Abstract

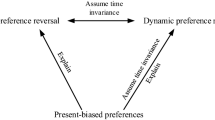

This chapter provides an axiomatic foundation for a particular type of preference shock model called the random discounting representation where a decision maker believes that her discount factors change randomly over time. For this purpose, we formulate an infinite horizon extension of Dekel, Lipman, and Rustichini (Econometrica 69:891–934, 2001), and identify the behavior that reduces all subjective uncertainties to those about future discount factors. We also show uniqueness of subjective belief about discount factors. Moreover, a behavioral comparison about preference for flexibility characterizes the condition that one’s subjective belief second-order stochastically dominates the other. Finally, the resulting model is applied to a consumption-savings problem.

The original article first appeared in the Journal of Economic Theory 144:1015–1053, 2009. A newly written addendum has been added to this book chapter.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

1.1 Objective and Outline

In intertemporal decision making, a decision maker (DM) faces two kinds of trade-offs among alternatives. The first is a trade-off from the difference of alternatives within a time period and the second is an intertemporal trade-off between different time periods. Anticipating intertemporal trade-offs seems more difficult than anticipating trade-offs within a period. Thus, we consider a DM who is certain about ranking of alternatives within a period, and at the same time is uncertain about future intertemporal discount rates.

In addition, several authors have mentioned psychological reasons for uncertainty about discount factors. As Yaari (1965) and Blanchard (1985) point out, a discount factor admits an interpretation as a probability of death. Depending on the future prospects of diseases, armed conflicts, and discoveries in medical treatments, the probabilities of death will change over time. An alternative interpretation is to think not of an agent but of a dynasty, in which case a discount factor is regarded as a degree of altruism. The bequest motives of the current generations may fluctuate over time because they may die without descendants. Becker and Mulligan (1997) suggest a model in which a discount factor depends on the quantity of resources the DM invests into making future pleasures less remote. For example, schooling may focus students’ attention on the future, and parents would spend resources on teaching their children to make better future plan. The choice of investment or effort level in these activities is affected by economic variables, for instance, interest rates or the DM’s wealth, which are uncertain by their own nature. Thus, these uncertainties may lead to random discounting.Footnote 1

Moreover, random discounting has been used in several macroeconomic models with infinite horizon since it is a useful device for generating heterogeneity among agents, in particular, for realistic wealth heterogeneity in quantitative models. For example, see Krusell and Smith (1998) and Chatterjee et al. (2007). However, preference shock to discounting is often postulated in an ad hoc way since shock cannot be observed directly by analysts. The reliance on these unobservable entities seems problematic.

In this chapter, we provide an axiomatic foundation for the random discounting model, in which the DM believes that her discount factors change randomly over time. Therefore, we demonstrate that there exists a behavior which can, in principle, pin down expected shocks to discount factors. For this purpose, we extend the two-period framework of Kreps (1979, 1992) and Dekel et al. (2001) (hereafter DLR) to an infinite horizon setting. They axiomatize a preference shock model by considering preference over menus (opportunity sets) of alternatives. If a DM is aware of uncertainties regarding her future preference over alternatives, then ranking of menus reflects how she perceives those uncertainties. Kreps and DLR derive the set of future preferences from the ranking of menus.

Behavioral characterization of random discounting shows that uncertainty about future preferences, whether it is about future discount factors or other aspects of preference, leads to a demand for flexibility—larger menus are preferred. This observation is made on the basis of Kreps and DLR. However, if uncertainty is only about discount factors, then flexibility has value only in limited cases. The behavioral characterization of random discounting takes the form of identifying primarily the instances where flexibility has no value (see the example that follows shortly for elaboration).

To analyze sequential decision making, we adopt the same domain of choice used by Gul and Pesendorfer (2004). Let C be the outcome space (consumption set), which is a compact metric space. There exists a compact metric space \(\mathcal{Z}\) such that \(\mathcal{Z}\) is homeomorphic to \(\mathcal{K}(\varDelta (C \times \mathcal{Z}))\), where \(\varDelta (C \times \mathcal{Z})\) is the set of lotteries, that is, all Borel probability measures over \(C \times \mathcal{Z}\) and \(\mathcal{K}(\cdot )\) denotes the set of all non-empty compact subsets of “⋅ ”. An element of \(\mathcal{Z}\), called a menu, is an opportunity set of lotteries over pairs of current consumption and future menus. Preference \(\succapprox\) is defined on \(\mathcal{Z}\simeq \mathcal{K}(\varDelta (C \times \mathcal{Z}))\).

We consider the following timing of decisions:

In period 0, the DM chooses a menu x. In period 1−, current discount factor α becomes known to the DM, and she chooses a lottery l out of the menu x in period 1. In period 1+, the DM receives a pair \((c,x^{{\prime}})\) according to realization of the lottery l, and consumption c takes place. The DM expects another discount factor \(\alpha ^{{\prime}}\) to be realized in the following period. Subsequently, she chooses another lottery \(l^{{\prime}}\) out of the menu \(x^{{\prime}}\), and so on.

Notice that our primitive \(\succapprox\) is preference in period 0. Thus, beyond period 0, the time line in Fig. 20.1 is not part of the formal model. However, if the DM has in mind this time line and anticipates uncertain discount factors to be resolved over time, then \(\succapprox\) should reflect the DM’s perception of those uncertainties. Hence, our domain can capture the expectation of random discounting.

We provide an axiomatic foundation for the following functional form, called the random discounting representation: there exists a non-constant, continuous, mixture linear function \(u:\varDelta (C) \rightarrow \mathbb{R}\), and a probability measure μ over [0, 1] with \(\mathbb{E}_{\mu }[\alpha ] <1\), such that \(\succapprox\) is represented numerically by the functional form,

where l c and l z are the marginal distributions of l on C and \(\mathcal{Z}\), respectively.

The above functional form can be interpreted as follows: the DM behaves as if she has in mind the time line described above, and anticipates a discount factor α to be realized with probability μ in every time period. After the realization of α, the DM evaluates a lottery by the weighted sum of its instantaneous expected utility u(l c ) and its expected continuation value \(\int U(z)\,\mathrm{d}l_{z}\). The same representation U is used to evaluate menus at all times. Hence, the representation has a stationary recursive structure and the DM’s belief about future discount factors is constant over time.

We show uniqueness of the DM’s belief μ. That is, the components (u, μ) of the representation are uniquely derived from preference. This result is in stark contrast to that of Kreps (1979, 1992) and DLR. Since future preference is state-dependent in their model, arbitrary manipulations on subjective probabilities are possible. In our model, a future utility function over \(\varDelta (C \times \mathcal{Z})\) is state-dependent as in DLR (α corresponds to a subjective state). However, notice that both the instantaneous expected utility u and the utility U over menus are independent of subjective states, and state-dependent components, 1 −α and α, add up to one. Hence, the representation cannot be maintained under arbitrary manipulations. A combination of the additive recursive structure and the normalization of discount factors ensures uniqueness.

Owing to uniqueness result, it is meaningful to compare subjective beliefs among agents. We provide a behavioral condition capturing a situation where one agent is more uncertain about discount factors than the other. For objective uncertainty, second-order stochastic dominance is widely used to describe such a comparison (Rothschild and Stiglitz 1970). If agent 2 perceives greater uncertainty about discount factors than agent 1, the former is more reluctant to make a commitment to a specific plan than the latter. This greater demand for flexibility is the behavioral manifestation of greater uncertainty about future discount factors. An implication of the behavioral comparison similar to DLR is also investigated and it shows contrasting results.

The resulting model is applied to a consumption-savings problem and it analyzes how uncertainty about discount factors affects savings behavior. By assuming an instantaneous utility function to be CRRA with the parameter \(\sigma <1\) (or \(\sigma> 1\)), savings rates increase (or decrease) when the DM becomes more uncertain about future discount factors in the sense of second-order stochastic dominance. This result can be interpreted based on the DM’s attitude toward flexibility. It is noted that uncertainty about discount factors has an opposite effect on savings when compared to uncertainty about interest rates.

1.2 Motivating Example

To understand the behavior that characterizes the random discounting model, we consider a simple example as follows: Let C stand for a set of monetary payoffs.

Suppose that DM faces uncertainty about future discount factors. As pointed out by Kreps (1979) and DLR, she may keep her options open until the uncertainty is resolved, that is, she may exhibit preference for flexibility. On considering two alternatives, ($60, {($100, z)}) and ($100, {($50, z)}) in \(\varDelta (C \times \mathcal{Z})\), chosen in period 1, there might be a difference in consumption levels between periods 1 and 2. However, from period 3 onward, both alternatives guarantee the same opportunity set z. We assume that \(\{($60,\{($100,z)\})\} \succapprox \{ ($100,\{($50,z)\})\}\). This ranking under commitment reflects the DM’s ex ante perspective on random discount factors. The DM, on average, believes that she will be patient in period 1 and prefer ($60, {($100, z)}) to ($100, {($50, z)}). However, the DM may still prefer keeping ($100, {($50, z)}) as an option if there is a possibility of becoming impatient in period 1, in which case ($100, {($50, z)}) would be more attractive than ($60, {($100, z)}). Hence, the DM may exhibit preference for flexibility as

However, if the DM is uncertain only about future discount factors, then other forms of flexibility may not be valued. In that case, the DM would be sure of her preference over consumption in the next period (in this example, consumption is scalar, and hence, greater consumption is preferred to less), and also other preference over menus for the rest of the horizon. Therefore, uncertainty is relevant for rankings only when an intertemporal trade-off must be made, as in comparing ($60, {($100, z)}) and ($100, {($50, z)}), between consumption for period 1 and the menu for period 2 onward. Hence, some forms of flexibility are not valuable on uncertainty related to future discount factors.

