Abstract

This chapter applies the general pricing framework developed in Chap. 10 to some standard one factor examples including stock options, currency options, futures options and a two factor model of exchange option.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

The key to using the general framework of the previous chapter is to interpret the excess return of each underlying factor to its market price of risk and its volatility

where (m i + q i − r) is the excess return of factor i. In calculating the excess return we must account for any income, or costs, associated with holding the asset underlying price x i . This is captured by the q i term which may be either a continuously compounded dividend or cost. In the next two sections we show how the general pricing structure of Sect. 10.4 may be applied, once Eq. (11.1) has been appropriately interpreted for the situation at hand. Section 11.2 considers some standard one-factor examples, whilst Sect. 11.3 considers some two-factor examples.

2 One-Factor Examples

2.1 Stock Options

In this case we have one underlying factor, the price x of the stock, which we assume here pays no dividend. It follows the diffusion process

and from (11.1) the excess expected return from holding the stock is

from which

Substituting this last expression into the general pricing Eq. (10.90) with n t = n = 1, n n = 0 we obtain

which is of course the Black–Scholes partial differential equation which we obtained earlier.

If the stock does pay a continuously compounded dividend q then the expected excess return relation becomes

so that (11.2) is replaced by

The partial differential equation (11.3) then becomes

2.2 Foreign Currency Options

Here we have one factor x which is the exchange rate (domestic currency/unit of foreign currency) that is the price of a unit of the foreign currency. The foreign currency yields continuously the risk free rate in the foreign country, which we denote by r f . If the diffusion process followed by the exchange rate is written as

the expected return from holding the foreign currency is (m + r f ) and hence the relationship (11.1) for expected excess return as it applies to foreign currency becomes

and hence

Upon substituting this into the general pricing Eq. (10.90) with n = 1 yields

which is the equation obtained by Garman and Kohlhagen (1983) for the pricing of a foreign currency option. In the case of a European call option with exercise exchange rate E on the foreign currency its solution turns out to be

where

It should also be noted that from (10.92) the foreign currency option value can also be expressed as

From (10.94) with q i = r f the dynamics for the exchange rate under the equivalent measure \(\tilde{\mathbb{P}}\) is given by

It is the conditional transition density function associated with (11.9) that is required to calculate the \(\tilde{\mathbb{E}}_{t}\) in (11.8).

2.3 Futures Options

In this case the factor x is the price of a futures contract on an underlying asset whose price is S. The derivative security in this case is an option on the futures contract. Simple arbitrage arguments can be used to show that the relationship between the futures price x and the price S of the asset underlying the futures contract, is

where T ∗ is the maturity date of the futures contract. Here

For example if the underlying asset were a commodity, then α would be, the risk-free rate plus storage costs minus the convenience yield. If the price of the underlying asset follows the diffusion process

then a straight forward application of Ito’s lemma reveals that x follows the diffusion process

It is well known that a futures price can be regarded as the price of a security paying a continuous dividend yield at the risk free rate r which means we set α = r in (11.13) (see Hull 2000). Thus applying (11.1) here yields (r +μ x ) − r = λ σ, i.e.

and so the pricing equation becomes

In the case of a European futures option the solution to this partial differential equation is

where

which is Black (1976) model. Note that formally Black’s model could be obtained from the foreign currency option model by setting r f = r. From (10.92) the futures option value can also be expressed as

where by use of (10.94) with q i = r, the dynamics of the futures price under the equivalent measure \(\tilde{\mathbb{P}}\) are

The transition probability density function associated with (11.15) is used to calculate \(\tilde{\mathbb{E}}_{t}\) in (11.14). Incidentally we note that (11.15) indicates that the futures price is a Martingale under the equivalent measure \(\tilde{\mathbb{P}}\).

3 Options on Two Underlying Factors

As an application of options on two underlying assets, both of which are traded, we consider exchange options which were first studied by Margrabe (1978) . These are the most basic of a class of multi-asset options (digital options , quotient options , foreign equity options , quanto options etc.) which derive their value from the correlation structure between two underlying traded assets. For much more information and details about multi-asset options, we refer the reader to Zhang (1997).

We consider the framework and notation of Sect. 10.3.1 dealing with two traded underlying assets. A European exchange option to pay the second asset in exchange for the first has payoff given by

This payoff differs from that of a standard European call option on x 1 in that the exercise price E is replaced by x 2(T), the value at maturity of the second asset. Alternatively, it could be regarded as a European put option on x 2 with exercise price equal to x 1(T). An investor might be interested in this type of option if x 1 and x 2 were negatively correlated and the investor wished to have some insurance against x 2 performing “badly”.

