Abstract

Since the beginning of the renovation process or “Doi Moi” in 1986, Vietnam’s economy has experienced relatively high economic growth. Besides greater openness in trade and investment, governance reform has been one of the driving forces of the country’s fast and sustainable growth. Fiscal decentralisation has been one of the key reforms that saw central government granting more fiscal autonomy to provincial governments, who now have a greater discretion than before in collecting and distributing resources for developmental purposes in their jurisdictions. Using a newly available provincial panel dataset, this paper examines the effects of fiscal decentralization on economic growth in Vietnam for the period 2004–2010 by applying new proxy measures of fiscal decentralisation as the ratio of different types of revenue over total expenditure of provinces. The results suggest a significant positive effect of fiscal decentralisation on provincial economic growth in Vietnam. The empirical models adopted also address the concerns of endogeneity and unobserved heterogeneity between provinces.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Over the past few decades, decentralisation has been one of the major reforms undertaken in both developed and developing countries. In the context of increasingly greater demand by citizens for better public services and liberalisation of cross-border investments, sub-national governments have been granted a greater degree of autonomy in political, administrative and fiscal authority. For Asian emerging market economies including China, Indonesia, India and Vietnam, this reform has been implemented successfully.

The theoretical literature suggests that greater devolution of fiscal authority to lower levels of government may contribute to the increased quality of public service provided at those jurisdictions. Fiscal decentralisation facilitates the transfer of power from central to local governments, which generally have better local knowledge and therefore would provide public services to effectively meet the needs of local constituents. It can also help create competition among local governments, which contributes to improving governance efficiency and effectiveness.

The improved quality of governance enables better policy in infrastructure (both physical and human capital) to attract more financial investment from both domestic and foreign investors to a particular jurisdiction. As a result, fiscal decentralization can potentially improve development outcomes such as higher foreign direct investment (FDI), exports, provincial gross domestic product (GDP), and health and educational outcomes.

Although decentralisation programs have been experimented and implemented at various degrees in many countries, there has not been much convincing empirical evidence of its effect, be it positive or negative, on local development at the sub national levels.

For the case of fiscal decentralisation in Vietnam, the literature is really sparse. Given the country’s high economic growth rate in recent years, considered as one of the emerging economic stars, the question about the likely contribution of the fiscal decentralisation reform program to its economic performance warrants attention. This question is even more interesting in the context of Vietnam’s unitary one party-state political system, which can make it more susceptible to some of the adverse aspects of decentralisation. A credible answer to address this question would have important implications not only for policy makers in Vietnam, but also bring valuable lessons that can be applied to other developing countries.

The current paper looks to provide evidence on the effect of fiscal decentralization on economic growth in provinces across Vietnam. The key question is: What is the effect of fiscal decentralization on economic growth across provinces, controlling for heterogeneity of provinces and potential endogeneity of fiscal decentralization?

As a contribution to the literature, this paper has used a newly available panel dataset, and new measures of fiscal decentralisation. Using a panel dataset covering 64 provinces in Vietnam for the 2004–10 period, the paper provides evidence that fiscal decentralisation has a positive and statistically significant effect on economic growth across country’s provinces.Footnote 1 By applying fixed effect and GMM models, the paper accounts for heterogeneity of provinces and addresses the potential endogeneity of fiscal decentralization.

The rest of the paper is organised in the following sections. Section two provides a brief summary of theoretical models on fiscal decentralisation and empirical findings. The next section gives a brief introduction of the current state of fiscal decentralisation in Vietnam. In section five, methodology and data are presented. Empirical results are given in section five and section six concludes.

2 Fiscal Decentralisation—Theoretical Models and Empirical Findings

Oates provides an excellent summary of the basic theoretical framework underlying the fiscal decentralisation literature (also called “theory of fiscal federalism”), which includes “assignment of functions to levels of government, the welfare gains from fiscal decentralisation, and the use of fiscal instruments” (Oates 1999, p. 1121).

Oates (1999) argues that the basic principle of fiscal decentralization is that public services should be provided by the lowest level of government. Imperfect information gives rise to a justification of how public service can be better delivered at the local level by local authority rather than by a central planner. As these information asymmetries exist, local governments usually have better knowledge of both local preferences and cost conditions than the central government. Also, it would be difficult for a centralised government to provide differentiated public goods to citizens in all local jurisdictions without incurring considerable cost. In addition to the lack of local information and knowledge, political constraints often put a limit on the capacity of central governments to provide unequal levels of public services in different localities. Therefore, on the grounds of economic efficiency, the decentralized provision of public goods is favoured.

