising firms that had filed invention patent applications each year, and the utility model sub-sample—consisting of firms that had filed utility model applications each year. For the full balanced sample, from 2007 to 2011, average invention patent applications per firm more than doubled from 0.97 to 2.09, whereas average utility model applications more than tripled, from 0.85 to 2.77. On the other hand, R&D expenditures had only registered a 75% increase in four years. Thus the growth of patent applications had far outpaced the growth of R&D expenditures.

The serial innovators that populate the invention sub-sample filed significantly more invention patent applications than the rest, but unlike the case of the balanced sample, the 53% increase from 24.97 to 38.09 applications a year is slightly smaller than the 59% increase of these innovators’ R&D expenditures.

The numbers for the utility model sub-sample exhibit different patterns. Although these firms also filed many more utility model applications than the average firm, unlike the serial innovators in the invention sub-sample, the growth of these firms’ utility models outstripped that of their R&D expenditures.

To measure the extensive versus intensive margin of growth, we define intensive margin of growth as that of the growth of the patents of the serial innovators discussed earlier. Using the numbers reported in Table 8.4, our calculation shows that 38% of the increase of 21,892 invention patent counts from 2007 to 2011 for the sample had come from the serial innovators. In other words, the extensive margin of growth had contributed 62% of the invention patenting growth. Similar calculation reveals that two thirds of the utility model application growth had resulted from the extensive margin of growth.

Taken together, these statistics indicate that (1) invention patent applications had been growing in proportion to R&D expenditures for the innovators—firms that had been consistently applying for such patents, but they had far outpaced the growth of R&D for those firms that were new to patenting or had only occasionally patented; (2) compared with invention patent applications, utility model applications had been growing faster than R&D expenditures; (3) the extensive margin of growth was responsible for the bulk of the recent patenting surge.

Industry Dimension

Both technology opportunity and the propensity to patent vary by industry (Levin et al. 1987; Cohen et al. 2000). The U.S. patent explosion, for example, was largely concentrated in the computing and electronics sectors (Hall 2004), which was partly explained by the predisposition of firms in these sectors to the strategic motive of seeking patents. We plot the industry distributions of invention patent and utility model applications for our balanced sample in Figs. 8.2 and 8.3. In each figure we compare the distribution of the beginning year with that of the ending year.

There are sharp differences in the propensity to patent across industries. The telecommunications equipment and computers industry dwarfs the other industries, accounting for over half of all manufacturing invention patents in 2007. The utility model applications are less concentrated, but the top five industries, general equipment, special equipment, transport equipment, electric, and telecommunication equipment and computers, accounted for three quarters of the total in 2007.

The distributions flattened somewhat from 2007 to 2011: the telecommunication equipment and computers industry’s share of invention patent applications fell to 39% in 2011. The top five industries based on invention patent applications in 2007 saw their share of the total fall from 77 to 69% in four years. Similarly the top five industries’ share of utility model applications fell from 74 to 68%, with the telecommunication equipment and computers industry losing its top position to the electric industry.

That patenting has been growing faster in sectors that have not traditionally been the most active in seeking patent rights is in line with our earlier observation that the extensive margin of growth explained the bulk of the patenting surge. It is notable that telecommunication equipment and computers, which is more prone to strategic patenting, has seen their patenting growth outpaced by that of sectors not usually associated with patenting for strategic gains. This raises questions about strategic patenting as an explanation of the patenting surge.

Geographical Dimension

As innovation figures more prominently in the evaluation of the performance of local government officials at various levels, patents have become an important performance indicator. The urge to boost their patent counts is likely to be greater in regions that had lagged in innovation and patenting. The plot of the geographical distribution of the invention patent applications in Fig. 8.4 shows that Guangdong dominates, accounting for over half of all manufacturing patents in 2007. But Guangdong saw its dominant position decline to 36% of the total in 2011. In figures not shown here where we excluded the telecommunications equipment and computers industry from the distribution, Guangdong’s dominance was much less salient. This is not surprising as Guangdong hosts some of the top manufacturers from the telecommunication equipment and computers industry (e.g., Huawei and Foxconn) and given that this industry was responsible for over half of the invention patent applications filed by Chinese manufacturing firms. Thus the erosion of Guangdong’s dominance in patent applications tracks the decline in the share of telecommunications equipment and computers in all patents.

For the rest of the provinces, all but three, i.e., Gansu, Qinghai, and Tianjin, gained shares from 2007 to 2011. This catch-up by the lagging provinces in patenting is another manifestation of the extensive margin of growth dominating the intensive one. Notwithstanding the catch-up, by 2011, Beijing, Guangdong, Jiangsu, Shandong and Shanghai remained as the top invention patent filing provinces/municipalities, although their share of the total declined from 77 to 67% in four years.