To illustrate further, consider a lottery l, yielding

with an equal probability of one-half. For current consumption, l induces the lottery yielding $0 or $120 with a probability of one-half, while it induces the lottery over menus with an equal chance of {($0, z)} or {($200, z)}. If $60 and {($100, z)} are both preferred to these induced lotteries respectively, then the DM does not face an intertemporal trade-off between ($60, {($100, z)}) and l. Irrespective of how patient she will be in the next period, l will not be chosen over ($60, {($100, z)}). Since there is no benefit in keeping l as an option with ($60, {($100, z)}), the DM will exhibit

In a later section, we formally provide axioms consistent with these behavior.

1.3 Related Literature

1.3.1 Macroeconomics

Random discounting in a number of infinite-horizon macroeconomic models, where its role broadly appears, generates suitable heterogeneity across agents. Models of wealth inequality based on standard and identical preferences and on uninsurable shocks to income can explain only a small part of the observed wealth inequality. Krusell and Smith (1998) consider shocks to discount factors and succeed in relating wealth heterogeneity predicted by the model to the observed data in the United States. Dutta and Michel (1998) use random discounting to model imperfect altruism to future generations, and derive a stationary wealth distribution where fewer agents hold higher levels of wealth. Karni and Zilcha (2000) prove that if the agents have random discount factors, in a steady-state competitive equilibrium, agents other than the most patient agents hold capital. This contrasts with the result in deterministic economies where only the most patient agents hold capital (see Becker 1980). Chatterjee et al. (2007) construct a general equilibrium model where agents with random discounting are allowed to default. They are able to match a default rate consistent with data partly because agents with low discount factors tend to consume more and default more frequently.

In models of monetary economics, random discounting also plays an important role. In a two-period model with random discounting, Goldman (1974) shows the possibility that an agent holds money that yields a lower interest than other interest-bearing assets. If the discount factor is random, after finding the discount factor, the agent may be willing to change her portfolio consisting of money and other assets. Since the transaction cost of money is lower than that of other assets, money allows the agent to change the portfolio more easily, and hence, can be valuable for the agent with random discounting.

Atkeson and Lucas (1992) and Farhi and Werning (2007) consider an intergenerational model, where each generation is composed of a continuum of agents who live for one-period and are altruistic to a descendant. Agents are ex ante identical but they experience taste-shocks to the degree of altruism (or discount factor), which are private information. The authors investigate the property of the second-best allocations of consumption. In these papers, agent’s private information about taste-shocks is elicited through an incentive-compatible mechanism, while in the present chapter, the information is elicited indirectly from the observable behavior of the agent.

1.3.2 Axiomatic Models

To provide a foundation for random discounting, we follow studies of preference on the opportunity set approach. Koopmans (1964) first introduces an opportunity set as a choice object to model sequential decision making and emphasizes that intertemporal choice may be essentially different from a once-and-for-all decision making. He points out that if a DM perceives uncertainty about future preferences, she may strictly prefer to leave some options open rather than to choose a completely specified future plan.

Kreps (1979, 1992) interprets uncertain future preferences as subjective uncertainties of the DM, and provides an axiomatic foundation for the subjective state space. Dekel et al. (2001) refine Kreps’s idea and show uniqueness of the subjective state space. Furthermore, Dekel et al. (2007) modify the argument of DLR surrounding the additive representation with subjective states. In this line of research, our result can be viewed as an infinite-horizon extension of DLR, where the DM’s subjective state space is specified to the set of sequences of discount factors.

Several authors provide sequential choice models consistent with preference for flexibility. Rustichini (2002) follows the same idea as DLR and considers closed subsets of \(C^{\infty }\) as choice objects. In this framework, all subjective uncertainties are resolved one period ahead. Kraus and Sagi (2006) follow the dynamic model of Kreps and Porteus (1978) and consider a sequence of preferences without the completeness axiom. Each incomplete preference is represented by the decision rule of the form, where one choice object is preferred to another if the former is unanimously preferred to the latter with respect to a set of uncertain future preferences. This uncertainty leads to preference for flexibility. Takeoka (2007) introduces objective states into DLR’s model and considers preference over menus of menus of Anscombe-Aumann acts, which is viewed as a three-period extension of DLR. He derives a subjective decision tree and a subjective probability measure on it as components of representation.

2 Model

2.1 Domain

Let C be the outcome space (consumption set), which is assumed to be compact and metric. Let Δ(C) be the set of lotteries, that is, all Borel probability measures over C. Under the weak convergence topology, Δ(C) is also compact and metric. Gul and Pesendorfer (2004) show that there exists a compact metric space \(\mathcal{Z}\) such that \(\mathcal{Z}\) is homeomorphic to \(\mathcal{K}(\varDelta (C \times \mathcal{Z}))\), where \(\mathcal{K}(\cdot )\) denotes the set of non-empty compact subsets of “⋅ ”.Footnote 2 Generic elements of \(\mathcal{Z}\) are denoted by x, y, z, ⋯ . Each such object is called a menu (or an opportunity set) of lotteries over pairs of current consumption and menu for the rest of the horizon.

Preference \(\succapprox\) is defined on \(\mathcal{Z}\simeq \mathcal{K}(\varDelta (C \times \mathcal{Z}))\). We have in mind the timing of decisions as mentioned in Fig. 20.1.

An important subdomain of \(\mathcal{Z}\) is the set \(\mathcal{L}\) of perfect commitment menus where DM is committed in every period. We identify a singleton menu with its only element. Then a perfect commitment menu can be viewed as a multistage lottery, considered by Epstein and Zin (1989), that is, \(\mathcal{L}\) is a subdomain of \(\mathcal{Z}\) satisfying \(\mathcal{L}\simeq \varDelta (C \times \mathcal{L})\). A formal treatment is found in Appendix section “Perfect Commitment Menus”.

The following examples illustrate that the recursive domain \(\mathcal{Z}\) can accommodate sequential decision problems.

Example 1 (Consumption-Savings Problem)

Given a constant interest rate r > 0 and an initial savings s > 0, DM decides a current consumption c and savings \(s^{{\prime}}\) carried over to the next period within the wealth of (1 + r)s. That is, the DM faces the budget constraint,

which is translated into the menu \(x(s) =\{ \left.(c,x(s^{{\prime}}))\right \vert (c,s^{{\prime}}) \in B(s)\}\). If r is random, x(s) can be modified to a set of lotteries.

Example 2 (Durable Goods)

A durable good provides flow of services, \(c =\{ c_{t}\}_{t=1}^{\infty }\) over certain time periods. The durability of goods depends both on the physical property and intensive use of goods. Let \(\{c =\{ c_{t}\}_{t=1}^{\infty }\,\vert \,f(c) \leq 0\}\) be the feasible set of flow of services associated with a durable good, where f is a technology frontier. Given the history of consumptions up to period t − 1, denoted by \(c^{t-1} = (c_{1},\cdots \,,c_{t-1})\), c t is a feasible consumption in period t if and only if \(f(c^{t-1},c_{t},c) \leq 0\) for some c. In other words, the DM faces the menu as

The DM prefers one durable good f to another g if and only if \(x_{f}(c^{0}) \succapprox x_{g}(c^{0})\).

Example 3 (Sampling Problem)

Given a wage offer w, which is a random sample from a distribution F, a DM has to decide whether to accept or reject the offer. If the DM accepts w, she receives current payoff from w and nothing for the rest of the horizon. Otherwise, the DM continues sampling, and receives a new random sample \(w^{{\prime}}\) in the next period. Sampling is repeated until the DM accepts an offer. This decision problem can be described formally as follows: given a current offer w, define the menu \(x(w) \equiv \{\text{accept }w,\text{continue}\}\). The object “accept w” is the consumption stream (w, {(0, {(0, ⋯ )})}), and “continue” is the lottery over menus of the form \(x(w^{{\prime}}) =\{ \mbox{ accept $w^{{\prime}}$, continue}\}\), where \(w^{{\prime}}\) is given according to the distribution F.

2.2 Random Discounting Representations

By taking any non-constant, continuous, mixture linear function \(u:\varDelta (C) \rightarrow \mathbb{R}\) and any Borel probability measure μ over [0, 1] with the mean \(\bar{\alpha }\equiv \mathbb{E}_{\mu }[\alpha ] <1\) we consider the functional form \(U: \mathcal{Z}\rightarrow \mathbb{R}\) defined as

where l c and l z denote the marginal distributions of l on C and \(\mathcal{Z}\), respectively.

The functional form (20.1) can be interpreted as follows: the DM behaves as if she has in mind the time line described in Fig. 20.1 and anticipates uncertainty about discount factors, which is captured by μ over [0, 1]. On the other hand, she is certain about future risk preference, u over Δ(C). Moreover, she is also certain about future ranking of menus, which is identical with the current ranking U. That is, the representation has a stationary and recursive structure. After considering the realization of discount factor α, the DM chooses a lottery out of the menu to maximize the “ex post” utility function,

which is the weighted sum of expected utilities from current consumption and the opportunity set for the rest of the horizon. The functional form (20.1) states that the DM evaluates a menu x by taking the expected value of these maximum values with respect to her subjective belief μ over discount factors.

Definition 1

Preference \(\succapprox\) on \(\mathcal{Z}\) admits a random discounting representation if \(\succapprox\) can be represented numerically by the functional form U as given by (20.1) with components (u, μ).

A random discounting representation coincides with a stationary cardinal utility function on the subdomain \(\mathcal{L}\) of perfect commitment menus. Since the DM has no opportunity for choice, random discounting does not matter on this subdomain. The functional form (20.1) reduces to

where l c and l L denote the marginal distributions of \(l \in \varDelta (C \times \mathcal{L})\) on C and \(\mathcal{L}\), respectively. This is a standard stationary recursive utility with a deterministic discount factor \(\bar{\alpha }<1\).

Apart from the difference of choice objects,Footnote 3 a random discounting representation is a special case of DLR’s additive representation of the form that

where S is a state space, μ is a non-negative measure on S, and V (⋅ , s) is a state-dependent expected utility function. Indeed, the ex post utility function (20.2) can be written as

with an index s ∈ S.

