Abstract

Although there is the development of affordable housing construction in China, it is still failed to curb the housing price and improve the supply and demand contradiction. Therefore, we need to understand the mechanism of the interaction between them. In this paper, we use the panel data over the period of 2002–2012 from 29 provinces in China to test the impacts of affordable housing market to housing price. The result shows that the price of affordable housing has a positive effect on housing price, but the area has a bidirectional effect on housing price and there are strong regional differences in the strength of influence. And the authors put forward policy recommendations according to the empirical results.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The government has always been committed to inhibiting the excessive growth of house prices, achieving market supply and demand balance and solving the housing problem of vulnerable groups. In spite of the several rounds of regulation, the government and resident are still not satisfied with the trend of housing price which is maintained at a reasonable price with steady growth. At present, low-income groups have quite little possibility to afford housing with such high housing price. Government has re-recognized that the construction of affordable housing can not be slackened through these failed policies. In recent years, the government promulgates large number of policies to build affordable housing aimed at clear the debt of neglecting the construction of it. In the capital of the central government on protection of housing construction funds investing, we can see that 2008 was 36.866 billion yuan, 55.056 billion yuan in 2009, 2010 was 63.2 billion yuan and 2011 central government subsidied to fund investment reached 152.2 billion yuan, 2012 was even reached 233.261 billion yuan.

Although the construction of is increasing, whether we can see the effect of this policy rapidly or witness little consequent of it as the policy can not take the pulse of quasi-market? The authors think that it lies on correct understanding to the interaction mechanism between affordable housing and housing market. Therefore the empirical study of relationship between supply of affordable housing and housing prices and correct understanding on the interaction mechanism between them and make affordable housing and housing interact positively in a rational framework. As a result, the two accelerate each other, interact better, and develop harmoniously, maximize the effectiveness of the common market and the government. The above-mentioned is quite urgent.

2 Literature Review

What does affordable housing price affect have on housing price? Whether it promotes or restrains housing price, or maybe there is little connection between them? There has been debate in academic theory circle.

At present, domestic scholars mainly has the following several kinds of understanding: (1) Promotion theory. In this view, affordable housing and commercial housing alternative is not strong, depending on demand for different groups respectively, analyzing from the supply side, that the supply of affordable housing will be reduced commodity residential land, thereby reducing the number of housing supply (Assaf et al. 2010; Aimin and Zhenglong 2012). (2) Reduction theory. In this view, affordable housing supply will ease the population living difficulties, and solve the housing problem, thereby reducing the price of commercial housing (Moulton 2014; Ryan and Enderle 2012). (3) Limitation theory. In this view, there is no clear correlation between the two, affordable housing is not valid for Home Basic. Wang Xianzhu views that effect is present, but is limited. He chooses Hong Kong’s public housing as a control to explain the mainland by the fitness room some negative impact on the market, come to the protection of housing market adjustment is insufficient to have an enormous impact on substantive conclusions. As can be seen from different angles scholars’ departure, the conclusion is also quite different (Xianzhu 2009; Youyi 2009).

The purpose of the present study is to answer two questions: Firstly, what would affordable housing have affect on commodity prices? Whether it is raised or decreased commodity prices. Secondly, how much is the extent of this influence? Only through scientific analysis of the quantitative relation, can we get rigorous conclusion.

3 Data Selection and Model Building

3.1 Panel Data

Panel data refers to the multidimensional data set which consists of a variable’s value of the individual (personal, family, enterprise or country) in a period. Such data can be tracked to obtain through a few individuals. From the cross section, panel data is composed of several individual section observation forms at some point value and each individual is a time series.

3.2 Data Selection

In this paper, we select the following data: (1) Supply of affordable housing. It mainly affects housing prices through price and availability. We use affordable housing sales area of application (AHA) to represent the supply of affordable housing. Although affordable housing includes low-rent housing and public rental, it is generally agreed that affordable housing is the main supply of affordable housing. And when it comes to quantity, it is accounted for the vast majority of affordable housing constitutes. The reason that we choose affordable housing sales area but not construction area is that we mainly aimed at revealing its affect on current housing price; (2) affordable housing price (AHP), We use affordable housing price to represent affordable housing price based on a same reason; (3) We use the average prices for sales of commercial housing (HP) to present commodity residential house price. As Shanghai and Tibet statistical data are missing and affordable housing system in the actual situation, the data object to 29 provinces, municipalities and autonomous regions of the real estate market development sample data span the period 2002–2012, a total sample of 319. Data comes from “China Statistical Yearbook”.