Similar patterns across provinces and over time emerge in Fig. 8.5, where the geographical distributions of utility models are plotted, except that they are less concentrated than are the invention patents. The top five regions filed 51% of all the applications in 2011, down from 62% in 2007.Footnote 6

Summary of Statistical Analysis

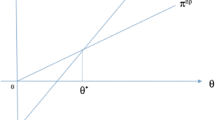

We further investigate the contributions of the extensive versus intensive margin of growth to China’s patenting surge by estimating a knowledge production function:

That is, we assume that the mean of patents produced by firm i in year t is proportional to the firm’s knowledge stock accumulated up to that year, which we approximate using a measure of R&D stock constructed using the firm’s historical R&D expenditures and the perpetual inventory model. In Eq. (8.1), we allow the R&D elasticity of patents to vary by year, while separately estimating year fixed effects, Dt. The vector of variables X collects the rest of the controls including firm size and firm fixed effects. For patents we use invention patent and utility model applications as two separate measures.

We estimate Eq. (8.1) using a conditional fixed effects Poisson estimator and correct for the inconsistency of the estimates of the standard errors by following Wooldridge (2002)’s suggestion of computing standard errors clustered by firm.

We will not reproduce the statistical estimates and the related discussion here. Interested readers can refer to Hu, Zhang and Zhao (forthcoming) for details. Instead we will just highlight the key results in summary form.

Our estimates of the patent production function show that (1) the patent—R&D association had become weaker from 2007 to 2011, particularly for utility models and for the sample of firms that exclude those from the telecommunication equipment and computers industry; and (2) there was a sharp increase in the propensity to patent in 2010 and 2011 for all but six industries that typically have greater propensity to patent, i.e., pharmaceutical, chemical fiber, electric and telecommunication equipment and computers.

Innovators Versus Non-innovators

A potential explanation of the declining patent elasticity of R&D is that it just reflects diminishing returns to R&D. As the firms increase their R&D efforts, they exhaust technology opportunities and R&D on the margin generates fewer patents. We subject the diminishing returns hypothesis to test by estimating the year-specific patent—R&D elasticities for two groups of firms: the innovators and the non-innovators. For the invention patent regressions, innovators are firms that filed for invention patent applications in each and every year from 2007 to 2011; for the utility model regressions, innovators are defined similarly using utility model applications.

Our definition of innovators versus non-innovators corresponds to the distinction we made earlier regarding the intensive versus extensive margin of growth of the patenting surge. There the intensive margin of growth was defined as growth of patenting by firms that are serial innovators, those that filed patent applications in each of the years from 2007 to 2011, whereas the extensive margin of growth was defined by what we now call non-innovators. Thus the current exercise will shed light on the nature of the patent-R&D correlation at the intensive and extensive margin of growth of China’s recent patenting surge.

The statistical results show that it was the non-innovators, rather than the innovators, that had seen diminishing association between patents and R&D. This militates against the exhaustion of technology opportunity and thus diminishing returns hypothesis as an explanation for the declining patent-R&D elasticity. This also raises questions about the quality of the extensive margin of the patenting growth, which we have observed earlier accounts for nearly two thirds of the patenting surge.

Patent Poor Versus Patent Rich Regions

If what drives the recent patenting surge is Chinese firms responding to the government policy incentives for acquiring patents, then we should expect such policy-driven patenting to be more prevalent in regions where there was relatively little patenting to begin with. In those regions, the local governments were more likely to provide incentives that would promote the acquisition of patents. Numerous authors have discussed the importance of competition between sub-national Chinese governments in explaining China’s economic success.Footnote 7 To examine this hypothesis, we separate the provinces into two groups, using the number of invention patents in force per 10,000 people in 2006, the year preceding the beginning year of our sample. Those provinces with their invention patents per 10,000 people above (and inclusive of) the median are classified as “patent rich”, whereas those with below median patent counts are called “patent poor.” In Table 8.5 we report the patent statistics for the 31 provinces/municipalities for 2006 and 2011. The last column contains the ratio of the 2011 figure to that of 2006. The entries in the table are sorted by the 2006 patent number in descending order.

Beijing, Shanghai, Tianjin, Guangdong, Liaoning, Zhejiang, and Jiangsu lead the country, with the first two municipalities already meeting the target set for 2015 in 2006. For 2006, the national median is Hunan’s 0.26, significantly below the national average of 0.55. From 2006 to 2011, the typical provinces had seen their invention patents per 10,000 people at least quadruple, with Guangdong, Chongqing, Anhui, Jiangsu and Zhejiang leading the race. Firms from the patent rich regions had on average increased their invention patents in force by 320%, whereas those from the patent poor regions had achieved growth of 324%.