DLR have a model of the form (20.3) with a signed measure μ, where choice based on some subjective states may be negatively evaluated from the ex ante perspective. The DM having such a representation does not necessarily desire flexibility. Similarly, it is possible to consider functional form (20.1) by assuming μ as a signed measure. For example, Gul and Pesendorfer (2004) correspond to the case where μ has one “regular” discount factor α > 0 with a positive weight and a completely myopic discount factor α = 0 with a negative weight.Footnote 4 In this chapter, however, we do not focus on this general model. First, unless some further restriction is imposed such as in Gul and Pesendorfer (2004), a model with a signed measure does not necessarily have a clear implication of how choice behavior evolves over time. Such a model is not appropriate as a dynamic model, while the random discounting representation can generate a stochastic choice according to the probability measure. Second, as Koopmans (1964) and Kreps (1979) point out, a dynamic model consistent with preference for flexibility is of its own interest.

3 Foundations

3.1 Axioms

The axioms which we consider on \(\succapprox\) are the following. The first two axioms are standard and need no explanation.

Axiom 1 (Order)

\(\succapprox\) is complete and transitive.

Axiom 2 (Continuity)

For all \(x \in \mathcal{Z}\), \(\{z \in \mathcal{Z}\vert x \succapprox z\}\) and \(\{z \in \mathcal{Z}\vert z \succapprox x\}\) are closed.

For any \(l \in \varDelta (C \times \mathcal{Z})\), l c and l z denote the marginal distributions of l on C and on \(\mathcal{Z}\), respectively.

Axiom 3 (Nondegeneracy)

There exist \(l,l^{{\prime}}\in \varDelta (C \times \mathcal{Z})\) such that \(l_{c}\neq l_{c}^{{\prime}}\), \(l_{z} = l_{z}^{{\prime}}\), and \(\{l\} \succ \{ l^{{\prime}}\}\).

The lotteries l and \(l^{{\prime}}\) differ only in the distribution of current consumption. Thus, strict preference for l over \(l^{{\prime}}\) presumably reveals that the DM’s risk preference over C is not constant.

The next three axioms are the same as those in Gul and Pesendorfer (2004).

Axiom 4 (Commitment Independence)

For all \(l,l^{{\prime}},l^{{\prime\prime}}\in \varDelta (C \times \mathcal{Z})\) and for all \(\lambda \in (0,1)\),

For all \(l,l^{{\prime}}\in \varDelta (C \times \mathcal{Z})\), \(\{l\} \succapprox \{ l^{{\prime}}\}\) means commitment preference, which reflects the DM’s ex ante perspective on future preference over lotteries. Axiom 4 states that commitment preference over lotteries satisfies the vNM independence.

Axiom 5 (Stationarity)

For all \(x,y \in \mathcal{Z}\) and c ∈ C, \(\{(c,x)\} \succapprox \{ (c,y)\} \Leftrightarrow x \succapprox y\).

Since current consumption is the same, the ranking between {(c, x)} and {(c, y)} reflects how the DM evaluates x and y in the next period. Thus, Stationarity means that the ranking over menus is identical across time.

In general, belief about future discount factors may depend on the history of consumptions and realizations of discount factors up to that period. Stationarity, however, excludes such history-dependent beliefs: the DM is sure that her belief about discount factors will not change over time. We adopt Stationarity because it seems sensible as a first step and because the general model seems much more difficult to characterize and is beyond our grasp at this time.

For any \((c,x),(c^{{\prime}},x^{{\prime}}) \in C \times \mathcal{Z}\) and \(\lambda \in [0,1]\), the notation

denotes the lottery over \(C \times \mathcal{Z}\) yielding (c, x) with probability \(\lambda\) and yielding \((c^{{\prime}},x^{{\prime}})\) with probability \(1-\lambda\).

For any \(x,x^{{\prime}}\in \mathcal{Z}\) and \(\lambda \in [0,1]\), define the mixture of two menus by considering the mixtures element by element between x and \(x^{{\prime}}\), that is,

If the DM identifies a two-stage lottery \(\lambda \circ l + (1-\lambda ) \circ l^{{\prime}}\) with its reduced lottery \(\lambda l + (1-\lambda )l^{{\prime}}\), \(\lambda x + (1-\lambda )x^{{\prime}}\) can also be viewed as a set of two-stage lotteries.

Axiom 6 (Timing Indifference)

For all \(x,x^{{\prime}}\in \mathcal{Z}\), c ∈ C, and \(\lambda \in (0,1)\),

Notice that \(\lambda \circ (c,x) + (1-\lambda ) \circ (c,x^{{\prime}})\) is the lottery yielding (c, x) with probability \(\lambda\) and yielding \((c,x^{{\prime}})\) with probability \(1-\lambda\), while \((c,\lambda x + (1-\lambda )x^{{\prime}})\) is the degenerate lottery that assigns the pair of consumption c and menu \(\lambda x + (1-\lambda )x^{{\prime}}\) of two-stage lotteries. Hence, these two lotteries differ in timing of resolution of randomization \(\lambda\). For the former, the DM makes choice out of a menu (either x or \(x^{{\prime}}\)) after the resolution of \(\lambda\), while for the latter, this order is reversed, that is, the choice out of the menu \(\lambda x + (1-\lambda )x^{{\prime}}\) is made before the resolution of \(\lambda\). Timing Indifference suggests that the DM does not care about this difference in timing. Timing Indifference can be justified by the same argument as in DLR. Suppose that a DM is uncertain about future preference over \(\varDelta (C \times \mathcal{Z})\), yet she surely anticipates that it will satisfy the expected utility axioms. Let l and \(l^{{\prime}}\) be a rational choice from x and \(x^{{\prime}}\), respectively, with respect to a future preference. Therefore, \((c,\lambda l + (1-\lambda )l^{{\prime}})\) is the expected choice from \(\lambda \circ (c,x) + (1-\lambda ) \circ (c,x^{{\prime}})\). On the other hand, if the future preference satisfies the expected utility axioms, \((c,\lambda l + (1-\lambda )l^{{\prime}})\) is a rational choice from \((c,\lambda x + (1-\lambda )x^{{\prime}})\) as well. Therefore, irrespective of the future preference, the two menus will ensure indifferent consequences.Footnote 5

Axioms 1, 2, and 4–6 appear in Gul and Pesendorfer (2004).Footnote 6 They consider a DM facing self-control problems. Such a DM may be better off by restricting available options and, hence, exhibits preference for commitment rather than for flexibility. A key axiom of their model is called Set Betweenness: for any \(x,y \in \mathcal{Z}\),

Even if \(x \succapprox y\), the DM may rank x over \(x \cup y\) because y may contain a tempting option and choosing from \(x \cup y\) may require costly self-control to the DM.

We adopt the following two axioms, which distinguish our model from theirs. As mentioned in Sect. 1.2, the DM facing uncertainty about her future preferences may want to keep options open as much as possible. This is because flexibility allows the DM to make a decision contingent upon realization of her future preference. This informational advantage leads to preference for flexibility. Such a DM would rank \(x \cup y\) over x even though \(x \succapprox y\). To accommodate such behavior, we follow Kreps and DLR, and assume (instead of Set Betweenness):

Axiom 7 (Monotonicity)

For all \(x,y \in \mathcal{Z}\), \(y \subset x \Rightarrow x \succapprox y\).

This axiom states that a bigger menu is always weakly preferred. That is, Monotonicity is consistent with preference for flexibility.Footnote 7

Monotonicity is consistent with any kind of uncertainty about future preferences. To identify behavior that reduces uncertainty about future preferences to that about future discount factors, we need to impose a qualification on the attitude toward flexibility. The DM facing random discount factors is sure how she evaluates consumption in the next period and a menu from that time period onward. Thus, uncertainty is relevant only when an intertemporal trade-off must be made. As mentioned in Sect. 1.2, such a DM should not value flexibility provided by “dominated lotteries”, which are now described formally.

Let \(l_{c} \otimes l_{z}\) denote the product measure on \(C \times \mathcal{Z}\) that consists of marginal distributions l c ∈ Δ(C) and \(l_{z} \in \varDelta (\mathcal{Z})\). We define dimension-wise dominance as follows:

Definition 2

For all \(l,l^{{\prime}}\in \varDelta (C \times \mathcal{Z})\), l dominates \(l^{{\prime}}\) if \(\{l_{c} \otimes l_{z}^{{\prime}}\}\succapprox \{ l_{c}^{{\prime}}\otimes l_{z}^{{\prime}}\}\) and \(\{l_{c}^{{\prime}}\otimes l_{z}\} \succapprox \{ l_{c}^{{\prime}}\otimes l_{z}^{{\prime}}\}\), where l c (resp. l z ) denotes the marginal distribution of l on C (resp. \(\mathcal{Z}\)).

If the DM is certain about her risk preferences over Δ(C) and over \(\varDelta (\mathcal{Z})\) in future, the commitment rankings appearing in the above definition should reflect those preferences. Since \(l_{c} \otimes l_{z}^{{\prime}}\) and \(l_{c}^{{\prime}}\otimes l_{z}^{{\prime}}\) differ only in marginal distributions on C, the ranking \(\{l_{c} \otimes l_{z}^{{\prime}}\}\succapprox \{ l_{c}^{{\prime}}\otimes l_{z}^{{\prime}}\}\) reflects that l c is preferred to \(l_{c}^{{\prime}}\) in terms of the future risk preference over Δ(C). Similarly, the ranking \(\{l_{c}^{{\prime}}\otimes l_{z}\} \succapprox \{ l_{c}^{{\prime}}\otimes l_{z}^{{\prime}}\}\) should reveal the DM’s future preference for l z over \(l_{z}^{{\prime}}\). If l dominates \(l^{{\prime}}\), the marginal distributions of l on C and \(\mathcal{Z}\) are both preferred to those of \(l^{{\prime}}\). Hence, l will definitely be chosen over \(l^{{\prime}}\) by the DM who is certain about her future risk preferences over C and \(\mathcal{Z}\).

