Abstract

Fostering a country’s competitiveness is crucial to provide a viable escape from the current crisis. Using a novel micro-level dataset (EFIGE dataset), this chapter analyzes the relationship between firm-level productivity and the ability of a firm to compete in international markets. Subsequently, the chapter investigates the link between productivity and access to external financing during the crisis. We found that more productive firms are less likely to apply for external financing, but once they do apply for extra credit, they experience a higher probability of obtaining the loan. This selection mechanism is, however, effective only at very low levels of productivity, and creates some friction when firms move up the productivity ladder. This evidence calls for renewed attention by policymakers to ensure that the implementation of new banking regulations is able to guarantee an allocation of credit and access to finance that correlates to firms’ underlying productivity.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The ability to “grow out” of the crisis is currently widely recognized as the only viable long-term option for the sustainability of the EU. The situation in Japan is similar, with signs that economic stagnation and high levels of public debt are once again looming. And yet, much of the current policy debate tends to revolve around the short-term aspects of recovery, related to financial stability in the wake of the crisis, be it the collapse of Lehman Brothers or the euro area. While the latter is of paramount importance for the overall sustainability of the world economy, much less emphasis is devoted to the equally important discussion on competitiveness-enhancing “structural” reforms conducive to higher growth and prosperity.

From a political economy perspective, the latter asymmetric behavior is quite rational; the political return on crisis-management policies is larger as governments have a greater ability to use well-known tools (fiscal or monetary policies) that are able to influence, in the short-run, the business cycle. In contrast, the political return on structural reforms is perceived to be low, as the effectiveness of the policy actions is less clear and, if anything, significant changes in competitiveness might take place only in the medium- to long-run. As a result, stability comes first in the political agenda, while structural reforms tend to be postponed to “better times”.

The risk of such an approach is that the resulting policy framework implicitly generates a trade-off between stability and competitiveness-enhancing policies, with the former clearly dominating the latter. While the political dividend of such a setup might be relevant in the short-run, over time the resulting institutional framework might impose a straightjacket on growth, with both Europe and Japan possibly being very stable over the next decades but also marginal players in the global arena.

To solve such a conundrum, it is useful to recall a general rule of economic policy, stating that the number of instruments at hand has to be equal to the number of objectives we want to achieve. It then follows that if stability and growth have to be jointly pursued in our quest for a new financial model, one should identify and use a set of tools able to exert effects on both the short- and long-term phase of the cycle. In other words, mutatis mutandis, one should complement policy actions envisaged as a short-term reaction to the crisis with regulatory changes in the structural features of the economy (essentially the functioning of labor and capital markets) in ways conducive to the creation of a more competitive economic environment characterized by higher growth rates.

In this chapter we attempt to capitalize on new evidence from a representative set of European firms, to assess the extent to which European financial markets are able to reallocate resources to firms in ways that are conducive to growth. We find a significant degree of heterogeneity across countries with some potentially adverse results in terms of competitiveness, showing a significant scope for policy action to reform the EU financial model to become more conducive to growth.

In particular, Sect. 2 of the chapter presents our dataset and Sect. 3 develops some measures of competitiveness at the firm-level, essentially related to productivity and the ability of firms to export to international markets. Section 4 links the characteristics of these “competitive” firms to the functioning of EU financial markets, while Sect. 5 concludes with some policy implications.

2 A Micro-level Approach: Data Description

This analysis relies on the EU-EFIGE/Bruegel-UniCredit dataset (hereafter the EFIGE dataset), a unique firm-level dataset collected within the project EFIGE—European Firms in a Global Economy: internal policies for external competitiveness, supported by the Directorate General Research of the European Commission through its 7th Framework Programme.Footnote 1 The dataset presents a number of desirable features, as it surveyed approximately 15,000 manufacturing firms of more than ten employees, across seven European countries, and is constructed to obtain representative samples for each country. Table 1 provides an overview of the sample.

The selected firms answered a questionnaire, covering several dimensions of their strategies. The topics of the various survey sections included ownership and managerial structure, labor force, innovation and R&D activities, exposure to international markets, financial relations and business environment. The survey was administrated in 2010 with a focus on the activities of the previous 2 years. However, by merging the dataset to balance sheet information, it was possible to collect balance sheet data for all the surveyed firms for the period 2001–2009, exploiting the information provided by Amadeus, a firm-level dataset by Bureau van Dijk covering firms all over Europe.Footnote 2 The latter enabled analysis with a multiple time dimension.