We have estimated Eq. (8.1) separately for the two regions. The results are quite different: for the patent rich regions, invention patents show greater correlation with R&D than do utility models, and the correlation declines significantly for the latter but not for the former, but for the patent poor regions, R&D is as correlated with utility models as it is with invention patents, and the patent-R&D elasticity declines over time for both utility models and invention patent applications. We also find that for the patent rich region, patents are highly correlated with firm size, measured by sales revenue, but there is no such correlation for the patent poor region. One potential explanation to rationalize the patent poor region’s patenting—rapidly growing and yet tenuously related to technology innovation—would be that it has been the consequence of the local governments in those regions rolling out policy incentives that have changed the firms’ motive for applying for patents.

Patents and Labor Productivity

Our data does not allow us to estimate total factor productivity; instead we investigate the link between patents and labor productivity, which we define as sales revenue per worker. For the patent measure, we use the number of patents that are legally active, or in force. This is the number of a firm’s patents that have been granted and that which the firm has chosen to pay the renewal fees for in order to keep them legally active. The advantages of using this measure are that (1) it is a stock measure, representing a firm’s cumulative patenting and innovation effort and (2) it is the number of patents that a firm chooses to maintain after they are granted by paying renewal fees, so that they are economically relevant. Therefore it is more desirable than stock measures constructed using patent applications or grants. The only shortcoming of using this measure is that in our database we only have data for this measure for the last three years, 2009–2011.

The labor productivity regression results follow similar patterns as those obtained by estimating the patent production function. That is, both the R&D-innovation connection and the innovation-productivity link have weakened over the years when the patenting surge took place. It would be interesting to see whether and how the results would change if we have a longer duration of the panel.

Concluding Remarks

China’s extraordinary patenting ascent in recent years has taken place against a backdrop of increasing technological sophistication of Chinese firms and Chinese government proactively promoting the acquisition of intellectual property. Chinese firms have been aggressively applying for patents as a result of their newly acquired capability to invent new technologies and their response to the government incentives and other strategic considerations. While the former is most likely to be a result of conscious R&D effort, the latter would have increased the propensity to patent independent of technology innovation.

We investigated the extent to which this most recent episode of patenting surge was driven by technology innovation by estimating a patent production function and by using a unique Chinese firm-level data set where the SIPO patent records have been matched to the large and medium size industrial firms. The data set covers the period of 2007–2011, which saw the most dramatic surge in Chinese patent applications. Our main findings include: (1) the extensive margin of growth, patenting by firms that were not actively patenting in the past, was responsible for nearly two thirds of the patenting surge; and (2) the association between patents and R&D had been weakening.

Another key insight of our research is that the increasing disjointedness between patents and R&D does not apply to all segments of the patenting surge. It is more conspicuous for utility models than for invention patents; it is less prominent for the telecommunication equipment and computers industry than for the other industries; it is most evident with firms that were not actively patenting in the past, or the extensive margin of the patenting growth; and it is far more striking for regions that had been lagging in patenting. These findings are reaffirmed by the results from regressing a firm’s labor productivity on its stock of patents in force.

We caution against potential misinterpretation of the findings reported here. While we have shown that a significant portion of the recent patenting surge may have less to do with technology innovation than meets the eye, it would be a mistake to think that China’s patent boom is just a mirage. As we have emphasized, the result mostly applies to the extensive margin of the patenting surge.

We have discussed two potential explanations for non-innovation related patenting: strategic considerations and government policy incentives. The evidence we have presented favors the government policy incentive hypothesis. But there could be other motivations that played a part in driving the patenting surge. For example, Chinese firms may have developed greater appreciation of the value of patents as an instrument to facilitate technology licensing, cooperation and venture financing, and as performance measures for R&D personnel. A full investigation of all these potential motives for applying for patents is beyond the scope of the paper.

The Chinese patenting surge adds to the on-going debate and discussion of the role of the patent system in technology innovation, and in economic development in general. What kind of patent system can best serve the development needs of China deserves greater attention of academics and policy makers than it currently receives. In particular, a greater appreciation of the less innocuous effect of rapidly growing patent right claims, especially those that could erect barriers for future technology innovation, is needed.

Notes

- 1.

Even this acceleration of R&D intensity at the aggregate level may belie the even more rapid growth in R&D in certain sectors of the Chinese economy, such as telecommunication equipment.

- 2.

We use the number of patents granted to non-individual applicants in 2011 as the numerator and R&D expenditures incurred in 2008 as the denominator. The R&D expenditures are measured in 2011 prices that have been adjusted for purchasing power parity—we obtained the figures by multiplying GDP in 2011 PPP prices by the R&D to GDP ratio. We build in a three-year lag between patent grant and R&D spending. The GDP and R&D to GDP ratio data are obtained from World Development Indicators (http://data.worldbank.org/indicator/all).

