Abstract

Wholesale trade firms and their role in international trade are examined using transaction and firm level data sets from Denmark for the period 1998–2006. Compared to internationally trading manufacturing firms, wholesale firms trading internationally are found to focus on fewer countries with more products and lower unit values, and their involvement in international trade transactions differ significantly across industries. Manufacturing industries with more competitive structure, lower firm size, lower capital intensity, higher production fragmentation and lower export/import intensities are found to have higher wholesale share of export. The analysis shows that export and import premia also exist among wholesale trade firms, which is in line with the idea that these premia result from fixed costs of exporting/importing. Systematic differences between wholesale trade firms in intermediate goods markets versus in consumption goods markets are also documented and found critical in understanding the role of intermediaries in international trade. While in intermediate goods export wholesale trade firms’ unit prices are found to be significantly higher than manufacturers unit prices of the same good, the opposite holds true for consumption goods export. Wholesale trade firms that specialize in export of intermediate goods are found to be more skill intensive and pay more in comparison to other exporting wholesale trade firms. The wage premium for exporters of intermediate goods for professional level occupations is robust to controlling for detailed firm and worker characteristics. The results suggest that theories highlighting the potential roles of intermediaries should take the intermediaries’ location in the supply chain into account.

The analysis is conducted while the author visited the Labor Market Dynamics and Growth Center at Aarhus University. The author is grateful to Henning Bunzel and the late Dale Mortensen for facilitating the access to the confidential data bases of the Statistics Denmark and for their support. Support of The Cycles, Adjustment, and Policy research unit, CAP, and the School of Economics and Business, Aarhus University are acknowledged with appreciation.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Studies show that the export and import behavior of manufacturing firms are important factors in improving industrial productivity as well as in technology and knowledge transfer between firms and countries (Bernard et al. 2007). In this light, the significant presence of intermediaries in manufacturing trade revealed by recently available customs data has received well deserved academic attention. While previous economics and management literature on intermediaries emphasizes the potential roles of intermediaries in facilitating trade between manufacturers and final consumers, recent literature that makes use of transaction-level international trade data focus on the fixed costs saving nature of trade intermediaries in export.

So far this literature treats the intermediation between two suppliers within the supply chain and intermediation between producer and final consumer uniformly. This paper documents empirical regularities in the role and significance of intermediaries in international trade from a small, open, and advanced country and provides insight into the determinants of intermediation in relation to product and industry characteristics in international trade. It is also shown that characteristics of trade firms differ systematically depending on the location of intermediation in the supply chain. To do that, transaction-level data from Danish customs, which include detailed information on all export and import transactions, are matched with firm-level accounting data that includes detailed business activity, sales, employment, capital, investment and other firm-level expenditures for the years 1998–2006.

Wholesale trade firms sell any type of goods. They simplify flow of goods, payments and information by acting as intermediaries between the manufacturer and the customer. The share of trade transacted via the manufacturer or a wholesale trade company varies substantially between different product groups or industries. Between 1993 and 2006, wholesale trade firms’ and manufacturers’ average share of imports are 57 and 31 % respectively, while their respective shares of export are 32 and 54 % in Denmark.Footnote 1 Intermediaries are found to be more active in import than in export, but in both export and import there is substantial heterogeneity in their involvement across industries. While the wholesale trade share is found to be on average 90 % in leather export, its share is 20 % in plastics export in Denmark.Footnote 2 Crude analysis of the data shows that the room for intermediaries is bigger in non-manufactured products, such as farm products, as would be expected. But even in the manufacturing sector intermediaries, and wholesale trade firms in particular, play a significant role in export and import.Footnote 3

To understand the relative concentration of wholesalers across manufacturing sectors in international trade, manufacturing sector characteristics are linked with the wholesale trade shares in those industries. Manufacturing industries with higher median firm size and capital intensity exhibit higher export share of wholesale trade firms. The results are in line with theories that relate fixed costs of exporting to the presence of wholesale trade firms.

Manufacturing industries with more competitive structure are found to have higher wholesale share of export. More specifically, controlling for firm and industry size, the wholesale trade share in export is negatively associated with firms’ age and industry concentrations indices, as measured by the Herfindahl-Hirschman index and the 4-firm concentration index, and it is positively associated with entry and exit rates. The wholesale trade share in export is also found to be higher in manufacturing industries where the degree of production fragmentation is higher. In general the wholesale trade shares in export and import at the industry level are found to be negatively correlated with the export and import intensities of manufacturing firms. This finding points to the role of intermediaries as trade facilitators.

Wholesale trade firms trading internationally are found to focus on fewer countries with more products and lower unit values, confirming that the Danish data exhibit stylized facts similar to what has recently been highlighted on the role of wholesale trade firms in export and import.

But this paper also highlights a number of new and interesting features about the wholesale trade firms. First it shows that similar to manufacturing firms, wholesale trade firms that export are bigger, more productive and more capital-intensive; they pay more and employ more educated employees in comparison to non-exporters. Importing wholesale trade firms also share most of these features, showing that both export and import premia exist also among wholesale trade firms. These findings are in line with the idea that these premia result from fixed costs associated with exporting/importing (Bernard et al. 2007).