Using the Amadeus data, a measure of firm-level productivity was computed. Among the various indicators of productivity (Unit Labor Cost, Labor Productivity, Total Factor Productivity—TFP), we adopted TFP, consistent with the theory and previous empirical results. As an indicator, TFP considers the impact of different factors of production on output and is easily comparable across sectors with different production functions. The idea behind TFP is that productivity can be thought of as a firm’s ability to combine inputs to obtain a given output. In other words, one could state that a firm that produces greater outputs, given a certain allocation of inputs, has a higher level of productivity. Thus, productivity is quantitatively captured as the residual term of the estimation of the following production function in Eq. (1):

Consistent with standard practice in the economic literature, productivity was computed following the approach proposed by Levinsohn and Petrin (Levinsohn and Petrin 2003). The authors provide a measure of Total Factor Productivity that is not affected by the simultaneity bias that might occur with a standard Ordinary Least Square (OLS) estimate of Eq. (1), because the residual term, which the model regards as productivity, is unobserved by the econometrician. However, some part of it might be known to the firm when deciding on the amount of inputs to be used, especially capital and labor. The solution adopted by the authors consists in a semi-parametric estimation of Eq. (1), using the total cost of materials as an instrumental variable to solve the simultaneity bias problem (see Levinsohn and Petrin 2003 for the assumptions behind this choice).

Table 2 shows the descriptive statistics for the sample. Note that the number of firms presented is constant over time, whereas the other figures vary. The table also reports the average value of each variable by country over the considered time span.

The table suggests that there are some relevant structural differences among the sample countries. We notice, for instance, that firms located in Italy and Spain are much smaller in terms of the average number of employees; conversely, firms located in the United Kingdom, Hungary and Germany employ many more workers than the sample average. This difference does not always correspond to a proportional mark-up in terms of TFP.

3 Competitiveness Analysis with Firm-Level Data

One of the advantages emerging from the use of firm-level data is that it is much easier to take into account the differentiated impact of policy actions accruing from firm heterogeneity, i.e., the fact (confirmed by a vast body of literature, as in Mayer and Ottaviano 2008) that within an industry or country there are many low-performing firms and just a few high-performers. The point is exemplified in Fig. 1: working at the aggregate-level, i.e., using “average” indicators at a country- or industry-level, would typically imply the assumption of an underlying normal distribution for each firm-level variable, as represented in blue in the figure. However, empirical evidence suggests that any firm performance will be displayed with the majority of firms located on the left-hand side of the distribution and just a few on the right tail. In other words, any performance indicator at an industry or country-level, deriving from the aggregation of heterogeneous firms, will be distributed according to a Pareto-type density function, as depicted in red in Fig. 1. It stands then that working at the aggregate-level would imply a misspecification of reality, because an eventual aggregate performance measure calculated using means risks being biased, most likely upwards, thus delivering a distorted picture of the real underlying competitive position of a given industry or country.

Actual distribution of firms. Source: Altomonte et al. (2011)

The same will be true if we try to assess the extent to which the structure of a given financial market is conducive for higher levels of competitiveness. In an environment characterized by firm heterogeneity, what really matters is not (only) whether, e.g., credit has been eased or not, on average, in the aftermath of the crisis, but rather whether this increase is in line with firms’ productivity. In other words, the general functioning of financial markets has to be assessed with respect to the differentiated impact it will generate on the heterogeneous performance of firms and, via this way, on the economy as a whole. Coming back to the previous example, if there has been a relatively low increase in the cost of credit for the more productive firms, the post-crisis context would set in motion a Schumpeterian selection effect in which less productive firms would find it increasingly difficult to access capital and therefore exit. This produces potential benefits for aggregate productivity. By the same token, a policy seeking to promote corporate access to capital in this context would also result in an efficient (with respect to productivity and growth) allocation of capital across firms.

In contrast, if the functioning of capital markets is such that access to capital is eased for all firms across the board, irrespective of their productivity levels, or, worse still, if the relatively less productive (but better connected) firms end up having better access to finance during and after the crisis, then the effect of the reallocation of capital induced by the crisis (and/or a specific policy in this context) would harm aggregate productivity, as the most competitive firms would be constrained in their growth.