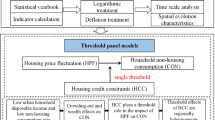

3.3 Model Building

3.3.1 Unit Root Test

At the 1 % significance level, affordable housing prices, the supply of affordable housing area and its price and housing price data are non-stationary time series data. There are unit root, so the order of the original sequence of a stationary test results show the affordable housing prices, supply area and the real estate prices exist an order one, consistent cointegration relationship between variables basis, and the test results are shown in Table 50.1.

3.3.2 Cointegration Test

By Counteraction test, indicators basically conform to several methods, such as Panel rho, Panel V test, data basically conform to the cointegration test, we can conclusion that the three have a long-term equilibrium relationship. Test indicators are shown in Table 50.2.

3.3.3 The Choice of Panel Model

In order to define the variables form, we build the influence of random effect model and fixed effect model.

Then we set out to Hausman test and likelihood ratio test (LR) to judge the influence form. The test results are shown in Table 50.3.

Hausman test and LR test results show that we can build individual fixed model, rather than the mixed model and the individual random model. In addition, by establishing the variable coefficient model, the fixed effects model, and the constant parameter model and set out to do F value test to determine the model forms.

Calculated according to the results of the regression, F2 = 5.33, F1 = 2.65, in a given significance level of 5 % F1 and F2 are greater than threshold, it refused to H1, H2, respectively, model with variable coefficients form should be adopted Table 50.4.

4 Empirical Tests

4.1 Cointegration Test Results

We build a fixed effects model with variable coefficients, affordable housing and commercial housing price volatility analysis of the relationship between the established model is as the following form:

The test result of the model as shown in Table 50.5, the price changes of affordable housing and commercial housing in 29 provinces are homodromous, e.g. the price of affordable housing has a long-term positive effect on the price of commercial housing. With every percentage of the price of affordable housing changed, the price of commercial housing increased by 1.845278233 at national level. As for the coefficient, there are differences among different provinces. Beijing has the highest influence degree whose coefficient is 4.282268, while Yunnan’s influence degree is the lowest and this coefficient is just 0.714382. As can be seen from the data, the coefficient of the eastern region with mature developed market is larger than the western region.

The area of affordable housing also has effect on the housing price, but the extent of the impact is smaller than the influence of the price. On a purely national level, a 1 % change in the area of affordable housing is associated with a 0.8065181 % increase in commercial housing price. The area of affordable housing has different impacts on the long-term price of commercial housing in different places and the impacts can be positive or negative. There are 13 provinces having been influenced positively while 16 provinces have been influenced negatively among 29 provinces. The correlation between the two-way effects and the market development is not obvious. Both the provinces with mature market and the provinces with less-developed one are under the two-side effects.

By synthesizing both the function characteristics, It can also illustrate that the affordable housing market substitution effect is less than the income effect of commercial housing in developed areas, the provinces where the real estate market is mature, so what the data embodies is the income effect, the rising of the price of the affordable houses brings about the price rising of the commercial houses. While in economically under-developed areas, the substitution effect is much more clear, the effect of which surpasses the income effect, so the overall presentation is the substitution effect, the affordable housing market can effectively influence the demand of the commercial housing market and alleviate the contradiction of tight supply.

4.2 The Test Result of Error Correction Model

Due to there is a cointegration relationship between the three variables, then when we next, establish panel error correction model, firstly, gain the residual term using the model of long-term relationship, then establish the dynamic panel error correction model.

Error correction model combined the short-term undulation with long-term equilibrium in a model which reflects free adjustment process of the system when the equilibrium appeared deviating. This paper establishes error correction model based on the panel data (Table 50.6), the model estimates R2 = 0.89, DW = 2.38 and the equation of fitting performance is good.

The price of short-term affordable housing has a positive impact on the price of commercial housing and the average elastic coefficient is 1.488364 which is smaller than the long-term one 1.845278233 at national level. Additionally, the size of the affordable housing also have positive impact on the price of commercial housing and its average coefficient is 2.374034 which is higher than the long-term average elastic coefficient 0.8065181. This also reflects the influence of the supply of affordable housing in the area is higher than the one which the price of commercial housing in the short term.

