Abstract

This paper examines the impact of mutual fund trading on stock prices in the Chinese equity market from 2004 to 2013. We have found that there is a strong positive contemporaneous correlation between stock returns and mutual fund holdings and trading. In addition, the price impact is more significant in mutual funds buying than in mutual funds selling. Finally, our findings support the hypothesis that the price impact of mutual fund holdings and trading on stock returns arise from momentum trading or price pressure.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

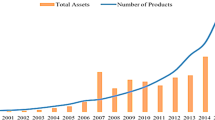

China opened its stock market in 1991. The first closed-end fund was set up in 1998, and the first open-end fund was set up in 2001. Since then, the mutual fund industry has been expanding rapidly. By the end of 2013, mutual funds managed total assets of more than 3 trillion RMB, and their investment accounted for about 15 % of the total value of the floating stocks in the Chinese equity market (see Table 1).

As major institutional investors, mutual funds are playing an increasingly important role in the Chinese equity market. Both practitioners and academia have shown deep interest in the performance of mutual funds. Are mutual funds “smart investors”? Do stocks held by mutual funds perform better than other stocks and why? While much evidence from overseas markets shows that mutual fund holdings have a positive correlation with stock returns, does the Chinese market follow the same pattern? This paper tries to answer the above questions by examining the price impact of mutual funds in the Chinese market and exploring the nature of the price impact. This paper is organized as follows: Sect. 2 reviews the literature; Sect. 3 discusses the data; Sect. 4 provides the empirical test results; and Sect. 5 states the authors’ conclusions.

2 Literature Review

Much evidence from overseas research shows that mutual funds have a significant price impact on stock returns (i.e., mutual fund holdings show a positive correlation with stock returns). The existing literature presents three major explanations for the positive correlation: momentum trading, information advantages, and price pressure.

Momentum traders buy stocks of historically superior performance and sell stocks of historically inferior performance. They anticipate that the price trend will continue moving in the same manner, and in this way they can obtain the desired profit in the future. Numerous research findings indicate that stock returns tend to have momentum in the short-term but reverse in the long-term. Jegadeesh and Titman [13] showed thatmomentum-trading strategy can be profitable over a 3–12-month time frame. Acharya [1] looked at equity markets inseveral different countries and confirmed the existence of momentum of stock returns in these markets.

If momentum trading is profitable and mutual fund investors follow momentum trading strategy, then the return on stocks traded by mutual fund investors will show a positive correlation with their trading. Thus, the stocks bought by mutual fund investors tend to have higher future returns, and the stocks sold by mutual fund investors tend to have lower future returns. Many empirical studies have provided evidence of momentum trading by mutual funds [4, 6]. Grinblatt et al. [11] examined the portfolios of 274 mutual funds during 1974–1984 and found 77 % of mutual funds were engaged in momentum trading. But some studies arrived at different conclusions. Campbell [5] and Yan [17] found no evidence of “herdin” and momentum trading. If the price impact of mutual fund trading is due to momentum strategy, the price impact would not last long and price reversal would likely occur in the mid-term future.

Another explanation for the positive correlation between mutual fund holdings and stock returns is information advantage. Institutional investors have tremendous advantages both in information acquisition and information analysis. They may learn the true value of stocks well in advance and trade based on their private information. Thus, the trading done by mutual fund investors is based on predicted changes in the value of the stocks and is positively correlated with stock returns.

Douglas [10] found that the stocks bought by mutual funds had higher future returns than stocks sold by mutual funds, and he argued that the “herding” behavior of mutual funds might be rational and speed the absorption of information, thus stabilizing the market. Dasgupta [9] also concluded that mutual funds improved the informational efficiency of the equity market. Compared to stocks with low mutual fund holdings, prices of stocks with high mutual fund holdings tend to be closer to their intrinsic values. Daniel et al. [8] found that the demand of mutual funds positively correlates with future stock returns. They believe that this indicates that mutual fund investors have some ability or means to predict future stock returns.