Another advantage of a decentralised system of public goods provision over a centralised one is that it can promote competition among local jurisdictions. According to Tiebout (1956), local authorities, as public service providers, compete with one another in attracting citizens, who are mobile and can choose their place of residence, to their jurisdictions. This competition among local authorities may eventually lead to increase in quantity and quality of public service delivered across jurisdictions.

Besides better understanding of local needs, lower levels of governments are directly accountable to their local constituents and under constant pressure to improve their functional efficiency and effectiveness. As a result, better local governance and more effective allocation of resources to improve local public goods such as infrastructure and human capital development would potentially bring about faster economic growth.

Although theoretical framework for fiscal decentralisation has been well established, the empirical evidence has been rather mixed. Davoodi and Zou (1998) investigated a cross section of 46 countries over the period 1970–1989 and concluded that fiscal decentralisation did not have a positive impact on growth. In contrast, Lin and Liu (2000) found evidence to support a positive impact of fiscal decentralization on economic growth for China using a panel of provincial level data from 1970 to 1993. Kalirajan and Otsuka (2012) find that fiscal decentralisation in India has promoted development “equitably across its states, particularly through health and education expenditures aimed at improving human capital development.” Faguet and Sánchez (2008) provide evidence that education outcomes have benefited from decentralisation In Bolivia and Colombia. Meanwhile, de Mello (2000) examines evidence from 30 countries and argues that problems with intergovernmental fiscal coordination may worsen fiscal deficit problems leading to macroeconomic instability.

For the case of Vietnam, Nguyen and Anwar (2011) found that revenue decentralisation has a positive effect, while expenditure decentralization a negative effect on economic growth. The study used fixed effect model on a panel of data from 1997 to 2007. However, the paper did not address the possible issue of endogeneity. Fixed effect can control implicitly for time-invariant unobserved factors. But, if explanatory variables are correlated with the error terms (unobserved time varying variables), the estimated coefficient would be inconsistent. What this paper actually shows is that the greater the share of a province in total budget revenue, the greater is the growth rate of that province. Without addressing the endogeneity of the provincial share of total budget revenue, the reverse relationship, that is higher growth rate in a province leads to higher share of that province’s revenue, may actually be the case in place.

2.1 Fiscal Decentralisation in Vietnam

Fiscal decentralisation history: Administratively, Vietnam’s 64 provinces are categorised into 6 regions. Every province has a People’s Committee, the provincial executive authority and People’s Council, the provincial equivalence of the National Assembly. The country is geographically, historically and culturally diverse. Three economic centres include Hanoi in the Northern part, Danang in the Central part and Ho Chi Minh City in the Southern part. Further away from these centres, provinces are less economically well off. Poorest provinces are mainly located in the mountainous areas in the North-eastern and North-western, and in central parts of the country.

Started in the mid-90s, fiscal decentralisation in Vietnam may have been motivated from top down, as well as bottom up. On the one hand, the magnitude and complexity of public service delivery to meet greater demand have prompted the central government to delegate more tasks and expenditure accordingly to subnational governments. On the other hand, some well off provinces, which are growing faster than the rest, have pushed for greater discretion in budget and fiscal matters through special rules. Currently, Hanoi and HCMC enjoy a special arrangement in revenue sharing with central government. Danang is one of the rising star provinces in recent years and also trying to pursue this direction.

Vietnam’s fiscal arrangement: Provincial level governments have full discretion as to how to assign revenue and expenditure to governments at lower levels (districts and communes). Martinez-Vazquez (2005) argues that the assignment of revenue and expenditure at district and commune levels should have been more defined in State Budget Law rather than at the discretion of provincial level. Nevertheless, it can be assumed that provincial governments, being responsible for the local development and accountable to their local citizens, may potentially do a better job at allocating resources and improving welfare for the locals than the central government. As a result, it would make sense to see the evidence through analysing the provincial level data.

Although provinces have not been granted authority to determine tax rates, they have been entitled to retain fully some of the locally collected taxes, as well as share revenue of some other taxes with the central government. This obviously allows provinces to have a greater discretion in how to spend this decentralized revenue (both fully assigned and shared revenue).

A majority of provinces are not self-sufficient, having to rely on shared revenue and central transfer to fund their expenditures. The exceptions include better endowed provinces such as Hanoi, HCMC, and Binh Duong. The extent to which these provinces rely on each of the three types of revenue can provide an indication of how pro-active they have been under the current decentralisation arrangement.