Second, there are important differences among wholesale trade firms in their involvement in international trade depending on the distance in the supply chain to the final consumers. In consumption goods markets, wholesale trade firms are found to focus on fewer countries with relatively more products in comparison to manufacturing firms. In intermediate goods markets, on the other hand, they are found to focus on products as well as countries. Comparing unit prices after controlling for detailed products and country fixed effects reveal that, while in consumption goods export wholesale trade firms’ unit prices are significantly lower in comparison to manufacturers’, their prices are significantly higher than manufacturers’ in intermediate goods export. Similarly, in consumption goods import wholesale trade firms’ unit prices found to be significantly lower but this is not the case in intermediate goods import.

Firm-level data also show that wholesale trade firms specializing in export of intermediate goods are bigger than other exporting wholesale trade firms. Controlling for size, wholesale trade firms that specialize in export of intermediate goods are found to be more skill intensive and pay more in comparison to other exporting wholesale trade firms. They are not found to be significantly different in terms of capital-labor ratio, investment and labor productivity. The wage premium for exporters of intermediate goods for professional level occupations is robust to controlling for detailed firm and worker-level characteristics as well as intensity of high-tech goods sales. Wholesale trade firms in intermediate goods markets may be developing product specific knowledge. More demanding firm to firm communication required in global production chains may be one reason behind this wage premium. These results indicate that in order to understand the role of wholesale trade firms in international trade it is important to consider their distance in the supply chain to the final consumers.

The presence of middlemen or intermediaries in markets, in general, is motivated by several possible factors including adverse selection and moral hazard (Biglaiser 1993; Biglaiser and Friedman 1994), and the existence of search and information frictions (Rubinstein and Wolinsky 1987). Biglaiser (1993) and Biglaiser and Friedman (1994) predict that intermediaries sell higher quality products by acting as quality guarantor. The results presented here suggest that such quality sorting may be more relevant considerations in explaining intermediaries role in intermediate goods market compared to consumption goods markets.

Among the recent studies that use transaction level trade data, Bernard et al. (2010) highlight a number of stylized facts about intermediaries engaging in international trade in the US using data from 2002. This paper complements theirs by providing additional detail to the understanding of the nature of intermediaries in international trade.

Ahn et al. (2011) and Akerman (2010) extend the heterogeneous trade model with intermediation technology. Their models predict that the share of trade handled through intermediaries increases with fixed costs of exporting. Similarly Bernard et al. (2011) provide empirical regularities on the relationship between intermediaries’ involvement in export and country specific fixed and variable costs using Italian data. Using Colombian and Chilean matched transaction data Blum et al. (2009) document that in a majority of exporter and importer matches at least one of the parties is a large international trader and that more than half of the Chilean exporters sell to a single Colombian importer. The authors then develop a model with matching frictions that replicate these findings. Felbermayr and Jung (2011) and Tang and Zhang (2012) on the other hand focus on hold-up problems to relate the country and product characteristics to the presence of export intermediaries. Except for Felbermayr and Jung (2011) and Tang and Zhang (2012), these papers do not look at the extent of intermediaries’ involvement across industries and products, which is the focus of this paper.Footnote 4 But all of these papers, including Felbermayr and Jung (2011) and Tang and Zhang (2012) uniquely treat intermediation between two suppliers and intermediation between producer and final consumer/retailers. The results presented in this paper show that empirical regularities may show contrast depending on the location of intermediation in the supply chain. The theories that highlight one or the other potential role of intermediaries should take these differences into account.

The paper is organized as follows. Data sets used in this study are described in the next section. Empirical analyses are presented in Sects. 3–5 followed by concluding remarks.

2 Data

The main data sets used in this study are transaction-level custom records and firm-level accounting data sets from Denmark, but other supplemental micro and macro data sets are also used, such as labor market surveys. This section summarizes the main data sets while details e.g. variable constructions, information on the additional data sets, are presented in the Appendix.

The firm-level data set (business statistics data) is compiled from survey results of firms that take part in an annual financial survey as well as from the annual tax reports, vat reports, and annual reports from incorporated companies. Wholesale trade firms are included in this data set starting from 1998. So the sample period used in this study is 1998–2006. The general business statistics include only firms that employ at least 0.5 FTE (full-time equivalent employment) and/or have had an estimated earnings of a certain size. Earning sizes are estimated differently for different industries. In the wholesale trade sectors, the lower limit of earnings is typically 500,000 Danish Kroner, while in the manufacturing industry, it ranges between 150,000 and 200,000 Danish Kroner. Table 14 in the Appendix provide summary statistics for the wholesale trade firms.

International trade data are available at the transaction-level starting from 1993. They contain firm id, the type of transaction (whether it is export or import), the value of transaction in Danish Kroner, the name and the code of the partner country, the amount of the transacted good, the unit of the amount, the name and the 8-digit combined nomenclature (CN) code of the good as well as the year of the transaction. The details of this data set is given in Pedersen (2009). For the years 1993–2006, firm id’s in the transactions data sets are matched with the main industry affiliation of firms using supplemental data sets within Statistics Denmark. As a result of this match 89 % of the firm ids’ in the export data and 94 % of the firm ids’ in the import data are matched with industry affiliations.

As wholesale firms specialize in logistics, marketing and distribution, they can be expected to employ fewer employees than manufacturing firms. Figure 1 shows the distribution of size (the logarithm of employment and the logarithm of capital assets) among manufacturing firms and among wholesale firms for the year 2000. From the figure it is apparent that wholesale firms employ fewer employees in general and have lower level of capital assets.