Price pressure is the third explanation for the price impact of mutual funds. Equity markets are seldom perfectly liquid. If mutual fund investors as a group are adding to their holdings of a certain stock, it is intuitive to expect that the large amount they demand will push up the price of the stock because mutual fund investors have to offer a premium price to persuade other investors to sell. In the case of mutual fund selling, mutual fund investors have to offer a price concession if they want to sell a large quantity of a stock [2, 3, 16]. If the positive correlation between institutional trading and stock returns is due to price pressure, then the price movement tends to reverse in the future when the pressure on the demand or supply disappears. However, Hu [12] argued that the price deviation due to pressure from supply or demand might also persist for a considerable period due to the limitation of arbitrage. Rebello [15] found that the price impact after mutual fund buying would persist instead of reversing, thus supporting the informational-advantage hypothesis of institutional buying. However, they both found price reversals after mutual fund selling which indicates that pressure from supply or demand is in fact the major cause of price impact in the case of mutual fund selling.

Most of the studies focused on developed markets. Our paper adds value to the existing literature on the price impact of mutual funds by providing evidence from China, an emerging but very important equity market. The findings of this paper also have practical implications for investors and regulators.

3 Data

Although strictly defined, mutual funds only include open-end funds; however, we also include closed-end data in our study. This is relevant because our focus is the price impact of both closed-end and open-end funds as institutional investors. The major source of information on mutual fund stock holdings is the portfolio from the semi-annual and annual report of mutual funds. In China, mutual funds are required to reveal their complete holdings for only the second and fourth quarter in the semi-annual and annual reports. Thus, only data from the semi-annual and annual reports are used in this study. Taking into consideration the reliability of the data, we chose stocks established before December 31, 2003 for our sampling group. The stock-holding data included in this study are from the beginning of 2004 to the end of 2013.

When studying the impact of mutual fund holdings on returns, the stocks with less than 1 % mutual fund holdings are excluded from the sampling, and when studying the impact of mutual fund trading on stock returns, the stocks with less than 1 % change in mutual fund holdings are excluded from the sampling. Stocks with missing data are also excluded from the sampling. Stock-holding data are collected from the semi-annual and annual reports of mutual funds, and other data are from the CSMAR (China Stock Market & Accounting Research Database).

4 Empirical Results

1. Mutual fund holdings and stock returns

We first tested the relationship between mutual fund holdings and stock returns by comparing the returns of stocks with high level and low level mutual fund holdings. We then sorted the stocks with mutual fund holdings into 10 groups and examined the stock returns of the groups with highest and lowest levels of mutual fund holdings. The stocks included in the high-level group were stocks with the highest deciles of mutual fund holdings, and the stocks in the low-level group were stocks with the lowest deciles of mutual fund holdings.

Table 2 provides the results of the sorting. The average return of the high-level group is much higher than the low-level group. During the sampling period, the average semi-annual return of the high-level group was 0.2349, while the average semi-annual return of the low-level group was only 0.0532. This implies a difference of 0.18 for a six-month holding period or 0.36 for a one-year holding period, which is economically highly significant. At the same time, the average return of the high-level group was 0.10 higher than the average return of the whole mutual fund holdings sampling.

We calculated the abnormal return by subtracting the market return from the average return of each group. The average abnormal return of stocks with mutual fund holdings was 0.1251 (i.e., the return of the stocks with mutual fund holdings was 0.1251 higher than the average market return during our sample period). The abnormal return of the high-level group was 0.2232.

We extended the above comparison to examining the relationship between stock returns and lagged mutual-fund holdings. Table 3 presents these empirical results. The return difference between the high-level and low-level groups was very small in this comparison. The average semi-annual return of the high-level group (0.1020) was 0.001 lower than the low-level group (0.1030) and 0.0054 lower than the whole mutual-fund holding sampling. If we look at the abnormal returns, then the average returns of the mutual fund holdings for the high-level group and the low-level group are all slightly lower than the average market return.

The empirical results of sorting indicate that there is a positive contemporaneous correlation between stock returns and mutual-fund holding levels. Stocks with high levels of mutual fund holdings tend to have much higher contemporaneous returns than stocks with low mutual fund holdings, and they also demonstrate higher than average contemporaneous market returns. But the level of mutual fund holdings does not show a significant correlation with lagged stock returns.