-

i.

Central-level fully assigned

With this source of tax revenue, provinces act as tax collecting agents for the central government. In each financial year, the central government sets revenue targets for every province. Taxes assigned totally to central government include oil tax, taxes on special consumption good, duties on imports, etc.

-

ii.

Shared revenue

A number of revenue sources are shared between provinces and central government. The general formula for determining sharing rates at the beginning of stability periods is as followsFootnote 2:

The sharing rate (R) is determined by the difference between total expenditure (TE) and own source tax revenue (B), divided by the estimate of shared tax collections (ER) in the province. If the RHS is greater than one, sharing rate is equal to 100%. This means that a province can keep the entire revenue from shared sources. If 0 < RHS < 1, the sharing rate is determined by the above mentioned formula.

More economically vibrant provinces can retain a smaller share of the shared taxes or their sharing rates are lower. In the first stabilisation period, 49 provinces had sharing rate of 100%, while 53 provinces had that in the second stabilisation. That is, the majority of provinces had their expenditure exceeding their own-source revenue, and had to take extra revenue through shared revenue and transfer from the Central government.

In reality, provinces may have incentives to overestimate their spending and underestimate their own-source or fully assigned revenue, so that extra funding to finance the deficit will come from shared revenue and possibly central transfer. That way, apart from the own-source revenue, provinces would receive more money from central government than if more realistic estimates are made. At the same time, provinces may also have an incentive to produce a low estimate of shared tax collections, so as to keep a greater portion of the revenue shared with central government. Provinces are entitled to keep up to 30% of all shared revenue actually collected in excess of the estimated amounts. This is yet another incentive that makes provinces more likely to produce a lower estimate of their shared revenue. They can keep 30% of whatever excess revenue they collected that exceeds the estimate.

-

iii.

Provincial level fully assigned (own source revenue)

This source of revenue indicates a province’s capacity to raise revenue locally and fund its activities. The share of this type of revenue in total revenue is normally low for a large number of provinces. This also means that a majority of provinces rely on shared revenue and central transfer.

A province’ decentralized revenue is the total of its shared revenue and own source revenue. This revenue represents the effective resources raised locally to fund a province’s expenditure excluding any direct assistance from the central government.

-

iv.

Central transfer:

There are two types of transfer. The first is balancing transfer, which is unconditional and available to poor provinces for equalizing purposes. The other is specific target transfer, which is conditional transfer and available to all provinces.

Determinants of fiscal decentralisation in Vietnam: According to Wu and Wang (2013), the literature has identified transfer dependency, economic development, population size and population density, and openness to trade and foreign direct investment as some of the key determinants of fiscal decentralisation.

Economic growth can be a driver for fiscal decentralisation. As their income rises, provinces may want to have a bigger say in how much revenue they can keep and how much and what to spend. On the one hand, as income increases across provinces, there’s been greater demand for public services. On the other hand, increased magnitude and complexity of public service delivery requires this work to be further delegated to subnational governments rather than being concentrated in the hand of the central government.

In Vietnam, the legal framework for fiscal decentralisation was further institutionalised and clarified with the issuance and enforcement of the State Budget Law (SBL) in 1996 and its amendment in 2002. The 2002 SBL provides a clearly defined legal framework for the determination of revenue and expenditure assignment to each level of government from central, provincial, district to communes. Sources of revenue and expenditure mandates are set out for each level of government. One feature of note is the granting of full authority for provincial governments to make decisions on the level of decentralisation at districts and communes governments. Although according to the SBL budgets of lower level governments are part of the upper level government, a provincial budget needs to be first approved by the respective People’s Council, a local body equivalent to the National Assembly at the central level.

Development of budget system in Vietnam during period 2004–2010: In Vietnam, the state budget is a unified budget of governments at all levels from local to central. There are three subnational levels of government in Vietnam, which include those at provincial, district and commune levels. At lower levels of government, annual budgets are prepared by the respective People’s Committees and must be approved by the People’s Council. As a local budget is approved by the People’s Council, it is then consolidated into the budget of government at higher level.

Budget planning in Vietnam is structured by stability periods, each of which normally lasts four or five years. During a stability period, governments at all levels adhere to the sharing rates that have been agreed upon for shared sources of revenue. These sharing rates stay relatively stable during this period and are the bases for determining tax revenue that are shared between central and provincial governments.