Figure 2 shows that wholesale trade firms on average sell more in comparison to the manufacturing firms, but, as one expects, their rate of value-added over sales is on average much lower compared to manufacturing firms.

While wholesale trade firms employ less people, they pay more on average than manufacturing firms as indicated by Table 1 and they also employ more educated employees.

3 Understanding Across Industry Distribution of Wholesale Share

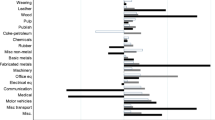

The share of trade transacted via manufacturers or wholesale trade companies varies substantially between different product groups or industries. Figure 3 presents the average shares of export/import transacted directly by manufacturers across broad product categories (CN chapters) between 1993 and 2006. Figure 4 presents the average shares of trade transacted via wholesale trade firms.Footnote 5 In the Appendix, Table 15 presents the respective shares across all broad product categories. Intermediaries are found to be more active in import than in export (except vegetable products, fats and oils, leather, footwear, and arms and arts) but on both sides there is also substantial heterogeneity across broad product categories. A higher share of wholesale trade in import compared to export is expected as wholesaler involvement at the later stages of the value chain is more likely due to the distribution and logistics services they provide.

Very low shares of direct manufacturing export are observed in vegetable products and leather coupled with proportionately high shares of wholesale trade in those product categories. This is most probably because these categories contain non-manufactured products mostly produced by farmers. What is most interesting is intermediaries’ significant involvement in export of manufactured products (as also documented in Ahn et al. (2011) for China or Bernard et al. (2010) for the US). Part of their involvement in export could be due to the firm boundary issue that manufacturers of final products may prefer to outsource distribution services and hence intermediaries export as part of their service in the distribution of the products domestically and internationally. In Fig. 5, the wholesale shares in export are shown separately for intermediate and consumption or final goods across broad product categories. The figure shows that intermediaries are more involved in final goods’ export except in vegetable products, food, leather and construction materials all of which largely contain non-manufactured goods (farming and mining).

In order to relate (manufacturing) industry characteristics to the wholesale export and import shares in that industry, the following industry-level equations are estimatedFootnote 6:

On the left hand side, there is the wholesale export/import share within manufacturing industry j (2-digit NACE) at year t.Footnote 7 On the right hand side, there are an industry characteristic and year fixed effects. Equation (2) controls for firms’ size, FirmSize jt , as measured by the logarithm of the median firm’s employment within manufacturing sector j. Equation (3) additionally controls for industry size, NumberOfFirms jt , which is the logarithm of the number of manufacturing firms in industry j at year t.

The industry characteristics are technology, openness, market structure and product type indicators for the corresponding manufacturing industries. Technology indicators are the median capital intensity as measured by the ratio of total fixed assets over total revenue (Capital Intensity), and production defragmentation as measured by the median of the ratio of the value-added over the value of production (Production Defragmentation). Openness indicators are export/import intensity defined as the median of the ratio of the export/import value over the total revenue (Export/Import Intensity). Market structure indicators are the logarithm of the median firm’s age (Log Firm Age), 4 Firm Concentration Rate, Herfindahl-Hirschman Index (HHI), and finally Entry and Exit Rates.Footnote 8

Table 2 reports estimates of β 1 a, β 1 b, and β 1 c in Eqs. (1) to (3) for export and Table 3 reports the same estimates for import.

The results on export as reported in Table 2 show that the wholesale share in export is negatively correlated with the number of manufacturing firms and the median firm-level employment in that industry. These findings are intuitive: Bigger firms or firms in industries with higher comparative advantage (as indicated by the number of producing firms) are more likely to pay the sunk entry costs of exporting a la Melitz (2003) and export directly rather than through wholesale trade firms.Footnote 9 In relatively big industries manufacturing firms may also have more opportunity to learn from each other about potential export opportunities.

Capital intensity, and production (de)fragmentation are found to be negatively associated with the wholesale share in export. This holds true even after controlling for the median (manufacturing) firm size and the number of (manufacturing) firms as well. Manufacturers may prefer to control distributional channels as a part of brand and product differentiation (Dent 2008) especially for industries that exhibit increasing returns to scale or industries with lower degree of production fragmentation.Footnote 10 Negative relationships between export and import intensities and wholesale trade share in export are in line with the trade facilitator role of traders where export and import are relatively rare activities.

The wholesale trade share in export is also found to be higher in more competitive industries as indicated by negative and significant coefficient estimates of the concentration indices (HHI and 4-firm) and firms’ age and positive and significant coefficients of entry and exit rates of manufacturing firms. Lower entry barriers in more competitive industries must allow small and young firms to operate easily and these firms are more likely to export through intermediaries. Concentration of industries may also be driven by increasing returns at the firm level so firms may be less likely to outsource distribution services in less competitive industries.

Table 3 presents the results for import. As in export, the wholesale import share is negatively related with the number of manufacturing firms operating in the industry and the median firm size, although the size effect is not found to be as important as in export. While all other characteristics have the same signs as in export, some such as median capital intensity, median firm’s age, entry and exit rates are not found to be significantly correlated with the wholesale import share. A weaker relationship between the share of wholesale import and manufacturing characteristics is expected since the manufacturing industry constitutes only part of the customers of the import traders as the import traders also import for retail and service sectors.