Sorting may reveal the price impact of mutual fund holdings in a simple way, but the criteria of sorting are highly arbitrary, and many other important factors which may affect stock returns are neglected. Thus, we used regression to further test the correlation between stock returns and mutual fund holdings. We first tested the correlation between stock returns and contemporaneous mutual fund holdings (i.e., the stock returns during each six-month period and the mutual-fund holding levels at the end of each of the six-month periods). The regression model is:

The dependant variable \(R_t\) is the return on stocks in period t, and \(H_t\) is the level of mutual-fund stock holdings at the end of period t (i.e., the percentage of floating shares held by all mutual funds). \(R_{t-1}\) and \(C_t\) are control variables in which \(R_{t-1}\) is the lag return of stocks in the previous period. If mutual funds follow positive-feedback strategy and stock returns have momentum in the short-term future, then stock returns can be partly explained by historical returns. \(C_t\) is the company size at the end of period t. Company size is included as a control variable in its logarithmic form. The other variables represented by “Year” are time dummies, and the first half of year 2004 serves as the omitted class.

As the lagged return is included in the explanatory variables, this may lead to the problem of endogeneity, which results in biased and inconsistent estimates in the regression of the panel data with fixed effect or random effect. Thus, we use the Arellano-Bond Dynamic Panel GMM Estimators in Stata to make the analysis.

Table 4 presents the results of the regression model. The results show that the coefficient of historical returns is significantly negative (coefficient,\(-\)0.0755) which indicates that there is a mean reverting phenomenon for the stock returns within the framework of the six-month period. If mutual funds follow a contrarian strategy based on the returns of the previous six months, then they could gain abnormal returns. The coefficient of the company size is positive and significant. It indicates that the returns of larger-sized companies tend to be higher.

The coefficient of mutual fund holdings is 0.0083 and significant at a 1 % level. This indicates that during the sampling period, generally stocks with higher mutual fund holdings tended to have higher contemporaneous returns, and this was consistent with the conclusion from the sorting in the previous test.

The positive correlation between stock returns and contemporaneous mutual fund holdings can arise from momentum trading, price pressure or informational advantage. Our test showed that overall the mutual funds did not follow momentum trading strategy; unfortunately, there was no way to directly test the hypothesis for the influence of price pressure and informational advantage because we did not have the data to observe the mutual fund trading within the test period. However, we can test the predictive power of mutual funds by looking at the returns in the sequential period for stocks held by mutual funds. If mutual fund holdings can predict future stock returns, then it is likely that mutual funds have an informational advantage. We follow the regression model in Eq. (1) by replacing the dependent variable \(R_t\) with \(R_{t+1}\), that is, we regress the lagged stock returns on the contemporaneous mutual fund holdings.

Table 5 presents results of Eq. (2). As in Eq. (1), the coefficient of stock return at t is significantly negative, and the coefficient of company size is significantly positive. The coefficient of stock holdings is negative and significant, which indicates there is reversal of stock returns. Combined with the results of Table 4, we may say that stocks with higher mutual fund holdings tend to have higher contemporaneous return but reversal occurs in the successive period. This supports the hypothesis of momentum trading or price pressure because in the case of these two, the stock returns tend to reverse in the sequential period. However, this does not support the hypothesis that mutual funds trade on superior private information.

2. Mutual funds trading and stock returns

In this section, we examine the relationship between mutual fund holdings and stock returns by looking at the change of mutual fund holdings. In accordance with the availability of data, the change of mutual fund holdings is calculated on a six-month basis as follows, the change of stock holdings at the end of year 2013 is obtained by subtracting the 2013 mid-year stock holdings from the 2013 year-end holdings.

Table 6 provides the correlation coefficients of change of mutual fund holdings and stock returns. It shows that during the whole sampling period, the mutual fund trading positively correlated with contemporaneous stock returns. In other words, stocks which are being purchased by more mutual funds have higher contemporaneous returns, and stocks which are being sold by more mutual funds have lower contemporaneous returns. The average correlation coefficient is 0.356 and highly significant.

We asked the question again: What is behind the positive correlation between mutual fund trading and contemporaneous stock return? As we did not know the details of trading during each period, we looked at the correlation between mutual fund trading and stock returns during the previous and successive periods in order to obtain any clues to the answer.

Table 6 shows that the average correlation coefficient between mutual fund trading and stock returns for the previous period is significant (0.035) but much smaller than 0.334. This indicates that momentum trading is unlikely a cause for the positive correlation between stock returns and mutual fund trading. Table 6 also presents the correlation between mutual fund trading and lagged stock returns. The average correlation coefficient is 0.074 and significant at the 1 % level. This indicates that mutual fund trading might be able to predict future price change, and the price change associated with contemporaneous mutual fund trading is persistent and does not reverse in the successive period. Thus, the empirical results of the correlation coefficient tend to support the information-advantage hypothesis, not the momentum-trading or price-pressure hypotheses.