The first step of the research is thus to identify “competitive” firms in our sample, to learn about their relations with financial intermediaries vs. those of relatively less competitive firms. We define competitiveness as the ability of firms to compete in international markets, as the latter is also often cited as a distinctive element of “competitiveness” at the country-level. Moreover, as will be explained in the following analysis, such a definition of competitiveness is strictly linked to each firm’s TFP.

We start our analysis by creating a binary variable, giving a value of one to those firms that exported at least part of their output before or during 2008, and otherwise zero. Table 3 provides the shares of exporting firms across the sample countries (the so-called “extensive margin” of exports).

It emerges that there are no structural differences among the considered countries, with the shares of the active firms being very similar to one another. However, in light of the above arguments, it could well be the case that within-country heterogeneity might matter more than across-country heterogeneity.

Figure 2 plots the (log) distribution of TFP for exporting firms vs. non-active abroad firms, which are defined as those that do not operate in any way in international markets (through export, import, outsourcing or foreign direct investment—FDI). It clearly emerges that those firms that are able to compete in international markets have, on average, higher TFP levels, as witnessed by the thicker right tail of the distribution. It also emerges, not surprisingly, that there is a substantial heterogeneity among firms (note that Fig. 2 reports a log-distribution), with a long right tail of very productive firms (even within firms that are non-active abroad) and a clear mass of relatively less productive firms.

Figure 3 provides further evidence supporting this issue, which reports the shares of exporting firms for the various TFP deciles.

It stands clear that after a certain level of productivity, the probability that the firm exports at least some of its products substantially increases, in particular from the 7th decile onward. Referring to the economic literature (e.g., Melitz 2003; Melitz and Ottaviano 2008), the latter can be considered in our sample as the “cut-off” (i.e., the minimum level) for productivity that enables firms to compete in international markets. Those firms that survive but cannot meet the “cut-off” are instead more likely to only operate in the domestic market.

The analyzed relationship is robust regarding econometric evidence, which shows on average a 10% productivity premium of exporting vs. domestic firms across the sample, even controlling for country- or industry-specific characteristics. Furthermore, the identified “cut-off” is significant as it is associated with a 95% probability of exporting when TFP is above the 7th decile of the underlying distribution (and always controlling for country and industry characteristics).

We can therefore conclude that the concept of TFP is a significant proxy of the competitiveness of a firm in international markets, and thus we can use this variable when assessing the functioning of financial institutions in Europe.

4 Competitiveness and Capital Markets

In this section we try to establish a link between our proxy of competitiveness and its relationship with the workings of financial markets. In particular, we analyze this interaction along three dimensions: the first relates to the financial characteristics of the firm, measured via a set of variables constructed using Amadeus balance sheet information; the second dimension exploits data provided by EFIGE and analyzes the extent to which firms are credit rationed as a function of their productivity; and finally we analyze the purposes and uses of the extra credit, when obtained.

Six indicators have been created to measure the financial shape of a firm following the growing literature on the link between firm-level performance and capital markets.Footnote 3 First, the Financial Independence Index (FII) is computed as the sum of capital and cash flows, divided by total assets; it measures the extent to which a firm self-finances its long-term economic activity. The Cash Ratio (CashR), obtained as the ratio between cash flows and current liabilities, measures the ability of a firm to repay short-term debt just with generated cash flows. The Index of Financial Pressure (IFP) is computed as the ratio between interest payments and the sum of profits, depreciation and interest payments itself; it ranges from zero to one, with one indicating higher financial pressure. The Current Ratio (CurrR), given by current assets over current liabilities, and measures the ability of a firm facing short-term debt with activities to be carried out in the short-term. The Liquidity Ratio (LR), computed as the difference between current assets and current liabilities, divided by total assets, measures the extent to which a firm is able to repay its current asset with short-term liabilities. Last, the Leverage Ratio (LevR), measured as the ratio between total debt and capital, indicates the degree that a company depends on external financial sources.Footnote 4

To correctly assess the relationships between the various financial characteristics and productivity, the following model is estimated:

where TFP is, as usual, Total Factor Productivity, F is one of the six financial indicators introduced aboveFootnote 5 and FE is a matrix of fixed firm-level controls for a country, the industry of activity (measured as 2-digit NACE revision 1.1), the size of the firm and the year of observation. The introduction of these controls enables the ruling out of a possible compositional effect that might bias the estimation, as some sectors or countries could be characterized by high productivity and better financial shape; controlling for the specified fixed-effects ensures that the estimate obtained is not driven by any compositional effect.