Based on the intergovernmental transfer relationship, there are 2 types of provinces: the subsidised provinces and contributing provinces. Subsidised provinces are the ones that receive central transfer to cover the gap between revenue and expenditure. These provinces’ assigned duty is to reduce the reliance on transfer over time. Most of provinces in Vietnam fall into this group. The other group, the contributing provinces, usually transfer a large percentage of locally collected revenue to the central government. These provinces have the duty to increase the contribution rate to the State/Central budget.

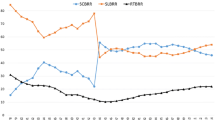

Incentives are in place to encourage provinces to increase their revenue collection and contribution to the State Budget. Reward to provinces that exceed the revenue targets for central shared revenue is not more than 30% of the difference between estimate and actual central shared revenue. For example, Ho Chi Minh City is entitled to 70% of marginal increase in revenue from shared sources compared to target level and 30% of marginal increase in revenue assigned 100% to central level compared to set target level. In contrast, provinces getting balance transfers enjoy 100% of shared revenue sources (Fig. 13.1).

During the period 2003–2012, shares of both subnational level governments’ revenue and expenditure in State budget saw a clear upward trend. In contrast, the share of central transfer to subnational level governments relative to total provincial expenditure is clearly decreasing. These trends indicate an increasingly greater discretion in revenue and expenditure allocation for provinces, as well as a smaller dependence on central transfer. This evidence also supports the general agreement that there has been a higher degree of fiscal decentralisation in Vietnam.

A closer look at the composition of State budget revenue helps reinforce this point. The greater decentralisation may be better reflected in trends of shared revenue and own source revenue. At national aggregate level, shared revenue assigned to provinces has increased in share of total revenue collected, while shared revenue assigned to central government has a decreased share over time. There may be three reasons for this. First, it may be that more provinces were allowed to keep 100% of the revenue raised from shared sources. Second, the sharing rate for provinces that have sharing rate less than 100% has increased over time, i.e. they could keep a larger share of this source of revenue than before. Third, the provinces with sharing rate of 100% have increased their total revenue collected from this source (Figs. 13.2 and 13.3).

Revenue assigned 100% to central governments has an increasing share over time. As a major part of this revenue came from taxes on imports and given the trade deficits during the sample period, the greater share of this type of revenue can be understandable. Meanwhile, provinces’ own source revenue has seen a declining share. This shows that growth in own source revenue has been slower than that in shared revenue and revenue assigned to the central government.

During the period, share of balance transfer in total local revenue at a national level has stayed relatively stable around 10%. Total transfer has also stayed around 25% of total local revenue.

3 Methodology and Data

3.1 Fiscal Decentralisation Measurement

At the national level, it would be informative to compare the relative size of the central government and subnational governments. Some indicators include ratio of total provincial expenditure and total public expenditure, ratio of total provincial revenue and total public revenue, and the provincial—central share in different types of revenue.

Both previous cross-country and within-country studies often adopted provincial share of total national revenue (expenditure) as measure of revenue (expenditure) decentralization. Although these measures of fiscal decentralisation may reflect the relative scale to which resources are allocated to subnational jurisdictions, what they truly measure is only the magnitude of tax revenue or public expenditure at the sub-national levels rather than the real degree of subnational governments’ autonomy in fiscal matters.

The measures of fiscal decentralisation adopted by Nguyen and Anwar (2011) are provincial share in total provincial expenditure (expenditure decentralisation) and in total provincial revenue (revenue decentralisation). While these measures were commonly used as measure of decentralisation in cross-country studies, they do not appear to be appropriate for a specific country study. Simply using a province’ share in total provincial expenditure is to focus on the relative size of provinces, not necessarily their respective degree of decentralisation. As a result, the appropriateness of these proxies is questionable.

More recently, Vo (2009) proposes a Fiscal decentralization index (FDI) that is equal to the geometric mean of the fiscal autonomy and fiscal importance of SNGs, that is ratio of own source revenue and province’s expenditure multiplied by ratio of province’s expenditure and total provincial expenditure.

Following a similar approach as Vo (2009), at the provincial level, the current paper adopts a measure of fiscal decentralization that takes into account the degree of fiscal autonomy and independence of provinces. More specifically, it is measured by the capacity of a province to fund its expenditure by own source revenue, shared revenue source and decentralised revenue, and less by transfer from central government. These proxies include the following:

-

Own source revenue/total provincial expenditure

-

Shared revenue/total provincial expenditure

-

Decentralized revenue/total provincial expenditure (where, decentralized revenue = own source revenue + shared revenue)

-

Composite index:

-

Revenue as share of expenditure * Share in total subnational revenue

-

Using different proxy measures of fiscal decentralisation may help with addressing the common concern that concept of decentralisation is not treated adequately in most studies in spite of its intrinsic multi-dimensionality. The current literature has seen a variety of measures used such as share of sub-national regions’ revenue (expenditure) in total national revenue (expenditure), and marginal retention rate of excess revenue (Lin and Liu 2000).