4 Comparing Manufacturing and Wholesale Trade Firms in International Trade

4.1 Firm-Level Differences

Table 4 reports that on average wholesale trade firms export ten 8-digit products, while manufacturing firms export eight products during the 1998–2006 period. Wholesale trade firms export to on average 4.5 countries while manufacturing firms export to 7.4 countries. That is, wholesale exporters export more products to less countries in comparison to manufacturing firms. This also holds true for imports, but to a lesser extent.

To examine differences between wholesale intermediaries and manufacturing firms engaging in international trade within broad product categories, Eq. (4) is estimated separately with export and import transaction data aggregated at the firm-level.

where I(WH it ) is an indicator whether firm i is an wholesale trade firm, and x it denotes characteristics (in logarithm) of firm i at period t: value of export/import, average price of exports/imports, the number of products exported/imported, the number of countries, the number of export/import transactions, and the number of years in the export/import market. The sample only includes firms that are identified by manufacturer or wholesale trade firms so the estimates of β 1 WH indicate the percentage difference in the characteristics for wholesale trade firms in comparison to manufacturing firms after controlling for industry and year fixed effects.Footnote 11

The results for export and import are presented in column (a) and in column (b) of Table 5 respectively. Starting from export, the results show that wholesale trade firms’ export is about 80 % less in comparison to manufacturing firms’ exports, they sell to a smaller number of countries (relative country focus); on the other hand they sell about 6.3 % more products and they are shorter lived in the export market. Wholesale trade firms do not seem to have significant price differences at the firm level in comparison to manufacturing firms. In column (b) the results show that the value of import is about 28 % more than the manufacturers’ imports, they import more products (about 9 %), their prices are lower, and they buy from a smaller number of countries (13.8 %). Finally wholesale importers are also found to be 8.3 % less tenured in the import market in comparison to manufacturer importers. The results indicate focus on country more than product as well as shorter tenure in the international markets are common properties of both export and import traders.

In order to gain insights into potentially distinct roles of intermediaries in consumption and intermediate goods markets, Eq. (4) is also estimated separately among intermediate and consumption goods.Footnote 12 To do that, before aggregating the transaction data at the firm-level, only transactions with either intermediate or consumption goods are kept in the sample. The results are presented at the lower panels of Table 5.

The result show that relative country focus among wholesale traders holds true whether we look at intermediate goods or consumption goods trade. But the number of exported/imported intermediate products is found to be smaller among traders in both export and import compared to manufacturers, indicating that intermediate goods traders may be building product specific knowledge. This seems not to be the case for consumption goods traders. The average price of intermediate goods exporters is found to be higher (9.2 %) in comparison to manufacturer exporters’ prices. There is no statistically significant difference found between wholesalers and manufacturers’ prices in consumption goods export. Only broad product categories are controlled for in these regressions so the price differences are expected to contain differences in the type and quality of the products as well. This will be taken into account in the next analysis below.

4.2 Unit Price Differences

This section presents an analysis to understand if there is any systematic differences in the unit prices of goods transacted by intermediaries versus manufacturers. On the one hand, manufacturing firms may be able to extract more surplus and so charge a higher price by controlling distributional channels.Footnote 13 Models with productivity sorting with fixed costs of exporting on the other hand, predict higher unit prices for wholesale trade exporters. Intermediation, in general, may result in double marginalization if the markets are not competitive or intermediaries may have a value creating role by providing additional services.Footnote 14

Here p ifc is the unit price of good i (at CN-8 digit) imported/exported from/to country c by firm f. I(W) and I(R) are wholesaler and retailer dummies respectively.

To see if there is any systematic difference for unit price differential between wholesaler and manufacturer depending on the type of goods they transact, the wholesaler dummy is also interacted with an intermediate good indicator, I(IG), as below.

Tables 6 and 7 show unit price differentials between intermediaries and manufacturers for the period 1998 through 2006 for export and import respectively. In these regressions the sample only includes transactions that are conducted via either manufacturing, wholesale or retailer companies excluding other types of firms such as business service firms. So the estimate of γ 1 in Eq. (5) indicates a unit price differential for wholesalers in comparison to manufacturing companies after controlling for 8-digit product by country fixed effects in a given year.

The results show that wholesalers’ price is on average lower compared to manufacturers, both in export and in import after controlling for detailed product (CN-8 digit) by country fixed effects. In export, the difference is not always significant and the F statistics are low before 2002. However, when the intermediate good dummy is interacted with the wholesale dummy, F statistics grow sizably and estimates of γ 1 become significant at the 1 % level. Estimates of γ 3, on the other hand are always positive and significant at the 1 % level. In 1998 wholesale prices are found to be on average about 2.9 % lower than manufacturers’ prices regardless of the type of goods. But when one controls for intermediate goods, wholesalers’ prices are found to be 9.3 % lower, while prices of intermediate goods of wholesalers are found to be about 7 % higher than manufacturers’ intermediate goods’ prices.Footnote 15 The findings are very similar across all the years, suggesting that wholesalers’ involvement in export in intermediate and consumption goods markets respectively have important distinctions. These results are quite different from Ahn et al. (2011) where intermediaries’ unit prices are shown to be higher than manufacturers’ in China.Footnote 16 Bernard et al. (2010), on the other hand, show wholesale traders’ unit prices on average lower than manufacturers. The results presented here for Denmark are in line with Bernard et al. (2010). But none of these studies look at the intermediate and consumption goods markets separately. Doing that, results show that the unit price differential between wholesalers and manufacturers in general depend on the type of goods, intermediate versus consumption. While unit prices of exporting wholesale companies are found to be lower in general compared to manufacturers’ prices, their prices are found to be significantly higher for intermediate goods.