From the point of the error correction system, the average of error correction coefficient is −1.29223 which shows that when the short-term fluctuations deviated from its long-term equilibrium, and it will be adjust unbalanced state back to equilibrium with −1.29223.

5 Discussion and Conclusions

In this paper, we use the panel data from 2002 to 2010 of 29 provinces, municipalities and autonomous regions to test the relationship between affordable housing market and housing price empirically and we have reached the following main conclusions and recommendations.

We can see that affordable housing market has different impacts on commercial housing market when studying from different angles. Looking from the price and area, the development of affordable housing market in the developed provinces, not only the housing price decreases as the policy expected, but also raises the commercial house price further. However, in less developed provinces, the development of affordable housing market has negative impact on the commercial house price. In the long term, the change of affordable housing market price has greater effect on commercial housing market than the change of supply area.

The short-term price of affordable housing has a positive impact on the price of commercial housing and the average elastic coefficient is 1.488364 which is smaller than the long-term one 1.845278233 at national level. Additionally, the size of the affordable housing also have positive impact on the price of commercial housing and its average coefficient is 2.374034 which is higher than the long-term average elastic coefficient 0.8065181. This also reflects the influence of the supply area of affordable housing is higher than the one which the price of commercial housing in the short term. What has great influence on the commercial housing market is the change of the supply area of the affordable housing, thus influencing supply and requisitioning government’s judgment about market movements and changing the expectations of both sides.

It also shows that in the short term non-market housing substitution effect is obvious, while the income effect is obvious in the long term. From the point of the error correction system, the average of error correction coefficient is −1. This shows that when the short-term fluctuations deviated from its long-term equilibrium, and it will be adjust unbalanced state back to equilibrium with −1.29223.

It can be seen from the empirical results that its impact on the real estate is positive whether it is from the price or the area of the affordable housing, namely, with the rising of the price of the affordable housing, the price of commodities will also rise, the number of the affordable housing will rise, and the price of the commercial houses will rise. Implications of this conclusion is that if policy control is only aimed at adjusting commercial housing price, the construction of the s affordable housing’s crowing out” effect is greater than its “substitution effect”, in case of the price falling. On the other hand, the construction of the affordable housing itself makes diversion only for a small part of the market, therefore, the substitution effect is not obvious, however, the security room solves the housing needs of those people who can’t get satisfy in real estate but really have living difficulties, this is its positive role.

As affordable housing market’s impact on the housing price fluctuations has regional differences, therefore, the national housing security policy which is to regulate the real estate market should take the differences into consideration as well. The same policy will make different results in the provinces where the market is developed and different provinces, in the economically underdeveloped regions, the construction of the affordable housing can well solve the housing shortage while with little success in economically developed areas, so the government should give policy measures separately for different regions in order to produce better policy results.

References

Assaf SA, Bubshaitr AA, Al-Muwasheer F (2010) Factors affecting affordable housing cost in Saudi Arabia. Int J Hous Markets Anal 3(4):290–307

Aimin P, Zhenglong H (2012) Affordable housing, land prices and housing prices. J Yanbian Univ 1

Moulton S (2014) Did affordable housing mandates cause the subprime mortgage crisis? J Hous Econ 24:21–38

Ryan S, Enderle BE (2012) Examining spatial patterns in affordable housing: the case of California density bonus implementation. J Hous Built Environ 27(4):413–425

Xianzhu W (2009) Impact of affordable housing on housing price. Econ Syst Reform 5

Youyi C (2009) Affordable housing policies on the real estate market and its price impact analysis. Price Theory Pract 4

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Xiaotian, P., Jun, Y. (2015). A Panel Data Analysis on the Relationship Between Supply of Affordable Housing and Housing Prices. In: Shen, L., Ye, K., Mao, C. (eds) Proceedings of the 19th International Symposium on Advancement of Construction Management and Real Estate. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-46994-1_50

Download citation

DOI: https://doi.org/10.1007/978-3-662-46994-1_50

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-46993-4

Online ISBN: 978-3-662-46994-1

eBook Packages: Business and EconomicsBusiness and Management (R0)