Model specification: The main goal of the model is to examine whether variations in degree of fiscal decentralisation (as proxied by ratio of revenue over expenditure) over time and across provinces may have a significant impact on economic growth of a province.

The provinces’ economy is assumed to have a neoclassical production function. The major factors of the economy include capital, labour, technology with fiscal decentralisation being an element contributing to technological and institutional progress.

Hypothesis: The key hypothesis to be tested is: Fiscal decentralisation has contributed positively to provincial economic growth in Vietnam. More specifically, the question is whether having higher own-source revenue raised by a province as share of its expenditure would lead to higher economic growth in that jurisdiction. If the answer is yes, one possible explanation may be that as a province enjoys a higher degree of decentralisation granted by the central government, they will become more proactive and effective in allocating resources to promote local development.

If the results prove otherwise, this would mean that greater autonomy has prompted provinces to act less responsibly and become less efficient and effective in making growth-enhancing policies. This would imply some potential problems of corruption and ineffective allocation.

Growth - decentralisation nexus:

Following Davoodi and Zou (1998), assuming the neoclassical production function augmented by fiscal decentralisation, a province’s economy can be characterised by:

where: \(0 < \alpha < 1, 0 < \beta < 1, and \left( {\alpha + \beta } \right) < 1\)

- Y:

-

growth rate of real gross provincial product per capita

- FD:

-

ratio of central transfer to total expenditure—indicating how much of its expenditure is financed from transfer; transfer/recurrent expenditure—indicating how much of its recurrent expenditure can be financed by transfer; transfer/capital expenditure

- K:

-

Capital investment: growth rate of real provincial non-state investment

- L:

-

Labour growth rate: is the growth rate of labour in the private sector

Population growth: growth rate of total population of province i at time t

Other control variables: growth rate of real export value, human capital (percentage of skilled labour)

Under a fixed effect model, the following regressions are employed to ascertain any potential impact of fiscal decentralisation on provincial economic growth:

Where:

- Y:

-

Growth rate of real gross provincial product per capita

- FD:

-

Fiscal decentralisation. The key measure of fiscal decentralisation adopted is the ratio of own-source revenue and total provincial expenditure, which measures the capacity of provinces in raising their own resources for their activities.

-

FD1: Own source revenue/total provincial expenditure

-

FD2: Shared revenue/total provincial expenditure

-

FD3: Decentralized revenue/total provincial expenditure.

In addition, composite measures of fiscal decentralisation are constructed by interacting FD1, FD2, and FD3 with the share in total subnational revenue. This measure can account for both the financial capacity and autonomy of provinces.

Other control variables that vary across provinces and can change over time include those that are theoretically expected to contribute to economic growth.

- POP:

-

Population growth: Based on neoclassical economic theory, population is considered to have a negative impact on growth. The reason is that a larger labour force means a lower capital per unit of effective labour, resulting in a lower marginal product of labour and eventually lower output growth. In fact, population growth varies across provinces in Vietnam

- P:

-

Inflation, annual provincial consumer price index growth rate.

- L:

-

Private labour growth, measured by the annual growth rate of labour in the private sector in a province. As this variable is also highly correlated with provincial foreign direct investment and non-state investment in general, it can act as a proxy for private investment growth (both foreign and domestic).

- \(X_{it}\) :

-

Growth rate of real export value

- BT:

-

Growth of balancing transfer: is an annual growth rate of central transfer to a province for equalizing purposes.

- \(\lambda_{t}\) :

-

Time fixed effect. This variable can help control for macroeconomic trend that affect all provinces in a similar manner. Examples of these effects are central government policies such as monetary policy, industrial policy, etc.

- \(\eta_{i}\) :

-

Province fixed effect. This variable would account for the differences across provinces that do not change over time or do so very slowly, if any at all.

- \(\varepsilon_{it}\) :

-

Idiosyncratic error term.

The diversity of provinces calls for controlling of the size effect, initial conditions, etc. A fixed effect model can account for those time invariant factors. “Another advantage of the panel over the cross-section regression is the alleviation of the endogeneity problem through the inclusion of lags of regressors as instruments” (Ding and Knight 2009).