The results for import presented in Table 7 show that retailers’ unit prices are significantly higher in comparison to manufacturers, probably indicating their closer distance to the final customers. The prices of wholesalers are also found to be lower in general. Wholesalers that import intermediate goods on the other hand are not found to have significantly lower prices in comparison to manufacturers’ unit prices.

The models with adverse selection (Biglaiser 1993) predict that intermediaries on average sell higher quality products, and their average prices are higher. The results here suggest a possibility of adverse selection problems in the intermediate goods markets. The differences in market structure of intermediaries in intermediate and consumption goods markets may also result in differences in prices as the possibility of double marginalization depends on competitiveness of the markets. Tables 17 to 18 show that concentration patterns are also different for wholesalers and manufacturers across these two different types of products. While concentration patterns of wholesale trade firms and manufacturers are similar in general (Table 16); wholesale trade firms’ concentration is higher in intermediate goods while manufacturers concentration is especially higher in consumption goods.

These results suggest hold-up problems that give rise to quality sorting of goods traded between manufacturers and wholesale traders may be more relevant in the consumption goods markets, while information frictions that give rise to adverse selection may be more important in the intermediate goods markets. These results overall suggest that in understanding the role of intermediaries in international trade it is critical to explicitly consider their location in the supply chain.

5 Export and Import Premia Among Wholesale Traders

International trade literature emphasizes the importance of export and import behavior in manufacturing firms’ performances (Bernard et al. 2007). There is a large literature on the sources of export premia among manufacturing firms. The two competing hypotheses are whether export premia are due to self-selection of more productive firms into export markets or whether they are due to learning by exporting, which is often thought to happen via the buyer supplier link that foreign buyers actively or passively channel knowledge to the local suppliers. One implicit assumption mostly made to motivate the learning by exporting hypothesis is that knowledge is channeled into manufacturing processes. To further this understanding it is important to see whether similar export and import premia also exist among wholesale trade firms as these firms do not manufacture, so no such learning can drive possible premia.

Table 8 show that 38 (47) % of wholesale firms export (import) during the sample period. Table 8 also indicates that more than 80 % of wholesale firms that export also import. Using business statistics data from 2000, Fig. 6 shows that both exporting wholesale firms and importing wholesale firms are on average larger (employment and capital) than non-exporting and non-importing wholesale firms respectively. It also indicates that exporting wholesale firms are on average larger than importing wholesale firms.

To quantify possible export and import premia, Eqs. (7) and (8) are estimated using business statistics data for the wholesale trade firms for 1998–2006.

In these equations x ijt denotes characteristics of wholesale trade firm i at period t in industry j in logarithm, lnFTE is the logarithm of the full-time equivalent number of employees, I(XP ijt ) is an export dummy and I(MP ijt ) is an import dummy. 4-digit industry and year dummies are also included. The coefficient β 1 indicates the percentage differences in the relevant firm characteristics controlling for size (measured by the number of employees), industry and time effects. The first column of Table 9 reports the differences between exporters and non-exporters among wholesale trade firms and the second column reports the differences between importers and non-importers among wholesale trade firms.

The results show that both export and import premia exist among wholesale trade firms. More specifically exporting wholesale trade firms are larger, they pay higher wages (8 %), and invest more (9.6 %). Their technology is relatively more capital intensive (7.6 %) and they have higher labor productivity (27.7 %) and employ more skill intensive employees. Similar differences also hold between importers and non-importers except for the capital intensity. These results are in line with the sunk costs driven self-selection hypothesis.

The previous analysis revealed that export intermediaries that focus on intermediate goods charge higher prices on average in comparison to manufacturers. To see if export premia also change depending on the location of the intermediaries in the supply chain, Eqs. (9) and (10) are estimated among wholesale trade exporters.

IGIntensity ijt is the ratio of exported intermediate goods over the total number of exported goods by wholesale trade firm i in industry j at year t. Similarly, CGIntensity ijt is the ratio of exported consumption goods over the total number of exported goods by wholesale trade firm i in industry j at year t.Footnote 17

The results in Table 10 show that wholesale trade exporters that specialize in exporting intermediate goods instead of consumption goods are larger on average. But after controlling for size, there are no significant differences found between wholesale exporters in intermediate goods versus in consumption goods in terms of labor productivity, capital labor ratios and investment intensity.

Table 11 reports intermediate goods premia in employee wages and characteristics. After controlling for firm employment, there are significant differences in employee characteristics and wages between wholesale trade exporters depending on their location in the supply chain. Wholesale firms that export intermediate goods employ significantly more skill-intensive employees. This is manifested in a significantly higher ratio of employees with college education as well as a higher ratio of employees with professional level of occupations. They also pay higher wages. The coefficients in columns 2 and 3 in Table 11 indicate that one standard deviation increase in the intermediate goods intensity is associated with 0.030 and 0.053 standard deviation increases in average hourly wages of basic level employees and of professional level employees respectively.