For any \(l \in \varDelta (C \times \mathcal{Z})\), let O(l) be the set of all lotteries dominated by l, that is,

If \(\succapprox\) satisfies Order, l ∈ O(l). Thus, a DM having preference for flexibility weakly prefers O(l) to {l}. However, there is no reason to choose a dominated lottery \(l^{{\prime}}\in O(l)\) over l. Hence, O(l) should be indifferent to {l}.

The same intuition should hold between a general menu x and the set

that is, O(x) is the set of all lotteries dominated by some lottery in x. Lemma 3 (i) in Appendix section “Proof of Theorem 1” shows that O(x) is a well-defined choice object, that is, \(O(x) \in \mathcal{Z}\) for all x.

Axiom 8 (Marginal Dominance)

For all \(x \in \mathcal{Z}\), \(x \sim O(x)\).

Marginal Dominance states that the DM should not care about dominated lotteries. Since \(x \subset O(x)\) when \(\succapprox\) satisfies Order, the DM having preference for flexibility weakly prefers O(x) to x. Thus, this axiom is a counterpoint to Monotonicity, and shows that it is not useful to keep dominated lotteries within the menu, that is, \(x \succapprox O(x)\). Such behavior can be justified if the DM believes that her future risk preference over Δ(C) is separated from her future ranking of menus, and these two preferences are known to the DM without uncertainty. Then, dominated lotteries are definitely useless because they give less utilities in the future, both immediate and remote, and hence the DM exhibits \(x \sim O(x)\).

Marginal Dominance involves a form of separability of preferences between immediate and remote future. Two remarks are in order: First, under this axiom, the DM cares only about the marginal distributions on C and \(\mathcal{Z}\)—the correlation between immediate consumption and the future opportunity set does not matter. Second, Marginal Dominance is stronger than the Separability axiom stated by Gul and Pesendorfer (2004), which requires a form of separability only in the singleton sets. That is, for any \(c,c^{{\prime}}\in C\) and \(x,x^{{\prime}}\in \mathcal{Z}\),

If \(\succapprox\) satisfies Marginal Dominance, for all \(l \in \varDelta (C \times \mathcal{Z})\), we have \(\{l\} \sim O(l) = O(l_{c} \otimes l_{z}) \sim \{ l_{c} \otimes l_{z}\}\). Thus, both the above singleton menus are indifferent to

which results in Separability.

3.2 Representation Results

It is now appropriate to state the main theorem.

Theorem 1

If preference \(\succapprox\) satisfies Order, Continuity, Nondegeneracy, Commitment Independence, Stationarity, Timing Indifference, Monotonicity, and Marginal Dominance, then there exists a random discounting representation (u,μ).

Conversely, for any pair (u,μ) with \(\bar{\alpha }<1\) , there exists a unique functional form U that satisfies functional equation ( 20.1 ) and the preference it represents satisfies all the axioms.

The above theorem is closely related to DLR’s study, and the role of the axioms may be well understood when compared with their axioms. DLR show that preference over menus of lotteries admits the additive representation (20.3) with a non-negative measure if and only if it satisfies Order, Continuity, Monotonicity, and the following axiomFootnote 8:

Axiom 9 (Independence)

For all x, y, z and \(\lambda \in (0,1]\),

Indeed, Commitment Independence, Stationarity, and Timing Indifference imply Independence.Footnote 9 Marginal Dominance plays a key role in restricting subjective states (future preferences) to differ only in intertemporal trade-offs between the immediate and remote future. The recursive form of the representation is due to Stationarity. For an outline of the proof of sufficiency, see Sect. 3.4. A formal proof is relegated to Appendix section “Proof of Theorem 1”.

According to the above argument, a natural strategy to obtain a random discounting representation would be to establish the additive representation (20.3) on \(\mathcal{K}(\varDelta (C \times \mathcal{Z}))\), and to manipulate the representation to convert the subjective state space S to the set of discount factors [0, 1] using the additional axioms (especially Marginal Dominance). However, we do not follow this strategy mainly because the first step is not immediate: DLR consider menus of lotteries over finite alternatives as choice objects and, hence, can regard the compact set of expected utility functions over lotteries as the subjective state space, while in this chapter, choice objects are menus of lotteries over a compact set. Thus, instead of dealing with the set of all mixture linear functions over the compact set, we start off with the subjective state space [0, 1] of discount factors and establish our functional form by adapting DLR’s argument. For an outline of the proof of sufficiency, see Sect. 3.4.

The next result considers uniqueness of the representation. If preference admits two distinct random discounting representations, say (u, μ) and \((u^{{\prime}},\mu ^{{\prime}})\), we cannot know which belief actually captures the DM’s subjective uncertainty about discount factors. Therefore, we have the following uniqueness result. A proof can be found in Appendix section “Proof of Theorem 2”.

Theorem 2

If two random discounting representations, U and \(U^{{\prime}}\) , with components (u,μ) and \((u^{{\prime}},\mu ^{{\prime}})\) respectively, represent the same preference, then:

-

(i)

u and \(u^{{\prime}}\) are cardinally equivalent; and

-

(ii)

\(\mu =\mu ^{{\prime}}\) .

Theorem 2 pins down a subjective probability measure μ over the set of future discount factors, which is interpreted as the set of subjective states of the DM. Our result is in contrast to Kreps (1979, 1992) and DLR, where probability measures over subjective states are not identified; since the ex post utility functions are state-dependent as shown in (20.3), probabilities assigned to those states can be manipulated arbitrarily. Formally, let ν be a probability measure which is absolute continuous with respect to μ. Then there is a function f such that \(V ^{{\prime}}(l,s) = V (l,s)f(s)\) and

which means that μ cannot be identified. On the other hand, our representation has an additive recursive structure, that is, the ex post utility functions are specified as shown in (20.4). Notice that both the instantaneous expected utility u and the utility U over menus are independent of subjective states, and state-dependent components, 1 −α(s) and α(s), add up to one for all s. Under the above manipulation, the representation is maintained only when f(s) = 1 almost surely, and thus ν = μ. Therefore, it is a combination of the additive recursive structure and the normalization of discount factors that ensures uniqueness of subjective beliefs.Footnote 10

3.3 Special Case: Deterministic Discounting

We imagine a “standard” DM with deterministic discounting, who is not anticipating any uncertainty about future discount factors. Such a DM should not care about flexibility, and should evaluate a menu by its best element according to a fixed weak order over singleton sets. That is,

where \(\{l^{x}\} \succapprox \{ l\}\) and \(\{l^{y}\} \succapprox \{ l^{{\prime}}\}\) for all l ∈ x and \(l^{{\prime}}\in y\). Kreps (1979) characterizes such a standard DM based on the next axiom:

Axiom 10 (Strategic Rationality)

For all \(x,y \in \mathcal{Z}\), \(x \succapprox y \Rightarrow x \sim x \cup y\).

Strategic Rationality states that as long as x is preferred to y, the DM does not care whether options in y are added into x or not. This axiom is more restrictive than Monotonicity, and excludes preference for flexibility.Footnote 11

Strategic Rationality is not enough to characterize deterministic discounting because it does not impose any restriction on the commitment ranking. The next axiom requires the dimension-wise dominance on singleton sets.

Axiom 11 (Commitment Marginal Dominance)

For all \(l \in \varDelta (C \times \mathcal{Z})\), \(\{l\} \sim O(l)\).

This axiom is weaker than Marginal Dominance, but the intuition is the same as before.

The next corollary of Theorem 3.1 characterizes deterministic discounting. Appendix section “Proofs of Corollary 1 and Proposition 1” can be referred for a proof.

Corollary 1

Preference \(\succapprox\) satisfies Order, Continuity, Nondegeneracy, Commitment Independence, Stationarity, Timing Indifference, Strategic Rationality, and Commitment Marginal Dominance if and only if \(\succapprox\) admits a random discounting representation (u,μ) such that μ is degenerate.

As mentioned above, Strategic Rationality implies Monotonicity. To verify that the set of axioms in Corollary 1 implies Marginal Dominance, we provide a further perspective on Strategic Rationality. A standard DM, who surely anticipates her preference in the next period, will rank menus according to the decision rule (20.7). Consequently, she should be indifferent between committing to a lottery \(l \in \varDelta (C \times \mathcal{Z})\) and having its “lower contour set”

which is the set of all lotteries that are no more desired than l with respect to commitment ranking. Accordingly, arranging \(O^{{\ast}}(x) \equiv \cup _{l\in x}O^{{\ast}}(l)\) for all \(x \in \mathcal{Z}\), the standard DM will satisfy the next axiom:

Axiom 12 (Dominance)

For all \(x \in \mathcal{Z}\), \(x \sim O^{{\ast}}(x)\).

This axiom states that DM does not care about keeping a lottery which is no more desired than some lottery in the menu in terms of commitment ranking. Even if \(\{l\} \succapprox \{ l^{{\prime}}\}\), the support of l may be different from that of \(l^{{\prime}}\), that is, these lotteries may differ in intertemporal trade-offs, and hence, the DM facing uncertainty about discount factors may be better off by keeping \(l^{{\prime}}\) as an option. However, Dominance implies that if \(\{l\} \succapprox \{ l^{{\prime}}\}\), the DM surely anticipates not to choose \(l^{{\prime}}\) in the next period, and does not care about flexibility regarding intertemporal trade-offs in the future. Hence, this axiom is a necessary condition for deterministic discounting.

As one might imagine, Dominance has close relations to Strategic Rationality and Marginal Dominance.

Proposition 1

Assume that \(\succapprox\) satisfies Order and Continuity.

-

(i)

Strategic Rationality is equivalent to Dominance.

-

(ii)

Dominance and Commitment Marginal Dominance imply Marginal Dominance.