Possible sources of endogeneity: Omitted variables: Other variables may affect both fiscal decentralisation and development outcomes and drive the difference between provinces, e.g.: human capital, varied effects of special targeted programs (different from national targeted programs), factors affecting all provinces but with varying effects across provinces in each period—need to control explicitly—macroeconomic variables, the impact of central government’s spending via line ministries’ allocation, etc.

Reserve causal relationship: Development outcomes may drive fiscal decentralization—FDI or exports revenue may affect the process of determining expenditure and transfer to some provinces. As such, a province that is more wealthy can have more tax revenue to finance their spending, also meaning a greater degree of autonomy.

Nevertheless, it can be argued that the adopted measure of fiscal decentralisation is exogenous. In determining estimate of expenditure allocation, budgeting is done on a per capita basis and key geographical variations, which are relatively fixed or slow to change. Also the sharing rates are determined once and often stay stable during each stability period. This indicates that the formula for expenditure and revenue assignment to provinces is not influenced by a province’s economic growth.

As another robustness check, dynamic panel data regressions are carried out using the system GMM or Arellano and Bond estimator, which can help address the endogeneity concerns.

Data: The current study utilises a unique unbalanced panel dataset of provincial level tax revenue and expenditure for the 2004–2010 period from the Ministry of Finance of Vietnam. Thanks to this comprehensive actual provincial budget dataset, it was possible to construct key variables used in the above specified models.

The three key types of revenue for provincial governments include own-source revenue, shared revenue, and decentralised revenue. These variables are then used to generate three different proxy measures of fiscal decentralisation in Vietnam. The Appendix provides a detailed description of tax revenue assignments to local governments in Vietnam as stipulated in SBL 2002. Given that the current literature mostly uses share of local expenditure in national total as proxy for fiscal decentralisation, this dataset is a contribution of the current paper, one of the first to construct and utilise more refined measures of fiscal decentralisation for Vietnam.

Total provincial expenditure is used as the common denominator for each of the three measures of fiscal decentralisation. This expenditure is the combined spending of all provincial and sub-provincial level governments in each province.

The dependent variable, growth rate of real per capita provincial product, and other control variables including inflation rate, annual growth rate of population, and the growth rate of labour in the private sector are obtained from the Vietnam’s General Statistical Office (Table 13.1).

For the second and third measure for fiscal decentralisation, namely the ratios of shared revenue and decentralised revenue, respectively, to total provincial expenditure, a number of provinces show values greater than one; which means their revenue is more than sufficient to cover their spending. This is understandable for cities/provinces such as Hanoi, Danang, Binh Duong, etc. in years when they saw an unexpected increase in tax revenue. The excess revenue after covering all expenditures is normally put into their reserve fund.

Growth rate of labour in the private sector has an average of 11.5% and maximum of 50.9%, reflecting its role as one of the key drivers of provincial economic growth, especially during the booming years around mid-2000s.

In the actual regressions, the current sample has included only 48 provinces, excluding those with unreasonably low values of own-source revenue. During the sample period, there are 8 provinces that are either merged with or split from other provinces. For purpose of consistency, these provinces are excluded from the regression sample. They include Hanoi, Ha Tay, Can Tho, Hau Giang, Dak Lak, Dak Nong, Dien Bien, and Lai Chau. Also, since a major share of GDP of Ba Ria Vung Tau is from oil revenue, which is a revenue source assigned totally to the central government, this province is not included in the sample.

4 Results

Fixed effect models

Fixed effect models account for the unobserved heterogeneity of provinces such initial conditions, geographical features, and local culture. These models help explain best the within variation of each province. The sample for models 1 and 3 in Table 13.2 include 48 provinces out of 64 provinces. In models 2 and 4, the sample is further reduced to 43 provinces. The rationale for this is that some new provinces are either split from or merged with another province, they are removed from the sample to ensure the consistency of data over time. Adjusted R-square obtained from least squares dummy variable regression for model (1) is 0.2796.

Table 13.2 shows results for fixed effect regression of real provincial GDP per-capita growth. In model 1, the main variable of interest, fiscal decentralisation, has a positive sign and is statistically significant at 10% level. This implies that on average, the higher degree of fiscal decentralisation of provinces has contributed positively to their economic growth. The first column of Table 13.2 shows a coefficient of 0.165 suggests that, ceteris paribus, a 1% increase in fiscal decentralisation will lead to a 0.165% increase in provincial growth rate.