To see if the wage premium can be explained by firm and labor characteristics, firm controls and worker characteristics at the firm level are added. The firm controls are whether a firm is single-plant, whether it is a proprietorship and firm’s age. The worker characteristics are female employee ratio, college rate, average tenure of employees and a quadratic term of average tenure of employees.Footnote 18 The results in Table 12 show that the premium of the overall average hourly wage and the average hourly wage of basic level employees can be explained by firm and worker characteristics. The average hourly wage of professional employees is still found to be significantly higher with the intensity of intermediate goods. High-tech good intensity is added as an additional control in Table 13 but the results are not affected. The coefficients of high-tech good intensity are found to be positive and significant indicating an additional wage premium associated with high tech goods.

So wholesale trade firms that export intermediate goods employ more educated employees and pay them proportionately more. The higher average hourly wages of basic level employees can be explained by firm and employee characteristics. But even after controlling for these factors as well as intensity of high-tech goods sales, average hourly wages of professional level employees are still found to be positively associated with the intermediate goods intensity. This could be due to communication requirements for intermediate goods which increases the need for professional level functions.

6 Concluding Remarks

I examine the presence of intermediaries in international trade using data from a small, open and advanced country, Denmark. A number of stylized facts about the wholesale trade firms are highlighted to understand the role of these firms and distribution channels in international trade in general.

Wholesale trade firms are found to employ fewer but more educated employees than manufacturing firms. They sell more but generate lower value-added. They are more likely to engage in import than in export but those wholesale trade firms that import are more likely to export as well. In general, they are found to focus on fewer countries with more products in comparison to manufacturing firms. Their share of export and import are found to be higher in manufacturing industries with lower export and import intensities and with higher degree of production fragmentation. Manufacturing industries with less market concentration, higher entry and exit rates and lower median firm age are found to exhibit higher export share of wholesale trade firms. Manufacturing industries with lower firm size and capital intensity are also found to have higher export share of wholesale trade firms, confirming theories that relate fixed costs of exporting to the presence of export intermediaries.

Characteristics of wholesale trade firms in international trade are shown to differ depending on whether they trade consumption goods or intermediate goods, trade in the latter of which has been growing steadily over the last decades due to internationalization of production and increasing outsourcing. Particularly, while wholesale traders in general command lower unit prices in international trade than manufacturers, exporting wholesale traders of intermediate goods command higher unit prices.

Both export and import premia exist also among wholesale trade firms. The results show that exporting wholesale firms are significantly larger, more capital and skill intensive in comparison to non-exporting wholesale trade firms, they pay higher wages and they are more productive. Similar differences also exist between importers and non-importers. Among trade exporters, firms that specialize in intermediate goods are found to have additional premia. They are found to be bigger, more skill-intensive both in terms of employees’ education levels and in occupation characteristics and pay higher wages in comparison to other exporting wholesale traders. The wage premium for professional occupations remains even after controlling for detailed firm and worker level characteristics.

In existing literature intermediaries are treated uniformly regardless of their location in the supply chain. In this paper I show that wholesale trade exporters differ systematically depending on whether they function in intermediate or consumption goods markets. The results suggest that when analyzing the role of intermediaries, attention should be given to whether the goods in question are consumption goods or intermediate goods.

Notes

- 1.

These numbers are higher in comparison to the similar numbers from the US as reported by Bernard et al. (2010) and China as reported by Ahn et al. (2011). For the year 2002, Bernard et al. (2010) reports the value share of intermediaries in export as 10 % and in import as 42 %. The value share of intermediaries in export for the year 2002 for China is reported as 29 % in Ahn et al. (2011).

- 2.

These statistics are average of data between 1993 and 2006.

- 3.

The analysis focuses on wholesale trade firms, including export and import agents but excluding the retail sector. Because of this focus, the terms “intermediary” and “wholesale” trade firms are used interchangeably throughout the paper.

- 4.

Felbermayr and Jung (2011) approaches the presence of trade intermediaries in export as a firm boundary problem. As in the spirit of Helpman et al. (2014) manufacturing firms face a trade off in their decision to choose an export mode due to the lack of enforceable cross-country contracts. They can use their own wholesale affiliate in the foreign country to avoid distortion due to hold up problem and incur fixed costs of distribution or that they use a trade intermediary but then face lower export revenues. Their model predicts productivity/quality sorting within industries similar to Ahn et al. (2011) and Akerman (2010). While their focus is still on the country specific costs, their model predicts firms producing high quality products with strong brand reputation are more likely to invest in distribution channels in foreign markets. Similarly Tang and Zhang (2012) consider a hold up problem in a heterogenous firm framework where intermediaries provide fixed cost saving technology. Distortions caused by the hold up problem in quality verification efforts necessary for foreign buyers drives the relationship between quality differentiation and the propensity to use an export intermediary. Their model predicts that the propensity to export via an intermediary decreases with vertical differentiation while it increases with horizontal differentiation of the products.

- 5.

Most of the trade is conducted via manufacturer and wholesale trade firms, but retail firms as well as other service firms are also present in international trade.

- 6.

Since the dependent variable is a share, the results are obtained using fractional logit model with robust standard errors as suggested by Papke and Wooldridge (1996). The results are robust to transforming the share variable as a log-odds ratio and are available upon request.