In the light of what emerged in Figs. 1 and 2 concerning the Pareto-shaped distribution of productivity, estimating the model in Eq. (2) via OLS appears inconsistent because this would imply working on average effects; we instead used a quantile regression (Koenker and Bassett 1978), which estimates a linear model for each specified quantile. This method captures the various impacts of the regressors considered at different levels of the dependent variable. Figure 4 provides a graphical representation of the coefficients estimated from Eq. (2), showing all six financial indicators considered for the ten deciles of TFP. Analyzing the figure, it is important to first focus on the vertical axis of each graph and note that each indicator is linked to TFP with a sign indicating that more productive firms are, on average, in better financial shape (with respect to all the indicators considered). This relationship would also have been estimated with an OLS model, as it is represented by the horizontal lines on the graphs indicating the “average” OLS estimated coefficient and its confidence interval. However, the quantile regression approach adopted goes further, providing information on the relationship at different levels of TFP. Indeed, it emerges that for all the analyzed indicators, with the exception of LevR, the relationship between TFP and financial well-being is not only positive, but it increases along the deciles of TFP. Thus, at higher levels of productivity, the positive relationship between the financial indicator with TFP is even stronger.Footnote 6

The positive and increasing relationship estimated is consistent with a simple comparison of the averages of the indicators at different levels of productivity, but the former does not suffer from the composition effect that might bias the latter, as discussed above. To provide further evidence, the average value of the FII is 0.36 for firms in the first decile of productivity and 0.66 for those in the last decile; likewise, the average value for Index of Financial Pressure decreases from 0.22 for the first decile to 0.06 for the final one. Comparable patterns were obtained for all indicators. This analysis provides some preliminary insights into the relationship between productivity and capital markets. Indeed, it suggests that there exists a relationship between the financial shape of a firm and its productivity—its ability to compete in international markets.

After identifying a link between productivity and financial well-being, we can now investigate whether more productive firms also have easier access to capital markets, in particular via the banking system. In other words, we wish to investigate the extent to which banks are able to discriminate among firms when dealing with credit requests. Note too that the timing of the survey, conducted in 2010 over the period 2008–2009, enabled us to focus on the effect of the crisis on credit rationing. Using EFIGE data, it was possible to identify 1,997 firms that applied for extra credit in 2008.

These firms have been subsequently classified according to the outcome of the request: firms whose requests were successful and credit granted at the same rate as the previous year were classified as non-rationed; those whose requests were successful but the loans were subject to higher rates than the previous year were classified as weakly credit rationed; and those whose requests for extra credit were denied were classified as strongly credit rationed.Footnote 7

Table 4 provides a snapshot of the issue in the various sample countries.Footnote 8 It is evident that in every country, with the exception of the United Kingdom, the most common classification is weak credit rationing, followed by strong rationing.

The table indicates that the issue of strong credit rationing is more likely to occur in southern Europe, especially Italy, where more than one in three firms had their credit applications denied. This percentage decreases until it reaches the value for the United Kingdom, where only 7.4% of the applicant firms were refused. In each country, the percentage of strongly-rationed firms is inversely proportional to that of non-rationed firms. However, it emerges that the vast majority of firms in all countries, with the exception of the United Kingdom, face the serious issue of weak rationing, with a percentage range of 33% (United Kingdom) to 48% (Hungary). This indicates that even if the bank did accept the credit request, the firm had to pay a higher interest rate compared with the previous year.

Figure 5 shows the percentages of the various extents of credit rationing according to the deciles of TFP. On the one hand, a virtuous pattern can be identified when considering together the non-rationed and weakly rationed firms, because the sum of the two categories increases with TFP deciles. The first decile has a value of 60%, increasing to 80% for the last one. The latter indicates that firms in the upper deciles of TFP, once they apply for more credit, are more likely to see their request fulfilled, possibly at marginally higher rates with respect to the previous year. Indeed, 39% of the firms in the first decile of productivity that applied for extra credit had their requests denied, while the figure lowers to 18% for firms in the tenth decile of productivity.