See Appendix section “Proofs of Corollary 1 and Proposition 1” for a proof. From this proposition, Strategic Rationality and Commitment Marginal Dominance together with the other axioms imply the set of axioms in Theorem 1.

3.4 Proof Sketch for Sufficiency of Theorem 1

As mentioned in Sect. 3.2, Commitment Independence, Stationarity, and Timing Indifference imply Independence. Focusing on the subdomain \(\mathcal{Z}_{1} \subset \mathcal{Z}\) consisting of convex menus, the mixture space theorem delivers a mixture linear representation \(U: \mathcal{Z}_{1} \rightarrow \mathbb{R}\). We have to show that U can be rewritten as the desired form.

Marginal Dominance implies that the DM is certain about her future risk preferences over C and \(\mathcal{Z}\). Let \(u:\varDelta (C) \rightarrow \mathbb{R}\) and \(W:\varDelta (\mathcal{Z}) \rightarrow \mathbb{R}\) be

where \(\underline{l} \in \varDelta (C \times \mathcal{Z})\) is a minimal lottery in terms of commitment ranking. These two functions should represent those future preferences.

Monotonicity captures preference for flexibility, which presumably reflects uncertainty about future preferences. Since u and W are sure for the DM, all the uncertainties about future preferences are effectively reduced to those about future discount factors. The DM should expect her future preference over \(\varDelta (C \times \mathcal{Z})\) to have the form of

where α ∈ [0, 1] is a subjective weight between u and W.

We identify a menu x with its “support function” \(\sigma _{x}: [0,1] \rightarrow \mathbb{R}\), defined by

That is, \(\sigma _{x} =\sigma _{y}\ \Leftrightarrow \ x = y\). This identification ensures that the mapping \(\sigma\) embeds the set of menus into the space of real-valued continuous functions on [0, 1], and hence, the functional \(V (f) = U(\sigma ^{-1}(f))\) is well-defined on the image of \(\sigma\). Following the similar argument by DLR (and Dekel et al. 2007), we show that there exists a unique probability measure μ over [0, 1] such that V (f) can be written as \(\int f(\alpha )\,\mathrm{d}\mu (\alpha )\), and hence,

The remaining step is to show that U has a stationary and recursive form as desired. Since W(l z ) is a mixture linear function, it has the expected utility form \(\int _{\mathcal{Z}}W(z)\,\mathrm{d}\mathop{\l }_{z}\). By Stationarity, W and U must represent the same preference. Moreover, Timing Indifference implies that W is mixture linear with respect to the mixture operation over menus. Hence, W(z) can be written as an affine transformation of U(z). Manipulating the functional form appropriately, we obtain the desired representation. Finally, Continuity and Nondegeneracy imply \(\bar{\alpha }<1\).

4 Greater Demand for Flexibility and Greater Uncertainty

We would like to analyze the situation where one agent is more uncertain about discount factors than another. We provide behavioral comparisons about preference for flexibility and characterize intuitive properties of subjective beliefs.

Consider two agents: Agent i has preference \(\succapprox ^{i}\) on \(\mathcal{Z}\), i = 1, 2. Since we are interested in comparing preference for flexibility, we focus on agents having identical commitment rankings. Recall that \(\mathcal{L}\) is the set of multistage lotteries. If an element of \(\mathcal{L}\) is chosen, there remains no opportunity for choice over the rest of the horizon. We say that \(\succapprox ^{1}\) and \(\succapprox ^{2}\) are equivalent on \(\mathcal{L}\) if, for all \(l,l^{{\prime}}\in \mathcal{L}\),

A DM’s preference for flexibility is captured by the Monotonicity axiom, that is, the DM prefers bigger menus. Hence, one can say that agent 2 has greater demand for flexibility than agent 1 if agent 2 strictly prefers a bigger menu whenever agent 1 does so. Such a behavioral comparison is provided by DLR. Formally:

Definition 3

Agent 2 desires more flexibility than agent 1 if, for all \(x,y \in \mathcal{Z}\) with \(y \subset x\), \(x \succ ^{1}y \Rightarrow x \succ ^{2}y\).

In a two-period model, DLR show that, under Definition 3, the subjective state space of agent 2 is bigger than that of agent 1. That is, greater demand for flexibility reflects greater uncertainty about future contingencies. In particular, in the case of their additive representation, the subjective state space corresponds to a support of non-negative measure. By analogy of DLR, one might expect that greater demand for flexibility reflects a bigger support of the subjective belief about discount factors.

Since a menu in \(\mathcal{Z}\) is an infinite horizon decision problem, preference for flexibility on \(\mathcal{Z}\) reflects the agent’s belief about sequence of discount factors over the rest of the horizon, while μ is her belief about discount factors only in the immediate future. To obtain a characterization result, it is relevant to specify preference for flexibility attributable solely to belief about the immediate future. To formalize the idea, define “the two-period domain” as

Holding a menu \(x \in \mathcal{Z}^{1}\), the agent can postpone a decision only until period 1, from which point on she has to make a commitment. A comparison of preference for flexibility on \(\mathcal{Z}^{1}\) corresponds to DLR’s two-period case.

Definition 4

Agent 2 desires more flexibility in the two-period model than agent 1 if, for all \(x,y \in \mathcal{Z}^{1}\) with \(y \subset x\), \(x \succ ^{1}y \Rightarrow x \succ ^{2}y\).

The next theorem is a counterpart of DLR. A proof is found in Appendix section “Proof of Theorem 3”.

Theorem 3

Assume that \(\succapprox ^{i}\) , i = 1,2, satisfy all the axioms of Theorem 1 and are equivalent on \(\mathcal{L}\) . The following conditions are equivalent:

-

(a)

Agent 2 desires more flexibility in the two-period model than agent 1.

-

(b)

There exist random discounting representations U i with \((u^{i},\mu ^{i})\) , i = 1,2, such that (i) \(u^{1} = u^{2}\) , and (ii) the support of μ 2 set-theoretically includes that of μ 1 .

Two remarks are in order: First, although μ i is constant over time, condition (b) does not imply that agent 2 desires more flexibility than agent 1. Indeed, under condition (b), we may find two menus z and \(z^{{\prime}}\) such that \(U^{1}(z)> U^{1}(z^{{\prime}})\) and \(U^{2}(z) \leq U^{2}(z^{{\prime}})\). Considering \(x \equiv \{ (c,z),(c,z^{{\prime}})\}\) and \(y \equiv \{ (c,z^{{\prime}})\}\) for some c ∈ C, we have \(y \subset x\) and \(U^{1}(x)> U^{1}(y)\), yet \(U^{2}(x) = U^{2}(y)\). Second, although our functional form is a special case of DLR’s, Theorem 3 does not follow directly from Theorem 2 (p. 910) of DLR regarding the characterization of Definition 4. DLR consider menus of lotteries over finite outcomes, while in our study, choice objects are menus of lotteries on a compact outcome space.

We next consider another behavioral comparison about preference for flexibility. If agent 2 faces more uncertainty about discount factors than agent 1, agent 2 is presumably more averse to making a commitment to a specific plan than agent 1 is. That is,

Definition 5

Agent 2 is more averse to commitment than agent 1 if, for all \(x \in \mathcal{Z}\) and \(l \in \mathcal{L}\), \(x \succ ^{1}\{l\} \Rightarrow x \succ ^{2}\{l\}\).

This condition states that if agent 1 strictly prefers a menu x to a completely spelled-out future plan {l}, so does agent 2. Since l does not necessarily belong to x, Definition 5 is independent of Definition 3.

In a similar way to Definition 4, the above condition can be restricted to the two-period domain.

Definition 6

Agent 2 is more averse to commitment in the two-period model than agent 1 if, for all \(x \in \mathcal{Z}^{1}\) and \(l \in \mathcal{L}\), \(x \succ ^{1}\{l\} \Rightarrow x \succ ^{2}\{l\}\).

Several authors adopt conditions identical to Definitions 5 and 6 in different contexts. Ahn (2008) considers preference over subsets of lotteries and interprets those subsets as ambiguous objects. Since singleton sets are then regarded as options without ambiguity, a similar comparison with Definition 5 shows that agent 1 is more ambiguity averse than agent 2. By taking preference over menus of lotteries, Sarver (2008) models a DM who anticipates regret from choice in the future and, hence, may prefer smaller menus. In his model, the identical comparison is interpreted as agent 1 being more regret prone than agent 2.Footnote 12

Now the implication of the above behavioral comparison is considered. We show that Definition 5 characterizes second-order stochastic dominance in terms of subjective beliefs. In case of objective uncertainty, second-order stochastic dominance has been widely used to describe increasing uncertainty since Rothschild and Stiglitz (1970).

Definition 7

Consider probability measures μ 1 and μ 2 over [0, 1]. Say that μ 1 exhibits second-order stochastic dominance over μ 2 if, for all continuous and concave functions \(v: [0,1] \rightarrow \mathbb{R}\),Footnote 13

Rothschild and Stiglitz (1970) show that the above condition holds if and only if μ 2 is obtained as μ 1 plus some “noise”.Footnote 14 Thus, second-order stochastic dominance is a natural ordering on probability measures to describe increasing uncertainty. One immediate observation is that \(\mathbb{E}_{\mu ^{1}}[\alpha ] = \mathbb{E}_{\mu ^{2}}[\alpha ]\) if μ 1 exhibits second-order stochastic dominance over μ 2 because v(α) = α is a convex and concave function.

We may now state a characterization result.

Theorem 4

Assume that \(\succapprox ^{i}\) , i = 1,2, satisfy all the axioms of Theorem 1 . Then the following conditions are equivalent:

-

(a)

Agent 2 is more averse to commitment than agent 1.

-

(b)

Agent 2 is more averse to commitment in the two-period model than agent 1.