Most other explanatory variables are statistically significant, except for the share of vocational students and growth rate of per capita non-state capital. As expected, growth in exports, growth in private sector labour force and growth in central transfer have positive contributions to provincial income growth. One may wonder about the role of central transfer. The positive effect of central transfer may not come as a surprise since a majority of the provinces receive and partly rely on balancing transfer from the central government. However, the insignificant effect of provincial share of vocational students (a proxy for human capital) and growth rate of per capita non-state capital (a proxy for private capital) is, to some extent, a puzzle. Nevertheless, one possible explanation is that their effects are already captured by the other variables, including growth of exports and private sector labour.

Column two in Table 13.2 are results of model FE2, which has the same specification as FE1, but an adjusted sample that excludes split or merged provinces. The estimated coefficient on fiscal decentralisation is still statistically significant at 10% level and has increased in magnitude from 0.165 to 0.171.

To check the sensitivity of the models’ specification to the two insignificant variables, the share of vocational students and growth rate of per capita non-state capital, models FE3 and FE4 are estimated without these variables. The regressions results are reported in two last columns in Table 13.2. Comparing models FD3 and FD4 with the first two models, the statistical significance and magnitude of fiscal decentralisation variable, as well as other variables, hardly vary. In model FE4, magnitude of FD variable even increases in magnitude to 0.179.

Across the four models in Table 13.2, the economic significance of fiscal decentralisation is noteworthy. Fiscal decentralisation is estimated to have the largest positive effect on provincial economic growth, which is greater than that of export growth, private sector’s labour growth, or central transfer growth.

Tables 13.3 and 13.4 show the results of regressions with alternative measures of fiscal decentralisation. The fiscal decentralisation variables and other key independent variables remain statistically significant. In terms of magnitude, the coefficient for fiscal decentralisation with shared revenue over total expenditure as a proxy has the largest value at 0.197 (model FE8). The broader proxy of fiscal decentralisation, ratio of decentralised revenue and total expenditure, has a coefficient of 0.1356 (model FE12). Overall, the effect of fiscal decentralisation on provincial economic growth is statistically significant and robust to all three alternative measures.

4.1 Composite Indicator of Fiscal Decentralisation

To further account for multiple dimensions of fiscal decentralisation, a composite indicator is employed in the provincial gross product per capita regressions. Following Vo (2009), the composite indicator of fiscal decentralisation takes both the financial capacity and level of fiscal autonomy of provinces into account. The composite indicator of fiscal decentralisation is calculated according to the formula:

where:

- FDI:

-

Fiscal decentralisation indicator

- \(OR_{i}\) :

-

Own source revenue of province i

- \(R_{i}\) :

-

Total revenue of province i

- \(E_{i}\) :

-

Total expenditure of province i.

Table 13.5 shows regressions with three alternative composite measures of fiscal decentralisation, which was constructed by taking the square root of ratio of revenue over expenditure interacted with share of province’s revenue in total subnational budgetary revenue. All three composite fiscal decentralisation variables are statistically significant at least at the 5% level. The coefficient for FDI1 has a value of 2.197, meaning that a 1% increase in FDI1 would lead per capita provincial income to rise by to 2.197%. The magnitude of the FDI coefficients should be interpreted differently from those in Tables 13.2, 13.3 and 13.4. As the relative financial capacity of a province is measured by its share in total subnational revenue, it will need to outperform others in the country in order to improve this ratio, which is a challenge to many provinces. As a result, with provinces’ relative financial capacity being taken in account, the impact of any reforms in fiscal decentralisation may bring greater rewards in terms of growth enhancement. This may help explain the greater economic significance of FDI variables compared with those in previous regressions.

4.2 Dynamic Panel Estimation Results

Table 13.6 shows the results of the General Method of Moments models, where a lag of the dependent variable is added to the right hand side and fiscal decentralisation variable FD1 treated as being endogenous. Specification tests show that all models satisfy the requirement that the error terms are serially uncorrelated.

From both model 2 and 3, it is clear that the fiscal decentralisation variable, ratio of own source revenue over expenditure, has a positive sign and statistically significant. This result is consistent with those of the fixed-effect models presented above. For other determinants of growth, while growth rate of labour in the private sector is statistically insignificant, and growth rate of industrial added value add is positive and strongly statistically significant in all three models (Table 13.6).