However, on the other hand, we notice that some forms of weak rationing persists during the crisis regardless of the TFP decile in which the firm requesting credit is operating. The latter casts a shadow on the ability of the financial markets to provide credit to the “right” firm via adequate forms of screening. Clearly, it is important to bear in mind that the variable on credit rationing is defined only for those firms that actually applied for extra credit, while the vast majority of firms in our sample decided not to follow this road, either because they did not require credit or perhaps due to the fact that they believed that they were unlikely to be successful. For these reasons, Fig. 5 provides a reduced level of information regarding the relationship between access to the capital markets and productivity.

Hence, to obtain a clearer overview of the issue, Table 5 (from which Fig. 5 was generated) presents further evidence regarding credit rationing across TFP deciles.Footnote 9 Indeed, the table suggests that the number of firms that apply for extra credit is not irrespective of productivity; as the last column of the table shows, the figure is constantly diminishing with the increase of TFP deciles, indicating that firms in higher deciles of productivity are self-selected, in the sense that, not surprisingly, they are less likely to apply for credit.

This evidence is of major importance with respect to the research question of this analysis, and it is also consistent with the evidence derived from Table 4. More productive firms have a stronger financial structure and rely less on external financing; as a direct implication they are less likely to apply for extra credit, and even if they do, they appear to have easier access to additional loans.

To assess the issue with a robust econometric tool, we estimate a Heckman selection model (Heckman 1976), where the first stage is a probit estimate on the probability of applying for more credit, given the productivity of a firm and the fact that it undertakes, or not, R&D activities.Footnote 10 Once the fact that the firm has actually applied for extra credit has been accounted for, the second stage consists in an OLS estimate of the correlation of TFP with three possible outcomes for the variable on credit rationing. The results (not reported here) support what has already emerged: productivity has a negative impact on the probability of requesting credit, but once the additional loan is requested, more productive firms face lower probabilities of seeing the request denied, and also of being charged higher interest rates.

In the next stage of the analysis we focus on assessing the extent to which banks are able to discriminate among firms. It has been shown in Table 4 that there is a strong ongoing relationship between Total Factor Productivity and the financial shape of a firm. Thus, it seems reasonable to assume that when deciding whether or not to grant a loan, banks are able to observe more easily the financial structure of a firm (and then decide) rather than its productivity.

We rely on this assumption and move to compare the relationship between TFP and the financial characteristics of the firms in the sub-sample of firms that did not apply for credit or applied and received it (both proper non-rationed firms and weakly rationed ones) vs. the sub-sample of strongly rationed firms. In particular, we focus on the two liquidity-related variables, CashR and CurrR, as these indicators do not depend directly on the fact of having received a loan, like FII and LevR, or through the repayment of interests, as with IFP.

If this relationship does not vary from one sub-sample to another, then it implies that banks are not effective in discriminating among firms; conversely, a significant change in the relationship would imply that credit rationed firms are actually different from others. From a more formal viewpoint, a quantile regression is appropriate here, following the model in Eq. (2), and includes an interaction term between the financial indicator (CashR and CurrR) and the binary variable “rationed” (taking a value of one for strongly rationed firms). The resulting equation is as follows:

Table 6 provides the results of the estimate for the coefficients of the financial indicators, for both rationed and non-rationed firms. The analysis on both variables suggests that rationed firms are actually different from non-rationed ones, but only if residing on the extreme left-hand side of the distribution of TFP. Indeed, we notice that in the first deciles of productivity the relationship of both financial variables with TFP for rationed firms is positive and steeper than the one estimated for the remainder of the sample. This implies that firms with low productivity are strongly related to very poor financial structure and for this reason tend to be credit constrained.

However, moving up the TFP deciles, with respect to both indicators, this relationship is weaker and, from the fourth decile onward, the coefficients estimated for the sub-sample of strongly rationed firms are no longer different from the rest of the sample. This indicates that banks are effective in discriminating among credit requests, mainly at very low levels of productivity, which are associated with very poor financial structures. After the 4th decile of productivity no structural difference emerges between the two sub-samples. This finding is important as it highlights the diminishing power of banks to select “good” firms as firms’ productivity increases, thus identifying a need for policies that improve access to capital markets.