-

(c)

There exist random discounting representations U i with \((u^{i},\mu ^{i})\) , i = 1,2, such that (i) \(u^{1} = u^{2}\) , and (ii) μ 1 exhibits second-order stochastic dominance over μ 2 .

A formal proof is relegated to Appendix section “Proof of Theorem 4”. By definition, condition (a) implies condition (b). The intuition behind (b)\(\Rightarrow\)(c) is as follows: Definition 6 implies that \(\succapprox ^{1}\) and \(\succapprox ^{2}\) are equivalent on \(\mathcal{L}\), and hence part (i) is obtained. Furthermore, together with this observation, Definition 6 implies that \(U^{2}(x) \geq U^{1}(x)\) for all \(x \in \mathcal{Z}^{1}\). Since, for all x, the function

is convex in α, the ranking \(U^{2}(x) \geq U^{1}(x)\) means that the integral of a convex function of the form (20.8) with respect to μ 2 is always bigger than that corresponding to μ 1. As the last step, we show that any continuous convex function v on [0, 1] can be arbitrarily approximated by a function of the form (20.8) if an affine transformation of u is chosen appropriately.

Unlike Theorem 3, condition (c) implies condition (a). That is, condition (c) is sufficient to show relative aversion to commitment with respect to not only “two-period menus” \(x \in \mathcal{Z}^{1}\) but also all infinite horizon decision problems \(x \in \mathcal{Z}\). In the proof, by exploiting the property of second-order stochastic dominance, we show that condition (c) ensures \(U^{2}(x) \geq U^{1}(x)\) for all \(x \in \mathcal{Z}\), which implies \(U^{2}(x) \geq U^{1}(x)> U^{1}(\{l\}) = U^{2}(\{l\})\) as desired.

5 Consumption-Savings Decisions Under Random Discounting

In this section, we apply the resulting model to a consumption-savings problem and analyze how random discounting affects consumption-savings decisions. We focus on the situation where the DM becomes more uncertain about discount factors in the sense of second-order stochastic dominance. We will characterize savings behavior when the DM has a CRRA utility function on consumption.

Recall Example 1 in Sect. 2.1. Assume that an interest rate r is constant as in the example. Given the savings s from the previous period, the DM evaluates x(s) according to the random discounting representation,

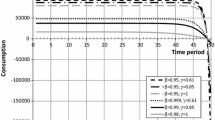

Throughout this section, the DM is assumed to have a CRRA utility function over instantaneous consumption, that is, \(u(c) = c^{1-\sigma }/(1-\sigma )\) for \(\sigma> 0\), \(\sigma \neq 1\). As is well-known, the inverse of \(\sigma\) is the elasticity of intertemporal substitution.

We examine the effect of the DM being more uncertain about future discount factors. Suppose that the DM changes her belief μ 1 to μ 2, where μ 1 second-order stochastically dominates μ 2. Let U i denote the random discounting representation with components (u, μ i), i = 1, 2.

After realization of α ∈ (0, 1), the DM faces the following problem:

Here, the current discount factor is known as α and the DM believes discount factors to follow distribution μ i over the rest of the horizon. From (20.9) and (20.10), the Bellman equation is obtained as

Let \(g_{\mu ^{i}}(s,\alpha )\) denote the savings function which solves problem (20.11).

We state the main result in this section. A proof is relegated to Appendix section “Proof of Theorem 5”.

Theorem 5

Assume that μ 1 second-order stochastically dominates μ 2 and \(\bar{\alpha }\equiv \mathbb{E}_{\mu ^{1}}[\alpha ] = \mathbb{E}_{\mu ^{2}}[\alpha ] <1/(1 + r)^{1-\sigma }\) . Then:

-

(i)

the DM saves a constant fraction of wealth, that is,

$$\displaystyle{g_{\mu ^{i}}(s,\alpha ) = \mathit{SR}_{\mu ^{i}}(\alpha )(1 + r)s,}$$where the savings rate \(\mathit{SR}_{\mu ^{i}}(\alpha ) \in (0,1)\) is uniquely determined, and;

-

(ii)

for all α ∈ (0,1), \(\mathit{SR}_{\mu ^{1}}(\alpha ) \lessgtr \mathit{SR}_{\mu ^{2}}(\alpha )\) if \(\sigma \lessgtr 1\) .

Part (i) is a characterization of the savings function, and is based on the assumption that u is a CRRA utility function. Owing to part (i), we can focus on the savings rate rather than the savings function to analyze the savings behavior of the DM. Part (ii) concerns a comparative analysis. Depending on the relative size of \(\sigma\) compared to one, the savings rate increases or decreases as the DM becomes more uncertain about discount factors.

To obtain the intuition behind part (ii), for each s, define the number \(\theta ^{i}(s)\) by

where \(V _{\bar{\alpha }}\) is the value function of the savings problem when a discount factor is constant over time and equal to the average \(\bar{\alpha }\), that is, for all s, \(V _{\bar{\alpha }}(s)\) is defined as

Let \(\mathbf{c}^{i} = (c_{1}^{i},c_{2}^{i},\cdots \,)\) be a solution to (20.13) that attains the maximum value \(V _{\bar{\alpha }}(\theta ^{i}(s))\). Then, the discounted sum of c i is equal to \(\theta ^{i}(s)\), that is, \(\theta ^{i}(s) =\sum _{ t=1}^{\infty }c_{t}^{i}/(1 + r)^{t}\), and (20.12) is equivalent to saying that \(\{\mathbf{c}^{i}\} \sim ^{i}x(s)\). Since the DM desires flexibility, \(\theta ^{i}(s)\) must be greater than s so as to compensate the DM for being committed to c i. Hence, the ratio \(\phi ^{i} \equiv \theta ^{i}(s)/s\) is interpreted as the commitment premium.Footnote 15 As uncertainty increases, the DM becomes more averse to commitment, and hence, ϕ i increases. From (20.12), maximization problem (20.10) is rewritten as

That is, increasing uncertainty has the same effect as if the rate of return from savings increases in the consumption-savings model with no uncertainty. Therefore, the substitution and income effects lead to the desired result.

Part (ii) of Theorem 5 includes, as a special case, a comparison between random and deterministic discounting with the same mean. According to the theorem, the savings increase or decrease depending on parameter \(\sigma\) when the DM becomes uncertain about discount factors, which implies that observed over-savings or under-savings behavior may be explained by subjective uncertainty about discount factors. Salanié and Treich (2006) provide the same observation in a three-period model.

Instead of uncertainty about discount factors, uncertainty about interest rates has been discussed in studies on consumption-savings, for example, Levhari and Srinivasan (1969), Sandmo (1970) and Rothschild and Stiglitz (1971). They report that increasing uncertainty will decrease (increase) savings in case of \(\sigma <(>)1\), which is the opposite to Theorem 5 (ii). Under risk aversion, the certainty equivalent of an uncertain interest rate always decreases as uncertainty increases. Hence, increasing uncertainty has the same effect as if the interest rate decreases in the consumption-savings problem with no uncertainty, while the commitment premium increases as discount factors become more uncertain. Thus, substitution and income effects lead to opposite implications.

Notes

- 1.

- 2.

The set \(\mathcal{K}(\varDelta (C \times \mathcal{Z}))\) is endowed with the Hausdorff metric. Details are relegated to Appendix section “Hausdorff Metric”.

- 3.

DLR consider preference over \(\mathcal{K}(\varDelta (C))\) with finite set C.

- 4.

A sophisticated DM, who is fully aware of time-inconsistency caused by hyperbolic discounting, may be viewed as a limiting case of their model, where the DM never exercises self-control at the moment of choice.

- 5.

- 6.

Their Nondegeneracy axiom requires the existence of menus x, y with \(x \succ y\) and \(x \subset y\). That is, this axiom captures preference for commitment—a DM may prefer a smaller menu.

- 7.

A sophisticated DM with hyperbolic discounting exhibits preference for commitment rather than for flexibility. Thus, such a DM is excluded by this axiom.

- 8.

Dekel et al. (2007) fill a gap in DLR surrounding this representation result.

- 9.

See Gul and Pesendorfer (2004, p. 125, footnote 7) for more details.

- 10.

To prevent arbitrary manipulations, DLR (p. 912) suggest that probability measures can be identified if some aspect of the ex post utility functions is state-independent. Such a condition is satisfied in our model.

- 11.

Strategic Rationality implies Monotonicity. Indeed, assume \(y \subset x\). Arguing by contradiction, suppose \(y \succ x\). Strategic Rationality implies \(x = x \cup y \sim y \succ x\), which is a contradiction.

- 12.

In literature on ambiguity in the Savage-type model, Epstein (1999) and Ghirardato and Marinacci (2002) adopt closely related conditions to capture comparative attitudes toward ambiguity aversion. They compare an arbitrary act with an unambiguous act instead of comparing an arbitrary menu with a commitment menu.

- 13.

Notice that continuity is not redundant because a concave function is continuous in the interior of the domain. In the original definition by Rothschild and Stiglitz (1970), continuity is not imposed.

- 14.

Their argument for this equivalence works even when continuity is imposed on v.

- 15.

Since u is CRRA, ϕ i is independent of s.

- 16.

They fix the argument (Lemma 12, p. 929) of DLR.

- 17.

In their model, C is assumed to be finite.

- 18.