- 3.

SIPO refers to all three as patents with the respective qualifiers of invention, utility model and design.

- 4.

We obtained these numbers from SIPO’s Patent Statistics Annual Report (www.sipo.gov.cn/tjxx/). The enterprise patents consistently accounted the bulk of all domestic service, or non-individual patents, e.g., they were consistently responsible for around 70% of all domestic, service applications for invention patents from 2007 to 2011.

- 5.

Invention patent applications include both successful and unsuccessful applications. The ratio of contemporaneous patent grants to applications does not correspond to the likelihood of a patent application being granted given the time it takes to process the application. Also since applications have been growing very rapidly in China, the contemporaneous ratio is particularly uninformative. Assuming an application-grant lag of three years, the grant to application ratio works out to be close to 60%.

- 6.

The top five regions for utility model applications in 2011 were Guangdong, Jiangsu, Zhejiang, Shanghai, Shandong, and Chongqing.

- 7.

For example, Xu (2011) characterized China’s fundamental economic institution as a regionally decentralized authoritarian regime that combines political centralization with economic decentralization. This system fosters inter-regional competition among the Chinese subnational governments and incentivizes policy making that promotes regional economic development and growth.

References

Branstetter, L., Li, G., & Veloso, F. (2015). The rise of international convention. In A.B. Jaffe & B. Jones (Eds.), The changing frontier: Rethinking science and innovation policy (pp. 135–168). University of Chicago Press.

Cohen, W. M., Nelson, R. R., & Walsh, J. P. (2000). Protecting their intellectual assets: Appropriability conditions and why US manufacturing firms patent (or not). NBER Working Paper No. 7552.

Hall, B. H. (2004). Exploring the patent explosion. NBER Working Paper No. 10605.

He, Z.-L., Tong, T. W., He, W., Zhang, Y., & Lu, J. (2013). Chinese patent database user documentation: Matching SIPO Patents to Chinese publicly-listed companies and subsidiaries.

Holmes, T. J., McGrattan, E. R., & Prescott, E. C. (2015). Quid pro quo: Technology capital transfers for market access in China. Review of Economic Studies (forthcoming).

Hu, A. G. (2010). Propensity to patent, competition and China’s foreign patenting surge. Research Policy, 39(7), 985–993.

Hu, A. G., & Jefferson, G. H. (2009, September). A great wall of patents: What is behind China’s recent patent explosion? Journal of Development Economics, 90(1), 57–68.

Hu, A. G., Zhang, P., & Zhao, L. (2017). China as number one? Evidence from China’s most recent patenting surge. Journal of Development Economics, 124, 109–119.

Jaffe, A. B., & Lerner, J. (2004). Innovation and its discontents: How our broken patent system is endangering innovation and progress, and what to do about it. Princeton: Princeton University Press.

Kim, L. (1997). Imitation to innovation: The dynamics of Korea’s technological learning. Boston: Harvard Business School Press.

Kortum, S., & Lerner, J. (1999). What is behind the recent surge in patenting? Research Policy, 28(1), 1–22.

Levin, R. C., Klevorick, A. K., Nelson, R. R., & Winter, S. G. (1987). Appropriating the returns from industrial research and development. Brookings Papers on Economic Activity, 1987, 783–820.

Li, X. (2012). Behind the recent surge of Chinese patenting: An institutional view. Research Policy, 41(1), 236–249.

Nagaoda, S. (2009). Reform of patent system in Japan and challenges. In National Research Council (Ed.), 21st Century Innovation Systems for Japan and the United States: Lessons from a Decade of Change: Report of a Symposium. The National Academies Press.

Sakakibara, M., & Branstetter, L. (2001, Spring). Do stronger patents induce more innovation? Evidence from the 1988 Japanese patent law reforms. Rand Journal of Economics, 32(1), 77–100.

Wooldridge, J. M. (2002). Econometric analysis of cross section and panel data. Cambridge, MA: MIT Press.

Xie, Z., & Zhang, X. (2015). The patterns of patents in China. China Economic Journal, 8(2), 122–142.

Xu, C. (2011). The fundamental institutions of China’s reforms and development. Journal of Economic Literature, 49(4), 1076–1151.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Hu, A.G., Zhang, P., Zhao, L. (2018). Patents and Innovation in China. In: Clarke, T., Lee, K. (eds) Innovation in the Asia Pacific. Springer, Singapore. https://doi.org/10.1007/978-981-10-5895-0_8

Download citation

DOI: https://doi.org/10.1007/978-981-10-5895-0_8

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-10-5893-6

Online ISBN: 978-981-10-5895-0

eBook Packages: Business and ManagementBusiness and Management (R0)