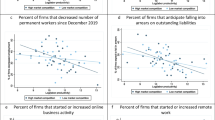

The last paragraph of this analysis on the link between productivity and capital markets focuses on the uses of external financing. As noted by Rajan and Zingales (1998), in a financial crisis there is a clear link between a firm’s performance and its reliance on external finance vs. internal cash flows, with the latter being a better setup in a crisis context. The EFIGE survey data also enable us to explore this issue, as shown in Table 7, revealing that on average 44.5% of European firms have applied for external finances during the crisis. However, this is a very heterogeneous picture, with figures ranging from as low as 20% for German firms to more than 60% in the case of Italian and Spanish firms. The issue is further deepened by focusing on those firms that actually increased the total amount of external financial resources in 2008–2009. In the second column of the table we see that almost half of the firms that depend on external financing actually increased the amount of the latter during the previous year. This is true for most of the countries with the exception of the United Kingdom and France, where percentages sit around 30%. To obtain a true understanding of the extent of this phenomenon, the figures have to be compared with the percentages provided in the first column of the table.

Moreover, it is of major relevance to understand whether a firm that applied for this external finance and obtained it means to use it to foster investments, to reorganize its financial structure or to fulfill some cash flow needs. Exploiting the richness of the dataset it is possible to identify the main use (one of six categories) of the obtained loans according: investments, M&A operations with related firms, M&A operations with unrelated firms, liquidity needs, optimization of the financial structure or other uses. All the possible usages of the loans listed should be considered favorably, as they all imply a plan of growth for the firm, with the exception of “liquidity needs” because the request of a loan with the scope of fulfilling cash flow needs is in itself an indicator of some malfunctioning of the firm, where it is unable to cope with its current economic activity needs.

Table 8 reports evidence from the sample of the uses of external financing, by country.Footnote 11 The main piece of information provided by the table is that loans meant to fulfill liquidity needs are by far the most frequent instance: more than one of every two granted loans are used with this purpose. Furthermore, the figure is particularly high in some countries, such as Italy and Spain, where the figures are 58% and 66%, respectively, and also the United Kingdom with a share of more than 40%. Data concerning Italy and Spain are particularly relevant if we combine them with the information provided by Table 7. Indeed, we notice that a significant number of firms in these two countries increased their external financing with respect to the rest of the sample, and the vast majority of those firms used the obtained loan to address liquidity deficiencies. Given the relevance of the issue it is important to specify that this figure strongly depends on the role of the banking system in each country. It is also important to bear in mind that the magnitude of the issue could suffer from an upward bias because of the specific timing of the survey (that is, the financial crisis, with all the well-known implications on liquidity). Nevertheless, the results are quite striking.

Consistent with the approach adopted so far, we now consider the destinations of extra credit, taking into account firm-level heterogeneity. Figure 6 shows the percentages of the various uses of external financing using TFP deciles. The first feature reported in the figure is that the share of firms using the extra credit for liquidity needs drops considerably as the TFP deciles increase, decreasing from more than 70% to 35% by the last TFP decile.

Jointly with this effect we also notice a relative increase in the occurrence of other uses of the external financing: mainly investment, optimization of the financial structure and M&A activities with related firms. This piece of information completes the framework of the analysis, from which it emerges that there is, indeed, a strong relationship between competitiveness and access to capital markets.

5 Conclusions and Policy Implications

The evidence collected shows a differentiated picture in terms of capital markets functioning in ways that are conducive for growth and competitiveness. First of all, we found that more productive firms are in general less likely to apply for external financing via bank loans. This is primarily due to their better financial shape, which means that they are less dependent on external resources in both the short- and long-term, but rely mainly on equity and operating cash flows. They are also subject to weaker financial pressure, which means that a smaller part of their economic activity is consumed by interest repayments.

However, it has been assessed that if more productive firms do apply for credit then they are more likely to receive it and to obtain it at the same interest rate as in the previous year. This seemingly trivial issue is, indeed, of major relevance because it suggests that even in a period of crisis with high liquidity constraints, banks in the surveyed countries have been, on average, able to discriminate and offer loans more easily to “good” firms rather than to unproductive ones.

However, we have further deepened this issue by identifying some ambiguity that occurs within this selection mechanism: banks appear significantly more effective in discriminating firms at very low levels of productivity whereas the selection process seems less precise moving up the deciles of productivity, namely from the fourth decile onward. The picture is eventually completed observing that once productive firms are granted extra credit, they are less likely to use it to replace deficiencies of the current economic activity. Rather, they are more likely to use it to foster economic growth through new investments or extraordinary finance operations, or to reorganize their financial structure.