References

Ahn DS (2008) Ambiguity without a state space. Rev Econ Stud 75:3–28

Atkeson A, Lucas RE Jr (1992) On efficient distribution with private information. Rev Econ Stud 59:427–453

Becker R (1980) On the long run steady state in a simple equilibrium with heterogeneous households. Quart J Econ 90:375–382

Becker GS, Mulligan CB (1997) The endogenous determination of time preference. Quart J Econ 112:729–758

Bertsekas DP, Shreve SE (1978) Stochastic optimal control: the discrete time case. Academic, New York

Blanchard, OJ (1985) Debt, deficits, and finite horizons. J Polit Econ 93:223–247

Chatterjee S, Corbae D, Nakajima M, Rios-Rull, JV (2007) A quantitative theory of unsecured consumer credit with risk of default. Econometrica 75:1525–1589

Dekel E, Lipman B, Rustichini A (2001) Representing preferences with a unique subjective state space. Econometrica 69:891–934

Dekel E, Lipman B, Rustichini A, Sarver T (2007) Representing preferences with a unique subjective state space: a corrigendum. Econometrica 75:591–600

Dutta J, Michel P (1998) The distribution of wealth with imperfect altruism. J Econ Theory 82:379–404

Epstein, LG (1999) A definition of uncertainty aversion. Rev Econ Stud 66:579–608

Epstein LG, Zin S (1989) Substitution, risk aversion, and the temporal behavior of consumption and asset returns: a theoretical framework. Econometrica 57:937–969

Epstein LG, Marinacci M, Seo K (2007) Coarse contingencies and ambiguity. Theor Econ 2:355–394

Farhi E, Werning I (2007) Inequality and social discounting. J Polit Econ 115:365–402

Ghirardato P, Marinacci M (2002) Ambiguity made precise: a comparative foundation. J Econ Theory 102:251–289

Goldman SM (1974) Flexibility and the demand for money. J Econ Theory 9:203–222

Gul F, Pesendorfer W (2001) Temptation and self-control. Econometrica 69:1403–1435

Gul F, Pesendorfer W (2004) Self-control and the theory of consumption. Econometrica 72:119–158

Higashi Y, Hyogo K, Takeoka N (2009) Subjective random discounting and intertemporal choice. J Econ Theory 144:1015–1053

Higashi Y, Hyogo K, Takeoka N (2014) Stochastic endogenous time preference. J Math Econ 51:77–92

Higashi Y, Hyogo K, Takeoka N, Tanaka H (2014) Comparative impatience under random discounting. Working paper

Karni E, Zilcha I (2000) Saving behavior in stationary equilibrium with random discounting. Econ Theory 15:551–564

Koopmans TC (1964) On flexibility of future preference. In: Shelley MW, Bryan GL (ed) Human judgments and optimality, chap 13. Academic, New York

Kraus A, Sagi JS (2006) Inter-temporal preference for flexibility and risky choice. J Math Econ 42:698–709

Kreps DM (1979) A representation theorem for preference for flexibility. Econometrica 47:565–578

Kreps DM (1992) Static choice and unforeseen contingencies. In: Dasgupta P, Gale D, Hart O, Maskin E (ed) Economic analysis of markets and games: essays in honor of Frank Hahn. MIT, Cambridge, pp 259–281

Kreps DM, Porteus EL (1978) Temporal resolution of uncertainty and dynamic choice theory. Econometrica 46:185–200

Krishna RV, Sadowski P (2013) Supplement to dynamic preference for flexibility: unobservable persistent taste shocks. Working paper

Krishna RV, Sadowski P (2014) Dynamic preference for flexibility. Econometrica 82:655–703

Krusell P, Smith A (1998) Income and wealth heterogeneity in the macroeconomy. J Polit Econ 106:867–896

Levhari D, Srinivasan TN (1969) Optimal savings under uncertainty. Rev Econ Stud 36:153–163

Mehra R, Sah R (2002) Mood fluctuations, projection bias, and volatility of equity prices. J Econ Dyn Control 26:869–887

Rothschild M, Stiglitz JE (1970) Increasing risk I: a definition. J Econ Theory 2:225–243

Rothschild M, Stiglitz JE (1971) Increasing risk II: its economic consequences. J Econ Theory 3:66–84

Rustichini A (2002) Preference for flexibility in infinite horizon problems. Econ Theory 20:677–702

Salanié F, Treich N (2006) Over-savings and hyperbolic discounting. Eur Econ Rev 50:1557–1570

Sandmo A (1970) The effect of uncertainty on saving decisions. Rev Econ Stud 37:353–360

Sarver T (2008) Anticipating regret: why fewer options may be better. Econometrica 76:263–305

Takeoka N (2007) Subjective probability over a subjective decision tree. J Econ Theory 136:536–571

Yaari ME (1965) Uncertain lifetime, life insurance, and the theory of the consumer. Rev Econ Stud 32:137–150

Acknowledgements

We would like to thank Larry Epstein for his illuminating guidance and constant support. We also thank Árpád Ábrahám, Larry Blume, Atsushi Kajii, Tomoyuki Nakajima, Jean-Marc Tallon, Katsutoshi Wakai, and the audiences of the 2005 JEA Spring Meeting, CETC 2006, and RUD 2006, Hosei, Keio, Kobe, Kyoto, Osaka, and Shiga Universities for useful comments. Detailed suggestions by an anonymous associate editor and two referees led to substantial improvements. Takeoka gratefully acknowledges the financial support by Grant-in-Aid for Scientific Research and MEXT.OPENRESEARCH(2004-2008). All remaining errors are the author’s responsibility.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendices

Hausdorff Metric

Let X be a compact metric space with a metric d. Let \(\mathcal{K}(X)\) be the set of all non-empty compact subsets of X. For x ∈ X and \(A,B \in \mathcal{K}(X)\), let

For all \(A,B \in \mathcal{K}(X)\), define the Hausdorff metric d H by

Then, d H satisfies (i) d H (A, B) ≥ 0, (ii) \(A = B \Leftrightarrow d_{H}(A,B) = 0\), (iii) \(d_{H}(A,B) = d_{H}(B,A)\), and (iv) \(d_{H}(A,B) \leq d_{H}(A,C) + d_{H}(C,B)\). Moreover, \(\mathcal{K}(X)\) is compact under the Hausdorff metric.

Perfect Commitment Menus

We follow the construction of menus by Gul and Pesendorfer (2004, Appendix A) (hereafter GP) and define the set \(\mathcal{L}\) of perfect commitment menus. Then we show that \(\mathcal{L}\) is homeomorphic to \(\varDelta (C \times \mathcal{L})\). That is, a perfect commitment menu can be viewed as a multistage lottery.

Let C denote the outcome space (consumption set), which is a compact metric space. We define the set of one-period consumption problems as \(\mathcal{Z}_{1} \equiv \mathcal{K}\left (\varDelta \left (C\right )\right )\). For t > 1, define the set of t-period consumption problems inductively as \(\mathcal{Z}_{t} \equiv \mathcal{K}\left (\varDelta \left (C \times \mathcal{Z}_{t-1}\right )\right )\). Let \(\mathcal{Z}^{{\ast}}\equiv \varPi _{t=1}^{\infty }\mathcal{Z}_{t}\). A menu is a consistent element of \(\mathcal{Z}^{{\ast}}\).

Formally, define \(G_{1}: C \times \mathcal{Z}_{1} \rightarrow C\), \(F_{1}:\varDelta (C \times \mathcal{Z}_{1}) \rightarrow \varDelta (C)\), and \(\overline{F}_{1}: \mathcal{K}(\varDelta (C \times \mathcal{Z}_{1})) \rightarrow \mathcal{K}(\varDelta (C))\) as follows:

for E in the Borel \(\sigma -\) algebra of C. For t > 1, we define inductively \(G_{t}: C \times \mathcal{Z}_{t} \rightarrow C \times \mathcal{Z}_{t-1}\), \(F_{t}:\varDelta (C \times \mathcal{Z}_{t}) \rightarrow \varDelta (C \times \mathcal{Z}_{t-1})\), and \(\overline{F}_{t}: \mathcal{K}(\varDelta (C \times \mathcal{Z}_{t})) \rightarrow \mathcal{K}(\varDelta (C \times \mathcal{Z}_{t-1}))\) by

for E in the Borel \(\sigma -\) algebra of \(C \times \mathcal{Z}_{t-1}\). Finally, we define \(\{z_{t}\}_{t=1}^{\infty }\in \mathcal{Z}^{{\ast}}\) is consistent if \(z_{t-1} = \overline{F}_{t-1}(z_{t})\) for every t > 1.

We identify a singleton menu with its only element by slightly abusing notation. Let \(\mathcal{L}_{1} \equiv \varDelta (C) \subset \mathcal{Z}_{1}\). An element of \(\mathcal{L}_{1}\) is a one-period “commitment” consumption problem. For t > 1, we define \(\mathcal{L}_{t}\) inductively as \(\mathcal{L}_{t} \equiv \varDelta (C \times \mathcal{L}_{t-1}) \subset \mathcal{Z}_{t}\). An element of \(\mathcal{L}_{t}\) is a t-period “commitment” consumption problem. Let \(\mathcal{L}^{{\ast}}\equiv \varPi _{t=1}^{\infty }\mathcal{L}_{t}\). We define the set of perfect commitment menus as \(\mathcal{L}\equiv \mathcal{Z}\cap \mathcal{L}^{{\ast}}\). Thus, an element in \(\mathcal{L}\) is a menu in which the DM is committed in every period.

Proposition 2

\(\mathcal{L}\) is homeomorphic to \(\varDelta (C \times \mathcal{L})\) .

Proof

GP construct a homeomorphism \(f: \mathcal{Z}\rightarrow \mathcal{K}(\varDelta (C \times \mathcal{Z}))\). Note that \(\mathcal{L}\) is compact since \(\mathcal{L}_{t}\) is compact for every t. It is sufficient to check that \(f(\mathcal{L}) =\varDelta (C \times \mathcal{L})\).

Definition 8

Let \(Y _{1} \equiv \hat{ L}_{1} \equiv \varDelta (C)\) and for t > 1 let \(Y _{t} \equiv \varDelta (C \times \varPi _{n=1}^{t-1}\mathcal{Z}_{n})\) and \(\hat{L}_{t} \equiv \varDelta (C \times \varPi _{n=1}^{t-1}\mathcal{L}_{n})\). Define \(Y ^{\mathit{kc}} \equiv \{\{\hat{\mu _{t}}\} \in \varPi _{t=1}^{\infty }Y _{t}\,\vert \,\text{marg}_{C\times \varPi _{n=1}^{t-1}\mathcal{Z}_{n}}\hat{\mu }_{t+1} =\hat{\mu } _{t}\}\). Let \(\hat{L}^{\mathit{kc}} = Y ^{\mathit{kc}} \cap \varPi _{t=1}^{\infty }\hat{L}_{t}\).