- 7.

CN product codes are matched with 2-digit industry (NACE) codes using correspondence tables between prodcom and CN provided by EuroStat RAMON.

- 8.

The median industry characteristics are calculated using firm-level data on the manufacturing industry between 1998 and 2006. Herfindahl-Hirschman Indices and 4-firm concentration indices are calculated by taking both domestic and foreign sales into account.

- 9.

- 10.

A company with a high level of brand recognition may be hurt by using the same distribution channels as used for cheaper generic products. Consider a product with a highly advertised specific function sold together with a cheaper alternative. The distributors may extract higher profit margin from the cheaper alternative by selling it together with the expensive one so that they can get a price which is close to the price of the expensive one.

- 11.

In Eq. (4) industry fixed effects are broad product category (CN Chapter) affiliations of firms. They do not indicate whether a firm is a manufacturer or trader of these products. CN Chapters are listed in Table 15 in the Appendix.

- 12.

Intermediate and consumption goods classification is based on BEC Rev. 3. See the Appendix for details.

- 13.

- 14.

The models with adverse selection (e.g. Biglaiser 1993) predict that intermediaries on average sell higher quality products, and their average prices are higher.

- 15.

Separate estimation of Eq. (5) among intermediate and consumption goods also confirm these findings. They are available upon request.

- 16.

Ahn et al. (2011) control for the size as measured by employment when analyzing unit price differences between manufacturers and intermediaries. Since wholesale trade firms are significantly smaller in terms of employment than manufacturers, one expects upward bias on the coefficients for unit prices of intermediaries they find. The different results obtained with Denmark as opposed to China may also be due to (potentially) higher share of intermediate goods in Chinese export data.

- 17.

The sets of intermediate and consumption goods are not exhaustive. First, the definition of intermediate goods do not include fuels and lubricants, second there are also capital and non-classified goods. Hence two equations, one with intermediate goods intensity and the other with consumption goods intensity are estimated instead of one.

- 18.

Empirical studies analyzing the impact of tenure on earnings usually find positive effect at a diminishing rate.

- 19.

Starting from 1999, the data set includes hospitality, transportation, telecommunication, real estate, rental services, information technology services, research and development services, and other consultancy and business services. It does not include agriculture, financial sector, public, education and medical service sectors.

- 20.

For the details of labor data set as well as other data sets used in this study see Utar (2014).

References

Ahn, J. B., Khandelwal, A. K., & Wei, S.-J. (2011). The role of intermediaries in facilitating trade. Journal of International Economics, 84(1), 73–85.

Akerman, A. (2010). A Theory on the Role of Wholesalers in International Trade Based on Economies of Scope. Research Papers in Economics 2010:1, Stockholm University, Department of Economics.

Bernard, A. B., Grazzi, M., & Tomasi, C. (2011). Intermediaries in International Trade: Direct Versus Indirect Modes of Export. NBER Working Paper No. 17711.

Bernard, A. B., Jensen, B., Redding, S. J., & Schott, P. K. (2007). Firms in international trade. Journal of Economic Perspectives, 21(3), 105–130.

Bernard, A. B., Jensen, B., Redding, S. J., & Schott, P. K. (2010). Wholesalers and retailers in U.S. trade. American Economic Review Papers and Proceedings, 100, 408–413.

Biglaiser, G. (1993). Middlemen as experts. Rand Journal of Economics, 24(2, Summer 1993), 212–223.

Biglaiser, G., & Friedman, J. (1994). Middlemen as guarantors of quality. International Journal of Industrial Organization, 12, 509–531.

Blum, B., Claro, S., & Horstmann, I. (2009). Intermediation and the Nature of Trade Costs: Theory and Evidence. Working Paper, University of Toronto.

Dent, J. (2008). Distribution channels: Understanding and managing the channels to market. London: Kogan Page Limited.

Felbermayr, G., & Jung, B. (2011). Trade intermediation and the organization of exporters. Review of International Economics, 19(4), 634–648.

Helpman, E., Melitz, M., & Yeaple, S. (2014). Export versus FDI with heterogeneous firms. American Economic Review, 94(1), 300–316.

Loschky, A. (2008). Reviewing the Nomenclature for High-Technology Trade – The Sectoral Approach. Paper presented at the 1st Meeting of the OECD Working Party on International Trade in Goods and Trade in Services Statistics (WPTGS), Paris, September 22–24, 2008.

Melitz, M. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71, 1695–1725.

Papke, L. E., & Wooldridge, J. M. (1996). Econometric methods for fractional response variables with an application to 401(K) plan participation rates. Journal of Applied Econometrics, 11, 619–632.

Pedersen, N. (2009). Essays in International Trade. Ph.D. dissertation, Northwestern University, Evanston, IL.

Rauch, J. E. (1999). Network versus markets in international trade. Journal of International Economics, 48, 7–35.

Rubinstein, A., & Wolinsky, A. (1987). Middlemen. The Quarterly Journal of Economics, 102(3), 581–593.

Tang, H., & Zhang, Y. (2012). Quality Differentiation and Trade Intermediation. Working Paper, Tufts University.

Utar, H. (2014). When the floodgates open: Northern firms’ response to removal of trade quotas on Chinese goods. American Economic Journal: Applied Economics, 6(4), 226–250.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1: Additional Tables

See Tables 14, 15, 16, 17, and 18.