We therefore derive a situation in which the underlying function of credit allocation by financial markets might have changed in some countries during the crisis, in ways not necessarily correlated with the productivity of the firms receiving credit. If the latter situation persists, we could face in some countries a situation in which credit is not allocated in terms of firms’ productivity, with detrimental consequences for growth.

The latter outcome clearly calls for renewed attention by policymakers, not only at an EU-level but also (because of the emerging heterogeneity) nationally, making sure that the implementation of new banking regulations is able to ensure an allocation of credit and an access to finance that correlates with the underlying firms’ productivity. Incidentally, such a feature of the credit markets does not often arise in the current debate on financial stability and reforms of banking regulation; but it is an issue that requires urgent discussion.

Notes

- 1.

Additional project information can be obtained from the official web site: www.efige.org

- 2.

See www.bvdinfo.com for further information on the dataset.

- 3.

- 4.

Annex shows the equations relative to each indicator.

- 5.

The indicators are not introduced together in the regression to avoid multicollinearity problems.

- 6.

The relationship estimated with respect to IFP and LevR is negative and decreases with TFP deciles because both indicators have a negative connotation.

- 7.

The definitions of weak and strong credit constraints are derived from those proposed by Minetti and Zhu (2011), who worked on a similar variable for Italy.

- 8.

Note that the percentages are computed over the number of firms that applied for extra credit, by country.

- 9.

Take note that the total number of credit rationed firms does not match the figure of 1,997 presented previously. This is because the 2008 TFP value for 736 firms is missing.

- 10.

The inclusion of R&D in the estimate has the function of exclusion restriction: it is a variable that is correlated with the selection term (probability of requesting extra credit) but not necessarily with the dependent variable of the outcome equation (TFP). Our results show that R&D is slightly positively and significantly correlated with TFP in our sample (+0.0377***), but much more with the probability of requesting credit (+0.2932***). The exclusion restriction helps the strong identification of the selection equation and thus of the model.

- 11.

Note that the original question in the survey concerns the use of the increased external finance, including different sources of financing, mainly bank loans and securities; given the purpose of the research we have considered only the firms that financed through the banking system. However, when considering both sources of financing the distribution of uses by TFP deciles is not affected by major structural changes.

References

Altomonte C, Barba Navaretti G, di Mauro F, Ottaviano G (2011) Assessing competitiveness: how firm-level data can help. Policy contributions 643, Bruegel

Forlani E (2010) Liquidity constraints and firm’s export activity. Development Working Papers 291, Centro Studi Luca d’Agliano, University of Milano

Heckman J (1976) The common structure of statistical models of truncation, sample selection, and limited dependent variables and a simple estimator for such models. Ann Econ Soc Meas 5:475–492

Kaplan S, Zingales L (1997) Do financing constraints explain why investment is correlated with cash flow? Q J Econ 112:169–215

Koenker RW, Bassett G Jr (1978) Regression quantiles. Econometrica, Econometric Society 46(1):33–50

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70(2):317–341

Mayer T, Ottaviano G (2008) The happy few: the internationalisation of European firms. Intereconomics: Review of European Economic Policy 43(3):135–148

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Melitz MJ, Ottaviano GIP (2008) Market size, trade, and productivity. Rev Econ Stud 75(1):295–316

Minetti R, Zhu SC (2011) Credit constraints and firm export: microeconomic evidence from Italy. J Int Econ 83(2):109–125

Nickell SJ, Nicolitsas D (1999) How does financial pressure affect firms? Eur Econ Rev 43:1435–1456

Rajan RG, Zingales L (1998) Financial dependence and growth. Am Econ Rev 88(3):559–586

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix: Description of the Financial Indicators

Appendix: Description of the Financial Indicators

Below is a list of the financial variables created. The subscripts indicate that each indicator is specific for firm i at time t.

Rights and permissions

Copyright information

© 2013 Springer Japan

About this chapter

Cite this chapter

Altomonte, C., Saggiorato, L. (2013). Is a New Financial Model Necessary for Growth?. In: Kaji, S., Ogawa, E. (eds) Who Will Provide the Next Financial Model?. Springer, Tokyo. https://doi.org/10.1007/978-4-431-54282-7_11

Download citation

DOI: https://doi.org/10.1007/978-4-431-54282-7_11

Published:

Publisher Name: Springer, Tokyo

Print ISBN: 978-4-431-54281-0

Online ISBN: 978-4-431-54282-7

eBook Packages: Business and EconomicsEconomics and Finance (R0)