As a positive effect of fiscal decentralisation on economic growth is supported by the data, another question is the possible mechanism through which this effect is realised. There are three channels, direct and indirect, that may be in place (Martinez-Vazquez and Robert 2003). First, greater provincial autonomy in resource allocation can lead to improvement in public service delivery such as infrastructure and law and order. Second, fiscal decentralisation provides incentives for provinces to promote the private sector activities. Third, local governments’ spending can improve local human capital through better educational and healthcare services.

5 Conclusion

The current paper empirically examines the effect of fiscal decentralisation in Vietnam using a fixed effect model on a provincial panel dataset for the period 2004–2010. By using a range of alternative measures of fiscal decentralisation, the paper shows that fiscal decentralisation has a significant and positive effect on provincial economic growth in Vietnam during the sample period. The results are further confirmed by GMM models to address the endogeneity concerns. In spite of the possible adverse consequences of decentralisation (Bardhan 2002), the positive effect of fiscal decentralisation on economic growth, on average, has so far outweighed any potential adverse effects in Vietnam. This finding has important policy implications. With the evidence of its growth enhancing effect, reforms in fiscal decentralisation should be further pursued and strengthened in Vietnam.

For future studies, several directions can be considered. Firstly, it would be informative to study the interaction between fiscal decentralisation and other institutional reforms, and whether these reforms have helped improve the governance quality. Secondly, further analysis can be done to dissect the various impact of fiscal decentralisation on growth across the distribution of provinces. Finally, it would be interesting to examine empirically the welfare effects of fiscal decentralisation such as poverty reduction and mechanism for realisation of these effects.

Notes

- 1.

Vietnam currently has 63 provinces after Ha Tay province was merged into Hanoi in 2008.

- 2.

Nguyen-Hoang and Schroeder (2010)

References

Bardhan, P. (2002). Decentralization of governance and development. Journal of Economic Perspectives, American Economic Association, 16(4), 185–205.

Davoodi, H., & Zou, H. -F. (1998). Fiscal decentralization and economic growth. Journal of Urban Economics, 43, 244–257.

de Mello, L. R. (2000). Fiscal decentralization and intergovernmental fiscal relations.

Ding, S., & Knight, J. (2009). Can the augmented Solow model explain China’s remarkable economic growth? A cross-country panel data analysis. Journal of Comparative Economics, 37(3), 432–452.

Faguet, J. -P., & Sánchez, F. (2008). Decentralization’s effects on educational outcomes in Bolivia and Colombia. World Development, 36(7), 1294–1316. doi:10.1016/j.worlddev.2007.06.021

Kalirajan, K., & Otsuka, K. (2012). Fiscal decentralization and development outcomes in India. World Development, Elsevier, 40(8), 1511–1521.

Lin, J. Y., & Liu, Z. (2000). Fiscal decentralization and economic growth in China. Economic Development and Cultural Change, 49(1), 1–21.

Martinez-Vazquez, J., & Robert, M. (2003). Fiscal decentralization and economic growth, World Development, 31(9), 1597–1661.

Martinez-Vazquez, J. (2005). Making fiscal decentralization work in Vietnam.

Nguyen, L. P., & Anwar, S. (2011). Fiscal decentralisation and economic growth in Vietnam. Journal of the Asia Pacific Economy, 16(1), 3–14.

Nguyen-Hoang, P., & Schroeder, L. (2010). An analysis of quasi-decentralized budgeting in Vietnam. International Journal of Public Administration, 33, 698–709.

Oates, W. E. (1999). An essay on fiscal federalism. Journal of Economic Literature, 37, 1120–1121.

Tiebout, C. (1956). A pure theory of local expenditures. Journal of Political Economy, 64, 416–424.

Vo, D. H. (2009). Fiscal decentralisation in Vietnam: lessons from selected Asian nations. Journal of the Asia Pacific Economy, 14(4), 399–419.

Wu, A. M., & Wang, W. (2013). Determinants of expenditure decentralization: Evidence from China. World Development, 46, 176–184.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

See Fig. A.1

Rights and permissions

Copyright information

© 2017 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Nguyen, T.D. (2017). Fiscal Decentralisation and Economic Growth: Evidence from Vietnam. In: Cooray, N., Abeyratne, S. (eds) Decentralization and Development of Sri Lanka Within a Unitary State. Springer, Singapore. https://doi.org/10.1007/978-981-10-4259-1_13

Download citation

DOI: https://doi.org/10.1007/978-981-10-4259-1_13

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-10-4258-4

Online ISBN: 978-981-10-4259-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)