GP show that for every \(\{\hat{\mu }_{t}\} \in Y ^{\mathit{kc}}\) there exists a unique \(\mu \in \varDelta (C \times \mathcal{Z}^{{\ast}})\) such that \(\text{marg}_{C}\mu =\hat{\mu } _{1}\) and \(\text{marg}_{C\times \varPi _{n=1}^{t}\mathcal{Z}_{n}}\mu =\hat{\mu } _{t}\). Then they define \(\psi: Y ^{\mathit{kc}} \rightarrow \varDelta (C \times \mathcal{Z}^{{\ast}})\) as the mapping that associates this μ with the corresponding \(\{\hat{\mu }_{t}\}\).

- Step 1::

-

\(\psi (\hat{L}^{\mathit{kc}}) =\varDelta (C \times \mathcal{L}^{{\ast}})\).

Note that, for a sequence \(\{\hat{l}_{t}\} \in \hat{ L}^{\mathit{kc}}\), it holds that

The same argument of Lemma 3 in GP shows that there exists a homeomorphism \(\psi ^{{\prime}}:\hat{ L}^{\mathit{kc}} \rightarrow \varDelta (C \times \mathcal{L}^{{\ast}})\) such that \(\text{marg}_{C}\psi ^{{\prime}}(\{\hat{l}_{t}\}) =\hat{ l}_{1}\) and \(\text{marg}_{C\times \varPi _{n=1}^{t-1}\mathcal{L}_{n}}\psi ^{{\prime}}(\{\hat{l}_{t}\}) =\hat{ l}_{t}\). The uniqueness part of the Kolmogorov’s Existence Theorem implies that \(\psi ^{{\prime}} =\psi \vert _{\hat{L}^{\mathit{kc}}}\). Step 1 thus follows.

Definition 9

Let \(D_{t} \equiv \{ (z_{1},\ldots,z_{t}) \in \varPi _{n=1}^{t}\mathcal{Z}_{n}\,\vert \,z_{k} = \overline{F}_{k}(z_{k+1}),\,\forall k = 1,\ldots,t - 1\}\) and \(D_{t}^{L} \equiv D_{t} \cap \varPi _{n=1}^{t}\mathcal{L}_{n}\). Define \(M^{c} \equiv \{\{\mu _{t}\} \in \varDelta (C) \times \varPi _{t=1}^{\infty }\varDelta (C \times \mathcal{Z}_{t})\,\vert \,F_{t}(\mu _{t+1}) =\mu _{t},\ \forall t \geq 1\}\). Let \(Y ^{c} \equiv \{\{\hat{\mu }_{t}\} \in Y ^{\mathit{kc}}\,\vert \,\hat{\mu }_{t+1}(C \times D_{t}) = 1,\forall t \geq 1\}\) and \(\hat{L}^{c} \equiv Y ^{c} \cap \hat{ L}^{\mathit{kc}}\).

Note that \(\mathcal{L} = M^{c} \cap \mathcal{L}^{{\ast}}\). GP show that for every \(\{\mu _{t}\} \in M^{c}\) there exists a unique \(\{\hat{\mu }_{t}\} \in Y ^{c}\) such that \(\hat{\mu }_{1} =\mu _{1}\) and \(\text{marg}_{C\times \mathcal{Z}_{t-1}}\hat{\mu }_{t} =\mu _{t}\) for every t ≥ 2. Then they define \(\phi: M^{c} \rightarrow Y ^{c}\) as the mapping that associates this {μ t } with the corresponding \(\{\hat{\mu }_{t}\}\).

- Step 2::

-

\(\phi (\mathcal{L}) =\hat{ L}^{c}\).

It is straightforward from the definition of ϕ that \(\phi (\mathcal{L}) \supset \hat{ L}^{c}\). We show \(\phi (\mathcal{L}) \subset \hat{ L}^{c}\) or \(\phi (\mathcal{L}) \subset \varPi _{t=1}^{\infty }\hat{L}_{t}\) by mathematical induction. Take \(\{l_{t}\} \in \mathcal{L}\) and let \(\{\hat{\mu }_{t}\} \equiv \phi (\{l_{t}\}) \in Y ^{c}\). By definition, \(\hat{\mu }_{1} = l_{1} \in \varDelta (C) =\hat{ L}_{1}\) and \(\hat{\mu }_{2} = \text{marg}_{C\times \mathcal{Z}_{1}}\hat{\mu }_{2} = l_{2} \in \varDelta (C \times \mathcal{L}_{1}) =\hat{ L}_{2}\).

Suppose that \(\hat{\mu }_{k} \in \hat{ L}_{k}\) for every k = 1, 2, …, t. Since \(\{\hat{\mu }_{t}\}\) is a Kolmogorov consistent sequence, \(\text{marg}_{C\times \varPi _{n=1}^{t-1}\mathcal{Z}_{n}}\hat{\mu }_{t+1} =\hat{\mu } _{t} \in \hat{ L}_{t}\). Thus, \(\hat{\mu }_{t+1} \in \varDelta (C \times \varPi _{n=1}^{t-1}\mathcal{L}_{n} \times \mathcal{Z}_{t})\). The definition of ϕ implies that \(\text{marg}_{C,\mathcal{Z}_{t}}\hat{\mu }_{t+1} = l_{t+1} \in \varDelta (C \times \mathcal{L}_{t})\). Therefore, \(\hat{\mu }_{t+1} \in \hat{ L}_{t+1} =\varDelta (C \times \varPi _{n=1}^{t}\mathcal{L}_{n})\).

- Step 3::

-

\(\psi (\hat{L}^{c}) =\{ l \in \varDelta (C \times \mathcal{L}^{{\ast}})\,\vert \,l(C \times \mathcal{L}) = 1\}\).

Since \(\hat{L}^{c} =\{\{\hat{ l}_{t}\} \in \hat{ L}^{\mathit{kc}}\,\vert \,\hat{l}_{t+1}(C \times D_{t}^{L}) = 1,\forall t \geqq 1\}\), Step 3 follows from the same argument of Lemma 5 in GP.

GP define \(\xi: \mathcal{Z}\rightarrow \mathcal{K}(M^{c})\) as \(\xi (z) \equiv \{\{\mu _{t}\} \in M^{c}\,\vert \,\mu _{t} \in z_{t},\ \forall t \geq 1\}\). Note that \(\xi\) is identity on \(\mathcal{L}\). Finally, the homeomorphism \(f: \mathcal{Z}\rightarrow \mathcal{K}(\varDelta (C \times \mathcal{Z}))\) is given by \(f(z) =\psi \circ \phi (\xi (z))\). Then the above steps imply that \(f(\mathcal{L}) =\psi \circ \phi (\xi (\mathcal{L})) =\psi \circ \phi (\mathcal{L}) =\varDelta (C \times \mathcal{L})\).

Proof of Theorem 1

4.1 Necessity

Necessity of the axioms is routine. We show that for any (u, μ) there exists U satisfying the functional equation.

Let \(\mathcal{U}\) be the Banach space of all real-valued continuous functions on \(\mathcal{Z}\) with the sup-norm metric. Define the operator \(T: \mathcal{U}\rightarrow \mathcal{U}\) by

Since T(U) is continuous, the operator T is well-defined. To show T is a contraction mapping, it suffices to verify that (i) T is monotonic, that is, T(U) ≥ T(V ) whenever U ≥ V, and (ii) T satisfies the discounting property, that is, there exists δ ∈ [0, 1) such that for any U and \(c \in \mathbb{R}\), T(U + c) = T(U) +δ c.

- Step 1::

-

T is monotonic.

Take any \(U,V \in \mathcal{U}\) with U ≥ V. Since \(\int U(z)\,\mathrm{d}l_{z} \geq \int V (z)\,\mathrm{d}l_{z}\) for all \(l \in \varDelta (C \times \mathcal{Z})\), we have

for all x and α, and hence T(U)(x) ≥ T(V )(x) as desired.

- Step 2::

-

T satisfies the discounting property.

Let \(\delta \equiv \bar{\alpha }\). By assumption, δ ∈ [0, 1). For any \(U \in \mathcal{U}\) and \(c \in \mathbb{R}\),

By Steps 1 and 2, T is a contraction mapping. Thus, the fixed point theorem (See Bertsekas and Shreve 1978, p. 55) ensures that there exists a unique \(U^{{\ast}}\in \mathcal{U}\) satisfying \(U^{{\ast}} = T(U^{{\ast}})\). This U ∗ satisfies Eq. (20.1).

4.2 Sufficiency

Lemma 1

Commitment Independence, Stationarity, and Timing Indifference imply Independence, that is,

for all \(x,y,z \in \mathcal{Z}\) and \(\lambda \in (0,1)\) .

Proof

Let \(x \succ y\). From Stationarity, \(\{(c,x)\} \succ \{ (c,y)\}\). For any \(\lambda \in (0,1)\), Commitment Independence implies \(\{\lambda \circ (c,x) + (1-\lambda ) \circ (c,z)\} \succ \{\lambda \circ (c,y) + (1-\lambda ) \circ (c,z)\}\). From Timing Indifference, \(\{(c,\lambda x + (1-\lambda )z)\} \succ \{ (c,\lambda y + (1-\lambda )z)\}\). Again, from Stationarity, \(\lambda x + (1-\lambda )z \succ \lambda y + (1-\lambda )z\). □

Let \(\overline{\mathrm{co}}(x)\) denote the closed convex hull of x. As in DLR, Order, Continuity, and Independence imply \(x \sim \overline{\mathrm{co}}(x)\). Hence we can pay attention to the sub-domain