Appendix 2: Data

2.1 Foreign Trade Data

The foreign trade data sets are compiled from the Danish Customs records. Each shipment record includes the date of the shipment, the value of shipment, the product code (CN-8 digit), and the name of the product, weight of the shipment, type of the weight and sometimes quantity information as well as the unique firm identifier. Statistics Denmark aggregated this data into annual shipments for each product (CN-8 digit), country and firm triplet. As provided by Statistics Denmark, the international transaction data set covers the universe of Danish firms’ transactions for the period 1993–2007. However, only product shipments of 10,000 kr (approx.1800 us $) or above are included in the data set for the transactions with the EU countries.

2.2 Business Statistics Data

Business statistics data are compiled from survey results of firms that take part in a yearly financial survey as well as from tax reports, vat reports, and annual reports from incorporated companies. The general business statistics include only firms that employ at least a 0.5 FTE (full-time equivalent number of employees) and/or have had an estimated earnings of a certain size. Earning sizes are estimated differently for different industries. In the wholesale trade sectors, the limit of earnings is typically over 500,000 Danish Kroner, while in the manufacturing industry, it ranges between 150,000 and 200,000 Danish Kroner. Some of the data for very small firms may be subject to imputation. This data set is available starting from 1995, but only manufacturing, construction and retail sectors are included until 1998. In 1998, the wholesale trade sector is included and starting from 1999 it covers almost all sectors including mining, and all business service sectors.Footnote 19 This data set is supplemented with the labor surveys (IDA) that provide information on wages, education and occupation characteristics for each individual in the labor force. In the labor (IDA) data set, for each employed person there is a unique firm identifier provided for the employer. Using this firm identifier, extracted information from IDA is merged with the Firm Accounting Data Set for each year. Only a couple of observations in firm accounting data were left unmatched from this matching.Footnote 20

Intermediaries are defined as firms with their main economic activity in 2-digit Danish Industrial Classification 51 (wholesale except of motor vehicles) as well as 6-digit industry classifications equal to 501010, 501020, 501030, 503010, 503020, and 504000 which are sale of motor vehicles, parts and accessories.

2.3 Matching Foreign Trade Data with Firm-Level Data Sets

Foreign trade as compiled from the custom records contain firm id’s but not a main business/industry affiliation, so it is not possible to identify the type of firms whether wholesale trade, retailer, manufacturer or service etc. from the foreign trade data alone. The analysis in this paper is carried out by matching the foreign trade data with the business statistics as well as other available data sets from Statistics Denmark such as tax data, and industry sales data. Between 1993 and 2007, most of the foreign data in the import side (94 % of firms) can be matched, less so in export (89 % of firms). A significant part of the transactions cannot be matched in the export side, probably due to reporting errors. Nevertheless during 1998 and 2006 which is the sample period used in the empirical analysis, 91 % of the exporting firms in custom data were matched with their corresponding industry affiliations.

2.4 Product Detail

Products description is based on the Combined Nomenclature (CN) 8 digit categories. The first 6 digits of the CN corresponds to the HS-6 digit classification. For example, 852812 product code refers to color television receivers with built-in picture tubes. In the CN-8 classification there are 19 different kinds of color television receivers depending on different characteristics such as display width, diagonal screen size, and lines of resolution.

2.4.1 Broad Product Classification

Product classification of the products as consumption, intermediate, or industrial good is based on BEC Rev. 3. Consumption goods are defined as (BEC = 112, 122, 522, > = 600). The rest are defined as industrial goods. Intermediate goods definition does not include fuels and lubricants and is defined as (BEC = 111, 121, 210, 220, 420, 530).

CN Chapters are used as broad product classifications and they are listed in Table 15. CN codes are matched with the corresponding manufacturing industries using PRODCOM. Prodcom provides statistics on the production of manufactured goods. Prodcom uses the product codes specified on the Prodcom List, which contains about 4500 different types of manufactured products. Products are identified by an 8-digit code: the first four digits are the classification of the producing enterprise given by the Statistical Classification of Economic Activities in the European Community (NACE). Most product codes correspond to one or more Combined Nomenclature (CN) codes, but some (mostly industrial services) do not. The matching between CN and PRODCOM are provided by EUROSTAT RAMON. The matches are executed for every year separately.

Rauch (1999) classification is used to classify products as homogenous, reference and differentiated goods. Classifications in Rauch (1999) are based on SITC codes. Correspondence tables between CN 8-digit and SITC 4-digit (provided by EUROSTAT RAMON) are used to link the classification with the Danish data.

High tech goods definitions follow OECD nomenclature (Loschky 2008). High-technology classification is based on both direct and indirect R&D intensities in relation to the production output or to the valued added. The indirect R&D intensity is defined as the R&D expenditures embodied in the intermediate products used in the production in another economic sector. See Loschky (2008) for more details.

Rights and permissions

Copyright information

© 2017 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Utar, H. (2017). Characteristics of International Trade Intermediaries and Their Location in the Supply Chain. In: Christensen, B., Kowalczyk, C. (eds) Globalization. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-49502-5_9

Download citation

DOI: https://doi.org/10.1007/978-3-662-49502-5_9

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-49500-1

Online ISBN: 978-3-662-49502-5

eBook Packages: Economics and FinanceEconomics and Finance (R0)