The correlation coefficient provides some information about the mutual fund trading and stock returns, but it might neglect the impact of other factors on the stock returns. Thus, we use the following regression models to further examine the relationship between mutual fund trading and stock returns:

The definition of variables in the above model follows that in Eq. (1). Equation (3) tests the relationship between mutual fund trading, contemporaneous stock returns, and \(\delta H_t=H_t-H_{t-1}\) (i.e., the change of mutual fund holdings from the end of the previous period to the end of the current period). Equation (4) tests the relationship between mutual fund trading and the lagged stock returns.

Table 7 presents the results of regression in Eq. (3). The coefficient of mutual fund trading is positive and highly significant. This indicates that during the sampling period, stock returns are positively correlated with contemporaneous mutual fund buying or selling. The stocks bought by mutual funds tend to have higher contemporaneous returns than stocks sold by mutual funds. In addition, the more the mutual funds buy, the higher the return. While the more the mutual funds sell, the lower the returns. The coefficient here is 0.0151, while the average coefficient in Table 4 for the case of mutual fund holdings is 0.0083. This means the mutual fund trading has a stronger impact on contemporaneous stock returns than mutual fund holdings. In Table 7, the coefficient of company size is positive. This indicates that the price impact of mutual fund trading also depends on the size of the mutual fund company. The larger the company is, the larger the price impact. Table 8 presents the results of Eq. (4). The coefficient of mutual fund trading is negative and statistically significant. This indicates that mutual fund trading has no predictive power and the contemporaneous price impact reverses in the successive period. This is opposite to the sign of the correlation coefficient in Table 6. The coefficient of contemporaneous return is negative and significant, indicating there is a return mean reverting phenomenon for the stocks traded by mutual funds.

3. Differences in the Price Impact Between Mutual Fund Buying and Selling

Some studies demonstrate that institutional buying and selling have different price impacts, and institutional buying has a larger price impact than institutional selling. One possible explanation is that institutional buying is more information-based than institutional selling. Due to investment constraints, most mutual fund managers are not allowed to sell short, thus the only way for them to make a profit is to purchase stocks at a relatively low price and hold them until they can sell them at a higher price. When mutual fund managers buy stocks, they may look at almost any stock available on the market, use their informational advantage and pick up those stocks they believe are most valuable. When mutual fund managers sell stocks in their portfolio, the selling might be information-based (i.e., they have learned those stocks are overvalued). But, there are also many other reasons for selling their portfolio stock, such as these stocks have risen to target prices and should be sold for rebalancing the portfolio, or the desire to redeem investments on the part of the investors forces the mutual funds to liquidate part of their stock assets. So, the purchasing behavior of the mutual fund managers might be more autonomous than the selling behavior,and they will base their decisions more heavily on information. If the above hypothesis is correct, we should be able to observe a difference in the price impact between mutual fund buying and selling, and from this we should observe that mutual fund buying has a stronger impact on prices than mutual fund selling.

Keim and Madhavan [14] provided evidence showing that mutual fund buying is more information-supported than selling. But there are also other studies with different observations. Chiyachantana [7] examined the equity markets of 36 countries and found that mutual funds have a different price impact during different market situations. In a bull market, the investors are more willing to buy than to sell, thus when institutional investors want to purchase a large block, they have to offer larger price premiums than what they would sell them for. In other words, in a bull market, purchasing has a larger price impact than selling. In a bear market, the investors are more willing to sell than to buy, thus when mutual funds want to sell a large block, they have to offer a larger price concession than what they had bought them for. Therefore, in this situation, selling has a larger price impact than buying.

In order to test if mutual fund buying and selling have different price impacts in the Chinese market, we regress the mutual fund trading on the contemporaneous stock returns accordingly for mutual fund buying and selling separately. The model follows Eq. (3).

Table 9 provides the empirical results of the price impact of mutual fund selling, and Table 10 provides the empirical results of the price impact of mutual fund buying. The regression results show that when mutual funds are sold (i.e., the holding level decreases), the coefficient of mutual funds selling is 0.0142, and when mutual funds are purchased (i.e., the holding level increases), the coefficient of mutual funds buying is 0.017. This indicates that the price impact is larger when mutual funds increase holdings than when they decrease holdings. This provides some evidence supporting the hypothesis that mutual fund buying is more information-based than selling. Our results do not support the hypothesis that the difference in the price impact is due to different market situations because our sampling period covers both bear and bull markets, but we can conclude that buying has a larger price impact than selling during most market periods.