The price of the exchange option satisfies the partial differential equation (10.21) subject to the terminal condition

Alteratively, we may use the martingale representation (10.31) so that

where we recall that \(\tilde{\mathbb{E}}_{t}\) is calculated using the distribution generated by the stochastic differential equations (10.28), which may be re-expressed as (see Sect. 6.3.2 and Problem 6.7)

We shall concentrate on the case represented by the stochastic differential equations (10.7) so that (11.17) becomes

Thus, the probability density function for the joint distribution of ln[x 1(T)∕x 1(t)], ln[x 2(T)∕x 2(t)] isFootnote 1

where \(v_{i}(T) \equiv \ln \left [x_{i}(T)/x_{i}(t)\right ]\) (as we are expressing the distribution of relative prices we have dropped the notation for conditioning on time t) and

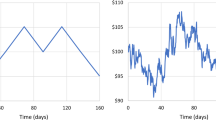

Equation (11.18) is the bivariate normal distribution for the logarithm of the relative prices (see Fig. 11.1). Equation (11.18) may also be expressed as

where

and

or, alternatively as

where now (with a slight abuse of notation)

and

We shall use \(\tilde{\pi }[x_{1}(T),x_{2}(T),T]\) to denote the corresponding probabilities in terms of the original asset prices x 1, x 2. In terms of these distributions, Eq. (11.16) becomes

where the region of integration is illustrated in Fig. 11.2.

Since the integration with respect to x 2 is performed, whilst x 1 is held constant, it is more convenient to use the conditional distributions (11.19), (11.20) (after converting to lnS). Thus, we may express (11.21) as

where

and

Our integration task is simplified by noting that the integrals J 1, J 2 are essentially the integrals A 1, A 2 that we evaluated in Appendix 3.1. The same changes of variables, completing the square etc., need to be applied to the evaluation of J 1 and J 2. In Appendix 11.1 we show that (setting τ = T − t)

when

and

Substituting (11.25) and (11.29) into (11.22) we have

where

and we show in Appendix 11.2 that

where

and that

where

Finally we use the result that (see Appendix 11.2)

from which we obtain

The value of the exchange option (see (11.28)) is given by

Notes

- 1.

See Problem 6.7. Note that the density function there denoted as p(y 1)(T), y 2(T), T | y 1(t), y 2(t), (t) is here denoted as \(\tilde{\pi }\) [v 1(T), v 2(T), T].

References

Black, F. (1976). The pricing of commodity contracts. Journal of Financial Economics, 3, 167–179.

Garman, M. B., & Kohlhagen, S. W. (1983). Foreign currency option values. Journal of International Money and Finance, 2, 231–237.

Hull, J. (2000). Options, futures and other derivatives (4th ed.). Boston: Prentice-Hall.

Margrabe, W. (1978). The value of an option to exchange one asset for another. Journal of Finance, 33, 177–186.

Zhang, P. G. (1997). Exotic options. Singapore: World Scientific.

Author information

Authors and Affiliations

Appendices

Appendix

Appendix 11.1 The Integrals J 1 and J 2

2.1 A. Evaluation of J 1(x 1, T)

From Eq. (11.23) we have

By use of (11.20) (expressed in terms of x 2, x 1) we have (setting τ = T − t)

where to simplify notation we have set

Since J 1 represents the area under the log-normal curve from (0, x 1), we may also express it as

Now we are dealing precisely with the integral A 2 in Eq. (3.29) of Appendix. 3.1, so that after appropriate identifications we may write

where

2.2 B. Evaluation of J 2(x 1, T)

From Eq. (11.24) we have

which by use of (11.20) may be expressed

or, in terms of the log price variable \(y_{2} =\ln \left (\frac{x_{2}(T)} {x_{2}(t)} \right )\)

where we have employed the same completion of the square technique as was used to simplify A 1 in Appendix 3.1. Setting

we then obtain

where

Recalling the definition of \(\mathcal{N}(d)\), we can finally write

Reexpressing this so as to highlight the dependence on x 1,

Appendix 11.2 The Integrals B 1 and B 2

3.1 The Integral B 1

With a slight re-arrangement of the argument of the \(\mathcal{N}\) function, B 1 can be written

Setting

we may re-express B 1 as

where

Completing the square in the exponent we can write

which after a further change of variable becomes

where

3.2 The Integral B 2

We make the change of variable

to obtain

Completing the square and simplifying,

A further change of variable allows us to write

where

Problems

Problem 11.1

Solve Eq. (11.6) in the case of a European foreign currency option to obtain the solution (11.7). Do this in two ways. First, by applying the Fourier transform techniques of Chap. 9 Note that by setting q = r f you can take a lot of the results set out there. Second, obtain the solution to the Kolmogorov backward equation associated with (11.9) and then use (11.8) and integration. To implement this approach you should use (6.23) (appropriately re-interpreted) to obtain \(\tilde{p}(x_{T},T\vert x,t)\). The integration may be done by using the results in Appendix 3.1. These will have to be extended slightly to accommodate the r f .

Rights and permissions

Copyright information

© 2015 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Chiarella, C., He, XZ., Nikitopoulos, C.S. (2015). Applying the General Pricing Framework. In: Derivative Security Pricing. Dynamic Modeling and Econometrics in Economics and Finance, vol 21. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-45906-5_11

Download citation

DOI: https://doi.org/10.1007/978-3-662-45906-5_11

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-45905-8

Online ISBN: 978-3-662-45906-5

eBook Packages: Business and EconomicsEconomics and Finance (R0)