5 Conclusion

Our empirical evidence shows that the percentage of mutual fund holdings is positively correlated with stock returns. The positive correlation is very strong in a contemporaneous relationship between mutual fund holdings and stock returns. The stocks with higher level of mutual fund holdings tend to have higher contemporaneous returns. In addition, the average return of stocks within mutual fund holdings is higher than the market returns.

The empirical evidence also shows that mutual fund holdings have some weak predicative power for future stock returns. In other words, stocks with high mutual fund holdings tend to have higher returns in the next period,while reversal occurs in the successive period. This supports the hypothesis of momentum trading or price pressure because in the case of momentum trading or price pressure, the stock returns tend to reverse in the successive period. The empirical evidence shows that the trading of mutual funds (the change of mutual fund holdings) is positively correlated with contemporaneous stock returns, i.e. stocks with higher increase (decrease) in mutual fund holdings tend to have higher (lower) contemporaneous return. Another finding of the empirical test is the asymmetric impact of buying and selling of mutual funds on stock return. We find that mutual fund buying has stronger impact on stock return than mutual fund selling.

In general, the test shows that mutual fund holdings and trading are positively correlated with stock returns, and our evidence supports the hypothesis that the price impact arises from momentum trading or price pressure.

References

Acharya VV, Pedersen LH (2005) Asset pricing with liquidity risk. J Financ Econ 77:375–410

Anand A, Irvine P et al (2012) Performance of institutional trading desks: an analysis of persistence in trading costs. Rev Financ Stud 25:557–598

Brown NC, Wei KD, Wermers R (2013) Analyst recommendations, mutual fund herding, and overreaction in stock prices. Manag Sci 60:1–20

Cai F, Zheng L (2004) Institutional trading and stock returns. Financ Res Lett 1:178–189

Campbell JY, Ramadorai T, Schwartz A (2009) Caught on tape: institutional trading, stock returns, and earnings announcements. J Financ Econ 92:66–91

Chih-Hsien JY (2008) Institutional trading and price momentum. Int Rev Financ 8:81–102

Chiyachantana CN, Jain PK et al (2004) International evidence on institutional trading behavior and price impact. J Financ 59:869–898

Daniel K, Grinblatt M et al (1997) Measuring mutual fund performance with characteristic-based benchmarks. J Financ 52:1035–1058

Dasgupta A, Prat A et al (2011) Institutional trade persistence and long-term equity returns. J Financ 66:635–653

Foster FD, Gallagher DR et al (2011) Institutional trading and share returns. J Banking Financ 35:3383–3399

Grinblatt M, Titman S, Wermers R (1995) Momentum investment strategies, portfolio performance, and herding: a study of mutual fund behavior. Am Econ Rev 85(5):1088–1105

Hu G, McLean RD et al (2014) The year-end trading activities of institutional investors: evidence from daily trades. Rev Finan Stud 27:1593–1614

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: implications for stock market efficiency. J Financ 48:65–91

Keim DB, Madhavan A (1996) The upstairs market for large-block transactions: analysis and measurement of price effects. Rev Financ Stud 9:1–36

Rebello M, Wei KD (2014) A glimpse behind a closed door: the long-term investment value of buy-side research and its effect on fund trades and performance. J Account Res 52:775–815

Ren F, Zhong LX (2012) The price impact asymmetry of institutional trading in the Chinese stock market. Physica A: Stat Mech Appl 391:2667–2677

Yan XS, Zhang Z (2009) Institutional investors and equity returns: are short-term institutions better informed? Rev financ Stud 22:893–924

Acknowledgments

This research was supported by the Social Science Fund of Sichuan Province (Grand No. Xq13B01).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Li, K., Zhou, B., Hu, D. (2015). The Impact of Mutual Fund Investment Trading on Stock Prices: Evidence from the Chinese Stock Market. In: Xu, J., Nickel, S., Machado, V., Hajiyev, A. (eds) Proceedings of the Ninth International Conference on Management Science and Engineering Management. Advances in Intelligent Systems and Computing, vol 362. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-47241-5_58

Download citation

DOI: https://doi.org/10.1007/978-3-662-47241-5_58

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-47240-8

Online ISBN: 978-3-662-47241-5

eBook Packages: EngineeringEngineering (R0)